Abstract

This paper studies the effect of transfer programs on the allocation of resources among household members. Based on a collective household model and data from Ecuador, I find important intra-household inequalities, but the transfer produces resource redistribution among household members. Unlike existing approaches, I also employ a framework that accounts for other household structures, finding that transfers impact resource allocation in extended households with children. I validate the main findings using experimental data and document that in-kind transfers are comparable to cash transfers in improving the within-household redistribution of resources. I further examine the potential implications of this reallocation of resources in several domains and find that transfers increase women’s control of resources and reduce women’s poverty. I also show that changes in women’s control of resources driven by the transfer affect the household’s consumption patterns and how households react to unexpected shocks. These results contribute to understanding better the redistributive and behavioral effects of income support programs.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The primary reason that many governments in developing countries implement cash transfer (CT) programs is to alleviate poverty by boosting the incomes of the poor. Over the last 30 years, such safety net programs have become an increasingly significant aspect of social policy in many Latin American countries and have expanded to multiple developing countries worldwide.Footnote 1

By influencing the amount of resources available to poor households, these programs are intended to promote desirable social outcomes such as gender empowerment and better childhood nutrition, education, and health. To attain these goals, most countries that have launched CT programs stipulate that the beneficiary of the transfer must be a female household head or the spouse of the male head of a household. This recurrent feature assumes that women are more concerned about children’s wellbeing; therefore, an increase in the economic resources controlled by women in households will translate into increased bargaining power for women, leading to better outcomes for the women and their children.

Nevertheless, this strategic targeting mechanism poses some questions that remain unanswered and require additional analysis. It is important to understand whether CT programs produce a reallocation of resources within households, whether this reallocation is consistent across different transfer modalities and types of households, and the potential implications of this redistribution process. Using data from Ecuador, this paper provides evidence regarding how household resources are apportioned among members, the role of CTs in shifting intra-household resource allocation in different types of households, and the implications in terms of women’s resource control, poverty measures, and patterns of consumption.

The analysis is implemented in several steps. First, I start by proposing a new procedure to estimate the effect of CT on resource shares using observational data and the targeting mechanism of the government. Using a collective household model referencing Dunbar et al. (2013), I structurally estimate the resource shares for the father, mother, and children.Footnote 2 The structure of the model allows for an examination of how CT affects the share of household resources allocated to each member. To address the potential endogeneity of receiving CT, I reconstruct the Ecuadorian government’s targeting mechanism to determine the program’s beneficiaries. Then, I estimate the structural model using an instrumental variable (IV) approach via the generalized method of moments (GMM). I find evidence that receiving CT payments generates redistribution of resources within households via an increase in women’s and children’s shares of resources, whereas men experience a decrease in resource shares.

Second, research on the effect of CT on intra-household allocations has predominantly focused on nuclear households. This paper aims to enhance existing literature by broadening the scope of the model to verify the external validity of the impact of CT programs on extended households with children. Analyzing the behavior of these types of households is relevant because they are prevalent in many developing countries. The program’s influence remains evident within these household structures, indicating that the impact of CT extends beyond solely nuclear households. Third, to validate the reliability of the results, I use data from a randomized evaluation of a transfer intervention in Ecuador and show that the effect of the CT on resource shares obtained from the model estimated using observational data is similar to a causal benchmark effect estimated using data from the RCT. Using this experimental data, I also provide novel evidence of the relevance of the transfer modality, which has not been previously explored. I find that in-kind transfers could be as effective as cash transfers in improving the within-household redistribution of resources.

Subsequently, I explore the potential implications of this redistribution of resources in several domains, beginning with women’s resource control. Using the model’s estimated parameters, I create a variable for measuring the amount of resources controlled by the woman relative to the man, similar to Tommasi (2019) and Calvi (2020). Results reveal that the mean distribution of women’s resource control in beneficiary households is 11% higher in relation to non-beneficiary households. Furthermore, there is significant heterogeneity in the share of women’s resources across her lifecycle. I then analyze the effect of the within the household allocation of resources on individuals’ wellbeing. Widely used indicators of poverty and inequality measure consumption at the household level; however, such procedures do not consider the different factors that could lead to the asymmetric allocation of resources among household members. Using the estimated parameters from the intra-household structural model, I evaluate individual (as opposed to household level) poverty, providing insights regarding intra-household inequality, finding women to be significantly poorer than men. Notably, CT reduces poverty rates for women relative to men, implying a reduction in within-household inequality. I also quantify the extent of misclassifications of individuals’ poverty status using per capita measures versus individual poverty measures. The findings reveal that women and children are at risk of living in poverty even in households with per capita expenditure above the poverty line.

As a proxy for women’s bargaining power, I construct an indicator for women’s majority control over household resources (Browning et al., 2013; Calvi, 2020; Tommasi, 2019). Using this variable, I analyze the effect of resource control on households’ demand for food, health, and education. To examine the response of household spending to women’s resource control, I model the demand on each item category as a function of prices, income, and demographics, referencing the specifications from the demand system estimation literature (Attanasio et al., 2012; Attanasio & Lechene, 2010; Deaton & Muellbauer, 1980). However, the variable defining whether the woman controls the majority of household resources could be mismeasured due to model misspecification and estimation. To account for this potential problem, I estimate the Mismeasured Robust Local Average Treatment Effect (MR-LATE) following the methodology of Calvi et al. (2022). This methodology identifies the LATE and obtains a consistent estimate when the treatment variable that is potentially endogenous is measured with error. The results indicate that households where the woman holds the majority of the resources spend around 5% more on food, 0.6% less on education, and health expenditure is unaffected. Finally, I complement this analysis by considering the effect of women’s resource control on the demand for food, education, and health when households experience unexpected shocks. The results suggest that households in which women exercise control the majority of household resources reduce food expenditure and increase health expenditure in response to unexpected shocks.

1.1 Related Literature

This paper contributes to three lines of literature: (i) the literature on the application of collective intra-household models to recover individual resource shares, (ii) the literature that studies the relationship between CTs and bargaining power, and (iii) the literature on poverty transfer programs and household behavior.

Analyzing the behavioral effects of CT programs under the assumption that households act as a single rational unit in which the benefits of a social program are distributed in equal proportion among all family members could be misleading. To address this assumption, this paper benefits from the literature on collective intra-household decision models (see, for instance, Apps & Rees, 1996; Blundell et al., 2007, 2005; Bourguignon et al., 2009; Browning et al., 1994, 2013; Cherchye et al., 2012; Chiappori, 1988, 1992; Chiappori & Ekeland, 2006, 2009). Attempts to identify resource shares assume that single women and men have similar preferences to those of married women and men (Bargain & Donni, 2012; Browning et al., 2013; Lewbel & Pendakur, 2008; Lise & Seitz, 2011); however, Dunbar et al. (2013) propose a framework that relaxes the assumptions related to similar preferences for different types of households. I apply this approach in this paper to identify the necessary parameters of the collective intra-household model.

