Abstract

In the current volatile, uncertain, complex, and ambiguous environment and digital era, value co-creation is an important strategy for competitive advantage of manufactures. Moreover, firms' relational capability (RC) and digital capability (DC) are vital driving forces of value co-creation. However, the complex relationships between relational capabilities and digital capabilities are not yet clear. Based on service-dominant logic (S-D logic), our study constructs a research framework and hypothesis of the antecedents and consequences of value co-creation. Besides, drawing on socio-technical congruence theory, we develop four matched typologies (high RC/high DC, low RC/low DC, low RC/high DC, and high RC/low DC), and investigate the effects of (in)congruence between RC and DC on value co-creation. The research model is tested with 340 survey data from Chinese manufactures using polynomial regression analyses and response surface modelling. Results show that RC and DC are positively related to value co-creation, and value co-creation positively affects firm innovation performance. In addition, empirical results suggest that RC/DC congruence has a linear positive effect, while RC/DC incongruence has an inverted U-shaped effect on value co-creation. Lastly, we also find that high RC/low DC leads to more value co-creation than high DC/low RC. These findings provide insights of firms' capabilities on value co-creation under S-D logic and contribute to practices of innovation management within strategic partnerships.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

As the environment becomes more volatile, uncertain, complex, and ambiguous (VUCA), it is difficult for manufacturers to create superior value simply by relying on their own resources and technology (Cozza & Zanfei, 2016; Münch et al., 2022; Tian & Li, 2017; Ukko et al., 2019). S-D logic emphasizes value co-creation through the interaction and integration between of firms and their partners (e.g., suppliers, distributors and customers) to achieve superior value (Simmons & Durkin, 2023; Vargo & Lusch, 2004, 2008). Successful value co-creation enables firms to obtain more extensive market information and resources, thereby fostering firm innovation performance (Manser Payne et al., 2021; Payne et al., 2008; Scuotto et al., 2021). Thus, value co-creation has become a key strategy for the creation of value and the achievement of better performance (Prajogo & Sohal, 2006; Singh et al., 2022; Tseng & Chiang, 2016). However, value co-creation remains a challenging endeavor due to negative factors such as low customer engagement and ineffective resource integration (Corsaro, 2019; Ghantous & Alnawas, 2021). Therefore, scholars are paying more attention to incentivizing and managing value co-creation in strategic partnerships.

A growing number of studies have been focused on the triggering elements of value co-creation in strategic partnerships (De Silva & Rossi, 2018; Siaw & Sarpong, 2021). Some studies have found that firms' capabilities, particularly their RC and DC, are important for value co-creation (Mu, 2015; Wielgos et al., 2021). Research has shown that RC provides access to heterogeneous resources and high-quality interactions for value co-creation (Faruquee et al., 2021; Nyamrunda & Freeman, 2021). As a transitioning market, China has long-standing "relational" social attributes (Yang et al., 2021), which leads to firms depending on RC to strengthen the relational and economic foundation needed for strategic cooperation (Zhou et al., 2014). Additionally, digital transformation has brought great advances to the Chinese economy and business operations (Li et al., 2022). Firms actively and effectively communicate with partners through digital platforms (Ramaswamy & Ozcan, 2018) to facilitate collaboration, get resources, and integrate capability (Inceoglu et al., 2024). Scholars and managers have considered DC to be a key driving force for value co-creation (Wielgos et al., 2021; Matarazzo et al., 2021).

However, there are several gaps in the related extant research. First, although previous studies have recognized the vital role of firms' capabilities in value co-creation (Nyamrunda & Freeman, 2021; Siaw & Sarpong, 2021), there is a lack of research that discusses the effect and underlying mechanism of both RC and DC on value co-creation, especially lacking a deep theoretical and empirical understanding of how digitization affects the process of resource mobilization, ultimately influences value co-creation and innovation performance (Inceoglu et al., 2024). Second, existing research has not yet explored the synergistic and heterogeneous effects of RC and DC on value co-creation. Specifically, very few studies have focused on the effects of RC/DC congruence on value co-creation. Whether high levels of congruence can lead to better value co-creation is still an open question. Additionally, under incongruent conditions, the effect of different levels of capability portfolios (high RC/low DC and high DC/low RC) on value co-creation requires further exploration. Third, the impact of value co-creation in strategic partnerships on innovation performance has not been fully explored in the extant research.

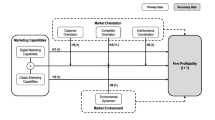

To fill these research gaps, first, based on S-D logic, our study constructs a research framework and hypotheses for the antecedents and consequences of value co-creation. Specifically, we explore the direct influence of RC and DC on value co-creation and uncover the impact of value co-creation on innovation performance. Second, drawing on socio-technical congruence theory (Bostrom & Heinen, 1977; Shirazi et al., 2021; Rajaguru et al., 2023), we consider RC as the reflection of a social system (Münch et al., 2022) and DC as the reflection of a technical system (Matarazzo et al., 2021; Shirazi et al., 2021), and investigate the effects of (in)congruent between RC and DC on value co-creation.

This study makes several potential contributions to the literature. First, we found that RC and DC are important triggers for value co-creation (De Silva & Rossi, 2018; Siaw & Sarpong, 2021), which enriches the research of value co-creation based on S-D logic. Second, our study draws on socio-technical congruence theory to explore the matching of RC and DC. We find that a high level of RC and DC congruence can lead to more value co-creation, and the high RC/low DC has better effects than the high DC/low RC on value co-creation. These findings verify the validity of socio-technical congruence theory in the field of value co-creation and reveal the synergistic and heterogeneous effects of RC and DC. Third, this study provides adequate explanations for improving innovation performance through value co-creation.

The remainder of this paper is structured as follows. Section 2 reviews the theoretical background. Section 3 proposes specific hypotheses. Section 4 describes methods and the results of empirical analyses. Section 5 discusses our findings, outlines their potential theoretical contributions and managerial implications, and identifies avenues for future research. Figure 1 presents the conceptual framework of our study.

2 Theoretical backgrounds

2.1 S-D logic and value co-creation

S-D logic emphasizes value co-creation between firms and partners through resource integration and interaction (Vargo & Lusch, 2004, 2008). Because partners having operational resources, such as knowledge and skills (Corsaro, 2019; Payne et al., 2008), they become participants who are able to co-production and co-design with manufacturer (Payne et al., 2008). Thus, traditional transactions become open, interactive and relational processes, and partners can actively participate in the value creation process and maintain a high level of collaboration with the firm.

Although much research on value co-creation has been focused on the B2C context, the literature on value co-creation in the B2B context has increased in recent years (Corsaro, 2019; Ghantous & Alnawas, 2021; Payne et al., 2008; Simmons & Durkin, 2023). From the perspective of S-D logic, value co-creation refers to collaborative behavior and the interaction process in which a firm and its partners co-create superior value (Corsaro, 2019; Payne et al., 2008; Vargo & Lusch, 2008) and achieve business goals (Simmons & Durkin, 2023). For example, a distributor/supplier who becomes involved in production activities that are traditionally the responsibility of the manufacturer (Karpen et al., 2012; Yang et al., 2021). Thus, in this paper, we define value co-creation as the active participation, interaction, and collaboration that occurs between firms and their partners (e.g., suppliers and distributors) in transactions to create superior value through joint problem solving and technology training (Corsaro, 2019; Simmons & Durkin, 2023; Vargo & Lusch, 2008).

