Abstract

In this paper the relationship between the pursuit of foreign patent rights by inventors or their assignees and economic development in the countries in which the respective inventors reside is examined. Outward-bound international patenting is contrasted with domestic patenting and with inward-bound international patenting. The empirical analysis establishes plausible evidence that outward-bound international patenting matters for economic development. The main conclusion, based on empirical research about the patenting profiles of 78 countries over 14 years, is that countries whose residents exhibit a relatively high proclivity for obtaining foreign patent protection for endogenous inventions are likely to enjoy relatively high levels of wealth per person. An implication of this conclusion is that the exploitation by national residents of foreign markets for the commercialization of endogenous technology through the sophisticated use of the intellectual property systems of foreign countries is an important factor for national economic development.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction: the importance of international patenting

Early in 2017 the World Intellectual Property Organization (WIPO) announced that it had published over 3 million international patent applications filed under WIPO’s Patent Cooperation Treaty (PCT) since the PCT system was launched in 1978 (Gurry 2017). The substantial growth in the use of the PCT system by innovators is one indicator of the growing popularity of international patenting. This result accords with the observations of a number of researchers during recent decades that international patenting, in addition to domestic patenting, has an important role to play for innovation, international trade and economic policy (Frietsch and Schmoch 2010; Geng and Saggi 2015; Huang and Jacob 2014; Keupp et al. 2012; Maskus 2008; Romero-De-Pablos and Azagra-Caro 2009; Schiffel and Kitti 1978; Soete and Wyatt 1983). The pursuit of international patent protection is a natural expression of internationally-oriented endogenous innovation, that is, the process by which home-country innovators appropriate value internationally from their home-grown technological innovations.

While the international dimension of patenting has certainly become a lively topic for academic inquiry, there is nevertheless a tendency for the literature to move loosely and ambiguously across a disjointed array of related but distinct topics, such as: the overall impact of intellectual property rights on innovation; the comparative impact of variations in national IP rights on national economies; comparative analysis of the influence of domestic intellectual property laws on endogenous research and innovation; the contentious place of intellectual property in international trade negotiations; the effect of the level of enforcement of patent rights on foreign direct investment; the impact of the domestic intellectual property environment on foreign-initiated R&D activity; the attractiveness or accessibility of foreign intellectual property settings for local innovators; the role of patenting in international trade; or the impact of patent law and intellectual property enforcement regimes on international competition. This disjointed literature has arguably made it difficult for managers or policy makers to derive cogent principles for intellectual property strategy from the extant research.

In that context, various scholars have explored the factors that appear to be associated with the rise in international patenting. Some have noted the influence of national innovation systems, particularly in countries with a relatively high representation of foreign inventors, multinational corporations, and global R&D centers (Shapira et al. 2011); some have emphasized the catalytic role of foreign direct investment (Zekos 2014); some have noted the role of international research-driven collaborations (Peeters and de la Potterie 2006; Thomson and Webster 2013; Thurner et al. 2015); some have focused on the emergence of new fields of technology (Pugatch et al. 2012) or new technology-intensive service activities (Maskus 2008) that, due to their innovative or knowledge intensive characteristics, intrinsically benefit from strong intellectual property (IP) rights; while others have tended to focus on the apparent natural relationship between increases in the level of the economy in a society and the subsequent strengthening of its IP rights, IP institutions and IP enforcement (Caliari and Chiarini 2016; Maskus 2000; Park 2008). Relative levels of patenting are also frequently used to compare the levels of innovativeness or high-technology intensity of countries (Basberg 1983, 1987; Chang et al. 2015; Schiffel and Kitti 1978; Schneider 2005). However, despite the keen attention this general field has garnered from scholars of economics, innovation, trade, public policy and law, consensus has not yet appeared in the literature about the economic and business correlates of patenting, about the underlying forces that drive patenting, or the relative impact of patenting on the economies of countries or on the performance of firms.

This paper contributes to this literature by investigating the relationship between, on one hand, the international patenting of inventions and, on the other hand, economic development in the home countries of inventors. In other words, the relationship between the pursuit of foreign patent rights by inventors or their assignees and economic development in the countries in which the respective inventors reside is analyzed.

The main and distinctive purpose of the analysis presented in this paper is to establish plausible evidence for the proposition that outward-bound international patenting matters for economic development in the home countries from which innovations emerge.

The main conclusion is that countries whose residents exhibit a relatively high proclivity for obtaining foreign patent protection for locally generated inventions are likely to enjoy relatively high levels of wealth per person. An implication of this conclusion is that the exploitation by national residents of foreign markets for the commercialization of endogenous technology through the sophisticated use of the intellectual property systems of foreign countries is an important factor for national economic development.

2 Three basic modes of patenting

A particular type of patenting behavior is thus of interest here and that is labelled in this paper as “outward-bound international patenting.” Outward-bound international patenting is contrasted with “domestic patenting,” where inventors or their local assignees seek patent rights from the government of their own country-of-residence, and with “inward-bound international patenting,” where foreign (non-resident) inventors or their assignees seek patent rights from the government of the local country in question, where they do not reside.

These three basic modes of patenting are illustrated in Fig. 1. In Mode One, domestic patenting, which is the simplest case, inventors or their assignees from the home country file patent applications with the patent office of their country of residence, in the hope of obtaining exclusive rights for their inventions within the jurisdiction of the government of their home country. In Mode Two, inward-bound international patenting, the patent office of that same “home” country receives applications from inventors or their assignees from foreign countries, who hope to gain exclusive rights for their inventions within the jurisdiction of the government of the “home” country in question (which is, of course, a foreign jurisdiction from the vantage point of the original inventors). In Mode Three, outward-bound international patenting, inventors or their assignees from the home country file patent applications with the patent offices of foreign countries in the hope of obtaining exclusive rights for their inventions within the jurisdictions of those foreign governments. Mode Two patenting, of course, becomes Mode Three patenting if one looks at it from the vantage point of the residents of one of the foreign countries. Thus, in this paper whenever reference is made to one or more of the three basic modes of patenting it is done so from the vantage point of the home country in question.

These three modes of patenting are not mutually exclusive and, in practice, they typically co-exist in any country that has a patent system. Many countries have laws requiring resident inventors to file domestic patent applications (Mode One) prior to filing foreign patent applications (Mode Three) (Anderson et al. 2014), so it is to be expected that the number of Mode One applications will typically be greater than the number of Mode Three applications. Nevertheless, the orientation of this paper towards endogenous innovation nevertheless leads to it being concerned primarily with Mode Three patenting, namely outward-bound international patenting, rather than with Mode One patenting.

3 Domestic intellectual property rights and economic development

Before reviewing the pertinent literature on international patenting, it is important to place this research in the context of the general literature on patenting and economic development. Beginning several decades ago with the pioneering work of scholars such as Edith Penrose, a debate has continued in the literature about whether or not less developed countries gain economic advantages from operating a patent system (Penrose 1973). Penrose’s conclusion back then was that, while less developed countries may gain some advantages from providing patent protection for their own local inventors (i.e., to support what is labelled here as “endogenous innovation”), they may “gain little or nothing, and may even lose, from granting patents on inventions developed, published, and primarily worked abroad” (Penrose 1973, p. 783). Her research thus set the tone for much subsequent work in which the economic merits of domestic (Mode One) patenting and international (Mode Two) patenting are contrasted.

