Abstract

This study defines reporting conservatism as a higher verification standard for probable gains compared to losses and builds a model that endogenously generates optimal behavior resembling an asymmetric preference for gains versus losses. Our model considers the setting where one party produces a resource and another tries to expropriate it. The key factor determining the extent of the gain-loss asymmetry is the level of information asymmetry or trust between the two parties. The information asymmetry-based results of our model provide a simpler explanation for the vast empirical literature on conservatism, where the bulk of the economic relationships among the parties appear to be information-based with little direct relation to explicit debt contracts, a factor that has been the focus of theoretical arguments. We also suggest new empirical analyzes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A hallmark of accounting systems across the globe is conservatism, that is, gains are treated more conservatively than losses (Watts 2003; Basu 1997). While accounting research has traditionally appealed to explicit contracting as the key driving factor (Kothari et al. 2010), Lambert (2010) suggests that the asymmetric treatment of gains and losses is too pervasive and broad a phenomenon to be exclusively driven by explicit contracts. The extensive empirical research on conservatism also documents driving factors that are far too diverse to be convincingly construed as elements of explicit contracts. In addition, theoretical studies such as Gigler et al. (2009) and Caskey and Hughes (2012) reach conflicting conclusions on the efficacy of conservatism for debt contracting, suggesting that noncontracting factors are worth exploring. We attempt an alternative theoretical model based on information asymmetry that parsimoniously explains the bulk of the empirical literature and proposes new empirical tests in a more straightforward manner.

The common practice in theoretical studies is to define conservatism as a stochastic downward bias in earnings that typically applies equally and symmetrically to both gains and losses (Chen et al. 2007). In this study, we pay closer attention to Basu (1997, p.4), who states, “I interpret conservatism as capturing accountants’ tendency to require a higher degree of verification for recognizing good news than bad news in financial statements.” We first formulate this definition of conservatism mathematically, connect it with the more commonly used definitions such as downward bias or timeliness, and then build a model that helps us understand this asymmetric verification standard from the lens of information asymmetry (as opposed to explicit contracting). That is, we build a model where the asymmetric treatment of gains and losses arises endogenously, and depends on the level of information asymmetry or trust between the interacting parties.

Our model has two interacting parties, one of whom produces a resource and another who attempts to expropriate it. This is a common situation in both primitive and modern business and other settings (Shleifer and Wolfenzon 2002). The producer in the model creates output using a stochastic production function. After production, the producer may confront an expropriator or stealer. In the joint equilibrium of the production-expropriation game, we show that the producer has a preference for smaller sure gains over an all-or-nothing gain gamble but an opposite preference for losses. That is, the producer will not share her output with the stealer but will launch an all-out fight, thus preferring an all-or-nothing loss gamble over a sure smaller loss. We show that this loss-gain asymmetry is robust to refinements such as the intuitive criterion. We also show that the loss-gain asymmetry weakens when information asymmetry between the two parties becomes smaller. This is a key contribution of the study that allows us to understand gain-loss behavioral asymmetry in terms of the underlying information asymmetry.

The endogenous nature of our gain-loss behavior implies that we can vary the underlying information asymmetry parameter to generate variation in this behavior. Using our formulation of conservatism, we then demonstrate how this variation translates into variation in the asymmetric verification standard in a reporting system. We show that, when users of financial reports are placed in settings where they know more, the gain-loss asymmetry in their preference declines, as does the resulting demand for conservatism. This is exactly the conclusion reached by several empirical tests of conservatism that show its correlation with various measures of information asymmetry in the overall business environment but do not tie it to specific debt and debt-like contracts written in those environments (Ball and Shivakumar 2005; Khan and Watts 2009; LaFond and Watts 2008). Section 4 discusses these empirical issues in detail.

Our focus on explaining the endogenous nature of conservatism distinguishes us from prior studies, such as Gigler et al. (2009, p.779), that take conservatism in accounting systems as given and examine the resulting impact on debt contracting.Footnote 1 Our study is thus more appropriately viewed as a measurement model of accounting, that is, a model of how parties endogenously value gain and loss transactions, as opposed to models that take the measurement properties of accounting systems as given and then examine their impact on specific economic decisions such as contracting. Our study therefore speaks to the review article by Lambert (2010), which notes that the measurement or valuation perspective is a crucial aspect of conservatism yet remains understudied relative to explicit contracting.

In particular, Lambert (2010, p.294) asks why the cutoff point in conservatism is zero, that is, gains versus losses, and when one should expect conservatism to be more or less stringently applied to measurement and valuation. Our model, in contrast to the downward-biasing approach of prior studies, endogenously generates an explicit reference point of zero, and Section 4 shows how the model can be empirically exploited to create new tests of cross-sectional variation in the application of conservatism to the measurement of gains and losses.

In his recent discussion, Cohen (2017) argues that the origins of behavioral preferences are an important but understudied research topic in accounting. He further suggests that such origins be discovered as equilibrium outcomes in two-sided games, which is what our study does. The asymmetric gain-loss behavior endogenously generated by our study is also consistent with several asymmetries of prospect theory. This theory, which essentially is a collection of asymmetries and biases in human preferences over probabilistic gain and loss gambles, has been used to explain many important phenomena in finance and economics research (Kahneman and Tversky 1979; Barberis and Huang 2007; Dellavigna 2009; Waymire 2014; Ebert and Strack 2015). But the research on endogeneity, or why humans have these asymmetries, is still at a formative stage (Lo 2004; Dickhaut et al. 2010). Modern evolutionary biology and psychology research argues that our preferences for financial and other modern-life resource gambles have been selected through evolutionary resource procurement games (Cosmides and Tooby 1997; Gintis 2009; Trivers 1971). This perspective finds special salience in the work of Kahneman (2011), who develops the notion of an ancient System 1 in the human brain that was selected for evolutionary survival but now plays a crucial role in how we approach modern-day gambles over resources. Recent economics studies are therefore beginning to use evolutionary arguments to explain behaviors and preferences (Steiner and Stewart 2016). Our model, while by no means a fully fleshed out evolutionary model, can be viewed along the same lines as well.Footnote 2

Section 2 develops our interpretation of conservatism and shows its connection to prior theoretical and empirical definitions. Section 3 develops the model. Section 4 shows that our model can comprehensively explain and extend the vast empirical literature on conservatism. Section 5 concludes.

2 A definition of conservatism

In this section, we provide our representation of conservatism and then relate it to prior theoretical and empirical definitions. Our starting point is that it is typically not feasible for an accounting system to record the entire probability distribution of the payoffs to a transaction. These systems instead record a briefer representation of the transaction, such as an estimate of the value a user would place on that transaction. A key criterion determining the credibility of an accounting system is its verification standards for reporting a transaction (Kothari et al. 2010, Section 2.1.2). In this context, Basu (1997) defines conservatism as a reporting standard that imposes a higher verification standard on the reporting of gains compared to losses. Basu (1997, p.4) states: “I interpret conservatism as capturing accountants’ tendency to require a higher degree of verification for recognizing good news than bad news in financial statements.”

2.1 Mathematical representation of conservatism

Modeling conservatism mathematically, however, has proved to be challenging. Many theoretical studies model conservatism as a stochastic downward biasing of true earnings (Kwon et al. 2001; Chen et al. 2007). Such stochastic downward biasing happens equally and symmetrically for both gains and losses and is therefore somewhat different than Basu’s definition. Gigler et al. (2009, Section 4) also model unconditional conservatism as a stochastic downward bias that is symmetric across gains and losses but then proceed to model conditional conservatism as a stochastic downward bias that changes with the level of earnings. However, note that their definition of conditional conservatism does not privilege zero, that is, the reference point between gains and losses, as the anchor point of asymmetry. Instead, that point is some arbitrary number (it is $50 in their Appendix), in contrast to the Basu (1997) and Lambert (2010, p.294) definitions that specifically emphasize gains and losses.