There are two main streams of research on value co-creation. In the first, the antecedents that can facilitate value co-creation, including capability (Faruquee et al., 2021; Siaw & Sarpong, 2021) and resource elements (Chaudhuri et al., 2023) are analyzed. Vargo and Lusch (2008) and Ngugi et al. (2010) focused on value co-creation in a supply chain and found that RC is a prerequisite for value co-creation. Some research has shown that DC and digitization, such as that achieved through social media, mobile devices, and cloud computing, provide convenient means for technology and information exchange (Wielgos et al., 2021; Atanu et al., 2022), which facilitates value co-creation among partnerships (Matarazzo et al., 2021). Other research has suggested that resource integration has an important influence on value co-creation (Bagheri et al., 2019; Vivona et al., 2023). Specifically, new digital applications, platforms, and devices have become important places for organizations to access new opportunities, customer needs, and resources (Chaudhuri et al., 2023; Zott & Amit, 2017). For example, the widespread use of digital platforms such as Alibaba and Amazon.com has changed the way firms interact with each other, gather information, and combine resources (Li et al., 2018a, 2018b; Ramaswamy & Ozcan, 2018). In addition, crowdfunding models relying on digital platforms in the capital market have been rapidly adopted (Scuotto et al., 2021; Butticè & Vismara, 2022; Inceoglu et al., 2024). Crowdfunding platforms engage in connections and interactions with stakeholders, mobilizing the value-creating capabilities of investors and financiers, and enhancing the comprehensive benefits of all parties, thus achieving value co-creation (Inceoglu et al., 2024; Manser Payne et al., 2021; Rossi et al., 2023).

In the second research stream, the consequences of value co-creation, including customer satisfaction, service innovation and firm performance, are analyzed. Navarro et al. (2016) argued that value co-creation between manufacturers and distributors can better meet customer needs and expectations and improve customer satisfaction. As a continuous process of integrating, matching and reconfiguring resources, value co-creation fosters service innovation (Nardelli & Broumels, 2018). Moreover, in the value co-creation process, close contact and communication between manufacturers and distributors is conducive to the accurate identification of market needs and the effective generation of valuable ideas (Chen et al., 2011), which are conducive to production and technological innovation and serve to enhance a firm's innovation performance (Foss et al., 2013; Manser Payne et al., 2021). In conclusion, based on S-D logic, we build a conceptual model to discuss the effects of RC and DC on value co-creation and explore the impact of value co-creation on innovation performance.

2.2 Socio-technical congruence theory and firm capabilities

Socio-technical congruence theory proposes that social systems (people and their relationships) and technological systems (technological components and their uses) are jointly coordinated to achieve superior benefits (Bostrom & Heinen, 1977; Minshull et al., 2022; Rajaguru et al., 2023). A social system refers to individuals or groups in which a firm collaborates with or from whom a firm can make demands, including customers, distributors and suppliers (Münch et al., 2022). A technical system includes the infrastructure, methods, tools and digital interconnection needed for the new technology implementation process (Minshull et al., 2022; Oesterreich & Teuteberg, 2019). Socio-technical congruence theory emphasizes the mutual adaptation and coordination of social and technical systems. When social and technological systems are highly matched, the expected benefits increase (Forkmann et al., 2018; Shirazi et al., 2021). Some studies have explored the importance of technological and social factors in the process of strategic cooperation (Shamim et al., 2020), demonstrating that socio-technical congruence fosters cooperation and resource exchange (Rajaguru et al., 2023; Shirazi et al., 2021). In other words, the congruence between social and technical systems can facilitate collaboration, information exchange and resource complementary. Therefore, socio-technical congruence theory provides a useful perspective that serves as the theoretical basis for this study.

In this study, we argue that strategic partnerships can be viewed as a system that is constructed from social and technical subsystems. The strategic goals of such a system are to create superior value and achieve better performance through value co-creation that occurs between the focal firm and its partners. The social system provides relational and emotional foundations,which is beneficial for firms to obtain resource support from their partners for value co-creation (Münch et al., 2022). The technical system provides a well-grounded information technology (IT) infrastructure that improves information acquisition and exchange in the value co-creation process (Shirazi et al., 2021). Therefore, we posit that RC reflects the social system, while DC reflects the technical system.

Specifically, RC is a firm's ability to build close, mutually understood and reciprocal relationships with its partners (De Silva & Rossi, 2018; Mu, 2015). RC provides access to heterogeneous resources for value creation (Ngugi et al., 2010; Zhou et al., 2021). DC is a firm's ability to construct information technology (IT) infrastructure for technical applications to realize digital interconnection with internal departments and external partners (Atanu et al., 2022; Struwe & Slepniov, 2023). Research has shown that new digital technologies such as Big Data and artificial intelligence have profoundly impacted firm cooperation (Scuotto et al., 2021). For example, the wide use of digital platforms, such as Alibaba and Amazon.com, changes firm ways of information collection and resource integration (Li et al., 2018a, 2018b; Matarazzo et al., 2021), which provides convenience for value co-creation. In addition, Inceoglu et al., (2024, p.3) argued that “digitization can dramatically transform how firms mobilize resources from their environments and interact with (prospective) resource providers, including the search, access, and governance of resources.” Based on socio-technical congruence theory, we will explore the effects and mechanisms of RC and DC (in)congruence on value co-creation. Specifically, we test whether RC/DC congruence may lead to more value co-creation than incongruence, and the high level of congruence produces better effects. In the incongruent condition, we argue that high RC/low DC could be better than high DC/low RC for value co-creation.

3 Research hypotheses

3.1 Effects of RC and DC on value co-creation

RC refers to the "social systems" in which an actor operates, which center on the key characteristic of trust (Forkmann et al., 2018; Rajaguru et al., 2023). First, trust, as an RC characteristic, helps to create a positive cooperative atmosphere, thus RC significantly affects resource exchange, combination, and sharing. Second, Kähkönen et al. (2015) conceptualized RC as a form of "resource interdependency". And they argued that focal firms would produce a behavioral choice to build ties with trusted partners as well as the opportunity for value co-creation. Third, RC also is conducive to repeated interactions, which increases knowledge sharing and resource acquisition between cooperative partners (Ng & Vargo, 2018; Ngugi et al., 2010; Zhou et al., 2021). Thus, RC facilitates information exchange, knowledge sharing, and resource acquisition, which is to be an effective antecedent of value co-creation. Accordingly, we present the following hypothesis:

Hypothesis 1

RC has a positive effect on value co-creation.

DC is like to "technical systems" that rely on information technology (IT) infrastructure and use digital application and interconnection as key characteristics (Minshull et al., 2022; Oesterreich & Teuteberg, 2019). On the one hand, from the perspective of DC, data are regarded as valuable information resources (Atanu et al., 2022). The application of digital platform can transmit real-time information about customer needs, which not only reduces the information search cost and information exchange cost but also decreases information asymmetry (Scuotto et al., 2021; Inceoglu et al., 2024). Particularly, DC allows for exploiting the potential of the valuable insights and knowledge extracted from large-sized, diverse, and up-to-date data on customers, markets, and competitors (Faruquee et al., 2021; Struwe & Slepniov, 2023), which can help firm to deal with the question of production and design, and prompt value co-creation. On the other hand, DC is based on digital technology, particularly on the building of a sharing platform to enable direct exchanges among the participants of value networks. The application of digital platform can improve the efficiency of resource allocation and integration (Butticè & Vismara, 2022), strengthen process supervision (Von Briel et al., 2018), and realize the transparent and controlled transaction process. This effectively reduces unethical behaviors in the cooperation, such as information leakage and opportunism (Inceoglu et al., 2024), which guarantees the resources exchanging in the cooperation. The couplings between value network participants become reinforced by digital technologies enable close collaboration and coordination among participants, such as the use of a platform to coordinate exchanges within a supply chain (Shamim et al., 2020). Therefore, DC motivates value co-creation. Accordingly, we develop the following hypothesis.

