Abstract

In order to study the market coordination under non-equilibrium dynamics, such as the one outlined in catallactics, we consider a multi-agent system with fixed topology, based upon a Hamiltonian structure, subject to flocking behavior. The assumptions of market segmentation and of imperfect competition are introduced. We show that the catallactic framework leads to the emergence of a stable market coordination, but is also a dissipative structure of cyclical nature, such that imperfect competition gives rise to a pseudo-competitive market. In case of risk-sharing, we find that catallactics yields an unstable trading system, which transforms the market risk into a systemic risk.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Approaching the well-known topic of coordination by market mechanisms can be done without necessarily going through the panoply of tools used in standard microeconomic theory. While recalling some of its fundamental principles in the following paragraphs, the work presented hereafter builds on three streams of academic literature, which are catallactics, agent-based modeling and risk management.

To start with, let us first recall that the issue of coordination is of major importance in economics, the question being addressed is how a multitude of actors interacting with each other manage to successfully coordinate their actions (Kapás 2006). Indeed, agents evolve in a setting where their own decisions depend upon the decisions of others (Ebeling 1987). Klein (1997) and Sautet (2002) refer to two kinds of coordination. The first one implies a concatenation of activities that leads to the production of coordinated results. The second relates to situations where an agent intentionally coordinates its actions with those of others. In this case, coordination is understood as an achievement of concerted action. One of the prevailing research questions in microeconomic theory is about the market equilibrium resulting from a collective coordination, in which quantity demanded and quantity supplied are equal. In time, formalizing this economic state has become a problem of mathematical analysis. Its solution has been mostly found in the use of optimization techniques borrowed from Lagrangian and Hamiltonian mechanics (Mirowski 1991).

In game theory, agents are considered to be strategic players in competition on the markets where they exert their market power (Abada et al. 2013). An interesting result from the game-theoretic literature shows that the indeterminacy of equilibrium, as a concept of optimal outcome issued from the players’ interactions, is inherent to the joint hypotheses of rationality and its common knowledge. In this case, the structure of the economy is reflexive, such that the goal of an agent is to forecast the behaviors of others (Taillard 2006). Schelling (1960) observed that focal points, as a mechanism that creates convergent expectations on which equilibrium to choose, play an essential role in coordination problems. In general, the papers related to this topic documented the way agents focus their attention on one prominent or conspicuous equilibrium (Young 1993). The two other equilibrium selection theories are introspection (Harsanyi and Selten 1988) and dynamics of convergence (Crawford and Haller 1990). The absence of equilibria can be the outcome of uncoupled dynamics, where the adjustment of a player’s strategy does not depend on the payoff functions of the other players (Hart and Mas-Colell 2003). The possibility that non-equilibria might be focal too, and thus might facilitate coordination, needs to be recognized and investigated (Bosch-Domènech and Vried 2013). The last authors find that the non-equilibrium focal point acts as an equilibrium selection device from which players coordinate on a small subset of what they term the associated Nash equilibria.

A complex system is regarded as efficient if it produces high coordinatedness. The fact that markets provide the broad institutional framework for coordinating is in the public domain. For instance, catallactics or spontaneous order is a theory proposed by Hayek (1978) to describe the order, brought about by the mutual adjustment of many individual economies, in a system that aims at reaching exchange rates and prices. The process has been suggested for the purpose of providing an explanation for the emergence of the free market system despite diverse ends pursued by its actors. It can be understood as a network of firms and households and has no specific purpose of its own (Kapás 2006). As for the kinds previously mentioned, the coordination achieved through catallactics forms part of the first one, because agents are not aware that they participate in a coordination game. In this sense, coordinatedness is a spontaneous outcome of market activities. The theory does not insist on the existence of equilibrium or that of multiple equilibria, for it sees coherence in economies to namely come from exchange. It should also be noted that it considers the unlikelihood of attaining optimality in coordination proceedings. Therefore, the only valid policy implication in this paradigm is to prevent artificial impediments to the exchange processes (Barry 1992).

Instead of representing individuals constrained by strong consistency requirements relative to equilibrium and rationality, agent-based modeling describes heterogeneous agents living in complex systems that evolve through time (Windrum et al. 2007; Müller and Pyka 2016). An underlying element of agent-based modeling is its bottom-up perspective, which describes a system from the perspective of its constituent units (Axelrod 1997; Bonabeau 2002). One well-known example of this principle comes from Reynolds (1987), who recreated the complex behavior of a flock of birds by disaggregating the flock into birds using three behavioral rules. It is noteworthy that no central authority governs the components in this framework: as a decentralized activity, each of them individually follows the rules and reacts only to its local neighborhood.Footnote 1 When applied to economics, this consists in modeling macro-entities, such as economic systems, through the actions and interactions of micro-agents, such as firms or households (Müller and Pyka 2016). By analyzing the strategic decision making in large populations of small interacting components, we situate the analysis within the mean-field theory, such that the effects on an agent from its neighborhood are approximated by an averaged effect (Lasry and Lions 2007).

A well-functioning market can howbeit be exposed to a multitude of shocks that can imperil the overall coordination organizing the economic system. Market risk is the possibility for an agent to experience profitability losses due to factors that affect the overall performance of the markets in which it is involved. It arises from the fluctuating prices of investments. The sub-components of market risk are currency risk, interest rate risk, commodity risk and equity risk. They can affect, in an undifferentiated way, various economic sectors both in terms of trade and profit. The market risk then spills over into a business risk (Reuvid 2011), the after-effects of which are taken into consideration in the present work. Exogenous economic shocks usually provoke unanticipated and exaggerated market volatility (Bloom 2009), which causes sharp swings in trade intensities. In response, long-term contracts were designed as a risk-sharing measure between producers and traders. They can also be used as a tool to mitigate the market power of the producers (Abada et al. 2013). Timely, risk-sharing through contracts and agreements occurs when two parties identify a market risk and agree to share the potential loss upon the likelihood of loss (Ramamohan Rao 2016). It is meant to be a precautionary measure which prevents the economic system from disintegrating. This scheme can be envisioned in form of flocking behavior facing an external obstacle (Olfati-Saber and Murray 2003), in which each agent applies a risk-sharing protocol so as to cushion the shock.

