Abstract

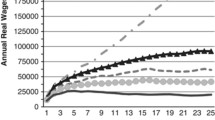

The study of student loan debt remains a timely and relevant higher education finance research and policy-oriented topic, especially when considering the alarming growth rates of student loan debt balances. The Quarterly Report on Household Debt and Credit released in May of 2018 shows that among all debt balances, student loans remain the only form of debt that virtually sextupled over the last 15-years, and this trend is not slowing down. Although aggregated trends are important, by definition they are limited in their capabilities to providing researchers, policy- and decision-makers with insights related to individual debt accumulation and, perhaps more importantly, with knowledge about the factors associated with variation of individual debt burden. Accordingly, the overarching goal of this study is to ameliorate this limitation in three meaningful ways. First, this is the first study that offers inferential estimates of the magnitude of student debt accumulation increase across two different decades (1991–2013) and institutional sectors (public 2- and 4-year colleges). Second, these estimates are based on student level undergraduate non-self-reported longitudinal loan debt disbursements. Third, the estimates not only account for individuals’ baseline differences at the moment of college entry, but also account for institution- and state-level indicators that took place during college enrollment and that may be related to the variation of student loan debt reliance. Two nationally representative samples (NELS and ELS) complemented with other institution- and state-level data were analyzed using doubly robust estimators build from propensity score weights and entropy balancing approaches that were robust to unobservable selection issues using Oster’s approach (J Bus Econ Stat 37(2):1–18, 2017). The results consistently indicated that, among all participants, student borrowing participation increased by 15 percentage points in the 2000s, compared to the 1990s, and individual debt accumulation at least doubled across decades. Notably, among 4-year degree holders, the 2-year path toward a 4-year degree consistently resulted in about 10% lower debt accumulation compared to the 4-year path toward a 4-year degree. Students who did not attain a 4-year degree were better served by having started college in the 2-year sector. In terms of overall debt increase, 4-year degree holders accrued about $8000 more on average than their counterparts did during the 1990s, however, the recent cohort also repaid about $11,000 more, on average (or three times as much), than participants did in the 1990s. These higher repayment behaviors observed among 4-year degree holders, resulted in similar amounts of their respective debt balances across decades. The implications are clear: students with higher propensities toward a 4-year degree attainment are likely to incur lower debt if they start college in the community college sector. However, before fully recommending this pathway, 2- and 4-year colleges’ articulation agreements should be strengthened to ease transfer and eventual degree completion. Without recommending consolidation or merger between 2- and 4-year institutions, researchers and policy makers can learn from the strategies implemented by successful cases such as Perimeter College and Georgia State. Finally, 4-year entrants with lower likelihood to attain a 4-year degree may be better served by beginning college in the 2-year sector instead. Predictive analytics and machine learning techniques can be used to identify these cases, as depicted in the discussion section of the study.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The Quarterly Report on Household Debt and Credit released in May of 2018 (Federal Reserve Bank of New York [FRBNY] 2018) indicated that among the six categories of loan types reported by the FRBNY,Footnote 1 student loan debt balances surpassed all other forms of debt growth since the fourth quarter of 2009 (see Fig. 3 in the Appendix).Footnote 2 Student loans are the only form of debt balances that virtually sextupled over the 15-year time-period (Jan 2003–Jan 2018) covered by the report.Footnote 3 As this alarming growth rate makes clear, the study of factors affecting loan debt accrual remains a research topic with timely and relevant policy implications and recommendations.

The aggregated trends shown in Fig. 3 in Appendix shed light on student debt balances across the contiguous United States over the past 15 years. But such estimates are limited in their ability to provide insights into individual debt accumulation and the factors associated with variation of individual debt burden. They do not tell us, for instance, whether starting college in the community college sector is associated with lower student loan debt accumulation and outstanding loan debt balance than starting college in the 4-year sector. Nor do they provide insight into undergraduate borrowing behaviors across sectors and decades. Using two nationally representative samples from two different decades, this study addresses these important issues and extends the current body of research on undergraduate student loan debt in meaningful ways.

This is the first study to offer inferential estimates of the magnitude of non-self-reported student debt accumulation increases across two different decades (i.e., 1991–2001 and 2002–2013) and institutional sectors (i.e., public four- and public 2-year colleges). Different from previous research, these estimates account for individuals’ characteristics at college entry as well as for institution-(e.g., an estimate of tuition and fee costs during college enrollment and having received other forms of financial aid by the institution) and state-level indicators (e.g., state merit- and need-based disbursements) that took place during college enrollment and that may be associated with loan reliance. Finally, the models control for college enrollment length based on participants’ 4-year degree attainment as explained below.

The public 2- and 4-year sectors included herein remain the starting point for 80% of first-time degree-seeking in-state college entrants and enroll about 73% of all undergraduate students in the contiguous United States (IPEDS 2016). Given the prevalence of enrollment in these two sectors, about fifty years of empirical research has been devoted to measuring their effects on students’ education (Brand et al. 2014; Clark 1960b; Dougherty 1994; Doyle 2009; González Canché 2018; Stephan et al. 2009) and occupational outcomes (Belfield and Bailey 2011; Hu et al. 2017; Jacobson and Mokher 2009; Marcotte 2010). A notable absence from this line of research is the analysis of the influence of these two sectors on student debt accrual (González Canché 2014b, 2018) with only two inferential studies (González Canché 2014b; Hu et al. 2017) and one descriptive report (Steele and Baum 2009) focused on analyzing the effects of these two sectors on undergraduate debt accumulation. This study addresses this latter limitation as well.

Purpose

The purpose of this study is twofold. The first is to test whether starting college in the community college (or public 2-year) sector is associated with lower student loan debt accumulation and outstanding loan debt balance owed as of the last wave of data collection (approximately 9 years after initial college enrollment) compared to loan debt accrual and burden given initial enrollment in the 4-year sector. An important methodological consideration when addressing this first purpose is that students who attain a 4-year degree have longer enrollment times than students who drop out of college during their second year, for example, or who only attain an associate’s degree. Since longer enrollment times required more resources to sustain this investment, lengthier enrollment times may require greater reliance on student loans as a form of aid to finance college attendance. Accordingly, failing to separate the models given the attainment of a 4-year degree may result in biased estimates of sector effects, as these estimates will capture the effect of longer or shorter enrollment times rather than the effect of sector of initial enrollment on student debt accrual and burden. To ameliorate this source of bias, the estimates were obtained while specifying models disaggregated conditional on bachelor’s degree attainment (see Fig. 1).

In addition to yielding less-biased estimates, this analytic strategy can be used to test whether a 4-year degree “costs the same,” in terms of loan debt, for those students who started in the 2-year sector and for students who began college at a 4-year institution. Similarly, the set of models that include only non-4-year degree holders allows testing whether similar students who did not attain a 4-year degree ended up with different loan debt amounts conditional on sector of initial college enrollment.

Based on the counterfactual and potential outcomes frameworks (Lewis 1973; Rubin 2005), before making any inferential claims, this study accounted for students’ systematic differences given their initial sector of enrollment. This adjustment is important because, compared to their 4-year counterparts, 2-year students tend to come from lower income households and have backgrounds that are otherwise underrepresented in higher education (González Canché 2014b, 2018). Moreover, doubly robust specifications were employed to account for factors during college—such as cost of tuition and fees and the availability of other forms of financial aid—that are expected to have influenced students’ borrowing behaviors over and above initial sector of enrollment. The institution-level indicators (e.g., tuition, fees, selectivity, region) were taken directly from the Integrated Postsecondary Education Data System (IPEDS), while the state-level indicators were retrieved from the U.S. Census Bureau and other data sources, such as the National Association of State Student Grant and Aid Programs (NASSGAP, 2004–2005).