In the mid-1990s a wave of empirical research appeared in which the economic benefits, or otherwise, of strong domestic IP rights were investigated (Ginarte and Park 1997; Gould and Gruben 1996; Lee et al. 1996; Maskus and Penubarti 1995; Primo Braga and Fink 1998). The authors of the published research on this topic from the mid-1990s tended to be more sanguine than Penrose about the potential benefits to poorer countries of providing local patent rights to foreign inventors and organizations. The main theme in that body of research was that strong IP rights in less developed countries, applied without discrimination to both domestic and foreign patent applicants, encouraged the transfer of technology and foreign direct investment more generally, from rich countries to poor countries, thereby stimulating domestic economic development through trade. The conclusions of Maskus and Penubarti (1995) were indicative: “… there is substantial evidence that, other things constant, stronger patent laws attract greater bilateral trade across all nations with this effect being particularly pronounced in the developing countries” (p. 241). In this literature, technology transfer from rich countries to poorer countries was generally viewed as the linking mechanism or channel by which strengthened domestic patent systems enhanced the economies of a poorer countries.

Thus, in the mid-1990s literature, the general presumption was that enhanced foreign direct investment, encouraged by strengthened domestic patent rights, was economically beneficial for less developed countries. As emphasized by Gould and Gruben (1996) and others, inbound foreign direct investment and the importation of foreign knowledge-intensive goods, were seen as facilitators rather than inhibitors of domestic economic development.

Another wave of research on this topic published during the following decade (Blyde and Acea 2003; Nunnenkamp and Spatz 2004; Park and Lippoldt 2002; Rafiquzzaman 2002; Schneider 2005; Smarzynska Javorcik 2004) confirmed, overall, the results of the early empirical work from the 1990s, with the added observation (e.g., Blyde and Acea 2003; Schneider 2005) that the advantages of enhanced technology transfer and foreign direct investment through strengthening IP rights may accrue even more strongly to developing countries than to already developed countries. Such conclusions need to be tempered, however, by considering research conducted during the same period which revealed that the ability of a country to enhance endogenous innovation by taking advantage of strengthened domestic patent protection may be constrained by its existing level of economic development, the educational level of its residents, and by the degree of freedom in the economy (Qian 2007).

During the subsequent decade research on this general topic continued apace, with the main conclusion from the previous two decades of research—namely, that strong domestic IP rights encouraged knowledge-intensive trade and foreign direct investment, and hence domestic economic development, in less developed countries—being confirmed through subsequent studies. The new post-2010 body of research, however, emphasized a new theme, namely, innovation. The majority of published research during this period pointed to enhanced innovation in the domestic economy as a vehicle by which strengthened IP rights (especially patent rights), trade and foreign direct investment, enhanced the economies of poorer countries (Fan et al. 2013; Hall et al. 2013; Hasan and Kobeissi 2012; Hu and Png 2013; Hu et al. 2016; Huang and Jacob 2014; Iwaisako et al. 2011; Kim et al. 2012; Lorenczik and Newiak 2012; Papageorgiadis and Sharma 2016; Pugatch et al. 2012; Sweet and Eterovic Maggio 2015; Tanaka and Iwaisako 2014). The main new argument in this third wave of research, in other words, was that increased foreign direct investment and trade, encouraged by strengthened local IP rights in the recipient countries, enhances economic development in those countries by facilitating endogenous innovation.

In contrast with the upbeat tone of the vast majority of empirical studies published during this post-2010 period, however, a few researchers returned to echoing the theme articulated by Edith Penrose during the 1970s, that less-developed countries may be either disadvantaged economically compared with developed countries by the strengthening of patent rights and trade in IP-protected goods (Kashcheeva 2013; Pathak et al. 2013), or advantaged but to a lesser degree than developed countries (Hu and Png 2013). Some stressed that while the relationship may actually be positive, the pathways by which strengthened domestic IP rights may enhance the economies of less-developed countries, and the form of those benefits, are complicated, ambiguous or contingent upon other factors in the domestic economy (Hudson and Minea 2013; Iwaisako et al. 2011; Kim et al. 2012). Some have argued, for example, that domestic IP rights must be strengthened dramatically, not just marginally enhanced, in order to yield robust benefits for less-developed countries (Lorenczik and Newiak 2012).

The body of research just reviewed here illuminates the relationship between intellectual property and economic development by addressing the impact of domestic IP systems on the domestic economy via inward-bound (Mode Two) international patenting. This domestic (home-country) impact may be experienced either directly, through foreign-sourced investment and trade, or indirectly, through the stimulus to endogenous innovation arising from foreign-initiated domestic manufacturing or domestic research and development activities in the local facilities of foreign enterprises. The primary interest of this article, however, is the impact on the domestic economy of outward-bound (Mode Three) patenting as part of the process of internationally-oriented endogenous technological innovation. Before addressing this topic directly, and empirically, what the literature has to say about the overall connection between intellectual property, international trade, innovation and economic development will be reviewed.

4 International patenting, trade, innovation and economic development

The nexus between intellectual property, international trade and innovation is now well established in the literature (Beatty 2015; Bosworth 1984; de Rassenfosse et al. 2016; Drivas et al. 2015; Eaton and Kortum 1996; Huang and Jacob 2014; Jinji et al. 2015; Kumar et al. 2011; Lefebvre et al. 1998; Madsen 2008; Mossinghof 1984; Palangkaraya et al. 2017; Papageorgiadis and Sharma 2016; Perkins and Neumayer 2011; Rosenzweig 2017; Schneider 2005; Soete and Wyatt 1983; Yang and Kuo 2008), even if the precise characteristics of that relationship may be contested. The preponderance of results from the published research points to a positive relationship between the strengthening and enforcement of intellectual property rights internationally and the growth of trade in knowledge-intensive goods and services. Mossinghof (1984), an early mover in this line of research, put it succinctly: “Intellectual property protection is crucial in fostering international trade.” (p. 235) The benefits of such IP-induced trade for facilitating domestic innovation at the level of the firm has also been recognized in the literature (Briggs and Park 2013; Gammeltoft and Hobdari 2017; Huang and Yu 2012; Kim et al. 2012; Maskus and Penubarti 1995; Peeters and de la Potterie 2006).

