Abstract

When liquidity providers for one asset obtain information from other asset prices, this may magnify the (upward or downward) comovement of asset liquidity. It also may yield an illiquidity multiplier (Cespa and Foucault, Review of Financial Studies, 27(6), 1615–1660, 2014). We empirically test the magnitude of this illiquidity multiplier for a sample of U.S. equity real estate investment trusts (REITs) using spatial autoregressive models (Zhu and Milcheva, Journal of Real Estate Finance and Economics, 61(3), 443–475, 2018). We find significant liquidity spillovers among REITs with geographically overlapping real estate holdings. Our findings suggest that the multiplier effect impacts neighboring REITs through cross-asset learning about firm fundamentals. This effect is stronger during market turmoil, after the Decimalization (a source of exogenous variation), and for REITs headquartered in MSAs with less information asymmetry.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Liquidity comovements can be significant determinants of asset pricing and market stability. Supply-side theories, such as funding liquidity constraints (Brunnermeier & Pedersen, 2009), and demand-side theories, including correlated trading behavior (Kamara et al., 2008; Koch et al., 2016), passive investment (Feng et al., 2006; Karolyi et al., 2012), and investor sentiment (Morck et al., 2000) can explain liquidity comovements.

Cespa and Foucault (2014) propose a new mechanism for examining liquidity comovements. They argue that in addition to funding liquidity constraints and correlated demand shocks, cross-asset learning—which generates a feedback loop and illiquidity multiplier—represents an important channel of liquidity spillovers.

A major focus of this paper is the liquidity risk factor for REITs, and how the risk factors of some REITs impact the risk factor of another particular REIT. What is the risk factor for REITs? One candidate would be the risk that is specific to their underlying assets, commercial real estate (Hoesli et al., 2017).Footnote 1 The underlying real estate of REITs are transacted in the local property markets, which are highly localized and segmented and are characterized by high transaction costs, long transaction duration, and asymmetric information (Garmaise & Moskowitz, 2004). And the geography of property holdings is likely to contain private (soft) information of REIT managers regarding local property markets. Such private information is valuable to and presents profitable opportunities for equity investors (Cici et al., 2011; Cohen et al., 2021; Ling et al., 2021a, 2021b, 2022; Wang & Zhou, 2020). On the other hand, practitioners notice that many REITs tend to invest in overlapping local property markets.Footnote 2 Consistent with practitioner expectation, we find that overlapping property holdings are likely to facilitate cross-asset learning, thereby increasing REITs’ vulnerability to certain local shocks, such as shocks to top-10, and gateway, MSAs. Shocks to one or more REITs may propagate to the entire REIT market through liquidity spillovers.

We suspect that we might see these liquidity spillovers spread throughout the industry? In the context of U.S. REITs, one might consider dealers in REIT A, who are well informed about A’s risk factor. The REIT A dealers may learn information on the risk factor of another REIT (REIT B) from the price (or fundamentals) of REIT B. If the risk factor of REIT B raises its cost of liquidity provision, the price of REIT B may become less useful information to dealers in REIT A, thus increasing the risk factor of REIT A and the cost of its liquidity provision. Therefore, the price of REIT A can be a noisy signal for dealers in REIT B, which may amplify REIT B’s illiquidity.

REITs are viewed as defensive investments, which reflect their underlying real estate. However, recent research (Riddiough & Steiner, 2020) find that REITs’ balance sheets are characterized by high debt usage, especially the use of unsecured debt, which might increase the lack of financial flexibility and thereby increasing REITs’ vulnerability to market turmoil. The surge of REIT investment vehicles since the S&P 500 began including REITs and Decimalization in 2001 and recent classification of REITs as a separate asset class are likely to enhance the cross-asset learning of REITs and increase the magnitude of any liquidity multiplier.

Our research contributes to the literature in several aspects. First, we empirically test the theoretical prediction of Cespa and Foucault (2014) with spatial econometrics tools. Unlike other publicly listed firms, 75% of REIT assets are required to be real estate related assets, which are location-specific. Therefore, instead of only relying on corporate headquarters as a proxy for firm location, we utilize a comprehensive dataset of historical corporate headquarters locations and asset locations to facilitate a better understanding of firm geography.

Second, prior studies (Hoesli et al., 2017; Karolyi et al., 2012; Luo et al., 2017) on liquidity commonality mostly rely on the \({R}^{2}\)-measure, which ignores liquidity spillovers, or propagations of illiquidity risk, across different assets. We apply spatial econometrics techniques (as in Anselin, 1988) to model and measure the liquidity spillovers and the corresponding multiplier effect on the coefficients of liquidity fundamentals. Our spatial lag coefficient (ρ) captures broader economic effects than the \({R}^{2}\)-measure.

Third, we complement the findings of Ghosh et al. (1998) and Zhu and Milcheva (2018) by showing that comovements of underlying real estate properties are important to the systemic risk of real estate companies – through the channel of liquidity spillovers. That is, a shock to the illiquidity of some REITs (i.e., shock, to gateway MSAs) might propagate to other REITs because of the informative nature of REIT price declines. The outcome may be market wide illiquidity and correlated equity returns.

Finally, our results complement the literature on asset liquidity and stock liquidity (e.g., Gopalan et al., 2012). We show that property market shocks reshape REIT liquidity through cross-asset learning. The illiquidity multiplier, which arises as an outcome of liquidity comovements, significantly magnifies the liquidity (or illiquidity) of REITs that have highly overlapping asset holdings.

The remainder of this paper is organized as follows: "Literature Review" section reviews existing literature; "Spatial Autoregressive Model and Liquidity Multiplier" section illustrates the construction of spatial lags and the mechanism of the liquidity multiplier; "Data" section provides a discussion of the data and the construction of the variables; "Spatial Weights Matrix" section presents the construction of spatial weights matrix; "Spatial Autoregressive Model Estimations" section exhibits the empirical results and a discussion of those implications; and, "Conclusions" section concludes the paper and suggests future works.