The second purpose of this study is to provide an estimate of undergraduate borrowing behaviors between and within sectors and across decades. The analytic framework employed allows for a comprehensive analysis of whether students who began college in either 2- or 4-year institutions represented in the 2000s (Education Longitudinal Study [ELS]) received, owed, and repaid higher amounts of undergraduate student loans than their counterparts observed in the 1990s sample (National Education Longitudinal Study [NELS]). The importance of using two nationally representative samples is threefold. First, neither of the samples have been examined using the entropy balancing approach or the doubly robust analytic framework employed herein. Second, in addition to assessing whether there have been changes in debt burden across decades as a function of initial sector of attendance, the comparison of the results provides a robustness check for the models implemented. Finally, rarely do researchers have the opportunity to test their models using two completely different samples, and this study takes advantage of the investment made by National Center for Education Statistics (NCES) to collect this wealth of information. It is important to note that the focus of the study is on undergraduate student loan debt. Consequently, all loan amounts are restricted to financing undergraduate education. To make the analyses and amounts comparable across decades, all loan amounts were adjusted for inflation using the Consumer Price Index Inflation Calculator provided by the Bureau of Labor Statistics (2018) and are represented in 2018 dollars.

The research questions addressed in this study are as follows:

-

1.

Did 2-year entrants who attained a bachelor’s degree accrue and repay similar amounts in student loan debt compared to their counterparts who started in the 4-year sector?

-

2.

Did 2-year entrants who did not attain a 4-year degree accrue and repay similar amounts in student loan debt compared to students who started in the 4-year sector?

-

3.

Have the amounts of student loan debt accrued and repaid by 4-year degree holders during the 2000s increased compared to the amounts accrued and repaid by 4-year degree holders during the 1990s?

-

4.

Have the amounts of student loan debt accrued and repaid by non-4-year degree holders during the 2000s increased compared to the amounts accrued and repaid by non-4-year degree holders during the 1990s?

-

5.

How do the answers to the previous two questions change when considering initial sector of enrollment?

These research questions have clear policy implications and recommendations. Specifically, although 2-year institutions charge a third of the tuition and fees charged by their public 4-year counterparts (American Association of Community Colleges [AACC] 2018), it remains unclear whether taking the 2-year route to a 4-year degree translates into a significant reduction of student loan debt burden. This argument holds in spite of a recent study in which Belfield et al. (2017) argued that “the total cost of a bachelor’s degree” is $2240 lower if a student begins at a community college compared to beginning college in a 4-year institution (or $72,390 and $74,630, respectively). Notably, these estimates did not account for diversion effects, which may potentially increase 2-year entrants’ reliance on loans (compared to 4-year natives). More specifically, the well-documented lack of effective articulation agreements between sectors may result in a loss of course credits when community college students transfer to 4-year institutions (González Canché 2018; Monaghan and Attewell 2014) and the resulting increase in time to 4-year degree attainment and forgone earnings due to college attendance. This loss of credits also implies that transfer students may have to pay for college credits at the higher 4-year rate (AACC 2018) while potentially having utilized need-based aid for credits already attained in the 2-year sector.

Even if the cost of a 4-year degree is similar for 2- and 4-year entrants, as suggested by Belfield et al. (2017), there is no guarantee that debt accrual will be similar across these participants. The well-known set of differences between 2- and 4-year students is likely to impact their levels of reliance on student loan debt to finance their education. That is, since 2-year students tend to come from lower socioeconomic backgrounds and typically have access to fewer sources of support, price sensitive 2-year students may need to borrow more heavily than their 4-year counterparts who are less financially constrained.Footnote 4 From this perspective, these differences in student bodies enrolling in the 2- and 4-year sectors suggest that the total cost of a degree (about $73,000 for both 2- and 4-year entrants, as suggested by Belfield et al. may be financed from different funding sources, given different participants’ need to rely on student loan debt. In times when the costs of attending college have reached all-time high amounts (Baum 2015), with continuously increasing outstanding debt balances (Kiefer 2016) that did not slow down even during and after the most recent economic crisis (Looney and Yannelis 2015), students should select the most cost-effective option toward the attainment of a college education.

Considering the context just described, the present study offers clear implications and recommendations. If the findings indicate that, among 4-year degree holders, initial college enrollment in the 2-year sector is more expensive in terms of loan debt than initial enrollment in the 4-year sector, then the recommendation will be that students with realistic expectations of 4-year degree attainment should avoid the 2-year path option toward a 4-year degree. Conversely, if the results indicate that, among 4-year degree holders, initial enrollment in the 2-year sector is associated with lower debt burden than starting college in the 4-year sector, this finding (along with the similar costs estimated by Belfield et al. 2017) would suggest that students with realistic expectations of attaining a 4-year degree may be better served by choosing the 2-year path toward a 4-year degree (the discussion section elaborates further on these recommendations including caveats and limitations). A similar set of recommendations can be surmised for non-4-year degree holders.

Background and Previous Studies

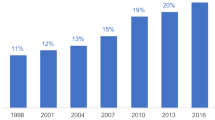

Federal loans were designed as a supplementary form of financial aid (Hearn 1998). Of the total federal aid disbursed to students in 1970–1971 (the earliest statistics found), loans accounted for 34% and grants constituted 65% (College Board 2014). Ten years later, loan aid had reached 50% of total federal aid. This upward trend peaked in 1996–1997 at 73%. Though the percentage of aid directed toward loans has since stabilized, it has remained above 61% of the total federal aid disbursement in undergraduate education, with grant aid consistently below 24% since 1990 (College Board 2014). The transition from grants to loans, along with the rapidly increasing education debt levels, have motivated researchers to analyze the effects of loans on students’ outcomes (Gross et al. 2009).

An extensive literature review indicates that studies on student loan debt can be categorized into four main themes. First, researchers have focused on analyzing the impact of loans on the educational attainment of 2- or 4-year students in terms of college access, choice, progression, and completion. Overall, the current state of the literature shows inconclusive or negative effects of loans on degree attainment (DesJardins et al. 2002; Dowd and Coury 2006; Gladieux and Perna 2005; Heller 2008).

The second line of inquiry has focused on the effects of loan debt on financial hardship. In this line of study, researchers have used likelihood of owning a home or having a mortgage, salary, and sector of employment as outcomes of consideration (Akers 2014; American Student Assistance 2013; Cho et al. 2015; Elliott et al. 2013; Field 2006; Houle and Berger 2014; Rothstein and Rouse 2007). Akers (2014), for example, found that there is not a strong positive relationship between student debt and financial hardship and that the highest rates of financial hardship are seen among households with relatively little outstanding student loan debt. Somewhat similar to Akers (2014), Rothstein and Rouse (2007) found that borrowers who graduated from a highly selective private college held higher-paying jobs than their college peers who received grants and did not borrow. In contrast to the preceding findings, Elliott et al. (2013) found that households with a member who attained a 4-year degree while incurring student loan debt were significantly less likely to have retirement savings, own a home, and accumulate assets. These apparent contradictory findings may be due to the differences in samples used for model specification. Rothstein and Rouse (2007), for example, estimated their models using data from a segment of the student population that is perhaps not truly representative of the typical population facing loan debt (i.e., Rothstein’s and Rouse’s samples sample came from students enrolled in a highly selective private institution), whereas Elliott et al. relied on the 2007–2009 Survey of Consumer Finances longitudinal data, which seeks representativeness by selecting approximately 6500 participating families randomly. Interestingly, even when authors have relied on the same source of data, their results do not perfectly align with one another—see Elliott et al. and Akers (2014). Consequently, the second line of research also offers inconclusive results.

