Abstract

The purpose of this paper is to assess the impact of economic changes in the 1990s and 2000s on the welfare of married households, taking into account the relative earnings structure of husband and wife. Modeling the household members’ joint labor supply, we find that families in which the wife is the higher wage earner experienced as much welfare gain in the 1990s and significantly higher welfare gains in the 2000s as families in which the husband is the higher wage earner.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction and background

The decades of the 1990s and the 2000s have provided startlingly different experiences for American families. While the 1990s were largely characterized by the continuation of the economic expansion that started in the 1980s, the experience of the “great recession” dominated the decade of the 2000s. Additionally, the shrinking wage gap between men and women that started in the 1980s continued over the following decades (for example, see Rios-Avila and Hotchkiss 2014). And further, there has been a fairly dramatic rise in the share of families in which wives earn more than husbands. Wang et al. (2013) report that the share of married mothers that out-earn their husbands rose from 4 % in 1960 to 15 % in 2011. Winkler (1998) calculates that married families in which wives (not necessarily just mothers) earn more than husbands rose from 16 % in 1981 to 23 % in 1996. While the incidence of higher earning wives is overall lower for families with children (as women in these families, ceteris paribus, are less likely to participate in the labor market in the first place), the growth over time is clear. The purpose of this paper is to assess the impact of economic changes in the 1990s and 2000s on the welfare of married households, taking into account the earnings of the husband and wife relative to one another.

There is some evidence in the literature to suggest that the relative earnings structure within the household affects the family’s welfare level, or general satisfaction, and their fragility (e.g., Bertrand et al. 2015).Footnote 1 There is also evidence provided as to the reasons for the growing share of women that out earn their husbands (e.g., Winkler 1997). As far as we can tell, however, there are no analyses of how families with different earnings structures have fared in face of very different economic pressures over time. The research question here is this: Given the changes in wages and non-labor income observed across time, how has welfare changed in families where the husband and wife have different relative earnings potential? We find that over two very different decades, families in which the wife is the higher wage earner increased their total welfare by as much during the 1990s and by more during the 2000s than families in which the husband earned the higher wage.

Our results are consistent with earlier work that found that, due to the relative wage changes during the 1980s, families in which the wife was in a higher earning category than her husband were materially better off (Hotchkiss et al. 1997). Taken together, the implication of the results in this paper, along with that of earlier analysis, is that over three decades of the shrinking wage gap and other economic influences, families in which the wife is the higher wage earner or is in a higher earnings category than her husband experienced at least as much welfare gain as families with a different relative earnings structure.

2 Methodology

To answer the research question stated above, we estimate utility function parameters that allow us to calculate the dollar equivalent change in utility between two time periods for families in which the husband earns the higher wage, in which the wife earns the higher wage, and in which the husband and wife earn similar wages. The parameters are estimated in the context of a joint labor supply model within a family utility maximization framework that recognizes the importance of labor supply decisions of each family member being made with consideration of market opportunities of the other member. The structural utility maximization framework that we employ in this paper is preferred to alternative labor supply specifications, as found, for example, in Hausman and Ruud (1984), Hoynes (1996), and van Soest et al. (2002), because it allows us to deconstruct welfare changes based on the welfare valuation by the family of consumption and non-market time of each member.

We model family utility in a neoclassical joint utility framework, which can be thought of as a reduced-form specification of family decision-making. This has the advantage of giving us a clear-cut expression of family welfare that allows for cross wage effects on each member’s labor supply decisions, hence capturing some of the relativity in market wages that seems to be driving preferences. In order to allow for heterogeneity in preferences across family types, utility function parameters, hence labor supply elasticities, are allowed to differ for families of different relative earnings types. Of course, we are still assuming homogeneity of preferences within family type, but this assumption is not unique to our analysis or the application of a structural utility maximization framework.

It is important to remember in this exercise that it is not only changes in income that will affect family welfare, but also how the family values that income, especially relative to how the family values the non-market time of each member as that also changes in response to wage changes. For example, in an environment in which the wage gap between men and women is shrinking, it might be expected that welfare will increase more in families that depend more on the wife’s earnings. However, changes in wages (and non-labor income) not only affect total income/consumption potential, but also affect working hours of both members, which will also impact welfare. Comparing welfare changes across families with different relative earnings structures, it becomes clear that it is not only the relative changes in wages that matter, but also the way each family type values income and non-market time.

Because we are interested in the change in utility for different family types (based on relative wages) and because preferences may vary by family type, we estimate a different set of parameters for each family type. In addition, we consider that preferences (even within family type) are likely to have changed over time, so we estimate utility function parameters at two different time periods (for each family type)—in 2012 in order to evaluate change in utility during the 2000s, and in 2003 to evaluate change in utility during the 1990s (roughly speaking).

While some of the effects observed in the data might be driven by changes in marriage sorting across time, we do not model selection of individuals into marriages of different relative earnings capacities. The evidence provided by the literature of significant discomfort associated with one particular type of relative earnings structure (i.e., wife earning more than her husband) suggests that individuals, on average, do not necessarily sort into these types of families on purpose. In addition, because of strong evidence for assortative mating, especially in dual-earner families (see Bloemen and Stancanelli 2015), which spouse earns more may be more likely attributable to random or institutional (e.g., discrimination) factors.Footnote 2 In addition, results in Shore (2015) suggest that marital sorting may be based more on the volatility of spousal earnings, rather than on their relative value. However, if couples do sort based on their preference for a particular relative earnings structure, we are likely to over-estimate the welfare gain among any family type in which wage changes have up-ended that earnings structure. Given that the 2007 recession disproportionately affected men (Wall 2009), it may be the case that families in which the wife earns more than her husband in 2012 are more likely than other earnings types to have had their preferred relative earnings structure reversed.

2.1 The family utility framework

The assumption of joint family utility (or, “collective” utility) is often rejected in favor of a bargaining structure to household decision making (for example, see McElroy 1990 and Apps and Rees 2009). However, there is evidence that the choice of structure for household decision making has very little implication for conclusions in micro simulation exercises (see Bargain and Moreau 2003). In addition, Blundell et al. (2007) find that both collective and bargaining models are consistent with their household labor supply model estimated in the U.K. Also, using U.S. data, Winkler (1997) finds that income pooling (implied by the collective utility model) is not rejected when cohabitors are in a long-term relationship, especially when children are present.Footnote 3 The joint utility framework is used here in order to evaluate welfare changes of the family (as opposed to independent welfare changes of the individual family members).

