Abstract

Using account-level transaction data in options and futures markets, we investigate the existence of market manipulation, which is the ability of large traders to trade strategically, impacting prices and making abnormal profits. First, large trader’s option positions have a quantity impact on the underlying asset’s price. Second, large traders generate significantly positive alphas from trading options and futures. Among the different investor types, proprietary dealers generate the largest positive alphas. Third, these abnormal returns are consistent with strategic trading and cross-market manipulation. The evidence supports market manipulation across the options and futures markets, but not within the futures market itself.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Market manipulation exists when trades have a quantity impact on the price and individuals trade strategically manipulating the price to their advantage to generate abnormal returns. Market manipulation is not just a theoretical construct. Its existence has been documented since the beginning of organized securities markets. It is not unique either to any country, asset class, or market structure (exchange traded/over-the-counter). And particularly relevant to this paper, it is often linked to derivatives markets and cross-market manipulation. In 2011, South Korean regulators sanctioned a Deutsche Bank unit for manipulating the stock market with derivatives positions in futures and options.Footnote 1 In 2014, the Chicago Board Options Exchange (CBOE), NASDAQ OMX, and the Intercontinental Exchange fined HAP Trading, L.L.C. $1.5 million for cross-market manipulation in options and the underlying securities.Footnote 2

Although well documented in financial markets, there are only a limited number of empirical investigations of market manipulation (particularly in derivatives markets) in the academic literature. This is mainly due to a lack of data, limitations of empirical proxies for manipulation, and small non-random samples of detected manipulations (see Putniņš 2011). In particular, account- or transaction-level studies of market manipulation are few in number as the relevant data are not often publicly available.Footnote 3 Using a unique set of account-level transactions in options and futures markets, this study provides a theoretically based empirical analysis of market manipulation by large traders in derivatives markets.

In this paper, we define manipulation as the ability to trade strategically, affecting prices and making abnormal profits.Footnote 4 Our notion of market manipulation focuses on a large traders’ strategic trading based on order flow information,Footnote 5 and contains the following distinctive features. First, strategic trading means that in the investor’s optimization, the investor recognizes that price P depends on trade size q, i.e., P(q). This means that in the optimization, the investor is not a price taker. Unlike the arbitrage pricing theory that invokes the price taking paradigm, the theory of manipulation studies arbitrage when traders affect prices (Jarrow 1992).Footnote 6

Second, order flow manipulation arises from the fact that the quantity impact of large investors on the price increases with the large investors’ trade size q, i.e., P′(q) > 0. When the market impact due to manipulation is not instantaneous (e.g., due to non-synchronous markets), large investors can take advantage of the delayed market impact and make abnormal profits.

Third, derivatives markets generate market manipulation trading strategies that would otherwise not exist. Jarrow (1994) shows that when the spot and derivatives markets are not in synchrony, a manipulator can “front run” his own trades to take advantage of any leads/lags in the price adjustments across the spot and the derivatives markets. An example of cross-market manipulation using derivatives is illustrated in Fig. 1: at time t, a large investor acquires a large position in the options market for strategic trading (i.e., knowing the order flow information of the quantity impact). When the underlying and derivatives markets are not in synchrony, the underlying price (P) does not adjust instantaneously to reflect the true “effective” purchases of the large trader through the option position (q*); as such, the large investor is able to exploit the order flow by first trading in the options market. At time t + 1, other investors observe the option order flow of the large investor and move the underlying price (i.e., setting P = P(q*)). Consequently, as the options prices move to reflect the adjusted underlying price, the large investor makes profits from the lag in the order flow between the two markets.

Basic model of strategic trading. This figure provides an example of cross-market manipulation using derivatives. At time t, a large investor acquires a large position in the options market for strategic trading (i.e., knowing the order flow information of the quantity impact). When the underlying and options markets are not in synchrony, the underlying price (P) does not adjust instantaneously to reflect the true “effective” purchases of the large trader through option positions (q*). At time t + 1, other investors observe the option order flow of the large investor and move the underlying price; i.e., setting P = P(q*). Consequently, the large investor makes profits from the order flow manipulation and the cross-market trades in the options market

Empirically, manipulators can be identified using the following features. First, a manipulator’s profits are uncorrelated with information although the price impact from trading could differ (have different sensitivity) because of order flow information or changes in the fundamental value (hide behind information). Second, manipulators’ returns should exhibit positive alphas after adjustment for risk. Unlike arbitrageurs whose alphas are due to a mispricing of the relevant assets, manipulators’ alphas exist due to strategic trading given a quantity impact on the price. Third, manipulators’ trades cause price changes; in contrast, liquidity providers and arbitrageurs are price takers and their trades do not lead or cause prices. Fourth, manipulators are proactive as they create trades and the sizes of their trades are “large”; in contrast, liquidity providers’ trades are small.

Based on the theoretical and empirical insights discussed above, this paper provides a unique setting and empirical study of market manipulation that adds to the literature in the following ways. First, while market manipulation may exist at different time scales, we examine market manipulation over the longer-term. Our experiment focuses on large traders’ activities at a daily time scale in order to exclude trades of high frequency liquidity providers. This daily time scale enables us to test the impact of order flow manipulation (e.g., large traders’ anticipation of their quantity impact) rather than short-term liquidity motivated trades.

Second, we provide an empirical study of cross-market manipulation in derivatives and their underlying markets, adding to this sparse literature (as noted above). Importantly, our investigation uses a unique and comprehensive account-level transaction database involving both Taiwan index futures and index options. These markets are among the fastest-growing emerging derivatives markets in the world.Footnote 7 As argued by Pan and Poteshman (2006), investors do not have superior information at the market level.Footnote 8 We focus on index futures and options, allowing us to examine large traders’ strategic trades based on fundamental and order flow information that excludes private information about fundamental value as a possible source for trading profits. While there are various options contracts traded on the Taiwan Futures Exchange (TAIFEX), we study the Taiwan Stock Exchange Capitalization Weighted Stock Index (TAIEX) Options, which are the most active option contracts traded on the TAIFEX. Since the underlying TAIEX is not traded, we treat the TAIEX Futures as the underlying traded asset in the pricing model for TAIEX Options. Furthermore, the transaction costs in Taiwan’s futures and options markets are small,Footnote 9 implying that any trading profits identified are unlikely to be eliminated by transaction costs.

Third, our comprehensive account-level transaction data enable us to study manipulation by observing the trading activities and outcomes (including paper and real profits) of large traders across both the futures and option markets at both an aggregate level and an individual account level. This enables us to avoid the non-observability problem, which is one of the main limitations that plagued the empirical literature on manipulation. We examine market manipulation over a sample period from January 2nd, 2007 to November 30th, 2012, which allows us to examine manipulation before, during, and after the financial crisis. We have a comprehensive sample that contains a total of 30,253 accounts of the large (top-10%) traders in these markets over the sample period generating a panel dataset of 12,022,001 account-day observations.

Fourth, our hypotheses and empirical analysis are based on the standard frictionless market asset pricing model where we relax the competitive market assumption in order to study market manipulation. Our empirical approach is based on the theoretical literature that derives necessary and sufficient conditions for the existence of market manipulation in frictionless markets (see Jarrow 1992, 1994). Jarrow (1992, 1994) provides a set of sufficient conditions on the market structure that exclude (1) market manipulation within a single market, called the Independence of Past Holdings, and (2) cross-market manipulation, called the Synchronous Markets. The “Independence of Past Holdings” condition implies that a large trader’s positions have no influence on subsequent movements of the underlying asset price. In this case, a large trader cannot manipulate prices with a quantity impact. The “Synchronous Market” condition is satisfied when the underlying adjusts instantaneously to trades in the derivative market. In this case, there is no market segmentation across the underlying and derivative markets, and cross-market manipulation is impossible.

