Abstract

When house sellers reach the end of a listing contract without a sale they are faced with several decisions. A seller who wants to continue to market the property can leave it on the market, relist the property immediately, or take it off the market for a period of time before relisting it. Research has shown that properties with longer time-on-market may carry a stigma and sell for less. In an attempt to mitigate the negative perception of a house that other buyers appear to have passed by, a seller can have the agent relist the property so it appears as a new listing. If a seller decides to relist the property, the owner also has to decide how long to wait before relisting. We use a hedonic approach to investigate the choices sellers have when deciding whether to relist their property and the impact those decisions have on the property’s selling price. We find that relisting a property results in a higher selling price and that to maximize price, the seller should relist the property with the same agent within 30 days.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

House sellers negotiate a listing contract with a real estate agent for a specified length of time during which they hope to find a buyer willing to pay their reservation price. In a slow market, the number of potential buyers and offers decline and the seller’s probability of sale decreases, so the listing contract is more likely to expire without receiving an acceptable offer. Sellers who reach the end of a listing contract without a sale face several decisions. First, the seller must decide whether to end all attempts to sell the property. If an owner wants to continue marketing the property, then an additional decision must be made whether to continue with the existing listing or relist the property. Relisting can either be done immediately or after taking it off the market for a period of time.

In this paper, we test whether relisting a property impacts its selling price. There are several reasons why we expect the relisting process to influence selling price. First, while sellers, in general, can hold out for a higher selling price, properties that remain listed and unsold on a Multiple Listing Service (MLS) for an unusually long period of time may become stigmatized because of adverse selection (Taylor 1999). Potential buyers may use the long listing time as a signal that the property has problems that are not immediately noticeable, but which earlier consumers discovered, prompting them to refuse to buy that property. Therefore, new potential buyers also shy away from the property. A long listing period can also be interpreted as a signal that the seller may be tired of waiting and might be willing to negotiate a lower price. Clearly, sellers have an incentive to take measures to avoid these negative signaling effects. One way sellers can mitigate the negative perception of long listing periods is to remove the property from active listing, then reintroduce the property as a “new” listing on the MLS in the near future. However, with information readily available from third party real estate websites and real estate agents, it is difficult for sellers to hide the property’s listing history. Therefore, taking the property off the market rather than immediately relisting it may only result in the seller missing a potential buyer’s offer and extending the total time needed to sell the property.

Second, relisting creates additional exposure for the property. When a property is relisted in the MLS it is displayed as a “new” listing. Even though the property’s previous listing history cannot be totally erased, the additional attention garnered from being a “new” listing may result in a quicker sale and higher price than a property whose initial listing has been extended. Third, previous research has found that sellers face increased pressure from their agent as the expiration of the listing contract approaches (Geltner et al. 1991). The increased pressure can result in a lower selling price as agents try to achieve a sale (Asabere et al. 1996; Clauretie and Daneshvary 2008). When a property is relisted, agent pressure to agree to a lower negotiated selling price, rather than hold out for a higher offer, may be reduced.

We examine how relisting decisions affect selling price while controlling for time-on-market using data on single-family home sales. We test the impact of (1) listing a house for sale on a continuous basis versus taking the property off the market and re-entering it as a new listing, (2) relisting the property multiple times, and (3) relisting the property immediately versus waiting a period of time. Most previous studies of house prices do not properly account for properties that are relisted. In addition, previous studies that include properties that sold after multiple listing periods only consider the final listing contract.

Our analysis is based on a large data set that spans a major metropolitan area during a slow market. This setting is ideal for our study for two reasons. First, properties are less likely to sell during a slow market, so sellers are more likely to be faced with the decision to relist. Second, in a slow market sellers have to weigh the benefits of taking the property off the market for a period of time (i.e., attempting to remove the stigma agents and potential buyers may associate with properties that have not sold) against the probability of missing a sale during the time the property is off the market. In a hot market, sellers are less likely to face the decision to relist and, when faced with the decision, may be less likely to take their property off the market for a period of time because the costs (i.e., missed sale) could far outweigh the potential benefits. However, in a slow market the reverse may be true.

Our results add to the literature on market efficiency in relation to real estate brokerage. If relisting a house results in a higher selling price than a comparable house that has not been relisted, then the relisting process contributes to market inefficiency. We also analyze the complexities of the relisting decision in greater detail than previous research. Our empirical approach clearly separates the effects of relisting from the effects of agent changes when investigating the impact of relisting a property on its selling price. Because our analysis focuses on a time period when the housing market required sellers to more carefully consider their marketing strategy options, we can test the effects of a wider range of relisting strategies than observed in earlier studies.

