Abstract

Research on entrepreneurship is mainly focused on the individual, and research on innovation has been mainly focused on institutions even though we know that both agency and context matter. To better integrate the two approaches, Acs et al. (Research Policy 43:476–494, 2014. doi:10.1016/j.respol.2013.08.016) introduced the national systems of entrepreneurship (NSE) as a framework for a resource allocation system driven by individual-level opportunity pursuit through the creation of new ventures and its outcomes regulated by country-specific institutional characteristics. This paper draws on the NSE framework, sets it in a larger context, examines the logic of the approach and introduces the special issue by summarizing the papers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

National prosperity is created, not inherited. It does not grow out of a country’s natural endowments, its labor pool, its interest rates, or its currency’s value, as classical economics insists. A nation’s competitiveness depends on the capacity of its industry to innovate and upgrade.

Michael Porter

1 Introduction

The central questions in the scholarly field of entrepreneurship are (1) why an individual chooses to become an entrepreneur, while others do not and (2) why entrepreneurial activities differ systematically across countries. While academic research has mostly focused on characteristic variation across individuals, there is only scare evidence about measurement of entrepreneurship at the country level. Entrepreneurship is without doubt important for economic development (Schumpeter 1911/1934), but there is still relatively little agreement “on what entrepreneurship fundamentally means as a country-level phenomenon” (Acs et al. 2014, p. 477).

Despite the emergence of a compelling literature identifying entrepreneurship performance on the individual level, evidence on the country level is still missing and a number of crucial questions and answers remain unanswered. Recognizing the literature on entrepreneurial activities and performance reveals that most of the findings have been presented as though they are general and valid across countries. Countries cover a range of different institutional settings, formal and informal, different cultures, norms and values and attitudes toward entrepreneurship that effects entrepreneurial performance (Autio et al. 2015).

To better understand entrepreneurship at the national level, Acs et al. (2014) introduced the concept of national systems of entrepreneurship (NSE) as a framework for a resource allocation system driven by individual-level opportunity pursuit through the creation of new ventures and its outcomes regulated by country-specific institutional characteristics.Footnote 1 They argued that entrepreneurship scholars have focused myopically on the individual and tended to ignore the regulating effect of context on individual action. The majority of the trade-offs and opportunity costs faced by entrepreneurs are regulated by context—for example national policies, resource distribution mechanisms, market access, social norms and so on. Because entrepreneurship researchers have focused on the individual and ignored the context, we have missed at least three important points:

-

1.

That it is the context that regulates who decides to start a new firm;

-

2.

It is the context that regulates what kind of firm they will start;

-

3.

That the context also decides how aggressively the firm will pursue growth and with what outcomes.

To shed light on these issues, we assembled a meeting of leading scholars of entrepreneurship and innovation from around the world for a conference on “National Systems of Entrepreneurship and Innovation” at the ZEW Mannheim in November 2014. The papers collected in this special issue are concerned about these three points and were selected as the most salient, adding the most value and insight to a dynamic literature in the context of national systems of entrepreneurship. The workshop on “National Systems of Entrepreneurship and Innovation,” organized in November 2014 in Mannheim by the ZEW Mannheim, Indiana University Bloomington and the University of Augsburg was dedicated to this new framework. The selected papers build upon and add to the NSE literature and are introduced in Sect. 4, after Sect. 2 that sets the framework for NSE in a larger context, and Sect. 3 summarizes the logic and ration behind the concept of NSE.

2 The framing of national systems of entrepreneurship

If one is interested in country-level outcomes—innovation, competitiveness, growth (Audretsch et al. 2015)—there are at least three approaches to understanding what makes countries and regions perform better over the past quarter century: national system of innovation (Nelson 1993); the competitive advantage of nations (Porter 1990); and competition and entrepreneurship (Kirzner 1973).

