“Men are from Mars, women are from Venus.”

John Gray (1992)

Abstract

This paper develops a theory of female labor supply in a general equilibrium framework in the context of a developing economy. In stage 1, men and women decide whether to get married foreseeing the power and market dynamics in stage 2. Single people make their own decisions whereas married couples make decisions together, the power distribution among partners is determined endogenously. It is shown that female labor supply can take different shapes due to structural differences between economies and multiple equilibria might occur, causing low female labor force participation trap. As for policy implications, we find that tax-break to the employers can give a huge boost to female employment and may reduce the wage-gap. However, tax-benefit to women may widen the wage-gap although both these policies empower women. We also conclude that true empowerment should come with the freedom of choice (to work); increasing female labor force participation does not necessarily empower women. Results found here resonate well with previous empirical findings and suggest additional testable implications.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

There exist differences between the preferences of men and women. These lead them to take different decisions in similar situations. Many empirical studies find that giving household subsidies to a woman rather than a man leads to different outcomes in the household expenditures, notably, child nutrition and schooling (see Senauer et al. 1988; Hopkins et al. 1994; Hoddinott and Haddad 1995; Handa 1999; Duflo 2003; Gitter and Barham 2008). Recently, there have been empirical studies suggesting differences in the household-decisions that can be attributed to differences in the power distribution between husbands and wives within households (Felkey 2013; Lancaster et al. 2006; Gitter and Barham 2008). It is, therefore, necessary to study the economic issues driven by decisions of women separately from those influenced by men; labor supply is one such decision.

The goal of this paper is to analytically study few policy implications on female labor force participation, gender specific wage-gap and women’s empowerment by developing a general theory of female labor supply—a theory that shows how the nature of female labor supply can take different forms and shapes due to cultural or structural differences between economies. Hence similar policies might have different economic implications. Therefore, before considering any proposal for policy reforms for raising female labor force participation to empower them, it is necessary to understand its behavior in that particular economy.

Labor supply plays a very important role in an economy’s development. A robust and ample labor force promotes development, and development, in turn, feeds back on labor market conditions. Studying the behavior of labor market can give rise to important policy implications. There have been many studies focusing on labor supply and in recent times, there has also been a fair amount of research on female labor supply in particular. Most of these are empirical (Blundell et al. 1987; Arellano and Meghir 1992; Grossbard-Shechtman 1993; Nakamura and Nakamura 1994; Eissa and Liebman 1996; Greenwood et al. 2005), and some theoretical (Grossbard-Shechtman 1984, 1993; Grossbard 2015; Apps and Rees 1997; Francois 1998; Vermeulen et al. 2006; Basu 2006; Atal 2012).

Usually a woman’s labor supply decision is not taken by her alone. All adult members of the household, including the adult males would typically participate in this decision. In a patriarchal society in a developing economy, the wife is often the powerless newcomer who is usually exploited as cheap labor for household work. Divorce is socially so costly that any threat to leave the family is not credible. This leads to a vicious cycle in which the woman is not allowed to build human capital and so remains powerless in household and other decision making, including child nutrition and girls’ education. Empowering women by raising their labor force participation may therefore address a lot of social problems, and ultimately assist in the country’s economic development.

To study the behavior of female labor supply, it is thus important to understand the household’s decision making process. On one hand, a working woman’s income adds to the household’s total income which increases the collective utility; on the other hand, working outside leaves a woman with less time to spend on household-work which in turn decreases household-utility. Therefore, a woman’s labor supply decision depends on the collective utility of the household, the power distribution between the members of the household and, of course, the market wages. The power of a woman is determined endogenously. The more a woman contributes to the family income compared to the other members of the family, the more power she gains; again, as the power of the woman increases in the household, she has more freedom to do what she prefers—household work or outside job.

This paper works with a general equilibrium model in which, for a married couple, the consumption and female labor supply decisions are made by the husband and wife together and the power distribution among them is determined endogenously. The producers employ both men and women to produce the consumption good; and everyone owns equal shares of profits earned by the firms. Foreseeing these dynamics in stage two, the eligible men and women decide whether to get married in stage 1. Using this model, it is shown that female labor supply can be increasing, or decreasing, or backward-bending, with respect to a rise in the market wage rate. Under certain circumstances, multiple equilibria might occur in the female labor market so that two economies with exactly the same fundamental characteristics might end up at two very different equilibria: one with high female labor force participation and the other with a low participation. Sometimes multiple equilibria might occur within households which give rise to the female labor supply taking the form of a correspondence. In such a situation, a slight rise in female labor demand may cause a huge increase in women’s employment.

The paper derives some important policy implications. We study the effects of tax-break programs for the employers of female labor and tax-benefit programs for women on their labor supply. It can be shown, using the model in this paper, that the effects of these policies on female labor force participation are not necessarily positive, contrary to what we would be led to believe if we rely solely on intuition. Even in economies with similar fundamental characteristics, the equilibrium female labor force participation may rise in one and fall in the other as a result of tax-benefits given to women or tax-breaks to the employers of women. This occurs because of the multiplicity of equilibria. The wage-gap may widen in both cases, but irrespective of that, these policies empower women. We also find that a tax-break to employers of female labor may give a huge boost to female employment and it may sometimes reduce the wage-gap.

There is a growing literature on collective models of household behavior (Bourguignon and Chiappori 1992, 1994; Vermeulen 2002; Lundberg 2005). Some of them relate female labor to the structure of household decision making theoretically. Francois’ (1998) paper was focused on gender discrimination. He showed that even in the absence of any gender-specific inefficiency, gender discrimination in the labor market may arise just “from the interaction between women and men within the household.” In Apps and Rees (1997) and Vermeulen et al. (2006), individual utility was maximized subject to weekly exceeding the reservation utility of the spouse (otherwise she would leave the household) and the household’s budget constraint; then a sharing rule of the family income was established in equilibrium leading to the labor supply decisions of the individual members.

