Abstract

The European Union (EU) recently adopted CO2 emissions mandates for new passenger cars, requiring steady reductions to 95 gCO2/km in 2021. We use a multi-sector computable general equilibrium (CGE) model, which includes a private transportation sector with an empirically-based parameterization of the relationship between income growth and demand for vehicle miles traveled. The model also includes representation of fleet turnover, and opportunities for fuel use and emissions abatement, including representation of electric vehicles. We analyze the impact of the mandates on oil demand, CO2 emissions, and economic welfare, and compare the results to an emission trading scenario that achieves identical emissions reductions. We find that vehicle emission standards reduce CO2 emissions from transportation by about 50 MtCO2 and lower the oil expenditures by about €6 billion, but at a net added cost of €12 billion in 2020. Tightening CO2 standards further after 2021 would cost the EU economy an additional €24–63 billion in 2025, compared with an emission trading system that achieves the same economy-wide CO2 reduction. We offer a discussion of the design features for incorporating transport into the emission trading system.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

European Union (EU) legislation sets mandatory CO2 emissions reduction targets for new cars (EC 2009). While this legislation is based on the EU strategy for passenger cars and light commercial vehicles that aims to fight climate change, reduce the EU reliance on imported fuels, and improve air quality, it is focused on the emissions from a specific greenhouse gas and on new car registrations only (EC 2007). For 2015 it requires an average efficiency of 130 grams of CO2 per kilometer (g/km) for the fleet of new passenger cars registered in the EU. The target is enhanced to 95 g/km by 2021. The estimate for the 2007 new car fleet average was about 159 g/km (EC 2014).

Most analyses of the EU car emission standards have been based on simplified benefit-cost calculations that estimate fuel savings and additional costs of introducing new technology deployment driven by the targets (e.g., TNO 2011; Ricardo-AEA 2014; ICCT 2014a). In the literature, there is a broad discussion on whether to incorporate road transport into the Emission Trading Scheme (ETS) of the EU. In simple terms, the emission trading scheme works as follows. The EU sets emission limits for the sectors of the economy that are covered by the scheme. The allowed emissions are divided into units. Emission trading between the covered entities results in an emission price. If the transportation sector is covered, the emission price will be reflected in fuel prices. Vehicle users and producers will react to prices and reduce emissions in the least costly way. On the other hand, emission standards are applied to new vehicles only, overlooking cost-effective opportunities to reduce fuel use in the existing fleet, as well as changes in demand and inter-market interactions.

Jochem (2009) used a partial equilibrium approach and studied emission trading between the transportation sector and other industries in Germany. His conclusion that emission trading leads to a small change in transportation demand was driven by his estimates of high willingness to pay for prestigious cars by German drivers and smaller mitigation costs in other sectors. Abrell (2011) argued to exclude private transport from carbon pricing, justified by high taxes on transport fuels. Frondel et al. (2011) assessed per-kilometer CO2 emission targets proposed by the European Commission and concluded that they lead to a significant rebound effect of increasing travel distances with increasing fuel consumption. They argued for emission trading as a less costly alternative. Flachsland et al. (2011) suggested that emission trading delivers additional efficiency by incentivizing demand side abatement options. Kieckhäfer et al. (2015) analyzed emission standards and concluded that policies combining an emission/energy consumption standard with an upstream (i.e., at the level of fuel providers) or midstream (i.e., at the level of car manufacturers) emission trading system are worth considering.

The goal of this paper is to assess the resulting CO2 emissions, energy, and economic impacts of the EU CO2 mandates, and compare them to an alternative scenario where vehicle emissions are part of an emission trading system designed to meet Europe’s announced economy-wide targets. In our study we focus on cars, while the EU also imposed the emission targets for vans (which account for around 10 % of the EU market for light-duty vehicles) and considered a strategy to reduce CO2 emissions from trucks, buses, and coaches (EC 2016).

We argue that assessment of the performance of the EU targets and alternatives should account for interactions of the transport sector with other energy sectors and with other parts of the economy. While Karplus and Paltsev (2012), and Rausch and Karplus (2014) have shown that such interactions are important in the US for an assessment of transportation policies, to our knowledge there are no published studies of the CO2 emission reduction from cars in the EU that account for wider economy impacts. For this purpose we apply a global, economy-wide model of energy and emissions. The MIT Economic Projection and Policy Analysis (EPPA) model (Paltsev et al. 2005) offers an analytic tool that includes a technology-rich representation of the passenger vehicle transport sector and its substitution with purchased modes, as documented in Karplus et al. (2013), and also captures interactions between all sectors of the economy, accounting for changes in international trade. In comparison to partial benefit-cost calculations, our approach allows for an assessment of economy-wide and welfare impacts of the CO2 reduction mechanisms.

While here we focus on a performance of two policy instruments (emission trading and emission standards) in the next decade, there are many other options to reduce emissions from transport that include new fuels, new modes of transport (Creutzig et al. 2015), public transit options (Feigon et al. 2003), consumer behavior (Schwanen et al. 2011), public policies like road taxes and feebates (Brand et al. 2013). Most of these options most likely will see a larger deployment beyond the horizon of our study (Heywood and MacKenzie 2015).

The paper is organized as follows. In Sect. 2 we discuss some fuel economy standard basics and describe in more detail the European standards. In Sect. 3 we describe the model used for the analysis. In Sect. 4 we implement a scenario analysis to study the effects of the EU CO2 standards for passenger cars. Section 5 provides a discussion of practical steps for bringing vehicles into the emission trading system and briefly discusses additional policy measures to stimulate innovation and technology deployment. Section 6 summarizes the results and conclusions.

Fuel standards basics and the European requirements

Tailpipe CO2 emissions standards, as adopted in Europe, are similar to fuel economy standards, such as the US Corporate Average Fuel Economy (CAFE) standards, which date to the Energy Policy and Conservation Act of 1975 (US EPCA 1975). Fuel use per mile or kilometer, the target in fuel economy standards, translates directly to CO2 emissions given the carbon content of the fuel. For example, 95 g/km is equivalent to 4.1 l of gasoline per 100 km (l/km) or 57.4 miles per gallon (mpg) of gasoline. In general, however, there is a gap between test standards and actual on-road performance of vehicles. A direct translation of targets between countries is further complicated as it also should reflect the mix of gasoline and diesel cars in each country because they have different fuel efficiencies. The ICCT (2014a) estimates that the 95 g/km target for the EU is equivalent to 3.8 l/km (considering a mix of gasoline and diesel cars) and to about 62 mpg in the US specification (considering the differences between the EU and US test standards).

Fuel economy standard basics

Emissions and fuel economy standards have become popular regulatory mechanisms with many countries setting emissions targets, despite economists’ questioning of their cost effectiveness (ICCT 2014a; Karplus et al. 2015). Most of the studies that claim the efficiency of standards consider their fuel and emission reduction potential, but either these studies do not consider the costs for the economy (e.g., Atabani et al. 2011) or they admit that their approach is not economically or socially optimal (e.g., Winkler et al. 2014). Fuel standards in different countries vary considerably in their stringency. Targets in Japan and the EU are among the most stringent, and other countries seek to reach an improved efficiency (for a comparison of targets in USA, EU, Japan, Korea, Mexico, China, India, Canada, and Brazil, see ICCT 2016). For example, China has suggested a relatively aggressive standard for 2020, equivalent to 5 l/km (Karplus et al. 2015).

An initial issue is the translation of targets defined by a specific test cycle to actual fuel use or emissions reductions. Test cycle settings differ among jurisdictions (e.g., Europe and the US) and differ from actual driving habits. The conditions under which the tests are conducted can also differ from actual road and environmental conditions. Currently, actual on-road fuel consumption exceeds the test results by about 20 % in the US (EPA 2014) and about 30 % in the EU (ICCT 2014b). In the EU, ICCT (2014b) identified the following primary reasons for the gap: deploying technology on cars that has benefits in the test but not on the road, switching off commonly-used equipment (such as air conditioning) during the test, and exploiting flexibilities in the testing procedure to reduce emissions only during the test.

