Abstract

Audit fee residuals (the error term from audit fee models) are widely used in the accounting research literature. Researchers, however, have adopted contrasting views of these fee residuals. One view is that fee residuals are a combination of noise and auditor rents (i.e., abnormal profits), while the other view is that they are a combination of noise and unobserved audit costs (including any risk premium and a normal rate of return on all factors of production). As a result, identical research findings are presently given conflicting policy interpretations. We use differences in fee residual persistence across continuing and new audit engagements to elucidate the extent to which fee residuals consist of unobserved audit costs, auditor rents, and noise elements. In a large sample of U.S. public company audit engagements, we find evidence suggesting that fee residuals largely consist of researcher-unobserved audit production costs common to all auditors. We discuss the implications of this finding for policy setters and for future auditing research.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Although audit fee residuals (hereafter, fee residuals) are widely studied in contemporary accounting research, their interpretation is contested.Footnote 1 Some researchers view them as evidence of auditor rents, which are usually defined (following Simunic 1980 and DeAngelo 1981) as audit fees in excess of normal audit production costs, inclusive of all risk premia as well as a normal profit on all factors of production. Others view fee residuals as evidence of researcher-unobserved audit production costs (unobserved costs). Francis (2011, p. 138) notes, however, that “… we have no idea if fee residuals measure a threat to independence,” adding that they “might simply capture abnormally high audit effort or the auditor’s pricing of (unobserved) client risk characteristics.” Our study presents large-sample empirical evidence that helps to resolve this conflict about the interpretation of fee residuals.

Two recent studies, Choi et al. (2010) and Hribar et al. (2014), exemplify the situation in the current research literature. Both studies document a negative association between fee residuals and measures of auditee financial reporting quality. Choi et al. (2010) view fee residuals as a measure of auditor rents and interpret their findings as evidence of auditor independence impairment (a socially undesirable outcome). Hribar et al. (2014), by contrast, view fee residuals as measures of unobserved audit effort and interpret the same finding as evidence that auditors expend more effort on verifying the appropriateness of financial statements that have lower quality (a socially desirable outcome).

Such discordant interpretations undermine the usefulness of fee residuals as a research construct. From a policy perspective, the inferences drawn by studies like Choi et al. (2010) and those drawn by studies like Hribar et al. (2014) have materially different regulatory implications: Choi et al.’s (2010) rent-centric interpretation can be used to motivate regulatory intervention in audit markets directed at curbing auditor rents. Hribar et al.’s (2014) cost-centric interpretation, on the other hand, can be used to motivate regulatory abstention on the grounds that market forces already compel auditors to exert higher effort on auditees with lower financial reporting quality. To resolve this conflict, it is necessary to ascertain the substantive information content of fee residuals: are they more appropriately interpreted as proxies for auditor rents or unobserved audit costs—or for neither?

We show analytically that, in competitive audit markets, the likely composition of fee residuals can be discerned from their differential ability to explain subsequent audit fees charged by continuing and new auditors (hereafter, fee residual persistence). If fee residuals consist mostly of unobserved costs common to both the exiting and incoming auditor, they will persist (i.e., explain subsequent year audit fees) at close to a dollar for dollar rate in both continuing and new engagements. If, on the other hand, fee residuals consist mostly of rents that both the exiting and incoming auditor expect to earn, they will persist in continuing engagements but will be discounted during auditor transitions. The reason for the discounting is that competition to become the new incumbent and earn future rents will lead new auditors to rebate the capitalized value of rents back to the auditee (DeAngelo 1981; Watts and Zimmerman 1986; Dye 1991; Kanodia and Mukherji 1994). Finally, if the fee residual largely consists of elements of costs or rents that are idiosyncratic to the exiting auditor (i.e., are not shared by or expected to accrue to the new auditor), then they should not be priced at all by the new auditor.

Using a panel of data on audit fees and fee determinants for the period 2001–2012, we report three key empirical findings. First, in continuing Big Four audit engagements, that is, when there is no auditor change, after controlling for other fee determinants, we find that fee residuals are highly serially correlated; they contain a large persistent component (albeit one that could be costs, rents, or a combination of both).Footnote 2 Second, in lateral Big Four auditor transitions fee residual persistence is about the same as in continuing Big Four engagements, suggesting that Big Four fee residuals largely consist of costs common to Big Four auditors. The failure to find a significant attenuation or reversal of fee residuals in lateral Big Four transitions, in particular, suggests that any rent component of the fee residual is likely to be small. Third, in Big Four to non-Big-Four auditor transitions, the coefficient of the lagged fee residual continues to be positive and is only somewhat smaller in magnitude than its counterpart in lateral Big Four auditor transitions. This finding indicates that most of the Big Four auditors’ fee residual consists of costs common to both Big Four and non-Big-Four auditors. In additional tests, we compute fee residuals using panel estimation techniques and obtain qualitatively similar results, indicating that our inferences are robust to a variety of specification errors including omitted variable bias.

Overall, the evidence suggests that fee residuals, as presently estimated, are mostly and most appropriately viewed as proxies for unobserved audit costs. Our findings provide support for the Hribar et al. (2014) interpretation that a negative association between fee residuals and audit quality reflects greater auditor effort in response to lower quality financial statements. Our findings, however, are inconsistent with Choi et al.’s (2010) interpretation of the same association as evidence of compromised audit quality resulting from auditor-auditee economic bonding. Our evidence also suggests that elucidating the factors that drive fee residuals is a promising avenue for future research.

The rest of this paper is organized as follows. In Sect. 2, we review prior literature, present an analytical model of residual audit fee persistence in continuing and new audit engagements, and outline our strategy for identifying rents in fee residuals. In Sect. 3, we describe research methods and the data used. In Sect. 4, we report results, and in Sect. 5, we present a summary, discuss some limitations inherent in our approach, and offer concluding remarks.

2 The analytics of fee residual persistence

2.1 Computing and interpreting fee residuals

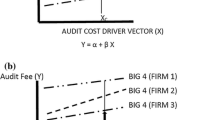

Fee residuals are usually computed as the difference between actual audit fees and expected audit fees predicted by a Simunic (1980) style audit fee model of the form

where y it is the audit fee for engagement i in period t, x it is a vector of engagement characteristics (e.g., auditee size, complexity, and riskiness), and \({\tilde{\varepsilon }}_{\text{it}}\) is an error term.

Researchers do not observe all the engagement characteristics that influence audit fees. Therefore they use observable characteristics of the engagement to proxy for these unobservable characteristics. The fee residual computed from this model, \({\tilde{\varepsilon }}_{\text{it}}\) can be thought of as the sum of the effects on y it of (i) any researcher-unobserved production costs, \({\text{cz}}_{\text{it}}\) that is, of fee determinants omitted from x it , (ii) of any auditor rents, ρ it , and (iii) of a pure noise component η it . Studies that adopt a rent-centric interpretation of the fee residual effectively assert that the cost and noise components of \({\hat{\varepsilon }}_{\text{it}}\) are both negligible. Studies that adopt a production cost-centric interpretation of the fee residual effectively assert that the rent and noise components of \({\hat{\varepsilon }}_{\text{it}}\) are both negligible. Lastly, studies that explicitly or implicitly adopt an agnostic interpretation assert that all three components of \({\hat{\varepsilon }}_{\text{it}}\) are nonnegligible.

DeFond et al. (2002) is an early example of the use of fee residuals to measure auditor rents (termed auditor-auditee economic bonding or excess profits). Using a variety of surrogates for auditor rents (residual audit fees, residual non-audit fees, and residual total fees), they find no association between their measures and auditor propensity to issue going-concern opinions. They interpret their findings as evidence that auditor rents do not impair auditor independence. An influential commentary by Kinney and Libby (2002, pp. 109–110) also advocates using fee residuals to measure the economic bond between auditor and auditee.