Interestingly, evidence has been published that the relationship between patenting and economic development in a country may typically be stronger with patenting by non-resident applicants (i.e., Mode Two patenting) than with patenting by resident applicants (i.e., Mode One patenting) (Khan et al. 2017). It also appears that improvements in total factor productivity for a country are associated more closely with Mode Two (non-resident) patenting than with Mode One (resident) patenting (Madsen 2008). Eaton and Kortuma’s study of OECD countries revealed that international trade in technology facilitated by non-resident (Mode Two) patenting accounted for more than half of economic growth in most countries (Eaton and Kortum 1996). Branstetter has argued that in general the benefits to a country of installing strong IP rights are more likely to come from increased domestic deployment of advanced technology by the affiliates of foreign firms than from endogenous innovation as such (Branstetter 2004). An analogous result was found by Xu and Chiang who, in their study of patenting in 48 countries over a period of two decades to the year 2000, found that all categories of countries appear to experience the absorption of foreign technology in disembodied form through non-resident patenting, although the relatively high level of technology spillovers from non-resident patenting compared with resident patenting appeared to be greater for middle- and low-income countries than for high-income countries (Xu and Chiang 2005). Mirzadeh and Nikzad examined this matter in detail for a selection of 20 countries over the period from 1980 to 2007 and concluded that the level of contribution to changes in gross domestic product (GDP) of both resident patenting (Mode One) and non-resident patenting (Mode Two) varies a great deal between countries, and that the relative contribution of these two forms of patenting to changes in GDP also varies a great deal between countries (Mirzadeh and Nikzad 2013).

Thus, with some minor variations on the theme, the available empirical literature points to international patenting rather than domestic patenting as the primary source of patent-induced economic development—especially in less developed countries—although it appears that the relationship is neither simple nor easily predictable for any particular country. However, it is Mode Two (inward bound) international patenting rather than Mode Three (outward bound) international patenting that has garnered the attention of researchers. Notwithstanding this bias in the literature, some research on the subject of Mode Three patenting has been published.

In their study of the cross-patenting activity of 30 countries between 1995 and 1998, Yang and Kuo discovered that variations in the levels of outward-bound international patenting between countries could be plausibly attributed to trade-related influences. In particular, they discovered—perhaps not surprisingly—that when countries’ increase their exports and outward foreign direct investments they will tend to apply for more patents in the destination countries with which they trade, because of their need to seek legal protection for their products in the countries to which they are exporting (Yang and Kuo 2008). Some pioneering research from the early 1990s suggested that the emergence of new science-based industries such as biotechnology, in which international collaborative research alliances are important, is an important factor (Arora and Gambardella 1994). One study along these lines from Germany, that focused on firm-level determinants of international patenting behavior, found that the propensity for international patenting by R&D-intensive enterprises increased with the size of the firm (Licht and Zoz 1998). Recent work by Yang and colleagues has produced new evidence that high levels of R&D expenditure and high stocks of human capability in R&D influence international patenting (Hu et al. 2014). There is also evidence from research about cross-patenting activity amongst OECD countries that an existing high mass of patents in both the source country and the destination country may explain subsequent levels of bilateral outward-bound international patenting (Archontakis and Varsakelis 2011).

While it is pleasing to see this research on outward-bound international patenting emerging in the literature, it appears that all of it is concerned with identifying what are the factors that cause outward-bound international patenting to take place. Unfortunately, it appears that there is little or no published research currently available on the effects, as opposed to causes, of variations in levels of outward-bound international patenting between nations. That is the gap in the literature that research reported in this paper is designed to address. It appears that answers to our questions need to be sought empirically rather than in the literature.

The balance of this paper will therefore be devoted to reporting the results of original empirical research that was conducted to address the fundamental question that underlies this paper: what is the relationship between the pursuit of foreign patent rights by inventors or their assignees and economic development in the countries in which the respective inventors reside?

5 The growth of outward-bound international patenting

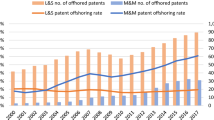

To help investigate the strength of the phenomenon of international patenting in recent years, the author of this paper created an index, labelled the International Patent Proclivity Ratio (IPPR), that is an indicator of the relative prominence of the international patenting behavior of inventors in the overall patenting profiles of countries. IPPR is calculated for each country by expressing the total number of its Mode Three patent applications in a given year as a proportion of all patent applications filed by residents of that country (Mode One applications plus Mode Three applications combined) for that same year. IPPRi,j is thus the ratio of foreign patent applications filed by residents of country j in year i to worldwide patent applications filed by residents of country j in year i (see Table 1 for details of this and other variables included in this study). Data on domestic and foreign patent applications were then collected for all countries for which comprehensive data over a period of 14 years, from 2000 to 2013, could be obtained, and then the annual IPPR for each country was calculated.Footnote 1 As shown in Fig. 2, the global mean of IPPR (i.e., the average proportion of worldwide patent applications for all countries in the data set accounted for by outward-bound foreign patent applications) effectively doubled over the fourteen years covered by our research, from 27% at the turn of the Millennium to 50% in 2013. In short, as revealed in Fig. 2, the results of the data analysis accord with the theme in the literature that international patenting is important; but they also reveal that Mode Three patenting—the particular type of patenting that is the main focus of this paper—has been growing in prominence during recent years as a component of world-wide patenting practice.

In the literature on patenting and economic development the distinction between the three basic modes of patenting (as highlighted in Fig. 1) is sometimes blurred or forgotten and, in particular, the distinction between Mode Two patenting and Mode Three patenting is typically overlooked. Most of the internationally oriented literature focuses on Mode Two patenting and the purported effect of strong domestic IP rights on inward-bound patenting by foreigners. Thus, while the issue of the relationship between Mode Three patenting and home country economic development has apparently not yet been the subject of a body of published scholarly research, there are at least two reasons why such an inquiry is merited. The first is that, as shown in Fig. 2, the phenomenon of outward-bound international patenting is growing in prominence, probably now accounting for more than half of all patenting worldwide. An international phenomenon of this scale simply deserves close attention. What’s going on here? Secondly, while the literature (with some dissenting voices) has revealed that the recipient countries of inward-bound international patenting typically benefit economically from such activity, the benefits to the source countries have not yet been adequately examined. While some scholarly attention has been directed towards understanding the forces driving such activities—mostly at the level of the firm rather than the nation—the economic value, or otherwise, to those countries incurring the costs of such international efforts should be understood.

6 Data sources, variables and research procedure

Before the results of the empirical analysis in this paper are reported, the main elements of the data collection and research procedure employed will be described. The research required collecting three categories of data from multiple countries over multiple years: national patent data, national economic data and national demographic data. An attempt was made to obtain comprehensive and valid data from as many countries as possible over as many years as possible. The patent data came from the World Intellectual Property Organization’s online data service, WIPO IP Statistics Data Center, http://ipstats.wipo.int/ipstatv2/index.htm (accessed 1 April 2015). The patent data downloaded from that source included domestic (Mode One) patent applications by home-country residents for the 14 years from 2000 to 2013 inclusive, and foreign (Mode Three) patent applications by home-country residents for the 14 years from 2000 to 2013 inclusive. These data were augmented by data from selected national patent offices when necessary and feasible. Our economic data came from the World Bank’s World Bank Open Data online information service, “GDP (current US$)” table, available at https://data.worldbank.org/indicator (accessed 1 April 2015). Our demographic data came from the World Bank’s World Bank Open Data online information service, “Population, total” table, available at https://data.worldbank.org/indicator (accessed 1 April 2015).

