Abstract

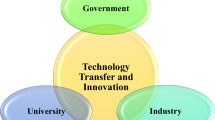

The strategic utilization of technology to enhance industrial competitiveness and product quality is pivotal for economic growth. As universities own more inventions, collaborative efforts between industry and academia become essential for regional competitiveness and overall economic advancement. This study explores Taiwan’s systematic approach to upgrading its infrastructure, emphasizing the significance of University–Industry Collaborations (UIC) in realizing Industry 4.0. Government strategies and policy decisions emerge as key drivers in fostering successful collaborative projects between industry and university teams. The relaxation of restrictions, particularly related to part-time teachers and technology transfer, along with the promotion of corporate programs, effective use of public funding, and the development of an innovative digital platform system for UIC, collectively contribute to establishing a robust university–industry cooperation mechanism. This mechanism has contributed to Taiwan’s move towards new digital advances in innovation and entrepreneurship, fostering industrial leadership and efficient governance.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The development of Science and Technology (S&T) capabilities is fundamental for driving economic and social progress in the highly competitive global economy. Governments must invest significantly in research and development (R&D) to create advanced information and communication technology (ICT) infrastructure and integrate novel technologies to foster innovation and progress.

University–industry collaborations (UIC) have become essential for advancing knowledge and technology transfer, offering long-term benefits to both parties (Balconi & Laboranti, 2006; De Fuentes & Dutrénit, 2012; Meissner et al., 2022). UIC facilitates the dissemination of scientific knowledge, supports research development, and promotes patent innovations within organizations, enabling the transformation of scientific findings into practical commercial applications (Bishop et al., 2011; Bodas Freitas et al., 2013). Furthermore, UIC fosters extensive economic and social exchanges, ultimately enhancing regional competitiveness and wealth (Acs et al., 2013; Frølund et al., 2018; Lehmann & Menter, 2015; Mueller, 2006; Wong et al., 2007).

However, collaboration between universities and industry is often confronted with challenges. Private companies struggle to evaluate research from various sources and identify suitable experts within academic research organizations (Dong & Glaister, 2006; Jee & Sohn, 2020; Solesvik & Westhead, 2010). Additionally, orientation asymmetry, characterized by differences in partner goals and expectations, can result in conflicts and hinder productive collaboration (Estrada et al., 2016; He et al., 2021; Muscio & Vallanti, 2014; Nsanzumuhire & Groot, 2020; Steinmo, 2015). Information asymmetry, involving disparities in knowledge, information, or resources among parties in transactions, can lead to inefficiencies and risks (Abramo et al., 2009; Wang et al., 2017).

Cultural and governance differences between industries and universities pose additional challenges (Frølund et al., 2018; Manotungvorapun & Gerdsri, 2019; Perkmann et al., 2012). Universities prioritize scientific objectives and publications, while industry focuses on profitability and may delay publication for patentable material (Bruneel et al., 2010; Bstieler et al., 2014; Ghauri & Rosendo-Rios, 2016; He et al., 2021; Hillerbrand & Werker, 2019). Tensions arise regarding knowledge disclosure between firms and scientific partners (Galán-Muros & Plewa, 2016; Markman et al., 2005; Muscio, 2009), with choices between secrecy, patenting, and publication (Gans et al., 2017) leading to significant conflicts.

Under other circumstances, collaborations between firms and universities often revolve around technology transfer and the strategic capture of tacit knowledge (Duysters & Lokshin, 2011; Melnychuk et al., 2021). Cultural differences can complicate partnerships between university and industry researchers, as these differences can cause miscommunication, misaligned expectations, and conflicts over working methods and communication styles (Barnes et al., 2006; de Wit-de Vries et al., 2018). The establishment of open communication, consensus on mutually agreeable goals, and formalization of each party’s responsibilities are essential to overcoming these challenges (Bstieler et al., 2014, 2017; Hemmert et al., 2014). In addition, regular workshops and joint training sessions can bridge cultural divides by fostering mutual understanding and aligning goals. These measures promote trust and trustworthy behavior, facilitating effective collaborative learning, creativity, and cooperation (Bellini et al., 2018; Bruneel et al., 2010; De Moortel & Crispeels, 2018; Harris & Lyon, 2013; Santoro & Bierly, 2006).

Furthermore, collaborations between universities and industry are often associated with significant uncertainty and risks. Partners face pressure to foster creativity and innovation, manage independently driven employees, and address geographical challenges (Brocke & Lippe, 2015; Fernandes & O’Sullivan, 2020; Hong & Su, 2013; König et al., 2013). Opportunism is a pervasive source of uncertainty in such relationships (Hong & Su, 2013; Santoro & Bierly, 2006). Moreover, conflicts arise due to differences in temporal orientation, relationship transcendence, claims of co-produced knowledge ownership, and power imbalances (Borah & Ellwood, 2021). Collectively, these factors present barriers to effective collaborations between universities and industry.

Recent research has explored various strategies to overcome UIC challenges, including systematic methods for partner selection. For instance, Wang et al. (2017) proposed a context-aware researcher recommendation system that assesses candidates for R&D project collaborations based on contextual trust analysis. Chung et al. (2021) advocated a patent-based approach, emphasizing the selection of inventor groups with technological expertise relevant to technology-based firms (TBFs). Jee and Sohn (2020) introduced a patent-based framework to identify partner candidates for entrepreneurial firms, considering knowledge acquisition and knowledge spillovers. The use of topic modeling and clustering techniques for partner selection, university matching, and core research team recognition has also been suggested (Kang et al., 2019; Ran et al., 2020).

Government involvement is pivotal in fostering UIC and technology transfer. Studies have delved into the multifaceted role of governments in this context. For instance, Chen et al. (2022) investigated the technology transfer systems within national research institutes, focusing on the Chinese Academy of Sciences. Motohashi and Muramatsu (2012) analyzed changes in UIC outcomes following the implementation of UIC policies in Japan during the late 1990s. Rasmussen and Rice (2012) outlined a conceptual framework for structuring government initiatives to enhance university technology transfer.

Specific policy adjustments have been thoroughly examined, covering legislative acts and regulations related to intellectual property (IP) ownership, high-tech policies, and the utilization of research results (Baldini, 2006; Cheng et al., 2018; Della Malva et al., 2013; Eickelpasch & Fritsch, 2005; Geuna & Rossi, 2011; Lissoni, 2013; Wen & Kobayashi, 2002). To further support endeavors in UIC, grants and subsidies have been implemented by both governments and industries (Hou et al., 2018; Huang & Chen, 2017; Kochenkova et al., 2015; Rasmussen, 2008; Song et al., 2022; Tseng et al., 2018; Wright et al., 2006). Additionally, numerous studies have explored the impact of funding within specific fields (Aldridge & Audretsch, 2010; Gray et al., 2020; Jung & Lee, 2014; Muscio & Nardone, 2012) and have investigated the consequences of policy changes at local and national levels in particular cases (Brimble & Doner, 2007; Patibandla & Petersen, 2002; Wu, 2007).

Nevertheless, there is a limited comprehensive analysis of government support initiatives aimed at promoting UIC and technology transfer. This paper delves into a thorough examination of the changes in Taiwan’s legal framework, specifically designed to address UIC challenges, facilitate technology transfer, and support UIC endeavors. We address two key questions: To what extent is the government involved in promoting UIC and technology transfer in Taiwan? How do UIC collaborations contribute to Taiwan’s transition toward the implementation of Industry 4.0?

This paper is structured as follows. Section 2 provides an in-depth exploration of the legal system governing technology transfer. It underscores the revisions made to existing laws and policies and the introduction of initiatives and programs that facilitate UIC and the transfer of technology. In Sect. 3, we present a case study focusing on a digital platform. This platform scrutinizes the landscape of academic and industrial cooperation in Taiwan, shedding light on how digital infrastructure plays a pivotal role in nurturing innovation and fostering technology transfer. Section 4 describes the changes in the Taiwanese technology transfer environment. Sections 5 and 6 present discussions, conclusions, and findings.

