Abstract

Using household travel diary data collected in Germany between 1997 and 2015, we employ an instrumental variable (IV) approach that enables us to consistently estimate both fuel price and efficiency elasticities. The aim is to gauge the relative impacts of fuel economy standards and fuel taxes on distance traveled. Our elasticity estimates indicate that higher fuel prices reduce driving to a substantial extent, though not to the same degree as higher fuel efficiency increases driving. This finding indicates an offsetting effect of fuel efficiency standards on the effectiveness of fuel taxation, calling into question the efficacy of the European Commission’s legislation to limit carbon dioxide emissions for new cars.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In April 2009, the European Commission passed legislation requiring automakers to reduce the average per-km carbon dioxide (CO2) emissions of newly registered automobiles to 130 g/km by 2015 (EC 2009), with an even stricter standard of 95 g/km now set for 2020.Footnote 1 According to a press release published by the Commission in 2007, the CO2 limits in the new legislation would “reduce the average emissions of CO2 from new passenger cars in the EU from around 160 g per km to 130 g per km,” which would “translate into a 19% reduction of CO2 emissions” (EC 2007).

But whether a CO2 reduction of this magnitude in fact materializes critically depends on the behavioral response of motorists to increased efficiency. Presuming that mobility is a conventional good, a decrease in the cost of driving due to an improvement in fuel efficiency would result in an increased demand for car travel. This demand increase is referred to as the direct rebound effect (Khazzoom 1980), as it offsets—at least partially—the reduction in energy demand that would otherwise result from an increase in efficiency. Though the existence of the direct rebound effect is widely accepted, its magnitude remains a contentious issue (e.g. Saunders 1992; Brookes 2000; Borenstein 2015; Chan and Gillingham 2015; Sorrell and Dimitroupoulos 2008).

Studies from the North American transport sector, where much of the literature originates, generally find relatively low rebound effects. Using a pooled cross-section of US states for 1966–2001, Small and Van Dender (2007), for example, uncover direct rebound effects varying between 2.2 and 15.3%, with similar findings obtained in a follow-up study from Hymel et al. (2010). Employing estimates of fuel price elasticities of travel demand to capture the direct rebound effect in individual transport, as is common in the literature, Gillingham et al. (2016: 75) report comparably low rebound effects for other studies from the US and Canada (e.g. Barla et al. 2009), ranging between 3 and 34%.

While empirical studies outside of North America are fewer in number, fuel price elasticity estimates are frequently higher (Brons et al. 2008). A recent example comes from the work of Weber and Farsi (2014). Rather than employing price elasticities, these authors are among the few analyses that base their estimates on the fuel efficiency elasticity of travel demand, finding rebound effects for the individual mobility behavior of Swiss households between 75 and 81%. In contrast, at the lower end of the estimates available from Europe are the results of De Borger et al. (2016a), who employ panel data for Danish households to estimate moderate rebound effects of some 7.5–10%.

Using detailed household travel diary data collected in Germany between 1997 and 2015 and an instrumental variable (IV) approach, we identify the rebound effect from estimating both fuel price and efficiency elasticities to gauge the relative impacts of fuel economy standards and fuel taxes on distance traveled. Although the identification of the rebound effect via the estimation of the fuel efficiency elasticity has the advantage of not hinging on a series of restrictive assumptions (see, e.g. Sorrell and Dimitroupoulos 2008; Linn 2016), the estimates may be subject to endogeneity bias.

Contrasting with fuel prices, which can largely be regarded as exogenous to households, this endogeneity owes to unobserved household characteristics that affect both the decision on the distance driven and the fuel economy of the vehicle when it is purchased (Linn 2016: 277). Unobserved environmental preferences, for example, may trigger the purchase of a car with a high fuel efficiency, but may also lead to low driving distances. These preferences may therefore be correlated with regressors capturing fuel efficiency and may thus bias the estimation results. In addition to such simultaneity biases, statistical inconsistencies may result from reverse causality: drivers who are prepared to drive longer distances, for instance, because of a job change, may tend to purchase more fuel-efficient cars (Gillingham 2012: 10; Mulalic and Rouwendal 2015).

In the spirit of an analysis of the Canadian light-duty vehicle fleet by Barla et al. (2009), several features of our approach ameliorate these potential problems. First, the panel dimension of our data allows the inclusion of fixed effects to control for the influence of unobserved heterogeneity that stays fixed over time. Second, we address the endogeneity problem that potentially plagues the estimate of the fuel efficiency elasticity by employing the vehicle tax rate per 100 cm3 engine capacity as an instrumental variable (IV). This tax rate, which is uniform across all German federal states and derived from both the fuel type and vehicle emissions, is argued to be correlated with fuel efficiency, but uncorrelated with mileage, thereby fulfilling the identification assumptions of IV estimators.

