Abstract

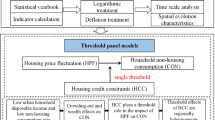

It is important to investigate the correlation between housing price and household consumption to gain an understanding of the behavior of the economy and effectively handle the consequences of economic development. In the last two decades, the accumulation of housing wealth by Chinese households has not been effectively transmitted to their final consumption. We discovered that the sustained increase in household wealth and housing-ownership rate in China has been accompanied by a decrease in consumption rate. We also identified a negative correlation between housing price and household consumption for both the homeowners who own one housing unit and those who own two units of housing. We investigated this phenomenon in China both theoretically and empirically by capturing the dual nature of housing as a consumption good and an investment vehicle. We found that the demand for second housing units is motivated by increasing housing consumption demand rather than pure investment needs. To explain the mechanisms that drive household-consumption behavior, we also explored the effects on household consumption of China’s educational system, marriage market and ageing society, as well as future housing-market uncertainty. The implications of government intervention in the housing market are discussed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The influence of housing price on household consumption has attracted considerable attention from researchers, particularly since the worldwide financial crisis (Muellbauer and Murphy 2008). Household consumption is a critical channel through which price uncertainties are transmitted to the national economy. It is crucial to explore the correlation between housing price and household consumption to capturing the consequences of housing-price volatility, and thereby gain fundamental understanding into economic behavior and ways of coping with future developments. These insights may help policy makers to devise strategies to advance economic growth and improve livelihoods at a household level.

Expenditure on housing wealth takes dual role of consumption and investment. Housing provides services and utilities and, at the same time, constitutes a store of value. In a dynamic housing market, household consumption and investment behavior may reflect the mechanisms by which households manage risks. For homeowners subjected to the investment constraint, the quantity of housing owned is at least as large as the quantity of housing consumed (Flavin and Yamashita 2002). The amount of housing consumed by these homeowners, determined by housing size, is at least identical to the amount of housing in which they have invested. In such cases, housing consumption and investment are inseparable. Living at home incurs imputed rental costs, as well as the opportunity cost of investment in a financial portfolio. A household decision is not a simple choice between current housing consumption and non-housing consumption; it is linked with portfolio decisions based on expected future housing development and financial-market dynamics. It is vital to acknowledge the dual role of housing as both a durable consumption good and an investment good in households’ portfolios to understand homeowners’ consumption behavior.

Most studies of housing wealth and household have focused on Western countries (Case and Deaton 2003; Lustig and Van Nieuwerburgh 2005; Munnell and Soto 2008). Researchers (such as Attanasio and Weber 1994; Poterba 2000; Ludwig and Slok 2002; Yao and Zhang 2005; Campbell and Cocco 2007) have investigated the connection between housing price and consumption, as well as the micro- and macro-level channels by which housing price affect consumption. In studies of the dual role of housing consumption and investment, researchers have focused on tenure choice (such as Ioannides and Rosenthal 1994) and portfolio choice (such as Brueckner 1997a; Yao and Zhang 2005; Piazzesi and Schneider 2008; Flavin and Nakagawa 2008). They have generally found that if housing investment and housing demand interact and are inseparable, a homeowner’s portfolio of stocks and housing is mean-variance inefficient (Brueckner 1997b), particularly if the household faces a borrowing constraint or incurs a cost on entering the stock market (Yao and Zhang 2005; Cocco 2005). In addition, Piazzesi and Schneider (2008) and Flavin and Nakagawa (2008) incorporated the dual role of housing consumption and investment into the standard consumption capital asset pricing model (C-CAPM), and found that housing amplifies the volatility of the composition of homeowners’ consumption baskets, and may pose a significant “composition risk” to the whole economy. Sebastien (2010) investigated household consumption with reference to the dual nature of housing-related expenditure. He indicated that the indivisibility of housing consumption and investment leads to suboptimal and excessively volatile household consumption. However, the correlation between housing price and household consumption, which is the major focus of our paper, has not been analyzed in previous studies.

Both empirical and theoretical research on the correlation between housing price and household consumption in China is fairly limited. Several researchers addressing Chinese consumption (such as Chamon and Prasad 2010; Wei and Zhang 2011) have focused on household savings and highlighted the role of the housing market, but the mechanism by which the housing market influences household consumption remains unclear. In urban China, housing price experienced consistent growth from 2004 to 2012 at an average annual rate of 10.71%, which is about 3.92 times greater than the average annual rate of increase from 1998 to 2003, according to the China Statistics Yearbook. This reflects a large increment in household wealth. In contrast, homeowners showed a sustained low propensity for consumption, which is denoted by the ratio of real private consumption to real gross domestic product (GDP). This indicator dropped from 48.4% in 1978 to 35.98% in 2012,Footnote 1 which is lower than both the average level in global transitional countries in the same period (55.1%) and the world average level (58.8%). The accumulation of housing wealth by households in China has not been effectively transmitted to household consumption. Efforts to ensure the sustainability of China’s economic development are threatened by the conflict between strategies to stabilize housing price and strategies to cope with lackluster consumption. It is important to examine the conflict between increasing housing wealth and decreasing household consumption in China not only to understand Chinese households’ consumption, but to capture the transformation of housing-market volatility into economic behavior via households’ consumption baskets.

China’s household consumption and housing market differ in several respects from their Western counterparts. First, Chinese households tend to have fairly low levels of debt (Liao et al. 2010) and to exhibit limited re-mortgaging behavior, due to a rigid national credit policy. As a result, the role of the “credit channel” may be less important in China than in many other countries, where it has been shown to have a critical influence on the correlation between housing price and household consumption (Aron and Muellbauer 2000; Muellbauer and Murphy 2008). Second, due to low returns and a volatile capital market, housing has become the most attractive asset for Chinese households. According to Wind Info, the annualized rate of return in China’s domestic A-share market was only 1.8% during the last two decades, whereas the annual growth in housing price was 10.71%. The average yield of the first housing units owned by Chinese households is 340.3%, and the second and third units yield as much as 143.3% and 96.7%.Footnote 2 Third, as residential property tax has not been widely promoted in China, housing services are inexpensive. Consequently, the number of Chinese households with multiple units, both owned and leased, has grown rapidly, particularly among the wealthy upper classes (Huang and Yi 2010).