2 Legal system for technology transfer in Taiwan

The National Science and Technology Council (NSTC) serves as the foremost entity in Taiwan overseeing scientific and technological innovation. Its primary focus lies in translating scientific research accomplishments into novel innovations and facilitating early-stage development. The infusion of new resources from the Ministry of Economic Affairs (MOEA), National Development Council, Financial Supervisory Commission, and other pertinent ministries and committees underscores the collaborative effort to nurture innovation. Initially established in 1959, the NSTC underwent a name change in 2014 to become the “Ministry of Science and Technology” (MOST). As of July 2022, it has been restructured into a ministry-level council, now recognized as the “National Science and Technology Council”.

In the past, while universities were significant sources of innovation, they often struggled to effectively commercialize academic research results. This challenge was primarily due to regulatory hurdles in the transfer of academic research findings and the absence of suitable R&D platforms for connecting research talent with corporate resources (Chang et al., 2005, 2006).

To foster interactions between academic research and industry, the Taiwan government undertook a comprehensive legal review. Through various ministries and committees, they introduced amendments to relax restrictions and regulations. The aim was to stimulate academic innovation, research, and development and encourage educators and student teams to establish new Research Service Companies (RSCs).Footnote 1 Furthermore, the government launched numerous support programs and activities, providing tools, resources, and workshops to facilitate industrial and corporate business activities. In the following sections, we will analyze the major overhaul of Taiwan’s technology transfer and innovation-related strategies, as well as its remarkable promotional programs.

2.1 Substantial relaxation of technology-transfer-related regulations

Inspired by the United States’ Bayh-Dole Act (1980), which strengthened the relationship between scientific research and technological development and spurred university–industry technology transfers and research collaborations, Taiwan enacted the “Fundamental Science and Technology Act” in 1999. Amendments were later made in 2003 and 2005. The primary goal of this legislation was to establish “fundamental guidelines and principles for the government in promoting scientific and technological development” (Fundamental Science and Technology Act, 1999). This Act is widely credited with fostering innovation and entrepreneurship in Taiwan and has been associated with significant increases in patent applications, technology transfers, and licensing income (Chang et al., 2006; Hsu & Yuan, 2013; Hu & Mathews, 2009; Mathews & Hu, 2007).

Despite the extensive research conducted at universities, the number of programs leading to commercialized developments remains relatively limited. A major constraint is the designation of research findings and associated patents as ‘state-owned property’ under Articles 2 and 3 of the National Property Act, which hampers the transfer of technological innovations (Hsu & Wu, 2012). Additionally, the Executive Yuan’s Government Scientific and Technological Research and Development Results Ownership and Utilization Regulations mandate that universities remit 20–50% of royalties generated by R&D results to the funding agencies. This substantial percentage diminishes the incentives for research institutions to promote technology transfer (Hsu & Wu, 2012). The constraints imposed by the National Property Act also restrict the equities of startups, thereby reducing academics’ motivation to transfer technologies to industry and consequently dampening researchers’ support for university technology transfer (Hsu & Wu, 2012). Furthermore, the Executive Yuan’s Government Scientific and Technological Research and Development Results Ownership and Utilization Regulations impose stringent restrictions on the utilization of R&D results offshore, complicating international collaborations.

Time constraints, along with the rules and regulations established by universities and government funding agencies, have also been identified as significant barriers to technology transfer (Shen, 2016). When universities encounter industry demands for “exclusive licenses,” both public and private institutions must report to the relevant authorities. This process can lead to missed market opportunities due to bureaucratic delays, fostering a wait-and-see attitude in the industry and stalling proactive cooperation between technology suppliers and demand parties.

Furthermore, despite the critical role of universities in technology transfer and securing technology funding, no regulations stipulate that technology transfer offices (TTOs) receive a specific percentage of income generated from successful transfers. The absence of such incentives hinders universities from hiring dedicated technology transfer personnel. Coupled with internal and external restrictions, particularly in national universities, these challenges significantly limit the effectiveness of the technology transfer process. Additionally, regulatory constraints complicate efforts by academic research teams to initiate businesses, reducing their capacity to support new startups and assist enterprises in achieving continuous technological advancements (Act Governing the Appointment of Educators, 1985). Specific restrictions, such as a 10% upper limit on shareholding (Civil Servant Work Act, 1947), further impede researchers, resulting in many research projects that could have been commercialized being shelved.

To address these shortcomings, the Taiwanese government has systematically revised relevant laws and regulations with the support of multiple ministries and committees. Table 1 outlines several policies and regulations amended to enhance university–industry collaboration (UIC) and technology transfer. In 2011, legislation was changed to exempt research results from national property regulation. Subsequent amendments in 2014 and 2015 allowed university researchers to invest in companies related to their research. Additionally, university campuses could be used by teachers and students to register start-up companies without incurring land value and housing taxes.

In 2017, the Executive Yuan introduced the ‘Plan of Establishing Innovative R&D Ecological Environment for Next-Generation Sci-Tech Talents,’ which eased restrictions on the utilization of academic research results. This marked a significant legal shift, leading to subsequent policies facilitating and encouraging technology transfer. In the same year, legal revisions granted universities ownership of their research results, enabling university researchers to engage in part-time jobs related to their original research. Researchers were also allowed to serve as members of R&D advisory committees or consultants for technology transferred to biotechnology or new drug companies. These regulations included income tax exemptions for the shares resulting from research achievements.

In 2018, a new regulation permitted researchers to serve as directors of start-up companies, and the previous shareholding ratio limit for start-up company shares was lifted. Concerning income arising from the technology transfer of research results, universities are now required to allocate a certain portion to deserving technology transfer personnel, who are exempt from responsibilities arising from their duties due to market price fluctuations. Furthermore, technology transfer results can now be manufactured or used outside the jurisdiction of Taiwan.

The relaxation of regulations, accompanied by the introduction of targeted measures to foster technological and scientific research transfers, can be regarded as a boost to the promotion of the technology transfer business in universities.

2.2 Government-funded university industry promoting programs

In alignment with the evolving requirements of both industry and academia, a range of projects and programs, initiated by various ministries, has been introduced in conjunction with regulatory relaxations. Table 2 delineates a catalog of these endeavors, all supported and financed by the Taiwanese government. The aim is to cultivate collaborations focused on technology exploration, transfer, and the development of entrepreneurship.

The inaugural UIC project, initiated in 2006, aimed to cultivate professional and technical personnel for enterprises by promoting the development of subject-based courses in technical colleges. Subsequently, in 2009, the government introduced the ‘U-start Plan for Innovation and Entrepreneurship’ to provide support for youth through mentoring and start-up awards. In 2012, two programs were introduced with the first focusing on promoting a culture of innovation and entrepreneurship on campuses. This was achieved by enhancing the quality of innovation and entrepreneurship courses. The second program encouraged universities and academic institutes to collaborate with domestic industries, jointly investing in the development of forward-looking technologies. The ‘Directions of Loans for Startup Funding for Young Entrepreneurs’ took effect in 2013, providing funding assistance for young individuals launching new businesses. In 2017, aligning with the ‘Plan of Establishing Innovative R&D Ecological Environment for Next-Generation Sci-Tech Talents’ by the Executive Yuan, the Ministry of Education (MOE) initiated the ‘Construction University Research Service Corporation (RSC) Incubation Mechanism’. Concurrent with amendments to technology-transfer-related laws, various ministries successively launched projects to promote the RSC. This strategic initiative aims to encourage professors to lead doctoral students in conducting joint research and development projects with industry. Anticipated outcomes include the recruitment of talented doctoral students by enterprises or the direct establishment of an RSC company by the R&D team.

