Abstract

This paper investigates whether changes in the monetary transmission mechanism as captured by the interest rate respond to variations in asset returns. We distinguish between low-volatility (bull) and high-volatility (bear) markets and employ a TVP-VAR approach with stochastic volatility to assess the evolution of the interest rate in relation to housing and stock returns. We measure the relative importance of housing and stock returns in the movements of the interest rate and their possible feedback effects over both time and horizon and across regimes. Empirical results from annual data on the US spanning the period from 1890 to 2012 indicate that the interest rate responds more strongly to asset returns during low-volatility (bull) regimes. While the bigger interest-rate effect of stock-return shocks occurs prior to the 1970s, the interest rate appears to respond more strongly to housing-return than stock return shocks after the 1970s. Similarly, a higher interest rate exerts a larger effect on both asset categories during low-volatility (bull) markets. Particularly, larger negative responses of housing return to interest-rate shocks occur after the 1980s, corresponding to the low-volatility (bull) regime in the housing market. Conversely, the stock-return effect of interest-rate shocks dominates before the 1980s, where stock-market booms achieved more importance.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The early 1980s saw the beginning of the Great Moderation, when many macroeconomic variables exhibited decreased volatility. Debate followed about the causes of this moderation. Did it reflect good policy or good luck? The good-policy proponents argued that policy makers now understood how to moderate the business cycle. The Great Moderation also saw a general fall in inflation rates around the world. A leading explanation of the declining inflation rates relied on inflation targeting, which many central banks adopted over this time frame. Of course, the financial crisis and Great Recession shattered that optimistic view of the policy making process and the ability of policy makers to moderate inflation and business cycle movements.Footnote 1

During the Great Moderation, however, asset prices became more volatile, leading eventually to the financial crisis and Great Recession. Borio et al. (1994) and Detken and Smets (2004) report the emergence of the boom-bust cycles in equity and housing prices across many developed countries during the 1980s. Further, Bernanke and Gertler (2001) argue that the increased asset-price volatility caught the attention of researchers and policy makers, especially since central bankers apparently now knew how to control inflation.

This study assesses the evolution of the monetary transmission mechanism as represented by the interest rate in relation to asset returns as measured by the log-difference in asset prices over the annual period of 1890 to 2012. This assessment adopts a time-varying parameter vector autoregressive (TVP-VAR) approach beginning with a Markov-switching autoregressive (MS-AR) model. Unlike previous studies, our approach measures the relationship between the two variables not only over different time and horizons but more importantly across different monetary transmission regimes. That is, our sample period covers several important changes that potentially affect the monetary transmission mechanism. First, the Federal Reserve did not exist prior to 1913. Second, the Great Depression led to significant regulatory change in the monetary sector as well as altered the Federal Reserve’s understanding of its role in the economy. Finally, the post-WWII period saw the Great Inflation (1970s), the Great Moderation (1980s through mid-2000s), and the Great Recession (late-2000s). Thus, the TVP-VAR method can account for historical episodes of structural changes with time-varying effects on the VAR parameters, which more standard methods cannot do.

A growing literature emphasizes the role of asset-price fluctuations in driving financial and business cycle dynamics (e.g., Bernanke and Gertler 2001). First, asset-price variation potentially affects the real economy as a consequence of a direct effect on household wealth on consumption demand (e.g., Zhou and Carroll 2012; Case et al. 2013; Liu et al. 2013; Guerrieri and Iacoviello 2013; Mian et al. 2013). Second, the balance-sheet channel argues that credit markets include significant frictions, whereby those borrowers with strong financial credentials stand a better chance of obtaining a loan than borrowers with weak financial credentials. Additionally, forward-looking, rational economic agents incorporate the fluctuation in asset prices in their expectations (Gelain and Lansing 2013), which, in turn, affects the propagation mechanism of shocks.

The emergence of asset–price inflations caused a reappraisal of what monetary policy makers should or should not do when faced with rapid increases in asset prices. Bernanke and Gertler (2001) argue that policy makers do not need to respond to rising asset prices that reflect changing fundamentals in asset markets. Rather policy makers only need to pay attention when asset prices rise because of non-fundamental factors and when asset-price changes cause important effects in the macroeocnomy. The ability of policy makers to identify the difference between fundamental and non-fundamental changes in asset prices proves most difficult. Thus, any policy that requires the central bank to diffuse asset-price inflation before it forms a bubble requires that the central bank identify bubble situations before and during their formation, no easy task

An additional problem faces monetary policy makers when faced with rising asset prices. Traditional monetary policy focuses on controlling inflation, typically measured by the consumer price index. But, this measure of inflation excludes asset-price movements. How should policy makers respond to a situation of low consumer price inflation coupled with rapid inflation in equity and real estate prices?

Asset-price shocks precipitate reactions from the policy makers and, hence, modify the transmission mechanism of macroeconomic policies. Two related issues are of particular interest. First, how can monetary policy makers use asset-price shocks to improve their ability to pursue financial and macroeconomic stability? Second, how does the monetary policy transmission mechanism affect asset prices? In fact, the recent global financial crisis and the subsequent Great Recession in the US, prompted by the crash of housing and stock markets, renewed the interest of researchers and policy makers in the linkages between monetary policy and asset prices, particularly, housing and stock prices.