Within this branch of the literature, previous studies have found mixed results regarding the effect of CT programs on individual resource shares. For example, Tommasi et al. (2016) and Sokullu and Valente (2022) conclude that the Mexican CT program tends to reduce women’s resource shares while increasing men’s or their children’s, while Tommasi (2019) finds the opposite. These contrasting results suggest that further research is required to provide evidence of the effectiveness of CT programs in the redistribution of resources within the household. The main aim of this work is to contribute to this literature in three ways. First, Tommasi et al. (2016), Tommasi (2019), and Sokullu and Valente (2022) estimate resource shares using data from the evaluation of a CT program in Mexico. Obtaining data from randomized evaluations to study the effects of CT programs could be complicated, particularly for multiple developing countries. In this paper, I seek to expand the structural approach by proposing a new method to estimate the effect of CT on resource shares by estimating a collective household model that uses observational data from a national survey and applies the targeting mechanism used by the governmental authority to classify program beneficiaries.Footnote 3 Second, to the extent of my knowledge, this is the first study that validates the results of the effect of CT on resource shares by comparing a model estimated using observational data with a model using experimental data. Using this data, I also provide novel evidence of the relevance of the transfer modality. Third, to date, there has been no investigation into the effect of welfare programs on extended households. This study contributes to the literature by analyzing the impact of CT programs on individuals’ share of resources when they live in the context of extended households with children.

Regarding the second branch of literature, several studies of the effect of CT programs on women’s decision-making power provide a mixed picture. For example, Adato and Roopnaraine (2010) find no evidence of a direct effect of Mexico’s CT on women’s decision-making, whereas Attanasio and Lechene (2010) detect minor changes in certain intra-household decision-making. Tommasi (2019) shows that eligibility to receive CT induces an increase in the women’s decision-making index, whereas Handa et al. (2009) find no evidence of the effect of CT on women’s decision-making power other than the ability to spend their own cash. To measure bargaining power, many studies have relied on a variety of approaches using indicators of decision control and self-reported decision-makings, unearned income, women’s share of income, pre-marriage assets, and differences in education (Gitter & Barham, 2008; Hoddinott & Haddad, 1995; Quisumbing, 1994; Reggio, 2011; Schady & Rosero, 2008; Schultz, 1990; Thomas, 1990; Thomas et al., 2002). This study references Tommasi (2019) and Calvi (2020), constructing a proxy variable for women’s bargaining power based on individual resource share. This research complements this literature by analyzing the implications of women’s majority resource control on significant dimensions, such as household demand and household responses to unexpected shocks.

Regarding the third branch of literature, previous research indicates that monetary incentives can affect households’ behavior (Angelucci & Garlick, 2015; Attanasio & Lechene, 2014; Bobonis, 2009) and children’s school performance, health, and nutrition (Behrman et al., 2005; Doepke & Tertilt, 2019; Duflo, 2003, 2011; Gertler, 2004; Paxson & Schady, 2010; Thomas, 1990). Regarding households’ allocation of consumption, Schady and Rosero (2008), Angelucci and Attanasio (2013), and Attanasio and Lechene (2014) establish that CT programs targeted for mothers are correlated to steady or higher household food expenditure. Tommasi (2019) shows that women’s resource control increases households’ demand for food. In contrast, using randomization of the beneficiary’s gender, some studies find no significant differences in the impact of such programs on household consumption, investment, and production (Akresh et al., 2016; Benhassine et al., 2015; Haushofer & Shapiro, 2016). These contrasting results suggest that consensus regarding the mechanisms behind intra-household allocation remains far from clear. To better understand these mechanisms, this paper uses a model of collective household behavior to identify the redistribution and control of household resources among individual members and to reveal the potential effects of poverty policies on these intra-household allocations. This study expands the literature by documenting the impact of women’s resource control on households’ demand for food, health, and education.

1.2 Outline

The rest of the paper is organized as follows: Section 2 summarizes the program’s most important features and describes the data. Section 3 presents the model, the identification of the model, and estimation results. Section 4 shows the implications in terms of women’s resource control, poverty measures, and patterns of consumption. Section 5 concludes.

2 Data

2.1 CT program in Ecuador

Ecuador is a middle-income South American country with a territory slightly smaller than the US state of Nevada.Footnote 4 The first CT program in Ecuador was entitled Bono Solidario, was implemented in 1998 as direct payment to compensate the poorest households for eliminating subsidies, and did not involve any co-responsibility on the part of the program’s recipients. After five years, in 2003, the program was restructured to consolidate two previous programs in Ecuador, the Bono Solidario program and the Beca Escolar program (a transfer of 5 USD per child per month, up to two children per household, conditional on children’s enrollment in school and a 90% attendance rate). This new CT program was called Bono de Desarrollo Humano (BDH). It featured an open inscription procedure based on identifying beneficiaries by relying on local priests, who were considered to have trustworthy knowledge of vulnerable people in their local communities.

The BDH program followed a human development approach, implementing the recommendations of international organizations. This was the first program to apply a proxy means test (PMT) to target the poorest families in Ecuador. The main objective of this new program was to improve the effectiveness of the targeting mechanism of this social policy and contribute to the formation of human capital (Carrillo & Ponce Jarrin, 2009). The change in the program’s structure required beneficiary families to enroll children between the ages of 5 to 18 in school and maintain an attendance rate higher than 75%.Footnote 5 Starting in 2007, a process of reconfiguring the BDH program began within the framework of Ecuador’s constitutional and political transformations. The method of identifying the beneficiaries of the BDH was modified over time, with important changes in 2009 and 2013, each time modifying the definition of the target population and the mechanism used to conduct the targeting. It is also notable that in contrast to the self-targeting mechanism of the Bono Solidario, the BDH uses a PMT to target potential beneficiaries.

Since the present study spans over two years, 2011–2012, the method for defining program beneficiaries is the one established in 2009. The government tracked and monitored potential beneficiaries through a process of registering families located in areas with higher poverty levels according to the 2001 Census. In this new phase, governmental authorities updated the targeting mechanism by implementing a new database called the Registro Social (RS) and constructing a new index called the Indice de Bienestar (RS index). This targeting structure was used from August 2009 to March 2013, and included another increase in the payment, with a CT fixed to 35 USD per month (16% of the minimum wage) for individuals with families with a score less than or equal to 36.59 points in RS index (Buser, 2015).

2.2 Data description

This study uses the 2011–2012 National Income and Expenditure Survey in Rural and Urban Households (Encuesta Nacional de Ingresos y Gastos de Hogares Urbanos y Rurales), which I will denote here as ENIGHUR for brevity. The ENIGHUR is a household survey that collects information on the amount, distribution, and structure of household income and expenditure, based on respondents’ demographic and socioeconomic characteristics. This data is convenient for identifying and estimating a collective household model because it allows for the generation of private assignable goods to households’ men, women, and children. The ENIGHUR also includes ample information to reconstruct the targeting mechanism used to identify potential beneficiaries of the BDH program and the actual beneficiaries of the BDH program.

To perform the analysis of interest on a homogenous sample, I select a subsample of the ENIGHUR that satisfies the following restrictions. To ensure comparability across household types, I select only households with both natural parents and one to four children. This restriction implies that households with at least one additional adult member in addition to the parents are excluded. The intention is to exclude households with potentially multiple decision-makers. To avoid outliers, households in the top or bottom one percent of the total household expenditures distribution are removed, and the sample is restricted to households in which the adults are between 18 and 65 years of age.

To avoid issues related to potential collateral effects of other programs, I drop households that declared receiving CT for geriatric condition, disabilities, or other circumstances from the sample, only keeping the households reporting to be non-beneficiaries and mother-type beneficiaries. I then narrow the subsample households to those with children under 12 years of age for consistency with the reported private assignable goods for childrenFootnote 6 and to address potential endogeneity related to the conditionality of the program. This also excludes adult children that could be assuming a decision-making role with parents. Finally, respondents lacking data for any household characteristics or relevant expenditures are excluded from the sample. The final sample is composed of 6242 households.Footnote 7

2.3 Descriptive statistics

Table 1 presents selected descriptive statistics for the sample used for the analysis. All the households in the analysis are couples with children.Footnote 8 This table indicates that the average man in the sample is 33 years old, whereas the average woman is 30 years old. The age difference within the couples in the sample amounts to 3.7 years. They have around 11 years of education, which is less than a high school diploma. In terms of family composition, on average, households have 1.9 children, the mean age of children is around 5 years old, and 49% of children are girls.