Aligned with this objective, the establishment of innovation and entrepreneurship courses, intellectual property service platforms, the development of distinctive research centers, and the founding of intellectual property management companies constitute significant measures contributing to the establishment of the RSC. Additionally, several programs with a focus on UIC in specific fields were introduced. Noteworthy examples include the launch of the REAL project in 2017 to connect the domestic semiconductor industry and academia, the Smart Healthcare Industry–University Alliance Program in 2021 stimulating UIC in the application of telemedicine, and the Sports Science Industry–University Cooperation Program designed to enhance the innovative application of smart sports and integrated services.

Among these projects, the establishment of an Intellectual Property Service Platform in 2017 and a Scientific Research Industrialization Platform in 2021 provided a crucial foundation for promoting RSC companies. A well-designed intellectual property platform can identify technologies with commercial value, plan technical intellectual property strategies, promote new technologies, facilitate technology transfers and industrial cooperation, and incubate new ventures.

This initiative is anticipated to expedite the transfer of new technologies from the laboratory to the marketplace, instill a culture of academic innovation to spur creativity in universities; and foster cooperation between universities and industries, with universities serving as R&D service providers. Ultimately, these efforts are expected to give rise to numerous new unicorn corporations in Taiwan.

3 A digital platform for university–industry collaborations

This section reports on the results of a project which was funded by the National Science and Technology Council, to build a digital platform to promote industry–university collaborations. The platform provides an online service for cooperative searches and makes it straightforward for universities and industries with similar areas of scientific knowledge and technical expertise to recognize each other and establish collaborative partnerships.

With this project, the scientific research industrialization platform is used to explore the major scientific research results of potential partner research institutions, and universities in particular. A cross-project integration database has already been built according to the current needs of university researchers and industries, the main service target of which includes seven University Alliances, involving 49 colleges and universities, which are considered to be among the most technologically advanced in Taiwan (Table 3).

3.1 Data sources

In the present project, data was procured from three primary sources—patents, scientific publications, and government-funded research, to provide comprehensive access to knowledge generated by researchers. The objective was to propose a platform designed to enhance the efficacy of university–industry collaboration. The information provided by these sources is described as follows:

Taiwan Intellectual Property Office (TIPO) The Taiwan Intellectual Property Office (TIPO) (tipo.gov.tw) operates under the jurisdiction of the Ministry of Economic Affairs (MOEA) and was established in 1999. It oversees patent, trademark, copyright, integrated circuit (IC) layout, and trade secret authorities. TIPO is tasked with formulating intellectual property (IP), drafting IP law, and coordinating inter-agency enforcement efforts. All patent documents contributed by university researchers from TIPO were extracted for data integration in this project.

Web of Science (WOS) The Web of Science (WOS) (clarivate.com) is a comprehensive platform offering access to multiple databases. These databases provide reference and citation data from academic journals, conference proceedings, books, and various documents across diverse academic disciplines. The WOS Core Collection encompasses over 21,100 peer-reviewed scholarly journals published worldwide, covering more than 250 academic disciplines, including the physical sciences, social sciences, and the arts & humanities. This collection is currently owned by Clarivate (formerly known as the Intellectual Property and Science business of Thomson Reuters).

The Government Research Bulletin (GRB) The Government Research Bulletin (GRB) (www.grb.gov.tw) serves as the official platform for disseminating the latest information related to government-funded research projects in Taiwan. Mandated by the Administration Act of Government R&D Projects in Taiwan, the GRB, operational since 1997, functions as a data warehouse. It collects and stores information from more than 530,000 projects conducted by research institutes (Wan-Hsu & Jia-Yu, 2019). The metadata of each project, including title, keywords, abstract, funding agency, executive institute, involved researchers, budgets, etc., is systematically collected and stored in a relational database format. This facilitates easy storage, categorization, querying, and filtering of data.

3.2 Operational modes

In the initial phase of the project, an analysis is conducted on the research results obtained from the TIPO, WOS, and GRB. This analysis aims to extract pertinent information corresponding to patents, individual publications, and government-funded research projects, respectively. The International Patent Classification Categorization Assistant Tool (IPCCAT) is employed to convert these results into a set of International Patent Classifications (IPC) most relevant to the research outcomes of university researchers. This method yields a comprehensive dataset encompassing patents, publications, research projects, and associated IPCs, which is then scrutinized to provide an overview of the current state of science and technology development in Taiwan.

Moving to the second step, a survey questionnaire containing multiple-choice questions is designed and distributed to university researchers. The objective is to gauge their inclination towards commercializing their knowledge and research findings. The questionnaire delves into the type of commercialization they would like to promote, exploring aspects such as willingness to lead an entrepreneurship science lab, transfer knowledge to other companies, participate in joint investments in entrepreneurship ventures, or engage in collaborative efforts with manufacturers.

In the third step, regional industry managers are appointed within each alliance. Their role involves conducting interviews with university researchers to comprehend the technical background of the inventions and the challenges they address. This approach facilitates the preparation of technology disclosure reports. Industry R&D managers are invited to contribute to the evaluation of technological innovations and determine the preferred orientation for their commercialization. This collaborative approach enables potential technologies to enter the university–industry cooperation process, fostering the development of technology transfers, derivatives, and new innovations based on their unique characteristics.

Subsequently, various types of analyses are generated based on the research results from both researchers and universities. The platform users benefit from comprehensive support for technology exploration and candidate selection. Figure 1 outlines the framework of the context awareness of the recommendation platform. From an industrial perspective, the platform employs distinct strategies to identify candidate researchers in universities and their fields of technical expertise. From a university researcher’s standpoint, the recommendation platform identifies key industries and manufacturers with whom research findings could be developed into marketable products.

3.3 Process of preparation for technology disclosure report

3.3.1 Questionnaire survey

Universities hold a pivotal role in contemporary societies, contributing significantly to education and knowledge generation. They not only educate a substantial portion of the population but also contribute to the creation of knowledge for new technologies and social innovation. The collaboration between universities and industries is increasingly recognized as a powerful tool for fostering innovation through the exchange of knowledge. However, within this collaborative landscape, there are various types of activities, and university researchers may have concerns regarding the protection of their intellectual property and the commercialization of their innovations. At this juncture, numerous decisions need to be made, and the opportunities that emerge hinge on the choices made by researchers.

This survey places paramount importance on understanding researchers’ willingness to commercialize their knowledge and comprehending the specific cooperative R&D commercialization strategies they require. Factors such as the involvement of large or small firms and the preference for transferring innovations to the market, whether through licensing agreements with existing companies, R&D cooperation, or the creation of a start-up, are key considerations. Recognizing that academics may have diverse requirements in scientific or technical collaboration, a survey questionnaire comprising eight questions was meticulously designed and disseminated to a selected group of university researchers. This aim is to gain an understanding of their goals and objectives in the context of collaborative research and commercialization strategies.

3.3.2 Technology disclosure report

The initial phase of the commercialization process involves the preparation of a technology disclosure report. This report serves as a comprehensive document allowing research teams from companies, universities, and various partner organizations to grasp the technology’s development stage and discern the nature of commercial opportunities. Early disclosure, exchange and effective communication of ideas play a pivotal role in facilitating access to market opportunities, fostering collaboration with industry, securing funding for further research and development, and implementing strategies for the protection of proprietary intellectual property rights.

Within the framework of this project, regional platform managers are designated to conduct interviews with university researchers, evaluating the development status of technologies with potential commercial value. When a technology emerges as sufficiently interesting, the regional platform manager completes the innovation disclosure form and subsequently invites the innovator to verify and/or edit it. This streamlined approach minimizes the effort required by the innovator and typically results in an accurate innovation disclosure, laying the groundwork for the potential development of a commercially viable product.

3.4 Taiwan higher education system and platform analysis

In this section, we delve into the educational framework of Taiwan’s higher education system, tracing its development and present-day structure. Following this, we conduct an in-depth analysis of the digital platform, investigating key aspects such as research group composition, scholar demographics, and the output of research projects. Through a comprehensive examination of these elements, we aim to offer a thorough understanding of the landscape of academia and research partnerships within Taiwan.