Given the stability goal of modern economies, numerous studies assess the interplay between asset prices and the US monetary policy with contradicting results. One reason for disparate findings reflects the fact that monetary policy experienced dramatic evolution over the past decades.Footnote 2 On the one hand, Bernanke and Gertler (2001) indicate that no need exists for monetary policy to react to asset-price fluctuations, except to the extent that they help forecasting inflation. Similarly, Filardo (2000) finds little evidence that the use of real estate and equity prices can improve the conduct of the monetary policy. Further, Gilchrist and Leahy (2002) argue strongly that asset prices should not enter monetary policy rules. Bordo and Wheelock (2004) find no consistent relationship between inflation and stock market booms. Indeed, they find that fundamentals partly drive booms in asset prices. Kohn (2009) notes that the Federal Open Market Committee (FOMC) frequently projects the future path of the economy based on different economic and policy assumptions, including the evolution of asset prices.

On the other hand, other studies document an important role for asset prices as information variables for the monetary transmission mechanism. Goodhart and Hofmann (2001) show that useful information about future inflation comes from financial conditions indexes that include property and stock prices. Mishkin (2001) supports this view and substantiates the important role of asset prices in the conduct of monetary policy. He notes, however, that targeting asset prices by central banks may worsen economic performance while eroding the central bank independence. More innovatively, Bordo and Jeanne (2002) argue that under certain circumstances, proactive monetary policy may diffuse asset-price booms. Accordingly, they show that in the event of a credit crunch, incorporating asset prices directly into the central bank objective function will probably prove more beneficial in terms of output gain than injecting liquidity ex post.

The TVP-VAR method that we employ shows that the effects of interest rate (asset return) shocks on asset returns (the interest rate) exhibit important time-varying patterns. The relative importance of the relationships between the interest rate, and housing and equity returns alter over time as the macroeconomy experiences different phases in the housing and equity markets. On the one hand, interest-rate shocks exert a larger effect on the housing return than the equity return after 1980. The equity return responds more vigorously to interest-rate shocks prior to1980. On the other hand, the interest rate responds positively and more strongly to housing- than equity-return shocks after the early-1970s, while the interest rate responds more strongly to equity-return shocks prior to early-1970s. Our findings support an important role for asset returns in the conduct of the monetary policy.

In the US literature, the few studies that implement the TVP-VAR methodology (e.g., Primiceri 2005; Koop et al. 2009; and Korobilis 2013) consider the effect of monetary policy as represented by the short-term interest rate on unemployment and inflation. The common theme from these studies establishes evidence of changes in the monetary policy transmission in response to exogenous shocks over the post-WWII period that variously ends in the 2000s. Against this backdrop, our study contributes to the existing literature in two ways. First, our paper, to the best of our knowledge, is the first to analyze the relationship between monetary policy and housing and equity return shocks over a much longer historical sample from 1890 to 2012, and hence, does not limit the analysis to post WWII data. Second, recognizing that both monetary policy and the asset markets have undergone considerable change over time, we apply a TVP-VAR methodology to control for any structural breaks that exist in the relationship between these three variables.Footnote 3 Again, to the best of our knowledge, no studies have analyzed the effect of monetary policy (asset prices) shocks on asset prices (monetary policy) using a TVP-VAR methodology for the US economy.

The paper adopts the following structure. The next section briefly presents the methodology. Section 3 describes the data. Section 4 discusses the empirical findings and section 5 concludes.

Empirical Methodology

Primiceri (2005) developed the TVP-VAR model. Its flexibility and robustness capture the time-varying properties underlying the structure of the economy. More recently, Nakajima (2011) argues that the TVP-VAR model with constant volatility probably produces biased estimates due to the variation of the volatility in disturbances, thus emphasizing the role of stochastic volatility. The TVP-VAR model with stochastic volatility avoids this misspecification issue by accommodating the simultaneous relations among variables as well as the heteroskedasticity of the innovations. This gain in flexibility comes at the expense of a more complicated estimation structure. The estimation of the model requires using Markov-Chain Monte-Carlo (MCMC) methods with Bayesian inference.

