Abstract

This paper focuses on a novel phenomenon—mobile banking diffusion—to illuminate unresolved questions: whether and how rivalry adoption and market structure affect the diffusion of a new technology. Using a unique, hand-collected dataset from the iTunes Store for 2008–2012, this study provides evidence that the adoptions of mobile banking apps by local rivals spur future adoptions. This effect is particularly strong in concentrated markets, where banks compete on non-price attributes. These results are robust to the application of instrumental variables that address the possibility that adoptions are merely simultaneous reactions to the same common forces.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

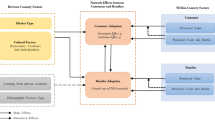

The prominent role of product market competition in spurring innovation has been the subject of a long line of research.Footnote 1 Yet, the theoretical literature on technology adoption and competition is quite limited (Milliou and Petrakis 2011).Footnote 2 Empirical studies are also inconclusive with regard to the impact of competition on adoption behavior, largely due to different definitions and measurements of competition. Moreover, research on the strategic considerations of adoption, mainly in response to the adoptions by proximate rivals, is scarce, which is further complicated by an identification challenge that adoptions might be merely simultaneous reactions to the same, partly unmeasured exogenous forces (i.e., technological opportunity).Footnote 3 Finally, almost none of the prior work explores the strategic interaction of rivalry adoption and market structure during the technology diffusion process.Footnote 4

This paper focuses on a novel phenomenon: the diffusion of mobile banking. Using a unique, hand-collected dataset that involves banks’ adoption of mobile apps from iTunes as a proxy for the adoption of mobile banking from July 2008 to June 2012, I investigate how banks react to the adoption by rivals in the same market, and whether the reactions depend on market structure. Based on a total of 99,960 bank-quarter observations with 694 adopting banks, I find that rivals’ adoptions strongly encourage the inclination to innovate, after accounting for the potential simultaneity bias through the use of an instrumental variables approach. This result provides evidence for the strategic motivation of banks in reaching their adoption decisions.

In the neo-Schumpeterian spirit, oligopolists exhibit a special affinity toward non-price competition, such as the adoption of technological innovations. To the extent that strategic features of mobile apps facilitate product differentiation, I argue that rivals’ adoptions of apps exert a greater impact on potential adopters in more concentrated markets than in less concentrated ones. Indeed, the results reveal that the likelihood of offering an app due to nearby competitors’ adoptions increases monotonically with the degree of market concentration proxied by the Hirshman-Herfinhdal index (HHI), and is the highest in the most concentrated markets. This finding supports the idea that oligopolistic firms tend to compete on non-price choices that are less subject to rivalrous retaliation than is true of price competition (Scherer and Ross 1990, p. 595).

This study makes two major contributions: First, it employs a unique, hand-collected dataset to conduct the first study of the latest generation of consumer-facing banking technology—mobile banking—to add to our understanding of the nature of firm interactions in the financial service sector, which has received growing attention in the innovation literature in the last decade (Frame and White 2015). A challenge in this literature is the absence of satisfactory measures of inventive activity. And earlier studies on technology adoptions by banks have almost exclusively relied on special survey data due to the scarcity of suitable data (e.g., Hannan and McDowell 1984a, b; Akhavein et al. 2005).Footnote 5

Second, this paper concentrates on the extent of adoption by local rivals to shed light on the competitive interactions that exist within local markets. Research on the strategic component of adoption decision during waves of technology diffusion has been limited; two major hurdles include the quality of measurements and potential simultaneity problems. The present study addresses both issues—measurement and simultaneity—and establishes that the impact of rivalry adoptions of a technology increases monotonically with the degree of market concentration; this is a result that contrasts with the findings in the classic study of ATM adoptions by Hannan and McDowell (1987).

