Abstract

Recent housing bubbles in OECD countries have been accompanied by large-scale household debt buildups and rising homeownership rates, and have generally occurred in jurisdictions with soft legal limits to loan-to-value (LTV) ratios. We show that all these empirical features can be rationalized within a simple political economy framework of macroprudential regulation, where household debt is secured by housing collateral and is constrained by LTV caps. Specifically, we study an overlapping generations model in which non-altruistic households exhibit heterogeneous tastes for housing tenure. Optimal tenure arrangements may require collateralized debt, which risk-neutral banks supply given the prevailing regulatory framework. Under majority rule, housing bubbles can generate their own electoral support: when collateral values are rationally expected to climb, relatively lax financial regulation is favored by both middle-class mortgage applicants and high-income homeowners, who fear house price reversion to market fundamentals. Home buyers’ beliefs about house price inflation then fuel increasing household leverage across income classes, resulting in a self-confirming housing bubble with widespread homeownership.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Housing is the largest component of households’ wealth in many advanced economies and fluctuations in its value can have large effects on financial and economic stability, as underscored by recent housing bubbles and crashes in OECD countries (Herring & Wachter, 1999; Reinhart & Rogoff, 2013; Asadov et al., 2023). Recent research has documented that extreme house price volatility has typically been fueled by rapid expansion of credit (Jordà et al., 2015), and that the boom-bust cycle in the housing markets of advanced countries has been driven by political factors (Schwartz & Seabrooke, 2009). In particular, the fast growth of US mortgages in the early 2000s was fostered by deliberate political actions aimed at allowing the middle-to-poor class to benefit from generous down-payment requirements in house purchases (Calomiris & Haber, 2014).Footnote 1

In this paper we propose a model where these two factors – fast credit growth and political factors – concur to fuel housing bubbles: what connects them is the influence of politics on financial regulation, which in turn affects the terms at which banks offer credit to households. Interestingly, housing bubbles themselves feed back on politics, creating their own electoral support. In other words, housing bubbles can arise as a political equilibrium outcome in a fully rational model of credit market regulation, whereby mortgage lending is constrained by loan-to-value (LTV) caps. The regulatory framework is embedded into a simple overlapping generations (OLG) economy populated by non-altruistic households, with heterogeneous endowments (e.g. labor income) and preferences for housing tenure (Attanasio et al., 2012). For households that need a mortgage to buy a house, credit is constrained by a collateral requirement (Kiyotaki & Moore, 1997), which depends on the expected housing value and the enforced LTV limit. On the assumption that households’ default risk is under-priced by financial markets, we show that majority voting can support a relatively lenient type of regulation, under which LTV caps are unresponsive to mortgage debt accumulation. This generates a feedback loop between credit and house prices, whereby the expectation of larger house prices enables banks to expand credit, and credit expansion itself fuels house price increases. As a consequence, an expectation-driven housing bubble emerges, along with fast-rising private indebtedness and a jump in the homeownership rate.

These equilibrium features are all consistent with a number of empirical facts concerning recent housing bubble episodes in OECD countries. As a notable example, the USA experienced a boom in real house prices of about 30% from 2000 to 2006, followed by an almost equal drop at the onset of the Great Recession in 2007, which are typical features of a bubble.Footnote 2 Other OECD countries – e.g. Denmark, Ireland, Spain and the United Kingdom – exhibited a similar upward pattern of real house prices within the same time window. Figure 1 plots the series of real house prices, normalized by disposable income, in the period 1995-2014 for the group of OECD countries that experienced similar episodes of housing bubbles in the last decade.Footnote 3

Along with a boom in house prices, the same countries featured a contemporaneous increase in aggregate leverage in the early 2000s. Figure 2 shows that the ratio of private indebtedness to GDP in the USA increased by more than 20 percentage points from the mid-1990s to the pre-recession years. A similar pattern, even quantitatively stronger, was observed in the other OECD countries.

Figures 1 and 2 suggest that the boom-bust cycle in house prices has been intertwined with a significant upsurge in household debt. The empirical literature has found that this increase in private indebtedness has been caused by a process of financial deregulation and innovation in the mortgage market. Agnello and Schuknecht (2011) find, using data for 18 industrialized countries in 1980-2007, that the probability of housing boom-bust episodes correlates positively with the increase in domestic credit, and that this correlation is larger in countries whose governments adopted financial deregulation measures. Similarly, using data from 48 countries, Cerutti et al. (2017) document that house price booms are more likely to occur in jurisdictions with relatively high LTV ratios and mortgage funding models based on securitization: remarkably, the median legal limit for the LTV in the 2000s was 110% in the UK and 100% in Ireland, Spain and the USA, against 83% for the median country in their sample.Footnote 4

A third piece of evidence concerns the evolution of homeownership rates in the years before the boom in house prices. As shown in Andrews and Sánchez (2011), homeownership rose significantly from mid-1990s to mid-2000s, in the countries that featured house price booms,Footnote 5 and innovations in the mortgage market appear to have affected the dynamics of homeownership rates. The relaxation of downpayment requirements on mortgages, that occurred in some OECD countries in the last decade, expanded access to the housing market, and produced an increase in homeownership among low-income, formerly credit-constrained households.

Our contribution is to develop a simple theoretical framework that connects these outcomes to financial regulation, and the latter to a self-sustaining political consensus, in the context of a rational expectations equilibrium. It has been recently emphasized that tolerating loose lending standards and excessive risk-taking by financial institutions is a key channel through which politics could influence housing prices (Gabriel et al., 2015). Intuitively, politics links as follows to financial regulation and thereby to credit expansion and ensuing housing market outcomes. If regulation tightens LTV caps, and thus collateral requirements faced by credit applicants, it constrains credit availability and may affect the tenure decision of low-income households. When housing is used as mortgage collateral, low-income households may favor relaxing collateral requirement. If housing is in fixed supply, households rationally expect that political support to housing finance will fuel home appreciation beyond fundamentals, and thus elect to purchase and own their residence only if they expect themselves to be able to resell it to next generation households at a relatively higher price. By the same token, financial intermediaries expect that rising house prices will cause collateral values to soar and enable borrowers to repay their loans through resale, and are thus willing to extend credit to mortgage applicants. Thus, even with time-invariant fundamentals, a feedback loop between credit and house prices can be sustained by rational beliefs about mortgage financing, in turn creating room for non-fundamental (bubbly) price dynamics to emerge. Such belief-driven bubble formation requires that the prevailing regulatory framework does not prevent banks from lending beyond the point where they would have negative net worth if the mortgage market collapses (equivalently, it credibly commits to bailing out banks in the case of housing bubble burst).

We remark that our analysis should not be interpreted as suggesting that democracy is to be regarded as a precondition for bubble formation – in fact, bubbly price dynamics would arise in the model economy as long as there exist (i) a pool of loanable funds that households expect to be large enough to meet their mortgage needs, and (ii) a financial sector that supports highly risky credit transactions across the world by under-pricing the domestic default risk (for, e.g., moral hazard reasons, see Glaeser & Nathanson, 2015). Our theoretical findings rather indicate that macroprudential measures emerging in the context of democratic political systems, where private sector characteristics (e.g. heterogeneous tastes for housing tenure, financial LTV ratios linked to expected housing values) jointly determine market outcomes, hardly serve as a barrier to the emergence of such phenomena, for they naturally reflect the distribution of “winners” and “losers” across the constituencies. In democracies, power is by definition contestable via formal institutions such as fair elections: when housing values are rationally expected to surge, a large pool of winners (the homeowners) will emerge to support electorally lax regulation; and lax regulatory standards, in turn, entail a strong promotion of owner-occupancy, thereby supporting the demand for residential housing backed by increased mortgage lending.

The remainder of the paper is organized as follows. Section 2 discusses the contributions of our paper to the existing literature. Section 3 outlines the basic framework, while the equilibrium analysis is undertaken in Section 4, where the conditions for rational housing bubbles to emerge are formally established. Section 5 discusses our modeling approach vis-à-vis potentially fruitful extensions, and also provides further insights into the implications of our results. Section 5 concludes.

Related Literature

Our paper relates to different strands of literature. First and foremost, it contributes to the work on the connections between housing and macroeconomics, e.g. Leung (2004) and Piazzesi and Schneider (2016). With a focus on the macro-housing-finance nexus, Leung and Ng (2019) review frontier research on the macroeconomic features of housing markets, emphasizing on the strength and statistical significance of correlations between macroeconomic variables (e.g real GDP) and housing market ones (e.g. real house price indexes). On the basis of these stylized facts and a review of extant macro-housing theories, Leung and Ng (2019) underscore the importance of introducing mortgage debt and the possibility of default in macro-housing models in order to improve our understanding of the endogenous mechanisms that contribute to determining house prices. In a recent critical review of the literature, Leung (2022) highlights an increasing tendency for micro-founded models of housing to incorporate agent heterogeneity to account for housing markets evidence. Against this backdrop, our framework of analysis allows for multiple sources of heterogeneity (in endowments and preferences for housing), mortgage debt and rental markets (along with for-sale ones), and endogenize both the rent and the house price in a rational expectations equilibrium setting.