The TVP-VAR model emerges from the basic structural VAR model defined as follows:

where y t denotes a k × 1 vector of observed variables, and A, F 1 , …, F s denote k × k matrices of coefficients. The disturbance vector u t is a k × 1 structural shock assumed to follow a normal distribution of the form u t ~ N(0, Σ), where

To specify the simultaneous relations of the structural shock by recursive identification, A takes on a lower-triangular structure as follows:,

The model in Eq. (1) solves for the following reduced form specification:

where B i = A ‐ 1 F i for i = 1, …, s. Stacking the elements in the rows of the B i ' s to form β (k 2 s × 1 vector), and defining X t = I k ⊗ (y ' t − 1 , …, y ' t − s ), where ⊗ denotes the Kronecker product, we can rewrite the model as follows:

By allowing the parameters to change over time, we can rewrite the model in the following specificationFootnote 4:

where the coefficients β t , and the parameters A t and Σ t are all time varying. To model the process for these time-varying parameters, Primiceri (2005) assumes the parameters in Eq. (6) follow random-walk processes.Footnote 5 Let a t = (a 21, a 31, a 32, a 41, …, a k,k − 1)' denote a stacked vector of the lower-triangular elements in A t and h t = (h 1t , …, h kt )' with h jt = log σ 2 jt for j = 1, …, k, t = s + 1, …, n. Thus,

for t = s + 1, …, n, where \( {\beta}_{s+1}\sim N\left({\mu}_{\beta_0},{\varSigma}_{\beta_0}\right), \) \( {a}_{s+1}\sim N\left({\mu}_{a_0},{\varSigma}_{\beta_0}\right) \) and \( {h}_{s+1}\sim N\left({\mu}_{h_0},{\varSigma}_{h_0}\right). \)

This methodology exploits the salient feature of the VAR model with time-varying coefficients to estimate a three variable VAR model (interest rate, housing return, and equity return), focusing on the dynamics of interest-rate adjustments in relation with both housing- and equity-return adjustments. By allowing all parameters to vary over time, this paper examines the assumption of parameter constancy for the VAR’s structural shocks based on the standard recursive identification procedure known as the Choleski decomposition. We achieve identification by imposing a lower triangular representation on the matrix A t . We adopt the recursive ordering of the variables that proves consistent with the VAR based empirical literature on monetary policy and asset returns (prices) (e.g., Bjørnland and Laitemo 2009; Banbura et al. 2010; Bjørnland and Jacobsen 2010 and 2013 and references cited there in). That is, the interest rate comes first in the ordering and it does not respond contemporaneously to housing and equity-return shocks, while the housing return reacts with a lag to equity return shocks. Thus, the housing return appears second in the ordering before the equity (stock-market) return.Footnote 6

Data

To examine the time-varying effects of housing- and equity-return shocks on monetary policy, we estimate the three-variable TVP-VAR model using annual data from 1890 to 2012. The dataset comes primarily from the Online Data section of Robert Shiller’s websiteFootnote 7 and includes the real stock market price, the real housing price, and the short term interest rate commonly used as the monetary policy instrument. The data series on these variables, however, only run to 2009 on Robert Shiller’s website. We update the data through 2012, using the definition of the variables and sources outlined in the data files of Robert Shiller. The interest-rate variable is stationary in levels. We transform the two asset-price variables into their log-differenced (i.e., return) form to ensure stationarity, given the existence of unit root in their level forms.Footnote 8 That is, the analysis uses the real stock market return (RSP), the real housing return (RHP), and the short term interest rate (R). Further, for ease of comparison and interpretation, we standardize all variables using the standard deviation. We choose a lag length of one based on the Akaike information criteria applied to a stable constant parameter VAR. Since we convert the variables into their growth rates and use one lag, the effective sample of our analysis starts in 1893.

Estimation Results

Table 1 reports the posterior estimates computed using the MCMC algorithm based on keeping 100,000 draws after 10,000 burn-ins.,Footnote 9 Footnote 10 We perform diagnostic tests for convergence and efficiency. The 95 % credibility intervals include the estimates of the posterior means and the convergence diagnostic (CD) statistics developed by Geweke (1992). We cannot reject the null hypothesis of convergence to the posterior distribution at the conventional level of significance. In addition, we also observe low inefficiency factors, confirming the efficiency (see Fig. 1) of the MCMC algorithm in replicating the posterior draws. These results indicate that all three set of parameters (\( {\varSigma}_{\beta_t} \), \( {\varSigma}_{a_t} \), \( {\varSigma}_{h_t} \)), as described in Eq. (7), do change over time.

Estimates of the Stochastic Volatility

Besides the time varying structure of the parameters of interest (\( {\varSigma}_{\beta_t} \), \( {\varSigma}_{a_t} \), \( {\varSigma}_{h_t} \)), the volatility of asset-return shocks seems to match the evolution of the interest rate. Figure 2 plots the posterior draws for each time series (top graphs) and the posterior estimates of the stochastic volatility (bottom graphs). The pattern depicted by the volatility of the interest-rate shocks seem compatible with the historical evolution of the US monetary policy, at least from the establishment of the Federal Reserve System in 1913. For example, Lubik and Schorfheide (2004) argue that the appointment of Paul Volker in 1979 as Federal Reserve Chairman marked a watershed event for monetary policy. Before Volker, the Federal Reserve implemented a passive monetary policy. That changes in 1979 and policy became much more aggressive. In their new Keynesian monetary dynamic stochastic general equilibrium (DSGE) model, they discover that the model exhibited indeterminacy and determinancy before and after 1979, respectively. We observe that 1979 saw the peak in interest-rate volatility.

