Abstract

We empirically investigate the theory that regulatory growth within an industry disproportionately burdens small businesses relative to their larger competitors. Using RegData 3.0, we find that a 10% increase in industry-specific regulatory restrictions is associated with a 0.5% reduction in the number of firms regardless of firm size, but a 0.6% reduction in employment only among small firms. We also find that consecutive years of high regulatory growth amplify the associated negative effects of future regulations on the number and employment of small firms, but we find no amplifying effects for large firms. Finally, we find that higher regulatory growth rates are associated with lower job destruction rates among establishments owned by large firms. These findings are consistent with the Public Choice theory of regulation and imply that regulatory growth leads to fewer small businesses and reduced small business employment, with minimal negative impacts on large businesses.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Regulations, by their nature, generate costs and benefits for the entities they affect. These effects can accrue in different ways and to different groups. Some of the effects are estimated in regulatory impact analyses prepared by the agencies responsible for the regulations. However, as regulations build up over time, their accumulation may have more significant effects than agencies are able to impute in their analyses of individual rules. Furthermore, the effects of accumulation may impact some groups more than others because of certain group characteristics. In this paper, we focus on discovering whether increases in regulations disproportionately burden small businesses as compared with large businesses. In particular, we seek to determine whether increases in regulations that apply to individual industries reduce the number or employment of small businesses in those industries, while having a more limited effect on their larger competitors.

Regulatory costs come in many forms, but a common manifestation is compliance costs—the costs that businesses incur to fulfill regulatory obligations. Compliance costs might include filling out paperwork, purchasing equipment to meet standards, or paying lawyers to advise on compliance strategies. Such compliance activities may have economies of scale that allow large businesses to navigate the regulatory landscape more easily than small businesses. For instance, large businesses are likely to have lawyers on payroll, while small businesses may be limited to contracting for legal services. Not only is the same legal advice likely to cost more from a contractor than from a full-time hire, but the contracted lawyer must spend extra time learning the specific details of the business. Moreover, many regulations have fixed rather than purely variable (per-unit) costs, and larger businesses are able to spread fixed costs over a larger volume of output. In other words, if regulations apply equally to all businesses within an industry, we should expect that the costs relative to the size of the business will be greater for small businesses than for large businesses.

If the burden of regulations falls disproportionately on small businesses, this burden is likely to have ripple effects throughout the economy owing to the importance of small businesses for employment growth, innovation, and economic opportunity. Small businesses represent a large portion of the US economy, in terms of both the number of businesses and the workforce. According to the US Census Bureau’s “Statistics of US Businesses” (SUSB), employer firms with fewer than 500 employees—the definition of a small business used by the Small Business Administration (SBA)—account for 99.7% of US businesses and 47.5% of US employees. Furthermore, research has shown not only that small businesses exhibit roughly the same rate of innovative activity per worker as large businesses, but that in some industries small businesses are more innovative than their larger counterparts (Audretsch, 1995). More recent work shows that much of the innovative activity and subsequent contributions to employment growth previously attributed to small businesses are in fact generally the result of “new” rather than “small” firms. Nonetheless, these new firms are also small firms at the stage when they contribute the most to employment growth (Graham et al., 2018; Haltiwanger et al., 2013).

In addition to these macroeconomic implications, the burden of regulatory costs on small businesses may have important distributional effects based on income levels. Low-income areas tend to have smaller businesses than other areas (Kugler et al., 2017), meaning that any disproportionately high costs for small businesses are likely to hit low-income areas hardest. Small businesses are also an important mechanism for economic mobility, specifically for low-income households with little access to capital. To the extent that regulations hurt small businesses or create barriers to entry, they may also limit the economic opportunities available to low-income households.

To mitigate these problems, Congress built relief mechanisms for small businesses into the regulatory process. For example, the Regulatory Flexibility Act of 1980 (1980) and the Small Business Regulatory Enforcement Fairness Act of 1996 (1996) instruct federal agencies to attempt to determine a regulation’s economic impact on small entities and explore alternatives that might reduce that impact, including partial or total exemptions. However, it is difficult to evaluate the full extent of small business exemptions or their characteristics, because there currently exists no way to scour the federal regulatory code for such information.

Some researchers have investigated the extent and effectiveness of exemptions, and the findings are mixed. While small businesses often receive special consideration in the policymaking process (Dixon et al., 2006), the nature of these considerations takes many forms, and the degree to which regulations include concessions for small businesses differs greatly by regulatory area (Keefe et al., 2005). Compounding the situation, many small business exemptions differ in their definition of what constitutes a small business (usually defined somewhere in the range of 11 to 100 employees, but sometimes defined based on annual revenue rather than number of employees) (Keefe et al., 2005). Most critically, it is unclear whether regulatory efforts to help small businesses are effective (Dixon et al., 2006).

The idea that regulatory burdens may fall disproportionately on small businesses is not new to the academic literature. However, limited data on the breadth and incidence of federal regulations have made empirical testing difficult. A few studies have attempted to look at the general effects of regulations on small businesses (Crain & Crain, 2014; Crain & Hopkins, 2001; Hopkins, 1995; Kitching et al., 2015), and others have examined specific case studies (Adler, 1993; Becker, 2005; Dean et al., 2000). While these studies are informative, the robustness of their results is debatable. General studies risk conflating the effects of other factors with those of regulations, and case studies paint only part of the picture. Moreover, much of the literature on small businesses and regulations has relied on potentially biased surveys of small business owners, who are asked to give feedback concerning the monetary and time burdens of compliance. However, a novel database called RegData, which quantifies federal regulatory restrictions within the Code of Federal Regulations (CFR) and identifies the industries those restrictions directly impact, now enables researchers to empirically test the effects of regulations on small businesses with more granularity and robustness (McLaughlin & Sherouse, 2019).

Using RegData, two papers have examined the impact of federal regulations on US entrepreneurship and arrived at opposite conclusions. The first, Bailey and Thomas (2017), empirically demonstrates that growth in industry-specific regulations reduces firm formation and hiring in the affected industries, with more pronounced effects for smaller firms. The second, Goldschlag and Tabarrok (2018), is unable to establish an empirical association between federal regulations and dynamism, which they measure using Davis-Haltiwanger-Schuh-transformed measures of formation and hiring among establishments (individual physical locations of a firm).Footnote 1 Clearly, the impact of regulations on the number of firms (or establishments) and employment levels remains an open question. Yet these previous studies only investigate the marginal impact of additional current-period regulations on industry-level employment and firm (or establishment) counts, and ignore possible “hangover” effects of recently promulgated regulations and possible intensifying effects of high current-period regulation growth. We contend that the volume of relatively new regulations affecting a small business can create a challenging compliance environment, which will in turn amplify the negative consequences of additional regulations. A small business will almost certainly find it more difficult and costly to comply with a new regulation if that business is already spending time and resources trying to comply with many other recent regulations.