Our work also speaks to the political economy debate on why many countries enforce policies that induce excessive expansion in aggregate leverage and sow the seeds for housing bubbles and subsequent crashes. In particular, McCarty et al. (2015) argue that financial crises are generally driven by “political bubbles”, i.e. policy biases that foster market behavior leading to financial instability, including the real estate-generated financial bubble and the 2008 financial crisis. Our analysis highlights that such policy biases tend to be self-supporting, essentially because housing bubbles can be extremely “popular”, at least as long as they last. This explains why macro-prudential authorities may have a very hard time trying to raise LTV ratios to fight a nascent or ongoing housing bubble, as their recommendations or actions may be very unpopular. This also suggests that it is important to delegate such macro-prudential policy decisions to authorities that have a degree of independence from the electorate, such as central banks, e.g. ESRB (2014).

Relatedly, our paper contributes to the policy debate on the impact of LTV ratios on systemic (in)stability that followed the financial crisis (Dell’Ariccia et al., 2011; Claessens et al., 2013; Montalvo & Raya, 2018), and more generally to the macroeconomic literature on the role of financial frictions and collateral constraints in shaping house price dynamics (Iacoviello, 2005; Kiyotaki et al., 2011).Footnote 6

Our analysis offers novel insights into the behavior of rational bubbles in OLG settings, whose study goes back to the seminal contributions by Samuelson (1958) and Tirole (1985). It is particularly related to work on rational bubbles in economies with credit market frictions (Farhi & Tirole, 2011), which investigates the potential loop between easy credit and house prices (Arce & López-Salido, 2011; Basco, 2014; Zhao, 2015). Kaplan et al. (2020) provide a quantitative theory of the housing boom and bust which identifies optimistic forecasts of future housing demand, rather than changes in credit conditions, as chief drivers of movements in house prices and rents. As in Kaplan et al. (2020), the distribution of preferences for housing services will play a crucial role in determining the emergence of belief-driven housing bubbles; taking such a distribution fixed, we focus on the interplay between homebuyers’ expectations about house price inflation and the evolving credit conditions in shaping political institutions, which in turn provides fertile ground for housing boom and bust episodes to arise.Footnote 7

In Enders and Hakenes (2021), a model entailing rational asset bubbles based on leverage is developed, in which the probability of continuation of the bubbles is endogenously determined as a time-varying (state-dependent) function of price, both being determined via market fundamentals, and traders’ expectations about the maximum market size. To focus on the political economy housing bubbles, in our analysis the probability of continuation is constant over time, irrespective of the underlying realization of the stochastic process for price (it therefore proves state-independent).

A recent article by Clain-Chamoset-Yvrard et al. (2023) studies housing bubbles in the context of an exchange OLG model, in which housing generates positive utility services, and can also serve as collateral in the mortgage market. A housing demand bubble is there defined as the divergence of the actual aggregate demand for houses from the demand that is explained by fundamentals (e.g. housing services); where the divergence is caused by the fact that houses can also be used as an investment vehicle. There are several key differences between Clain-Chamoset-Yvrard et al. (2023)’s modeling approach and ours. First, Clain-Chamoset-Yvrard et al. (2023) characterize housing bubbles as a positive demand for housing that agents formulate when adult in order to finance consumption expenditures when old; by contrast, the house price process cannot contain any bubble component, and therefore it equals the discounted value of future services generated by the house. Our model rather entails the following: housing allocations remain constant over time, and yet the endogenous house price process is shaped by self-confirming beliefs about rising housing prices, and thus diverges away from the market fundamentals. Second, Clain-Chamoset-Yvrard et al. (2023) assume rental markets away, and therefore do not study the optimal tenure decisions of forward-looking agents. In an attempt to emphasize the demand effect of housing and the role of agent heterogeneity, we explicitly consider rental markets along with for-sale ones, and endogenize both the rent and the house price in a rational expectations equilibrium setting. Third, Clain-Chamoset-Yvrard et al. (2023)’s model identifies three distinct sources of fluctuations (local indeterminacy, a multiplicity of stable steady states, and endogenous regime switching), absent any exogenous shocks to fundamentals or to beliefs about house price inflation. Our OLG model, by contrast, features a unique (bubble-free) steady state, where house prices reflect market fundamentals solely, and an uncountable (continuously infinite) set of bubbly equilibrium paths that (i) are driven by agents’ self-confirming beliefs, and (ii) end in market crashes with probability one, returning to market fundamentals. Fourth, and most importantly, we delve into a different dimension, i.e. the political economy of housing bubbles, a facet untouched by Clain-Chamoset-Yvrard et al. (2023).Footnote 8

The peculiar features of equilibrium multiplicity in our model economy makes the ensuing bubbly house price dynamics quite different from the price equilibrium studied in Leung and Tse (2017). These authors develop a search-theoretic housing model in which the market interplay between liquidity-constrained end-user households and arbitraging investors (flippers in US financial jargon) who feature both an inventory and a financing/bargaining advantage over the former can generate multiple steady-state equilibria. Our model rather exhibits a unique steady-state equilibrium (for any feasible parameter configuration, the supply of housing is fixed, and the aggregate demand for for-sale housing is everywhere downward sloping), and a continuum of equilibrium paths (for some positive measure subsets of the parameter space) that all diverge away from the steady state with positive probability and yet revert to it with probability one at an unknown date.Footnote 9

A Simple Model

We consider a simple discrete-time, infinite-horizon OLG model populated by a unit mass \(\mathcal {I}\) of two-period lived, non-altruistic households i, each endowed with time-invariant income \(y_i \in [\underline{y}, \bar{y}]\), with \(0<\underline{y}<\bar{y}<\infty \).

Households care about second-period consumption of a non-durable good and housing services, with a non-empty convex subset \(N_\epsilon \subset \mathcal {I}\) of young households enjoying a utility premium from owning their residence. Given housing purchase and rental prices, households optimally decide whether to become renters (R) or owner-occupiers (O) at time t. Houses are either rented from a large set of competitive (risk-neutral) real estate agencies or bought/sold in a competitive housing property market (aggregate housing stock is fixed at \(H>0\)). Home-buyers purchase their house when young at price \(q_{t}\) and resell, when old, at the resale price \(q_{t+1}\) before buying second-period consumption. Renters pay a price \(\rho _{t}\) for their house when young and return it to the real estate agencies when old. The consumption good is bought on a competitive market, and its price is set equal to one.Footnote 10

Housing can also be used as collateral: households who choose to buy housing can borrow subject to a collateral constraint, by which their borrowing cannot exceed a fraction \(\phi _{t}\in [0,1]\) of the expected value of the house. The supply of mortgage loans is restricted by regulation, which enforces a loan-to-value (LTV) limit or cap \(\bar{\phi }_t\) on \(\phi _t\).

Households

Households maximize expected utility from consumption and housing

Here, the parameter \(\epsilon _i \in \left[ 1, \epsilon ^H \right] \) captures household i’s utility premium from owing their residence: for any underlying income level, it equals one if \(i \notin N_{\epsilon }\), or it is strictly larger than one – up to some \(\epsilon ^H \in (1, \infty )\) – if \(i \in N_{\epsilon }\) and household i becomes an owner-occupier. Finally, \(\tilde{E}^h_t[\cdot ]\) denotes households’ subjective expectations conditional on all the information available at time t.

Let \(s_{i,t}\) denote the financial savings of household i given their tenure decision.Footnote 11 The objective (1) is then maximized subject to standard budget constraints (2) and (3), a collateral requirement (4) and non-negativity constraints (5), i.e.

Here, \(r_{t}\) is the interest rate and \(\tilde{E}^b_t[\cdot ]\) captures banks’ forward-looking beliefs as a function of their information set a time t.

Since households have no second-period income, young households who opt for rental housing are not eligible for loans as they would not be able to fulfill their debt obligations. By contrast, would-be owner-occupiers can access the credit market subject to the collateral requirement (4), and are protected by limited liability: if default occurs, the house is transferred to the lender in the form of second-period repayment, and the corresponding homeowner’s consumption drops to zero.

Banks

In each time period, mortgage loans are offered by unit continuum of identical competitive, risk-neutral banks that have limited equity \(E \in (0, \infty )\) and raise funds in infinitely inelastic supply, at the unit cost \(\bar{r}>0\) (\(\bar{r} < \infty \)) from international financial markets. Banks are assumed to under-price the risk of default resulting from a large rise in the demand for collateralized debt which is not baked by housing fundamentals (e.g. Glaeser & Nathanson, 2015).Footnote 12 As a consequence, financial intermediaries set the LTV ratio \(\phi _t\) conditional on borrowers’ expected ability to fulfill their debt obligations, provided the former does not exceed the regulatory ceiling \(\bar{\phi }_t\). Since borrower i’s (expected) repayment requires \(\tilde{E}^b_t \left[ q_{t+1} h^O_{i,t}\right] \ge -s_{i,t}(1+r_t)\), it follows that \(\phi _t \le 1/(1+\bar{r})\).

