Abstract

In this paper, I investigate the relationship between national saving rates and capital account liberalization for a panel of 102 countries over the time period 1996–2007, employing three different de jure measures of financial openness. My results indicate that the influence of capital account liberalization on national saving depends on the degree of domestic financial development as well as on initial capital account restrictions. Easing borrowing constraints in an underdeveloped domestic financial market lowers saving, as the negative effect from easier access to credit globally outweighs the positive effect of high interest rates on savings as the financial repression paradigm predicts; on the contrary, financial globalization under a highly developed domestic financial market provides mixed results driven by the ambiguous effect of interest rates on savings. In addition, initial capital account restrictions have proved catalytic in the effectiveness of tightening episodes, a fact that could potentially affect national saving patterns. More precisely, my results indicate that developed (developing) countries with not advanced financial markets starting their liberalization process with severe initial capital account restrictions, increase (decrease) their savings in response to liberalization while they reduce (increase) savings as the domestic financial market becomes more developed. Furthermore, waiving restrictions on capital inflows or outflows provides additional insights regarding national savings patterns as they are strongly connected to domestic national accounts and, thus, national saving. The further examination of liberalization episodes on inflows and outflows confirms the causal relationship between the current and the capital account.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The importance of saving for economic growth was highlighted by both endogenous and exogenous growth models. For instance, in the traditional Solow (1956) growth model, higher saving leads to a higher level of income in the steady state (and thus to higher growth rates during a long-lasting transition path). Similarly, the “endogenous growth” models (e.g., Romer 1986; Lucas 1988; Grossman and Helpman 1991), predict that higher saving leads to a permanently higher rate of growth. An illustrative application of the theoretical predictions of the traditional growth models is found in the contrast of the growth experience between the high-saving countries of East Asia and the low-saving countries of Latin America since the 1960s.

Although a large strand of the literature (Edison et al. 2004; Bekaert et al. 2005, 2011; Henry 2007; Quinn and Toyoda 2008; Alper and Cakici 2009) investigates the effects of capital account liberalization (e.g., financial globalization) on growth, the empirical literature has not devoted much to the study of whether financial globalization affects directly and independently national saving. This would prove an important question to answer since it could provide us an explanation to the growth benefits that financial globalization could bring, failing to corroborate the theoretical predictions of many economists (Eichengreen 2001; Mishkin 2006; Kose et al. 2009; Rodrik and Subramanian 2009).Footnote 1

This paper aims to fill this gap in the empirical literature by examining whether de jure measures of financial globalization (FG, thereafter) – thus avoiding some of the endogeneity issues present when the current account deficit is used as a proxy for globalization–have an independent influence on national saving, which, however, may be intermediated by the state of domestic financial development. The catalytic role of domestic financial development for savings was identified by the related literature on financial repression since the early 1970s (e.g., McKinnon 1973; Shaw 1973). These authors argued that loosening financial restrictions could lead to higher interest rates, which, in turn, could rise saving. Although, in theory, there is increased uncertainty about the sign of the effect of interest rates on savings, an inference of the financial repression paradigm is that the implications of FG on saving are related to the level of the domestic financial sector development. For instance, if it is assumed that FG takes place in the presence of an underdeveloped domestic financial market with extensive credit constraints, by easing borrowing constraints for domestic agents, any effect it may have on interest rates could be mitigated by a negative effect on saving as a result of easier access to credit. On the contrary, if FG takes place under a state of high domestic financial development, the result of this will depend mostly on its impact on interest rates, and the ambiguous effect of the latter on saving.

Capital account liberalization (or FG in my case), that is easing restrictions on capital flows across a country’s borders, has been associated with a number of benefits, but also has been accused for playing a catalytic role in a number of financial crises. In theory, FG potentially results in financial openness of an economy and higher financial integration with the rest of the world. However, in practice, the experience is quite different, if one considers the case of countries that either had strict controls in place, but capital outflows were inevitable in times of economic distress (e.g., Latin America during the 1970s and 1980s), or had no significant controls, but have realized only minimal inflows (e.g., some countries in Africa). Thus, the initial state of capital account restrictions in a country is crucial to be considered, since, for instance, if a country has stringent regulations in place, capital account liberalization can be interpreted as signaling a country’s commitment to sound economic policies that could enhance national income and thus savings. On the other hand, when a country experiences liberalization with already relatively open capital accounts, maintaining or continue adopting sound policies is prerequisite to keep domestic and foreign players investing in that country, providing obvious benefits in terms of long-term growth (Kose and Prasad 2012). Moreover, investigating the effectiveness of capital account liberalization by taking into account the existing restrictions of the economy can provide different results in terms of managing capital flows (Saborowski et al. 2014) that could potentially affect saving rate patterns.

Capital controls have been increasingly used by many countries since the Global Financial Crisis (GFC). The number of measures increased both on inflows and outflows since 2008 (Fernández et al. 2015). In fact, there were more controls on inflows than outflows between 1995 and 2019. However, Bricogne et al. (2021) find that restrictions on inflows are more effective than controls on outflows in managing capital flows effectively. Thus, it is worthwhile studying liberalization episodes on capital inflows and outflows separately since it may provide significant insights of their impact on national savings. What is more is that, until the GFC, net flows were used when analyzing capital flows to a country, therefore, my study is relevant as it tries to link capital account liberalization with national domestic accounts and, thus, savings.

I conduct an empirical investigation using a relatively large dataset consisting of 102 countries (30 developed and 72 developing) over the time period 1996–2007 – thus covering incidents of capital account liberalization episodes that took place in the 1990s for some developing countries. Besides, the same period was characterized by large liberalization reforms for some developed countries as well (e.g., Greece). Moreover, in an effort to find robust findings of the effects of capital account liberalizations, I employ different measures of capital account openness, i.e., the Chinn and Ito (2008) index, the Quinn index (see e.g., Quinn 1997; Quinn and Toyoda 2008; Quinn et al. 2011), as well as the index put together by Fernández et al. (2015).

My results are in line with previous findings in the literature in that they confirm the importance of key determinants for national saving rates (Loyaza et al. 2000; Grigoli et al. 2018, among others). Furthermore, regarding the influence of capital account liberalization on national saving I find that the effects vary, depending on the degree of domestic financial development as well as on the initial capital account restrictions.

More precisely, my results show that developed countries with underdeveloped financial markets and severe initial capital account restrictions, increase their savings in response to liberalization, while they reduce savings as the domestic financial market becomes more developed. However, a contradicting result is uncovered when financial development is proxied by stock market capitalization and size (both as % of GDP).Footnote 2 On the contrary, developing countries with severe initial capital account restrictions and underdeveloped financial markets, reduce their savings in response to liberalizations, while they increase their saving rates when the domestic financial market is developed. Finally, breaking down capital flows into inflows and outflows and performing the same exercise provides significant insights on the causal relationship between the current and the capital account. This is considered a plausible outcome since in the case of liberalization on gross capital inflows, ceteris paribus, net inflows increase, and a capital account surplus combined with a current account deficit are realized, meaning that national savings fall and part of domestic investment is financed by capital inflows. In contrast, a liberalization of gross capital outflows results in a reduction of net inflows, which translates to a capital account deficit and a current account surplus. The latter case indicates that part of the increased national savings is used to finance investments of other countries through capital outflows. An expected unclear result is anticipated, though, if someone considers measures that combine both inflows and outflows.

The rest of the paper is structured as follows. Section 2 includes a discussion of the main literature concerning saving rates and capital flows. Section 3 summarizes data and presents the empirical strategy. In Section 4, I discuss the basic findings and the robustness exercise I have undertaken. The last section concludes.