Studies have also disagreed with each other on these formulations of conservatism. Gigler et al. (2009, p.778) argue that their downward biasing technique represents conservatism better than the downward biasing approach of Guay and Verrecchia (2006). In turn, Kothari et al. (2010, footnote 40) cast doubt on the validity of the Gigler et al. (2009) model. Lambert (2010) discusses the Kothari et al. (2010) survey and suggests that the whole conservatism debate is not properly focused in that too much emphasis is placed on contracting over valuation. Lambert further argues that the definition of conservatism is not a fully mathematically precise concept (p.294). It is therefore unlikely that we can arrive at a mathematical representation of conservatism that has universal acceptance. At best, we can hope for a plausible representation.

We first present our representation of conservatism, which we believe pays particular attention to asymmetric verification criterion for gains and losses, as defined by Basu. We recognize that the end result in our case also pushes earnings downward relative to a nonconservative baseline, but the path by which we get there is more explicitly laid out in line with Basu. Prior studies’ approach can thus be construed as being more “reduced-form” (see footnote 1). We also relate our definition to empirical definitions such as asymmetric timeliness.

FASB (2010, Section BC3.34) states: “Verifiable information can be used with confidence. Lack of verifiability does not render information useless, but users are likely to be more cautious because there is greater risk that the information does not faithfully represent what it purports to represent.” This means that the reporting choice is not just a function of the transaction itself, but also of the user and his attitudes toward financial lotteries. We formalize the user perspective of verification standards next and then provide an example of the reporting rules for contingent gains and losses.

Lambert (2010, p.293) notes that accounting rules on conservatism are typically written at the transaction level. Consider a probabilistic gain transaction G that generates a gain of magnitude x with probability p and 0 with probability 1 − p. Analogously, consider a symmetric probabilistic loss transaction L that generates a loss of magnitude x with probability p and 0 with probability 1 − p. The question is: how should the accounting system record these transactions, given the constraint that the recording should be a number and not a full description of the transaction?

Assume that the lottery G is recorded at x G and the lottery L is recorded at (x L ), where brackets indicate the standard accounting convention of losses. In a symmetric treatment of the transactions G and L, the magnitudes of the recorded gain and the recorded loss should be the same, that is, x G = x L (though the accounting system will report x L with brackets). Under conservatism, our main assumption is that the magnitude of the recorded gain will be smaller than the magnitude of the recorded loss. That is, the lottery G will be recorded at a smaller gain magnitude than the lottery L’s loss magnitude, that is, x G < x L . This is our interpretation of stronger verification standards for gains over losses: despite being equal in probabilistic magnitude, lottery G is recorded at a smaller magnitude than lottery L.

What could be a rationale for such a valuation? Consider just the gain lottery G. Now suppose that we can show that a user is indifferent between or slightly prefers a small sure gain of magnitude x G < x over the lottery G. Then x G is a good representation of the lottery for this user. This observation suggests that user preferences over gambles offer a pathway to appropriately represent a gamble by a single number. Next suppose we can show that the same user greatly prefers to play the loss gamble L than take a small sure loss of magnitude ≤ x G . This is what we attempt in the next section where we create a model that generates such a user endogenously as an equilibrium outcome. Note that this user is a rational maximizer of wealth and prefers to avoid a loss, but when unavoidably faced with a sure small loss versus a loss lottery, the endogenously optimal contextual behavior is for him to prefer the loss lottery to a sure smaller loss. For such a user, a sure loss of x G or a smaller amount is likely not a good representation of the loss lottery L because the user strictly prefers the loss lottery over this sure loss. An arguably better representation of L would then be a loss of a greater magnitude x L , that is, x L > x G . In our model, we get the extreme case that the user prefers the loss gamble to any sure intermediate loss, that is, any sure loss of magnitude ∈ (0,x) understates the value of the loss gamble. Perhaps x L = x is then an appropriate representation, consistent with accounting rules that book the whole amount for probable losses but not for probable gains (x L = x > x G ).

We are not claiming that our representation of x L > x G is beyond dispute; we are just claiming it is reasonable, given the preferences our model generates. For example, we acknowledge that our representation of the loss gamble L does not have as clear a utility function-based certainty equivalent interpretation as our representation of the gain gamble G. This is because a context-dependent preference for losses, such as the one endogenously generated by our model, typically does not lend itself to a mathematically facile and context-free monotonic utility function (even though the user in our model is a rational maximizer). But as discussed above, prior literature has been unable to agree on a precise mathematical definition of conservatism. This is because accounting rules are fundamentally not mathematical constructs. Conservatism is not a stochastic downward biasing of “true” earnings (along with the specific constraints on stochasticity imposed by Gigler et al. (2009), and nor is it a certainty equivalent. These are just alternative mathematical approximations, and reasonable people can disagree on any mathematical formulation of conservatism, including ours.Footnote 3

Note that our argument is couched in magnitudes of gains and losses (and this is the approach financial accounting reports typically take: for example, the magnitude of property, plant, and equipment less the magnitude of accumulated depreciation). Our notions of symmetry and asymmetry are therefore reflections around zero. A different kind of symmetry on the real line is translation. For example, consider the lottery G and shift or translate its payoffs by a negative number so that it becomes a loss lottery. (In this case, it is more useful notationally to abandon the accounting convention and use explicit plus and minus signs.) If a user has decreasing absolute risk aversion (and this is but one example), he will evaluate the lottery L at a point − x L that is closer to its lower payoff of − x and farther away from its higher payoff of 0, as compared to lottery G, which he evaluates at a point + x G that relatively further away from its lower payoff of 0 and closer to its higher payoff of + x. This is because the user is more risk averse in the range of lottery L payoffs and less risk averse in the range of lottery G payoffs. In this case also, we can potentially get the same magnitude outcome |− x L | > | + x G | or x L > x G . In our view, the main shortcoming of using decreasing absolute risk aversion (or other such functions) to explain conservatism is that such functions do not come with automatic endogenous reference points separating gains from losses (Lambert 2010, p.294). And modeling this endogenous reference point, which is central to our definition of conservatism, requires a more elaborate setup that we develop in the next section.Footnote 4

Our emphasis on the explicit reference point makes it instructive to compare our formulation of conservatism with that of Gigler et al. (2009, Section 4). They also assume a binary lottery as we do, but then exogenously assert the existence of downward-biased signal y conditional on the true payoff x1 or x2. Such a signal y with specific conditional probabilities based on the true future payoff can arise only if the auditor has access to the joint correlated distribution of x1, x2, y.Footnote 5 From where does the auditor get access to such a joint correlated distribution (or a family of such distributions, for Gigler et al. (2009) assume that the conditional distribution can be altered at will by the auditor)? Gigler et al. (2009, pp.779-780) answer by noting: “We develop a reduced-form statistical representation of conservatism ... Our goal here is to motivate and capture these statistical effects of conservatism, without formulating an explicit model of the measurement process.” Our study’s focus on the measurement process means that we cannot hope for the exogenous availability of a family of correlated joint distributions of x1, x2, y from which we can choose at will. Instead, we must explicitly assume that the only information the auditor has is that the transaction will generate x1 with probability p, and x2 with probability 1 − p. The auditor must create a uni-dimensional measure of the transaction based on only this information, and our goal is to show that this measurement process endogenously has conservatism properties.Footnote 6

To a researcher who views conservatism as a stochastic downward bias in earnings or as an empirical timeliness construct, the introduction of constructs such as a user and his attitudes toward gambles, etc., may all seem irrelevant. We therefore relate our construct to both institutional and empirical literature on conservatism.

2.2 Example: IFRS and GAAP reporting rules for contingent gains and losses

We illustrate the validity of our valuation of gain and loss lotteries G and L by using the accounting treatment of contingent gains and losses as an example. We pick contingent gains and losses because they comprise a vast variety of transactions ranging from warranties, restructurings, lawsuits, contractual obligations, etc.Footnote 7 As with our representation above, these rules compute a measure based on probabilities, payoffs, and risk attitudes.

Probabilities

Under U.S. GAAP, one of the conditions that must be met before an entity can accrue an estimated loss from a loss contingency is that “it is probable that an asset had been impaired or a liability had been incurred at the date of the financial statements.” That is, “it must be probable that one or more future events will occur confirming the fact of the loss” (ASC 450-20-25-2(a)). Under IFRS, one of the conditions for recognizing a provision as a liability is that “it is probable that an outflow of resources ... will be required to settle the obligation” (paragraph 14 of IAS 37). A key difference between U.S. GAAP and IFRS in applying the above conditions lies in the definition of “probable.” Paragraph 23 of IAS 37 defines probable as “more likely than not to occur” (that is,“the probability that the event will occur is greater than the probability that it will not”). ASC 450-20-20 defines “probable” as “likely to occur.”