Our paper estimates how changes in the stock of regulations influence both the number of small and large firms and the total employment of these businesses across a wider set of industries classified at the more detailed 6-digit North American Industry Classification System (NAICS) level (as opposed to the 4-digit and 3-digit levels considered by the above papers) over a longer time horizon (1998 to 2015 as opposed to 1998 to 2011 and 1999 to 2013 in the above papers). We find that a 10% increase in industry-specific regulatory restrictions is associated with a 0.5% reduction in the number of firms regardless of firm size, but a 0.6% reduction in employment only among small firms. While our results are similar to the findings of Bailey and Thomas (2017), we also find evidence that both current and prior spells of high regulation growth amplify the intensity with which regulations erode the total number of firms and employment of small firms within an industry.Footnote 2

Given the Census Bureau’s recent release of updated Business Dynamics Statistics (BDS) (2021), which provide better establishment-level data than the SUSB dataset, we retest the findings of Goldschlag and Tabarrok (2018). Using dynamism and entrepreneurship measures derived from BDS data, we find that increased regulation growth is associated with a lower startup rate for small establishments but that this does not hold for establishments operated by large firms. Moreover, increased regulation growth is associated with a lower job creation rate among newly formed establishments and a lower job destruction rate among continuing large establishments. Taken together, these results are consistent with the Public Choice theory of regulation, which holds that high levels of regulation act like a barrier to entry that hurt small businesses the most and give a competitive edge to large businesses that can more easily comply.

These findings have important implications for policy, particularly given recent actions to address regulatory accumulation in both the executive and legislative branches. In 2016, President Trump issued Executive Order 13,771, creating a regulatory budget designed to reduce regulatory accumulation. This executive order applied only to a small subset of rules deemed “significant,” and required that executive branch agencies identify two rules for elimination for every new rule they propose, and that they offset the costs of new rules by eliminating or modifying existing ones. Similarly, members of Congress have put forth multiple proposals to improve or reduce regulations such as the Regulatory Accountability Act of 2017 and the Regulations from the Executive in Need of Scrutiny Act of 2017, but the most relevant is the recently proposed Small Business Regulatory Flexibility Improvements Act of 2017. This Act amends the previous Regulatory Flexibility Act of 1980 (1980) and the Small Business Regulatory Enforcement Fairness Act of 1996 (1996) to create stronger regulatory protections for small businesses and reduce the regulatory burden they face. All of these actions reflect a growing sentiment that the accumulation of many thousands of regulations may have negative consequences, particularly for specific groups such as small business owners and employees. Our paper sheds some much-needed light on whether and how regulations may disproportionately affect small businesses.

This paper is organized as follows. Section 2 reviews the literature on the effects of regulations on small businesses. Section 3 describes the data we use in the study. Section 4 describes the regression model we use to estimate the impact of regulations on firms and employment, and Sect. 5 presents the results. Section 6 describes the regression model we use to estimate the impact of regulations on measures of establishment-level dynamism and entrepreneurship. Section 7 concludes with a discussion of the topic and results.

2 Background

Although our study is one of the first to address how changes in the stock of regulations influence the number of businesses of different sizes across industries, a large body of research exists on whether and how regulations might affect small businesses. Bradford (2004) develops a mathematical model of how regulatory costs and benefits affect businesses of different sizes to determine whether small business exemptions are justified. However, he falls short of providing a general answer owing to uncertainty about the compounding effects of many regulations, as well as case-by-case considerations regarding transaction costs. Using a dynamic general equilibrium model, Dhawan and Guo (2001) predict that increased regulations reduce the number of small firms and small firms’ share of employment and output. Chambers and Guo (2021) find strong empirical support for the employment and output predictions. Becker (2005) presents a case study of asymmetric enforcement of the Clean Air Act, which exempts small businesses from many regulations. He finds that many asymmetries exist, some favoring small businesses and some favoring large businesses, and he is unable to draw any conclusions regarding whether regulations favor small businesses specifically. Dean et al. (2000) also study the effects of environmental regulations on small businesses, finding that greater intensity of regulation is associated with fewer small business formations but no change in large business formations. Similarly, Pashigian (1984) finds that environmental laws place a greater burden on small plants than large plants.

Bailey and Thomas (2017) represent a major step forward for the literature as they are the first to combine RegData and SUSB to estimate the impact of industry-specific regulations on firm births, firm deaths, and employment growth among large and small firms. Using these data between 1998 and 2011 at the 4-digit NAICS level, they find that more heavily regulated industries experienced both fewer firm births and slower employment growth. However, Goldschlag and Tabarrok (2018) find no empirical association between federal regulations and the establishment startup rate, seeming to contradict the Bailey and Thomas results.

Regarding the cumulative costs of regulations, Bradford (2004) argues that they may be less than the sum of the individual (marginal) costs of each regulation. For example, different regulations sometimes include similar or identical personnel training requirements, which can be combined into a single training to reduce costs. Thus, Bradford argues that the cumulative costs of regulations are increasing at a declining rate. This is in sharp contrast to Adler (1993), who argues that regulatory costs have a compounding effect. Adler claims that, “when regulations are issued with little regard for their marginal impact when added to existing requirements, their results can be particularly oppressive.” Both authors predict that compliance costs are an increasing function of the total regulatory burden. However, neither addresses the two central questions of our paper: First, does the pace of short-run changes in federal regulations differentially impact the number of small and large firms (or establishments) within an industry? Second, how do these changes impact total employment for small and large firms (or establishments) within an industry?