2 Related Literature

The theoretical and empirical literature investigating saving behavior primarily in developing countries is vast and earlier reviews and appraisals of this literature include King (1985), Gersovitz (1988), and Deaton (1989); however, none of these studies have examined the effect of Financial Globalization (FG) on savings. Thus, this section focuses only on the review of the most recent literature that has either provided the framework for subsequent studies or has examined the effects of FG and/or domestic financial development on national saving.

Many studies (see, among others, Edwards 1996; Loyaza et al. 2000; Grigoli et al. 2018) investigate the impact of several important macroeconomic determinants on savings rates including also the level of financial development of the economy. More specifically, Edwards (1996), studying the determinants of private and public saving rates for OECD and less developed economies, finds a positive effect of financial development on private saving; on the other hand, a reduction in the current account balance crowds out private saving in a less than one-to-one way (the so-called “savings displacement” hypothesis). On the contrary, various studies (see, e.g., Schmidtc-Hebbel et al. 1992; Jappelli and Pagano 1994; Loyaza et al. 2000) uncover a negative relationship between financial development and savings, suggesting that increases in private credit flow cause a reduction in saving. Moreover, another important finding is that an increase in external saving (i.e., a worsening of the current account deficit or an improvement of the capital account balance) is partly offset by a decline of private saving.Footnote 3 Similarly, and significantly from my perspective Grigoli et al. (2018) examine the de jure effects of FG; using the Quinn index of capital controls, they find that fewer restrictions on capital account transactions do not have a (statistically) significant effect on private saving, but household saving reacts negatively and significantly to larger capital account openness.Footnote 4

However, the abovementioned studies focus only on linear relationships. To this end, Aizenman et al. (2019), accounting for non-linearities (a study closer in spirit to my paper), investigate the impact of policy interest rates on private savings, taking into consideration the possible influence of interactions with output volatility, old-age dependency, and financial development.Footnote 5 The reason behind this is that, precautionary saving will respond to economic or policy conditions; they find that domestic financial development has a negative impact on private saving, but this impact weakens as the real interest rate falls.Footnote 6 Moreover, Horioka and Terada-Hagiwara (2012) identify the existence of a nonlinear concave relationship between financial development and the domestic saving rate, i.e., financial sector development leads to a higher domestic saving rate up to a point. The existence of a non-linear relationship is consistent with the theoretical model of Wang et al. (2017) and with the discussions in Chinn and Prasad (2003) and Jha et al. (2009).

This paper is also related to the literature that examines the importance of national saving for the creation of global imbalances. Building on Ito and Chinn (2007), Chinn et al. (2012) find that domestic financial development impacts negatively on national saving for emerging economies, but it has no effect for industrial countries, and the less developed ones. Moreover, using the Chinn-Ito index of FG, they find that capital account openness has no effect on national saving for all country groups.Footnote 7

At the other end of the spectrum, there is a large part of the literature that investigates capital flows and their links with important macroeconomic indicators. McKinnon and Pill (1996, 1998) show how capital inflows in the presence of domestic financial market imperfections impact negatively on savings. Another contribution by Ju and Wei (2010) has also provided a framework for understanding further the linkages between the state of domestic financial development and the effect of FG on national saving. They investigate the conditions under which financial globalization can be a substitute for reforms of domestic financial system, and they find that FG can lead to an increase of savings by effectively bypassing the inefficiency of the domestic financial system and poor corporate governance of a country.Footnote 8 Bush (2019) tests whether capital flows are affected by capital account liberalization policies by considering also the level of financial development of the economy. In the same spirit, Landi and Schiavone (2021) investigate, among other things, the effectiveness of capital controls in reducing the volume of capital flows; however, the focus of the present study is on liberalization episodes.

It is obvious there is a direct effect of financial development on savings, while the impact of waiving capital restrictions provides mixed results. To the best of my knowledge, the related literature, has not studied so far, the potential interplay between the level of domestic financial development and liberalization episodes of the capital account; this is the first study that examines the combined effects of these two factors on national savings. For instance, when the capital account is liberalized, the demand for new (foreign) financial assets will depend on the degree to which similar assets are available domestically prior to liberalization. Furthermore, situations of strict vs lax initial capital account restrictions may be the key in altering the results, something that was not tested before.

3 Data and Empirical Methodology

3.1 Data

The dataset used for this study is an unbalanced panel covering a total of 102 countries listed in the Appendix (Tables 5 and 6)Footnote 9 over the period 1996 to 2007.Footnote 10 The sources of data include the IMF World Economic Outlook, the World Bank World Development Indicators (WDI), Chinn and Ito (2008), Quinn and Toyoda (2008), Fernández et al. (2015), Beck et al. (2001), and Sviydzenka (2016).

The dependent variable is the national saving rate, which is defined as gross national saving as a percentage of GNI. The basic set of control variables are grouped into specific categories, namely (i) income, (ii) price, (iii) demographics, (iv) trade, (v) policy, (vi) financial development, and (vii) capital account liberalizations. As mostly interested in the effects of the interaction between the latter two groups of variables, here I only briefly discuss the variables included in this analysis and their expected effects.Footnote 11

The first group includes the logarithm of GNI per capita and its growth rate with their expected effect being ambiguous. The price variables include inflation (based on CPI), the countries’ (logarithm of) terms of trade and the real interest rate. Higher inflation and higher terms of trade are expected to influence savings positively, whereas the effect of an increase of the real interest rate is ambiguous.Footnote 12 The group of demographic variables includes the percentage of urban population, the (old) age dependency ratio, the population growth rate, and the aging speed (Phillips et al. 2013; Cubeddu et al. 2019). Higher aging speed is expected to exert a positive effect on savings, whereas a higher population growth rate and a higher old-age dependency ratio are expected to have a negative effect on savings. Instead, the effect of the urbanization rate is ambiguous. Moreover, trade openness is expected to increase the savings rate (see e.g., Tang 2020). Policy variables include government spending on health and the cyclically adjusted fiscal balance. The effect of government expenditure on health is ambiguous (Grigoli et al. 2018), as well as the impact of fiscal balance (Phillips et al. 2013; Cubeddu et al. 2019).

Let’s now consider the degree of financial development of a country. The proxies I employ in the main body of the analysis include (as percentages of GDP) private credit, stock market capitalization, the sum of the previous two (size) (Beck et al. 2001), and the Financial Development index (Sviydzenka 2016).Footnote 13 Higher levels of financial development tend to reflect deep and well-regulated financial markets, which offer a wide range of financial assets and may lead to higher (private) saving rates. On the other hand, well developed financial markets allow for better risk diversification, reducing the need for precautionary saving, thereby leading to lower saving rates. Moreover, stock market capitalization is part of wealth, and its increase could be associated with increases in consumption and reductions in savings. Therefore, the rising levels of financial development are going to have an ambiguous effect on saving rates.

In order to define capital account liberalization episodes, I employ the indices put together by Chinn and Ito (2008), Quinn and Toyoda (2008) and Fernández et al. (2015).Footnote 14 I calculate the changes in these indices and define a liberalization episode when the change is larger than zero. I also define a large liberalization episode when the change of the index is larger than one standard deviation (of the change) (see subsection 4.2). This effectively allows to measure the effect of a capital account liberalization on savings, by comparing countries that have liberalized to those that have not.Footnote 15 Such a liberalization, allows individuals to better diversify country-specific risk, making use of financial instruments available in international financial markets. This could have two conflicting effects: an increase of savings resulting from higher demand for new assets, but also a reduction in savings arising from lower precautionary savings because of better diversification. Moreover, to the extent that individuals are unable to borrow as much as they wish in the domestic market, a liberalization could well result to a reduction in savings. So, the effect of a liberalization on savings will be ambiguous.