Literature Review

Recent findings suggest that assets’ liquidity vary with economic conditions and across geographic locations. Loughran and Schultz (2005) find that after adjusting for size and other factors, the shares of rural firms trade much less often than urban firms (i.e., firms located in the 10 largest MSAs in terms of total population). Their finding suggests that access to locality information and social factors can also affect cross-sectional liquidity. Bernile, Korniotis, et al. (2015), Bernile, Kumar, et al. (2015)) examine whether state- and MSA-level economic conditions affect the liquidity of stocks issued by local firms. They find that liquidity of local stocks is positively associated with performance of the local economy.

Several studies have explored the mechanisms of liquidity commonality.Footnote 3 On the supply side, when there is a large loss on initial position and funding liquidity constraints of liquidity providers (i.e., margin goes up), the provision of liquidity across many securities falls and commonality increases (Brunnermeier & Pedersen, 2009; Glascock & Lu-Andrews, 2014; Jensen & Moorman, 2010; Næs et al., 2011). On the demand side, correlated trading behavior (Kamara et al., 2008; Karolyi et al., 2012; Koch et al., 2016), passive investment (Morck et al., 2000), and investor sentiment are all likely explanations for liquidity commonality. Luo et al. (2017) are the first to analyze the effect of home ownership on local liquidity commonality. They find that the effect of high home ownership significantly increases local liquidity commonality for less-liquid stocks.

One empirical challenge of examining firm-level price/liquidity spillovers is the measurement of firm location. The conventional finance literature has widely adopted corporate headquarters as firm locations because corporate headquarters are the center of information exchange between a firm and its suppliers, service providers, and investors (Davis & Henderson, 2008; Pirinsky & Wang, 2006). However, recent papers have deviated from this argument by showing that the geography of underlying assets is also informative to investors (Bernile, Korniotis, et al., 2015; Bernile, Kumar, et al., 2015; Landier et al., 2009). This evidence is especially true for REITs since the underlying real estate assets held by REITs are location-specific, and acquisitions and dispositions might reveal strategic actions of REITs (Ling et al., 2022; Ling, Naranjo, et al., 2021; Ling, Wang, et al., 2021).

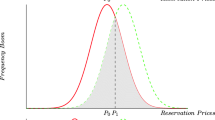

The most relevant works to our paper are Cespa and Foucault (2014) and Hoesli et al. (2017). Cespa and Foucault (2014) lay the theoretical framework for the illiquidity multiplier. They express the liquidity multiplier as \(\kappa\equiv\left(1-\varnothing\right)^{-1}\), where \(0<{\phi } <1\) and \(\kappa \ge 1\). \({\phi }\) is the magnitude of liquidity spillovers of asset j and the other assets -j. When the equilibrium is unique, idiosyncratic shocks to the illiquidity of asset j induce positive comovements in the illiquidity of both assets. As a result, the OLS estimation of the coefficient of liquidity fundamentals would underestimate the true (total) effect by a multiplier of \(\kappa\). However, empirical calibration of \(\kappa\) remains a challenge.Footnote 4

Hoesli et al. (2017) empirically tested the asset pricing model of Acharya and Pedersen (2005) and find that commonality with the underlying property market represents a significant risk factor for REIT returns but the effect is time-varying and asymmetric – i.e., the effect only exists during market downturns. However, their results are based on the \({R}^{2}\) measure, which assumes independence of the illiquidity of firms.

Spatial econometrics techniques have been employed to study the cross-section of asset returns (Zhu & Milcheva, 2018) and optimal capital usage (Wang et al., 2019). Zhu and Milcheva (2018) are among the first to explore the linkages between returns on listed real estate stocks (mainly REITs) and the location of the underlying assets, or the real estate properties. They show that the extent of spatial comovements across the underlying assets explain the cross-sectional variation of real estate abnormal returns and thereby contain valuable price information. Wang et al. (2019) focus on common stocks and find that there is evidence of competition for scarce capital across U.S. states and MSAs; their study utilizes the spatial autoregressive model in estimating the extent of competition.

Spatial Autoregressive Model and Liquidity Multiplier

We use Spatial autoregressive model (hereby SAR model) to empirically examine the magnitude of liquidity spillovers proposed by Cespa and Foucault (2014). The SAR model is an approach to model the idea of spatial spillovers, where levels of the outcome variable y (i.e., liquidity of a particular REIT, in our case) may depend on the levels of y in neighboring geographic units, and other control variables. Within the context of liquidity spillovers, common forms of a SAR model can be expressed as follows, respectively.Footnote 5

where Y represents an N × T by 1 vector of REIT-level ILLIQ and X represents an N × T by k matrix of liquidity fundamentals, where N is the number of REITs, T the number of time periods covered by the data, and k is the number of explanatory variables in the matrix X. W is the N × T by N × T spatial weights matrix which captures commonality of underlying real estate properties. \(WY\) is a matrix of spatial lags, and it represents the weighted average of other jurisdictions' endogenous variable (e.g., ILLIQ). It has been shown (Kelejian & Prucha, 1998) that Eq. (1) can be estimated by an instrumental variables techniques.Footnote 6 For Eq. (1), \(X\) is the appropriate instrument for itself, and \(WX\) is the instrument for \(WY\). The spatial coefficient parameter estimate, \(\widehat{\rho }\), represents the magnitude of liquidity comovements.