The IV approach has been employed to address a range of themes in the transportation literature, including the influence of endogenous social interaction effects on automobile ownership (Goetzke and Weinberger 2012) and the impact of urban form on vehicle mileage (Vance and Hedel 2007). The application of the IV approach in the present study advances our earlier work (Frondel et al. 2008, 2012; Frondel and Vance 2013) by simultaneously relaxing two assumptions that, as pointed out by Linn (2016: 259), have been commonly invoked in the literature. The first assumption is that increases in fuel prices and fuel efficiency have opposing impacts on vehicle miles traveled (VMT), but these impacts are equal in magnitude. If true, this equality would seriously undermine the case for Europe’s turn to efficiency standards, since by increasing driving, the standards would offset the effectiveness of existing fuel taxes. The second assumption is that fuel efficiency is uncorrelated with unobserved attributes of the motorist and car that affect the utility of driving. Hence, to test the first assumption requires controlling for any such correlation, accomplished here through the joint application of fixed-effects and IV approaches.

Several results emerge from our analysis. First, the rebound estimates obtained for single-vehicle households approach 70%, which is roughly in line with our earlier studies for Germany (e.g. Frondel et al. 2012; Frondel and Vance 2013). As these studies do not include a control for fuel efficiency, they rely on fuel price elasticity estimates to infer the size of the rebound effect, thereby avoiding potential endogeneity problems. In this regard, a second key finding is that the magnitude of the rebound obtained from a standard fixed-effects model that includes fuel efficiency as an explanatory variable is virtually the same as that obtained from a model that instruments for efficiency, notwithstanding a considerably higher standard error on the IV estimate. The last main finding is that the estimated rebound effect is nearly 30 percentage points higher in magnitude than the estimated fuel price elasticity, a result that is statistically significant based on the fixed-effects model. Higher fuel efficiency thereby increases driving by at least the same degree as higher fuel prices decrease driving, suggesting an offsetting effect of fuel efficiency standards on the effectiveness of fuel taxation.

The following section describes the panel data set. The “Methodological issues” section offers a concise overview of the direct rebound effect and motivates our estimation method. The presentation and interpretation of the results is given in the “Empirical results” section. The last section summarizes and concludes.

Data

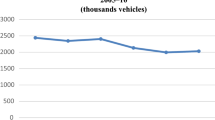

The data used in this research is drawn from the German Mobility Panel (MOP 2016) and covers eighteen years, spanning 1997 through 2015. Participating households are surveyed upwards of three consecutive years for a period of roughly six weeks in the spring. A total of 940 single-car households are observed over two years of the survey, with the remaining 851 observed over all three years. The resulting estimation sample thus comprises 4433 observations covering 1791 households, roughly 17% of which changed their car during the three-year survey duration.

By limiting the sample to single-car households, which comprise about 62% of all car-owning households in Germany (Ritter and Vance 2013), we abstract from complexities associated with the substitution between cars in multi-vehicle households. In fact, the empirical results obtained by De Borger et al. (2016b) for Danish households, for example, indicate that failure to capture substitution between cars within multi-vehicle households can result in substantial biases.

The questionnaire records data on the price paid for fuel with each visit to the gas station, the amount tanked, the kilometers (kms) driven between each visit, as well as sundry automobile attributes and socio-demographic features of the households, the descriptive statics for which are presented in Table 1. We derive the dependent variable by summing the total kms driven over the six weeks and convert this sum into a monthly figure to account for the fact that there were minor deviations in the number of days that respondents recorded information.

The key explanatory variable for identifying the direct rebound effect is the fuel efficiency μ. As elaborated below, fuel efficiency is instrumented using the tax rate per 100 cm3 cubic capacity, a time-varying variable whose values are obtained from the Ministry of Finance and earlier work by Vance and Mehlin (2009). The second key explanatory variable for our simultaneous investigation of the effects of fuel taxes and efficiency standards is the real price p paid for fuel per liter that is reported on the first visit to the gas station.Footnote 2

The suite of additional control variables that are hypothesized to influence the extent of motorized travel include, among others, the demographic composition of the household, its income, and dummy variables indicating whether any employed member of the household changed jobs in the preceding year and whether the household undertook a vacation with the car in the year of the survey. Landscape features, such as public transit accessibility and building density, also bear on mobility decisions, but as these variables hardly vary over the three-year survey period, their influence is captured through the fixed effects.