The aim of this paper is to fill the gap in housing-consumption research by capturing the dual role of housing in household consumption. The influence of housing price on consumption in China is investigated with reference to the characteristics of housing as both a durable consumption good and an investment asset. We connect household-consumption choices with predictions of future wealth based on current price changes, and highlight the theoretical correlation between housing and consumption. We construct a simple theoretical model of the dual role of housing consumption and housing investment in household decisions, and investigate the correlation between housing price and household consumption under the assumption that housing is an ordinary but costly good. We test the theoretical model with micro-level empirical analysis, and find that housing price have a significantly negative influence on household consumption for all households in China, regardless of their ownership status. We discover that homeowners who own multiple housing units still tend to reduce their consumption when subject to increasing housing price. We further explain this phenomenon with reference to China’s particular housing-market conditions and household-consumption needs, and analyze the effects of several family-related variables—families with children at school, families with unmarried male children, and families that include elderly people—on the negative correlation between housing price and consumption.

The remainder of this paper is organized as follows. Second section provides background information on housing wealth and household consumption in China. In the third section, we construct a theoretical model of household consumption that incorporates both housing-consumption and housing-investment decisions. In the fourth, empirical tests are carried out and the correlation between housing price and consumption in China is investigated. In this section, we also discuss housing consumption and the policy implications of our findings. Fifth section concludes the study.

Stylized Factors Determining Housing Wealth and Household Consumption in China

The acceleration of economic development over the last two decades has greatly affected the housing wealth of urban Chinese households. The share of the net value of housing assets in total net wealth rose from 44% in 2002 to 73.4% in 2010. From 2000 to 2012, households’ average housing wealth increased from RMB123,700 to RMB510,900, with an annual growth rate of more than 14.07%. During the same period, household income and household consumption showed a sustained increase, but at a rate lower than that of housing price. At the national level, annual disposable income per capita increased from RMB5,854 in 1999 to RMB21,810 in 2010, with an annual growth rate of 11.61%. Household consumption per capita also increased at an annual rate of 10.44% (see Fig. 1).

However, household consumption in China as measured by the ratio of household consumption to income reached its lowest level in 2011, with a share of only 49% in China’s output (see Fig. 2). This contribution was not only much smaller than the share of household consumption in countries belonging to the Organization for Economic Co-operation and Development (OECD), but much smaller than the equivalent figures in two other large developing countries, India and Brazil, in which consumption made up 71% and 80% of GDP in 2008, respectively. In Asian countries such as Japan and Korea, the share of consumption in GDP is consistently larger than 70%.

To gain further insight into the distribution of housing wealth in China, we present statistics on housing tenure and housing wealth in 2002 and 2009 in Table 1. The data are obtained from a household survey conducted by the National Statistics Bureau of China. Further information on the survey can be found in “Theoretical Model of Housing price and Household Consumption, Incorporating the Dual Role of Housing” section. At the national level, ownership rate exceeded 84% in 2002 and 89% in 2009. In both years, ownership rate was distributed almost evenly across the three regions. However, a significant and rapid growth in housing wealth occurred between 2002 and 2009, particularly in the eastern region of China. In 2002, housing wealth in eastern China was approximately double that in mid-China and western China; in 2009, housing wealth in eastern China was triple that in the other regions. This reflects the dramatic increase in housing price in all regions of China during this period, especially in eastern areas.

In addition, as shown in Fig. 3, the percentage of multiple-unit owners increased significantly in all regions of China from 2002 to 2009. Eastern China is believed to have the largest proportion of multiple-unit owners, which may be due to regional differences in levels of urbanization and market development. However, we show that the percentage of multiple-unit owners increased in parallel in the three regions of China from 2002 to 2009. Given the significant differences among housing returns of the three regions, it is unlikely that these similar rates of increase can be attributed purely to homeowners’ desire to invest in housing.

Theoretical Model of Housing Price and Household Consumption, Incorporating the Dual Role of Housing

In this section, we provide a simple theoretical analysis of the optimal dynamic consumption of households facing substantial housing-price risk. Acknowledging the dual characteristics of housing as a consumption good and an investment vehicle, we also examine the decision-making process of household when facing a choice for mixed motivations of housing consumption and housing investment.

As an investment asset, housing has a special role as collateral for credit. Housing investment tends to be highly leveraged; an investor is usually required to invest a certain fraction of the house price (Fan and Yavas 2017). However, the results of studies of mortgage decisions in China indicate that housing purchases in this country have fairly low leverage (Fan et al. 2017). In addition, refinancing due to housing appreciation is limited, due to China’s emerging and immature credit market. Thus, we ignore the credit constraint on budget in our model. Our analysis will base on two scenarios. In the first, households’ housing-investment decisions are separable from their housing-consumption decisions. In the second, consumption and investment are indivisible when household decisions are made.

Model of Housing Price and Household Consumption with Separable Role of Consumption and Investment

We begin by addressing household decisions influenced separately by housing-investment motives (H it ) and housing-consumption motives (H ct ). In this scenario, it is possible for households to optimize their consumption and investment separately (Cauley et al. 2007; Henderson and Ioannides 1983). In theory, renters can be regarded as unconstrained households. In some previous empirical studies of western settings (such as Brueckner 1997a; Ioannides and Rosenthal 1994; Sebastien 2010), households with more than one unit have been identified as unconstrained households for whom housing consumption is separable from housing investment. This identification is based on the assumption that households are able to choose to own more housing than they consume, and that units purchased in addition to primary housing are generally related to investment value. Multiple-unit owners whose primary-housing or additional-housing decisions are significantly determined by both consumption and investment needs can also be defined as constrained.

When credit constraints and high transaction costs are ignored, housing-investment assets are treated indifferently from other risky assets, following Markowitz’s (1952) portfolio theory, which indicates that investors consider the mean and variance of returns on a portfolio when making decisions. Optimal housing investment depends on the expected excess return on investment, the conditional covariance matrix of returns on assets and investors’ relative risk aversion level (Samuelson 1970). The latter can be deduced directly from the intratemporal first-order condition of the utility function (details provided in Appendix 1), as follows:

where P t is housing price, u ht is the growth rate of housing price, u pt is the return on other financial assets and var(u ht ) is the variance of the expected growth rate of housing price. Here, A = − V′′/V′, is the constant relative risk aversion of individuals.