Within the framework of the neoclassical family labor supply model, a family maximizes a utility function that represents the household welfare. Assuming, for simplicity, that there are only two members in the household (husband and wife) and the family chooses levels of non-market time for each member and a joint consumption level in order to solve the following problem:

Define T as total time available for an individual; L 1 = T−h 1 will be referred to as the husband’s non-market time, and L 2 = T−h 2 will be referred to as the wife’s non-market time; h 1 is the labor supply of the husband; h 2 is the labor supply of the wife; C is total money income (or consumption with price equal to one); w 1 is the husband’s after-tax market wage; w 2 is the wife’s after-tax market wage; and Y is after-tax non-labor income.Footnote 4 Note that the terms L 1 and L 2 correspond to all uses of non-market time, including home production activities and leisure.Footnote 5

The solution to the maximization problem in Eq. (1) can be expressed in terms of the indirect utility function, which is solely a function of the wages of the husband and wife and non-labor income of the family:

where \(h_1^*\left( {{w_1},{w_2},Y} \right)\) and \(h_2^*\left( {{w_1},{w_2},Y} \right)\) correspond to the optimal labor supply equations (desired hours) for the husband and wife, respectively.Footnote 6

By totally differentiating the indirect utility function, we can simulate the change in welfare that results from changes in optimal hours of work and consumption in response to changes in wages and non-labor income (also see Apps and Rees 2009, p. 263):

where U 1 is the family’s marginal utility of the husband’s non-market time, U 2 is the family’s marginal utility of the wife’s non-market time, and U 3 is the family’s marginal utility of consumption. Equation (3) makes it clear that the change in welfare not only depends on the individual labor supply responses, but also on the family’s marginal evaluation of a change in non-market time and non-labor income.

Expressed in terms of changes in wages and non-labor income, and re-arranging terms to illuminate the contribution of those changes to family welfare through their impact on husband’s labor supply, wife’s labor supply, and total family income, the total derivative in Eq. (3) becomes:

The multiple steps involved in calculating this change in family welfare are described below along with a discussion of the estimation issues faced when undertaking this sort of simulation exercise. Remember, we are after an assessment of the progress of welfare in families of different earnings structures, rather than merely a snapshot of their relative welfare levels.

2.2 Estimation issues

The direction and magnitude of the change in utility that result from changes in the husband’s and wife’s wages and family non-labor income cannot be determined analytically; they depend on the direction of the wage changes and the size of the labor supply responses of the husband and wife to own and to spouse wage changes, as well as the relative size of the additional utility the family attains from consumptions of non-market time (i.e., additional leisure or home production) by the husband and wife and from changes in non-labor income.

There are many divergent empirical issues raised in the literature in relation to estimating labor supply responses to wage changes, i.e., estimates of labor supply elasticities. The goal here is to produce reasonable labor supply elasticities that are consistent with the literature. Toward that end, the methodology adopted takes the simplest approach possible while maintaining basic theoretical and empirical integrity.Footnote 7

2.2.1 Functional form

In order to obtain estimates of the pieces of the change in utility in Eq. (4) a specific functional form of utility must be specified. Following others (e.g., Heim 2009; Hotchkiss et al. 1997, 2012; Ransom 1987), we estimate a quadratic form of the utility function:

where Z is a vector with elements Z 1 = T−h 1, Z 2 = T−h 2, and Z 3 = w 1 h 1 + w 2 h 2 + Y; α is a vector of parameters and Β is a symmetric matrix of parameters.Footnote 8 This functional form has the advantage of belonging to the class of flexible functional forms in the sense that it can be thought of as a second order approximation to an arbitrary utility function (when the second order conditions with respect to non-market time comply with \({U_{11}} < 0,{U_{22}} < 0\,\& \,{U_{11}}*{U_{22}} >U_{12}^2\)). In addition, it is possible to produce analytical closed-form solutions for both the husband’s and wife’s labor supply functions. Obtaining the first order conditions of this unconstrained maximization problem results in a system of equations linear in h:Footnote 9

This system can be solved simultaneously, and the desired hours become \(h_1^* = f\left( {{w_1},{w_2},Y} \right)\) and \(h_2^* = g\left( {{w_1},{w_2},Y} \right)\), which represent the number of hours the members of a household would like to work, given the parameters that define their household utility function, given after-tax wages and non-labor income.

Observed hours (\(\tilde h\)), however, might differ from the optimum hours due to stochastic errors, such that:

where we assume that (e 1, e 2) follows a bivariate Normal distribution with mean 0 and covariance matrix ∑.

2.2.2 Empirical specification

Estimation of this model can be thought of as a simultaneous Tobit model, where we have four kinds of families: those where both spouses work, those where only one of the spouses works (2 cases), and those where neither of them work. Allowing for hours adjustments along the extensive margin for the wife when assessing labor supply responses to wage changes has been found to make a significant difference when assessing total labor supply response (for example, see Eissa et al. 2008; Heim 2009). However, extensive margin hours adjustments appear to be unimportant for men (Blundell et al. 1988; Heim 2009). We opt for the most flexible specification, which allows for extensive margin hours adjustments for both the husband and wife (as in Hotchkiss et al. 2012).

The presence of non-working wives and husbands raises one empirical issue identified by Keane (2011) that must be addressed: market wages are not observed for family members who do not work. To obtain estimates of those wages, we take the standard approach in the literature of estimating a selectivity-corrected wage equation on the sample of working men and women, using regressors observable for both working and nonworking individuals (Heckman 1974).Footnote 10 The resulting parameter estimates are then used to predict wages for nonworking men and women based on their observable characteristics.

The maximum likelihood function corresponding to the joint labor supply optimization problem can be written as follows:

where φ and Φ correspond to the probability density and cumulative distribution functions of a univariate normal, and ψ and Ψ represent the probability density and cumulative distribution functions of the bivariate normal. Also, H = 1 if the husband is working and W = 1 if the wife is working (0 otherwise), σ i (i = 1, 2) represents the standard deviations of (e 1, e 2), and ρ is the correlation between the stochastic errors.

