Abstract

Climate change poses an existential threat to the global economy. While there is a growing body of literature on the economic consequences of climate change, research on the link between climate change and sovereign default risk is nonexistent. We aim to fill this gap in the literature by estimating the impact of climate change vulnerability and resilience on the probability of sovereign debt default. Using a sample of 116 countries over the period 1995–2017, we find that climate change vulnerability and resilience have significant effects on the probability of sovereign debt default, especially among low-income countries. That is, countries with greater vulnerability to climate change face a higher likelihood of debt default compared to more climate resilient countries. These findings remain robust to a battery of sensitivity checks, including alternative measures of sovereign debt default, model specifications, and estimation methodologies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Climate change poses an existential threat to the world economy. With the global average surface temperature rising by 1.1 degrees Celsius since 1880, the frequency and severity of climate shocks—ranging from heatwaves and droughts to hurricanes and coastal flooding—have intensified across the world (Fig. 1). Looking ahead, extreme weather events are projected to worsen as the global annual mean temperatures increase by as much as 4 degrees Celsius over the next century (IPCC 2007; Stern 2007; IPCC 2014).Footnote 1 The economic and financial consequences of climate change will likely be felt across the world, but the extent of potential vulnerability depends on the size and composition of economies, the resilience of institutions and physical infrastructure, and the capacity for adaption and mitigation.

While there is a growing body of literature pointing to significant negative effects of climate-related shifts in the physical environment on economic growth (Gallup et al. 1999; Nordhaus 2006; Dell et al. 2012), research on how climate change can affect financial systems remains a contentious issue with no specific empirical analysis of sovereign default risk.Footnote 2 In Cevik and Jalles (2020), we show that climate change vulnerability and resilience have significant effects on government bond yields and spreads, after controlling for conventional macroeconomic factors, especially in developing countries. In this paper, we uncover another layer of empirical information by estimating the impact of climate change on the probability of sovereign default in a group of 116 countries over the period 1995–2017, taking advantage of a comprehensive dataset on sovereign defaults compiled jointly by the Bank of Canada and the Bank of England and a dataset of climate change vulnerability and resilience developed by the Notre Dame Global Adaptation Institute (ND-GAIN).Footnote 3

This paper contributes to the literature by looking beyond previous studies and providing robust empirical evidence on the relationship between climate change and sovereign defaults, which impose large welfare losses, as countries are cut off from capital markets and creditors typically suffer large losses. We employ alternative estimation methodologies and control for conventional determinants of sovereign default risk. Using a large panel of 116 countries over the period 1995–2017, we find that climate change vulnerability and resilience have significant effects on the probability of sovereign debt default, especially among low-income countries. That is, countries with greater vulnerability to climate change face a higher likelihood of debt default compared to more climate resilient countries. We also find that climate change resilience has a similarly significant negative impact on the probability of debt default. That is, countries that are more resilient to climate change have a lower risk of default relative to countries with greater vulnerability to climate change. These findings remain robust to a battery of sensitivity checks, including alternative measures of debt default, model specifications, and estimation methodologies.

The econometric evidence presented in this paper has policy implications, especially for developing countries that are relatively more vulnerable to risks associated with climate change. While climate change is an inevitable reality across the world with increasing temperatures, changing weather patterns, melting glaciers, intensifying storms and rising sea levels, the negative coefficient on climate resilience shows that enhancing structural resilience through cost-effective mitigation and adaptation, strengthening financial resilience through fiscal buffers and insurance schemes, and improving economic diversification and policy management can help cope with the consequences of climate change for public finances and thereby reduce the likelihood of sovereign default.

The remainder of this paper is organized as follows. Section 2 provides an overview of the related literature. Section 3 describes the data used in the analysis. Section 4 introduces the salient features of our econometric strategy and presents the empirical results, including a series of robustness checks. Finally, Section 5 offers concluding remarks with policy implications.