In addition, it is easy to deduce that the optimal ratio of non-housing consumption to housing consumption depends on the household’s relative preference for non-housing goods in comparison with housing goods, as well as the rental price of housing, as shown in Eq. (3.2):

where, \( {c}_t^{\ast } \) is the household’s optimal non-housing consumption; ω measures the household’s preference for non-housing consumption relative to housing consumption; and ρ is the discount rate of P t , which is used to measure the rental cost incurred by owning a house. In this case, we find a positive correlation between housing wealth and non-housing consumption. An increment in housing price prompts household consumption when housing stock is consistent or growing.Footnote 3

Model of Housing Price and Household Consumption with Inseparable Role of Consumption and Investment

In this model, the household is constrained, which implies they cannot separate housing consumption and housing investment decisions in other words. In this case, the cost of owning housing covers both implicit rents and the opportunity costs associated with housing services. As shown later, therefore, homeowners’ consumption allocation also affects the wealth of their portfolios. Generally, a single-unit owner is regarded as a constrained household. Theoretically, a single-unit owner may consume a fraction of the housing he/she owns, and rent out the remaining fraction to others as an investment. However, this is rarely the case in practice.Footnote 4 For a single-unit owner, H ct = H it = H t , where H ct is the amount of housing consumption, H it is the amount of housing investment and H t is the total amount of housing owned. Multiple-unit owners may also be constrained if their additional units are not predominantly investment assets.

For constrained homeowners, housing consumption is inseparable from housing investment, which also indicates that housing-consumption decisions are equivalent to housing-investment decisions when choosing a portfolio. To most accurately represent China’s economic environment, we ignore the correlation between returns on stock and returns on housing. Accordingly, a household cannot compensate for the suboptimal allocation of portfolio space to housing by adjusting the level of stock held in its portfolio.Footnote 5 For such households, owning a home incurs the opportunity cost associated with investment in a financial portfolio, in addition to rental costs. Consequently, (3.2) should be modified as follows:

Opportunity cost can be reduced further, as shown below (more details provided in the appendices):

where, αh, t is the implied portfolio share in housing, i.e. \( {\alpha}_{\mathrm{h},t}=\frac{H_{ct}{P}_t}{W_t} \). H ct = H it = H t .

Substituting opportunity cost into Eq. (3.3) gives Eq. (3.4), which represents household consumption as the difference in housing choice between an owner who can and an owner who cannot separate housing consumption and housing investment.

here, \( {\alpha}_{h,t}^{\ast } \) is the optimal portfolio share of housing available to households not subject to the investment constraint.Footnote 6

According to Eq. (3.4), a household’s choice between housing consumption and non-housing consumption also depends on the share of housing assets in the household’s portfolio. The difference between αh, t and the optimal share, \( {\alpha}_{h,t}^{\ast } \), determines the sign of the opportunity cost.Footnote 7 Opportunity cost takes a negative value when the share of housing in the household’s wealth is under-weighted relative to the optimal share (\( {\alpha}_{h,t}<{\alpha}_{h,t}^{\ast } \)); otherwise, it takes a positive value. When housing price increase, homeowners’ allocation of wealth to housing also increases. Either αh, t or \( {\alpha}_{h,t}^{\ast } \) may increase, because the opportunity cost associated with housing investment decreases with an increasingly wealthy household portfolio. Homeowners whose intention to invest in housing is separable from their intention to consume housing will purchase an optimal level of housing wealth to maximize their utility. Consequently, \( {\alpha}_{h,t}^{\ast } \) will approach 1. In contrast, homeowners whose housing-investment and housing-consumption decisions are inseparable cannot optimize the share of wealth allocated to housing (i.e. cannot achieve \( {\alpha}_{h,t}^{\ast } \)) because they must also consider service costs. As a result, \( \left({\alpha}_{h,t}-{\alpha}_{h,t}^{\ast}\right) \) takes a negative value.

From Eq. (3.4), the negative value of\( \left({\alpha}_{h,t}-{\alpha}_{h,t}^{\ast}\right) \), opportunity cost will be negative. The final expected effect of housing price on non-housing consumption depends on the relative value of opportunity cost and the cost of housing services (ρ). It is negative if the opportunity cost is larger than the cost of housing services. In this situation, increasing housing price cause the homeowner to increase the share of housing in his consumption budget, which decreases the ratio of non-housing consumption to total consumption. Otherwise if the opportunity cost is less than the cost of housing services, the effect of housing price on non-housing consumption will be positive. We can also expect the correlation between housing price and consumption to be insignificant if the opportunity cost is similar to the cost of housing services.

The theoretical model described above suggests that the dual nature of housing-related expenditure as consumption and investment has important implications for households’ consumption allocation. Using this dual-role model, the correlation between housing price and consumption is expected to vary as the cost of housing services and opportunity cost increase and decrease. Given China’s specific political and social conditions, we would expect the correlation between housing price and consumption to be negative for constrained households. First, Chinese individuals tend to have higher levels of constant relative risk aversion (A), due to imperfect social security (further details on China’s institutions are provided below). According to the study of Wang and Cai (2011), this coefficient lies between 3 and 6, which is much larger than the equivalent coefficient in other countries (Hansen and Singleton 1983; Bucciol and Miniaci 2011). Using Eq. (3.4), a high level of constant relative risk aversion increases contributes to relatively higher opportunity cost. Second, due to the absence of property tax in China, housing services are extremely inexpensive for all households, even those that own more than one unit. In this circumstance, the value of owner-occupied housing leads to a subsidized appreciation in opportunity cost after families have paid the unit costs of housing services, resulting in an overall decline in the cost of housing (ρ). Thus, the relative value of opportunity cost can be expected to outweigh the cost of housing services for constrained homeowners in China, regardless of whether they own single or multiple units.

Given the difficulty of identifying constrained owners from the limited information provided by the household survey—a common limitation of such surveys in many countries—the aim of this study is to understand consumption behavior in response to changing housing price in China. We do not seek primarily to investigate the reasons for Chinese homeowners’ decision to purchase multiple housing units, or to ascertain whether multiple-unit owners are constrained, although both processes are important to the analysis. Our chief aims are to estimate the influence of housing price on consumption for both single-unit and multiple-unit owners, and to investigate and understand their correlation by exploring consumption behavior with reference to households’ risk attributes, which are shaped by distinct Chinese social mechanisms.

In the next section, we use the dataset obtained from the Chinese-household survey to empirically test household-consumption behavior in China.