In order to study the market coordination under non-equilibrium dynamics, such as the one outlined in catallactics, we consider a multi-agent system with fixed topology, based upon a Hamiltonian structure, subject to flocking behavior. The clustering of agents through flocking has previously been considered in Raafat et al. (2009) and Terano et al. (2009), but mostly to investigate on biological and mobile-agent systems. To the best of our knowledge, the present research article is the first to envisage market emergence and evolution as such. With respect to the existing literature in economics (Debreu 1959) combined with agent-modeling (Matsuda et al. 2010), the assumptions of market segmentation – as a result of monopolistic competition (Chamberlin 1953; Guttman and Maes 2006) – and of imperfect competition (Burguet and Sákovics 1999; Bunn and Martoccia 2008) are introduced. Indeed, assumptions of monopoly or perfect competition are often made in classical microeconomics, whereas real world settings are mostly located in between (Weiss 1999). In case of perfect competition, all agents try to maximize their expected profit. The absence of monopolistic markets is then justified by the fact that when a monopoly begins to vindicate its market power, the consumers react by decreasing their demand (Csercsik 2016). The paper could also fit into the alternative paradigm of complexity economics, which holds that the economy is a system neither in equilibrium nor optimal, which would otherwise be performed by dint of optimal collective moves. The system is rather in motion and is built on structures that form and reform. Such a complex system is associated with non-equilibrium (Arthur 2014).

We show that the evolution of market positions depends on market powers and on the evolution of trade intensities, the latter being contingent on the joint-evolving of partnering agents and of market segmentation. Likewise, we find that the catallactic framework leads to the emergence of a stable market coordination, but is also a dissipative structure of cyclical nature, such that imperfect competition gives rise to a pseudo-competitive market. In the risk-sharing scenario, the evolution of market positions depends, in addition, on the number of partnering agents and on the level of risk transfer they agree on. In this case, the catallactic framework emerges as an unstable trading system which transforms the market risk into a systemic risk.

The remained of the paper is organized as follows. Section 2 provides a detailed description of agent flocking behavior in a Hamiltonian energy-based structure. In Section 3, we extend the analysis to the risk-sharing scenario. Section 4 is devoted to illustrating simulation examples. Section 5 concludes.

2 Model

2.1 Dynamics

Following the works by Olfati-Saber and Murray (2003), Wang and Wang (2010) and Luo et al. (2010), denote the following framework of N agents, where the evolution of the market position of each agent, described by m-dimensional equations which map control inputs to states, evolves according to the dynamics of its market power (\(\dot {r}_{i}\)) and of its trade intensity (\(\dot {v}_{i}\)) through

for i = 1, ... , N, where \(r_{i} \in \mathbb {R}_{+}^{m}\) corresponds to the market power of agent i,Footnote 2\(v_{i} \in \mathbb {R}_{+}^{m}\) is its trade intensityFootnote 3 and \(u_{i} \in \mathbb {R}_{+}^{m}\) is the control input of agent i which stands for its economic behavior governed by Reynolds’ three rules, which are cohesion, separation and alignment.Footnote 4 In the market paradigm, cohesion would stand for the capacity of agents to establish long-term corporate partnerships for the purpose of ensuring their perennity, separation would imply the absence of an outlawed collusive behavior between them, and alignment, as a third rule, would suggest the maintenance of atomicity, such that none of them has the capacity to influence the overall market price.

Provided the existing literature on flocking models,Footnote 5 the following assumptions on the dynamic system are made: (1) agents have knowledge of market powers and of trade intensities of agents involved in partnership and that of market segments at stake; (2) the trade intensities of agents are assumed to be non-linear, such that the atomicity constraint is partially relaxed, allowing for the presence of imperfect competition; (3) agents targeting a specific market segment tend to engage in business partnerships, while those addressing different segments separate from the former.

Consider the relative market power vectors by rij = ri − rj, for i = 1, ... , N and i ≠ j. The aggregate model of flocking is a linear combination of all behavior rule vectors (García-Pedrajas et al. 2010). Thereby, the behavior or control protocol of agent i is defined as ui = αi + kβi, where \(\alpha _{i} \in \mathbb {R}_{+}^{m}\) reflects the cohesion and separation rules, and \(\beta _{i} \in \mathbb {R}_{+}^{m}\) stands for the alignment rule weighted by coefficient k > 0. Indeed, the results of the rules are weighted and summed to give a steering force that will be used by an agent to calculate its velocity with respect to the neighborhood (Lapalu et al. 2013). In our modeling framework, the linear combination enables to avoid trade-offs between the three rules at stake. For example, would the rules be subject to convex combinations, the overall coordination could be in danger.

2.2 Topology

In what follows, the exchanges between agents are unoriented, that is, the directionality of trade is ignored. Likewise, the cost of engaging in a business partnership is not being taken account of. The topology of the multi-agent system can thus be represented by a graph that is both undirected and unweighted (Caldarelli 2010).Footnote 6 Let G be a graph consisting of a set of vertices, V = {v1, ... , vN}, and of E = {(vi, vj) ∈ V × V, j ≠ i}, the set of edges or connections between those agents. Graph G is computed for each time period t, where t ∈ [0, ∞). The adjacency matrix A = [aij] is defined as a matrix with elements such that aij = 1, if (i, j) ∈ E, and aij = 0 otherwise. If two agents exchange, they are considered to be in partnership and connected in the topology. The set of partners of agent i at time t, from which the trading market emerges, is defined by Ni(t) = {j ∈ V : (i, j) ∈ E}. The cluster of trading agents in a competitive market (M) is given by

where ∥⋅∥ is the Euclidean norm in \(\mathbb {R}_{+}^{m}\) and R – which is assumed to be constant in time – exemplifies the threshold gap in market powers below which the monopolistic market setting is prevented. Otherwise, the initial set of trading partners is no longer observable.