Grossbard-Shechtman (1984, 1993) and Grossbard (2015) study the interdependence between marriage market and labor market (both male and female), where marriage is treated as exchange of household work between spouses at a shadow price. In these articles, each individual maximizes own utility by supplying his/her own labor for household work and outside work and demanding household work from the spouse. The general equilibrium occurs in all four markets and that determines the labor supply decisions of both men and women for their household work and outside work. Hence, in Grossbard-Shechtman (1984, 1993), Grossbard (2015), Apps and Rees (1997) and Vermeulen et al. (2006), (1) individual utilities are maximized first and then the sharing rule of family income is established (which indicates the power distribution in the household); (2) men influence female labor force participation only indirectly through the markets for labor (where the wages are determined in equilibrium), outputs, and in the case of Grossbard’s models, markets for household work. However, in the current paper, the husband and wife together choose the power distribution in the household by choosing the wife’s labor supply for household work and outside work. The wife’s say in this decision depends upon her power within the household which is endogenously determined in the household equilibrium. This leads us to study policy implications on female labor force participation and particularly women’s empowerment.

The model developed in the present paper is more closely related to the one in Basu (2006) and Atal (2012). Using a collective utility model, Basu (2006) showed how a household might end up with multiple equilibria while choosing the effort-level of the woman for working outside home. However, he assumed that wages are fixed which can be justified as long as we are considering one household at a time. One household (consisting of one woman) cannot have any significant impact on the wages. But when we aggregate all the household decisions to get the total female labor supply, we cannot take female and, for that matter, male wages to be fixed because market wages are determined endogenously. They depend on the labor demand and the total labor supply. Therefore, building upon the partial equilibrium model outlined in Basu (2006), I have worked out a general equilibrium model to study the policy implications of interest. Additionally, households were exogenously given in Basu (2006), whereas in the current paper, men and women decide whether to get married foreseeing the power dynamics and general equilibrium in the next stage. Atal (2012) gives a sketch of the market equilibrium in stage two of the model developed in this paper and conjectures the policy implications that are extensively analyzed here.

2 Model

The model in this paper is a static game with two stages where men and women decide to get married in stage 1 and then join the labor force in stage 2. If not married, the women choose how much effort to put in the household work and outside work. However, if married, then the couple makes these decisions together to maximize the collective household utility.

There are \(N\) women and \(N\) men eligible for marriage, each one of them own equal share of a firm producing the consumption good \(x\) with equal share of profits. Let \(e_{i}\in \left[ 0,1\right]\) denote woman \(i\)’s effort put to work outside home and \(h_{i}\in \left[ 0,1\right]\) be her effort on household work, \(\left( e_{i}+h_{i}\right) \in \left[ 0,1\right]\). Let \(\alpha\) denote a woman’s exhaustion from outside job in terms of household work, i.e., the exhaustion from working for one hour outside is equivalent to the exhaustion from working \(\alpha\) hours in the household, \(\alpha \in \left( 0,2\right)\). Basically, working at home or outside are perfectly substitutable choices for the woman and \(\alpha\) works as a preference parameter here. Hence working one hour outside is equivalent to working \(\alpha\) hours at home for the woman. For simplicity, suppose there are only two types of women.Footnote 1 \(N_{1}\) women are of type \(\alpha _{1}\) and the remaining \(\left( N-N_{1}\right)\) women are of type \(\alpha _{2}\), where \(0<\alpha _{2}<\alpha _{1}<2\) and \(N_{1}<N\). Let \(w_{f}\) be the wages for female laborFootnote 2 and \(w_{m}\) be the wages for male labor. To focus on the analysis of female labor supply, assume that the man always puts his entire effort \(1\) for outside work.

The male \(\left( m\right)\) and female \(\left( f\right)\) have different utility functions. While not married, each individual maximizes his/her own utility. However, when they are married, they take the household-decisions collectively. In stage 1 of this model, each single individual decides whether to get married, and then in stage 2 the market-clearing general equilibrium occurs.

After marriage, the couple’s objective is to maximize a weighted average of the utility each of them gets from their collective decisions. The weights depend on the power distribution in the household. Let \(\theta _{i}\in \left[ 0,1\right]\) denote the power of the type \(i\) woman in the household if she is married. Hence \(\left( 1-\theta _{i}\right)\) is the power of the man in that household. Following the arguments of Agarwal (1997) and Basu (2006), it will be assumed that this index of power is endogenous to the household, that is, while \(\theta _{i}\) influences household decisions, the decisions in turn influence \(\theta _{i}\). The woman may gain more power by earning money from an outside job and thus increasing the total household income; on the other hand, she can choose to do more of what she likes—outside job or household work—if she has more power. This endogeneity of power is not at odds with the empirical findings; see Bittman et al. (2003).

Let \(x\) be the consumption good and normalize its price at \(1\). For technical ease, assume that there is only one consumption good and both agents gain some utility from it. Let \(v\left( .\right)\) denote the utility of a person from the household work done by the woman and assume \(v\left( 0\right) \ge 0,v^{\prime }\left( .\right) >0,v^{\prime \prime }\left( .\right) <0\), i.e., the utility is positive and increases at a decreasing rate.Footnote 3 Let us denote the disutility caused by effort on outside work by \(c\left( .\right)\), where \(c^{\prime }\left( .\right) >0,c^{\prime \prime }\left( .\right) >0\), i.e., the disutility increases at an increasing rate. Assume that \(v^{\prime }\left( 1\right) >c^{\prime }\left( 1\right)\), i.e., for all \(h\), the woman’s marginal utility from her work at home is more than her marginal disutility from that. This guarantees that the optimum choice of \(e_{i}\) and \(h_{i}\) are such that \(\left( e_{i}+h_{i}\right) =1\), i.e., the woman puts her entire effort \(1\) on work—household and outside. Also assume that \(v\left( 0\right) \ge c\left( 2\right)\) so that the total utility is non-negative.