We find that relisting a property has a positive impact on selling price relative to properties that are not relisted. However, it is in the seller’s best interest to relist the property quickly rather than holding it off the market for a long period of time. Relisting the property with the same agent achieves a higher price than relisting with a new agent. The rest of the paper is organized as follows: We first review related empirical studies in the “Literature Review” section; the “Theory and Model” section discusses our underlying theory and the model used in our analysis; “Data” details the data used in the study; “Results” present the empirical results; and “Conclusions” summarizes our findings and offers our concluding remarks.

Literature Review

Many studies employ a hedonic model to estimate the selling price of single-family homes. [See Sirmans et al. (2005) for a review.] These studies identify a range of structural, neighborhood, and market characteristics that influence selling price, including, but not limited to, lot size, house age, number of bedrooms and bathrooms, basement, deck, and occupancy status. In recent years, the increased number of properties selling under distressed conditions has prompted researchers to include foreclosure status in their models. The literature shows that distressed properties created through mortgage defaults sell at a significant discount of up to 25 %, depending on location and methodology used (Pennington-Cross 2006; Clauretie and Daneshvary 2009). Moreover, Daneshvary et al. (2011) find different effects for foreclosed houses than for short sales with a smaller discount among short sales.

Researchers recognize the possible relationship between selling price and time-on-market that should be accounted for in pricing models; however, empirical studies attempting to quantify the relationship have produced mixed results. Initial studies that use very small samples find a positive relationship between selling price and time-on-market (Miller 1978; Asabere and Huffman 1993). Follow-up studies, such as Waller et al. (2010), find price and time-on-market are inversely related. Kang and Gardner (1989) suggest the relationship between selling price and marketing duration is dependent upon housing market conditions and interest rates, which is a possible explanation for the different results among otherwise similar studies. Anglin et al. (2003) find that list price is positively related to time-on-market, but are unable to estimate a relationship between list price and selling price that would complement predictions about time-on-market. They do conclude that increased market inventory, such as during an economic slowdown, lengthens time-on-market for an individual seller. Although the relationship is unclear, there is a consensus that controlling for time-on-market is an important consideration when modeling house selling prices.

Other factors that have been found to influence house price are the length of the seller’s listing contract and principal-agent conflicts. Geltner et al. (1991) provide theoretical support for a finite duration listing contract inducing an agent to increase effort level compared to a contract of unlimited duration. Similarly, Waller et al. (2010) find that a shorter listing contract leads to a shorter time-on-market. Geltner et al. (1991) further show that the principal-agent conflict over reservation price increases near the end of the listing contract period. Similarly, Clauretie and Daneshvary (2008) attribute the likelihood of selling at a lower price near expiration of a listing contract to agent pressure to lower reservation price to obtain a sale. Asabere et al. (1996) find that selling price decreases as the expiration of the listing contract approaches. They attribute this result to sellers lowering their reservation price in response to increasing opportunity costs at the expiration of a listing contract. If the contract does expire without a sale, relisting the house with the same agent would incur lower seller opportunity costs than locating a new agent and negotiating a new listing contract (Miceli 1989).

Most previous studies of house prices either do not address the issue of relisting in their specification (such as Brastow et al. 2012) or they specifically focus on the final listing period during which a sale is negotiated (Waller et al. 2010). While relisting has not been the primary topic of rigorous empirical study, there is some empirical evidence that relisting a property affects both selling price and time-on-market. This evidence is typically a by-product of studies focusing on other unrelated questions. For example, Carrillo and Pope (2012) recognize that a difference could exist between how long a property is on the market and how long a listing is active because of the possibility of relisting, but they analyze each listing of a property as a separate observation anyway. An exception to this practice is Smith (2009) who considers expired as well as relisted properties in an effort to avoid distortions by censoring of difficult-to-market properties in studies that only consider completed sales or treat each listing, including relistings, as a separate observation. He aggregates multiple listing contracts into a single observation if the property was relisted within 30 days. His focus, however, is on the importance of exact location and his data include both single-family and condominiums (many of which are rentals owned by investors). Even studies that explicitly examine the time-on-market measurement censoring problem of contract expiration and relistings such as Kalra and Chan (1994), treat each relisting of a single property as a separate observation. Similarly, Rutherford et al. (2005, 2007) concede that their analysis of selling prices may underestimate time-on-market because they are uncertain which properties were relisted after expiration of an initial contract. As Benefield and Hardin (2014) suggest, the handling of relisted properties substantially influences model outcomes, so much of the existing literature incorporating time-on-market measures should be reevaluated to account for relisted properties. Highlighting the importance of considering relisting in analyzing house sales, Tucker et al. (2013) discuss how sellers may pull a listing off the market to reset their time-on-market to zero. Their survey of homeowners suggests a significant number of buyers are unaware of sellers’ tendency to manipulate time-on-market in this way. Another consideration when isolating the influence of relisting on house prices is whether the seller changes listing agents during the relisting process. Daneshvary and Clauretie (2013) find that changing agents has an adverse effect on selling price based on a sample of just over 4,000 MLS sales observations from 2005 through 2007 in two relatively new (average age just over 5 years) neighborhoods; however, they do not isolate the effect of relisting from agent change in their analysis.