Housing Price and Household Consumption in China: An Empirical Study of Household-Survey Data

Database: Urban Household Survey (UHS) in China

We empirically analyze data from the Urban Household Survey conducted by the Chinese Statistics Bureau from 2002 to 2009. It is widely acknowledged that micro-level data provide useful insights into household consumption (Browning and Lusardi 1996; Campbell and Cocco 2007). The survey used in our study covers 118 cities in nine provinces and municipalities. The data comprise socio-economic information on households in these regions, such as household members’ ages, education levels and occupations, household income and household asset liabilities. To ensure that the data were representative of China’s urban population, stratified random sampling was used to select households to participate in the UHS. However, migrant workers and extremely wealthy households were excluded. The survey obtained data on household consumption, living conditions and housing wealth. Approximately one third of the households sampled in each year were rotated out of the sample in the subsequent year. As this limits the value of panel analysis, we analyze pooled cross-sectional data from the survey. After deleting null and unreliable information, we analyze data on 118,395 households in 12 large and medium-sized cities from 2002 to 2009.Footnote 8

Our estimation of the relationship between housing price and household consumption is based on Eq. 3.4. We use household size and the local-registration status (hukou),Footnote 9 age and marital status of the household head to capture each household’s level of risk aversion and relative preference for housing consumption. To prevent collinearity between price and consumption, we include both housing price in the current year and housing price in the previous year in the equation. The key variables used in the equation are described in the Appendix.

In the dataset, “Income” refers to total household income, such as salary, subsidies, income from financial assets and unregulated income. The National Statistics Bureau of China defines non-housing consumption as food, clothing, household utilities, medical services, transportation, education and miscellaneous services. “Regional housing price” are sold commodity housing price obtained by the National Statistics Bureau of China for each year. In addition, we use dummy variables for year and province to control for the heterogeneity of macroeconomic factors, years and regions. The variables are adjusted by the respective local consumer price indices (CPIs).

Empirical Results: Price-Consumption Correlation for Households in China

Homeowners constitute 87.7% of the households in the data-set, and 8.22% of these homeowners own multiple housing units. However, a fairly limited number of households (less than 0.7% of the multiple-unit owners) own more than two units. Therefore, we define owners of multiple units as households possessing second units.

The housing-consumption results for all of the households (owners, renters, homeowners with only one unit and homeowners with second units) are presented in Table 2. Descriptions of the variables are provided in the appendices.

To avoid selection bias, we use a two-stage Heckman procedure (Heckman 1979) to control for selectivity and simultaneity (Haurin et al. 1991; Jud and Seaks 1994; Duca and Whitesell 1995). We incorporate the inverse Mills ratio (lambda) into the following equation, \( {Lambda}_i=\frac{\phi \left(-{X}_{2i}/{\sigma}_2\right)}{\phi \Big({X}_{2i}/{\sigma}_2} \). Here, ϕ denotes the normal density function. Mill’s ratio (lambda) is estimated from a probit model using the full sample (results shown in Table 4). The ratio is a monotonically decreasing function of the probability that a homeowner is selected for the sample. When the ratio is incorporated into the model as an additional variable with a sample restricted to homeowners, the bias increases with the omission of variables, which indicates that the influence of tenure choice can be corrected. As shown in Table 2, lambda is negative in two cases, which suggests that selection bias does exist. In the adjusted model, Heckman’s two-stage methods have been used to correct the bias.

Consistent with the findings of certain other studies in a Chinese setting (Yang et al. 2014, 2017), the results in Table 2 indicate that housing price has a negative effect on household consumption for all households.Footnote 10 All of the other variables have the expected signs. The remarkable increase in housing wealth in China has not stimulated household consumption; on the contrary, it has significantly reduced consumption, even that of homeowners with single and multiple units. This result differs considerably from most findings in countries such as the United States (Belsky 2004), the United Kingdom (Campbell and Cocco 2007), Spain (Bover 2005) and Sweden (Chen 2006).

In particular, we observe that the housing-price increment in China has significantly reduced the consumption of households possessing second units. This result is inconsistent with the discovery made in previous studies (Belsky 2004; Campbell and Cocco 2007; Betermier 2010) that the housing-investment and housing-consumption decisions of homeowners with second units tend to be separable.Footnote 11 Our results suggest that the substitution effects of housing and consumption are significant for both single-unit and multiple-unit owners.

As mentioned above, it is not our major objective to determine whether multiple-unit owners are constrained. However, our findings regarding the negative effects of housing price and consumption suggest that multiple-unit owners are usually unable to separate their investment decisions from their consumption decisions. In this case, we would expect the substitution effect of housing price on household consumption to be greater for households with a high level of risk aversion, as suggested by equation (3.4). Next, we thus conduct a probit regression to identify the characteristics that lead homeowners to purchase multiple units, and thereby capture the group of households that tend to have higher risk-averse level. Second, we construct cross-terms to determine whether the substitution effect of housing price on consumption is significantly high for households with a high level of risk aversion. These processes not only enable us to test our theoretical predictions; more importantly, they provide in-depth insights into the characteristics of households’ consumption behavior and the effects of China’s social and economic institutions on households’ consumption decisions. In addition, they help us to understand the reasons for the housing-purchase decisions made by households (which are also explored using the first stage of the adjusted Heckman procedure above).

Empirical Results: Delimitation of Group with High Risk Aversion

Before conducting the tests, we compare the major characteristics of the two homeowner groups, as presented in Table 3. We find that on average the owners of second housing units have higher levels of household income and consumption. Households possessing more than one unit also tend to have greater debt and to live in larger homes. No significant differences in the age of the household head, family size or marital status are found between the two groups.

Household relative risk aversion (A), or consumption preference (ω) are posing significant effects on household consumption level suggested by model. The household survey used in this study does not provide specific information on relative risk aversion or consumption preference. However, socio-economic factors can be used as proxies for these parameters. The standard determinants of risk aversion are wealth and income and it is widely acknowledged that risk aversion decreases with the increment of income and wealth (Riley Jr and Chow 1992; Tanaka et al. 2010). However, mixed results have been obtained in developing countries (Wik et al. 2004). The ratios of loan to income and loan to value are used as proxies for households’ risk aversion (Tanaka et al. 2010). We also control for household hukou and occupation to capture particular Chinese socio-economic characteristics that may influence investment decisions.