Over the subsequent decade, the use of fee residuals to surrogate for auditor rents has become quite popular. Notable studies include Srinidhi and Gul (2007), who find no systematic association between fee residuals and earnings quality; Hope and Langli (2010), who find no association between large (and positive) fee residuals and auditors’ propensity to issue going-concern opinions for Norwegian companies; Kanagaretnam et al. (2010), who find no association between positive fee residuals and under-provision of loan losses of banks; and Choi et al. (2010), who find a positive association between (positive) fee residuals and larger abnormal accruals (lower financial reporting quality).Footnote 3

In sharp contrast to the rent-centric interpretation of fee residuals as excess profits, Ettredge and Greenberg (1990) view fee residuals as production efficiency measures: positive (negative) residuals indicate that the auditor is an inefficient (efficient) producer relative to other auditors. Hribar et al. (2014) view fee residuals as a measure of extra audit effort or risk premium charged by the auditor when faced with poor auditee accounting quality. Similarly, Ball et al. (2012) view higher fee residuals as a proxy for higher auditee demand for financial statement verification and report that voluntary disclosures by auditees that have higher fee residuals are both more accurate and more credible to investors. Related, studies that use private data sets (e.g., O’Keefe et al. 1994; Bell et al. 2001, 2008) document many nonpublic drivers of audit labor usage and mix, for example, the number of audit reports issued, number of auditee business locations, and perceived auditor business risk. All of these factors exemplify the researcher-unobserved audit fee determinants omitted from the estimated fee model (elements of \({\text{z}}_{\text{it}}\)).

A relatively small number of studies adopt an agnostic view of fee residuals. For instance, Higgs and Skantz (2006) argue that fee residuals may be composed of both auditor rents and unobserved audit costs. However, in their empirical analyses they do not attempt to separate the fee residual into the rent and cost components.

In sum, prior research has (a) made extensive use of fee residuals as a research construct and (b) adopted conflicting interpretations of the fee residual, leading to (c) different interpretations of similar empirical findings. In Appendix 1, we review some of the key studies that offer rent-centric, cost-centric, or agnostic interpretations of the fee residual, reporting in the authors’ words the interpretations each study places on the fee residual and the resulting policy implications they draw. In so doing, we establish, first, that the three streams of research appear to have evolved in parallel with very little interplay. Second, we elucidate how audit costs, auditor risk premium, and auditor rents, which are key constructs for our study, have been defined in prior research.

Our discomfort with the divergent readings of fee residuals being offered in parallel streams of contemporary research studies is not isolated. For instance, Francis (2011, p. 138) observes:

I am skeptical of the use of abnormal fees to measure auditor independence because we have no idea if fee residuals measure a threat to independence. Alternatively abnormal audit fees might simply capture abnormally high audit effort or the auditor’s pricing of (unobserved) client risk characteristics.

The purpose of our study is resolve this ambiguity regarding the interpretation of fee residuals by investigating the following question: do fee residuals reflect primarily audit costs or primarily auditor rents, or are they best viewed as an admixture consisting of significant components of both costs and rents (and therefore, without further refinement, are not a good proxy for either)?

2.2 Identifying the substantive information content of fee residuals

As noted earlier, in principle, fee residuals from Eq. (1) reflect the sum of researcher—unobserved production costs (including normal risk premia), auditor rents, and noise. Furthermore, both the cost and rent component can contain elements of persistent factors (costs and rents) that are common to all auditors, common to some auditors, or are specific to the incumbent auditor. As a result, the residual from Eq. (1) can be recast as

where cc, ic, cr, and ir represent, respectively, common costs, idiosyncratic costs, common rents, and idiosyncratic rents accruing to the incumbent auditor and the last component is a noise term.

2.2.1 Defining the components of the fee residual

Examples of the two types (common and idiosyncratic) of researcher—unobserved costs and rents may help clarify the substantive content of this two—way classification scheme. We, therefore, discuss each of these four categories in turn.

2.2.1.1 Common costs (cc)

Costs that can be (a) expected to be included in fees, (b) be borne by any incumbent auditor irrespective of its identity, and (c) unobservable by the researcher.Footnote 4 Some examples are costs associated with preparing multiple audit reports, with auditing multiple auditee locations, or the auditor’s expected litigation, regulatory, and reputation costs associated with risk of auditee business failure. All of these costs are observable to the auditor and the auditee but are not usually to researchers and are likely to be incurred by all auditors irrespective of their identity.

2.2.1.2 Idiosyncratic costs (ic)

Costs that are specific to a given auditor–auditee relationship and are not expected to carry over in an auditor change. For example, the auditee may acquire a new business or start a new venture that involves specialized accounting and the current auditor may be forced to use outside specialists for a higher cost. The new auditor, on the other hand, may possess the requisite expertise in-house and offer its services at a lower fee. The extra cost incurred (and recovered) by the old auditor but not incurred by the new auditor represents the idiosyncratic cost component of the old auditor’s fee.

2.2.1.3 Common rents (cr)

Auditor changes occasion both auditor startup and auditee switching costs (search costs, cost of adverse market reactions to the news of an auditor switch, opportunity costs of auditee staff learning to work with the new auditor).Footnote 5 These frictions may create a holdup problem between the auditor and the auditee and, when accompanied by material levels of auditor bargaining power, enable incumbent auditors to charge fees in excess of all of its normal production costs.Footnote 6 This holdup problem is the source of common rent that most prior research discusses, and, in competitive audit markets, its present value is expected to be rebated back to the auditee by any new auditor (DeAngelo 1981; Watts and Zimmerman 1986; Dye 1991; Kanodia and Mukherji 1994).

2.2.1.4 Idiosyncratic rents (ir)

Analogous to idiosyncratic costs, these are rents that accrue to the predecessor but not to the successor, usually due to market power differences between the two auditors. For instance, in transitions from Big Four to non-Big-Four auditors, the successor is generally presumed to possess little (or no) market power and to earn commensurately lower (or no) rents. In such transitions, any rents that the Big Four predecessor can charge but that a non-Big-Four successor cannot would exemplify idiosyncratic rents.

Note that, in this schema, whether costs and rents are classified as common or idiosyncratic depends on the identities of the predecessor and successor auditors. For instance, in a transition from one Big Four auditor to another, many of the researcher-unobserved audit production costs as well the magnitude of rents will be common to both the exiting and the incoming auditor. In a transition from a Big Four to a non-Big-Four auditor, by contrast, some of the exiting Big Four auditor’s costs and rents many not be incurred or earned by the incoming non-Big-Four auditor because Big Four auditors are generally thought to have higher costs as well as to earn higher rents than their non-Big-Four counterparts. For this reason, in our empirical analyses, we treat Big- Four to Big-Four auditor transitions, where both auditors are thought to have broadly similar cost structures and to be able to earn similar levels of rents, as the principal basis for our inferences.

2.2.2 Distinguishing between the cost and rent components of residual fees

In continuing (steady state) audit engagements, ceteris paribus, the first four components of the fee residual should continue to determine audit fees in every period and should persist at a close to dollar for dollar rate while the last term reflects noise that would not be expected to affect future audit fees. Consequently, in continuing engagements, the lagged fee residual can be expected to persist at a positive rate close to one, with the difference from unity being the likely proportion of noise in the fee residual.

In auditor transitions, however, matters can be expected to be quite different. By definition, (and as with continuing engagements), the first term—which is common to both the predecessor and successor auditors—can be expected to affect the successor’s audit costs, and therefore its audit fee, at a dollar-for-dollar rate. The second and fourth terms, which are specific to the predecessor, should, much like the last (noise) term, not affect the successor’s fee. The third term, which reflects the rents the new auditor also expects to earn in future periods, however, can be expected to be treated very differently by the new auditor. Since the new auditor expects to earn an annual stream of rents equal to cr, in theory, competition among auditors to become the new incumbent—and thereby earn the stream of annual rents—will force all bidding auditors to rebate the present value of the entire expected rent stream back to the auditee (DeAngelo 1981; Watts and Zimmerman 1986; Dye 1991; Kanodia and Mukherji 1994). Consequently, in pricing a new engagement, the successor auditor’s weights on the various components of the predecessor’s fee residual will be 1 for the first component, 0 for the second and fourth components, and a present value factor, −K, for the third component.

By the foregoing logic, the expected fee equations for continuing and new engagements are:

where Eq. (3C) is for continuing auditees and (3N) for new auditees. In particular, note that the coefficients of cc, ic, cr, and ir are each close to one in the first equation and are one, zero, −K, and zero respectively in the second equation. (Note also that cc and ir drop out in Eq. 3N.)

In practice, the individual components of \({\tilde{\varepsilon }}_{\text{it}}\) cannot be observed by the researcher. However, Eqs. (3C) and (3N) can be recast in terms of \({\tilde{\varepsilon }}_{{{\text{it}} - 1}}\) obtain the specification:

where, as we show next, the coefficients γ C and γ N will be functions of the extent to which the lagged fee residual is comprised of the four components cc, ic, cr, and ir. As a result, empirical estimates of γ C and γ N, the respective coefficients of lagged fee residual in the two equations should illuminate the extent to which fee residuals consist of auditor rents.Footnote 7

First consider the case where \({\tilde{\varepsilon }}_{{{\text{it}} - 1}}\) onsists entirely of idiosyncratic noise, that is, forces that do not affect subsequent audit production by any auditor. In this polar case, the weight of the lagged fee residual in both Eqs. (4C) and (4N) should be zero, that is, the lagged fee residual should not explain subsequent audit fees for either continuing or new engagements. Thus a test of γ C = 0 can illuminate the extent to which residual audit fees on continuing engagements contain persistent influences (costs or rents).