While Benefield and Hardin (2014) examine relistings, their empirical analysis is focused on different definitions of time-on-market and the impact of relistings on marketing duration measures rather than the impact on price. By defining relisting as properties that are removed and then put back on the market within 48 days, they identify 304 relistings within their 1,686 observations of relatively new properties (average age 2.2 years) sold during 2004 to 2007 in a single submarket. The analysis on their full sample indicates that relisting a property with multiple agents has a highly significant negative influence on final selling price. A weak negative relationship is shown between the act of relisting and selling price; however, relistings with agent changes are not isolated from relistings without agent changes in this specification. Furthermore, their examination of the small number of relistings in a single submarket suggests that relisting with the same agent results in a significantly higher selling price than changing agents does. Meanwhile, the total number of times a property is relisted, disregarding whether there was an agent change, does not have a significant impact on selling price. The length of the time gap between listings from 1 to 48 days also does not appear to influence final selling price in their model.

Theory and Methodology

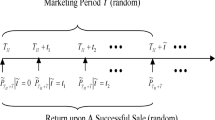

Selling a property in the U.S. can be described within an auction framework. Sellers advertise a house for sale at a list price that serves as a signal to potential buyers who place bids on the property over time. If the bids are below the seller’s initial expectation and don’t meet the seller’s reservation price, then the seller can either wait for a higher bid or reduce his/her expectations and accept an offer at a revised lower reservation price. If the seller does not receive any bids, then the list price may be reduced to signal to potential buyers that lower bids will be accepted.

Taylor (1999) develops a theoretical model to demonstrate the influence of knowledge about previous prospective buyers’ inspection of house quality and price history on house buyer behavior and seller incentives. Potential buyers may interpret the reason a seemingly desirable house has been on the market for a long time as either no one else has found the house (few qualified buyers), the house has been overpriced, or earlier potential buyers discovered an unapparent flaw in the property. If the seller sets a high price in the first period, potential buyers are more likely to attribute the failure to sell on idiosyncratic taste rather than low quality. If the expected number of first-period consumers is low, then the signal dampening effect of a consumer walking away from a higher priced house dominates the option-value effect of unobservability of first-period inspections of quality. Sellers have no way to communicate to buyers that the lack of sale in the first period was due to the lack of a serious buyer rather than a problem with quality. Consumers cannot rely on such claims anyway because the seller of a low quality house can also erroneously make the same claim. Because second-period consumers see the lack of a sale in the first-period as bad news, it may be better for the seller to start over with a new listing, in effect, a new first-period. This would increase the likelihood that a potential buyer would perceive an unsold house as yet undiscovered by others in the market while decreasing the likelihood that potential buyers would perceive long time-on-market as a signal that a house is either overpriced or contains a defect discovered by earlier prospective buyers.

If, during the first listing period, no consumer chooses to participate in the auction, then no sale occurs. During the second listing period, a new group of consumers arrives and each decides whether to bid on the house. Second listing period consumers cannot observe why the house did not sell in the first listing period. Houses that remain on the market longer than average can become stigmatized because potential buyers assume previous prospects discovered a significant problem with the property (Anglin et al. 2003). Uncertainty about why the house did not sell in the first listing period may result in more pessimistic offers in the second listing period. In fact, in a market where consumers cannot observe why a property did not sell, it may be better for sellers to “cut their losses” by selling in the first listing period, at a lower price, than to suffer the ill-effects of consumer herding away from the property in the second period.

The seller’s agent may influence the negotiated selling price. To maximize profits across single-family house sales that may generate a relatively low amount of commission per sale, agents have an incentive to increase their sales volume and, thereby, compensation. If the listing is nearing expiration and the agent is unsure if the owner will relist, then the agent has an incentive to ensure a sale before the end of the listing period or else forego any potential commission. Research comparing the sales of agent-owned and other houses reflects how agents may be influencing sellers to accept lower prices. Rutherford et al. (2005) find that houses owned by real estate agents sell at higher prices than other houses while Levitt and Syverson (2008) and Rutherford et al. (2007) find a similar premium, but also a longer time-on-market.

If a seller decides to change agents, it may signal either that the house was overpriced and the seller has unrealistic expectations so agent efforts are futile, that the house has a flaw that the listing agent was unable to overcome, or that the seller is impatient with agent efforts and motivated to make a sale. A perception that the house is overpriced or has a flaw would reduce the arrival rate of potential buyers and the distribution of offers that the seller receives, resulting in a longer time-on-market and lower selling price (Daneshvary and Clauretie 2013). All three agent change signals create lower bargaining power for the seller. Yavas and Yang (1995) relate sellers with lower relative bargaining power to lower selling prices. In addition, Springer (1996) finds that motivated sellers have lower bargaining power and sell their houses at a discount price.