To illustrate the spatial multiplier effect, consider a simplified example with only two REITs, Equity Residential (Ticker: EQR) and Essex Property Trust (Ticker: ESS), in one quarter, t. Suppose X is MB and Y is ILLIQ. Then the two rows of observations in Eq. (1) would be written as:

Based on these two equations, a 1% increase in \({Market-to-book}_{EQR}\) leads to a \(\beta \mathrm{\%}\) rise (if \(\beta\) >0) or fall (if \(\beta\) <0) in Log(Amihud’s illiquidity)EQR. But this change in Log(Amihud’s illiquidity)EQR leads to a \(\rho \beta \mathrm{\%}\) change in Log(Amihud’s illiquidity)ESS, which this leads to another \({\rho }^{2}\beta \%\) change in Log(Amihud’s illiquidity)EQR, and so on and so forth. This liquidity multiplier effect is just \([1+\rho +{\rho }^{2}+{\rho }^{3}+\dots ]\) and assuming -1< \(\rho\) < 1, can be expressed as \(\frac{1}{1-\rho }\). Note that this expression is the same as \(K\equiv\left(1-\varnothing\right)^{-1}\) derived in Cespa and Foucault (2014). It is straightforward to generalize this to the case involving multiple REITs. Using the example from Column (2), Table 3 below, if the direct effect on Market-to-book, \({\beta }_{Market-to-book}=0.221, \rho =0.116\), then the total effect (including the liquidity multiplier effect) is \(0.221\times \frac{1}{1-\left(0.116\right)}\approx 0.250\). Had we ignored the liquidity multiplier effect, this would have led to an underestimation of the impact by approximately 12% and a clear violation of Stable Unit Treatment Value Assumption (SUTVA).Footnote 7

Data

There are 156 REITs in our sample, and the time periods range from the first quarter of 1995 through the fourth quarter of 2014 (we have an unbalanced panel). Summary statistics are presented in Table 1 and variable definitions are in the Appendix. The pairwise correlations of dependent and independent variables are shown in Table 2, with stars indicating statistical significance at the 1% level.

We use the natural logarithm of Amihud Illiquidity, ILLIQ, to proxy for market liquidity of a particular REIT. ILLIQ is computed as the logarithm of the average of quarterly average of absolute daily return to the product of absolute daily price and daily volume. It can be interpreted as the daily price response associated with one dollar of trading volume. The intuition is that over time, the ex-ante stock excess return is increasing in the expected illiquidity of the market (Amihud, 2002).

Specifically, for individual REIT i in quarter q,

where \({D}_{i,q}\) represents the trading days available for firm i within a quarter q, \({R}_{i,s,q,d}\) is the daily stock return, \({Vol}_{i,s,q,d}\) is the daily trading volume. ILLIQ in our sample has a mean (median) of -5.51 (-5.71). Cannon and Cole (2011) documented that REITs’ Amihud Illiquidity ranges between 0.002 and 0.147 from 1994 through 2007, which translates into an ILLIQ of -6.215 to -1.917 based on log transformation.

REIT historical headquarters addresses are obtained from the Compustat Snapshot quarterly database (historical addresses). The Compustat items add1, city, state, addzip correspond to the street address, city, state, and zipcode of a particular REIT’s headquarters location. We also obtain the current REIT headquarter location from the Compustat quarterly database (current addresses). Both datasets are geocoded in the TAMU geocoding database to identify the latitude and longitude coordinates and the core-based statistical area (CBSA) code of the REIT headquarters, as well as an indicator variable of whether or not the CBSA is a micro area.Footnote 8 Finally, we merge both datasets and we identify any relocations. We replace all the current headquarters addresses with historical addresses prior to the relocation date. Property characteristics and latitude and longitude coordinates are obtained from the SNL Real Estate. We then use the latitude and longitude coordinates of the REIT headquarters and their underlying real estate properties to calculate the great circle distance.

Our control variables are similar to Gopalan et al. (2012). Gopalan et al. (2012) predict that larger asset liquidity (e.g., WAL1) reduces uncertainty regarding assets in place, but also facilitates more future investments, thereby increasing the level of uncertainty. Therefore, the effect of WAL1 on REIT liquidity depends on which of the two opposite effects dominates. It is worthwhile noticing that the level of investments (MB) decreases the relationship between WAL1 and REIT liquidity, and we control for this in our empirical model. Other control variables include firm size (MKTCAP), leverage (LEVERAGE), profitability (ROA), momentum (MOM), and return volatility (RETVOL). Except for return volatility, all other variables are associated with better firm performance and less uncertainty, thereby improving REIT liquidity.

Correlation matrix in Table 2 confirms our conjectures. Most variables are negatively associate with ILLIQ at 1% statistical level. RETVOL is positively correlated with ILLIQ. Interestingly, we find WAL and CASH to be positively correlated with ILLIQ. Said it differently, more cash and liquid asset holdings by a typical REIT translate into larger illiquidity of its listed shares. This finding contrasts with the negative relation for non-financial firms documented in Gopalan et al. (2012). Since REITs are widely deemed as a public pass-through structure (Titman, 2017) with regulated payout ratio, a REIT with large cash hoard might be less attractive to the investors, thus resulting in less liquid shares.

Spatial Weights Matrix

We perform our analysis using a sample of 156 U.S.-based REITs from 1995 through 2014. Our spatial weights matrix is constructed following a similar approach to Zhu and Milcheva (2018). We first calculate the distance, \({d}_{i,l,j,k,t}\) between property l of firm i in year t and property (or headquarters) k of firm j in year t. For simplicity, consider Equity Residential (EQR) and Essex Property Trust (ESS) as an example. EQR and ESS hold 299 and 251 properties, respectively, by the end of 2014. The geographic distributions of their property holdings are shown in Fig. 1. Then the first step would be to generate 150,648 observations (299 × 252 + 251 × 300, since EQR has 300 locations including its headquarters, and ESS has 252 including its headquarters).

Equity Residential (EQR) vs. Essex Property Trust (ESS). This figure shows the geographic distribution of the underlying properties of two REITs, Equity Residential (EQR) and Essex Property Trust (ESS). Properties held by EQR is in red color and properties held by ESS is in blue. Panel A shows the nationwide distribution. Panels B, C, and D show the geographic overlap of properties held by EQR and ESS in Seattle, San Francisco, and Los Angeles & San Diego markets, respectively.