The broadest approach to economic performance at the level of a country is the concept of national systems of innovation (NSI) (Nelson 1993; Lundvall 1992; Edquist 1997). The main theoretical underpinnings are that knowledge is a fundamental resource in the economy that knowledge is produced and accumulates through an interactive and cumulative process of innovation that is embedded in a national institutional context and that the context therefore maters for innovation outcomes. The term “system” connotes a set of institutions whose interactions determine the innovative performance of national firms. It is important to understand what the system means in the NSI literature. According to Rosenberg and Nelson (1993, 4–5), the system concept “…is that of a set of institutional actors that, together, plays the major role in influencing innovative performance.” Systems constitute of multiple components that work together to produce system performance. In the NSI literature, systems are not created. Rather, they are inherited, evolving structures, and the key task of the researcher is to understand this structure so the system could be rigged to deliver improved performance.

The NSI concept is mostly about context, how institutions drive knowledge production and application and how countries differ according to their “…set of institutions…” but totally overlooks the individual agency (Acs et al. 2014, p. 477). In the NSI literature, individuals are almost treated exogenously given and contextual variables and settings where in the focus of academic research and policy makers (Acs et al. 2016). In other words, NSI helped us understand where we were as nations but not how to improve our position. It is perhaps a little surprising, if not ironic, that although the NSI literature was heavily influenced by the Schumpeterian tradition, the entrepreneur remained conspicuously absent in this literature.

The second approach to national economic outcome is associated with Michael Porter’s (1990) work on the Competitive Advantage of Nations. While Porter was also interested in nations and innovation like Nelson, he took the analysis one step further. The central question to answer according to Porter is, “Why do firms in some industries achieve international success and others do not?” In addition, to understanding the role of institutions, Porter argued that firm strategy is also an important aspect of global competitiveness. To understand the environment, Porter introduced the “diamond”: a concept that tied together factor conditions, demand conditions, related and supplier industries and firm strategy, structure and rivalry. Porter argued that productivity and competitive advantage in an economy require specialization. In the Competitive Advantage of Nations, he “introduced the concept of a cluster, or group of interconnected firms, suppliers, related industries, and specialized institutions in particular fields that are present in particular locations.” Porter offered a sophisticated view between agglomeration economics and competition and strategy by focusing on clusters.

Cluster analysis provided case study evidence of regions and industries that led to better performance. Porter’s diamond model and cluster evidence became the model for thinking about policy at the economy level. The diamond identified the institutional context and clusters showed how they can be improved. If one set of institutions was missing, performance would be suboptimal and could be fixed in a relatively short period of time. Porter’s approach was an improvement over NSI because clusters were able to provide a policy perspective. However, they were similar in at least one respect. They both took the number of firms as given, providing no role for new firms in the commercialization of knowledge and left entrepreneurship out of the analysis.

The third approach to national economic outcome focuses on entrepreneurship (Baumol et al. 2009). It helps to start out with a clear statement of what we mean by entrepreneurship as a national phenomenon. Entrepreneurship is about human action: What they do and what outcomes emerge from their actions. The outcome of entrepreneurship for many is opportunity recognition or the individual-opportunity nexus (Shane and Venkataraman 2000). However, the nexus is simply a first step into the unknown.

There are two prominent approaches in the entrepreneurship literature on national performance. While the two approaches are similar in many respects, they differ fundamentally on the role they assign to the entrepreneur. The first approach is that of Israel Kirzner (1973). This Kirznerian approach stresses the importance of market processes over equilibrium analysis. The focus is on competition and entrepreneurship. The Schumpeterian system (1911/1934) stresses the role of evolution and innovation in the market mechanism by shifting the production function. For Schumpeter, entrepreneurship is important primarily in sparking economic development by creating disequilibrium. For Kirzner entrepreneurship is important primarily in enabling the market process to work itself out in all contexts. For Kirzner (1973, p. 81 emphasis original), “the function of the entrepreneur consists not of shifting the curves of cost or revenues which face him, but of noticing that they have in fact shifted.” In essence the Schumpeterian entrepreneur is about creating a new production function—one that did not exist before—and the Kirznerian entrepreneur is about operating in the context of the existing production function. The latter does not necessarily lead to improved national performance. If the production function is not shifted, and shifted often, after a while there will be nothing for Kirznerian entrepreneurs to do as the market will equilibrate, and long run stagnation will set in. What is missing from the Austrian story is a way to connect up agency with institutions that tied together the entrepreneur with a set of modern institutions along the lines of NSI and/or clusters that improved national performance.