Hypothesis 2

DC has a positive effect on value co-creation.

3.2 Effects of the congruence between RC and DC on value co-creation

Value co-creation emerges from the combination of resources, the coordination of activities and the connection among partners. Value co-creation is not created by a single firm, rather, it requires resources and other forms of cooperation, such as technology sharing and information exchange (Ng & Vargo, 2018; Vargo & Lusch, 2008). In strategic partnerships where value co-creation is the focus, firms tend to share information, stay flexible, and act together. Based on socio-technical congruence theory, we expect that value co-creation increases when a firm's DC is more congruent with its RC. DC that reduces the costs of sustaining relationships for firms, coupled with an equivalent level of RC, increases the level of trust exhibited in the relationship, which ensures that both sides exchange resources and share information and encourages both parties to co-create value (Rajaguru et al., 2023; Shirazi et al., 2021).

In contrast, when a firm's DC is high, but its RC is low, value co-creation is not likely to be optimal. Firms with high DC have a greater reliance on the results of digital technologies, thereby strengthening the rigidity of DC and ignoring the flexibility of emotional factors. The lack of RC in a firm makes partners hesitant to take actions such as the sharing of proprietary information, technology and resources, as partners are not confident in the firm's benevolence and are cautious of being exploited (Ford et al., 2018). Moreover, the rigidity derived from high DC and the perceived risk and trust crisis that arises from low RC can induce the firm to resort to more formal control strategies in its strategic partnerships. For example, detailed contracts and intensive monitoring (Andersen et al., 2009) undermine the development of partnerships and discourage partner willingness to share and cooperate beyond their contractually stipulated roles (Lambert & Enz, 2012), which is not beneficial for value co-creation.

We also expect that value co-creation becomes sub-optimal when RC is high, but DC is low. Although a high level of RC is favorable for inter-firm cooperation, low DC suggests that a firm cannot rely on digital technology to gain faster access to partners' information and select the right partner for technology co-creation, thus dispelling the firm’s enthusiasm for cooperation to promote value co-creation (Faruquee et al., 2021; Woodside & Baxter, 2013). Accordingly, we develop the following hypothesis:

Hypothesis 3a

Value co-creation is greater when RC and DC are congruent than when they are incongruent.

According to socio-technical congruence theory, distinguishing the level of congruence also becomes important. The nature of congruence, rather than simply the matching of two components, is critical for obtaining superior benefits (Minshull et al., 2022; Rajaguru et al., 2023). Therefore, differentiating between the congruence for low RC/DC and that for high RC/DC is necessary.

Specifically, we hypothesize that there are different levels of value co-creation based on a firm's congruence between their RC and DC at different levels. When both RC and DC are low, we assume that value co-creation would be hardly any. Such partnerships are more likely to constitute an arm's-length or transitional exchange, and the behaviors that occur in this condition are limited to buying and selling rather than involving deep communication, strategy adjustment, or sharing resources. In contrast, when RC and DC both increase and come into congruence at higher levels, value co-creation accrues due to a combination of lower economic cost and emotional motivation. High levels of both RC and DC not only create an urgent need to coordinate with their partners to achieve value co-creation or avoid losses (Stephen & Coote, 2017) but also increase firm trust in compliance and adaptation (Davies et al., 2011), which makes information exchange, technology cooperation, flexibility, and sharing (Atanu et al., 2022; Struwe & Slepniov, 2023) more common in strategic partnerships. In addition, when a firm's RC and DC both increase and come into congruence at higher levels, the increased willingness to cooperate that is based on close relationship links and the increased information transparency brought about by the widespread use of digital technology provide a dual motivation for value co-creation. Accordingly, we present the following hypothesis:

Hypothesis 3b

Value co-creation is greater when RC and DC are congruent at higher levels than when they are congruent at lower levels.

3.3 Effects of incongruence between RC and DC on value co-creation

However, the differences in the levels at which firm's RC and DC function and the reality of a dynamic and iterative market environment make the ideal match between RC and DC less common. This imbalance is reflected by the alternation of the two capabilities over time under certain spatial conditions. Firm capabilities tend to be dominated by one competency and supported by the other, including the combination of "high RC/low DC" and "high DC/low RC".

Some studies consider the focus of a firm to be more on the use of RC in the process of value co-creation (Ngugi et al., 2010; Shirazi et al., 2021). Compared with DC, which can be used to quickly access external information, RC can be used to better maintain trust and promote interfirm interaction and cooperation (Kähkönen et al., 2015). Particularly, as the current market environment becomes more volatile, firms place a greater focus on connecting with partners, accessing heterogeneous resources across organizations, addressing market risks and creating value. In addition, DC complements RC (Shirazi et al., 2021). Although DC is more useful for firms to access information, and technology knowledge, expanding the ways and means for RC to access resources. However, DC requires a high level of RC to increase effective value co-creation. This is particularly true of mature industries facing transformation, such as manufacture, where a complete balance between the two types of capabilities is not possible. However, more effective value co-creation requires a focus on RC to ensure the stability of strategic partnerships and to respond to market changes. Considering that the essence of value co-creation is interaction, we propose the following hypothesis:

Hypothesis 4

Value co-creation is greater under incongruent high RC/low DC than under incongruent high DC/low RC.

3.4 Effects of value co-creation on innovation performance

According to Zhang et al. (2020), value co-creation with partners serves as a new source of innovation performance. Interaction is the core of the value co-creation process (Ng & Vargo, 2018; Vargo & Lusch, 2008). Constructive interactivity, deep engagement, and a propensity to act on both sides are conducive to firm recognizing the technology and resource differences of its partners (Manser Payne et al., 2021; Tseng & Chiang, 2016), which is beneficial for firm integrating partners knowledge and resource to prompt new products development. Zaborek and Mazur (2019) also mentioned that to succeed in innovation, firms need to align their resources, capabilities, and processes with their partners' value-generating processes. The innovation of firms relies on the knowledge and resources of partners, the major improvement of existing products, and the development of novel products (Nayal et al., 2022). In addition, value co-creation changes conventional innovation in a novel way. Firms close contact and communicate with their partners to exchange information about the needs and requirements of customers (Woodside & Baxter, 2013), and obtain valuable ideas (Chen et al., 2011), which are conducive to production and technological innovation and serve to enhance a firm's innovation performance (Foss et al., 2013; Manser Payne et al., 2021). Due to such considerations, we hypothesize the following:

Hypothesis 5

Value co-creation has a positive impact on innovation performance.

4 Methods

4.1 Data and sample

To test our research hypothesis, we compiled an English questionnaire after an extensive literature review. Our scales are adapted from mature scales and translated into Chinese according to language conventions to ensure that questionnaires are better understood and answered by those completing them. We used translation and reverse translation techniques (Luo et al., 2011) to compare the initial English scale with the subsequent English scale. If errors were found, we revised the previous translation to ensure the questionnaire's cross-cultural validity and conceptual consistency. We then advanced 30 middle or high managers with a pilot study to verify the questionnaire and the accuracy and appropriateness of its words and terms. Based on the results of the pilot study and feedback, the questionnaire was adjusted and revised again both to better adapt it to China's economic and political environment and to ensure that it accurately reflected the problem that we were studying.