2 A Brief Overview of the Literature

This paper draws from two prolific threads of the literature: determinants of sovereign debt defaults and the macroeconomic impact of climate change. First, most studies on sovereign defaults acknowledge and find strong evidence that macroeconomic factors matter, including the volatility of growth and terms-of-trade, as well as political and institutional variables (Catão and Sutton 2002; Reinhart et al. 2003; Catão and Kapur 2004; Vaugirard 2005; Manasse and Roubini 2009; Panizza et al. 2009; Reinhart and Rogoff 2009; Hilscher and Nosbusch 2010; Cohen and Valadier 2015). In particular, Aguiar and Gopinath (2006) and Arellano (2008) link sovereign defaults to exogenous income shocks and asset position changes. Likewise, Sturzenegger and Zettelmeyer (2006) find that debt defaults are triggered by an adverse terms-of-trade shock, an economic recession in creditor countries, and an increase in the cost of borrowing.Footnote 4

Second, there is a growing literature on the economic and financial effects of climate-related shifts in the physical environment.Footnote 5 Starting with Nordhaus (1991, 1992) and Cline (1992), aggregate damage functions have become a mainstay of analyzing the climate-economy nexus. Although identifying the macroeconomic impact of annual variation in climatic conditions remains a challenging empirical task, Gallup et al. (1999), Nordhaus (2006), and Dell et al. (2012) find that higher temperatures result in a significant reduction in economic growth in developing countries. Burke et al. (2015) confirm this finding and conclude that an increase in temperature would have a greater damage in countries that are concentrated in geographic areas with hotter climates. Using expanded datasets, Acevedo et al. (2018), Burke and Tanutama (2019) and Kahn et al. (2019) show that the long-term macroeconomic impact of weather anomalies is uneven across countries and that economic growth responds nonlinearly to temperature. In a related vein, it is widely documented that climate change by increasing the frequency and severity of natural disasters affects economic development (Loyaza et al., 2012; Noy 2009; Raddatz 2009; Skidmore and Toya 2002; Rasmussen 2004), reduces the accumulation of human capital (Cuaresma 2010) and worsens a country’s trade balance (Gassebner et al. 2010).

There is, however, no existing research on the relationship between climate change and sovereign default. The closest line of research concerns the impact of climate change on asset prices. Cevik and Jalles (2020) show that climate change vulnerability and resilience have significant effects on government bond yields and spreads, especially in developing countries. In a similar vein, Bansal et al. (2016) and IMF (2020) find that the risk of climate change—as proxied by temperature rises—has a negative effect on asset valuations, while Bernstein et al. (2019) show that real estate exposed to the physical risk of sea level rise sell at a discount relative to otherwise similar unexposed properties. Likewise, focusing on the U.S., Painter (2020) find that counties more likely to be affected by climate change pay more in underwriting fees and initial yields to issue long-term municipal bonds compared to counties unlikely to be affected by climate change.

3 Data Overview

We use several sources to construct a panel dataset of annual observations covering 116 countries over the period 1995–2017.Footnote 6 Economic and financial statistics are assembled from the IMF’s International Financial Statistics (IFS) and World Economic Outlook (WEO) databases, and the World Bank’s World Development Indicators (WDI) database. The data on sovereign defaults is drawn from a comprehensive database developed by the Bank of Canada in partnership with the Bank of England. The database provides estimates of the nominal value of government debt in default, including obligations owed to official and private creditors by country and debt type and aggregated globally (Beers and de Leon-Manlagnit 2019). The database builds on previously published datasets compiled by various public and private sector sources, and combines elements of these, together with new information, to develop comprehensive estimates of stocks of government obligations in default. These include bonds and other marketable securities, bank loans and official loans, valued in US dollars, for the period from 1960 to 2019 on both a country-by-country and a global basis.Footnote 7 Consistent with the literature, the database considers a default when debt service is not made on the due date or within a specified grace period, when payments are not made with the time frame specified under a guarantee, or, absent an outright payment default, when creditors incur material economic losses on the sovereign debt they hold due to the government action. Accordingly, an episode of sovereign default is defined as a binary variable a country has non-missing and non-zero value in a given year in the database.Footnote 8 The database also compiles sovereign debt defaults by the main creditor categories, including foreign currency-denominated loans and bonds and domestic currency-denominated debt, and debt extended by private creditors, multilateral institutions, the Paris Club, and other official creditors.