Next consider the case where the lagged fee residual consists purely of common costs, that is, \({\tilde{\varepsilon }}_{{{\text{it}} - 1}} = {\text{cc}}_{\text{i}}\) with the shares of the other components including noise being zero. In this case, by Eqs. (4C) and (4N), we would expect to observe γ C = γ N = 1.Footnote 8 By the same logic, should \({\tilde{\varepsilon }}_{{{\text{it}} - 1}}\) consist partly of cc and a noise term \({\tilde{\eta }}_{{{\text{it}} - 1}}\) we would expect to observe γ C = γ N = 1−α, where α is the fraction of \({\tilde{\varepsilon }}_{{{\text{it}} - 1}}\) represented by \({\tilde{\eta }}_{{{\text{it}} - 1}}\) that is, \({\tilde{\eta }}_{{{\text{it}} - 1}} /{\tilde{\varepsilon }}_{{{\text{it}} - 1}}\) Generalizing the setting to one where the lagged fee residual is a mixture of common and idiosyncratic costs and noise, that is, \({\tilde{\varepsilon }}_{{{\text{it}} - 1}} = {\text{cc}}_{\text{i}} + {\text{ic}}_{\text{i}} + {\tilde{\eta }}_{{{\text{it}} - 1}}\) for continuing engagements, one would expect to observe γ C = 1−α as before. However, since the idiosyncratic cost should not affect the successor, on new engagements one would expect to observe γ N = 1−β, where \(\upbeta = ({\text{ic}}_{\text{i}} + {\tilde{\eta }}_{{{\text{it}} - 1}} )/{\tilde{\varepsilon }}_{{{\text{it}} - 1}}\). Much the same would be true were \({\tilde{\varepsilon }}_{{{\text{it}} - 1}}\) to include some idiosyncratic rent, ir i , as well since that component too would be expected to affect the continuing auditor’s costs but not those of the new auditor. However, in this case, while one would still expect to observe γ C = 1−α as before, γ N would be expected to have the value 1−θ, where \(\theta = ({\text{ic}}_{\text{i}} + {\text{ir}}_{\text{i}} + {\tilde{\eta }}_{{{\text{it}} - 1}} )/{\tilde{\varepsilon }}_{{{\text{it}} - 1}}\)

Note that β will vary with the fraction of ϵit−1 that is comprised of common costs, cc. As the relative contribution of cc to ϵit−1 increases (equivalently, as the relative contribution of ic decreases), β will decrease (γ N will increase). Consequently, when cost structures are materially indistinguishable across auditors, that is, ic = 0, the expression for β reduces to that for α and one would expect to observe γ C = γ N. As a result, an empirical finding that, in lateral Big Four transitions, γ C = γ N would provide strong evidence that the fee residual contains no appreciable amount of rents. By contrast, since non-Big-Four auditors are expected to have lower costs than Big Four auditors, even when ϵit−1 contains no rents, one would expect to observe β ≥ α, that is, γ N ≤ γ C in Big Four to non-Big-Four transitions. The persistence of fee residuals across lateral Big Four auditor transitions, therefore, constitutes a stronger test of the extent to which fee residuals contain rents than does its persistence across Big Four to non-Big-Four auditor transitions.

By contrast, in a scenario where \({\tilde{\varepsilon }}_{{{\text{it}} - 1}} = {\text{cr}}_{\text{i}}\) that is, the lagged residual consists purely of auditor rents common to all auditors, we would expect to observe γ C = 1 and γ N = −K and, in the general case, where \({\tilde{\varepsilon }}_{{{\text{it}} - 1}} = {\text{cc}}_{\text{i}} + {\text{ic}}_{\text{i}} + {\text{cr}}_{\text{i}} + {\text{ir}}_{\text{i}} + {\tilde{\eta }}_{{{\text{it}} - 1}}\) one would expect to observe γ C = 1−α and γ N = 1−δ, where \(\delta = ({\text{ic}}_{\text{i}} + {\text{ir}}_{\text{i}} + ({\text{K}} + 1){\text{cr}}_{\text{i}} + {\tilde{\eta }}_{{{\text{it}} - 1}} )/{\tilde{\varepsilon }}_{{{\text{it}} - 1}}\). Note that, unlike all of the previous cases, the coefficient on cr i in the expression for δ is \(({\text{K}} + 1)\) as a result of which, even when common rents, cr i , are a relatively small component of the residual fee, 1−δ can take values smaller than minus one and the coefficient γ N can be expected to be negative.Footnote 9 Our empirical analyses, described next, build on this intuition.

3 Methods and data

3.1 Computing residual fees

We compute the residual fee charged by an incumbent auditor, RFee it , as the unexplained fee from the model:Footnote 10

where

-

Ln(Afee) is the natural logarithm of the audit fee paid to the external auditor for the fiscal year in question (expressed in constant 1999 US dollars using the US Bureau of Labor Statistics Consumer Price Index series as deflator).

-

Ln(TA) is the natural logarithm of auditee total assets (TA) in constant 1999 US dollars.

-

Loss takes the value 1 if the company reports negative net income, 0 otherwise.

-

ROA is auditee return on assets (operating income after depreciation divided by total assets) winsorized at 1 %.

-

Leverage is the ratio of total liabilities to total assets winsorized at 1 %.

-

InvRec is the sum of auditee inventory and receivables divided by auditee total assets.

-

ForOps takes the value 1 if the auditee reports a foreign currency translation adjustment, 0 otherwise.

-

√Employees is the square root of the number of auditee employees (measured in thousands).

-

Nsegments is the number of business segments

-

NewFin takes the value 1 if sum of new equity and debt issue exceeds $50,000, 0 otherwise.

-

ExtDist takes the value 1 if the absolute value of extraordinary items or discontinued operations exceeds $10,000, 0 otherwise.

-

GCO takes the value 1 if the auditor opinion for the fiscal year includes a going-concern qualification, 0 otherwise.

-

ICWeak takes the value 1 if the auditor reports an internal control weakness, 0 otherwise.

-

Busy takes the value 1 if the auditee fiscal year ends in December, 0 otherwise.

-

Delay is the number of calendar days elapsed between the auditee’s fiscal year-end and the date of the audit opinion winsorized at 1 %.

-

Afiler takes the value 1 if auditee market value of equity at the end of the fiscal year exceeds $75 million, 0 otherwise.

Coefficients for all of the explanatory variables are expected to have a positive sign, except for ROA which is expected to have a negative sign since more profitable auditees pose lower audit risk. Three aspects of the RFee it computation are worthy of note. First, fee residuals for year t are obtained by estimating model (2) for all years up to and including year t. This ensures that the fee residual for each year is based on all data that would have been available to auditors in year t + 1 (our test year) to prepare their bids, precluding introduction of ex post information or hindsight bias in the fee model coefficients (and consequently in fee residuals).Footnote 11

Second, model (2) is estimated using only current and past data for continuing engagements: any year during which an auditor change occurs is excluded from the estimation process. This procedure ensures that the fee residual is computed from a model calibrated upon engagements where the auditor is most likely to earn rents. Third, since Big Four and non-Big-Four audit production and fee functions differ significantly (Chaney et al. 2004; Sankaraguruswamy and Whisenant 2009), we estimate model (2) separately, each year, for Big Four and non-Big-Four auditees. The second and third restrictions ensure that, when an auditee switches from a Big Four (non-Big-Four) auditor to a non-Big- Four (Big Four) auditor, fee residuals for all subsequent years are computed using only data from periods audited by a comparable (non-Big- Four or Big Four) auditor.

As noted earlier, the fee residual from this model will capture the combined influence of all researcher-unobserved factors that influence audit fees, that is, fee determinants excluded from Eq. (2) as well as estimation error (noise). While many of these factors are likely to (a) be correlated with observed fee determinants and (b) vary slowly over time, suggesting a need for panel estimation of the fee model, most prior research studies obtain fee residuals from pooled OLS estimation of model (2). To ensure comparability with prior research, we base our principal inferences on tests that employ OLS fee residuals. In robustness tests, however, we account for the (unknown) correlations between omitted and observed fee determinants and obtain residual fees via fixed-effects panel estimation of model (2) (see Sect. 4.3, additional analyses).