3.4.1 Taiwan higher education system

Figure 2 illustrates the temporal evolution of lecturer numbers within higher education institutions across Taiwan from 2001 to 2022. The depicted trend showcases a notable surge in lecturer figures from 2001 through 2008, starting at 44,769 and peaking at 51,501. Following this peak, although witnessing intermittent declines, the count generally sustained levels exceeding 50,000 over subsequent years. However, around 2014, a gradual decline set in, reaching its lowest point at 44,388 in 2022, a figure lower than that recorded in 2001. This downward trajectory may be attributed to demographic factors, particularly the diminishing fertility and birth rates within Taiwan’s population structure.

In Fig. 3, the trajectory of master’s and PhD graduates from 2001 to 2022 is presented, showcasing both the steady increase and fluctuations in their numbers over time. The bar chart depicts the progression of master’s graduates, while the line chart delineates the trend of PhD graduates. From 2001 to 2013, there was a notable surge in both master’s and PhD graduates. The count of master’s graduates, starting at 1501 in 2001, experienced substantial growth, peaking at 60,218 in 2012, before gradually tapering off. By 2022, the number of master’s graduates stood at 52,259. Similarly, the number of PhD graduates witnessed a significant upswing, surpassing 4000 between 2012 and 2014, with a peak of 4048 in 2013. Subsequently, there was a marked decline, hitting a nadir in 2018 with 3306 PhD graduates. However, a resurgence occurred thereafter, reaching a minor peak in 2020 with 3557 graduates. This growth can be attributed to various government policies aimed at fostering collaboration between universities and industries, along with initiatives like the REAL project, which ensured minimum salaries for PhD students (NSTC, 2020).

Despite Taiwan’s declining birth rates, the number of master’s and PhD graduates has remained relatively stable, albeit experiencing a slight downturn around 2014. Notably, the figures for both categories in 2022 were twice as high as those in 2001, with master’s graduates increasing from 25,900 to 52,259 and PhD graduates rising from 1501 to 3446.

3.4.2 Overall analysis of the digital platform

3.4.2.1 Analysis of research group and age distribution

The distribution of scholars across different research groups is illustrated in Fig. 4. From a total of 18 recorded research groups, the Engineering group stands out as the largest, comprising 8246 scholars, which accounts for nearly 45% of the total. The Medicine and Hygiene group ranks second in size, encompassing 4133 scholars, representing 22% of the total scholar count. Following closely is the Life Science group with 1553 scholars, making up 8% of the total. Art Group, Mass Communication, and Foreign Language Group have significantly fewer scholars, with 29, 17, and 11 scholars respectively.

This distribution is understandable given that Taiwan’s economy is primarily based on the information and communications technology (ICT) industry. Consequently, there is a higher concentration of scholars in related fields such as Engineering and Life Sciences, which are crucial to the continued growth and innovation within the ICT sector. Moreover, the substantial presence of scholars in Medicine and Hygiene reflects the growing importance of healthcare and biotechnological advancements in Taiwan’s economic framework. Conversely, the relatively low numbers in the Arts, Mass Communication, and Foreign Languages groups highlight the country’s strategic emphasis on technical and scientific disciplines to sustain its competitive edge in the global market.

Figure 5 provides a glimpse into the age demographics of scholars across 18 recorded research groups. In the engineering group, scholars encompass the highest concentration within the age range of 38–68. Notably, the distribution peaks at 410 scholars at the age of 58, closely followed by 390 scholars at 59, and 384 scholars at 57, indicating a robust presence of mid-career professionals. Interestingly, there is also a significant presence of scholars aged 70–80, and even beyond, underlining the sustained engagement and expertise contribution from seasoned professionals within this field.

Turning to the Medicine and Hygiene group, scholars exhibit a concentration between the ages of 43 and 66, reflecting a diverse mix of experience levels and career stages. This group witnessed its peak with 224 scholars at the age of 56, closely followed by 211 scholars at the age of 59.

In contrast, the Life Sciences Group presents a more evenly distributed age profile. While the highest number of scholars falls within the age range of 37–67, indicating a diverse mix of early-career, mid-career, and seasoned professionals, there isn’t a discernible peak. Instead, the distribution reveals three smaller peaks: 83 scholars aged 57, 70 scholars aged 47, and 69 scholars aged 54, showcasing a balanced representation across various age brackets. This pattern emphasizes the balanced distribution across different age brackets within the field, reflecting the inclusive nature of research endeavors and the varied career trajectories of scholars in life sciences.

3.4.2.2 Analysis of research output and project activities

An overall analysis of patents, publications, and completed projects distributed by scholars in the past 5 years reveals that the Global Industry Platform (GIP) of NTU System claims the highest number of patents, registering 2493, constituting 33% of the total patents across the 7 alliances. Following closely is the National Tsing Hua University Scientific Research Industrialization Platform with 1503 patents, contributing to 20% of the total, and the Taoyuan–Taichung Scientific Research & Industrialization Platform with 1171 patents, representing 16% of the overall count. The Global Industry Platform (GIP) of NTU System maintains its leadership in publications, with 47,502 papers authored by researchers within the consortium from 2017 to 2021, accounting for 29% of the total publications produced by the 7 alliances. The Taoyuan-Taichung Scientific Research & Industrialization Platform follows with 39,281 papers, representing 24% of all publications. Additionally, the Global Industry Platform (GIP) of NTU System leads in completed projects, with 33,389 projects, making up 50% of the total completed projects within the 7 alliances. Subsequent contributors include the Taiwan Gloria Center with 6684 projects and the Gloria 2.0 South with 6521 projects, each accounting for approximately 10% of all completed projects (Fig. 6).

In terms of all types of research output, the Global Industry Platform (GIP) of NTU System consistently leads among the 7 alliances, followed by the Taoyuan-Taichung Scientific Research & Industrialization Platform, and the National Tsing Hua University Scientific Research Industrialization Platform.

Figure 7a illustrates the distribution of completed projects among different alliances over time. The Global Industry Platform of the NTU System maintains as a leader in project implementation, with a significantly higher number of completed projects compared to the other four alliances. It has completed 97,631 projects, accounting for 26.7% of the total, nearly double that of the second-ranking Gloria 2.0 South, which completed 55,976 projects (15,3% of the total). In other words, the Global Industry Platform the NTU System receives the highest funding from the Taiwanese government for its research endeavors, indicating that its numerous projects attract substantial financial support. The Taiwan Gloria Center, National Tsing Hua University Platform, and New Industry Alliance exhibit similar numbers of completed projects, with 50,223 (13.8%), 49,209 (13.5%), and 48,026 (13.2%) projects respectively. Taoyuan-Taichung Platform and Southern Taiwan Gloria trail behind with 34,592 and 29,374 completed projects, constituting 9.48% and 8.05% respectively.

Figure 7b presents the distribution of researchers among different alliances. The Global Industry Platform of the NTU System, Gloria 2.0 South, and Taiwan Gloria Center maintain their lead in terms of researcher count. The Global Industry Platform boasts the highest number of researchers at 5560, representing approximately 28% of the total researchers count. This is followed by Gloria 2.0 South and Taiwan Gloria Center with 3526 (17.8%) and 2720 (13.7%) researchers respectively. The National Tsing Hua University Platform and Taoyuan-Taichung Platform report similar numbers of researchers, with 2366 and 2313, accounting for 11.9% and 11.7% respectively. Southern Taiwan Gloria and New Industry Alliance are lagging with 1870 and 1452 researchers, constituting 9.44% and 7.33% respectively.