Our research aims to investigate manufacturers' value co-creation in the strategic partnership. A manufacturer is a firm that produces, designs and provides productions and services in a transaction. In the data collection process, we randomly selected 560 manufacturers from the list of domestic enterprises in the manufacturing, technical services, transportation, warehousing, and logistics industries as an initial sample. Subsequently, we called these firms to ask if they would volunteer to participate in our study, and 507 firms said they would. We mailed research instructions and questionnaires to these firms, asking them to identify appropriate middle and senior managers as respondents. We emphasized the academic and anonymous nature of the questionnaire in the questionnaire guidelines and emails to increase the response rate and objective authenticity. Questionnaire distributed lasted more than two months, after several rounds of reminders and recalls, we finally recovered 440 questionnaires. After excluding questionnaires with incomplete information and missing data, we received 340 actual valid questionnaires with a valid recovery rate of 77.27%.

Since the questionnaire-interview research method is prone to non-response bias, we conducted an independent sample T-test by comparing the firm size objective question items of respondents and non-respondents. The results showed that there was no significant difference between the two groups in firm size (number of employees) (t = − 1.421, p = 0.158 > 0.05). Therefore, non-response bias did not seem to be a major concern for our dataset. Meanwhile, more than 60% of the sample firms are at a mature stage of development, ensuring that the sample firms studied have a high level of maturity, as shown in Table 1.

4.2 Measures

Well-established multi-item scales from previous research were adapted to measure the constructs of our conceptual model. Table 2 provides details of all the measured items and their validity assessments, based on 7-point Likert scale (1 means "strongly disagree" and 7 means "strongly agree").

Specifically, the items measuring RC were adapted from Mu (2015). These items measured how firms choose partners, coordinate relationships, and integrate relationship resources. The measurement items for DC were adapted from Wielgos et al. (2021). These items measured the use of digital technologies and platforms by firms to improve digital connectivity. The items for measuring value co-creation were adapted from Corsaro (2019) and Ghantous and Alnawas (2021). These constructs were measured by assessing how firms solve problems with partners, exchange knowledge, and support each other. The measurement items to assess innovation performance were adapted from Calantone et al. (2002) and Prajogo and Sohal (2006). These constructs were measured by evaluating firm product and technology innovations.

We also added three control variables: age, gender, and education background. Firstly, the age of managers is closely related to their working time, which is a potential factor affecting firm's decision-making and behavior (Kumar, 2023). Secondly, we have controlled the gender of managers. The gender difference also has a potential impact on firm's decision-making (Apesteguia et al., 2012). Finally, we also control the managers' education background. Education background would potentially affect managers choose partners and develop the relationship network (Ding, 2011).

4.3 Common method variance and measure validity

To reduce potential common method bias, we used an ex ante and post hoc approach, namely study design and statistical analysis (Podsakoff et al., 2003). First, we protected the anonymity of the respondents and improved the wording of the items. Second, we used the marker variable method recommended by Lindell and Whitney (2001). The lowest positive correlation in the correlation matrix was 0.025, which we use to estimate the common method bias. After adjusting the observed correlations, the correlations between the independent and dependent variables maintained their statistical significance, suggesting that common method bias was not a serious problem.

Our measurement model was analyzed by CFA using AMOS 26.0. The results indicated that the measurement model fits the data well (χ2/df = 1.559, P = 0.000, RMSEA = 0.041, NFI = 0.943, TLI = 0.974, CFI = 0.979, IFI = 0.979) and is statistically significant, making the model suitable for the next step of correlation and regression analysis. We used confirmatory factor analysis to evaluate the reliability and validity of the multi-item structure in the model. As shown in Table 2, Cronbach's alpha and composite reliability (CR) for each construct exceeded the 0.700 threshold, indicating adequate reliability (Fornell & Larcker, 1981). All factor loadings were significant, and the average variance extracted (AVE) for each construct was above the cutoff value of 0.500, indicating good convergent validity (Bagozzi & Yi, 1988). We measured discriminant validity by comparing the square root of the AVE for individual constructs with the correlations between all pairs of variables. As shown in Table 3, the square root of the AVE for each construct was greater than the highest correlation between all pairs of variables, indicating satisfactory discriminant validity (Fornell & Larcker, 1981).

4.4 Analysis

Polynomial regressions To test the direct effects and (in)congruence effects of RC and DC (H1-H4), we used polynomial regression analyses and response surface modeling since they involve not only the interactions of RC and DC, but also curvilinear relationships between predictors and outcome variables. Specifically, the dependent variables (value co-creation) were regressed on control variables as well as five polynomial terms, that is, RC, DC, RC2, RC × DC, and DC2. RC and DC were scale-centered around the midpoint of the scale (Edwards, 2002; Edwards & Parry, 1993). In addition to the significance of regression coefficients, we also investigated the slopes and curvatures along the congruence line (RC = DC) and incongruence line (RC = − DC) as they directly test the congruence effects of RC and DC (Edwards & Cable, 2009; Edwards & Parry, 1993). In polynomial regression, the effects of RC and DC (in)congruence on value co-creation were represented by the following equation:

To explore the polynomial effects, the estimated coefficient for each polynomial term was used to compute the slope and curvature along the (in)congruence line (Edwards & Parry, 1993). Based on the suggestions provided by Edwards and Parry (1993), the slope and curvature of the incongruence line could be computed by substituting –RC for DC in Eq. 1:

After rearranging and gathering similar terms, the equation becomes:

The slope of the surface along the incongruence line is represented by the quantity [qslope = \({\text{b}}_{1}\) − \({\text{b}}_{2}\)]. The curvature of the surface is represented by the quantity [qcurvature = \({\text{b}}_{3}-{\text{b}}_{4}+ {\text{b}}_{5}\)].

Based on the suggestions provided by Edwards and Parry (1993), the slope and curvature of the congruence line could be computed by substituting RC for DC in Eq. 1:

After rearranging and gathering similar terms, the equation becomes:

The slope of the surface along the incongruence line is represented by the quantity [qslope = \({\text{b}}_{1}\)+ \({\text{b}}_{2}\)]. The curvature of the surface is represented by the quantity [qcurvature = \({\text{b}}_{3}+{\text{b}}_{4}+ {\text{b}}_{5}\)].

4.5 Results

We report the estimation results in Table 4. Table 4 presents the estimated coefficients as well as slopes and curvatures along the congruent and incongruent lines for polynomial regression predicting value co-creation.

The regression results in Table 4, Model 2 shows that RC has a significantly positive impact on value co-creation (β = 0.233 and p < 0.001). Model 2 shows that DC has a significantly positive impact on value co-creation (β = 0.269 and p < 0.001). Therefore, H1 and H2 are verified. The column 5 in Table 4 shows that value co-creation has a significantly positive impact on innovation performance (β = 0.659 and p < 0.001). Therefore, H5 is verified.