Methodological issues

The most natural definition of the direct rebound effect is based on the elasticity of service demand s with respect to energy efficiency (Berkhout et al. 2000)Footnote 3:

where s is measured in an individual mobility context in vehicle kms or miles and efficiency \(\mu\) is defined by: \(\mu\) = s/e, the ratio of service demand s to the required energy input e.

However, for several reasons, such as the likely endogeneity of energy efficiency (Sorrell et al. 2009: 1361), the overwhelming majority of earlier empirical studies has refrained from gauging the rebound effect by estimating the efficiency elasticity \(\eta_{\mu } \left( s \right)\), instead employing estimates of fuel price or fuel cost elasticities as rebound proxies. In contrast, along the lines of recent empirical studies, such as Linn (2016) and Weber and Farsi (2014), we employ instrumental variable (IV) methods to cope with the endogeneity of \(\mu\), allowing us to identify the rebound effect on the basis of Definition 1, i.e. efficiency elasticity \(\eta_{\mu } \left( s \right)\).

In line with this focus, we estimate the following model specification, where the logged monthly vehicle kms traveled, ln(s), is regressed on logged fuel efficiency, ln(\(\mu\)), logged fuel prices, ln (p e ), and a vector \(\varvec{x}\) of control variables described in the previous section:

Subscripts i and t are used to denote the observation and time period, respectively. \(\zeta_{i}\) denotes an unknown individual-specific term, and \(v_{it}\) is a random component that varies over individuals and time. On the basis of this specification and Definition 1, the rebound effect can be identified by an estimate of the coefficient \(\alpha_{\mu }\) on the logged fuel efficiency.

Simultaneously estimating the relative impacts of both fuel efficiency standards and fuel taxes requires an IV approach in which at least one instrumental variable is employed for the likely endogenous variable \(\mu\). For an IV approach to be a reasonable identification strategy, any instrumental variable z is required to be correlated with fuel efficiency \(\mu\), i.e. \(Cov\left( {\mu ,z} \right) \ne 0\) (Assumption 1), while it should not be correlated with the error term \(\varepsilon\): \(Cov\left( {\mu ,\varepsilon } \right) = 0\) (Assumption 2), where \(\varepsilon\) is given by \(\varepsilon_{it}\): = \(\zeta_{i}\) + \(v_{it}\). If either of these two identification assumptions is violated, employing z as an instrument for \(\mu\) is not a viable approach.

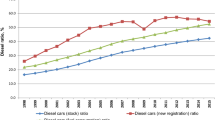

Our use of the motor vehicle tax rate per 100 cm3 cubic capacity would seem to fulfill these requirements, although the second assumption is principally not testable. In Germany and elsewhere in Europe, the declared aim of this lump-sum tax is to privilege cars with low emissions. The calculation of the tax has gone through several iterations over the years. Prior to 2009, it was based on a fixed rate per 100 cm3 cubic capacity, which was increased several times in an effort to discourage the purchase of high-emitting cars. As of 2009, the tax was restructured to be based not only on cubic capacity, but also directly on emissions themselves.

Petrol cars, for example, incur a tax of 2.00 € per 100 cm3 cubic capacity, augmented by an additional tax penalty of 2.00 € for every gram of CO2 emitted per km beyond a threshold of 110 gs (ADAC 2016). The corresponding figures for diesel are 9.50 € per 100 cm3 cubic capacity with the same 2.00 € penalty for each gram exceeding the 110 g threshold. Being negatively correlated with the endogenous variable fuel efficiency (see also Table 2), the motor vehicle tax rate per 100 cm3 should be an appropriate instrument, as this lump-sum fee should not affect the dependent variable distance driven, nor the error term.

Apart from the motor vehicle tax rate, we explored additional instruments, such as fuel prices at the time of the purchase of the vehicle (Linn 2016: 260) and the average vehicle efficiency prevailing in the household’s zip code of residence, all of which turned out to be very weakly correlated with fuel efficiency in terms of partial correlation coefficients. This leaves us with a single instrument for the endogenous variable fuel efficiency, thereby obviating the need for over-identification tests. In this just-identified case, alternative estimators, such as two-stage least squares (2SLS) and the more general methods of moments estimator (GMM), reduce to the IV estimator (Cameron and Trivedi 2009: 174,175).