Meulendyke (1998) describes how US monetary policy evolved over time with various changes reflecting different monetary policy objectives and their subsequent instruments. More specifically, the low volatility observed prior to 1970s matches diverse monetary frameworks for which interest rates did not play as important a role. Initially designed to control money and credit through bank reserves coordination (1920s), the open market policy of the Federal Reserve became more objective in the 1930s with the primarily goal of easing financial conditions following the Great Depression prompted by the collapse of the stock market. During World War II, monetary policy accommodated the war effort by holding down the cost of its financing in the 1940s. The passage of the Treasury-Federal Reserve Accord of 1951 released the Federal Reserve from the obligation of keeping the interest cost of the federal debt low, which they did during World War II. The Federal Reserve adopted the “bills only” policy in the 1950s, which confined monetary policy to open markets operations in short maturity Treasury securities, bills, and certificates of indebtedness with discount rate and reserve requirement changes used as occasional supplements. Interestingly, the Federal Reserve adjusted margin requirements on stock purchase occasionally to boost or dampen credit use (Meulendyke 1998), thus reflecting the observed increase in the volatility of the interest-rate shocks.

In the late 1970s, US monetary policy moved from funds rate targeting to targeting money and non-borrowed reserves (1979–1982) and subsequently to monetary and economic objectives with borrowed reserves targets. This makes interest rates the key instrument in the conduct of the US monetary policy, hence justifying the higher interest-rate volatility towards the end of the sample period. In relation to asset markets, the big increase in the volatility of the interest rate in early 1980s coincides with the boom period of the two asset prices and the lowering of both asset-return volatilities.

We observe some interesting differences with regards to the evolution of the two asset returns. The real housing return exhibits relative spikes between 1891 and 1951, although Shiller (2005) indicates the absence of any major real estate boom before 1940 and associates the observed decrease to World War I with the great influenza pandemic of 1918–19, the severe recession in 1920–21, and the high unemployment during the 1930s Great Depression. Between the 1940s and 1960s, while interest-rate volatility remains low, the real housing return exhibits a relative increase in volatility whereas the real equity-return volatility shows a downward trend. After a long period of relative stability, the real housing return experiences new increases in volatility toward the end of the sample, coinciding with the recent housing boom, which began prior to the financial crisis and Great Recession in the late 2000s. In the second half of the 2000s, where peaks in the housing market followed peaks in the stock market with an average lag of 3 years, we observe the same increase in asset-return and interest-rate volatility. This suggests the possibility of significant changes in the relationship between the interest rate and asset returns over time, hence providing the rationale for using a TVP-VAR where the sources of time variation include both the coefficients and the variance of the innovations.

Prior to World War II, monetary policy experienced three phases. The gold standard operated prior to World War I where housing-return volatility exceeded equity-return volatility and interest-rate volatility followed a downward trend into the war period. During World War I the newly charted Federal Reserve kept the interest cost of the federal debt low and we observe relatively low interest-rate volatility. After World War I, the world community tried to return to the gold standard, which did not succeed. In the interwar period, housing-return volatility declined while equity-return volatility rose, reaching its peak in our sample during the Great Depression. In addition, the nominal interest rate falls to its lowest point during the Great Depression until the more recent financial crisis and Great Recession.

Evolution of the Monetary Policy

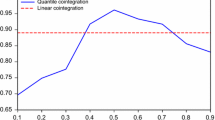

With the evidence of high volatilities in the dynamics of housing and equity returns, we also explore the possibility of regime switches in the two financial markets, which may bring out policy changes across regimes. We implement a Markov Switching Autoregressive (MS-AR) model estimated for each asset category, which allows the identification of periods of high and low volatility. The existing literature argues that high (low) volatility of asset prices leads to bear (bull) markets (French et al. 1987; Campbell and Hentschel 1992; Glosten et al. 1993; Ang et al. 2006).Footnote 11 Fig. 3 plots the smoothed probabilities for the bull market.Footnote 12 Consistent with the 1998–2007 housing boom, the housing market appears to enter the low-volatility (bull) regime from 1960s to the second half of 2000s. Unlike the housing market, the low-volatility (bull) regimes in the stock market disseminate throughout the sample period. Moreover, the patterns reveal different episodes of equity price booms identified by Bordo and Wheelock (2004): the 1920s, 1930s, 1950s, 1960s, 1980s and 1990s.

In sum, the housing return exhibits one extended low-volatility (bull) period from the mid-1950s through the mid-2000s whereas the equity return exhibits a series of low-volatility (bull) episodes that spread across the entire sample period. The low housing-return volatility period achieved a probability of one for nearly its entire length. The equity return experience of low volatility never achieved a probability of one. Choosing low equity return volatility periods only for a probability of greater than 0.5, we identify 10 episodes, early-1900s, late-1910s, mid-1920s, mid- and late-1930s, early-1950s, early-1960s, early-1970s, mid-1980s, and late-1990s.