Payoffs

Under both U.S. GAAP and IFRS, the amount recorded as a loss contingency or provision should be the best estimate of the expenditure required to settle the obligation. If the best estimate of the expenditure is a range, and if one amount in that range represents a better estimate than any other amount within the range, that amount should be recorded (ASC 450-20-30-1 and paragraph 36 of IAS 37). Under U.S. GAAP, if no amount in the range is a better estimate than any other amount, an entity should use the minimum amount in the range for recording the liability (ASC 450-20-30-1). In contrast, under IFRS, if no amount in the range is a better estimate than any other amount, an entity should use the midpoint of the range for recording the liability (paragraph 39 of IAS 37). If the obligation involves a large population of items, an entity should estimate the liability by weighting all possible outcomes by their associated probabilities (that is, the probability-weighted expected value is used to measure the liability).

Reported values

Under both U.S. GAAP and IFRS, the standard for recognition of a gain contingency (or contingent asset) is substantially higher than the standard for recognition of a loss contingency. Under U.S. GAAP, a gain contingency is recognized if realization is assured beyond a reasonable doubt. Therefore virtually all uncertainties, if any exist, about the timing and amount of realization of a gain contingency should be resolved before the gain is recognized in the financial statements. Under IFRS, a contingent asset is not recognized in the financial statements. Paragraph 33 of IAS 37 states that, “when the realization of income is virtually certain, then the related asset is not a contingent asset and its recognition is appropriate.”

In the example of our lotteries G and L, the above discussion suggests that x G < x L .

2.3 Our definition and the empirical literature

From an empirical perspective, it is also not easy to directly establish the existence of asymmetric verification standards; the empirical researcher often cannot observe the economic details of the actual transactions needed to make this judgment. As a result, the empirical literature conceptualizes verification standards in terms of timing (that is, the Basu “kink”). Basu (1997, p.4) states: “Under my interpretation of conservatism, earnings reflects bad news more quickly than good news. For instance, unrealized losses are typically recognized earlier than unrealized gains.” While the notion of time is not explicitly modeled in the definition of conservatism both in our study and prior studies (Gigler et al. 2009), it is implicitly present in the definition of our lottery. To see why, consider the statement: “earnings reflects bad news more quickly than good news.” Good news and bad news both have to be probabilistic gambles; otherwise they will be booked for sure. Next, suppose that sequence of individual transactions is a random sequences of lotteries L and G that are both equally likely and independent of each other. On average, the true cumulative economic earnings are zero, but the accounting system each period will as likely record (x L ) as x G , giving it a downward bias since x L > x G . Now the idea that losses are recognized faster means that at any given point in time, the magnitude of the loss gamble written on the books on average is greater than the magnitude of the gain gamble written on the books on average, which is what we obtain and what all other downward-biasing theory models assert.Footnote 8

In sum, while recognizing that it is not possible to unambiguously convert the FASB’s definition of verification standards to a unique mathematical representation, we believe that our modeling of conservatism is more detailed and closer to Basu’s spirit than the “reduced-form” approach of stochastic downward biasing of both positive and negative earnings that is employed by many theoretical studies. Our modeling also fits in with the empirical notion of asymmetric timeliness better than the reduced-form approach. Our next goal is to build a model that endogenously generates conservatism as defined above. We recognize that innumerable such models can be built, but our aim is to build one that comprehensively explains the wide empirical patterns observed in the literature.

3 The model

3.1 Model requirements

Our goal is to create a model that generates the above “asymmetric verification standards for gains and losses” definition of conservatism endogenously in such a manner that the comparative statics have the power to confront and extend the vast empirical literature on conservatism. Our best judgment suggests that such a model has the following features.

-

1.

The model deals with resources that can be produced (gains) or expropriated (losses).Footnote 9

-

2.

As equilibrium behavior, the model has the parties endogenously preferring loss gambles to sure small losses, but the opposite in gains, that is, the parties preferring small sure gains to gain gambles. This result can then, we argue in Section 3.5, be interpreted as being consistent with our “asymmetric verification standards for gains and losses” definition of conservatism.

-

3.

The equilibrium must be robust to refinements. Although the list of refinements is large, we use an important one: the intuitive criterion.Footnote 10

-

4.

The comparative static of the equilibrium behavior hinges on information asymmetry between the parties. This approach, we show in Section 4, comprehensively explain the empirical literature and generates new empirical predictions.

3.2 The model

The resource game is comprised of a producer (or a hunter) who procures/hunts a calorie resource and possibly confronts a stealer who wishes to expropriate this resource. The hunter-stealer or the kleptoparasitsm problem is an evolutionarily ancient one and is widespread among a wide range of species, including current-day primates (Gorman et al. 1998; Sapolsky 1998, p. 358). This problem is thus likely to have occurred repeatedly in ancient hominid lineage and has survived in various forms in modern-day societies: the hunter/farmer/entrepreneur/producer has always had to contend with a stealer/marauder/raider/expropriater (Shleifer et al. 1998). Note that this is a pure production-stealing game, which does not assume the presence of highly effective law-and-order enforcing individuals who can stop the stealer (Shleifer et al. 1998; Shleifer and Wolfenzon 2002). We therefore employ terms like “stealing,” “fighting,” “cost of fighting,” “strong,” “weak,” etc., recognizing that these actions may take different forms in different individual and group settings and societies but the underlying intent and economics are the same. For example, is wasteful spending a form of expropriation? Yes, because the counterparty took the money from the owner and delivered nothing. Did the counterparty view the owner as “weak”? Yes, because the owner fell for the counterparty’s wiles.

The producer expends caloric effort \(e \in \left [\underline {e}, \bar {e}\right ]\). The production outcome or the resource output is a stochastic variable in an exogenous range \(\tilde {y} \in \left [\underline {y}, \bar {y}\right ]\) (\(0 < \underline {y} < \bar {y}\)). We assume that, if the producer exerts minimum effort, all sizes of the output are equally likely. As the producer starts exerting more effort, a larger output becomes increasingly more likely. We represent this phenomenon with a probability density function that is flat at the minimum effort and becomes steeper as the effort level e increases.

The expected output for an effort level \(e \in [\underline {e}, \bar {e}]\) is therefore:Footnote 11

It can be verified that \(f(y;e)\) satisfies the monotone likelihood ratio property (MLRP), that is, \(\frac {\partial }{\partial y}\left (\frac {f_{e}(y;e)}{f(y,e)}\right ) > 0\), which in turn implies first-order stochastic dominance. Consequently, as the producer’s effort e increases, the likelihood of higher values of y increases. The effort e costs the producer \(C(e)\), where C is a strictly increasing positive convex function with \(C'(\underline {e}) = 0\) and \(C^{\prime }(\bar {e}) = \infty \). This assumption of decreasing marginal returns to effort is central to the producer’s behavior in the production process.Footnote 12

If the producer gets to consume the output y, the game is over. However, we assume that, after acquiring the resource and before consuming it, there is a probability m,0 ≤ m ≤ 1, that the producer meets a stealer or an expropriator who can see the output y.