Related to the CT program, 28% of households are beneficiaries of the program in the sample. Table 1 also shows expenditure information. Like many consumption expenditure surveys, the ENIGHUR asks whether the reported expenditure is monthly, quarterly, semi-annually, or annually depending on the consumption item. The values are then transformed into monthly expenditure. To calculate assignable good expenditures for each household member, I use person-level clothing and footwear expenditures. To obtain the household’s total expenditure, I aggregate all non-durable expenditures. Table 1 indicates that the average household’s total expenditure (including expenditure in food) is 571.85 USD (in 2011 prices). Expenditures in clothing and footwear represent a small portion of the total budget shares (2% and 3%). Finally, household’s food, education, and health budget shares are 31%, 2%, 6%, respectively.Footnote 9

3 Structural analysis of household behavior

3.1 Intra-household allocation with children

To identify the share of household resources controlled by each household member and quantify the CT effect on the reallocation of resources, I use a collective intra-household model similar to Dunbar et al. (2013). Consider a household formed by three types of agents \(i \in \{\female, \male, k\}\). I assume that all households are composed of one female (♀), one male (♂) and children (k), and all men and women live in couple households. Households are heterogeneous in several observable characteristics, such as geographic location, family composition, sociodemographic factors, and parents’ socioeconomic variables. The agents within this household could have distinct preferences; however, they have to jointly decide on the purchase of L goods. Let’s define \({{{\bf{p}}}}=\left({p}_{1},\ldots ,{p}_{L}\right)\) as the L-vectors of market prices, \({{{\bf{{x}}}^{s}}}=\left({x}_{1}^{s},\ldots ,{x}_{L}^{s}\right)\) as the L-vectors of quantities of each good l purchased by a household of size s, \({{{\bf{{c}}}^{i}}}=\left({c}_{1}^{i},\ldots {c}_{L}^{i}\right)\) as the L-vectors of quantities of private good equivalents of each good l consumed by member i of the household and y as the household’s total expenditure. As in Browning et al. (2013) and Dunbar et al. (2013), I assume economies of scale in consumption through a linear (Barten-type) consumption technology, which takes the form of a matrix denoted by A with L × L dimension. The advantage of this framework is that it enables the conversion of the household’s purchased quantities x into a bundle of private good equivalents ci, which is then apportioned among the household members, so c = c♀ + c♂ + ck = A−1x.Footnote 10

Each agent i, derive utility from consumption of the bundle of L goods, denoted as \({U}^{i}\left({{{{\bf{c}}}}}^{i}\right)\).Footnote 11 Each agent’s total utility may also depend on the utility of other household agents, leisure, and being a member of a household. For simplicity, I assume that each agent i’s utility is weakly separable over the sub-utility functions for goods. So, for instance, member i who gets utility from other family members’ well-being as well as her own would have a utility function given by \({\overline{U}}^{i}={\overline{U}}^{i}\left[{U}^{1}\left({{{{\bf{c}}}}}^{1}\right),\ldots ,{U}^{I}\left({{{{\bf{c}}}}}^{I}\right)\right]\). As \({\overline{U}}^{i}\) depends upon \({{{{\bf{c}}}}}^{{i}^{{\prime} }\ne i}\) only through the consumption utilities they produce, direct consumption externalities are ruled out. Therefore, \({U}^{i}\left({{{{\bf{c}}}}}^{i}\right)\) should be interpreted as a sub-utility function over goods, which may be just one component of total utility.Footnote 12 Each household maximizes a social welfare function, \(\overline{U}\), defined as:

Note that each household member’s Pareto weight \({\mu }^{i}\left(p/y\right)\) in Equation (1) is a function of prices, household expenditure, and other individual characteristics. An important assumption of collective models is that, even though agents within the household may have heterogeneity in preferences, they make consumption decisions efficiently. Therefore, efficient allocations can be described as resulting from the following maximization problem:

Solving the maximization problem in Equation (2), we can obtain the quantity of private good equivalents, ci, for each member \(i \in \{\female, \male, k\}\). Then, pricing these bundles at within household shadow prices \({A}^{{\prime} }{{{\bf{p}}}}\) it is possible to obtain the resource shares ηi, which represents the fraction of the household’s total resources that are assigned to each agent within the household.

The Pareto efficient allocation allows us to use duality theory and decentralization welfare theorems to characterize the collective model expressed in Equation (2). Specifically, the solution to the maximization problem in Equation (2) can be decomposed into a two-stage process (Chiappori, 1992). In the first stage, household members decide on the optimal allocation of resources. This defines the resource shares for each member. The second stage deals with the individual maximization of their own utility function. Conditional upon knowing ηi, each household member performs an individual utility maximization subject to a Lindahl-type shadow budget constraint that defines the optimal bundle ci. Then, we have a set of indirect utility functions \({V}^{i}\left({A}^{{\prime} }{{{\bf{p}}}},{\eta }^{i}y\right)\) for \(i \in \{\female, \male,k\}\) evaluated at these shadow (Lindahl) prices. By substituting the indirect utility functions \({V}^{i}\left({A}^{{\prime} }{{{\bf{p}}}},{\eta }^{i}y\right)\) for \(i \in \{\female, \male,k\}\) in Equation (2), the household program simplifies to the choice of optimal resource shares subject to the constraint that total resource shares must sum to one. Note that each household member maximizes their own utility subject to a shadow budget constraint specific to that member. In this framework, scale economies in consumption resulting from sharing are reflected in the difference between shadow and market prices. Then, the household’s demand functions for each good l arising from the maximization in Equation (2) are given by:

where \({h}_{l}^{i}\) are individual demand functions, and η♂, η♀ and sηk = 1 − η♂ − η♀ are the resource shares of the respective agent member \(i \in \{\female, \male,k\}\).

3.2 Identification and estimation strategy

3.2.1 Resource share identification

To identify the resource share, it is necessary to have a private assignable good for each household agent. A private assignable good has the characteristic that is consumed exclusively by one member of the household and therefore does not exhibit economies of scale in consumption.Footnote 13 Two restrictions are imposed by Dunbar et al. (2013) for identification. The first is that ηi does not depend on household expenditure y, at least at low expenditure levels.Footnote 14 The second is some restrictions on the shapes of individual Engel curves.Footnote 15 Under these conditions, it is possible to simplify the household demand functions given in Equation (3), since the private assignable good’s shadow price is the same as its market price.

For a private assignable good of agent i, it is possible to re-express the household demand in Equation (3) as the product of ηi and the demand function for individual resource of household member i given by the Engel curve function wi. Then, the household demand functions for private assignable goods are given by:

In Equation (4), Wi represents the share of total household expenditures devoted to each agent i private assignable good, ηi is the resource share assigned to agent i and wi represents the unobserved share of agent i’s resources that the individual would spend on his private good when maximizing his own utility function given the shadow price \({A}^{{\prime} }{{{\bf{p}}}}\). Recognizing that budget shares on assignable goods (clothing and footwear), denoted as Wi, and resource shares, represented by ηi, are different objects is crucial for the present analysis. Since household members may have heterogeneous preferences for their private assignable goods, Wi cannot simply be used as a metric of ηi. In particular, the proportional value of the assignable good budget shares does not directly determine the proportional value of resource shares, i.e., W♀ > W♂ > Wk does not imply that η♀ > η♂ > ηk.