3.5 Long-term sustainability and potential future developments of the digital platform

University–industry collaboration is increasingly critical for driving innovation and technological advancements. The major challenge in these R&D collaborations is finding suitable collaborators. The proposed platform addresses the challenge of finding suitable collaborators by supporting various activities, including technology exploration, technology transfer, business diversion, industry matching, entrepreneurship development, membership management, performance management, and data collection and analysis. This comprehensive support structure simplifies the process for companies seeking researchers relevant to their R&D projects and significantly contributes to the development of numerous university–industry collaborations.

The platform bridges the gap between industry and academia by connecting talented researchers with forward-looking innovation and application industries. This contributes to industrial transformation by exploring major scientific research results and the business potential of academic institutions, assisting in technology translation, patent layout, and entrepreneurial contributions. The Platform Project Promotion Office has developed a one-stop cloud system to support these activities, fostering cross-institutional and cross-regional collaboration. By linking assistant managers, patent engineers, and key cases, the platform provides traceable and analyzable commercialization counseling process data and derivative benefits.

In future phases, the platform expects to deepen its integration with research institutions, establishing an inquiry and guidance system to better identify major research findings of academic institutions. It will further assist academic research institutions in accelerating industry–university–research cooperation platforms and market linkages through comprehensive support. This will strengthen the commercialization of scientific research results and drive industrial transformation by connecting high-level talents with innovative industries. By focusing on these areas, the platform aims to remain sustainable and continuously evolve, addressing the emerging needs of both academic and industrial partners and fostering a robust ecosystem of innovation and commercialization.

4 Changes in the Taiwanese technology transfer environment

The relaxation of regulations relevant to technology transfer and the active promotion of innovation and entrepreneurship initiatives have laid the foundation for a thriving innovation ecosystem in Taiwan.

The regulatory adjustments have created an environment conducive for Taiwanese universities to assert patent rights, utilize income from patent licensing and technology transfer to assemble proficient technology transfer teams, and propel the commercialization of research outcomes within the university setting. This positive cycle has been further facilitated by enabling faculty members to hold positions in external research institutions, relaxing the most stringent regulations related to shareholding and taxation, and allowing the use of university campus addresses by new start-ups. Additionally, post-technology transfer, product manufacturing, and overseas shipment have become feasible.

Furthermore, innovation and entrepreneurship programs have emerged as valuable avenues for universities and companies to secure funding and entrepreneurial resources. The recently developed ‘Digital Platform for University–Industry Collaborations’ is a resource for industry R&D managers, offering access to potential researchers in specific fields and facilitating the establishment of future research partnerships. Simultaneously, researchers keen on commercializing their knowledge can leverage that platform to connect with potential manufacturers and refine their commercialization strategies.

This section initially highlights the role of UIC in fostering the growth of Taiwan’s capacity for innovation. It then outlines the achievements resulting from regulatory adjustments and the promotion of entrepreneurship programs, showcasing an increase in patent applications and UIC projects leading to commercialization, new ventures, and patent promotion. Subsequently, it discusses forthcoming challenges that require attention to ensure sustained long-term growth.

4.1 The role of UIC in the growth of Taiwan’s capacity for innovation

While innovation has historically served as a pivotal factor for Taiwan’s competitive advantage in the global economy, the government has played a significant role in advancing its scientific and technological achievements through the prompt implementation of relevant public policies. According to the latest data on Research and Development (R&D) investment from the Government Research Bulletin (grb.gov.tw), Taiwan has witnessed a substantial increase in R&D funding. Specifically, the funding escalated from approximately 1.94 billion USD (62.7 billion NTD) in 2010 to 4.24 billion USD (137.4 billion NTD) in 2020. In recent years, it has remained around 2.8 billion USD to 3.1 billion USD (93 billion NTD to 100 billion NTD) (Government Research Bulletin, 2023), as shown in Fig. 8. In the context of R&D expenditure as a percentage of GDP, this figure rose from 2.82% in 2010 to 3.79% in 2021, slightly surpassing the growth observed in the United States and Japan, which reported percentages of 3.46% and 3.3%, respectively (Ministry of Economic Affairs, Department of Statistics, 2021).

Over the years, Taiwan has actively championed technology expansion initiatives that have notably contributed to the development of valuable technologies. The global standing of Taiwan’s national industries has earned widespread recognition, as evidenced by the World Economic Forum (2019) (WEF) ranking, placing Taiwan 12th out of 141 economies. Remarkably, Taiwan secured the fourth position for the diversity of its workforce, and innovative capabilities, and the third position for the number of patent applications per million inhabitants (Schwab, 2019). The recently released World Competitiveness Yearbook 2023 by the International Institute for Management Development (IMD) further underscores Taiwan’s success, with an overall 6th ranking among 64 economies, an improvement from its ranking of 7th last year and the highest achieved since 2012. This ranking positions Taiwan as the second most competitive economy in Asia, trailing behind only Singapore. Notably, Taiwan’s rankings by the IMD have shown significant improvement from 2018 to 2023, progressing from 17 to 6th (International Institute for Management Development, 2023).

According to the latest report from the International Monetary Fund, Taiwan’s per capita GDP is anticipated to reach approximately US$36,830 in 2023, up from US$35,510 in 2022. Notably, Taiwan’s per capita GDP exceeded Japan’s US$34,360 in 2022, marking a historic milestone, and surpassed South Korea’s US$33,590 for the first time since 2003 (International Monetary Fund, 2022).

The semiconductor industry in Taiwan plays a pivotal role in driving the nation’s economy, being among its foremost sectors in terms of output value and export share (Office of the President, Republic of China (Taiwan), 2024; Tung, 2023). In 2022, the industry’s output value surpassed US$160 billion, placing Taiwan second only to the USA in this regard. Furthermore, with a workforce of 330 thousand individuals, it stands as a significant contributor to employment (Taiwan Semiconductor Industry Association Convention, 2022; Tung, 2023). By 2023, semiconductor exports accounted for a substantial 40% of Taiwan’s total exports, underscoring its vital role in the nation’s trade landscape (Taiwan Institute of Economic Research, 2024).

Recognizing the imperative to address the shortage of chip talent, Taiwan has taken proactive measures. The National Key Fields Industry–University Cooperation and Skilled Personnel Training Act, enacted in May 2021, facilitates collaboration between companies and national universities to cultivate talent in critical sectors. Thirteen Taiwanese universities now boast semiconductor colleges or departments, a testament to the nation’s commitment to nurturing expertise in this field (Tung, 2023). Since 2020, the NSTC has partnered with esteemed chambers of commerce such as the Taiwan Integrated Circuit (IC) Industry and Academia Research Alliance (TIARA) and the Advanced Microsystems and Package Technology Alliance (AMPA) to spearhead advanced technology research initiatives. A total of 56 projects focusing on IC design, wafer manufacturing, and IC packaging and testing have received funding totaling 3.6 million USD (around 116.16 million NTD), supporting eight universities in forging research alliances with the industry. Over 30 companies have participated in this alliance, with investments exceeding 5 million USD (162.21 million NTD) (NSTC, 2020). Significantly, the REAL project’s promotion has served as a catalyst for semiconductor research and development across academia and industry. This initiative stands as a notable achievement, having nurtured 124 doctoral talents in less than 2 years, and facilitating over 1.4 million USD (45 million NTD) in technology transfer and academia-industry collaborations. The project is expected to contribute an estimated US$94 million (around 3 billion NTD) in future technology transfer activities (NSTC, 2020).