This model does not allow the option of divorce or remarriage because it may complicate things making the model intractable. One can justify this assumption if the social cost of divorce or remarriage is huge. I also assume rational expectation which guarantees that men and women can perfectly foresee the future and hence they can also predict the divorce which leads them not to get married in the first stage because divorce is costly. The model in this paper might not be applicable to all the societies. I have a patriarchal society in a developing economy framework in mind while setting up the model and analyzing it.

2.1 Stage 2: household and market equilibrium

We solve this two-stage game using backward induction. In stage 1, without loss of generality, suppose type 1 women are married and type 2 women stay single. To make sure this is indeed an equilibrium, we have to check the out of equilibrium options as well. Following are the utility functions when they are single and when they are married. Superscript \(s\) denotes single women’s labor choice.

If they are single, the individual utilities are:

For a married couple, the collective utility is given by:

Note that the utility maximizing effort for outside job \(\left( e_{i}\right)\) for a single woman might not be the same as of a married woman because the married couple maximizes the household utility instead of her own utility. The utilities are maximized subject to the budget constraints. For a single woman, the budget constraint is: \(x\le \left( e_{i}^{s}w_{f}+\frac{\pi }{2N} \right)\); for a single man, it is: \(x\le \left( w_{m}+\frac{\pi }{2N} \right)\); and for the married couple, the budget constraint is: \(x\le \left( w_{m}+e_{i}w_{f}+\frac{\pi }{N}\right)\), where \(\pi\) is the profit of the firm.

Since the utilities are strictly increasing in \(x\), the budget constraints hold with equality. Substituting for \(x\) from the budget constraints, we can re-write the utility functions as follows:

Typically, because of the dependence of the budget constraint on the non-wage income \(\pi\), we should have a family of labor supply curves (each curve indexed by the profit-level). However, in this case, the utility maximizing labor supply will be independent of the level of non-wage income. This arises because we have a utility function which is quasi-linear in the consumption good, and we are assuming an interior solution. That is, any increase in non-wage income (wage rates being given) would be fully reflected in a corresponding increase in the consumption good, \(x\), to restore budget equality. Hence, the utility functions of single women and married households are maximized w.r.t. \(e_{i}\in \left[ 0,1\right]\). When the woman’s power is \(\theta _{i}\) and the market wage rate for her labor is \(w_{f}\), the utility maximizing effort \(\left( e_{i}\right)\) by the woman for her outside job is given by the solution of the first order condition: Footnote 4

where \(\theta _{i}\) is endogenously determined in the household equilibrium (defined later). For a single woman, it is:

Let us now focus on the couple with type \(i\) woman. The equation above gives us the household-utility maximizing effort supplied by the woman for outside job, \(e_{i}\):

Implicitly differentiating the first order condition (1) , find that:

The statement above simply means that if the woman’s disutility from working at home is less than her disutility from working outside, then the more power she gains in the household, the more she can choose to work at home. It also says that if the woman prefers working at home more than the man likes her household work, then the more power she gains, the more she can choose to work at home. True empowerment comes with the freedom of choice.

The woman can acquire more power in the household by earning and contributing more into the household income. Suppose the power of a woman \(\left( \theta _{i}\right)\) in the household depends not only on the relative wages she earns compared to the man \(\left( \frac{e_{i}w_{f}}{w_{m}} \right)\), but also on the prevailing relative market wage for female labor \(\left( \frac{w_{f}}{w_{m}}\right)\). If \(\frac{w_{f}}{w_{m}}\) is very high, then even a woman who does not actually go outside for a job (i.e., \(e_{i}=0\)), can enjoy a pretty high power by the mere availability of a very good outside option. On the other hand, if \(\frac{w_{f}}{w_{m}}=0\) (or a very low value), then the woman cannot gain a lot of power by working outside even for full-time. Therefore, we can write the power of a woman \(\left( \theta _{i}\right)\) in the household as a function of \(\left( e_{i},\frac{w_{f}}{ w_{m}}\right)\) so that \(\theta _{i}\) is increasing in \(e_{i}\) and as \(\left( \frac{w_{f}}{w_{m}}\right)\) increases, \(\theta _{i}\) shifts up:

Definition 1

A household equilibrium in this model, for given market wage rates \(\left( w_{f},w_{m}\right)\), is described by \(\left( e_{i}^{*}\left( w_{f},w_{m}\right) ,\theta _{i}^{*}\left( w_{f},w_{m}\right) \right)\) where:

Now let us look at the producers’ side. Suppose the labor markets are perfectly competitive and there exists some substitutability between male labor and female labor. The producer chooses the amount of inputs (or the two kinds of labor) to maximize profit:

where \(F\left( L_{f},L_{m}\right)\) is the production function with two inputs—female labor and male labor, with positive marginal products. Footnote 5 Assuming a strictly concave production function, we get the demand for both kinds of labor by each firm:

Concavity of the production function guarantees downward sloping labor demand curves with an upward shift caused by the increase in wages for the other kind of labor since male labor and female labor are substitutes to some extent. For further simplification, we assume constant returns to scale so that \(\pi =0\).Footnote 6

Definition 2

As the price of the consumption good is assumed to be \(1\), the market equilibrium of this model is defined by the equilibrium wage rates for female and male labor \(\left( w_{f}^{*},w_{m}^{*}\right)\) where the demand for labor equals its supply, i.e.,

Note that \(e_{i}=e_{i}^{*}\left( w_{f}^{*},w_{m}^{*}\right)\), given by the household equilibrium if type \(i\) women are married; otherwise \(e_{i}=e_{i}^{s}\left( w_{f}^{*}\right)\), given by the solution of equation (2).