Based on the theoretical foundation, experimental design, and unique dataset discussed above, our empirical investigation is divided into two parts. The first part tests for violations of the “Independence of Past Holdings” and “Synchronous Markets” conditions, which are sufficient conditions precluding market manipulation in futures markets and cross-markets, respectively.Footnote 10 A violation of these conditions is necessary for the existence of market manipulation. Since these are characteristics of the market, we examine the large traders as “a group” at the aggregate account-level, and test whether the futures/options markets satisfy these necessary conditions for manipulation. With respect to the “Synchronous Markets” condition, we first demonstrate that daily options trading positions of large traders have predictive power over short-term (1-day ahead) returns in the underlying futures. In addition, we estimate a Vector Autoregressive (VAR) system of the relations between options trading positions of large traders and changes in price of the underlying futures. We also perform a Granger causality test on these cross-market relations. We find evidence that large traders’ options positions Granger cause changes in the prices of the underlying futures. This finding is also important to differentiate manipulators from liquidity providers or arbitrageurs (i.e., manipulators’ trades lead price changes; in contrast, liquidity providers and arbitrageurs are price takers and their trades do not lead prices).Footnote 11 In conjunction, this evidence shows that the “Synchronous Markets” condition is violated, which implies cross-market manipulation is possible. We test the “Independence of Past Holdings” condition as a special case of the above methodology using a Granger causality test. We find that large traders’ positions in index futures do not lead futures returns, validating the “Independence of Past Holdings” condition. Consequently, manipulation should not be possible within the futures market.

Our second part examines risk-adjusted returns (alphas) of the large investors at the individual account-level to verify that manipulation does not exist in the futures market and to document the existence of cross-market manipulation. Recalling that we excluded private information based on fundamental value by our experimental design, this implies that the abnormal trading profits must be due to market manipulation, i.e., strategic trading given a quantity impact on market prices. Following this agenda, after adjusting returns for systematic risk, we find evidence that positive alpha trading strategies exist for large traders. Large traders earn a significant and positive daily alpha of + 0.6% from trading in the options market. The positive alpha of large traders results mainly from trading in the options market, not the futures market. Among the different types of large traders, large proprietary dealers earn the greatest risk-adjusted performance (with daily alpha of + 3.8%) followed by large foreign institutions (with daily alpha of + 2.6%). Furthermore, the significance of large traders’ profit is robust across the pre-crisis, crisis, and post-crisis periods. Given that the transaction costs in Taiwan’s futures and options markets are small when compared with the contract value (which is the basis we used to compute the rate of return), the large traders’ alpha remains economically significant after adjusting for trading costs. In addition, the large traders’ alpha is consistent with strategic trading based on order flow information over a daily time scale, rather than the trades of high frequency liquidity providers who operate on smaller time scales and with smaller trading magnitudes. To provide evidence on cross-market manipulation, we examine individual account-level profits from cross-market trades. We find that large traders who can trade in both option (derivative) and futures (underlying) markets generate larger realized and risk-adjusted returns—compared with other large traders who trade in either options or futures only.

The existence of abnormal trading profits itself provides only another necessary condition for the existence of market manipulation (i.e., manipulators should generate positive alphas after adjustment for risk). In order to demonstrate a sufficient condition, we need to show that these abnormal trading profits are not due to mispricings (i.e., unlike arbitrageurs whose alphas are due to mispricing of the relevant assets, manipulators’ alphas exist due to strategic trading given a quantity impact on the price). To document that these trading profits are not due to mispricings, we distinguish between risk-adjusted returns (alphas) computed with realized returns (“actual profits”) vis-à-vis unrealized returns (“paper profits” based on marking-to-market).Footnote 12 We find that large traders do not generate significant positive alphas based on unrealized returns. The insignificance of positive paper profits supports the contention that large traders’ profits are due to strategic trades and order flow, and not mispricings.

To further differentiate manipulation from mispricings, we conduct the following tests. For each investor account, we compute realized returns during trading days (trade cycle) and unrealized returns during non-trading days. We find that the options realized return (actual profit) is positive and significant during trading days, and that options unrealized return (paper profit) is negative and significant on non-trading days. These results support the assertion that trading strategically has value. Furthermore, for each trading cycle of an investor, we computed the cumulative realized return over the trading period. Then, we compare this cumulative realized return with a hypothetical return from a buy-and-hold strategy in futures market over this same time period.Footnote 13 We find that on average, cumulative realized returns of options trades over the trading period are significantly larger than the hypothetical returns from a buy-and-hold strategy in futures market over the same trading period. In contrast, cumulative realized returns of futures trades over the trading period are less than the hypothetical buy-and-hold strategy in futures market over the same time period. These findings are again consistent with the existence of cross-market manipulation but no manipulation within the futures market.

Last, we conduct further analysis to shed light on the mechanism underlying cross-market manipulation. We find that large traders’ realized profits in the options market depend upon their positions in both options and futures market. We also find that the large traders’ realized profits from the underlying (futures) market depend upon their cross-market positions in the options market rather than their positions in the futures market.

Our study makes several important contributions to the existing literature. Although the account-level studies in financial markets (e.g., Khwaja and Mian 2005; Baron et al. 2014; Chow et al. 2013) can reveal important and unique insights on traders’ behaviors and outcomes at the micro-level, these studies are rare in the literature due to data availability. Our examination of account-level trades in derivatives markets contributes to the account-level studies and provides an ideal empirical setting to unambiguously examine market manipulation. Using account-level data, we are able to identify quantity impact, which cannot be done using prices alone. Our findings contribute to studies that examine cross-market effects between spot and derivatives markets. The empirical evidence in this regard is mixed.Footnote 14 The existing studies generally focus on informed trading of firm-specific information (e.g., Amin and Lee 1997; Cao et al. 2005; Pan and Poteshman 2006; Roll et al. 2010), leverage (e.g., Easley et al. 1998), short-selling constraint (e.g., Johnson and So 2012), and hedging activities (e.g., Hu 2014) as the mechanisms underlying the cross-market relations between options and the underlying markets. In contrast to these studies, our study provides the new insight and evidence that options market can lead the underlying due to a large traders’ manipulation based on order flow information.

Existing empirical studies of large traders in the context of manipulation are quite limited (see Allen et al. 2006). Our study contributes to the literature by providing new evidence on large traders’ market manipulation over the longer-term scale and cross-market manipulation involving derivatives.Footnote 15 Our tests and results differentiate manipulation from informed trading and arbitrage. Our study is related to the study by Ni et al. (2005), which shows that options markets affect the prices of the underlying stock via the hedging trades of options market makers and manipulation by proprietary traders. Our study differs from Ni et al. (2005) in the following ways. Our study focuses on index options and market manipulation based on order flow information and a large traders’ quantity impact on the price; in contrast, Ni et al. (2005) examine equity options and manipulation of the underlying at option maturity dates. Ni et al. (2005) focus on examination of proprietary traders in the options market and their analysis does not involve the observation of proprietary traders’ trading in the underlying market. In contrast, our study considers cross-market manipulations involving both the options and the underlying (futures) markets. Importantly, our study provides a direct test of market manipulation by using account-level data and identifying large investors and their quantity impacts. While Ni et al. (2005) look at estimated profits of aggregated investor types not account-level, we show the actual profits from individual large traders based on account-level data.Footnote 16

An outline of this paper is as follows. Section 2 describes the market, the data, and the large traders in our database. Section 3 investigates the larger traders’ profits. Section 4 tests the futures and options market structures to see if market manipulation is possible. Section 5 shows that the larger traders generate abnormal returns on their positions, and that these returns are consistent with cross-market manipulation. Section 6 concludes.