The choice of de jure measures of capital controls allows one to better investigate liberalization episodes since they capture legal restrictions on capital flows compared to de facto indicators, which consider actual realized economic variables. The IMF’s Annual Report on Exchange Arrangements and Exchange Restrictions (AREAER) is the primary source for most de jure indicators of financial openness. The Chinn and Ito (2008) index is measuring a country's degree of capital account openness and is based on the binary dummy variables that codify the tabulation of restrictions on cross-border financial transactions reported in the IMF's AREAER based on multiple exchange rates, current account and capital account restrictions and requirements on the surrender of export proceeds. The index put together by Chinn and Ito (2008), including all four abovementioned categories, allows to incorporate the extent of capital controls. On the other hand, though, Quinn and Toyoda (2008) indicator takes into account the severity of restrictions balancing across all categories of financial transactions (Quinn et al. 2011), which means that incorporates some level of intensity. Quinn and Toyoda (2008) index is constructed based on capital account and financial current account regulations covering six categories: payment for imports; receipts from exports; payment for invisibles; receipts from invisibles; capital flows by residents and by nonresidents. Finally, the index put together by Fernández et al. (2015) is also an ideal indicator for this study since it breaks down to different subsets of transaction types yielding indices by asset category, residency status, and inflows vs outflows. This facilitates an analysis in line with the IMF Balance of Payment Manual’s focus on the direction of capital flows.

The crucial issue here is the interplay between the level of domestic financial development and a liberalization of the capital account. The demand for new (foreign) financial assets when the capital account is liberalized, will depend on the degree to which similar assets were made available by the domestic financial system prior to the liberalization, hence on the level of domestic financial development. Moreover, a liberalization episode might generate different effects in countries that start from situations of very stringent capital restrictions vs situations of more lax conditions. So, the overall effect of a liberalization episode will depend on the level of financial development of the country of interest, but also on whether the initial situation was one of high restrictions or not. I explore this overall effect below.

3.2 Empirical Strategy

Ι empirically assess the effects of capital account liberalizations by specifying a fixed effects panel regression model of the form:

where \({s}_{i,t}\) denotes the national saving rate, \({{\varvec{x}}}_{i,t}\) contains the rest of control variables for country \(i\) at time \(t\) (which includes all the relevant variables discussed in the previous subsection), and \({a}_{i}\) and \({\lambda }_{t}\) denote country and time fixed effects that capture unobserved heterogeneity, while \({\varepsilon }_{i,t}\) is a zero-mean error term. \(LIB\) is a liberalization episode based on the relevant capital control index constructed as \(LIB=1\left\{\Delta Index>0\right\}\), \(FDEV\) denotes a measure of domestic financial development, \(CAPLOW\) is an indicator that takes the value 1 when the relevant capital control index lies at the lowest 50% of its distribution (and 0 otherwise).Footnote 16

Letting hats denote the estimated parameter values, note that the overall effect of liberalization episodes (relative to countries that have not liberalized) is given by:

when \(CAPLOW=1\) and by

when \(CAPLOW=0\). From (2) and (3) it is clear that the overall effect depends on the degree of financial development of the country at hand (\(FDEV\)) as well whether the initial condition was one of high or not high capital account restrictions (\(CAPLOW\)). Moreover, simple inspection of the estimated parameters will not suffice to infer the direction and significance of a liberalization episode. Rather in what follows I proceed by evaluating (2) and (3) for varying degrees of financial development and report the results graphically.Footnote 17

Following Loyaza et al. (2000), I treat the log of real per capita GNI, its growth rate, inflation, the real deposit rate, cyclically adjusted fiscal balance, and government expenditure on health as endogenous variables, assuming that they may be correlated with present and past error terms. On the other hand, terms of trade, old-age dependency ratio, the share of urban population, the population growth rate, aging speed, and trade openness are treated as exogenous variables. Moreover, the initial state of capital account restrictions and the domestic financial development variables are considered as predetermined variables.

However, an endogeneity problem still arises since \({s}_{i,t-1}\) is correlated with the independent variables (for example, income growth).Footnote 18 I deal with this issue by applying the system GMM estimator proposed by Arellano and Bover (1995) and Blundell and Bond (1998), which is a more efficient estimator than the difference GMM estimator proposed by Arellano and Bond (1991). This procedure allows to take as instruments the second and higher order lags of the endogenous dependent variable \({s}_{i,t-1}\) and the endogenous \({{\varvec{x}}}_{i,t}\) regressors. Since the rule of thumb is to keep the number of instruments less than or equal to the number of countries, I try to maintain the number of instruments small and use two to five lags of all endogenous and the lagged dependent variable in (1).Footnote 19 In what follows, clustered standard error at the country level is used.

In all estimations I try to safeguard by excluding outliers from my analysis. I start by excluding observations for the (gross) saving rate that is lower than -30% of GDP and larger than 75% of GDP. I also exclude observations where the sum of private credit to GDP and stock market capitalization to GDP exceeds 400% and 350% respectively; where the growth rate of per capita GNI is less than -10% or higher than 20%, and observations where inflation is less than -10% and larger than 45%.Footnote 20

4 Empirical Findings

In this section I discuss the results of regressions, measuring the effects of liberalization episodes defined using the three capital account restriction indices, for various proxies of domestic financial development (private credit, stock market capitalization, and the sum of private credit and stock market capitalization, all as percentages of GDP). In general, the liberalization episodes I study are relatively few, reflecting the fact that many of the countries in the sample had already begun their capital account liberalization process before the beginning of my sample.

To begin with, I note that I get many significant estimated coefficients.Footnote 21 More precisely, I find that the coefficient of the lagged saving rate is invariably significant and positive, whereas in most specifications the estimated coefficient of terms of trade is also found to be positive and significant, in line with the discussion in the previous section. In addition, I find that the coefficient of real interest rate, age dependency ratio and population growth rate are negative in the specification including the full sample of countries, whereas in the developed country group I get the exact opposite signs. This means that, in the latter case, the impact of a growing and older population, as well as higher real interest rates on savings is positive.

The result concerning interest rates can be considered plausible as the overall effect of the rates of return of financial assets on savings is ambiguous. According to the Permanent Income Hypothesis (PIH) and the Life Cycle Hypothesis (LCH), a rise in the rate of return on financial assets held by consumers entails income, substitution, and human-wealth effects (Grigoli et al. 2018). If the consumer is a net holder of financial assets, the substitution and human-wealth effects dominate and a higher rate of return results in higher savings. On the other hand, the income effect is negative, hence the combined net effect is ambiguous. If the consumer is a net debtor, the income effect turns positive.

Age dependency ratio (old) is expected to be negative, as it is in the case of the full sample,Footnote 22 because according to the LCH agents save for their old age while working and dissave during retirement (Modigliani and Brumberg 1954). Higher population growth rate has a negative effect on savings for the full sample of countries, whereas it has a positive impact for the developed country group. It could be regarded as a reasonable outcome, as higher population growth resulting probably from waves of mass immigration reflects an increase in the working force of population. The percentage of workers increases and thus savings increase according to the LCH. On the other hand, we may end up with higher fractions of old-age individuals from immigration waves (older than 64) to the working-age population (aged 15 – 64). In this case, we expect lower saving: according to models of the life cycle, older people tend to consume more and dissave. In addition, a higher aging speed implies a higher survival probability of (presently) younger individuals, increasing the need for life-cycle savings, a fact that is confirmed by the positive coefficient of aging speed in my results.

Moreover, I find that the coefficient of trade openness is positive and significant, in line with the model of Tang (2020). I also find that the coefficient of (log) GNI per capita is positive and significant indicating that higher levels of income result in higher savings according to PIH and LCH, which predict that current income should be largely saved. Furthermore, I find that higher levels of private credit results in higher savings rates, as a developed and well-regulated domestic financial and capital market enhances the availability of more financial and saving instruments, and thus, offers the potential for individuals to increase their wealth and saving. Also, the coefficient of inflation is found to be positive which can be attributed to the existence of higher uncertainty that results in precautionary savings.