An important drawback of IV estimates is that the related standard errors are typically larger than those of the respective OLS, fixed- or random effects estimates (Bauer et al. 2009: 327). That is, if a variable that is deemed to be endogenous were actually to be exogenous, the IV estimator would be less efficient than the OLS and fixed-effects estimators while all these estimators are consistent. Moreover, if an instrument is only weakly correlated with an endogenous regressor, the standard errors of the IV estimates are much larger, so that the loss of precision will be severe.

Even worse is that with weak instruments, IV estimates are inconsistent and biased in the same direction as OLS estimates (Chao and Swanson 2005). As is pointed out by Bound et al. (1993, 1995), when the excluded instruments are only weakly correlated with the endogenous variables, the cure in the form of the IV approach can be worse than the disease resulting from biased and inconsistent OLS estimates. Given these potential problems, it is reasonable to perform an endogeneity test that examines whether a potentially endogenous variable is in fact exogenous, a question we take up in the following section.

Empirical results

To provide for a reference point for the results obtained from our IV approach, we first estimate Specification 2 using standard panel estimation methods, thereby ignoring the endogeneity of the fuel efficiency variable. Because a Hausman test rejected the application of a random-effects estimator, in what follows we focus exclusively on the results from the fixed-effects estimator.

Referring to the rebound effect given by Definition 1, the estimated coefficient \(\alpha_{\mu }\) amounts to 67% (Table 2), implying that some 67% of the potential energy savings due to an efficiency improvement is lost to increased driving. Similar to the findings of Barla et al. (2009) and Linn (2016), our fixed-effects estimates suggest that the response to fuel economy is stronger than to fuel prices, as the fuel price elasticity, at −0.39, differs in magnitude from the fuel efficiency elasticity of 0.67. In fact, the null hypothesis \(H_{0} : \alpha_{{p_{e} }} = - \alpha_{\mu }\) that the magnitudes of the fuel efficiency elasticity and the fuel price elasticity are equal can be rejected at the 5% significance level, as the test statistic of 6.04 (Table 2) is larger than the corresponding critical value of \(F\left( {1,\infty } \right) = 3.84.\)

With respect to the remaining fixed-effects estimates, it is perhaps not surprising that many are statistically insignificant. This is clearly the result of very low variability of time-persistent variables, such as the number of children. Two exceptions are the dummies indicating a car vacation and the number of employed household members, both of which are positively associated with the distance driven.

Of course, interpretation of all the estimates from the standard fixed-effects regression is subject to the caveat that they may be biased from the potential endogeneity of \(\mu\). To explore this possibility, we follow Wooldridge (2006: 532) in testing whether the error term \(\eta\) of the first-stage equation

is correlated with the error term \(\upsilon\) of Eq. 2. Vector \(\varvec{x}\) includes the same control variables as in Eq. 2 and z is called the excluded instrument, because z represents our single instrumental variable tax rate that does not appear in Eq. 2.

Although both \(\eta\) and \(\upsilon\) cannot be observed, one can employ the residuals of the first- and second-stage regressions and test whether they are correlated. Alternatively, one can plug the residual \(\hat{\eta }\) as an additional regressor into Eq. 2 and test the statistical significance of its coefficient. In fact, this is the essential idea of the Durbin-Wu-Hausman test for endogeneity (Cameron and Trivedi 2009: 183). With a t statistic of 12.41 for the fixed-effects estimation using a cluster-robust covariance estimator, this test clearly rejects the hypothesis that \(\ln (\mu )\) is exogenous.

While this outcome suggests the application of an IV approach, its validity depends on the strength of our instrument. An initial indication is given by the highly significant coefficient estimate of the motor vehicle tax rate originating from the first-stage regression in the middle panel of Table 2. We obtain the expected result that the tax rate is negatively correlated with the fuel efficiency of cars, reflecting the intention of the legislator to privilege cars with low emissions and, hence, high fuel efficiencies. A more formal gauge of the strength of the instrument is given by the rule of thumb of Staiger and Stock (1997), according to which the F statistic for the coefficient \(\beta_{z}\) of the first-stage Eq. 3 should exceed the threshold of 10 (Baum et al. 2007: 490, Murray 2006).Footnote 4 With an F statistic of \(F \left( {1;1, 583} \right) = 37.04\) resulting from the first-stage estimation using a heteroskedasticity-robust covariance estimator, we reject the hypothesis that the second-stage Eq. 2 is weakly identified.Footnote 5

Moreover, the IV approach is based on the assumption that the excluded instruments affect the dependent variable only indirectly, through their correlations with the included endogenous variables. Yet, if an excluded instrument exerts both direct and indirect influences on the dependent variable, the exclusion restriction must be rejected. This can be readily tested by including an excluded instrument as a regressor in Eq. 2. Upon adding our instrumental variable \(z\), the tax rate per 100 cm3, as an additional regressor to Eq. 2, for the fixed-effects estimation (not presented), the resulting t-statistic amounts to \(t = 0.06\) when calculating heteroscedasticity-robust standard errors. This result does not allow for rejecting the hypothesis that \(z\) exerts no effect on the dependent variable, the logged monthly vehicle-kms traveled.