The 14-year time period of 2000–2013 was selected because at the time when the data were collected (April 2015) they were the only years for which appropriate data for the majority of member states of the World Intellectual Property Organization could be easily obtained online from the WIPO IP Statistics Data Center. Some countries eventually had to be removed from the data set because they either disappeared as independent countries, or underwent changes of borders, during the 14-year period, thereby generating data anomalies or confounding some of the required calculations; and some had to be removed due to missing data. After carefully checking and cleaning all the data, and deleting countries from the data set for which reliable and adequate information could not be obtained, a final list of 78 countries for which comprehensive combined patent, economic and demographic data for all years from 2000 to 2013 could be obtained, was assembled. All economic data were expressed in 2005 US constant dollar values. The final list of countries included in the comprehensive data set may be found in “Appendix”.Footnote 2

Table 1 provides a list of all variables employed in the analysis, together with a formal definition or formula for each variable. The values for all variables included in the analysis for this paper were calculated from the data obtained from the three sources just described. All tables and figures included in this paper are original contributions.

The main variable employed here as a measure of Mode Three patenting is the International Patent Application Density Index (IPAD). IPAD was created by the author of this paper as a robust way to compare the outward-bound international patenting behavior of countries that may be dissimilar in size, wealth, technological capabilities, or economic openness, or whose domestic IP environments may be unequal. IPAD is a normalized version of IPPR in which the IPPR for country j in year i is divided by the global mean for IPPR for all countries in year i worldwide. In other words, IPAD is a measure of the relative “density” of a nation’s outward-bound international patenting behavior compared with that of other nations. The exact formula for IPAD is:

where PDi,j is the number of domestic patent applications filed in year i by residents of country j and PFi,j is the number of foreign patent applications filed in year i by residents of country j.

IPAD is designed so that, all other things being equal, a normal country, with average Mode Three patenting behavior, would be expected to achieve a score of 1.0 for IPAD. Thus, a country with an IPAD score greater than 1.0 would be interpreted to be performing better than the global norm in its Mode Three patenting, and a country with an IPAD score lower than 1.0 would be seen as under-performing compared to the global norm for Mode Three patenting. In short, a country with an IPAD score of greater than 1.0 for any particular year would be considered to be globally “competitive” in outward-bound international patenting that year. Changes in a country’s IPAD score over time may be used as an indicator of changes in its global competitiveness in outward-bound international patenting.

A choice was made to use foreign patent applications by home-country residents rather than foreign patents issued to home-country residents as the raw data for measuring Mode Three patenting for a few reasons. Firstly, and most importantly, patent applications are an indication of the future intent of inventors or their assignees to engage in some kind of international trade, whether through technology licensing or direct engagement in foreign manufacturing or sales. Thus, they may be seen as an indication of the strategic intent of inventors or their assignees to seek to appropriate value internationally from endogenous innovation. Secondly, variations between countries in the subtleties of patent law and the exigencies of the patent examination process in national patent offices means that there are messy differences between foreign jurisdictions in the likelihood of patents being issued for the same invention. Thirdly, variations between national patent offices in the pendency rate for decision-making on the granting of patents, and even variations in pendency rates over time within individual patent offices, exacerbate the problems of analytically linking the patent-related decision-making of inventors to other variables of interest. These factors make analysis of changes over time in both patent data and economic data more reliable—or at least easier to interpret—if patent applications rather than patent grants are used. The advantages of this approach have long been recognized in the patent analytics literature (Basberg 1987, esp. p. 138).

7 Preliminary investigation of the relationship between patenting and the economy

To generate a preliminary comparison of the relationships between Mode One patenting and national wealth, and Mode Three patenting and national wealth, the data for each of these modes of patenting were normalized as the number of applications per million residents for each of the 78 countries in our data set. Logarithms of the normalized data were then separately regressed for Mode One patent applications and Mode Three patent applications against the logarithms of GDP per capita for each country. For each type of patenting by residents (domestic and foreign) the calculations were done for two points in time, the year 2000 and the year 2013. The results are presented in Fig. 3a, b.

Figure 3a, b reveals that there is a readily observable positive relationship across nations between per capita GDP and both domestic patent applications by residents and foreign patent applications by residents. Interestingly, the correlation is much stronger for foreign patent applications than it is for domestic applications. Additionally, the figures show that the strength of the correlation between international patent applications and per capita GDP increased slightly over time (from 0.79 in 2000 to 0.82 in 2013) in contrast with the case of domestic patent applications (which remained generally stable, shifting slightly from 0.52 to 0.51 during the same period). These results provide provisional support for the main argument of this paper, which is that countries whose residents exhibit a relatively high proclivity for obtaining foreign patent protection for locally generated inventions are likely to enjoy relatively high levels of wealth per person.

These results do not prove that differentials in outward-bound international patenting are the primary determinants of variations in per capita wealth between nations, and they should not be taken as proof of a direct causal relationship between the level of outward-bound international patenting of a country’s residents and its level of economic development. At this stage we may simply conclude that there is a visible association between the respective levels of Mode Three patenting and the per capita wealth of nations. The variable that has been employed here as an indicator of Mode Three patenting, namely IPAD, is based upon patent applications rather than granted patents. As such, it may be interpreted as an indicator of the likely intention of inventors or their assignees from the home country to either engage in international trade in products or services incorporating their inventions, or to appropriate value from those inventions by licensing or selling their foreign patent rights to organizations that, in turn, intend to commercialize the inventions outside the home country of the inventors. It may also be interpreted as an indicator of the belief of inventors or their assignees that there is potential for international commercialization of their inventions. At a minimum, IPAD may be seen as an indicator of strategic intent by stakeholders in a home country to generate value from endogenous innovation through international trade rather than just domestic application of the home-grown inventions.

For the vast majority of countries (if not all countries) foreign markets represent a larger potential market opportunity for locally generated innovations than does the domestic market. We should therefore expect to see international trade in technology-intensive products and services as a prominent part of the businesses of countries with highly developed economies, or of countries seeking to rise up the international economic-development spectrum. Given the important role of intellectual property rights in the commercialization of inventions, it should not be surprising to discover an association (as illustrated in Fig. 3a, b) between national economic development and foreign patenting by national residents. IPAD may be seen as a predictor of international trade in endogenous inventions, but also as a key component of the process of engaging in international trade of technology-intensive products and services. Further research will be required to expose and untangle the detailed mechanisms by which national economic development is facilitated by internationally oriented innovation. Intellectual property is, of course, only part of the picture. However, the preliminary evidence presented here provides justification for such further research, and motivation to more closely investigate the relationship between outward-bound patenting and national wealth. The first of these goals (i.e., investigating the actual pathways and mechanisms that constitute the relationship between outward-bound patenting and national economic development) may be pursued in subsequent research projects. The second of these goals (i.e., further analyzing the relationship between Mode Three patenting and per capita national wealth) will be the main focus of the balance of this paper. While the nature of the causality between the variables may not be ascertained with certainty in this paper, the strength of the relationship between the selected indicators may.

8 Per capita national wealth and outward-bound international patenting by residents

Given the ostensible evidence of a positive relationship between Mode Three patenting and relative per capita wealth levels between countries (presented in Fig. 3a, b), the relationship between the independent variable, IPAD, and per capita GNP, over time was then tested by regressing the logarithm of each of these variables against each other for every year from 2000 to 2013. The results are presented in Fig. 4.