3.2 Preliminary: testing the maintained assumption of audit market competitiveness

To investigate competition in the market for new auditees, we first estimate, separately for Big Four and non-Big-Four auditees, the model:

where New is equal to 1 for a first-year laterally switching (Big Four to Big Four or non-Big- Four to non-Big-Four) audit engagement and 0 otherwise. In this model, the coefficient on New (b1) speaks to audit market competitiveness. If the market is competitive and the predecessor and successor auditors expect to earn rents, the coefficient on New will be negative and significant. Competition to become the new incumbent and earn future rents will lead new auditors to rebate the capitalized value of the future rents back to the auditee (DeAngelo 1981; Watts and Zimmerman 1986; Dye 1991; Kanodia and Mukherji 1994) and the coefficient on New will capture this rebate.

3.3 Testing fee persistence

To illuminate our key issue of interest, the extent to which the preceding year’s residual fees explain audit fees on continuing and new engagements, we estimate the augmented model:

where

-

LRFeePos is the value of the lagged residual, \({\hat{\varepsilon }}_{{{\text{i}}({\text{t}} - 1)}}\) obtained from the first stage if that residual is ≥0 and 0 otherwise;

-

LRFeeNeg is the value of the lagged residual, \({\hat{\varepsilon }}_{{{\text{i}}({\text{t}} - 1)}}\) obtained from the first stage if that residual is <0 and 0 otherwise;

and other model variables are as defined earlier. We estimate this model, separately for the Big Four and non-Big-Four continuing and new auditees using OLS (after including year and industry indicators).Footnote 12

In Eq. (7), the coefficients on LRFeePos and LRFeeNeg speak to the persistence of positive and negative lagged fee residuals, after current levels of known fee determinants have been accounted for. It is useful to separate out the positive and negative fee residuals for at least two reasons. First, prior studies (DeFond et al. 2002; Hope and Langli 2010; Larcker and Richardson 2004; Kanagaretnam et al. 2010; Choi et al. 2010; Asthana and Boone 2012) argue that the positive and negative fee residuals are likely to contain different amounts of rents. For instance, Choi et al. (2010) argue that, while positive fee residuals indicate an above-expected fee (a potential source of rents, more likely to result in compromised auditor independence), negative fee residuals indicate a below-expected fee (a potential loss engagement, less likely to result in compromised auditor independence).Footnote 13

Second, the coefficient on the combined residual is difficult to interpret. For instance, a negative coefficient on the combined residual is consistent with the new auditor either (a) discounting positive excess fees charged by the predecessor auditor or (b) reversing the lower than expected fee charged by the predecessor. Given, the differential interpretation ascribed to positive and negative residual fees in prior literature, the coefficient on each is likely to be of interest in its own right.

3.4 Data

Our sample consists of all public company audit engagements for which financial statement, audit fee, and opinion data are available in the Compustat and AuditAnalytics databases and that

-

1.

are US-domiciled entities and

-

2.

have a primary Standard Industrial Classification (SIC) code other than 4400–4999 or 6000–6999 (both inclusive).

Restriction (1) confines the sample to US auditees since audits may be produced and priced differently across national legal and institutional boundaries. Restriction (2) drops financial (4400–4999) and regulated industries (6000–6999) because their audit production functions are different from those of industrial firms. (e.g., Stein et al. 1994; Fields et al. 2004). To eliminate confounds due to differences in audit production functions across larger and smaller auditors, we estimate Eqs. (2) and (3) separately for Big Four and non-Big-Four auditees. Table 1 reports sample attrition due to the data restrictions imposed in this study.

Table 2, Panels A and B, report descriptive statistics for Big Four and non-Big-Four auditees. A comparison of panel A with panel B reveals that Big Four auditees are, on average, much larger than their non-Big-Four counterparts: mean audit fees and total assets of Big Four auditees are about $1.797 million (AFee) and $4.312 billion (TA) respectively compared to fees and total assets of about $236,000 (AFee) and about $168 million (TA) respectively for non-Big-Four auditees. Big Four auditee financial performance is also better than that of non-Big-Four auditees: 31 % of Big Four auditees report a loss, and mean ROA for Big Four auditees is 0.01, compared to 57 % and −0.64 for non-Big-Four auditees. Third, and related, Big Four auditees are less likely to face imminent financial distress than non-Big-Four auditees (mean GCO 0.03 vs. 0.23). Fourth, Big Four auditors are more likely than Non-Big-Four auditors to issue adverse internal control opinions (4 vs. 2 %). This difference likely reflects the higher proportion of Big-Four auditees that are accelerated filers (mean Afiler = 0.89 vs. 0.32 for Non-Big-Four auditees) and therefore subject to internal control audits under the Sarbanes–Oxley Act.

Table 3 reports (year and industry indicators omitted), by way of illustration, the estimates of Eq. (2) used to compute lagged fee residuals for 2012. Recall that we employ rolling window estimation with 2001 being the first year of data. Therefore, in estimating the lagged fee residuals for 2012, we use all available observations for the years 2001–2011. We use analogous procedures to compute the lagged fee residual for each year of our analysis.

In Table 3, all of the variables in the Big Four fee model (reported in column 2) are significant in the expected direction at the 10 % level of significance (or better). By contrast, in the non-Big-Four model (reported in column 3), GCO is not significant, indicating lower auditor responsiveness to certain auditee risk characteristics relative to the Big Four model. The model intercept as well as several coefficients, most notably auditee size, also differ discernibly across the two models. An untabulated F test rejects the hypotheses of model equality (F(16, 6314) = 72.25, p < 0.01), validating separate estimation for Big Four and Non-Big-Four auditees.

Before presenting the results of the various estimation models, it may be useful to note that the fee residuals computed from this estimation procedure are highly serially correlated (first-order autocorrelation in the fee residual series is about 0.77 for the Big Four auditee sample and 0.82 for non-Big-Four auditees).Footnote 14 This finding is novel and provides strong prima facie evidence that fee residuals from OLS estimation of the type of fee models presently in general use contain a significant nonnoise component. The purpose of our study is to illuminate the extent to which this nonnoise component consists of unobserved audit costs versus auditor rents.

4 Results

4.1 Preliminary: competition in the market for new auditees

Table 4 reports the results of pooled OLS estimation of model (6) separately for Big Four and Non-Big-Four auditees for the period 2003–2012. To account for repeated observations on the same auditee, reported significance levels are based on standard errors clustered by auditee.

In the Big Four auditee sample (results reported in the first two columns of Table 4), all of the control variables are significant in the expected direction at the 10 % level (or better) and model R2 is fairly high (about 0.81). The key features of the results reported in these two columns is that, relative to the fees paid by their continuing auditees, Big Four auditors offer significant discounts to new auditees. The coefficient on New is negative and significant (−0.151, p < 0.01), indicating that the new Big Four auditor provides a first-year fee discount of about 14 % [100*(1−e −0.151)].Footnote 15 The findings for non-Big-Four auditees (results reported in columns three and four of Table 4) are qualitatively similar. The most notable difference is that, as expected, non-Big-Four auditors offer their new auditees significantly smaller fee discounts: the mean initial fee discount is only about 10 % [100*(1−e −0.109)]. Collectively, the findings in Table 4 are consistent with prior findings in the literature and indicate intra-Big-Four auditor competition for new auditees (e.g., Francis 1984; Francis and Simon 1987; Simon and Francis 1988; Ettredge and Greenberg 1990; Craswell and Francis 1999; Ghosh and Lustgarten 2006; Sankaraguruswamy and Whisenant 2009). In principle, the magnitude of this initial fee discount reflects the sum of (a) any auditor optimism in bidding for a new engagements, (b) the present value of all expected auditor rents rebated back to the auditee, less (c) any start-up costs that may be recovered by the new auditor.

4.2 Determining the information content of fee residuals

Table 5 reports the results of estimating Eq. (4) separately for continuing Big Four (columns 1 and 2), continuing non-Big-Four (columns 3 and 4), laterally switching Big Four (columns 5 and 6), laterally switching non-Big-Four (columns 7 and 8), auditees and auditees switching, i.e., from Big-Four to non-Big-Four auditors (columns 9 and 10). Columns 1 and 2, columns 5 and 6, and columns 9 and 10 correspond to the three principal tests described earlier. The remaining columns of Table 5 provide additional context for interpreting these results. As in Table 4, reported significance levels are based on standard errors clustered by auditee.

