Abstract

The 2008 alimony reform in Germany considerably reduced post-marital and caregiver alimony. We analyze how individuals adapted to these changed rulings in terms of labor supply, the intra-household allocation of leisure, and marital stability. We use the German Socio-Economic Panel (SOEP) and conduct a difference-in-difference analysis to investigate couples’ behavioral responses to the reform. In general, the results do not confirm theoretical expectations from labor supply and household bargaining models. In particular, we do not find evidence that women increase their labor supply as a result of the negative expected income effect. Neither do our results reveal that leisure is shifted from women to men as a response to the changed bargaining positions. We find some evidence that married couples are more likely to separate after the reform, but this effect vanishes once unobserved heterogeneity at the couple level is controlled for.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

For a long time, alimony regulations have been a means to protect the spouse concentrating on housework and childcare within a marriage, providing them with payment entitlements in the case of divorce. In addition, they have been a means to protect the welfare state from benefit claims, by balancing (tax) benefits for married couples with (post-)marital duties. Even after the introduction of ‘no-fault divorce’ in the 20th century, alimony regulations were preserved, and some countries such as Canada and Brazil further introduced alimony claims for non-married couples upon separation, this way harmonizing the legal rights of marital and non-marital unions. The 2008 alimony reform in Germany, in contrast, harmonized the rulings for married and non-married couples from the opposite direction, by reducing the entitlements for married couples.

In this paper, we analyze the behavioral responses of married couples to this reform in terms of labor supply, the intra-household allocation of leisure, and marital stability. The empirical investigation of such effects is crucial to assess the longer-term consequences of the reform. When female labor force participation does not increase, the objective of increased economic post-marital self-responsibility cannot be reached and the state might be forced to compensate a part of the reduced alimony payments in terms of unemployment benefits or social welfare.

Since alimony payments have been mostly received by women and paid by men, opposed reactions of men and women to the reform are expected. From the perspective of a labor supply model, the alimony reform translates into a negative income effect for women, who can now expect less post-marital and caregiver alimony upon divorce. Therefore, women’s labor supply is expected to increase as to balance the adverse effect, while their leisure should decrease. For men, the income effect works in the opposite direction, i.e., the increased income after the reform is expected to reduce men’s labor supply. However, as alimony payments depend on men’s income, the substitution effect associated with the alimony reform would induce men to increase their labor supply, so that the overall effect on men’s labor supply is ambiguous. Intra-household bargaining models further suggest that the shift of financial resources from wives to husbands in the case of divorce changes the intra-household allocation of resources even within marriage. Transferring leisure (or other goods) from women to men could balance the altered options outside marriage, such that the decision to divorce would not be affected. However, if the assumptions of transferable utility and low-cost bargaining are not fulfilled, the divorce rate could also increase, because men face lower alimony payments, or decrease, because less women file for divorce due to the increased financial consequences. The expected effect of the reform on separation rates is therefore ambiguous.

Previous studies on changes in divorce law have mainly focused on evaluating the effects of the introduction of the ‘no-fault’ or ‘unilateral divorce’Footnote 1, showing that individuals indeed react to such reforms. Friedberg (1998) and Wolfers (2006) find increases in divorce rates after the introduction of unilateral divorce in the USA. For a panel of European countries, González and Viitanen (2009) obtain similar results, and find even stronger effects for the introduction of no-fault divorce schemes. Further studies show that divorce laws can also affect outcomes other than the divorce rate. Peters (1986), for example, finds no effect of the introduction of unilateral divorce in the USA on divorce rates or fertility, but on female labor force participation, divorce settlement payments and remarriage rates. Gray (1998) analyzes heterogeneous effects by type of marital property regime and shows that with community-property law, the bargaining position of women improved with the introduction of unilateral divorce and led women to decrease their home production and increase their leisure, while opposite effects are found under separate property systems. Focusing on alternative measures of bargaining power, Stevenson and Wolfers (2006) demonstrate that the introduction of unilateral divorce in the USA had a negative effect on domestic violence, suicides, and homicides with female victims. Brassiolo (2016) finds decreased domestic violence as a result from facilitations of divorce in Spain. For the European case as a whole, Kneip und Bauer (2007) show that the introduction of unilateral divorce led to rising divorce rates and thereby increased female labor force participation and lowered fertility.

Analyses of the behavioral responses to changes in alimony law, however, are relatively scarce. Exceptions are Rangel (2006) and Chiappori et al. (2017), who investigate the effects of the introduction of alimony claims for cohabiting couples in Brazil and Canada, respectively. Both studies apply difference-in-difference analyses using couples who were not affected by the reform as control groups. The authors find that, as expected by theory, those women who benefitted from the reform decreased their labor supply, at least at the intensive margin. Rangel (2006) finds reductions in women’s working hours by 3%. Chiappori et al. (2017) show that for women who were surprised by the reform, the probability to work full-time decreased by 4.7% points, while no such effects, or even reversed patterns, are found for couples that were formed after the legal change, possibly because of changes at the matching stage. At the extensive margin, i.e., for women’s labor force participation, neither of the two studies finds significant changes. The result of stronger reactions at the intensive rather than the extensive margin of labor supply is confirmed by Altindag et al. (2017), who study shifts in the intra-household allocation of market work and housework as a response to the introduction of joint custody law in the USA. The authors find that mothers increased their working hours and fathers decreased their household work by 8% each. Mothers’ probability to work, however, was not affected by the reform.

With respect to the introduction of alimony claims for cohabiting couples in Brazil, Rangel (2006) further shows that the years of schooling of first-born daughters of these couples increased and that cohabiting women significantly reduced their housekeeping activities. For men, he does not find corresponding changes in working or housekeeping activities. For the Canadian case, Chiappori et al. (2017) reveal that those couples who were surprised by the reform were less likely to get married and the cohabitation period was longer, while the total duration of the relationship was not affected. The fact that divorce laws play an important role at the matching stage has also been shown for the USA. Wong (2016) uses the introduction of homemaking provisions that take into account the spouses’ contribution to household production for property division after divorce and shows that this let marriage rates to increase by up to 10%.

For Germany, empirical evidence on the behavioral response to changes in alimony law is even rarer. In the year following the 2008 reform, the Bertelsmann Foundation conducted a survey on the public awareness of the changes in alimony law, and on the reactions to and the opinion on the reform. Overall, 16% of the 1560 interviewed persons (from randomly drawn households with children up to age 25) had not heard about the reform, 57% had at least heard about it, and 17% reported to know details. The results further reveal that men evaluated the reform more positively than women. However, both men and women stated that the reform had incentivized them to increase their labor supply and to share childcare and paid labor in a more egalitarian way (Bertelsmann Stiftung 2009, pp. 7, 9, 11, 12). In terms of causal evaluations, the study by Fahn et al. (2016) represents the only quantitative analysis of the effects of the German alimony reform so far. Using administrative vital statistics as well as data from the German Microcensus, the authors find that the abolition of caregiver alimony for married parents with children above the age of three years led to a decrease in relative in-wedlock fertility and fewer marriages.