Considering consumption preference, household family structure tends to be important in distinguishing consumption behaviors. The demand for housing in China is significantly affected by cultural traditions and expectations such as the obligation to take care of the elderly and the so-called “mother-in-law phenomenon,” wherein mothers demand houses as a condition of marriage to their daughters. In addition, it has been increasingly observed that the quality of primary- and middle-school education is significantly capitalized into housing price, due to the disparate quality of schools in urban China (Feng and Lu 2010). (This issue is discussed further in “Empirical Test: Substitution Effect for Groups with High Risk Aversion” section) Therefore, we control for families with children who are in primary and middle school, families with unmarried male children younger than 25 years oldFootnote 12 and families with elderly members to capture the determinants of housing consumption that arise specifically from China’s socio-economic and cultural conditions.

Table 4 presents the results of a probit regression on households’ likelihood of owning second housing units. We find that households with higher incomes and households with more debt are especially likely to own more than one unit. High levels of income and debt are associated with low risk aversion and/or high affordability, both of which encourage households to purchase second housing units. In addition, the regression results also suggest that households inclusive of children younger than junior-school age, elderly people or unmarried male children aged below 25 are more likely to purchase multiple housing units.Footnote 13 These specific groups of households tend to be characterized as higher risk-averse family due to specific social systems and circumstances, and their multiple-unit purchasing behaviors might be difficult to be explained by suggesting separated investment purpose, but would be interpreted by intention of consumption increment that is accompanied by inseparable investment act instead.

In this case, we would expect housing price and consumption to have a significantly higher substitution effect for the abovementioned groups. We thus add interaction variables to the regression to capture the correlation between price and consumption for these groups. The results also reveal significant political implications, as discussed in “Discussion: Housing Consumption and Political Implications in China” section.

Empirical Test: Substitution Effect for Groups with High Risk Aversion

We further include interaction terms to control for price and the more risk-averse groups specified above. The results are displayed in Table 5. Consistent with our theoretical prediction, we find that the interaction variables introduced to the equation have significantly negative effects. Households inclusive of children at school, unmarried male children and/or elderly people have greater housing-consumption needs, and thus a greater negative influence on consumption at a national level. The results for the other variables included in the equation are the same as those for the variables presented in Table 2.

Discussion: Housing Consumption and Political Implications in China

We show that housing wealth has a significant substitution effect on household consumption for all households in urban China. Both our theoretical and empirical results suggest that although the rate of homeownership in China is high, Chinese households are still likely to continue accumulating housing wealth while reducing other forms of consumption. More risk-averse families (households with children at school, households with unmarried male children and households with elderly members) are particularly likely to reduce their consumption due to their desire for second housing units. The results of a rigorous two-step empirical test confirm the validity of our theoretical framework.

The dual nature of housing-related expenditure and the inseparability of its two components arise from the combination of consumption-based and investment-based motives for purchasing additional housing. This inseparability is a prerequisite for the existence of a substitution effect. The results of the 2005 China General Social Survey indicate that in China, investment makes up only 7% of householders’ motivation to purchase second housing units. Our results suggest that Chinese homeowners tend to regard additional housing as a way of meeting consumption needs, rather than as a separate investment. In 2010, the central government of China announced a series of measures designed to control speculative investment in housing to limit the rise in housing price. In more than 49 Chinese cities, the purchasing of second and third homes was strictly restricted to resident households.Footnote 14 The assumption underlying this policy is that multiple houses are purchased primarily as speculative investments.Footnote 15 Accordingly, the government expects that constraining the capacity for speculative investment will help to stabilize housing price. However, our results indicate that this measure may pose only a short-term effect on the market. It may encourage individuals to delay their purchases of second homes until market conditions are more favorable, and thus to save money for future investment opportunities. There is no significant evidence of a decrease in either housing price or sales volume since the implementation of the policy (Qiao 2012). Indeed, some individuals have been able to use the black market to evade the regulations and obtain second housing units at no extra cost.Footnote 16 It is important for policy makers to understand housing-consumption performance if they are to design effective policies and improve existing ones.

The relatively high risk-averse tendency in China prompts higher opportunity cost compared with low housing service cost, which greatly enhances the possibility of a negative \( \frac{c_t}{H_t} \), and is directly responsible for the substitution effect between housing price and household consumption. This mechanism is closely linked with China’s cultural traditions as well as its political and social-security systems.

In previous studies, researchers such as Chamon and Prasad (2010) and Wei and Zhang (2011) have suggested that families with unmarried male children are often motivated to save money by the desire to improve their standing in the marriage market. Our research not only confirms that the role of marriage market influences household consumption, but provides supplementary evidence that the purchasing of second houses enables families to compete in the marriage market. In this paper, we do not focus on the underlying reasons for this phenomenon, such as China’s single-child policy, gender ratio and cultural traditions. More detailed discussion can be found in Chamon and Prasad (2010), Wei and Zhang (2011). Nevertheless, our results suggest that additional housing consumption is regarded as a precautionary channel to improve families’ marriage prospects. To a certain extent, this strategy reflects households’ uncertainty about the future housing market. Households are likely to purchase housing to hedge against potential market uncertainty in the future. Therefore, we would expect households in regions with more dynamic housing price to save more money in the form of additional housing.

Early in the 1950s, the Chinese government introduced “key” public schools (elementary and secondary) into the educational system. Key schools were allocated much greater funds, better facilities and higher-quality teachers than ordinary schools (World Bank 1985). Although the key-school system was abolished in the 1990s in accordance with the 9-year compulsory-education policy, those former key schools retained significant advantages over other schools (Feng and Lu 2010). The “by lots, nearby school” policy mandated that only residents of a key-school district could enroll in a key school. Consequently, school quality has been significantly capitalized into households’ housing wealth (Feng and Lu 2010). Our results suggest that families whose primary housing is not located in key-school districts may wish to purchase second homes to remain close to high-quality schools and thereby obtain better educational resources. However, we noticed that the contribution of the government’s educational investment to GDP is extremely low, reaching an average of only 3.3% in 2008, compared with an average of 5.5% across the EU21 countries, 5.9% across the OECD countries and 7.2% in the United States. The extra cost of educational opportunities increases households’ financial burden and places additional pressure on household consumption. Improving educational quality and reducing the inequality of schools, albeit in opposition to the government’s public policies, will have important positive implications for the housing market.