Real Estate Agencies

A large number of perfectly competitive real estate agencies operates by trading houses on the rental and the proprietary markets. As a result of competitive pressure, they optimally set rents according to a basic no arbitrage condition: at equilibrium, the overall housing stock H is allocated between the rental and the property markets up to the point where the current sale price on the proprietary market is equal to the rental price plus the discounted future resale price that real estate agencies expect to face, i.e. \(q_t=\rho _t+\frac{\tilde{E}^{a}_t[q_{t+1}]}{1+r}\).

Regulatory Framework and Voting

The policy variable \(\bar{\phi }_t\) is the outcome of a majority vote involving both young and old households. At any time, two policy types — call them austere (A) and lenient (L) — stand for election, that reflect different approaches to macroprudential regulation. The austere type is meant to capture the presence of regulatory concerns about the way financial institutions manage their own risk and the consequences of a collapse of the mortgage finance system; it therefore links the LTV cap to the ability of banks to use their own equity to cope with potential losses. The lenient one, by contrast, determines the maximum amount of loans based on the expected market value of houses irrespective of the outstanding (aggregate) mortgage debt.

Formally, we assume that the austere type A forcefully opposes excessive surges in private indebtedness: if, at some period t, (past) aggregate mortgage debt exceeds some finite level \(\bar{s}(E)>0\) (a function of aggregate banks’ equity), then a relatively harder (possibly zero) LTV cap on new loans is enforced from time t onward. The lenient type L, by contrast, does not condition maximum permissible leverage on banks’ exposure to default risk.Footnote 13

Given time invariance of the economy’s fundamentals, regulatory variables associated with the two macroprudential approaches are naturally modeled as sequences \(\left\{ \bar{\phi }^A_t \right\} \) and \(\left\{ \bar{\phi }^L_t \right\} \) satisfying \(\bar{\phi }^A_t < \bar{\phi }^L_t\) for all t and

where D denotes the (endogenous) set of mortgage borrowers. Voters simultaneously vote for one or the other type, holding correct expectations about future patterns of \(\left\{ \bar{\phi }^A_t, \bar{\phi }^L_t \right\} \). If household i is subjectively indifferent between the two alternatives, then she is assumed to refrain from voting — abstention from indifference as in Brody and Page (1973).

Equilibrium Notion

We define a political equilibrium as follows:

Definition 1

Given preferences and endowments, a political equilibrium (PE henceforth) is a collection of sequences \(\left( \rho ^*_t, q^*_{t}, h^{*}_{i,t}, c^{*}_{i, t+1}, \bar{\phi }^{*}_t \right) _{t=1}^{\infty }\) of prices, allocations and LTV caps such that

-

(i)

the majority of voters supports \(\bar{\phi }^{*}_t \in \left\{ \bar{\phi }^A_t, \bar{\phi }_t^L \right\} \);

-

(ii)

\(\rho ^{*}_t, q^{*}_{t} >0\);

-

(iii)

For \(j=\left\{ h,b,r\right\} \) and for all i, it holds \(\tilde{E}^j_t[\omega _{t+1}]=\mathbb {E}_{t}[\omega _{t+1}]\) for any equilibrium variable \(\omega _t=\left\{ \rho _t^*, q^{*}_t, h_{i,t}^*, c^{*}_{i,t}, \bar{\phi }^{*}_t\right\} \), where \(\mathbb {E}_t\) denotes the rational (objectively true) expectation operator conditional on time t information;

-

(iv)

the allocations maximize expected utility (1) subject to (2), (3), (4) and (5);

-

(v)

banks make zero (expected) profits;

-

(vi)

the housing and rental market clear at prices \((\rho _{t}^{*},q_{t}^{*},q_{t+1}^{*})\) for all \(t\ge 1\), i.e.

$$\begin{aligned} \int _{N^O} h^{O^*}_{i, t}di+ \int _{\mathcal {I}\setminus N^O}h^{R^*}_{i, t}di=H \end{aligned}$$where \(N^O\) is the equilibrium set of owner-occupiers;

-

(vii)

prices \((\rho _{t}^{*},q_{t}^{*},q_{t+1}^{*})\) satisfy \(q^{*}_t=\rho ^{*}_t+\frac{\mathbb {E}_t \left[ q^{*}_{t+1} \right] }{1+r}\).

Point (i) requires the existence of a majority, point (ii) requires both the housing and rental prices to be strictly positive, point (iii) imposes the rational expectations requirement that all the agents beliefs are model-consistent and coincide with the statistical conditional expectation attached to the equilibrium law of motion for endogenous variables. Points (iv), (v) and (vi) are conventional optimality and market clearing conditions for a competitive equilibrium with price-taking. Finally, point (vii) states that at equilibrium no further imbalance between market prices can be profitably exploited by the real estate agencies.

For the house price \(q_t\) to qualify as a rational expectations equilibrium, in each time period, given the current information and expectations about future price developments, it must fulfill the fundamental pricing equation that characterize the market equilibrium. Since households’ endowments and the interest rate on mortgage leverage are held constant, any bubble-free (fundamental) equilibrium is such that all quantities and prices are time-invariant. A bubbly equilibrium, by contrast, will feature a non-fundamental house price component whose dynamics are consistent with the pricing equations generated by the model.

To characterize the political equilibrium, we first determine households’ decision rules and the competitive equilibrium conditional on a given \(\bar{\phi }\), with households and banks acting as price-takers. As a second step, we look at the voters’ choice of the policy platform \(\bar{\phi }^{*}\), taking into account the distribution of voters associated with the LTV caps associated with the two distinct policy types. According to the previous definition, households vote their preferred policy when holding rational expectations about the effects of the voting outcome on the their utility.

Equilibrium Analysis

Tenure and Mortgage Leverage Choices

A crucial feature of our model is that the optimal tenure and mortgage leverage decisions of households both depend on the interplay between their heterogeneous tastes for housing tenure, on the one hand, and the tightness of the collateral constraint relative to the households’ income, on the other.

Let F be the distribution of endowment income across households i, satisfying \(F(y_i)>0\) for all \(y_i \in [\underline{y}, \bar{y}]\), and \(\Omega :=\left\{ F, \bar{\epsilon }, N_{\epsilon }, \bar{r}, \bar{s}(E)\right\} \) denote the model’s parameter set. In any candidate equilibrium, banks make zero (expected) profits (\(r_{t}=\bar{r}\) for all t) and there is no rationing on quantity: all banks will lend up to the bound set by the prevailing LTV ratio — i.e. \(\phi _t =\min \left\{ \bar{\phi }_t, 1/(1+\bar{r})\right\} \) — such that the supply of loans is equal to the expected discounted value of housing.

Our first result is about existence (and uniqueness) of a bubble-free competitive equilibrium, and the underlying distribution of households by tenure:

Proposition 1

For given \(\Omega \) and \(\bar{\phi }_t=\bar{\phi } \in [0,1)\) for all t

-

(i)

A bubble-free competitive equilibrium \(\left( \rho _{bf}^*, q_{bf}^*, h^{*}_{i, bf}, c^{*}_{i, bf} \right) \) always exists, and it is unique,

-

(ii)

If \(\bar{\phi } \ge \frac{1}{1+\bar{r}}\), then in the bubble-free equilibrium \(N^{O}=N_{\epsilon }\);

-

(iii)

If \(\bar{\phi } < \frac{1}{1+\bar{r}}\), then there exist thresholds \(\tilde{\epsilon }_i\left( \Omega \right) \) for all \(i \in N_\epsilon \) such that in the bubble-free equilibrium \(N^O \subseteq N_{\epsilon }\), and \(i \in N^O\) if and only if \(\epsilon _i \ge \tilde{\epsilon }_i\left( \Omega \right) \).

Proof

- See the Appendix. \(\square \)

In the bubble-free equilibrium, allocations and prices are uniquely determined as functions of the model’s fundamentals, and thus reflect the standard (net present value of the) housing dividend stream. Requiring the supply of funds to the banking sector to be large enough allows us to rule out rationing on the mortgage market: given the LTV ratio they face, all constrained households will obtain the loan they apply to in order to purchase their desired residence, irrespective of their actual income profile. When the policy-induced LTV cap does not constrain mortgage lending — that is, when \(\bar{\phi }\ge 1/(1+\bar{r}\)) — the renting versus buying decision is simply driven by her deep preferences for homeownership, irrespective of the household’s income level: households \(i \in N_\epsilon \) buy, the others \(i \notin N_\epsilon \) rent.

When the LTV cap is operative, by contrast, it further reduces credit availability in the economy, and hence potentially impacts on the tenure decision of households. Notice that, by force of the no arbitrage condition, the rental price for a housing unit is strictly lower than the one required for house purchasing. Thus, in a constrained economy would-be buyers might be forced to scale down their housing demand in order to enjoy strictly positive consumption. Hence, to induce them to purchase their property, the taste for homeownership must be sufficiently strong. As a main consequence, an overly tight collateral constraint may well lead households to overturn their housing tenure decision rather than simply induce downsizing, thus leading to tenure arrangements which do depend on the distribution of income in the economy. A natural corollary is the following

Corollary 1

For given \(\left( \Omega , \bar{\phi }\right) \), the bubble-free competitive equilibrium involves strictly positive allocations \(\left\{ h_{i, bf}^{R*}, h_{i, bf}^{O*}, c_{i, bf}^{R*}, c_{i, bf}^{O*} \right\} \) for all households i if and only if \(\underline{y} \ge \frac{1}{1+\bar{r}}\).