The stochastic errors accounted for in Eq. (8) represent errors in optimization—observed hours do not exactly reflect desired hours. Keane (2011) points out that there may exist measurement error in observed wages and non-labor income. This classical measurement error may bias elasticity estimates toward zero. Heim (2009), using a methodology most similar to the one used here, presents results showing that accounting for measurement error produces elasticities practically identical to when it is not accounted for. A typical strategy to mitigate the introduction of measurement error on wages per hour has been to restrict the sample to hourly paid workers. Unfortunately, the estimation strategy detailed here requires a lot of data and is not estimable with the restricted sample size of hourly workers only. Instead, if the person is not paid by the hour, we use information available about usual weekly earnings and usual hours worked per week. This means our wage estimate might suffer from what Keane refers to as “denominator bias,” which will have the tendency of biasing labor supply elasticities downward. If this were the case, the estimated labor supply response to own wage changes, for example, would be larger than reported here.

2.2.3 Endogeneity

Keane (2011) also identifies two potential sources of endogeneity. First, it is reasonable to expect that observed wages and non-labor income are correlated with a person’s taste for work (reflected through hours of work). Both fixed effects and instrumental variables have been used to resolve this issue but are simply not possible in this case since we do not have panel data and because of the non-linear nature of the labor supply functions to be estimated. In addition to the inclusion of variables expected to affect the taste for work (e.g., children), we expect that the inclusion of spousal variables (through the estimation of joint labor supply) will help to remove additional sources of correlation from the error term (i.e., because of positive assortative mating, people with similar taste for work will be married to each other; see Lam 1988 and Herrnstein and Murray 1994).

Second, in light of the kinked budget constraint created by the progressivity of the tax system, the after-tax wage rate and after tax non-labor income depends on which tax bracket the worker falls, which depends on the number of hours worked. The simplest approach to addressing this issue was first proposed by Hall (1973) and basically “linearizes” the budget constraint segment on which each person is observed by simply recalculating unearned income to find its “virtual” intercept as if it were extended beyond the specific segment. This strategy amounts to assuming that preferences are strictly convex, which means that family members would make the same hours choice facing this linearized budget constraint that they would have made facing the non-linear budget constraint.Footnote 11 If this assumption is binding, Keane points out that labor supply elasticities will be biased in a negative direction, underestimating the labor supply response to wage changes. Also, this assumption will only have implications for those few families for which the changes mean a movement across tax brackets, and we are focusing on the impact of relatively small changes in real wages and real non-labor income.

An additional concern Keane (2011) identifies in the literature is making sure the hours/wage combinations observed in the data are coming off workers’ labor supply curve, rather than off employers’ labor demand curve. Identification of the labor supply relationship boils down to including regressors (determinants of hours) that reflect the demand for a person’s skills (thus determine the observed wage) that are not reflective of that person’s taste for work. Toward that end, we include an indicator for race that could affect observed wage through employer discrimination, but, ceteris paribus, should not affect taste for work.

Further, we only marginally control for the presence of fixed costs of working raised by Apps and Rees (2009) by including the presence of children in the determination of hours. Heim (2009) presents results showing that once demographics are controlled for, additional consideration of fixed costs only very slightly impacts estimates of the parameters of the utility function (Heim 2009, p. Table 3).

3 Data

The Current Population Survey (CPS) is administered by the U.S. Bureau of Labor Statistics each month to roughly 60,000 households. The survey has a limited longitudinal aspect in that households are interviewed for four consecutive months, not interviewed for 8 months, then interviewed again for 4 months. Households, families, and individuals can be matched across these survey months if they remain in the same physical location. In survey months four and eight, the household is said to be in the “outgoing rotation” group, and members of the household are asked more detailed questions about their labor market experience, such as wages and hours of work.

We make use of the CPS outgoing rotation groups in March, April, May, and June from 2012 and 2003 in order to construct the samples for which the family labor supply model is estimated at each time period’s end point. Detailed non-labor income is obtained by matching each family to the March supplement, which is the month in which this information is collected. Multiple months of outgoing rotation groups are used in order to expand the sample size. We restrict the samples in the following ways:

Structural restrictions

-

include only households with husband and wife present and between18–64 years of age, in order to focus on adult family members prior to retirement;

-

exclude households with unmarried same- or opposite sex adults/partners or children older then 18 years old in order not to confound the spousal labor supply decision with that of other adult household members;

-

exclude households in which the main activity of either spouse is self-employment, since it is difficult to estimate market hourly earnings (wage) for someone who is self-employed.Footnote 12

Homogeneity restrictions

-

exclude households with non-positive total household income, negative non-labor income, after-tax hourly wages greater than $250 or less than $0.50, or after-tax weekly total income greater than $10,000

-

exclude households for which the calculated marginal tax rate is 75 % or higher

The estimation of this joint labor supply model is tricky. These were the most minimal “trimming” that we needed to undertake to generate convergence on theoretically consistent utility function parameter estimates (e.g., positive marginal utilities). Less than 1 % of our sample is lost due to homogeneity restrictions.

Information on the detailed sources of family income, number of children, and earnings available from the CPS is used to calculate the marginal tax rate on earnings (wages) and the total tax liability (in any year of interest) using the National Bureau of Economic Research (NBER) TAXSIM tax calculator (http://www.nber.org/~taxsim/; see also Feenberg and Coutts 1993).Footnote 13 The Tax calculator requires more information, such as number of itemized deductions, than is available from the CPS, so we made assumptions for the missing values as recommended by the managers of the tax calculator. For example, there is no information in the CPS that would allow one to calculate itemized deductions (mortgage payments, charitable contributions, etc.), so values of zero are entered for the missing information. Although this means we do not have as accurate a calculation of the family’s actual tax liability as we would like, it is important to remember that the assumptions for each family do not change across years of comparison.

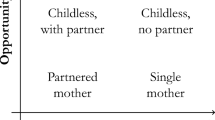

3.1 Family classification

Based on husbands’ and wives’ after-tax hourly wages, both effective and predicted hourly wages, families are placed in one of three groups: (1) husband and wife have similar wages (within 0.2 log points, or 20 %, of one another), (2) the husband’s wage is greater (0.2 log points higher) than his wife’s wage, and (3) the wife’s wage is greater (0.2 log points higher) than her husband’s wage.Footnote 14 Creating a band for “similar” wages is done for two primary reasons. First, the band of similarity is to allow for measurement error in the reporting and calculating of hourly wages (also see Winkler 1998, who describes the implausible number of families with members who earn exactly the same amount). Secondly, the 20 % band accommodates family members who switch high-wage status from time to time. In other words, we want to be sure that the relative wage classification that we observe at one point in time is reflective of this family’s typical relative wage situation. Winkler et al. (2005) find that the relative earnings position over a 3-year period of time switched for up to 40 % of married couples. This is also one reason we use relative hourly wages to classify families, rather than relative earnings. We expect wages to reflect a more consistent valuation of relative earning potential within the family than earnings at any point in time, which is also dependent on hours worked. We expect much greater variation in a person’s hours than in their earning potential. In addition, the exercise to obtain utility function parameters is the estimation of optimal labor supply (hours), which figures into the construction of earnings—in other words, we don’t want to use our ex post outcome to classify families ex ante.