The main explanatory variables of interest are vulnerability and resilience to climate change as measured by the ND-GAIN indices, which capture a country’s overall susceptibility to climate-related disruptions and capacity to deal with the consequences of climate change, respectively.Footnote 9 The composite indices are based on 45 indicators, of which 36 variables contributing to the vulnerability score and 9 variables constituting the resilience score. Vulnerability refers to “a country’s exposure, sensitivity, and capacity to adapt to the impacts of climate change” and comprise indicators of six life-supporting sectors—food, water, health, ecosystem services, human habitat and infrastructure. Resilience, on the other hand, assesses “a country’s capacity to apply economic investments and convert them to adaptation actions” and covers three areas—economic, governance and social resilience—with nine indicators.Footnote 10

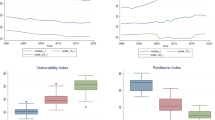

Figure 2 shows the time profile and box-whisker plots for both the climate change vulnerability and resilience indices for the entire sample and income group, respectively. Although the ND-GAIN indices show improvements in climate change vulnerability and resilience in recent years, there is significant heterogeneity across countries. For example, while the mean value of climate change resilience is 48, it varies between a minimum of 32.3 and a maximum of 70.9. Similarly, with the mean value of 33.7, climate change resilience varies between a minimum of 0.2 and a maximum of 71.3. It is also clear from the data that advanced economies are much less vulnerable to climate change than developing countries. It is important to highlight that the time-series variation in the ND-GAIN indices reflect the changes in countries’ levels of vulnerability and resilience (which are not necessarily forward-looking), not from the changes in the projected vulnerability and resilience to physical risks associated with climate change.

Aggregate pictures, however, hide marked heterogeneity across countries that should not go unnoticed. Figure 3a compares the climate change vulnerability index in 1995 with that in 2017. We can see that Canada, Australia, some parts of South America and Asia improved the situation, while Sub-Saharan Africa remained relatively unchanged over the past two decades. In Fig. 3b, we do the same for the climate change resilience index. It is interesting to observe a slight deterioration in the case of the US and in some countries in Sub-Saharan Africa, but improvements in Europe, Russia and other parts of South East Asia as well as South America.

a Climate Change Vulnerability Across the World in 1995 vs 2017. Note: color scheme for less (blue) to more vulnerable to climate change (red). Source: ND-GAIN; authors’ calculations. b Climate Change Resilience Across the World in 1995 vs 2017. Note: color scheme for less (red) to more resilient to climate change (blue). Source: ND-GAIN; authors’ calculations

Following the literature, we introduce a set of control variables following recent papers studying the determinants of sovereign default, including the level and growth rate of real GDP, consumer price inflation, government debt as a share of GDP, financial development as measured by domestic credit to the private sector as a share of GDP, the terms-of-trade index, the real effective exchange rate (REER) index.Footnote 11 There is a significant degree of dispersion across countries (and country groupings) in terms of climate change vulnerability and resilience as well as macroeconomic, fiscal and financial performance, as presented in Appendix Table 5.

4 Empirical Strategy and Results

We empirically investigate the long-term impact of climate change on sovereign defaults. Based on a bivariate characterization, we estimate logistic regressions to assess the probability of debt default and test the impact of climate change, while controlling for conventional determinants of sovereign defaults identified in the literature. In the binary choice model, the dependent variable takes the value 1 in a given year if a country is in default, and the value of 0 otherwise (non-occurrence of default). Accordingly, we estimate the following baseline model:

in which βs are the parameters to be estimated, Climate denotes the measures of climate change vulnerability and resilience, X is a vector of other exogenous variables, and Φ(·) is the logistic function. Using disaggregated indices rather than the overall ND-GAIN index allows us to estimate the separate effects of climate change vulnerability and resilience on the risk of sovereign default. The structural model associated with model (1) can be written as:

where the dependent variable, \( {\mathrm{D}}_{\mathrm{it}}^{\ast } \), is a binary variable taking the value of 1 if there is sovereign default in country i and time t; Climateit − 1 denotes the measures of climate change vulnerability and resilience country i and time t-1; Xi, t − 1 is a set of control variables including government debt, real GDP per capita, real GDP growth, consumer price inflation, a measure of financial development, the terms-of-trade index, and the REER. All control variables are lagged by one year to avoid the problems of simultaneity and endogeneity. The ηi and μt coefficients denote the time-invariant country-specific effects and the time effects controlling for common shocks that may affect the probability of sovereign default across all countries in a given year, respectively. εi, t is an idiosyncratic error term that satisfies the standard assumptions of zero mean and constant variance. To account for possible heteroskedasticity, robust standard errors are clustered at the country level.