In order to operationalize the theoretical literature on entrepreneurship at the economy level and fill this hole in the entrepreneurship literature, a group of scholars in 2004 set out to integrate agency and outcome in a coherent framework.Footnote 2 Knowledge spillover entrepreneurship provided a bridge between entrepreneurship and national performance, not just on why some people choose to become entrepreneurs while others do not, but also how and why entrepreneurship is a critical factor in regard to improving economic performance (Acs et al. 2009, 2012, 2013; Ghio et al. 2015). According to the knowledge spillover theory of entrepreneurship (KSTE), the context in which decision making is derived can influence one’s determination to become an entrepreneur (Minola et al. 2015). By commercializing the ideas that evolved from an incumbent organization but commercialized independent of this organization via the creation of a new firm, the entrepreneurs not only serve as a conduit for the spillover of knowledge, but also for the ensuing innovative activity and enhanced economic performance (Acs et al. 2009, 2012; Audretsch and Caiazza 2015). The KSTE is consistent with the Schumpeterian view of entrepreneurship that the role of the entrepreneur is to create a new production function.

The KSTE also introduced the concept of the knowledge filter (Carlsson et al. 2009; Acs et al. 2009). The knowledge filter is a subset of institutions that hinder the commercialization of knowledge by entrepreneurs. However, the theory fell short in one important respect. While identifying the importance of the knowledge filter in the commercialization of technology, the KSTE never produced the detailed working of the institutional system that either NSI or clusters provided. What is still missing here is an explanation of the interaction of agency and institutions in a coherent system at the national level.

With the introduction of national system of entrepreneurship (NSE), Acs, Autio and Szerb (2014, 2015) develop an approach that integrates the importance of agency along the lines of the KSTE and institutions as an alternative perspective to NSI, explaining not just why some people choose to become entrepreneurs while others do not, but also how and why performance differs in large across counties. They develop a new index methodology characterizing national systems of entrepreneurship recognizing interactions with different components and in particular identifying bottleneck factors that hold back entrepreneurial performance. The systemic approach of national systems of entrepreneurship considers institutional arrangements beyond geographical proximity and location-specific endowment and thus provides a more realistic portrayal of the phenomenon of entrepreneurship at the country level. The approach also forces researchers and policy makers to think in systemic terms that widen the perspective when considering both individual- and country-level indicators.

3 The logic of national system of entrepreneurship

It is widely accepted that an “entrepreneurial” country does not simply mean that there are more entrepreneurs. Or, as Acs et al. (2014) argue, while Uganda has the highest self-employment rate on the planet, followed closely by countries such as Peru, even if these two countries have many merits, they are hardly leading examples of economic productivity and dynamism. In the NSE perspective, the fundamental aspect of entrepreneurship is not the pure number of entrepreneurial firms, but that it drives productive resource allocation in countries. At the country or national level, this dynamic resource reallocation drives total factor productivity and, therefore, economic growth (Acs et al. 2015, p. 17).

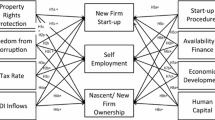

Acs et al. (2014) argue that central in the entrepreneurial process is not the pure existence of opportunities, but how entrepreneurs get access to resources and mobilize them in order to pursue the opportunities. They define a national system of entrepreneurship as “…the dynamic, institutionally embedded interaction between entrepreneurial attitudes, activities, and aspirations, by individuals, which drives the allocation of resources through the creation and operation of new ventures” (p. 479).

Lafuente et al. (2015) combine the efficiency hypothesis of the knowledge spillover theory of entrepreneurship within the framework of national system of entrepreneurship. Using a comprehensive database for 63 countries for 2012, they employ data envelopment analysis and confirm that innovation-driven economies make a more efficient use of their resources and that the accumulation of market potential by existing incumbent businesses explains country-level inefficiency. Regardless of the stage of development, knowledge formation is a response to market opportunities and a healthy national system of entrepreneurship is associated with knowledge spillovers that are a prerequisite for higher levels of efficiency.