We contribute to this literature by evaluating couples’ behavioral responses to the reform more broadly. In contrast to the reforms investigated in the previous literature, the 2008 alimony reform in Germany did not introduce new alimony claims, but rather reduced the entitlements for married couples, this way changing the expected financial situation after divorce. Unlike Fahn et al. (2016), we do not only focus on the changes in caregiver alimony, but more generally on different types of alimony payments after divorce. Accordingly, we do not exclusively target couples’ outcomes such as separation or divorce but include analyses on individual adaptations to the reform in terms of labor supply and leisure. In the empirical analysis, we use the German Socio-Economic Panel (SOEP) and apply a difference-in-difference model to estimate spouses’ reactions to the reform. As the reform was universal in the sense that it changed the legal basis for all (back then) current and future alimony payments after divorce, without any cut-off rules or other exogenous variation, our aim is not to disentangle the overall causal effect of the reform. Rather, we focus on analyzing differences in the behavioral response of never-married cohabiting couples and couples who had first married in the years before the 2008 reform and were then ‘surprised’ by the new ruling. Accordingly, our results provide evidence on the short-term effects on those who were already married before the reform, while they do not tell us anything about the long-term effects on couples who were formed after the reform. We further explore the heterogeneous effects of the reform by conducting sub-sample regressions for different groups of individuals.

Overall, we do not find strong behavioral responses in terms of intra-household time allocation. In particular, female labor supply did not increase significantly, and no shifts of leisure from women to men are found. We do find some evidence that the reform increased the separation rate of married couples, but this effect vanishes once unobserved heterogeneity at the couple level is controlled for.

The remainder of this article is structured as follows: In Section 2, we describe the main features of the German alimony law and of the 2008 reform and derive its expected effects based on different theoretical approaches. The empirical strategy and the data used are described in Section 3. In Section 4, we present our estimation results, and Section 5 concludes.

2 Institutional and theoretical background

2.1 The 2008 alimony reform in Germany

After the divorce of a marriage, alimony claims can be made by an ex-spouse who cannot sustain him- or herself against the former partner, provided the latter’s income exceeds the deductible for basic needs. The German alimony law specifies several circumstances which can justify such claims, including child care, elderliness, illness or affliction, unemployment, (further) vocational training or re-training, and reasons of equity. These claims result in alimony payments for child care (‘caregiver support’) and post-marital alimony (also called ‘divorce alimony’). The latter is based on two principles: the compensation of disadvantages that emerged within or were caused by the marriage, and post-marital solidarity (Wellenhofer 2011). While child support, i.e., alimony payments provided by the parent not living with their child to contribute to the child’s living, is determined by family courts following specific rates, volume and duration of these payments are determined by family courts on an individual basis.

Before the new German alimony law took effect in January 2008, the last main changes of this law had been introduced in 1977. These had encompassed the abolition of the fault principle, which had reduced alimony claims to persons not responsible for marital breakup. Until the end of 2007, the legal situation had therefore not changed for a long time. For previously married parents with children, full caregiver alimony was paid after a divorce to the parent who cared for the common child(ren) until the (youngest) child’s 8th birthday. Until the 15th birthday, the caring parent was expected to work part-time. For separated, but previously unmarried parents, caregiver alimony was usually only paid until the 3rd birthday. Post-marital alimony was paid generously but could be limited in time and volume in certain cases, e.g., when the marriage had been of short durationFootnote 2. In the case that the income of the ex-spouse with the higher income did not suffice to cover the demands of all alimony claimantsFootnote 3, the claims of children and ex-spouses were given equal priority. In contrast to countries such as Canada, alimony claims between unmarried cohabiting partners upon separation (other than for caregiving) have never been in place in Germany.

The 2008 alimony reform in Germany entailed several changes to this lawFootnote 4, which were meant to serve three main purposes: (i) strengthen children’s well-being, (ii) emphasize post-marital self-responsibility, and (iii) simplify the alimony law. The main change with regard to the first objective was a new ranking for the case of conflicting claims: While until 2008, the ex-spouse had been on a par with underage childrenFootnote 5, these children are now put first in the ranking of several alimony claimants. (Ex-)spouses are ranked second if they can assert alimony claims due to child care or if the marriage is or was of long durationFootnote 6, and ranked third in any other case. The following ranks four through seven comprise older children as well as grandchildren and other offspring, own parents and more distant relatives. If the income of the alimony payer does not cover all claims, they are answered one after the other, as long as the liable party’s income still exceeds the deductible (Wellenhofer 2011). This means that on average, children receive more and ex-spouses receive less alimony after the reform.

Hence, the measures to achieve the first objective of the reform already contributed to the second objective: Improving the position of children in the order of alimony claimants automatically forced ex-spouses to rely less on alimony payments than before. In addition, three further main changes emphasized post-marital self-responsibility: First, ex-spouses who take care of the couple’s children have now lower caregiver alimony claims in the sense that they are expected to work from their child’s 3rd birthday on. Thus, the threshold for divorced parents was adapted to the old ruling for alimony claims between non-married parents after their separation. Second, the ‘principle of self-responsibility’ was introduced in the law. While the old law started from the situation where one divorced spouse cannot meet his or her own needs, the new version states as a rule that each spouse is responsible to earn their own living after divorce, and alimony claims are rather an exception to this rule. Third, alimony claims can now also be refused or limited (in time and volume) when the claimant is living again in a long-term relationship, and not only—as before—in the case of re-marriage.

The new law affects almost all marriages, also those that had started before 2008. Only marriages that were divorced before July 1977 are exempted. Given that all alimony payments except for child support are decided on by family courts on an individual basis, alimony payments that were decided on before 2008 have not been changed automatically. A retrial can be requested provided that a considerable change can be expected, and the change is not unreasonable for the other party.Footnote 7

While the new alimony law only took effect in January 2008, the discussion of a reform of the alimony law started already in 2000, when a reform of child support had become necessary as a reaction to a decision of the Federal Constitutional Court of Germany (Bundesverfassungsgericht) as of 1998 (BT-Drs. 14/3781 2000, p. 1). However, a first legal draft was not presented and discussed in parliament and the Committee on Legal Affairs until 2006 (Deutscher Bundestag 2006). At that point, the new law was planned to take effect in April or July 2007 (Deutscher Bundestag 2006, pp. 24, 28). In response to the reform draft, several petitions were launched, but warnings of several experts concerning the constitutionality of the planned caregiver support regulations were not taken into account. Two days before the legal draft was about to pass in parliament in May 2007, the Federal Constitutional Court intervened and declared the planned caregiver alimony regulations to be unconstitutional (Bundesverfassungsgericht 2007), as the new regulations on caregiver support had foreseen to maintain differences in the treatment of formerly married and unmarried parents (BT-Drs. 16/1830 2006, pp. 7, 8, 13). Therefore, the introduction of the law was again postponed, the draft was adapted another time and finally passed in parliament on November 9, 2007. The ‘Unterhaltsrechtsänderungsgesetz’ (law to change the alimony law) was published on December 21, 2007, and took effect on January 1, 2008 (Deutscher Bundestag 2007).