Another method of evaluating the evolution of the monetary transmission mechanism considers the impulse response functions from the TVP-VAR model over selected horizons (we consider 1 to 6 years ahead) at all points in time.Footnote 13 This approach adds a third dimension to the analysis, hence allowing the interpretation in terms of magnitude of the responses at each step and across regimes. We begin by estimating the constant VAR impulse responses as a benchmark, which capture the average levels of impulse response functions at all points in time over the sample period. Despite the initial positive, but insignificant, response of equity return to a positive interest-rate shock, which lasts less than a year, the average effect of the interest-rate shock on both asset returns appears negative and generally insignificant throughout the time horizon (See panel A of Fig. 4). The direction of the effect corroborates the view in the monetary literature that an increase in the interest rate likely lowers asset prices. The initial negative response of the housing return to an interest-rate shock, however, does prove significant in year one and then becomes insignificant, but negative, while rising to nearly zero in the remaining forecast horizon. Moreover, in terms of magnitude, the housing-return effect dominates the equity-return effect of the interest-rate shock in the short run (1 year), which contradicts the evidence from the TVP-VAR.

Unlike the constant VAR model, panel B of Fig. 4 reveals a price puzzle at some points in time with the positive response of the housing return across different horizons. This puzzle effect possibly emerges as a result of the lack of information contained in the parsimonious three variables VAR (Korobilis 2013). More interestingly, the magnitude of the housing-return response to an interest-rate shock exceeds in absolute value the response of the equity return after 1980, which includes the boom period in the housing market. In absolute value, the response of the housing return to a one-standard-deviation change in the interest rate ranges between 1- and 6 % compared to the response of the equity return, which lies between 0- and 1 %. This contrasts with the relatively larger response of the equity return to an interest-rate shock prior to 1980, where the magnitude ranges between 1- and 5 % in absolute value against a 1- to 3 % response of the housing return to a one-standard-deviation change in the interest rate.

On the other hand, the positive feedback effects from both asset-return shocks to the interest rate prove consistent with previous studies (e.g., Demary 2010; Ncube and Ndou 2011; Gupta et al. 2012; Peretti et al. 2012; Simo-Kengne et al. 2013) and indicate that the monetary authorities increase the interest rate as asset returns increase, giving a countercyclical response of monetary policy to asset returns. Results from the constant VAR model show that equity-return shocks exhibit the larger effect on the interest rate over the 6-year horizon (see panel A of Fig. 5).

Panel B of Fig. 5, however, shows that the interest rate responds more strongly to housing-return shocks during its low-volatility (bull) regime. That is, the housing-return effect exceeds the equity-return effect after the early-1970s when the housing market experienced a low-volatility (bull) regime. During that period, the magnitude of the housing-return effect oscillates between 10- and 20 % across horizons while a one-standard-deviation change in the equity return falls between 0- and 10 %. Similarly, the response of the interest rate to an equity-return shock appears stronger across horizons in the early part of the sample, where stock market episodes of low volatility (booms) saw more prominence. Prior to 1970, a positive shock to the equity return leads to a 5- to 30 % increase in interest rate at all horizons against a positive response to a housing-return shock ranging between 0- and 10 %.Footnote 14

Conclusion

The evolution of the US monetary policy experienced numerous modifications and adjustments in response to various exogenous shocks of different sources. This paper evaluates a long dataset, covering annual observations over the period of 1890–2012, to characterize the dynamic relationship between asset returns and US monetary transmission, as captured by the nominal interest rate, based on a stochastic TVP-VAR approach and distinguishes between low- and high-volatility regimes to allow for more detailed interpretations. Moreover, we supplement the TVP-VAR approach with a MS-AR model to identify switches between high- and low-volatility regimes.

The empirical results substantiate a larger response of the interest rate to asset-return shocks during low-volatility (bull) regimes, which correspond to a larger effect of interest-rate shocks on asset returns during boom periods. More specifically, interest-rate shocks exert a larger effect on the housing return than the equity return after 1980 that corresponds to the low-volatility (bull) regime in the housing market. The equity return responds more vigorously to interest-rate shocks prior to1980.

We also find feedback effects of asset-return shocks onto the interest rate. The interest rate responds positively and more strongly to housing- than equity-return shocks after the early-1970s, while the interest rate responds more strongly to equity-return shocks prior to early-1970s, where stock-market booms exhibited more prominence. Our findings support an important role for asset returns in the conduct of the monetary policy.

We further explore the possibility of regime switches between low- and high-volatility markets, using a Markov Switching Autoregressive (MS-AR) model estimated for each asset category. We identify periods of high volatility (bear markets) and low volatility (bull markets). The housing market experiences an extended and continuous low-volatility (bull) regime from the 1960s to the second half of the 2000s. Unlike the housing market, the low-volatility (bull) regimes in the stock market appear throughout the sample period for relatively short periods of time.

Finally, our results indicate that the 1970s featured a dramatic change in the relationships between asset returns and the interest rate. Chairman Volker took the leadership of the Federal Reserve Board of Governors in 1979 as the macroeconomy transitioned from the Great Inflation to the Great Moderation. The proponents of the good policy explanation of the Great Moderation view Volker’s appointment as critical. That is, our findings support the view of Lubik and Schorfheide (2004), who argue that the Volker’s appointment marked a watershed event for monetary policy. Before Volker, the Federal Reserve implemented a passive monetary policy in their view.