A third line of research on student loans is focused on default rates. Gross et al. (2009) presented a comprehensive review of the academic literature on student loan default from 1978 to 2007. The main question addressed in this line of research concerns whether student loan default is a function of student characteristics. The key findings are that students attending less-selective institutions (e.g., for-profit, and public 2-year institutions) tend to have higher default rates than those from more selective colleges and universities (Deming et al. 2011; Gross et al. 2009; Kesterman 2005; Podgursky et al. 2002) and students enrolled in more affluent institutions tend to have lower loan default rates (Gross et al. 2009; Volkwein et al. 1998). A common characteristic across these studies is that authors have, to a great extent, not accounted for systematic differences in the student bodies attending different types of institutions. It is likely that students attending less-selective colleges default more because these types of students have fewer resources for repayment, regardless of the amounts borrowed, than those attending more selective colleges and universities. Complementary to this idea is the finding that only about 18% of students who owe more than $100,000 default, which practically doubles the default rates of students owing less than $5000 (34%) (Dynarski 2016).

Researchers have also examined the relationship between student loan default and consumer credit debt (Baum and O’Malley 2003; Baum and Saunders 1998; Pinto and Mansfield 2006). These studies indicate that students with credit card debt tend to be more at risk of default on their education loans than students with no credit card debt (Fry 2014; Pinto and Mansfield 2006). Students appear to prioritize the repayment of credit card and/or other types of debt over repayment of student loans.

The fourth and final line of research on loan debt focuses on institutional effects on default rates. Scholars have observed that individual-level analyses prevail in this line of research (Belfield 2013; Deming et al. 2011; Hillman 2014). After controlling for student characteristics, institutional sector strongly predicts default. Specifically, the for-profit sector is the most associated with default (Deming et al. 2011; Hillman 2014), followed by the community college sector (Deming et al. 2011).

Despite the remarkable role of the public 2- and 4-year sectors in providing college access, studies on loan debt that focus on these institutions are in scant supply. A descriptive report by Steele and Baum (2009) showed that most of the total increase in loan recipients from 2003 to 2008 occurred in the 2-year sector. The percentage of students receiving an associate’s degree in 2008 who received an education loan increased by 11 percentage points compared to students who received an associate’s degree in 2004. During the same time period, there was only one percentage point change for students with educational loans in the public 4-year sector who received a bachelor’s degree (Steele and Baum 2009, p. 2, Table 2). An important characteristic of Steele and Baum’s comparison is that their percentages accounted for only bachelor’s and associate’s degree recipients. Their report does not account for 2-year students who transferred to a 4-year institution and attained a bachelor’s degree. In this respect, their estimates of dollar increases for 2- versus 4-year students ($1507 and $1026, respectively) are conservative, as 2-year transferees may require more time and loans to finish their degrees in the 4-year sector.

González Canché (2014b) and Hu et al. (2017) offered inferential studies focused on public 2- and 4-year colleges that intersected with the third and fourth lines of research just described. While emphasizing sector effects, both studies relied on data that allowed for quasi-experimental analyses at the individual level while utilizing institutional sector as the treatment condition. Specifically, González Canché tested whether the public 2-year path toward a 4-year degree was an option that would result in lower amounts of debt owed within 9 years of college enrollment. He found that, in the 1990s, the 2-year path toward a bachelor’s degree cost the same as the 4-year path in terms of loan debt. Using a more recent source of data (2004–2009) Hu et al. (2017) found that initial community college students accrued $2221 less in cumulative student loan debt. From a methodological point of view, the major limitation of these two studies is that the authors ignored all during-college enrollment factors that were likely to affect the variation of debt accumulation, such as amount of tuition and fees paid and the receipt of non-loan forms or financial aid (federal work-study, grant aid, tuition waivers, to mention a few). The omission of these indicators may have translated into biased estimates, a limitation addressed in the current study. In addition, the current study also incorporates the most recently released data collected to offer the most current estimates available. Indeed, the Education Longitudinal Study employed herein released its final wave of data in 2014.

In synthesis, this is the first study to offer inferential estimates of the magnitude of student debt accumulation increase across two different decades (1991–2013) and institutional sectors (public 2- and 4-year colleges), which represents an important contribution toward our understanding of borrowing reliance and burden across decades and sectors.

Conceptual Framework

This study is informed by stratification theory (Bourdieu 1986; Hauser 1970) and the counterfactual or potential outcomes frameworks (Lewis 1973; Rubin 2005). Stratification theory suggests that college-choice decisions do not happen on a level playing field. Students’ access to different forms of financial, social, and cultural capitals, as depicted by Bourdieu (1986), not only play an important role in the formation of expectations about higher education, including deciding to attend college and selecting the sector of college attendance, but also influence students’ ability to afford to attend a 4-year institution. More specifically, the different tuition costs, with 2-year colleges charging a third of the tuition prices charged by public 4-year colleges, affect price-sensitive students’ decisions given their perceived prospects of being able to afford college attendance.

Educational stratification theory (Hauser 1970) is particularly useful in understanding the expected relationship between students’ resources, college choice, and loan debt accumulation and repayment behaviors. Considering that educational stratification theory has consistently shown a strong relationship between academic achievement and socioeconomic status (SES) (Palardy 2008; Wyatt et al. 2012), it is expected that students from wealthier backgrounds, who are less price sensitive and have access to more sources of support, will also be more likely to select attendance in the 4-year sector rather than in the community college sector. This decision is based on the greater prestige that the 4-year sector holds in the higher education hierarchy given its more selective and perceived more academically rigorous environments compared to the 2-year setting. From this view, even though the tuition and fee prices charged by these institutions are higher, 4-year students would also have access to other means to afford this investment. On the other end of the spectrum, lower-income and/or first-generation college students, who tend to have access to fewer resources and sources of support than students who typically attend the 4-year sector, would also be more likely to select the 2-year sector (González Canché 2018), even if they initially aspire to attend a 4-year institution and are academically prepared to do so. This discussion suggests that before asking whether initial community college attendance resulted in lower or higher student loan debt reliance than initial 4-year college enrollment, one should first account for differences in the availability of capital, which not only affects students’ college-going decisions but also affects their need to rely on student loan debt to attend college.

From more philosophical and methodological perspectives, researchers would ideally obtain unbiased estimates by observing the same student i in two counterfactual or potential outcome situations (Lewis 1973; Rubin 2005). In the first, student i decides to attend a community college at time t. In the second, the same student i enrolls in a 4-year institution also at time t. After time has passed and the outcomes associated with each situation are captured at time t + n (where n is the amount of time that has passed), one would simply need to observe the difference from each case (Caliendo and Kopeinig 2008; Holland 1986; Rubin 2005) in order to evaluate which decision yielded higher student loan debt burden. The attainment of these truly unbiased estimates is impossible (Holland 1986; Rubin 2005), however, and is the single most important reason why the estimates obtained in this study do not claim to be causal. Instead, the estimates presented in this study aim to be less biased by creating comparison groups to serve as counterfactual cases (see Table 1, Appendix Tables 8 and 9). The selection of the indicators in these groups was informed by stratification theory (Bourdieu 1986; Hauser 1970) as well as literature assessing the effect of initial sector of enrollment on students’ educational outcomes using analytic techniques that also relied on the counterfactual framework (Doyle 2009; Hu et al. 2017; Stephan et al. 2009).