Proof

- Follows from the proof to Proposition 1. \(\square \)

We next show that the model also admits bubbly equilibria, in which allocations remain constant over time and yet prices reflect self-confirming beliefs about rising housing prices. Let \(b_t\!=\!q_t-q^{*}_{bf}\) denote a strictly positive price component other than the fundamental (time-invariant) one \(q_{bf}\). As emphasized by the early literature on speculative rational bubbles (Blanchard, 1979; Blanchard & Watson, 1982), existence of stochastic bubbles requires belief coordination across agents: for any given \(\bar{\phi }\), households, banks and real estate agencies all assign the same probability distribution \(G(b_t)\) to the process for the non-fundamental price component \(b_t\) on the unbounded support \((0, \infty )\). A natural candidate distribution \(G(\cdot )\) is in bi-nomial, state-independent form

and

i.e. the bubble is believed to grow without bound, yet it has finite expected duration and thus will end with probability one — see Eq. (7). Moreover, once it has collapsed, the bubble is expected not to start over again — see (8).

Notice that, by definition, a RE equilibrium bubble entails diverging expected prices relative to their fundamental value (i.e. \(\mathbb {E}_t[b_{t+1}] \rightarrow \infty \) as \(t \rightarrow \infty \)). This implies that, with positive probability, households will have to take a loan to buy a house at some time, even if in the bubble-free equilibrium they could buy a house without borrowing. The specification for \(G(\cdot )\) formalizes the idea that, for a rational bubble to develop, it is necessary not only that banks lend at the start of the bubble, but also that they are expected to lend any amount required to sustain the bubble as long as it proceeds. Importantly, if the regulatory standards are such that banks will refuse to refinance home-owners at some point in time if the bubble proceeds, everyone knows that the bubble cannot last beyond that time: at that date, if the bubble has lasted that long, the price can at most remain at that level forever (the price path should flatten out), and cannot be expected to grow bigger. This anticipation makes it impossible for a rational bubble to develop in the first place.Footnote 14

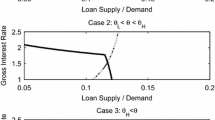

Our next result stipulates that, in a world of time invariant fundamentals, self-fulfilling expectations about bubbly price growth can however be sustained in equilibrium only if the LTV cap, albeit operative, does not prevent would-be homeowners with the lowest income from purchasing their ideal residence. Formally

Proposition 2

For all \(\Omega \) and \(\bar{\phi } \in [0, 1)\) for which a bubble-free equilibrium exists, define \(y_\epsilon :=\min \left\{ y_i:\, i \in N_\epsilon \right\} \). Then

-

(i)

A bubbly equilibrium \(\left( \rho ^*_{t,b}, q^{*}_{t,b}, h^{*}_{i,b}, c^{*}_{i,b} \right) \) with time invariant allocations exists if and only if \(y_\epsilon \ge \frac{1-\bar{\phi }}{\bar{r}}\);

-

(ii)

In the bubbly equilibrium, \(\rho ^{*}_{t,b}=\rho ^{*}_{bf}\) and \(q_{t, b}^{*}=b_t^{*}+q_{bf}^{*}\), where the sequence \(\left\{ b^{*}_t \right\} \) satisfies

$$\begin{aligned} b^{*}_{t+1}=\frac{1+\bar{r}}{1-\pi } b^{*}_{t},\qquad \mathbb {E}_0[b_0]=b_0>0 \end{aligned}$$(9)

Proof

- See the Appendix. \(\square \)

Proposition 2 has two main implications. First, insofar as the house price diverges from its fundamental value, it experiences a strictly positive growth rate, for it has to compensate home-buyers for the probability of a bust in the proprietary market. Second, a bubbly equilibrium is more likely to arise, all else equal, the softer the enforced LTV cap on mortgage lending is. When bubbly price dynamics do emerge, the equilibrium set of owner-occupiers is \(N^{O}=N_{\epsilon }\) and the financial position \(s_{i, t}\) of the latter entails increasing leverage as long as the bubble keeps running. When the bubble bursts, the housing market crashes and the house price will return to its fundamental value \(q^{*}_{bf}\). Given the forward-looking behavior of the real estate agencies, the equilibrium rental price never divorces from its fundamental value, even when a housing bubble is present.Footnote 15

Political Equilibrium

The analysis of the PE requires distinguishing the voting behavior of old and young households. At any time \(t>1\), old homeowners form a homogeneous group whose utility depends on current period consumption, and thus are subjectively indifferent across current policy proposals \(\left( \phi _A, \phi _L \right) \), for their financial position and ensuing consumption prospects are fully determined by the prevailing LTV cap as elected in the period \(t-1\). As a result, any majority supporting the policy-induced LTV limit \(\bar{\phi }\) must emerge from the voting behavior of young households, who rather care about their whole life time.

As argued above, both (candidate) renters’ and home-buyers’ utility depends on their tastes for housing tenure and the ability to afford their most preferred level of housing subject to the collateral constraint. On the one hand, at any time \(t \ge 1\), young households \(i \notin N_{\epsilon }\) always end up renting their residence; as a consequence, they will favor the regulatory framework under which the rental price \(\rho _t\) — that in equilibrium is tied to the housing price \(q_t\) as a result of the operation of real estate agencies — is the lowest; and \(\rho _t\) increases with \(\phi _t\) as long as there is a positive measure set \(N^O\) of constrained owner-occupiers in equilibrium, irrespective of the occurrence of bubbly price dynamics.

On the other, young households with a strong preference for home-buying (\(i \in N_{\epsilon }\)) would like collateral requirements to neither prevent them from buying their ideal residence, nor constrain mortgage lending to future generations in case home price inflation is present. Abstracting from the case in which households’ income is sufficiently large so as to make the financial constraint (however tight) redundant, candidate homebuyers in fact have a strong incentive in supporting the policy proposal, if any, which relaxes the collateral requirement they face (when buying) as well as that imposed on future generations of would-be homeowners, which in turn allows current owners to rationally expect to be able to resell at a relatively higher price and thus enjoy their desired level of consumption.

In a world of time invariant fundamentals, the following necessary condition applies

Corollary 2

For given \(\Omega \), if a bubbly PE exists, then it must feature \(\bar{\phi }^{*}_t=\phi ^L\) for all t.

Proof

- See the Appendix. \(\square \)

A political equilibrium with bubbly price dynamics thus requires existence of a majority of candidate renters and homebuyers supporting the lenient type of macruprudential policy. Renters will oppose the policy type enforcing the loosest and yet operative constraint on mortgage lending, i.e. at each time period t they will unambiguously vote for the the austere proposal \(\bar{\phi }^A\) as long as the latter entails higher utility from rental housing services relative to \(\bar{\phi }^L\). When faced with the tenure decision, candidate owner-occupiers cannot entertain inflationary expectations about future housing prices over the long term if they also expect a sharp drop in the LTV cap on the collateral requirement, as generated by sustained growth in private indebtedness. The emergence of a housing bubble in fact relies on the feedback loop between credit provision and house prices, as driven by coordinated beliefs about future home appreciation; such beliefs cannot be consistent with rational expectations, if the LTV policy is expected to curb mortgage lending at some point, however distant, in the future.

In the bubbly equilibrium, housing and consumption allocations are constant over time, yet banks expand collateralized loans in order to support the bubble-induced increasing demand for leverage that households express, so that those holding benefits from homeownership turn out to be the ones who buy their residence, boosting the equilibrium homeownership rate. This is our key result, as summarized in the following

Proposition 3

For given \(\Omega \), a PE with time-invariant allocations and bubbly housing prices exists if \(b_0>0\) and \(y_\epsilon \in \left[ \frac{1-\phi ^L}{\bar{r}}, \frac{1}{\bar{r}}\right) \). In such equilibrium

Proof

- See the Appendix. \(\square \)

A main consequence of the previous result is that high interest rate environments, which typically discourage the occurrence of bubbly phenomena in OLG models (Tirole, 1985), rather represent a fertile ground for housing bubbles to arise in our framework, for they provide relatively stronger incentives to low-income households to politically support a relaxation of mortgage underwriting rules (collateral requirements). The model also suggests that, in a bubbly price equilibrium, the rent-to-price ratio decreases over time, until the bubble eventually bursts and the house price falls back to the market fundamental. These two implications are both consistent with recent empirical work suggesting that lower rent-to-price ratios and higher short-term interest rates inflate the probability of housing market crashes (Dotsis et al., 2023).