2 Mobile Banking

Mobile banking involves the use of a mobile phone to access financial accounts by means of a bank’s web page, either through a mobile web browser, text messaging (SMS), or a mobile application (hereafter, “mobile app”).Footnote 6 Mobile banking has grown substantially in the last few years, as is indicated in the Federal Reserve’s annual survey reports (Federal Reserve 2012, 2013, 2014, 2015).Footnote 7 In particular, mobile apps catalyze the growth of mobile banking and have been regarded as the superior mobile platform. Mobile apps create unique user experiences with rich interface capabilities for distributing banking services, and thus are better perceived as strategic technologies that enable banks to be differentiated.

Mobile apps have proliferated since July 2008, when Bank of America used the iPhone platform to introduce the first app. The number of banks with an iPhone app more than tripled from 149 to 479 during 2011 (see Fig. 1). By June 2012, which is the end of the sample period, 694 out of 6019 U.S. banks had introduced iPhone apps.Footnote 8 Table 1 presents the adoption rates by bank size (Panel A) and geographic region (Panel B). As can be seen, large banks are more likely to adopt, consistent with the prior literature on technology adoption. When they are grouped by Federal Reserve District, banks under the jurisdiction of Boston, Dallas, or St. Louis Fed show the greatest propensities to offer mobile apps, while banks in Minneapolis Fed District exhibit the lowest.

What drives the mobile app adoptions by banks? Anecdotal evidence suggests that the fundamental goal is to deepen customer relationships (Crosman 2012), since mobile apps enable banks to develop divergent distribution channels and to deliver customized financial services, thus enhancing customer satisfaction. Similar to Internet websites, mobile apps mainly offer transactional-based services. Recently, banks have started to monetize some of the mobile conveniences (Crosman 2013).Footnote 9 As such, apps might allow banks to grow revenues, while their impact on cost reduction is less clear. For example, banks may invest more in advertising to market their new mobile services, and may have to hire specialized employees to roll out and maintain the apps and to address security issues.

3 Prior Literature and Hypothesis Development

Given the vital role of financial intermediation in the functioning of the whole economy, the adoption of financial innovation by banks has long been acknowledged as an important field of study (Frame and White 2004). A recent survey by Frame and White (2015) notes increased research effort toward understanding the adoption of financial innovation in the last decade. This section reviews the most relevant studies in the literature and formalizes statements of how a firm’s adoption of a new technology depends on market structure and the adoptions by competitors in the market.

To begin, the role of market structure in technology adoption is quite ambiguous. Theoretical models suggest no economic reason to link the rewards from innovation with market structure (Reinganum 1981). Empirical evidence is also inconclusive. For instance, Hannan and McDowell (1984a, b) document that banks are more likely to adopt ATMs in more concentrated markets. In contrast, Escuer et al. (1991) show that the speed of ATM adoptions by Spanish banks is maximized at some intermediate level of market concentration. Yet, Akhavein et al. (2005) show little effect of market concentration on the adoption of small business credit scoring by large U.S. banks. Therefore, I make no prediction concerning the effect of market concentration on mobile app adoption.

Regarding the impact of adoption by rivals on the adoption decision, theory indicates two opposing forces that could generate a differential in expected profits with and without the innovation.Footnote 10 An increase in rivals’ adoptions reduces returns from adopting an innovation. However, the increase in rivals’ adoptions also reduces the profits from not adopting, as customers might switch to adopting rivals for better services. Despite the ambiguous predictions, two empirical studies that examine the adoption of ATMs (Hannan and McDowell 1987) and online banking (Hernández-Murillo et al. 2010) both document a positive impact of rivals’ adoptions on bank innovative behavior, which suggests that the decline in profits from not adopting dominates. Whether prior findings hold for mobile app adoption is an empirical question because the net effect of adoption by rivals cannot be predicted with confidence.