Separate utility function parameters are estimated for families in each of these groups since we would expect, based on the literature cited earlier, that preferences differ depending on which family member is observed earning a higher wage. For those cases in which the husband or wife is not working, their imputed after-tax wages are used to classify them with respect to the three family types. After-tax wages and non-labor income are in real values, reflecting the end-point of each decade.

The trends reflected in our data in the shares of families in which the wife earns a higher wage than her husband are consistent with trends shown by others in relative earnings (e.g., Bertrand et al. 2015; Winkler et al. 2005). The share of families in which the wife earns a higher wage than her husband increases from 16 to 18 to 21 % from 1994 to 2003 to 2012, respectively. Figure 1 reproduces, using our data, the charts used by Bertrand et al. to illustrate the distribution of families based on the wife’s relative contribution to family income. Rather than plot the distribution by the relative contribution to total income (which would include hours of work), Fig. 1 plots the distribution of families based on the wife’s contribution of relative hourly earning potential (wife’s wage divided by the sum of wife’s and husband’s wage) for 3 years, 1994, 2003, and 2012. The data in Fig. 1 reflect the “cliff” at 50 % illustrated in Bertrand et al.’s data. They point to this distinct break as evidence that families find being in the right tail (where the wife earns more than her husband) distasteful.

Distribution of families based on the wife’s relative hourly earning potential, 1994, 2003, and 2012. Note: Authors’ calculations, U.S. Bureau of Labor Statistics, Current Population Survey (http://www.bls.gov/cps/earnings.htm#demographics). The wife’s relative hourly earning potential is calculated as the ratio of the wife’s wage divided by the sum of the wife’s and husband’s wage. Calculated using only families with observed wages for both members. Density points to the left of the 50 % demarcation reflect families in which the husband’s wage is greater than the wife’s wage; points to the right are where wife’s wage is greater than the Husband wage

3.2 Sample means

Table 1 contains sample averages across family types for the 2 years used for estimation. As expected, labor supply is lower for both husbands and wives across all family types in 2012 than in 2003.Footnote 15 Families in which the wife earns the higher wage have the fewest young children; the highest non-labor income; and the highest education, wages, and age among wives. Generally, after-tax real wages and non-labor income were rising in the 1990s and increasing less in the 2000s. Additionally, consistent with Wang et al. (2013), we also see that total consumption (after-tax earnings plus non-labor income) is greatest, on average, among families in which the wife earns more than her husband.

The periods of time used for analysis were chosen for a number of reasons. Earlier work (Hotchkiss et al. 1997; Hotchkiss and Moore 2002) analyzed welfare changes among two-earner couples during the 1980s, so this analysis can be seen roughly as an extension of that work, with a different focus.Footnote 16 In addition, there was a major redesign of the CPS in 1994, so that year provides an obvious starting point. Also, both time periods are the same length; contain a recession, albeit the 2007–8 recession was considerably deeper; and end at least 2 years after the end of a recession.

3.3 Simulating changes in wages and non-labor income

An important component of simulating the change in family welfare (detailed in Eq. 4) is to obtain an appropriate counterfactual of the average wage and non-labor income, in both cases after taxes, that households in, say, 2012, would have faced in 2003. Since we don’t have access to a panel data set (i.e., we can’t see the actual wages families in 2012 earned in 2003), we opt to use an inverse probability weighting methodology, akin to the one used in DiNardo et al. (1996), in order to create a counterfactual distribution of 2003 wages with the household characteristics observed in 2012.

This amounts to estimating the probability of an observation (in the combined 2003 and 2012 samples) being observed in year 2012 using as explanatory variables age of the husband, age of the wife, their squares and cross multiples, education of husband and wife, interaction between education and age, race of husband and wife, and the number of children of different ages:

The parameter estimates from this logit model are then used to construct the inverse probability ratio, \(\frac{{{\rm{\Lambda }}\left( {X\prime \hat b} \right)}}{{1 - {\rm{\Lambda }}\left( {X\prime \hat b} \right)}}\), for each household in 2003. This is used as a weight for calculating what the average husband and wife wages (and household non-labor income) would be for the 2012 families, based on the 2003 wage (and non-labor income) distribution:

These 2003 counterfactual wages (cf) are then averaged within family type (i.e., husband/wife earns more or the same) in order to compare with observed wages in 2012 for the same family type. The expected wage change of, for example, the husband between 2003 and 2012 (dw 1 in Eq. 4) for family type k is then given by

where \({T_k} = \mathop {\sum }\limits_{i{\it{\epsilon }}k}^{N_k^{2003}} \left[ {\frac{{{\rm{\Lambda }}\left( {X\prime \hat b} \right)}}{{1 - {\rm{\Lambda }}\left( {X\prime \hat b} \right)}}} \right]\). This calculation is analogously performed for dw 2 and dY in Eq. (4). This procedure is repeated to obtain 1994 counterfactual wages and non-labor income for families observed in 2003.

Changes in wages (dw 1 and dw 2) and non-labor income (dY) are also reported in Table 1. These are the actual stylized level changes in wages and non-labor income that are plugged into the change in utility equation (Eq. 4). Both husbands and wives experienced positive wage changes across all family types in the decade ending in 2003. On a percentage basis, wives experienced greater gains during the decade, with the largest percentage gains going to wives in families in which the husband is the higher earner (note that a 9.1 % change over the decade amounts to a little less than 1 % per year). The greatest percentage gains in (virtual) non-labor income during this early period accrued to families in which the wife earns more. Among these families, the greatest gains in non-labor income (not shown) were in the form of educational benefits, disability, and retirement, and other/unspecified income. The largest contributors to the loss in non-labor income experienced by families with similar wages were declines in welfare and survivor’s benefits.