According to the model’s predictions, popular housing-finance policies, rather than cheap credit in itself, represent one of the main preconditions for bubbly price dynamics to occur in housing markets. However, our analysis should not be taken as suggesting that democratic politics is co-responsible for the emergence of price bubbles in housing markets, but rather that it operates as a neutral filter between agents’ preferences for public policies and the design of regulatory intervention: if market conditions as well as private agents expectations and own balance of expected costs and benefits jointly fail to support a feedback loop between house prices and mortgage debt, then democracy will not be systematically correlated with the occurrence of boom-bust episodes in house price dynamics. In fact, democracy and house prices tied to fundamentals are mutually consistent in our framework when, e.g., the share of population exhibiting a preference for ownership (an unobservable variable) comprises middle to low-income households who would be constrained on the mortgage market under the lenient regulatory framework.

Discussion

Our framework of analysis builds upon three main assumptions: first, there exist households with an innate preference for homeownership relative to rental agreements, who thus face peculiar incentives in their housing tenure decision; second, the provision of loans to young households is restricted by a collateral requirement, whereby houses themselves serve as collateral; third, the supply of mortgages is affected by credit market regulation in the form of an explicit LTV limit, as enforced by the ruling political coalition.

The first two assumptions are meant to capture a number of realistic features of both housing and mortgage markets in developed countries. Households derive utility from both housing services and consumption of non-durable goods, and routinely engage in tenure decisions in the presence of uncertainty about future house prices, knowing that owned houses represent both a store of value and a pledgeable collateral. While related to key sociological factors (e.g. owner-occupation fulfills people’s sense of belonging), the utility premium derived from owning one’s residence can be motivated by straightforward moral hazard considerations, whereby owner-occupiers fully seize the benefits of hidden actions (e.g. renovation work) that affect the value of their residence, while renters do not.

Mortgage markets typically display more or less severe frictions, such as e.g. the need for securing loans of potential new home-buyers, who are able to borrow only a fraction of the (expected) value to the house. The actual working of these markets is affected by a number of macroeconomic prudential policies, as enforced by regulatory authorities in order to mitigate borrower risk and shelter the economy from adverse financial shocks (Cerutti et al., 2017).

The role of financial frictions in shaping the equilibrium properties of the model is key. As shown, the level of the homeownership rate in equilibrium depends on the expected house prices and the tightness of the collateral constraint. In this setting, there exists room for housing bubbles to arise as long as some households that would opt for rental housing when constrained by the collateral requirement start buying houses when housing values are rationally expected to climb, and continue doing so insofar as they expect themselves to be able to re-sell their own residence at a higher price; self-fulfilling expectations about bubbly price growth can thus be sustained all along the equilibrium path when the LTV cap (the policy variable), albeit operative, does not prevent would-be homeowners – those exhibiting pride of ownership – with the lowest income from purchasing their ideal residence.Footnote 16

In our model, each individual behaves as a sincere voter, and any individual indifference across policy alternatives results in full abstention. The abstention assumption is crucial in narrowing down the voting preferences of each individual, which need not be single-peaked. For example, individuals with a sufficiently high level of endowment have flat preferences over available policy proposals. Failure of single-peakedness calls for caution in characterizing the individually optimal LTV policy over the full policy spectrum and then computing the equilibrium policy by aggregating over the distribution of sincere voters; in fact, this would require additional assumptions (such as uniformly random voting) to break indifference ties. We nonetheless conjecture that our analysis would remain unaffected, provided the measure of the subset \(N_{\epsilon }\) of households is sufficiently large relative to the others (\(\mathcal {I}\setminus N^{\epsilon }\)), so that a majority of low-income candidate home-buyers would still be willing to support a relatively more lenient regulatory framework in equilibrium.

Our analysis deliberately abstracts from policy-induced direct costs for the electorate of the eventual bursting of the bubble and the ensuing systemic mortgage default. Consider, for instance, the possibility that the government bails out the financial institutions that bore the risk of excess credit and are forced to cope with the collapse of the mortgage market; if the bailout is tax-financed, it entails additional costs for the taxpayers – so that the implicit government insurance involves a wealth transfer from the taxpayers to the struggling financial institutions – and therefore distorts incentives ex ante in terms of optimal tenure arrangements of households who expect future government bailouts to take place when a housing bubble, if present, eventually ends.Footnote 17 The trade-offs faced by renters, in particular, might be dramatically altered to the point of leading them to ever oppose a lenient type of macroprudential policy: as they are indifferent across policy proposals when no bailout-related cost is present, the benefit from a low rental price (induced by a constantly low, debt independent LTV cap which still allows home-owners to purchase their ideal residence) can fall short of the expected cost of bailouts, provided they’re not shielded from the exposure of financial institutions to contingent liabilities (non-performing mortgage debt). Under these circumstances, the outcome of electoral politics can well be a regulatory framework that fully deters the emergence of belief-driven housing bubbles by linking the LTV cap to the aggregate dynamics of mortgage debt accumulation.Footnote 18

In a more articulated framework, the implicit bailout guarantee provided by the government might also generate indirect costs, insofar as it may end up promoting excessive risk taking and moral hazard on the part of financial intermediaries, thereby favoring the supply of cheap credit and ultimately feeding expectations of rising housing values across the electorate; by the same token, the bailout as well as the tax policy may be part of the policy proposals on which elections are conducted.

While our theoretical investigation only considers majority voting within a democracy, the issue of how nondemocratic forms of government rule and what kind of goals they seek to attain is a sensible one, given the recently increased number of nondemocracies around the world and their growing share of world-wide GDP, largely due to the Chinese contribution in this respect.Footnote 19 Indeed, as critically reviewed in Gehlbach et al. (2016) and Egorov and Sonin (2020), over the last years theoretical work in political science has been studying foundational principles of behavior (e.g. censorship and propaganda, repression of protests) and the formal institutional rules, if any, such forms of governments are expected to comply with. These efforts have yielded an array of different models of nondemocratic political systems which appear dishearteningly fragmented and complex: while a democracy’s constitutional framework, such as electoral and legislative rules, precisely define the core elements and trade-offs of public decision-making (actors, constraints, set of actions and procedures by which actions interact to produce outcomes fulfilling the constraints), nondemocratic systems are less amenable to formal modeling for they largely involve noninstitutional actions that overtly violate constitutional constraints (e.g. threat/use of violence in repressions or solution of political conflicts) and typically aim at circumventing or overturning formal rules (e.g. electoral fraud). This in turn raises key methodological issues that less frequently appear in the analysis of democratic politics. We believe that a formal theory of the design of financial regulation in nondemocratic systems, and how this latter contributes to shaping expectations and tenure decisions of households and the ensuing housing price dynamics, is well beyond the scope of the present paper and yet represents a fruitful avenue for future research.

Conclusion

This paper has developed a simple OLG model in which homeownership is endogenously shaped by the severity of credit market frictions (LTV limits). Households vote for different types of macroprudential policy in the form of LTV limits on collateralized debt. We establish conditions under which a stochastic bubble that bursts with probability one exists, whereby housing prices divorce from market fundamentals and experience belief-driven growth.

If a housing bubble materializes, both increasing households’ leverage and a jump in the homeownership rate obtain in equilibrium. These theoretical features square well with some of the empirical regularities documented for the recent housing bubble episodes in OECD countries like Denmark, Ireland, Spain, UK and USA. Our paper contributes to the policy debate that regards the role of high LTV in shaping the stability of the housing and of the credit markets and suggests a plausible political economy mechanism that rationalizes the emergence of high levels of private indebtedness.

Notes

In the same vein, Gabriel et al. (2015) document the Congressional influence in extension and pricing of subprime mortgage credit.

Dynamic stochastic macro models calibrated on the US economy in 2000-06 can explain only a fraction of the observed time variation in house prices, providing indirect support to the hypothesis that the unexplained component might be generated by non-fundamental factors (Sommer et al., 2013; Menno & Oliviero, 2020).

The analysis draws on the house price index reported in the OECD house prices database. Housing bubbles episodes are defined as episodes of large inflation in house prices followed by large deflation. Specifically, following Bordo and Jeanne (2002), we define boom and bust episodes by comparing each country’s 3-year moving average of the annual house price growth with their long-run historical average and standard deviation. We would also like to refer the reader to Bourassa et al. (2019) for a thorough comparison of econometric procedures to measure house price bubbles; Fabozzi and Xiao (2019) for the implementation of a recursive regression methodology for the estimation of a bubble’s timeline; Fabozzi et al. (2020) for an empirical analysis of real estate indices for the US and UK economies, pointing to the existence of significant periods of overvaluation in residential real estate; and Canepa et al. (2022) for the exploration of the impact of financial globalization on the dynamics of the real estate market in London.

Agnello et al. (2020) report evidence on the role of mortgage sector liberalization in increasing the length of housing boom and bust episodes in a panel of 20 OECD countries over the period 1970Q1-2015Q4, suggesting that government involvement in housing finance should be designed so as to dampen the destabilizing effects of excessive house price fluctuations.

Asadov et al. (2023) offer empirical evidence that the sign of house price returns has a distinctive impact on economic growth, and that house price volatility significantly contributes to economic instability.