2.2 Expected behavioral responses to the alimony reform

The expected responses to the decreased post-marital and caregiver alimony mainly depend on whether an individual expects to be payer or recipient of alimony payments, and on how strong the expected changes in alimony are. The direction of alimony payments in the case of separation or divorce is determined by the (expected) relative income of partners, and by who is or expects to be the main caregiver of common children. While no comprehensive official statistics on the gender of alimony beneficiaries are available, official data (Statistisches Bundesamt 2017) show that between 2005 and 2010, which is the main time horizon of our analysis, 87% of single parents in Germany were women. In addition, labor income differs largely between men and women: According to SOEP data for the sample considered in this analysis, the gross labor income of women was still 29% lower than that of men. Accordingly, as indicated by SOEP data for the years 2005–2010, about 95% of alimony payments were received by women. This confirms that the reductions in post-marital and caregiver alimony on average translated to a negative (expected) income change for women, and to a positive change for men. For the reason of simplicity, we therefore consider women as alimony beneficiaries and men as alimony payers.

From the perspective of individual labor supply models (e.g., Becker 1965, Gronau 1977), the reduced expected alimony payments for women clearly translate into a negative income effect. Assuming leisure to be a normal good, the negative income effect should induce women to reduce their leisure. Accordingly, they can be expected to increase their labor supply by taking up a waged employment or raising their working hours. As the reform had a differential effect for both genders, opposite income effects are expected for men, whose expected income increases with the reform.

As alimony payments depend on the (relative) income of partners, substitution effects may also occur, which have merely been discussed in previous literature. When sticking to the individual labor supply model with a given income of the partner (during or after marriage), however, the substitution effects are not symmetric for women and men. For men, the substitution effect is comparable to the effect of a tax reduction on labor, since the expected share of income to be paid for alimony has decreased with the reform. Once basic needs and potential children’s alimony claims are covered, men’s budget line therefore steepens. The resulting positive substitution effect thus works against the negative income effect. For women, the substitution effect is less obvious. The reform reduced the alimony payments from a level that often maintained women’s previous living standard for a long time to a lower net present value, as the possibilities to limit the payments in time and volume were extended. This steepens the budget line of their expected income from own earnings and payments received from the point where their own earnings exceed the expected pre-reform alimony payments to the point where their own earnings exceed the expected post-reform alimony payments. Depending on the pre-reform optimum, this positive substitution effect can therefore reinforce the income effect.

Considering that the alimony reform changed rulings after divorce, not only adjustments at the individual level, but also at the household level can be expected. From the perspective of an intra-household bargaining model, not the individual income change matters, but even more the relative position of a partner. The allocation of resources such as individual consumption goods or leisure between heterogeneous partners within the household is assumed to be the result of a bargaining process. The relative bargaining power of each partner may partly be determined by each partner’s income, but also by other factors affecting the individual utility after a separation. In this context, the reduction in alimony payments for women worsens wives’ bargaining power, since their options outside marriage deteriorate in financial terms. Accordingly, husbands’ bargaining power increases as they have to pay lower post-marital and caregiver support in case of a divorce. Following the Becker–Coase theorem (Coase 1960, Becker et al. 1977, Becker 1993) such changes in partners’ outside options and thus bargaining power should only affect the decision to separate when the sum of wealth (or utility) of the partners outside versus within marriage changes. If one partner is put better off outside marriage at the cost of the other spouse, but the overall wealth outside (and within) marriage is not affected, the couple will not be less or more likely to separate, as the changed relative positions are compensated in a bargaining process. The bargaining power of the partner whose outside options improves will increase and (s)he will be able to obtain a larger share of the household’s goods for individual use.Footnote 8 Accordingly, we expect the leisure time of women to decrease and that of men to rise, which is in line with the predictions of the labor supply model for women.Footnote 9

Given that such a compensation of the changed relative outside options of the partners takes place, the decision to separate should not be affected by the reform—at least if the sum of wealth for both partners is not changed. For spouses with children, however, the alimony reform did not only lead to zero-sum shifts of expected alimony payments between spouses but increased the child support in cases where the income of the spouse with the higher income does not suffice to cover all potential alimony claims. For these couples, where the reform also transferred resources to a third party not deciding upon divorce, the decision whether to divorce might have been influenced, even if the Becker-Coase theorem holds. If child support is transferred to the caregiver’s bank account, as common for underage children, this might result in a cushioned reform effect: even though mothers should receive less post-marital and caregiver alimony, this could partly be outweighed by higher child support payments.

Even if changed options outside marriage are not balanced by intra-household shifts of resources and the theorem does not hold, it is still not clear whether or how couples’ probability to divorces changes. In a unilateral divorce scheme as prevalent in Germany, the improved options of men outside their marriage might translate into an increased number of divorces. At the same time, however, less women might file for divorce, as their options outside marriage have deteriorated. Since the effects on the probability of husbands and wives to file for divorce might not be symmetric, the overall effect of the reform on marital stability is ambiguous.

Table 9 summarizes the expected behavioral responses to the alimony reform from the different models for both women and men. For women, the two theoretical models discussed unambiguously predict an increase of women’s labor supply and a decrease of their leisure time in response to the alimony reform. For men, the expected reactions are not as clear, as the negative labor supply effect induced by the positive income shock and the increased bargaining power within the household works against the positive labor supply effect induced by the increased returns to labor. For marital stability, the Becker-Coase theorem predicts an unchanged probability to separate. However, in the setting of the alimony reform, it is not clear whether all of the underlying assumptions are fulfilled.

In general, the scope of the effects described also depends on the possibilities to adjust and on how large the changes in expected income by altered alimony payments are. Possibilities to adjust are determined in particular by whether main family decisions such as the choice of a partner, marriage and having children have already been made. Younger persons who are neither in a long-term relationship nor have children should have the largest possibilities to adjust: as Chiappori et al. (2017) argue, alimony reforms might even have effects on the matching stage. When the expected income of a potential partner changes, people might prefer to get married to another person. However, those already married at the reform date can also be expected to show strong reactions to the reform, as they should be more likely to get divorced in the future than those who might not want to get married at all. This argument is in line with Chiappori et al. (2017), who find larger adaptations of couples formed before than after the alimony reform in Canada. Also in our setting, differential effects by marital status can be expected because the alimony reform in Germany adapted the rulings for post-marital and caregiver alimony for divorced persons towards that of non-married separated couples, as described in Section 2.1. Post-marital alimony was reduced (while corresponding entitlements upon separation did not exist for non-married couples even before the reform) and caregiver entitlements for divorced parents were completely adapted to the pre-reform rulings for previously unmarried separated parents, with a common threshold of the children’s 3rd birthday.

3 Methodology

3.1 Empirical strategy

To empirically assess spouses’ behavioral response to the 2008 German alimony reform, we estimate the following difference-in-difference model

where yit is the behavioral outcome of individual (couple) i at time t. To test the predictions of the labor supply model, we use spouses’ labor force participation, measured as a binary variable, and their daily working hours, conditional on labor force participation, as outcome measures for the extensive and intensive margin of labor supply.Footnote 10 In addition, we look at spouses’ hours of leisure per typical weekday as a measure for household bargaining. For these outcomes, we estimate the model separately for men and women as we expect them to have reacted differently to the reform. Lastly, we investigate couples’ probability to separate to estimate the reform effect on the stability of relationships.