In addition to the regulatory literature, there is a growing body of research investigating changes in US business dynamism, which has important implications for any study measuring changes in the number of firms by size. For the past forty years, business dynamism has been slowing in the US, as is evident from the decline in both the startup rate of firms and the pace of job creation and destruction. Using data from the Census Bureau’s Business Dynamics Statistics, Decker et al. (2014) find that the annual firm startup rate (or entry rate) declined from an average of 12.0% to an average of 10.6% between the late 1980s and the mid-2000s.Footnote 3 Furthermore, while the rate of net entry of firms (firm entry minus firm exit) remained positive during this period, it turned negative in 2008 (Hathaway & Litan, 2014). Similarly, the rate of job creation averaged around 18.9% in the late 1980s but decreased to around 15.8% in the mid-2000s (Decker et al., 2014). The shift in job creation was especially evident following recent recessions when the US economy experienced “jobless recoveries”—declining employment in the early stages of economic recovery—resulting from stagnation and dynamic structural changes (Burger & Schwartz, 2018). Any driving forces behind these secular declines in startup and job creation rates are also likely to affect the distribution of firms by size within any industry. Although our firm-based model controls for any gradual or persistent changes to distribution that result from these or other secular changes, we directly estimate the impact of regulation growth on these dynamism metrics in Sect. 6.

3 Data

For our measure of federal regulations, we use RegData 3.0, which quantifies restrictions in the Code of Federal Regulations (CFR) on an annual basis for the years 1970–2016 (McLaughlin & Sherouse, 2019). Counting restrictions, while not perfect because some restrictions are more burdensome than others, nonetheless is an improvement over basic page counts since some pages may contain many restrictions while others contain few. Using the CFR rather than the Federal Register (FR) also accounts for the stock of regulations rather than the flow. The FR (a flow measure) increases in volume for every federal regulatory action, meaning that, for example, deregulatory actions would appear as increases to the regulatory code and therefore the restriction count. However, the CFR (a stock measure) only includes regulations that are currently in effect, so deregulatory actions would be reflected by the removal of defunct rules, thus decreasing the restriction count.

To obtain this restriction measure of regulation, RegData first searches the CFR for restrictive words, such as “shall” or “must.” It then uses the machine-learning model described below to assign probabilities to each NAICS industry likely to be affected by a given regulatory restriction (Al-Ubaydli & McLaughlin, 2017). The model is trained to identify each NAICS industry using a set of tens of thousands of final rules and proposed rules published in the FR that explicitly mention NAICS industries by name. RegData identifies industry relevance of these rules from the two-digit to six-digit NAICS levels, with two-digit industries being the broadest (e.g., 23—Construction) and six-digit industries being the most granular (e.g., 238140—Masonry Contractors). RegData then assigns probabilities that a given restriction identified in the CFR is relevant to each NAICS industry based on a regularized logit classification model.Footnote 4 To limit potential false positives, the authors evaluated each industry classifier’s performance based on a method of assessing predictive accuracy of machine-learning algorithms, and they removed industries that performed below a minimum threshold (McLaughlin & Sherouse, 2019). The authors also omitted industries for which there were too few training documents to produce reliable probabilities.Footnote 5

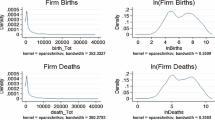

We combine the data from RegData with SUSB data, which provide the number of firms and total employment for businesses of various sizes at the 6-digit NAICS level each year from 1998 to 2015.Footnote 6 SUSB defines a firm as “a business organization consisting of one or more domestic establishments in the same state and industry that were specified under common ownership and control.” It defines size by the number of employees, grouping businesses into six categories: 0–4, 5–9, 10–19, 20–99, 100–499, and 500+ employees. It is important to note that firms can move between categories over time for various reasons—for instance, they might hire additional workers, lay workers off, or merge with other firms. Summary statistics for the combined panel, which includes 4550 observations, are reported in Table 1.

To test the impact of regulations on various measures of dynamism (which are establishment based), we combine the data from RegData with the Census Bureau’s BDS dataset. The BDS dataset provides annual estimates of establishment births and deaths, as well as job creation and destruction among establishments operated by firms of varying size (1–4, 5–9, 10–19, 20–99, 100–499, 500–999, 1000- 2499, 2500- 4999, 5000- 9999, and 10,000+ employees). The industry granularity is limited to the 4-digit NAICS level, but the panel spans a wider time range (1978 to 2018) than the SUSB (1998 to 2015).Footnote 7 Summary statistics for the combined panel, which includes 4715 observations, are reported in Table 2.

Table 3 provides the distribution of firms by size and year in the US between 1998 and 2015, as reported by SUSB. Over this time period, very small firms (0–4 employees) constituted the bulk of all firms (61.21%), while all small firms (0–499 employees), as defined by the SBA, represented more than 99% of all firms. Large firms (500+ employees) represented less than one-third of 1% of all firms. Nonetheless, large firms were important sources of overall employment. Table 4 provides the distribution of employment by firm size between 1998 and 2015, as reported by SUSB. Over this period, large firms provided just under 51% of total employment, while all small firms (0–499 employees) provided the remaining 49%. The smallest firms (0–4 employees) provided approximately 5% of all employment.Footnote 8

4 Firm regression models

Building a model that explains the structure of the US economy and its distribution of firms of varying sizes by industry would be a monumental task and is beyond the scope of this paper. Instead, we seek to model changes in the number of firms over time—that is, we are concerned with the flow rather than the stock of firms by industry. This approach is advantageous in that any invariant or slowly evolving characteristics that influence the level of firms by size within an industry will exert little or no effect on the annual growth rate of firms. This protects against the potential bias created by the declining rates of startups and job creation identified by Decker et al. (2014). This flow approach also yields a simpler framework wherein the growth rate of total firms is regressed on exogenous factors that drive that growth. Following extensive identification testing, Bailey and Thomas (2017) employ a similar identification strategy, wherein they regress the natural log of firm births (or firm deaths or new hires, all of which are flow variables) on the log of industry-specific regulations and panel fixed effectsFootnote 9:

where i is the cross-sectional NAICS industry index and t is the time period index. The industry fixed effects (αi) capture idiosyncratic and exogenous differences in firm births (or deaths or new hires) across industries while the period fixed effects (ηt) capture the impact of business cycles or other common trends impacting firm and employment formation. Within this double-log framework, the coefficient on regulation (β) is an elasticity equal to the percent change in new firm births for a 1% change in industry-specific regulation.