Finally, I get an ambiguous effect of cyclically adjusted fiscal balance. In the examined case of developed countries, I uncover a statistically significant negative coefficient, which indicates that Ricardian equivalence holds, whereas, in the developing country group specification I find a positive effect. When, for instance, fiscal balance decreases – and this happens through government spending increase or tax cut – national savings increase, since private agents anticipate higher taxes in the future as the government will seek to satisfy its intertemporal budget constraint.Footnote 23 However, the positive coefficient indicates that the Ricardian equivalence proposition raise doubts on its validity for developing countries (Khalid 1996), due to the fact that some underlying assumptions of this theorem fail to materialize (e.g., the presence of liquidity restrictions). Therefore, the overall level of national savings falls.

4.1 Baseline Estimation Results

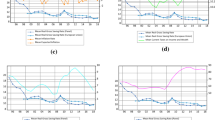

The existing literature (e.g., Edison et al. 2004; Bekaert et al. 2005, 2011; Henry 2007; Quinn and Toyoda 2008) has identified significant effects of liberalization episodes on growth. Here I try to assess the effects of such episodes on national saving rates. As explained above, the overall effect of liberalization depends on the level of domestic financial development as well as on whether the liberalization takes place in a regime of relatively strong capital account restrictions or not – see Eqs. (2) and (3). Figures 1, 2, 3, and 4, report graphically the estimated values of Eqs. (2) and (3), for different proxies of domestic financial development.Footnote 24

The Effects of Liberalization Episodes with Private Credit (% GDP). Notes: The figure reports the estimated effects of liberalization episodes as measured by the Chinn-Ito, the FKRSU, and the Quinn indices for various degrees of private credit (l.privcredit) for two regimes of initial capital account restrictions (CAPLOW = 0 and CAPLOW = 1)

The Effects of Liberalization Episodes with Stock Market Capitalization (% GDP). Notes: The figure reports the estimated effects of liberalization episodes as measured by the Chinn-Ito, the FKRSU, and the Quinn indices for various degrees of stock market capitalization (l.stock_cap) for two regimes of initial capital account restrictions (CAPLOW = 0 and CAPLOW = 1)

The Effects of Liberalization Episodes with Size (Private credit + Stock market capitalization, both % of GDP). Notes: The figure reports the estimated effects of liberalization episodes as measured by the Chinn-Ito, the FKRSU, and the Quinn indices for various degrees of size (l.size) for two regimes of initial capital account restrictions (CAPLOW = 0 and CAPLOW = 1)

The Effects of Liberalization Episodes with Financial Development Index (FD). Notes: The figure reports the estimated effects of liberalization episodes as measured by the Chinn-Ito, the FKRSU, and the Quinn indices for various degrees of Financial Development Index (l.FD) for two regimes of initial capital account restrictions (CAPLOW = 0 and CAPLOW = 1)

Figure 1 depicts the effects of capital account liberalizations, as measured by the difference of each index, when the level of domestic financial development is proxied by the private credit to GDP ratio. In particular, Panel A shows the effects of a capital account liberalization for all countries in the sample, Panel B for developed countries, and Panel C for developing countries only, using the Chinn-Ito index. I find that for the group of countries as a whole, a liberalization has a (statistically) significant negative effect on the national saving rate when the private credit to GDP ratio is below 35% and there are strong capital account restrictions (\(CAPLOW=1\)). In developed countries, I find that for private credit values between 51%–137% (relatively developed market), savings decrease in response to liberalization when the country experiences severe initial capital account restrictions, whereas there is an increase in national saving rate for developing countries for high values of financial development (> 79%). However, for private credit values up to 17%, national savings decrease in developing countries. Hence, the effect I uncover for developed countries seems to be driven by countries like The Bahamas, Barbados, Cyprus, Greece, Malta, and Slovenia, whereas for the developing country group with a developed domestic financial market the relevant countries included are China, Korea, Malaysia, South Africa, and Thailand.

In Panels D, E and F of Fig. 1, I report the effect of liberalization measured using the Fernández et al. (2015) index (FKRSU in what follows). I find that such a liberalization increases the national savings rate only when strong capital account restrictions are in place (\(CAPLOW=1\)) and when the private credit to GDP ratio is at relatively low levels (below 59% for the sample of developed countries). This range corresponds to countries like Iceland, Kuwait, and Slovenia.

Figure 2 shows similar findings when the level of domestic financial development is proxied by the stock market capitalization to GDP ratio. In panels D, E and F of Fig. 2, results when the liberalization is based on the FKRSU index are presented. I note that there is virtually no effect on savings when there are weak capital account restrictions (\(CAPLOW=0\)), but instead when the liberalization takes place in a regime of severe capital account restrictions (\(CAPLOW=1\)) there is a significant increase in the national savings rate, when the stock market capitalization ratio is above 105% for the sample of developed countries (Australia, Kuwait, Singapore, Switzerland). In turn, when liberalizations are defined based on the Quinn index (Panels G, H, and I of Fig. 2), I find that national savings decrease significantly when the country starts its liberalization process with strong capital account restrictions and stock market capitalization takes values between 22.5% and 25%. This result is driven by countries like Australia, Barbados, Cyprus, Greece, Iceland, Israel, Japan, and Malta.

In Fig. 3, I report results of similar liberalization episodes when the level of domestic development is measured by the sum of stock market capitalization and private credit, i.e., size. My findings are similar to those In Fig. 1 for the Chinn-Ito index, in that there is a significant reduction in savings following a liberalization when the initial capital account restrictions are relatively strong (\(CAPLOW=1\)). This effect is significant for the full sample of countries when size is below 57.5% of GDP. Furthermore, in the developed country group there is a reduction in savings when size takes values between 115% and 117.5% and the economy starts the liberalization process with severe capital account restrictions. Countries in this range include Barbados, Cyprus, Greece, Malta, and Slovenia. Finally, in panels G, H, and I (results based on the Quinn index), I get a slightly different result compared to the ones presented so far. When looking at the developed country group, I note there is a significant reduction in the savings rate, regardless of the initial regime of capital account restrictions for the whole range of size and when size is below 122.5% (in the cases where \(CAPLOW=0\) and \(CAPLOW=1\) respectively).

Moreover, Fig. 4 summarizes the effects of capital account liberalizations when domestic financial development is proxied by the Financial Development index (FD) (Sviydzenka 2016). Panels A, B and C report results based on the Chinn-Ito index. When the whole sample of countries is considered, I note that there is a significant reduction in the savings rate when \(CAPLOW=1\) and FD values are below 0.27. Moreover, in developed countries, there is also a reduction in savings for FD values between 0.44 – 0.51 and the country starts with strong capital account restrictions its liberalization process (i.e., \(CAPLOW=1\)). The countries in this range are The Bahamas, Barbados, Greece, and Slovenia. As we can notice from panels D, E and F where I report results based on the FKRSU index in developing countries, what I get is that savings increase in response to liberalization when \(CAPLOW=1\) for values 0.44 – 0.64 of the FD index (Brazil, Chile, China, Poland, Thailand, Turkey among others).

My baseline estimation results can be summarized as follows. In the developed country group, a liberalization episode results in lower national savings rates when the country begins its liberalization process with severe initial capital account restrictions and its domestic financial market is developed enough (from small to medium/high values of the financial development). However, when the domestic financial market is underdeveloped, national savings increase. This result generally holds, except for the cases, in which, the FKRSU and Quinn indices are used to measure liberalization, and financial development is proxied by stock market capitalization and size, respectively. In these cases, I end up with a reduction in savings for low levels of stock market capitalization and an increase in national savings for higher values of size (probably driven by stock market capitalization). On the contrary, developing countries respond to liberalization by increasing their savings if their domestic markets are developed and they experience severe initial capital account restrictions while reducing their savings when financial development indices take low values. Finally, when I consider the full sample of countries, I find a reduction in savings for low values of domestic financial development when countries start their liberalization process with strong capital account restrictions. This result is probably driven by the developing country group.