2.2 Stage 1: marriage decision and general equilibrium

Moving one step back, given the household and market equilibria, the general equilibrium occurs when the marriage decisions are consistent so that no one would like to deviate from his/her decision unilaterally. They get married if both of them are better off being in a marriage (or a household). If any one of them can get a strictly higher utility staying single, then he/she stays single. Assume that \(N\) is large enough so that unilateral deviation does not change the market wages.

Note that because of our assumptions on \(v\left( .\right)\) and \(c\left( .\right)\), the woman’s contribution to the household utility is always positive and hence the man always wants to get married. However, whether the woman wants to get married or not, that depends on the utilities from being single or married. Hence the general equilibrium with type 1 women married and type 2 women staying single is described by the following system of equations:

and

The first equation means that for a type 1 woman, the collective household utility is more than her utility had she stayed single. The second equation means that type 2 women stay single because she prefers to do so.

Next, let us derive the female labor supply curve and consequently the equilibrium assuming the single crossing property between the man’s and the woman’s utility functions as two extreme cases. This means that we assume either of the following two cases. In case I, \(\alpha _{i}>1\) for all \(i\) and in case II, it is exactly the opposite, i.e., \(\alpha _{i}<1\) for all \(i\). Let us analyze these two extreme cases in the following two sections and describe the household equilibrium and the market equilibrium in each case.Footnote 7 No matter what, single women’s outside work effort is increasing in their wages: \(\frac{\partial e_{i}^{s}}{ \partial w_{f}}>0\).

2.3 Household work less painful

In this extreme case, suppose \(\alpha _{i}>1\) for all \(i\) so that the women’s disutility from working at home is less than their disutility from working outside. As a result, from Eq. (3), the household’s collective utility maximizing effort supplied by the woman for outside job decreases as her power increases: \(\frac{\partial e_{1}}{\partial \theta _{1}}<0\). However, the woman can acquire more power by working more outside (thus earning more): \(\frac{\partial \theta _{1}}{\partial e_{1}}>0\). Thus there exists a unique household equilibrium in this case. To find the market equilibrium, we first need to construct the female labor supply from the household equilibria at different market wages for female labor. From the first order condition of the household’s utility maximization problem given by Eq. (1), it is easy to check that:

We can think of it as a substitution effect of a price-rise. The market wage-rate \(w_{f}\) is nothing but the price (or opportunity cost) of working one hour at home for the woman. Hence, as a result of a rise in wages, she will want to work less at home and work more outside. While this is the only effect of increase in the market wage-rate for single women, it has an additional “power-gain effect” for married women. As we have argued earlier, the more the market wage is, the more power the woman earns:

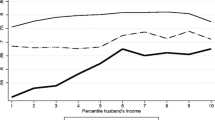

and the more power she earns, the less she wants to work outside because \(\alpha _{1}>1\). Therefore, the total effect of the increased wages on her outside work choice is ambiguous. As the wage-rate for female labor rises, the household equilibrium \(e_{1}^{*}\) may either increase or decrease or remain unchanged. If \(e_{1}^{*}\left( w_{f},w_{m}\right)\) increases as \(w_{f}\) increases, then the female labor supply curve is increasing as usual because \(e_{2}^{s}\left( w_{f}\right)\) is increasing in \(w_{f}\). But if \(e_{i}^{*}\left( w_{f},w_{m}\right)\) decreases as \(w_{f}\) increases, then interesting outcomes may occur since the aggregate female labor supply curve may now be decreasing. In Fig. 1, we can see a situation where the effort-level in the household-equilibrium falls as female-wages increase. This may give rise to a downward sloping or backward bending supply curve for female labor if married women’s power gain effect is stronger than all women’s substitution effect of rise in their wages.

While the mechanism that generates backward bending labor supply curve in this model originates just from the endogeneity of the intra-household bargaining power of the woman and her work-decision, I agree that there may exist other plausible reasons why labor supply may be backward-bending. For example, there may be income effects in labor supply in a usual labor-leisure choice model. But in the current model, leisure does not add any utility, household-work does, which also requires some physical labor involvement along with time.

Assuming downward sloping demand curve for female labor, with a backward bending labor supply curve, we might have multiple equilibria in some situations in the female labor market although there exists a unique household equilibrium.Footnote 8 One such situation is shown in Fig. 2.

Therefore, two economies, similar in every fundamental aspect, might end up at two different equilibria and thus they look very different from outside in terms of the outcome. One of them might have a very high female labor force participation in equilibrium and low market wage rates. And in the other one, women may spend more time at household work in equilibrium although the market wage rates in both the labor markets are very high.

2.4 Outside work less painful

In this extreme case, we consider \(\alpha _{i}<1\) for all \(i\) so that the women’s disutility from working at home is more than their disutility from working outside. Hence, from Eq. (3), as the power of the woman increases, her effort supply for outside job increases: \(\frac{ \partial e_{1}}{\partial \theta _{1}}>0\). Since both the “power-gain effect” and effort supply are increasing in this case, we might have multiple equilibria in a household as shown in Basu (2006). As we did in the previous case, let us now find the market equilibrium here. For that, we need to construct the female labor supply first, that is, allow the female-wages to change and check what happens to the household equilibrium.

If we incorporate changes in wages for female-labor, the multiplicity of household equilibria might not exist. To see this, first note that as wage-rate \(w_{f}\) increases, the power \(\theta _{1}\) increases and the effort-supply \(e_{1}\left( \theta _{1},w_{f}\right)\) also increases. After a sufficient increase in \(w_{f}\), multiple equilibria may vanish and the household ends up at the unique equilibrium with a very high effort-level \(e_{1}\). Similarly, for sufficiently low wages for female-labor, the household may have a unique equilibrium with very low effort-level. Since for wages in some particular range we might have multiple equilibria for each household, the female labor supply for each household in such a situation is given by a correspondence. If all the households choose the same equilibrium, then the aggregate female labor supply looks like the correspondence as in Fig. 3. In this case, a slight rise in female labor demand might give a huge boost to the female labor force participation (in hours). If the number of households is very large and they choose one of the multiple equilibria randomly, then the labor supply includes the entire shaded region shown in Fig. 3.