The results reveal a statistically significant correlation (Adjusted R Squared) for the whole set of 78 countries in the data set ranging between a minimum of 0.35 and maximum of 0.65 over the 14 years for which we have data. In all cases the probability of the high correlation being explained by chance is < 0.0001.

Using cluster analysis, the set of 78 countries was then divided into three groups based on their per capita GDP—poor countries, mid-tier countries and wealthy countries—and then the regression calculations were repeated. The disaggregated results (also shown in Fig. 4) reveal that amongst poor countries, when analyzed independently as a standalone group, there is effectively no correlation between the logarithm of IPAD and the logarithm of per capita GDP at any time over the 14 years (except for three years, when a low correlation may be observed, but when, except for 2004, the correlation is not statistically significant). In short, it appears that there is no relationship between outward-bound international patenting and per capita levels of wealth amongst poor countries, when they are analyzed independently as a standalone discrete group.

However, the disaggregated results also show that there is a statistically significant correlation (Adjusted R Squared) between the logarithm of IPAD and the logarithm of per capita GDP for both mid-tier and wealthy countries, as standalone groups, for all 14 years included in the data set. While the strength of the correlation fluctuated during the first half of the time period covered by the data set, for both mid-tier and wealthy countries, it stabilized and rose somewhat during the second half of the 14-year period, ending at around 0.31 for wealthy countries and 0.34 for mid-tier countries. The strength of the relationship also seems to be growing over time during recent years, just as is the proportion of patenting worldwide accounted for by outward-bound international patenting by residents (compare the results in Figs. 2, 4). In summary, the results plotted in Fig. 4 support the primary argument of this paper—that countries whose residents exhibit a relatively high proclivity for obtaining foreign patent protection for locally generated inventions are likely to enjoy relatively high levels of wealth per person—but this principle apparently does not apply so simply to poor countries when treated as a standalone group. The evidence produced by the analysis here so far suggests that there is some type of threshold—of either wealth or outward-bound international patenting, or both (which is more likely the case)—over which a country must pass before the economic benefits of increased outward-bound international patenting are likely to be enjoyed.

These results do not mean that a poor country is prevented from changing its status over time—by increasing its endogenous innovation, international patenting and international trade—to move into the mid-tier wealth group. Rather, it means that statistically significant associations between IPAD and per capita GDP may only be observed when the data set includes a range of countries other than the ones labelled here as “poor.” In short, there is greater variety in the data across the whole population of countries, and across the set of more wealthy countries, than there is amongst the less wealthy countries.

9 Outward-bound International patenting across countries and across time

The results summarized visually in Figs. 3a, b and 4 thus evoke an answer to the fundamental question in this research about the relationship between the pursuit of foreign patent rights by inventors and economic development in the countries in which the inventors reside. Two formal hypotheses are put forward here to help test the robustness of the results:

- Hypothesis one::

Variations between countries in their per capita wealth are associated with variations in the relative levels of outward-bound international patenting of their residents

- Hypothesis two::

Changes over time in the per capita wealth of a country are associated with changes over time in the level of outward-bound international patenting of its residents

Four simple models, described in Table 2, were formulated to help test these two hypotheses. Model 1 is a simple static model designed to test the first hypothesis, and models 2, 3 and 4 are simple dynamic models designed to test the second hypothesis. All variables included in the models are described or defined in Table 1. The formula in Model 1 is the same formula as the one used to calculate the correlations reported earlier in Fig. 4.

Analysis-of-variance calculations were conducted for all four models for all 78 countries in the data set. The results, which are summarized in Table 3, show that for each of the four models the null hypothesis may be rejected. In other words, in all four cases there is an extremely low probability that the positive relationship between the variables may be explained by chance. The results for Model 1 (for 2013) support the first hypothesis and confirm that the preliminary conclusions presented earlier in this paper—that countries whose residents exhibit a relatively high proclivity for obtaining foreign patent protection for locally generated inventions are likely to enjoy relatively high levels of wealth per person—were justified.

The results for Model 2 show that there is a statistically significant relationship, across the whole data set of 78 countries, between total changes in Mode Three patenting and total changes in per capita GDP for all 14 years. Model 3 is similar to Model 2, except that it seeks to disaggregate the effect of changes in Mode Three patenting between each of the first and second halves of the 14-year period on changes in per capita GDP over the whole period. The results for Model 3 are especially interesting because they show that changes in patenting behaviors between 2000 and 2007 appear to be more influential than changes in patenting behaviors between 2007 and 2013 on changes in per capita GDP over the whole 14 years. In short, there appears to be some kind of lag effect; and that is consistent with what would be expected in support of the second hypothesis. Model 4 seeks to isolate the effects of changes in patenting behaviors during the first half of the 14-year period and changes in per capita GDP during the second half of the 14-year period. The results are positive, although not as strong as the case for Model 2 and Model 3.

In summary, the results from the statistical calculations reported in Table 3 support both Hypothesis One and Hypothesis Two.

Table 4 contains the results of the calculations for Model 1 for each cluster of countries according to their per capita wealth levels. As expected, when each group is treated as a discrete standalone set, there are statistically significant results for wealthy countries and for mid-tier countries. In short, the results from the statistical calculations reported in Table 4 support Hypothesis One, with the exception of poor countries when treated as a standalone group.

Finally, to further examine the dynamic nature of the relationship between IPAD and per capita GDP, the countries were once again disaggregated into three separate clusters based upon their relative per capita wealth, and separate analysis-of-variance calculations under Model 2 were then run for each cluster. The results, which are summarized in Table 5, show that when the data set is broken up into discrete sets of countries based upon wealth levels, the strong relationship between changes in Mode Three patenting and changes in per capita GDP over time that is observable for all 78 countries is statistically significant only for the mid-tier cluster. Thus, Hypothesis Two is confirmed by the results in Table 5, but with the caveat that this conclusion only holds when either all categories of countries, or just mid-tier countries, are included in the calculations. This result suggests that the strategy implications of the research presented in this paper are especially poignant for middle-income or transitional economies which seek to move up the international economic ladder through the pursuit of innovation and international trade.

10 Conclusions and implications for future research

During recent decades there has been a global boom in patenting activity as a reflection of the perceived importance of both technological innovation and knowledge-intensive trade as sources of national economic development. This boom has included a significant shift in the worldwide balance between domestic patenting and international patenting towards international patenting. This paper has presented plausible evidence that differences between countries in the level of their outward-bound international patenting may influence their relative levels of wealth. It has also presented plausible evidence that individual countries may enjoy enhanced economic development by engaging in higher levels of outward-bound international patenting. Thus, it can be argued that the exploitation by national residents of foreign markets for the commercialization of endogenous technology through the sophisticated use of the intellectual property systems of foreign countries is an important factor for national economic development. These results have practical implications for academic research and public policy.