Many empirical studies use log-linear regression models to estimate determinants of selling price. The model regresses the log of selling price on physical characteristics of the house, location, and time of sale. The log-log functional form may also be used by incorporating the natural logarithm of continuous independent variables. Additional variables, such as foreclosure status, listing contract status, and listing agent status can also be incorporated into the standard hedonic pricing model (Rosen 1974). To incorporate the influence the decision to relist has on the final selling price, we develop the following model:

where Price is the price of house i in neighborhood n at time t. The selling price of a house is a function of the vectors of physical characteristics of the house, X; distressed conditions surrounding the sale, D; neighborhood characteristics, N; location and time trend variables representing fixed effects for the exact geographic location and year and season of sale, T; the natural logarithm of predicted time-on-market, \( \widehat{TOM} \); Inverse Mills Ratio, IMR; and the variables of interest, L, which represent the decisions sellers face about relisting.

The house characteristics X consist of standard features included in residential hedonic pricing equations. As detailed in Table 1, house size is accounted for through a series of variables including the natural logarithm of the number of square feet of living area, finished basement, bonus room, and number of bedrooms, bathrooms, and half-bathrooms. The presence of a theater or media room indicates a more upscale house. Lot features include the size of the lot and whether the property is a corner lot or has an in-ground sprinkler system. We also include a dummy variable for whether the house has a deck or patio. The natural logarithm of the house’s age is also included.

Because we are examining sales after the real estate crisis and subsequent recession, a large number of properties (approximately 34 % of the sample) were sold under distress. We create two measures of distress D. The first variable, Foreclosure, combines sales marked as foreclosures, bank owned or government owned. The second distress variable, ShortSale, includes properties that were sold as short sales.Footnote 1 The neighborhood variables N include dummy variables for the existence of a homeowners’ association and a clubhouse. The location and time trend variables T are comprised of two sets of controls. Location is a set of census tract dummy variables that control for local characteristics that may influence property values. We further allow error terms to be clustered at the census tract level. This makes our standard error estimates robust to spatial autocorrelation at the census tract level. Dummy variables are also used for the fixed effects of year and season of sale.

In the first step of our study, our variables of interest L represent whether or not the property is relisted prior to sale. The relist variables are dummy variables for whether a house sold during its initial listing period, was relisted without an agent change (True Relist), or was relisted with an agent change (Agent Change). In this way, we investigate whether relisting a property “refreshes” the listing with agents or makes it appear as a new listing without the stigma of having been passed over by earlier potential buyers, which may signal overpricing or a latent defect. We expand the analysis to the number of relistings as well.

We also include predicted time-on-market (\( \widehat{TOM} \)) and Inverse Mills Ratio (IMR) variables to address the potential endogeneity present in the relationship between selling price and time on the market. Predicted time-on-market (\( \widehat{TOM} \)) is the predicted number of days that the property would be actively listed on the MLS.Footnote 2

After we investigate the impact of relisting on selling price using all sold properties, we shift our focus to the subset of relisted properties. We examine the effect of relisting strategies by specifying the relisting decisions variables, L, in Eq. 1 as the number of days a property is off the market before being relisted for the final time first as a continuous variable (Relist Gap) and then as a series of interval dummy variables.

Data

The data used in this analysis consist of single-family house sales between January 2011 and March 2013 in the five counties that form the urban core of the Atlanta, Georgia metropolitan area. All the information about the properties except square footage comes from their multiple listing service records. Because the listings do not consistently report living area, we match the properties to county tax assessor records that contain a square footage measurement.