The time-varying degree matrix of G is represented by D = [dij], the valence of Ni(t), and the graph Laplacian matrix \(L=[l_{ij}] \in \mathbb {R}^{N \times N}\) is defined as equal to − 1 when j ∈ Ni(t), |Ni| when j = i, and 0 otherwise. In what follows, m-dimensional graph Laplacians (Olfati-Saber 2006; Luo et al. 2010) shall be used

where ⊗ denotes the Kronecker product and \(I_{m} \in \mathbb {R}^{m \times m}\) is an m-dimensional identity matrix.

2.3 Hamiltonian

An energy-based approach of the market system – which has long been put off –, such as the conservation law described by Samuelson and Solow (1956) in the search of the optimal growth path, is reintroduced. The total energy Hamiltonian function of agent i, which is also chosen as a Lyapunov function candidate, is defined so as to enable investigating the shift of agent i position on the market at time tFootnote 7

for i = 1, ... , N, where Vi(t) corresponds to a stored potential energy function of agent i or its profitability gained from the market power,Footnote 8 which is assumed to be independent from those of other agents in the partnership. This postulate is motivated by the fact that accumulated profitability corresponds to the existing viability that does not depend on the trades being made. For instance, trading partners can be fast-growing unprofitable companies. The second term Ei(t) corresponds to the kinetic energy of agent i, that is, the opportunity for increase or the threat of decline in market power or profitability relative to the change in trade intensities of partnering agents. As for Φi(t), it denotes the repulsive potential function or the market segmentation, defined as a non-negative smooth pairwise potential function, in such a way that agents in pursuit of profitability on different market segments gi, for i = 1, ... , N, separate from each other.Footnote 9

Lemma 1

In a non-equilibrium Hamiltonian structure, the market position of agent i at time t results from its stored profitability via market power, its change in profitability contingent on trade intensities of partnering agents, along with its search for profitability through market segmentation.

Given the definition of ui, αi, which contains the cohesion and separation rules, is chosen to be the negative of the Hamiltonian partial derivative over ri, thereby representing the marginal loss of agent i total energy in light of its market power at time t. Likewise, βi, which stands for the alignment rule, equals the negative difference in trade intensities or the impact on profitability of agent i at time t from the aggregated trade intensity of the partnering neighborhood. The precedent yields

where aij > 0 is the adjacency matrix and fij is the vector field symbolizing the tiered rate of change in trade intensity, where fij(x(t)) is continuous, with x(t) ∈ Ni(t), fij(x(t)) = −fji(−x(t)), \(x(t) \subseteq \mathbb {R}_{+}^{m}\) and x(t)Tfij(x(t)) > 0. The dynamic model then resumes to

The differentiation of potential functions leads to the measure of forces that are exerted on the system, that is, the opportunities and threats for agent i to preserve its position on the market. Accordingly, we obtain

The state of the system is thus defined by the market power of node vi(t), that is, the evolution of agent i depends on where it stands at time t. It is also defined by the change in trade intensity, from which results its magnitude of market power, depending on the trade-off between (1) the combined force yielded by (1’) the profitability and by (1”) the negative feedback from the neighboring trade intensities acting on agent i. The change also comes from (2) the repulsive force issued from the separation of agents heading toward different market segments. When \(\dot {v}_{i} = 0\), the forces hereinabove cancel each other and the evolution of market power is null or stabilized. Using Lemma 1, the following proposition can be formalized.

Proposition 1

In a non-equilibrium Hamiltonian structure,the evolution of profitability of agenti at timet + 𝜖, with𝜖 > 0,depends on its market power as well as on the evolution of its trade intensity,the latter being contingent on the joint-evolving of trade intensities ofpartnering agents and that of market segmentation.

It can be easily noticed that the vector field is not conservative, for the partial derivatives yield different results. This property implies that the trajectory toward the profitability objective is path dependent.Footnote 10 As a result, the choice of a particular trajectory during the displacement to a target market share decides on the final position of agent i. The outcome thus validates the facts that imperfect competition, through non-linear trade intensities, as well as the repulsive potential function, as a trigger to market segmentation, do impact the energy conservation, that is, the market position of agent i can either be improved or deteriorate.

Corollary 1

Under the Hamiltonian formulation of non-equilibrium dynamics, market segmentation annuls the effects resulting from imperfect competition.

The set of all possible positions of the dynamic system is the configuration space. When we stack the vectors of the system inputs, that is, \(r:=\left ({r_{1}^{T}}, ... , {r_{N}^{T}} \right )^{T}\) and \(v:=\left ({v_{1}^{T}}, ... , {v_{N}^{T}} \right )^{T}\), the aggregated state of the network can be shaped in form of a Hamiltonian system

The Laplacian matrix L is symmetric and positive semi-definite. Given than k > 0 and Im > 0, k(L ⊗ Im) is positive semi-definite as well. As long as aij > 0, the network connectivity should be preserved at time t. Hence, we remark that the Hamiltonian structure applied to a network topology enables to maintain the network connected: a condition which is necessary, but not sufficient, for a stable market setting to emerge.

From the foregoing, let us now explore the asymptotic stability of the dynamic system. The time derivative of the Hamiltonian equals to

which corresponds to a stable flocking system of exchanges.Footnote 11 The following proposition ensues.

Proposition 2

Under the Hamiltonian formulation of non-equilibrium dynamics, the catallactic framework leads to the emergence of a stable market coordination.