Standards also often include other credits that relax the actual target, or manufacturers may find it less costly to simply pay noncompliance penalties. In the US and EU, credits are available for reductions of hydrofluorocarbons (HFCs) used as refrigerants in air conditioning. Anderson and Sallee (2011) also point to the extensive use of credits for flex-fuel vehicles, an exception in recent US CAFE standards. The spread of flex-fuel vehicles was an objective of the legislation, anticipating a growing supply of ethanol, which would reduce oil imports and CO2 emissions. As it turned out, however, very little of the E85 fuel (an 85 % ethanol blend) was available and so most of these flex vehicles continued to use petroleum-based fuels (EIA 2016) with no benefit to fuel imports or CO2 emissions. While exceptions in legislation may or may not achieve the expected objective, they relax the actual fuel standard and can reduce the estimated compliance costs (Anderson and Sallee 2011).

While adjustments can be made to the stated standard to better estimate their effectiveness, economists’ concern is that the standards can actually affect consumer behavior and result in lower savings of fuel or emissions. To the extent the vehicles are more costly, the sales of efficient new vehicles may be reduced and old vehicles retained in the fleet longer. New cars that are purchased have lower fuel costs per distance traveled, possibly leading to an increase in annual distance traveled—widely known as a “rebound” effect (Small and Van Dender 2007). Moreover, the standards apply only to new vehicles, whereas a fuel or emissions tax creates opportunities to reduce fuel use in the existing fleet—for instance, through changes in driving habits, improved vehicle maintenance, earlier retirement of old vehicles, or in the case of emissions, substitution of low carbon energy sources.

Taxes are widely considered to be the most cost-effective option for displacing petroleum-based fuel use because they impact the whole fleet (not just new cars) and reduce travel. Households respond to a fuel price increase by pursuing the least costly opportunity to reduce fuel use. The choice of fuel abatement options reflects the availability and cost of fuel-saving technologies as well as consumer willingness to substitute between vehicle attributes such as horsepower or weight and higher fuel economy (Karplus, 2011). Higher fuel prices have been shown to incentivize consumer purchases of more efficient vehicles, although consumer responses have been shown to vary across regions (Klier and Linn 2011). Despite the advantages, fuel taxes have failed to gain political traction in the United States (Knittel 2012). Europe, on the other hand, already has among the highest fuel taxes in the world, and opposition to increasing the gasoline tax has been strong, particularly given the recent economic slowdown (Sterner 2012).

Regulatory processes that assess the energy, emissions, and economic impacts of these fuel economy programs typically rely on vehicle fleet and technology models that do not capture behavioral impacts or broader macroeconomic effects. Regulatory impact assessments in the United States (EPA 2012a, b) have focused on the new vehicle fleet and have not assessed impacts on fleet turnover, non-transport sectors, or global oil price and demand. In the EU, EUCLIMIT project included an economy-wide model to provide specific projections (such as sectoral value added) for use in more detailed energy and transport models; however, variables such as international fuel prices were still assumed to be exogenous to the economy-wide model. In addition, there were no feedbacks from the detailed transportation model to the economy-wide model (Eur-Lex 2014).

A reason frequently given for implementing or tightening new vehicle fuel economy standards is that consumers underestimate the value of fuel savings over the life of the car, and therefore are unwilling to pay extra for efficiency at the time of vehicle purchase, requiring correction through policy (Greene et al. 2005). Recent work has tested this hypothesis. One study suggests that consumers that are indifferent between one dollar in fuel costs and 76 cents in vehicle purchase price (Allcott and Wozny 2014), suggesting mild undervaluation, while other empirical work finds scant evidence of consumer myopia (Goldberg 1998; Knittel et al. 2013). Their work suggests that consumers respond rationally to price mechanisms. In this case, policy makers can use relatively more efficient tools, like carbon taxes or gasoline taxes, to influence both what cars people buy and how much people drive, leaving little need for additional policy intervention (such as fuel standards).

Comparison of cap and trade and fuel economy standards include that of Rausch and Karplus (2014), who use a model of the US and find that a cap-and-trade system is more efficient than fuel standards, and a combination of cap-and-trade and fuel standards reduces inefficiencies but is still less cost-effective in comparison to an economy-wide emission trading scheme because low-cost opportunities remain underutilized due to the costlier requirements. Paltsev et al. (2015) considered a sequential policy design, where global emissions were first regulated in the power generation and private transportation sectors, but later were combined with economy-wide emissions trading to reduce the cost of mitigation.

Ellerman et al. (2006) examined possible links between CAFE standards in the US with a proposed cap and trade system. They concluded that in the presence of an overall carbon cap, the CAFE standards are “a poor regulatory policy” for dealing with carbon emissions, whether or not it is integrated with the cap-and-trade system. The standards increase the cost of meeting certain emission targets by reducing flexibility of options for emission reductions and shifting the cost onto new car purchasers. A useful aspect of their study is the discussion of the practical steps needed to bring transportation under emissions trading in a cost-effective manner that engages both upstream (level of fuel provider) and downstream (level of car owner) actors.

European vehicle standards

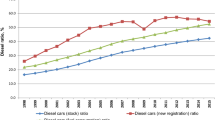

In comparison to the US, the EU has only recently pursued standards, having instead previously relied on fuel taxes. The new standards began with a voluntary agreement with car manufacturers to achieve 140 g/km for new vehicles sold in 2008–2009. The target was not achieved and a mandatory standard was introduced when legislation obliged manufacturers, to ensure that their fleet of new passenger cars sold in the EU, achieved an average of 130 g/km for the year 2015 (EC 2009). The legislation includes a so-called “limit value curve” to allow heavier cars to have higher emissions than lighter cars while preserving the overall fleet average and does not set an efficiency requirement for any specific car. A target of 95 g/km was specified for the year 2020, with full implementation later delayed to 2021. In 2013 the European Parliament’s Environmental Committee issued a report calling for a 2025 target in the range of 68–78 g/km (EPRS 2014).

A summary of historic, enacted and proposed CO2 emission reductions through 2025 for the fleet of new cars in the EU is shown in Fig. 1, with the US standards shown for comparison. Historically, the average EU cars are more fuel-efficient (and produce less tailpipe CO2 emissions per kilometer) than US cars, which economists would likely attribute to higher fuel taxes in the EU. Differential fuel taxes for diesel and gasoline have also contributed to a much larger penetration of diesel cars, which have higher fuel efficiency in liters per kilometer. The US standards are specified through 2025, but they are enacted only up through the 2021 model year, with a mid-term review of the standards scheduled to take place in 2017.

As mentioned previously, the EU currently sets two targets for new cars: for 2015 at an average of 130 g/km and for 2021 at an average of 95 g/km. A gradual phase-in of the targets is achieved by increasing the percentage of the new vehicle fleet to which they apply. By 2020, 95 % of the fleet of new cars has to comply with the 95 g/km target, which, according to ICCT (2014a), makes it effectively a 98 g/km target for 2020. Full compliance must be achieved by 2021. In Fig. 1 the requirements are drawn as a simple linear approximation between the 2015 and 2020 targets, with the range under discussion for 2025 also shown.

Based on data of the European Environment Agency (EEA 2014), in 2013 the fleet average for new cars was 127 g/km, falling below the 2015 standard, even though the phase-in schedule required that only 75 % of the fleet of newly-registered cars in 2013 meet the 130 g/km target. While seemingly good news, the EU system of testing cars to measure fuel economy and CO2 emissions shows a growing gap between the test results and on-road performance of cars. The ICCT (2014b) estimates the divergence has grown from 8 % in 2001 to 31 % in 2013. Transport & Environment (2014) estimates that without action the divergence is likely to grow to over 50 % by 2020. Applying the 31 % difference to the 2013 test results leads to about 166 g/km for the actual on-road performance of new cars. The growing difference between test results and on-road performance is a concern both in the EU and USA, and changes have been proposed for the testing and labelling of cars to better represent the fuel economy drivers are likely to experience (EPA 2014).