Turning to the IV regression in the right panel of Table 2, the estimates do not differ substantially from those of the standard fixed-effects estimation. Specifically, the estimate of −0.39 on the fuel price elasticity is identical to the estimate resulting from the standard fixed-effects estimator. We likewise find a strong correspondence with respect to the rebound estimate corresponding to Definition 1: the coefficient estimate of 0.694 hardly differs from the non-instrumented variant. Yet, the standard error of the IV estimate is substantially higher, rendering it statistically insignificant.Footnote 6

One consequence of this lower precision is that unlike in the standard fixed-effects model, at any conventional significance level, we cannot reject the null hypothesis \(H_{0} :\alpha_{{p_{e} }} = - \alpha_{\mu }\) that the magnitudes of the fuel efficiency elasticity and the fuel price elasticity are equal. In fact, the test statistic of \(\chi^{2} = 0.20\) (Table 2) is less than the corresponding critical value of \(\chi^{2} \left( 1 \right) = 3.84\) at the 5% significance level and also less than the critical value of \(\chi^{2} \left( 1 \right) = 2.71\) for the 10% significance level.

This finding, which would imply that falling fuel prices have the same effect on distance traveled as an increase in fuel efficiency of the same degree, confirms former results obtained by Frondel et al. (2008) and Frondel et al. 2012). But while the equality of the size of the coefficients \(\alpha_{\mu }\) and \(\alpha_{{p_{e} }}\), reflected by \(H_{0}\), appears to be intuitive at first glance, this assumption may not hold in practice for a variety of reasons, such as differences in the persistence of gasoline price and fuel economy shocks (Linn 2016: 259). A rejection of \(H_{0} ,\) as in our standard fixed-effects estimation, is therefore not a surprising result. The consequence of such an outcome is that the common identification of the rebound effect via fuel price elasticities would be invalid—see also Gillingham (2012), who finds that fuel economy affects distance traveled less than fuel prices.

In sum, while approaching the estimation of the rebound effect from the natural angle of estimating the fuel efficiency elasticity, we find an effect of 67–69% that lies at the high end, but confirms the outcomes of our former studies, which range between 57 and 67% (Frondel et al. 2008) and 57–62% (Frondel et al. 2012). These magnitudes are also in line with the results of Weber and Farsi (2014) for Switzerland (75—81%), a European country that is comparable to Germany, and fit into the general picture that the rebound effect estimates from outside North America are larger (Weber and Farsi 2014: 5). Nevertheless, there are several studies for Europe whose estimates are at the low end (De Borger and Mulalic 2012; De Borger et al. 2016a, b; Matos and Silva 2011). For example, the best estimate of De Borger, Mulalic and Rouwendal (2016a) of the rebound effect for car transport in Denmark is some 7.5–10%.

The discrepancy between the findings for Europe and the US, where long-run direct rebound effects revolve around 20% (Weber and Farsi 2014: 6), may be explained by differences in the mobility behavior of American and Non-American households, the infrastructure in public transport and other country-specific differences, such as longer driving distances and fewer alternative modes in the US, as well as the kind of data employed. In fact, the discrepancies between our rebound effect estimates and, for instance, those of Small and Van Dender (2007) and Hymel, Small and Van Dender (2010), who employ US state level data, comport with the finding that fuel price elasticities from household-level data are generally larger than those from aggregate time series data (Wadud et al. 2010: 65).

Another important reason for the observed discrepancies is the method of identification of the rebound effect via fuel efficiency elasticities, rather than price elasticities, which was the common approach in earlier studies. Apparently, the estimates resulting from IV approaches that employ instruments to infer the direct rebound from fuel efficiency elasticities tend to be at the high end. Linn’s (2016) IV estimate of the fuel economy rebound effect of 44%, for example, is substantially larger than the estimates of other recent US studies.

Admittedly, although these arguments may explain part of the discrepancies between our estimates and the low rebound effects of other studies, they are not exhaustive. Specifically, we have no explanation for the differences between our estimates and the low rebound effects that De Borger, Mulalic and Rouwendal (2016a) find for car transport in Denmark. Both are European studies that are based on household data and employ IV techniques. Comparative analysis that hones in on the source of differences between the high rebound estimates seen for Germany and Switzerland, on the one hand, and the low estimates obtained for Denmark, on the other, is a promising area for future research.