In the next section, we analyze some important policy implications targeted at increasing the female labor force participation to empower women, in light of our model.

3 Some tax implications

Although almost half of the population in the world is female, they occupy a much smaller proportion of population in terms of employment. In the year 2000, women held only 30 % share of the total employed positions. The average hourly wage-rate of women was just three-quarters of that of men. Aiming at reducing the gender-inequality, various countries have been considering different policies to increase female labor force participation and reduce the wage-gap. They have been trying to do so by providing micro-credit facilities targeted at women, various tax-schemes, facilitating vocational training programs, raising general awareness of the society, implementing affirmative action programs, and so on. These policies might not generate the desired effect always (see Atal and Dubey 2014 on affirmative action.) In this section, we analyze the implications of some tax policies on the female labor supply, wage-gap and women’s empowerment.

Apps and Rees (1988, 1999a, b) have studied various tax reforms in the household production models. Individual utilities were maximized subject to the budget constraints given by a share of the family income; utility was generated from consumption and household work as well. The focus of these studies however were to analyze the effects on social welfare, whereas the focus in this paper is to study the effect on women’s labor force participation, and more importantly, their empowerment and wage-gap.

To gain some more tractability in this model, we analyze the policy implications by taking some particular functional forms for the terms in the utility function and the production function. The functional forms are chosen such that we do not lose much generality in the outcomes of the model and still capture a developing economy’s society to some extent. The household equilibria, the market equilibria and the general equilibria are derived in the “Appendix”. We use those results to carry on the comparative statics results and study the policy implications. While studying policy implications, we study only marginal changes in the policies which do not affect the strict inequalities needed for the marriage decision, because the changes can be made really small so that men and women do not change their states.

3.1 Income tax benefit to women

One of the policies specially aimed at increasing the participation of women in the labor force includes giving tax-benefits to women on their incomes. Until recently, women used to get a higher lump-sum tax benefit compared to men in India.Footnote 9 There has been a rising literature on gender-based taxation. Alesina et al. (2011) find that “tax rates on labor income should be lower for women than for men.” Using the model described in Vermeulen et al. (2006), Myck et al. (2006) and Beninger et al. (2006) find that although giving a lump-sum tax benefit to the man or the woman raises the couple’s collective budget constraint by the same amount, the identity of the receiver has gender-specific behavioral outcomes on the labor supply. To see the implications of giving income tax benefit to women in our model, we can do the following comparative statics exercise.

In case of an income tax benefit to women, the net female wage rate (gross female wage rate minus taxes plus transfer payments) changes and a tax-benefit simply means a rise in net female wages received. As a result, it is easy to find that single women’s labor supply rises and given \(\theta\), the married couple’s utility maximizing effort supply of the woman also rises. Again, since the wife’s net wage rate is now higher, she can gain more power from the same amount of effort put on outside job, i.e., \(\theta \left( e,\frac{w_{f}}{w_{m}}\right)\) shifts up. This exercise has been worked out in Fig. 1 in Sect. 2.3 for the case where household work is relatively less painful to all women. From this figure, it is evident that the equilibrium effort supply of the woman (and thus total female labor supply) might go up or go down as a result of the tax-benefit to women. Footnote 10 Note that since a tax-benefit of value \(\tau\) on net wage-rate \(w_{f}\) is equivalent to a rise in the net wage rate by the same amount, the entire female labor supply curve (or correspondence) shifts vertically down by that amount:

where \(L_{f}^{S}\) and \(\widetilde{L_{f}^{S}}\) denote the female labor supply before and after the introduction of tax-benefit, respectively. Hence, in an economy with a backward-bending female labor supply curve as shown in Fig. 2 and multiple equilibria in the female labor market, introducing a tax-benefit to women might lead to different outcomes depending on which market equilibrium the economy is at. In Fig. 4, we can see that a tax-benefit causes an increase in female labor force participation (in terms of hours) in one equilibrium (from \(L_{f2}\) to \(\widetilde{L}_{f2}\)), whereas, in the other equilibrium, it falls: \(\widetilde{L}_{f1}<L_{f1}\). As a result, the wages of both men and women change causing a change in the intra-household bargaining power of women, which then leads to a change in female labor supply.

Finally, at the new general equilibrium, for the specific functional forms in “Appendix”, as a result of the introduction of a tax-benefit program to women, female employment rises, female wages fall and male wages rise causing the wage-gap to widen if the female labor supply is increasing. Opposite happens if we are on the downward slope of a backward bending labor supply. In both the cases, female power rises. There have been many empirical works for measuring the effectiveness of some tax-benefit programs (see Eissa and Liebman 1996; Blundell et al. 1998; Grogger 2003). Most of them find a positive impact on women’s labor force participation. Eissa and Liebman (1996) found that for one group of women, the effect was positive and for another group of women, it was zero.

Note that even when the wage-gap is widening, women’s power is still increasing. So widening wage-gap cannot indicate loss of female power. From welfare’s point of view, giving income tax benefit to increase female labor force participation and thus empower women is a welfare improving policy if the woman’s disutility from working at home is more than her disutility from working outside.Footnote 11 Here comes the freedom of choice. If women like to work at home more than working outside, then giving incentives to improve female labor force participation may increase female power, but at the cost of reduced welfare.

3.2 Tax-break to the employers of female labor

Another policy we may consider for raising female labor force participation is giving tax-break to the employers of women. This will increase the demand for female labor. In Fig. 5, consider a situation where an economy starts with a demand for labor \(L_{f0}^{D}\) and it is at a low participation equilibrium \(L_{f0}\). Then, due to a tax-benefit to the employers for employing women at work, the demand for female labor shifts up to the one given by \(L_{f1}^{D}\) in Fig. 5. As a result, the economy reaches a new equilibrium at \(L_{f1}\) where both the supply and demand for female labor are much more compared to the initial equilibrium causing a huge increase in women’s employment. Note that the relative wages go down as a result, causing a loss of female power in the household, which may lead to a fall in female labor supply again.