The ultimate goal of selecting these indicators is that once comparable groups have been created statistically, researchers may be better positioned to address whether 2- versus 4-year college enrollment decisions were associated with different debt accumulation and repayment behaviors. Nonetheless, it is shortsighted to assume that making participants statistically similar at college entry is enough to capture sector effects on loan borrowing behaviors. These two sectors present important differences in providing students with access to resources (including waivers, merit-based aid, and work study, for instance) and cost of attendance (including tuition and fees, for example) that likely impact students’ levels of dependence on loan debt. Therefore, statistical control of individual-level indicators at college entry and the subsequent omission of factors and variables that took place during college enrollment would constitute a problem of omitted variable bias. To minimize this potential problem, the models also control for indicators that took place during college enrollment.

As shown in Fig. 1, the models account for indicators measured before students enrolled in college. These indicators (shown in Table 1, Appendix Tables 8 and 9) serve to create counterfactual comparison groups that “look the same” at the time of college enrollment (as detailed below in the next section). In addition, the models account for during-college enrollment indicators that are shown in Table 10, also in the Appendix, and discussed in the “Data Sources and Analytic Techniques” section.

Students’ borrowing status is another conceptual aspect considered in this study that has important implications for model specification. As depicted in Fig. 1, one set of models will be estimated for all 2- and 4-year entrants regardless of whether they borrowed during college enrollment. A different set of models will be restricted to students who actually received at least one student loan. The set of samples that include all participants convey information about average sector effects on loan behaviors. For example, estimating models regardless of loan disbursement status yields the average expected amount of undergraduate loan disbursed and owed conditional on initial sector of enrollment and 4-year degree attainment status. Similarly, the analyses restricted to borrowers convey information about the average sector effects on debt for students who actually relied on loans as a form of undergraduate financial aid. Creating these two sets of models is informative given that media coverage tends to omit whether estimates about loan debt owed by college graduates is pooled across all college students or is restricted to students who received at least one loan.

Data Sources and Analytic Techniques

This study relies on two unique datasets comprising state-, institution-, and student-level information. The student-level indicators were taken from the National Education Longitudinal Study (NELS) of 1988 and the Education Longitudinal Study (ELS) of 2002. These studies are the two most current and comparable nationally-representative samples of students, documenting their transition from high school to college and then to the job market.Footnote 5 The institution-level variables were retrieved both from NELS and ELS and the IPEDS. The state-level indicators were retrieved from the NASSGAP, the U.S. Census, and official websites of state and regional tuition reduction agreements (see MSEP 2014; NEBHED 2014; SREB 2014; WICHE 2014).

The analytic sample is limited to NELS and ELS participants who first enrolled in a public 2- or 4-year institution and were not enrolled in college as of December 31, of 1998 and 2010, respectively. These latter restrictions allowed NELS and ELS students to be out of college before the outcomes were measured, which made their outcomes contemporaneously exogeneous from college enrollment. Using two mutually exclusive yet otherwise identical analytic samples ensured that any change in the magnitude of the estimates over time was due to structural changes in students’ borrowing/repaying behaviors rather than changes in model specifications across samples. Moreover, the analysis of two analytic samples allows for testing whether any potential loan debt disparities between 2- and 4-year entrants remained constant or changed across samples (over time). Finally, the use of two samples allows for an analysis of how the nationally representative sample contained in ELS differs from the sample captured by NELS in terms of academic, socioeconomic backgrounds, and sources of support.

In terms of the inferential scope of the study, the national representativeness of the NELS and ELS samples is validated by the fact that 74% of their respective participants started in the public 2- and 4-year sectors. This percentage is in accordance with the scope of public 2- and 4-year institutions, which combined enroll 73% of all undergraduate college students in the United States (IPEDS 2016). This representativeness reinforces the inferential power that comes from ‘adequately’ analyzing these students’ academic and loan-debt trajectories across decades. Finally, both analytic strategies were implemented with and without the survey weights contained in the NELS and ELS samples, with results mirroring each specification. These similarities make these inferences applicable to the populations of interest across decades.

Outcome Variables

All financial aid data were taken from the National Student Loan Data System for Students (NSLDS), which were linked to the restricted versions of NELS and ELS surveys. The loan data account for individual longitudinal disbursement and repayment information about all participants who enrolled in any Title IV institution between 1991 and 2000 and between 2002 and 2012 for NELS and ELS, respectively. All the loan outcome variables analyzed in this study were restricted to undergraduate loan disbursements and repayments. As shown in Table 3 these outcomes are: total student loan accrued, outstanding balance, and amount repaid as of the last wave of data collection conducted by the NSLDS (2001 in NELS and 2013 in ELS).

Variable Selection

The set of variables and indicators included in this study were selected to capture students’ multiple sources of support during high school (e.g., academic, social, and financial). Specifically, the student-level variables from NELS and ELS captured students’ various resources in the form of (a) social capital, such as support from parents, relatives, and high school teachers and counselors to pursue a college education; (b) economic capital, including SES, having access to private tutors and private classes, the need to work to support their education in high school, importance placed on availability of financial aid in college-going decisions, and attending public elementary school; and (c) proxies of cultural capital, including participation in advanced placement classes, the importance placed on good grades, academic recognition, and having taken the SAT/ACT, all of which can reflect a college-going culture typically associated with students coming from families who are more likely to afford extra investment in education. These variables and indicators are shown in Table 1, Appendix Tables 8 and 9.

The models further adjusted for factors and variables that measure individual- (in terms of financial aid disbursements), institution-, and state-level variables assumed to affect students’ borrowing behaviors during college enrollment. The individual- and institution-level variables were selected to account for other forms of financial aid offered to each student by the institutions they attended. These forms of aid accounted for grants, loans, participation in the Federal work-study program, and waivers. This aid information was taken from the student-institution files contained in the NELS and ELS studies. In addition, an estimate of the total tuition and fees that students paid during undergraduate college enrollment was computed for each student. Given that NELS and ELS do not provide this information, these estimates charges were calculated from data retrieved from the IPEDS (all IPEDS’ data matched students’ enrollment periods).

A proxy for the level of institutional selectivity of the institutions in which students enrolled was captured using the Carnegie classification of 2000 as provided by the IPEDS (2016). This classification considered colleges and universities as institutions offering associate’s degrees, doctoral/research, master’s, baccalaureate, and special focus institutions that included schools of engineering, medical schools, and schools of business and management. Although this classification is not relevant for community college entrants, it is important for 4-year students (and 2-year students who transferred to a 4-year institution) given the tuition variation associated with such a classification, with doctoral and research institutions charging the highest tuition and fee amounts and potentially offering greater opportunities for waiver and federal work-study prospects than comprehensive 4-year colleges, for example. In an attempt to further capture institutional heterogeneity, a binary indicator called open-door (1, 0 otherwise) was created based on the variable OPENADMP also found in the IPEDS. The models also included institution size and locale to capture whether institutions were located in cities, suburbs, towns, or rural areas, as these factors (including open-door admission policies) are known to be related to tuition variation (González Canché 2014a). Land-grant status of colleges was also added; as these institutions are assumed to serve local or in-state students, and enrollment there may capture other forms of aid or support not captured by the NELS and ELS surveys.

State-level indicators included a measure of per-capita disposable personal income (dollars), defined as total personal income minus personal current taxes, taken from The Bureau of Economic Analysis (2004–2005) during college enrollment. This indicator is included as it may capture tuition variation that is dependent on the states’ financial well-being (González Canché 2017b). The doubly robust models also included a measure of college demanders (González Canché 2019), defined as the proportion of state inhabitants age 18–24 (United States Census Bureau Population Estimates 2014). In addition, given that some authors have discussed the influence of state and regional tuition-reduction agreements on mobility flows across neighboring states, which in turn affects tuition and fees variation (González Canché 2014a, b, 2019), the models incorporated this information, as provided by the New England Board of Higher Education (NEBHED 2014), the Western Interstate Commission for Higher Education (WICHE 2014), the Southern Regional Education Board (SREB 2014), and the Midwest Student Exchange Program (MSEP 2014). Finally, models included states’ total amount of merit, loan, and need-based financial aid spent during the year students were enrolled in college as these disbursements may also have affected the final tuition costs paid by students. This information was retrieved from several reports taken from the NASSGAP.

Analytic Approaches: Propensity Score Modeling (PSM) and the Use of Observables

The analytic approaches employed in this study—propensity score weighting (PSW) and entropy balancing (EB)—were selected to test for and minimize possible systematic differences based on sector of initial college enrollment (e.g., participants who began college in the 2-year sector may have had access to fewer resources than participants who first attended a 4-year institution). Both PSW and EB belong to the propensity score modeling (PSM) framework. As such, both assume that selection into exposure to a given condition (e.g., initial community college attendance) is determined by observable rather than unobservable variables (Rosenbaum and Rubin 1983). From this perspective, if analysts can identify a set of truly influential predictors and indicators that explain participants’ probabilities of being exposed to such a condition, then such information may be used to reduce biases based on systematic observed differences that may not only have affected students’ college sector choice in the first place but that may also have driven differences in their outcomes. If participants are statistically similar in terms of all other covariates except for their sector of initial college enrollment, then any observed difference in their outcomes can then be assumed to have been driven by such enrollment decision. More specifically, this means that if 4-year degree holders who first attended a community college systematically accrued lower student loan debt than their similar counterparts who attended a 4-year institution initially, then the assumption that the community college path toward a 4-year degree is a more affordable choice in terms of loan debt is more likely to be true.

Because PSW and EB approaches follow divergent algorithms to obtain individual-level weights that aim to reduce baseline differences across 2- and 4-year entrants, and across cohorts, their use in a single study provides us with sensitivity and robustness checks for the conclusions reached and implications and recommendations suggested. Nonetheless, the analytic framework also included sensitivity checks based on unobservable selection and coefficient stability as depicted by Oster (2017) and discussed before the “Findings” section.

Propensity Score Weighting

PSW’s main advantage is that it uses the statistical rigor of machine learning and classification techniques to estimate propensity scores based on the best model specification reached through covariate interaction and linear, quadratic, and higher order forms of each predictor. PSW uses generalized boosted models (GBM) to execute thousands of regression trees (9000 in this case) until the best model specification is reached (Ridgeway et al. 2014). In addition, GBM avoids multicollinearity issues by shrinking the magnitude of the coefficients of highly correlated predictors. This penalization is achieved by applying a lasso (least absolute subset selection and shrinkage operator) as follows

where t = 1 is initial enrollment in the community college sector that will be compared with initial enrollment in the 4-year sector. Instead of relying on the standard procedure to obtain participants’ probabilities of exposure using logit models in the form \(\log \frac{{{\text{P}}\left( {{\text{t}} = 1|{\text{x}}} \right)}}{{1 - {\text{P}}\left( {{\text{t}} = 1|{\text{x}}} \right)}}\) (which yields \({{\beta^{\prime}x}}\) in Eq. (1) that are obtained with a single draw rather than thousands of iterations), PSW applies a lasso operator. Specifically, \({{\lambda }}\mathop \sum \limits_{{{\text{j}} = 1}}^{\text{J}} \left| {{{\beta }}_{\text{j}} } \right|\) is a penalty term that decreases the overall value of \({{\beta}}_{\text{j}}\); consequently, \({\text{l}}\upbeta\) is the adjusted or more stable estimate of \(\beta^{\prime}x\), obtained with the standard and “potentially unstable logistic regression” approach (Ridgeway et al. 2014, pp. 28–29). Another advantage of the lasso operator is that it produces a predictive model with greater out-of-sample predictive performance than models using variable subset selection methods. The value of \(\lambda\) that maximizes the positive properties of \({\text{l}}\upbeta\) was estimated using boosting, a machine learning meta-algorithm for a “range of values of \(\lambda\) with no additional computational effort” (Ridgeway et al. 2014, p. 29).

The estimate of \({\text{l}}\upbeta\) is typically depicted as e(x) in the propensity score modeling literature (Rosenbaum and Rubin 1983). Given that e(x) can take an infinite value, one method to use its statistical power is to rely on matching mechanisms (Rosenbaum and Rubin 1983) where, conditional on e(x) values, the covariates \({\text{x}}_{\text{i}}\) become balanced (see Becker and Ichino 2002, for a survey of the most frequently used balancing mechanisms). Two important limitations of matching are sample reduction and potential unbalance. Sample reduction takes place when finding suitable matches given participants’ propensities toward exposure to treatment is not possible given their distances, which surpassed a given threshold. Unbalance may take place when analysts decide to retain all participants by either finding a nearest neighbor based on individuals’ propensities or by applying a kernel function. However, when such propensity distances are far between treated and control units, their \({\text{x}}_{\text{i}}\) may remain unbalanced, hence the main goal of matching would not be achieved in this case.

PSW overcomes the limitation of sample loss by obtaining weights that make the control units similar to their treated counterparts, which is referred to as Average Treatment Effect on the Treated (ATET). Depending on the algorithm employed to obtain the propensities, these weights may also overcome the limitation of unbalanced samples. Indeed, as explained below, both the PSW and the EB were successful in overcoming these two limitations.

The ATET weights obtained using PSW were defined as follows \({\text{w}}\left( {\text{x}} \right) = {\text{K}}\frac{{{\text{f}}\left( {{\text{t}} = 1 | {\text{x}}} \right)}}{{{\text{f}}\left( {{\text{t}} = 0 | {\text{x}}} \right)}} = {\text{K}}\frac{{{\text{e}}\left( {\text{x}} \right)}}{{1 - {\text{e}}\left( {\text{x}} \right)}}\), where e(x) is the propensity score or the estimate of \(l\beta\) described above and K is a normalization constant that cancels out in the outcomes analysis (Ridgeway et al. 2014, p. 27).

Finally, a value added of the GBM application is the identification of influential predictors of treatment status throughout the thousands of iterations executed to estimate \(l\beta\). The equation for relative influence measures the percentage of times a variable \(x_{i}\) was selected as a significant predictor for estimating the probability of treatment (or control) assignment during the number of trees or iterations and interaction-depth procedures (in the form of linear quadratic and higher order terms) executed to find the best model specification. The equation weights each variable’s contribution by the squared improvement that the variable adds to the model (Friedman 2001). The relative influence of each variable is scaled so that the sum adds to 100, with higher numbers indicating stronger influence on treatment prediction (Elith et al. 2008; Ridgeway 2007).Footnote 6 This information is shown under column “ %Infl” in Table 1.

Entropy Balancing [EB]

In EB, the detection of a counterfactual unit follows the same logic as in PSW and is estimated as follows (Hainmueller and Xu 2013):

where \(Y\left( 0 \right)|T = 1\) is the counterfactual outcome of 4-year entrants had they started college in the 2-year sector (T = 1). Just as in the case of PSW, this counterfactual outcome is obtained given a weight \(w_{i}\), that is captured with each participant’s propensity to begin college in the 2-year sector \([({\text{e}}\left( {\text{x}} \right) = {\text{pr}}({\text{t}} = 1|{\text{x}}_{\text{i}} )]\) given a set of theoretically and empirically relevant characteristics (\({\text{x}}_{\text{i}}\)) that may not only have affected treatment status but that may also have had an effect on outcome variation. In accordance to the notion of ATET, every control participant had a weight \(w_{i}\) with a positive non-zero value indicating that control students had a non-zero chance to have been exposed to the treated condition (see Rosenbaum and Rubin 1983). In the case of treated individuals \(w_{i}\) equals 1, as they are assumed to be a good representation of the population of interest. This ATET follows the same intuition behind PSW (enabling comparing their respective estimates) with the main difference being the algorithms used to obtain \(w_{i}\).

Different from the PSW procedure, the \(w_{i}\) obtained using EB has the main goal of minimizing the distance between control and treated units conditioning on up to three moments per xi such that each \(w_{i}\)|t = 0 will follow

where \(mr\) contains constraints \(c_{ri} \left( {x_{i} } \right)\) weighted by \(w_{i}\) to balance the control sample on up to three central moments. This process ensures, through thousands of iterations, that a set of non-zero weights will minimize the distance between the characteristics of control students \(\left( {{\text{x}}_{\text{i}} | {\text{t}} = 0,{\text{w}}_{\text{i}} } \right)\) and the characteristics of their treated counterparts \(\left( {{\text{x}}_{\text{i}} | {\text{t}} = 1} \right)\) (Hainmueller and Xu 2013). This distance reduction can be expressed as \(\left( {{\text{x}}_{\text{i}} | {\text{t}} = 0,{\text{w}}_{\text{i}} } \right) \approx \left( {{\text{x}}_{\text{i}} | {\text{t}} = 1} \right)\) in the mean, variance, and skewness for each \({\text{x}}_{\text{i}} |{\text{t}} = 0\). This minimization process follows the Newton’s optimization method in a similar fashion as other data driven optimization methods implemented in the synthetic control method framework (Abadie et al. 2010), for example. See Hainmueller and Xu (2013) for more details regarding the creation of the EB weights and the mathematical implementation of the Newtonian optimization process.

Performance Tests for PSW and EB

Even though neither PSW nor EB can adjust for unmeasured covariates that may have impacted participants’ college-choice decisions, Ridgeway et al. (2014) argued that the quality of the adjustment for the observed covariates achieved by PSW can be tested with the following conditions. First, the weighted statistics of the covariates of the comparison group(s) should be statistically the same to those of the treatment group. This property can be corroborated in Table 1 for PSW and Appendix Tables 8 and 9 for the EB procedures. Second, the absolute standard differences in observables should shrink, as shown in Fig. 3a, b in Appendix for the PSW approach. Finally, the propensity scores estimates should cover the entire 0–1 probability of being in the treatment and control groups. This property is shown in Fig. 3c, d in Appendix. In short, all these properties were met across samples as described further in the “Findings” section, which is a good indication of their performance in the current study.Footnote 7

Hainmueller and Xu (2013) argued that (a) if the number of iterations allowed during the optimization process is large enough to find a set of wi that successfully minimizes the distances in the three moments and (b) there is no collinearity problems among the xi, then a table showing whether balance was achieved is not necessary. Nonetheless, to compare the performance of EB with that of PSW, the balance tables resulting from this approach are presented in Appendix Tables 8 and 9. Although the optimization process balanced on the three central moments, due to space constraints the results shown below contain only the mean and standard deviation (square root of the variance) of the indicators included to predict e(x).

Doubly Robust Specifications Using PSW and EB

Both PSW and EB rendered weights to create a balanced control sample. The main advantage of these weighting methods is that these weights can be used like survey sampling weights, thus allowing researchers to employ them in different statistical approaches, including doubly robust procedures. In this study, the final set of models estimated the predicted effect of initial enrollment in the 2-year sector on total undergraduate loan debt accumulated and outstanding balances owed as a function of individual-, institutional-, and state-level indicators that took place during college enrollment. This approach is recommended by Ridgeway et al. (2014) as a strategy to either adjust for predictors of treatment status that remain unbalanced or to include covariates that were captured after the treatment assignment took place or both. Here the models relied on pre-college indicators to estimate the propensity to 2-year enrollment, subsequently the expected variation of the outcomes was measured as a function of during-college enrollment indicators and treatment status using the PSW and EB weights.

Note that Table 1, Appendix Tables 8 and 9 not only shows the variables used in estimating the propensities toward treatment assignment but also indicates that a total of 14 of these 34 student-level variables presented problems of missing data. Due to the theoretical relevance of the variables chosen, instead of dropping participants with missing responses, methods of multiple imputation using chained equations (van Buuren and Groothuis-Oudshoorn 2011) were implemented.Footnote 8 Finally, note that models with and without survey weights included in NELS and ELS were used during the balancing procedures and rendered the same inferences with negligibly differences in the balances. Accordingly, the inferences made herein can be applied to the respective national populations in the 1990s and 2000s.

Sensitivity Analyses: Unobservable Selection and Coefficient Stability

The model-building process presented in this manuscript primarily relied on participants’ self-selection based on their observable characteristics. There were two primary tests used to verify how sensitive the models were to unobservables affecting the inferences discussed below. The first was the Heckman control function, which yielded similar inferences to the models presented herein. Nonetheless, given the assumptions behind this analytic procedure (see González Canché 2014b, 2017a), this approach has been criticized. Accordingly, this study in addition relied on a recent approach called unobservable selection and coefficient stability (Oster 2017). In this approach, one can compare unconditional models that only included treatment status as a predictor per each outcome of interest with models that in addition included the indicators used to predict treatment status, which are the variables effectively included in Table 1. According to Altonji et al. (2005) and Oster (2017), the inclusion of these predictors will increase the R-squared (or \(R^{2}\) in Table 1) in the model according to a given outcome of interest (i.e., total debt accrued, owed and repaid as show in Table 1). By adding these covariates one can assess for the stability of the magnitude and direction of the coefficient associated with treatment status. Notably, although the variable selection employed in this study aimed to capture as much observed information as possible that may not only be associated with treatment status, but that also may have affected the outcomes of interest, there may have remained other unobserved factors that may have affected participants prospects to select initial enrollment in the community college sector. From this view, considering that the estimation strategy merely relies on observables, it is appropriate to test for stability of coefficient based on unobservables following Oster’s approach.

This method renders an estimate of a coefficient \({{\updelta }}\) that measures the magnitude required for the selection on unobservables, as a proportion of selection on observables, to “wipe out” the coefficient magnitude associated with treatment status. More specifically, following Altonji et al. (2005) and implemented in Oster (2017), the estimation of \(\updelta\) is obtained as follows

where \(\delta\) can be interpreted as capturing how large the effect of unobservables (\(w_{2}\)) needs to be relative to the effect of observables (\(w_{1}\)) for the coefficient associated with treatment status to be zero. This implies that this test is appropriate when the treatment effect is statistically significant.

In the test for coefficient stability, Oster (2017) argues that unobservable selection may be captured by changes in the coefficient of determination or \(R^{2}\), which measures the proportion of variance explained by the observables. Oster goes on stating that rarely do models’ \(R^{2}\)s reach their maximum value of 1, but that one can increase this value to an upper bound of 0.3. This is conceptually important given that by increasing this value 0.3 times researchers, would be scaling the coefficient of proportionality to a new value referred to as Rmax. Following Oster’s recommendation, the sensitivity tests shown in Table 1 were computed with a Rmax value of each model’s observed \(R^{2}\) multiplied by 1.3 (\(R^{2}\)*1.3 = Rmax). If coefficients present small to no changes when the explained variance grows, then a high degree of selection on unobservables proportionate to the estimable degree of selection on observables would be necessary as captured in \(\delta\). In this view, \(\delta\) captures how important selection on unobservables is required to be in order to either make the treatment coefficient zero or to explain any of the observed gaps in the estimated outcomes associated with treatment status. For example, if the estimated delta is 4.5, one can conclude that selection into the community college sector based on unobservable determinants would have to be 4.5 times as informative as selection based on the observed characteristics for the observed treatment coefficient be zero or, that the observed gaps are due to unobservables. These tests were executed with models that regressed the outcomes of interest and included treatment and control variables (shown in Table 1) with (see columns 4-year wt in Table 1) and without PS weights (see columns 4-year uwt in Table 1). In all instances of unweighted procedures, the \(\delta\)s indicate that selection based on unobservables would have needed to be at least twice as important as the selection based on observables. Notably, when the selection based on observables in addition included the PS weights, these \(\delta\) magnitudes increased to at least 6.8. In conclusion, the findings presented below are robust to selection issues based on unobserved indicators, providing more evidence about the quasi-causal effect of enrollment in the community college sector and variations in different forms of debt burden.