2 The market, the data, and the large traders

In this section we discuss the market we study, the data we use to test market manipulation, and the large traders in our database.

2.1 The market

The Taiwan Futures Exchange (TAIFEX) was established in 1997, it launched the first futures contract in July 1998, and the first options contract in December 2001. The trading volume combining futures and options is 202,411,093 contracts in 2014, which make the TAIFEX one of the most important emerging derivatives markets.Footnote 17 Among all of the available futures contracts, the TAIEX Futures (tick symbol: TX) on the Taiwan Stock Exchange Capitalization Weighted Stock Index (the TAIEX index), is the most liquidly traded. It had an annual volume equal to 24,759,873 contracts in 2014, accounting for about 50% of the overall trading volume of TAIFEX’s futures contracts.Footnote 18

Since its introduction in December 2001, the TAIEX Options (TXO), an European-style option contract on the Taiwan Stock Exchange Capitalization Weighted Stock Index, has become the most active options contract. The trading volume of TXO has grown from 21.72 million contracts in 2003 to 151.62 million contracts in 2014. TXO accounts for more than 70% of the total volume in the TAIFEX in 2014 and is ranked as one of the most actively traded equity index options in the world.Footnote 19 Whereas individual traders account for about 60% of all trading volume in the spot and futures markets, institutional traders tend to dominate Taiwan’s options market.Footnote 20

The unique experiment of Taiwan’s options market allows us to focus on index options so that we can test manipulation due to order flow and strategic trades of large traders. Since the TAIEX is not available for trading in any form, instead of directly using the underlying spot index, we employ TAIEX Futures in the pricing model of TAIEX Options.Footnote 21 Lastly, the transaction costs in Taiwan’s futures and options markets are small, implying that the large traders’ profits are unlikely to be eliminated by transaction costs.Footnote 22

2.2 The data

We obtained the complete intraday transaction history of all accounts on the front-month TX contract and the TXO contract between January 2nd, 2007 and November 30th, 2012. Although the TX and TXO contracts with various maturities are listed for trading (including the front month, the next calendar month, and the next three quarterly months), the front-month TX and TXO contracts generally account for more than 90% of the overall trading volume of all available TX and TXO contracts. The TX is a futures contract whose value is equal to the index level of the TAIEX multiplied by 200 New Taiwan Dollars (NT$). The TXO is a European type option contract whose value is equal to the index level of the TAIEX multiplied by 50 New Taiwan Dollars (NT$). For comparison purposes, 1 US$ is approximately equal to 30 NT$.

We obtain three data files containing, respectively, all transactions, orders, and quotations for TX and TXO. The three data files are summarized in Table 13 in Appendix. These datasets also have a code linking the transaction, order, and quotation files. By merging these files, we can identify the originating account/identity and associated order and quotation information for all trades.

2.3 The large traders

We construct our sample of large traders according to the following steps. First, we track the trading activities of each account. We calculate the dollar delta per contract as follows:

where Deltat(TX), Deltat(CallK), and Deltat(PutK) are the dollar deltas per contract on date t for the TX, the TXO call with strike K, and the TXO put with strike K, respectively; Indext is the level of the TAIEX index; CallDeltaK,t and PutDeltaK,t are N(d1) and N(d1) − 1 in the Black–Scholes–Merton formula computed on date t for the TXO call and put with strike K.Footnote 23 For each account-level trade, we measure the equivalent trading positions in the underlying asset by summing up the dollar deltas of all contracts in a particular trade.

Second, we consider all accounts that are active more than 10% of the trading days in each year during the sample period.

Third, we identify large traders based on the absolute value of the equivalent trading positions in the underlying in order to examine the quantity impact of their trades on the underlying price. From derivatives pricing theory we know that a derivative’s delta measures the equivalent position in the underlying asset. We compute the daily dollar delta for both the TX and TXO using closing prices for the contracts. We calculate the daily equivalent trading in the underlying (“delta demand”) of each investor by multiplying the net position changes in both the TX and TXO contracts by the corresponding dollar delta. In the futures and/or options markets, the total dollar deltas or equivalent position of trading in the underlying (\( D_{i,t}^{Total} \)) of investor i at date t is:

where Buyi,t(TX) (Selli,t(TX)) is the number of futures contracts investor i buys (sells) on date t, BuyCalli,t(TXOK) (SellCalli,t(TXOK)) is the number of call options with strike K investor i buys (sells) on date t, and BuyPuti,t(TXOK) (SellPuti,t(TXOK)) is the number of put options with strike K investor i buys (sells) on date t.Footnote 24 Deltat(TX), Deltat(CallK), and Deltat(PutK) are the dollar deltas per contract on date t for the TX, the TXO call with strike K, and the TXO put with strike K, respectively. Deltat(TX), Deltat(CallK), and Deltat(PutK) are defined in Eqs. (1), (2), and (3) respectively.

We rank the active accounts according to the annual average absolute value of dollar delta year by year, combining futures and options: for each investor i, we compute an annual average of daily absolute value of total dollar deltas (\( D_{i,t}^{Total} \)) over T active trading days for investor i in a given year:

A large trader in a particular year is defined to be an account whose annual average absolute value of the dollar delta (see Eq. (5) above) is ranked among the top-10% across all active accounts in that year.

3 Large traders’ profits

As a preliminary investigation, this section studies a necessary condition for the existence of market manipulation, which is that the large traders’ positions are profitable. Our account-level transaction sample is comprehensive, containing a total of 30,253 large trader accounts (with an average of 8167 large trader accounts per year) over the sample period and a panel dataset of 12,022,001 account-day observations. This unique dataset allows us to examine account-level trading records of large traders in both the futures and options markets.

Based on the account-level trading data described in Sect. 2.2, we compute the daily realized returns of each account to examine the investor’s actual profitability. We also compute the realized returns based on both percentage and dollar units. For percentage realized return, we define ri,t as the realized return on day t for large trader i by taking all positions closed out on trading day t into consideration.

where \( P_{i,l,t}^{S} \) is the sell price of the long contract l for large trader i on day t; \( P_{i,l,t}^{B,AC} \) is the buy price determined by the average-cost method right before the long contract l is closed out for large trader i on day tFootnote 25; n1 is the number of long contracts closed out on day t for large trader i; \( P_{i,s,t}^{B} \) the buy price of the short contract s for large trader i on day t; \( P_{i,s,t}^{S,AC} \) is the sell price determined by the average-cost method right before the short contract s is closed out for large trader i on day t; and n2 is the number of short contracts closed out on day t for large trader i.

For dollar realized returns, we compute the following:

Note that we use contract value instead of margin to compute the realized returns. As such, these realized returns are computed without leverage, implying that the realized returns with leverage would be about ten times the reported results. In addition, the realized returns (in percentage term or dollar term) of each investor’s account (i.e., ri,t in Eq. (6) or Ri,t in Eq. (7) above) can be computed from the following market(s): (1) the total realized returns, which include the realized returns from both options and futures trading. Our calculation of (1) the total realized return can be decomposed into the futures realized return and the options realized return where (2) the futures realized returns are the realized returns from futures trading, and (3) the options realized returns are the realized returns from options trading.Footnote 26

To show that large investors’ trading profits are due to market manipulation rather than mispricings, we distinguish between realized returns (“actual profits”) vis-à-vis unrealized returns (“paper profits” based on marking-to-market).Footnote 27 To examine the investor’s “paper profits”, we define \( r_{i,t}^{u} \) as the percentage unrealized return on day t for large trader i by taking all positions open at the close of trading day t into consideration.

where \( P_{i,l,t}^{C} \) is the market closing price of the long contract l for large trader i on day t; \( P_{i,l,t}^{B,AC} \) is the buy price of the open long contract l determined by the average-cost method at market close for large trader i on day t; m1 is the number of long contracts open at market close on day t for large trader i; \( P_{i,s,t}^{C} \) the market closing price of the short contract s for large trader i on day t; \( P_{i,s,t}^{S,AC} \) is the sell price of the open short contract s determined by the average-cost method at market close for large trader i on day t; and m2 is the number of short contracts open at market close on day t for large trader i.