Intellectual property is a vehicle by which the benefits of endogenous technological innovation may be increased and appropriated. There are obviously many other factors besides patenting, in general, and outward-bound international patenting, in particular, that play a role in generating domestic economic development from endogenous innovation. However, in order to focus attention on the insufficiently studied role of outward-bound international patenting in national economic development, these factors were deliberately left aside from the empirical research in this paper. Future research on outward-bound international patenting ought to rectify this weakness by examining the interaction of this particular type of patenting with other factors—including, for example, financial, political, organizational, human, industry, macroeconomic or technology-related forces, or the pre-existing patent stock of a country—that may mediate, complement or drive patenting behavior at either the firm level or the country level.

Additionally, while the research reported in this paper has produced plausible evidence that differentials in outward-bound international patenting are a determinant of differentials in national per capita wealth, the causal relationship is almost certainly mostly indirect rather than direct. Unfortunately, the data drawn upon for this research are insufficient to allow us to investigate the intervening or mediating variables. As suggested earlier in this paper, a country’s relative level of Mode Three patenting (as measured by its IPAD index) may be interpreted as an indicator of the intentions of that country’s local innovators to engage in, or appropriate value from, international trade in technology-intensive products and services. Thus, increased export income from sales to foreign markets—derived, for example, from sales of patent-protected products and services to foreign customers, from license revenue generated by locally-owned foreign patents, or from sales of equity in locally-owned foreign enterprises with licenses to locally-owned foreign patents—is most likely the most immediate direct cause of the domestic growth in per capita GDP observed in our data. While Mode Three patenting should therefore be seen in the first instance as an indicator of a complex set of innovation-related activities (such as the ones just iterated) that lead to enhanced domestic economic development, it should nevertheless also be seen as one of the actual important practical activities that contribute to the economic outcomes.

Outward-bound international patenting thus has a dual nature: it is both an advance indicator of a set of vectors of domestic economic development as well as one of those vectors itself. Proactive outward-bound international patenting arguably creates one of the conditions under which the various direct causes of (innovation and trade related) domestic economic development are enabled. However, while indicative evidence for this has argument been presented here, thoroughly investigating and analyzing such factors and their interplay is beyond the scope of this paper.

An underlying theme in this paper is that an increase in outward-bound international patenting may lead to an increase in wealth levels per person in a country over time. In other words, that Mode Three patenting may constructively mediate (i.e., positively affect) the relationship between endogenous innovation and the local economic benefits of endogenous innovation. The partial lag-effect between rising IPAD scores and rising per capita GDP that may be observed in Table 3 provides support for this theme. This research has provided plausible evidence to suggest that (while we do not yet understand the mechanism of the causality, and we cannot be certain about it) there is a causal relationship between Mode Three patenting and domestic economic development. However, could it be that, at least under some circumstances, the causality runs in the opposite direction? Is it possible that there is some kind of feedback at play whereby countries that attain higher levels of economic development might naturally then invest more heavily in international patenting? It seems plausible that, for most countries, a kind of virtuous circle may be in play here. Conversely, it is also plausible that, for some countries, a vicious circle may be in play, whereby poverty undermines the stimuli to endogenous innovation, which in turn reduces the stimulus for international patenting, which in turn reduces the opportunity for those countries to earn revenue from international trade in technology-intensive products and services, thereby exacerbating the relative poverty of such countries and further undermining the prospects for appropriating value internationally from endogenous innovation. This topic deserves greater attention. However, such research must be left to another project.

In short, future academic research on the general topic of this paper ought to address at least two questions. Firstly, what are the variables that mediate the relationship between outward-bound international patenting and domestic economic development, and what is the relationship between the variables? Secondly, what is the direction of the causality between changes in outward-bound international patenting and changes in the per capita wealth of nations?

The primary public-policy implication of the research presented here is that national governments ought to investigate the possibility of directing more effort towards facilitating domestic innovators to commercialize the results of their work internationally in comparison with the effort such governments currently direct towards trying to improve the local IP environment for foreign and local investors. Insofar as innovators may need support from their home governments to succeed in commercializing endogenous innovations internationally—and, of course, this is a further question to be investigated—policies should arguably be designed to encourage inventors or their assignees from the home nation to understand and use the vehicle of outward-bound international patenting. The foreseeable economic benefits of doing so appear to be especially promising for mid-tier countries that are seeking to make a strategic transition to a higher level of technological and economic development.

In conclusion, the majority of the academic literature concerned with intellectual property, economic development and international trade has tended to focus on the twin issues of the impact of the local IP environment on local innovation, and the impact of the local IP environment on inward-bound foreign direct investment and technology transfer. In contrast, the results of this paper suggest that more attention in academic research should be directed towards understanding the ways in which endogenous national innovation may be enhanced through greater international engagement in technology commercialization by home-grown innovators. In particular, the phenomenon of outward-bound international patenting ought to be given much more attention, compared with inward-bound international patenting and domestic patenting, in academic research and public policy.

Notes

See the Sect. 6 below for details of the data collection procedure and the countries included in the data set for this research.

Note: In carrying out the empirical parts of the research for this paper the author received some assistance from Mr. Alexander Vidiborskiy, a student working under his supervision at the Skolkovo Institute of Science and Technology, for data collection, data cleaning and data sorting, computation of basic variables, and preliminary data analysis.

References

Anderson, M. H., Cislo, D., Saavedra, J., & Cameron, K. (2014). Why international inventors might want to consider filing their first patent application at the United States Patent Office and the convergence of patent harmonization and e-commerce. Santa Clara High Technology Law Journal,30(4), 555–579.

Archontakis, F., & Varsakelis, N. C. (2011). US patents abroad: Does gravity matter? The Journal of Technology Transfer,36(4), 404–416. https://doi.org/10.1007/s10961-010-9156-9.

Arora, A., & Gambardella, A. (1994). Evaluating technological information and utilizing it. Journal of Economic Behavior & Organization,24(1), 91–114. https://doi.org/10.1016/0167-2681(94)90055-8.

Basberg, B. L. (1983). Foreign patenting in the US as a technology indicator. Research Policy,12(4), 227–237. https://doi.org/10.1016/0048-7333(83)90004-5.

Basberg, B. L. (1987). Patents and the measurement of technological change: A survey of the literature. Research Policy,16(2–4), 131–141. https://doi.org/10.1016/0048-7333(87)90027-8.

Beatty, E. (2015). Globalization and technological capabilities: Evidence from Mexico’s patent records ca. 1870–1911. Estudios de Economía,42(2), 45–65.

Blyde, J. S., & Acea, C. (2003). How does intellectual property affect foreign direct investment in Latin America? Integration and Trade,7(19), 135–152.

Bosworth, D. L. (1984). Foreign patent flows to and from the United Kingdom. Research Policy,13(2), 115–124. https://doi.org/10.1016/0048-7333(84)90010-6.

Branstetter, L. G. (2004). Do stronger patents induce more local innovation? Journal of International Economic Law,7(2), 359–370. https://doi.org/10.1093/jiel/7.2.359.

Briggs, K., & Park, W. G. (2013). There will be exports and licensing: The effects of patent rights and innovation on firm sales. The Journal of International Trade & Economic Development. https://doi.org/10.1080/09638199.2013.843199.