The influence of rivalry adoptions on firm innovational effort might vary with market structure. Hannan and McDowell (1987) is the only well-known study that takes up the joint impact of market concentration and rival precedence on technology adoption. Using annual data, they find a weaker impact of rival precedence on ATM adoptions by banks in more concentrated markets and argue that the failure to adopt a successful innovation might affect the survivability of firms more profoundly in more competitive markets (Hannan and McDowell 1987). ATMs are typically a labor-saving technology and may encourage banks to compete on price, especially when adopting rivals can make pricing moves (Arrow 1962). Thus, their finding is actually in line with oligopoly theories that posit that firms in concentrated markets often find price competition unappealing due to a high degree of interdependence (Scherer and Ross 1990, p. 595).

A more important implication of oligopolistic competition to the present research is that oligopolists exhibit a special affinity toward competing on non-price dimensions such as advertising (Scherer and Ross 1990, p. 595) and quality improvements (e.g., by offering mobile financial services), which are harder to monitor and less subject to rivals’ effective retaliation than is true of price competition. Thus, observed market structure and the type of competition it promotes will condition how a firm reacts to competitors’ technological advances.Footnote 11 As a result, firms react more to rivals’ decisions of adopting apps in concentrated markets where non-price competition is more likely to prevail. This rationale leads to the principal hypothesis in this study: The influence of rivals’ adoptions on mobile app adoption is greater in more concentrated markets than in less concentrated markets.

4 Data and Method

4.1 Sample

The data on mobile app adoption from July 2008 to June 2012 were hand-collected from the iTunes Store. iTunes records all of the customer reviews for each app, including the review date. I use the date of the first customer review as a proxy for the app launch date. The page for each app in iTunes includes the link to the institutional website and the range of services that are provided. Each institution’s webpage includes the headquarters location, allowing a match to bank financial data. There were 694 mobile app adopters that were identifiable commercial banks via the “find office” option on the FDIC website and that met all the data requirements as discussed later.Footnote 12

While it would be desirable also to include mobile apps for Android phones (the other major platform), those data are incomplete.Footnote 13 I use iPhone app adoption as a proxy for the adoption of the mobile banking app technology because iTunes had the first app store in the market and still holds the leading position.Footnote 14 To provide supportive evidence, I selected 553 iPhone-app adopters and conducted follow-up research including phone interviews.Footnote 15 As reported in Table 6 in the “Appendix”, the results revealed that only 5 % of these banks released Android apps ahead of iPhone apps.Footnote 16

In addition to the adoption data, other information was gathered from three data sources. Bank financials were obtained from the Consolidated Reports of Condition and Income (Call reports) from the website of the Federal Reserve Bank of Chicago. Branch-level data on deposits and locations were collected from the Summary of Deposits from the FDIC website. Finally, economic and demographic data were obtained from the Bureau of Labor Statistics.

The initial merged sample consists of 114,149 bank-quarter observations. Firms are required to have non-zero values for total assets, transaction deposits, and the number of workers to be retained in the sample. For the purposes of this study, banks without any consumer deposits are deleted, as mobile apps primarily deliver financial services to individual depositors. I exclude observations with a loan-to-assets ratio that is equal to zero or >90 % because these banks do not engage in both deposit-taking and lending as typical commercial banks do. These screening criteria, along with data requirements for all the variables, yield a final sample of 99,960 quarterly observations over the entire adoption period.

4.2 Empirical Methodology

As banks face idiosyncratic short-run circumstances that influence the costs and benefits of adopting mobile apps, a Cox proportional hazard model can represent both the effects of rivals’ adoptions and market structure that is conditional on the covariates that might affect adoptions. The model specifies a hazard rate of the form:

where h[t, x(t), β], referred to as the hazard rate, is the probability that a bank developed a mobile app at time t given that it has not done so before time t. x(t) is the vector of explanatory variables, and β is a vector of parameters to be estimated. h 0(t) is the baseline hazard rate without specific functional form. In each quarter t, β captures the effect of change in x(t) on the relative risk of failure (probability of adoption). A positive coefficient suggests that an increase in the variable increases the hazard of adoption.