Notes

For example, Kim and Nelson (1999), McConnell and Perez-Quiros (2000), Blanchard and Simon (2001), and Ahmed et al. (2004), among others, document a structural change in the volatility of U.S. GDP growth, finding a rather dramatic reduction in GDP volatility. Stock and Watson (2003), Bhar and Hamori (2003), Mills and Wang (2003), and Summers (2005) show a structural break in the volatility decline of the output growth rate for Japan and other G7 countries, although the break occurs at different times.

Based on the Bai and Perron (2003) tests for structural breaks, with 5-percent trimming of the sample and at the 10 % significance level, we detect as many as five breaks in each of the three equations of the VAR model. The dates for the interest rate, real housing returns, and real stock returns equations correspond, respectively, as follows: 1898, 1969, 1975, 1981, and 1987; 1918, 1931, 1939, 1947, and 2007, and; 1900, 1908, 1941, 1947, and 2003. Complete details of these results are available from the authors.

Random-walk processes allow for both temporary and permanent shifts in the coefficients. The drifting coefficient captures a possible non-linearity, such as a gradual change or a structural break. In practice, this assumption implies a possibility that the time-varying coefficients capture not only the true movement but also some spurious movements, because the parameters can freely move under the random-walk assumption. In other words, a risk exists for the time-varying coefficients to over fit the data, if the relationships between the variables are obscure. To avoid this situation, it may prove better to assume stationarity for the time-varying coefficients. For example, we can model each coefficient to follow an AR(1) process, where the absolute value of the persistence parameter is less than one. In this formulation, however, the estimation of a structural change or a permanent shift of the coefficient will prove difficult even if it exists. In other words, it is important to choose the model specification of the time-varying coefficients such that it is suitable for the data, the economic theories, and the purpose of the analysis (Nakajima 2011).

Based on the suggestion of an anonymous referee, however, we also computed the impulse response functions by ordering the interest rate last with real housing and equity returns ordered first and second, respectively, and then interchanging the order of stock and housing returns, but still retaining interest rate in the third position. The results were qualitatively similar and are available from the authors.

We use standard unit-root tests: Augmented-Dickey-Fuller (ADF) (Dickey and Fuller 1981), Phillips-Perron (PP) (Phillips and Perron 1988), Dickey-Fuller with Generalised-Least-Squares-detrending (DF-GLS) (Elliott et al. 1996), and the Ng-Perron modified version of the PP (NP-MZt) (Ng and Perron 2001) tests to confirm that the log-levels of the asset-price variables under consideration follow an integrated process of order 1 or I(1) processes. The unit-root tests are available from the authors.

The MCMC method assesses the joint posterior distributions of the parameters of interest based on certain prior probability densities that are set in advance. This paper implements the code of Nakajima (2011) by assuming the following priors: Σ β ∼ IW(25, 0.01I), (Σ a ) − 2 i ∼ G(4, 0.02), (Σ h ) − 2 i ∼ G(4, 0.02), where (Σ a ) − 2 i and (Σ h ) − 2 i are the ith diagonal of elements of Σ a and Σ h , respectively. IW and G denote the inverse Wishart and the Gamma distributions, respectively. We use flat priors to set initial values of time-varying parameters such that: \( {\mu_{\beta}}_{{}_0}={\mu_a}_{{}_0}={\mu_h}_{{}_0}=0 \) and \( {\varSigma_{\beta}}_{{}_0}={\varSigma_a}_{{}_0}={\varSigma_h}_{{}_0}=10\times I. \)

Based on the suggestions of an anonymous referee, we used the posterior of the first 10 observations as priors for the sample period covering 1901–2012. Our results were, however, qualitatively similar to the ones obtained based on the prior specifications discussed in Footnote 9. Further details on these results are available from the authors.

Refer to the estimation results in Table 2 dealing with the identification of the bull and bear regimes in the housing and stock markets.

For a standard constant-parameter VAR model, the impulse responses are drawn for each set of two variables. By contrast, for the TVP-VAR model, we can draw the impulse responses in an additional dimension (i.e., Compute the responses at all points in time using the estimated time-varying parameters). In that case, several ways exist to simulate the impulse responses based on the parameter estimates of the TVP-VAR model. Considering the comparability over time, we follow Nakajima (2011) and compute the impulse responses by fixing an initial shock size equal to the time-series average of stochastic volatility over the sample period and use the simultaneous relations at each point in time. To compute the recursive innovation of the variable, we use the estimated time-varying coefficients from the current date to future periods. Around the end of the sample period, we set constant the coefficients in future periods for convenience.