Furthermore, LaSalle’s invariance principle addresses the asymptotic stability of a system (Dragicevic and Sinclair-Desgagné 2013). Given the trajectory toward the objective, the principle gives v(t)Tfij(v(t)) → 0 when t → ∞. In consequence, vi − vj tends to the null-space of L asymptomatically. This implies that vi = vj. Therefore, the trade intensities of all N agents converge to the average one from time 0 or \(\bar {v}(t) \equiv \frac {1}{N} {\sum }_{i = 1}^{N} v_{i}(0)\), which provokes the dissipation of imperfect competition. The dynamic system thus proves to be dissipative, with respect to a supply rate function \(s \in \mathbb {R}_{+}^{m}\), encapsulated in the Lyapunov function (Arcak et al. 2016), such that

for 𝜖 > 0 and τ ∈ [t, t + 𝜖].

In parallel, the non-linear evolution of trade intensities, which can then be understood as market frictions, generates a cyclic behavior (Ogula 2003). The last is generally encountered in oscillatory systems (Strogatz 1994). The catallactic structure is thus dissipative and of cyclical nature. Indeed, flocks are out-of-equilibrium systems, where energy is continuously injected and dissipated at the individual level (Cavagna et al. 2015). In the market paradigm, the result can be interpreted in terms of continuous changeability of market powers by reason of perpetual variation of trade intensities. And yet, the mean values should remain stationary at an aggregated level. This result coincides with the claim, stated by Hayek (1978), according to which the enterprise monopolies can emerge but cannot endlessly dominate the market, even if they can temporarily harm the market process of spontaneity and evolution, simply because they are automatically removed by free competition (Papaioannou 2012). Thereby, the dissipativity of the dynamic system impedes the gains from exchanges to lock the market powers reached by the agents, especially if they are highly lopsided. On the other side, the negativity of the Hamiltonian partial derivative over ri prevents the agents from colluding. The overall coordination on different market segments is hence ensured.

Just as the prices charged on the market tend to draw near the market clearing price, which reflects the price of a market in equilibrium, we see that, under non-equilibrium dynamics, the trade intensities tend to approach the mean value. The latter is invariable in time. This result suggests the spontaneous emergence of a stable trading setting in which the exchanges are operated through uniform agreements. Nevertheless, by means of imperfect competition, the presence of which is inevitable, and by that of market segmentation, the market power of participants fluctuates. Without achieving perfect competition in stationarity, the catallactic framework thus leads to pseudo-competitive markets. This implies that vi ≠ vj should occur at least in an ephemeral way.

Corollary 2

Under the Hamiltonian formulation of non-equilibrium dynamics, the catallactic framework goes through perfect competition in a transient phase.

To reach a steady competitive market, the property of having vi = vj, or identical trading intensities, would have to be unconditionally verified. Due to the presence of market frictions, this is impossible to satisfy (Cho and Meyn 2010). In reality, all trading opportunities, which would lead to uniform agent profiles, cannot be seized. Nevertheless, market frictions have a higher impact in the short-run than in the long-run (Syz 2008). Consequently, pseudo-competition ought to lead to perfect competition when t → ∞.

3 Risk-Sharing

The following refers to modeling undertaken by Olfati-Saber and Murray (2003) and Namatame and Chen (2016). Let us now consider the risk-sharing scenario, in which all agents are exposed to an exogenous shock. Should this be the case, the risk of profitability loss, induced by the shock, is shared between the agents. Those are supposed to hold bilateral relations through a degree-weighted transfer of risk \((1-\phi )d_{i}^{-1}\), where ϕ ∈ [0, 1] is the level of risk and D = [dij], for i = 1, ... , N, is a diagonal degree matrix. This time, we have

We have \(\lim _{\phi \to 0} \left \{ (1- \phi )v_{i}(t)/d_{i} - \phi v_{j}(t)/d_{j} \right \} = v_{i}(t)/d_{i}\) and a limit equal to − vj(t)/dj as ϕ → 1. When the occurrence of risk is considered to be null, the trade intensity of agent i is weighted by the the number of its partnering agents. On the contrary, as the risk heads toward certainty, the evolution of profitability matches with the shared loss in trade intensity. This time, the latter is theoretically mutualized through the risk-sharing contract and is dependent on the neighborhood of the partnering agent.

We obtain

The state of the system is equivalent to that of the standard case, with the exception that the negative feedback, relative to the neighboring trade intensities acting on agent i, is now subject to risk-sharing, which implies that it both depends on the level of risk transfer and on the network topology or degree distribution. This is summarized in the following proposition.

Proposition 3

In a non-equilibrium Hamiltonian structure withrisk-sharing, the evolution of profitability of agenti at timet + 𝜖, with𝜖 > 0, depends on its market power as well as on the evolution of its trade intensity,the latter being contingent on the joint-evolving of trade intensities relative tothe number of partnering agents, the level of risk transfer they agreed on, andthat of market segmentation.

In the light of the correspondence between the degree matrix and the adjacency matrix, where dij = −aij, the Hamiltonian system in the risk-sharing scenario becomes

When ϕ > 0, the Hamiltonian structure enables to maintain the network connected; otherwise, ϕ = 0 yields a Laplacian which unveils the disconnection of agents. In fact, as the market coordination of agents is now intended for sharing risk, the absence of risk implies the uselessness to coordinate through the market setting. Ergo, the emergence of the market coordination is triggered by the sole appreciation of risk.

The time derivative of the Hamiltonian yields

which is a feature of an unstable system of trading.

Proposition 4

Under the Hamiltonian formulation of non-equilibrium dynamics with risk-sharing, the catallactic framework leads to the emergence of an unstable market coordination.

Provided that \(\dot {H}(r(t), v(t))\) is positive semidefinite, LaSalle’s invariance principle cannot be used as a criterion to prove its asymptotic stability. When the purpose of market coordination resumes to initiating risk-sharing between the agents, their trade intensities converge to the average value from time 0 at ϕ = 0. This is in contradiction with the fact that the value implies an absence of risk as well as a Laplacian of a disconnected network.

We can thus summarize the precedent by stating that risk-sharing contracts enable to initiate an overall market coordination, but – through this mechanism – the latter also runs the risk of collapsing in time. As a consequence, the loss in profitability should dismantle the market coordination, which signifies the occurrence of a systemic risk.Footnote 12

Corollary 3

Under the Hamiltonian formulation of non-equilibrium dynamics with risk-sharing, the catallactic framework transforms the market risk into a systemic risk.