As shown in column 4, along the incongruence line, the slope is not significant (β = 0.098, n.s.) and the curvature is significant and negative (β = − 0.206 and p < 0.01), thus supporting H3a. In addition, Fig. 2 illustrates the response surface based on these coefficients. The surface in Fig. 2 shows that it curves down along the RC = − DC line, indicating that value co-creation is greater when the RC is more congruent with its DC, and any deviation from the congruence point (i.e., moving to its right or left) decreases value co-creation. Then, the slope along the congruence line for value co-creation is significant and positive (β = 0.522 and p < 0.001) while the curvature is not (0.016, n.s.), thus supporting H3b. The response surface in Fig. 2 also indicates that the level of value co-creation is higher at the rear corner (high RC/high DC) than at the front corner (low RC/low DC). Therefore, value co-creation is greater when RC and DC are congruent at higher levels than when they are congruent at lower levels. To test the incongruent effect posited in H4, we calculated the lateral shift quantity (\((\text{b}2-\text{b}1)/[2(\text{b}3-\text{b}4+\text{b}5)]\)), which indicates the magnitude and direction of alateral shift of the response surface along the incongruence line (Atwater et al., 1998; Liu et al., 2020; Vogel et al., 2016). If the sign of \((\text{b}2-\text{b}1)/[2(\text{b}3-\text{b}4+\text{b}5)]\) is positive, the response surface rotates counterclockwise along the incongruence line. And the left side of the consistency line is RC < DC area and the right side is RC > DC area. Since \((\text{b}2-\text{b}1)/[2(\text{b}3-\text{b}4+\text{b}5)]\) (0.237 > 0) is positive quantity, that is, the part of the response surface located on the right side (RC > DC) of the congruence line is larger than the part on the left side (RC < DC), thus supporting H4.

5 Discussion

5.1 Conclusion

In this study, based on S-D logic and socio-technical congruence theory, we construct a framework focused on the relationships among firm capabilities, value co-creation and innovation performance. This study demonstrates major findings. Our results show that RC and DC are positively related to value co-creation and value co-creation has a positive effect on innovation performance. Moreover, we develop four matched typologies, namely, high RC/high DC, low RC/low DC, low RC/high DC, and high RC/low DC. The empirical results suggest that RC/DC congruence has a linear positive effect, while RC/DC incongruence has an inverted U-shaped effect on value co-creation. Further, high RC/low DC leads to more value co-creation than high DC/low RC.

In summary, first, these findings demonstrate that both RC and DC are important for value co-creation in strategic partnerships. Second, these findings strongly emphasize the importance of RC/DC congruence for value co-creation, which can take firms capabilities from heterogeneous to synergistic, thus achieving superior value. Moreover, our findings also reveal the sub-optimal combination between RC and DC under incongruent conditions. Finally, this study enriches the literature on value co-creation with innovation performance.

5.2 Theoretical contributions

First, based on S-D logic, this study deconstructs the antecedents of value co-creation in detail. In VUCA environments, firms not only need RC to maintain trust with partners and provide an interactive basis (Mu, 2015) but also DC to access a wide range of information and resources for value co-creation (Atanu et al., 2022). Value co-creation through integrating capability has become a new research hotspot, and the changes in the role mechanism of value co-creation have attracted academic attention. Our findings reveal the different mechanisms of RC and DC on value co-creation. That is, RC enables firms to link more closely with their partners and facilitates interaction quality and resource sharing. DC helps firms improve their communication efficiency and controls information exchange by utilizing digital technology. Particularly, new digital applications, platforms, and devices have become important places for organizations to access new opportunities, customer needs, and resources (Chaudhuri et al., 2023; Zott & Amit, 2017), which has changed the way firms interact with each other, gather information, and combine resources (Inceoglu et al., 2024; Li et al., 2018a, 2018b). Our work provides evidence for the vital role of the firm's capabilities in value co-creation (Chaudhuri et al., 2023) and enriches the research on the effect of firm capabilities on value co-creation under S-D logic. Moreover, our work also contributes to the new expanded view of digitization and resource mobilization pointed by Inceoglu et al. (2024) and provides new lights to this view by exploring how it impacts value co-creation.

Second, based on socio-technical congruence theory, this study analyses the effect of RC and DC (in)congruence on value co-creation in depth. Prior research has shown that increased capability promotes value co-creation (Struwe & Slepniov, 2023; O'Dwyer et al., 2023). Furthermore, our research shows that enhancing the match between RC and DC is more conducive to value co-creation. Our findings are consistent with the view that “the synergy of social and digital support can promote value co-creation” (Shirazi et al., 2021). In addition, we find that the higher level of congruence between RC and DC promotes more value co-creation. When the two capabilities are matched, their simultaneous enhancement more effectively realizes synergistic effects. In a low RC/low DC condition, firm behaviors are limited to buying and selling. In contrast, high RC/high DC enables the firm to communicate in detail, adjust its strategy, and share resources, which is more beneficial for value co-creation. This confirms the core idea of socio-technical congruence theory (Bostrom & Heinen, 1977; Münch et al., 2022), that is, a higher level of synergy between the social system and technical system can produce more benefits.

Moreover, in exploring the incongruence between RC and DC, we also clarified the heterogeneous role of two capabilities, that is, high RC/low DC is more effective than high DC/low RC for value co-creation. Our findings are consistent with those of Shirazi et al. (2021). Although social and technical factors are both salient to value co-creation, “social support emerged as the most potent predictor of value co-creation” (Shirazi et al., 2021, p1). In addition, high DC/low RC conditions incur and underscore information security questions, which verifies the view of the "IT paradox" (Hajli et al., 2015). Overall, these findings provide a new perspective for exploring the relationship between capabilities and value co-creation, which also extends the boundary of socio-technical congruence theory.

Third, we further extend the impact of value co-creation on firms' innovation performance. Prior research has emphasized that product and technological innovation are important factors for a firm’s innovation performance (Li et al., 2019). Our research shows that in the value co-creation process, firms obtain innovative resources and market information through active communication and interaction with their partners (Zaborek & Mazur, 2019), which promotes new product development, technological improvement, and innovation performance. Our findings are consistent with those of Manser Payne et al. (2021). Moreover, our study enriches the research on value co-creation in the field of innovation management in strategic partnerships.

Finally, our findings have reference significance for interfirm technology transfer and exchange. Previous studies have noted that technology transfer and equity crowdfunding are a specific form of value co-creation (Bagheri et al., 2019; Butticè & Vismara, 2022; Vivona et al., 2023). In hence, our study provides the possible solution for the question that “how the involvement of these investors can contribute to value creation in equity crowdfunded firms remain” (Butticè & Vismara, 2022, p. 1238). Moreover, given the intricate and interconnected nature of digitalization spanning various research field (Inceoglu et al., 2024), thus, our findings of RC and DC (in) congruence may have similar influences on technology transfer and equity crowdfunding as those on value co-creation, which provides insight for technology transfer and equity crowdfunding management.

5.3 Managerial implications

First, this study highlights the fact that value co-creation plays a crucial role in innovation performance. Managers should actively engage in cross-organizational cooperation and interact with suppliers, distributors, customers, and others (Manser Payne et al., 2021; Nayal et al., 2022), which will help firms better understand market needs and improve product innovations, thus enhancing innovation performance. Managers can also establish knowledge platforms to share and exchange knowledge with their partners, which can stimulate the efficiency of innovation and improve innovation performance. Moreover, managers can rely on digital platforms to build innovation ecosystems (Butticè & Vismara, 2022; Inceoglu et al., 2024), then expand network relationships with other participants to carry out various value co-creation activities and promote innovation performance.

Second, our findings suggest that RC and DC contribute to value co-creation. Managers should emphasize and strengthen their RC by building and maintaining trust, developing effective communication, and enhancing their coordination with partners (Mu, 2015). Managers develop good RC to ensure the stable economic transactions through the inclusion of both partners in the network community and further the socio-emotional factors (e.g., trust, business ethics, etc.) nurtured by social relationships. With the rapid development of digital technology, managers should also focus on the cultivation of DC using digital tools and platforms for information exchange, data analysis , and digital product development. Firms need to focus some of their efforts on enhancing DC to ensure the effective operation of the interaction channels of all parties and enhance value co-creation. For example, for crowdfunding platforms, improving DC can guarantee the security and stability of online transactions, and increase the number, frequency, and quality of stakeholder interactions (Butticè & Vismara, 2022).