Based on the suggestions of an anonymous referee, we also estimated a two-regime Bayesian Markov-Switching (MS) VAR ordered as R, RHP, and RSP. Balcilar et al. (2015) report complete details of the Bayesian MS-VAR. Based on impulse response functions obtained from 2000 posterior draws with a burn-in of 1000 draws, the results suggest that positive interest rate shocks depress asset prices in both regimes, though some evidence exists of stock returns appreciating at shorter horizons, but this effect is statistically insignificant. Further, positive asset returns shocks lead to a positive response of the interest rate. So, in general, our results are similar to the single-regime constant parameter VAR model. Note, however, that we cannot compare the results with our TVP-VAR model, as the number of regimes in the TVP-VAR equals the number of observations (i.e., 122 in our case). Further, the results are time varying and not based on full-sample, two-regime estimation as in the MS-VAR. Complete details of these results are available from the authors.

References

Ahmed, S., Levin, A., & Wilson, B. A. (2004). Recent U.S. macroeconomic stability: Good policies, good practices, or good luck? The Review of Economics and Statistics, 86, 824–832.

Ang, A., Hodrick, R. J., Xing, Y., & Zhang, X. (2006). The cross‐section of volatility and expected returns. The Journal of Finance, 61, 259–299.

Bai, J., & Perron, P. (2003). Computation and analysis of multiple structural change models. Journal of Applied Ecology, 18, 1–22.

Balcilar, M., Gupta, R., & Miller, S. M. (2015). Regime switching model of US crude Oil and stock market prices: 1859–2013. Energy Economics, 49, 317–327.

Banbura, M., Giannone, D., & Reichlin, L. (2010). Large Bayesian vector auto regressions. Journal of Applied Econlogy, 25, 71–92.

Bernanke, B., & Gertler, M. (2001). Monetary policy and asset prices volatility. NBER working paper 7559, Cambridge.

Bhar, R., & Hamori, S. (2003). Alternative characterization of the volatility in the growth rate of real GDP. Japan and the World Economy, 15, 223–231.

Bjørnland, H. C., & Jacobsen, D. H. (2010). The role of house prices in the monetary policy transmission mechanism in small open economies. Journal of Financial Stability, 6, 218–229.

Bjørnland, H. C., & Jacobsen, D. H. (2013). House prices and stock prices: Different roles in the U.S. monetary transmission mechanism. The Scandinavian Journal of Economics, 115, 1084–1106.

Bjørnland, H. C., & Laitemo, K. (2009). Identifying the Interdependence between US Monetary Policy and the Stock Market. Journal of Monetary Economics, 56, 275–282.

Blanchard, O., & Simon, J. (2001). The long and large decline in U.S. output volatility. Brookings Papers on Economic Activity, 32, 135–174.

Boivin, J. (2005). Has US monetary policy changed? Evidence from drifting coefficients and real-time data. NBER working paper 11314, Cambridge.

Bordo, M. D., & Jeanne, O. (2002). Monetary policy and asset prices: Does benign neglect make sense? International Finance, 5(2), 139–164.

Bordo, M.D., & Wheelock, D.C. (2004). Monetary policy and asset prices: A look back at past US stock market booms. NBER working paper 10704, Cambridge.

Borio, C.E.V., Kennedy, N., & Prowse, S.D. (1994). Exploring aggregate asset price fluctuations across countries: Measurement, determinants, and monetary policy implications. Bank for International Settlements, BIS Economics Papers no. 40.

Campbell, J. Y., & Hentschel, L. (1992). No news is good news: An asymmetric model of changing volatility in stock returns. Journal of Financial Economics, 31, 281–318.

Case, K., Quigley, J., & Shiller, R. (2013). Wealth effects revisited: 1975–2012. NBER Working Paper No. 18667.

Demary, M. (2010). The interplay between output, inflation, interest rates and house prices. International Evidence Journal of Property Research, 27(1), 1–17.

Detken, C., & Smets, F. (2004). Asset price booms and monetary policy. ECB Working Paper Series No. 364.

Dickey, D., & Fuller, W. (1981). Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica, 49, 1057–1072.

Elliott, G., Rothenberg, T. J., & Stock, J. H. (1996). Efficient tests for an autoregressive unit root. Econometrica, 64(4), 813–836.

Filardo, A.J. (2000). Monetary policy and asset prices. Federal Reserve Bank of Kansas City Economic Review, Third Quarter, 11–37.

French, K. R., Schwert, G. W., & Stambaugh, R. F. (1987). Expected stock returns and volatility. Journal of Financial Economics, 19, 3–29.

Gelain, P., & Lansing, K.J. (2013). House prices, expectations and time-varying fundamentals. Federal Reserve Bank of San Francisco Working Paper 2013–03.

Geweke, J. (1992). Evaluating the accuracy of sampling-based approaches to the calculation of posterior moments. In J. M. In Bernado, J. O. Berger, A. P. Dawid, & A. F. M. Smith (Eds.), Bayesian statistics (Vol. 4, pp. 169–188). New York: Oxford University Press.

Gilchrist, S., & Leahy, J. V. (2002). Monetary policy and asset prices. Journal of Monetary Economics, 49, 75–97.