Unfortunately, the Census Bureau does not publish firm birth and death data at the desired 6-digit NAICS industry level. Consequently, we use the year-over-year growth rate in the total number of firms within an industry (\({firmGrowth}_{it}\)). This measure is related to the birth and death measures employed by Bailey and Thomas (2017), as shown in the following decomposition:

where the entry of firms (\({entrants}_{it}\)) stems from the birth of new firms (\({births}_{it}\)), existing firms expanding into new industries (i.e., multi-establishment, multi-industry firms), and continuing firms moving between size categories (e.g., a small firm that crosses the large firm employment threshold), while the exit of firms (\({exits}_{it}\)) stems from the death of existing firms (\({deaths}_{it}\)), multi-industry firms exiting a given industry, and continuing firms moving between size categories.Footnote 10 Equation (2) can therefore be restated as:

where \({netPromotion}_{it}\) is the net flow of existing firms between size classifications and \({miscNetChanges}_{it}\) is all other net miscellaneous sources of firm count fluctuation (reclassification of a firm to a different industry, sample errors, changes in sampling methodology, etc.). For small firms, the appropriate measure of \({netPromotion}_{it}\) equals the total number of firms considered large in the previous year that have fewer than 500 employees in the current year (or “demoted firms”) minus the total number of firms considered small in the previous year that have 500 or more employees in the current year (or “promoted firms”). Hence for small firms, the foregoing is essentially a measure of “net demotion.” For large firms, the net flow of firms is exactly reversed, with \({netPromotion}_{it}\) equaling the total number of promoted firms less the total number of demoted firms.

Using the latest SUSB data on total US establishment births and deaths at the NAICS 4-digit level (i.e., between 2014 and 2015), we can estimate the relative magnitude of these flows. For small firms (fewer than 500 employees), there was a net increase of 48,058 establishments between the start of 2014 and 2015, or a 0.86% growth in net small establishments. Over the same period, small establishment births minus deaths totaled 57,956 (or 1.04% of initial small establishments) and the residual − 9,898 establishments (or − 0.18% of initial small establishments) is the sum of small establishment net promotion and miscellaneous net changes. For large firms (500+ employees), there was a net increase of 29,091 establishments between the start of 2014 and 2015, or a 2.38% growth in net large establishments. Over the same period, large establishment births minus deaths totaled 19,017 (or 1.56% of initial large establishments) and the residual 10,074 establishments (or 0.82% of initial large establishments) is the sum of large establishment net promotion and miscellaneous net changes. Because net promotion across small and large firms’ establishments must sum to zero, the sum of \({miscNetChanges}_{it}\) across small and large firms’ establishments is 176, which can be safely disregarded moving forward because of its small size. Partially differentiating Eq. (3) with respect to industry regulations yields the following:

With respect to small firms, if our prior expectations are that federal regulations reduce firm births, increase firm deaths, increase the rate of firm demotion (i.e., firms shrinking in employment and being reclassified as small), and decrease the rate of firm promotion (i.e., small firms hindered from growing and becoming large firms), then the sign of \(\frac{\partial \Delta {firms}_{it}}{\partial {regs}_{it}}\) is ambiguous, as the first two terms have a negative expected sign (i.e., \(\frac{{\partial births}_{it}}{\partial {regs}_{it}}-\frac{{\partial deaths}_{it}}{\partial {regs}_{it}}<0\)), but the last term has a positive expected sign (\(\frac{{\partial netPromotion}_{it}}{\partial {regs}_{it}}\) > 0). Intuitively, if regulations stunt the growth of small firms, they remain small, while some large firms inevitably retrogress (because of regulations, competition, or any number of factors), swelling the ranks of the small firms. Therefore, any empirical evidence that regulations are associated with fewer net small firms should be interpreted as a strong information signal that regulations reduce small firm activity. For large firms, the expected sign of \(\frac{\partial \Delta {firms}_{it}}{\partial {regs}_{it}}\) is negative, since the expected sign on the first two terms remains negative (i.e., \(\frac{{\partial births}_{it}}{\partial {regs}_{it}}-\frac{{\partial deaths}_{it}}{\partial {regs}_{it}}<0\))—as regulatory costs create barriers to entry for firms of all sizes—and the expected sign on the net promotion term is opposite that of small firms (i.e., \(\frac{{\partial netPromotion}_{it}}{\partial {regs}_{it}}\) < 0). Therefore, any empirical evidence that regulations are associated with more net large firms should be interpreted as a strong information signal in favor of the Public Choice theory of regulation.

Our baseline model is as follows:

where \({FirmGrowth}_{it}\) is the year-over-year growth rate in the total number of firms of a given size in industry i (i.e., \(100*\Delta log({firms}_{it})\)); \({\alpha }_{i}\) is the industry-specific fixed effect capturing the long-run growth rate of industry i; \({\eta }_{t}\) is the period fixed effect capturing business cycles or other common trends impacting firm formation; \({RegGrowth}_{it}\) is the year-over-year growth rate in the number federal regulatory restrictions that pertain to industry i (i.e.,\(100*\Delta log({regs}_{it})\)); and \({u}_{it}\) is a mean-zero error term. Given our model specification, the coefficient on regulation growth (\(\beta \)) is an elasticity measure equal to the percent change in the number of firms for a 1% change in regulations.Footnote 11 Assuming the number of firms by size does not affect regulatory policy, the growth elasticity of the regulation coefficient reveals the sensitivity of firms of a given size class to increases in the rate of regulation.

Analogously to Eq. (5) above, we also estimate the impact of federal regulation growth on the growth rate of employment within various industries by replacing the \({FirmGrowth}_{it}\) dependent variable with \({EmploymentGrowth}_{it}\):

We consider two firm size classifications: small firms as defined by the SBA (0–499 employees) and large firms (500 or more employees). Given the findings of Bailey and Thomas (2017), there is reason to believe that the impact of regulations depends on firm size, and this hypothesis is testable given our firm size classifications.

Although we have controlled for the common influence of the US business cycle on firms across industries, it is reasonable to anticipate that exogenous shocks may influence multiple industries simultaneously. Because of this, industry panels should exhibit cross-sectional dependence (i.e., contemporaneous shocks to different industries are likely correlated). While common exogenous shocks do not bias coefficient point estimates, they do impact coefficient standard errors and therefore inferential test statistics. Following common empirical practice, we compensate by using White robust standard errors clustered by time period in assessing the statistical significance of coefficient estimates.