4 Simulations

4.1 Flocking

Based on the properties previously obtained, the aim of this section is to illustrate, through simple numerical examples, the long-term market configuration. Its evolution depends on market powers and on trade intensities. Consider a system of 4 agents with fixed topology specified in (1).

The initial positions of agents are generated by a random integer between 0 and 1, the initial velocities are generated by a random integer between 0 and 1, and the weighting parameter k equals 5. The objectives in market powers of 0.25, 0.50 and 0.75 are respectively allotted to agent 2, agent 3 and agent 4. As we now launch the numerical simulations, the model outputs can be examined in Fig. 1.

Time-evolving market powers (\(\dot {r}_{i}\)), for i = 1, ... , 4, in a time interval t ∈ [0, 10]. The blue trajectory corresponds to v1, the red trajectory to v2, the green trajectory to v3 and the purple one to v4. The time dimension is displayed along the x-axis. The y-axis denotes the relative market powers as a function of time (vi(t)). The variations in trade intensities (\(\dot {v}_{i}\)) are represented by the changing slopes. The black dotted curve outlines the average trade intensity \(\bar {v}(t)\)

Under imperfect competition and market segmentation, the market coordination between agents, distinguished by their market positions and objectives, can be attained through the flocking process, thereby validating Proposition 2. In spite of significant differences in market powers randomly generated at t = 0, the latter tend to homogenize, by cause of market corrections, as of the first period: the uphold of Proposition 1 is thus endorsed as well. The separation rule is verified by the fact that the respective paths do not overlap, except in an ephemeral manner.

On the subject of trade intensities, which are represented by the slopes of the trajectory curves, after a sharp inflation of market power of agent 3 at t = 2, they rapidly converge at t = 3 and remain in a trend of small variations until t = 9. This is due to the alignment rule. As partially stated in Corollary 1, the catallactic framework does not freeze out the occurrence of imperfect competition or that of market volatility. Instead, it eliminates these market symptoms through segmentation within a short time-frame, which is, after all, the structural role it has been assigned.

On the side of the objectives pursued by agents 2, 3 and 4, they are respectively attained, if not surpassed, at t = 6, t = 2, and t = 10. We should note that they are systematically achieved to the detriment of other agents which market powers either fall or collapse. This corresponds to a market state characterized by two segments, one of which is a transient monopoly while the other experiences perfect competition. And yet, as observed at the early stage, this configuration is of a short period of time, which entails the cyclical structure of market dynamics, leading back automatically to a pseudo-competitive setting. Surprisingly, agent 3 reaches its intended goal before agent 2. Once again, this can be explained by its outsider position at t = 1, after which it targets a different market segment in which it holds the competitive monopoly. Just afterward, the cohesion rule brings it back to its relative market position, before stabilizing the flocking of agents until the very end.

At last, let us point out that, such as proved in Proposition 2, the average value of velocities is of 0.25 with a standard deviation equal to 0.00. Although perfect competition is impossible to drag out, the stability of the average trade intensity throughout the simulation period confirms the dissipativity stated in Corollary 2.

For comparison purposes, we then simulated a market augmented by 2 agents, endowed with respective market powers of 0.33 and 0.60. The main difference with the benchmark framework of 4 agents lies in their respective trajectories, which are subject to larger oscillations. The market segmentation is thus slightly accentuated. Thanks to the maintenance of cohesion, this phenomenon does not jeopardize the overall market coordination. Another interesting feature is about the average trade intensity. Throughout the additional simulation, its level stands steadily at 0.16, be it a standard deviation of 0.00, which corresponds to a downward deviation from the previous case. The catallactic framework is thus uniquely sensitive to the increasing number of market participants at the level of the average trade intensity. Through the fall of the latter, the result confirms that the atomistic market structure is in real capacity to prevent the appearance of monopolistic practices, for the attempt to gain an exclusive market position is more challenging with lower mean trading opportunities.

4.2 Risk-Sharing

Let us now consider the previous parameters with regard to the risk-sharing protocol. We set ϕ = 0.5 and di = 3, for i = 1, ... , 4. The choice, in the simulation example, of a level of risk equal to 0.5 comes from the fact that we are not considering expected utility functions but a statistical expectation of the risk. For example, trivial lotteries are mostly based on outcomes distinguished by a probability of 0.5. The latter indicates an outcome that is as likely to happen as it is to not happen.

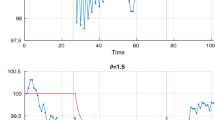

The validity of Proposition 3 can be checked by observing the evolution of trajectories depicted in Fig. 2. Likewise, the trading system with transfer of risk leads to an unstable flocking process or market coordination which allows to validate Proposition 4. Indeed, after a random sampling of agents at t = 0, with two distinguished segments where agent 1 holds competitive monopoly while agents 2, 3 and 4 operate in perfect competition, the market setting rapidly falls down at t = 1. Although this reconfiguration eventually means that all agents now operate in a single segment characterized by atomicity, the drop of the average value of velocities from 0.25 to 0.00 implies the momentary cessation of market activity. Even with the cohesion and alignment rules, agent 1 gets permanently disconnected from t = 1. At t = 3, the market coordination gets back up off the ground, but the market collapse reoccurs at t = 4. Only from this point of time, and until the time-frame terminal, does it stabilize at the value of 0.25. On the basis of the above, the average value of velocities is of 0.18 with a standard deviation equal to 0.12, which is consistent with the unenforceability of LaSalle’s principle previously described.