To gauge reliably the effect of adoptions by proximate competitors on mobile app adoption, I identify rival banks at the branch level. In each quarter, I calculate Local Rival Adoptions as the percentage of competitors that had introduced mobile apps in each market and weight the percentage by the deposit shares that a bank has in each market. I define a market at the MSA level when a bank operates within an MSA, otherwise at the county level. Hence, Local Rival Adoptions dynamically captures the weighted average competitive interactions that exist in the markets where a bank has operations. The proxy for the market structure is the market concentration ratio, which is computed as the deposit-weighted sum of squared deposit shares of banks within each market and denoted as HHI_Deposits.

The vector x(t) incorporates a host of controls and market and quarter fixed effects. To mitigate the concern that there might be some other firm-specific factors that are connected to the adoption decisions, I follow the literature on technology adoption and include the log of bank assets, the log of the age of the bank, fee income relative to deposits, the share of consumer deposits, advertising expenses, an advertising reporting dummy variable (Dadmk),Footnote 17 labor costs, salary per worker, workers per branch, the log of the number of branches, the Tier 1 capital ratio, and annual asset growth. Further, loan loss provisions, loan charge-offs, and a dummy variable that indicates whether a bank has received Troubled Asset Relief Program (TARP) funds (TARP Receiver) are included to control for the possibility that adoption might be affected by the 2008 financial crisis.

To control for local market conditions, I include the fraction of the population within the age category 20–34 (Young Population), annual job growth rate, and the area wage level. These market variables are weighted by the deposit shares of a bank to construct bank-specific variables, so as to reflect the average market conditions where the bank operates. Moreover, the market fixed effects control for common time-invariant unobserved market characteristics that may have driven adoptions by both rivals and potential adopters. Urban markets are defined at the MSA level; outside MSAs, markets are defined at the county level. The quarter fixed effects account for transitory nation-wide factors, such as negative macroeconomic conditions, that could influence the likelihood of adoption. All variable definitions and sources are listed in Table 2.

Table 3 reports the summary statistics for all of the variables that are used in the analyses. All continuous variables are winsorized at the 1st and 99th percentiles to mitigate the effect of outliers. Of particular interest, the average percentage of rivals with mobile apps among adopting banks is 32.03 %, much higher than the mean fraction among banks in non-adopting status during the entire sample period (11.36 %); this difference is statistically significant at a 1 % level, evident from the difference-in-means test in the last column. Moreover, mobile app adopters are situated in significantly less concentrated markets than are their counterparts. As a final note, mobile app adopters are significantly different from non-adopters in virtually all of the measured dimensions except for labor costs and loan loss provisions.

4.3 Identification

Although the market fixed effects account for the average effect of time-invariant unobserved market heterogeneity, it is still possible that some other time-varying market factors simultaneously determine adoptions by rivals and potential adopters. To tackle this simultaneity bias, I use an instrumental variables (IV) approach. Specifically, Local Rival Adoptions are instrumented by adopting rivals’ deposit shares outside the market and a dummy variable that indicates whether a bank is headquartered in an MSA.

The main instrument, which is denoted as Rivals’ Outside-Market Deposit Shares, is constructed as follows: In each quarter, I compute the deposit shares of adopting rivals that are out of the market for any given market, adjusting for the market shares of the rivals, and then weight by the deposit shares of each bank. Essentially, I extract the portion of rivals’ decisions that are uncorrelated with adoptions within the market to explain rivalry adoptions. While rivals’ deposits in other markets affect their propensities to adopt, there is little reason to think that out-of-market attributes of peers have a direct impact on future adoptions in that market, other than through rivals’ innovative strategies. Similarly, a bank’s headquarters location determines its innovation incentives, but is unlikely to directly affect potential adoptions. Hence, these two variables are reasonably justified to be valid instruments.Footnote 18

Nevertheless, the IV method does not fully resolve the simultaneous bias due to unobservable market characteristics. Note, however, I address this issue in three ways. First, the host of controls should capture a wide range of unobservable effects. Second, the incorporation of market fixed effects removes the time-invariant unobserved market heterogeneity. Third, I cluster the standard errors at the market level to correct for heteroskedasticity and within-market correlations of residuals.Footnote 19