5 Estimation results

After providing baseline estimation results for models (5) and (6), we turn our attention to a key focus of the paper: Is the rapid growth of regulations or several years of successive regulatory build-up associated with an intensifying negative impact on firm or employment levels, and does the relationship differ by firm size?

5.1 Baseline regression results

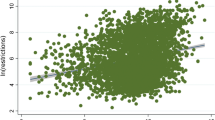

Table 5 reports the baseline regression estimates of models (5) and (6) for large firms (with 500 or more employees) and small firms of two size classifications: (i) fewer than 100 employees and (ii) fewer than 500 employees. The lower small firm size threshold is commonly used in empirical research while the larger threshold of fewer than 500 employees follows the SBA’s small business classification and is thus our preferred measure. Both measures yield nearly identical regulation growth coefficient estimates, as reflected in Table 5. Therefore, for the sake of brevity, the remaining model estimates report results for our preferred definition of a small business.Footnote 12

The first three columns of Table 5 report the estimation results for Eq. (5). Regardless of firm size, we find a negative and statistically significant association between the growth rate of industry regulations and the growth rate of firms within that industry. In the first column, the coefficient on regulation growth equals − 0.0449 and is statistically significant at the 5% level for small firms with fewer than 100 employees. In the second column, the coefficient on regulation growth equals − 0.0463 and is statistically significant at the 1% level for firms with fewer than 500 employees. These results are nearly identical and indicate that a 1% increase in federal regulations is associated with an approximate 0.045% reduction in small firms. To put this into perspective, a hypothetical 10% across-the-board increase in regulations in 2015 (which is approximately one standard deviation in regulation growth) would be associated with over 27,000 fewer small businesses in the US.

When we turn to large businesses—firms with 500 or more employees (see the third column)—regulation growth is associated with a statistically significant reduction in the total number of firms. The estimated elasticity measure equals − 0.0544, which is similar to the elasticity measure for small firms.

To measure the association between federal regulation growth and total sectoral employment in firms of varying sizes, we provide estimates of Eq. (6) in the fourth through sixth columns of Table 5. For small firms, a 1% increase in federal regulations is associated with a statistically significant 0.0553 to 0.0643% reduction in employment in the affected industry, depending on the size classification of small firms. As before, we can put this result into perspective using 2015 figures. Rounding the coefficients to two decimal points (0.06) indicates that a 10% across-the-board increase in federal regulations would be associated with a loss of just under 379,000 jobs. We find that regulation growth does not have a statistically significant impact on employment among large firms, even though the point estimate (− 0.0540) is very close in magnitude to the small firm estimates. Therefore, we cannot say with confidence that large firms shed jobs in response to marginal changes in regulations.

Taking the above findings together, our paper and Bailey and Thomas (2017) tell a similar story. Both find that greater regulation is associated with declines in total firms and employment of approximately one-half of a percent per 10% increase in industry-specific regulation. In addition, both papers suggest that regulations have a mixed impact on large businesses. Bailey and Thomas (2017) find that large firms exit at a slower pace in an environment of growing regulation, but that large firms reduce the rate at which they hire new employees. We find evidence that higher regulation is associated with a decline in the total number of large firms, but that overall industry-level employment in large firms is unaffected. Taken together, the decline in the total number of large firms without a loss of total employment is consistent with consolidation (mergers) amongst large businesses in response to high regulation growth.

5.2 The impact of consecutive spells of above-average regulation growth

Turning to a key purpose of this study, we address the hypothesis that regulations have a “build-up effect,” whereby consecutive years of high regulation growth have a cumulative or increasing negative impact on total firms and employment within an industry. To informally test this hypothesis, we modify Eq. (5) as follows:

where the dummy variable \({\delta }_{high}\) equals 1 when industry i experienced above-average growth in industry-specific federal regulations in the preceding year (i.e., \({RegGrowth}_{it-1} >4.18\%)\). This variable enters as both an intercept and slope dummy, allowing the impact of regulation growth to vary depending on the severity of past regulation growth episodes. For cases where industries endure a prior year of above-average regulation growth, \({\beta }_{1}+{\beta }_{2}\) captures this high-stress elasticity measure while \({\beta }_{1}\) captures the regulation-firm elasticity in all other cases. Therefore, we use a one-sided t-test on \({\beta }_{2}\) to determine whether marginal increases in current regulation growth are associated with greater firm attrition following a year of high regulation growth:

Analogously to Eq. (6) above, we also estimate the impact of federal regulation growth on the growth rate of employment by replacing the dependent variable with \({EmploymentGrowth}_{it}\):

Table 6 reports the estimation results for models (7) and (8). Turning first to whether marginal increases in current regulation growth are associated with greater firm attrition (or greater loss of employment) following one year of high regulation growth, we find that the estimation results do not support this hypothesis. For both large and small firms, the marginal impact of higher current-year regulation growth for either total firms or employment is independent of prior-year regulation growth. Nonetheless, the high growth intercept dummy (\({\beta }_{0}\)) is negative and statistically significant for small firms. Specifically, if industry regulation growth in the previous year exceeded the average level of regulation growth in the sample (4.18%), we should expect at least a 0.6% reduction in total small firms within that industry, all else equal. This level effect implies that excessive regulatory compliance burdens from the prior year spill over into the current year, irrespective of current regulatory changes. Interestingly, a very different picture emerges for large firms, wherein the estimated high growth intercept dummy (\({\beta }_{0}\)) is positive and statistically significant (0.8063).

Turning to the employment growth regressions in the third and fourth columns of Table 6, the high growth intercept dummy (\({\beta }_{0}\)) is statistically insignificant for both small and large firms. There does not appear to be an employment spillover effect stemming from high regulation growth in the prior year. This implies that firms make swift employment adjustments in the year in which regulations are promulgated rather than delaying such actions to the next year.

Lastly, we examine the impact of two consecutive years of above-average regulation growth on the total number of large and small firms and their employment. Given our previous results that prior regulation growth does not affect the magnitude of the current regulation elasticity measure, we omit the high-growth slope dummy and estimate the following regression model:

where the dummy variable \({\delta }_{high}\) equals 1 when the two preceding two years experienced above-average growth in industry-specific federal regulations (i.e., \({RegGrowth}_{it-1}>4.18\% \) and \({RegGrowth}_{it-2}>4.18\%) \). Table 7 reveals that prolonged spells of high regulation growth are associated with significant harm to small business while having little discernible effect on large firms. Specifically, when an industry experiences above-average regulation growth in each of the preceding 2 years, the number of small firms within an industry declines by approximately 1.4%, all else equal. This two-year level effect is approximately double that associated with the single-year dummy, implying that regulatory spillover effects compound. Similarly, when an industry experiences above average regulation growth in each of the preceding 2 years, employment of small firms within that industry declines by approximately 1.3%, all else equal. By contrast, the high-growth dummy is notably statistically insignificant for growth of firms and employment in the large firm regressions (see the second and fourth columns).