Time-evolving market powers (\(\dot {r}_{i}\)), for i = 1, ... , 4, with likelihood of an exogenous shock and risk-sharing, in a time interval t ∈ [0, 10]. The blue trajectory corresponds to v1, the red trajectory to v2, the green trajectory to v3 and the purple one to v4. The time dimension is displayed along the x-axis. The y-axis denotes the relative market powers as a function of time (vi(t)). The variations in trade intensities (\(\dot {v}_{i}\)) are represented by the changing slopes. The black dotted curve outlines the average trade intensity \(\bar {v}(t)\)

Moreover, the transformation of the market risk into a systemic risk can be observed through increasing volatility in market powers, where changing trade intensities lead to acute swinging of market takeover and segmentation. Through this result, we confirm the statement from Corollary 3.

In order to see how the catallactic framework with risk sharing reacts to an increased number of participants, we once again simulated a scenario with 6 agents. The results validate the previous findings of market instability, temporary occurrence of monopolistic situations and of market crashes. This time as well, the average trade intensity decreases, with an average value of 0.13 and a standard deviation of 0.07. When the market does not fail to function, the risk sharing increases the likelihood of having an exclusive monopoly. Heading toward more trading agents does not permit stabilizing the market coordination.

5 Conclusion

Such as brought to light by Backhaus and Wagner (2005), the concern of welfare economics is to study the relationship between economic welfare and different forms for the economic organization of societies. The authors point out that Edgeworth (1897) treated public finance to be a choice-theoretic enterprise, where the state policy choices are assimilated to the market choices of an individual, while Wicksell (1896) saw it as a catallactic enterprise, where the state provided the institutional framework for easing interactions between distinctive types of agents. An interventionist state was then assimilated to the choice-theoretic one, while the participative state to that revolving around the catallactic framework.

The beneficial feature of competitive markets results in allocative efficiency that enables to use resources for production of goods and services. It also guarantees maximum welfare in mutually beneficial exchanges. Nevertheless, one of the major critics addressed to the free market mechanisms is their inability to correct for the market failures, such as pollution or the exhaustion of natural resources, known as the negative externalities. This is why internalizing systems, like the Pigovian tax regime, have been proposed as a remedy (Jaeger 2011). Through a principal-agent model, Segal (2003) shows that, under negative increasing externalities, all contracts end up generating excessive trade from the social viewpoint. Since the coordination of agents on their preferred equilibrium reduces the aggregate trade, it is found to be socially beneficial. His result urges to impose a nondiscrimination requirement, from which the principal offers the same menu profile to all agents, and to facilitate their coordination on their preferred equilibrium.

Although we do not consider coordination to result from an equilibrium process, our results are still in keeping with these findings. Indeed, the catallactic perspective of the market dynamics (1) advocates a participative role of the state in facilitating the exchanges between agents; through flocking, the market coordination (2) happens to depend on uniform agreements with levels equal to those observable at the emerging market state, in which the trade intensities do not cause excessive trade.

Let us also dedicate a few lines on the subject of market volatility. Caton and Wagner (2015) consider the economy to be a macro-system constituted through an open-ended ecology of plans, the latter being derived from micro-level interactions of firms. They concede that the theoretical discussion about entrepreneurship should be based on rule-following rather than on computational maximization. According to the authors, such a system would correspond to a macro-ecology naturally exposed to volatility. Through a non-equilibrium Hamiltonian structure and a dynamic behavior based on Reynolds’ flocking rules, we succeed in proposing a theoretical framework that encompasses these aspects of the economic systems.

As for the ability of catallactics to promptly react to exogenous risks, our results indicate that, under the risk-sharing arrangements, the framework could, instead of mitigating against the risk, to what it has been initially intended, generate greater risk by spreading it, which partly questions its robustness in dynamic environments. This has been earlier propounded by Ardaiz et al. (2006). Although it has been supported that some financial crises might just eliminate inefficient players in the system (De Bandt and Hartmann 2000), our framework reveals that networked systems free of regulation cannot prevent negative spillovers from spreading on a large scale. Put differently, in the event of failure of global coordination actions, the market can be considered as incomplete (Smeers 2003). Given that incomplete markets are those in which perfect risk transfer is not possible (Staum 2008), incompleteness calls for the regulation of risk sharing (Allen and Gale 2007). This invites the macroprudential authority – such as a central bank – to focus more on the system interconnectedness (Smaga 2014). Such as previously claimed by Ramamohan Rao (2016), public policies should aim to monitor the contagion effects more closely.

One evident extension of the present work could consist in a detailed study of risk-sharing contracts. There might exist a threshold level below which the spread of risk could be mitigated. To undertake such a study, two important modifications of the model should be provided. The first would be that of reasoning from a weighted graph. The latter would no longer rely on average effects, which is the main limit of this model, but would automatically distinguish between large and small economic agents. The second alteration, which follows from the first, would be to conduct a sensitivity analysis based on their various degrees and centrality. As a matter of fact, an agent isolated to a certain extent may slow down the spread of risk, which could cease the triggering of the systemic risk. Were this the case, it would imply that agents highly susceptible to risk – with more or less market power at disposal – ought to be partially detached from or located on the frontier of the market cluster. In sum, keeping the population of market participants gathered, while avoiding contagion among them, might lead us to reflect on modified rules of the flocking behavior. Further research could also deal with the stochastic version of flocking, notably by adding stochastic noise terms and by redefining flocking in such a setting (Cucker and Smale 2007; Ha et al. 2013).

Because flocking dynamics is a stylized representation of network patterns, this article ought to be considered as exploratory. Aside from this fact, data studies should be conducted in order to validate or invalidate the soundness of the methodology.

Notes

The particle-swarm optimization method (Kennedy and Eberhart 1995) is based on the observed behaviors of swarms of insects or flocks of birds (Ghaderi et al. 2012; Csercsik 2016). The main characteristic of swarm intelligence is that problem solutions emerge from the collaborative behavior of individuals within a swarm (Netjinda et al. 2015). Nevertheless, the mentioned papers employ optimization techniques which we relax with respect to the catallactic mechanism design.

Market power is considered as the ability of a firm to improve its profitability by imposing its pricing on the market. Firms with high market power then become price makers, while maintaining their market shares (i.e. trade intensities) undeteriorated (Asprilla et al. 2016). Indeed, the rate of profit is driven more by changes in market power than by changes within the production at sale (Webber 2016).