The binary variable post-reformt equals one for the years 2008 to 2010, i.e., the post-reform period, and zero for the years 2005 to 2007, i.e., the pre-reform period.Footnote 11 As the reform originally should have been introduced in spring 2007, it could of course be the case that adaptations to the reform not only started when it took effect, but already earlier. However, as the law was passed in parliament in November 2007, and was published after final checks only in December 2007, we argue that people could at least not be sure about the new alimony regulations until the end of 2007 and therefore use 2008 as the first post-reform year. Nonetheless, as we cannot rule out that behavioral responses occurred already before 2008, we conduct a robustness check in which we exclude the year 2007 from the regression (see Section 4.3).

The binary variable treatmenti distinguishes between those treated and those not (or less) treated by the reform. Given that it is not possible to estimate overall causal effects of the reform, our aim is to investigate the differential effects for those most strongly and those less strongly affected by the reform. As we expect individuals who got married before the reform to react more strongly than non-married, cohabiting couples, we use the former as the treatment group and the latter as the control group. This approach is similar to the one used by Brassiolo (2016) who also uses cohabiting couples as a control group for married couples in his analysis of changes in Spanish divorce law. In particular, we distinguish between couples who got married for the first time at some point between 2005 and 2007 (i.e., in the pre-reform period) and couples who were never married before 2008 but were cohabiting at some point between 2005 and 2007. We condition on pre-reform characteristics only, as the reform might have influenced the evolution or dissolution of relationships. This is in contrast to the study by Fahn et al. (2016), who do not condition on pre-reform characteristics. The model thus estimates the additional effect of the alimony reform for married couples as compared to non-married, cohabiting couples. This can be interpreted as a lower bound to the overall effect, assuming that married couples react more strongly to the reform than non-married cohabiting couples, who only possibly will get married sometime.

The coefficient γ is our main coefficient of interest. It describes how the outcomes of the treatment group changed relative to the outcomes of the control group after the reform was implemented. The identification of this coefficient is based on the assumption that, conditional on all other control variables, the outcomes of the treatment and the control group would have followed parallel trends in case the reform had not been implemented.Footnote 12 We argue that this is plausible because other family or labor market policies that were implemented within our observation period, as, e.g., the introduction of a new parental leave regulation (‘Elterngeld’)Footnote 13, should equally affect the behavior of married and unmarried couples. For tax policies restricted to married couples, no major changes were conducted in the period analyzed. In addition, unlike the majority of studies analyzing the impact of the introduction of unilateral divorce laws, which are usually based on aggregate data, we are able to control for a variety of observable as well as unobservable individual and household characteristics that might be correlated with our outcome variables.

The observable characteristics, as denoted by Xit, include the individual’s age in years, which is also included as a squared term to account for non-linear effects, and his or her education, distinguishing between low-, medium-, and high-skilled individuals. Low education comprises individuals who have no school degree or a lower-secondary degree. Medium-skilled individuals have completed higher-secondary education, i.e., they have a vocational degree or the highest school degree, and high-skilled individuals have completed tertiary education, i.e., they have a college or university degree. We further control for whether the individual is single or married (with the reference group being non-married persons cohabiting with their partner) as well as the duration in years of cohabitation and marriage, respectively, and its square. Moreover, we include the number of children until the age of 15 and dummy variables for the presence of children aged 0 to 2 and children aged 3 to 5 in the household as control variables.

In addition, τt represents a vector of year fixed effects and θst a vector of federal state specific linear time trends. The latter is included to control for region-specific trends in our outcome variables. εit denotes the error term.

While Eq. (1) only controls for observable characteristics of the individual and the couple, respectively, we further make use of the longitudinal nature of the survey data and estimate the following fixed effects model

where μi is a fixed effect for each individual (couple). This allows us to eliminate any time invariant unobserved heterogeneity at the individual (couple) level.

In addition to our baseline estimates, we conduct several heterogeneity analyses to investigate whether different sub-groups react more or less strongly to the reform. First, we split the sample according to the (potential) earnings difference between the partners, as those couples that are most specialized should have reacted most strongly to the reform. Second, we distinguish between couples who have children between 3 and 8 years and those whose children are younger or older than 8 years, or who have no children. As caregiver alimony for children aged 3–8 years is no longer paid after the reform, the former group should have reacted more strongly to the reform. Third, we split the sample by men’s degree of satisfaction with family life in the pre-reform period. We argue that couples in which the man was already dissatisfied with the relationship when the alimony reform was enacted have the highest probability to separate, as the costs of divorce for men were significantly reduced with the reform.

The model is estimated using ordinary least squares (OLS) for all outcomes. All standard errors are heteroscedasticity-robust and clustered at the level of the individual and the couple, respectively.

3.2 Data and summary statistics

For our empirical analysis, we use data from the German Socio-Economic Panel (SOEP), since it includes comprehensive information on family events such as marriage and separation, on time use, as well as standard socio-economic characteristics including labor outcomes, for a relatively large number of observations. It is an annual longitudinal survey conducted since 1984, where every year between 10,000 and 25,000 adults from the age of 16 years onwards are asked about ‘Living in Germany’. We use the SOEP long-format data where the different waves are already combined and selected variables are harmonized where necessary.Footnote 14

As main time horizon for our analysis, we choose the years 2005 through 2010, to cover several years before and after the reform. As our focus is on first marriages, we only consider individuals who got married for the first time in the pre-treatment period (the treatment group) and individuals who were never married before 2008 (the control group). In addition, we restrict our sample to individuals between 18 and 65 years of age.

Table 1 shows the pre-reform summary statistics for the resulting sample.Footnote 15 It includes the mean and standard deviation of all dependent and independent variables by gender and for both the treatment and the control group. For each gender, the mean difference between the treatment and control group is given, and the statistical significance of the difference is indicated as calculated by a t-test. For women, labor force participation is higher in the control group than in the treatment group.Footnote 16 The opposite is the case for men. While men in the treatment and the control group have almost the same working hours (measured per average weekday in the week of the interview), women who did not get married in the pre-reform period work significantly more hours per day than those in the treatment group, though the difference is very small. Still, they report having more leisure time per workday, and this difference is similar for men. The separation rate is much higher for never-married individuals than for individuals having married in the pre-reform period. The latter are also slightly older and have higher education levels. The duration of cohabitation is on average lower for the recently-married than for those cohabiting in the pre-reform period. Finally, the recently-married are more likely to have children, which is in line with them having lower labor supply and less leisure time.

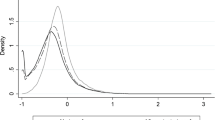

The main assumption of our identification strategy is that, conditional on all other control variables, the outcomes of the treatment and the control group would have followed parallel trends in case the reform had not been implemented. Figure 1 shows the pre- and post-treatment trends of our four outcome variables for the treatment and the control group, conditional on all covariates. For women, the pre-reform trends in labor force participation rates, working hours and leisure are largely parallel for newly-married and never-married cohabiting women. For men, working hours and leisure time of the treatment and the control group follow parallel trends as well, while the pre-treatment trends in labor force participation of the treatment and the control group cut across between 2003 and 2005. The results for men’s labor force participation therefore have to be interpreted with some caution. With respect to couples’ separation rates, the probability to separate increases for both married and unmarried couples prior to the reform, but this increase is slightly stronger for non-married couples between 2003 and 2005. Although our baseline estimates cover the time period 2005 to 2010 only, this could challenge the common trend assumption.