In the second step, we aggregate across the distances for property l of firm i in year t. Specifically, for property l of firm i in year t, the aggregated distance is expressed as the minimum of distances calculated in the first step,

and the same holds for property k of REIT j in year t. Continuing from our previous example, after the second step, we would expect 550 observations (299 + 251).

In order to convert the aggregated distances into contiguity matrices, we calculate the proportion of properties of firm i that are regarded as ‘neighbors’ to firm j, and vice versa. The benchmark we choose for a neighbor is within 25 km.Footnote 9 The outcome can be viewed as the extent of geographic overlap of assets held by firm i and j.

We first construct a dummy variable that indicates whether or not property l of firm i is less than 25 km away from at least one of the properties held by firm j or firm j’s headquarters.

Then we calculate the proportion of properties of firm i that are regarded as ‘neighbors’ to firm j and vice versa,

where \({L}_{t}\) is the total number of properties held by firm i in year t. Finally, the spatial weights for firm i and firm j is:

In our previous example, most of EQR’s property holdings are in major metropolitan areas (e.g. Boston, New York, Washington, D.C., Seattle, San Francisco, Los Angeles, San Diego) along both the west and east coasts. However, ESS’s property holdings are mostly in the west coast (e.g. Seattle, San Francisco, Los Angeles, San Diego) and highly overlap with EQR’s property holdings. Therefore, EQR’s property holdings are more disperse than those of ESS. And one would expect \({w}_{i,l,j,t}\) of ESS (probably close to 1) to be higher than that of EQR. Consistent with our conjecture, while 49.71% of EQR’s underlying properties are within 25 km to any of ESS’s properties and/or its headquarters, 96.41% of ESS’s underlying properties are within 25 km to any of EQR’s properties and/or its headquarters. In accordance with Eq. (7), we keep \({w}_{j,k,i,t}\) of EQR (the minimum of the two proportions, 49.71%) as the spatial weights of EQR-ESS pair in our two-company world example. These panels are balanced throughout each year. We row-standardize the spatial weights matrix so that for each firm i, \(\sum_{j}{w}_{i,j,t}=1\). For each REIT i, the spatial lagged (dependent or independent) variable, \({W\_VAR}_{i}\) is calculated as the weighted average of the \({VAR}_{-i}\) of all the other companies -i in the same cross-section (i.e., quarter t), \(\sum_{j}{w}_{i,-i,t}\cdot {VAR}_{-i,t}\).

Spatial Autoregressive Model Estimations

Time Series Trend in Spatial Coefficients

In a few minutes after 2:30 p.m. on May 6, 2010, limited order books for multiple asset classes suddenly became very thin. The 2010 “flash crash” leads to a sudden market-wide evaporation of liquidity and plummeted security prices. REITs (e.g., EQR) were no exception. For instance, the largest decline in EQR’s share price prior to the “flash crash” was 41.15% (Ivanov, 2013). Surging volatility, as well as decline in price informativeness, significantly constrained liquidity providers’ ability to supply liquidity, which further exacerbated marketwise illiquidity and price uncertainty. Therefore, the declining share price and drop in liquidity are likely due to liquidity suppliers’ decision to curtail their provision of liquidity by cancelling limit orders rather than correlated demand shocks (Borkovec et al., 2010; Hameed et al., 2010; Cespa & Foucault, 2014). In this subsection, we examine the conjecture that illiquidity contagion, or the magnitude of the spatial coefficient, \(\rho\), peaked during periods with large price uncertainty, which coincided with recessions.

Methodology

For each year, we estimate the following cross-sectional IV regression:

-

Stage 1:

$$\begin{array}{l}W\_{ILLIQ}_{i}={\gamma }_{0}+{\gamma }_{1}W\_{RETVOL}_{i}+{\gamma }_{2}W\_{MOM}_{i}+\\ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ {\gamma }_{3}W\_{LEVERAGE}_{i}+{\gamma }_{4}W\_{MB}_{i}+{\gamma }_{5}W\_{MKTCAP}_{i}+\\ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ {\gamma }_{6}W\_{ROA}_{i}+{\gamma }_{7}W\_{CASH}_{i}+{\gamma }_{8}W\_{WAL1}_{i}+{\varepsilon }_{i}\end{array}$$(8) -

Stage 2:

$$\begin{array}{l}{ILLIQ}_{i}={\beta }_{0}+\rho \widehat{W\_{ILLIQ}_{i}}+{\beta }_{1}{RETVOL}_{i}+{\beta }_{2}{MOM}_{i}+\\ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ {\beta }_{3}{LEVERAGE}_{i}+{\beta }_{4}{MB}_{i}+{\beta }_{5}{MKTCAP}_{i}+{\beta }_{6}{ROA}_{i}\\ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ +{\beta }_{7}{CASH}_{i}+{\beta }_{8}{WAL1}_{i}+{\varepsilon }_{i}\end{array}$$(9)

where the spatial coefficient, \(\rho\), is the coefficient of interest for liquidity spillovers. In other words, it is the coefficient estimate on the spatial lags of the dependent variable (ILLIQ).

We also estimate the conventional R2-based measure of liquidity commonality (Karolyi et al., 2012; Luo et al., 2017) with the following regression:

Consistent with Luo et al. (2017), we regress the daily, d, stock liquidity (ILLIQ) of a REIT, i, against lead, current, and lag values on the equally weighted liquidity of all REIT stocks in our sample to capture market-wide liquidity (ILLIQm) on an annual, t, basis and record the corresponding R2 values.