Summary and conclusion

Using a panel of household travel diary data collected in Germany and an instrumental variable approach to deal with the endogeneity of fuel efficiency, we have simultaneously estimated fuel price and fuel efficiency elasticities to provide a basis for assessing the policy impacts of both fuel taxes and fuel economy standards on distance traveled. We find that the magnitude of the fuel efficiency elasticity is higher from that of the fuel price elasticity, which suggests that efficiency standards offset the effects of reduced vehicle travel from fuel taxes.

In addition, from the estimates of the fuel efficiency elasticity, we derive the direct rebound effect, the behaviorally induced offset in the reduction of energy consumption following efficiency improvements. Irrespective of whether the fuel efficiency variable is instrumented, the rebound estimates resulting from our panel estimations are on the order of 69% for single-car households, meaning that roughly 69% of the potential energy saving from efficiency improvements in Germany is lost to increased driving. Hence, while proponents of efficiency standards argue that higher efficiency saves motorists money from decreased per-km costs of driving (EC 2007), our estimation results indicate that an immediate consequence of this benefit is that motorists drive more. Taken together, these results call into question the effectiveness of the European Commission’s current emphasis on efficiency standards as a pollution control instrument (Frondel et al. 2011).

While an assessment of welfare effects from fuel taxation and efficiency standards extends beyond the scope of the present study, our findings complement a long of line of simulation studies finding negative welfare impacts from fuel efficiency standards. Karplus et al. (2013) recent estimates from a computable general equilibrium model, for example, suggest that fuel efficiency standards are at least six times more expensive than a tax on fuel, verifying other studies finding that fuel taxes may be a more effective measure of reducing gasoline consumption (e.g. Austin and Dinan 2005; Crandall 1992; Kleit 2004; Li et al. 2014). That these studies all originate from the US, where the responsiveness to fuel costs are likely to be low relative to other parts of the globe (Brons et al. 2008), highlights the potential for even costlier welfare consequences in the German context, a point warranting further investigation.

Notwithstanding the political advantages of efficiency standards, whose costs to consumers and the economy are largely obscured, we would argue that the economic logic in favor of standards is wanting given the large rebound effects identified in this study. It is therefore regrettable that European policy-makers have proceeded down this path, and have recently set an even stricter CO2 standard of 95 g/km by 2020. Our results suggest that the efficiency standards introduced with the 2009 legislation will blunt what had been a highly effective climate protection policy based on fuel taxation, one under which the efficiency of the European car fleet has grown substantially.

Notes

In effect, as the benchmark of 130 g/km is equivalent to, for example, a fuel consumption of 5.6 L of petrol per 100 km, these targets represent a fuel efficiency standard.

The price series was deflated using a consumer price index for Germany obtained from Destatis (2015). We additionally explored alternative ways of calculating the fuel price, such as by dividing the total expenditures for fuel over the survey period by the total liters purchased or by taking an average of all reported prices, but found that these alternative measures had a negligible bearing on the estimates.

The indirect rebound effect has also been distinguished in the literature (see, e.g., Greene et al. 1999). Roughly speaking, the indirect rebound arises from an income effect: lower per-unit cost of an energy service implies ceteris paribus that real income grows. For a precise distinction between direct and indirect rebound effects, see the microeconomic framework provided by Borenstein (2015).

This rule accounts for the fact that, as Bound et al. (1995), Staiger and Stock (1997) and others have shown, the weak-instruments problem can arise even if the endogenous variables and the instruments are correlated at conventional significance levels of 5 and 1% and the researcher is using a large sample (Baum et al. 2007: 489).

In our case of a single endogenous variable, the F statistic on \(\beta_{z}\) resulting from the first-stage regression (3) using a heteroskedasticity-robust covariance estimator is identical to the more general statistic of Kleibergen and Paap (2006), which has to be employed if the assumption of independent and identically distributed (i. i. d.) errors is invalid.

As much of the variation in fuel efficiency comes from those households that switched their vehicle, we have focused on those households and have re-estimated Eq. (2) only for car switchers, the results of which are reported in Table 3 in the “Appendix”. While the results for the key variables, fuel prices and fuel efficiency, differ in magnitude, they are not statistically significant in case of the IV estimation. Most notably, this is due to drastically increased standard errors as a consequence of the strong reduction in the numbers of observations.