At the new general equilibrium, for the specific functional forms in “Appendix”, the introduction of a tax-break program to the employers of female labor will be as effective in increasing the women’s employment and their empowerment as in the case of the tax-benefit program worked out in the previous section. Additionally, unlike the previous case, we have an increase in female wages leading to an ambiguous effect on the wage-gap as opposed to a widening wage-gap. In fact, in this case, wage-gap reduces under certain parametric restrictions.

And, last but not the least, the impact on welfare, of giving a tax-break to the employers of female labor, is identical to that of giving equal amount of tax-benefit to female employees. Hence, in the model worked out in the “Appendix”, giving a tax-break to employers is clearly a better policy instrument than the tax-benefit to women. In fact, in case of a female labor supply correspondence, if the government decides to rescind on the policy slowly, i.e., by gradually reducing the tax-break so that the demand for female labor moves back to the initial one, the economy may end up being at the high participation equilibrium instead of the low one where it originally started, as shown in Fig. 5.

4 Conclusion

In this paper, we developed a theoretical model for studying the nature of female labor supply in a developing economy. Since the labor supply decision of a woman is taken by the entire household instead of just the individual herself, we have considered a collective utility model to explain the behavior of female labor supply. The power of the woman, and thus the power distribution between all members of the household, has been taken to be endogenous here. Under this setting, it has been shown that female labor supply can take various shapes as the market wage rate changes. Sometimes multiple equilibria might occur in the female labor market. Hence we can have different policy implications for different economies depending on the behavior (or shapes) of their female labor supply (and also their demand for female labor). Not only that, policy implications might differ for the same economy at different time-points depending on the initial equilibrium before the policy-imposition.

In light of the general equilibrium model developed in this paper, we derived some important tax implications on female labor force participation, women’s empowerment at household bargaining and the wage-gap between men and women. We analyzed the effects of tax-benefit programs for women and tax-break programs for their employers. These policies may increase female labor force participation and increase female power, but they may widen the wage-gap between men and women. Tax-break to the employers of female employees may work as a better tool for reducing the wage-gap, increasing female labor force participation and empowering women. Welfare improvement is the same under these policies.

In the entire analysis above, we assumed that women have same productivity which is far from reality. Further research on female labor supply and women’s empowerment can be done where women have heterogeneous skills. We can think of the scope of education as well in this context. Education can help an individual in acquiring more skill and thus gain more power to bargain for higher wages from the employer. However, getting some education is costly. Even if basic primary education may be freely available in many countries, acquiring education may involve an opportunity cost because of the time spent on it. This might give rise to interesting outcomes in women’s participation decisions in skilled or unskilled labor force, the literacy rate among them and women’s empowerment in an economy.

Notes

This simplification can easily be generalized.

Women do not get paid in terms of wages for their household work.

The husband and the wife may have different utilities from the household work, see Atal (2012). To minimize the notational complications, we assume they are the same. As long as the utility functions are increasing and concave, the results remain qualitatively similar.

If \(w_{f}\le v^{\prime }\left( 1\right) +\theta _{i}\left( \alpha _{i}-1\right) c^{\prime }\left( 1\right)\), then \(e_{i}=0\) and if \(w_{f}\ge v^{\prime }\left( 0\right) +\theta _{i}\left( \alpha _{i}-1\right) c^{\prime }\left( \alpha _{i}\right)\), then \(e_{i}=1\).

To avoid any kind of complementarity between the inputs, assume that the elasticity of substitution is at least as much as \(1\), i.e., \(\frac{\left( \frac{\partial F}{\partial L_{f}}/\frac{\partial F}{\partial L_{m}}\right) }{ \left( L_{f}/L_{m}\right) }\ge -\frac{d\left( \frac{\partial F}{\partial L_{f}}/\frac{\partial F}{\partial L_{m}}\right) }{d\left( L_{f}/L_{m}\right) }\).

Even if we do not make this assumption, all the results of this model hold qualitatively.

For \(\alpha _{i}=1\), the effort supplied by the woman does not depend on the power \(\theta _{i}\) and hence the female labor supply curve will just be increasing with the wages \(w_{f}\).

I have elsewhere, along with co-authors, established a different setting where, again with feasible wages, one gets multiple equilibria though through a very different mechanism (see Atal et al. 2010).

If outside work is relatively less painful, as in Sect. 2.2, the female labor supply will go up.

This is a sufficient condition, but not necessary.

If \(w_{f}\le \frac{A}{E+1}-2B\theta _{i}\left( 1-\alpha _{i}\right)\), then \(e_{i}=0\) and if \(w_{f}\ge \frac{A}{E}-2B\theta _{i}\alpha _{i}\left( 1-\alpha _{i}\right)\), then \(e_{i}=1\).

References

Agarwal, B. (1997). “Bargaining” and gender relations: Within and beyond the household. Feminist Economics, 3(1), 1–51.

Alesina, A., Ichino, A., & Karabarbounis, L. (2011). Gender based taxation and the division of family chores. American Economic Journal: Economic Policy, 3(2), 1–40.

Apps, P., & Rees, R. (1988). Taxation and the household. Journal of Public Economics, 35(3), 355–369.

Apps, P., & Rees, R. (1997). Collective labor supply and household production. Journal of Political Economy, 105(1), 178–190.

Apps, P., & Rees, R. (1999). Individual versus joint taxation in models with household production. Journal of Political Economy, 107(2), 393–403.

Apps, P., & Rees, R. (1999). On the taxation of trade within and between households. Journal of Public Economics, 73(2), 241–263.