Caliari, T., & Chiarini, T. (2016). Knowledge production and economic development: Empirical evidences. Journal of the Knowledge Economy. https://doi.org/10.1007/s13132-016-0435-z.

Chang, X., McLean, R. D., Zhang, B., & Zhang, W. (2015). Patents and productivity growth: Evidence from global patent awards. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2371600.

de Rassenfosse, G., Palangkaraya, A., & Webster, E. (2016). Why do patents facilitate trade in technology? Testing the disclosure and appropriation effects. Research Policy,45(7), 1326–1336. https://doi.org/10.1016/j.respol.2016.03.017.

Drivas, K., Fafaliou, I., Fampiou, E., & Yannelis, D. (2015). The effect of patent grant on the geographic reach of patent trade. The Journal of High Technology Management Research,26(1), 58–65. https://doi.org/10.1016/j.hitech.2015.04.006.

Eaton, J., & Kortum, S. (1996). Trade in ideas Patenting and productivity in the OECD. Journal of International Economics,40(3–4), 251–278. https://doi.org/10.1016/0022-1996(95)01407-1.

Fan, J. P. H., Gillan, S. L., & Yu, X. (2013). Innovation or imitation? Journal of Multinational Financial Management,23(3), 208–234. https://doi.org/10.1016/j.mulfin.2013.03.001.

Frietsch, R., & Schmoch, U. (2010). Transnational patents and international markets. Scientometrics,82(1), 185–200. https://doi.org/10.1007/s11192-009-0082-2.

Gammeltoft, P., & Hobdari, B. (2017). Emerging market multinationals, international knowledge flows and innovation. International Journal of Technology Management,74(1/2/3/4), 1–22. https://doi.org/10.1504/IJTM.2017.083619.

Geng, D., & Saggi, K. (2015). The nature of innovative activity and the protection of intellectual property in Asia. Asian Economic Policy Review,10(1), 71–91. https://doi.org/10.1111/aepr.12084.

Ginarte, J. C., & Park, W. G. (1997). Determinants of patent rights: A cross-national study. Research Policy,26(3), 283–301. https://doi.org/10.1016/S0048-7333(97)00022-X.

Gould, D. M., & Gruben, W. C. (1996). The role of intellectual property rights in economic growth. Journal of Development Economics,48(2), 323–350. https://doi.org/10.1016/0304-3878(95)00039-9.

Gurry, F. (2017). The PCT system: Overview and possible future directions and priorities. Geneva: Memorandum by the Director General of WIPO.

Hall, B. H., Helmers, C., Rogers, M., & Sena, V. (2013). The importance (or not) of patents to UK firms. Oxford Economic Papers,65(3), 603–629. https://doi.org/10.1093/oep/gpt012.

Hasan, I., & Kobeissi, N. (2012). Innovations, intellectual protection rights and information technology: An empirical investigation in the MENA region. Electronic Commerce Research,12(4), 455–484. https://doi.org/10.1007/s10660-012-9100-1.

Hu, X., Li, Y., Petti, C., Tang, Y., & Chen, L. (2016). The relationship between non-resident patent applications and intellectual property rights. In Proceedings of the 22nd international conference on industrial engineering and engineering management 2015 (pp. 579–589). Paris: Atlantis Press. https://doi.org/10.2991/978-94-6239-180-2_56.

Hu, A. G. Z., & Png, I. P. L. (2013). Patent rights and economic growth: Evidence from cross-country panels of manufacturing industries. Oxford Economic Papers,65(3), 675–698. https://doi.org/10.1093/oep/gpt011.

Hu, J., Yang, C., & Chen, C. (2014). R&D efficiency and the national innovation system: An international comparison using the distance function approach. Bulletin of Economic Research,66(1), 55–71. https://doi.org/10.1111/j.1467-8586.2011.00417.x.

Huang, C., & Jacob, J. (2014). Determinants of quadic patenting: Market access, imitative threat, competition and strength of intellectual property rights. Technological Forecasting and Social Change,85, 4–16. https://doi.org/10.1016/j.techfore.2013.04.004.

Huang, K.-F., & Yu, C.-M. J. (2012). Cross-regional patenting. Management International Review,52(2), 213–231. https://doi.org/10.1007/s11575-012-0131-6.

Hudson, J., & Minea, A. (2013). Innovation, intellectual property rights, and economic development: A unified empirical investigation. World Development,46, 66–78. https://doi.org/10.1016/j.worlddev.2013.01.023.

Iwaisako, T., Tanaka, H., & Futagami, K. (2011). A welfare analysis of global patent protection in a model with endogenous innovation and foreign direct investment. European Economic Review,55(8), 1137–1151. https://doi.org/10.1016/j.euroecorev.2011.05.001.

Jinji, N., Zhang, X., & Haruna, S. (2015). Trade patterns and international technology spillovers: Evidence from patent citations. Review of World Economics,151(4), 635–658. https://doi.org/10.1007/s10290-015-0223-z.

Kashcheeva, M. (2013). The role of foreign direct investment in the relation between intellectual property rights and growth. Oxford Economic Papers,65(3), 699–720. https://doi.org/10.1093/oep/gpt015.

Keupp, M. M., Friesike, S., & von Zedtwitz, M. (2012). How do foreign firms patent in emerging economies with weak appropriability regimes? Archetypes and motives. Research Policy,41(8), 1422–1439. https://doi.org/10.1016/j.respol.2012.03.019.

Khan, H. U. R., Zaman, K., Khan, A., & Islam, T. (2017). Quadrilateral relationship between information and communications technology, patent applications, research and development expenditures, and growth factors: Evidence from the group of seven (G-7) countries. Social Indicators Research,133(3), 1165–1191. https://doi.org/10.1007/s11205-016-1402-6.

Kim, Y. K., Lee, K., Park, W. G., & Choo, K. (2012). Appropriate intellectual property protection and economic growth in countries at different levels of development. Research Policy,41(2), 358–375. https://doi.org/10.1016/j.respol.2011.09.003.

Kumar, R., Tripathi, R. C., & Tiwari, M. D. (2011). A case study of impact of patenting in the current developing economies in Asia. Scientometrics,88(2), 575–587. https://doi.org/10.1007/s11192-011-0405-y.

Lee, J.-Y., Mansfield, E., Lee, J.-Y., & Mansfield, E. (1996). Intellectual property protection and US foreign direct investment. The Review of Economics and Statistics.

Lefebvre, É., Lefebvre, L. A., & Bourgault, M. (1998). R&D-related capabilities as determinants of export performance. Small Business Economics,10(4), 365–377. https://doi.org/10.1023/A:1007960431147.

Licht, G., & Zoz, K. (1998). Patents and R & D an econometric investigation using applications for German, European and US patents by German companies. Annals of Economics and Statistics. https://doi.org/10.2307/20076120.

Lorenczik, C., & Newiak, M. (2012). Imitation and innovation driven development under imperfect intellectual property rights. European Economic Review,56(7), 1361–1375. https://doi.org/10.1016/j.euroecorev.2012.07.003.