As a baseline, the logistic model of sovereign default is estimated for the full sample and separately for emerging market economies and low-income countries during the period 1995–2017. Table 1 presents the results for climate change vulnerability, which is found to have a statistically and economically significant effect on the probability of sovereign debt default. The coefficient on climate change vulnerability ranges between 0.122 and 0.407 depending on the sample coverage, but always remaining positive and statistically significant. This means that greater vulnerability to climate change is associated with higher risk of sovereign default. According to our benchmark model based on the full sample, a one percentage point increase in climate change vulnerability is associated with an increase of 0.41% in the probability of debt default.

The estimation results for climate change resilience, presented in Table 2, confirm that investing in adaptation and mitigation helps lower the probability of sovereign default in our sample of countries during the period 1995–2017. The coefficient on climate change resilience has a statistically and economically significant coefficient, ranging between −0.324 and − 0.402 according to the model specification. In other words, countries that are more resilient to climate change face a lower risk of sovereign default relative to countries with greater vulnerability to risks associated with climate change. According to our benchmark specification, a one percentage point increase in climate change resilience is associated with a decrease of 0.33% in the likelihood of debt default.

These effects of climate change vulnerability and resilience remain robust to the inclusion of other control variables, including foreign reserves, external debt, budget balance, or political and institutional factors as suggested by Kohlscheen (2007), for which we obtain coefficients that are as expected and broadly comparable to the findings in previous studies looking at determinants of sovereign defaults (not shown but available upon request). Nevertheless, we perform several sensitivity checks to validate the robustness of our baseline empirical results.

First, the probability of sovereign default is estimated using the alternative probit model. These results, presented in Table 3 both for climate change vulnerability and resilience, confirm the impact of climate change on sovereign default risk. However, these results should be read with caution as probit models do not render themselves well to the fixed-effects treatment due to the incidental parameter problem (Wooldridge 2002).

Second, we estimate the logistic model for the probability of sovereign default on different types of debt and creditors, including foreign currency-denominated loans and bonds and domestic currency-denominated debt, and debt extended by private creditors, multilateral institutions and the Paris Club, an informal group of 22 bilateral official lenders. These granular estimation results are presented in Appendix Tables 6–7. While they are broadly consistent with our baseline findings, we are cautious due to the small number of rare events that could reduce statistical significance.

For the reason mentioned earlier, our final robustness exercise consists in estimating a rare-events logit (or relogit) model. In a logistic regression, the Maximum Likelihood estimates are consistent but only asymptotically unbiased. The basic problem is having a number of units (default episodes) in a panel that has no events. This means that the country-specific indicators corresponding to the all-zero countries perfectly predict the zeroes in the outcome variable (King 2001). This is a well-known phenomenon in the statistical literature (for an overview see Gao and Shen 2007). The simplest way of dealing with this problem is decreasing the rareness of the event of interest, which is not possible in our setting. Alternatively, we use the bias correction method—the relogit estimator—proposed by King and Zeng (2001).Footnote 12 The relogit estimator for dichotomous dependent variables provides a lower mean square error in the presence of rare events and can be defined as follows:

with i = 1, …, N; t = 1, …, T, where \( \varPhi \left(\cdotp \right)=\frac{1}{1+{e}^{-\left(Z{\prime}_{it}\vartheta \right)}}=\frac{1}{1+{e}^{-\left(\gamma +{\beta}_1\mathrm{Climate}+{\beta}_2X\right)}},\gamma, {\beta}_1,\mathrm{and}\ {\beta}_2 \)are the vectors of the parameters to be estimated, and Φ(·)is the logistic function.