Going through the results in more detail the following underlying mechanisms are evident. In developing countries, it is obvious that access to international capital markets results in foreign resource inflows that can be used to augment their private saving and thus national savings.Footnote 25 Starting from severe initial capital account restrictions (e.g., China) accompanied by a moderate to well-developed domestic financial market, amplified by portfolio investment and foreign bank lending, a liberalization episode leads to an increase in national saving rates. The mechanism is that larger capital inflows could reach higher rates of capital accumulation and thus growth.Footnote 26 This could also be the case of global saving glut hypothesis, which states that financial development combined with comprehensive financial liberalization policies can mitigate saving levels, allowing excess saving to be “recycled” within the region in the case of East Asian economies (Ito and Chinn 2007). On the other hand, for low values of financial development, savings decrease in response to liberalization as these countries gain access to other financing options available in international markets, and thus, boost their consumption levels by saving less.

On the contrary, in developed countries with relatively developed domestic financial markets, savings decrease in response to liberalization when the country experiences strong initial capital account restrictions, while savings increase for lower levels of financial development. Bearing in mind the countries that are characterized by medium to high levels of financial development (e.g., Greece in 1996 and Cyprus in 1996 – 1999) and also considering the initial level of capital account restrictions, we can derive the following result: in countries that have just begun their capital account openness process (like Greece in 1996) and their financial markets are developed, new borrowing opportunities from abroad amplify further their consumptions plans. Rapid growth of domestic credit, largely financed out of capital inflows, leads to higher levels of domestic consumption. On the other hand, residents in countries with underdeveloped financial markets may opt for other financial opportunities abroad improving their portfolios and increasing their wealth, thus, having the chance to probably save more. This means that developed countries respond by increasing savings, perhaps, due to precautionary incentives, as long as the domestic financial market is not developed. However, the contradicting result found with the FKRSU and Quinn indices when financial development is proxied by stock market capitalization and size is not considered unreasonable. In this case, a liberalization episode combined with increasing stock market value attracts larger foreign investment funds, that in turn raise national income and accordingly saving rates. On the other hand, with a not very high stock market value, a liberalization event results in lower national savings.

4.2 Robustness Analysis

In order to evaluate the robustness of my results I have performed a series of experiments by redefining the liberalization events.Footnote 27 In this case, I get a similar pattern, as in my baseline specification, for both developed and developing countries. My main findings here can be summarized as follows. When cases of large liberalization episodes in developed countries are considered, national savings decrease significantly in response to these episodes for medium to relatively high values of financial development (as measured by private credit and FD index). However, when stock market capitalization and size are used as proxies for domestic financial development, I find that regardless of the level of initial capital account restrictions, savings follow a downward trajectory. More precisely, in the liberalization episodes proxied by the FKRSU index, for low levels of financial development (FD), savings increase, while for higher values of the FD index savings fall. Turning to the developing country group, I get one significant result identified in episodes with the Chinn-Ito index when the country is fully restricted. In this case, national savings decrease for low values of private credit. Finally, concerning the whole sample of countries, I find a reduction in savings regardless of the level of initial restrictions when liberalization is measured by the Chinn-Ito index and financial development is proxied by the FD index and private credit.

In detail, first, I redefined liberalization episodes to be large events: that is a liberalization to have taken place when the change in (any) index exceeds one standard deviation, namely, \({LIB}^{*}=1\left\{\Delta Index>\sigma (\Delta Index)\right\}\). When domestic financial development is proxied by private credit (Fig. 5), I find quite different results to those reported In Fig. 1, namely, liberalizations defined by the Chinn-Ito index result in lower savings rates for the full sample of countries when the initial capital account regime is one with weak restrictions (\(CAPLOW=0\)) for the whole range of private credit. Savings also decrease when \(CAPLOW=1\) and private credit values are below 25%. Moreover, concerning the developed country group, I find that when the country begins its liberalization process with strong initial capital account restrictions (i.e., \(CAPLOW=1\)), savings decrease in response to a large liberalization episode as measured by the Chinn-Ito, the FKRSU, and the Quinn indices. More precisely, for private credit values over 61% (Chinn-Ito), over 97% (FKRSU), and up to 23% (Quinn), national savings rates decrease. These results correspond to countries like Australia, Cyprus, Malta, Singapore, and Switzerland. Finally, in developing countries, savings also decrease for values below 25% of private credit when \(CAPLOW=1\).

The Effects of Large Liberalization Episodes with Private Credit (% GDP). Notes: The figure reports the estimated effects of large liberalization episodes as measured by the Chinn-Ito, the FKRSU, and the Quinn indices for various degrees of private credit (l.privcredit) for two regimes of initial capital account restrictions (CAPLOW = 0 and CAPLOW = 1)

When I proxy domestic financial development by the stock market capitalization (Fig. 6), I get the following result: employing the Chinn-Ito index, a large liberalization episode leads to a significant reduction in saving rates when the initial capital account regime is one of high restrictions and the stock market capitalization is between 32.5%-65% for the sample of developed countries. These countries include Barbados, Cyprus, Greece, Malta, and Slovenia.

The Effects of Large Liberalization Episodes with Stock Market Capitalization (% GDP). Notes: The figure reports the estimated effects of large liberalization episodes as measured by the Chinn-Ito, the FKRSU, and the Quinn indices for various degrees of stock market capitalization (l.stock_cap) for two regimes of initial capital account restrictions (CAPLOW = 0 and CAPLOW = 1)

Results, when I employ size as the proxy for domestic financial development (Fig. 7), show that when \(CAPLOW\) equals one, a significant reduction in the saving rate following a liberalization measured by the Chinn-Ito and FKRSU indices takes place. This holds only for the developed group of countries when size is between 90%–175% (for Chinn-Ito) and over 147.5% (for FKRSU). Regardless of the state of initial capital account restrictions, I find that a large liberalization episode, as measured by the Quinn index, results in a reduction of national savings rates for values of size for the whole range of financial development and below 122.5% (weak and strong restrictions respectively). In developing countries, a reduction in savings takes place when the Chinn-Ito index is used, and the country starts its liberalization process with severe initial restrictions. This holds for size values below 25%.

The Effects of Large Liberalization Episodes with Size (Private credit + Stock market capitalization, both % of GDP). Notes: The figure reports the estimated effects of large liberalization episodes as measured by the Chinn-Ito, the FKRSU, and the Quinn indices for various degrees of size (l.size) for two regimes of initial capital account restrictions (CAPLOW = 0 and CAPLOW = 1)

Finally, when I proxy domestic financial development by the Financial Development index (FD) (Fig. 8), the following significant results are evident: for the full sample of countries and when the Chinn-Ito index is used, I find that for either \(CAPLOW=0\) or \(CAPLOW=1\), national savings fall in response to a large liberalization episode. Furthermore, in developed countries, liberalization as measured by the Chinn-Ito index leads to a reduction in savings for FD values between 0.48 – 0.58, when the country starts with severe initial capital account restrictions its liberalization process (The Bahamas, Barbados, Greece, Slovenia). Finally, when I consider the FKRSU index, I find that savings increase for \(CAPLOW=0\) and for FD values below 0.25, whereas for values over 0.68 savings decrease. Countries that fall in the latter range include Australia, Cyprus, Singapore, and Switzerland.