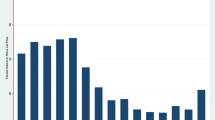

The time period selected for this study represents a slow real estate market. In slow markets, the number of potential buyers decrease and the average time-on-market may increase. As time-on-market increases, the likelihood that a property will sell during the initial listing contract period (typically 90 days in this market) decreases and more sellers are likely to face the decision whether to relist their property or take it off the market. Slow real estate markets are typically characterized by declining sales volume, lower home prices, and soft market fundamentals. Market fundamentals that drive residential real estate include population growth, employment rates, and per capita personal income. During our study period, the Atlanta MSA’s population only grew 1.65 % annually, well below its peak growth rate of 3.4 % in 2006 (U.S. Census 2013). The unemployment rate averaged 9.2 % after fluctuating between 3.0 and 6.0 % in the early 2000’s (Federal Reserve Bank of St. Louis 2013a). After dropping to $37,500 in 2009, per capita personal income almost recovered to 2007 levels of $40,000 (Federal Reserve Bank of St. Louis 2013b). Average house sales volume in the Atlanta MSA was 12,586 houses per month between 2000 and 2007. Monthly sales volume dropped to 7,407 in 2008 and bottomed out at 5,032 in 2011. House sales averaged 5,896 per month during our study period (Corelogic 2013). New housing starts were also relatively sluggish. New housing starts averaged approximately 3,220 units per month for the 11 years prior to our study period compared to only 701 units per month from 2011 through early 2013 (Federal Reserve Bank of St. Louis 2013c). Home prices were also relatively low compared to the previous 11 years. The Case-Shiller Home Price Index shows that house prices in Atlanta started declining in 2007 and bottomed out in early 2012 (S&P/Case-Shiller Home Price Indices 2013). Thus, the time period selected for our study captures the bottom of the housing market in metropolitan Atlanta when sellers were faced with low sales volume and reduced prices.Footnote 3 This is the ideal timeframe in which to test the impact of relisting a property because properties are more likely to go unsold during a slow market, so sellers are more likely to face the decision whether to relist.

Because we are interested in the entire listing history and not just the final listing that resulted in a sale, we identify each unique single-family house in the data set that sold and match it with its earlier listing periods during which it did not sell. We combine the listing periods for each property to get a precise count of the number of times the property was listed and develop an accurate measure of each property’s active days on the market.Footnote 4 If a property was taken off the market for more than 60 days, we treat it as a new listing rather than a relisting.Footnote 5

We apply several filters to systematically clean the data. We remove records for which tax records containing the living area of the house were unavailable. We exclude houses that were less than 1 year old when they sold because prices of houses in new subdivisions may not be reflective of the broader market until the new development reaches a critical mass (Sirmans et al. 1997). We remove records that have a negative time-on-market when calculated using each property’s final off-market date minus its initial entry date. To eliminate outliers and minimize data errors, we also exclude houses built before 1900 as well as those that reported fewer than 2 or more than 8 bedrooms, 0 or more than six bathrooms, more than two half bathrooms, and lot sizes above five acres. The filters for bedrooms and bathrooms represent the removal of the top and bottom 1 % of our sample. We also remove observations with a selling price in the top and bottom 5 % of our sample. Our sample now contains properties with selling prices between $20,000 and $490,000. The filters we apply limit the variability in our housing sample and ensure it is reasonably homogenous as suggested by Butler (1980).

Our initial dataset contained 55,121 sales transactions. The cleaned data set is comprised of 47,337 transactions. Of these, 40,695 sold during their first listing contract. If a property did not sell during its initial listing and was entered a second time into the MLS, it is considered relisted. Our data set contains 6,642 relisted properties. Previous research has revealed that changing listing agents has a negative influence on price, so it is important to distinguish between relisting without an agent change (2,417 observations) and relisting with a different agent (4,225 observations). Table 2 provides detailed summary statistics for each variable.

Results

We present three specifications in Table 3. Specification (1) is a baseline hedonic estimation of log of selling price on our full sample. Model (2) adds dummy variables representing whether a house is relisted with an agent change (Agent Change) or relisted without an agent change (True Relist) at least once prior to sale. Model (3) breaks down the number of times a property is relisted without an agent change.

The explanatory power of the models is strong with an R2 of approximately 85 %. All the structural, lot, and neighborhood characteristics are significant at the 5 % level or higher. As expected, larger houses in terms of square footage and number of rooms and houses that contain rooms that would be considered luxuries sell for higher prices. External improvements such as a deck, patio or sprinklers also have a positive influence on selling price. Houses located on lots larger than one-half acre and corner lots in communities that have a homeowners’ association and a neighborhood clubhouse also sell for a higher price. Properties sold under distress (short sale or foreclosure) tend to sell at a discount.

In Model (2), we incorporate a seller’s option to relist. Sellers who want their property to remain active on the market can continue with an existing listing, relist their property with the same agent, or change agents. If a seller decides to relist their property, they can do so immediately or after taking the property off the market for a period of time. We find the effect of changing agents is negative and significant, similar to the findings of Daneshvary and Clauretie (2013) and Benefield and Hardin (2014). Turning to our variable of interest, we see that properties that are relisted without an agent change (True Relist) bring a significantly higher price in the market. This initial result seems to indicate that, in a slow market, relisting with the same agent may “reset” the property, either by making it appear as a new listing without the stigma of having been passed over by earlier potential buyers or by reminding agents that the property is available. It is possible that some buyers were unaware of sellers’ manipulation of time on market and were thus unable to recognize listings that were authentically fresh.Footnote 6

In model (3), we investigate the impact of relisting a property multiple times with the same agent. The results suggest that subsequent relistings without changing agents continue to exert a positive influence on price. Thus, our results support the inferences about price and time-on-market that follow from Taylor’s (1999) model: buyers attribute long time-on-market to overpricing or defects, which lead to lower offers; sellers seem to understand buyers’ interpretation of time-on-market and its effect on selling price, so they take action by relisting to avoid such stigma.