The producer and stealer are strangers, and each only cares about his or her personal gain (Nowak and Sigmund 2005, p.1291). Each must decide whether to fight for the output. Should such a fight occur, the outcome is not ex ante known. Specifically, the outcome depends on the relative strengths of the two parties. We model this situation as the producer having a type \(\theta \in {\Theta }\) = {Tough, Weak}. The Tough producer will win the fight, and the Weak producer will lose the fight.Footnote 13

Ex ante, the probability that the producer is Tough is \(\phi \in (0,1)\), and the probability that the producer is Weak is \(1-\phi \). This prior \(\phi \) is common knowledge. When the meeting actually occurs, both parties get private information about the producer’s real type. The producer gets a perfect private signal of \(\theta \), her type, but the stealer gets an imperfect private signal, say based on the producer’s outwardly visible (or disclosed) state. This signal \(\sigma _{s}\) is better than pure noise, that is, is correct with probability \(q_{s}\in \left (\frac {1}{2},1\right )\). The stealer uses this signal to update his information on \(\theta \) from the baseline probability \(\phi \).Footnote 14 Thus,

The costs and the benefits to the fight are common knowledge parameters and are as follows. If the producer is Tough (T), she keeps the output but suffers a defense cost \(\mu _{pT}\). If the producer is Weak (W), she loses the output and also suffers an injury \(\mu _{pW}\). Likewise, the stealer’s cost of attacking is \(\mu _{sW}\) if the producer is Weak and \(\mu _{sT}\) if the producer is Tough. We assume the Tough producer finds it worthwhile to defend the output; otherwise the game always ends with the producer walking away when confronted, a situation more straightforwardly represented by \(\phi = 0\). We therefore specify that the range of \(\tilde {y}\) in the production game exceeds \(\mu _{pT}\), a feature we embed in the model by letting \(\underline {y} > \mu _{pT}\).

The timeline of the fight is in Fig. 1. Figure 2 illustrates the game and the information sets.

Timeline (see Fig. 2 for the information sets)

Extensive form game once the producer and stealer meet. The hollow circles represent moves by Nature, the full circles represent moves by the producer, and the squares represent moves by the stealer. The bracketed terms represent the payoffs of the agent. The first term is the producer’s payoff, and the second is the stealer’s. The dotted ovals represent the information sets of each agent

3.3 Equilibrium

The producer produces y and then possibly faces a stealer who can see the output y. We solve the equilibrium by first computing the perfect Bayesian equilibrium in the stealing game and then backward induct to find the equilibrium effort level in the production game.

We first show the equilibrium in the stealing game in Fig. 2. All proofs are in the Appendix.

Proposition 1

If the producer with output y and a stealer meet, the unique equilibrium of the stealing game in Fig. 2 is:

-

1.

If the producer is Weak, she will leave if the stealer attacks. The stealer keeps the output and incurs no fight costs.

-

2.

If the producer is Tough, she will fight if the stealer attacks. The producer gets \(y-\mu _{pT}\), and the stealer gets \(-\mu _{sT}\).

-

3.

If the stealer gets the signal Weak, he will attack if and only if:

$$ y > \frac{(1-q_{s})\phi} {q_{s}(1-\phi)} \mu_{sT} \equiv y_{W}. $$(3) -

4.

If the stealer gets the signal Tough, he will attack if and only if:

$$ y >\frac{q_{s}\phi} {(1-q_{s})(1-\phi)} \mu_{sT} \equiv y_{T}. $$(4)

Our finding in Proposition 1 that only some engagements lead to a fight is consistent with the literature on strategic behavior in survival games (Smith and Price 1973). Intuitively, the stealer will attack if he believes the producer is Weak, and Eqs. 3 and 4 capture his posterior beliefs regarding that possibility. In particular, because \(q_{s} > \frac {1}{2}\), \(y_{T} > y_{W}\), that is, if the stealer’s optimal choice is to attack when he receives the Tough signal, he will also attack when he receives the Weak signal.

The results of the stealing game in Proposition 1 imply that the producer will not always get to consume the original output y from the production game. Instead the producer with an original output y gets to consume \(B(y)\), where:

For example, when \(y > y_{T}\) and a stealer appears (which happens with probability m), the stealer will always fight, leaving the producer with \((y - \mu _{pT})\) when the producer is Tough (which happens with probability \(\phi \)) and zero otherwise. Note that \(B(y)\) has discontinuous drops at the thresholds \(y_{W}\) and \(y_{T}\). The reason is that when the stealer elects to fight, the Tough producer incurs a discrete cost of \(\mu _{pT}\), and the stealer’s decision to fight as a function of his signal changes exactly at these thresholds. In the regions where it is continuous, \(B(y)\) is a linear increasing function in y, indicating that a larger output yields larger gross benefits to the producer. We give a numerical example shortly.

At the beginning of the combined production-stealing game, the producer therefore maximizes:

This maximization yields:

Proposition 2

The production maximization problem in Eq. 6 is strictly concave in the effort e and therefore has a unique solution.

The concavity result of Proposition 2 forms the basis for the endogenous switch in the preferences toward gains and losses described in Section 3.5. Propositions 1 and 2 complete the equilibrium of the game in Fig. 2.

As a numerical example, consider \(m = 0.75\), \(\phi = 0.5\), \(q_{s} = 0.6\), \(\mu _{pT} = 4\), \(\mu _{sT} = 12\), and \(y \in [5,25]\). Figure 3 provides a plot of \(B(y)\) for this set of parameters. Note that the discontinuities occur at \(y_{W} = 8\) and \(y_{T} = 18\). In addition, if the cost function \(C(e) = -e - ln(1-e), e \in [0,1]\), the optimal e = 0.5768 > 0.

We next discuss some features of this equilibrium. Specifically, we concentrate on the stealing game because it is a two-person game, rather than the production game which is a one-person game.

3.4 Information asymmetry and loss sharing to avoid conflict

Our stealing equilibrium generates fights that are socially costly. The costs of fights are pure deadweight losses, which both the producer and stealer would like to avoid. It is therefore of interest to see whether another equilibrium in a modified game exists that avoids such fights. For example, the producer could offer the stealer a deterministic \(\tau _{T}\) share of her output when she is a Tough producer, and a deterministic \(\tau _{W}\) share of her output when she is a Weak producer, in the hope that the stealer will not engage in a costly fight. We have the following proposition.

Proposition 3

The sharing game has a sequential equilibrium that is unique for every value of y and satisfies the intuitive criterion. This equilibrium is \(\tau _{T}=\tau _{W}= 0\), except for small ranges of y just after the discontinuity points \(y_{W}\) and \(y_{T}\) of \(B(y)\), where the optimal sharing is positive. These sharing ranges can be made arbitrarily small by reducing μ p T , the Tough producer’s fighting cost. The sharing ranges do not exist if the stealer’s signal \(q_{s}\) crosses an accuracy threshold.

Beliefs are a critical part of the equilibrium because the strategy for the players must be optimal with respect to their beliefs. The proof defines belief restrictions for both pooling and separating equilibria. These are standard restrictions on beliefs from the signaling literature: the belief must be equal to the prior probability if it is a pooling equilibrium, and must fully reveal if it is a separating equilibrium.

Proposition 3 emerges from two main properties of the equilibrium. The first property is that there are no separating equilibria: the weak producer always wants to mimic the tough producer. The second property is that there are two types of pooling equilibria: the no-sharing equilibrium, which holds for most of the output levels, and positive sharing, which exists for certain output levels near the target thresholds defined in Proposition 1.

The intuition for zero equilibrium transfers is that the Tough producer cannot identify herself as Tough by sharing because the Weak producer mimics the Tough producer’s sharing; the Tough producer therefore offers the lowest amount, zero. The positive sharing equilibrium over a certain range of y arises not from an informational but instead from a transactional aspect of the model: the Tough producer’s cost of fighting is always \(\mu _{pT}\), and it may not be worth expending this discrete cost if sharing a small part of the output causes the stealer to discontinuously lower his probability of attack. For example, if y is just above \(y_{W}\), the Tough producer is better off sharing a small amount and reducing y below the threshold \(y_{W}\): the stealer never attacks if the output size is less than \(y_{W}\). The proof makes it clear that as \(\mu _{pT}\) becomes smaller, the range of y worth defending increases, all the way to the full range.

The ranges \(y \leq y_{W}\) and \(y > y_{T}\) are not interesting because the stealer always retreats or attacks, irrespective of his signal. The most important case is when the range of the output \([\underline {y}, \bar {y}]\) is within the range \([y_{W}, y_{T}]\). In this case, the stealer attacks if his signal is Weak and retreats if his signal is Tough. For this important case, the equilibrium \(\tau _{T}=\tau _{W}= 0\). The intuition, as stated above, is that the Tough producer cannot signal her type by sharing because the Weak producer mimics the Tough producer. The Tough producer therefore offers zero. The proof also makes it clear that a sufficiently precise stealer’s signal ensures that \([\underline {y}, \bar {y}]\) is within the range \([y_{W}, y_{T}]\), causing this important case to prevail. For the numerical example after Proposition 2, the threshold \(q_{s}\) is \(\frac {12}{17}\).