3.1 The most profitable trades and accounts

Based on the account-level trading data in Sect. 2.2 and the daily realized returns described above, we examine the most profitable trades and accounts. At the individual account-level, we examine both the top-100 most profitable trades and the top-100 most profitable accounts. We find that 57(31) out of the 100(50) most profitable trades were made by one single account (who is a proprietary dealer). Table 14 in the Appendix shows that the most profitable trade made $20.03 million USD when the large trader closed the position.Footnote 28 Also, this trader is seen to be the top overall trader (see Table 14 in Appendix). Furthermore, among the 100 most profitable trades, we found the following distributions across trader types: (1) foreign institutions made 35 of the most profitable trades, (2) proprietary dealers made 58 of the most profitable trades, (3) domestic institutions made 2 of the most profitable trades, and (4) individual investors did not have any trades among the top-100.

To study which traders generate the most profits, Table 15 in the Appendix presents the top traders among our large trader sample. Panel A of Table 15 (which provides rankings for all large traders who trade in both the options and futures markets) shows that the top trader made a total profit of $211.33 million USD during our sample period of 2007–2012. Similarly, the next best trader made a total profit of $146.67 million USD, and the 3rd best trader made a total profit of $88.33 million USD.Footnote 29 Further examination (not reported here) shows that the top-100 large traders made a total profit of $2.05 billion USD during year 2007–2012.Footnote 30

To differentiate manipulation in the underlying futures market or cross-markets it is useful to identify the source of profits for the large and profitable traders. In this regard, we examine the ranking of the top traders in the option and futures market, respectively. Panel B of Table 15 presents the ranking of top traders in the options market. We see that the most profitable traders rely on option trades to generate their profits. For example, the 2nd best trader in both the options and futures markets (Panel A) is also the 2nd best trader with option trades in Panel B. Last, we examine the ranking of the top traders in futures contracts. Panel C of Table 15 reveals that the top trader in both the options and futures markets (Panel A) is also the top trader in the futures market. Similarly, the 2nd and 3rd best traders in Panel A are also the 3rd and 2nd best traders, respectively, in the futures market. In summary, this anecdotal evidence suggests that the large traders are profitable, hence manipulation is possible, and that likely manipulators may trade in both the options and futures markets.Footnote 31 Dollar profits, although informative, do not normalize for the large traders’ capital at risk. This normalization is pursued in the next section when we study the large traders’ returns.

3.2 Large traders’ returns

We now investigate the large traders’ returns based on the daily realized returns computed in Eqs. (6) and (7). Table 1 reports summary statistics of the large traders’ realized return.Footnote 32 Panel A of Table 1 reports the daily total realized returns (including both options and futures trading). Column (3) of Panel A shows that the average daily dollar realized returns fluctuate over time (e.g., the average daily realized returns are negative for years 2008 and 2011). Column (4) of Panel A presents the daily average realized returns as a percentage change. It shows that the average daily total realized returns are 0.58%. Unlike the dollar daily returns, the percentage daily returns are all positive from 2007 to 2012.

Panels B and C of Table 1 report the daily realized returns for the options and futures markets, respectively. In contrast to column (3) of Panel A, column (3) of Panel B shows that the average dollar realized returns in the options market are all positives from year 2007 to 2012. Option trading by the large traders is persistent with positive performance over time. Panel C of Table 1 presents the realized returns of the large traders in the futures markets. The results show that the average realized returns of futures trading are negative in both dollar and percentage terms.Footnote 33

In summary, the significance of the positive daily realized returns reported in Table 1 indicate that the large traders’ accounts are profitable. Interestingly, the large traders’ profits from options market are larger than the profits from futures market. Also notable are the negative returns for futures trades. These results suggest that the main sources of profits for large traders are from the options market, consistent with the notion that the options market and/or cross-market manipulation is possible, but that manipulation in the underlying futures market alone is unlikely.

3.3 Investor heterogeneity

During the sample period of 2007–2012, our account-level dataset contains information on the larger traders’ “investor types” including: (1) Foreign Institutions (with 217 accounts), (2) Proprietary Dealers (with 53 accounts), (3) Domestic Institutions (with 368 accounts), and (4) Individual Traders (with 29,297 accounts).Footnote 34 Table 2 presents the profitability of the different investor types in both the options and futures markets (Panel A), the options market (Panel B), and the futures market (Panel C). In Table 2, Panel A shows that foreign institutions have the largest average daily dollar realized returns from both the options and futures markets, followed by the proprietary dealers, individual traders, and domestic institutions. Column (4) of Panel A provides a different insight based on percentage returns. In terms of percentage returns, proprietary dealers have the best trading performance (with average daily total realized returns of 3.80%), followed by foreign institutions (2.56%), domestic institutions (0.72%), and individual traders (0.55%).

These returns are broken down into their performance in options and futures, respectively. Panel B of Table 2 shows that for the options market, propriety dealers have the most profitable trades, followed by foreign institutions, domestic institutions, and individual traders. Column (4) of Panel B yields the same conclusion based on percentage realized returns: proprietary dealers have average daily realized returns of 3.83% from option trading, followed by foreign institutions (2.51%), domestic institutions (0.73%), and individual traders (0.57%). Panel C of Table 2 presents the different investor type performance in the futures market. As shown, foreign institutions are the only investor type that had positive average daily dollar returns in the futures market. All of the other investor types incur average daily losses in the futures market. The ranking of losses from largest to smallest are: proprietary dealers, domestic institutions, and individual traders. In terms of percentage returns in futures markets, the results are similar. Although foreign institutions are the only investor type with a positive average percentage return, the magnitude of the return is quite small.Footnote 35 Our findings offer new insight to the account-level study by Chow et al. (2013), which excludes the examination of large traders and finds that foreign traders have the worst returns during the final settlement days in the futures market.

3.4 Cross-market trading

We perform a further analysis on the individual account-level profits to study cross-market trades. Our dataset enables us to identify large traders who only trade in the options market, the futures market, or both in the futures and options markets. For this purpose, cross-market trades are identified as observations with both a realized return in futures and in options on the same day.Footnote 36 Table 3 shows that the average dollar and percentage returns of cross-market trades in both the options and futures markets are larger than trades in only the options or futures. Cross-market trades generate an average realized return of 5.64%.Footnote 37 These findings show that large traders who trade in both the option (derivative) and futures (underlying) markets, as opposed to only a single market, obtain larger realized returns.

4 Market structure tests

This section investigates both the futures’ and options’ market structures to determine whether market manipulation is possible. This section is based on the sufficient conditions precluding market manipulation contained in Jarrow (1992, 1994). The violation of these conditions is necessary for the existence of market manipulation.