Columns 1 and 2 of Table 5 present the results of the first test, residual fee persistence in continuing Big Four audit engagements. The coefficients on LRFeePos (b1) and LRFeeNeg (b2), the main focus of interest, are both positive and significant (0.678 and 0.849, respectively, one-tail p value < 0.01 in each case). Overall, continuing Big Four auditees that pay above (below) average fees in one year are likely to pay above (below) average fees in the next year. Columns 3 and 4 provide additional context for these findings by examining fee persistence in continuing non-Big-Four engagements: the coefficients on LRFeePos and LRFeeNeg for non-Big-Four auditees are also both positive (0.800 and 0.777 respectively, one-tail p value < 0.01). Overall, these four columns provide strong evidence that, for both Big Four and non-Big-Four continuing engagements, residual audit fees largely reflect systemic engagement-specific influences rather than noise factors.

Columns 5 and 6 of Table 5 speak to the second lateral-Big-Four auditor-transition test. The coefficients of LRFeePos and LRFeeNeg are both positive and significant (0.668 and 0.809, respectively, one-tail p value < 0.01 in each case). These coefficients are both almost identical to those documented in column 1, indicating that residual audit fees from continuing Big Four audit engagements consists largely of researcher-unobserved audit production costs common to all Big Four auditors. Since positive fee residuals are most likely to contain common rents, the fact that positive residuals are not discounted by successor auditor provides particularly strong evidence that residual audit fees are unlikely to contain common rents. The finding that the coefficient of LRFeePos after a lateral Big Four auditor transition is almost identical to that documented in column 1 provides particularly strong evidence that the persistent component of residual audit fees from continuing Big Four audit engagements consists largely of researcher-unobserved audit production costs common to all Big Four auditors.Footnote 16

Columns 7 and 8 provide additional context for the second test—and also set the stage for the third test—by reporting the coefficient of LRFeePos and LRFeeNeg for laterally-switching non-Big-Four auditees. In column 7, the coefficient on LRFeePos (0.574) is significantly different from the corresponding LRFeePos coefficient (0.800) in Column (3) [χ2(1) = 5.20, p < 0.05]. The difference of about 0.22 suggests that the (non-Big-Four) predecessor’s fee residual contains either some idiosyncratic costs or rents (ic or ir) excluded from the (also non-Big-Four) successor’s fee or some common rents (cr) that the new auditor also expects to earn (and therefore discounts in the first period). Note that, even if the entire difference reflects discounting of common rents by the new auditor, at a present value factor of −5 (i.e., by setting K = 5), the upper bound on the magnitude of common rents earned by the predecessor cannot exceed about 4 % (0.22/5) of its residual fee. The coefficient on LRFeeNeg (0.615) is also significantly different from the corresponding LRFeeNeg coefficient (0.777) in Column (3) [χ2(1) = 4.07, p > 0.05]. This finding indicates that the new non-Big-Four auditor reverses some of the relative underpricing by the predecessor non-Big-Four auditor.

Columns 9 and 10 of Table 5 report the results of the third test, residual fee persistence on Big Four audit engagements that switch to smaller non-Big-Four auditors. As noted earlier, this test confounds the effects of the successor auditor earning lower rents (driving the persistence to zero) with the effect of discounting costs that the successor does not share with the Big Four predecessor (which also would drive residual fee persistence to zero).Footnote 17 Empirically, however, the coefficients on both LRFeePos and LRFeeNeg are positive and significant (0.590 and 0.574, respectively, one-tail p value < 0.01) in column 9. Moreover, the coefficient on LRFeePos (0.590) is not significantly different from the corresponding LRFeePos coefficient (0.678) in Column (1) [χ2(1) = 0.82, p > 0.10]. This finding suggests that the persistent component of the Big Four auditors’ fee residual consists largely of audit production costs that are common to both Big Four and non-Big-Four auditors. By contrast, the coefficient on LRFeeNeg (0.574) in column (9) is significantly different from the corresponding LRFeeNeg coefficient (0.849) in Column (1) [χ2(1) = 6.04, p < 0.05]. The difference of about 0.28 indicates that non-Big-Four successor auditors, on average, reverse part of the underpricing by the predecessor Big Four auditor, which may reflect (relative) cost inefficiency on the part of the successor auditor. Collectively, the evidence indicates that Big Four auditors’ fee residuals largely comprise of unobserved audit production costs and rents are likely to be fairly small.Footnote 18

4.3 Additional analyses

4.3.1 Alternate model specification

Separately estimating model (4) on continuing and new auditees allows for the possibility that continuing and new auditees may have different coefficients for the test and control variables. However, such estimation does not allow us to test for the sample wide mean first-year fee discounts offered by auditors. Therefore we also test the following interaction model that includes a variable (New) that will capture the first-year fee discount but will not allow all the coefficients to vary across continuing and new auditees. The model we employ is

where

-

New is equal to 1 for a first-year audit engagement and 0 otherwise;

-

LRFeePos is the value of the lagged residual, \(\hat{\varepsilon }_{{{\text{i}}({\text{t}} - 1)}}\) obtained from the first stage if that residual is ≥0 and 0 otherwise;

-

LRFeeNeg is the value of the lagged residual, \(\hat{\varepsilon }_{{{\text{i}}({\text{t}} - 1)}}\) obtained from the first stage if that residual is <0 and 0 otherwise;

and other model variables are as defined earlier. In this model, New captures the first year fee discount while the coefficients on LRFeePos (b 2 ) and LRFeeNeg (b 3 ) speak to the persistence of positive and negative residual fees in continuing engagements. When lagged residual fees reflect systematic engagement-specific influences, both b2 and b3 can be expected to be positive and significant. Finally, in this test, the sign and magnitude of the sum (b 2 + b 4 ) of the coefficients on LRFeePos and New*LRFeePos and the sum (b 3 + b 5 ) of the coefficients on LRFeeNeg and New*LRFeeNeg (b5) speak to the persistence of lagged residual in auditor switches. As a result, our predictions for the sign and magnitude of these sums are the same as our predictions for the persistence of lagged residuals in auditor switches.

Table 6 reports the results of estimating model (5) for (a) continuing and laterally switching Big Four auditees (column 1 and 2), (b) continuing and laterally switching non-Big-Four auditees (columns 3 and 4), and (c) continuing non-Big-Four auditees and auditees switching from Big Four to non-Big-Four auditors (columns 5 and 6). The results reported in Column 1 suggest that Big Four auditors offer initial fee discounts of about 18 % (e−0.202−1), while those reported in Column 3 indicate that non-Big-Four auditors offer smaller discounts [of about 7.5 % (e−0.078−1)]. Interestingly, the coefficient on New is positive (0.137, p < 0.01), indicating that auditees switching from Big Four auditors to non-Big-Four auditors pay about 14 % [100*(e 0.147−1)] more than do comparable non-Big-Four auditees.Footnote 19 Second, the sum of the coefficients (b2 + b4, b3 + b5) is positive and significant for all auditor transitions (last two rows of Table 6). This finding is inconsistent with the lagged residual largely consisting of common rents: were that to be the case, one would expect both sums to be negative and significant for lateral Big Four switches (and zero for both lateral non-Big-Four switches and Big Four to non-Big-Four auditor switches). As in Table 5, the results in Table 6 indicate that fee residuals consist largely of researcher-unobserved audit production costs (or noise) and that their rent component is, at best, small.

4.3.2 Tests based on panel estimation of residual fees

As discussed in the above, most prior studies estimate residual fees using an OLS analysis that includes industry or year fixed effects or both (but not auditee-level fixed effects). The results of such analyses can be interpreted as unbiased and consistent estimators of the fee residual under the stronger assumption that researcher-unobserved influences that affect observed audit fees are uncorrelated with the observed vector of fee determinants (the included regressors). If, however, the researcher-unobserved influences on audit fees are correlated with the observed determinants, OLS estimates are likely to biased and inconsistent. To account for the (unknown) correlations between omitted factors and observed fee determinants, we obtain residual fees via fixed-effects panel estimation of model (5).Footnote 20 In this approach, fee residuals are computed as the sum of the random noise term and the auditee fixed effect component (the composite Stata panel residual ue). In this section, we report the results of replicating our analyses using panel estimation.