Equation (4) describes a system of three equations, where Wi and y are observable for each agent i, and the objective is the identification of resource shares ηi for each \(i=\female, \male, k\). The main complication in identifying these resource shares comes from the inability to observe ηi and wi on the right-hand side of Equation (4). Therefore, following Dunbar et al. (2013), it is necessary to impose some preference restrictions. By restricting the shapes of the functions wi to have similar curvatures either across household members or household types (number of children), it is possible to identify the resources shares without relying on any additional restriction on the shape of the preference function wi. Let’s assume that individual preferences are described by utility functions that belong to the PIGLOG class. Then, in Equation (4), each household member’s private assignable good Engel curve is linear in the logarithm of own expenditure. So, the system of equations can be expressed as:

where αi and βi represent linear combinations of underlying preference parameters. For identification, it is necessary to impose either similarities of preferences across household agents, called SAP ("Similar Across People"), or similarities of preferences across households, called SAT ("Similar Across Types"), or combine both. The data drives the choice to restrict the utility functions among individuals of the same type. On the other hand, Dunbar et al. (2013) suggests that the combination of SAP and SAT strengthen the identification. I combine both, SAP and SAT, which implies that β♂ = β♀ = βk = β. To relax this assumption in the estimation, the resource shares and the preference parameters are allowed to vary with observable household characteristics (including household size). To account for unobservable heterogeneity, I include additive error terms in the system of equations. It is assumed that errors are correlated across equations and clustered at the census sector (sampling unit) level.Footnote 16

The main goal of the model is to determine the impact of receiving a CT on the share of resources of each household member. CT programs may impact the decision process and change individual preferences over time (De Rock et al., 2022). To account for this, in Equation (5), the preference parameters and resource shares are allowed to vary with the program participation.Footnote 17 However, before proceeding with the estimation of the model, it is important to address a potential endogeneity problem with the variable of interest, which is CT program participation (receiving the transfer).

3.2.2 Addressing the endogeneity of receiving the transfer

To consider the potential endogeneity of participating in the CT program, I reconstruct the targeting mechanism used by the Ecuadorian government to determine the program’s beneficiaries. The eligibility index is constructed using a confidential methodology and survey data executed by the Coordinating Ministry of Social Development (MCDS) called “Registro Social”. With this database, the Technical Secretariat Unit of the MCDS generates a proxy means test index, which is expected to be related to consumption poverty, but with a multidimensional perspective based on Bourguignon and Chakravarty (2003). The RS index is bounded between 0 and 100 and is created using non-linear principal component analysis (NLPCA) with the combination of 30 variables. The set of variables can be organized into the following domains: asset possession, dwelling and household characteristics, and individual characteristics.

3.2.3 Reconstruction of the eligibility index

The set of 30 variables allows classifying households according to their eligibility status based on a cutoff (Fabara, 2009). Households that score less than or equal to 36.59 points in the RS index were eligible to receive the program. While the RS index is constructed using 30 variables, the database available for this study contains information on 25 of the 30 variables. To replicate the eligibility index, I obtained access to confidential administrative information from the Ecuadorian government. This information includes the database used by the MCDS to select beneficiaries, the methodology and list of variables used to construct the index, and the cutoff value to select beneficiaries. I worked with this database (Registro Social) using only the 25 variables available in the ENIGHUR survey data. Following the same methodology of the Ecuadorian government (non-linear principal components), I re-estimated the index to find new weights for the restricted set of 25 variables and create an index replica.Footnote 18 Then, using these new weights, I can compute the eligibility index using the ENIGHUR survey data.Footnote 19

3.2.4 Index-specific discontinuity

Using an index replica implies that the original cutoff of 36.59 may not be the cutoff where the households are exogenously selected to be beneficiaries of the program. To address this issue, I use a strategy from the structural break literature, following Card et al. (2008) and Ozier (2018). The algorithm used works as follows. First, I restrict the attention to a window of scores (5 points) around the actual eligibility cutoff on the eligibility index. Then, I regress the outcome (receiving the transfer) on indicators for hypothetical discontinuities from 31.59 to 41.59 points and a piecewise linear control for RS eligibility score, one potential discontinuity at a time. Following Ozier (2018), I consider the discontinuity whose regression delivers the maximum R2 value as the “true" cutoff. I perform a similar approach to obtain the point where the probability of receiving the transfer experiences the biggest discontinuity. The R2-maximizing cutoff is 40.66 points rather than 36.59. The discontinuity in the probability of receiving the transfer corroborates this value. Considering this to be the “true" discontinuity, I use this value for the cutoff in the estimation that follows.Footnote 20

3.2.5 GMM estimation

The model is estimated using an instrumental variable (IV) approach via generalized method of moments (GMM). The index replica and eligibility cutoff allow for constructing an instrumental variable that defines the assignment to treatment. Let εi be an error term for each of the equations in the system (5) and z be a vector of instruments uncorrelated with the error terms εi.Footnote 21 Then, \(E\left[{\varepsilon }^{i}z\right]=0\) implies:

and

for \(i \in \{\female, \male\}\). These moment conditions allow for the estimation of the model’s parameters by using GMM. It is possible to construct optimal instruments for these moment conditions by taking the derivatives of the error terms εi with respect to the model parameters η, α and β.Footnote 22

To improve efficiency, I follow Dunbar et al. (2013) and construct instruments that are close to optimal by suitable transformations of the observed instrument. The estimation procedure is implemented in several steps. First, I estimate Probit predictions of the CT program participation on the basis of all observed exogenous variables. This is analogous to the first stage of two-stage least squares, when the first stage equations are non-linear. Then, I obtain initial values of model parameters estimating the model via non-linear seemingly unrelated regression (NLSUR), ignoring the CT’s endogeneity.Footnote 23 After that, I evaluate the derivatives of the error terms εi with respect to the model parameters η, α and β at the NLSUR pre-estimates, and plug-in Probit predictions of the CT program participation rather than the true values. Finally, I estimate the model described by the system of Equations (6) and (7) via GMM.

In this specification, the exogenous variables include: the log of expenditure, all demographic variables, the CT eligibility dummy variable, and a flexible functional form of the eligibility index. The endogenous variable is the dummy indicating if a household received the CT.Footnote 24 Opting for these instruments proves advantageous as we extend beyond the cutoff, introducing flexibility and refining the precision of treatment effect estimates. Using many valid instruments also has the potential to improve efficiency. In addition, it expedites convergence in the estimation process and allows for additional tests to assess the relevance of multiple instruments.

The instruments are very strong in predicting the reception of the CT, conditional on socioeconomic and sociodemographic variables and the log of expenditure. The F-statistic on the excluded instruments in the first stage is over 300. Regarding the exclusion restriction, the instrument (being eligible or not for the program) is a non-linear function of the eligibility index. The identification of the effect of the CT program comes from the non-linearity imposed by the program design to select beneficiaries.Footnote 25 Also, the Hansen J-tests of overidentifying restrictions do not suggest that the instruments are endogenous and hence do not reject the hypothesis of instrument validity (with a p-value of 0.157). GMM estimators are iterated until the estimated parameters and error/orthogonality condition covariance matrices converge.

3.3 Estimation of resource shares

The estimated coefficients of the effect of CT on the resource shares of fathers (η♂), mothers (η♀), and children \(\left({\eta }^{k}\right)\) are reported in Table 2. The first four columns present the estimation results of the benchmark specification with dummies for each child. Unlike Tommasi et al. (2016) and Sokullu and Valente (2022), where the CT reduced women’s resource shares while increasing men’s or their children’s, I find that the transfer (CT dummy) decreases fathers’ resource share and increases mothers’ and children’s. Regarding the proportion of this resource reallocation, the positive effect on mothers is larger in magnitude than children’s. Consistent with the literature (see, Klein & Barham, 2018; Tommasi, 2019), these results imply that CT could have an important role in households’ redistribution of resources.

Results also indicate that household composition is an important consideration. When the number of children increases, both adults’ shares reduce; however, on average, the reduction in the mother’s share is larger in magnitude compared to the father’s share. For example, when a household has a second child, the father’s share is reduced by 3% on average, whereas the mother’s share is reduced by 13% on average. Table 2 also reveals that the amount of household resources allocated to children grows as the number of children increases; however, each child’s average share declines. These findings align with the idea of a quantity-quality trade-off (see, Becker & Lewis, 1973; Rosenzweig & Zhang, 2009). A reference household with one child directs 19% of its expenditure to the child’s consumption. With two children, this share rises to 25%, and with four children, to 33%. The amount of resources per child steadily declines from an average of 19% when a household has one child to an average of 8.2% when a household has four children.

When we estimate non-linear models, distinct specifications may cause the findings to be unstable. In this type of household model, uncertainty regarding the sharing rule’s location could result in considerable variability in the estimates. A typical specification that may cause instability is whether the number of children enters the resource shares and latent intercepts as categorical variables or linearly. In the context of this study, the choice of the number of children, entering as dummy variables or linearly, does not produce instability in the estimates. This robustness check is very informative and the results are reported in Columns (5)–(7), demonstrating that the estimated parameters in the specification in which children enter linearly are consistent with the results obtained in the initial specification. In Online Appendix A.4, I provide additional specifications presenting the robustness of the benchmark specification results.

3.4 Effect of the CT program on extended households

The aim of this paper is to estimate the impact of receiving a CT on the share of resources of each household member. This is natural in nuclear household with children which is the benchmark analysis. However, a potential limitation is the use of a non-representative sample. To estimate the benchmark model, a sample was selected to comply with either the collective model assumptions (nuclear families) or data restrictions (clothes for children under age 12). To address this limitation and check the external validity of the results to other types of households, I investigate if the CT affects the intra-household resource allocation in extended families with children. To this aim, I use a model similar to Calvi (2020), which extends the system in Equation (5).

In this new framework, women are treated as an aggregate person; therefore, the resource share of women is divided equally among the women in the household (the same applies for men and children). Women’s total resource share in households with N♀ women is thus given by H♀ = N♀η♀, where H♀ denotes the proportion of total household expenditure consumed by women. As a result, H♀ is a proxy measure for women’s total bargaining power. Let’s assume that individual preferences are described by utility functions that belong to the PIGLOG class. Then, the demand functions for private assignable goods in households with N♂ men, N♀ women, and NK children can be expressed as:

where W♂, W♀ and Wk are the budget shares spent on women’s, men’s, and children’s private assignable goods, and αi and βi represent linear combinations of underlying preference parameters. To identify resource shares, I impose similarities of preferences for private assignable goods across household members. The restriction implies that β♂ = β♀ = βk = β, which means that resource shares can be identified by comparing household demands for private assignable goods across individuals within households. To relax this assumption in the estimation, the resource shares and the preference parameters are allowed to vary with observable household characteristics (including household size).Footnote 26

Using the system described in Equation (8), I estimate the factors that affect the resource shares of women (H♀), men (H♂), and children \(\left({H}^{k}\right)\). I focus on the effect of CT on each member resource shares, and the results are presented in Table 3. The CT decrease men’s resource shares while increasing women’s and children’s. Similar to nuclear households, the positive effect on women is larger in magnitude than on children. The results also indicate that household composition is an important consideration. Women’s resource shares increase with the number of women in the household and decrease with the number of men. Furthermore, the number of children reduces the men’s and women’s resource shares and increases the children’s share of resources. These results agree with the findings of the benchmark model estimated using nuclear households and confirm that resource redistribution caused by the CT program is also prevalent in extended households with children.

3.5 Comparison to RCT results and the role of transfer modality

To validate the reliability of the results of the previous section, I use data from a randomized evaluation of an intervention implemented by the World Food Program in Ecuador called “Food, Cash, or Voucher.” The main advantage of using this well-designed experiment is that it allows one to estimate a causal benchmark effect and compare the result from the model using observational data to those obtained from the randomized control trial (RCT) data.

The goal of the intervention was to promote better food consumption, empower women in terms of food consumption decisions, and mitigate the strained relations between Colombian refugees and Ecuadorian citizens. In the experimental program, beneficiaries received a monthly transfer of 40 USD per month for six months (similar to the 35 USD per month in the observational data). The intervention paid out the transfers to mothers. Like the governmental CT program, the experimental intervention imposes a conditionality consisting of attending a nutritional training program. Only poor households and households with at least one Colombian member were eligible for the program. Moreover, if any household member participated in the Governmental cash transfer program, the household was ineligible to participate in this experiment. The intervention was conducted in 2011, which is advantageous because it coincides with the period of analysis in the observational data (2011-2012). Overall, the experimental data is very useful for this validation exercise because the transfer incentives were exogenous, the program imposed a conditionality, delivered a similar amount of money as the Governmental program, and were carried out during the same period of analysis. In addition, the information in the dataset is very comprehensive and includes the variables necessary to estimate the proposed structural model empirically.Footnote 27

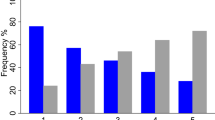

Results of the estimation using the RCT data are reported in Table 4. The first three columns present the estimation results of the benchmark specification with dummies for each child of the effect of the pooled treatment. Then, in Columns (4)–(6), I show the estimates of the in-kind and cash treatment arms. I find evidence that the CT reduces fathers’ resource share and increases mothers’ and children’s. Moreover, I explore the effect by transfer modality (cash or in-kind). I find that the magnitude of the impact varies depending on the transfer modality. Although in-kind transfers have a lower effect than cash transfers, both considerably impact how resources are allocated within households.

These results provide evidence that transfers not only have the potential to decrease inequality–at least in the short term–but also that in-kind transfers could be as effective as cash transfers in improving the within-household redistribution of resources. Moreover, it is evident from comparing the experimental and observational results that the direction and magnitude of the CT effects identified using the RCT data are consistent with those found using the observational data. This helps reinforce the causal interpretation of the findings using observational data in the previous subsections.

4 Implications

4.1 Women’s resource control

Thus far, the empirical analysis has focused on individual levels of resource shares in reference households and the marginal effects of various demographic characteristics; however, given that household characteristics themselves covary with household structure (size), this does not indicate how aggregate resource sharing changes across household sizes. I will now concentrate on nuclear households with children because this is a natural setting for studying intra-household bargaining power. Table 2 illustrates that the model provides reliable and stable estimates of the parameters of interest. Using these estimates, I next estimate the resource shares for women (\(\hat{\eta }\)♀), men (\(\hat{\eta }\)♂), and children \(\left({\hat{\eta }}^{k}\right)\) in each household. Figure 1 presents density-based scatterplots of the relationships between the resource shares of men, women, and children. It is notable that as adult members’ resource shares increase, the resources allocated to children decrease. There is also a negative relationship between men’s and women’s resource shares, and the level of women’s resource share is lower than men’s.