Moreover, several ground-breaking technologies have emerged from successful collaborations between university and industry partners, exemplified by the collaboration between Taiwan Semiconductor Manufacturing Co., Ltd. (TSMC) and the National Chiao Tung University. This partnership yielded the development of a nano-double-crystal copper wire and electroplating process technology, garnering recognition with publications in the prestigious journal Nature (Chen et al., 2020). Notable achievements also include the collaboration between the National Tsinghua University and Bio-Pro Scientific start-up company, resulting in the award-winning NeuLive, being honored with the “COMPUTEX d&i awards” special prize in 2019. NeuLive addresses challenges in constructing large instruments, and intricate circuitry, and mitigating human error. Through modularization and mass production, leveraging Ching Hua University’s wafer research, the project aims to pioneer innovative medical materials, bringing substantial benefits to healthcare and propelling Taiwan’s electronics industry into the realm of high-added value biomedical products (COMPUTEX d&i gold and specialty awards, 2019). Additionally, the collaboration between the Massachusetts Institute of Technology (MIT), the National Taiwan University (NTU), and TSMC stands out as they jointly pursue the development of technology aimed at realizing sub-nanometer semiconductors. The outcomes of this collaborative research, recently featured in the scientific journal Nature (Shen et al., 2021), play a pivotal role in maintaining Taiwan’s forefront position in advanced integrated circuit technology development. These specific research achievements underscore Taiwan’s ongoing contribution to cutting-edge technological advancements.

These achievements underscore Taiwan’s persistent commitment to fostering research and development, emphasizing the pivotal role of collaboration between universities and industries as a cornerstone of efficient national innovation systems. Public policies, marked by legislative changes and targeted programs promoting UIC and technological transfer, have played a pivotal role in encouraging fruitful partnerships between businesses and academic institutions.

However, it is crucial to acknowledge that Taiwan’s economic expansion, as reflected in its per capita GDP growth, is influenced by a multitude of factors beyond the purview of this study. While policies fostering UIC and technology transfer may have contributed significantly to economic growth, other determinants such as global economic trends, geopolitical dynamics, trade policies, and domestic reforms also play pivotal roles. Additionally, while our analysis highlights successful instances of university–industry collaborations and innovative technologies, it is essential to consider their broader implications. For instance, while technologies like NeuLive show promise in addressing specific challenges, their overall impact on Taiwan’s economic growth and competitiveness may vary. Future research endeavors should explore the scalability and commercial viability of such technologies, as well as their potential to deliver broader societal and economic benefits.

4.2 Distribution of patents and articles from UIC partnerships

Drawing on data extracted from the Web of Science database for journal articles and the Derwent Innovation Database for patent applications, specifically covering the years 2000–2022 (as depicted in Fig. 9), this extensive analysis sheds light on the landscape of university–industry collaboration (UIC) in Taiwan.

From 2000 to 2022, Taiwan globally filed a total of 8691 co-patenting applications and produced 16,123 journal articles from UIC partnerships. Figure A graphically portrays the evolution of these articles and patents, highlighting the collaboration between Taiwanese universities and industries on a global scale.

The trajectory of journal articles reveals a remarkable upward trend. Starting with 234 articles in 2000, the count surged to a peak of 1059 in 2021, followed by a slight decline to 1024 articles in 2022. Despite this minor dip, the number of articles consistently increased, indicating a robust upward trend in UIC partnerships over the years. Conversely, the number of co-patenting applications exhibits a less pronounced, though overall ascending, pattern with fluctuations. The initial peak occurred in 2011 with 615 filings, followed by some declines and subsequent increases, reaching a new peak of 679 filings in 2017 before gradually tapering off. By 2022, the count stood at 355, likely influenced by the challenges posed by the COVID-19 pandemic.

Further analysis, based on data from the Derwent Innovation Database spanning 2002–2021 (Fig. 10), reveals insights into Taiwan’s co-patenting activities. During this period, a total of 2151 co-patenting applications were filed with the Taiwan Intellectual Property Office (TIPO), and 1356 co-patenting applications were submitted to the United States Patent and Trademark Office (USPTO). These collaborative patent filings, which arise from UIC, reflect a significant surge in Taiwan’s co-patenting endeavors, a trend that gained momentum following the implementation of the Bayh-Dole Act in the early 2000s.

A closer examination of this dataset, divided into 5-year segments, unveils discernible patterns. The mid-2000s marked a turning point, witnessing an intensified commitment to co-patenting activities. Notably, the period between 2016 and 2019 emerged as a pinnacle of productivity, coinciding with the relaxation of regulations concerning technology transfer and the engagement of part-time teachers from national universities. However, the upward trajectory observed over 2 decades experienced a sharp decline in 2020 and 2021. The abrupt downturn during these years is attributed to the far-reaching impacts of the COVID-19 pandemic, which ushered in self-isolation measures and social restrictions affecting both academic institutions and industries.

To identify the universities and companies most active in co-patenting activities for UIC, we conducted an analysis of the top key patent owners over time. Figure 11a and b display two heatmaps illustrating these dynamics. The x-axis represents the years from 2001 to 2022, while the y-axis shows the top 10 university patent owners and the top 10 company patent owners. The color spectrum ranges from light pink, indicating lower activity, to dark pink, indicating higher activity.

Figure 11a shows the top ten universities most active in co-patenting activities for UIC. The heatmap reveals patterns and trends in co-patenting applications. National Taiwan University leads with the highest number of co-patenting applications, totaling 1022 with the USPTO and TIPO. This university experienced a substantial surge in co-patenting applications from 2007 onwards. The peak period, indicated by the dark pink color, was between 2016 and 2019, with around 100 co-patenting applications annually, peaking at 120 in 2017. National YangMing ChiaoTung University ranks second with 430 co-patenting applications, followed by National Tsing Hua University with 294 applications. National YangMing ChiaoTung University initiated co-patenting in 2004 with 2 patents and showed a stable increase over time, peaking at 48 patents in 2019. Conversely, National Tsing Hua University experienced significant fluctuations in co-patenting applications, with high activity periods from 2009 to 2012 and 2016 to 2020, peaking at 51 applications in 2017 and 32 in 2019.

Figure 11b describes the top 10 company patent owners most active in co-patenting activities for UIC. Taiwan Semiconductor Manufacturing (TSMC) leads with 481 co-patenting applications, starting its collaboration with universities in 2014 with 40 applications. By 2019, TSMC had reached its highest activity level, indicated by the dark pink color, with 106 patents. Chang Chun Group is second with 239 patents, focusing on university collaborations primarily between 2015 and 2020, peaking at 91 applications in 2017. Tatung Company, principally owned and intellectually supported by Tatung University (Tatung University, 2024), ranks third with 237 patents. Their most active period was between 2003 and 2010, peaking at 50 patents in 2008, with a gradual decline thereafter, except for a brief resurgence in 2015 with 14 patents.

4.3 Analysis of UIC projects in Taiwan

Transitioning from the exploration of university–industry co-patenting activities over the past 2 decades, we now investigate the UIC projects in Taiwan from 2015 to 2019. This perspective offers an understanding of the collaborative landscape, considering both the intellectual property outcomes and the tangible projects that have contributed to commercialization, new ventures, and patent promotion.

An examination of the UIC projects in Taiwan from 2015 to 2019 indicates a dynamic trend characterized by fluctuations yet showcasing an overall upward trajectory. The highest number of projects was observed in 2018, with 68 projects, it then showed a downward trend in 2019 with 47 projects (Fig. 12b). Of particular significance is the dominance of UIC projects resulting in commercialization, totaling 172 projects and constituting a substantial 83.9% of the total UIC projects. Additionally, projects resulting in new ventures accounted for 17 projects (8.29%), while those contributing to patent promotion amounted to 16 projects (7.8%) (Fig. 12a).

It is noteworthy that, there is an exclusive focus on commercialization in 2017 and 2018, across all three collaboration categories—commercialization, new venture, and patent promotion – resulting in 37 and 68 projects, respectively (Fig. 12d). The distribution of projects across various fields is depicted in Fig. 12c, revealing that Biotechnology/Medical Devices and Smart Machinery emerged as the highest number with 70 and 68 projects, representing 34.1% and 30.7% respectively. Information and Communication Technology (ICT) followed closely with 38 projects (18.5%), while Green Energy contributed 29 projects (14.1%). Business Management/Digital Finance exhibited the fewest projects, totaling 5 and accounting for 2.4%.