Efforts such as ours, to estimate cost and effectiveness of such measures, must reflect as best they can the relationship between test standards and the likely actual on-road performance of vehicles. If the standards are taken at face value in the model, costs of compliance and effectiveness will be overestimated. On the other hand, if test standards are changed to better reflect actual on-road performance, the cost and effectiveness of the standards will be underestimated in a model that takes the current divergence into account. We incorporate the current divergence between laboratory and on-road performance by keeping a 30 % difference between the test cycle and on-road performance in our calculations.

Model and scenarios

We approach analysis of the European standards using a global economic model, with detail on vehicle options for fuel saving and their costs, capable of capturing rebound and leakage effects while estimating fuel savings, emissions reductions, and economic costs of the regulations. We capture leakage that occurs across sectors within economies, across regions, and between new and used passenger vehicles. The rebound effect is captured based on parameterization of the costs associated with vehicle efficiency improvements, the contribution of resulting fuel savings given diverse taxation regimes for motor vehicle fuel, and heterogeneity in vehicle ownership and travel demand patterns. The model further captures how these two effects interact with each other.

Model description

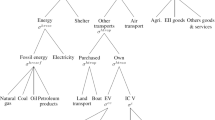

We use the MIT Economic Projection and Policy Analysis (EPPA) model (Paltsev et al. 2005; Karplus et al. 2013) for the analysis. It provides a multi-region, multi-sector recursive dynamic representation of the global economy. Data on production, consumption, intermediate inputs, international trade, energy and taxes for the base year of 2004 are from the Global Trade Analysis Project (GTAP) dataset (Narayanan et al. 2012). The GTAP dataset is aggregated into 16 regions (Table 1) and 24 sectors, including several advanced technology sectors parameterized with supplementary engineering cost data. The model includes representation of CO2 and non-CO2 (methane, CH4; nitrous oxide, N2O; hydrofluorocarbons, HFCs; perfluorocarbons, PFCs; and sulphur hexafluoride, SF6) greenhouse gas (GHG) emissions abatement, and calculates reductions from gas-specific control measures as well as those occurring as a byproduct of actions directed at CO2. The model also tracks major air pollutants (sulfates, SOx; nitrogen oxides, NOx; black carbon, BC; organic carbon, OC; carbon monoxide, CO; ammonia, NH3; and non-methane volatile organic compounds, VOCs); however, different impacts of local air emissions in cities and on the countryside are not considered. The data on GHG and air pollutants are documented in Waugh et al. (2011).

From 2005 the model solves at 5-year intervals, with economic growth and energy use for 2005–2015 calibrated to data and short-term projections from the International Monetary Fund (IMF 2015) and the International Energy Agency (IEA 2015). The model includes a technology-rich representation of the private passenger vehicle transport sector and its substitution with purchased modes of transportation, including aviation, rail, and marine transport, as well as road transport that is purchased by households as service (Paltsev et al. 2004). Several features were incorporated into the EPPA model to explicitly represent passenger vehicle transport sector detail (Karplus et al. 2013). These features include an empirically-based parameterization of the relationship between income growth and demand for vehicle miles traveled (VMT), a representation of fleet turnover, and opportunities for fuel use and emissions abatement, including representation of electric vehicles. The opportunities for fuel efficiency improvement are parameterized based on data from the U.S Environmental Protection Agency (EPA 2010; EPA 2012b) as described in Karplus (2011), Karplus and Paltsev (2012), and Karplus et al. (2013).

Given that the CO2 standards apply only to new model-year vehicles, differentiation between the new and used vehicle fleets is essential. We also include a parameterization of the total miles traveled in both new (0–5-year-old) and used (6 years and older) vehicles, tracking changes in travel demand in response to income and cost-per-kilometer changes. We represent the ability to substitute between new and used vehicles—another way consumers may respond to changes in relative vehicle and fuel prices as affected by the introduction of vehicle standards, fuel prices, or carbon prices (reflected in fuel prices). Details are provided in Karplus et al. (2015).

As noted, our representation of vehicle efficiency options is based on studies in the US. No comparable study has been done for the EU but the cost and fuel savings associated with different options is, first and foremost, a matter of technology possibilities that face automakers worldwide. Studies in Europe include an evaluation done by TNO (2011), which relied primarily on the existing literature and in-house expertise. In the US study, the US EPA included extensive communication with car manufacturers. The budget of the EPA studies was around an order of magnitude higher than that of the TNO work for the EU, and the lower budget obviously limited what the TNO could undertake (TNO 2011). While a detailed study of costs of efficiency improvements in Europe would be ideal, we believe the US study offers a reasonable estimate of the technological options available to manufacturers.

If the marginal cost of improving vehicle efficiency is rising, one might argue we underestimate costs using the EPA US-based assessment because the EU fleet is already more efficient than the US fleet. The fuel economy standards are implemented in the EPPA model as constraints on the fuel used per kilometer of household travel. They are converted to CO2 standards based on characteristics of the fleet (composition of diesel and gasoline vehicles). The standards are imposed at their values based on ex ante usage assumptions (i.e., before any change in miles traveled due to the higher efficiency). This approach forces the model to simulate adoption of vehicle technologies that achieve the imposed standard at least cost (see additional details in the Online Supplementary Material). The production function specification for vehicles creates a Constant Elasticity of Substitution (CES) nest where the elasticity of substitution between fuel and powertrain capital captures the increasing cost of marginal improvements in vehicle efficiency, holding other characteristics of the vehicle fixed (Karplus et al. 2013). When simulated, tradeoffs between the powertrain and other characteristics of the vehicle, and the response of total vehicles-miles traveled due to lower energy costs per km are captured. The form of the utility function, the input shares, and the substitution elasticity between vehicle and powertrain capital determines how much the cost of travel changes in response to changes in the underlying CO2 requirements and vehicle characteristics, which in turn determines the magnitude of the rebound effect. Demand for new vehicles is also affected by their cost. The model assumes consumers consider fuel savings over the life of the vehicle, but because of the recursive dynamic solution of the model they value savings given fuel prices in the year the vehicle is purchased. With rising fuel prices, this implies that some undervaluation of future fuel savings can exist, with potential room for fuel standards to improve on these myopic decisions.

As with any modeling, there are limitations. For example, the rebound effect is empirically-based, but it is also interconnected with travel time budget because time forms a major part of the total cost of mobility. The rebound effect is bounded by the total available time, but the time saved by faster travel can either be spent on additional work or leisure, which may have different impacts on the rebound effect. In addition, it is based on a subjective nature of the value of time. Another example is a change in preferences towards driving and modes of transportation. The model reflects current preferences about auto ownership, driving patterns and attitudes towards owning a bigger or smaller car. While it is possible to change consumer preferences in the model, there is no empirical evidence about the magnitudes of these effects and their development over time. In this study we do not address substantial changes in preferences for self-driving vehicles or the attitude of younger generation about driving in comparison to the previous generations. As most of these changes are likely to be longer-term issues, the results for the next decade that we consider in this study may be less impacted.