The parameters can be estimated by maximum likelihood, and the variance of the estimated coefficients can be expressed as \( Var\left(\hat{\vartheta}\right)={\left(Z\prime VZ\right)}^{-1} \), where V is a diagonal matrix, with diagonal entries equal to Φ(·) · [1 − Φ(·)]. In the case of rare events, Φ(·) will be generally small. However, as pointed out by King and Zeng (1999a, 1999b, 2001), the estimates of Φ(·) and Φ(·) · [1 − Φ(·)] among observations that include rare events (in our case, for which D = 1) will be typically larger than those among observations that do not include rare events (i.e., for which D = 0). Consequently, their contribution to the variance will be smaller, rendering additional ‘rare’ events more informative than additional ‘frequent’ events. Therefore, we follow King and Zeng (1999a, 1999b) and correct for the small sample and rare events biases and estimate a relogit model where the sampling design is random or conditional on Z′it. These results, presented in Appendix Table 8, validate the baseline findings and remain robust to the inclusion of additional control variables such as government revenues and exports.

5 Conclusion

Climate change is an existential risk. While there is a growing body of literature on the economic consequences of climate change, research on the link between climate change and sovereign default is nonexistent. We fill this gap in the literature by estimating the impact of climate change vulnerability and resilience on the probability of sovereign debt default. Using a large panel of 116 countries over the period 1995–2017, we find that climate change vulnerability and resilience have significant effects on the probability of sovereign debt default, especially among low-income countries. That is, countries with greater vulnerability to climate change face a higher likelihood of debt default compared to more climate resilient countries. Our empirical results also indicate that climate change resilience has a similarly significant negative impact on the probability of sovereign debt default. That is, countries that are more resilient to climate change have a lower risk of debt default relative to countries with greater vulnerability to climate change. These findings remain robust to a battery of sensitivity checks, including alternative measures of debt default, model specifications, and estimation methodologies.

The econometric evidence presented in this paper has policy implications, especially for developing countries that are relatively more vulnerable to risks associated with climate change. While climate change is an inevitable reality across the world with increasing temperatures, changing weather patterns, melting glaciers, intensifying storms and rising sea levels, the negative coefficient on climate resilience shows that enhancing structural resilience through cost-effective mitigation and adaptation, strengthening financial resilience through fiscal buffers and insurance schemes, and improving economic diversification and policy management can help cope with the consequences of climate change for public finances and thereby reduce the likelihood of sovereign default. In particular, low-income countries with limited fiscal capacity could benefit from debt-for-nature swaps designed to mobilize resources for investments in environmental conservation measures while reducing the debt burden (Hansen 1989).

Notes

Climate refers to a distribution of weather outcomes for a given location, and climate change describes environmental shifts in the distribution of weather outcomes toward extremes.

In a recent article, for example, Cochrane (2021) presented a skeptic view of climate-related risks to financial stability.

In this paper, we focus on countries’ exposure to physical risks that correspond to the potential economic and financial losses caused by climate change. However, it should be noted that transition risks related to the process of adjusting toward a low-carbon economy, such as stranded asset exposures in the financial system, can also amount to a sizable burden.

There is also literature on the recovery rate after a debt restructuring process. See e.g. Edwards (2015) for a study on the Argentine case.

Tol (2018) provides a recent overview of this expanding literature.

The list of countries is presented in Appendix Table 4.

Since 1960, 147 governments have defaulted on their obligations—well over half the current universe of 214 sovereigns. Defaults had the biggest global impact in the 1980s, peaking at US$450 billion, or 6.1% of world public debt, by 1990. The scale of defaults has fallen substantially since then. Over the past decade, it has ranged between 0.3 and 0.9% of world public debt, and in 2019 it was an estimated 0.4%.

The analysis of the determinants of sovereign defaults depends on the very definition of debt defaults. It is common in many empirical studies to use debt crises synonymously with debt defaults for simplicity. However, this can be problematic especially in the post-1990s period, as pointed out by Pescatori and Sy (2007). Ams and others (2018) suggest several other ways to define sovereign debt default, including the database used in this paper.

The ND-GAIN database, covering 184 countries over the period 1995–2017, is available at https://gain.nd.edu/.