Relationship between Household Members’ Resource Shares. The figure provides information on the relationship between the resource shares of the mother, father and children. The scatter plots are density based and show the means of the shares for each individual within the household (a) Child vs. Mother (b) Child vs. Father (c) Mother vs. Father

Next, Table 5 presents descriptive statistics, distinguished by CT program participation. This table presents the mean, standard deviation, minimum, and maximum of the estimated resource shares for each family member.Footnote 28 In both types of households, the resource share for women is lower than that for men. In non-beneficiary households, women’s resource shares are 59.76% of men’s, whereas in beneficiary households, women’s resource shares are 92% of men’s. The CT raises the total share allocated to children (43% vs. 40%); however, it reduces the share per child (23% vs. 26%). This suggests that there are differences in fertility among beneficiary and non-beneficiary households. Resource shares are modeled as linear functions of household characteristics; therefore, these measures are not necessarily bounded between 0 and 1. As can be seen from Table 5 the smallest and largest values of the estimated resource shares are bounded between the 0–1 range, validating the reliability of the model.

Using the predicted resource shares, I compute the amount of resources controlled by women relative to men \(R=\frac{{\hat{\eta}}^{\female}}{{\hat{\eta}}^{\female}+{\hat{\eta}}^{\male}}\). The summary statistics of this measure for each type of household are reported at the bottom of Table 5. The results indicate that women in non-beneficiary households control 40.2% of household resources, whereas in beneficiary households, they control 51.5%. This implies that women in beneficiary households experience an increase of 11.3% of resource control relative to men. This result is congruent with the findings of Klein and Barham (2018), who show that in Mexico, PROGRESA largely increased women’s decision-making power, and with the results of Tommasi (2019), who finds that PROGRESA increased women’s resource control, although the effect of CT in Tommasi (2019) is smaller in magnitude.

I also compute an alternative measure of the amount of resources controlled by women. This measure sums mother’s and children’s resource shares, as mothers are eligible to receive CT conditional on caring for the children. Using this measure, women in non-beneficiary households are estimated to control 64.2% of household resources and women in beneficiary households control 72%. Similar to the benchmark measure, this alternative measure indicates that women in beneficiary households experience an increase of 8% resource control relative men; therefore, both measures of resource control are consistent. However, the benchmark measure is preferred because it only considers women’s resource share, which provides a more transparent comparison of beneficiary and non-beneficiary households, and offers a conservative measure.Footnote 29

The rise in resource allocation to women and children reveals the enhanced economic empowerment women gain from transfers. Compared to children, the greater increase in women’s share can be related to the study’s focus on households with young children (up to age 12). Even in the absence of transfers, it is likely that households typically allocate some resources to meet young children’s needs. In such cases, households with women receiving transfers may allocate significant resources to purposes not directly related to their children.

4.2 Individual poverty and intra-household inequality

Understanding how households allocate resources under different circumstances is fundamental to measuring individuals’ well-being. Poverty and inequality indicators often measure consumption and expenditure at the household level, assuming equal sharing of resources within households. However, intra-household inequalities can significantly impact poverty assessments, especially in developing countries, where a significant portion of the population has low household expenditure levels. Moreover, in the context of this study, analyzing how CT impacts the poverty of each household member is of considerable importance for evaluating the welfare effects of the CT program.

I analyze the behavior of individual poverty based on eligibility status and participation in the CT program. To accurately measure the program’s effect on individual poverty, the numbers reported in Table 6 are for households close to the eligibility threshold (10 points around the eligibility threshold in the eligibility index). The results suggest that women in both eligible and non-eligible households contribute the majority to explaining households’ poverty level. It is notable that CT reduces the prevalence of poverty for women. Table 6 reveals that CT reduces women’s poverty by 19 percentage points for eligible households. Similarly, in non-eligible households CT mitigates women’s poverty by 13 percentage points. Table 6 also indicates that the women in households that do not participate in the CT program (both eligible and non-eligible) are substantially poorer compared to the other household members.Footnote 30

Furthermore, in Appendix A.9, I investigate misclassification problems, quantifying the number of misclassified individuals using a measure based on household per capita consumption versus individual consumption. I provide evidence of misclassification issues in a range between 11% and 12%, which has important implications for individuals’ wellbeing. These results suggest that women and children are at risk of living in poverty even in households with per capita expenditure above the poverty line, highlighting the need to consider alternative indicators to ensure that the most vulnerable populations are not overlooked.

4.3 Consumption patterns

By influencing the amount of resources available to poor households, CT programs are intended to promote desirable social outcomes such as gender empowerment by shifting the control of household resources towards the targeted individual. In the context of Ecuador, the CT is targeted to women, which leads one to expect that the allocation of household resources in beneficiary households will be closer to women’s preferences. To link women’s resource control and the household demand for food, education, and health, I need to define an appropriate specification that is concordant with the context of this study and implementable given the available data.Footnote 31

Specification. To analyze the relationship between women’s resource control and patterns of consumption, I estimate Engel curves for food, education, and health. Specifically, I estimate:

where \(D=\left(R > 0.5\right)\), is an appropriate treatment for measuring the effect of women’s majority control over household resources on the demand for each good. The underlying assumption is that an individual within the household who controls the majority of household resources has enough bargaining power, or decision control, to make choices about the household’s spending. Wig is the budget share for good category g in household i, δ is the main parameter of interest and measures the effect of women’s majority control over household resources, vector P is the interaction between the 3 regions and 12 months, X are control variables, and ε is the error term. I estimate the effect by comparing households where the mother controls the majority of the household’s resources to those where the mother controls the minority of the household’s resources.Footnote 32 Since the actual underlying value of women’s resource control is unobserved, I address this identification problem using a Mismeasured Robust LATE (MR-LATE) estimator proposed by Calvi et al. (2022). MR-LATE recovers the treatment effects when a discrete treatment variable that is potentially endogenous is measured with error (Calvi et al., 2022).

Household Demand Responses. The first column of Table 7 reports the estimation results of Engel curves without controls, column 2 presents the estimation results of the Engel curves with controls, and the remaining columns show the results of the MR-LATE estimates under different percentages of misclassification. These estimates allow for the control of potential measurement error by accounting for 2.5%, 5%, and 10% of possible misclassified individuals in the sample. Panel A of Table 7 indicates that the women’s resource control positively affects the demand for food in all specifications. The results suggest that households in which mothers exercise control the majority of household resources increase the demand for food by 2.5–5% compared to households where the mothers control the minority of resources, contingent on the specification. These effects are congruent with the recent literature (see, Klein & Barham, 2018; Tommasi, 2019).Footnote 33

Panel B of Table 7 illustrates that women’s resource control has a negative effect on the demand of education in all specifications, although the magnitude of the effect is relatively small and economically not significant.Footnote 34 This is reasonable since Ecuador’s primary school enrollment for children less than 12 years old was practically universal, and the conditionality imposed by the program is to enroll children in the public school system.Footnote 35 These results suggest that when women have higher bargaining power, and their children benefit from widespread access to education, they opt to reallocate resources, focusing on increasing expenditures on food. Lastly, Panel C of Table 7 presents the results from the effect of women’s resource control on the demand for health. The result suggests that women’s majority control over household resources do not have a robust effect on households’ demand for health.