Third, our findings suggest the value of maintaining synergy between RC and DC. On the one hand, managers should focus on the balance between RC and DC and make efforts to build matched social and technical systems that can foster interfirm interaction and resource exchange, thereby ultimately promoting value co-creation. Thus, managers should invest and allocate more resources to realize a higher level of RC and DC congruence. On the other hand, our findings also suggest caution for managers aiming to conduct RC and DC management. Based on these results, we provide suggestions for managers facing resource constraints. These managers should consciously prioritize the development of RC, gradually improve DC, and ultimately achieve a matched state. Using this tactic, firms can address the dilemma of unmatched capabilities without impairing value co-creation in strategic partnerships.

5.4 Limitations and future directions

Our study has several limitations that should be addressed in future endeavors. First, our conceptual model was tested by using cross-sectional survey data. If feasible, a longitudinal design is recommended for future explorations into the dynamic evolution of the relationships between variables. Second, in this study, we focus on the effects of RC and DC on value co-creation. Future research can explore the effect of other capabilities, such as big data analytics capabilities and market-sensing capabilities (Alshanty & Emeagwali, 2019; Ciampi et al., 2021), and their (in)congruence on value co-creation. Third, there may be contingent factors that influence the (in)congruence effect of RC and DC, such as market uncertainty, the institutional environment, and competitive pressures. Researchers can explore the effect of contingency factors in the future. Fourth, we suggest that secondary data or other scales can be used to measure the level of value co-creation and other variables.

References

Alshanty, A. M., & Emeagwali, O. L. (2019). Market-sensing capability, knowledge creation and innovation: The moderating role of entrepreneurial-orientation. Journal of Innovation & Knowledge, 4(3), 171–178. https://doi.org/10.1016/j.jik.2019.02.002

Andersen, P. H., Christensen, P. R., & Damgaard, T. (2009). Diverging expectations in buyer-seller relationships: Institutional contexts and relationship norms. Industrial Marketing Management, 38(7), 814–824. https://doi.org/10.1016/j.indmarman.2008.04.016

Apesteguia, J., Azmat, G., & Iriberri, N. (2012). The impact of gender composition on team performance and decision making: Evidence from the field. Management Science, 58(1), 78–93. https://doi.org/10.1287/mnsc.1110.1348

Atanu, C., Nachiappan, S., & Manoj, D. (2022). Circular economy and digital capabilities of SMEs for providing value to customers: Combined resource-based view and ambidexterity perspective. Journal of Business Research, 142, 32–44. https://doi.org/10.1016/j.jbusres.2021.12.039

Atwater, L. E., Ostroff, C., Yammarino, F. J., & Fleenor, J. W. (1998). Self-other agreement: Does it really matter? Personnel Psychology, 51(3), 577–598. https://doi.org/10.1111/j.1744-66570.1998.tb00252.x

Bagheri, S., Kusters, R. J., & Trienekens, J. J. (2019). Customer knowledge transfer challenges in a co-creation value network: Toward a reference model. International Journal of Information Management, 47, 198–214. https://doi.org/10.1016/j.ijinfomgt.2018.12.019

Bagozzi, R. P., & Yi, Y. (1988). On the evaluation of structural equation models. Journal of the Academy of Marketing Science, 16(1), 74–94. https://doi.org/10.1007/BF02723327

Bostrom, R. P., & Heinen, J. S. (1977). MIS problems and failures: A socio-technical perspective, part II: The application of socio-technical theory. MIS Quarterly, 1, 11–28. https://doi.org/10.2307/249019

Butticè, V., & Vismara, S. (2022). Inclusive digital finance: The industry of equity crowdfunding. The Journal of Technology Transfer, 47(4), 1224–1241. https://doi.org/10.1007/s10961-021-09875-0

Calantone, R. J., Cavusgil, S. T., & Zhao, Y. (2002). Learning orientation, firm innovation cap-ability, and firm performance. Industrial Marketing Management, 31(6), 515–524. https://doi.org/10.1016/S0019-8501(01)00203-6

Chaudhuri, A., Naseraldin, H., & Narayanamurthy, G. (2023). Healthcare 3D printing service innovation: Resources and capabilities for value co-creation. Technovation, 121, 102596. https://doi.org/10.1016/j.technovation.2022.102596

Chen, J., Chen, Y., & Vanhaverbeke, W. (2011). The influence of scope, depth, and orientation of external technology sources on the innovative performance of Chinese firms. Technovation, 31(8), 362–373. https://doi.org/10.1016/j.technovation.2011.03.002

Ciampi, F., Demi, S., Magrini, A., Marzi, G., & Papa, A. (2021). Exploring the impact of big data analytics capabilities on business model innovation: The mediating role of entrepreneurial orientation. Journal of Business Research, 123, 1–13. https://doi.org/10.1016/j.jbusres.2020.09.023

Corsaro, D. (2019). Capturing the broader picture of value co-creation management. European Management Journal, 37(1), 99–116. https://doi.org/10.1016/j.emj.2018.07.007

Cozza, C., & Zanfei, A. (2016). Firm heterogeneity, absorptive capacity and technical linkages with external parties in Italy. The Journal of Technology Transfer, 41(4), 872–890. https://doi.org/10.1007/s10961-015-9404-0

Davies, M. A. P., Lassar, W., Manolis, C., Prince, M., & Winsor, R. D. (2011). A model of trust and compliance in franchise relationships. Journal of Business Venturing, 26(3), 321–340. https://doi.org/10.1016/j.jbusvent.2009.09.005

De Silva, M., & Rossi, F. (2018). The effect of firms’ relational capabilities on knowledge acquisition and co-creation with universities. Technological Forecasting and Social Change, 133, 72–84. https://doi.org/10.1016/j.techfore.2018.03.004

Ding, W. W. (2011). The impact of founders’ professional-education background on the adoption of open science by for-profit biotechnology firms. Management Science, 57(2), 257–273. https://doi.org/10.1287/mnsc.1100.1278

Edwards, J. R. (2002). Alternatives to difference scores: Polynomial regression analysis and response surface methodology. In F. Drasgow & N. W. Schmitt (Eds.), Advances in measurement and data analysis (pp. 350–400). Jossey-Bass.