Madsen, J. B. (2008). Economic growth, TFP convergence and the World export of ideas: A century of evidence. Scandinavian Journal of Economics,110(1), 145–167. https://doi.org/10.1111/j.1467-9442.2008.00530.x.

Maskus, K. E. (2000). Intellectual property rights in the global economy. Washington, DC: Institute for International Economics.

Maskus, K. E. (2008). The globalization of intellectual property rights and innovation in services. Journal of Industry, Competition and Trade,8(3–4), 247–267. https://doi.org/10.1007/s10842-008-0040-3.

Maskus, K. E., & Penubarti, M. (1995). How trade-related are intellectual property rights? Journal of International Economics,39(3–4), 227–248. https://doi.org/10.1016/0022-1996(95)01377-8.

Mirzadeh, A., & Nikzad, N. (2013). An analysis of relation between resident and non-resident patents and gross domestic product: Studying 20 countries. International Journal of Management and Social Sciences,1(2), 26–29.

Mossinghof, G. J. (1984). The importance of intellectual property protection in international trade. Boston College International and Comparative Law Review,7(2), 235–249.

Nunnenkamp, P., & Spatz, J. (2004). Intellectual property rights and foreign direct investment: A disaggregated analysis. Review of World Economics,140(3), 393–414. https://doi.org/10.1007/BF02665982.

Palangkaraya, A., Jensen, P. H., & Webster, E. (2017). The effect of patents on trade. Journal of International Economics,105, 1–9. https://doi.org/10.1016/j.jinteco.2016.12.002.

Papageorgiadis, N., & Sharma, A. (2016). Intellectual property rights and innovation: A panel analysis. Economics Letters,141, 70–72. https://doi.org/10.1016/j.econlet.2016.01.003.

Park, W. G. (2008). International patent protection: 1960–2005. Research Policy,37(4), 761–766. https://doi.org/10.1016/j.respol.2008.01.006.

Park, W. G., & Lippoldt, D. (2002). The impact of trade-related intellectual property rights on trade and foreign direct investment in developing Countries. Working Party of the Trade Committee,42(October), 1–21.

Pathak, S., Xavier-Oliveira, E., & Laplume, A. O. (2013). Influence of intellectual property, foreign investment, and technological adoption on technology entrepreneurship. Journal of Business Research,66(10), 2090–2101. https://doi.org/10.1016/j.jbusres.2013.02.035.

Peeters, C., & de la Potterie, B. V. P. (2006). Innovation strategy and the patenting behavior of firms. Journal of Evolutionary Economics,16(1–2), 109–135. https://doi.org/10.1007/s00191-005-0010-4.

Penrose, E. (1973). International patenting and the less-developed countries. Economic Journal,83(331), 768–786.

Perkins, R., & Neumayer, E. (2011). Transnational spatial dependencies in the geography of non-resident patent filings. Journal of Economic Geography,11(1), 37–60. https://doi.org/10.1093/jeg/lbp057.

Primo Braga, C. A., & Fink, C. (1998). The relationship between intellectual property rights and foreign direct investment. Duke Journal of Comparative & International Law,9, 163–187.

Pugatch, M. P., Torstensson, D., & Chu, R. (2012). Taking stock: How global biotechnology benefits from intellectual property rights. Washington, DC.

Qian, Y. (2007). Do national patent laws stimulate domestic innovation in a global patenting environment? A cross-country analysis of pharmaceutical patent protection, 1978–2002. Review of Economics and Statistics,89(3), 436–453. https://doi.org/10.1162/rest.89.3.436.

Rafiquzzaman, M. (2002). The impact of patent rights on international trade: Evidence from Canada. Canadian Journal of Economics,35(2), 307–330.

Romero-De-Pablos, A., & Azagra-Caro, J. M. (2009). Internationalisation of patents by Public Research Organisations from a historical and an economic perspective. Scientometrics,79(2), 329–340. https://doi.org/10.1007/s11192-009-0421-3.

Rosenzweig, S. (2017). The effects of diversified technology and country knowledge on the impact of technological innovation. The Journal of Technology Transfer,42(3), 564–584. https://doi.org/10.1007/s10961-016-9492-5.

Schiffel, D., & Kitti, C. (1978). Rates of invention: international patent comparisons. Research Policy,7(4), 324–340. https://doi.org/10.1016/0048-7333(78)90010-0.

Schneider, P. H. (2005). International trade, economic growth and intellectual property rights: A panel data study of developed and developing countries. Journal of Development Economics,78(2), 529–547. https://doi.org/10.1016/j.jdeveco.2004.09.001.

Shapira, P., Youtie, J., & Kay, L. (2011). National innovation systems and the globalization of nanotechnology innovation. The Journal of Technology Transfer,36(6), 587–604. https://doi.org/10.1007/s10961-011-9212-0.

Smarzynska Javorcik, B. (2004). The composition of foreign direct investment and protection of intellectual property rights: Evidence from transition economies. European Economic Review,48(1), 39–62. https://doi.org/10.1016/S0014-2921(02)00257-X.

Soete, L. G., & Wyatt, S. M. E. (1983). The use of foreign patenting as an internationally comparable science and technology output indicator. Scientometrics,5(1), 31–54. https://doi.org/10.1007/BF02097176.

Sweet, C. M., & Eterovic Maggio, D. S. (2015). Do stronger intellectual property rights increase innovation? World Development,66, 665–677. https://doi.org/10.1016/j.worlddev.2014.08.025.

Tanaka, H., & Iwaisako, T. (2014). Intellectual property rights and foreign direct investment: A welfare analysis. European Economic Review,67, 107–124. https://doi.org/10.1016/j.euroecorev.2014.01.013.

Thomson, R., & Webster, E. (2013). Risk and vertical separation: The case of developing new technology. Oxford Economic Papers,65(3), 653–674. https://doi.org/10.1093/oep/gpt014.

Thurner, T. W., Gershman, M., & Roud, V. (2015). Partnerships as internationalization strategy: Russian entrepreneurs between local restrictions and global opportunities. Journal of International Entrepreneurship,13, 118–137. https://doi.org/10.1007/s10843-015-0146-8.

Xu, B., & Chiang, E. P. (2005). Trade, patents and international technology diffusion. The Journal of International Trade & Economic Development,14(1), 115–135. https://doi.org/10.1080/0963819042000333270.

Yang, C.-H., & Kuo, N.-F. (2008). Trade-related influences, foreign intellectual property rights and outbound international patenting. Research Policy,37(3), 446–459. https://doi.org/10.1016/j.respol.2007.11.008.

Zekos, G. I. (2014). The influence of patents, copyright, trademarks and competition on GDP, GDP Growth, Trade and FDI. IUP Journal of Management Research,13(4), 7–26.

Author information

Authors and Affiliations

Corresponding author

Appendix

Rights and permissions

About this article

Cite this article

Willoughby, K.W. Endogenous innovation, outward-bound international patenting and national economic development. J Technol Transf 45, 844–869 (2020). https://doi.org/10.1007/s10961-018-9705-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-018-9705-1

Keywords

- International patenting

- Outward-bound international patenting

- Intellectual property management

- IP and trade

- Endogenous innovation

- Technology commercialization