In the decade ending in 2012, all family types, except where the husband earns more, experienced gains in non-labor income. The largest gains for families in which the wife earns more were from welfare, supplemental security income, and rental income. Wage gains for wives were very similar across all family types during the later decade, with the largest wage gains for men appearing in families with similar wages.

As will be seen later, these larger wage and non-labor income gains among some family types suggest where we are likely to see the greatest gains in welfare across the decades, but the mapping is not one-to-one. Welfare changes are not determined simply by change in wage and income but also the value families of different types place on that income and on the non-market time that will adjust to changes in wages.

4 Results

4.1 Estimated labor supply elasticities

The maximum likelihood labor supply estimates are reported in Appendix 2 and are as expected, for the most part. For example, across all family types, hours increase at a decreasing rate with age; the presence of children has a mixed impact on the labor supply of both husbands and wives across different family types; black (Hispanic) husbands and wives work fewer (more) hours than their white counter-parts; and husbands with higher levels of education work more hours than those with less than high school, whereas only wives with a high school degree work more hours than their less-than-high-school educated counter-parts.

The estimated marginal utilities and labor supply elasticities of interest are shown in Table 2. As expected, income elasticities on the intensive (hours) margin and extensive (participation) margin are negative for both husbands and wives; and both intensive and extensive cross-wage elasticities (when non-zero) are negative, except when husband and wife earn similar wages. We also observe, as expected, that wives’ hours and participation decisions are more sensitive to wages than their husbands’.

The estimated own wage hours elasticities for husbands are consistent with estimates reported by Kaiser et al. (1992) for Germany; and Ransom (1987), Pencavel (2002), and Heim (2009) using U.S. data.Footnote 17 In addition, the estimates for wives’ labor supply elasticities are on the low side, but within the ballpark of those reported in the literature using U.S. data. For example, the range of estimates found in Blau and Kahn (2007), Cogan (1981), Hausman (1981), Heim (2009), Hotchkiss et al. (1997), Ransom (1987), and Triest (1990) is 0.12–0.97.Footnote 18 Furthermore, the estimated negative cross-wage elasticities (except where the wife and husband earn similar wages) indicate that husbands and wives view their non-market time as substitutes; this is consistent with cross-elasticities estimated in Heim (2009), Hotchkiss et al. (2012, 2014), and Ransom (1987). The bottom line here is that the estimated labor supply elasticities (both extensive and intensive) are reasonable.

4.2 Changes in family welfare

Figure 2 illustrates the estimated dollar equivalent utility change for the average family in each relative wage classification.Footnote 19 Dollar equivalent utility change is calculated by dividing total utility change (dV) by the family’s marginal utility with respect to income (U 3). Considering the changes in both real after-tax wages and non-labor family income across two decades, and potential changes in preferences, families in all relative wage categories experienced much larger welfare gains during the 1990s than in the 2000s (the decade of the Great Recession). The average 1990s family in which the husband earned a higher wage experienced a marginally bigger (although not statistically significantly larger) gain in welfare across the decade than the average 1990s family in which the wife was the higher wage earner ($91.30 per week vs. $84.81 per week, respectively). Both of those family types gained more welfare than the average family in which the spouses earned about the same wage; at $41.14/week, this average family gained only half as much welfare as the other types of families.

Dollar equivalent changes (per week) in family welfare across two time periods

Note: Husband and wife have similar wages means they are within 0.2 log points of one another; the husband’s wage being greater (less than) the wife’s wage means that his wage is more (less) than 0.2 log points of his wife’s wage. Bootstrapped (250 iterations) standard errors in parentheses

The story is different in the 2000s. During the decade of the Great Recession, families in which the wife was the higher wage earner gained the greatest amount of welfare—an average of $21.55/week—higher (but not statistically) than the marginally lower gain of $20.51/week for the average family in which the husband and wife earned similar wages and statistically significantly more than the $3.88/week gain for the average family in which the husband was the higher wage earner. This is not too surprising as the 2007–2009 recession was known for it’s disproportionate impact on industries in which men are over-represented—a fact that led to the dubbing by some of the recession as a “man-cession” (see, for example Rampell 2009). Consequently, a smaller welfare gain among families in which the husband is the higher wage earner (or, rather, higher potential wage earner) could derive from him not actually realizing that potential in the labor market or from suffering larger declines in wages than his wife.

Referring back to Table 1, we can see one contributor for these different welfare change outcomes across the decades.Footnote 20 In the 2000s, in families in which she was the higher wage earner, the wife experienced an average real after-tax wage gain of $0.38 but only $0.33 in families in which the husband earned the higher wage. At the same time, husbands experienced only a $0.09 average real after-tax wage increase in families in which the wife earned the higher wage and actually faced an average wage decline of $0.03 if he earned the higher wage. In addition, virtual non-labor income rose more—by an average $5.09/week—in families in which the wife earned the higher wage, whereas families in which the husband earned the higher wage experienced an average loss in weekly virtual income of $1.75/week. In other words, in the 2000s, wage gains by both the husband and wife, as well as gains in non-labor income were smaller among families in which the husband was the high wage earner.

During the 1990s, wages rose for both the husband and wife in all types, although by different relative amounts depending on who was the higher wage earner. This suggests why the welfare gains comparing families in which the wife or husband earned the higher wage were not statistically different from one another in the 1990s. By contrast, wage gains were smaller for both the husband and wife in families in which they earned about the same, and virtual non-labor income declined in these families—making the welfare gains for this family type in the 1990s significantly less than the other family types.

4.3 Decomposing changes in family welfare

The change in family utility across the two time periods can be decomposed into contributions from the direct influence from wages and non-labor income and the indirect influence (through labor supply changes) of changes in behavior in response to those wage and non-labor income changes. Table 3 illustrates how Eq. (4) can be decomposed in this way, using the full sample change for the decade ending in 2012 for illustration. Between 2003 and 2012, the average family experienced a welfare gain of nearly six utils (a dollar equivalent $10.48 as seen in Fig. 2). Positive gains in wages and non-labor income contributed the largest component (6.6017) to this welfare gain; the increase in wife wages exceeded the decline in husband wages, producing an overall positive direct impact.

The net labor market response resulted in a decline in non-market time for both family members (an increase in non-market time from own wage elasticity and small decline in non-market time from cross wage elasticity), hence a negative contribution to the welfare gain (−0.6136). In addition, the total contribution of wage changes (5.3572) exceeded the contribution of the change in non-labor income (0.6309). Table 4 presents the decomposition of change in utility for all family types across both decades.