Glosten, L. R., Jagannathan, R., & Runkle, D. E. (1993). On the relation between the expected value and the volatility of the nominal excess return on stocks. The Journal of Finance, 48, 1779–1801.

Goodhart, C., & Hofmann, B. (2001). Asset prices, financial conditions and the transmission of monetary policy. Conference on Asset Prices, Exchange Rates, and Monetary Policy, Stanford University, March 2–3, 2001.

Guerrieri, L., & Iacoviello, M. (2013). Collateral constraints and macroeconomic asymmetries. Mimeo, Boston College.

Gupta, R., Jurgilas, M., Miller, S. M., & van Wyk, D. (2012). Financial market liberalization, monetary policy and housing sector dynamics. International Business and Economics Research Journal, 11(1), 69–82.

Kim, C. J., & Nelson, C. R. (1999). Has the U.S. economy become more stable? A Bayesian approach based on a Markov-Switching model of the business cycle. Review of Economics and Statistics, 81, 1–10.

Kohn, D. L. (2009). Monetary policy and asset prices revisited. Cato Journal, 29(1), 31–44.

Koop, G., Leon-Gonzalez, R., & Strachan, R. W. (2009). On the evolution of the monetary policy transmission mechanism. Journal of Economic Dynamics and Control, 33, 997–1017.

Korobilis, D. (2013). Assessing the transmission of monetary policy using time-varying parameter dynamic factor models. Oxford Bulletin of Economics and Statistics, 75(2), 157–179.

Liu, Z., Wang, P., & Zha, T. (2013). Land-price dynamics and macroeconomic fluctuations. Econometrica, 81, 1147–1184.

Lubik, T. A., & Schorfheide, F. (2004). Testing for indeterminacy: An application to US monetary policy. American Economic Review, 94(1), 190–217.

McConnell, M. M., & Perez-Quiros, G. (2000). Output fluctuations in the United States: What has changed since the early 1980’s? American Economic Review, 90, 1464–1476.

Meulendyke, A. M. (1998). US monetary policy and financial markets. Federal Reserve Bank of New York.

Mian, A.R., Rao, K., & Sufi, A. (2013). Household balance sheets, consumption, and the economic slump. Chicago Booth Research Paper no. 13–42, Fama-Miller Working Paper.

Mills, T. C., & Wang, P. (2003). Have output growth rates stabilized? Evidence from the G-7 economies. Scottish Journal of Political Economy, 50, 232–246.

Mishkin, F.S. (2001). The transmission mechanism and the role of asset prices in monetary policy. NBER working paper 8617, Cambridge.

Nakajima, J. (2011). Time-varying parameter VAR model with stochastic volatility: An overview of methodology and empirical applications. Monetary and Economic Studies, 107–142.

Ncube, M., & Ndou, E. (2011). Monetary policy transmission, house prices and consumer spending in South Africa: An SVAR approach. Working Paper 133, African Development Bank.

Ng, S., & Perron, P. (2001). Lag lenth selection and the construction of unit root tests with good size and power. Econometrica, 69, 1519–1554.

Peretti, V., Gupta, R., & Inglesi-Lotz, R. (2012). Do house prices impact consumption and interest rate in South Africa? Evidence from a Time Varying Vector Autoregressive model. Economics, Financial Markets and Management, 4, 101–120.

Phillips, P., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 75, 335–346.

Primiceri, G. E. (2005). Time varying structural vector autoregressions and monetary policy. Review of Economic Studies, 72, 821–852.

Shiller, R. J. (2005). Irrational exuberance. Princeton: Princeton University Press.

Simo-Kengne, B. D., Balcilar, M., Gupta, R., Aye, G. C., & Reid, M. (2013). Is the relationship between monetary policy and house prices asymmetric across bull and bear markets in South Africa? Evidence from a Markov-Switching Vector Autoregressive model. Economic Modelling, 32(1), 161–171.

Sims, C. A., & Zha, T. (2006). Were regime switches in US monetary policy? American Economic Review, 96(1), 54–81.

Stock, J. H., & Watson, M.W. (2003). Has the business cycle changed? Evidence and explanations, Monetary Policy and Uncertainty: Adapting to a Changing Economy. Proceedings of symposium sponsored by Federal Reserve Bank of Kansas City, Jackson Hole, Wyo., 9–56.

Summers, P.M. (2005). What caused the Great Moderation? Some cross-country evidence. Economic Review (Third Quarter), Federal Reserve Bank of Kansas City, 5–32.

Zhou, X., & Carroll, C. D. (2012). Dynamics of wealth and consumption: new and improved measures for U.S. states. The B.E. Journal of Macroeconomics, 12, 1–44.

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank an anonymous referee for many helpful comments. Any remaining errors, however, are solely ours

Rights and permissions

About this article

Cite this article

Simo-Kengne, B.D., Miller, S.M., Gupta, R. et al. Evolution of the Monetary Transmission Mechanism in the US: the Role of Asset Returns. J Real Estate Finan Econ 52, 226–243 (2016). https://doi.org/10.1007/s11146-015-9512-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-015-9512-5