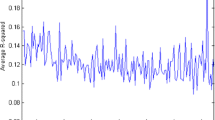

We plot \(\rho\) and R2 for each year in Fig. 2. Consistent with the literature on liquidity commonality and liquidity dry-up (Hoesli et al., 2017; Karolyi et al., 2012), we find that our spatial coefficient, \(\rho\), peaked when the economy was in turmoil. Moreover, the time-series trend in the spatial coefficient offers more stable predictions on illiquidity contagion than and the conventional measure, R2, during periods of liquidity dry-up (e.g., the “2010 Flash Crash”). Therefore, the spatial coefficient might contain the information of both the R2-based measure and the cross-asset learning channel (Cespa & Foucault, 2014) of liquidity commonality, which takes effect through an illiquidity multiplier during extreme market conditions. The four recessions corresponding to the peaks of \(\rho\) are the 1997 Asian Financial Crisis, 2001 Dot-com bubble, 2008 Financial Crisis, and 2011 European Sovereign Debt Crisis.

Time-series trend of spatial coefficients. This figure is the plot of the annual spatial coefficients (ρ) estimated from Eq. (9) and the annual R-squared-based measure (R2) from Eq. (10). ρ is the coefficient of the fitted value of the spatial lags of ILLIQ estimated from Eq. (8). Peaks are corresponding to 1997 Asian Financial Crisis, 2001 Dot-com bubble, 2008 Financial Crisis, and 2011 European Sovereign Debt Crisis.

Firm-Level Spatial Analysis of REIT Liquidity

Our findings from above suggests that the magnitude of illiquidity contagion varies over time. Without more rigorous regression analysis, we are not able to conclude that the explanatory power of spatial coefficient is not undermined nor consumed by time-constant and/or time-varying unobserved effects. In particular, the drop in liquidity during the 2010 “flash crash” appeared to be more severe for certain property types (e.g., residential), certain REITs (e.g., large REITs). Therefore, we employ pooled-OLS and panel regressions to mitigate potential confounding effects.

Methodology

In Table 3, columns (1) and (2), we are estimating the following pooled-OLS/panel IV model. We estimate the fitted value of the spatial lags of independent variable at Stage 1, then use the fitted value as our main test variable of interest in Stage 2.

-

Stage 1:

$$\begin{array}{l}W\_{ILLIQ}_{i,t}={\gamma }_{0}+{\gamma }_{1}W\_{RETVOL}_{i,t}+{\gamma }_{2}W\_{MOM}_{i,t}+{\gamma }_{3}W\_{LEVERAGE}_{i,t}\\ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ +{\gamma }_{4}W\_{MB}_{i,t}+{\gamma }_{5}W\_{MKTCAP}_{i,t}+{\gamma }_{6}W\_{ROA}_{i,t}\\ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ +{\gamma }_{7}W\_{CASH}_{i,t}+{\gamma }_{8}W\_{WAL1}_{i,t}+{\alpha }_{i}+{{\theta }_{p}+\tau }_{t}\end{array}$$(11) -

Stage 2:

$$\begin{array}{l}{ILLIQ}_{i,t}={\beta }_{0}+\rho \widehat{W\_{ILLIQ}_{i,t}}+{\beta }_{1}{RETVOL}_{i,t}+{\beta }_{2}{MOM}_{i,t}+\\ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ {\beta }_{3}{LEVERAGE}_{i,t}+{\beta }_{4}{MB}_{i,t}+{\beta }_{5}{MKTCAP}_{i,t}+{\beta }_{6}{ROA}_{i,t}\\ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ +{\beta }_{7}{CASH}_{i,t}+{\beta }_{8}{WAL1}_{i,t}+{\alpha }_{i}+{\theta }_{p}+{\tau }_{t}\end{array}$$(12)

where the spatial coefficient, ρ, is the coefficient of interest for liquidity spillovers. Equation (11) and (12) are IV estimations based on an unbalanced panel dataset. To control for cross-sectional and time-series heterogeneity, we include REIT/major property type fixed effects and quarter fixed effects. We also cluster standard errors at REIT level.

All else being equal, we find significant market liquidity comovements among REITs with highly overlapping property holdings. The magnitude of liquidity comovement in our research is very similar to that of REIT return comovement (Zhu & Milcheva, 2018). In Column (1) and (2), the coefficient on the fitted spatial lags of ILLIQ, ρ, ranges from 0.116 to 0.118 depending on the model specification and is positive and significant. As we illustrated above, the spatial multiplier effect on coefficient estimates is \(\frac{1}{1-\rho }\), which is equal to 1.13. The direct effect with pooled-OLS or panel regressions underestimates the true coefficients by 12%. This underestimation is also economically meaningful. For instance, the coefficient (direct effect) on MKTCAP is -1.307 (-1.279) estimated from pooled-OLS (panel) regression analysis. Therefore, all else equal, one standard deviation increase in market capitalization would lead to a 74% (73%) decline in Amihud illiquidity.Footnote 10 However, the total effect should be 78% (77%).

Estimated coefficients on the control variables are consistent with those for conventional firms reported in Gopalan et al. (2012). Control variables that are associated with less uncertainty of future cash flows negatively predicts ILLIQ. Return volatility and Market-to-book ratio are positively correlated with ILLIQ because variations in stock returns and large number of growth opportunities increase the uncertainty of future cash flows, thereby increasing the illiquidity of a REIT. Within the context of REITs, higher WAL1 appears to be associated with higher illiquidity. Taken together, our results provide evidence of enhanced cross-asset learning (knowledge spillovers) of REITs with similar fundamental characteristics (Cespa & Foucault, 2014). This positive spillover effect is robust to time-constant and time-varying unobserved effects.

Does Local Information Environment Explain the Liquidity Multiplier Effect?

Thus far, our results support the conjecture that liquidity providers of a particular REIT i derive price information from the fundamentals of REIT i and other REITs –i. We show that the magnitude of cross-asset learning is positively affected by the price informativeness of alternative assets. Next, we examine how cross-asset learning responds to variations in information environment due to cross-sectional heterogeneity and structural changes in equity market.