Selecting a national strategy to foster and promote entrepreneurship is complex, already, but when considering all the pillars and subpillars of a national system of entrepreneurship becomes rather mind-boggling. While the definition of NSE captures some of the difficulties finding and defining a good design for a national system of entrepreneurship and, even more, of successful imitation, there is a logic of “fit” underlying this concept. Certain strategies, institutional settings, individual activities and attitudes toward entrepreneurship do fit one another, and others do not or less. Moreover, there are frequently recognizable, understandable and predictable relations among the institutional settings where the entrepreneurial interactions are bedded in, and the individual choice variables which drive the allocation of resources through the creation and operation of new ventures and that determine which constellations of choices will do well and which are less likely to do so. Recognizing these relations and understanding their implications, causes and consequences is the guide for designing a national system of entrepreneurship.

The idea that strategy and structure—entrepreneurship policy and systems—need to fit with another and with the national and, in a globalized world, international environment is an old one. Acs et al. (2014) developed and introduced a system of coherent patterns in a simple, intuitive and powerful way. The key ideas behind are the relationships, the complementary, across the pillars and subpillars of variables, and the importance of bottleneck factors. Complementary among choice variables, entrepreneurial activities, attitudes and aspirations, non-convexity in the set of available choices, and non-concavity in the relationships between choice and performance (Roberts 2004, 34f). The concept of complementary in its simplest way is the interaction of two variables. Two choice variables are complements, when doing more of one of them increases the returns to doing more of the other. In contrast, activities are substitutes if doing more of one reduces the attractiveness of doing more of the other. Complementary gives rise to clear patterns of coherence in design in the national system of entrepreneurship in that the whole, the national system of entrepreneurship, being more than the sum of the different parts, or the several pillars (like provision of venture capital, education system, tax system, among others). Coherence among a set of complementary variables or pillars tends to result in all of them being set at a higher level or all at a lower level—each of the patterns following its own logic. Non-convexity and non-concavity mean that there can multiple coherent patterns exist that are quite distinct. In a mathematical sense, convexity of the set of alternatives or pillars is that if two options are available, then any intermediate choice is also possible, in particular that choices are infinitely divisible. While this may hold for a set of monetary choice variables, like taxes or public venture capital, this assumption does not hold for most of the choice variables important for entrepreneurship and resource allocation. Concavity of the objective function, like GDP per capita, economic dynamic or start-up rates, deals with the nature of relationship between decision variables and performance for a given environment or situation (see Roberts 2004, 52f). In the case of a single variable, like the provision of venture capital, concavity means that the impact on performance, say start-up rates, of successive increments is decreasing, perhaps becoming negative.

While in the single-choice variable, single output and static environment, a best solution exists, this does not hold for a set of choice variables, distinctive measures of performance and a non-static environment. In this sense, Acs et al. (2014) design a systematic and systemic framework of a national system of entrepreneurship, based on the interactions among changes in different variables, pillars, subpillars, in affecting performance, i.e., some measures of entrepreneurship. They build on these ideas of complements and substitutes and extend the relations among aspects of national institutional arrangements, individual entrepreneurship activities, actions and aspirations and developed a framework for entrepreneurship on the national level. They argue that entrepreneurship is an embedded action: Both the individual and the context matter. What is needed, therefore, is a systemic understanding of the entrepreneurial process. The national systems of entrepreneurship (NSE) approach seeks to address this gap. Therefore, the main emphasis of policy should be on identifying system-level bottlenecks and alleviating them. A corollary of the above is that we may be able to improve system-level performance by smart (re)allocation of policy resources. However, to do this successfully, one needs to understand the complementary, the relative strengths and weaknesses of the multiple factors that make up the system.

To seek and achieve this outcome, Acs et al. (2014) developed the global entrepreneurship and development index (GEDI: www.thegedi.org). GEDI draws on the global entrepreneurship monitor (GEM) data and the NSE philosophy to compile a multi-item index for profiling NSEs in different countries. The index is made up of “pillars,” which reflect “attitudes,” “activities” and “aspirations,” respectively. Each pillar combines an individual-level aggregate from the GEM data (for example, national percentage of individuals who perceive skills for entrepreneurship) with a matching measure of a national descriptor (for example, gross enrollment in tertiary education). Complementary is given by the product of two variables—like start-up skill perceptions are likely to be more impactful if the population is highly educated, as this will increase the resulting quality of new entrepreneurs.