5.3 The impact of high contemporaneous regulation growth

Finally, we seek to determine if rising contemporaneous regulation growth intensifies the impact of additional marginal changes in regulation—i.e., is the regulation elasticity measure fixed or is it an increasing function of the contemporaneous rate of regulation growth? To informally test this question, we augment Eq. (5) with a quadratic regulation growth term:

The first and second columns of Table 8 report the regression results for Eq. (10). For small firms, the coefficient of squared regulation (− 0.0004) is negative and statistically significant, suggesting that as the pace of regulation growth increases, the associated loss of small firms intensifies in response to any additional regulations (i.e., \(\frac{\partial FirmGrowth}{\partial RegGrowth}{=\beta }_{1}+{2\beta }_{2}RegGrowth\)). At the average rate of regulation growth (4.18%), the firm growth-regulation elasticity equals − 0.0371. However, if we increase the regulation growth rate by two standard deviations to 24.44%, the firm growth-regulation elasticity climbs by nearly 44% to − 0.0534. By comparison, large firms do not exhibit this behavior as the quadratic term is statistically insignificant.

As with Eq. (10) above, we also estimate the impact of federal regulation growth on the associated growth rate of employment by replacing the dependent variable with \({EmploymentGrowth}_{it}\):

Unlike the firm growth regression models, none of the estimated quadratic terms in Eq. (11)—see the third and fourth columns of Table 8—are statistically significant. Thus, we find no evidence that the intensity of job losses accelerates with the rate of regulation growth.

6 Establishment regression models

An important shortcoming of our results is that we cannot distinguish between the startup of new large firms and the movement of existing small firms into the large firm category because of employment growth. Additionally, we cannot distinguish between the death of large firms and the movement of existing large firms into the small firm category because of employment losses. Moreover, at the 6-digit NAICS level of granularity, the SUSB data only provide total industry employment, meaning we cannot distinguish between a decline in job creation versus an increase in job destruction.

To overcome these limitations, we estimate the impact of federal regulations on industry establishments and their employment patterns. Specifically, we match RegData with establishment and employment data from BDS at the 4-digit NAICS level (the most granular level provided by BDS). We chose BDS data over SUSB for this component of our analysis for several reasons. First, the annual coverage is over 20 years longer (1978 to 2018 vs 1998 to 2015). Second, BDS disaggregates the sources of job creation (or destruction) between continuing establishments and new (or exiting) establishments.

Goldschlag and Tabarrok (2018) regress the establishment startup rate for small and large firms on current and lagged values of the natural log of RegData in a two-way fixed effect panel model at the 4-digit NAICS level. We use a similar model, but we substitute the level of regulation (\(log({regs}_{it})\)) with the growth rate of regulation (\({RegGrowth}_{it}\)).Footnote 13:

This flow-on-flow specification is consistent with our baseline models in Sect. 4 and makes the results in this section more comparable with our findings in Sect. 5. Regression estimates are provided in Table 9. Unlike Goldschlag and Tabarrok (2018), we find empirical evidence that industry-level regulations are associated with a reduced establishment startup rate. Specifically, a one percentage point increase in the regulatory growth rate is associated with a 0.007 to 0.0087 percentage point reduction in the small establishment startup rate, while a one percentage point increase in the regulatory growth rate in the prior year is associated with a 0.0098 to 0.0111 percentage point reduction in the small establishment startup rate.

Although these effects are small in magnitude, they have the potential to add up over long time horizons. For example, if regulations increased at a consistent rate of 3.64% per year (which equals the mean growth rate of 4-digit NAICS industry regulations between 1978 and 2018), our results suggest that we should observe an associated 0.0612 to 0.0721 percentage point decline in the startup rate each year or 1.53 to 1.80 percentage points over a quarter century. This is similar in magnitude to the 1.4 percentage point decline in the US startup rate between the late 1980s and the mid-2000s (12 to 10.6% total) noted by Decker et al. (2014). Admittedly, such an extrapolation is speculative as it implicitly makes strong general equilibrium assumptions not modeled by our regression equation. To put these results into perspective, Akcigit and Ates (2019) use a general equilibrium model that includes tax policy, R&D subsidies, knowledge diffusion, and entry costs—which could be interpreted as regulatory barriers—to estimate that entry costs only account for approximately 18% of the decline in the entry rate of new firms along their model’s balanced growth path. Although our “back of the envelope” estimates are likely too large, they nonetheless underscore the need for more research (both theoretical and empirical) on the long-run impact of regulations on startup activity.

By contrast, we do not find a statistically significant association between current or prior changes in regulations and the large firm startup rate. This is consistent with the Public Choice theory of regulation. That said, when we replace the startup rate in Eq. (12) with the exit rate of establishments, we find that past regulatory growth is not associated with the exit of small or large firms.Footnote 14 This result is not consistent with either the regulation-as-a-tax or Public Choice theory of regulation.

To determine if there is any association between the growth in federal regulations and the creation of jobs in establishments owned by small and large firms, we replace the dependent variable in Eq. (12) with the job creation rateFootnote 15:

Consistent with Goldschlag and Tabarrok (2018), we find no evidence that regulatory growth impacts the overall job creation rate of small or large firms.Footnote 16 However, BDS disaggregates job creation into two categories: (1) job creation from newly created establishments and (2) job creation from continuing establishments. Using the model from Eq. (13), we separately regress the job creation rate from each of these categories and report the results in Tables 10 and 11.