For all family types, the direct effect of changes in non-labor income and wages dominates the indirect labor market effect in their respective contributions to change in welfare. However, ignoring the indirect effect would result in mis-calculating the total welfare change by as much as a negative 21 % to a positive 9 %. In addition, we cannot just look at the changes in wages and non-labor income to discern which family type experiences the greatest welfare gain. In order to make comparisons across family types, we need to divide the welfare change in utils by the family type’s marginal utility of income to translate it into the dollar equivalent welfare change.

Between 1994 and 2003, although families in which the husband earns a higher wage than his wife experienced greater percentage gains in wages and a greater gain in “utils,” the different valuation those family types place on utils produces dollar equivalent welfare gains that are statistically insignificantly different from welfare gains of families in which the wife earns the higher wage. Similarly, across the 2003–2012 time period, while households in which the husband and wife earn similar wages faced higher percentage increases in wages, their dollar equivalent welfare gain is lower, but not statistically different, than the dollar equivalent welfare gain in families where the wife earns a higher wage.

The point of this exercise is to illustrate that estimating labor supply responses to changes in wages and non-labor income over time in the context of a structural utility model allows a much more nuanced and accurate assessment of the relative welfare gains from those changes across different types of families.

5 Conclusions

The purpose of this paper was to assess the impact of economic changes in the 1990s and 2000s on the welfare of married households, taking into account the earnings of the husband and wife relative to one another. The share of families in which the wife earns a higher wage than her husband has been growing over the past several decades (e.g., see Bertrand et al. 2015), and this paper shows that changes in wages and non-labor income over the past two decades impacted family welfare differently across relative earnings structures of the husband and wife.

We find that total welfare of the average family in which the wife earns a higher wage than her husband rose just as much during the prosperous 1990s as it did for the average family in which the husband was the high wage earner, despite the latter experiencing larger earnings increases. In addition, the highest welfare gain in the dismal 2000s was among families in which the wife was the high wage earner (although the welfare gains were only marginally better than for families in which the spouses earned about the same wage). For all families, of course, the decade of the Great Recession meant smaller welfare gains all around than were experienced by families in the 1990s.

By decomposing those welfare gains across family type, we were also able to illustrate that while direct changes in income (non-labor and earned income) dominated the observed changes in welfare, the indirect effect of welfare caused by the labor supply responses was negative for all families but those where wives earned higher wages than their husbands. We also see that a ranking based merely on the level or percentage changes in wages and non-labor income by family type does not necessarily determine the ranking of the impact of those changes on welfare.

Earlier work by Hotchkiss et al. (1997) found that families in which the wife was in a higher earning category than her husband had greater increases in material well-being across the decade from 1983 to 1993.Footnote 21 This means that over three decades of analysis, families in which the wife is the higher wage earner or is in a higher earnings category than her husband experienced at least as much welfare gain as families with a different relative earnings structure. This doesn’t necessarily mean, however, that families in which the wife is the higher wage earner are happier (i.e., have higher utility levels)—in fact, Bertrand et al. (2015) would suggest otherwise. However, the results in this paper suggest that the growing incidence of wives earning more than her husband is, at the least, not putting welfare growth of families in jeopardy. In fact, since men have been hit hardest in every recession since at least the 1970s (Wall 2009), the non-traditional earnings structure may serve as a kind of insurance for welfare growth during economic downturns, as was seen in the results here for the decade ending in 2012.

Notes

An alternative theoretical treatment of mutually determined marital and labor market outcomes can be found in Grossbard-Shechtman (1984).

Additionally, Bonke (2015, p. 90) finds that the, “great majority of households [in the Danish Household Survey] pool their incomes,” although this doesn’t necessarily preclude an absence of bargaining behavior.

Net of taxes, wages and non-labor income are computed using a publicly available tax calculator developed by the National Bureau of Economic Analysis called TAXSIM (http://users.nber.org/~taxsim/).

Apps and Rees (2009) are highly critical of family utility models that do not include measures of household production, but even they acknowledge that not much can be done without the availability of richer data (p. 108). Since the focus of the analysis in this paper is utility at the household level, the absence of home production activities is not crucial. It has been suggested that the BLS Time Use Survey would be useful here, but that survey has one respondent per household so data necessary for modeling joint decisions is not available in that survey.

Note that marriage formation and dissolution are exogenous to the optimization problem here. It is a static model. Clearly, marriage formation decisions occurred prior to observing these couples in the data, and it is unknown and not relevant (to the question at hand) whether dissolution of these marriages occurs after the optimization problem investigated here.

Many of the caveats, warnings, solutions, and implications related to this specific model were first detailed in Hotchkiss et al. (2012).

Z 1 and Z 2 are re-parameterized to account for individual and family characteristics, such as age, race, education, and number of children. Further details are found in Appendix 1.

Expressions for Ω i (i=1–5) are given in Appendix 1.

For purposes of identification, the Heckman selection equation uses non-labor income, number of children in the household, and spouse education as exclusion restriction variables.

This assumption of strictly convex preferences can be tested by analyzing the second order conditions of the maximization problem, which are akin to the internal consistency conditions established by Amemiya (1974, p. 1006). Using the nomenclature presented in Eqs. 6 and 7, the conditions imply that Ω1<0; Ω4<0 and Ω1Ω4>Ω2*Ω2, which are found to be true for all the models estimated here.

Given the nature of self-employed activities, in a short period of time, reported earnings can be negative, even if, in the long term, the market value of a self-employed worker’s time would be positive. The welfare gains of the self-employed are left for future work.

In addition to the detailed income source information from the CPS data, we also include information on property tax, CPS imputed capital gains and capital losses. All households are classified as if they were declaring taxes jointly and the main earner is identified as that with the highest total earned income. The tax simulation was implemented using the Stata taxsim interface. Data was prepared based on the recommendations found at http://users.nber.org/~taxsim/to-taxsim/cps/.

Using wage differentials between husband and wife of 0.15 and 0.25 log points produced similar results and the same conclusions.

See Hotchkiss and Rios-Avila (2013) for an analysis of the decline in labor force participation over this time period.

These earlier analyses only included families in which both spouses were working, whereas here we allow for non-participation of both members, and the focus of the earlier work was on the role of the shrinking male/female wage gap and on documenting welfare gains across the income distribution.

Similar to Ransom (1987), while the uncompensated wage elasticity can be negative, the corresponding compensated own wage elasticity for husbands is always positive.