While there may be multiple coherent patterns for complementary features, what typically not work is a “mix and match” (Roberts 2004, 39) among elements of different pillars and subpillars. Thus, Acs et al. (2014) identified and introduced the concept of bottlenecks as the main causes for a mismatch or lack of gains from complementary. Since countries differ according to these bottlenecks, they also differ in their national systems of entrepreneurship and thus measures of performance. For instance, assume that the institutional setting is restrictive against entrepreneurship in that sense that economic failure, voluntarily or not, would lead to a strong individual punishment and reduction in his long live earnings, as it is the case in Germany (Audretsch and Lehmann 2016). Then, a 1 % increase in the complementary variable, venture capital, would lead to an increase in entrepreneurship <1 %, if at all. Instead increasing the amount of venture capital, reducing the bottleneck, the legal restrictions would then increase the marginal effects. The same holds for the higher education system in countries with a lack of entrepreneurial orientation (Audretsch et al. 2015).

The GEDI index as introduced by Acs et al. (2014) applies a “Penalty for Bottleneck” algorithm: If there are poorly performing pillars, other pillar values are “penalized” to reflect the notion that the poorly performing pillar may constitute a bottleneck for system performance. With this Penalty for Bottleneck algorithm, it is possible to start “optimizing” policy portfolios—that is to determine how policy resources should be allocated if policies should always seek to address the most weakly performing pillars first.

The national system of entrepreneurship (NSE) introduced by Acs et al. (2014) provides a framework for policy makers identifying coherent patterns and relationships among key variables. National systems of entrepreneurship are complex socioeconomic structures that are brought to life by individual-level action. This action is embedded in multipolar interactions between individual and organizational stakeholders that make up the system, and it is expressed through the creation and operation of new ventures. In the ecological literature, the benefits generated by national system of entrepreneurship are commonly referred to as services and the practice of managing and enhancing such benefits is referred to as policy. The dual services created by national system of entrepreneurship is resource allocation toward productive uses and the innovative, high-growth ventures that drive this process. Because national system of entrepreneurship services is created through a myriad of localized interactions between stakeholders, it is not easy to trace gaps in system performance back to specific, well-defined market and structural failures that could be addressed in a top-down mode (Autio and Levie 2015).

A number of important insights into policy and management problems follow from recognizing these facts and embracing the possibility, and even the likelihood, that concavity and convexity will not hold, leading to the penalty of bottlenecks. The first is a basis for understanding why some countries (or regions on the local level) seem to constantly change their institutional settings for entrepreneurship policy. This involves shifting from centralized policy issues to decentralized issues and then back again, for example, shifting property rights from the individual level to the organizational level and vice versa. A second insight is that there may be multiple choices for national entrepreneurship systems that are coherent patterns. New high-tech start-ups are perhaps more important in countries with large and public companies, generating a division of labor between the generation and commercialization of ideas, and less in countries with a dominance of small- and medium-sized companies (Audretsch and Lehmann 2016). Yet among these different but coherent patterns, some may yield much better performance, like GDP growth per capita, than others. Finally, coherence and the existence of bottlenecks have a double meaning. First, it requires that no small adjustments in the set of pillars can increase performance, since the choice is locally best. A little better way to do things yields no really improvement. Second, when the pillars or choice variables are multidimensional, as it is the case, then no change in one pillar, except the bottleneck pillar, can change performance. Third, if the whole national system of entrepreneurship is at a coherent level point, even it shows poor performance, it is still possible that policy makers cannot find a better solution unless every element or relevant pillar is changed in a coordinated fashion (see Roberts 2004, p. 57).

4 The papers

The first paper, written by McCann and Ortega-Argilés (2016), is entitled Smart Specialization, Entrepreneurship and SMEs: Issues and Challenges for a Results-Oriented EU Regional Policy. Smart specialization is a key strategy concept in European 20–20 development agenda (EU cohesion policy). The basic rationale behind this concept is prioritizing resources to activities like new venture creation and R&D in branches or a specific technology where regions have already competitive advantages. Their paper adds to the literature on NSE, discussing and analyzing pillars spurring regional competitiveness through innovation, knowledge spillovers and entrepreneurship growth. McCann and Ortega argue that, in order to evaluate good policy prioritizations, it is essential to rely on outcome-oriented, i.e., measurable, framework conditions. They thus provide a brilliant state-of-the-art review about sound entrepreneurial ecosystems, their key driving conditions and regional specialization strategies.