Table 7 reports results analogous to those reported in Table 3 after estimating model (5) using panel estimation methods. The model used to estimate the results reported in Table 7 therefore includes industry, year, and auditee fixed effects. Table 8 reports results analogous to those reported in Table 4, while Table 9 reports results analogous to Table 5. A key difference between Tables 8 and 4 is that Table 8 includes lagged panel residuals as instruments for unobserved auditee fixed effects (thereby obtaining consistent and unbiased coefficient estimates of the fee model parameters, including the new auditee fee discount).Footnote 21

The most notable differences between the results reported in Tables 3 and 7 is that the panel estimates reported in Table 7 show (a) a coefficient of auditee size that is only 0.75 times as large as its panel estimation counterpart (the coefficient of Ln(TA) is 0.316 in Table 7 vs. 0.445 in Table 3), (b) a substantially larger intercept (5.834 in Table 7 vs. 4.244 in Table 3), and (c) smaller coefficient magnitudes in general than those obtained in the OLS estimation. These differences in parameter estimates indicate that correcting for the fee impact of any researcher-unobserved (and therefore omitted) time-invariant fee determinants has a material impact on the magnitudes of fee model coefficients reported in prior research.

Note that Table 7 reports four different R2 for the model. The within, between, and overall R2 are computed as part of the panel estimation routine in Stata (xtreg, fe). In this routine, the groups are considered to be fixed, and their effects are subtracted from the model before the fit is performed. As a result, the impact of groups on model fit is ignored while computing the R2 of the estimated model. By contrast, the R2 reported in the last row of Table 5 is computed using the areg routine in Stata. In this routine, a coefficient is estimated for each of the covariates plus each of the groups included in the model. As a result, the impact of groups on model fit is included in computing the R2 of the estimated model.Footnote 22

Comparing the results reported in Table 8 to their analogs in Table 4 reveals that substituting the panel residuals for OLS residuals does not materially impact our findings. In both Tables 8 and 4, the new auditee discount for Big Four auditees is about 14 %, while the new auditee discount for the non-Big-Four auditees is about 10 % discount in Table 4 and about 7 % in Table 8 [100*(1−e−0.073)]. The coefficients for lagged fee residuals are positive and significant for both the Big Four and non-Big-Four samples in Table 8, indicating high fee residual persistence. Overall, the results in Table 8 confirm the findings of first-year fee discounts and residual fee persistence noted in Table 4.

Comparing the results reported in Tables 5 and 9 also reveals no significant differences. In both tables, continuing Big Four auditees exhibit similar degrees of residual fee persistence. For instance, for continuing Big Four auditees, the coefficients for LRFeePos and LRFeeNeg are 0.678 and 0.849 in Table 5 and about 0.690 and 0.749, respectively, in Table 9. For non-Big-Four auditees, however, panel residuals are slightly less persistent than OLS residuals. The coefficients for LRFeePos and LRFeeNeg for non-Big-Four auditees are 0.800 and 0.777 in Table 5 and 0.586 and 0.572 in Table 9. The coefficients of both LRFeePos and LRFeeNeg for lateral Big Four and Big Four to smaller auditor switches (columns 5 and 6 and columns 9 and 10 respectively) are qualitatively similar across Tables 9 and 5.Footnote 23

Overall, the panel residual based analyses confirm the principal conclusions of the OLS analyses: we find that fee residuals are highly persistent in continuing audits, and we do not find evidence that the successor auditor discounts the predecessor auditor’s fee residual. These findings provide strong evidence that the persistent component of residual audit fees consist largely of researcher-unobserved audit production costs common to all auditors.

4.3.3 Alternate approach to estimating fee residuals

For greater consistency with some prior studies, we also replicated the analyses reported in Table 5 after computing fee residuals using pooled OLS estimation of model (2) across all auditees (both Big Four and non-Big-Four) by including a Big Four indicator variable in model (2). Our principal findings (untabulated) and inferences are, in all material respects, unaltered by this change. For instance, using pooled OLS model residuals, we find that the coefficients of positive lagged residual fees are 0.674 (one-tail p value < 0.01) for continuing Big Four auditees and 0.649 (one-tail p value < 0.01) for laterally switching Big Four auditees. The corresponding coefficients of negative lagged residual fees are 0.860 (one-tail p value < 0.01, continuing auditees) and are 0.830 (one-tail p value < 0.01, laterally switching auditees). The other coefficients, without exception, similarly closely conform to those reported in Table 5.

Overall, the results from various analyses using OLS and panel residuals and alternate residual estimation procedures suggest that residual fees are comprised largely of unobserved production costs common to all auditors (and are likely to contain only small amounts of rents).

5 Concluding remarks

We show analytically how differential persistence of audit fee residuals across various types of audit engagements can elucidate the extent to which fee residuals consist of researcher—unobserved audit costs, auditor rents, and noise components. Empirically, in a comprehensive sample of U.S. public company audit engagements conducted during 2001–2012, we document evidence suggesting that fee residuals are largely comprised of unobserved audit production costs and noise.

Our interpretations are subject to several caveats. First, our analysis speaks only to the interpretation of the fee residual. Rents contained in either the intercept or the coefficients of fee determinants are beyond the scope of our study. Second, we follow prior research and infer audit market competitiveness from the discounting (net of auditor startup costs, if any) of fees charged on new audit engagements. Third, we follow prior literature in defining auditor rents as fees in excess of normal production costs inclusive of all costs of auditor risk-bearing (i.e., inclusive of all litigation, regulatory, and reputation costs arising from potentially lax auditing) as well as a normal rate of return on all factors of production. Consequently, should both the predecessor and the successor expect to conduct lax audits, the resulting increase in risk-bearing costs will persist in auditor transitions while only the (presumably larger) rents will be discounted at their capitalized value. Fourth, we estimate the relative magnitude of two inherently unobservable components of the fee residual by examining the pricing of fee residuals in auditor transitions, which are known to be complex phenomena and about which much remains to be learned.

Our finding that fee residuals are highly persistent in continuing engagements, as well as in lateral and downward switches, has three key implications. First, given that they largely consist of researcher-unobserved audit production costs common to all auditors, lagged residual fees can be useful predictors of expected (or normal) fees in continuing as well as new engagements. Second, given their significant incremental explanatory power in the fee model, elucidating the factors that drive fee residuals offers a promising avenue for future research. Third, and most salient, our evidence implies that negative associations between measures of audit quality or financial reporting quality, and audit fee residuals are best interpreted as evidence of additional auditor effort on higher risk engagements rather than of the adverse impact of auditor rents on auditor independence.

Notes

Fee residuals are computed as the difference between actual audit fees and predicted audit fees from a regression of audit fees on engagement attributes known to affect audit production costs (see Simunic 1980).

We refer to Deloitte LLP, Ernst and Young LLP, KPMG LLP, and PricewaterhouseCoopers LLP collectively as the Big Four auditors and to all other auditors as non-Big-Four auditors. Auditees of Arthur Andersen LLP are excluded from our analyses.

As in DeFond et al. (2002), many of these studies use multiple measures of auditor rents. Our findings speak only to inferences based on the use of audit fee residuals as a measure of auditor rents. Inferences based on other measures are beyond the scope of our present investigation.

Recall that in the framework discussed earlier (Simunic 1980), audit production costs include all normal costs of audit production, including a competitive compensation for any litigation, regulatory, and reputation risk borne by the auditor.

Survey evidence cited in GAO (2003, pp. 27–28) and PCAOB (2011) indicates that these costs can be quite substantial relative to the annual audit fee for a continuing engagement when these costs are not incurred. Respondents indicated that the auditor’s setup costs are usually in excess of 20 % and the auditee’s share in excess of about 17 % of the recurring audit fee. Furthermore, the survey finds that (under the current system of long auditor tenure) both auditors and auditees usually absorb their portion of these setup costs.

Prior research notes that switching costs alone are not sufficient to generate auditor rents. The magnitude of rents also depends on the distribution of bargaining power between the auditor and the auditee (Dye 1991; Kanodia and Mukherji 1994). The distribution of such power is an empirical question, and whether the switching costs documented in GAO (2003) and PCAOB (2011) do in fact give rise to sizeable auditor rents in the U.S. public company audit market is not presently known. Our tests are designed to illuminate the extent to which audit fee residuals from continuing audit engagements contain a material common rent component.