Ling, Naranjo, et al. (2021), Ling, Wang, et al. (2021)) and Loughran and Schultz (2005) documented that firms headquartered in top-10/gateway MSAs enjoy higher stock liquidity because they have better information environment than the other firms. Moreover, Ling Naranjo, and Scheick (2021), Ling, Wang, et al. (2021)) argue that home concentration of firms’ underlying properties can affect returns on investor portfolios. They find that monthly return on an equally-weighted portfolio of high home concentration REITs outperforms the return of low home concentration portfolio by 40 basis points after controlling for potential confounding factors.

Structural changes in security markets might significantly alter information environment. For instance, Bernile, Korniotis, et al. (2015), Bernile, Kumar, et al. (2015)) show that the advent of Decimalization significantly improves the predictability of stock liquidity, especially in locations with scarcer liquidity to begin with (e.g., rural states).Footnote 11 Taken together, we predict that the spatial coefficient is positively correlated with events and proxies that capture better information environment, including more accessible locations of REIT management teams (headquarters) and REIT underlying assets (real properties), and the Decimalization.

Methodology

Similar to Eqs. (11) and (12), we estimate the following pooled-OLS/panel IV model, but with interactions between lagged ILLIQ and alternative dummy variables that capture local information environment.

-

Stage 1:

$$\begin{array}{l}\left[\begin{array}{c}W\_IL{LIQ}_{i,t}\\ {Dum}_{i,t}\times W\_{ILLIQ}_{i,t}\end{array}\right]={\gamma }_{0}+\sum_{i=1}^{8}{\gamma }_{i}W\_{Control}_{i,t}+\sum_{j=1}^{8}{\varphi }_{j}{Dum}_{i,t}\times \\ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ W\_{Control}_{i,t}+{\alpha }_{i}+{\theta }_{p}+{\tau }_{t}\end{array}$$(13) -

Stage 2:

$$\begin{array}{l}{ILLIQ}_{i,t}={\beta }_{0}+{\rho }_{1}\widehat{W\_{ILLIQ}_{i,t}}+{\rho }_{2}\widehat{{Dum}_{i,t}\times W\_{ILLIQ}_{i,t}}+{\beta }_{1}{Dum}_{i,t}\\ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ +{\beta }_{2}{RETVOL}_{i,t}+{\beta }_{3}{MOM}_{i,t}+{\beta }_{4}{LEVERAGE}_{i,t}+{\beta }_{5}{MB}_{i,t}\\ \begin{array}{l} \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ +{\beta }_{6}{MKTCAP}_{i,t}+{\beta }_{7}{ROA}_{i,t}+{\beta }_{8}{CASH}_{i,t}+{\beta }_{9}{WAL1}_{i,t}\\ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ +{\alpha }_{i}+{\theta }_{p}+{\tau }_{t}\end{array}\end{array}$$(14)

The difference between the pair of Eqs. (13) and (14) and the pair of Eqs. (11) and (12) is that in the former pair, we include interactions between the spatial lags of ILLIQ and independent variables and URBAN, GATEWAY, or High HOMECON. We include these interactions to examine how liquidity spillovers respond to cross-sectional variations in an information environment.

Consistent with the prior research, we find that the positive spillover effect is stronger for REITs located in top-10/gateway MSAs. For instance, in Table 3, column (3), all else equal, REITs headquartered in urban (top-10) MSAs have a spatial coefficient of 0.163 (0.105 + 0.0579), which is much larger than that of their non-urban counterparts (0.105). We find consistent evidence in column (4) when panel regression is employed instead of pooled-OLS regression. Similarly, REITs headquartered in the six gateway MSAs have a spatial coefficient ranges 0.164 to 0.166 depending on model specification. We expect this resemblance since URBAN and GATEWAY are highly correlated (0.66).

We complement Ling, Naranjo, et al. (2021), Ling, Wang, et al. (2021)) by showing that REITs with high home concentration tend to have stronger liquidity spillover effect because of less information asymmetry. As reported in columns (7) and (8), the spatial coefficient for high home concentration REITs is 0.131 (0.133) when pooled-OLS (panel) regression is employed, which is much larger than 0.106 (0.108) for low home concentration REITs. Our results in this subsection indicate that REITs with less discrete management teams and underlying assets enjoy better information environment, which in turn facilitate and enhance cross-asset learning among liquidity providers.

Liquidity Comovement and the Decimalization

Finally, we use structural change in NASDAQ to identify the link between liquidity spillover effect and cross-asset learning. The Decimalization in April 2001 significantly altered the information environment of all listed shares. It is unlikely to be affected by any factors specific to REITs, thereby presenting a source of exogenous variation in information environment of REITs. If the spatial coefficient estimates become larger after the completion of the Decimalization, we might argue that liquidity spillover effect is information-driven.

The model setup is the same as Eqs. (11) and (12) and the results are reported in Table 4. The cutoff date is the Decimalization (second quarter of 2001). We first estimate a pooled-OLS regression. Results for pre- and post-Decimalization subperiods are reported in columns (1) and (2), respectively. We show that the liquidity spillover effect becomes much stronger following the completion of the Decimalization. The spatial coefficient is negative and insignificant (-0.099) before the Decimalization took place and is positive and significant at 1% statistical level (0.241) during the post-Decimalization period. We find similar evidence in the last two columns using panel regression analysis. Our results in Table 4 support an information-driven liquidity spillover effect.

Conclusions

We examine the liquidity spillovers of REITs due to geographically overlapping property holdings. Consistent with Cespa and Foucault (2014)’s prediction, we find that cross-asset learning is an important channel of REIT liquidity spillovers. We find that idiosyncratic shocks to the liquidity fundamentals propagate to other REITs through cross-asset learning. Such liquidity spillovers magnify the comovements of REIT liquidity by generating a multiplier effect on the coefficient estimates of liquidity fundamentals. This underscores the importance of using spatial modeling to avoid downward biased estimates of liquidity fundamentals on REIT liquidity.