To more closely examine the effect of relisting decisions on the final selling price, we confine our analysis to the 2,417 houses that were relisted without an agent change prior to sale. Both models in Table 4 regress log of selling price on the same groups of structure, lot, neighborhood, and distress variables while controlling for time and location fixed effects. The R2 of each model is approximately 88 %. Model (4), includes a continuous relist gap variable that represents the number of days the seller took the property off the market prior to the final listing period during which the house sold. Because we find no discount associated with relisting a property, we are not surprised to find that the coefficient on the relist gap variable is negative, indicating that if a seller does decide to take the property off the market it should be relisted as soon as possible. Relisting the property quickly increases the property’s market exposure, helping the seller achieve the highest price. In model (5), we use dummy variables for relist gaps of varying lengths to consider whether the length of the gap between listing contracts affects price. The significant positive effect for taking the property off the market for less than 30 days is expected because it minimizes the gap between listings and includes immediate relistings. Our results suggest that taking a property off the MLS for a short period of time and then gaining exposure as a “new” listing and reminding agents of the property’s availability results in a higher selling price.

Conclusions

During a slow housing market, owners are more likely to reach the end of their listing contract without finding a buyer and face several decisions if they want their house to remain listed for sale. They must decide whether to relist their house with the same agent or change agents. They also have to decide whether to relist immediately or to take the house off the market for a period of time before relisting. Under the market conditions present in many parts of the US during the recent recession, some owners repeatedly faced these tough decisions.

Previous research indicates that selling prices tend to be lower near the end of a listing contract period (Asabere et al. 1996) as the seller’s bargaining power declines and the agent’s incentive to close a sale to earn a commission increases (Clauretie and Daneshvary 2008). If a seller thinks the offers are too low, then the opportunity cost of continuing to market the property may be offset by a higher final selling price. Relisting a property keeps it active in the MLS system, making it more likely to attract potential buyers who might be missed if the property is taken out of the system. Agents often receive announcements of new listings and relisting may prompt such a message, which reminds selling agents of a house they may have forgotten about. This is especially likely in a slow market with a large inventory of unsold houses. On the other hand, relisting may signal that the house has a defect that has deterred other prospective buyers (Taylor 1999). Sellers might think that the best strategy is to take a property off the market long enough that it appears to be a “new” listing to potential buyers who have entered the market since the expiration of the earlier listing, potentially removing any stigma attached to a property that has been passed over by many earlier potential buyers. Despite these potential relationships between relisting decisions and selling price, few house price studies have examined the relisting phenomenon, limiting their analysis to the listing period during which a property sold or removing relisted properties from their sample entirely.

Our analysis of single-family house transactions during a period when relisting of properties was relatively common because of the slow housing market indicates that relisting a property with the same agent and without a gap between listing contracts brings a higher selling price than any other scenario in the study (properties that sell during the first listing contract, properties relisted after a gap in time, or properties relisted with a different agent). Our findings support the assertion that sellers are more likely to accept a lower price as the initial listing contract nears expiration. The seller may be persuaded by the agent whose contract is expiring to lower the reservation price or the seller may unilaterally decide to lower the reservation price to avoid the cost of negotiating a new listing contract. However, to achieve the highest price under slow market conditions, the seller should relist the property with the same agent immediately, rather than wait a period of time or start the marketing process again with a new agent.

The ability of a seller to influence the selling price of the house by simply reinstating it as a new listing illustrates the inefficiency of the market. We provide empirical evidence that aligns with Tucker et al.’s (2013) consumer survey results that suggest that sellers can manipulate the market by relisting their house. We contribute to the literature by undertaking a more detailed analysis of the complexities of the relisting decision than previous research with a larger dataset than used in many other studies. We also offer insights into a time period when the small number of potential buyers relative to the large inventory of unsold properties available in the housing market required sellers to more carefully consider their marketing strategy, providing the opportunity for a more detailed examination of a range of relisting strategies than in earlier studies.

Notes

We have also estimated our model while leaving out all distressed properties. Removal of the distressed properties does not impact the significance or sign of the coefficients in our model. These results are available upon request.

Details of calculation of the predicted time on the market and Inverse Mills Ratio are presented in the Appendix.

Excluding sales during the first quarter of 2013 when the housing market started to slightly improve has no effect on the results of the analysis.

Recognizing that some properties may have entered the data collection period already in their second listing period, which would lead to underestimation of their total active days on the market, we tested removing all sales in the first two quarters of the data collection period as they would be the most likely to have already been relisted. The results were unchanged.