The no-sharing result of Proposition 3 implies that the producer will launch an all-or-nothing fight for her output. This aggressive behavior for losses contrasts the producer’s concave or risk-averse production function for gains (Eq. 6).Footnote 15 No sharing also leads to socially wasteful fights, which leads us to seek other alternatives that cognitively advanced individuals endowed with Kahneman System 2 can use to prevent such fights.

It turns out that the key economic force behind the robustness of the model’s stealing equilibrium is the information asymmetry between the producer and the stealer. If this information asymmetry can be reduced, one can generate more cooperative solutions. For example, when the stealer’s signal is perfectly accurate, there is no conflict because a stealer will not engage a known Tough producer, and a known Weak producer will always surrender to the stealer. That is:

Proposition 4

The unique Subgame Perfect Nash Equilibrium of the complete information game involves no fighting in equilibrium.

-

1.

When the producer is Tough, the stealer will leave. The producer earns y and the stealer gets nothing.

-

2.

When the producer is Weak, the producer will leave. The stealer earns y and the producer gets nothing.

This avoids Proposition 1’s (weakly) nonzero fighting costs.

The above proposition immediately suggests the following observation.

Observation 1

The absence of fights implies that that the full-information equilibrium has a social surplus, relative to Proposition 1. If all parties can trust each other, they can create a full-information environment and then share the surplus in a manner that each party is better off (in an ex ante sense), relative to the Proposition 1 outcome. This sharing outcome stands in contrast to the no-sharing outcome of Proposition 3.

The above observation raises the question as to how the complete information situation can be enabled. Consider a solution documented by modern biological research on social primates such as chimpanzees: the use of impartial third parties (von Rohr et al. 2012). The origins of impartiality presumably have both a biological moral basis and a social basis (that is, norms, reputations, and other social incentives), reflecting the cognitive skills represented by Kahneman System 2 (Trivers 1971). We illustrate this point by introducing an exogenous impartial party who will truthfully reveal the producer’s type for an ex ante transfer k from the producer.Footnote 16 The next proposition characterizes a Tough producer’s demand for this third party’s services.

Proposition 5

If the certification fee k is less than her cost of conflict \((k<\mu _{pT})\), the Tough producer certifies, and the no-fight equilibrium of Proposition 4 ensues.

The tough producer’s willingness to sacrifice a fixed amount ex ante is different from her behavior in Proposition 3. More generally, the producer and the stealer could be part of the same social group that engages repeatedly and whose members care about each other (Wilson 2012). In such cases, it is likely that the producer and stealer will share the output and not engage in costly infighting. It is in this manner that trust, information asymmetry, and other group-related factors drive individual behaviors and preferences.Footnote 17

3.5 Interpretation of the model

While many interpretations of the model are feasible, our interpretation of the model turns on the notion of preference, with the simple idea being that the agent prefers the optimal strategy to suboptimal strategies. We link this idea to the standard decision-theoretic view of preferences shortly. Viewed thusly, a key result of the model is that the producer prefers an all-or-nothing loss gamble to a sure small loss but opposite for gains: she prefers a small sure gain over a gain gamble.

To see this, first consider the behavior in the production game. Equation 2 shows that holding the production effort e constant, the producer only cares about the expected output \(\mathbb {E}[\tilde {y}|e] \equiv {\int }_{\mu _{pT}}^{\bar {y}} y f(y;e)\,dy\). The producer is thus risk-neutral. On the other hand, if the producer is a given a lottery between executing two choices, \(\{e_{0}, \mathbb {E}[\tilde {y}|e_{0}]\}\) and \(\{e_{2}, \mathbb {E}[\tilde {y}|e_{2}]\}\) with \(e_{2} > e_{0}\), there is a sure intermediate choice \(\{e_{1}, \mathbb {E}[\tilde {y}|e_{1}]\}\), with \(e_{2} > e_{1} > e_{0}\), that the producer prefers to execute over the lottery. This preference arises because the producer’s production function is concave in e (Proposition 2). Thus overall the producer prefers an intermediate sure gain to an all-or-nothing gain gamble. However, the same producer, when confronted with a stealer, will exhibit a preference for all-or-nothing loss gambles over a sure smaller loss (Proposition 3). Note that the strength of the producer is relative to the stealer, which varies from game to game. In each game, the producer has a pure strategy over the stealer with the Tough(Weak) producer always fighting(retreating). However, over many games, the observed behavior of the producer will be either to let go or to keep the output but never to share a part of it. This loss preference is robust but is context dependent: if the context is changed to one of full information and trust (Observation 1), the all-or-nothing loss preference is ameliorated.

While our notion of preference arises from optimal behavior, the standard economic definition of preference is something the agent is exogenously endowed with. In particular, the standard preferences are rigged to obey certain standard mathematical regularities so that they can be converted to utility functions (Kreps 1990, Section 3.5). And utility functions are ubiquitous concepts that most theorists (including this study) use without hesitation in the objective functions of their optimization models.Footnote 18 We rig our preferences in a different way. We follow the seminal economic work of Kahneman (2011), whose basic idea, borrowed from evolutionary psychology and other related fields, is that evolution has encoded winning strategies in games such as our survival game as preferences. This is also the thrust of Cohen (2017), who argues that the origins of preferences are an important but understudied research topic in accounting and suggests that such origins be discovered as equilibrium outcomes in two-sided games.Footnote 19 We therefore have the following observation.

Observation 2

The setting of Proposition 3 generates a preference for all-or-nothing gambles in losses over small sure losses that contrasts the preference for a small sure gain over a gamble in gains. The loss preference is robust but context dependent. It is ameliorated in complete information and complete trust contexts (Observation 1). Footnote 20

This observation applied to our definition of conservatism in Section 2 leads to the following observation.

Observation 3

In the context of reporting settings, users demand a more conservative reporting of probable gains than probable losses.

In addition, the full-information results in Observation 1 and Proposition 5 imply that the asymmetry in the verification standard for probable gains versus losses is ameliorated in settings where individuals deal with counterparties whom they trust or about whom they have information. The demand for conservatism should thus be lower in social resource exchange settings where the level of information asymmetry among the counterparties is lower or the level of mutual trust is higher. Footnote 21

4 Empirical implications

In the context of our model, we can think of the investor as someone who owns a resource and the manager as a steward of that resource. The game between the investor and the manager is thus one of resources, with the investor being concerned that the manager might misappropriate the resource. In our model, the stealer is a pure stealer, whereas the manager in reality is not a pure stealer but also a productive employee. However, the whole premise of the expropriation literature (Shleifer and Wolfenzon 2002) is that the manager has an opportunity to expropriate the portion of the output that is legitimately not his, that is, the portion of the output that belongs to the investor after the manager has been paid his due. Consequently, for this portion of the output, the manager can be construed as a pure stealer or expropriator, and it is in this context that we apply our model. In addition, note that the notion of information asymmetry, which is central to our model, naturally applies to the investor-manager setting.

The idea of information asymmetry among the interacting parties and the resulting response should apply to any resource game, old or new. Accordingly, Basu (1997, Section 2.2) notes that conservative reporting predates modern capital markets (Littleton 1941). Since agency and information asymmetry problems were rife even in ancient commerce (Greif 2006; Waymire and Basu 2008; Basu et al. 2009; Basu 2009), our model is consistent with the observed demand for conservatism from individuals in those settings.