Scenarios

We consider several scenarios regarding the EU CO2 emissions targets. Our “No Policy” scenario considers no economy-wide greenhouse gas (GHG) reduction targets and no mandatory CO2 emissions reduction targets for new cars. It provides the basis against which we compare the outcomes of the other scenarios. The “Emission Trading” scenario considers the EU GHG reduction targets (20 % reduction by 2020 and 40 % reduction by 2030 relative to 1990 levels) achieved by an economy-wide emission trading system. Here, permit trading is allowed across all sectors within the EU. The “Current ES” scenario adds to Emission Trading the current emissions standards for vehicles of 130 g/km in 2015 improving to 98 g/km by 2020, and holds the requirement in 2025 at the 2021 target of 95 g/km. The Current ES scenario is imposed on top of a system that allows trading with vehicle emissions, but in this scenario the emission standards for vehicles are higher than those in the Emission Trading scenario. It effectively results in removing vehicles from the trading system and adjusting the emission trading in other sectors to ensure that Europe meets its international commitment of 20 % by 2020 and 40 % by 2030. We then add two scenarios that tighten targets further in 2025: to 78 g/km (“ES78”) and to 68 g/km (“ES68”). We assume that the difference between the test values and on-road performance of new cars remains at 2013 levels of 30 %. Table 2 summarizes the scenarios, which we run from 2010 to 2025, at five-year time steps of the model.

For simplicity, we omit some features of the vehicle emission standard regulations that could loosen stringency in practice—for example, super-credits for extremely low emission vehicles and eco-innovations. We also assume that car manufacturers meet the standards rather than paying a penalty for excess emissions (set at €95 per g/km of exceedance per car sold). It is difficult to quantify the impact of these features. Super-credits incentivize cleaner vehicles and reduce emissions, but the scale will depend on the cost of innovative technologies, which are uncertain. The penalty is quite costly, so we expect the impact of these provisions to be limited.

Beyond the scenarios listed in Table 2, we also explored an alternative setting for a comparison of policies. Following Karplus et al. (2015), we first imposed the EU CO2 mandates on new cars. In this setting, we did not consider any additional emission targets for the other sectors of the EU economy. Based on the resulting CO2 profiles, we then created scenarios to simulate an emissions trading scheme with emission reduction goals identical to those achieved by the emission standards. In this alternative setting, emission trading results in lower costs in comparison to the emission trading scenarios provided in Table 2 because it does not incorporate abatements required to achieve the EU’s goals of 20 % reduction in 2020 and 40 % reduction in 2030. In this alternative comparison, the difference in the costs between standards and emission trading scenarios is similar to the setting described in Table 2. We therefore focus on cases for which the EU GHG targets are met with or without new car emission standards.

Results

We first describe the trends in new vehicles and the total fleet in terms of fuel economy and CO2 emissions per kilometer under each of the scenarios. We then describe the energy and total vehicle emissions implications of the each scenario. Lastly we evaluate the policy costs.

Impact of the current policies on new cars and total fleet

To illustrate how the CO2 mandate affects the efficiency of fuel use, we show projected on-road fuel consumption in liters per 100 km traveled for an average on-road vehicle in the new fleet and total vehicle fleet (Fig. 2). As anticipated, we observe a declining trend in fuel efficiency through 2025, with declines in the total fleet lagging the new fleet as newer vintages of vehicles gradually replace the old vehicle stock. The model solves in 5-year time steps and so intervening years are linear interpolations. In 2025 the new fleet is projected to have on-road fuel consumption of 4.9 l/km in the Current ES scenario, 4.1 l/km in the ES78 scenario, and 3.5 l/km in the ES68 scenario. The corresponding numbers for the total fleet in 2025 are 6.1 l/km in the Current ES scenario, 5.5 l/km in the ES78 scenario, and 5.1 l/km in the ES68 scenario.

On-road CO2 emissions per kilometer for new cars and the total fleet in the Current ES scenario are presented in Fig. 3, along with the actual test cycle requirements. Emissions per kilometer follow the fuel consumption trajectory. The curves for test cycle requirements are lower (i.e., less emissions per km) than the new vehicles’ CO2 emissions per kilometer, reflecting our assumption that the on-road performance of vehicles is 30 % lower (i.e., more emissions per km) than the test cycle. In the Current ES Scenario, the mandates for new cars are set to be tightened from 130 g/km in 2015 to 95 g/km in 2025, while on road the new cars achieve 169 g/km in 2015 and 123 g/km in 2025 and the total fleet performance improves from 192 g/km in 2015 to 152 g/km in 2025. In the ES78 and ES68 scenarios, new cars in 2025 achieve 101 g/km and 88 g/km, respectively. The total fleet performances in 2025 in these scenarios are 137 g/km and 127 g/km, correspondingly.

Energy and environmental impacts of the current policies

We now consider the net effect of the current EU CO2 emission mandates on energy and environmental outcomes. We first focus on the change in the total EU oil consumption, shown in Table 3. The No Policy scenario shows a slight decrease in oil use over the 2010–2025 period due to fuel efficiency improvements that happen even without new CO2 standards (the total impact is somewhat counterweighted by an increase in the number of vehicles in the EU, but this increase is rather slow). The Emission Trading scenario further reduces the total EU year-on-year oil use by around 23 million tonnes of oil (mtoe) in 2020 and by around 55 mtoe in 2025, about 4 and 10 % reductions relative to the No Policy scenario in 2020 and 2025, respectively. The Current ES scenario creates an additional reduction in the EU oil consumption of 12 mtoe/year in 2020 and 14 mtoe/year in 2025. With the steeper 2025 targets, the corresponding declines in the ES78 and ES68 scenarios are 18 and 20 mtoe/year in 2025.

Based on the projected oil price of around $75/barrel in 2020 and $80/barrel in 2025, we can estimate fuel expenditure savings in the Current ES scenario, which we find to be about €5.9 billion ($6.7 billion at the current exchange rates) in 2020 and about €7.1 billion ($8.2 billion) in 2025. Higher emission targets in 2025 would save more in reduced oil payments (€9.1 billion Euro in ES78 and €10.4 billion Euro in ES68), but as we show later, they would also cost more (because they require the use of costlier options for car manufacturers to achieve even better fuel and emission performance). Lower oil price trajectories lead to smaller fuel expenditure savings. If the gasoline price is lower, drivers pay less for the same amount of fuel. As a result, higher costs of the vehicles induced by the standards are justified to a lesser extent as the savings on fuel purchases are reduced. For example, at an oil price of $40/barrel for the projected period, in the Current ES fuel savings are reduced to €2.7 billion in 2020 and €4 billion in 2025.

Turning to CO2 emissions in the policy scenarios, our simulation approach ensures that a consistent EU-wide emissions target is achieved in both the Emission Trading and Current ES scenarios; however, private vehicle emissions differ in these scenarios. As shown in Table 4, economy-wide emissions in the Emission Trading and Current ES scenarios are 3385 million tonnes of CO2 (MtCO2) in 2020 and 3123 MtCO2 in 2025, which is a reduction from the No Policy of 220 MtCO2 in 2020 and 550 MtCO2 in 2025. Vehicle emissions are reduced by 18 MtCO2 in 2020 and 28 MtCO2 in 2025 in the Emission Trading scenario. The Current ES scenario (which represents Emission Trading + Standards) in 2020 forces an additional abatement of 47 MtCO2, for a total reduction from vehicles of 65 MtCO2, which is nearly 4 times more than in the Emission Trading scenario.

However, that is indicative of the fact that there are lower cost reductions elsewhere that are exploited in the Emission Trading scenario. We also observe that emission reductions from private cars are relatively modest compared to the total EU CO2 emissions—about 3,100–3,400 MtCO2 in 2020–2025. The total reduction from vehicles in Current ES compared with No Policy is only about 2 % of economy-wide emissions. Emission reductions by sector are different in the Current ES and Emission Trading scenarios. As reported in Table 4, vehicle emissions abatement is lower in the Emission Trading scenario, which is compensated by an increased reduction in all other sectors of the economy with most additional abatement in electricity and energy-intensive sectors.

Potential emission reductions due to the displacement of petroleum-based fuels are partially offset by increases in vehicle travel due to the reduced cost per mile (a result of both higher vehicle efficiency and reduced fuel cost). In short, total CO2 emissions suggest that when viewed in the EU-wide perspective, the net effect of current mandates on total EU CO2 emissions is fairly modest. We consider the cost effectiveness of achieving these reductions relative to an efficient instrument targeting CO2 in the next section.