4.1 The hypotheses

In a frictionless market, where large traders’ trades have a quantity impact on the price, Jarrow (1992, 1994) provides a set of sufficient conditions on the market structure that exclude (1) market manipulation within a single market, called the Independence of Past Holdings, and (2) cross-market manipulation between the underlying and derivative markets, called the Synchronous Markets. In our setting, the Independence of Past Holdings condition implies that a large trader’s positions have no influence on subsequent movements of the futures price. In essence, the quantity impact on the price is only temporary; disappearing immediately after the trade is executed. In this case, the quantity impact is equivalent to an endogenous transaction cost and a large trader cannot manipulate futures prices to their advantage. The Synchronous Markets condition is satisfied when the futures market (the underlying) adjusts instantaneously to trades in the options market. In essence, there is an efficient transmission of information across the two different but related markets. Because there is no market segmentation, even temporarily across the two markets, cross-market manipulation is impossible.

4.2 Dollar deltas

To test these sufficient conditions precluding market manipulation, we need to identify the implied equivalent positions of the large traders in the underlying TAIEX index. From derivatives pricing theory we know that a derivative’s delta measures the equivalent position in the underlying asset. We compute the daily dollar delta for both the TX and TXO using closing prices for the contracts.

We use Eq. (4) as equivalent trading in the underlying (“delta demand”) of each investor by multiplying the net position changes in both the TX and TXO contracts by the corresponding dollar delta. We note that the dollar deltas are additive across the options and futures markets. For subsequent analysis, it is convenient to investigate the dollar deltas in the options and futures markets alone. The dollar deltas in the options market of the large investor i at date t (\( D_{i,t}^{Options} \)) and the dollar deltas in the futures markets of the large investor i at date t (\( D_{i,t}^{Futures} \)) are given by expressions (9) and (10), respectively.

Since these conditions relate to market structure, the subsequent tests are based on the large traders’ positions at an aggregate-level.

4.3 Synchronous markets

In this section, we test the sufficient condition for no cross-market manipulation using daily account-level trading data aggregated across all traders. The equivalent trading position in the underlying for a group of n large traders on date t is therefore

where Di,t is the equivalent trading in the underlying for large investor i at date t. For both options and futures markets, \( D_{i,t} = D_{i,t}^{Total} \), which is defined in Eq. (4). For options market only, \( D_{i,t} = D_{i,t}^{Options} \), which is defined in Eq. (9). For futures market only, \( D_{i,t} = D_{i,t}^{Futures} \), which is defined in Eq. (10).

We first examine whether the aggregated large traders’ positions have predictive power over short-term index futures returns. If the Taiwan futures market satisfies the synchronous markets condition, then the aggregated positions of the large traders should have no systematic relation or predictability to futures returns. In contradiction to this condition, the results in Table 4 indicate that the daily trading of large traders who trade in both futures and options markets have predictive power over short-term (1-day ahead) returns. Table 4 reports the futures market returns around large positive or negative trading positions in the underlying by large traders. Panel A of Table 4 shows that if large traders actively take Long positions in the options and futures contract (i.e., with large positive delta demand), the same (next) day return is + 1.4319% (+ 0.1909%). In contrast, Panel A shows that when the large traders sell, the same (next) return is − 1.2590% (− 0.3125%). This result suggests that a large negative delta demand (Short position) can create a profit of + 1.2590% (+ 0.3125%) on the same (next) day.

By combining the results from the long and short positions of the large traders, we can gain further insights into the trading strategies of the large traders over time. Panel A of Table 4 shows that the Long-Short difference (the difference in returns between the top and bottom groups in large delta demand) equals to + 2.6909% (+ 0.5034%) on the same (next) day. In the context of strategic trading, the large traders could adopt a market timing strategy where they dynamically adjust between long (day purchase) and short (day short) positions over time, creating a return spread of + 2.6909% (+ 0.5034%) on the same (next) day.

Panels B and C of Table 4 also show that large traders’ trading in options and futures markets exhibit a systematic relation with actual futures returns. In Panels B and C, a large Positive delta demand has a positive relation with futures returns while a large Negative delta demand has a negative relation with futures returns. We note that large traders’ delta demands in the 2nd, 3rd, and 4th quintile are related to smaller changes in futures returns. These results are inconsistent with the validity of the synchronous market condition implying that cross-market manipulation is possible.

To further test the synchronous markets condition, we examine the dynamic relation between trading of the large traders and the prices of the underlying (in our case the futures prices) by estimating a multivariate vector autoregressive (VAR) system, which contains the equations of (1) equivalent trading in the underlying (delta demand) of the large traders, and (2) changes in the prices of the underlying (the futures prices).Footnote 38 We then employ a Granger causality test that involves estimation of the following bivariate models:

where St is the futures (underlying) market price and \( D_{t}^{Large Investors} \) is the options (derivative) trading of the large traders considered as a group and defined in Eq. (11).

To test the synchronous market condition, we examine whether the derivatives trading of the large traders who trade in both the options and futures markets predict future prices of the underlying (the futures price). The null hypothesis (no causality) is: H0: c1 = c2 = 0. If derivatives and the underlying markets are not synchronous, then the trading activities of the large traders should lead the underlying market’s prices, i.e., we should expect to see that trading positions of large traders Granger causes prices of the underlying (i.e., a change in futures prices for the case of Taiwan).

We estimate the VAR system with a lag length of 10 (T = 10), which should capture any long-memory price effects.Footnote 39 We perform the Granger causality test based on the VAR system described above for lead-lag relations between the large traders’ equivalent trading in the underlying (delta demands) and the change in the prices of the underlying (futures price).

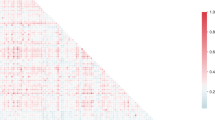

To demonstrate that the synchronous market condition is violated and cross-market manipulation is possible, Panel B of Table 5 shows that the large traders’ trading in the options market Granger causes futures prices during the overall period 2007–2012. Interestingly, Panel A of Table 5 shows that the large traders’ total trading positions in both the options and futures markets do not lead futures price during the sample period of 2007–2012.Footnote 40 Moreover, we examine the results for different sub-samples of financial market periods, including the pre-crisis (January 2nd, 2007 to December 31st, 2007), the financial crisis period (January 1st, 2008 to March 31st, 2009), and the post-crisis period (April 1st, 2009 to November 30th, 2012). Panel A shows that the large traders’ total trading positions in both futures and options markets do not lead futures price during sub-periods of pre-crisis, crisis, and post-crisis. More importantly, Panel B of Table 5 shows that the large traders’ option trading position does Granger cause futures prices. In summary, these Granger tests show that large traders’ option trading Granger causes changes in prices of the underlying (futures prices). Furthermore, examining the pre-crisis, crisis, and post-crisis periods we found that the causality is significant mainly during the financial crisis period and post-crisis period. The Granger causality tests are inconsistent with the satisfaction of the synchronous market condition, implying that cross-market manipulation is possible.

4.4 Independence of past holdings

This section tests for the validity of the independence of past holdings condition. This is a special case of the above methodology where the tests are restricted to just examining the futures demands on futures, ignoring the option positions.

As before, we perform a Granger causality test to verify whether prices depend on holdings, and not the other way around.Footnote 41 Panel C of Table 5 reports the results. The tests show that there is no evidence of a causal relation between the large traders’ trading in the futures market and changes in the future prices. These results support the validity of the independence of past holdings condition. In other words, we find no evidence that in the futures market, large traders’ trading leads changes in futures prices, i.e., the past holdings of large traders do not predict futures prices. This implies that manipulation within the futures market itself is unlikely.

5 Large trader manipulation

The previous sections of the paper provide evidence regarding the satisfaction of necessary conditions for the existence of cross-market manipulation, but not for manipulation within the futures market. This section examines sufficient conditions for the existence of cross-market manipulation, and it provides additional support for the non-existence of manipulation within the futures market. Because such verifications are trader specific, this “sufficient condition” analysis is based on the individual account-level large traders’ positions and profits.