Edwards, J. R., & Cable, D. M. (2009). The value of value congruence. Journal of Applied Psychology, 94(3), 654–677. https://doi.org/10.1037/a0014891

Edwards, J. R., & Parry, M. E. (1993). On the use of polynomial regression equations as an alternative to difference scores in organizational research. Academy of Management Journal, 36(6), 1577–1613. https://doi.org/10.2307/256822

Faruquee, M., Paulraj, A., & Irawan, C. A. (2021). Strategic supplier relationships and supply chain resilience: Is digital transformation that precludes trust beneficial? International Journ-Al of Operations & Production Management, 41(7), 1192–1219. https://doi.org/10.1108/IJOPM-10-2020-0702

Ford, J. A., Verreynne, M. L., & Steen, J. (2018). Limits to networking capabilities: Relationsh-ip trade-offs and innovation. Industrial Marketing Management, 74, 50–64. https://doi.org/10.1016/j.indmarman.2017.09.022

Forkmann, S., Henneberg, S. C., & Mitrega, M. (2018). Capabilities in business relationships and networks: Research recommendations and directions. Industrial Marketing Management, 47, 4–26. https://doi.org/10.1016/j.indmarman.2018.07.007

Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39–50. https://doi.org/10.2307/3151312

Foss, N. J., Lyngsie, J., & Zahra, S. A. (2013). The role of external knowledge sources and organizational design in the process of opportunity exploitation. Strategic Management Journal, 34(12), 1453–1471. https://doi.org/10.1002/smj.2135

Ghantous, N., & Alnawas, I. (2021). Zooming in on co-creation practices of international franchisors. Industrial Marketing Management, 92, 1–13. https://doi.org/10.1016/j.indmarman.2020.10.014

Hajli, M., Sims, J. M., & Ibragimov, V. (2015). Information technology (IT) productivity paradox in the 21st century. International Journal of Productivity and Performance Management, 64(4), 457–478. https://doi.org/10.1108/IJPPM-12-2012-0129

Inceoglu, I., Vanacker, T., & Vismara, S. (2024). Digitalization and Resource Mobilization. British Journal of Management, 35(2), 576–593. https://doi.org/10.1111/1467-8551.12817

Kähkönen, A. K., Lintukangas, K., & Hallikas, J. (2015). Buyer’s dependence in value creating supplier relationships. Supply Chain Management: An International Journal, 20(2), 151–162. https://doi.org/10.1108/SCM-02-2014-0062

Karpen, I. O., Bove, L. L., & Lukas, B. A. (2012). Linking service-dominant logic and strategic business practice: A conceptual model of a service-dominant orientation. Journal of Service Research, 15(1), 21–38. https://doi.org/10.1177/1094670511425697

Kumar, A. (2023). Leadership and decision-making: Top management team age demographic a-nd environmental strategy. Journal of Management & Organization, 29(1), 69–85. https://doi.org/10.1017/jmo.2019.91

Lambert, D. M., & Enz, M. G. (2012). Managing and measuring value co-creation in business-to-business relationships. Journal of Marketing Management, 28(13/14), 1588–1625. https://doi.org/10.1080/0267257X.2012.736877

Li, H., Qu, S., & Scherpereel, C. M. (2018a). A Technology Alliance’s Stability Evolution Bas-ed on a Network Structure Analysis. Innovation, 20, 240–259. https://doi.org/10.1080/14479338.2018.1443818

Li, J., Pan, Y., Yang, Y., & Tse, C. H. (2022). Digital platform attention and international sales: An attention-based view. Journal of International Business Studies, 53(8), 1817–1835. https://doi.org/10.1057/s41267-022-00528-4

Li, L., Su, F., Zhang, W., & Mao, J. Y. (2018b). Digital transformation by SME entrepreneurs: A capability perspective. Information Systems Journal, 28(6), 1129–1157. https://doi.org/10.1111/isj.12153

Li, X., Xie, Q., Jiang, J., Zhou, Y., & Huang, L. (2019). Identifying and monitoring the development trends of emerging technologies using patent analysis and Twitter data mining: The case of perovskite solar cell technology. Technological Forecasting and Social Change, 146, 687–705. https://doi.org/10.1016/j.techfore.2018.06.004

Lindell, M. K., & Whitney, D. J. (2001). Accounting for common method variance in cross-sectional research designs. Journal of Applied Psychology, 86(1), 114–121. https://doi.org/10.1037/0021-9010.86.1.114

Liu, Y., Chen, D. Q., & Gao, W. (2020). How does customer orientation (in) congruence affect B2B electronic commerce platform firms’ performance? Industrial Marketing Management, 87, 18–30. https://doi.org/10.1016/j.indmarman.2020.02.027

Luo, Y., Liu, Y., Zhang, L., & Huang, Y. (2011). A taxonomy of control mechanisms and effects on channel cooperation in China. Journal of the Academy of Marketing Science, 39(2), 307–326. https://doi.org/10.1007/s11747-010-0198-1

Manser Payne, E. H., Dahl, A. J., & Peltier, J. (2021). Digital servitization value co-creation framework for AI services: A research agenda for digital transformation in financial service ecosystems. Journal of Research in Interactive Marketing, 15(2), 200–222. https://doi.org/10.1108/JRIM-12-2020-0252

Matarazzo, M., Penco, L., Profumo, G., & Quaglia, R. (2021). Digital transformation and customer value creation in Made in Italy SMEs: A dynamic capabilities perspective. Journal of Business Research, 123, 642–656. https://doi.org/10.1016/j.jbusres.2020.10.033

Minshull, L. K., Dehe, B., & Kotcharin, S. (2022). Exploring the impact of a sequential lean implementation within a micro-firm-a socio-technical perspective. Journal of Business Research, 151, 156–169. https://doi.org/10.1016/j.jbusres.2022.06.052

Mu, J. (2015). Marketing capability, organizational adaptation and new product development per-formance. Industrial Marketing Management, 49, 151–166. https://doi.org/10.1016/j.indmarman.2015.05.003

Münch, C., Marx, E., Benz, L., Hartmann, E., & Matzner, M. (2022). Capabilities of digital servitization: Evidence from the socio-technical systems theory. Technological Forecasting and Social Change, 176, 121361. https://doi.org/10.1016/j.techfore.2021.121361

Nardelli, G., & Broumels, M. (2018). Managing innovation processes through value co-creation: A process case from business-to-business service practice. International Journal of Innovation Management, 22(03), 1850030. https://doi.org/10.1142/S1363919618500305

Navarro, S., Llinares, C., & Garzon, D. (2016). Exploring the relationship between co-creation and satisfaction using QCA. Journal of Business Research, 69(4), 1336–1339. https://doi.org/10.1016/j.jbusres.2015.10.103

Nayal, K., Raut, R. D., Yadav, V. S., Priyadarshinee, P., & Narkhede, B. E. (2022). The impact of sustainable development strategy on sustainable supply chain firm performance in the digital transformation era. Business Strategy and the Environment, 31(3), 845–859. https://doi.org/10.1002/bse.2921

Ng, I. C. L., & Vargo, S. L. (2018). Service-dominant logic, service ecosystems and institutions: An editorial. Journal of Service Management, 29(4), 518–520. https://doi.org/10.1108/JOSM-07-2018-412

Ngugi, I. K., Johnsen, R. E., & Erdélyi, P. (2010). Relational capabilities for value co-creation and innovation in SMEs. Journal of Small Business and Enterprise Development, 17(2), 260–278. https://doi.org/10.1108/14626001011041256

Nyamrunda, F. C., & Freeman, S. (2021). Strategic agility, dynamic relational capability and trust among SMEs in transitional economies. Journal of World Business, 56(3), 101175. https://doi.org/10.1016/j.jwb.2020.101175

O’Dwyer, M., Filieri, R., & O’Malley, L. (2023). Establishing successful university–industry collaborations: Barriers and enablers deconstructed. The Journal of Technology Transfer, 48(3), 900–931. https://doi.org/10.1007/s10961-022-09932-2

Oesterreich, T. D., & Teuteberg, F. (2019). Behind the scenes: Understanding the socio-technical barriers to BIM adoption through the theoretical lens of information systems research. Technological Forecasting and Social Change, 146(2018), 413–431. https://doi.org/10.1016/j.techfore.2019.01.003

Payne, A. F., Storbacka, K., & Frow, P. (2008). Managing the co-creation of value. Journal of the Academy of Marketing Science, 36, 83–96. https://doi.org/10.1007/s11747-007-0070-0

Podsakoff, P. M., MacKenzie, S. B., Lee, J. Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879. https://doi.org/10.1037/0021-9010.88.5.879