References

ADAC: Die Kraftfahrzeug-Steuer. http://www.adac.de/infotestrat/fahrzeugkauf-und-verkauf/kfz-steuer/ (2016)

Austin, D., Dinan, T.: Clearing the air: the costs and consequences of higher CAFE standards and increased Gasoline Taxes. J. Environ. Econ. Manag. 50, 562–582 (2005)

Barla, B., Lamonde, B., Miranda-Moreno, L.F., Boucher, N.: Traveled distance, stock and fuel efficiency of private vehicles in Canada: price elasticities and rebound effect. Transportation 36, 389–402 (2009)

Bauer, T.K., Fertig, M., Schmidt, C.M.: Empirische Wirtschaftsforschung. Eine Einführung. Springer, Heidelberg (2009)

Baum, C.F., Schaffer, M.E., Stillmann, S.: Enhanced routines for instrumental variables/generalized methods of moments estimation and testing. Stata J. 7(4), 465–506 (2007)

Berkhout, P.H.G., Muskens, J.C., Velthuisjen, J.W.: Defining the rebound effect. Energy Policy 28, 425–432 (2000)

Borenstein, S.: A microeconomic framework for evaluating energy efficiency rebound and some implications. Energy J 36(1), 1–21 (2015)

Bound, J., Jaeger, D. A., Baker, R.: The cure can be worse than the disease: A cautionary tale regarding instrumental variables. NBER, Technical Working Paper No. 137 (1993)

Bound, J., Jaeger, D.A., Baker, R.: Problems with instrumental variables estimation when the correlation between the instruments and the endogenous explanatory variables is weak. J. Am. Stat. Assoc. 90(430), 443–450 (1995)

Brookes, L.: Energy efficiency fallacies revisited. Energy Policy 28, 355–367 (2000)

Brons, M., Nijkamp, P., Pels, E., Rietveld, P.: A meta-analysis of the price elasticity of gasoline demand. A SUR Approach. Energy Econ. 30(5), 2015–2122 (2008)

Cameron, A.C., Trivedi, P.K.: Microeconometrics Using Stata. Stata Press, Texas (2009)

Chan, N., Gillingham, K.: The microeconomic theory of the rebound effect and its welfare implications. J. Assoc. Environ. Resour. Econ. 2(1), 133–159 (2015)

Chao, J.C., Swanson, N.R.: Consistent estimation with a large number of weak instruments. Econometrica 73(5), 1673–1692 (2005)

Crandall, R.W.: Corporate average fuel economy standards. J. Econ. Perspect. 6(2), 171–180 (1992)

De Borger, B., Mulalic, I.: The determinants of fuel use in the trucking industry—volume, fleet characteristics and the rebound effect. Transp. Policy 24, 284–295 (2012)

De Borger, B., Mulalic, I., Rouwendal, J.: Measuring the rebound effect with micro data. J. Environ. Econ. Manag. 79, 1–17 (2016a)

De Borger, B., Mulalic, I., Rouwendal, J.: Substitution between Cars with the Household. Transp. Res. Part A: Policy Pract. 85, 135–156 (2016b)

Destatis: Federal Statistical Office Germany. http://www.destatis.de/ (2015)

EC—European Commission: Commission proposal to limit the CO2 emissions from cars to help fight climate change, reduce fuel costs and increase European competitiveness. http://europa.eu/rapid/press-release_IP-07-1965_en.htm (2007)

EC—European Commission: Regulation (EC) No 443/2009 of the European Parliament and of the Council of 23 April 2009. Off. J. Eur. Union, L140 (2009)

Frondel, M., Peters, J., Vance, C.: Identifying the rebound: evidence from a German household panel. Energy J 29(4), 154–163 (2008)

Frondel, M., Ritter, N., Vance, C.: Heterogeneity in the rebound: further evidence for Germany. Energy Economics 34(2), 388–394 (2012)

Frondel, M., Schmidt, C.M., Vance, C.: A regression on climate policy: the European Commission’s Legislation to Reduce CO2 Emissions from Automobiles. Transp. Res. Part A: Policy Pract. 45(10), 1043–1051 (2011)

Frondel, M., Vance, C.: Re-identifying the rebound: What about asymmetry? Energy J. 34(4), 43–54 (2013)

Gillingham, K., Rapson, D., Wagner, G.: The rebound effect and energy efficiency policy. Rev. Environ. Econ. Policy 10(1), 68–88 (2016)

Gillingham, K.: Selection on anticipated driving and the consumer response to changing gasoline prices. Working Paper, School of Forestry and Environment Studies, Yale University (2012)