We obtain similar results for families inclusive of older people, which are also found to be likely to purchase additional housing units. Research has shown that more and more elderly people in China are living alone or with their spouses only (Palmer and Deng 2008). Nevertheless, the results of a Health and Retirement Longitudinal Study conducted from 2011 to 2012 indicate that roughly 43% of Chinese aged 60 and over live with a child, and another 31% and 13% have children living in the same neighborhood and the same county, respectively. This can be explained that traditional Chinese emphasis on the significant role of family, particularly the need to care for grandchildren and take care of older people (Ko and Hank 2013). Additional housing helps to meet this demand by assisting family members in caring for children and elderly people.

To summarize, we find that Chinese homeowners have primarily consumption-based motives for purchasing multiple homes. We show that the reason for purchasing a second house is usually similar to the reason for purchasing the first, making it impossible to separate a household’s level of housing investment from its level of housing consumption. In this sense, we expect second-housing stock to be sensitive not only to price changes, but to household-consumption needs. Chinese homeowners usually consume additional housing to compensate for other forms of consumption related to education, marriage and caring for the elderly. This places pressure on households, and significantly results in sub- optimal level of household consumption, which in turn causes a low consumption rate in society. In the housing market, the demand for second homes restricts housing supply and thus inflates housing price. Consequently, affordability is reduced for new enters in the housing market, and housing wealth stratification will be further intensified.

Meanwhile, in response to rapidly rising housing price, many Chinese households are purchasing second homes to hedge against future uncertainties in areas such as education, marriage and retirement. This behavior is encouraged by the free property tax policy. However, the “second-home problem” in urban China is far more than merely a housing problem. The increasing number of second homes has negative consequences for the whole economy, not just the housing market, and should thus be addressed in the government’s public policies on education and pensions. It is the central issue for housing market as well as for whole economy. Housing policies can only be effective if they are integrated with the country’s social-welfare system.

Conclusion

Low household consumption level has been regarded as a challenge for Chinese sustainable economic development. By 2009, home ownership had increased to more than 87%, and housing price grew rapidly from 2004 to 2009, at an annual rate of 11.32%. However, these trends were accompanied by a consistent decrease in household consumption propensity. This mystery has been explored in previous studies from the perspectives of Chinese economic and social transformation with incorporating housing into household consumption function as an ordinary but costly goods.

In this study, the dual characteristics of housing as a consumption good and an investment asset are modeled in the household-consumption function. We model the interaction between a volatile housing market and the process by which households choose between housing-services consumption and housing investment. It has been suggested that households whose housing-investment and housing-consumption intentions are separable are able to optimize both their consumption and their investment level, and hence prompt their total consumption as housing price rises. However, this hypothesis is not supported by the results of our empirical analysis of micro-level survey data on Chinese households. We find that households who purchase additional housing units are motivated by the desire to consume housing, not purely by the desire to invest in property. This increases the substitution effect of housing consumption and housing investment, particularly for families with higher levels of risk aversion and thus higher opportunity costs, such as households inclusive of children at primary and middle school, unmarried male children and/or elderly people. We make recommendations for governmental housing policies and highlight the potential role of China’s welfare system in such improvements.

Notes

The remaining proportion of GDP (51.6% in 1978 and 64.02% in 2012) comprised investment by industries rather than households. It is difficult to account for the contribution of personal housing investment to GDP.

The mean value of urban residents’ financial assets is RMB112,000, and their mean housing assets are 8.3 times greater, according to the 2011 Chinese Household Financial Investigation Report, which was funded by the Southwestern University of Finance and Economics.

In this case, housing investment and housing consumption are separable. Rising housing prices are not expected to alter stock. Instead, households can directly adjust their level of housing investment.

Sebastien (2010) proved that the indivisibility of housing consumption from housing investment leads to a suboptimal composition of household consumption.

Many other studies of the asset-pricing model have highlighted the role of the share of housing consumption, which is referred as “composition risk” by Piazzesi et al. (2007).

Beijing, Chengdu, Dalian, Guangzhou, Hangzhou, Hefei, Lanzhou, Ningbo, Shenzhen, Shenyang, Wuhan and Xian.

Hukou refers to a household-registration record that officially identifies an individual as a resident of a given area. it is one of China’s most important institutions, as it defines individuals’ socio-economic status and access to welfare benefits.

We also estimate the regression for renters only, and find a significant correlation between price and consumption. However, the process of renting involves tenure choice, which is not modeled in our theory and is not our focus of the study.

In Betermier’s (2010) study, homeowners with characteristics extremely similar to those of unconstrained owners are considered to be constrained homeowners. We also test for this case, and obtain fairly consistent results.

We believe that families inclusive of children at primary and middle school are especially eager to live close to schools; high-school children often take buses to school or live in school dormitories. According to Chinese policy, males of 25 years old are in the later period of marriageable age.

We estimate the regression with an “unmarried female child” variable and find no significant results.

On April 17, 2010, the State Council issued the “New 10 Articles,” which were designed to drive speculative demand out of the market. The new measures set down-payments for first mortgages at 30% of purchase price, increased down-payments and interest rates for purchases of second and third homes, and housing purchases by those who are not local city residents are restricted.

No data are available for people who purchased more than one unit. More data are required to draw conclusions regarding homeowners’ purpose in purchasing multiple housing units.

According to mass-media reports, many broker companies are arranging “masculine and feminine elements contracts” and “individual transactions” to evade the regulations. See http://house.focus.cn/news/2013-04-12/3127019.html and http://365jia.cn/news/2011-05-12/8353A4921118AFFA.html.

References

Aron, J., & Muellbauer, J. (2000). Personal and corporate saving in South Africa. World Bank Economic Review, 14(3), 509–544. https://doi.org/10.1093/wber/14.3.509.

Attanasio, O.P., Weber, G. (1994). Is consumption growth consistent with intertemporal optimization? Evidence from the consumer expenditure survey (No. w4795). National Bureau of Economic Research.

Belsky, E. (2004). Housing wealth effects: Housing’s Impact on wealth accumulation, wealth distribution and consumer spending. Joint Center for Housing Studies, National Association of REALTORS, Harvard University.

Betermier, S. (2010). Essays on the consumption and investment decisions of households in the presence of housing and human capital. UC Berkerley.

Bover, O. (2005). Wealth effects on consumption: Micro-econometric estimates from the spanish survey of household finances. Working Paper, No. 0522.