Turning to modern markets, empirical studies find that conservative reporting is less prevalent in firms that are privately held by a group of investors (Ball and Shivakumar 2005), but more prevalent in public firms with more information asymmetry (LaFond and Watts 2008) and in firms with lower managerial ownership (LaFond and Roychowdhury 2008). Likewise, Kim et al. (2013) show that, in seasoned equity offerings, investors value conservatism more in firms with higher levels of information asymmetry. To motivate and explain their findings, the above empirical studies offer a reasoned conjecture that conservatism helps investors monitor the firm but rarely offer a precise description of debt or debt-like contracts specifically tailored to the empirical setting under study. Our perspective, in light of Observation 3, is that the important common feature the above settings share is that conservatism is less important when investors and managers are more familiar with each other or share common goals. In private firms, investor-manager familiarity arises because investors are likely fewer and more involved in firm operations. Likewise, managerial ownership is more likely to align manager and investor interest. Observation 3 suggests that it is these settings’ lower information asymmetry characteristic that changes user preference in a manner that lowers the user demand for conservatism in performance measures.Footnote 22

Our model also speaks to studies such as Khan and Watts (2009) that find that firms with longer investment cycles, higher idiosyncratic uncertainty, and higher information asymmetry have higher accounting conservatism, and studies such as Hui et al. (2012) that find that the bargaining relationships between the firm and its suppliers and customers affect conservatism. To the extent that factors such as long investment cycles and repeated bargaining increase communication and reduce information asymmetry among investors and managers, our model’s finding applies: information asymmetry impacts endogenous preferences and changes the demand for asymmetric verification standards.

Our model also suggests an important role for voluntary disclosures. Kothari et al. (2009, p.243) argue that conservative reporting arose to counter managers’ preference to issue optimistic voluntary disclosures. Our take is slightly different. We first note that management optimism is not as universal as conservatism: if managers believe that they will incur stock market and reputational penalties if future performance does not meet optimistic disclosures, they will not issue optimistic voluntary disclosures. Therefore, as with Basu (1997, Section 2.2), we put conservatism as the historical primitive, catering to an investor with asymmetric preference. Then, as managers and investors develop various credible arrangements to reduce information asymmetry, they can supplement baseline rules with nonconservative voluntary disclosures. Extending this logic further offers a potential alternative explanation for the observed time-series variation in conservatism (Basu 1997, Table 6). Explanations have pointed to the evolution of specific institutional features such as litigation (Holthausen and Watts 2001, Section 4.2). Our study suggests that one way to view the evolution of these individual institutions is in terms of the broader evolution in information asymmetry patterns in societies, a point of view that has been adopted by recent studies such as by Bloom et al. (2012).

Finally, our comparative statics are based primarily in social configurations of the interacting parties. However, behavioral economic studies show that asymmetric preference for losses diminishes as an individual gains more experience in trading, even absent any explicit changes in social configurations (List 2003, 2004). Our conjecture based on our model is that experienced individuals feel they understand their counterparties better, even if these counterparties are not explicitly visible.Footnote 23

In sum, theoretical studies have explained conservatism in the context of explicit debt covenants or managerial compensation contracts (Caskey and Hughes 2012; Gao 2013). While the empirical settings above can always be viewed as indirect proxies for these contracts, our contribution is that we provide an alterative explanation that is valid to the extent these settings do not proxy for debt and debt-like contracts.

4.1 Proposed empirical tests

Traditional conservatism theories of monitoring and contingent control would suggest examining more instances of these specific mechanisms to discover empirical patterns of conservatism. Our model, on the other hand, suggests that future tests could examine the nature of the social relationships among the interacting parties as potential determinants of conservatism. For example, one could supplement LaFond and Roychowdhury (2008)’s measures of management and private ownership with measures of the longevity of managers and investors (i.e., management tenure and stock churn) as well as the professional and social connections between these parties (i.e., interlocking board memberships, cross-ownership patterns, etc.). Such stakeholders are likely more familiar with the firm and may thus demand less conservative reporting. One could also extend the industry concentration measures of Hui et al. (2012) with survey measures of the social nature of the relationships between a firm and its customers and suppliers (Bloom et al. 2012). Finally, another potential research avenue is to examine conservatism and conservative behavior in trust-based laboratory experiments (Effron and Miller 2011).Footnote 24

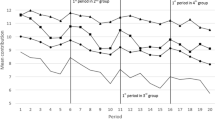

Our model also alerted us to a robust empirical regularity in the conservatism literature for which a simple explanation is lacking. This robust regularity is that there is much more variation on the bad news Basu coefficient (losses) than the good news Basu coefficient (gains). This asymmetric variation in the Basu coefficient occurs at the country, firm, and firm-characteristic level (Bushman and Piotroski 2006; Khan and Watts 2009; LaFond and Watts 2008). For example, in the country-level analysis of Bushman and Piotroski (2006, Table 2), the standard deviation of the bad news coefficient across countries is 0.16, while the standard deviation of the good news coefficient is 0.04. Likewise, in Khan and Watts (2009, Table 3), the corresponding standard deviations are 0.21 and 0.07. LaFond and Watts (2008, Table 2) also show that firm-level characteristics such as information asymmetry affect the bad news coefficient more strongly. The above regularity is consistent with Observation 3, which suggests that changes in information asymmetry change the preferences for losses; the bad news coefficient should indeed exhibit more variation. Future empirical work can further explore such empirical regularities.

Finally, recent neuroaccounting research examines the neurological foundations of the preferences and demand for accounting information. This research, which conducts fMRI scans of human subjects in experimental settings with financial data, largely views each individual subject as an atomistic decision-maker (Waymire 2014). Our model suggests that this research can expand its scope to a more realistic strategic multi-person decision setting by manipulating the level of trust and information asymmetry among the test subjects and then observing the resulting changes in the demand for conservatism in performance measures.

5 Conclusion

Theoretical studies often model conservatism in a “reduced-form” way as a downward stochastic bias to earnings that applies to both gains and losses. This study follows Basu (1997) closely and defines reporting conservatism in a more detailed manner as a higher verification standard for probable gains compared to losses and builds a model that endogenously generates optimal behavior resembling an asymmetric preference for gains and losses. Our model points to information asymmetry among the interacting parties as an important driver of the empirically observed variation in conservatism.

Accounting researchers have argued for a century whether explicit contracting can explain conservatism (Scott et al. 1926). Our model suggests that conservatism appears to be driven not just by explicit contracts like debt covenants but also by information-based implicit contracts such as trust and culture, concepts that have gained renewed currency in recent behavioral economics, finance, and accounting literature (Alesina and Giuliano 2015; Jha and Chen 2015), but have not been sufficiently explored in the empirical conservatism literature.Footnote 25

Cohen (2017) argues that accounting research should study the origins of behavioral preferences and derive them as equilibrium outcomes in two-sided games. While our model does that, it is fundamentally a measurement model of accounting, that is, it assumes that the measurement rule for a lottery should be based on its valuation by a given party and then endogenously derives this valuation. This point of view is advocated by Lambert (2010), who argues that measurement and valuation are crucial but understudied features of conservatism, relative to explicit contracting. In Section 4, we offer several new empirical ideas based on our interpretation of our model as a producer-expropriator setting. However, we acknowledge that our model itself does explicitly show the impact of the endogenous measurement rule on specific economic decisions by the model’s actors. Yet the theoretical setting of our model is likely amenable to such extensions. It is an incomplete information game that can be extended to other noncontractual settings, such as duopoly games between competing or collaborating firms. It would be interesting to see whether conservatism in disclosure endogenously emerges in such games and how conservatism affects competitive actions such as pricing, quantity choice, and entry-exit, as well as collaborative trust-based actions such as joint ventures, technology sharing, and other decisions. Furthermore, ours is a one-period static model. Extending it to dynamic games could yield novel insight into the time-series implications of conservatism.

Notes

Gigler et al. (2009, p.779) explicitly note that “we do not seek to characterize conservatism by modeling the actual measurement process ... Instead, we develop a reduced form statistical representation of conservatism.”

Kahneman (2011)’s subtler point is that it’s not just preferences that are evolutionary but also the survival games. Two firms fighting for market share may spill no blood today (at least in advanced countries), but the notions of winning/losing/gains/losses/signaling/threatening are all evolutionary in nature. And it is precisely because the human brain recognizes the evolutionary skeleton of these games that it activates the evolutionary response. Breiter et al. (2001) document how gains and losses trigger different responses in the amygdala, while Knutson et al. (2003) show that gains trigger increased neuronal activation in the mesial prefrontal cortex, while losses trigger activity in the hippocampus. In addition, Montague and Berns (2002) show that the human brain evaluates monetary and material rewards similarly, suggesting that the various asymmetries in investor attitudes toward financial gains and losses in modern stock markets appear to be emerging from an evolutionary timeframe. Chen et al. (2006)’s results lend further credence to this evolutionary survival conjecture, showing that capuchin monkeys also display various gain-loss asymmetries. Also see Williams (1966, pp.77-83).