The Effects of Large Liberalization Episodes with Financial Development Index (FD). Notes: The figure reports the estimated effects of large liberalization episodes as measured by the Chinn-Ito, the FKRSU, and the Quinn indices for various degrees of Financial Development Index (l.FD) for two regimes of initial capital account restrictions (CAPLOW = 0 and CAPLOW = 1)

4.3 The Role of Capital Inflows and Outflows

Disaggregating capital flows into inflows and outflows could provide further insights on the above findings of liberalization episodes, as restrictions on capital flows may have different results in terms of effectiveness (Bricogne et al. 2021), that could potentially influence national saving patterns. Capital flows refer to cross-border financial transactions recorded in economies’ external financial accounts (IMF 2013). More precisely, gross capital inflows are net sales of domestic financial instruments to foreign residents and, thus, they end up to receipts from foreigners, entered as a credit (+) in the Balance of Payments (BoP). On the other hand, gross capital outflows are net purchases of foreign financial instruments by domestic residents and they result in payments to foreigners and, thus, they are recorded as a debit (-) in the BoP. Net capital flows are the difference between gross inflows and outflows.

Net flows of a country provide information on the real economy and reflect the current account balance. In other words, net flows are the financial counterpart to the current account balance and they are strongly connected to the domestic national accounts explaining when a country is financed by borrowing (current account deficit and capital account surplus) or it finances other countries by lending (current account surplus and capital account deficit). In more detail, purchasing assets abroad, i.e., experiencing a capital account deficit, is strongly related to a current account surplus and vice versa; borrowing from the rest of the world correlates with a deficit in the current account. An issue of causality with the relationship between capital flows and domestic savings arises here, though, since examining the discrete effect of a liberalization episode on inflows (outflows), the result is a reduction (increase) in national savings respectively. However, similarly, higher (lower) savings, ceteris paribus, lead to larger amounts of outflows (inflows).

Performing the same exercise as described in subsection 3.2 but using data on inflows and outflows as offered by the database put together by Fernández et al. (2015), I examine and discuss, here, results of (large) liberalization episodes on national saving rates.

Figures 9, 10, 11, and 12 depict results on the effects of capital account liberalizations of inflows and outflows (given by the FKRSU index) when domestic financial development is proxied by private credit (% of GDP), stock market capitalization (% of GDP), size (private credit and stock market capitalization, both % of GDP) and the Financial Development index (FD) (Sviydzenka 2016). Panels A, B and C report results for all, developed and developing countries respectively. Significant results concern the whole sample of countries and the developed country group. For a developed financial system (stock market capitalization between 140%–220%), and a stringent initial capital account regime (i.e., \(CAPLOW=1\)), a liberalization of outflows leads to an increase of national savings (Fig. 10, Panel A). The same result is found also for developed countries, when \(CAPLOW=1\) and stock market capitalization takes values between 107.5%–162.5% (Fig. 10, Panel B). A liberalization of outflows means that countries in these groups lend to the rest of the world, experiencing a capital account deficit and a surplus in the current account.Footnote 28

The Effects of Liberalization Episodes of Capital Inflows and Outflows (as measured by the FKRSU index) when financial development is proxied by Private Credit (% of GDP). Notes: The figure reports the estimated effects of liberalization episodes of capital inflows and outflows as measured by the FKRSU index for various degrees of Private Credit as % of GDP (l.cred) for two regimes of initial capital account restrictions (CAPLOW = 0 and CAPLOW = 1)

The Effects of Liberalization Episodes of Capital Inflows and Outflows (as measured by the FKRSU index) when financial development is proxied by Stock Market Capitalization (% of GDP). Notes: The figure reports the estimated effects of liberalization episodes of capital inflows and outflows as measured by the FKRSU index for various degrees of Stock market Capitalization as % of GDP (l.stock_cap) for two regimes of initial capital account restrictions (CAPLOW = 0 and CAPLOW = 1)

The Effects of Liberalization Episodes of Capital Inflows and Outflows (as measured by the FKRSU index) when financial development is proxied by Size (Private credit + Stock market capitalization, both % of GDP). Notes: The figure reports the estimated effects of liberalization episodes of capital inflows and outflows as measured by the FKRSU index for various degrees of Size (Private credit + Stock market capitalization, both % of GDP (l.size)) for two regimes of initial capital account restrictions (CAPLOW = 0 and CAPLOW = 1)

The Effects of Liberalization Episodes of Capital Inflows (as measured by the FKRSU index) when financial development is proxied by the Financial Development (FD) index. Notes: The figure reports the estimated effects of liberalization episodes of capital inflows and outflows as measured by the FKRSU index for various degrees of Financial Development Index (l.FD) for two regimes of initial capital account restrictions (CAPLOW = 0 and CAPLOW = 1)

When large liberalization episodes are considered (Figs. 13, 14, 15, and 16), the following pattern is uncovered for developed countries: for a relatively developed domestic financial system as measured by private credit (% of GDP), stock market capitalization (% of GDP), size (private credit and stock market capitalization, both % of GDP, and the Financial Development Index (FD)),Footnote 29 and starting from a regime with severe initial capital account restrictions, a large liberalization on capital inflows results in a reduction of national savings (Figs. 13, 14, 15, and 16, Panel B). This can be explained as a rise in inflows translates to a capital account surplus and a current account deficit, which means that savings are not sufficient to finance domestic investment plans.Footnote 30

The Effects of Large Liberalization Episodes of Capital Inflows and Outflows (as measured by the FKRSU index) when financial development is proxied by Private Credit (% of GDP). Notes: The figure reports the estimated effects of large liberalization episodes of capital inflows and outflows as measured by the FKRSU index for various degrees of Private Credit as % of GDP (l.cred) for two regimes of initial capital account restrictions (CAPLOW = 0 and CAPLOW = 1)

The Effects of Large Liberalization Episodes of Capital Inflows and Outflows (as measured by the FKRSU index) when financial development is proxied by Stock Market Capitalization (% of GDP). Notes: The figure reports the estimated effects of large liberalization episodes of capital inflows and outflows as measured by the FKRSU index for various degrees of Stock Market Capitalization as % of GDP (l.stock_cap) for two regimes of initial capital account restrictions (CAPLOW = 0 and CAPLOW = 1)

The Effects of Large Liberalization Episodes of Capital Inflows and Outflows (as measured by the FKRSU index) when financial development is proxied by Size (Private credit + Stock market capitalization, both % of GDP). Notes: The figure reports the estimated effects of large liberalization episodes of capital inflows and outflows as measured by the FKRSU index for various degrees of Size (Private credit + Stock market capitalization, both % of GDP (l.size)) for two regimes of initial capital account restrictions (CAPLOW = 0 and CAPLOW = 1)

The Effects of Large Liberalization Episodes of Capital Inflows and Outflows (as measured by the FKRSU index) when financial development is proxied by the Financial Development (FD) index. Notes: The figure reports the estimated effects of large liberalization episodes of capital inflows and outflows as measured by the FKRSU index for various degrees of Financial Development Index (l.FD) for two regimes of initial capital account restrictions (CAPLOW = 0 and CAPLOW = 1)

5 Summary of Results

In this subsection, three summary tables (Tables 1, 2, and 3) that contain the main significant results of this study are provided and they principally concern the case in which the country starts its liberalization process with severe initial capital account restrictions (i.e., \(CAPLOW=1\)). Results are reported for all country groups (all, developed and developing), for each capital control index (Chinn and Ito 2008; Quinn 1997; Fernández et al. 2015) and for the different measures of financial development (private credit and stock market capitalization, both as % of GDP, the sum of the previous two (size), and the Financial Development index (Sviydzenka 2016)), accounting also for the level of financial development (low, medium, high) of the country. The last column of the tables depicts the direction of the effect on national savings (increase or reduction).