In his paper entitled Public-Sector Entrepreneurship and the Creation of a Sustainable Innovative Economy, Leyden (2016) elaborates different aspects of the entrepreneurial environment from the public-sector point of view. Leyden explores the impact of policies on public-sector entrepreneurship and contributes to the literature on NSE with this perspective by trying to structure the analysis of stimulation and inhibition of entrepreneurship. This paper develops an NSE-based theoretical model of the entrepreneurial environment that integrates into a functional whole the various subsets of that environment that others have studied and explores the role that NSE-guided public policy can play in improving the entrepreneurial environment for both private-sector and public-sector entrepreneurs. In the private sector, such public policies would focus on enhancing the creative environment, the exchange environment, the incentive and feedback structures and the access to resources.

An important choice variable and institutional setting is tax policy. In 2000, the UK Government introduced tax credits for SMEs to promote and support R&D, and since then, the policy has become more generous in this respect, particularly since 2008. In his paper You can lead a firm to R&D but can you make it innovate? UK Evidence from SMEs, Cowling (2016) questions whether SMEs take-up of tax credits has actually led to an increase in entrepreneurial activities like product, service or process innovations. His evidence suggests that there is little to justify the expenditure in foregone taxes given the current distribution of credits. Cowling (2016) thus suggests that issuance of tax credits should take more account of a firms’ strategic intent in respect of innovation and its internal capabilities, both of which were found to have the closest and strongest associations with incremental and radical innovation.

The provision of entrepreneurial finance is a major pillar and often a bottleneck of national systems of entrepreneurship. In his paper Equity retention and Social Network Theory in Equity Crowdfunding, Vismara (2016) makes two contributions to research on national system of entrepreneurship. First, he compares its regulation around the world and discusses how this impacts the development of markets. Second, he investigates the signaling role played toward external investors by equity retention and social capital. His empirical results combine findings in classical entrepreneurial finance settings, like venture capital and IPOs, with evidence from other, non-equity crowdfunding markets.

National systems of entrepreneurship (NSE) are fundamentally resource allocation systems driven by individual entrepreneurship choice variables and institutional settings, reflecting costs and benefits of actions on the individual level. Such costs and benefits are by far not static but shaped endogenously and exogenous shocks. The financial crisis in 2007/2008 constitutes such an exogenous shock altering the costs and benefits of entrepreneurial actions, in particular credit conditions. In their paper Entry and exit in severe recessions: Lessons from the 2008–2013 Portuguese economic crisis, Carreira and Teixeira (2015) provide evidence that in the extreme scenario of a deep recession the efficiency in the resource reallocation process is actually reduced, possibly due to credit market stringency. While they did not find any strong evidence that job reallocation is countercyclical, a non-negligible number of high-productivity firms actually shut down. They conclude that stringent credit constraints generate counterproductive destruction, hampering economic recovery. A national system of entrepreneurship should thus follow countercyclical policies to reduce credit market frictions to enhance stronger productivity growth after the crises occurred.

The study Entrepreneurial readiness in the context of national systems of entrepreneurship by Schillo and Persault (2016) contributes to the emerging stream of literature on national systems of entrepreneurship (Acs et al. 2014) and investigates the importance of systemic contingencies between individual-level and country-level variables. Focusing on the concept of entrepreneurial readiness derived from the GEM adult population survey, they demonstrate that entrepreneurial readiness has substantial explanatory power with regard to individuals’ entrepreneurial intentions. They conclude that individuals’ entrepreneurial intentions are not only a function of their personal entrepreneurial readiness, but also of contingencies between individual entrepreneurial readiness and a number of dimensions of the national environment.