Auditor startup costs associated with new engagements are unlikely to materially impact these coefficient estimates for two reasons. First, as noted earlier, audit firms generally absorb the startup costs associated with the initial year audit (GAO 2003, p. 28). Consequently, such costs are usually excluded from the dependent variable, y it . Second, even were y it to contain some element of startup costs, since the predecessor does not have to bear any startup costs, there is little reason to expect the lagged residual fee, ϵ it−1 , to be systematically correlated with the successor’s startup costs. Consequently, our estimates of γ C and γ N are unlikely to be affected by the existence of new auditor startup costs.

In this case, note that (3C) and (3 N) both reduce to yit = a + cci + ηit = a + ϵ it−1 + ηit, which implies γ C = γ N = 1 in Eqs. (4C) and (4N). The coefficients in each of the special cases discussed below follow directly from analogous substitutions of the respective definitions of ϵit−1 into Eqs. (3C) and (3N).

Specifically, if the lagged residual fee consists only of common costs and rents, the impact of these two factors on successor’s fee is expected to be 1 × cc−K × cr. When cr/cc ≥ 1/K, the expected coefficient of lagged fee residuals will be nonpositive! For example, when K = 5 and the lagged residual, ϵit−1, consists only of cc and cr, whenever the common rent, cr, is >17 % of ϵit−1 (i.e., the common cost, cc, is <83 % of ϵit−1), the expected value of γ N is 1 × 0.83−5 × 0.17 = (−) 0.02. (In this example, we have chosen to set ic i = ir i = η = 0 and cr i /ϵ i,t−1 = 0.17, so that δ = {0 + 0−(5 + 1)cr i + 0}/ϵ i,t−1 = − 6 × cr i /ϵi,t−1. = 1.02 and 1 − δ = (−) 0.02). If fee residuals were to largely be comprised of rents, an priori necessary condition for fee residuals to be a credible proxy for rents, e.g., if 70–80 % of the fee residual were rents, the coefficient of lagged fee residuals can be expected to be in the vicinity of minus 3 to minus 4.

See Appendix 2 for formal variable definitions. Note that this specification includes all of the audit production cost drivers that have consistently been used in prior research to compute fee residuals. As a result, our procedure yields fee residuals that are (a) comparable to residuals used in prior research and (b) exclude factors such as auditor-related and/or audit market effects whose nature (i.e., whether they represent costs or rents) is presently not known. For instance, our model does not include measures of auditor industry specialization the nature of which (i.e., whether they are costs or rents) is presently are not known. Including auditor industry specialization measures would therefore remove from the residual part of the rents that accrue to incumbent auditors. Our approach of excluding variables that represent such unknown fee influences gives our estimate of the fee residual its best shot at capturing any possible auditor rents. However, as noted in footnote 23, including auditor specific variables in the model has no material impact on our findings.

To elaborate, we estimate Eq. (5) using rolling windows. Specifically, we use data from years 2001 and 2002 to estimate the audit fee residual for year 2002. When testing the persistence of lagged fee residuals, the 2002 residual is used as the lagged residual for year 2003. We compute the fee residual for 2003 using data from years 2001, 2002, and 2003 and use the 2003 residual in the lagged residual persistence tests for 2004.

Specifically, we first estimate model (5) for all continuing Big Four engagements and, separately, for all continuing non-Big-Four engagements. We then use the residuals from these estimates as the lagged fee residuals on new engagements. Since the fee residuals are computed separately for Big Four and non-Big-Four engagements, our tests of fee residual persistence across auditor switches are conditioned on both auditee origin and destination (i.e., we conduct separate tests for lateral Big N, for lateral non-Big-N and for Big-N to non-Big N switches).

Note that—by construction—about half of the fee residuals from any well-specified regression model can be expected to be negative. Since economic rents, by definition, represent excess profits, an intrinsically nonnegative construct, it is conceptually difficult to ascribe a meaningful rent-centric interpretation to negative residuals. For instance, especially given the levels of residual fee persistence on continuing engagements that we document in this study, it is difficult to justify why—year after year, on about half of the engagements—auditors would continue to conduct engagements that generate losses (yield negative rents). By contrast, negative residuals are easier to explain from the cost-centric perspective. For example, negative residuals may be driven by an omitted risk factors that makes the auditee less risky than the average firm.

It may also be useful here to note, by way of comparison, the first-order autocorrelation of the residual fees estimated from a (single) pooled-fee model estimated for the period 2001–2011 is about 0.79 for Big Four auditees and 0.83 for non-Big-Four auditees. This comparison indicates that the rolling-window estimation procedure does not materially affect autocorrelation in the fee residual series.

Auditor_fkey, the unique auditor identifier in the AuditAnalytics database tracks firm names rather than the identity of the underlying entity. Such name changes do not, however, result in a change in the underlying entity’s PCAOB auditor registration number. For instance, in 2009, BDO Seidman LLP (auditor_fkey = 7) legally changed its name to BDO USA LLP (auditor_fkey = 11,761). Likewise, in 2011, McGladrey & Pullen (old auditor_fkey = 10) changed its legal name to McGladrey LLP (new auditor_fkey = 16,168). Neither change affected the firms’ PCAOB auditor registration numbers, which respectively remained 243 and 49 after the change. We mitigate against such measurement error in the classification of continuing and new engagements by classifying an observation as an auditor switch only if the auditor’s PCAOB registration number in the auditorsinfo file (available at directory/wrds/audit/sasdata/audit_comp) changes.

In the terminology of Sect. 2, this finding indicates that, in lateral Big Four auditor transition, for positive lagged residual fees, which are considered to be the most likely instances where auditors earn rents, γ C (0.678 in column 2) = γ N (0.668 in column 5). A formal test for equality of coefficients produces a χ2(1) of 0.00, p > 0.10. This finding provides strong evidence that positive lagged fee residuals consist largely of unobserved production costs common to the predecessor and successor auditor and contain very little by way of auditor rents. Similarly, for negative lagged fee residuals, γ C (0.849 in column 2) = γ N (0.809 in column 5). In this instance too, we fail to reject the null hypothesis that the two coefficients are equal χ2(1) = 1.97, p > 0.10).

Recall that a successor non-Big-Four auditor is less likely to earn rents than was the successor Big Four auditor in the third test. Fee persistence in the third test can, therefore, be expected to be lower than in the second test. As discussed earlier, however, a non-Big-Four successor is likely to also have lower audit production costs than the Big Four successor auditor in the second test. Consequently, overall, the lateral Big Four auditor transition test is, in our view, the more powerful test.

Columns (5) to (10) report results for auditor switches which are rare events with very few repeat observations involving the same auditee. For consistency, with the results reported in columns (1) to (4), we estimate the models reported in columns (5) to (10) using cluster-robust standard errors as well. However, our results are materially unchanged if we instead use unclustered heteroskedasticity robust standard errors.

To the best of our knowledge, this result has not been reported in prior research. Untabulated analyses show that fees paid to the new non-Big-Four auditor by these auditees are also, on average, about 33 % [100*(1−e−040)] lower than the “counterfactual” fees these auditees would have paid the predecessor Big Four auditor, a finding that is consistent with prior research (cf. Chaney et al. 2004). However, as noted earlier, the finding that such auditees pay more than a similar continuing non-Big-Four auditee would pay its auditor is new.

To compute 2011 residual fees, Eq. (2) is estimated separately for Big Four and non-Big-Four auditees, using data for all years during the period 2001–2011 when the auditee was a continuing Big Four (or non-Big-Four) auditee. For both estimations, a Hausman test rejects the null hypothesis that the random effects model is the preferred model (Big Four model: χ2(26) = 659.31, p < 0.01; Non-Big-Four model: χ2(26) = 856.17, p < 0.01). For parsimony, we do not tabulate the 2003–2010 residual fee models (all of which yield qualitatively similar coefficient estimates and model fit statistics).

Both definitions of model R2 are widely used (see http://www.stata.com/support/faqs/statistics/areg-versus-xtreg-fe/ for a brief discussion and http://www.stata.com/statalist/archive/2003-05/msg00336.html for details).