Prajogo, D. I., & Sohal, A. S. (2006). The integration of TQM and technology/R&D managem-ent in determining quality and innovation performance. Omega, 34(3), 296–312. https://doi.org/10.1016/j.omega.2004.11.004

Rajaguru, R., Matanda, M. J., & Verma, P. (2023). Information system integration, forecast information quality and market responsiveness: Role of socio-technical congruence. Technological Forecasting and Social Change, 186, 122117. https://doi.org/10.1016/j.techfore.2022.122117

Ramaswamy, V., & Ozcan, K. (2018). Offerings as digitalized interactive platforms: A conceptual framework and implications. Journal of Marketing, 82(4), 19–31. https://doi.org/10.1509/jm.15.0365

Rossi, A., Vanacker, T., & Vismara, S. (2023). Unsuccessful equity crowdfunding offerings and the persistence in equity fundraising of family business start-ups. Entrepreneurship Theory and Practice, 47(4), 1327–1355. https://doi.org/10.1177/10422587221121290

Scuotto, V., Nicotra, M., Del Giudice, M., Krueger, N., & Gregori, G. L. (2021). A microfoundational perspective on SMEs’ growth in the digital transformation era. Journal of Business Research, 129, 382–392. https://doi.org/10.1016/j.jbusres.2021.01.045

Shamim, S., Zeng, J., Khan, Z., & Zia, N. U. (2020). Big data analytics capability and decision-making performance in emerging market firms: The role of contractual and relational governance mechanisms. Technological Forecasting and Social Change, 161, 120315. https://doi.org/10.1016/j.techfore.2020.120315

Shirazi, F., Wu, Y., Hajli, A., Zadeh, A. H., Hajli, N., & Lin, X. (2021). Value co-creation in online healthcare communities. Technological Forecasting and Social Change, 167, 120665. https://doi.org/10.1016/j.techfore.2021.120665

Siaw, C. A., & Sarpong, D. (2021). Dynamic exchange capabilities for value co-creation in ecosystems. Journal of Business Research, 134, 493–506. https://doi.org/10.1016/j.jbusres.2021.05.060

Simmons, G., & Durkin, M. (2023). Expanding understanding of brand value co-creation on social media from an SD logic perspective: Introducing structuration theory. Marketing Theory, 14705931231165098. https://doi.org/10.1177/14705931231165098

Singh, S. K., Del Giudice, M., Chiappetta Jabbour, C. J., Latan, H., & Sohal, A. S. (2022). Stakeholder pressure, green innovation, and performance in small and medium-sized enterprises: The role of green dynamic capabilities. Business Strategy and the Environment, 31(1), 500–514. https://doi.org/10.1002/bse.2906

Stephen, A. T., & Coote, L. V. (2017). Interfirm behavior and goal alignment in relational exchanges. Journal of Business Research, 60(4), 285–295. https://doi.org/10.1016/j.jbusres.2006.10.022

Struwe, S., & Slepniov, D. (2023). Unlocking digital servitization: A conceptualization of value co-creation capabilities. Journal of Business Research, 160, 113825. https://doi.org/10.1016/j.jbusres.2023.113825

Tian, L., & Li, Y. (2017). Double-edged sword effect of independent innovations and foreign cooperation: Evidence from China. The Journal of Technology Transfer, 42(6), 1276–1291. https://doi.org/10.1007/s10961-016-9511-6

Tseng, F. M., & Chiang, L. L. L. (2016). Why does customer co-creation improve new travel product performance? Journal of Business Research, 69(6), 2309–2317. https://doi.org/10.1016/j.jbusres.2015.12.047

Ukko, J., Nasiri, M., Saunila, M., & Rantala, T. (2019). Sustainability strategy as a moderator in the relationship between digital business strategy and financial performance. Journal of Cleaner Production, 236, 117626. https://doi.org/10.1016/j.jclepro.2019.117626

Vargo, S. L., & Lusch, R. F. (2004). The Four Service Marketing Myths: Remnants of a Goods-based, Manufacturing Model. Journal of Service Research, 6(4), 324–335. https://doi.org/10.1177/1094670503262946

Vargo, S. L., & Lusch, R. F. (2008). Service-dominant Logic: Continuing the Evolution. Journal of the Academy of Marketing Science, 36(1), 1–10. https://doi.org/10.1007/s11747-007-0069-6

Vivona, R., Demircioglu, M. A., & Audretsch, D. B. (2023). The costs of collaborative innovation. The Journal of Technology Transfer, 48(3), 873–899. https://doi.org/10.1007/s10961-022-09933-1

Vogel, R. M., Rodell, J. B., & Lynch, J. W. (2016). Engaged and productive misfits: How job crafting and leisure activity mitigate the negative effects of value incongruence. Academy of Management Journal, 59(5), 1561–1584. https://doi.org/10.5465/amj.2014.0850

Von Briel, F., Davidsson, P., & Recker, J. (2018). Digital technologies as external enablers of new venture creation in the IT hardware sector. Entrepreneurship Theory and Practice, 42(1), 47–69. https://doi.org/10.1177/1042258717732779

Wielgos, D. M., Homburg, C., & Kuehnl, C. (2021). Digital business capability: Its impact on firm and customer performance. Journal of the Academy of Marketing Science, 49(4), 762–789. https://doi.org/10.1007/s11747-021-00771-5

Woodside, A. G., & Baxter, R. (2013). Achieving accuracy, generalization-to-contexts, and complexity in theories of business-to-business decision processes. Industrial Marketing Management, 42(3), 382–393. https://doi.org/10.1016/j.indmarman.2013.02.004

Yang, W., Zhang, Y., Zhou, Y., & Zhang, L. (2021). Performance effects of trust-dependence congruence: The mediating role of relational behaviors. Journal of Business Research, 129, 341–350. https://doi.org/10.1016/j.jbusres.2021.02.060

Zaborek, P., & Mazur, J. (2019). Enabling value co-creation with consumers as a driver of business performance: A dual perspective of Polish manufacturing and service SMEs. Journal of Business Research, 104, 541–551. https://doi.org/10.1016/j.jbusres.2018.12.067

Zhang, H., Gupta, S., Sun, W., & Zou, Y. (2020). How social-media-enabled co-creation between customers and the firm drives business value? The perspective of organizational learnin-g and social Capital. Information & Management, 57(3), 103200. https://doi.org/10.1016/j.im.2019.103200

Zhou, J., Sheng, S., & Zhang, C. (2021). Deterring unethical behaviors in marketing channels: The role of distributor whistleblowing. Journal of Business Ethics, 187(1), 97–115. https://doi.org/10.1007/s10551-021-04931-z

Zhou, K. Z., Li, J. J., Sheng, S., & Shao, A. T. (2014). The evolving role of managerial ties and firm capabilities in an emerging economy: Evidence from China. Journal of the Academy of Marketing Science, 42(6), 581–595. https://doi.org/10.1007/s11747-014-0371-z

Zott, C., & Amit, R. (2017). Business model innovation: How to create value in a digital world. Marketing Intelligence Review, 9(1), 18–23. https://doi.org/10.1515/gfkmir-2017-0003

Funding

This research was funded by the National Natural Science Foundation of China (71902013; 72272119).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Yang, W., Han, F., Zhou, Y. et al. More relational or more digital? The synchronous and ambivalent influences of firm capabilities on value co-creation. J Technol Transf (2024). https://doi.org/10.1007/s10961-024-10105-6

Accepted:

Published:

DOI: https://doi.org/10.1007/s10961-024-10105-6