As reported and discussed in previous sections, when the country starts its liberalization process with severe initial capital account restrictions and the domestic financial system is highly developed, national savings decrease in the case of developed countries and increase when the country group under examination concerns developing economies (Tables 1 and 2). Developed countries respond to loosening restrictions of the capital account by reducing savings as they can opt for other financing opportunities abroad, while developing economies react to liberalizations by increasing savings, meaning that these countries attract foreign capital passing through their banking systems, increasing credit availability and ending up to capital accumulation and higher saving rates – a fact that could be explained by the saving glut hypothesis. When the domestic financial sector is underdeveloped, a positive effect on savings is realized for developed countries, whereas a negative sign is evident for the group of developing economies. It seems that in the latter case liberalization episodes outweigh the effects of the financial repression paradigm, as countries respond by reducing savings due to easier access to international markets. Results for the whole group of countries are mainly driven by developing economies.

Waiving restrictions on capital inflows and outflows provides further insights on the results of the baseline estimations (Table 3). In the case of developed countries, a liberalization of outflows results in higher savings if the domestic financial sector is developed and stringent regulations are already in place. This finding is close to the prediction by Saborowski et al. (2014), who find that a tightening of outflow restrictions is effective if supported by either strong macroeconomic fundamentals, or if existing restrictions are already fairly comprehensive; however, they concentrate their analysis on capital controls only concerning capital outflows mainly. In my case, the focus is on liberalization episodes of the capital account. More precisely, if the loosening of capital account inflows restrictions, is not supported by strong fundamentals (e.g., domestic sector financial development) and severe restrictions are in place, then net inflows may not increase as expected because they would potentially provoke considerable increases in gross outflows. This result could provide also an explanation in that findings for developed countries from the baseline model are principally driven by capital inflows. On the other hand, a liberalization of outflows leads to an increase of savings when the domestic sector is not underdeveloped and stringent regulations are already in place.

6 Concluding Remarks

The growth effects of capital account liberalization have received considerable attention, with many scholars identifying a positive effect of liberalization episodes. The existing literature however has not identified the effects of liberalization episodes on national savings rates, even though savings play a central role both in theoretical models and in practice for sustained growth rates. I try to fill this gap by providing a comprehensive set of evidence of the effects of waiving restrictions in a country’s capital account on savings.

I employ data covering the period 1996–2007 for a panel of 102 economies (30 developed and 72 developing) and use three de jure measures of capital account restrictions, namely the indices of Chinn and Ito (2008), of Quinn (1997) and of Fernández et al. (2015). The results provide the following very interesting insights. Developed countries tend to increase their savings in response to liberalization when the domestic financial market is underdeveloped and start their liberalization process with severe initial capital account restrictions. But, as the financial market becomes more developed, they decrease their savings. Considering developed countries that have just started to liberalize their markets and are characterized by underdeveloped financial markets, they respond to liberalization by increasing their savings due to precautionary incentives, but as credit becomes available in the country, they can opt for more financing opportunities and asset investments, resulting in reductions of their saving rates. However, a contradicting interesting result is uncovered when financial development is proxied by stock market capitalization and size. In this case, a liberalization episode combined with increasing stock market value attracts larger foreign investment funds that in turn raise national income and accordingly saving rates. On the other hand, with a not very high stock market value, a liberalization event results in lower national savings.

At the other end of the spectrum, I get a very familiar pattern for developing countries. I provide evidence of reductions in saving rates for underdeveloped financial markets and increases for more advanced domestic markets, in cases that countries begin their liberalization process with severe initial capital account restrictions. These countries, in the case of highly developed domestic markets, attract international capital inflows that pass through the banking system and increase credit availability. As a result, capital accumulation is inevitable, and savings follow an upward trajectory. This could also be the case of the saving glut hypothesis. On the other hand, considering the case of underdeveloped financial markets and severe initial capital account restrictions, developing countries decrease their savings in response to liberalization as they gain access to other financing options from international markets, and thus, boost their consumption levels by saving less.

The breakdown of capital flows into inflows and outflows provides further insights in the interpretation of the results. Confirming the causal relationship between capital and current account, liberalization episodes on outflows for highly developed domestic financial systems results in national saving increases, when the country starts the liberalization process with severe initial capital account restrictions (this applies for the full and developed sample of countries). On the contrary, liberalization of inflows leads to reduced national saving rates, when the domestic financial market is not underdeveloped, and initial capital restrictions are stringent (in the case of developed countries). This finding is close to the prediction by Saborowski et al. (2014), in that, if loosening of capital account inflows restrictions is not supported by strong fundamentals (e.g., domestic sector financial development) and existing stringent regulations, then net inflows may not increase as expected because they would potentially provoke considerable increases in gross outflows.

Nevertheless, it is also worthwhile, for future research, to investigate and analyze the effects of liberalization episodes on different types of capital flows on national savings. For instance, Bricogne et al. (2021) find that capital account restrictions on outflows are effective only for FDI, but not on equity or debt portfolio flows and on other investments, which form generally the largest share of capital flows. In contrast, restrictions on inflows are mostly effective for FDI, debt portfolio flows and other investments and less so for equity portfolio flows.

Notes

The importance of national saving for economic growth is also given prominence in the findings of Prasad, Rajan, and Subramanian (2007) and Gourinchas and Jeanne (2013), who find that countries that grow more rapidly are those that rely less and not more on foreign capital; and in turn foreign capital tends to go to countries that experience not high, but low productivity growth.

Size is defined as the sum of private credit and stock market capitalization (both as % of GDP).

In a study of household saving determinants for EU countries, Rocher and Stierle (2015) examined a variant of the savings-displacement hypothesis and found that the net inflow of foreign direct investment is negatively related with household saving.

Grigoli et al. (2018) do not report results regarding the influence of capital account openness on national saving taking into consideration its interaction with the level of financial development.

Another similar study that takes into consideration the interaction between capital account liberalization and financial development is the one by Eichengreen et al. (2011). However, the authors examine these effects on industry growth.

Nabar (2011) has examined the Chinese experience of rising household saving and declining real interest rates during the 2000s, and on the basis of province-level data over the 1996–2009 period, he shows that there is a negative relationship between the return on saving and household saving.

In their analysis they consider several familiar hypotheses and arguments that have been offered to explain global imbalances. These include the twin deficit hypothesis (Chinn 2005), the saving glut hypothesis (Greenspan 2005a, b; Bernanke 2005; Clarida 2005), and the asset bubble driven explanation of current account balances (Aizenmann and Jinjarak 2009; Fratzscher and Straub 2009).

A finding that is also confirmed in the present paper for the developed country group.

The dataset consists of 30 developed and 72 developing economies. The division of the sample into developed and developing countries is based on the per capita income classification table reported by the World Bank. I relied on the reported per capita incomes in 2000 as it can plausibly be considered that many of the countries had already liberalized their capital accounts by then.

The period chosen reflects my effort to compare the three measures of de jure restrictions over a common time period for which data are available, namely 1996–2007. The three capital account indices cover different time spans; however, they overlap between 1996–2007, and this provides the ground for effective comparison between them.

I leave a more detailed discussion of these effects in an online Appendix.

This is measured by the rate paid by commercial or similar banks for demand, time, or savings deposits adjusted for inflation (CPI-based).

Sviydzenka (2016) creates a number of indices that summarize how developed financial institutions and financial markets are in terms of their depth, access, and efficiency, culminating in the final index of financial development.

All three indices have been rescaled to take values in the [0,1] interval, with higher values reflecting a less restricted economy – some details on these indices are provided in an online Appendix. In fact, the Quinn index goes back to the 1960s and the Chinn-Ito back to the 1970s, but the FKRSU index begins only in 1995. I have therefore chosen to focus on the common sample of all three indices in the main part of my analysis (see also footnote 9).

Essentially this allows to compare countries in a treatment group, namely those that liberalized their capital accounts, and a control group, i.e., those that did not liberalize their capital accounts. Of course, the latter group also includes countries that have completely open capital accounts, as these cannot liberalize any further.