By trade intensity, we mean the magnitude of exchanges realized with neighboring partners. This tells us whether or not an agent trades more than the population does on average. In a perfectly competitive market, all trading opportunities between all agents are executed.

Cohesion: in order to form a single unit, agents stay close together; Separation: agents cannot be in the same place at the same time, such that they keep a reasonable distance between each other; Alignment: in order to stay bundled, agents seek to follow the same path, which consists in regulating the velocity of an agent to the average of its neighborhood.

A detailed overview is available in Luo et al. (2010).

Besides, by focusing our attention on the mean effects on the network, as would be the case in the mean-field theory, the eventuality of having a graph weighted by trade intensities is canceled by the implicit consideration of uniform edges aggregated through the mean effect.

We can notice the absence of costate variables, for the framework based on catallactics does not seek to optimize an objective function. Instead of optimally controlling the system trajectory, the function expresses the temporal rate of change of the trading system.

A firm’s profitability depends in part on whether other firms can easily compete with it.

The squared distance places greater weight on agents that are farther apart, which means that agents evolving on a common market segment tend to situate close to each other.

Even in presence of optimizing agents, the trajectory an economy follows, which will be sub-optimal, will be subject to path-dependence (Arthur 1989).

The relative inequality, whereby \(\dot {H}(r(t), v(t))= 0\) is a possibility, involves the likeliness to face cyclical behavior in flocking dynamics.

Despite the fact that the systemic risk is usually due to an endogenous risk, such as the cascading failure, the impact of the likelihood of the risk on the market configuration is what we emphasize on in this setting.

References

Abada I, Gabriel S, Briat V, Massol O (2013) A generalized nash-cournot model for the northwestern european natural gas markets with a fuel substitution demand function: the GaMMES model. Networks and Spatial Economics 13:1–42

Allen D, Gale F (2007) Systemic risk and regulation the risks of financial institutions. Chicago University Press, Chicago

Arcak M, Meissen C, Packard A (2016) Networks of dissipative systems briefs in electrical and computer engineering. Springer, Berlin

Ardaiz O, Artigas P, Eymann T, Freitag F, Navarro L, Reinicke M (2006) The catallaxy approach for decentralized economic-based allocation in grid resource and service markets. Appl Intell 25:131–145

Arthur W (1989) Competing technologies, increasing returns, and lock-in by historical events. Econ J 97:642–665

Arthur W (2014) Complexity and the economy. Oxford University Press, Oxford

Asprilla A, Berman N, Cadot O, Jaud M (2016) Trade policy and market power: firm-level evidence. FERDI working papers P161:40

Axelrod R (1997) The complexity of cooperation: agent-based models of competition and collaboration. Princeton University Press, Princeton

Backhaus J, Wagner R (2005) Society, state, and public finance: setting the analytical stage handbook of public finance. Kluwer Academic Publishers, Boston

Barry N (1992) Subjectivism, catallactics and the foundations of economic order praxiologies and the philosophy of economics. Transaction Books, New Brunswick

Bloom N (2009) The impact of uncertainty shocks. Econometrica 77:623–685

Bonabeau E (2002) Agent-based modeling: methods and techniques for simulating human systems. Proc Natl Acad Sci 99:7280–7287

Bosch-Domènech A, Vried N (2013) On the role of non-equilibrium focal points as coordination devices. J Econ Behav Organ 94:52–67

Bunn D, Martoccia M (2008) Analyzing the price-effects of vertical and horizontal market power with agent based simulation, IEEE power and energy society general meeting – conversion and delivery of electrical energy in the 21st century

Burguet R, Sákovics J (1999) Imperfect competition in auction design. Int Econ Rev 40:231–247

Caldarelli G (2010) Complex networks. EOLSS Publications, Paris

Caton J, Wagner R (2015) Volatility in catallactical systems: austrian cycle theory revisited new thinking in austrian political economy: advances in austrian economics. Emerald Group Publishing Limited, Bingley

Cavagna A, Del Castello L, Giardina I, Grigera T, Jelic A, Melillo S, Mora T, Parisi L, Silvestri E, Viale M, Walczak A (2015) Flocking and turning: a new model for self-organized collective motion. J Stat Phys 158:601–627

Chamberlin E (1953) La théorie de la concurrence monopolistique – une nouvelle orientation de la Théorie de la Valeur. Presses Universitaires de France, Paris

Cho I-K, Meyn S (2010) Efficiency and marginal cost pricing in dynamic competitive markets with friction. Theor Econ 5:215–239

Crawford V, Haller H (1990) Learning how to cooperate: optimal play in repeated coordination games. Econometrica 58:571–595

Csercsik D (2016) Competition and cooperation in a bidding model of electrical energy trade. Networks and Spatial Economics 16:1043–1073

Cucker F, Smale S (2007) Emergent behavior in flocks. IEEE Trans Autom Control 52:852–862

De Bandt O, Hartmann P (2000) Systemic risk: a survey, european central bank, working paper 35

Debreu G (1959) Theory of value: an axiomatic analysis of economic equilibrium. Yale University Press, New Haven

Dragicevic A, Sinclair-Desgagné B (2013) Sustainable network dynamics. Ecol Model 270:43–53

Ebeling R (1987) Cooperation in anonymity. Crit Rev 1:50–61

Edgeworth F (1897) The pure theory of taxation classics in the theory of public finance. Macmillan, London

García-Pedrajas N, Herrera F, Fyfe C, Benítez Sánchez J, Ali M (2010) Trends in applied intelligent systems. In: Proceedings of the 23rd international conference on industrial engineering and other applications of applied intelligent systems, cordoba

Ghaderi A, Jabalameli M, Barzinpour F, Rahmaniani R (2012) An efficient hybrid particle swarm optimization algorithm for solving the uncapacitated continuous location-allocation problem. Networks and Spatial Economics 12:421–439