Goetzke, F., Weinberger, R.: Separating contextual from endogenous effects in automobile ownership models. Environ. Plann.-Part A 44(5), 1032–1046 (2012)

Greene, D.L., Kahn, J.R., Gibson, R.C.: Fuel economy rebound effect for U.S. household vehicles. Energy J. 20(3), 1–31 (1999)

Hymel, K.M., Small, K.A., Van Dender, K.: Induced demand and rebound effects in road transport. Transp. Res. Part B 44, 1220–1241 (2010)

Karplus, V., Paltsev, S., Babiker, M., Reilly, J.M.: Should a vehicle fuel economy standard be combined with an economy-wide greenhouse gas emissions constraint? Implications for energy and climate policy in the United States. Energy Economics 36, 322–333 (2013)

Khazzoom, D.J.: Economic implications of mandated efficiency standards for household appliances. Energy J. 1, 21–40 (1980)

Kleibergen, F., Paap, R.: Generalized reduced rank tests using the singular value decomposition. J. Econom. 133(1), 97–126 (2006)

Kleit, A.N.: Impacts of long-range increases in the fuel economy (CAFE) standard. Econ. Inq. 42(2), 279–294 (2004)

Li, S., Linn, J., Muehlegger, E.: Gasoline taxes and consumer behavior. Am. Econ. J.: Econ. Policy 6(4), 302–342 (2014)

Linn, J.: The rebound effect for passenger vehicles. Energy J. 37(2), 257–288 (2016)

Matos, F.J.F., Silva, F.J.F.: The rebound effect on road freight transport: empirical evidence from Portugal. Energy Policy 39(5), 2833–2841 (2011)

MOP: The german mobility panel. http://mobilitaetspanel.ifv.uni-karlsruhe.de/de/studie/index.html (2016)

Mulalic, I., Rouwendal, J.: The impact of fixed and variable cost on automobile demand: evidence from Denmark. Econ. Transp. 4(4), 227–240 (2015)

Murray, M.P.: Avoiding invalid instruments and coping with weak instruments. J. Econ. Perspect. 20(4), 111–132 (2006)

Ritter, N., Vance, C.: Do fewer people mean fewer cars? Population decline and car ownership in Germany. Transp. Res. Part A: Policy Pract. 50, 74–85 (2013)

Saunders, H.: The Khazzoom-Brookes postulate and neoclassical growth. Energy J. 13(4), 131 (1992)

Small, K.A., Van Dender, K.: Fuel efficiency and motor vehicle travel: the declining rebound effect. Energy J. 28(1), 25–52 (2007)

Sorrell, S., Dimitroupoulos, J., Sommerville, M.: Empirical estimates of the direct rebound effect: a review. Energy Policy 37(4), 1356–1371 (2009)

Sorrell, S., Dimitroupoulos, J.: The rebound effect: microeconomic definitions, limitations, and extensions. Ecol. Econ. 65(3), 636–649 (2008)

Staiger, D., Stock, J.H.: Instrumental variables regression with weak instruments. Econometrica 65(3), 557–586 (1997)

Vance, C., Hedel, R.: The impact of urban form on automobile travel: disentangling causation from correlation. Transportation 34, 575–588 (2007)

Vance, C., Mehlin, M.: Fuel costs, circulation taxes, and car market shares: implications for climate policy. Transp. Res. Rec. 2134, 31–36 (2009)

Wadud, Z., Graham, G.J., Noland, R.B.: Gasoline demand with heterogeneity in household responses. Energy J. 31(1), 47–74 (2010)

Weber, S., Farsi, M.: Travel Distance and Fuel Efficiency: An estimation of the rebound effect using micro-data in Switzerland. IRENE Working Paper 14-03, University of Neuchatel, Institute of Economic Research (2014)

Wooldridge, J.M.: Introductory econometrics—a modern approach, 3rd edn. Thomson, South-Western (2006)

Acknowledgements

We are grateful for invaluable comments and suggestions by Christoph M. Schmidt, as well as three anonymous reviewers. This work has been partly supported by the NRW Ministry of Innovation, Science, and Research within the project “Rebound Effects in NRW” and by the Collaborative Research Center “Statistical Modeling of Nonlinear Dynamic Processes” (SFB 823) of the German Research Foundation (DFG), within Project A3, “Dynamic Technology Modeling”.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

See Table 3.

Rights and permissions

About this article

Cite this article

Frondel, M., Vance, C. Drivers’ response to fuel taxes and efficiency standards: evidence from Germany. Transportation 45, 989–1001 (2018). https://doi.org/10.1007/s11116-017-9759-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11116-017-9759-1