Trends in outcomes of treatment and control group. Notes: The graphs depict the average predicted outcome value by year of the treatment and control group. The treatment group includes cohabiting couples who got married for the first time in the pre-reform period. The control group includes cohabiting couples who did not get married until at least 2007. Control variables are the same as in Tables 2–4. Confidence intervals (95%) are calculated with robust standard errors clustered at the individual/couple’s level

4 Results

4.1 Basic results

Our basic estimation results at the individual level are shown in Table 2 for women and in Table 3 for men. In each of the two tables, the first three columns show the results of estimating the pooled difference-in-difference model depicted in Eq. (1), while the last three columns display the results of the fixed effects model presented in Eq. (2). The results of the pooled OLS regressions reveal that for all outcomes considered, the coefficient for the treatment-group dummy is not statistically different from zero, suggesting that conditional on other individual and family characteristics, newly-married and never-married partners did not differ in terms of their labor supply and their intra-household allocation of leisure prior to the reform. However, we also hardly find any evidence that the reform had a differential impact on the labor supply or leisure time of both groups. With respect to women’s labor force participation, the respective interaction effect is positive and sufficiently large in both the pooled model and the fixed effects model (about 1–3% points), but not statistically different from zero. As the standard errors are large, only reform effects on women’s labor force participation that are larger than 10% can be ruled out based on the confidence interval of the fixed effects estimator. The limited number of observations in our survey design thus raises the question whether our study is underpowered to statistically detect small effect sizes. A post-hoc power calculation reveals that based on the number of observations in our study, we would be able to detect effects that are larger than 3.5% points (given a significance level of 0.1 and a desired power of 0.8). While this would rule out the detection of very small effects, we can still conclude that the reform did not lead to large changes in the labor force participation of married women.

For men, we also find a positive but somewhat smaller and insignificant reform effect on labor force participation. However, as the labor force participation rates of newly-married and never-married men did not follow parallel trends in all years prior to the reform, the labor force participation results for men should be interpreted with caution. In general, the signs of the coefficients are in line with the results of the survey by Bertelsmann Stiftung (2009), where both women and men had announced to increase their labor supply as a response to the reform. Regarding the intensive margin of labor supply, spouses’ actual working hours, the interaction effects are close to zero and not statistically significant for both women and men irrespective of the specification.Footnote 17 Thus, the expected increase in the labor supply of married women after the reform can in general not be confirmed empirically. In terms of shifts of intra-household resources such as leisure, the results also do not show the hypothesized shift from women to men, as no differential responses of married and non-married cohabiting couples can be detected.

Table 4 shows the results for the probability to separate, estimated at the couples’ level. While the Becker-Coase theorem suggests that shifts in the allocation of resources outside the marriage should not affect the probability to separate, the pooled OLS model shows a large and statistically significant effect for the interaction of the post-reform and the treatment group dummy. Compared to couples who never got married until the reform, couples who got married for the first time before the reform are about 4% points more likely to separate from 2008 on. As the reform reduced the expected cost of divorce for men, this result could suggest that some men who were on the margin of wanting to separate decided to do so after the reform. However, the last two columns of Table 4 reveal that the positive reform effect on separation rates completely vanishes once couple fixed effects are added to the model. One explanation for the diverging results of the pooled OLS and the FE model is time-varying panel non-response, accruing from the fact that couples have to be dropped from our analysis sample once they are separated. As Lechner et al. (2016) show, in a difference-in-difference framework such non-random panel attrition will lead to inconsistent OLS estimates, while the fixed effects estimates may still be consistent.Footnote 18 Hence, our conclusion is that there is no robust reform effect on couples’ probability to separate.

The coefficients for the other control variables included in the regressions at the individual and couples’ level are in general in line with common findings. The relationship between age and labor force participation is inverted U-shaped, while the relationship between age and leisure goes in the opposite direction. In addition, women who are married and have small children are less likely to participate in the labor market, while the number or the age of the children do not affect men’s labor supply but reduce their (and women’s) leisure time. With respect to the regressions at the couples’ level, only few characteristics have explanatory power for the probability to separate. The results again show that married couples are less likely to separate than unmarried couples. Women’s age and education are also predictive for couples’ separation probabilities, while men’s characteristics have no effect on marital stability.

4.2 Heterogeneity analyses

Given that we do not find significant increases in female labor supply or shifts of leisure from women to men for the overall sample, we conduct several heterogeneity analyses to investigate whether the effects are more prevalent for those groups most exposed to the reform. First, we split the sample by the difference in potential earnings between the two partners, arguing that households in which the partners are most specialized should have reacted most strongly to the reform. Potential earnings are calculated by estimating Mincer wage regressions for full-time employed single men and women aged 25–45 in the pre-reform period and using the estimated parameters from these models to predict the potential (full-time) earnings of the married and cohabiting men and women in our sample.Footnote 19 Table 5 shows the respective results, separately for whether the difference in potential pre-reform earnings between the partners is above or below the median. In terms of significance, none of the estimated reform effects is statistically different from zero for both groups. In terms of the size of the reform effect on women’s labor force participation, the interaction effect is larger for couples with a low difference in potential pre-reform earnings, which contradicts our expectation that couples who are most specialized before the reform react most strongly to it. However, given that the income difference is largest for women with the lowest potential earnings, it is also not surprising that these women react less strongly to the reform. Besides the fact that it might be more difficult for these women to find a job, joint taxation of married couples creates a large disincentive for women to enter the labor market, especially when the earnings difference between the wife and the husband is high. In the fixed effects model, the difference in the size of the reform effect on women’s working hours and leisure between the groups is as expected, but again none of the coefficients is statistically significant.

Second, we disentangle the differential reform effect by the age of the spouses’ children. Here, we exploit the fact that the reform adapted the regulation for caregiver alimony between previously married parents to the regulation for never-married separated parents. As explained in Section 2.1, since 2008 full alimony is normally granted to the separated or divorced caregiver only until the (youngest) common child is 3 years old. Before 2008, a threshold of 8 years (in some cases even up to 11 or 15 years) applied to previously married caregivers. Accordingly, Table 6 shows the reform effect separately for parents whose children were between 3 and 8 years old in the post-reform period and for those whose children were younger or older than 3–8 years or who had no children in the post-reform period.Footnote 20 With respect to women’s labor supply, the fixed effects results indeed reveal that the positive reform effect on labor supply and working hours is larger for mothers of children aged 3–8 than for the comparison group. However, none of the effects is statistically significant. If anything, we find a positive effect on the labor force participation of men with children in the relevant age group. In addition, we do not find evidence for shifts in leisure time from women to men, irrespective of the age of the children. Hence, both for the overall sample and for those groups most exposed to the reform, we do hardly find any responses in terms of labor supply and intra-household allocation of leisure as a result of the reform.