Economic impacts

The cost of a policy can be assessed with different metrics: a change in GDP, a change in consumption, a change in welfare, energy system cost, and the area under the marginal abatement cost (MAC) curve. For economists, the preferred measure of cost is a change in welfare. It can be measured as “equivalent variation” or “compensating variation” and can be loosely interpreted as the amount of extra income consumers would need to compensate them for the losses caused by the policy change. For a discussion of the relationships among these different cost concepts see Paltsev and Capros (2013). We report economic impacts in terms of changes in macroeconomic consumption, measured as equivalent variation. In the model setting used for this study, an annual consumption change is equal to the annual welfare change. For the scenarios considered here, we found that GDP impacts are similar to the changes in macroeconomic consumption when both are calculated as percentage changes.

Macroeconomic consumption changes are the net effect of the policy, accounting for the increase in vehicle manufacturing costs (less any fuel savings), as well as effects of broader changes in allocative efficiency caused by the policy. The broader changes include such things as changes in other prices in the economy, investment, terms of trade effects, and reduction in fuel tax revenue. For example, more expensive vehicles require more saving going toward purchase of the vehicle, squeezing out other investment and adding to the cost of the policy. Another example is that reduced demand for oil leads to a reduction in the world oil price, and since Europe is a net oil importer it benefits from the lower price. These international changes in price are more broadly referred to as changes in the terms of trade. Given the interdependencies of these effects it is impossible to completely separate them. Paltsev et al. (2007) offer a more detailed discussion of direct and indirect costs of climate policy.

We find on balance net consumption costs for both the Emission Trading and Current ES when compared with the No Policy scenario (Table 5). Emission Trading has a net cost of €2 billion in 2015, rising to €4.9 billion in 2020, and to about €8 billion in 2025. Adding the vehicle mandates in Current ES increases the costs by €0.7 billion in 2015 (to €2.7 billion), and by €12.3 billion in 2020 (to €17.2 billion). By 2025 the additional consumption losses about double to €24.1 billion from the 2020 level of losses in Current ES, even though the emissions target only falls from 98 g/km in 2020 to 95 g/km.

Increases in costs are driven in part by economic growth and reallocation of investment from other uses to transportation. The impacts of crowding out of investment and the resulting changes in sectoral capital accumulation have cumulative impacts on costs. With projected new car sales in the EU at about 13 million per year, the €12 billion added cost in 2020 in Current ES means the standards amount to an additional cost of about €925 per new car sold. This is a consumption loss divided by the number of vehicles sold, and is hence net of fuel savings and includes other indirect economic costs (and benefits such as from terms of trade changes).

While economy-wide emissions are identical in both Current ES and Emission Trading, it is instructive to divide the total cost by the total emissions reduction to get an average cost per ton of emissions reduction. Combining information on the total economy-wide emission reduction of 220 MtCO2 (Table 4) and costs of €4.9 billion and €17.2 billion (Table 5), we can compare the average economy-wide costs of €22 per tonne of CO2 in the Emission Trading scenario and €78 per tonne of CO2 in the Current ES scenario, which makes the standards on average about 3.5 times more costly as an instrument to reduce emissions. Even more informative is an average cost of additional emission reductions in vehicles. For 2020 the additional vehicle emissions reductions are 47 MtCO2 (18 MtCO2 in the Emission Trading scenario vs 65 MtCO2 in the Current ES scenario) at an added cost of €12.3 billion, making the average cost of this reduction about €260 per tonne of CO2. Comparing these gives another sense of the economic inefficiency of the mandates.

As noted earlier, current mandates for vehicles are specified only to 2021. In the Current ES scenario we assumed this standard remained unchanged in 2025. Scenarios ES78 and ES68 allow us to estimate the costs of the tighter targets under discussion for 2025 (EPRS 2014). As shown in Table 4 the costs are significant at €50.7 billion (€42.5 billion more than Emission Trading) in ES78 and €70.9 billion (€62.7 billion more) in ES68. These tighter standards come at ever-higher costs per ton of emissions reduction. The average cost of the 16 MtCO2 of additional reduction in ES78 (beyond Current ES in 2025) is €1,125 per tonne of CO2; the average cost of the 10 billion tons of additional reduction in ES68 (beyond ES78) is €2,020 per tonne of CO2. Compared with the average cost per ton reduced with emissions trading, this calculation helps to indicate the degree of inefficiency created by the vehicle emissions mandates. Lower oil prices make standards even less attractive in terms of the resulting macroeconomic costs because of the reduced benefits from oil expenditure reductions. For example, in 2020 in the Current ES scenario the additional cost is increased from €12.3 billion (when oil price is $75/barrel) to €16.5 billion (when oil price is $40/barrel).

Government tax revenues are reduced in the policy scenarios because the policies reduce overall economic activity and fuel use, which is a significant source of government revenue in Europe. An argument can be made that tax revenue-neutrality should be enforced to estimate the full policy cost. This could be accomplished by raising tax rates to compensate for revenue lost due to the declining tax base. Higher tax rates will generally lead to higher welfare costs, but the total additional cost will depend on which taxes are raised (Rausch et al. 2010). On the other hand, Gitiaux et al. (2012) showed that tax reform that reduces the very high fuel taxes in Europe and replaces the revenue with other taxes could actually improve welfare.

Including road transport into the EU emission trading scheme

According to our analysis, reducing emissions in transport using standards is significantly more costly than using an emission trading scheme. A logical consequence is to call for a different policy approach in the EU that uses the ETS to address transport emissions. Although the current EU legislation states that emissions standards will be in place at least until the 2020s (EU 2014), the EU Council remains committed to the ETS and has made clear that including transport in the ETS is still an option (EU 2008). The practical aspects and implications of bringing private transportation into the EU ETS will be discussed in the following section (for an extended discussion, see also Achtnicht et al. 2015).

Regulated entity

In its current form, the EU ETS obliges the actual emitters to hold emission allowances, thereby implementing a rather direct “polluter pays” approach. However, in a situation with millions of car owners as mobile emitters, the choice of the regulated entity must first be addressed (i.e., who in the transport sector should be required to hold allowances corresponding to the emissions caused by transport activities). In principle, any point of regulation along the fuel chain could be chosen as a regulated entity—from upstream fuel providers (refineries, etc.) to mid-stream car manufacturers to downstream car owners. The point of regulation should be chosen such that the extended ETS incentivizes all abatement options along the fuel chain, ensures that all emissions are covered, and fully accounts for transaction costs (Flachsland et al. 2011).

If upstream car manufacturers were chosen as the regulated entity, lifetime emissions estimates for vehicles would be required (Desbarats 2009). If downstream users were chosen, just as with standards, influence from the regulation on the vehicle use after purchase would be limited. The high number of downstream users is likely to make the choice of consumers as the regulated entity extremely costly (Raux and Marlot 2005) and barely practicable.

Regulating mid-stream fuel providers seems to be the most encouraging option. Monitoring emissions at the level of fuel providers would be relatively easy as fuel sales are already monitored in all EU countries for fuel tax purposes. Refineries are already covered by the EU ETS for production-related emissions and hence have experience with the ETS system. The number of refineries is much lower than the number of potential downstream users, i.e. 243 million passenger cars and more than 512 million potential car users in the EU (Kieckhäfer et al. 2015). However, the cost of emission allowances is likely to be passed on to consumers through higher fuel prices, incentivizing the implementation of a wide range of abatement options ranging from adjusting behavior to technological options.

Relation to existing EU ETS

One cost effective way to include road transport would be to integrate the sector fully in the existing EU ETS. Another option is to create a (linked) separate ETS for road transport alone, similar to what has been done for aviation (EU 2008). A separate ETS for road transport would make it possible to insulate the sectors in the existing EU ETS from effects on the allowance price from the inclusion of road transport. It would also allow differentiation of the stringency of reduction targets in the separated systems. However, for exactly that reason, the system would be less cost effective.