With respect to jobs created by new establishments, we find evidence that industry-level regulations are associated with a reduced job creation rate. Specifically, a one percentage point increase in the regulatory growth rate in the prior year is associated with a 0.0076 to 0.0081 percentage point reduction in the small establishment job creation rate. The coefficient estimates on current regulatory growth are universally negative, but statistically insignificant. As with the startup rate, if regulations increased at a consistent rate of 3.64% per year, our results suggest that we should observe an associated 0.69 to 0.74 percentage point decline in the job creation rate for small establishments over a quarter century. This only accounts for about one quarter of the overall 3.1 percentage point decline in the US job creation rate noted by Decker et al. (2014) in the period between the late 1980s and the mid-2000s. We also find weak evidence that regulatory growth lagged two periods is associated with a lower job creation rate among new large establishments, but find no statistically significant association between current or one-period lagged regulatory growth and job creation among newly created large establishments. With respect to jobs created by continuing establishments, we find no empirical evidence that industry-level regulations are associated with a reduced job creation rate (see Table 11).

Finally, to determine if there is any association between regulatory growth and job loss in establishments owned by small and large firms, we separately regress the job destruction rate on current and lagged regulation growth.Footnote 17

We find that regulatory growth (lagged one year) is negatively associated with the job destruction rate at establishments owned by large firms, but no such association exists for small establishments (see Table 12). This result contrasts with Goldschlag and Tabarrok (2018), who find that greater regulation is associated with higher rates of job destruction among establishments owned by large firms. Because BDS separates job losses between continuing and exiting establishments, we can determine the source of this negative association at large-firm establishments. With respect to exiting establishments, we find no statistically significant relationship between regulatory growth (current or lagged) and the job destruction rate, irrespective of establishment size. However, for continuing establishments, the story is different. Consistent with our initial results, we find that regulatory growth (lagged one year) is negatively associated with the job destruction rate at continuing establishments owned by large firms—that is, higher regulatory growth leads to fewer job losses—but no such association exists at continuing establishments owned by small firms (see Table 13). These results taken together are consistent with the Public Choice theory of regulation, whereby large incumbent firms are better able to absorb compliance costs and reap the benefits of reduced competition.

7 Conclusion

Economic theory tells us that regulations, if applied equally to businesses of all sizes, are likely to disproportionately harm smaller businesses. While there are some relief mechanisms for smaller businesses we still do not know the extent of their availability, let alone the degree to which they actually balance the burden of regulations. Although the disparate effects of regulatory costs have long been discussed in the political and academic realms, ours is the first study (to our knowledge) to consider whether recent regulatory rulemaking can create a challenging compliance environment for small businesses and whether the marginal effect of each new regulation might grow as the rate of regulatory rulemaking increases. Yet either of these effects may in turn exacerbate and amplify the negative consequences of additional regulations.

We find that increases in industry-specific regulations are associated with decreases in the number of small and large firms as well as decreases in the total level of employment within small firms, while having no association with changes to employment of large firms. These declines in the number of small firms and their associated employment levels are amplified when they follow previous years of high regulation growth, implying that prior regulatory increases spill over and disproportionately burden small businesses. We also find that rising contemporaneous regulation growth intensifies the negative impact of each new regulation on small businesses. In other words, the negative effects of regulations are not proportional to the number of regulations; these effects grow at an increasing rate as regulations accumulate. No such increasing effect appears to exist for large businesses.

Turning to establishment data, we find that higher regulatory growth rates are associated with a decline in several popular measures of dynamism. Specifically, higher regulatory growth rates are associated with both a lower startup rate and job creation rate among small establishments. We do not find strong evidence that this is true for establishments owned by large firms, though we do find that higher regulatory growth rates are associated with lower job destruction rates among these establishments. Collectively, these results are consistent with a Public Choice theory of regulation.

Existing research shows that regulations are associated with disproportionately high costs for lower-income households. Our study advances this research by showing how regulatory accumulation appears to harm small businesses relative to their larger competitors. Since small businesses are more common in low-income areas, and because small businesses provide low-income households with opportunities for economic advancement, any negative effects of regulations on small businesses add to the list of regressive regulatory effects. Furthermore, small businesses comprise a large portion of the economy, significantly impacting employment and innovation. Our findings imply that we must consider not only the overall costs and benefits of regulations to the parties immediately affected, but also the disproportionate effects of regulations and regulatory accumulation on specific groups. Consideration of these costs is essential for understanding the true effects of regulations, and for ensuring a fair economic system.

Data availability

The data that support the findings of this study are openly available from QuantGov at https://www.quantgov.org/download-interactively and from Census at https://www.census.gov/programs-surveys/susb/data/tables.html.

Notes

See Davis et al. (1998) for more details on the Davis-Haltiwanger-Schuh transformation.

Bailey and Thomas (2017) find that a 10 percent increase in industry-specific regulatory restrictions is associated with a 0.5 percent reduction in the birth rate of all firms (pooled together). They also find that a 10 percent increase in industry-specific regulatory restrictions is associated with a 0.6 percent reduction in new hires among all firms (pooled together).

This rate fell to just below eight percent in the midst of the Great Recession.

The authors tested three models—nearest neighbors and random forests being the other two—using five-fold cross-validation. The authors chose the logit model because it performed the best of the three.

For the sake of space, we must omit many important details regarding the development and accuracy of RegData. A more detailed explanation can be found in McLaughlin and Sherouse (2019).

We chose SUSB over County Business Patterns for two reasons: (1) SUSB has data at the firm and establishment levels, while CBP has data only at the establishment level (which means its data misrepresent the total number of “businesses”); and (2) the Census Bureau recommends that County Business Patterns data not be used as a time series.

Although the BDS dataset contains firm startup and shutdown data, it is limited to the 4-digit NAICS industry level. This tradeoff between granularity and period coverage explains the nearly identical size of the SUSB panel (4550 observations) and BDS panel (4715 observations). However, the dynamism measures of interest are only available at the 4-digit NAICS industry level in both the SUSB and BDS. Consequently, the BDS panel used in this paper is over four times larger than the SUSB panel used by Goldschlag and Tabarrok (2018).

Although SUSB includes the category 0–4 employees, the data omit nonemployer firms. This implies that the small business share of the total workforce (as opposed to workers at employer firms) is greater than indicated by the numbers listed here.

Bailey and Thomas (2017) alternatively use contemporaneous and lagged measures of industry regulation and obtain nearly identical results.

It is also conceivable that firms could enter (or exit) periods of inactivity, whereby all employees are temporarily laid off (or re-hired), thereby affecting industry firm counts. Likewise, changes in industry classification criteria or methodological changes by the Census Bureau could affect firm counts in rare cases.