As noted in footnote 10, many fee models include measures of auditor-specific factors (such as auditor industry expertise). Since it is not known whether the returns to these factors represent costs or rents and for comparability with most prior research (cf. Hope and Langli 2010; Ball et al. 2012; Hribar et al. 2014), we leave these premia embedded in the fee residual and include in the model only those variables that are known to be cost drivers (inclusive of all expected liability/regulatory and reputation risk costs). This approach gives our estimate of the residual fee its best shot at capturing any auditor rents. However, we re-estimated the model reported in Table 9 after adding auditor fixed effects as well as measures of auditor office size and auditor industry specialization. (Recall that auditee, industry and year fixed effects are already controlled for in Table 9). We find that the coefficient of the lagged residual fee in lateral Big N transitions is about the same as it was in Tables 5 and 9, indicating that controlling for auditor fixed effects does not materially affect the persistence of the fee residual in such transitions. In lateral non-Big-N auditor transitions, in contrast, including auditor fixed effects leads to a much larger decline in fee residual persistence, consistent with the conjecture that the non-Big-N auditors are far more heterogeneous as a group than are the Big N auditors. As noted earlier, whether these auditor fixed effects reflect costs or rents is not presently known. Consequently, in the paper, we focus only on models that leave these auditor fixed effects in the fee residual. Extending the analysis to better understand the impact of auditor—specific factors on fees offers a profitable area for future research, and we thank an anonymous reviewer for drawing our attention to this possibility.

While Gul and Srinidhi (2007) motivate the use of residual audit fees using Kinney and Libby’s economic bonding argument, they find no association between residual audit fees and the magnitude of auditee abnormal accruals (their measure of audit quality), which they interpret as follows: “This implies that when audit fees are unexpectedly high, it is difficult to distinguish whether it reflects an unexpectedly high audit effort (with consequent improvement in accrual quality) or excessive rents (that result in a deterioration of accrual quality).”

The exception, as noted earlier, is Gul and Srinidhi (2007), who do allude, albeit in passing, to a possible cost-centric interpretation when offering an ex post explanation of an observed lack of association between residual audit fees and their measure of audit quality. Asthana and Boone (2009) too allude to the possibility that fee residuals may include the effects of unobserved drivers of audit effort.

References

Asthana, S. C., & Boone, J. P. (2012). Abnormal audit fee and audit quality. Auditing: A Journal of Practice & Theory, 31(3), 1–22.

Ball, R., Jayaraman, S., & Shivakumar, L. (2012). Audited financial reporting and voluntary disclosure as complements: a test of the confirmation hypothesis. Journal of Accounting and Economics, 53(1–2), 136–166.

Bell, T. B., Doogar, R., & Solomon, I. (2008). Audit labor usage and fees under business risk auditing. Journal of Accounting Research, 46(4), 729–760.

Bell, T. B., Landsman, W. R., & Shackelford, D. A. (2001). Auditors’ perceived business risk and audit fees: Analysis and evidence. Journal of Accounting Research, 39(1), 35–43.

Chaney, P. K., Jeter, D. C., & Shivakumar, L. (2004). Self-selection of auditors and audit pricing in private firms. The Accounting Review, 79(1), 51–72.

Choi, J. H., Kim, J. B., & Zang, Y. (2010). Do abnormally high audit fees impair audit quality? Auditing: A Journal of Practice and Theory, 29(2), 115–140.

Craswell, A. T., & Francis, J. R. (1999). Pricing initial audit engagements: A test of competing theories. The Accounting Review, 74(2), 201–216.

DeAngelo, L. E. (1981). Auditor independence, ‘low balling’, and disclosure regulation. Journal of Accounting and Economics, 3(2), 113–127.

DeFond, M. L., Raghunandan, K., & Subramanyam, K. (2002). Do non-audit service fees impair auditor independence? Evidence from going-concern audit opinions. Journal of Accounting Research, 40(4), 1247–1274.

Dye, R. A. (1991). Informationally motivated auditor replacement. Journal of Accounting and Economics, 14(4), 347–374.

Ettredge, M., & Greenberg, R. (1990). Determinants of fee cutting on initial audit engagements. Journal of Accounting Research, 28(1), 198–210.

Fields, L. P., Fraser, D. R., & Wilkins, M. S. (2004). An investigation of the pricing of audit services for financial institutions. Journal of Accounting and Public Policy, 23(1), 53–77.

Francis, J. R. (1984). The effect of audit firm size on audit prices: A study of the Australian market. Journal of Accounting and Economics, 6(2), 133–151.

Francis, J. R. (2011). A framework for understanding and researching audit quality. Auditing: A Journal of Practice and Theory, 30(2), 125–152.

Francis, J. R., & Simon, D. T. (1987). A test of audit pricing in the small-client segment of the US audit market. The Accounting Review, 62(1), 145–157.

GAO. (2008). Audits of public companies: Continued concentration in audit market for large public companies does not call for immediate action. GAO-08-163.

Ghosh, A., & Lustgarten, S. (2006). Pricing of initial audit engagements by large and small audit firms. Contemporary Accounting Research, 23(2), 333–368.

Government Accountability Office (GAO). (2003). Public accounting firms: Required study on the effects of mandatory audit firm rotation. GAO-04-216.

Higgs, J. L., & Skantz, T. R. (2006). Audit and non-audit fees and the market’s reaction to earnings announcements. Auditing: A Journal of Practice & Theory, 25(1), 1–26.

Hope, O. K., & Langli, J. (2010). Auditor independence in a private firm and low litigation risk setting. The Accounting Review, 85(2), 573–605.

Hribar, P., Kravet, T., & Wilson, R. (2014). A new measure of accounting quality. Review of Accounting Studies, 19(1), 506–538.

Kanagaretnam, K., Krishnan, G. V., & Lobo, G. J. (2010). An empirical analysis of auditor independence in the banking industry. The Accounting Review, 85(6), 2011–2046.

Kanodia, C., & Mukherji, A. (1994). Audit pricing, lowballing and auditor turnover: A dynamic analysis. The Accounting Review, 69(4), 593–615.

Kinney, W. R, Jr, & Libby, R. (2002). Discussion of the relation between auditors’ fees for non-audit services and earnings management. The Accounting Review, 77(Supplement), 107–114.

Larcker, D. F., & Richardson, S. A. (2004). Fees paid to audit firms, accrual choices, and corporate governance. Journal of Accounting Research, 42(3), 625–658.

O’Keefe, T. B., Simunic, D. A., & Stein, M. T. (1994). The production of audit services: Evidence from a major public accounting firm. Journal of Accounting Research, 32(2), 241–261.

Public Company Accounting Oversight Board (PCAOB). (2011). Concept release on auditor independence and audit firm rotation. PCAOB Release Number 2011-006.

Sankaraguruswamy, S., & Whisenant, S. (2009). Pricing initial audit engagements: Empirical evidence following public disclosure of audit fees. Working paper available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=452680.

Simon, D. T., & Francis, J. R. (1988). The effects of auditor change on audit fees: Tests of price cutting and price recovery. The Accounting Review, 63(2), 255–269.

Simunic, D. A. (1980). The pricing of audit services: Theory and evidence. Journal of Accounting Research, 18(1), 161–190.

Srinidhi, B. N., & Gul, F. A. (2007). The differential effects of auditors’ non-audit and audit fees on accrual quality. Contemporary Accounting Research., 24(2), 595–629.

Stein, M. T., Simunic, D. A., & O’Keefe, T. B. (1994). Industry differences in the production of audit services. Auditing: A Journal of Practice and Theory, 13(1), 128–142.

Watts, R. L., & Zimmerman, J. L. (1986). Positive accounting theory. Upper Saddle River, NJ: Prentice-Hall.

Wooldridge, J. M. (2002). Econometric analysis of cross section and panel data. Cambridge: MIT Press.

Acknowledgments

We appreciate comments from A. Rashad Abdel-Khalik, Ashok Banerjee, Corey Cassell, Anne Farrell, Jere. R. Francis, Keejae Hong, Manju Jaiswall, Sanjay Kallapur, Linda Myers, James Myers, Mark Peecher, Paul Polinski, Stephen P. Rowe, Srini Sankaraguruswamy, Kaustav Sen, Theodore Sougiannis, William F. Wright and seminar participants at the Indian Institute of Management Calcutta, the Indian School of Business Accounting Research Conference, the University of Arkansas, The University of Illinois and The University of North Carolina, Charlotte on earlier versions of this paper.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Cost-centric interpretations of the fee residual

One of earliest explicitly cost-centric readings of residual audit fees is offered by Ettredge and Greenberg (1990) who note that

[I]n a competitive setting cross-sectional differences in audit fees should be highly correlated with differences in audit costs. We employ the old auditor’s fee as a surrogate for cost and compare it with the “expected” fee given the client’s characteristics. The expected fee is derived from a regression model … Each client’s fee residual is obtained from the regression … In similar fashion, the new auditor’s fee is used as a dependent variable in a regression with the same independent variables. If a new auditor has a positive regression residual, that auditor should be a high-cost provider relative to other new auditors.

More recently Ball et al. (2012) motivate a cost-centric reading of the fee residual as follows: