Abstract

Two recent enforcement actions highlight important aspects of the economic analyses that have been performed at the Antitrust Division of the U.S. Department of Justice over this past year: The Novelis-Aleris merger illustrates how the decision-making tools that are used by market participants can reveal market characteristics that are key to merger analysis. The acquisition of Aetna by CVS raised several novel issues. A complex regulatory framework affected optimal bidding behavior among insurers and injected unique considerations into the analysis of a horizontal consolidation. Analysis of vertical aspects of the merger required accounting for variation in the mode of competition across a supply chain.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The Antitrust Division of the U.S. Department of Justice brought enforcement actions in several markets this past year, including mobile wireless services, retransmission of media content, and booking services for air travel, among others.To inform these enforcement decisions, Division economists conduct analyses that apply economic tools and principles that encapsulate the most important elements of competition to estimate the likely impact of mergers and other conduct.

This paper discusses two of the Division’s recent investigations that highlight different aspects of how our economists work to evaluate potential harm and, when appropriate, support an enforcement action: The investigation of the Novelis-Aleris merger, which culminated in arbitration, provides an example of how the analysis of ordinary-course-of-business documents can offer opportunities to make critical economic inferences from real world data. Using a tool that the acquiring firm used to predict the aggregate demand for the product at issue, Division economists found that an attempted increase in the price of aluminum auto body sheet would not be disciplined by substitution to steel.

The investigation of the CVS-Aetna merger, which culminated in a Tunney Act review in U.S. District Court, presented challenges for the analysis of both horizontal and vertical issues. The horizontal issues were complicated by Medicare’s regulatory framework. We explain how this regulation creates discontinuous jumps in demand that served to heighten the anticompetitive concerns from the merger. The vertical issues were complicated by differences in competition across multiple levels of supply chains with varying levels of vertical integration. Division economists found practical solutions to these modeling challenges.

2 Novelis Acquisition of Aleris

In July 2018, Novelis Inc. announced its intent to acquire the Aleris Corporation for $2.6 billion. Both firms are global producers of flat-rolled aluminum, which is used to manufacture aircraft and automobile parts, beverage cans, and other specialty products in construction, packaging, and electronics. After a careful investigation, the Antitrust Division became concerned about the acquisition’s impact on the market for aluminum autobody sheet (ABS). Aluminum ABS is used primarily in the manufacture of a car’s “closures” like the hood, doors, and liftgate as opposed to the car’s structural parts. Novelis and Aleris were two of only four firms with aluminum ABS manufacturing facilities in North America. The Division concluded that the acquisition of Aleris, a relatively new entrant into North America, by industry leader Novelis would, if unremedied, lead to higher prices for car manufacturers and ultimately higher prices for automobiles.

2.1 Competitive Concerns Lead to Arbitration

Historically, all car closures were made from steel, and even today steel is the leading material in the manufacture of closures. But despite being three to four times more expensive than steel, aluminum ABS has been displacing steel. Aluminum’s distinct advantage is weight. A part manufactured from aluminum is generally 30 to 40 percent lighter than traditional steel, and car manufacturers have faced increasing regulatory and competitive pressures to “light-weight” cars, driving demand for aluminum ABS despite the significant price premium over steel.

Two factors are driving this adoption: One is the increasingly strict fleet fuel standards – which are known as Corporate Average Fuel Economy or CAFE – that have forced car makers to remove weight from vehicles to improve fleet gas mileage. The other – which are referred to as “secondary benefits” – arises from consumer preferences and production complementarities that are correlated with lighter vehicles. These include better handling, better gas mileage, and the ability to use a smaller engine or less powerful brakes. As a result, the demand for light-weighting is not uniform across vehicles. Demand is greatest for the heaviest vehicles – sport-utility vehicles (SUVs) and pick-up trucks – where CAFE standards are more likely to bind and the value to consumers of improved handling and better gas mileage is greatest.

Concerned that this acquisition would eliminate important competition between the aluminum ABS manufacturers, the Antitrust Division filed a lawsuit to enjoin the acquisition in September, 2019. If allowed to proceed with the merger, Novelis would have accounted for the majority of North American aluminum ABS capacity. In addition, ABS manufacturers enter long-term contracts that commit their capacity for many years. Novelis and Aleris were best positioned in the near term to compete for new business from car manufacturers because Aleris, as a relatively new entrant, had significant excess capacity and Novelis was expanding capacity.

Novelis maintained that steel was the incumbent material and that the acquisition should not raise competitive concerns because car makers could defeat any attempt to exercise market power over aluminum ABS by reverting (or threatening to revert) parts to steel. Indeed, the automotive uses of steel are so prevalent that in any market that includes both aluminum ABS and steel, the merged firm would have a tiny market share.

Both sides agreed that the question of market definition was pivotal.Footnote 1 If, as Novelis maintained, a relevant antitrust market could not exclude steel, the Division would be unlikely to persuade a court that the merger would have anticompetitive effects. However, if the relevant market for analyzing the transaction is the narrower, aluminum ABS-only market, the Antitrust Division would enjoy a strong presumption of anticompetitive harm and would be likely to prevail at trial.

The Antitrust Division and Novelis agreed to embark on a unique road: Arbitrate the single issue of market definition. Both sides would present evidence to an arbitrator, who would decide on the appropriate relevant product market. If the arbitrator found a narrow aluminum ABS market, Novelis would divest all of Aleris’s domestic aluminum ABS capacity. If the arbitrator found that steel was necessarily part of the relevant market, the acquisition would proceed unencumbered.

2.2 Market Definition Presents a Focused Economic Question

The purpose of defining a market for antitrust is to focus the analysis on those products that impose significant competitive constraints to the products of the merging firms. It is generally a demand-side exercise that identifies which products consumers would turn to in response to a price increase. Not every substitute need be included in the market. The standard for delineating the market used in the Horizontal Merger Guidelines and generally adopted by courts is the “hypothetical monopolist” test. The test asks if a hypothetical monopolist could profitably impose a small but significant increase in price (SSNIP) – most often 5% – on at least one product in the candidate market, including a product of the merging firms. If it would do so, then the candidate market includes enough substitutes to qualify as a “relevant antitrust market.” Thus, the core question presented in this arbitration was whether a hypothetical monopolist of aluminum ABS would raise the price of aluminum ABS by at least 5%. If not, for example, because car makers would switch a large portion of aluminum ABS purchases back to steel, then the market is too narrowly defined and must be expanded (in this case, to include steel).

2.3 Applying Real World Evidence to the Relevant Question

The hypothetical monopolist test can be implemented in different ways: Standard empirical approaches include the use of critical loss analysis, upward pricing pressure, and merger simulation. Critical loss can be a relatively simple test to implement. Explaining how it was implemented in the present case provides a helpful context in which to highlight the opportunities that Division economists have to assemble real-world evidence to address questions that are relevant for enforcement decisions.

In this case, critical loss analysis uses estimates of the products’ contribution margin to calculate a critical threshold for aggregate elasticity to determine whether a given price increase would be profitable. If the actual elasticity of demand is greater than (more elastic than) this critical elasticity, the price increase is unprofitable. If the actual elasticity is less than the critical elasticity, the price increase is profitable. Key, then, to this critical loss analysis is estimating the actual aggregate elasticity for the candidate market.Footnote 2

2.3.1 Novelis’s Demand Model

Finding an accurate estimate of the aggregate elasticity can be challenging. While the Antitrust Division has civil-investigative powers, the data that are required to econometrically estimate the aggregate elasticity may not be available; and even when they are, good identification strategies for avoiding well-known endogeneity issues may not exist. The Antitrust Division also has access to internal business plans that reveal a firm’s decision-making processes and can sometimes be used to infer demand elasticities. But these approaches do not always yield a specific prediction or relate directly to the specific questions that arise in antitrust analyses. Thus, finding elasticities remains a significant challenge to implementing some economic models.

This case, however, offered the type of real-world evidence that can provide valuable insights for economists. Novelis had invested in and utilized a demand model to assist in planning for future capacity investments. The model was designed to forecast total market demand for aluminum ABS based on a number of product characteristics and the utility that car manufacturers derived from using aluminum ABS.

At its core, a tool that determines the input material for a part should balance two factors: The first is the cost of using aluminum instead of steel for a part. Using the prices of raw aluminum and steel and their conversion to the part at issue, one can calculate the extra cost for aluminum for each kilogram of weight saved. This estimated cost should account for the relative efficiency from using aluminum on a part-by-part basis.Footnote 3 This cost needs to be weighed against the second factor, a measure of a car maker’s willingness-to-pay for light-weighting. The willingness-to-pay is a function of the level of CAFE standards, the vehicle class, its retail price, and other characteristics, such as whether it is an electric vehicle (where light-weighting is critical for the vehicle’s range). If the willingness-to-pay exceeds the cost, this type of model would predict that the part would be made from aluminum.

The model calculated total demand for aluminum ABS by aggregating the demand on a part-by-part basis from the individual parts of every vehicle in design or expected to be redesigned in the future. This type of internal demand model thus provides an opportunity to raise the price of aluminum ABS (within the model) and observe how the model predicts market demand to respond, holding all other factors constant. Essentially, using the model in this way yields an estimate of the aggregate elasticity of demand that is derived directly from the parties’ in-the-ordinary-course-of-business documents.

Inherent in the creation of this demand model is a recognition that aluminum and steel are functional substitutes where a sufficiently large price differential could generate substitution back to steel from aluminum. Market definition, however, does not turn solely on whether the cross-price elasticity is positive. Instead, to determine whether steel is a close enough substitute to necessitate its inclusion in the relevant market, the demand for aluminum ABS needs to be elastic enough to render unprofitable a price increase of at least a SSNIP by the hypothetical monopolist. Put differently, in the absence of price discrimination, are there enough parts that would switch to steel in response to a SSNIP to make the price increase unprofitable?

The Division often considers actual business processes, used by market participants, in its attempts to answer the key questions in its merger analyses, and Novelis’s demand model was well suited to this purpose. By varying the price of aluminum ABS in the model and holding all else constant, the demand curve for aluminum ABS could be traced out. In response to small changes in price, the Division concluded that very few parts made from aluminum ABS would likely switch back to steel. As a result, the aggregate elasticity that was implied by the Novelis model was less than the critical elasticity, which demonstrated that aluminum ABS is a relevant market.

The arbiter in this case found that aluminum ABS is a relevant antitrust market, pointing to, among other evidence, the documentary record of price reductions that were driven by competitive bidding among aluminum ABS suppliers rather than by the threat of substitution to steel. As a result of the arbiter’s ruling, the Division secured a divestiture of Aleris’s North American ABS capacity.

3 The Merger of CVS & Aetna

In December 2017, CVS Health Corporation announced an agreement to acquire Aetna Inc. for approximately $69 billion. The nation’s largest retail pharmacy chain – which was already a major supplier of pharmacy benefit manager (PBM) services that connected health insurance plans to pharmacies and drug manufacturers – would merge with the nation’s third-largest health insurance company.Footnote 4 CVS and Aetna were also two of the four largest providers of individual prescription drug plans (“PDP”) to Medicare-eligible consumers – a horizontal combination that would likely lessen competition substantially in a number of markets for these plans.Footnote 5 Due to the nature of the regulatory algorithm that is used to assign lower-income consumers to these plans, our competitive concerns were especially pronounced in PDP markets where the merging firms together accounted for a high share of lower-income consumers.Footnote 6

Division economists also spent a substantial amount of time investigating whether anticompetitive harm would result from the vertical combination of several lines of Aetna’s insurance business with CVS’s presence throughout the pharmacy services supply chain. The Division found that the merger was unlikely to result in a substantial lessening of competition from these vertical combinations. In reaching that decision, Division economists needed to address modeling challenges that had not been previously addressed in the academic literature.

3.1 A Horizontal Theory of Harm in Medicare Prescription Drug Plans

Medicare Part D was established by the Medicare Modernization Act of 2003 (MMA) to cover prescription drugs that are not covered by Parts A or B of Medicare, which insure Medicare-eligible Americans for expenditure on hospital and physician services, respectively. An individual who is enrolled in traditional Medicare can access the Part D benefit through the purchase of a standalone PDP. PDPs are offered by private insurers that compete for enrollment in one or more of the 34 regions that are designated by the Center for Medicare and Medicaid Services (“CMS”).Footnote 7 Individuals with incomes below a certain threshold qualify for a low-income subsidy (“LIS”), which covers a given dollar amount of their Part D premium.Footnote 8 In 2018, approximately 36% of the individuals who were enrolled in a PDP were LIS eligible.Footnote 9 As discussed below, the method by which the amount of the subsidy is determined and the mechanism for enrolling LIS-eligible individuals who do not actively choose a plan have important implications for economic modeling and the assessment of potential competitive effects in these markets.

3.1.1 Modeling LIS Auto-Enrollment

There are three related aspects of the regulations that surround the LIS that have the potential to alter the competitive effects from the merger: First, the amount of the per-enrollee LIS (which is also known as the “LIS benchmark”) in each of the 34 regions is calculated as the LIS-enrollment weighted average of premiums for that region. This means that insurers with a higher percentage of the LIS-enrollment will have a greater influence over the LIS benchmark.

Second, when a newly LIS-eligible individual fails to choose a PDP, she is randomly assigned to a plan that is priced at or below the LIS benchmark.Footnote 10 Such PDPs are termed “zero premium” because the federal subsidy completely offsets the premium costs for LIS-eligible individuals. This introduces a discontinuity into the demand function that insurers face. The discontinuity arises because the insurer will receive a large amount of enrollment in the form of LIS auto-enrollees if its PDP is priced at or below the LIS benchmark. The precise change in the quantity that is demanded for a PDP due to pricing at or below the benchmark is affected by the number of LIS eligible individuals, the portion of LIS-eligible individuals who do not choose a plan, and the number of insurers who bid at or below the benchmark. It does not, however, depend on the premium that the insurer charges as long as the premium is at or below the benchmark.Footnote 11

Finally, insurers that have previously auto-enrolled individuals in their plan may keep those enrollees if their current year premium is below or within a de minimis amount of the LIS benchmark. This introduces a second discontinuity in the demand curve at the “de minimis price”.Footnote 12

In order to highlight the impact of these factors, Division economists modeled demand for a PDP as the sum of the following four sources of demand: (1) individuals who do not qualify for a LIS and therefore face the full premium that is set by the insurer; (2) LIS-eligible individuals who actively choose their plan; (3) newly LIS-eligible individuals who do not choose a plan and are therefore auto-enrolled in a zero-premium plan; and (4) LIS-eligible individuals who were previously enrolled automatically and therefore either remain in their existing plan or are moved by CMS to another plan if their previous plan is no longer zero-premium.

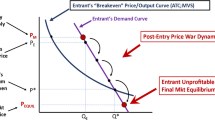

Figure 1 below shows a simplified version of the aggregate demand for a single PDP.Footnote 13 As described above, the third and fourth categories of demand, the auto-enrollees, explain the two discontinuities in demand depicted in Fig. 1. Demand from each of these groups is only sensitive to whether the bid premium is above or below the LIS benchmark or the de minimis price, respectively. The fourth group generally makes up a larger portion of the overall auto-enrollees.Footnote 14 Therefore, plans that have achieved auto-enrollment in the past are particularly concerned with keeping their premium below the benchmark. In many PDP regions, CVS and Aetna had significant numbers of LIS customers, including the auto-enrollees who are responsible for these discontinuities. This motivated our decision to incorporate the complexity that is associated with these two categories of PDP demand into our analysis of the merger.

Our analysis revealed the importance to an insurer’s bidding strategy of the uncertainty that surrounds the values of the benchmark and the de minimis price. This uncertainty should cause at least some PDP insurers to shade their bids in order to remain below these thresholds and in particular below the de minimis price.Footnote 15 The loss of customers from bidding just above the de minimis price are typically much greater than the marginal gains from a price reduction once the price is already below the threshold.Footnote 16 Furthermore, an insurer’s existing number of LIS customers increases the weight of that insurer’s bid in CMS’s calculation of the LIS benchmark. As a consequence, an insurer with greater enrollment of LIS customers would be less likely to exceed the de minimis price for any given bid premium, all else equal, as a matter of arithmetic.Footnote 17

Since the merger would raise CVS’ percentage of LIS members by a substantial amount in some regions, CVS’s bids would command substantially greater weight when calculating the benchmark. Therefore, the merger would convey to CVS greater certainty about where the LIS benchmarks would be relative to its own bids. This would allow the merged firm to increase its basic plan premiums with less concern about bidding more than a de minimis amount above the LIS benchmark: The reduced uncertainty should lead the merged firm to lessen the amount by which it shades its bids in its effort to remain under the de minimis price.

Therefore, economic theory suggests that our more traditional concerns of horizontal harm from combining sellers of substitute products could be exacerbated in some regions where the merger causes a substantial increase in the number of LIS members that are served by CVS.Footnote 18 The Division addressed its competitive concerns by requiring CVS to divest Aetna’s individual PDP business nationwide.Footnote 19

3.2 A Vertical Theory of Raising Rival Insurers’ Cost of PBM Services

There are a series of vertical relationships that govern the provision of pharmaceuticals in the United States. Most insurers contract out their pharmacy benefits to a pharmacy benefit manager (“PBM”). These pharmacy benefits include both a formulary – which determines the specific drugs that are covered and at what co-payment rate – and a pharmacy network: which determines where prescriptions may be filled. The PBM negotiates on behalf of the insurer with pharmaceutical manufacturers for rebates in return for placement on a formulary and with pharmacies for discounts in return for being in network.

Prior to its merger with Aetna, CVS was already present on two levels of this supply chain through its PBM and CVS pharmacies. As an insurer, Aetna contracted with CVS for PBM services. The Division’s vertical investigation considered several potential theories of harm to health insurance competition. We discuss here the possibility that the merger would provide CVS with an incentive to offer less attractive terms when marketing its PBM services to insurers that compete with Aetna.Footnote 20

Raising the costs of a significant input for rival insurers through less aggressive competition in PBM services may cause those firms to be less effective competitors in downstream markets for insurance. By acquiring Aetna’s insurance business, CVS may now benefit from such a strategy through, for example, the ability to capture some of the sales diverted from these rival insurers. At the same time, the merger also presented an opportunity to eliminate a double margin (“EDM”), as the merged firm would have access to PBM services at marginal cost. The EDM effect, if realized, could lead to more aggressive pricing of downstream insurance products: not only for the merged firm but also for rivals that may feel compelled to respond. Since the EDM effect may offset the raising rivals’ cost effect, in whole or in part, estimating the net effect of the merger through this theory of harm involves accounting for both potential effects. Our modeling, described below, considered the raising rivals’ costs and EDM effects together since they both flow from aligning the incentives of the merged firm’s upstream and downstream entities.

3.2.1 Estimating the impact of this vertical combination through modeling

We strive to apply models that capture the important elements of competition in the markets at issue. Insurers typically issue requests for proposals (RFPs) for PBM services and select a single PBM after multiple rounds of bidding. This RFP process can be modeled as a second-price auction. Second-price auction models (e.g., Brannman and Froeb (2000), Miller (2014), Waehrer and Perry (2003) have been used to analyze horizontal mergers among competing input suppliers. Podwol and Raskovich (2021) demonstrate how one might integrate such a model of bidding competition upstream with a model of downstream competition for end-customers.Footnote 21 Vertical simulation models allowed us to assess the merger’s overall impact on incentives by incorporating the benefits that the merged firm might expect from reduced competition downstream (including higher prices and capturing sales diverted from rival insurers) into its upstream bidding decision.

Applying a Podwol-Raskovich type of model to the relevant markets identified various factors that contributed to our conclusion that the merger was unlikely to lead to vertical harm. In particular, there were rival insurers that accounted for substantial shares in many insurance markets that were also vertically integrated with PBMs. These integrated rivals placed limits on CVS’s ability to increase the PBM costs of rivals and on the amount of diverted insurance sales the merged firm could hope to recapture. The Division concluded that the vertical combination of CVS’s PBM and Aetna’s insurance business would be unlikely to result in a substantial lessening of competition.

4 Conclusion

Antitrust Division economists apply economic tools and intuition to analyze markets and predict the effects of mergers and potentially anticompetitive business practices. Our work presents endless opportunities to deduce relevant insights from available evidence and to further our understanding of how competition manifests in a wide variety of settings.

Notes

See Plaintiff United States’ Explanation of Plan to Refer this Matter to Arbitration, United States v. Novelis Inc., No.: 1:19-cv-02033, ECF No. 11 (N.D. Ohio Sept. 9, 2019).

The problems that can arise without an estimate of the aggregate elasticity are well known. See, for example, Katz and Shapiro (2003).

For example, because a hood is basically a rectangle with very little scrap waste, it is very efficiently made from aluminum. Doors are less efficient because cutting out the space for the window results in expensive waste.

See Competitive Impact Statement, Case 1:18-cv-02340, Document 3, Filed 10/10/2018.

See the Complaint, paragraph 34 (available at https://www.justice.gov/atr/case-document/file/1100091/download).

Complaint, paragraph 35.

The Division conducted analyses, similar to those in the Aetna/Humana merger investigation (including switching analyses and a SSNIP test), to determine that individual PDPs were a properly defined product market. CMS regulation was again determinative for geographic market. See Gerstle et al (2017).

CMS determines the low-income subsidy amount (generally referred to as the “LIS benchmark”) for each of the 34 PDP regions by calculating the LIS-enrollment weighted average premium in that region. See https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/Downloads/PartDandMABenchmarks2020.pdf for a description of the methodology. The premiums are submitted by the PDP sponsors during the CMS bid process each year.

The subsidy may be applied only to the basic portion of a plan’s premium. There are also enhanced plans; but a LIS enrollee would be required to pay any premium that is associated with the enhanced benefit. Therefore, the LIS auto-enrollees (discussed later) are not assigned to enhanced plans, and the discussion below applies only to basic plans.

Each insurer with a premium at or below the benchmark will receive the same number of LIS auto-enrollees.

The de minimis amount is generally $2, and insurers are required to waive any premium above the benchmark for previously auto-enrolled individuals in order to maintain that enrollment. The “de minimis price” will be the LIS benchmark for the region plus $2. For instance, if the LIS benchmark was $20, the de minimis price will be $22.

One simplification is that Fig. 1 assumes that the bid premium that is submitted for this PDP has no impact on the LIS benchmark.

In a given year, LIS enrollment may increase by only a few percentage points. See footnote 9 for a link to data on LIS enrollment.

Not every PDP insurer has LIS enrollment. Some insurers seem uninterested in bidding low enough to earn LIS auto-enrollment. These insurers consistently bid well above the benchmark. The analysis here focuses on the strategy of insurers that had been bidding below (or near) the LIS benchmark prior to the merger, as CVS and Aetna had in most regions.

An insurer’s preference for being at the benchmark will depend on various factors, which include the number of new LIS auto-enrollees at stake in the bid and the amount of incumbent LIS members that previously auto-enrolled in the plan.

The same cannot be said for its likelihood of exceeding the LIS benchmark itself: Consider a simple example of two bidders A and B that simultaneously submit bids. Suppose that bidder A has a weight of 1/3 in the calculation of a benchmark and bidder B has a weight of 2/3. If each bidder perceives the other firm’s bid to be uniformly distributed between 0 and $10, then each firm would perceive the same probability of bidding below the benchmark, despite the difference in their weights. However, firm B’s greater weight reduces the probability that submitting a bid of $5 would be more than $2 above the benchmark relative to firm A’s perceived probability in exceeding this de minimis threshold when submitting a bid in the same amount.

There are additional considerations beyond those presented here: For example, an increased influence over the benchmark may also lead insurers to give greater consideration to how their bids influence the LIS eligibility of rival plans.

The divested assets were purchased by WellCare Health Plans, Inc.

The additional theories of harm included vertical effects that involved CVS’s various pharmacy businesses.

Their methodology embeds a measure of the degree to which the normal relationship between costs and bidding strategy in a second-price auction is altered by the incentives that are induced by a vertical merger and how this tends to affect downstream prices.

References

Brannman, L., & Froeb, L. (2000). Mergers, cartels, set-asides, and bidding preferences in asymmetric oral auctions. Review of Economics and Statistics, 82(2), 283–290.

Gerstle, A. D., Knudsen, H. C., Lee, J. K., Majure, W. R., & Williamson, D. V. (2017). Economics at the antitrust division 2016–2017: Healthcare, nuclear waste, and agriculture. Review of Industrial Organization, 51(4), 515–528.

Katz, M. L., & Shapiro, C. (2003). Critical loss: Let’s tell the whole story. Antitrust, 17(2), 49–56.

Miller, N. (2014). Modeling the effects of mergers in procurement. International Journal of Industrial Organization, 37, 201–208.

Podwol, J. & Raskovich, A. (2021). Analyzing vertical mergers with auctions upstream. EAG Working Paper Series, forthcoming

Waehrer, K., & Perry, M. K. (2003). The effects of mergers in open-auction markets. RAND Journal of Economics, 34(2), 287–304.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The views expressed do not purport to reflect those of the U.S. Department of Justice, and nothing in this document may be cited in any enforcement proceeding against the Department of Justice.

Rights and permissions

About this article

Cite this article

Drennan, R., Knudsen, H.C., Whalen, W.T. et al. The Year in Review: Economics at the Antitrust Division 2019–2020. Rev Ind Organ 57, 815–825 (2020). https://doi.org/10.1007/s11151-020-09793-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-020-09793-9