Our empirical results show that liquidity spillovers are stronger among REITs headquartered in top-10 and gateway MSAs, REITs that hold greater proportion of underlying real estate close to their headquarters, and for REITs during market turmoil. These results indicate that cross-asset learning about property-level private (soft) information shapes the market liquidity of REITs at firm level. We adopt different definitions and cutoff points from Gupta et al. (2017) and Zhu and Milcheva (2018) for our spatial weights matrix to check the robustness of our results.

We also find that the Decimalization introduced exogenous variation in the information environment of the U.S. equity markets, which in turn strengthened cross-asset learning and enhanced the liquidity spillovers among REITs.

Notes

The underlying assets of REITs are predominantly commercial real estate. For instance, according to NAREIT, “at least 75 percent of a REIT's assets must consist of real estate assets such as real property or loans secured by real property”.

Seeking Alpha website wrote in June 7th, 2016: “… over the last year Essex Property Trust (ESS) has adopted a strategy similar to Equity Residential (EQR), moving its portfolio closer to tenant desired features like Whole Foods Market”. Also, in this article “… we see value in comparing EQR to Essex Property Trust (NYSE: ESS) due to an increasing geographic overlap between the two REIT portfolios”.

Karolyi, Lee, and Van Dijk (2012) provide an excellent survey of existing explanations for liquidity commonality and empirically test them using international data.

Cespa and Foucault (2014): “it would be interesting to measure empirically the strength of liquidity spillovers across asset classes… Another interesting issue is how the number of assets affects the amplification mechanism described in our paper and whether some assets are more pivotal for liquidity spillovers, because their prices are followed by more dealers or because their payoff structure makes them informative about a large number of assets”.

(Cohen, 2010).

Based on Gershgorin’s Theorem (Cohen, 2002), spatial lags of dependent variables are valid instruments for spatial lags of independent variable.

SUTVA requires that “the (potential outcome) observation on one unit should be unaffected by the particular assignment of treatments to the other units” (Cox, 1958). One of the assumptions of SUTVA is that spillovers, or indirect effects, across units do not exist (Wang, Cohen, and Glascock, 2019).

Based on 2010 Census, the United States has 929 CBSAs, including 380 metropolitan statistical areas (MSAs) and 541 micropolitan statistical areas (μSAs).

In an unreported analysis, we also constructed spatial weights matrices using 10, 50, 75, and 100 km as alternative benchmarks. The results are similar and are not sensitive to how we define the benchmark.

The mean (standard deviation) of market capitalization is 2,089 (3,691). Since both Amihud illiquidity and market capitalization are log transformed, one standard deviation increase in the market capitalization would lead to \(1-{(1+\frac{\mathrm{3,691}}{\mathrm{2,089}})}^{\beta }\) change in Amihud illiquidity.

Investopedia wrote: “The U.S. Securities and Exchange Commission (SEC) ordered all stock markets within the U.S. to convert to decimalization by April 9, 2001, and all price quotes since appear in the decimal trading format… The switch was made to decimalization to conform to standard international practices and to make it easier for investors to interpret and react to changing price quotes”.

References

Acharya, V. V., & Pedersen, L. H. (2005). Asset pricing with liquidity risk. Journal of Financial Economics, 77(2), 375–410.

Amihud, Y. (2002). Illiquidity and stock returns: Cross-section and time-series effects. Journal of Financial Markets (Amsterdam, Netherlands), 5(1), 31–56.

Anselin, L. (1988). Spatial econometrics: methods and models. Kluwer Academic Publishers.

Bernile, G., Korniotis, G., Kumar, A., & Wang, Q. (2015a). Local business cycles and local liquidity. Journal of Financial and Quantitative Analysis, 50(5), 987–1010.

Bernile, G., Kumar, A., & Sulaeman, J. (2015b). Home away from Home: Geography of Information and Local Investors. Review of Financial Studies, 28(7), 2009–2049.

Borkovec, M., Domowitz, I., Serbin, V., & Yegerman, H. (2010). Liquidity and price discovery in exchange-traded funds: One of several possible lessons from the flash crash. Journal of Index Investing, 1(2), 24–42.

Brunnermeier, M. K., & Pedersen, L. H. (2009). Market liquidity and funding liquidity. Review of Financial Studies, 22(6), 2201–2238.

Cannon, S. E., & Cole, R. A. (2011). Changes in REIT liquidity 1988–2007: Evidence from daily data. Journal of Real Estate Finance and Economics, 43(1), 258–280.

Cespa, G., & Foucault, T. (2014). Illiquidity contagion and liquidity crashes. Review of Financial Studies, 27(6), 1615–1660.

Cici, G., Corgel, J., & Gibson, S. (2011). Can fund managers select outperforming REITs? Examining fund holdings and trades. Real Estate Economics, 39(3), 455–486.

Cohen, J. P. (2002). Reciprocal state and local airport spending spillovers and symmetric responses to cuts and increases in federal airport grants. Public Finance Review, 30(1), 41–55.

Cohen, J. P. (2010). The broader effects of transportation infrastructure: Spatial econometrics and productivity approaches. Transportation Research Part e: Logistics and Transportation Review, 46(3), 317–326.

Cohen, J., Barr, J., & Kim, E. (2021). Storm surges, informational shocks, and the price of urban real estate: An application to the case of Hurricane Sandy. Regional Science and Urban Economics, 90, 103–694.

Cox, D. R. (1958). Planning of experiments. Wiley.

Davis, J. C., & Henderson, J. V. (2008). The agglomeration of headquarters. Regional Science and Urban Economics, 38(5), 445–460.

Feng, Z., Ghosh, C., & Sirmans, C. F. (2006). Changes in REIT stock prices, trading volume and institutional ownership resulting from S&P REIT index changes. Journal of Real Estate Portfolio Management, 12(1), 59–71.

Garmaise, M. J., & Moskowitz, T. J. (2004). Confronting information asymmetries: Evidence from real estate markets. Review of Financial Studies, 17(2), 405–437.