4.4 Challenges for the entrepreneurial ecosystem and sustainable growth

The strategic development of Taiwan’s innovation and entrepreneurship culture is aimed at fostering lasting impact as the nation’s technological and industrial environment continues to mature. With the loosening of technology transfer regulations, the implementation of promotional programs, and the establishment of an industrialization platform, Taiwan’s universities and industries are well-positioned to navigate entrepreneurial shifts effectively. The sustained growth of this ecosystem depends on the active engagement and collaborative spirit of universities, innovative research teams, and industries. Furthermore, the substantial growth of entrepreneurship in Taiwan relies on the availability of ample technological, intellectual, and financial resources.

As this entrepreneurship ecosystem evolves, several challenges must be addressed. These challenges include concerns related to patent commercialization, the acceleration of RSC incubation, the promotion of forward-looking research results and industrial interactions in Taiwan, and the advancement of industrial innovation. Beyond government policies, universities need to cultivate an environment actively promoting technology transfer. It is crucial to create opportunities for researchers to recognize the benefits of closer collaboration with businesses, and vice-versa. Research evaluation should encompass both innovation and academic excellence. Encouraging businesses to boost R&D investments while ensuring that research remains a wellspring of innovation is essential for enhancing their competitiveness in global markets.

Moreover, a fundamental difference exists in the motivations of university researchers, primarily driven by academic publications, compared to the practical aspects of the industry. This disparity often leads to challenges, such as varying cost concepts, lack of experience in mass production, difficulty in transitioning from research and development to mass production, and significant disparities in equipment platforms. These obstacles can be daunting and discourage manufacturers from investing in the technology transfer process. Furthermore, the current deficiency in technology market service presents an additional obstacle, complicating scientists’ efforts to persuade businesses to commercialize their research results.

In tandem with these challenges, when companies seek assistance from universities to overcome technological bottlenecks or enhance existing technologies, a common challenge arises—the gap between “theory” and “practical application”. Technologies developed in the university environment, while innovative, often face hurdles in adapting to industrial applications, resulting in a prolonged path to robust commercialization (Bruneel et al., 2010; Gilsing et al., 2011; Ken et al., 2009; Sá et al., 2010). Moreover, the scarcity of professional technology transfer managers exacerbates this issue, hindering effective alignment between technology supply and demand, and impeding technological improvements (Jones‐Evans et al., 1999; Shen, 2016). To address this challenge, the development of a digital platform becomes crucial in promoting UIC. This platform facilitates the hiring and cultivation of numerous technology transfer managers, pivotal in recognizing and promoting forward-looking technologies. Their primary roles include assessing the commercial potential and suitability of these technologies for patent or copyright protection. This approach is anticipated to bridge the gap between theory and application, offering follow-up services post-technology transfer contract signing.

If the platform project successfully enhances the current situation by recruiting professional talent for the technology transfer business and employing professionals as facilitators between the research team and industry, it will improve communication efficiency between the two parties. This improvement should help counter the industry’s stereotypical perception that academic research is inherently difficult or impractical for industrial applications. Additionally, with the relaxation of technology transfer regulations, companies are now able to invite members of university research teams in pivotal R&D advisory roles or engage them as consultants. Proactive understanding and cooperation between entities are expected to eliminate existing technical bottlenecks and facilitate the accomplishment of technical upgrades.

5 Discussion

The eased technology transfer regulations, along with active innovation and entrepreneurship initiatives, have established a flourishing innovation ecosystem in Taiwan. This empowers universities to assert patent rights, commercialize research, ease shareholding and taxation regulations, and support startups. Post-technology transfer, manufacturing, and overseas shipment of products become feasible. Additionally, the digital platform facilitates collaborative projects, streamlining access to relevant researchers for R&D and bridging the academia-industry gap for comprehensive commercial applications. However, four additional issues warrant further discussion.

5.1 Collaborative strategies for comprehensive technological solutions

Technological innovation is recognized as a tool for enhancing quality and bolstering product competitiveness, with universities serving as key hubs for technological and intellectual property creativity. However, the filing of a single patent does not always seamlessly translate into successful integration. Companies typically seek solutions for complex problems, and a single patent owned by a university or researcher may not fully align with all their requirements. The integration of additional technologies from different institutions or universities becomes imperative to create a viable set of technical solutions. Conferences or meetings that facilitate collaborative partnerships between universities and industries with similar scientific experience and interest in specific research areas are crucial. Such gatherings enable researchers working in analogous technological domains, sharing common needs, to form specialized interest groups. This collaborative approach allows them to exchange ideas and collectively advance specific areas of knowledge, expediting R&D progress for all involved parties.

5.2 Navigating operational challenges in emerging RSCs through incubation guidance

Revisions in the law and regulations, coupled with initiatives and programs fostering the transfer of technological and scientific research, can be viewed as catalysts for advancing the technology transfer landscape in Taiwanese universities. These enhancements are anticipated to pave the way for the establishment of numerous new RSCs in Taiwan. While these RSCs are poised to be at the forefront of technological innovation, their research teams may encounter initial operational challenges, including fundraising, market expansion, supply chain collaboration, acquisition of marketing channels, manpower recruitment and development, and various other business management requirements. Given that the operational capabilities of these companies have received relatively less attention in the RSC plan, subsequent guidance from the existing incubation system may be essential. This support can aid in maintaining their financial and managerial resilience, enabling them to grow sustainably and contribute to the industry in the long term.

5.3 The impact of Taiwan’s technology transfer legislation revisions on businesses of varying size

The recent relaxation of Taiwan’s technology transfer legislation has proven highly advantageous for companies at both ends of the size and investment spectrum, particularly benefiting unicorns and emerging start-ups. However, this regulatory change has posed challenges for Small and Medium Businesses (SMBs) due to resource constraints and limited expertise. To ensure that SMBs can also capitalize on the benefit of the revised legislation, there is a pressing need for additional support and resources to assist them in navigating and leveraging these new opportunities effectively.

5.4 Maximizing data sources in the industrialization platform

It is important to note that the industrialization platform gathers information from three main data sources (TIPO, WOS, and GRB), related to each researcher’s contributions, including patents, publications, and projects. Although this information is collected from multiple sources, there is also another database known as the National Digital Library of Theses and Dissertations in Taiwan (NDLTD), which is the result of a collaborative collection of theses established between the National Central Library and universities. The associated database provides access to abstracts and full-text retrieval of academic dissertations and theses approved by the Ministry of Education of Taiwan since 1956.Footnote 2 It would be more effective to include the information of this database in the platform.

6 Conclusion

To address the issue of abundant research results with limited commercial applications, the Taiwanese government has systematically revised relevant laws and regulations with the support of multiple ministries and committees.

This study examines Taiwan’s research landscape and the significant impact of recent legislative revisions and initiatives aimed at promoting the transfer of technological and scientific research. Our analysis begins with a detailed exploration of the legal system for technology transfer in Taiwan, highlighting the substantial relaxation of technology-transfer-related regulations and the government-funded university–industry promotion programs. Additionally, we introduce the digital platform for UIC, established by the Taiwanese government to enhance infrastructure and foster collaborations between universities and industries. This provides an overview of the current research landscape in Taiwan. We then analyze the changes in the Taiwanese technology transfer environment, assessing the impact of regulatory relaxation on university–industry collaborations and the development of innovative technologies.

The findings underscore the impactful role of recent legislative revisions and initiatives in promoting the transfer of technological and scientific research. These changes have significantly facilitated successful collaborative projects between industry and university teams, establishing an effective University–Industry Collaboration (UIC) mechanism. This has led to the development of noteworthy technologies and tangible projects contributing to commercialization, new ventures, and patent promotion resulting from ongoing collaborations. Notably, comprehensive support from the Taiwanese government for the domestic semiconductor industry, fostering connections between the industry and academia, has further propelled this progress. Universities subsidized under UIC programs have demonstrated enhanced capabilities in developing their UIC context and improving academic innovation performance. Importantly, greater UIC funding correlates with enhanced academic innovation performance, as evidenced by an increase in paper and patent publications, highlighting the positive outcomes of these collaborative efforts. These findings align with the results of studies conducted by Cheng et al. (2018) and Tseng et al. (2018).