Benefield and Hardin (2014) use 48 days and Genesove and Mayer (1997) use 4 weeks. Our findings remain unchanged when 30 and 48 days are used instead of 60 days as the criteria for a “new” listing.

To deter the manipulation of time-on-market, the real estate listing services in some states, such as Massachusetts, have changed their policy governing home listings. The revised policies require the time-on-market measure for a house to be an accurate cumulative total that includes previous listings.

References

Anglin, P. M., Rutherford, R., & Springer, T. M. (2003). The trade-off between the selling price of residential properties and time-on-the-market: the impact of price setting. Journal of Real Estate Finance and Economics, 26, 95–111.

Asabere, P. K., & Huffman, F. E. (1993). Price concessions, time on the market, and the actual sale price of homes. Journal of Real Estate Finance and Economics, 6, 167–174.

Asabere, P. K., Huffman, F. E., & Johnson, R. L. (1996). Contract expiration and sales price. Journal of Real Estate Finance and Economics, 13, 255–266.

Benefield, J. D., & Hardin, W. G., III. (2014). Does time-on market measurement matter? Journal of Real Estate Finance and Economics. doi:10.1007/s11146-013-9450-z.

Brastow, R. T., Springer, T. M., & Waller, B. D. (2012). Efficiency and incentives in residential brokerage. Journal of Real Estate Finance and Economics, 45, 1041–1061.

Butler, R. V. (1980). Cross-sectional variation in the hedonic relationship for urban housing markets. Journal of Regional Science, 20, 439–453.

Carrillo, P. E., & Pope, J. C. (2012). Are homes hot or cold potatoes? The distribution of marketing time in the housing market. Regional Science and Urban Economics, 42, 189–197.

Clauretie, T. M., & Daneshvary, N. (2008). Principal-agent conflict and broker effort near listing contract expiration. Journal of Real Estate Finance and Economics, 37, 147–161.

Clauretie, T. M., & Daneshvary, N. (2009). Estimating the house foreclosure discount corrected for spatial price interdependence and endogeneity of marketing time. Real Estate Economics, 37, 43–67.

Corelogic. (2013). Total residential housing sales volume in Atlanta-Sandy Springs-Roswell, GA [Data file].

Daneshvary, N., & Clauretie, T. M. (2013). Agent change and seller bargaining power: a case of principal agent problem in the housing market. Journal of Real Estate Finance and Economics, 47, 416–433.

Daneshvary, N., Clauretie, T., & Kader, A. (2011). Short-term own-price and spillover effects of distressed residential properties: the case of a housing crash. Journal of Real Estate Research, 33, 179–207.

Federal Reserve Bank of St. Louis. (2013a). Employees on nonfarm payrolls in Atlanta-Sandy Springs-Marietta, GA [Data file]. http://research.stlouisfed.org/fred2. Accessed 26 Sept 2013.

Federal Reserve Bank of St. Louis. (2013b). Per capita personal income in Atlanta-Sandy Springs-Marietta, GA [Data file]. http://research.stlouisfed.org/fred2. Accessed 26 Sept 2013.

Federal Reserve Bank of St. Louis. (2013c). Privately owned housing starts authorized by building permits: 1-unit structures for Atlanta-Sandy Springs-Marietta, GA [Data file]. http://research.stlouisfed.org/fred2. Accessed 26 Sept 2013.

Geltner, D., Kluger, B. D., & Miller, N. G. (1991). Optimal price and selling effort from the perspectives of the broker and seller. Real Estate Economics, 19, 1–24.

Haurin, D. (1988). The duration of marketing time of residential housing. AREUEA Journal, 16, 396–410.

Jud, G. D., Seaks, T. G., & Winkler, D. T. (1996). Time on the market: the impact of residential brokerage. Journal of Real Estate Research, 12, 447–458.

Kalra, R., & Chan, K. C. (1994). Censored sample bias, macroeconomic factors, and time on market of residential housing. Journal of Real Estate Research, 9, 253–262.

Kang, H. B., & Gardner, M. J. (1989). Selling price and marketing time in the residential real estate market. Journal of Real Estate Research, 4, 21–35.

Knight, J. R. (2002). Listing price, time on market, and ultimate selling price: causes and effects of listing price changes. Real Estate Economics, 30, 213–237.

Levitt, S. D., & Syverson, C. (2008). Market distortions when agents are better informed: the value of information in real estate transactions. Review of Economics and Statistics, 90, 599–611.

Miceli, T. J. (1989). The optimal duration of real estate listing contracts. Journal of the American Real Estate and Urban Economics Association, 17, 267–277.

Miller, N. G. (1978). Time on the market and selling price. Real Estate Economics, 6, 164–174.

Pennington-Cross, A. (2006). The value of foreclosed property. Journal of Real Estate Research, 28, 193–214.