Also see Killingsworth (1983, p. 107).

We present results for the average family in each relative wage classification as opposed to the average welfare change within each classification because it is at the average values of the variables used to generate the parameter coefficients that we can be sure the first order conditions for the utility maximization problem are satisfied.

Another potential source, of course, is a change in preferences, which would be reflected through differences in estimated utility function parameters found in Appendix 2.

The analysis by Hotchkiss et al. (1997) differed from the one in this paper primarily by using a sample of dual earner families only, not allowing for non-workers.

References

Amemiya, T. (1974). Multivariate regression and simultaneous equation models when the dependent variables are truncated normal. Econometrica, 42(6), 999–1012. doi:10.2307/1914214.

Apps, P., & Rees, R. (2009). Public economics and the household. Cambridge: Cambridge University Press.

Bargain, O., & Moreau, N. (2003). Is the collective model of labor supply useful for tax policy analysis? A Simulation Exercise (CESifo Working Paper Series No. 1052). CESifo Group Munich. http://econpapers.repec.org/paper/cesceswps/_5f1052.htm.

Bertrand, M., Kamenica, E., & Pan, J. (2015). Gender identity and relative income within households. The Quarterly Journal of Economics, 130(2), 571–614. doi:10.1093/qje/qjv001.

Blau, F. D., & Kahn, L. M. (2007). Changes in the labor supply behavior of married women: 1980–2000. Journal of Labor Economics, 25(3), 393–438. doi:10.1086/513416.

Bloemen, H. G., & Stancanelli, E. G. F. (2015). Toyboys or supergirls? An analysis of partners’ employment outcomes when she outearns him. Review of Economics of the Household, 13(3), 501–530. doi:10.1007/s11150-013-9212-y.

Blundell, R., Chiappori, P. -A., Magnac, T., & Meghir, C. (2007). Collective labour supply: Heterogeneity and non-participation. The Review of Economic Studies, 74(2), 417–445.

Blundell, R., Meghir, C., Symons, E., & Walker, I. (1988). Labour supply specification and the evaluation of tax reforms. Journal of Public Economics, 36(1), 23–52. doi:10.1016/0047-2727(88)90021-7.

Bonke, J. (2015). Pooling of income and sharing of consumption within households. Review of Economics of the Household, 13(1), 73–93. doi:10.1007/s11150-013-9184-y.

Bourgeois, T. (2014, September 4). How we did it, how we do it: When the wife makes more money than the husband. The Huffington Post. blog. http://www.huffingtonpost.com/trudy-bourgeois/how-we-did-it-how-we-do-i_b_5767546.html. Accessed 15 October 2015.

Cogan, J. F. (1981). Fixed costs and labor supply. Econometrica, 49(4), 945–963. doi:10.2307/1912512.

DiNardo, J., Fortin, N. M., & Lemieux, T. (1996). Labor market institutions and the distribution of wages, 1973-1992: A semiparametric approach. Econometrica, 64(5), 1001–1044.

Eissa, N., Kleven, H. J., & Kreiner, C. T. (2008). Evaluation of four tax reforms in the United States: Labor supply and welfare effects for single mothers. Journal of Public Economics, 92(3–4), 795–816. doi:10.1016/j.jpubeco.2007.08.005.

Feenberg, D., & Coutts, E. (1993). An introduction to the TAXSIM model. Journal of Policy Analysis and Management, 12(1), 189–194. doi:10.2307/3325474.

Griswold, A. (2014, February 12). Most women who earn more than their husbands aren’t happy about it. Business Insider. http://www.businessinsider.com/women-earn-more-than-husbands-and-happiness-2014-2. Accessed 15 October 2015

Grossbard-Shechtman, A. (1984). A theory of allocation of time in markets for labour and marriage. The Economic Journal, 94(376), 863–882. doi:10.2307/2232300.

Hall, R. E. (1973). Wages, income, and hours of work in the U.S. labor force. In G. G. Cain, & H. W. Watts (Eds.), Income maintenance and labor supply (pp. 102–162). Chicago, IL: University of Chicago Press.

Hausman, J. A. (1981). The effect of taxes on labor supply. In H. Aaron, & J. Pechman (Eds.), How taxes affect economic behavior. Washington, DC: Brookings.

Hausman, J. A., & Ruud, P. (1984). Family labor supply with taxes. The American Economic Review, 74(2), 242–248.

Heckman, J. (1974). Shadow prices, market wages, and labor supply. Econometrica, 42(4), 679–694. doi:10.2307/1913937.

Heim, B. T. (2009). Structural estimation of family labor supply with taxes: Estimating a continuous hours model using a direct utility specification. Journal of Human Resources, 44(2), 350–385. doi:10.1353/jhr.2009.0002.

Herrnstein, R. J., & Murray, C. A. (1994). The bell curve: Intelligence and class structure in American life. New York, NY: Free Press.

Hotchkiss, J. L., Kassis, M. M., & Moore, R. E. (1997). Running hard and falling behind: A welfare analysis of two-earner families. Journal of Population Economics, 10(3), 237–250. http://www.jstor.org/stable/20007544. Accessed 15 October 2015.

Hotchkiss, J. L., & Moore, R. E. (2002). Changes in the welfare of two-earner families across the income distribution, 1983-1993. Applied Economics Letters, 9(7), 429–431. doi:http://www.tandfonline.com/loi/rael20.

Hotchkiss, J. L., Moore, R. E., & Rios-Avila, F. (2012). Assessing the welfare impact of tax reform: A case study of the 2001 U.S. tax cut. Review of Income and Wealth, 58(2), 233–256. doi:10.1111/j.1475-4991.2012.00493.x.

Hotchkiss, J. L., Moore, R. E., & Rios-Avila, F. (2014). Family welfare and the great recession (FRB Atlanta Working Paper No. No. 2014–10). Federal Reserve Bank of Atlanta. https://ideas.repec.org/p/fip/fedawp/2014-10.html. Accessed 15 October 2015.

Hotchkiss, J. L., & Rios-Avila, F. (2013). Identifying factors behind the decline in the U.S. labor force participation rate. Business and Economic Research, 3(1), 257–275. doi:10.5296/ber.v3i1.3370.

Hoynes, H. W. (1996). Welfare transfers in two-parent families: Labor supply and welfare participation under AFDC-UP. Econometrica, 64(2), 295–332.