Finally, Peroni and Rillo (2016) focus on individual background and education of immigrants on entrepreneurship. This paper highlights an important in issue in Europe and a challenge for the efficiency of national systems of entrepreneurship in integrating immigrants into a national economy. The study Entrepreneurship and immigration: evidence from GEM Luxembourg analyzes the role of immigration background and education in creating new business initiatives in Luxembourg, a country where 44 % of the resident population is immigrant. They investigate the features of entrepreneurs and of the Luxembourgish System of Entrepreneurship using the Global Entrepreneurship Monitoring surveys of 2013 and 2014. Studying the effect of immigration through all the stages of entrepreneurial process, they find that first-generation immigrants, and in particular highly educated ones, are more interested in starting a new business than non-immigrants. They conclude that a national system of entrepreneurship should also focus on policies to attract highly educated immigrants to promote entrepreneurial initiatives.

Notes

It is important to understand how national systems of entrepreneurship (NSE) fit in the broader ecosystem literature, as well as trying to understand exactly what the concept means. The concept of NSE (Acs et al. 2014, 479) introduced entrepreneurship into Nelson’s national systems of innovation (NSI). The concept of NSE is new and this special issue will explore its applications to the broader subject. However, Acs et al. (2014) use the concept of NSE interchangeable with the concept of entrepreneurial ecosystems (Autio and Levie 2015, p. 1). Both NSE and entrepreneurial ecosystems are about institutions, agency and place, and the policy issue emerges as to the “strategic management of place” (Audretsch 2015) or what Acs et al. (2014) call the system. What is the strategic management of place if not the management of entrepreneurial ecosystems? Small business economics has another special issue forthcoming (Entrepreneurial Ecosystems, edited by O’connor, Stam, Acs & Audretsch) that will further explore this topic.

Acs, Audretsch, Brauenhelm and Carlsson in 2004–2005 produce a set of working papers published by CEPR, the Royal Institute of Technology and the Max Planck Institute of Economics.

References

Acs, Z. J., Audretsch, D. B., Braunerhjelm, P., & Carlsson, B. (2012). Growth and entrepreneurship. Small Business Economics, 39(2), 213–245. doi:10.1007/s11187-010-9307-2.

Acs, Z. J., Audretsch, D. B., & Lehmann, E. E. (2013). The knowledge spillover theory of entrepreneurship. Small Business Economics, 41, 757–774. doi:10.1007/s11187-013-9505-9.

Acs, Z. J., Audretsch, D. B., Lehmann, E. E., & Licht, G. (2016). National system of innovation. Journal of Technology Transfer (forthcoming).

Acs, Z. J., Autio, E., & Szerb, L. (2014). National systems of entrepreneurship: Measurement issues and policy implications. Research Policy, 43, 476–494. doi:10.1016/j.respol.2013.08.016.

Acs, Z. J., Autio, E., & Szerb, L. (2015). National systems of Entrepreneurship. In Z. J. Acs, E. Autio, & L. Szerb (Eds.), Global entrepreneurship and development index 2014. Springer briefs in economics, chapter 2 (pp. 13–26). Heidelberg: Springer. doi:10.1007/978-3-319-14932-5_2.

Acs, Z. J., Braunerhjelm, P., Audretsch, D. B., & Carlsson, B. (2009). The knowledge spillover theory of entrepreneurship. Small Business Economics, 32(1), 15–30. doi:10.1007/s11187-008-9157-3.

Audretsch, D. B. (2015). The strategic management of place. In D. B. Audretsch, A. N. Link, & M. L. Walshok (Eds.), The oxford handbook of local competitiveness (pp. 13–33). New York, NY: Oxford University Press.

Audretsch, D. B., & Caiazza, R. (2015). Technology transfer and entrepreneurship: Cross-national analysis. Journal of Technology Transfer,. doi:10.1007/s10961-015-9441-8.

Audretsch, D. B., Kuratko, D. F., & Link, A. N. (2015a). Making sense of the elusive paradigm of entrepreneurship. Small Business Economics, 45(4), 703–712. doi:10.1007/s11187-015-9663-z.

Audretsch, D. B., & Lehmann, E. E. (2016). The seven secrets of Germany. Economic resilience in an era of global turbulence. New York, NY: Oxford University Press.

Audretsch, D. B., Lehmann, E. E., & Paleari, S. (2015b). Academic policy and entrepreneurship: A European perspective. Journal of Technology Transfer, 40(3), 363–368. doi:10.1007/s10961-014-9359-6.