5 Empirical Findings

This section discusses results that are estimated from the Cox proportional hazard model. Table 4 gives the coefficients and t-statistics based on heteroskedasticity-robust standard errors clustered by market. In column (1), the coefficient of Local Rival Adoptions is positive and significant at a 1 % level, which indicates that the likelihood that a bank will offer a mobile app increases with the proportion of adoptions by proximate rivals. The coefficient of HHI_Deposits has a negative sign and is significant at a 5 % level, which suggests that banks that operate in less concentrated markets exhibit higher propensities to adopt. When I interact Local Rival Adoptions with HHI_Deposits in column (2), the coefficient of the interaction term is positive (t = 3.54), which indicates that banks react more positively to rivals’ adoptions in more concentrated markets.

To address the simultaneity concern, I apply the IV approach as described previously. The IV estimates are reported in columns (3) and (4) of Table 4. Column (3) shows that the instrumented Local Rival Adoptions has an even stronger positive impact on the adoption decisions, with the coefficient significant at the 1 % statistical level. This result supports the notion that the adoption of a mobile service channel is a strategic, defensive move, which is similar to the phenomenon of Internet banking (DeYoung et al. 2007; Hernández-Murillo et al. 2010). However, the coefficient of HHI_Deposits becomes insignificant, which implies that market structure alone has little predictive power on the likelihood of adoption; this finding lends support to the argument of Reinganum (1981) and is in line with the findings in Akhavein et al. (2005).

Of particular importance, column (4) of Table 4 shows that the coefficient of the interaction term is still statistically significant at a 1 % level (t = 3.72). Consequently, I obtain robust evidence that adoptions by proximate competitors have a greater positive impact on adoption decisions in more concentrated markets, which supports the concept of oligopolistic non-price competition (Scherer and Ross 1990, p. 595). As mentioned, this adoption pattern differs from the findings in Hannan and McDowell (1987), possibly due to the different mode of competition and the distinct strategic nature of the innovative products.

Some control variables show the effect of heterogeneity of participants on the rate of adoption. For instance, consistent with the literature, bank size (lnAssets) positively predicts the odds of adoption, which provides evidence for the rank effects that larger banks are more likely to invest in technologies because of scale economies (Karshenas and Stoneman 1993).Footnote 20 The adoptions are positively associated with deposit-related fee income (Fee Income), which is consistent with the argument that mobile apps are considered as part of a retail strategy to improve service quality. Banks that report advertising spending and incur greater advertising expenses are more likely to adopt, which implies that mobile apps are more appealing to image-focused customers. Finally, the probability of adoption is negatively related with loan charge-offs, which indicates that banks’ willingness to innovate was negatively affected by the crisis.

Column (5) reports the results of the first-stage IV regression. Both of the instruments are significantly associated with the percentage of rivals’ adoptions, after controlling for market and quarter fixed effects. The adjusted R2 is 0.83, which demonstrates that the instruments explain a substantial portion of the variation in rivalry adoptions in a given market and thus mitigates the concern of potentially weak instruments. The F-statistic of the joint significance of the two instruments is 96.06, which exceeds the requisite 10 to ensure minimal bias of the instrumental variables estimate (Stock et al. 2002). Finally, the test of over identifying restrictions (Hansen J-statistic) fails to reject the null that all instruments are valid.

To assess further the differential impact of adoptions by competitors with market structure, I sort the sample into quartiles that are based on HHI_Deposits, rebalanced quarterly. The three dividing points, averaged over the sample period, are 0.1279, 0.1773, and 0.2553. A Chow test rejects the equality of the four subgroups (p value < 0.0001). I then estimate the hazard model on each group and compare the estimates of Local Rival Adoptions across quartiles. For brevity, only the coefficients and t-statistics that are associated with the key variable are reported, with all the controls as well as market and quarter fixed effects incorporated in each regression.