Lastly, we investigate heterogeneous effects at the couples’ level. In particular, we expect couples in which men were not satisfied with the relationship in the pre-reform period to react most strongly to the reform in terms of higher separation probabilities. Table 7 thus shows the estimated reform effects separately for couples in which men’s satisfaction with family life in the pre-reform period was above or below the median.Footnote 21 The pooled OLS results reveal indeed that couples in which men where less satisfied with family life prior to the reform are most likely to separate after 2008, while no reform effect is found for the high satisfaction group. However, the effect for the low satisfaction group becomes smaller and turns insignificant in the fixed effects model. Instead, the fixed effects model reveals a negative and significant reform effect on the separation probability for couples in which the male partner is highly satisfied—a group that is expected to be hardly affected by the reform. One possible explanation for this result could be that the level of satisfaction with family life of the male and the female partner is highly correlated, so that the effect is a result of less married women filing for divorce after the reform. However, when conditioning on women’s level of satisfaction in the pre-reform period, no reform effect is found for the group of couples in which women are highly satisfied.

4.3 Robustness checks and discussion

In addition to the analyses by sub-groups, we conduct several robustness checks. One concern could be that our control group of non-married cohabiting couples could also react to the reform. To make sure that our results are not driven by the choice of the particular control group, we therefore use single, never-married individuals as an alternative control group.Footnote 22 The results are overall robust to the choice of this alternative control group, revealing no significant reform effect on the labor supply or leisure time of married individuals (see Table 12). We do, though, find some evidence that married men decreased their working hours compared to single men after the reform, which would support the hypothesis that the income effect associated with the reduced expected alimony payments after a divorce induced men to reduce their labor supply. The substitution effect seems to be of minor importance in this context. Furthermore, we conduct several sensitivity analyses with respect to the years included in the analysis. First, we follow Fahn et al. (2016) and exclude the year 2007 from the pre-reform period, in order to rule out that our findings are driven by possible anticipation effects of the reform. Second, we check the robustness of our results by extending the pre- and post-reform period by one and two further years (2004–2011 and 2003–2012). The results of these sensitivity analyses support our previous findings and are shown in Tables 13 and 14.

Hence, our basic conclusions do not change: In general, we do not find evidence for an increase in labor supply of newly-married as opposed to never-married women in response to the reform. Neither do we find evidence for shifts of leisure from women to men. These results do not support the hypotheses derived from labor supply and intra-household bargaining models. This is partly in contrast to previous studies on alimony reforms in Brazil and Canada (Rangel 2006, Chiappori et al. 2017), where significant labor supply responses of women were found after the introduction of new alimony claims. While these studies do not find significant changes in women’s probability to be active in the labor force, their results reveal adaptations at the intensive margin of women’s labor supply. Although the empirical approach applied in these studies is similar to the one we use, the reform intensity in our setting might be lower, as alimony claims in Germany were only reduced but not completely abolished with the reform, which might explain the diverging results.

In addition, while Fahn et al. (2016) show that the reduction in caregiver alimony in Germany reduced marriage rates, we do not find robust evidence for similar effects on couples’ marital stability. This finding, however, is in line with the predictions of the Becker–Coase theorem, which suggests that a change in the relative utility of partners outside marriage should not affect the probability to separate due to changes in the allocation of resources within marriage.

Possibly, we do not find corresponding responses to the reform because the expected reactions to the reform in terms of labor supply or leisure were too small to be identified. This is particularly important since we focus on the difference in the adaptation between newly- and never-married persons, as in the absence of specific cutoff-rules an overall causal effect of the reform cannot be identified. Labor supply might not be easily adjustable, especially for persons who already got married and might have decided on intra-household specialization (e.g., housework vs. paid labor) and had children before the reform.

Although our treatment group should have higher probabilities to react to the reform, missing reactions in terms of labor supply or leisure could also be the consequence of lower possibilities of the treatment group to react, as compared to the control group. This is in line with the finding by Fahn et al. (2016) of a declined probability to get married when caregiver alimony is reduced. Cohabiting women who did not get married previous to the reform could have increased their labor supply or extended their education and postponed or renounced marriage. However, our analysis of singles as an alternative control group produces reform effects of similar or even smaller size than the respective effects obtained from using non-married cohabiting partners as a control group. This reveals that behavioral responses by cohabiting couples to the reform cannot explain the zero effects found in this study.

Our difference-in-difference analysis focuses on persons who were still married or cohabiting at the reform date, which means that possible adaptations are mostly reactions to expected changes. Accordingly, for behavioral responses to the reform to take place, individuals must be sufficiently forward-looking, and the discount rate may not be too high. Furthermore, individuals must be informed about the reform. A survey conducted by Bertelsmann Stiftung (2009) reveals that only 16% of all individuals had not heard about the reform. Assuming that knowledge was similar in our sample and that it did not differ between the treatment and the control group, the reform effects on those being aware of the reform are thus 19% higher than those for the full sample. However, even if the reform effects on those who have heard about the reform are higher, they are not large enough to alter any of our main findings, especially that the alimony reform did not lead to (large) changes in married women’s labor supply.

Although a substantial share of the interviewed persons knew about the reform and the media coverage on the reform was large, the survey by the Bertelsmann Foundation also reveals that only 17% of all individuals knew details about the reform. One could argue that only those women who saw divorce as a realistic option actually informed themselves about the reform and could have reacted to it. If only 17% of the individuals could have reacted to the reform, the reform effects on those individuals would be almost five times higher than those for the full sample. It could thus well be that only a small percentage of the newly-wed women perceived divorce as a credible threat, but for those who did, the reform had a significant impact on their labor force participation.Footnote 23

Lastly, it is important to point out that our analysis is only able to capture the (expected) short-term effects of the reform on couples that were already formed before the reform. While we do not find any behavioral responses for this group, it is still possible that the reform is effective at increasing the labor supply of married women for couples that were formed after the reform. However, the hypothesis of such longer term effects of alimony reforms is not supported by Chiappori et al. (2017), who show for the case of Canada that couples formed after the alimony reform reacted less strongly to it than couples formed before the reform.

5 Conclusion

The aim of this study is to provide an empirical investigation of spouses’ behavioral responses to the 2008 alimony reform in Germany. As the reform reduced post-marital and caregiver alimony between ex-spouses and alimony payments have mostly been received by women and paid by men, differential responses by gender in terms of adjustments in labor supply and leisure can be expected.

The introduction of the reform does not allow for an overall causal estimation of behavioral responses, as everyone who got married or considered to do so at some point could have been affected by the reform in terms of (expected) altered alimony payments after a possible divorce. Accordingly, we use a difference-in-difference setting to investigate the differential behavioral response of never-married cohabiting couples and couples who got married for the first time in the pre-reform period. Since the 2008 alimony reform mainly harmonized the rulings for married and non-married couples by reducing the entitlements for married couples, we expect married couples to react more strongly to the reform than non-married couples.

Based on SOEP data for the years 2005–2010, we do not find significant increases in the labor supply of married women as a response to the reform. Neither do shifts of leisure from married women to men seem to have taken place, not even for sub-groups most exposed to the reform in terms of the potential earnings difference between the partners or the age of the children. While there is some evidence that marital dissolution increased with the reform, this effect vanishes once unobserved heterogeneity at the couples’ level is controlled for. The result that the changed relative positions of partners outside marriage have no effect on marital stability is in accordance with the Becker-Coase theorem. However, the main rationale behind this prediction, namely a shift in intra-household resources between partners, cannot be confirmed by our analysis.