Findings

This section contains the study’s summary statistics and inferential analyses. The former presents the distribution of the predictor and control variables used in the computation of the propensity scores relying on PSW (Table 1) and EB procedures (Appendix Tables 8 and 9). These tables also contain the results of applying the PS and EB weights to assess whether balance was achieved. Changes in the distribution of borrowing participation across decades along with the distribution of the outcome variables across decades are presented in Tables 2 and 3, respectively. To close the descriptive section, Table 10 in the Appendix contains the distribution of the control indicators used in the doubly robust procedures. In line with the research questions, the inferential section contains results of loan debt accumulation and outstanding debt balance (or debt burden) as of the last wave of data collection across samples (2001 in NELS and 2013 in ELS). These results are separated by participants’ 4-year degree attainment status and can be found in Tables 4 and 5. Finally, Table 6 presents estimates of debt repayment to more comprehensively assess changes across decades and within sectors over and above borrowing participation. In accordance with the conceptual analytic strategies delineated in Fig. 1 and informed by the research questions, Table 4 contains all students regardless of whether they relied on student loan debt, whereas Tables 5 and 6 are restricted to actual borrowers.

Summary Statistics: PSW and EB Performance

Table 1, Appendix Tables 8, and 9 serve a triple function. They (a) contain the summary descriptive statistics of the covariates and factors utilized to account for baseline differences between 2- and 4-year entrants, (b) test whether the weighting procedures reduced these baseline differences when creating the counterfactual scenarios in the NELS and ELS samples, and (c) enable assessment of how 2- and 4-year entrants changed across the decades observed.

The result of the PSW approach is shown in Table 1, wherein the columns “2-year” and “4-year uwt” (where uwt stands for unweighted) contain the raw mean values describing the characteristics of 2- and 4-year entrants. The literature review and the conceptual lenses used suggest that these factors and covariates should be systematically different across sectors.

As expected, 70% (NELS) and 86% (ELS) of the unweighted distributions in the samples present statistically significant differences across 2- and 4-year entrants. Notably, the 16-percentage point difference across decades suggests that the system has become more stratified, with the most recent cohort showing greater disparities across students’ resources and academic performance given their initial sector of enrollment. The PSW results are shown in the columns “4-year wt” (where wt stands for weighted). In this case the control group is 4-year students who were weighted to resemble the baseline indicators of 2-year students. These results indicate that, compared to the 2-year student characteristics, none of the weighted baseline variables of 4-year entrants presented statistically significant differences in the samples.

The standardized contribution of each explanatory variable is shown under the column “ % Infl” in Table 1. The two samples consistently indicate that measures of academic achievement (grades), expectations of a 4-year degree, and socioeconomic status in high school played important roles in distinguishing between 2- and 4-year entrants. The most important predictor in the NELS model was having taken the ACT or SAT test for college admission, followed by expectations of attaining at least a 4-year degree. In the ELS sample the most influential predictor was the expectation of obtaining at least a bachelor’s degree, followed by having taken the ACT or SAT tests. It is likely that having taken the SAT/ACT tests in the ELS sample was not the most influential factor given that 98% of 4-year entrants did so, whereas in the NELS sample only 89% took at least one of these tests, which allowed for more variation to be modeled. Although SES became less influential as a predictor in the ELS sample, it is worth noting that 2-year entrants consistently came from lower income backgrounds across samples, as reflected by their negative mean values in this index,Footnote 9 which is composed of education level, income, and occupation prestige of students’ parents or guardians.

Appendix Tables 8 and 9, show the results obtained from the EB procedures. In addition to the weighted and unweighted distributions of the control sample and the unweighted distributions of the 2-year sample, these tables show the standard deviation and the probability values testing whether control participants’ xis are significantly different when compared to the treated sample’s xi distributions. In both samples the unweighted comparisons mirror those obtained in the unweighted versions of the PSW procedure. More importantly, none of the weighted comparisons obtained from the EB show differences. Indeed, the performance of EB in recreating truly similar samples is remarkable.

In conclusion, both the PSW and the EB render weights that result in balanced samples with regards to baseline characteristics that predict treatment status. For comparison purposes, a set of inferential models use these weights to estimate the effect of initial sector of enrollment on students’ debt outcomes. In addition, a subsequent set of models accounts for the expected variation of the outcome variables using factors measured during college enrollment (see Appendix Table 10) that likely affected the variation in the outcome of interest over and above probabilities of treatment assignment and/or selection as depicted in Fig. 1.

The main patterns observed in Table 1 are as expected: 2-year entrants in both samples were consistently more likely to have fewer sources of monetary, social, and economic support. The distribution of pre-treatment (high school) SES scores reflects that 2-year entrants came from lower-income families, were more likely to have attended public elementary schools, and had less support from teachers, relatives, and parents to attend college after high school graduation than their 4-year counterparts. In addition, 2-year entrants in the ELS sample were more likely to consider financial aid offerings in college as an important condition influencing their decisions to continue with their education. With regard to academic achievement, 2-year entrants were less likely to take advanced placement classes and PSAT, SAT, and ACT tests. They also were more likely to have stopped their schooling at some point during their K-12 education, to be married, and to have children before college enrollment.

Figure 4a, b in the appendix show the absolute weighted and un weighted standard mean differences of baseline covariates used in the first stage of the PSW approach in the NELS and ELS samples, respectively. Congruent with Table 1, in both samples the weighting mechanisms significantly reduced baseline differences between participants. Figure 4c, d in Appendix show the common support upon which the analyses were conducted. This figure is important given that it shows the propensity score density distribution of 2- and 4-year entrants with respect to their probabilities of starting college in the 2-year sector. The density plots of 4-year entrants consistently showed positive or right skewed distributions, which means that across decades there were few 4-year entrants with high propensities toward initial 2-year enrollment. This positive skewness is reflected by their corresponding boxplots, which corroborated that not only did most of the 4-year entrants have lower propensities toward initial 2-year enrollment, but that 4-year entrants with high propensities toward initial 2-year enrollment were classified as outliers in the 4-year subsamples. The information in Fig. 3c, d in Appendix is particularly relevant when deciding between using matching or weighting procedures. In cases like the ones presented in this study, with skewed distributions and outliers, finding matches across the common support would be troublesome in some regions of the 0–1 propensities toward treatment. This hurdle would likely lead to facing one or two of the limitations depicted in the methods section above (dropping cases and/or lack of balance). Despite these density distributions, as described above and shown in Table 1, the weights resulting from the GBM and the Newton’s optimization created control groups that resembled 2-year students’ observed attributes at the moment of college entry.