Household Responses to Shocks. Finally, documenting the existence of heterogeneity in household demand in the face of an unexpected shock depending on whether women have greater bargaining power is fundamental for the design of policies to mitigate the effect of adverse shocks. Women in households admitted to being beneficiaries of a CT program could experience an increase in their intra-household bargaining power, increasing the perceived legitimacy of their claims related to consumption decisions when the household experiences unexpected difficult situations.

To corroborate this hypothesis, I analyze how women’s majority resource control affects the demand for food, education, and health when households experience unexpected shocks. I allow adverse shocks reported by households to shift the demand as a covariate in Xi in Equation (9). An (unexpected) shock is documented to have occurred if the household faced one of the following situations: economic shocks, health and family shocks, crime and legal shocks, and natural disaster shocks. A standard unexpected shock is a health shock; therefore, the analysis begins by evaluating this shock category. Since there are a variety of shock domains, using each individual domain could overstress the significance of impacts due to chance. Therefore, I construct an indicator that takes the value of one if a household experienced an adverse shock in any of the considered domains, and zero otherwise.Footnote 36 Specifically, I consider the domains most likely to be unexpected and exogenous. These include the death or illness of a household member, fire in the home, business, or property, robbery, kidnaping, assault, and suffering natural disasters.

The main goal is to examine different spending responses by interacting the shock index with the dummy variable D, which defines whether the woman controls the majority of household resources in Equation (9). The interaction term generates a differential effect of an unexpected shock among households where the woman holds the majority of the resources and their counterparts. The estimation follows the same methodology as in the previous subsection. Each regression controls for shocks in each of the other shock categories.Footnote 37

Results in Table 8 indicate that when there are adverse health shocks, households where the mother controls the majority of resources reduce food expenditures and increase expenditures in health (since the unexpected shocks analyzed mainly affect this category) compared to households where the mother controls the minority of resources. There is not any important differential effect on expenditures in education. The effects are consistent when we analyze the indicator that aggregates several shock domains.

A tentative explanation for this finding is that poor households in developing countries are typically uninsured and cannot execute a consumption smoothing strategy. Therefore, a household affected by a shock must reallocate resources. When mothers are the primary resource controllers, they face difficult choices during unexpected shocks, potentially impacting their well-being and that of their children. While households where women control the majority of resources tend to allocate more to food expenditure, they tend to reallocate resources from food to health when facing shocks, indicating potential resource constraints. Conversely, households with fathers as primary controllers may have more economic stability, as they can adjust resources for health without compromising food budgets. Reducing food spending during shocks in mother-led households may harm family members’ nutrition, especially children and vulnerable individuals.

Policymakers and organizations focusing on poverty alleviation should consider these findings when designing interventions. They may need to tailor interventions based on resource control dynamics, focusing on robust safety nets for households where mothers are primary resource managers during shocks to safeguard both food and health budgets and ensure the welfare of vulnerable family members. It is important to acknowledge that some households could be more prone, given their characteristics, to suffer specific shocks. Therefore, the result presented in this section should be interpreted as compelling evidence that when the woman controls the majority of resources, it influences how the households react to unexpected shocks.

5 Conclusion

Poverty alleviation and desirable social outcomes are common priorities of every developing country and numerous international organizations. Public policies have been implemented to rapidly increase the amount of resources available to poor households in many nations. In this context, it is essential to better understand the redistributive effects of such policies. CT programs impact the budget constraints of beneficiary households as well as affecting the intra-household allocation of resources and household behavior in specific domains; therefore, social policies may need to consider all these channels to design effective income support programs to achieve the intended goals.

This paper presents a comprehensive procedure to analyze how intra-household resource allocations and women’s resource control responds to CT. Using rich household expenditure data and the targeting mechanism of a CT program in Ecuador, a structural household model is estimated using a GMM approach. Specifically, I quantify the effect of CT on the share of resources allocated to each household member (father, mother, and children), revealing that CT induces a redistribution of resources within the household, increasing the share of resources allocated to women and children. Then, the study examined the impact of CT on resource shares in extended households with children, finding that resource redistribution caused by the CT program is also prevalent in these households. Additionally, I evaluated the validity of the study’s major findings by contrasting a model estimated using observational data with a model estimated using experimental data, confirming the robustness of the benchmark results. The potential implications of the reallocation of resources induced by the CT program are then explored in several domains–women’s resource control, poverty and inequality, and consumption patterns.

Changes in women’s resource control when households received the transfer were striking. CT also generated welfare gains by reducing poverty, especially for women and children. I then construct a proxy for women’s bargaining power as women’s resource control and link this measure with the household demand for food, education, and health. I find that households in which the mother has the majority of resource control increase the share of food (5%), decrease the share of education (0.6%), and health expenditure is not affected. In the final assessment, compelling evidence indicates that when the woman controls the majority of resources, it influences how the households react to unexpected shocks.

Through a comprehensive structural analysis using observational and experimental data, I have illustrated how CT programs can significantly affect the allocation of resources and decision-making within households. In addition, I have also provided evidence of the relevance of the transfer modality and the effects of such programs in extended households with children. By understanding the distributive and behavioral effects of CT programs, researchers and policymakers can design and implement more effective social protection policies that improve the well-being of vulnerable households.

Overall, this research contributes to the ongoing discussion around poverty reduction and social policy, providing valuable insights into the potential impact of CT programs on intra-household inequality in households with children. Moreover, this approach could be applied in multiple contexts and nations to evaluate income-based programs more comprehensively. The necessary data on household expenditure, program participation, and the targeting mechanism for selecting beneficiaries used for the empirical application is already available in many countries, where this framework can be used to assess the redistributive effects of their specific programs. While the present study offers an in-depth analysis of how CT targeted to women impacts the distribution of resources within households, it is important to recognize that it did not explore alternative scenarios where transfers are targeted toward men. Further research might explore the potential differences and implications of such a targeted approach on the outcomes examined in this study.

Data availability

This study uses survey data from the National Institute of Statistics and Census of Ecuador, administrative registry data from the Social Registry of Ecuador, and experimental data from a cash transfer program in Northern Ecuador. The survey data is publicly available. Access to the administrative data is restricted. The Social Registry of Ecuador manages the data under the Technical Standards for the Collection, Update, Use, and Transfer of Social Registry Information. Transfer of databases is not allowed according to the Technical Standards Act. Any researcher or institution that wishes to apply for microdata will only be granted access after signing a confidentiality agreement. The author will be happy to assist in obtaining the data. The experimental data will be available upon request.

Code availability

All computational codes supporting this study’s findings will be available upon request.

Notes

In Latin America, CT programs were launched in 1995 in Brazil, followed by Mexico in 1997. Soon after, many other Latin American and Caribbean countries, such as Argentina, Chile, Colombia, Costa Rica, Ecuador, Honduras, Jamaica, Nicaragua and Uruguay, also implemented these types of social assistance programs. In 2009, over 40 countries around the world adopted this type social policy (Fiszbein et al., 2009), and by 2014, CTs had spread to nearly 70 countries around the world (Lindert, 2014).

The identification of resource shares relies on information regarding private assignable goods. A good is considered private if it is non-shareable, and it is considered assignable if it is possible to determine the agent within the household that consumed it. This study uses clothing and footwear as private assignable goods.

This approach will be useful for applications in many contexts where there is a lack of experimental data on the program’s implementation, but the information is available on the targeting mechanism for selecting beneficiaries.