In log–log models, the dependent variable, say ln(y), is regressed on a covariate of interest, say ln(x), and other log- transformed covariates. The coefficient on ln(x) has an elasticity interpretation: it reveals the percent change in y that results from a one percent change in x. If this model is first differenced, we now regress Δln(y) on Δln(x) and the first difference of the remaining logged covariates. Note that the coefficient on Δln(x) remains unchanged by the transformation and therefore retains the same elasticity interpretation. The inclusion of fixed effects in Eq. (5) does not alter this interpretation, but we include them per our identification strategy.

The establishment startup rate is defined as 100 times the current number of new establishments divided by the average number of existing establishments in the current and prior period.

These results are not included but are available from the authors upon request.

The job creation rate is defined as 100 times the current number of new jobs created by establishments divided by the average number of existing jobs at establishments in the current and prior period.

Goldschlag and Tabarrok (2018) find mixed results. When regressing the job creation rate for all firms on the natural log of current regulation, they find no statistically significant association between said variables. However, when including one and two period lags of the log of regulation, they find a positive and statistically significant association between log regulations lagged one period and the startup rate. They conclude that “the results suggest that lagged regulation indices are no better able to account for the decline [in the job creation rate] than regulation at time t.”.

The job destruction rate is defined as 100 times the current number of jobs eliminated by establishments divided by the average number of jobs at establishments in the current and prior period.

References

Adler, J. (1993). Taken to the cleaners: A case study of the overregulation of American small business. Policy Analysis No. 200, Cato Institute, Washington, DC, December 22.

Akcigit, U., & Ates, S. T. (2019). What happened to U.S. business dynamism? National Bureau of Economic Research, Working Paper 25756.

Al-Ubaydli, O., & McLaughlin, P. A. (2017). RegData: A numerical database on industry-specific regulations for all United States Industries and Federal Regulations, 1997–2012. Regulation & Governance, 11, 109–123.

Audretsch, D. B. (1995). Innovation and industry evolution (pp. 31–38). MIT Press.

Bailey, J. B., & Thomas, D. W. (2017). Regulating away competition: The effect of regulation on entrepreneurship and employment. Journal of Regulatory Economics, 52, 237–254.

Becker, R. (2005). Air pollution abatement costs under the clean air act: Evidence from the PACE survey. Journal of Environmental Economics and Management, 50, 144–169.

Bradford, S. (2004). Does size matter? An economic analysis of small business exemptions from regulations. Journal of Small and Emerging Business Law, 8, 1–37.

Burger, J. D., & Schwartz, J. S. (2018). Jobless recoveries: Stagnation or structural change? Economic Inquiry, 56, 709–723.

Chambers, D., & Guo, J.-T. (2021). Employment and output effects of federal regulations on small business. Pacific Economic Review. https://doi.org/10.1111/1468-0106.12353

Crain, W. M., & Crain, N. V. (2014). The cost of federal regulation to the US economy, manufacturing, and small business. National Association of Manufacturers.

Crain, W. M., & Hopkins, T. D. (2001). The impact of regulatory costs on small firms. Office of Advocacy, Small Business Administration.

Davis, S. J., Haltiwanger, J. C., & Schuh, S. (1998). Job creation and destruction. MIT Press.

Dean, T. J., Brown, R. L., & Stango, V. (2000). Environmental regulation as a barrier to the formation of small manufacturing establishments: A longitudinal analysis. Journal of Environmental Economics and Management, 40, 56–75.

Decker, R., Haltiwanger, J., Jarmin, R., & Miranda, J. (2014). The role of entrepreneurship in US job creation and economic dynamism. The Journal of Economic Perspectives, 28, 3–24.

Dhawan, R., & Guo, J. (2001). Declining share of small firms in U.S. output: Causes and consequences. Economic Inquiry, 39, 651–662.

Dixon, L., Gates, S. M., Kapur, K., Seabury, S. A., & Talley, E. (2006). The impact of regulation and litigation on small business entrepreneurship: An overview. RAND Working Paper.

Goldschlag, N., & Tabarrok, A. (2018). Is regulation to blame for the decline in American entrepreneurship? Economic Policy, 33, 5–44.

SJH Graham, C Grim, T Islam, AC Marco, J Miranda (2018) Business Dynamics of Innovating Firms: Linking US Patents with Administrative Data on Workers and Firms. Journal of Economics & Management Strategy, 27, 372–402.

Haltiwanger, J., Jarmin, R. S., & Miranda, J. (2013). Who creates jobs? Small versus large versus young. The Review of Economics and Statistics, 95, 347–361.

Hathaway, I., & Litan, R. E. (2014). Declining business dynamism in the United States: A look at states and metros. Brookings Institution.

Hopkins, T. D. (1995). Profiles of regulatory costs. Small Business Administration.

Keefe, R., Gates, S., & Talley, E. (2005). Criteria used to define a small business in determining thresholds for the application of federal statutes. RAND Working Paper.

Kitching, J., Hart, M., & Wilson, N. (2015). Burden or benefit? Regulation as a dynamic influence on small business performance. International Small Business Journal, 33, 130–147.

Kugler, M., Michaelides, M., Nanda, N., & Agbayani, C. (2017). Entrepreneurship in low-income areas. IMPAQ International, LLC for Small Business Administration Office of Advocacy.

McLaughlin, P. A., & Sherouse, O. (2019). RegData 2.2: A panel dataset on US federal regulations. Public Choice, 180, 43–55.

Pashigian, B. P. (1984). The effect of environmental regulation on optimal plant size and factor shares. Journal of Law & Economics, 27, 1–28.

Regulatory Flexibility Act of 1980, Pub. L. No. 96-354, 94 Stat. 1164 (1980)

Small Business Regulatory Enforcement Fairness Act of 1996, Pub. L. No. 104-121 (1996)

US Census Bureau. (2018). Statistics of US Businesses: Annual Data Tables by Establishment Industry. Retrieved February 13, 2018 from https://www.census.gov/programs-surveys/susb/data/tables.html

US Census Bureau. (2021). Business Dynamics Statistics: BDS Data. Retrieved April 8, 2021 from https://www.census.gov/programs-surveys/bds/data.html

Funding

No funds, grants, or other support was received.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Chambers, D., McLaughlin, P.A. & Richards, T. Regulation, entrepreneurship, and firm size. J Regul Econ 61, 108–134 (2022). https://doi.org/10.1007/s11149-022-09446-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-022-09446-7