One possible explanation is that many people did not have enough information about the reform to adjust their behavior to it, or that they do not take into account or strongly discount future income effects. Also, adjustment possibilities for the treatment group might have been too small when married persons had higher intra-household specialization. Moreover, the legal change and its expected effects may not have been large enough to produce many detectable effects, in particular since increases in child support could have cushioned decreases in post-marital and caregiver alimony.

Although we are not able to evaluate the overall causal effect of the alimony reform, our results at least cast reasonable doubts that the main objectives of the reform—increasing the post-marital self-responsibility of women—have been reached. Though the reform lowered post-marital alimony, no clear balancing effect in terms of increased female labor force participation was found. This suggests that either poverty has increased among divorced women, or that these women still depend on payments provided by others. While this could be new partners, it is likely that at least part of the reduced alimony payments are compensated by the state, in terms of unemployment benefits or social welfare.

Notes

With no-fault divorce, a marriage can be dissolved even if neither spouse can be blamed for the breakdown of marriage, e.g., because of having committed adultery. Many countries even have been accepting this ‘irretrievable breakdown of marriage’ as a reason for divorce if it is put forward by only one spouse. These legal schemes are then classified as ‘unilateral divorce’ regimes, as opposed to ‘consent’ (also called ‘bilateral’ or ‘mutual divorce’).

While the law does not define this short duration in years, legal practice has set it to between two and three years (Bundesgerichtshof 1986).

This is a frequent case according to Borth (2007).

See Table 8 for a comparison of the old and new rulings.

Again, the law does not define this duration in years. Legal practice used to apply a threshold of around 10 years (Born et al. 2012: Sec. 1609, margin number 21).

For a change to be considerable, the expected change in alimony payments has to be approximately 10% (Gruber 2013, S. 113).

The validity of the theorem is based on the assumptions of transferable utility and low bargaining or transaction costs. Moreover, as Rangel (2006) argues, the threat of ending the relationship has to be sufficiently credible, which he expects to be the case rather for unmarried than married couples. Otherwise, the change of the threat point would not need to affect the bargaining process. A more detailed discussion of the Becker–Coase theorem and its assumptions is included in Chiappori et al. (2009, 2015).

If one partner’s leisure time increases (decreases), either his/her housework time or his/her working time has to decrease (increase). Hence, the changed bargaining position can also affect the partner’s labor supply.

We have also used overall labor supply, i.e., working hours unconditional on labor force participation, as an alternative outcome. In addition, following Rangel (2006) and Chiappori et al. (2017), we have used the logarithm of daily working hours as well as transitions from part-time to full-time employment as alternative measures for responses at the intensive margin of labor supply. The results are similar to those on working hours conditional on labor force participation and therefore not shown here

Determining the duration of the post- and the pre-reform period is of course to some extent arbitrary. We decided to include several years before and after the reform to be able to control for general time trends and to not let outcomes of a single year determine the results. We also check the robustness of our results by adding one and two further years to each of the pre- and post-reform period (see Section 4.3).

Pre-treatment trends for all outcome variables are shown in Fig. 1.

On 1 January 2007, a new parental leave benefit called Elterngeld (‘parental money’) replaced a previous benefit called Erziehungsgeld (‘child-raising money’). Whereas the previous benefit was specifically targeted towards low-income families, the new Elterngeld is a much more generous transfer, which depends on parental labor earnings in the pre-birth period (see Kluve and Tamm (2013) for a more extensive discussion of the new parental leave regulation).

A detailed documentation of the SOEP data, data collection, sample composition, and representativeness can be found in Wagner et al. (2007). A description of version 31.1 of the dataset, which is the version we use, is available at https://doi.org/10.5684/soep.v31.

Labor force participation is a binary variable equal to one for persons who are working, are on leave or are unemployed, and equal to zero for the remaining, who are not working and are not registered as searching for work. It is set to missing for persons who already have retired.

Note that post-hoc power calculations reveal that the number of observations in our study is large enough to detect effect sizes found in previous studies.

Note that in the FE regression, identification of the treatment effect only comes from couples who are observed both before and after the reform, which means that results are conditional on the couple staying together until the reform.

The wage regressions estimate the logarithm of gross monthly earnings as a function of age and its square, labor market experience and its square, a set of indicator variables for the highest degree of education, federal state fixed effects as well as year fixed effects.

Of course, by including parents with young children or parents without children in the comparisons group, the composition of this group could be influenced by potential reform effects on (in-wedlock vs. out-of-wedlock) fertility. However, excluding parents with young or without children would result in a too small sample size.

The two groups are built on the basis of men’s average pre-reform satisfaction with their family life in the years 2006–2007 (as the variable is not available for 2005).

Except for men’s labor force participation, the pre-trends for married and single individuals follow parallel trends for all outcomes.

Of course, given that about one third of all marriages get divorced in Germany (Statistisches Bundesamt 2016), this would imply that people are to some extent myopic and do not fully consider the risk of divorce when making decisions about labor supply and the intra-household division of labor.

References

Altindag, D. T., Nunley, J., & Seals, A. (2017). Child-custody reform and the division of labor in the household. Review of Economics of the Household, 15(3), 833–856.

Becker, G. S. (1965). A theory of the allocation of time. The Economic Journal, 75(299), 493–517.

Becker, G. S. (1993). A Treatise on the Family. Cambridge, Massachusetts: Harvard University Press.

Becker, G. S., Landes, E. M., & Michael, R. T. (1977). An economic analysis of marital instability. Journal of Political Economy, 85(6), 1141–1187.

Bertelsmann Stiftung (2009). Das neue Unterhaltsrecht—Mehr Fairness nach der Trennung?: Dokumentation einer Umfrage. http://www.bertelsmann-stiftung.de/fileadmin/files/BSt/Presse/imported/downloads/xcms_bst_dms_28424_28425_2.pdf. Accessed 14 Jan 2015.

BGB (2007). Bürgerliches Gesetzbuch [in der Fassung der Bekanntmachung vom 2. Januar 2002; zuletzt geändert durch Art. 2 Abs. 16 Gesetz zur Reform des Personenstandsrechts (Personenstandsrechtsreformgesetz - PStRG) vom 19.2.2007] (60th ed., Beck-Texte, Vol. 5001). München: Deutscher Taschenbuch-Verlag.

BGB (2008). Bürgerliches Gesetzbuch [in der Fassung der Bekanntmachung vom 2. Januar 2002; zuletzt geändert durch Art. 1 Gesetz zur Änderung des Unterhaltsrechts vom 21.12.2007] (61st ed., Beck-Texte, Vol. 5001). München: Deutscher Taschenbuch-Verlag.

Born, W, Schwab, D, Säcker, F. J., & Rixecker, R. (2012). Familienrecht II: §§ 1589 - 1921 SGB VIII. In: In D. Schwab (Ed.) Münchener Kommentar zum Bürgerlichen Gesetzbuch. 6th ed. Vol. 8. München: C. H. Beck.