Summary Statistics of Students’ Borrowing Participation and Debt Distribution

The majority of students during the 2000s (see Table 2), regardless of bachelor’s degree attainment status, relied on student loans to finance their education. The observed increase of borrowers across decades was 15.12 percentage points, reaching 57.2% in the 2000s compared to 42.08% during the 1990s. Among these students, the subgroup that increased participation in borrowing behaviors the most (with a 22.84 percentage point change) was configured by non-4-year degree holders who began college in the 4-year sector (reaching 66%). The second and third most active subgroups in the 2000s were 2- and 4-year entrants who attained a bachelor’s degree (65% and 60%, respectively). Although these percentages provide a summary of students’ borrowing participation, they do not address the questions related to debt accumulation and burden that motivated this study.

Table 3 contains the summary statistics of the non-self-reported undergraduate loan information in 2018 dollars. These loan amounts were restricted to undergraduate enrollment and included only participants whose highest degree attained as of the last wave of data gathered was a 4-year degree. The rationale behind this decision was to avoid cases wherein debt burden was due to participation in graduate or professional degrees that may have implied limited exposure to the labor market, which would then have constrained participants’ possibilities of repaying their undergraduate loan debt (González Canché 2017a). Once more, the loan information is disaggregated by NELS and ELS samples and within each sample by initial 2- and 4-year enrollment and by a subsample of actual borrowers.

The aggregate samples show that ELS participants requested 1.4 more loans, on average, that their NELS counterparts a decade later. Regardless of sector of initial enrollment and borrowing status, the total amount disbursed grew by around $5800 USD on average across decades. Note that 2- and 4-year entrants in the 2000s repaid 3.26 times the amounts repaid by 2- and 4-year entrants in 1990s. Aside from having repaid more, the amounts still owed 9 years after initial college enrollment in the later ELS sample were about $3000 higher than the amounts owed by students captured in the NELS sample ($8350 and $5204, respectively). Initial 2- and 4-year entrants in the ELS sample had an outstanding loan debt balance 47% and 43.5% higher than the balances observed the NELS sample.

When these summary statistics are limited to actual borrowers, regardless of the attainment of a 4-year degree, the debt amounts accrued, repaid, and owed show important variations. The average amount borrowed by 2-year entrants in the ELS sample increased by $6000 with respect to the amounts borrowed a decade earlier (growing from $13,061 to $19,210). 2-year entrants in the ELS sample also repaid twice the amount repaid by their predecessors, reaching an outstanding balance as of 2001 of $15,360 USD, on average (sd = $16,591). Notably, the magnitudes of debt accrued held true for initial 4-year entrants, with the main difference being that ELS 4-year entrants repaid three times as much debt as their NELS counterparts, reaching an average repaid amount of more than $9250 on average (sd = $12,386). Comparisons between sectors, within decades, indicate that 4-year entrants in the ELS sample accrued about $3700 more debt than their 2-year counterparts; however, these 4-year entrants also repaid about $4890 more than initial 2-year students. These higher repayment activities explain why the outstanding balances are slightly lower for initial 4-year entrants in the ELS sample than the balances observed for 2-year participants. Repayment behaviors in the NELS sample across sectors show smaller differences, with 4-year entrants repaying about $1000 more than their 2-year counterparts.

Table 10, in the appendix, contains the variables used in the doubly robust estimations. The row “Tuition & Fees” shows the average total cost of tuition and fees paid during undergraduate education by sector of entrance. In general, 2-year entrants in the NELS sample paid higher average total cost of tuition and fees during undergraduate education than their 4-year counterparts. These average costs increased considerably in the ELS sample, almost tripling these average costs paid by 2-year entrants across decades. This table also shows a slight decrease in the proportion of grant recipients across cohorts and sectors and an increase in the proportion of students who relied on loan aid. These two trends are in accordance with national trends in higher education (see College Board 2014). Notably, the proportion of 2-year entrants who received grant aid was consistently lower across decades (below 0.385) compared to the proportion of 4-year entrants (0.50) who also received grant aid. Similarly, work-study recipients were concentrated in the 4-year sector rather than in the 2-year sector across decades. In terms of locale, the highest proportion of students attended institutions located in cities, and suburban areas, with about 20% of 2-year entrants attending an institution located in rural areas.

An interesting difference across selectivity in the 2-year sector is that in the NELS sample only about 50% of the community colleges represented were classified as open-door institutions according to the IPEDS. A decade later, this percentage increased to 96.2%. The merging process used to create this indicator was the same across samples, with this information directly retrieved from the IPEDS. State and regional indicators show important disparities in mean amounts of state merit aid disbursements across decades, increasing seven times for 2-year entrants and 10 times for 4-year students. In the case of need-based aid, 2-year entrants were located in states that had higher average disbursements across decades compared to the state-level disbursements for 4-year entrants. Disposable income was similar for both 2- and 4-year entrants, but such amounts almost doubled in the 2000s. The number of potential demanders of higher education (population 18–24 years of age) increased across decades. In terms of regional agreements, in the 1990s 2-year students were concentrated in states located in the Western Interstate Commission for Higher Education region (31%), whereas their 4-year counterparts were clustered in states that belonged to the Southern Regional Education Board region (34%). Taken together, all the differences highlighted herein serve to justify the need to include these indicators in doubly robust procedures.

Quasi-Causal Results

The results presented in this section are divided into two broad categories: average sector effects on all students (Table 4) and average sector effects on borrowers (Tables 5 and 6). All the tables present the real average dollar estimates (in 2018 USD) for 2- and 4-year entrants. Models with logarithmic transformations of the outcome variables rendered similar inferences.

Tables 4 and 5 contain 64 models in total (32 in each table). In line with the research questions and the analytic strategy shown in Fig. 1, each table presents results separated by 4-year degree holders and non-4-year degree holders. Moreover, each subgroup contains estimates of the total amounts in undergraduate loan debt accrued and of the amounts of outstanding balances owed by participants as of the last waves of data collection. Table 4 contains all NELS and ELS participants, whereas Table 5 is limited to actual borrowers within each sample. The first two sets of models in each table show the amounts disbursed to and outstanding balances owed by 4-year degree holders. Results from the next two sets of models show the amounts accrued and still owed by non-4-year degree holders. Finally, each table shows PSW and EB estimates with and without adjustment for the indicators contained in Table 10. The inclusion of non-doubly robust estimates serves to test whether the inferences obtained without controlling for during-college enrollment indicators held true using doubly robust estimators.

Amounts Accrued and Owed by All 4-Year Degree Holders

The non-doubly-robust PSW and EB estimates shown in Table 4 consistently reflect that during the 1990s (NELS sample) beginning college in the 2-year sector and attaining a 4-year degree resulted in similar amounts of debt accumulation, compared to beginning in the 4-year sector and obtaining a 4-year degree, a finding that is similar to the conclusion reached by (González Canché 2014b). In the ELS sample only the PSW indicates a significant reduction of debt accumulation, with the EB estimate not reaching a p.value of 0.05. The doubly robust estimates render different conclusions. These estimates consistently show that across all estimates, the 2-year path toward a 4-year degree resulted in an expected lower debt accumulation than the 4-year path to a 4-year degree.

With respect to outstanding debt burden as of the last wave of data collection, the non-doubly-robust PSW and EB estimates consistently reflect no difference in amounts across samples as a function of initial sector of enrollment for 4-year degree holders. Nonetheless, the doubly robust models indicate that in the 1990s, NELS participants who began college in the 2-year sector and attained a 4-year degree had lower debt burden in the last wave of data collection than their 4-year counterparts who also attained a 4-year degree. For ELS students a decade later, there were no differences in the PSW doubly robust estimates, but the EB doubly robust models indicate an increase of about $700 in 2018 USD in the expected outstanding debt burden for 2-year students who attained a 4-year degree. Recall that these estimates include all undergraduate students regardless of whether they used debt to help finance their college education.

Amounts Accrued and Owed by All Non-4-Year Degree Holders