According to the World Bank, in 2019, Ecuador had a population of 17.3 million and a GDP per capita of 11,878 (in PPP US dollars).

Although the co-responsibility of the program was imposed since the creation of the BDH, the enforcement of these requirements only became partially effective in 2007.

This restriction is data-driven, as households were asked how much they spend on clothing and footwear for girls and boys under 12 years of age in the survey.

I recognize that this sample does not include other types of households. The reason for this exclusion is that it facilitates our interpretation of the effect of the CT on the intra-houshold allocation of resources and female bargaining power. Also, it does allow for a rigorous investigation of the assumptions that underpin the structural model used to estimate each household member’s resource shares. This sample represents approximately 77% of the total coupled families with children in the original sample, making the study a valuable and relevant contribution. Furthermore, in a robustness exercise, I will check the external validity of the results by expanding the model and the sample to consider extended families with children.

Additional descriptive statistics differentiating by CT program participation are available in Online Appendix A.1.

The education expenditure only includes preschool, primary and secondary education, and excludes expenditure in post-secondary education, college, and tuition expenses not attributable to any educational level. This procedure allows for the consideration of expenditures in education related only to children between 0 and 12 years old.

This consumption technology provides a general structure to model sharing and jointness of consumption. Let’s look at a typical example used in the literature. If good l is a private good (i.e., not jointly consumed), the lth row of matrix A will have 1 in the lth column and zeros everywhere else. Now, suppose that we look at a married couple without children. The couple jointly rides their automobile half of the time, implying that both share the cost of gasoline (50% each). When one family member rides alone, that member must assume the payment of gasoline. In this context, gasoline consumption, in terms of private good equivalents, is 1.5 times larger than the gasoline consumed at the household level. Assuming that gasoline consumption is independent of the consumption of other goods, then the lth diagonal element of matrix A will be \(\frac{2}{3}\) such that: View \(x_{l}=\frac{2}{3}\left(c_{l}^{\male}+c_{l}^{\female}\right)\) for l being gasoline. In this case, \(\frac{2}{3}\) reflects the degree of publicness of good l within the household.

The utility function is assumed to be monotonically increasing, twice continuously differentiable, and strictly quasiconcave.

The children’s utility could be interpreted in two ways. \({U}^{k}\left({{{{\bf{c}}}}}^{k}\right)\) might represent the child’s utility function over the bundle of goods ck, or it could be the utility function their parents believe the child possesses.

To clarify this concept, a private good does not feature economies of scale in consumption (e.g., food). An assignable good is also private if consumed exclusively by a household member of type i (e.g., clothing and footwear items).

Considering different expenditure levels in the sample might make the assumption of resource shares independence with respect to total household expenditure slightly more demanding. Also, it is not possible to straightforwardly test this assumption. However, using the model estimates, I provide empirical support in Online Appendix A.5 that this assumption is likely to hold. Additionally, it exits empirical evidence in the literature that supports this identification assumption (see, for instance, Cherchye et al., 2012; Menon et al., 2012).

In this context, an Engel curve defines the relationship between a budget share and total spending, holding prices constant.

The census sector is a statistical division that is defined as the workload of field operations in statistical research by governmental institutions.

Specifically, we have that: \({\alpha }^{i}={\delta }_{0}^{{\alpha }_{i}}+{\delta }_{1}^{{\alpha }_{i}}{X}_{1}+\ldots +{\delta }_{n}^{{\alpha }_{i}}{X}_{n}+{\delta }_{CT}^{{\alpha }_{i}}CT\), \(\beta ={\delta }_{0}^{\beta }+{\delta }_{1}^{\beta }{X}_{1}+\ldots +{\delta }_{n}^{\beta }{X}_{n}+{\delta }_{CT}^{\beta }CT\), and \({\eta }^{i}={\delta }_{0}^{{\eta }_{i}}+{\delta }_{1}^{{\eta }_{i}}{X}_{1}+\ldots +{\delta }_{n}^{{\eta }_{i}}{X}_{n}+{\delta }_{CT}^{{\eta }_{i}}CT\), for each \(i=\female, \male,k\).

With the available input from the ENIGHUR, I run the categorical principal components analysis (CATPCA) algorithm used by the Ecuadorian government, attempting to replicate the index as close to the original.

Further details of the procedure to construct the index replica are in Online Appendix A.2.

Online Appendix A.2 provides a detailed description of the methodology used and the results to obtain the actual discontinuity in the index replica.

Any function using any of the conditionally exogenous variables with respect to εi can be used as instruments.

This notion of optimal instruments is based on the first-order criteria for minimizing a quadratic criterion function.

Iterated NLSUR is equivalent to maximum likelihood with multivariate normal errors.

In this specification, I Instrument CT program participation with the CT eligibility dummy and a flexible functional form of the eligibility index. In the analysis, the potential endogeneity of total expenditure is also taken into account. In Online Appendix A.4 I do a number of robustness checks including other instruments and specifications. The results remain very similar supporting the validity of the benchmark model specification.

Online Appendix A.3 shows the relationship between CT program participation and the eligibility index (RS index). As expected, there is a negative relationship between the RS index and the probability of being treated. In general, as the RS index rises, the likelihood of getting the treatment decreases. Moreover, there is a significant decline at the cutoff point.

A comprehensive description of the data selection for the analysis of extended households is presented in Appendix A.7.

A detailed explanation of the data from the “Food, Cash, or Voucher” intervention is presented in the Appendix A.6

Resource shares consider the empirical distributions of the covariates since they are estimated as linear combinations of these variables.

To further assess the redistribution of resources within the household caused by CT, Appendix A.8 presents the empirical distribution of resource shares and compares it to those obtained from the experimental sample.

For comparison, according to the National Institute of Statistics and Census, the poverty in Ecuador was around 25.6% and 27.3% in 2011 and 2012, respectively. Of course, these numbers include all types of households in the calculation, and it is reported just for reference purposes, as only coupled households with children are considered in this study.

One of the edges to measure the effectiveness of CT programs that target women is to analyze if the program produced a shift in the control of household resources towards the targeted person. In the context of the present analysis, this implies that mothers may influence the allocation of resources (household budget) in a way that is more in line with their preferences. The mechanism behind this idea is straightforward: an increase in the mother’s control of resources will imply that the observed household behavior is closer to her preferences.

Discussion of estimation issues regarding the Engel curves are relegated to Appendix A.10.

Online Appendix A.12 examines additional specifications that link women’s resource control and the household demand for different food groups.

The items included in this category include tuition of formal education and expenditure related to elementary, primary, and secondary education. This category does not include transportation expenditures associated with sending the children to school because there is no possibility of observing these expenditure items in the data.

One possible concern is that children are now required to attend school and therefore need specific clothing for that purpose. In Ecuador, wearing school uniform is mandatory. However, in 2007, the Ecuadorian government introduced a program that provides free uniforms for public schools. By 2008, they began expanding the program to public schools located in urban areas, fully implementing it by 2010. Through this initiative, the government covers the expenses associated with uniforms, ensuring that the schools benefiting from the program do not face any financial deductions. Since the timeframe of the current study is between 2011 and 2012, during which the school uniforms were subsidized, this concern is unlikely to affect the results.

In Online Appendix A.13, I explore this effect’s heterogeneity by disaggregating the result by each type of shock domain.

It is unlikely that the shocks affect prices through general equilibrium effects because they are all idiosyncratic and specific to each household.