Potentially cheaper reduction measures in the ETS sectors would not be utilized before more expensive measures in the transportation sector (and vice versa). The externality generated by CO2 emissions does not depend on the source of the emissions, and the most cost effective regulation requires that abatement costs are equalized across sectors. As our analysis shows, when transport is included in the emission trading system, production and exports of the electricity and energy-intensive sectors are not substantially affected, which is an argument for a full integration of transports into the EU ETS.

The results of our analysis discussed above confirm the findings from other studies that concluded that the marginal abatement cost curve for the road transport sector is steeper than for the remaining EU ETS (Blom et al. 2007; Cambridge Econometrics 2014; Heinrichs et al. 2014). Once road transport is included in the ETS, compared to a situation with standards, emission reductions are shifted to other ETS sectors (mostly to electricity and energy-intensive industries). As a consequence, the full inclusion of road transport into the EU ETS with a single common cap achieves efficiency gains, but also redistributes resources between sectors: compliance costs for the road sector are reduced while compliance costs for other sectors are increased. This results in distributional issues between sectors and highlights carbon leakage problems for energy-intensive trade-exposed sectors, which might see their international competitiveness negatively affected. However, the impact of road transport inclusion on the allowance price depends on the exact setting of the cap as well as the marginal abatement cost curve for the enlarged EU ETS. Our analysis suggests rather moderate allowance price increases. For example, in 2025 an economy-wide carbon price increases from about €17/tCO2 in the Current ES scenario to about €21/tCO2 in the Emission Trading scenario.

Additional market failures

Concerns about the dynamic efficiency of the ETS are sometimes raised. Our results show that emission reductions will at first take place predominantly in other ETS sectors, and later in the transport sector, only as allowance prices rise. The question is: will the necessary technological developments in the transport sector occur without standards? The existing literature has generally supported the notion that market-based regulation such as emissions trading or taxing carbon provides the most effective long-term incentives for innovation as long as reduction targets are set appropriately (Jaffe and Stavins 1995). Some researchers (e.g., Mock et al. 2014) argue that emission standards force car manufacturers to continuously innovate, while emission trading would prevent innovation. This argument is based on a static view that car manufacturers somehow realize that more stringent emissions standards are coming and they need to innovate to meet these standards, but the car manufacturers cannot foresee (or see it as unlikely) that emission reductions are getting more stringent over time and therefore they do not innovate. With certain emission reduction goals, the same emission targets at a country level will be achieved with either instrument, but with emission trading they would be achieved at a lower cost. Recent research shows that emission trading in the EU has already contributed significantly to innovation in the field of low-carbon technologies and thus to long-term emission reductions (Martin et al. 2012; Calel and Dechezleprêtre 2016).

Additional regulation is nevertheless reasonable as innovation and adoption of new technologies is associated with additional market failures beyond the CO2 externality. These knowledge spillovers imply too little technology innovation and diffusion compared to the social optimum in the absence of additional regulation. There are also path dependencies, which act as barriers to the adoption and diffusion of new technologies (Arthur 1989). Alternative fuel vehicles (e.g., electric, fuel cell, etc.) require the existence of a network where these vehicles can refuel or recharge. The need for a network of suited refueling stations can then slow down or stop the uptake of a new propulsion technology. This is a coordination problem as a low uptake also implies that there is little incentive to expand the available network. The problem is further exacerbated with learning by doing externalities such that improvements in the efficiency of a technology also increase with use. Hence, there is no guarantee that the most efficient technology would emerge naturally as the long run market leader.

Acemoglu et al. (2012) find evidence of path dependencies in clean versus dirty innovation, which imply that sunk costs (investment into dirty technologies) will arise if a firm switches to cleaner technologies. Aghion et al. (2016) show path dependencies in “dirty” patents (internal combustion engine). They further show that firms innovate relatively more in clean technologies (e.g. electric and hybrid) when they face higher fuel prices. Given the additional externalities and path dependencies, Acemoglu et al. (2012) along with many others have advocated for a policy mix where market based mechanisms like the ETS punish current emissions, while innovation and diffusion are supported by subsidies and research support programs. Emission standards as they exist in the EU are a poor instrument for overcoming the prevailing market failures, as they do not internalize the positive externalities of innovation and supply networks.

Conclusions

Although CO2 mandates are implemented at the sectoral level, this analysis illustrates the importance of an economy-wide analysis. Capturing both the rebound and the leakage effects, our model results suggest that at the EU level a CO2 mandate serves energy policy goals (i.e., a reduction in oil use) far better than long-term global climate change mitigation objectives. Reductions in demand for petroleum as well as other fuels are further facilitated by the costs that a CO2 mandate places on the economy, as capital costs rise to achieve vehicle efficiency improvements or accommodate the production of alternative fuel vehicles.

We find that in comparison to emission trading the vehicle mandates in 2020 reduce the CO2 emissions from transportation by about 50 MtCO2 and lower oil expenditures by about €6 billion, but the mandates cost an additional €12 billion in 2020. Keeping the 2021 mandates unchanged for 2025 leads to the EU consumption loss of about €24 billion in 2025. Increasing the emission targets further to 78–68 g/km leads to an annual consumption loss of €40-63 billion in 2025. We find that CO2 mandates are not as cost effective as an emission trading scheme, with annual consumption loss rising to 0.69 % in 2025 under the proposed high emission standard, compared to 0.08 % under an emission trading system that reaches the same target for emissions reduction.

As with any modeling, the exact numerical values should be treated with a great degree of caution as many aspects of the markets and industry details are simplified or beneath the level of model aggregation. On the other hand, the model projections allow testing of the viability and implications of the proposed policies. Our analysis suggests that policies that appear “fair” by requiring equal emissions reductions from all sectors may incur a hefty toll. By contrast, market-based instruments that achieve an equivalent overall reduction shrink the economic pie by a substantially smaller margin. The emission trading system results in modest reductions in refined oil use in passenger vehicle transportation, while standards would require large reductions from the transportation sector. We stress the need and importance of the detailed studies on additional costs for meeting CO2 standards in the EU. We base our results on the US studies as we are not aware of the comparable EU exercises. Such study requires an involvement of the industry and transportation research centers. The existing TNO (2011) report needs to be expanded to include the latest car industry data.

Our results suggest that bringing transportation under the EU Emission Trading Scheme (ETS) is an alternative to the CO2 standards that is worth considering. It may seem fair to require the same percentage reduction from all sectors, but at least for the transportation sector this equal reduction design leads to severe distortions in terms of the total economic cost of a policy. The advantage of an emissions trading system is that it searches out the cheapest way to reduce emissions. If it is more expensive to reduce emissions from cars, it can reduce emissions elsewhere. Efficient regulation of CO2 emissions will improve the feasibility of far reaching emission reduction goals in Europe.

While the current EU ETS is mostly related to electricity and energy-intensive industries, it would be feasible to extend it to transportation fuels. Such an expansion could involve completely integrating the transport sector, which would be the most cost effective regulation, or it could—at least temporarily—consist of a parallel trading scheme with a gateway as done for aviation. In order to incentivize abatement measures along the fuel chain while taking transaction costs into account, the most suitable choice of regulated entity for private transport would be the fuel providers. With emissions trading that covered transportation fuels, the currently targeted EU-wide emission reductions would be achieved at a lower cost and in the long run it would bring a growing sector under a fixed cap.

The presence of additional market failures and path dependencies affecting the development and deployment of new technologies implies that an optimal policy for transportation is likely to require policy measures complementary to emissions trading. Such policy measure should directly address the positive knowledge externality from innovation as well as the coordination problems which impair the expansion of necessary infrastructure. Bringing transport under the ETS will not solve all market failures in the transportation sector. However, it would address one market failure in an economically sensible way and would free resources to address the other problems.