Alternative approaches to the analysis of excessive house price appreciation focus on past price appreciations and changes in fundamentals (Brunnermeier & Oehmke, 2013; Hattapoglu & Hoxha, 2014; Hashimoto & Im, 2016) or irrational sentimental shocks (Anastasiou et al., 2021) as a trigger of price fluctuations that resemble bubbly dynamics.

Hillebrand and Kikuchi (2015) also construct an OLG model without economic growth in which the house price does not contain a bubble component at the steady state, and a divergent path (the bubble) can be sustained by unbounded debt financing. A distinctive feature of our analysis vis-à-vis Hillebrand and Kikuchi (2015) is the focus on the politics of housing and macroprudential regulation; and the fact that the housing bubble in our model is supported by non-operative collateral requirements and yet behaves as a non-predetermined variable, in line with the classical theory of speculative bubbles and crashes.

Leung and Chen (2006) exploit an OLG structure to investigate the time-series properties of land prices and their welfare implications of different cohorts. Both Leung and Chen (2006) and our paper share the view that inter-generational transactions of (land and) real estate can qualify as a natural mechanism leading to enriched price dynamics. The forces that shape this mechanism, however, are rather different. In Leung and Chen (2006), under perfect foresight a negative relationship between the present land price and the future land price can emerge as a result of optimal consumption smoothing decisions of households, which in turn allows for stable cycles to emerge. In our model, under rational expectations, forecast errors (i.e., a discrepancy between actual and expected future price paths) can be sustained in equilibrium without violating any of the rational expectation requirements (in particular, such errors are orthogonal to the information available to the agents when forming expectations); this in turn allows the pricing equation to admit a multiplicity of solutions other than the steady state (the bubbles).

For simplicity, we do not model the production side of the consumption sector, and assume the consumption good is supplied inelastically. The initial old are assumed not to own housing. This is without loss of generality, as discussed next.

The financial position of the initial old \(s_{i,0}\) is exogenously given, and normalized to zero.

Using U.S. bank data, Levitin et al. (2020) show that mortgage risk premiums failed to price the increase in risk as the volume of private-label mortgage-backed securitized mortgages expanded and lending terms eased over the period preceding the 2008 financial crisis.

We can think of \(\bar{s}(E)\) as indexing different degree of political aversion to excessive leverage in the economy. Remarkably, the existence of housing price bubbles does not require this limit, however large, to be part of the information set upon which rational agents form their own expectations, provided it is known to be finite.

We can imagine the probability \(\pi \) as being related to the likelihood of a sudden shortage of funds from international financial markets that banks can channel to mortgage applicants. An alternative assumption would have financial resources to be finite but coming in unknown size, with banks attaching a sufficiently high probability to this latter being very large, i.e. a Pareto distribution, as in Enders and Hakenes (2021). A main implication would be that price dynamics would feed themselves into the probability of the continuation of non-fundamental price dynamics (state dependence). In order not to shift the focus from the political economy aspects of housing bubbles, we leave to future research the analysis of the equilibrium properties of the model in this enriched setup.

Bubble price components \(b^*_t\) are indexed by the arbitrary initial condition \(b_0\), and thus there exists a continuously infinite set of such equilibrium processes. Albeit similar in nature, this feature of equilibrium multiplicity is conceptually different from the issue of equilibrium indeterminacy in linear rational expectations models, which rather pertains to the characterization of the full set of causal and asymptotically stable solutions with or without arbitrarily given initial conditions, see e.g. Sorge (2020).

The finding that beliefs shocks matter for actual house price dynamics echoes the analysis of Chowdhury et al. (2022), who argue that shocks to house prices can relax household down payment constraints and increase household mobility and housing demand. See also Lai and Van Order (2017) for empirical results suggesting strong cyclical deviations in house price dynamics, which are mean-reverting.

The likelihood of taxpayer-funded bailouts is not necessarily large for any kind of bailout intervention, e.g. the law might stipulate that the cost recovery be borne by the insured entities ex post.

In the tax-financed bailout setting, a simple sufficient condition for this political equilibrium outcome to occur is that less than half of the population enjoys a utility premium from owing their residence.

Notice that \(\hat{\epsilon }_i>\underline{\epsilon }_i\) if and only if \(y_i> (1+\bar{r})^{-1}\) for this implies \(V^R_i({\textbf {p}}^*, \bar{\phi }) > V^{Rconst}_i({\textbf {p}}^*, \bar{\phi })\) .

References

Agnello, L., Castro, V., & Sousa, R. M. (2020). The housing cycle: what role for mortgage market development and housing finance? The Journal of Real Estate Finance and Economics, 61, 607–670.

Agnello, L., & Schuknecht, L. (2011). Booms and Busts in Housing Markets: Determinants and Implications. Journal of Housing Economics, 20(3), 171–190.

Anastasiou, D., Kapopoulos, P. & Zekente, K.- M. (2021). Sentimental Shocks and House Prices. The Journal of Real Estate Finance and Economics. https://doi.org/10.1007/s11146-021-09871-z

Andrews, D., & Sánchez, A. C. (2011). The evolution of homeownership rates in selected OECD countries: demographic and public policy influences. OECD Journal: Economic Studies, 2011(1), 1–37.

Arce, Ó., & López-Salido, D. (2011). Housing bubbles. American Economic Journal: Macroeconomics, 3(1), 212–41.

Asadov, A.I., Ibrahim, M.H. & Yildirim, R. (2023). Impact of house price on economic stability: some lessons from OECD countries. The Journal of Real Estate Finance and Economics. https://doi.org/10.1007/s11146-023-09945-0

Attanasio, O. P., Bottazzi, R., Low, H. W., Nesheim, L., & Wakefield, M. (2012). Modelling the demand for housing over the life cycle. Review of Economic Dynamics, 15(1), 1–18.

Basco, S. (2014). Globalization and Financial Development: A Model of the Dot-com and the Housing Bubbles. Journal of International Economics, 92(1), 78–94.

Blanchard, O. J. (1979). Speculative Bubbles, crashes and rational expectations. Economics letters, 3(4), 387–389.

Blanchard, O. J. & Watson, M. W. (1982). Bubbles, rational expectations and financial markets. In: Crises in the Economic and Financial Structure, edited by Paul Wachtel, Lexington, Mass.: Lexington Press.

Bordo, M. D., & Jeanne, O. (2002). Boom-busts in asset prices, economic instability, and monetary policy. National Bureau of Economic Research: Tech. rep.

Bourassa, S. C., Hoesli, M., & Oikarinen, E. (2019). Measuring house price bubbles. Real Estate Economics, 47(2), 534–563.

Brody, R. A., & Page, B. I. (1973). Indifference, alientation and rational decisions. Public Choice, 15(1), 1–17.

Brunnermeier, M.K. & Oehmke, M. (2013). Bubbles, financial crises, and systemic risk. In: Handbook of the Economics of Finance, vol. 2, Elsevier: 1221–1288.

Calomiris, C. W., & Haber, S. H. (2014). Fragile by Design. The Political Origins of Banking Crises and Scarce Credit: Princeton University Press.

Canepa, A., Chini, E. Z., & Alqaralleh, H. (2022). Global Cities and Local Challenges: Booms and Busts in the London Real Estate Market. The Journal of Real Estate Finance and Economics, 64, 1–29.

Cerutti, E., Dagher, J., & Dell’Ariccia, G. (2017). Housing Finance and Real-Estate Booms: A cross-country Perspective. Journal of Housing Economics, 38, 1–13.

Chowdhury, M. S. R., Damianov, D. S. & Escobari, D. (2022). Price exuberance and contagion across housing markets: evidence from US metropolitan areas. The Journal of Real Estate Finance and Economics. https://doi.org/10.1007/s11146-022-09925-w.

Claessens, S., Ghosh, S. R., & Mihet, R. (2013). Macro-prudential policies to mitigate financial system vulnerabilities. Journal of International Money and Finance, 39, 153–185.

Clain-Chamoset-Yvrard, L., Raurich, X. & Seegmuller, T. (2023). Rational housing demand bubble. Economic Theory. https://doi.org/10.1007/s00199-023-01501-4.

Dell’Ariccia, M. G., Rabanal, P., Crowe, C. W. & Igan, D. (2011). Policies for macrofinancial stability: options to deal with real estate booms. International Monetary Fund

Dotsis, G., Petris, P. & Psychoyios, D. (2023). Assessing Housing Market Crashes over the Past 150 years. The Journal of Real Estate Finance and Economics. https://doi.org/10.1007/s11146-023-09960-1

Egorov, G. & Sonin, K. (2020). The Political Economics of Non-democracy. National Bureau of Economic Research, Working Paper 27949.

Enders, Z., & Hakenes, H. (2021). Market Depth, Leverage, and Speculative Bubbles. Journal of the European Economic Association, 19(5), 2577–2621.

ESRB (2014). Allocating macro-prudential powers. Tech. Rep. No. 5, ESRB Advisory Scientific Committee.

Fabozzi, F. J., Kynigakis, I., Panopoulou, E., & Tunaru, R. S. (2020). Detecting Bubbles in the US and UK Real Estate Markets. The Journal of Real Estate Finance and Economics, 60, 469–513.