Rosen, S. (1974). Hedonic prices and implicit markets: product differentiation in pure competition. Journal of Political Economy, 82, 34–55.

Rutherford, R. C., Springer, T. M., & Yavas, A. (2005). Conflicts between principals and agents: evidence from residential brokerage. Journal of Financial Economics, 76, 627–665.

Rutherford, R. C., Springer, T. M., & Yavas, A. (2007). Evidence of information asymmetries in the market for residential condominiums. Journal of Real Estate Finance and Economics, 35, 23–38.

S&P/Case-Shiller Home Price Indices. (2013). Home Price Index for Atlanta, Georgia [Data file]. http://research.stlouisfed.org/fred2. Accessed 26 Sept 2013.

Sirmans, C. F., Turnbull, G. K., & Dombrow, J. (1997). Residential development, risk, and land prices. Journal of Regional Science, 37, 613–628.

Sirmans, G. S., Macpherson, D. A., & Zietz, E. N. (2005). The composition of hedonic pricing models. Journal of Real Estate Literature, 13, 3–43.

Smith, B. C. (2009). Spatial heterogeneity in listing duration: the influence of relative location to marketability. Journal of Housing Research, 18, 151–171.

Springer, T. M. (1996). Single-family housing transactions: seller motivation, price and marketing time. Journal of Real Estate Finance and Economics, 13, 237–254.

Taylor, C. R. (1999). Time-on-the-market as a sign of quality. Review of Economic Studies, 66, 555–578.

Tucker, C., Zhang, J., & Zhu, T. (2013). Days on market and home sales. RAND Journal of Economics, 44, 337–360.

Turnbull, G. K., Dombrow, J., & Sirmans, C. F. (2006). Big house, little house: relative size and value. Real Estate Economics, 34, 439–456.

United States Census Bureau. (2013). Population by MSA: Atlanta-Sandy Springs-Marietta, GA [Data file]. http://www.census.gov/. Accessed 26 Sept 2013.

Waller, B. D., Brastow, R., & Johnson, K. H. (2010). Listing contract length and time on market. Journal of Real Estate Research, 32, 271–288.

Yavas, A., & Yang, S. (1995). The strategic role of listing price in marketing real estate. Real Estate Economics, 23, 347–369.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Predicted time on the market (\( \widehat{TOM} \)) is estimated using the following equation:

where predicted time-on-market is a function of degree of overpricing, DOP; list price reduction, R; and the atypicality of the house, A. Predicted selling price is used to estimate DOP (see Eq. 3). The results for our intermediate steps are available in Table 5.

The degree of overpricing variable is calculated using the property’s original list price in the first listing contract and predicted selling price. The predicted selling price is obtained using a version of Eq. 1 that is comprised of the physical characteristics of the house, X; distressed conditions surrounding the sale, D; neighborhood characteristics, N; and location and time trend variables representing fixed effects for the exact geographic location and year and season of sale, T.

Previous research finds houses with unusual attributes sell for less and take longer to sell (Haurin 1988; Jud et al. 1996). To capture the atypicality effect we use a model similar to the one presented by Turnbull et al. (2006). They measure the extent to which a given house is either larger or smaller than the average living area in the surrounding neighborhood. We index all houses within a one half mile radius of house i by J. The standardized measure of the relative house size is:

where N j is the number of surrounding houses in the neighborhood J. In order to allow for asymmetric relative house size effects on selling price, we define the relative size variables Larger i and Smaller i as the absolute values of the positive and negative values of Localsize i respectively:

List price reduction, R, is a dummy variable that takes on the value of 1 if the property’s list price was reduced during the final listing period. If the property’s list price at the beginning of the final listing period equals the list price when the property sold, R takes on the value of 0. Knight (2002) reports that a dummy variable representing whether the list price is changed during the listing period is significantly related to time-on-market.

We also estimate a probit model, where the dependent variable is the probability of a property being relisted, to produce the Inverse Mills Ratio (IMR) used in Eq. 1. The probit estimation is calculated using the following equation:

The independent variables in the probit model are degree of overpricing (DOP) as described above and relisted time-on-market (TOM L ). The time-on-market variable used in the probit model is calculated as the number of days the property was actively listed on the MLS. It represents the sum of all the listing contract periods from the starting date of the original listing contract to the time of sale or to the date it was relisted, whichever comes first. In this way, we avoid Benefield and Hardin’s (2014) criticism of using an MLS calculated time-on-market and correctly count the entire initial listing period plus all subsequent relisting periods. We calculate TOM L as follows:

Rights and permissions

About this article

Cite this article

Smith, P.S., Gibler, K.M. & Zahirovic-Herbert, V. The Effect of Relisting on House Selling Price. J Real Estate Finan Econ 52, 176–195 (2016). https://doi.org/10.1007/s11146-015-9503-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-015-9503-6