References

Abrell, J.: Private Transport and the European Emission Trading System: Revenue Recycling, Public Transport Subsidies, and Congestion Effects. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1844300 (2011)

Acemoglu, D., Aghion, P., Bursztyn, L., Hemous, D.: The environment and directed technical change. Am. Econ. Rev. 102, 131–166 (2012)

Achtnicht, M., von Graevenitz, K., Koesler, S., Löschel, A., Schoeman, B., Tovar, M.: Including road transport in the EU-ETS—an alternative for the future? Report, Centre for European Economic Research (ZEW GmbH) http://ftp.zew.de/pub/zew-docs/gutachten/RoadTransport-EU-ETS_ZEW2015.pdf (2015)

Aghion, P., Dechezleprêtre, A., Hemous, D., Martin, R., Van Reenen, J.: Carbon taxes, path dependency and directed technical change: evidence from the auto industry. J. Polit. Econ. 124(1), 1–51 (2016)

Allcott, H., Wozny, N.: Gasoline prices, fuel economy, and the energy paradox. Rev. Econ. Stat. 96, 779–795 (2014)

Anderson, S., Sallee, J.: Using loopholes to reveal the marginal cost of regulation: the case of fuel-economy standards. Am. Econ. Rev. 101, 1375–1409 (2011)

Arthur, W.: Competing technologies, increasing returns, and lock-in by historical events. Econ. J. 99, 116–131 (1989)

Atabani, A., Badruddin, I., Mekhilef, S., Silitonga, A.: A review on global fuel economy standards, labels and technologies in the transportation sector. Renew. Sustain. Energy Rev. 15, 4586–4610 (2011)

Blom, M., Kampman, B., Nelissen, D.: Price effects of incorporation of transportation into EU ETS. CE Delft Report, Delft (2007)

Brand, C., Anable, J., Tran, M.: Accelerating the transformation to a low carbon passenger transport system: the role of car purchase taxes, feebates, road taxes and scrappage incentives in the UK. Transp. Res. Part A 49, 132–148 (2013)

Calel, R., Dechezleprêtre, A.: Environmental policy and directed technological change: evidence from the European carbon market. Rev. Econ. Stat. 98(1), 173–191 (2016)

Cambridge Econometrics: the impact of including the road transport sector in the EU ETS. A report for the European Climate Foundation, Cambridge (2014)

Creutzig, F., Jochem, P., Edelenbosch, O., Mattauch, L., van Vuuren, D., McCollum, D., Minx, J.: Transport: a roadblock to climate change mitigation? Science 350, 911–912 (2015)

Desbarats, J.: An analysis of the obstacles to inclusion of road transport emissions in the European Union’s emissions trading scheme. http://www.ieep.eu/assets/455/final_report_uberarbeitet.pdf (2009)

EC [European Commission]: Communication from the Commission to the Council and the European Parliament: Results of the review of the Community Strategy to reduce CO2 emissions from passenger cars and light-commercial vehicles. Brussels, Belgium (2007)

EC [European Commission]: Road transport: reducing CO2 emissions from vehicles. http://ec.europa.eu/clima/policies/transport/vehicles/index_en.htm (2016)

EC [European Council]: Regulation No 443/2009 of the European Parliament and of the Council of 23 April 2009 Setting emission performance standards for new passenger cars as part of the Community’s integrated approach to reduce CO2 emissions from light-duty vehicles, Brussels, Belgium. http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=CELEX:32009R0443:en:NOT (2009)

EC [European Council]: Conclusions on 2030 Climate and Energy Policy Framework, SN 79/14, Brussels (2014a)

EEA [European Environment Agency]: Monitoring of CO2 Emissions from Passenger Cars—Regulation 443/2009, European Environment Agency. http://www.eea.europa.eu/data-and-maps/data/co2-cars-emission-7 (2014)

EIA [Energy Information Administration]: Almost all U.S. gasoline is blended with 10% ethanol. http://www.eia.gov/todayinenergy/detail.cfm?id=26092# (2016)

Ellerman, A., Jacoby, H., Zimmerman, M.: Bringing transportation into a cap-and-trade regime. MIT Joint Program on the Science and Policy of Global Change. Report 136. Cambridge, MA (2006)

EPA [U.S. Environmental Protection Agency]: Final rulemaking to establish light-duty vehicle greenhouse gas emission standards and Corporate Average Fuel Economy Standards: Joint technical support document, U.S. Environmental Protection Agency (2010)

EPA [U.S. Environmental Protection Agency]: EPA optimization model for reducing emissions of greenhouse gases from automobiles (OMEGA). Assessment and Standards Division, Office of Transportation and Air Quality, U.S. Environmental Protection Agency. http://www.epa.gov/oms/climate/documents/420r12024.pdf (2012a)

EPA [U.S. Environmental Protection Agency]: Regulatory impact analysis: final rulemaking for 2017–2025 light-duty vehicle greenhouse gas emission standards and corporate average fuel economy standards. http://www.epa.gov/oms/climate/documents/420r12016.pdf (2012b)

EPA [U.S. Environmental Protection Agency]: Fuel economy testing and labeling. Office of Transportation and Air Quality, EPA-420-F-14-015 (2014)

EPRS [European Parliamentary Research Service]: Reducing CO2 Emissions from New Cars, Briefing 20/02/2014, European Union (2014)

EU: Directive 2008/101/EC of the European Parliament and of the Council of 19 November 2008 amending Directive 2003/87/EC so as to include aviation activities in the scheme for greenhouse gas emission allowance trading within the Community, Brussels (2008)

EU: Regulation No 333/2014 of the European Parliament and of the Council of 11 March 2014 amending Regulation (EC) No 443/2009 to define the modalities for reaching the 2020 target to reduce CO2 emissions from new passenger cars. http://eur-lex.europa.eu/legal-content/EN/TXT/?uri=uriserv:OJ.L_.2014.103.01.0015.01.ENG (2014)

Eur-Lex.: Proposal for a Regulation of the European Parliament and of the Council amending Regulation (EU) No 510/2011 to define the modalities for reaching the 2020 target to reduce CO2 emissions from new light commercial vehicles. http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=SWD:2012:0213:FIN:EN:HTML (2014)

Flachsland, C., Brunner, S., Edenhofer, O., Creutzig, F.: Climate policies for road transport revisited (II): Closing the policy gap with cap-and-trade. Energy Policy 39, 2100–2110 (2011)

Feigon, S., Hoyt, D. McNally, L., Mooney-Bullock, R.: Travel matters: Mitigating Climate Change with Sustainable Surface Transportation, Transportation Research Board. http://onlinepubs.trb.org/onlinepubs/tcrp/tcrp_rpt_93.pdf (2003)

Frondel, M., Schmidt, C., Vance, C.: A regression on climate policy: The European Commission’s legislation to reduce CO2 emissions from automobiles. Transp. Res. Part A 45, 1043–1051 (2011)

Gitiaux, X., Rausch, S., Paltsev, S., Reilly, J.: Biofuels, climate policy and the European vehicle fleet. J. Transp. Econ. Policy 46, 1–23 (2012)

Goldberg, P.: The effects of the corporate average fuel efficiency standards in the US. J. Ind. Econ. 46, 1–33 (1998)

Greene, D., Patterson, P., Singh, M., Li, J.: Feebates, rebates, and gas-guzzler taxes: a study of incentives for increased fuel economy. Energy Policy 33, 757–775 (2005)

Heywood, J. MacKenzie, D.: On the road toward 2050: potential for substantial reductions in light-duty vehicle energy use and greenhouse gas emissions. Massachusetts Institute of Technology. http://mitei.mit.edu/publications/reports-studies/on-the-road-toward-2050 (2015)

Heinrichs, H., Jochem, P., Fichtner, W.: Including road transport in the EU ETS: a model-based analysis of the German electricity and transport sector. Energy 69, 708–720 (2014)

ICCT [International Council on Clean Transportation]: EU CO2 emission standards for passenger cars and light-commercial vehicles. International Council on Clean Transportation, Washington, D.C (2014a)