Guttman R, Maes P (2006) Cooperative vs. competitive multi-agent negotiations in retail electronic commerce, cooperative information agents II learning, mobility and electronic commerce for information discovery on the internet. Lect Notes Comput Sci 1435:135–147

Ha S-Y, Kim K-K, Lee K (2013) A mathematical model for multi-name credit based on community flocking. Quant Finan 15:841–851

Harsanyi J, Selten R (1988) A general theory of equilibrium selection in games. MIT Press, Cambridge

Hart S, Mas-Colell A (2003) Uncoupled dynamics do not lead to nash equilibrium. The American Economic Review 93:1830–1836

Hayek F (1978) Law, legislation and liberty: the mirage of social justice. University of Chicago Press, Chicago

Jaeger W (2011) The welfare Effects of Environmental Taxation. Environ Resour Econ 49:101–19

Kapás J (2006) The coordination problems, the market and the firm. New Perspectives on Political Economy 2:14–36

Kennedy J, Eberhart R (1995) Particle swarm optimization. Proceedings of the IEEE International Conference on Neural Networks 4:1942–1948

Klein D (1997) Convention, social order, and the two coordinations. Constit Polit Econ 8:319–335

Lapalu J, Bouchard K, Bouzouane A, Bouchard B, Giroux S (2013) Unsupervised mining of activities for smart home prediction. Procedia Computer Science 19:503–510

Lasry J-M, Lions P-L (2007) Mean field games. Japan J Math 2:229–260

Luo X, Li S, Guan X (2010) Flocking algorithm with multi-target tracking for multi-agent systems. Pattern Recogn Lett 31:800–805

Matsuda T, Kaihara T, Fujii N (2010) Resource allocation analysis in perfectly competitive virtual market with demand constraints of consumers. Advances in Practical Multi-Agent Systems 325:181–200

Mirowski P (1991) More heat than light: economics as social physics physics as nature’s economics. Cambridge University Press, Cambridge

Müller M., Pyka A (2016) Economic behaviour and agent-based modelling handbook of behavioral economics. Routledge, New York

Namatame A, Chen S-H (2016) Agent-based Modeling and network dynamics. Oxford University Press, Oxford

Netjinda N, Achalakul T, Sirinaovakul B (2015) Particle swarm optimization inspired by starling flock behavior. Appl Soft Comput 35:411–422

Ogula D (2003) Attractors, strange attractors and fractals encyclopedia of public administration and public policy: A–J. Marcel Dekker, New York

Olfati-Saber R (2006) Flocking for multi-agent dynamic systems: algorithms and theory. IEEE Trans Autom Control 51:401–420

Olfati-Saber R, Murray R (2003) Flocking with obstacle avoidance: cooperation with limited communication in mobile networks. IEEE Conference on Decision and Control 42:2022–2028

Papaioannou T (2012) Reading Hayek in the 21st Century: a critical inquiry into his political thought. Palgrave Macmillan, New York

Raafat R, Chater N, Frith C (2009) Herding in humans. Trends Cogn Sci 13:420–428

Ramamohan Rao T (2016) Risk sharing risk spreading and efficient regulation. Springer India, New Delhi

Reuvid J (2011) Managing business risk: a practical guide to protecting your business. Kogan Page Publishers, London

Reynolds C (1987) Flocks, herds and schools: a distributed behavioral model. Comput Graph 21:25–34

Samuelson P, Solow R (1956) A complete capital model involving heterogeneous capital goods. Q J Econ 70:537–562

Sautet F (2002) Economic transformation the pretence of knowledge and the process of entrepreneurial competition. Mimeo, New Zealand Treasury

Schelling T (1960) The strategy of conflict. Harvard University Press, Cambridge

Segal I (2003) Coordination and discrimination in contracting with externalities: divide and conquer? J Econ Theory 113:147–181

Smaga P (2014) The concept of systemic risk, systemic risk center of the london school of economics and political science, Special Paper, 5

Smeers Y (2003) Market incompleteness in regional electricity transmission. Part II: the forward and real time markets. Networks and Spatial Economics 3:175–196

Staum J (2008) Incomplete markets. Handbooks in Operations Research and Management Science 15:511–563

Strogatz S (1994) Nonlinear dynamics and chaos. Addison-Wesley, Boston

Syz J (2008) Property derivatives: pricing hedging and applications. Wiley, Hoboken

Taillard P-A (2006) Quel degré de rationalité Favorise la Coordination des Agents? Rev Econ Polit 116:23–42

Terano T, Kita H, Takahashi S, Deguchi H (2009) Agent-based approaches in economic and social complex systems V. Springer Science and Business Media, Berlin

Wang Q, Wang Y (2010) Flocking control protocol design for a class of multi-agent systems based on hamiltonian framework. Proceedings of the Chinese Control Conference 29:4554–4559

Webber M (2016) Market power and the rate of profit. Environ Plan A 48:2529–2531

Weiss G (1999) Multiagent systems: a modern approach to distributed artificial intelligence. MIT Press, Cambridge

Wicksell K (1896) A new principle of just taxation classics in the theory of public finance. Macmillan, London

Windrum P, Fagiolo G, Moneta A (2007) Empirical validation of agent-based models: alternatives and prospects. Journal of Artificial Societies and Social Simulation 10:1–19

Young H (1993) The evolution of conventions. Econometrica 61:57–84

Acknowledgment

The author would like to thank François Delarue (CNRS, Université Nice Sophia Antipolis), for his valuable comments on this work, as well as the discussants from CentraleSupélec Laboratory of Mathematics in Interaction with Computer Science (MICS). He is also grateful to the anonymous referees and to the editor for their thorough comments and suggestions, which significantly contributed to improving the quality of the paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Dragicevic, A.Z. Market Coordination Under Non-Equilibrium Dynamics. Netw Spat Econ 19, 697–715 (2019). https://doi.org/10.1007/s11067-018-9414-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11067-018-9414-1