To be more exact for the index of Chinn-Ito, \(CAPLOW\) takes the value 1 when the index takes values in the lower 52% of its distribution; in the lower 49% for the index of Quinn, and in the lower 48% for the FKRSU. This reflects the fact that the distributions tend to be “flat” around their medians. For instance, the index of Chinn-Ito attains the same values between its 45th and its 52nd percentile; the index of Quinn between its 48th and its 60th percentile; and the index of FKRSU between its 46th and 47th percentile. Varying these thresholds around these values does not make much difference in my results below.

Note that regression coefficients usually reported are when all right-hand-side variables are evaluated at their averages. So, it could well be the case that while individual coefficients are statistically insignificant, particular (non-linear) combinations of these coefficients turn out to be significant. For instance, the estimated standard error of (2) will depend not only on the estimated variances of \(\widehat{{\gamma }_{2}}\), \(\widehat{{\gamma }_{3}}\), and \(\widehat{{\gamma }_{4}}\) but also on their covariance and the values of \(FDEV\) used in evaluating (2).

A solution to this problem would be to first difference the equation, but even so \({s}_{i,t-1}\) would be correlated with the current error term \({\varepsilon }_{i,t}\) making OLS estimators inconsistent and biased even with a fixed effects estimator (Nickell 1981).

The number of instruments in these sets of regressions is 46.

I do this in order for our results not to be distorted by extreme values of these variables.

Tables with the results of estimated coefficients are available in an online Appendix.

In the developed country group, we find a positive coefficient for age dependency ratio which contradicts LCH.

Private saving constitutes the largest part in national savings (the other being government saving).

Based on simple summary statistics the chosen ranges (in percentages of GDP) for these measures are for private credit [3%, 170%], for stock market capitalization [0, 220%], for size [10%, 345%] and for FD [0,1].

Private saving constitutes the largest part of national savings.

More precisely, it was argued that some specific types of foreign capital inflows, principally foreign direct investment, facilitate the transfer of managerial and technological knowhow (Bosworth et al. 1999).

I also performed robustness checks considering private saving as the dependent variable. My findings are robust and provide the same insights as national saving rate does. These results are available upon request.

Only one contradicting result compared to the main findings is uncovered for developed countries when a liberalization episode on inflows takes place for stock market capitalization values between 95%–220%. In this case, national savings increase. This different outcome could be explained as the USA, a large country in terms of GDP, that potentially could drive the results, is dropped off this group.

69%-169% for private credit values (% of GDP), 45%-220% for stock market capitalization (% of GDP), 105%-345% for size (private credit and stock market capitalization, both % of GDP), and 0.58–0.85 for FD.

The disaggregation of capital flows in inflows and outflows can enhance the understanding of the effects of liberalization episodes on national savings. It seems that my initial results of liberalization episodes of capital flows on national savings concerning the developed country group seem to be driven by waiving restrictions in capital inflows.

References

Aizenman J, Jinjarak Y (2009) Current Account Patterns and National Real Estate Markets. J Urban Econ 66(2):75–89

Aizenman J, Cheung YW, Ito H (2019) The Interest Rate Effect on Private Saving: Alternative Perspectives. J Int Commer Econ Policy 10(01):1950002

Alper EC, Cakici MS (2009) Financial Liberalization, Fiscal Prudence, and Growth: Panel Evidence from 1980–2003. Open Econ Rev 20:509–524

Arellano M, Bond S (1991) Some Test of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Rev Econ Stud 58:277–297

Arellano M, Bover O (1995) Another Look at the Instrumental Variable Estimation of Error Component Models. J Econo 68(1):29–51

Beck T, Demirgüc-Kunt A, Levine R (2001) A new database on financial development and structure. In: Demirgüc-Kunt A, Levine R (eds) Financial Structure and Economic Growth: A Cross-Country Comparison of Banks, Markets, and Development. MIT Press, Cambridge, MA

Bekaert G, Harvey CR, Lundblad C (2005) Does financial liberalization spur growth? J Financ Econ 77(1):3–55

Bekaert G, Harvey CR, Lundblad C (2011) Financial Openness and Productivity. World Dev 39(1):1–19

Bernanke B (2005) The Global Saving Glut and the US Current Account. Virginia Association of Economics, Richmond, VA (Remarks at the Sandridge Lecture (March 10))

Blundell R, Bond S (1998) Initial Conditions and Moment Restrictions in Dynamic Panel Data Models. J Econom 87(1):115–143

Bosworth PB, Collins SM, Reinhart CM (1999): “Capital Flows to Developing Economies: Implications for Saving and Investment.” Brook Pap Econ Act 1:143–180

Bricogne J-C, Cosson A, Garnier-Sauveplane A, Lecat R, Peresa I, Vanzhulova Y (2021) Financial flows, macro-prudential policies, capital restrictions and institutions: what do gravity equations tell us? Banque de France (Working Paper No. 842)

Bush G (2019) Financial Development and the Effects of Capital Controls. Open Econ Rev 30:559–592

Chinn M (2005) Getting Serious about the Twin Deficits. Council on Foreign Relations, New York (Council Special Report No. 10)

Chinn MD, Ito H (2008) A New Measure of Financial Openness. J Comp Policy Anal 10(3):309–322

Chinn MD, Prasad ES (2003) Medium-term determinants of current accounts in industrial and developing countries: an empirical exploration. J Int Econ 59(1):47–76

Chinn MD, Eichengreen B, Ito H (2012) Rebalancing global growth. In: Canuto O, Leipziger D (eds) Ascent After Decline: Regrowing Global Economies After the Great Recession. World Bank

Clarida R (2005) Japan, China and the U.S. Current Account Deficit. Cato J 25:111–114

Cubeddu LM, Krogstrup S, Adler G, Rabanal P, Dao MC, Hannan SA, Juvenal L, Nan L, Osorio Buitron C, Rebillard C, Garcia-Macia D, Jones C, Rodriguez J, Suk Chang K, Gautam D, Wang Z (2019) The External Balance Assessment Methodology: 2018 Update. IMF (Working Papers 19/65)

Deaton A (1989) Saving in Developing Countries: Theory and Review. World Bank Econ Rev 3(suppl_1):61–96

Edison HJ, Klein MW, Ricci AL, Sløk T (2004) Capital Account Liberalization and Economic Performance: Survey and Synthesis. IMF Staff Pap 51(2):220–256

Edwards S (1996) Why Are Latin America’s Savings Rates So Low? An International Comparative Analysis. J Dev Econ 51(1):5–44

Eichengreen B (2001) Capital Account Liberalization: What Do Cross-Country Studies Tell Us? World Bank Econ Rev 15(3):341–365

Eichengreen B, Gullapall R, Panizza U (2011) Capital account liberalization, financial development and industry growth: A synthetic view. J Int Money Financ 30(6):1090–1106

Fernández A, Klein MW, Rebucci A, Schindler M, Uribe M (2015) Capital Control Measures: A New Data Set. IMF Econ Rev 64:548–574

Fratzscher M, Straub R (2009) Asset Prices and Current Account Fluctuations in G-7 Economies. IMF Econ Rev 633–654. https://doi.org/10.1057/imfsp.2009.8

Gersovitz M (1988) Saving and development. Handb Dev Econ 1:384–424

Gourinchas P-O, Jeanne O (2013) Capital Flows to Developing Countries: The Allocation Puzzle. Rev Econ Stud 80(4):1484–1515

Greenspan A (2005a) Mortgage banking. American Bankers Association Annual Conference Convention, vol 26. Palm Desert California

Greenspan A (2005b) Current account. Advancing Enterprise 2005 Conference, vol 4. London, England

Grigoli F, Herman A, Hebbel-Schmidt K (2018) Saving in the world. World Dev 104:257–270

Grossman G, Helpman E (1991) Quality Ladders in the Theory of Growth. Rev Econ Stud 58(1):43–61