Arellano, M., & Meghir, C. (1992). Female labour supply and on-the-job search: An empirical model estimated using complementary data sets. Review of Economic Studies, 59, 537–557.

Atal, V., Basu, K., Gray, J., & Lee, T. (2010). Literacy traps: Society-wide education and individual skill premia. International Journal of Economic Theory, 6(1), 137–148.

Atal, V. (2012). Tax policies, female labor force participation and women’s empowerment. In M. Lownes-Jackson & R. Guy (Eds.), Economic empowerment for women: A global perspective. Santa Rosa, California: Informing Science Press.

Atal, V., & Dubey, R. (2014). Affirmative action and empowerment: Friends or foes? Economics Bulletin, 34(2), 1012–1018.

Basu, K. (2006). Gender and say: A model of household behavior with endogenously-determined balance of power. The Economic Journal, 116(4), 558–580.

Beninger, D., Bargain, O., Beblo, M., Blundell, R., Carrasco, R., Chiuri, M., et al. (2006). Evaluating the move to a linear tax system in Germany and other European countries. Review of Economics of the Household, 4(2), 159–180.

Bittman, M., England, P., Sayer, L., Folbre, N., & Matheson, G. (2003). When does gender trump money? Bargaining and time in household work. American Journal of Sociology, 109(1), 186–214.

Blundell, R., Duncan, A., & Meghir, C. (1998). Estimating labor supply responses using tax reforms. Econometrica, 66(4), 827–861.

Blundell, R., Ham, J., & Meghir, C. (1987). Unemployment and female labour supply. The Economic Journal, 97, 44–64.

Bourguignon, F., & Chiappori, P. (1992). Collective models of household behavior: An introduction. European Economic Review, 36, 355–364.

Bourguignon, F., & Chiappori, P. (1994). The collective approach to household behavior. In R. Blundell, I. Preston, & I. Walker (Eds.), The measurement of household welfare. New York: Cambridge University Press.

Duflo, E. (2003). Grandmothers and granddaughters: Old-age pensions and intrahousehold allocations in South Africa. The World Bank Economic Review, 17(1), 1–25.

Eissa, N., & Liebman, J. B. (1996). Labor supply response to the earned income tax credit. The Quarterly Journal of Economics, 111(2), 605–637.

Felkey, A. J. (2013). Husbands, wives and the peculiar economics of household public goods. European Journal of Development Research, 25(3), 445–465.

Francois, P. (1998). Gender discrimination without gender difference: Theory and policy responses. Journal of Public Economics, 68, 1–32.

Gitter, S. R., & Barham, B. L. (2008). Women’s power, conditional cash transfers, and schooling in Nicaragua. The World Bank Economic Review, 22(2), 271–290.

Greenwood, J., Seshadri, A., & Yorukoglu, M. (2005). Engines of liberation. The Review of Economic Studies, 72(1), 109–133.

Grogger, J. (2003). The effects of time limits, the EITC, and other policy changes on welfare use, work, and income among female-headed families. The Review of Economics and Statistics, 85(2), 394–408.

Grossbard, S. (2015). The marriage motive: A price theory of marriage. How marriage markets affect employment, consumption and savings. New York: Springer.

Grossbard-Shechtman, A. (1984). A theory of allocation of time in markets for labour and marriage. The Economic Journal, 94(376), 863–882.

Grossbard-Shechtman, S. (1993). On the economics of marriage: A theory of marriage labor and divorce. Boulder, Colorado: Westview Press.

Handa, S. (1999). Maternal education and child height. Economic Development and Cultural Change, 47, 421–439.

Hoddinott, J., & Haddad, L. (1995). Does female income share influence household expenditures? Evidence from Cote D’Ivoire. Oxford Bulletin of Economics and Statistics, 51, 77–96.

Hopkins, J., Levin, C., & Haddad, L. (1994). Women’s income and household expenditure patterns: Gender or flow? Evidence from Niger. American Journal of Agricultural Economics, 76, 1219–1225.

Lancaster, G., Maitra, P., & Ray, R. (2006). Endogenous intra-household balance of power and its impact on expenditure patterns: Evidence from India. Economica, 73, 435–460.

Lundberg, S. (2005). Gender and household decision-making. In F. Bettio & A. Verashchagina (Eds.), Frontiers in Gender Economics. New York: Routledge.

Myck, M., Bargain, O., Beblo, M., Beninger, D., Blundell, R., Carrasco, R., et al. (2006). The working families’ tax credit and some European tax reforms in a collective setting. Review of Economics of the Household, 4(2), 129–158.

Nakamura, A., & Nakamura, M. (1994). Predicting female labor supply: Effects of children and recent work experience. The Journal of Human Resources, 29(2), 304–327.

Senauer, B., Garcia, G., & Jacinto, E. (1988). Determinants of the intrahousehold allocation of food in the rural Philippines. American Journal of Agricultural Economics, 70, 170–180.

Vermeulen, F. (2002). Collective household models: Principles and main results. Journal of Economic Surveys, 16, 533–564.

Vermeulen, F., Bargain, O., Beblo, M., Beninger, D., Blundell, R., Carrasco, R., et al. (2006). Collective models of labor supply with nonconvex budget sets and nonparticipation: A calibration approach. Review of Economics of the Household, 4(2), 113–127.

Acknowledgments

I am grateful to Talia Bar, Kaushik Basu, Ram Sewak Dubey, Tapan Mitra, Luis San Vicente Portes, the participants of the Advanced Graduate Workshop conducted by Joseph Stiglitz at Manchester University, the Development Economics Seminar at Cornell University, Brown Bag Research Seminar at Montclair State University, 2011 New York State Economics Association Conference, Economics Seminar at Binghamton University and 22nd Annual IAFFE Conference for numerous extremely helpful comments. I am especially thankful to the editor Shoshana Grossbard and three anonymous referees for their valuable comments and guidance to improve this paper significantly.