5.1 The theory

As mentioned in the introduction, the existence of trading profits is a necessary, but not sufficient condition for the existence of manipulation. To prove the existence of manipulation one must show that: (1) there are abnormal profits after adjusting for systematic risk, i.e., there are positive alphas, and (2) the abnormal profits are not due to mispricings or due to fundamental value based information trading. We note that due to our experimental design in using futures on a stock index, information based trading is excluded. Hence, if positive alphas are proven to exist, then we only need to show that there are no mispricings.Footnote 42

5.2 Risk adjusted returns (alphas)

To estimate the large trader’s risk-adjusted returns (alphas), we estimate a factor model with the large investor’s realized percentage returns as the dependent variable and the Taiwan’s futures market index returns as the market risk factor:

where ri,t is the daily realized returns of the large trader i at date t, which is defined in Eq. (6). St is the daily percentage change in futures prices at date t, β is the estimated factor loading, and α is the estimated alpha. εi,t is the residual of the regression. Since the large trader’s returns in index options and futures are driven by changes in the market index, we use a single-factor model with market index returns as the only risk factor. Recall that a large trader’s returns in index options and futures are not due to information based trading, hence only systematic market risk is necessary to estimate risk-adjusted returns.Footnote 43

The results are reported in Table 6. Panel A presents the results of estimated alphas using total realized returns as the dependent variable. Model (1) shows that the estimated daily alpha is 0.006 and significant at the 1% level. Models (2)–(5) present the estimated alphas for different types of traders. Among the different types of traders, proprietary dealers have the highest abnormal returns, followed by foreign institutions, domestic institutions, and the individual traders.Footnote 44

Panel B presents the results for only the option realized returns. The results are similar to Panel A. Panel C presents the results for only the futures realized returns. In contrast, none of the investor types have significantly positive alphas when considering realized returns of futures trading. Interestingly, the estimated coefficient for the change in the futures price [β in Eq. (13)] is significant and negative for all investor types except for the individual traders. This suggests that except for large individual traders, large traders generally use derivatives for hedging purposes (with a negative beta).

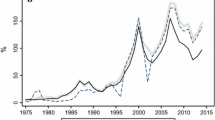

It is interesting to investigate trading during the financial crisis to see whether large traders earned abnormal returns (alphas) there as well. As shown in Table 7, the large traders’ performance varies over time. Nonetheless, we find that positive alphas are robust; they exist pre-crisis, during the crisis, and in the post-crisis period, with a slightly greater magnitude during the pre-crisis period. Panel A reports the results from the estimated factor model (using total realized returns as the dependent variable) during the pre-crisis period of January 2nd, 2007 to December 31st, 2007 [Model (1)], the crisis period of January 1st, 2008 to March 31st, 2009, and the post-crisis period of April 1st, 2009 to November 30th, 2012. Model (1) shows a higher estimated alpha, but Models (2) and (3) also show positive and significant alpha. These results suggest that the large traders’ ability to generate abnormal returns is persistent. Panel B presents the estimated factor model and alphas for options trading. The results in Models (1) to (3) show that the estimated alpha is higher in pre-crisis period [Model (1)] while the alpha remains positive and significant during the crisis period [Model (2)] and the post-crisis period [Model (3)]. In contrast, Panel C shows that the estimated alpha is not positive in the futures market, regardless of the sub-sample periods.

Finally, Table 8 shows that cross-market trades (see Model (1) in Table 8) generate the largest risk-adjusted returns (alphas). As discussed in Sect. 3.4, cross-market trades are identified as observations with realized returns in both futures and options.Footnote 45 These results further support cross-market manipulation as large traders can realize largest risk-adjusted returns when they trade in both the option (derivative) and futures (underlying) markets. Section 5.4 provides further analysis to shed light on the mechanism underlying the cross-market manipulation and the driver of the manipulation profits for large investors.

In summary, these results imply that the different large traders earn abnormal returns from trading in the options market and options/futures market, not from trading in the futures markets alone. Given that the transaction costs in Taiwan’s futures and options markets are small (see Sect. 2.1), these abnormal returns of the large traders are economically significant even after their inclusion. As an illustrative example, the round-trip transaction cost of TAIEX Futures is about 0.01% of contract value (which is equivalent to the average percentage transaction cost per trade), including both fixed costs and transaction taxes; the round-trip fixed cost plus transaction tax for an at-the-money 11-trading-day-to-maturity TAIEX Option is approximately 2%.Footnote 46 Note that there is no tax on trading gains in the Taiwan futures and options markets. After adjusting for these average percentage transaction costs, the average annualized alpha of certain types of large traders is still strictly greater than zero. For example, proprietary dealers (see Table 6) have the highest risk-adjusted returns with an estimated daily alpha of 3.8% in both the futures and options markets. Using the transaction cost approximation of 0.01% in futures and 2% in options discussed above, the estimated daily alpha net of transaction costs is approximately 1.79% for proprietary dealers. Similarly, cross-market trades (see Table 8) generate the largest risk-adjusted returns with an estimated daily alpha of 5.7%, which is approximately 3.69% net of transaction costs.

The absence of abnormal returns from trading in the futures market is consistent with the non-existence of market manipulation and the satisfaction of the independence of past holdings condition noted earlier. The existence of abnormal returns in the options market and cross-market trading is another necessary condition for the existence of cross-market manipulation. To verify that manipulation exists, we still need to show that these abnormal returns are not due to mispricings. This investigation is performed next.

5.3 Mispricings versus market manipulation

To study whether the abnormal returns are due to either mispricings or market manipulation, we perform a number of tests. If the abnormal returns are due to mispricings, one would expect that both “paper profits” (unrealized returns) and “real profits” (real returns) are positive.Footnote 47 This is because the profits are due to under-valuation of the relevant assets, and not strategic trading given a quantity impact on the price. In this case marking-to-market retains value. In contrast, if the abnormal returns are due to market manipulation, one would expect the paper profits to be zero or non-existence because the returns are obtained by strategic trading.

In the previous section, we demonstrated that the real profits are positive. This only leaves an investigation of the paper profits or unrealized returns. Table 9 contains these results. Here, one observes that the large traders do not generate significant positive alphas based on unrealized returns. As shown in all panels of Table 9, none of the estimated alphas are significantly positive. In Table 9, Model (1) shows that the estimated alpha is significantly negative for either total unrealized returns, option unrealized returns, or futures unrealized returns. These findings are inconsistent with the abnormal returns being due to market mispricings.

To further verify the existence of market manipulation, we conduct two additional tests. In the first test, we use the daily delta of the traders to identify their trading and non-trading days.Footnote 48 We use daily delta to track the opening position (when delta changes from zero to non-zero) and closing position (when delta changes from non-zero to zero) so that we can identify a “trade cycle.”Footnote 49 Using this framework, we can identify realized returns during trading days (trading cycle) and unrealized returns during non-trading days. We estimate the factor model using the sub-sample of trading days only and find that the options realized return is positive and significant during trading days. In contrast, we estimate the model using the sub-sample of non-trading days only and find that the options unrealized returns (paper profits) are significantly negative on non-trading days.

Table 10 presents the results of options realized returns on trading days (Panel A) and options unrealized returns on non-trading days (Panel B). These results show that abnormal returns (alphas) are only earned on trading days and support that trading strategically has value. Also, note that these findings apply to options trades only. We also identify the “trade cycle” for future trades only, and report the results of futures realized returns on trading days (Panel C of Table 10) and futures unrealized returns on non-trading days (Panel D of Table 10). Similar to our previous findings, the alpha is negative (significant) if we use futures trades to re-estimate the abnormal returns (alpha). These findings confirm the possibility of cross-market manipulation and the absence of manipulation in the underlying (futures) market.