Borth, H. (2007). Unterhaltsrechtsänderungsgesetz: (UÄndG): Gesetz zur Änderung des Unterhaltsrechts (FamRZ-Buch, Vol. 24). Bielefeld: Gieseking.

Brassiolo, P. (2016). Domestic violence and divorce law: When divorce threats become credible. Journal of Labor Economics, 34(2), 443–477.

BT-Drs. 14/3781 (2000). Drucksache des deutschen Bundestages: Beschlussempfehlung und Bericht des Rechtsausschusses (6. Ausschuss) zu dem Gesetzentwurf der Fraktionen SPD und BÜNDNIS 90/DIE GRÜNEN – Drucksache 14/1247 – Entwurf eines Gesetzes zur Ächtung der Gewalt in der Erziehung. Accessed 5 Jul 2000.

BT-Drs. 16/1830 (2006). Gesetzentwurf der Bundesregierung: Entwurf eines Gesetzes zur Änderung des Unterhaltsrechts. Accessed 15 Jun 2006.

Bundesgerichtshof (1986). IVb ZS, Urteil vom 09.07.1986 - IVb ZR 39/85. FamRZ, 886–889.

Bundesverfassungsgericht (2007). 1. Senat, Beschluss v. 28.2.2007 - 1 BvL 9/04. FamRZ, 965–974.

Chiappori, P.-A., Iyigun, M., & Weiss, Y. (2009). Divorce Laws, Remarriage and Spousal Welfare. Unpublished Working Paper. https://www.researchgate.net/profile/Pierre_Chiappori/publication/264858176_Divorce_Laws_Remarriage_and_Spousal_Welfare/links/544503410cf2534c76602da1.pdf. Accessed 7 Apr 2019.

Chiappori, P.-A., Iyigun, M., & Weiss, Y. (2015). The Becker-Coase Theorem Reconsidered. Journal of Demographic Economics, 81(2), 157–177.

Chiappori, P.-A., Iyigun, M., Lafortune, J., & Weiss, Y. (2017). Changing the rules midway: the impact of granting alimony rights on existing and newly-formed partnerships. The Economic Journal , 127(604), 1874–1905.

Coase, R. H. (1960). The Problem of Social Cost. The Journal of Law & Economics, 3, 1–44.

Deutscher Bundestag (2006). Protokoll der 28. Sitzung des Rechtsausschusses (6. Ausschuss) der 16. Wahlperiode. Accessed 16 Dec 2006.

Deutscher Bundestag (2007). Gesetz zur Änderung des Unterhaltsrechts: Vom 21. Dezember 2007. Bundesgesetzblatt Teil I, 3189–3193.

Fahn, M., Rees, R., & Wuppermann, A. (2016). Relational contracts for household formation, fertility choice and separation. Journal of Population Economics, 29(2), 421–455.

Friedberg, L. (1998). Did unilateral divorce raise divorce rates? Evidence from panel data. The American Economic Review, 88(3), 608–627.

González, L., & Viitanen, T. K. (2009). The effect of divorce laws on divorce rates in Europe. European Economic Review, 53(2), 127–138.

Gray, J. S. (1998). Divorce-law changes, household bargaining, and married women’s labor supply. The American Economic Review, 88(3), 628–642.

Gruber, U. (2013). Münchener Kommentar zur Zivilprozessordnung. In T. Rauscher, P. Wax, & J. Wenzel (Eds.), Münchener Kommentar zur Zivilprozessordnung mit Gerichtsverfassungsgesetz und Nebengesetzen. München: Beck.

Gronau, R. (1977). Leisure, home production, and work—the theory of the allocation of time revisited. Journal of Political Economy, 85(6), 1099–1123.

Kluve, J., & Tamm, M. (2013). Parental leave regulations, mothers’ labor force attachment and fathers’ childcare involvement: Evidence from a natural experiment. Journal of Population Economics, 26(3), 983–1005.

Kneip, T., & Bauer, G. (2007). Effects of different divorce probabilities on female labor force participation and fertility. Arbeitspapier, Mannheimer Zentrum für Europäische Sozialforschung, 102. Mannheim: Universität Mannheim, Mannheimer Zentrum für Europäische Sozialforschung (MZES).

Lechner, M., Rodriguez-Planas, N., & Fernández Kranz, D. (2016). Difference-in-difference estimation by FE and OLS when there is panel non-response. Journal of Applied Statistics, 43(11), 2044–2052.

Peters, H. E. (1986). Marriage and divorce: informational constraints and private contracting. The American Economic Review, 76(3), 437–454.

Rangel, M. A. (2006). Alimony rights and intrahousehold allocation of resources: evidence from Brazil. The Economic Journal, 116(513), 627–658.

Statistisches Bundesamt (2016). Statistik der rechtskräftigen Beschlüsse in Eheauflösungssachen (Scheidungsstatistik) und Statistik der Aufhebung von Lebenspartnerschaften: Fachserie 1 Reihe 1.4. https://www.destatis.de/DE/Publikationen/Thematisch/Bevoelkerung/Bevoelkerungsbewegung/Scheidungsstatistik2010140167004.pdf?__blob=publicationFile. Accessed 1 Jun 2018.

Statistisches Bundesamt (2017). Bevölkerung und Erwerbstätigkeit: Fachserie 1 Reihe 3, Haushalte und Familien, Ergebnisse des Mikrozensus. https://www.destatis.de/DE/Publikationen/Thematisch/Bevoelkerung/HaushalteMikrozensus/HaushalteFamilien2010300167004.pdf?__blob=publicationFile. Accessed 1 Jun 2018.

Stevenson, B., & Wolfers, J. (2006). Bargaining in the shadow of the law: divorce laws and family distress. Quarterly Journal of Economics, 121(1), 267–288.

Wagner, G. G., Frick, J. R., & Schupp, J. (2007). The German Socio-Economic Panel Study (SOEP)—Scope, Evolution and Enhancements. Schmollers Jahrbuch: Zeitschrift für Wirtschafts und Sozialwissenschaften, 127(1), 139–169.

Wellenhofer, M. (2011). Familienrecht. 2nd ed. München: Beck.

Wolfers, J. (2006). Did unilateral divorce laws raise divorce rates? A reconciliation and new results. The American Economic Review, 96(5), 1802–1820.

Wong, H.-P. C. (2016). Credible commitments and marriage: when the homemaker gets her share at divorce. Journal of Demographic Economics, 82(3), 241–279.

Acknowledgements

The authors are grateful to the editors, Shoshana Grossbard and Tansel Yilmazer, two anonymous reviewers, Thomas Bauer, Christina Gathmann, and participants at the BeNa internal workshop 2015, the 9th RGS Doctoral Conference, the 2016 Annual Conference of the Verein für Socialpolitik and the 28th Annual Conference of the European Association of Labour Economists for valuable comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare that they have no conflict of interest.

Additional information

Publisher’s note: Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Bredtmann, J., Vonnahme, C. Less money after divorce – how the 2008 alimony reform in Germany affected spouses’ labor supply, leisure and marital stability. Rev Econ Household 17, 1191–1223 (2019). https://doi.org/10.1007/s11150-019-09448-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11150-019-09448-z