Fabozzi, F. J., & Xiao, K. (2019). The timeline estimation of bubbles: the case of real estate. Real Estate Economics, 47(2), 564–594.

Farhi, E., & Tirole, J. (2011). Bubbly liquidity. The Review of Economic Studies, 79(2), 678–706.

Gabriel, S. A., Kahn, M. E., & Vaughn, R. K. (2015). Congressional influence as a determinant of subprime lending. Journal of Housing Economics, 28, 91–102.

Gehlbach, S., Sonin, K., & Svolik, M. W. (2016). Formal models of nondemocratic politics. Annual Review of Political Science, 19, 565–584.

Glaeser, E. L., & Nathanson, C. G. (2015). Housing bubbles. Handbook of Regional and Urban Economics, 5, 701–751.

Hashimoto, K.- I. & Im, R. (2016). Bubbles and unemployment in an endogenous growth model. Oxford Economic Papers, 68(4), 1084–1106.

Hattapoglu, M., & Hoxha, I. (2014). The dependency of rent-to-price ratio on appreciation expectations: an empirical approach. The Journal of Real Estate Finance and Economics, 49, 185–204.

Herring, R. & Wachter, S. (1999). Real estate booms and banking busts: an international perspective. The Wharton School Research Paper No. 99–27.

Hillebrand, M., & Kikuchi, T. (2015). A mechanism for booms and busts in housing prices. Journal of Economic Dynamics and Control, 51, 204–217.

Iacoviello, M. (2005). House prices, borrowing constraints, and monetary policy in the business cycle. American Economic Review, 95(3), 739–764.

Jordà, Ò., Schularick, M., & Taylor, A. M. (2015). Leveraged bubbles. Journal of Monetary Economics, 76, S1–S20.

Kaplan, G., Mitman, K., & Violante, G. L. (2020). The housing boom and bust: model meets evidence. Journal of Political Economy, 128(9), 3285–3345.

Kiyotaki, N., Michaelides, A., & Nikolov, K. (2011). Winners and losers in housing markets. Journal of Money, Credit and Banking, 43(2–3), 255–296.

Kiyotaki, N., & Moore, J. (1997). Credit cycles. Journal of Political Economy, 105(2), 211–248.

Lai, R. N., & Van Order, R. (2017). US house prices over the last 30 years: bubbles, regime shifts and market (In)efficiency. Real Estate Economics, 45(2), 259–300.

Levitin, A. J., Lin, D., & Wachter, S. M. (2020). Mortgage risk premiums during the housing bubble. The Journal of Real Estate Finance and Economics, 60, 421–468.

Leung, C. K. Y. (2004). Macroeconomics and housing: a review of the literature. Journal of Housing Economics, 13(4), 249–267.

Leung, C. K. Y. (2022). Housing and macroeconomics. Hoover Institution Economics Working Paper 22131.

Leung, C. K. Y., & Chen, N.- K. (2006). Intrinsic cycles of land price: a simple model. Journal of Real Estate Research, 28(3), 293–320.

Leung, C.K.Y. & Ng, C.Y.J. (2019). Macroeconomic aspects of housing. In: Oxford Research Encyclopedia of Economics and Finance.

Leung, C. K. Y. & Tse, C.- Y. (2017). Flipping in the housing market. Journal of Economic Dynamics and Control, 76(C): 232–263.

Liu, R., Hui, E.C.-M., Lv, J., & Chen, Y. (2017). What drives housing markets: fundamentals or bubbles? The Journal of Real Estate Finance and Economics, 55(4), 395–415.

McCarty, N., Poole, K. P., & Rosenthal, H. (2015). Political bubbles: financial crises and the failure of American democracy. Princeton University Press.

Menno, D., & Oliviero, T. (2020). Financial intermediation, house prices, and the welfare effects of the US great recession. European Economic Review, 129, 103568.

Montalvo, J. G., & Raya, J. M. (2018). Constraints on LTV as a macroprudential tool: a precautionary tale. Oxford Economic Papers, 70(3), 821–845.

Piazzesi, M., & Schneider, M. (2016). Housing and Macroeconomics. Handbook of Macroeconomics, 2, 1547–1640.

Reinhart, C. M., & Rogoff, K. S. (2013). Banking crises: an equal opportunity menace. Journal of Banking & Finance, 37(11), 4557–4573.

Samuelson, P. A. (1958). An exact consumption-loan model of interest with or without the social contrivance of money. Journal of Political Economy, 66(6), 467–482.

Schwartz, H. M. & Seabrooke, L. (2009). Varieties of Residential Capitalism in the International Political economy: Old Welfare States and the New Politics of Housing. In: The Politics of Housing Booms and Busts, Springer, 1–27.

Shen, S., Zhao, Y., & Pang, J. (2022). Local housing market sentiments and returns: evidence from China. The Journal of Real Estate Finance and Economics. https://doi.org/10.1007/s11146-022-09933-w

Sommer, K., Sullivan, P., & Verbrugge, R. (2013). The equilibrium effect of fundamentals on house prices and rents. Journal of Monetary Economics, 60(7), 854–870.

Sorge, M. M. (2020). Arbitrary initial conditions and the dimension of indeterminacy in linear rational expectations models. Decisions in Economics and Finance, 43(1), 363–372.

Tirole, J. (1985). Asset bubbles and overlapping generations. Econometrica, 53(6), 1499–1528.

Zhao, B. (2015). Rational housing bubble. Economic Theory, 60, 141–201.

Acknowledgements

I owe a debt of gratitude to Tommaso Oliviero and Marco Pagano, for insightful discussions on the main idea of the paper. I also wish to thank the Editor and a reviewer for many valuable suggestions, that have helped me to greatly improve the paper along several dimensions. Comments from Giovanni Andreottola, Stefano Giglio, Salvatore Piccolo, Francisco Queirós, Annalisa Scognamiglio and participants at the First Behavioral Macroeconomics Workshop (University of Bamberg), the 21th Workshop on Quantitative Finance (University of Naples Parthenope) and the 11th N.E.R.I. Workshop (University of Naples Federico II) are gratefully acknowledged. Any remaining errors are my sole responsibility.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

The authors have no relevant financial or non-financial interests to disclose. The authors have no competing interests to declare that are relevant to the content of this article. The authors certify that they have no affiliations with or involvement in any organization or entity with any financial interest or non-financial interest in the subject matter or materials discussed in this manuscript. The authors have no financial or proprietary interests in any material discussed in this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix: Proof of Proposition 1

-

i)

Let

$$\begin{aligned} V^j_{i, t}({\textbf {p}}_t; \phi ):=\max _{h^j_{i, t}, c^j_{i, t+1}} U_{i}(h^j_{i, t}, c^j_{i, t+1}),\qquad j \in \left\{ R, O \right\} \end{aligned}$$(12)denote the indirect utility to household i from either renting or buying, given prices \({\textbf {p}}_t:=(\rho _t, q_t, q_{t+1})'\) and the prevailing LTV ratio \(\phi =\min \left\{ \bar{\phi }, (1+\bar{r})^{-1} \right\} \), with \(r_t=\bar{r}\) in equilibrium. Assuming that indifferent households become renters, household i will opt for home-buying if and only if

$$V^O_{i, t}({\textbf {p}}_t; \phi )>V^R_{i, t}({\textbf {p}}_t; \phi )$$. The demand of household i for rental housing solves

$$\begin{aligned} \max _{h_{i, t}^R} \quad \log (h_{i, t}^R) +\mathbb {E}_t [(y_i-\rho _t h_{i, t}^R)(1+r)] \end{aligned}$$$$\begin{aligned} s.t. \quad y_i-\rho _t h_{i,t}^R \ge 0,\quad h_{i,t}^R \ge 0 \end{aligned}$$where the first constraint (no borrowing) reflects the inability of would-be renters to obtain a loan, and thus sets an upper bound on the demand for rental housing. The first-order condition for an interior solution delivers

$$\begin{aligned} h_{i, t}^R=\frac{1}{(1+r)\rho _t} \end{aligned}$$otherwise, the constrained solution \(h^R_{i,t}=\frac{y_i}{\rho _t}\) emerges. By the same token, the demand of household i for proprietary housing solves

$$\begin{aligned} \max _{h_{i,t}^O} \quad \log (\epsilon ^{h} h_{i,t}^O) + \mathbb {E}_t \left[ (y_i - q_t h^O_{i,t})(1+r)+q_{t+1}h_{i,t} \right] \end{aligned}$$$$\begin{aligned} s.t. \quad y_i-q_t h_{i,t}^O \ge -\phi \mathbb {E}_t\left[ h_{i,t}^O q_{t+1} \right] ,\quad h_{i, t}^O \ge 0 \end{aligned}$$$$\begin{aligned} \left( y_i - q_t h^O_{i,t} \right) (1+r)+q_{t+1}h^O_{i,t} \ge 0 \end{aligned}$$where the first constraint is the collateral requirement. If the latter does not bind, then the first-order condition for an interior solution yields