Browning, M., & Lusardi, A. (1996). Household saving: Micro theories and micro facts. Journal of Economic Literature, 34(4), 1797–1855.

Brueckner, J. K. (1997a). Infrastructure financing and urban development: The economics of impact fees. Journal of Public Economics, 66(3), 383–407. https://doi.org/10.1016/S0047-2727(97)00036-4.

Brueckner, J. K. (1997b). Consumption and investment motives and the portfolio choices of homeowners. The Journal of Real Estate Finance and Economics, 15(2), 159–180.

Bucciol, A., & Miniaci, R. (2011). Household portfolios and implicit risk preference. Review of Economics and Statistics, 93(4), 1235–1250.

Campbell, J. Y., & Cocco, J. F. (2007). How do house prices affect consumption? Evidence from micro data. Journal of Monetary Economics, 54(3), 591–621. https://doi.org/10.1016/j.jmoneco.2005.10.016.

Case A, Deaton A. (2003). Consumption, health, gender, and poverty. World Bank Publications.

Cauley, S., Pavlov, A., & Schwartz, E. (2007). Homeownership as a constraint on portfolio allocation. Journal of Real Estate Finance and Economics, 34(3), 283–311. https://doi.org/10.1007/s11146-007-9019-9.

Chamon, M., & Prasad, E. (2010). Why are saving rates of urban households in China rising? American Economic Journal: Macroeconomics, 2(1), 93–130.

Chen, J. (2006). Re-evaluating the association between housing wealth and aggregate consumption: New evidence from Sweden. Journal of Housing Economics, 15(4), 321–348. https://doi.org/10.1016/j.jhe.2006.10.004.

Cocco, J. F. (2005). Portfolio choice in the presence of housing. Review of Financial Studies, 18(2), 535–567. https://doi.org/10.1093/rfs/hhi006.

Duca, J. V., & Whitesell, W. C. (1995). Credit cards and money demand: A cross-sectional study. Journal of Money, Credit and Banking, 27(2), 604–623.

Fan, Y., Yavas, A. (2017). How does mortgage debt affect household consumption? Micro Evidence from China. SSRN Working Paper, No. 2966987.

Fan, Y., Wu, J., & Yang, Z. (2017). Informal borrowing and home purchase: Evidence from urban China. Regional Science and Urban Economics, 67, 108–118. https://doi.org/10.1016/j.regsciurbeco.2017.09.003.

Feng, H., & Lu, M. (2010). School quality and housing prices: Empirical evidence based on a natural experiment in shanghai, China. The Journal of World Economy, 12, 89–104 (In Chinese.)

Flavin, M., & Nakagawa, S. (2008). A model of housing in the presence of adjustment costs: A structural interpretation of habit persistence. The American Economic Review, 98(1), 474–495.

Flavin, M., & Yamashita, T. (2002). Owner-occupied housing and the composition of the household portfolio. The American Economic Review, 92(1), 345–362. https://doi.org/10.1257/000282802760015775.

Hansen, L. P., & Singleton, K. J. (1983). Stochastic consumption, risk aversion, and the temporal behavior of asset returns. Journal of Political Economy, 91(2), 249–265. https://doi.org/10.1086/261141.

Haurin, D. R., Hendershott, P. H., & Kim, D. (1991). Local house price indexes: 1982–1991. Real Estate Economics, 19(3), 451–472. https://doi.org/10.1111/1540-6229.00562.

Heckman, J.J. (1979). Sample selection bias as a specification error. Econometrica: Journal of the Econometric Society, 153–161.

Henderson, J. V., & Ioannides, Y. M. (1983). A model of housing tenure choice. American Economic Review, 73(1), 98–113.

Huang, Y. Q., & Yi, C. D. (2010). Consumption and tenure choice of multiple homes in transitional urban China. International Journal of Housing Policy, 10(2), 105–131. https://doi.org/10.1080/14616718.2010.480852.

Ioannides, Y. M., & Rosenthal, S. S. (1994). Estimating the consumption and investment demands for housing and their effect on housing tenure status. The Review of Economics and Statistics, 76(1), 127–141. https://doi.org/10.2307/2109831.

Jud, D. G., & Seaks, T. G. (1994). Sample selection bias in estimating housing sales prices. Journal of Real Estate Research, 9(3), 289–298.

Ko, P.C., Hank, K. (2013). Grandparents caring for grandchildren in China and Korea: Findings from CHSRLES and KLoSA. Journal of Gerontology, Series B: Psychological Science and Social Science.

Kraft, H., & Munk, C. (2011). Optimal housing, consumption, and investment decisions over the life cycle. Management Science, 57(6), 1025–1041. https://doi.org/10.1287/mnsc.1110.1336.

Liao, L., Huang, N., & Yao, R. (2010). Family finances in urban China: Evidence from a National Survey. Journal of Family and Economic Issues, 31(3), 259–279. https://doi.org/10.1007/s10834-010-9218-z.

Ludwig, A., Slok, T. (2002). The impact of changes in stock prices and house prices on consumption in OECD Countries. IMF Working Paper.

Lustig, H. N., & Van Nieuwerburgh, S. G. (2005). Housing collateral, consumption insurance, and risk premier: An empirical perspective. The Journal of Finance, 60(3), 1167–1219. https://doi.org/10.1111/j.1540-6261.2005.00759.x.

Markowitz, H. (1952). Portfolio selection. Journal of Finance, 7, 77–91.

Muellbauer, J., & Murphy, A. (2008). Housing markets and the economy: The assessment. Oxford Review of Economic Policy, 24(1), 1–33. https://doi.org/10.1093/oxrep/grn011.

Munnell, A.H., Soto, M. (2008). The housing bubble and retirement security. Center for Retirement Research at Boston College.

Palmer, E., Deng, Q. (2008). What has economic transition meant for the well-being of the elderly in China? In inequality and public policy in China (pp. 182–203), edited by B. A. Gustafsson, S. Li.

Piazzesi, M., Schneider, M. (2008). Inflation illusion, credit, and asset prices. In Asset Prices and Monetary Policy (pp. 147–189). University of Chicago Press.

Poterba, J. M. (2000). Stock market wealth and consumption. Journal of Economic Perspectives, 14(2), 99–118. https://doi.org/10.1257/jep.14.2.99.

Qiao, K. Y. (2012). Has house purchase limit policy taken effect? Evidence from China 70 upper middle cities. Research on Economics and Management, 12, 25–34 (In Chinese.)