Ghosh, C., Guttery, R. S., & Sirmans, C. F. (1998). Contagion and REIT stock prices. Journal of Real Estate Research, 16(3), 389–400.

Glascock, J., & Lu-Andrews, R. (2014). An examination of macroeconomic effects on the liquidity of REITs. The Journal of Real Estate Finance and Economics, 49(1), 23–46.

Gopalan, R., Kadan, O., & Pevzner, M. (2012). Asset liquidity and stock liquidity. Journal of Financial and Quantitative Analysis, 47(2), 333–364.

Gupta, A., Kokas, S., & Michaelides, A. (2017). Credit market spillovers: Evidence from a Syndicated Loan. Working Paper.

Hameed, A., Kang, W., & Viswanathan, S. (2010). Stock market declines and liquidity. Journal of Finance, 65(1), 257–293.

Hartzell, J., Sun, L., & Titman, S. (2014). Institutional investors as monitors of corporate diversification decisions: Evidence from real estate investment trusts. Journal of Corporate Finance (Amsterdam, Netherlands), 25, 61–72.

Hoesli, M., Kadilli, A., & Reka, K. (2017). Commonality in liquidity and real estate securities. Journal of Real Estate Finance and Economics, 55(1), 65–105.

Ivanov, S. I. (2013). Analysis of REITs and REIT ETFs cointegration during the flash crash. Journal of Accounting and Finance, 13(4), 74–82.

Jensen, G. R., & Moorman, T. (2010). Inter-temporal variation in the illiquidity premium. Journal of Financial Economics, 98(2), 338–358.

Kamara, A., Lou, X., & Sadka, R. (2008). The divergence of liquidity commonality in the cross-section of stocks. Journal of Financial Economics, 89(3), 444–466.

Karolyi, G. A., Lee, K. H., & Van Dijk, M. A. (2012). Understanding commonality in liquidity around the world. Journal of Financial Economics, 105(1), 82–112.

Kelejian, H. H., & Prucha, I. R. (1998). A generalized spatial two-stage least squares procedure for estimating a spatial autoregressive model with autoregressive disturbances. Journal of Real Estate Finance and Economics, 17(1), 99–121.

Koch, A., Ruenzi, S., & Starks, L. (2016). Commonality in liquidity: A demand-side explanation. Review of Financial Studies, 29(8), 1943–1974.

Landier, A., Nair, V. B., & Wulf, J. (2009). Trade-offs in staying close: Corporate decision making and geographic dispersion. Review of Financial Studies, 22(3), 1119–1148.

Ling, D. C., Naranjo, A., & Scheick, B. (2021a). There’s no place like home: Local asset concentration, information asymmetries and commercial real estate returns. Real Estate Economics, 49(1), 36–74.

Ling, D., Wang, C., & Zhou, T. (2021b). The geography of real property information and investment: Firm location, asset location and institutional ownership. Real Estate Economics, 49(1), 287–331.

Ling, D., Wang, C., & Zhou, T. (2022). Asset productivity, local information diffusion, and commercial real estate returns. Real Estate Economics, 50(1), 89–121.

Loughran, T., & Schultz, P. (2005). Liquidity: Urban versus rural firms. Journal of Financial Economics, 78(2), 341–374.

Luo, J., Xu, L., & Zurbruegg, R. (2017). The impact of housing wealth on stock liquidity. Review of Finance, 21(6), 2315–2352.

Morck, R., Yeung, B., & Yu, W. (2000). The information content of stock markets: Why do emerging markets have synchronous stock price movements? Journal of Financial Economics, 58(1–2), 215–260.

Næs, R., Skjeltorp, J., & Ødegaard, B. (2011). Stock market liquidity and the business cycle. The Journal of Finance, 57(3), 1171–1200.

Pirinsky, C., & Wang, Q. (2006). Does corporate headquarters location matter for stock returns? Journal of Finance, 61(4), 1991–2015.

Riddiough, T. J., & Steiner, E. (2020). Financial flexibility and manager-shareholder conflict. Real Estate Economics, 48(1), 200–239.

Titman, S. (2017). Does Ownership Structure Matter? European Financial Management : The Journal of the European Financial Management Association, 23(3), 357–375.

Wang, C., & Zhou, T. (2020). Trade-offs between asset location and proximity to home: Evidence from REIT property sell-offs. Journal of Real Estate Finance and Economics, 63(1), 82–121.

Wang, C., Cohen, J. P., & Glascock, J. L. (2019). Geographic proximity and competition for scarce capital: Evidence from U.S. stocks and REITs. International Real Estate Review, 22(4), 535–570.

Zhu, B., & Milcheva, S. (2018). The pricing of spatial linkages in companies’ underlying assets. Journal of Real Estate Finance and Economics, 61(3), 443–475.

Acknowledgements

We acknowledge helpful comments from Wayne R. Archer, John Clapp, Xiaoying Deng, Zifeng Feng, David Harrison, Shantaram Hegde, Mariya Letdin, Tobias Mühlhofer, Geoffrey Turnbull, and seminar participants at the 2018 FSU-UF-UCF Critical Issues in Real Estate Symposium, the American Real Estate Society (ARES), the Global Chinese Real Estate Congress (GCREC), and the American Real Estate and Urban Economics Association (AREUEA-ASSA) Conference. All errors remain our own. Address correspondence to Chongyu Wang, Department of Real Estate and Construction, The University of Hong Kong, Pok Fu Lam, Hong Kong.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

About this article

Cite this article

Wang, C., Cohen, J.P. & Glascock, J.L. Geographically Overlapping Real Estate Assets, Liquidity Spillovers, and Liquidity Multiplier Effects. J Real Estate Finan Econ (2022). https://doi.org/10.1007/s11146-022-09905-0

Accepted:

Published:

DOI: https://doi.org/10.1007/s11146-022-09905-0