Author information

Authors and Affiliations

Corresponding author

Appendix: Model with specific functional forms

Appendix: Model with specific functional forms

Let us take the following functional forms for \(v\left( .\right)\) and \(c\left( .\right)\):

Assume that \(A\ge 8B\) so that for all \(h\), the woman’s marginal utility from her work at home is more than her marginal disutility from that. This guarantees that the optimum choice of \(e\) and \(h\) by the household are such that \(\left( e+h\right) =1\), i.e., the woman puts her entire effort \(1\) on work—household and outside. Also, assume that \(2>\alpha _{1}>1>\alpha _{2}>0\), so that type 1 women are more likely to get married compared to type 2 women.

Since the utilities are strictly increasing in \(x\), the budget constraints hold with equality. Substituting for \(x\) from the budget constraints, we define the utility functions as follows:

\(\widetilde{u}_{fi}\) and \(\widetilde{U}_{i}\) are maximized w.r.t. \(e_{i}\in \left[ 0,1\right]\). Therefore, for a single woman, the utility maximizing effort \(\left( e_{i}^{s}\right)\) is given by the solution of the following:

On the other hand, the utility maximizing effort by the married woman for her outside job is given by the solution of the following first order condition:Footnote 12

Let us consider the parameters in the range where we always get interior solution for household equilibrium. Implicitly differentiating the first order condition (4), find that:

Suppose the intra-household bargaining power of a married woman \(\left( \theta _{i}\right)\) as a function of \(\left( e_{i},\frac{w_{f}}{w_{m}} \right)\) is defined as follows:

Hence the household equilibrium is given by \(e_{i}^{*}\) which is the solution of the following equation:

Implicitly differentiating the household equilibrium w.r.t. \(w_{f}\), we find that:

From (4), we know that \(w_{f}>\frac{A}{\left( E+1-e_{i}^{*}\right) }\) iff \(\alpha _{i}>1\). Hence the female labor supply from the household with type \(i\) woman has a downward sloping portion iff one of the following conditions is true:

- 1. :

-

\(\alpha _{i} > 1\,\text { and }\,\frac{\gamma \left( 1-\theta _{i}^{*}\right) }{w_{f}}\left( w_{f}-\frac{A}{\left( E+1-e_{i}^{*}\right) }\right) >1\);

- 2. :

-

\(\alpha _{i} < 1\,\text { and }\,\frac{A}{\left( E+1-e_{i}^{*}\right) ^{2}}+2B\theta _{i}^{*}\left( \alpha _{i}-1\right) ^{2}<\frac{ \gamma \left( 1-\theta _{i}^{*}\right) }{\left( 1+e_{i}^{*}\right) } \left( \frac{A}{\left( E+1-e_{i}^{*}\right) }-w_{f}\right)\).

Note that the single women’s labor supply is always increasing. The aggregate female labor supply is given by:

Now let us look at the producer’s side. The production function is given by a constant returns to scale Cobb-Douglas production function:

The producer chooses the amount of inputs (or the two kinds of labor) to maximize profit. Therefore we get the demand for both kinds of labor by the firm:

where \(X\) is the total output produced which in equilibrium will be such that:

Hence the market equilibrium is given by the following system of equations where \(\tau \ge 0\) is the potential tax-benefit to women and \(t\ge 0\) is the potential tax-break to the employer of female labor.

Additionally, the following two conditions must hold in general equilibrium so that no one unilaterally deviates from marrying or staying single.

Under our initial assumption of \(2>\alpha _{1}>1>\alpha _{2}>0\), it can be checked that the conditions above indeed hold true in equilibrium. Note that we are considering strict inequalities only so that when we study policy implications, we can change the parameters in such a little amount that these inequalities do not change, hence the number of married couples and singles remain the same before and after the introduction of the policies.

The total welfare in the society is given by:

Suppose \(\eta \in \left\{ \tau ,t\right\}\) is a parameter in the model. Then, for finding the comparative statics results of \(\eta\) on \(e,\theta\) and \(\frac{w_{f}}{w_{m}}\) when \(\eta =0\), we have to differentiate the equilibrium conditions given above with respect to \(\eta\) and evaluate at \(\eta =0\). Substituting from (5) and re-arranging, we get:

Solving, we find that the denominator \(D\) is:

For \(\beta ,\gamma ,\frac{B}{A}\) small enough, this denominator is positive.

Now let us study the policy implications under the above mentioned functional forms.

1.1 Income tax benefit to women

We are looking for the effects of an increase in a tax-benefit \(\tau\) from \(0\). Fully differentiating the equilibrium system w.r.t. \(\tau\) and solving, we get:

Hence female employment will rise if the female labor supply is not backward bending. Also,

Hence male wages will go up and female wages will go down widening the wage-gap if the labor supply curve is increasing and opposite happens for the backward bending portion. Note that even when the wage-gap is widening, women’s power still increases: \(\frac{d\theta _{1}^{*}}{d\tau }\ge 0\). So widening wage-gap may not indicate loss of female power.

1.2 Tax-break to the employers of female labor

In this case, effectively, the female wages to the employers are \(\left( w_{f}-t\right) ,t>0\). We are looking for the effect of a rise in \(t\) from \(0\). Solving, we find the exact same effect on women’s employment and power and welfare as in the previous policy of giving income tax benefit to women. The only difference is in the female wages and the wage-gap.

Hence \(w_{f}\) increases and there is an ambiguous effect on wage-gap. More importantly, sometimes, the wage-gap might widen from tax-benefit, but reduce by giving tax-break to employers.

Rights and permissions

About this article

Cite this article

Atal, V. Say at home, or stay at home? Policy implications on female labor supply and empowerment. Rev Econ Household 15, 1081–1103 (2017). https://doi.org/10.1007/s11150-015-9281-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11150-015-9281-1