Kaiser, H., Essen, Uvan, & Spahn, P. B. (1992). Income taxation and the supply of labour in West Germany: A microeconometric analysis with special reference to the West German income tax reforms 1986–1990. Jahrbücher für Nationalökonomie und Statistik, 209(1/2), 87–105.

Keane, M. P. (2011). Labor supply and taxes: A survey. Journal of Economic Literature, 49(4), 961–1075. doi:10.1257/jel.49.4.961.

Killingsworth, M. R. (1983). Labor supply. Cambridge [Cambridgeshire]; New York, NY: Cambridge University Press.

Lam, D. (1988). Marriage markets and assortative mating with household public goods: Theoretical results and empirical implications. The Journal of Human Resources, 23(4), 462–487. doi:10.2307/145809.

McElroy, M. B. (1990). The empirical content of nash-bargained household behavior. The Journal of Human Resources, 25(4), 559–583. doi:10.2307/145667.

Muthen, B. (1990). Moments of the censored and truncated bivariate normal distribution. British Journal of Mathematical and Statistical Psychology, 43(1), 131–143. doi:10.1111/j.2044-8317.1990.tb00930.x.

Pencavel, J. (2002). A cohort analysis of the association between work hours and wages among men. The Journal of Human Resources, 37(2), 251–274. doi:10.2307/3069647.

Rampell, C. (2009, August 10). The mancession. Economix Blog. blog. http://economix.blogs.nytimes.com/2009/08/10/the-mancession/?_r=0. Accessed 16 October 2015.

Ransom, M. R. (1987). An empirical model of discrete and continuous choice in family labor supply. The Review of Economics and Statistics, 69(3), 465–472. doi:10.2307/1925534.

Rios-Avila, F., & Hotchkiss, J. L. (2014). A decade of flat wages? (Policy Note No. 2014/4). Levy Economics Institute of Bard College. http://www.levyinstitute.org/publications/a-decade-of-flat-wages.

Scarantino, D. A. (2013, June 24). “I make less than my wife”: How 3 real men feel about it. LearnVest. http://www.learnvest.com/2013/06/i-make-less-than-my-wife-how-3-real-men-feel-about-it/. Accessed 16 October 2015.

Shore, S. H. (2015). The co-movement of couples’ incomes. Review of Economics of the Household, 13(3), 569–588. doi:10.1007/s11150-013-9204-y.

Stewart, S. (2014, April 30). Are female breadwinners a recipe for disaster? New York Post. http://nypost.com/2014/04/30/are-female-breadwinners-a-recipe-for-disaster/. Accessed 16 October 2015.

Triest, R. K. (1990). The effect of income taxation on labor supply in the United States. The Journal of Human Resources, 25(3), 491–516. doi:10.2307/145991.

van Soest, A., Das, M., & Gong, X. (2002). A structural labour supply model with flexible preferences. Journal of Econometrics, 107(1–2), 345–374.

Wall, H. J. (2009). The “man-cession” of 2008-2009: It’s big, but it’s not great. St. Louis, MO: Federal Reserve Bank of St. Louis 4–9.

Wang, W., Parker, K., & Taylor, P. (2013, May 29). Breadwinner moms. Pew Research Center’s Social & Demographic Trends Project. http://www.pewsocialtrends.org/2013/05/29/breadwinner-moms/. Accessed 5 October 2015.

Winkler, A. E. (1997). Economic decision-making by cohabitors: Findings regarding income pooling. Applied Economics, 29(8), 1079–1090. doi:10.1080/000368497326471.

Winkler, A. E. (1998). Earnings of husbands and wives in dual-earner families. Monthly Labor Review, 121(4), 42–48. http://ezproxy.gsu.edu/login?url=http://search.ebscohost.com/login.aspx?direct=true&db=bth&AN=1207520&site=eds-live. Accessed 16 October 2015.

Winkler, A. E., McBride, T. D., & Andrews, C. (2005). Wives who outearn their husbands: A transitory or persistent phenomenon for couples? Demography, 42(3), 523–535. http://ezproxy.gsu.edu/login?url=http://search.ebscohost.com/login.aspx?direct=true&db=edsjsr&AN=edsjsr.4147360&site=eds-live. Accessed 16 October 2015.

Wolfram Research, Inc. (2010). Mathematica, Version 8.0. Champaign, IL.

Disclaimer

The views expressed here are not necessarily those of the Federal Reserve Bank of Atlanta or of the Federal Reserve System. Comments from Anne E. Winkler, Phanindra Wunnava, and participants of the Federal Reserve System Applied Micro meeting and the Southern Economic Association meeting are greatly appreciated.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare they have no conflict of interest.

Appendices

Appendix 1

1.1 This appendix presents the first order conditions of families' utility maximization problem, derivation of the labor supply equations, and the liklihood function estimated

The quadratic functional form as presented in Eq. (5) in the text can also be written in the following form:

where \({L_1} = T - {h_1};{L_2} = T - {h_2};\;{\rm{and}}\;C = {w_1}{h_1} + {w_2}{h_2} + Y\)

This becomes an unconstrained utility maximization problem which depends on the working hours h 1 and h 2, assuming that Y (non-labor income) is exogenous. The corresponding first order conditions become:

There is no need to specify a time endowment (T) in order to estimate the labor supply functions because \(a_1^*\), \(a_2^*\), and \(a_3^*\) are re-parameterized functions of T and Y. This re-parameterization is necessary for identification of the labor supply equations. It is through these starred parameters that differences in tastes across families are allowed to enter. Specifically,

where X 1 and X 2 are vectors of individual and family characteristics and Γ1 and Γ2 are parameters to be estimated. Individual characteristics included in X are age, age squared, race, and education. Family characteristics include number of children. Non-labor family income enters separately.

Using Eqs. (14) and (15), we can solve the system obtaining the values of h 1 and h 2 that maximize the utility function, in the following way:

where:

From Eqs. (16) and (17), the solutions for \(h_1^*\) and \(h_2^*\) become:

These derivatives are obtained with the help of Mathematica® (Wolfram Research, Inc. 2010). We calculate expected hours conditional on being positive according to (Muthen 1990).

Appendix 2

Rights and permissions

About this article

Cite this article

Hotchkiss, J.L., Moore, R.E., Rios-Avila, F. et al. A tale of two decades: Relative intra-family earning capacity and changes in family welfare over time. Rev Econ Household 15, 707–737 (2017). https://doi.org/10.1007/s11150-016-9354-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11150-016-9354-9