As a robustness check, we use the full sample of options realized returns where actual returns are used on trading days and a zero return is used on a non-trading day (not including unrealized return or paper profit). The result reported in Panel E of Table 10 shows that the alpha is still significantly positive but it becomes very small in magnitude (e.g., the estimated alpha of 0.006 in Panel E is smaller than the estimated alpha of 0.034 in Panel A, although alphas in both cases are significantly different from zero). This robustness test further confirms that the large traders’ profits are more consistent with manipulation (strategic trading) rather than arbitrage.

For our second test, we use daily deltas to track the opening position (when delta changes from zero to non-zero) and closing position (when delta changes from non-zero to zero) so that we can identify a “trade cycle” (see Table 16 in Appendix for an example of trade cycle). For each trade cycle, we computed the cumulative realized return over the trading period. Then, we compare this cumulative realized return with a “hypothetical” return from a buy-and-hold strategy in the futures market over the same time period. Since we measure both futures and options returns based on notional (contract) value, due to the exchange’s margin requirements equalizing risk across both contract types, the percentage change returns of options (based on contract value) are comparable to the percentage change returns of futures (based on contract value). The idea behind this test is that if the profits are due to manipulation—strategic trading, then the realized returns should outperform a buy-and-hold strategy.

The results are reported in Table 11. Panel A shows that on average, cumulative realized returns of options trades over the trading periods are significantly larger than the “hypothetical” returns from a buy-and-hold strategy in futures market over the same time period.Footnote 50 Panel B shows that on average, the cumulative realized returns of futures trades over the trading periods are less than the “hypothetical” buy-and-hold strategy in futures market over the same time period.

As a further analysis, we compare the average daily returns and volatility during the trading days, and importantly, approximate a mean-to-volatility ratio. The results in Panel C of Table 11 show that average realized returns of options trades during the trading days are significantly larger than the average returns from a buy-and-hold strategy in futures over the same time trading period. The mean-to-volatility ratio is also larger for realized returns of options trades during the trading days. In contrast, Panel D shows that the average realized returns of futures trades on trading days are less than the average returns of a buy-and-hold strategy in futures, with a negative and lower mean-to-volatility ratio.

In summary, these tests support the claim that the large trader’s abnormal realized returns in options and options/futures markets are due to cross-market manipulation and not market mispricings. They also are consistent with the non-existence of market manipulation in the underlying futures market.

5.4 Further analysis on cross-market manipulation

When markets are not synchronous (as shown in Table 5), cross-market manipulation is possible as market prices do not adjust instantaneously to the true “effective” purchases of a large trader who can disguise some of his purchases in the option markets (Jarrow 1994). To further examine cross-market manipulation, we examine whether large traders’ realized profits are driven by their order flows and quantity impacts in the options and futures markets. We estimate the effects of the large traders’ option and futures positions (measured by the absolute values of option delta and futures delta) on realized dollar returns in options and/or futures markets. The following models are estimated for the realized dollar returns for the sub-sample of the large investors’ trading days with non-zero option deltas and non-zero futures deltas:

where the dependent variable Ri,t+1 is the 1-day ahead total realized dollar returns of the large investor i at time t +1 in both the options and futures markets (reported in Panel A of Table 12), in the options market (reported in Panel B of Table 12), or in the futures market (reported in Panel C of Table 12). Explanatory variables include the large traders’ options position measured by the absolute value of the option delta [i.e.,\( \left| {D_{i,t}^{Options} } \right| \) where \( D_{i,t}^{Options} \) is defined in Eq. (9)] of the large investor i at time t and the large traders’ futures position measured by the absolute value of the futures delta [i.e., \( \left| {D_{i,t}^{Futures} } \right| \) where \( D_{i,t}^{Futures} \) is defined in Eq. (10)] of the large investor i at time t. The control variable is the contemporaneous realized dollar returns Returnsi,t of the large investor i at time t.

In Table 12, Panel A shows that both the absolute value of the option delta and the absolute value of the futures delta have statistically and economically significant positive effects on the 1-day ahead total dollar returns for the large traders. This finding suggests that cross-market trades by large traders using positions in both the derivative (option) and the underlying (futures) markets create a quantity impact that makes profits. This is also consistent with our earlier findings that large traders made their largest risk-adjusted returns from cross-market trades (as shown in Table 8).

Panels B and C examine the effects of option and futures deltas on the large investors’ profits from the options market and futures market, respectively, and they provide the following insights. First, Panel B shows that the absolute value of the futures delta has a positive and significant effect on the 1-day ahead option dollar returns for large traders. This finding is interesting because it shows that large traders’ profits in the options market not only depend upon their positions in the options market but they also depend upon their positions in the futures market. A possible explanation is that the large traders’ cross-market trades and order flow manipulation in the derivative (option) market may also rely on trades in the underlying (futures) position. As illustrated in Fig. 1, when the large traders create large delta positions in options, they may also take positions in the underlying futures market to further manipulate the order flows so that other investors will notice a price movement in the futures market and the effect of the large traders’ delta positions in the options market. As such, the large traders’ profits in the options market depend on their positions in both the option and futures markets as the results in Panel B suggested.

Panel C shows that the absolute value of the option delta has a positive and significant effect on the 1-day ahead futures dollar returns for the large traders. This suggests that the large traders’ profits from the underlying (futures) market depend on their cross-market positions in the options market. A possible explanation is that when other investors observe the large traders’ order flow information in the options market, futures prices can move significantly and contribute to the large traders’ profits in the futures market. Also, Panel C shows that the large traders’ profits in the futures market do not depend on their positions in the futures but in the options, further confirming that large traders’ profits arise from the order flow manipulation in the options market.

5.5 Summary

The evidence from our unique account-level data and experiment are consistent with market manipulation based on strategic trades of large investors, who can create a quantity impact on the price and use options to impact the value of the underlying. Together, our findings imply the following. First, the market structure tests in Tables 4 and 5 show that the necessary conditions of no market manipulation (Jarrow 1992, 1994), including: (1) the Independence of Past Holdings and (2) the Synchronous Markets, are violated as a large trader’s option positions at the aggregate-level have a quantity impact on the underlying asset’s price. The violations of these conditions imply that market manipulation, specifically the cross-market manipulation using options market, is possible. Second, the individual account-level analysis in Tables 6 and 7 provide evidence of abnormal profits that are consistent with large traders’ strategic trades and order flow manipulation. In particular, the results in Table 8 show that cross-market trades by large investors generate the largest risk-adjusted returns, consistent with the possibility of cross-market manipulation. Given that that the necessary conditions of no market manipulation (such as synchronous markets) are violated at the aggregate-level, the account-level analysis show that large traders can take advantage of non-synchronous markets and make abnormal profits from option (cross-market) trades with a quantity impact on the price and order flow manipulation. The analysis in Table 12 confirms this insight by showing that the large traders’ realized profits depend on their trading positions in both the option and futures markets. To differentiate our analysis of market manipulation from arbitrage opportunities, the results in Tables 9, 10, and 11 show that active not passive profits are significant (e.g., actual not paper profits are significant and abnormal profits are significant only on trading days).

Overall, our evidence demonstrates that the lead-lag relation between the options and the underlying market are consistent with cross-market manipulation, an insight that is often ignored in the existing literature. Specifically, our findings suggest that large investors acquire large positions in the options market in order to manipulate order flow information and to create a quantity impact on the underlying futures market prices. When other investors do not immediately observe the quantity impact of the large investors’ true “effective” purchases that are camouflaged by their option trades, large investors are able to manipulate the order flow information using these option trades and consequently realize abnormal profits from their strategic trading.