Panel A of Table 5 presents the results. The effect of Local Rival Adoptions on the odds of adoption increases monotonically from banks in the bottom quartile (the least concentrated markets) to those in the top quartile of HHI_Deposits (the most concentrated markets). A χ2 test rejects the null hypothesis that these four estimates are not significantly different from each other (p value < 0.0001). This finding confirms that future adoptions are determined jointly by nearby competitors’ strategic moves and market structure, and that the role of adoptions by peers in stimulating the adoption of a strategic technology is reinforced by market concentration.

To investigate whether the adoption pattern in MSAs differs from that in rural areas, I repeat the main regression (reported in column (4) of Table 4) on MSA banks, which is defined as those that are headquartered in MSAs, and on non-MSA banks.Footnote 21 Panel B of Table 5 displays the findings. The interactive effect of rivalry adoptions and market concentration is more pronounced among MSA banks but is not significant among rural banks. Possibly, there is not much variation in the degree of market concentration for rural banks because they are often located in a single county and/or far apart (DeYoung et al. 2007).

One potential concern is that if large banks dominate in a number of markets, and if these banks are the ones that adopt the innovation first, then the results might merely reflect a size effect of adopting banks in the diffusion of innovation. This concern is addressed in two ways. First, I control for adopting rivals’ assets (Rival Assets), defined as total assets of rivals with apps in any given quarter scaled by total assets of banks in the market, and weighted by the deposit shares of each bank. This variable measures the strength of rivals that adopted apps. Second, further to capture the dominant-fringe market structure, I construct deposit-weighted HHI based on bank assets, denoted as HHI_Assets. Panel C of Table 5 shows that the results are robust to the additions of Rival Assets (column 1), or HHI_Assets (column 2), or both (column 3), which suggests that the size effect of adopting rivals should not affect the main conclusions.

As a final robustness check, I examine whether the results hold for the timing of adoption by estimating a Tobit model. The dependent variable, Time Since Adoption, is defined as the number of quarters that a bank had offered the mobile app by 2012:Q2. The model is estimated on a cross-sectional data for 2008:Q2 with the instrumented Local Rival Adoptions as of 2012:Q2. Essentially, I examine the timing of adoption that is observed in 2012:Q2, while controlling for the pre-adoption characteristics. As this method is less reliable, I report the estimates in Table 7 in the “Appendix”. The marginal effect is the change in the expected value of Time Since Adoption for banks that adopted apps. In spite of the lower power of the test, the Tobit estimations generate qualitatively similar results.

6 Conclusion

Using a unique dataset on the first wave of mobile app adoption by 694 U.S. commercial banks, this study shows robust evidence that firms react positively to the innovational effort of proximate rivals, and that such reactions depend on market structure. More specifically, the stimulating impact of adoptions by rivals in the same market upon adoption decisions is the weakest in more competitive markets (which are more likely to be marked by price competition), is monotonically increasing with the level of market concentration, and is the strongest in highly concentrated markets (which are more likely to be marked by non-price competition).

This evidence provides direct support for the neo-Schumpeterian hypothesis and the economic theory of oligopolistic competition: Firms in concentrated markets display rivalrous urges through non-price dimensions such as technological advances (Scherer and Ross 1990).

Notes

An extensive body of theoretical literature studies the relationship between firm investment in research and development, the index of inventive activity, and industrial concentration (Kamien and Schwartz 1975).

One exception is the research on the adoption of automated teller machines (ATMs) by U.S. banks. Hannan and McDowell (1987) discover that the positive role of peers’ adoptions in ATM diffusion diminishes in more concentrated markets.

See Frame and White (2004) for their first detailed literature review of the adoption of financial innovations.

Mobile banking is distinct from mobile payment techniques, such as Google Wallet and Paypal services, which enable users to make “tap payments” through a near field communication (NFC) chip that is installed in the smartphone (Federal Reserve 2012).