The ND-GAIN database refers to this series as “readiness” for climate change, which we use as a measure of resilience against climate change. In this context, it should also be noted that the ND-GAIN indices do not reflect fiscal insurance schemes for natural disasters that may occur due to climate change.

King and Zeng (2001) describe rare events as “dozens to thousands of times fewer ones […] than zeroes.”

References

Acevedo S, Mrkaic M, Novta N, Pugacheva E, Topalova P (2018) The effects of weather shocks on economic activity: what are the channels of impact? In: IMF Working Paper No. 18/144. International Monetary Fund, Washington

Aguiar M, Gopinath G (2006) Defaultable Debt, Interest Rates and the Current Account. J Int Econ 69(1):64–83

Arellano C (2008) Default risk and income fluctuations in emerging economies. Am Econ Rev 98:690–712

Bansal R, Kiku D, Ochoa M (2016) Price of Long-Run Temperature Shifts in Capital Markets. In: NBER Working Paper No. 22529. National Bureau of Economic Research, Cambridge

Beers D, de Leon-Manlagnit P (2019) The BoC-BoE sovereign default database: What’s new in 2019? In: Bank of Canada Staff Working Paper No. 2019–39. Bank of Canada, Ottawa

Bernstein A, Gustafson M, Lewis R (2019) Disaster on the horizon: the Price effect of sea level rise. J Financ Econ 134:253–272

Burke M, Tanutama V (2019) Climatic Constraints on Aggregate Economic Output. In: NBER Working Paper No. 25779. National Bureau of Economic Research, Cambridge

Burke M, Hsiang S, Miguel E (2015) Global nonlinear effect of temperature on economic production. Nature 527:235–239

Catão L, Kapur S (2004) Missing Link: Volatility and the Debt Intolerance Paradox. In: IMF Working Paper No. 04/51. International Monetary Fund, Washington, DC

Catão L, Sutton B (2002) Sovereign Defaults: The Role of Volatility. In: IMF Working Paper No. 02/149. International Monetary Fund, Washington, DC

Cevik S, Jalles J (2020) This Changes Everything: Climate Shocks and Sovereign Bonds. In: IMF Working Paper No. 20/79. International Monetary Fund, Washington, DC

Cline W (1992) The economics of global warming. New York University Press, New York

Cochrane J (2021) Don’t let financial regulators dream up climate solutions. City Journal 24:2021 https://www.city-journal.org/dont-let-financial-regulators-dream-up-climate-solutions

Cohen D, Valadier C (2015) Endogenous Debt Crises. J Int Money Financ 51:337–369

Cuaresma J (2010) Natural Disasters and Human Capital Accumulation. World Bank Econ Rev 24:280–302

Dell M, Jones B, Olken B (2012) Temperature shocks and economic growth: evidence from the last half century. Am Econ J Macroecon 4:66–95

Edwards S (2015) Sovereign Default debt restructuring and recovery rates: was the Argentinean “haircut” excessive? Open Econ Rev 26:839–867

Gallup J, Sachs J, Mellinger A (1999) Geography and economic development. Int Reg Sci Rev 22:179–232

Gao S, Shen J (2007) Asymptotic properties of a double penalized maximum likelihood estimator in logistic regression. Statistics and Probability Letters 77:925–930

Gassebner M, Keck A, Teh R (2010) Shaken, Not Stirred: The Impact of Disasters on International Trade. Rev Int Econ 18:351–368

Hansen S (1989) Debt for nature swaps — overview and discussion of key issues. Ecol Econ 1:77–93

Hilscher J, Nosbusch Y (2010) Determinants of sovereign risk: macroeconomic fundamentals and the pricing of sovereign debt. Review of Finance 14:235–262

Intergovernmental Panel on Climate Change (IPCC) (2007) Fourth assessment report, intergovernmental panel on climate change. Cambridge University Press, New York

Intergovernmental Panel on Climate Change (IPCC) (2014) Climate change in 2014: mitigation of climate change. Working group III contribution to the fifth assessment report of the intergovernmental panel on climate change. Cambridge University Press, New York

International Monetary Fund (2020) Physical Risk and Equity Prices. In: Global Financial Stability Report, Chapter 5. International Monetary Fund, Washington, DC