Riley Jr, W. B., & Chow, K. V. (1992). Asset allocation and individual risk aversion. Financial Analysts Journal, 48(6), 32–37.

Samuelson, P. (1970). The fundamental approximation theorem of portfolio analysis in terms of means, variances and higher moments. Review of Economic Studies, 37(4), 537–542. https://doi.org/10.2307/2296483.

Sebastien, B. (2010). Consumption and investment of housing in portfolio. Doctoral thesis at UC Berkeley.

Tanaka, T., Camerer, C. F., & Neuyen, Q. (2010). Risk and time preferences: Linking experimental and household survey data from Vietnam. The American Economic Review, 100(1), 557–571. https://doi.org/10.1257/aer.100.1.557.

Wang, X., & Cai, M. C. (2011). Analysis of risk aversion coefficient determination and influencing factors of Chinese residents - empirical study based on Chinese residents to invest in behavioral data. Financial Research, 08, 192–206 (In Chinese.)

Wei, S. J., & Zhang, X. B. (2011). The competitive saving motive: Evidence from rising sex ratios and savings rates in China. Journal of Political Economy, 119(3), 511–564. https://doi.org/10.1086/660887.

Wik, M., Aragie Kebede, T., Bergland, O., & Holden, S. T. (2004). On the measurement of risk aversion from experimental data. Applied Economics, 36(21), 2443–2451. https://doi.org/10.1080/0003684042000280580.

World Bank (1985). World development report, 1985. Washington, DC; New York: Oxford University Press.

Yang, Z., Zhang, H., Chen, J. (2014). How does the motivation of purchasing a second residence affect housing wealth effect: A micro study on basis of urban household survey data. Forthcoming in Finance Analysis. (In Chinese.)

Yang, Z., Fan, Y., & Cheung, C. H. Y. (2017). Housing assets to the elderly in urban China: To fund or to hedge? Housing Studies, 32(5), 638–658. https://doi.org/10.1080/02673037.2016.1228853.

Yao, R., & Zhang, H. H. (2005). Optimal consumption and portfolio choices with risky housing and borrowing constraints. Review of Financial Studies, 18(1), 197–239. https://doi.org/10.1093/rfs/hhh007.

Acknowledgements

This research is supported by the National Natural Science Foundation of China (No. 71673154 and 71461137002). The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

Derivation of the model

In our model, the utility function at time t of a household with life length T (T > 0) is U(Ct, H t ), which is a time-separable and time-invariant utility function describing the household’s preference for housing services (H t ) relative to non-housing goods (C t ). We assume that no bequest motive exists, and that the household consumes all of its remaining wealth in period T. The optimal allocation of consumption and housing is given by the Bellman equation shown below, in which the household arrives at the maximum level of current utility plus the expected discounted value in period t + 1 as a function of future consumption and housing price:

where E is expectation and Wt + 1 is total wealth, including housing wealth, in the period t + 1. H ct is the unit of housing consumption, H it is the unit of housing investment and H t denotes the total housing owned. To simplify the model, we define only one financial asset, S t .

Meanwhile, we assume that the household’s expected housing price in the next stage will reach P t (1 + u h ), where P t is housing price in period t and u h is growth rate. The financial asset S t receives u p per period in profit. The period to period budget constraint incorporates differences in housing-asset value, as follows: P t (H t − Ht − 1). We assume that the household can rent out separate housing investments and obtain rent to optimize household profit, as shown in R t H it , where R t is the rent price per housing unit in period t (Henderson and Ioannides 1983).

Therefore, the budget constraint can be represented as follows:

where Y t is total income and C t is non-housing consumption.

Homeowners who can make separate decisions regarding housing consumption and investment are motivated to consume housing and invest in housing by two distinct mechanisms. These mechanisms can be incorporated into our model. We use the Lagrangian-multiplier method to obtain the first-order extreme conditions, as follows.

Thus, the equation determining H It can be written as follows.

Using the Taylor expansion, we can write \( {V}_{t+1}^{\prime } \) as the following approximate equation.

We can then obtain the following.

var(u h ) is the variance in the expected growth rate of housing price, and indicates individuals’ confidence in the price trend as well as the risks associated with housing investment. A = − V′′/V′, which denotes an individual’s relative risk aversion.

To compare housing-investment decisions with housing-consumption decisions, we rewrite Eq. (7) as follows.

Combining the above equation with Eqs. (5) and (6) gives the relationship between the marginal utility of housing consumption and that of other consumption.

The equation above indicates that the marginal utility of housing consumption and the marginal utility of non-housing consumption are related solely to user cost, assuming that the utility function of households’ consumption is written as follows,

where, ω measures the household’s preference for non-housing consumption relative to housing consumption, and γ is the coefficient of relative risk aversion over the entire consumption basket.

We know that the household’s consumption structure is determined by the following principle:

which suggests that the household’s housing-consumption decisions differ from its housing-investment decisions. Here, ρ is the discount rate of P t .

To address the case of a homeowner for whom housing investment and housing consumption are indivisible, we follow Sebastien’s (2010) general procedure. We assume that the homeowner’s mean-variance utility is as follow:

where, μ w denotes expected future wealth, γ is the risk-aversion constant and σ w is the standard deviation of future wealth.

If the movements of stock and housing are uncorrelated, we can write:

where, σ i is the standard deviation of asset i (which may be housing asset H, financial asset S or future wealth W), α i is the portfolio share and r is the interest rate.

We further obtain that:

where λ s is the Sharpe ratio of asset S.

Maximizing the utility function under the budget constraint determined in Eq. (10), we obtain:

And further,

Substituting all of these results for the homeowner’s utility gives the marginal utility of the ratio of housing.

It is then easy to obtain the opportunity cost, as follows:

where

As discussed in the text, opportunity cost influences the consumption decisions of homeowners for whom the intention to invest in housing is inseparable from the intention to consume housing.

We substitute Eq. (11) for Eq. (12) to give Eq. (3.3) in the text as follows:

Appendix 2

Key Variables in the Empirical Tests

Rights and permissions

About this article

Cite this article

Yang, Z., Fan, Y. & Zhao, L. A Reexamination of Housing Price and Household Consumption in China: The Dual Role of Housing Consumption and Housing Investment. J Real Estate Finan Econ 56, 472–499 (2018). https://doi.org/10.1007/s11146-017-9648-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-017-9648-6