Mobile banking has attracted considerable attention from the Federal Reserve, financial institutions, and social media. In March 2012, Board of Governors of the Federal Reserve System reported the findings from its first online survey (conducted in December 2011) that examines the use of mobile technology to access financial services and make financial decisions. As part of its ongoing efforts, the Board has continued to conduct the survey annually, with the latest one being in December 2014. One of the key findings from these surveys is that mobile phones and mobile Internet access are in widespread use.

iTunes stopped disclosing newly launched banking apps in September 2012. Consequently, the sample period ends in June 2012.

One of the major advantages of mobile banking is the Remote Deposit Capture (RDC), which allows customers to deposit checks by snapping digital photos without going to a banking center.

Milliou and Petrakis (2011) provide the one theoretical work that is also relevant to this argument. By contrasting Cournot (non-price) competition with Bertrand (price) competition to capture the effect of increased competitive pressure (Singh and Vives 1984), they show that Cournot competition encourages the adoption of an innovation by the second firm more than does Bertrand competition.

The “find office” option is available at: http://www2.fdic.gov/sod/sodInstBranch.asp?barItem=1.

Each Android app lists only 48 pages of reviews, with 10 reviews per page. Thus, the earliest customer review is not available if a bank has above 480 reviews. I was not able to get data from Google, despite repeated requests.

Google’s Android market, Blackberry apps world, Nokia store, Windows Phone marketplace, and Amazon app store were released 3, 10, 11, 29, and 34 months later than the initial launch of the Apple App store, respectively.

I acknowledge that this methodology suffers selection biases. To the best of my knowledge, there is no complete information available on Google Play as to how many banks adopted Android apps since Google lists only 480 “bank” relevant apps.

According to the Call Reports, advertising and marketing expenses only need to be reported if they are above $25,000 or 3 % of “other non-interest” expenses. There are roughly one-third of the observations in the sample do not have data on advertising expenses. So the advertising reporting dummy (Dadmk) is used to mitigate this measurement error.

In the empirical analysis, I provide detailed identification tests to show the validity of the instruments.

Results are robust when the standard errors are clustered at the MSA level.

A Chow test rejects the equality of MSA banks and non-MSA banks (p value < 0.0001).

References

Aghion, P., Bloom, N., Blundell, R., Griffith, R., & Howitt, P. (2005). Competition and innovation: An inverted-u relationship. The Quarterly Journal of Economics, 120(2), 701–728.

Akhavein, J., Frame, W. S., & White, L. J. (2005). The diffusion of financial innovation: An examination of the adoption of small business credit scoring by large banking organizations. Journal of Business, 78(2), 577–596.

Arrow, K. (1962). Economic welfare and the allocation of resources for invention. In Universities-National Bureau (Ed.), The rate and direction of inventive activity: Economic and social factors (pp. 609–626). Princeton: Princeton University Press.

Board of Governors of the Federal Reserve System, (2012, 2013, 2014, 2015), Survey Report of Consumers and Mobile Financial Services. Available at: http://www.federalreserve.gov/communitydev/mobile_finance_publications.htm.

Bofondi, M., & Lotti, F. (2006). Innovation in the retail banking industry: The diffusion of credit scoring. Review of Industrial Organization, 28(4), 343–358.

Crosman, P. (2012). Banks seek sticky relationships from mobile apps. American Banker. Retrieved from http://www.americanbanker.com/issues/177_25/bankers-share-customer-retention-motive-mobile-banking-survey-1046383-1.html.

Crosman, P. (2013). Mobile banking pricing model becomes clearer as more banks charge fees. American Banker. Retrieved from http://www.americanbanker.com/issues/178_210/mobile-banking-pricing-model-becomes-clearer-as-more-banks-charge-fees-1063276-1.html.

DeYoung, R., Lang, W., & Nolle, D. L. (2007). How the Internet affects output and performance at community banks. Journal of Banking & Finance, 31(4), 1033–1060.