Throughout this study, it is acknowledged that, despite the enactment of the “Fundamental Science and Technology Act” in 1999, substantial legislative relaxation transpired only in recent years. The observed outcomes, characterized by an upward trend in patent applications since the early 2000s, have become more pronounced following the significant relaxation of laws in 2011, reaching a productivity zenith in 2019. However, there exists a temporal lag in the manifestation of impacts from UIC projects contributing to commercialization, new ventures, and patent promotion. These projects have recently gained momentum, especially between 2015 and 2019, with a significant focus on commercialization in the biotechnology/medical devices and smart machinery sectors. The most notable achievements have emerged since the major legal relaxations in 2011, which mandated increased annual funding for science and technology, enhanced support for human resources and infrastructure, and exempted financial gains from national property regulations. Subsequent relaxations, including permissions for university researchers to invest in related companies and the easing of restrictions on the utilization of academic research results, have further contributed to these observed positive trends.

Although there have been significant advancements in the number of patent applications and UIC projects contributing to commercialization, it is important to note that the establishment of new firms through these projects remains limited. This could be attributed to challenges within the technology market, including a lack of specialized services that hinder the optimization of supply and demand dynamics. Furthermore, it is crucial to recognize that the analysis of UIC projects between 2015 and 2019 might not fully capture the impacts of the significant relaxation of laws on the trends of UIC projects. Therefore, a comprehensive exploration of UIC projects over time is necessary to assess the true impact of regulatory changes.

Despite these challenges, Taiwan’s national innovative capacity continues to evolve, with universities playing a central role in driving innovation forward. The increasing ownership of inventions by universities reflects Taiwan’s acknowledgment of their crucial contribution to technology development. This evolving landscape positions universities at the forefront of innovation, signaling a promising trajectory for Taiwan’s technological advancement.

Data availability

Data will be made available on request.

Notes

The Ministry of Education encourages the establishment of Research Service Companies (RSCs) by implementing a supportive framework within universities. As a component of the "University Industrial Innovation R&D Plan," this endeavor entails professors guiding doctoral-level R&D talents in collaboration with industry resources. The goal is to nurture talent and undertake innovative technology research and development.

For more information, see. https://etds.ncl.edu.tw/cgi-bin/gs32/gsweb.cgi/ccd=OzjdP./webmge?switchlang=en.

References

Journals

Abramo, G., D’Angelo, C. A., Di Costa, F., & Solazzi, M. (2009). The role of information asymmetry in the market for university–industry research collaboration. The Journal of Technology Transfer, 36(1), 84–100. https://doi.org/10.1007/s10961-009-9131-5

Acs, Z. J., Audretsch, D. B., & Lehmann, E. E. (2013). The knowledge spillover theory of entrepreneurship. Small Business Economics, 41(4), 757–774. https://doi.org/10.1007/s11187-013-9505-9

Aldridge, T., & Audretsch, D. B. (2010). Does policy influence the commercialization route? Evidence from National Institutes of Health funded scientists. Research Policy, 39(5), 583–588. https://doi.org/10.1016/j.respol.2010.02.005

Balconi, M., & Laboranti, A. (2006). University–industry interactions in applied research: The case of microelectronics. Research Policy, 35(10), 1616–1630. https://doi.org/10.1016/j.respol.2006.09.018

Baldini, N. (2006). The Act on inventions at public research institutions: Danish universities’ patenting activity. Scientometrics, 69(2), 387–407. https://doi.org/10.1007/s11192-006-0159-0

Barnes, T. A., Pashby, I. R., & Gibbons, A. M. (2006). Managing collaborative R&D projects development of a practical management tool. International Journal of Project Management, 24(5), 395–404. https://doi.org/10.1016/j.ijproman.2006.03.003

Bellini, E., Piroli, G., & Pennacchio, L. (2018). Collaborative know-how and trust in university–industry collaborations: Empirical evidence from ICT firms. The Journal of Technology Transfer, 44(6), 1939–1963. https://doi.org/10.1007/s10961-018-9655-7

Bishop, K., D’Este, P., & Neely, A. (2011). Gaining from interactions with universities: Multiple methods for nurturing absorptive capacity. Research Policy, 40(1), 30–40. https://doi.org/10.1016/j.respol.2010.09.009

Bodas Freitas, I. M., Marques, R. A., & e Silva, E. M. P. (2013). University–industry collaboration and innovation in emergent and mature industries in new industrialized countries. Research Policy, 42(2), 443–453. https://doi.org/10.1016/j.respol.2012.06.006

Borah, D., & Ellwood, P. (2021). The micro-foundations of conflicts in joint university–industry laboratories. Technological Forecasting and Social Change. https://doi.org/10.1016/j.techfore.2021.121377

Brimble, P., & Doner, R. F. (2007). University–industry linkages and economic development: The case of Thailand. World Development, 35(6), 1021–1036. https://doi.org/10.1016/j.worlddev.2006.05.009

Bruneel, J., D’Este, P., & Salter, A. (2010). Investigating the factors that diminish the barriers to university–industry collaboration. Research Policy, 39(7), 858–868. https://doi.org/10.1016/j.respol.2010.03.006

Bstieler, L., Hemmert, M., & Barczak, G. (2014). Trust formation in university–industry collaborations in the U.S. biotechnology industry: IP policies, shared governance, and champions*,†. Journal of Product Innovation Management, 32(1), 111–121. https://doi.org/10.1111/jpim.12242

Bstieler, L., Hemmert, M., & Barczak, G. (2017). The changing bases of mutual trust formation in inter-organizational relationships: A dyadic study of university–industry research collaborations. Journal of Business Research, 74, 47–54. https://doi.org/10.1016/j.jbusres.2017.01.006

Chang, Y.-C., Chen, M.-H., Hua, M., & Yang, P. Y. (2005). Industrializing academic knowledge in Taiwan. Research-Technology Management, 48(4), 45–50. https://doi.org/10.1080/08956308.2005.11657324

Chang, Y.-C., Chen, M.-H., Hua, M., & Yang, P. Y. (2006). Managing academic innovation in Taiwan: Towards a “scientific–economic” framework. Technological Forecasting and Social Change, 73(2), 199–213. https://doi.org/10.1016/j.techfore.2004.10.004

Chen, K., Zhang, C., Feng, Z., Yi, Z., & Ning, L. (2022). Technology transfer systems and modes of national research institutes: Evidence from the Chinese academy of sciences. Research Policy, 51(3), 104471–104471. https://doi.org/10.1016/j.respol.2021.104471

Chen, T.-A., Chuu, C.-P., Tseng, C.-C., Wen, C.-K., Wong, H.-S.P., Pan, S., Li, R., Chao, T.-A., Chueh, W.-C., Zhang, Y., Fu, Q., Yakobson, B. I., Chang, W.-H., & Li, L.-J. (2020). Wafer-scale single-crystal hexagonal boron nitride monolayers on Cu (111). Nature, 579(7798), 219–223. https://doi.org/10.1038/s41586-020-2009-2

Cheng, H., Zhang, Z., Huang, Q., & Liao, Z. (2018). The effect of university–industry collaboration policy on universities’ knowledge innovation and achievements transformation: Based on innovation chain. The Journal of Technology Transfer, 45(2), 522–543. https://doi.org/10.1007/s10961-018-9653-9

Chung, J., Ko, N., & Yoon, J. (2021). Inventor group identification approach for selecting university–industry collaboration partners. Technological Forecasting and Social Change, 171, 120988. https://doi.org/10.1016/j.techfore.2021.120988