Autio, E., Kenny, M., Mustar, P., Siegel, D. S., & Wright, M. (2015). Entrepreneurial innovation: The importance of context. Research Policy, 43, 1097–1108.

Autio, E., & Levie, J. (2015). Management of entrepreneurial ecosystems. Mimeo: Imperial college Business School.

Baumol, W., Litan, R., & Shramm, C. (2009). Good capitalism bad capitalism. New Haven, CT: Yale University Press.

Carlsson, B., Acs, Z. J., Braunerhjelm, P., & Audretsch, D. B. (2009). Knowledge creation, entrepreneurship and economic growth: A historical review. Industry and Corporate Change, 18, 1193–1229.

Carreira, C., & Teixeira, P. (2015). Entry and exit in severe recessions: Lessons from the 2008–2013 Portuguese economic crisis. Small Business Economics (in this issue). doi:10.1007/s11187-016-9703-3.

Cowling, M. (2016). You can lead a firm to R&D but can you make it innovate? UK evidence from SMEs. Small Business Economics (in this issue). doi:10.1007/s11187-016-9704-y.

Edquist, C. (1997). Systems of innovation approaches—Their emergence and characteristics. In C. Edquist (Ed.), Systems of innovation: Technologies, institutions, and organizations (pp. 1–35). London: Routledge.

Ghio, N., Guerini, M., Lehmann, E. E., & Rossi-Lamastra, C. (2015). The emergence of the knowledge spillover theory of entrepreneurship. Small Business Economics, 44(1), 1–18. doi:10.1007/s11187-014-9588-y.

Kirzner, I. M. (1973). Competition and entrepreneurship. Chicago, IL: University of Chicago Press.

Lafuente, E., Szerb, L., & Acs, Z. J. (2015). Country level efficiency and national systems of entrepreneurship: A data envelopment analysis approach. Journal of Technology Transfer,. doi:10.1007/s10961-015-9440-9.

Leyden, D. (2016). Public-sector entrepreneurship and the creation of a sustainable innovative economy. Small Business Economics (this issue). doi:10.1007/s11187-016-9706-0.

Lundvall, B.-A. (Ed.). (1992). National systems of innovation: Toward a theory of innovation and interactive learning. London: Anthem Press.

McCann, P., & Ortega-Argilés, R. (2016). Smart specialization, entrepreneurship and SMEs: Issues and challenges for a results-oriented EU regional policy. Small Business Economics (in this issue). doi:10.1007/s11187-016-9707-z.

Minola, T., Criaco, G., & Obschonka, M. (2015). Age, culture, and self-employment motivation. Small Business Economics,. doi:10.1007/s11187-015-9685-6.

Nelson, R. R. (1993). National systems of innovation: A comparative analysis. Oxford: Oxford University Press.

Peroni, C., & Rillo, S. (2016). Entrepreneurship and immigration: Evidence from GEM Luxembourg. Small Business Economics (in this issue). doi:10.1007/s11187-016-9708-y.

Porter, M. (1990). The competitive advantage of nations. Cambridge, MA: Harvard University Press.

Roberts, P. (2004). The modern firm. New York, NY: Oxford University Press.

Rosenberg, N., & Nelson, R. (1993). Technical innovation and national systems. In R. R. Nelson (Ed.), National innovation systems: A comparative analysis (pp. 3–22). Oxford: Oxford University Press.

Schillo, S., & Persault, J. (2016). Entrepreneurial readiness in the context of national systems of entrepreneurship, Small Business Economics (in this issue). doi:10.1007/s11187-016-9709-x.

Schumpeter, J. (1911/1934). The theory of economic development: An inquiry into profits, capital, credit, interest, and the business cycle. New Brunswick: Transaction Publishers.

Shane, S., & Venkataraman, S. (2000). The promise of entrepreneurship as a field of research. The Academy of Management Review, 25(1), 217–226.

Vismara, S. (2016). Equity retention and social network theory in equity crowdfunding. Small Business Economics (in this issue). doi:10.1007/s11187-016-9710-4.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Acs, Z.J., Audretsch, D.B., Lehmann, E.E. et al. National systems of entrepreneurship. Small Bus Econ 46, 527–535 (2016). https://doi.org/10.1007/s11187-016-9705-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-016-9705-1