Kahn M, Mohaddes K, Ng R, Pesaran M, Raissi M, Yang J-C (2019) Long-Term Macroeconomic Effects of Climate Change: A Cross-Country Analysis. In: IMF Working Paper No. 19/215. International Monetary Fund, Washington, DC

Kaminsky G, Vega-García P (2016) Systemic and idiosyncratic sovereign debt crises. J Eur Econ Assoc 14:80–114

King G (2001) Proper nouns and methodological propriety: pooling dyads in international relations data. Int Organ 55:497–507

King G, Zeng L (1999a) Logistic Regression in Rare Events Data. In: Department of Government Working Paper. Harvard University, Cambridge

King G, Zeng L (1999b) Estimating Absolute, Relative, and Attributable Risks in Case-Control Studies. In: Department of Government Working Paper. Harvard University, Cambridge

King G, Zeng L (2001) Explaining rare events in international relations. Int Organ 55:693–715

Kohlscheen E (2007) Why are there serial defaulters? Evidence from Constitutions. J Law Econ 50:713–730

Manasse P, Roubini N (2009) Rule of thumb for sovereign debt crises. J Int Econ 78:192–205

Nordhaus W (1991) To slow or not to slow: the economics of the greenhouse effect. Econ J 101:920–937

Nordhaus W (1992) An optimal transition path for controlling greenhouse gases. Science 258:1315–1319

Nordhaus W (2006) Geography and macroeconomics: new data and new findings. Proc Natl Acad Sci U S A 103:3510–3517

Noy I (2009) The macroeconomic consequences of disasters. J Dev Econ 88:221–231

Painter M (2020) An inconvenient cost: the effects of climate change on municipal bonds. J Financ Econ 135:468–482

Panizza U, Sturzenegger F, Zettelmeyer J (2009) The economics and law of sovereign debt and default. J Econ Lit 47:651–698

Pescatori A, Sy A (2007) Are debt crises adequately defined? IMF Staff Pap 54:306–337

Raddatz C (2009) The wrath of God: Macroeconomic Costs of Natural Disasters. In: World Bank Policy Research Working Paper No. 5039. World Bank, Washington, DC

Rasmussen T (2004) Macroeconomic Implications of Natural Disasters in the Caribbean. In: IMF Working Paper No. 04/224. International Monetary Fund, Washington, DC

Reinhart C, Rogoff K (2009) This time is different: eight centuries of financial folly. Princeton University Press, Princeton

Reinhart C, Trebesch C (2016) Sovereign debt relief and its aftermath. J Eur Econ Assoc 14:215–251

Reinhart C, Rogoff K, Savastano M (2003) Debt Intolerance. Brook Pap Econ Act 34:1–74

Skidmore M, Toya H (2002) Do natural disasters promote long-run growth? Econ Inq 40:664–687

Stern N (2007) The economics of climate change: the Stern review. Cambridge University Press, Cambridge

Sturzenegger F, Zettelmeyer J (2006) Debt defaults and lessons from a decade of crises. MIT Press, Cambridge

Tol R (2018) The economic impacts of climate change. Rev Environ Econ Policy 12:4–25

Vaugirard V (2005) Crony capitalism and sovereign default. Open Econ Rev 16:77–99

Wooldridge J (2002) Econometric analysis of cross section and panel data. MIT Press

Acknowledgements

The authors would like to thank the editor, George Tavlas, and two anonymous referee for their insightful comments that led to marked improvements in the paper. An earlier version of this article benefited from comments and suggestions by Cristian Alonso, Pierre Guerin, Mick Keen, Yuko Kinoshita, Roberto Piazza, and Aleksandra Zdzienicka. This work was supported by the FCT (Fundação para a Ciência e a Tecnologia) [grant numbers UID/ECO/00436/2019]. The views expressed herein are those of the authors and should not be attributed to the IMF, its Executive Board, or its management (Cevik) and the University of Lisbon’s School of Economics and Management (Jalles).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Cevik, S., Jalles, J.T. An Apocalypse Foretold: Climate Shocks and Sovereign Defaults. Open Econ Rev 33, 89–108 (2022). https://doi.org/10.1007/s11079-021-09624-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-021-09624-8