Escuer, M. E., Redondo, Y. P., & Fumás, V. S. (1991). Market structure and the adoption of innovations: The case of the spanish banking sector. Economics of Innovation and New Technology, 1(4), 295–307.

Frame, W. S., & White, L. J. (2004). Empirical studies of financial innovation: Lots of talk, little action? Journal of Economic Literature, 42(1), 116–144.

Frame, W. S., & White, L. J. (2015). Technological change, financial innovation, and diffusion in banking. In A. N. Berger, P. Molyneux, & J. O. S. Wilson (Eds.), The oxford handbook of banking (2nd ed., pp. 271–292). Oxford: Oxford University Press.

Hannan, T. H., & McDowell, J. M. (1984a). The determinants of technology adoption: The case of the banking firm. RAND Journal of Economics, 15(3), 328–335.

Hannan, T. H., & McDowell, J. M. (1984b). Market concentration and the diffusion of new technology in the banking industry. The Review of Economics and Statistics, 66(4), 686–691.

Hannan, T. H., & McDowell, J. M. (1987). Rival precedence and the dynamics of technology adoption: An empirical analysis. Economica, 54(214), 155–171.

Hernández-Murillo, R., Llobet, G., & Fuentes, R. (2010). Strategic online banking adoption. Journal of Banking & Finance, 34(7), 1650–1663.

Kamien, M. I., & Schwartz, N. L. (1975). Market structure and innovation: A survey. Journal of Economic Literature, 13(1), 1–37.

Karshenas, M., & Stoneman, P. L. (1993). Rank, stock, order, and epidemic effects in the diffusion of new process technologies: An empirical model. RAND Journal of Economics, 24(4), 503–528.

Mansfield, E. (1968). Industrial research and technological innovation: An econometric analysis. New York: Norton.

Milliou, C., & Petrakis, E. (2011). Timing of technology adoption and product market competition. International Journal of Industrial Organization, 29(5), 513–523.

Reinganum, J. F. (1981). Market structure and the diffusion of new technology. The Bell Journal of Economics, 12(2), 618–624.

Scherer, F. M. (1965). Firm size, market structure, opportunity, and the output of patented inventions. The American Economic Review, 55(5), 1097–1125.

Scherer, F. M., & Ross, D. (1990). Industrial market structure and economic performance. Boston: Houghton Mifflin Company, Print.

Schumpeter, J. A. (1950). Capitalism, socialism and democracy. New York: Harper & Bros.

Singh, N., & Vives, X. (1984). Price and quantity competition in a differentiated duopoly. RAND Journal of Economics, 15(4), 546–554.

Stock, J. H., Wright, J. H., & Yogo, M. (2002). A survey of weak instruments and weak identification in generalized method of moments. Journal of Business & Economic Statistics, 20(4), 518–529.

Acknowledgments

I am grateful to Robert DeYoung for his substantial guidance and support in finishing this research project during my doctoral program. I have also benefitted greatly from the constructive suggestions of George Bittlingmayer, Lawrence J. White (the Editor), and two anonymous referees. For helpful comments, I would like to thank Ferhat Akbas, Christopher Anderson, Allen Berger, Lamont Black, Amel Dean, Yuliya Demyanyk, Ling T. He, Elizabeth Fuerherm, Mark Haug, Jian Huang, Minjie Huang, Yeonju Jang, Chao Jiang, Paul Koch, Lei Li, Felix Meschke, John Pepper, Gokhan Torna, Babajide Wintoki, Dave Wangrow, and Raluca Roman, as well as seminar participants at the University of Kansas, the 2013 Southern Finance Association (SFA) meeting, and the 2014 Community Banking Research and Policy Conference at the Federal Reserve Bank of St. Louis. All remaining errors are my own.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

He, Z. Rivalry, Market Structure and Innovation: The Case of Mobile Banking. Rev Ind Organ 47, 219–242 (2015). https://doi.org/10.1007/s11151-015-9466-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-015-9466-z