$$\begin{aligned} h_{i, t}^O=\frac{1}{(1+r)q_{t}-\mathbb {E}_t[q_{t+1}]} \end{aligned}$$provided the latter is non-negative. When the collateral constrained bites, housing demand will simply reads as \(h_{i, t}^O=\frac{y_i}{q_t-\phi \mathbb {E}_t [q_{t+1}]}\). In a bubble-free equilibrium, \(\rho _t=\rho \) and \(q_t=q_{t+1}=q\) for all \(t>0\), where \((\rho , q)\) depend on the economy’s fundamentals only. Thus, individual demand functions for housing services read as

$$\begin{aligned} h^{R*}_i=\frac{1}{\rho }\min \left\{ y_i, \frac{1}{1+\bar{r}} \right\} ,\quad h^{O*}_i=\frac{1}{q}\min \left\{ \frac{y_i}{1-\phi }, \frac{1}{\bar{r}} \right\} \end{aligned}$$(13)so that renters (respectively buyers) of type i are constrained if and only if \(y_i \le (1+\bar{r})^{-1}\) (resp. \(y_i \le (1-\phi )\bar{r}^{-1}\)). Whether constrained or not, individual housing demands are uniquely defined for any given price couple \((\rho , q)\) and (strictly) downward sloping, and so will the aggregate demand for both rental and owner-occupied housing. As the overall housing stock comes in fixed supply \(H>0\), a unique bubble-free competitive equilibrium will thus exist.

-

ii)

Non-operative LTV cap: \(\bar{\phi } \ge \frac{1}{1+r}\). By the equilibrium notion (1), in any competitive equilibrium the no arbitrage condition \(\rho ^*=\frac{r}{1+r}q^*\) holds. Also, bank competition in the credit market leads to \(r_t=\bar{r}\) and \(\phi =(1+r)^{-1}\). This has two implications for housing demand: first, whichever household i is not enough wealthy to become a saver when opting for rented housing — i.e. when \(y_i<(1+\bar{r})^{-1}\) — will necessarily constrained on the owner-occupied market for it holds \((1+\bar{r})^{-1}=\bar{r}^{-1}(1-\phi )\), and no positive consumption can be enjoyed upon entering either market. Second, if unconstrained, the housing and consumption allocations are strictly positive and yet independent of the housing tenure decision, i.e. for each household i with \(y_i \ge (1+\bar{r})^{-1}\) it holds

$$\begin{aligned} {\begin{matrix} h^{R*}_i&{}=\frac{1}{(1+\bar{r})\rho ^*}=\frac{1}{\bar{r} q^*}=h^{O*}_i\\ &{}c_i^{R*}=y(1+\bar{r})-1=c_i^{O*} \end{matrix}} \end{aligned}$$(14)It follows that in equilibrium \(V^R_i({\textbf {p}}^*, \bar{\phi })<V^O_i({\textbf {p}}^*, \bar{\phi })\) if and only if \(\epsilon _i>1\). That is, when \(\bar{\phi } \ge \frac{1}{1+r}\), household i becomes an owner-occupier if and only if \(i \in N_\epsilon \), irrespective of her endowment income \(y_i\).

-

iii)

Operative LTV cap: \(\bar{\phi } < \frac{1}{1+r}\). In this case we have \(\phi =\bar{\phi }\) and \((1+\bar{r})^{-1}<\bar{r}^{-1}(1-\bar{\phi })\). Using (13) and the no arbitrage condition, it follows that for household i with \(y_i < (1+\bar{r})^{-1}\) it holds:

$$\begin{aligned} {\begin{matrix} &{}h^{R*}_i=\frac{y_i}{\rho ^*}>\frac{y_i}{(1-\bar{\phi }) q^*}=h^{O*}_i\\ c_i^{R*}&{}=0<y_i \left[ (1+{\bar{r}})-\frac{\bar{r}}{1-\bar{\phi }}\right] =c_i^{O*} \end{matrix}} \end{aligned}$$(15)and home buying will occur if and only if \(V^R_i({\textbf {p}}^*, \bar{\phi })< V^O_i({\textbf {p}}^*, \bar{\phi })\), which is equivalent to requiring (after some manipulation)

$$\begin{aligned} \log \left( \frac{\alpha }{\epsilon _i} \right) < y_i (1+\bar{r}) \frac{\alpha -1}{\alpha },\qquad \alpha :=(1-\bar{\phi })\frac{1+\bar{r}}{\bar{r}} \end{aligned}$$(16)where \(\alpha >1\). Notice that the LHS of (16) is strictly decreasing in \(\epsilon _i\), whereas the RHS is independent of \(\epsilon _i\) and strictly positive because of the restriction on \(\bar{\phi }\). Let \(\epsilon _i=1\). Since \(y_i < (1+\bar{r})^{-1}\) by assumption, a sufficient condition for (16) to be violated is that \(\log (\alpha ) \ge (\alpha -1)/\alpha \). Notice that the latter holds with equality at \(\alpha =1\), while

$$\begin{aligned} \frac{d \log \alpha }{d \alpha }>\frac{d (\alpha -1)/\alpha }{d \alpha } \quad \forall \alpha >1 \end{aligned}$$(17)implies \(\log (\alpha ) > (\alpha -1)/\alpha \) for all \(\alpha >1\). It follows that, when \(y_i < \frac{1}{1+\bar{r}}\), household i becomes an owner-occupier if and only if \(\epsilon _i \ge \underline{\epsilon }_i\), where \(\underline{\epsilon }_i>1\) solves

$$\begin{aligned} \log \left( \underline{\epsilon }_i \right) =\log (\alpha )- y_i (1+\bar{r}) \frac{\alpha -1}{\alpha } \end{aligned}$$(18)When \( (1+\bar{r})^{-1} \le y_i < (1-\bar{\phi })\bar{r}^{-1}\), households i would manage to pay the rental price out of their income and yet are not enough wealthy to avoid being constrained by the collateral requirement if opting for purchased housing. Owing to (13) and the no arbitrage condition, we have:

$$\begin{aligned} {\begin{matrix} &{}h^{R*}_i=\frac{1}{(1+\bar{r})\rho ^*}>\frac{y_i}{(1-\bar{\phi }) q^*}=h^{O*}_i\\ c_i^{R*}&{}=y_i(1+\bar{r})-1<y_i\left[ (1+\bar{r})-\frac{\bar{r}}{1-\bar{\phi }}\right] =c_i^{O*} \end{matrix}} \end{aligned}$$(19)Hence, home buying will occur if and only if \(V^R_i({\textbf {p}}^*, \bar{\phi })< V^O_i({\textbf {p}}^*, \bar{\phi })\). Since it holds \(V^R_i({\textbf {p}}^*, \bar{\phi }) \ge V^{Rconst}_i({\textbf {p}}^*, \bar{\phi })\) – where the RHS is the value function of a constrained renter – a similar argument as the one exploited before proves that, when \(\frac{1}{1+\bar{r}} \le y_i < \frac{(1-\bar{\phi })}{\bar{r}}\), household i becomes an owner-occupier if and only if \(\epsilon _i \ge \hat{\epsilon }_i\), where \(\hat{\epsilon }_i \ge \underline{\epsilon }_i\).Footnote 20 Finally, when \(y_i \ge (1-\bar{\phi })\bar{r}^{-1}\), it is easily verified that \(h^{R*}_i=h^{O*}_i\) and \(c^{R*}_i=c^{O*}_i\), and therefore \(V^R_i({\textbf {p}}^*, \bar{\phi }) \le V^O_i({\textbf {p}}^*, \bar{\phi })\) always holds, with a strict inequality sign if and only if \(\epsilon _i>1\). The assertion then follows by letting \(\tilde{\epsilon }_i\left( \Omega \right) =\underline{\epsilon }_i\) (for all i with \(y_i<(1+\bar{r})\)) and \(\tilde{\epsilon }_i\left( \Omega \right) =\hat{\epsilon }_i\) (for all i with \( (1+\bar{r})^{-1} \le y_i < (1-\bar{\phi })\bar{r}^{-1}\)).

Proof of Proposition 2

Sufficiency. Assume \(y_\epsilon \ge \frac{1-\bar{\phi }}{\bar{r}}\), then — irrespective of whether the LTV cap is operative or not — each home buyers is not constrained in equilibrium, and thus the equilibrium pricing equation for \(q^{*}_t\) reads as

where \(z(\cdot )\) is a constant function of the equilibrium time-invariant demand for proprietary housing \(\int _{N^O}h_i^{O*}di=h^{O*}\) for \(i \in N^{O}=N_\epsilon \), as stemming from the market clearing condition, which does not depend on \(\bar{\phi }\) (all owner-occupiers are unconstrained). While (20) is apparently fulfilled when \(q^{*}_{bf}=\frac{1+\bar{r}}{\bar{r}}z(h^{O*})\) for all t (the fundamental solution), it also admits an uncountable infinite set of explosive solutions \(q^{*}_{t, b} =b_t+ q^{*}_{bf}\) with \(b_t\) satisfying