Context-dependent preferences that do not yield traditional montonic utility functions have been extensively studied both in behavioral and mathematical economics (Chipman 1960), and this literature recognizes both the virtues and the mathematical cumbersomeness of such preferences, relative to traditional preferences that have other shortcomings but yield monotonic utility functions (Kreps 1990, Section 3.5).

In fact, there is no guarantee that preferences with such reference points can be built up into a utility function, for the existence of a utility function demands considerable mathematical regularities from the underlying preferences (Chipman 1960). Our goal however is not to build full-fledged utility functions but simply to construct endogenous preferences that we can use to compare lotteries and sure payoffs.

Note that it is essential that the joint distribution of x1, x2, y be correlated. Otherwise the conditional distribution of y given the future realization of {x1, x2} will be the marginal distribution of y itself and thus has no information content.

Our focus on the asymmetric treatment of gains versus losses is silent on the relative treatment of lotteries with smaller gains versus lotteries with larger gains, or lotteries with smaller losses versus lotteries with larger losses. If we follow Gigler et al. (2009) and exogenously posit the existence of a joint correlated distribution x1, x2, y with various statistical properties, we will have a mathematical answer for all possible ranges of x1, x2, y, but the question is if that is what the FASB’s definition of conservatism really means. In other words, the notion of conservation is not so precisely defined by the FASB or Basu (1997) so as to give an unambiguous mathematical answer for every lottery (Lambert 2010, p.294). We therefore view conservatism in the limited sense as any measurement system that imposes an asymmetrical treatment of probable gains versus probable loss. Also see footnote 4 where we argue that we build our endogenous preferences for this limited sense of conservatism.

Over time, each lottery will pay off, and the clean surplus relation means the that the lottery will be finally recorded at its liquidation value. Our bias is therefore related to the set of lotteries that have not yet paid off at any given point in time. We acknowledge that our logic may not work when the sequence of transactions is not i.i.d. More interestingly, Gigler et al. (2009, p.784) explicitly eschew the timeliness argument and state instead that Basu’s statistical regularity is amenable to more than one interpretation and use an alternative explanation to fit Basu to their model. So we are not alone in not having nailed down the timeliness argument completely.

Every loss is the counterparty expropriating money from the agent without giving anything back in return.

In additional analysis, we have also checked robustness to the ESS criterion.

Throughout the model, both in the production stage and protecting the output from the stealer stage, we assume that the probability measure and the unit of output are such that maximizing the expected value of output maximizes the probability of survival for the entity.

The assumption of decreasing marginal returns is not controversial even in biological production games; the hunter may get too tired searching for a large catch (Laundre 2014). The convex function \(C(e)\) is one way to model this phenomenon.

Note that because the stealer and the producer are assumed to be strangers, a one-period analysis will suffice, even if the game is played repeatedly among strangers in the population.

The model allows for \(\phi \) to vary by stealer. There is nothing in the model that requires \(\phi \) to be the same for all stealers.

The strength of the producer is relative to the stealer, which depends from game to game. In each game, the producer has a pure strategy over the stealer, but over many games, the observed behavior of the producer will be either to let go or to keep the output but never to share a part of it.

The use of exogenous impartial third parties to generate better outcomes has precedence in standard game theory as well; see Kreps (1990, pp.411–412). Also note that k accrues to the impartial party and is therefore not a social loss like the fight costs.

Studying how trust and reputation for impartiality are built, either through repeated games or some other mechanism, is beyond the scope of this study (Alesina and Giuliano 2015); our more modest goal is to show how such trust, when present, can alter the nature of information asymmetry and thus preferences.

When preferences fail to satisfy the necessary mathematical regularities, the utility function that emerges is a not a typical function but a complicated vector-like object (Chipman 1960).

Note that these preferences are valid for both producers and stealers. The preferencetoward a surer gamble is typically defined in a setting where the individual’s information setdoes not change as he chooses among gambles. But as Fig. 2notes, the stealer’s informationsets and beliefs evolve in the game. The stealer’s decision to fight when he is more certainthat the producer is Weak is not inconsistent with his overall preference for a surer gaingamble, should such a gamble be available. As Proposition5 notes, the stealer will fight whenthere is no certification, because his information set at that point is that the producer isWeak with a probability of one.

Our approach of linking verification standards to user preferences raises the issue of userpreference heterogeneity (Kothari et al. 2010, Section 2.3). Our interest isnot in the fact that different users’ reporting preferences are different. Instead, our focusis that these preferences switch their sign at zero. On average therefore one should see anasymmetry in reporting standards for probable gains versus probable losses.

Basu’s empirical measure of conservatism, which almost all the above studies employ in some form or the other, relies not just on earnings but also on prices. And prices depend on both investor preference and investor information sets. We acknowledge that the representative investor from an accounting perspective may not necessarily be the marginal investor in the firm’s stock who determines the price; see footnote 5 in Barberis (2013). Gigler et al. (2009, p.784) explicitly list Basu’s assumptions on the investor information sets.

See, for example, Henrich et al. (2001), who show that individuals’ experience with markets is correlated with greater fairness in experimental games.

Interestingly, accounting research has examined the association between social capital and several accounting variables (Jha and Chen 2015), but we are not aware of any similar empirical analysis of conservatism.

The ideas of trust and culture have a rich history in economic thought. In his 1751 Enquiry concerning the Principles of Morals, David Hume notes: “It is sufficient for our present purpose, if it be allowed, what surely, without the greatest absurdity, cannot be disputed, that there is some benevolence, however small, infused into our bosom; some spark of friendship for human kind; some particle of the dove, kneaded into our frame, along with the elements of the wolf and serpent.”

References

Alesina, A., & Giuliano, P. (2015). Culture and institutions. Journal of Economic Literature, 53, 898–944.

Ball, R., & Shivakumar, L. (2005). Earnings quality in uk private firms: Comparative loss recognition timeliness. Journal of Accounting and Economics, 39, 83–128.

Barberis, N. (2013). Thirty years of prospect theory in economics: A review and assessment. Journal of Economic Perspectives, 27, 173–196.

Barberis, N., & Huang, M. (2007). The loss aversion/narrow farming approach to the equity premium puzzle. In: Mehra, R., editor, Handbook of the Equity Risk Premium, Elsevier Science, pp. 199–229.

Basu, S. (1997). The conservatism principle and the asymmetric timeliness of earnings. Journal of Accounting and Economics, 24, 3–37.

Basu, S. (2009). Conservatism research: Historical development and future prospects. China Journal of Accounting Research, 2, 1–20.

Basu, S., Kirk, M., Waymire, G. (2009). Memory, transaction records, and the wealth of nations. Accounting, Organizations and Society, 34, 895–917.

Bloom, N., Sadun, R., Reenen, J.V. (2012). The organization of firms across countries. The Quarterly Journal of Economics, 127, 1663–1705.

Breiter, H., Aharon, I., Kahneman, D., Dale, A., et al. (2001). Functional imaging of neural responses to expectancy and experience of monetary gains and losses. Neuron, 30, 619–639.

Bushman, R., & Piotroski, J. (2006). Financial reporting incentives for conservative accounting: The influence of legal and political institutions. Journal of Accounting and Economics, 42, 107–148.

Caskey, J., & Hughes, J. (2012). Assessing the impact of alternative fair value measures on the efficiency of project selection and continuation. The Accounting Review, 87, 483–512.

Chen, M., Lakshminaryanana, V., Santos, R. (2006). How basic are behavioral biases? evidence from capuchin monkey trading behavior. Journal of Political Economy, 114, 517–537.

Chen, Q., Hemmer, T., Zhang, Y. (2007). On the relation between conservatism in accounting standards and incentives for earnings management. Journal of Accounting Research, 45, 541–565.