6 Conclusion

This paper provides an empirical study of market manipulation in derivatives markets by examining strategic trades and profits of large traders. Using a comprehensive account-level transaction database in options and futures markets, we examine both the aggregate and individual holdings of large traders to test for the existence of market manipulation. To test necessary conditions for manipulation, we examine large traders as “a group” (at the aggregate-level) and test whether the futures/options markets satisfy a sufficient condition that precludes manipulation. The rejection of these sufficient conditions is a necessary condition for market manipulation. In this regard, the evidence is consistent with no market manipulation in the futures market, but that cross-market manipulation is possible. To test sufficient conditions for cross-market manipulation, we first show the existence of abnormal realized returns, and then we show that these returns are not due to either private information trading or market mispricings. These tests are inconsistent with market mispricings, thereby providing strong evidence that these abnormal returns are due to cross-market manipulation.

A moment’s reflection reveals that market manipulation can exist at different time scales – high frequency, intraday, longer-term. This paper investigates only the existence of manipulation over the longer time horizon. It is an interesting research question as to the existence or not of market manipulation within the smaller time scales. As future research, we will study the possibility of market manipulation at the high-frequency time scale.

Notes

See “South Korea Sanctions Deutsche Unit for Market Manipulation” by Se Young Lee and Alison Tudor, The Wall Street Journal, February 24th, 2011.

See “HAP Trading, chief fined $1.5 mln for options manipulation CHICAGO Mon May 12, 2014”, Reuters, May 12th, 2014.

There are three major strands to this empirical market manipulation literature. The first strand investigates asset price patterns resulting from manipulation (see, e.g., Carhart et al. 2002; Hillion and Suominen 2004; Ni et al. 2005; Blocher et al. 2011; Ben-David et al. 2013; Comerton-Forde and Putniņš 2014). The second strand studies known manipulation cases (see, e.g., Mei et al. 2004; Jiang et al. 2005; Merrick et al. 2005; Aggarwal and Wu 2006; Allen et al. 2006; Comerton-Forde and Putniņš 2011; Atanasov et al. 2015). The third strand provides an examination of market manipulation using account-level or transaction-level data (see, e.g., Khwaja and Mian 2005; Chow et al. 2013).

Our notion of market manipulation does not imply the trading activity is illegal, and we do not examine the welfare effects of market manipulation. As common to the literature, we use the term “large” to differentiate a trader whose trades have a quantity impact on the price from a “small” trader whose trades do not. Of course, a quantity impact is related to the size of trade, clarifying the use of the word “large.”

Order flow information is included within our definition of market manipulation, i.e., trading strategically knowing the quantity impact of a trade on the price due to order flow information.

In theory, manipulators are differentiated from other types of traders with the key difference of a quantity impact on the price. While other types of traders (such as arbitrageurs and liquidity suppliers) are price takers, manipulation requires a quantity impact on the price where the trader trades with knowledge of its effect.

See Sect. 2.1 for institutional background of Taiwan Futures Exchange (TAIFEX).

Pan and Poteshman (2006) use index option markets to examine whether investors possess information about future market-wide stock price movements. They do not find any evidence of informed trading in the index option market.

See Sect. 2.1 and Footnote 22 for transaction costs in Taiwan futures and options markets.

This trading advantage is sometimes called trading based on order flow information, as opposed to fundamental value information.

We emphasize that strategic trading based on a quantity impact of a trade is manipulation. Our results are consistent with this interpretation, and they do not support the hypothesis that large traders are price takers and liquidity providers.

According to Jarrow (1992), arbitrage pricing theory invokes the price taking paradigm. The theory of manipulation studies arbitrage when traders affect prices. This generalization requires distinguishing between “paper” wealth and “real” wealth when valuing a trader’s position. For a price taker, these values are identical; but for a large trader they are distinct.

Although options and futures have different implicit leverage in the contracts, we measure both futures and options returns based on notional (contract) value. The exchanges purposefully impose margins to equalize the likelihood of losses due to these leverage differences across contract types. Consequently, the percentage returns of options (based on contract value) are comparable to the percentage returns of futures (based on contract value).

While studies such as Manaster and Rendleman (1982), Bhattacharya (1987), Anthony (1988), Easley et al. (1998), Chakravarty et al. (2004), Pan and Poteshman (2006), Roll et al. (2010), and Johnson and So (2012) find that particular types of options order flows can predict future stock prices, others such as Stephan and Whaley (1990), Chan et al. (1993), and O’Connor (1999) find the opposite.

Compared to futures market manipulation, manipulation in options markets has also been relatively less studied (Roch 2012). Our paper provides new evidence in this area as well.

Ni et al. (2005) rely on estimated profits of proprietary traders and may ignore the cost of manipulation. In contrast, our unique data allows us to compute the large traders’ (including proprietary traders’) actual profits, which include trading and other costs.

According to Futures Industry Association, the TAIFEX was among the top-50 derivatives exchanges in the world and ranked 18th in 2014 by number of contracts traded and/or cleared.

The TAIFEX has no market makers or specialists and operates in an order-driven electronic environment where futures prices are determined by limit and market orders.

In 2014, TXO was ranked 6th among equity index options contracts in the world by number of contracts traded.

Our data are obtained from the Taiwan Stock Exchange Corporation (www.tse.com.tw) and the Taiwan Futures Exchange (www.taifex.com.tw).

Note that in Taiwan, index futures contracts are tradeable but the underlying spot index is non-tradeable. Also, futures markets are similar to spot markets where all types of traders can trade (in contrast, the options market is mainly traded by institutional traders in Taiwan). As such, we use futures as the “tradeable” underlying to estimate actual trading profit of large traders in options and futures markets.

The trading costs per contract in Taiwan futures and options markets are based on a fixed-amount commission fee per contract and a transaction tax, a fixed rate on contract value. Also, there is no tax on trading gains in Taiwan futures and options markets. For example, the single-trip trading cost of a TAIEX Futures, including the transaction tax based on 0.002% of the contract value and a fixed commission fee per contract, is about $3.20 USD per contract. The single-trip trading cost of the TAIEX Options, including the transaction tax based on 0.1% of the contract value and a fixed commission fee per contract, is about $0.83 USD per contract (for at-the-money contracts).

The TX (TXO) is a futures (European type option) contract whose value is equal to the index level of the TAIEX multiplied by 200 (50) NT$. Since the TAIEX is non-tradeable, we employ the TX in the pricing model of the TXO while dividends are already impounded into the TX price.

The delta of a put option is negative, and therefore the effects of both call and put options do not neutralize.

The average cost method is defined as follows. After each acquisition of additional position, the moving average unit cost is computed by dividing the total cost of existing position by the total number of existing contracts. For example, suppose that an investor holds 10 contracts of TAIEX futures with average cost (in Taiwan NT dollar) equal to 9250 at the end of the previous trading day. This investor purchases 2 contracts with cost equal to 9200 and 9180 respectively today. The moving average cost for this investor’s position after the purchase becomes 9240 (which is (10*9250 + 9200 + 9180)/12).

In this computation, the trader may trade in only one market, in which case the return is just for that market.

According to Jarrow (1992), the theory of manipulation requires distinguishing between “paper” wealth and “real” wealth when valuing a trader’s position. Paper wealth is defined as the value of the speculator’s position evaluated at the prices supported by the large trader. Real wealth is the value of the large trader’s position after liquidation (i.e., return to zero holdings). See Sect. 5.3 for the analyses and results that differentiate market manipulation from mispricings.