ICCT [International Council on Clean Transportation]: From Laboratory to Road: A 2014 Update of Official and “Real-World” Fuel Consumption and CO2 Values for Passenger Cars in Europe. International Council on Clean Transportation Europe, Berlin http://www.theicct.org/sites/default/files/publications/ICCT_LaboratoryToRoad_2014_Report_English.pdf (2014b)

ICCT [International Council on Clean Transportation]: Global Passenger Vehicle Standards. International Council on Clean Transportation, Washington, D.C. http://www.theicct.org/info-tools/global-passenger-vehicle-standards (2016)

IEA [International Energy Agency]: World Energy Outlook, Paris (2015)

IMF [International Monetary Fund]: World Economic Outlook. Washington, DC (2015)

Jaffe, A., Stavins, R.: Dynamic incentives of environmental regulations: the effect of alternative policy instruments on technology diffusion. J. Environ. Econ. Manag. 29, 43–63 (1995)

Jochem, P.: A CO2 Emission Trading Scheme for German Road Transport. Nomos-Verlag, Baden-Baden (2009)

Karplus, V.: Climate and energy policy for U.S. passenger vehicles: a technology-rich economic modeling and policy analysis. Ph.D. Thesis. Engineering Systems Division, Massachusetts Institute of Technology, Cambridge, MA (2011)

Karplus, V., Paltsev, S.: Proposed vehicle fuel economy standards in the United States for 2017–2025: impacts on the economy, energy, and greenhouse gas emissions. Transp. Res. Rec. 2287, 132–139 (2012)

Karplus, V., Paltsev, S., Babiker, M., Reilly, J.: Applying engineering and fleet detail to represent passenger vehicle transport in a computable general equilibrium model. Econ. Model. 30, 295–305 (2013)

Karplus, V., Kishimoto, P., Paltsev, S.: The global energy, CO2 emissions, and economic impact of vehicle fuel economy standards. J. Transp. Econ. Policy 49, 517–538 (2015)

Kieckhäfer, K., Feld, V., Jochem, P., Wachter, K., Spengler, T.S., Walther, G., Fichtner, W.: Prospects for regulating the CO2 emissions from passenger cars within the European Union after 2023. Z. für Umweltpol. und Umweltr. 38(4), 425–450 (2015)

Klier, T., Linn, J.: Fuel Prices and New Vehicle Fuel Economy in Europe. Resources for the Future, Washington, D.C. (2011)

Knittel, C.: Reducing petroleum consumption from transportation. J. Econ. Perspect. 26, 93–118 (2012)

Knittel, C., Busse, M., Zettelmeyer, F.: Are consumers myopic? Evidence from new and used car purchases. Am. Econ. Rev. 103, 220–256 (2013)

Martin, R., Muûls M., Wagner U.: Carbon markets, carbon prices and innovation: Evidence from interviews with managers. London School of Economics, http://www.aeaweb.org/aea/2013conference/program/retrieve.php?pdfid=372 (2012)

Mock, P., Tietge, U., German, J., Bandivadekar, A.: Road Transport in the EU Emissions Trading System: An Engineering Perspective. Working Paper 2014-11, International Council on Clean Transportation (2014)

Narayanan, B., Aguiar, A., McDougall, R.: Global Trade, Assistance, and Production: The GTAP 8 Data Base. Center for Global Trade Analysis, Purdue University, West Lafayette (2012)

Paltsev, S., Viguier, L., Babiker, M., Reilly, J., Tay, K-H.: Disaggregating Household Transport in the MIT-EPPA Model. MIT Joint Program on the Science and Policy of Global Change, Technical Note 5, Cambridge, MA (2004)

Paltsev, S., Reilly, J., Jacoby, H., Eckhaus, R., J. McFarland, J., Sarofim, M. Babiker, M.: The MIT Emissions Prediction and Policy Analysis (EPPA) Model: Version 4. Report 125. MIT Joint Program on the Science and Policy of Global Change. Cambridge, MA (2005)

Paltsev, S., Reilly, J., Jacoby, H., Tay, K.-H.: How (and Why) do climate policy costs differ among countries? In: Schlesinger, M., et al. (eds.) Human-Induced Climate Change: An Interdisciplinary Assessment, 282–293. Cambridge University Press, Cambridge (2007)

Paltsev, S., Capros, P.: Cost concepts for climate change mitigation. Clim. Change Econ. 4, 1340003 (2013)

Paltsev, S., Karplus, V., Chen, H., Karkatsouli, I., Reilly, J., Jacoby, H.: Regulatory control of vehicle and power plant emissions: how effective and at what cost? Clim. Policy 15, 438–457 (2015)

Rausch, S., Metcalf, G., Reilly, J., Paltsev, S.: Distributional implications of alternative U.S. greenhouse gas control measures. B.E. J. Econ. Anal. Policy 10(1), 1–44 (2010)

Rausch, S., Karplus, V.: Markets versus Regulation: the efficiency and distributional impacts of U.S. climate policy proposals. Energy J. 35(SI1), 199–227 (2014)

Raux, C., Marlot, G.: A system of tradable CO2 permits applied to fuel consumption by motorists. Transp. Policy 12, 255–265 (2005)

Ricardo-AEA.: Evaluation of Regulations 443/2009 and 510/2011 on the reduction of CO2 emissions from light-duty vehicles. Brussels, 9th December 2014 (2014)

Schwanen, T., Banister, D., Anable, J.: Scientific research about climate change mitigation in transport: a critical review. Transp. Res. Part A 45, 993–1006 (2011)

Small, K., Van Dender, K.: Fuel efficiency and motor vehicle travel: the declining rebound effect. Energy J. 28, 25–52 (2007)

Sterner, T.: Distributional effects of taxing transport fuel. Energy Policy 41, 75–83 (2012)

TNO: Support for the revision of Regulation (EC) No 443/2009 on CO2 emissions from cars. Service request #1 for Framework Contract on Vehicle Emissions. Delft http://ec.europa.eu/clima/policies/transport/vehicles/cars/docs/study_car_2011_en.pdf (2011)

Transport & Environment.: Manipulation of fuel economy test results by carmakers: further evidence, costs, and solutions. http://www.transportenvironment.org/sites/te/files/publications/2014%20Mind%20the%20Gap_T%26E%20Briefing_FINAL.pdf (2014)

US EPCA.: United States Energy Policy and Conservation Act of 1975. Pub. L. No. 94–163 (1975)

Waugh, C., Paltsev, S., Selin, N., Reilly, J., Morris J., Sarofim, M.: Emission Inventory for Non-CO2 Greenhouse Gases and Air Pollutants in EPPA 5. MIT Joint Program on the Science and Policy of Global Change, Technical Note 12, Cambridge, MA (2011)

Winkler, S., Wallington, T., Maas, H., Hass, H.: Light-duty vehicle CO2 targets consistent with 450 ppm CO2 stabilization. Environ. Sci. Technol. 48, 6453–6460 (2014)

Acknowledgments

We are thankful to Jamie Bartholomay and three anonymous reviewers for their valuable contribution. The authors affiliated with the MIT Joint Program on the Science and Policy of Global Change gratefully acknowledge the financial support to the Program from the U.S. Department of Energy, Office of Science under DE-FG02-94ER61937, the U.S. Environmental Protection Agency under XA-83600001-1, and other government, industry, and foundation sponsors of the Joint Program on the Science and Policy of Global Change (For a complete list of sponsors, please visit http://globalchange.mit.edu/sponsors/all). The authors affiliated with the ZEW gratefully acknowledge funding by Adam Opel AG/General Motors and BMW as part of the project “The Future of Europe’s Strategy to Reduce CO2 Emissions from Road Transport”. Any opinions expressed in the paper are those of the authors.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Paltsev, S., Henry Chen, YH., Karplus, V. et al. Reducing CO2 from cars in the European Union. Transportation 45, 573–595 (2018). https://doi.org/10.1007/s11116-016-9741-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11116-016-9741-3