Chipman, J. (1960). The foundations of utility. Econometrica, 28, 193–224.

Cohen, L. (2017). Discussion: Do common inherited beliefs and values influence ceo pay? Journal of Accounting and Economics, forthcoming.

Cosmides, L., & Tooby, J. (1997). Evolutionary psychology: A primer. UCSB Psychology Department.

Dellavigna, S. (2009). Psychology and economics: Evidence from the field. Journal of Economic Literature, 47, 315–372.

Dickhaut, J., Basu, S., McCabe, K., Waymire, G. (2010). Neuroaccounting: Consilience between the biologically evolved brain and culturally evolved accounting principles. Accounting Horizons, 24, 221–255.

Ebert, S., & Strack, P. (2015). Until the bitter end: On prospect theory in a dynamic context. The American Economic Review, 105, 1618–1633.

Effron, D., & Miller, D. (2011). Reducing exposure to trust-related risks to avoid self-blame. Personality and Social Psychology Bulletin, 37, 181–192.

FASB. (2010). Statements of Financial Accounting Concepts No 8: Conceptual Framework for Financial Reporting. Chapter 1, The Objective of General Purpose Financial Reporting, and Chapter 3, Qualitiative Characteristics of Useful Financial Information. Financial Accounting Standards Board, Norwalk, CT.

Gao, P. (2013). A measurement approach to conservatism and earnings management. Journal of Accounting and Economics, 55, 251–268.

Gigler, F., Kanodia, C., Sapra, H., Venugopalan, R. (2009). Accounting conservatism and the efficiency of debt contracts. Journal of Accounting Research, 47, 767–797.

Gintis, H. (2009). Game theory evolving. Princeton: Princeton University Press.

Gorman, M.L., Mills, M.G., Raath, J.P., Speakman, J.R. (1998). High hunting costs make african wild dogs vulnerable to kleptoparasitism by hyaenas. Nature, 391, 479.

Greif, A. (2006). The birth of impersonal exchange: The community responsibility system and impartial justice. Journal of Economic Perspectives, 20, 221–236.

Guay, W., & Verrecchia, R. (2006). Discussion of an economic framework for conservative accounting and bushman and piotroski. Journal of Accounting and Economics, 42, 149–165.

Henrich, J., & et al. (2001). In search of homo economicus: Behavioral experiments in 15 small-scale societies. American Economic Review P&P, 91, 73–78.

Holthausen, R. , & Watts, R. (2001). The relevance of the value-relevance literature for financial accounting standard setting. Journal of Accounting and Economics, 31, 3–75.

Hui, K., Klasa, S., Yeung, E. (2012). Corporate suppliers and customers and accounting conservatism. Journal of Accounting and Economics, 53, 115–135.

Jha, A., & Chen, Y. (2015). Audit fees and social capital. The Accounting Review, 90, 611–639.

Kahneman, D. (2011). Thinking, Fast and Slow. Farrar, Straus and Giroux.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263–291.

Khan, M., & Watts, R. (2009). Estimation and empirical properties of a firm-year measure of conservatism. Journal of Accounting and Economics, 48, 132–150.

Kim, Y., Li, S., Pan, C., Zuo, L. (2013). The role of accounting conservatism in the equity market: Evidence from seasoned equity offerings. The Accounting Review, 88, 1327–1356.

Knutson, B., & et al. (2003). A region of mesial prefrontal cortex tracks monetarily rewarding outcomes: Characterization with rapid event-related fmri. NeuroImage, 18, 263–272.

Kothari, S.P., Shu, S., Wysocki, P. (2009). Do managers withhold bad news Journal of Accounting Research, 47, 241–276.

Kothari, S., Ramanna, K., Skinner, D. (2010). Implications for gaap from an analysis of positive research in accounting. Journal of Accounting and Economics, 50, 246–286.

Kreps, D. (1990). A course in microeconomic theory. Princeton: Princeton University Press.

Kwon, Y., Newman, D., Suh, Y. (2001). The demand for accounting conservatism for management control. Review of Accounting Studies, 6, 29–51.

LaFond, R., & Roychowdhury, S. (2008). Managerial ownership and accounting conservatism. Journal of Accounting Research, 46, 101–135.

LaFond, R., & Watts, R. (2008). The information role of conservatism. The Accounting Review, 83, 447–478.

Lambert, R. (2010). Discssion of “implications for gaap from an analysis of positive research in accounting”. Journal of Accounting and Economics, 50, 287–295.

Laundre, J. (2014). How large predators manage the cost of hunting. Science, 6205, 33–34.

List, J. (2003). Does market experience eliminate market anomalies Quarterly Journal of Economics, 118, 41–71.

List, J. (2004). Neoclassical theory versus prospect theory: Evidence from the marketplace. Econometrica, 72, 615–625.

Littleton, A. (1941). A genealogy for “cost or market”. The Accounting Review, 16, 161–167.

Lo, A. (2004). The adaptive markets hypothesis: Market efficiency from an evolutionary perspective. Journal of Portfolio Management, 30, 15–29.

Montague, R., & Berns, G. (2002). Neural economics and the biological substrates of valuation. Neuron, 36, 265–284.

Nowak, M., & Sigmund, K. (2005). Evolution of indirect reciprocity. Nature, 437, 1291–1298.

von Rohr, C., & et al. (2012). Impartial third-party interventions in captive chimpanzees: A reflection of community concern. PLoS ONE, 7, e32494.

Sapolsky, R. (1998). Why zebras don’t get ulcers. New York: Henry Holt & Co.

Scott, D., & et al. (1926). Conservatism in inventory valuations. The Accounting Review, 1, 18–30.

Shleifer, A., & Wolfenzon, D. (2002). Investor protection and equity markets. Journal of Financial Economics, 66, 3–27.

Shleifer, A., LaPorta, R, de Silanes, F.L. (1998). Law and finance. Journal of Political Economy, 106, 1113–1155.

Smith, J.M., & Price, G. (1973). The logic of animal conflict. Nature, 246, 15–18.

Steiner, J., & Stewart, C. (2016). Perceiving prospects properly. American Economic Review, 106, 1601–1631.

Trivers, R. (1971). The evolution of reciprocal altruism. The Quarterly Review of Biology, 46, 35–57.

Watts, R. (2003). Conservatism in accounting part i: Explanations and implications. Accounting Horizons, 17, 207–221.

Waymire, G. (2014). Neuroscience and ultimate causation in accounting research. The Accounting Review, 89, 2011–2019.

Waymire, G., & Basu, S. (2008). Accounting is an evolved economic institution. Foundations and Trends in Accounting, 2, 1–174.

Williams, G. (1966). Adaptation and natural selection. Princeton: Princeton University Press.

Wilson, E. (2012). The social conquest of earth. New York: Liverlight Press.

Acknowledgments

We are especially grateful to two anonymous reviewers and Stephen Penman (editor). We also thank Sudipta Basu, S.P. Kothari, John List, Robert Trivers (Rutgers), and seminar participants at Arizona State, George Mason, Maryland, Miami, Michigan State, Minnesota, UBC, UC Irvine, UCLA, USC, UT Dallas, and UVA for their comments.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof

Proposition 1

Let a s (σ s ) be the stealer’s strategy as a function of his signalσ s ∈{T, W}for T = Tough and W = Weak. Let a p (𝜃) be the producer’s strategy as a function of her type 𝜃 ∈{T, W}. Let b be the vector of beliefs at each information set in the extended game. We seek to find the perfect Bayesian equilibrium\((a_{s}^{*}(\sigma _{s}),a_{p}^{*}(\theta ))\).

To solve, work backwards. Figure 2 presents the extensive form of the game. Observe that the producer has a nontrivial choice only when the stealer chooses to fight. For a producer of type 𝜃= T, she earns y − μ p T by fighting and 0 by leaving, regardless of the stealer’s signal. Sincey > μ p T by assumption, ap∗(T) = F. Similarly, a Weak producer makes a choice only when the stealer chooses to fight. This producer earns 0 by leaving and− μ p W by fighting, regardless of the stealer’s signal. Thus ap∗(W) = L. This proves parts 3 and 4.