Abstract

The paper analyses how geographical clustering of beneficiaries might affect the effectiveness of public innovation support programs. The geographical proximity of firms operating in the same industry or field of technology is expected to facilitate innovation through knowledge spillovers and other localization advantages. Public innovation support programs may leverage these advantages by focusing on firms that operate in a cluster. We investigate this link using data from a large German program that co-funds R&D projects of SMEs in key technology areas called ‘Innovative SMEs’. We employ three alternative cluster measures which capture industry, technology and knowledge dimensions of clusters. Regardless of the measure, firms located in a geographical cluster are more likely to participate in the program. Firms being part of a knowledge-based cluster significantly increase their chance of receiving public financial support. We find no effects, however, of geographical clustering on the program’s effectiveness in terms of input or output additionality.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

There is ample evidence that geographical clustering of economic activities can have positive innovation impacts for firms operating in such a cluster. These positive effects are often linked to localization economies (Marshall 1890), e.g. labor market pooling, supplier specialization, demand concentration and knowledge spillovers within industries. Innovation policy may try to leverage these positive cluster effects in two main ways. On the one hand, dedicated cluster policies attempt to actively support the emergence of (high-tech) clusters by providing incentives to relocate activities to a certain region, and by promoting linkages among actors within that region. On the other hand, the delivery of support schemes may be focused, either intentionally or due to self-selection by the programs’ target group, on beneficiaries that are part of existing clusters. In this case, positive cluster effects may contribute to the program’s objectives (e.g. advancing the development of new technology).

In this paper, we look at the latter part of cluster-related policy making, and investigate whether geographical clustering of firms affects the effectiveness of public innovation support programs. This includes three distinct research questions. Firstly, we explore the role of clusters in a firm’s decision to apply for funding in a public innovation program. Secondly, we investigate whether innovation programs actually focus on clusters, i.e. if the presence in a geographical cluster increases the probability that a firm will receive public funding. Thirdly, we analyze whether firms in a cluster experience greater impacts from public funding compared to firms which do not belong to a cluster. Such greater impacts would indicate a higher effectiveness of programs that focus their resources on clusters. Our research is linked to prior research on the role of co-operation in R&D subsidy programs (Czarnitzki et al. 2007; Hottenrott and Lopes-Bento 2014; Sakakibara 2001; Branstetter and Sakakibara 2002). These studies do not, however, explicitly take the geographic dimension of co-operation into account, nor do they consider other effects of geographical clustering. By looking at cluster effects on programs that do not explicitly promote cluster building, our research complements studies on the impacts of dedicated cluster programs (Falck et al. 2010; Nishimura and Okamuro 2011a, b).

We use the term ‘geographical cluster’ in this paper to denote any concentration of similar economic activities in a given space. The similarity in economic activities may concern outputs (i.e. markets) or inputs (i.e. technology). We measure output-related clusters in terms of the number of firms within a region operating within the same industry. Input-related clusters are determined on the basis of the stock of patents in a certain field of technology. In addition, we use a third cluster measure relating to the stock of prior public funding activities in a certain knowledge area. Throughout the paper, the term ‘cluster’ denotes merely the geographical concentration of similar activities; we do not consider the existence or strength of linkages between firms in a geographical cluster.

We link our cluster measures to firm-level data taken from an innovation support program run by the German federal government, named ‘Innovative SMEs’. This program started in 2007 and provides financial support to R&D projects in SMEs’ across a large range of technologies. Our data include both firms that received subsidies for R&D projects and firms that unsuccessfully applied to the program for the first 4 years of program operation. Both groups of firms are merged with the data from the German innovation survey in order to analyze whether firms which are part of a cluster are more likely to participate in the program. We link firms to clusters on the basis of firms’ geographical location on the one hand, and the industry, field of technology and knowledge area, in which they are involved, on the other. By focusing on SMEs we avoid the problem of assigning firms with multiple locations to one region; literally all firms in our sample are single-location firms.

We implement a three-step selection model of the program’s effects on input and output additionality. In the first step we model a firm’s decision to participate in the program. The second step models a firm’s success in receiving public subsidies, in the case that it applied to the program. The third step estimates the program’s impact on the level of R&D expenditures in funded firms (input additionality) and the level of (expected) sales from new products developed in the funded project (output additionality), using unsuccessful applicants as a control group. We find that firms located in a geographical cluster are more likely to participate in the program. The probability of receiving public funding is higher for firms in knowledge clusters, while we find no significant effects for industry or technology clusters. We do not find any impact of geographical clustering on the effectiveness of the program, neither for input nor for output additionality.

In the next section, we discuss the theoretical background of our study and present the research questions for our empirical analysis, the methodology and data base for which is presented in Sect. 3. Section 4 contains the main results of the model estimations and Sect. 5 summarizes the key findings and presents some conclusions on the potential role of geographical clustering in public innovation support.

2 Theoretical background and research questions

2.1 Clusters and innovation

The literature on the link between geographical clusters and innovation has identified a variety of reasons as to why the spatial concentration of industries will promote innovation. Starting from Marshall (1890) localization externalities, producers in a cluster may benefit from sharing the costs of common resources, including a pool of skilled labor and access to specialized suppliers, and are likely to learn from each other. While localization economies will reduce producers’ unit costs and hence productivity through external economies of scale, the stimulus for innovation rests on more specific characteristics of clusters, particularly with respect to the nature and organization of knowledge flows within a cluster (Glaeser et al. 1992; Cooke 2001; Audretsch and Feldman 1996, 2004). Though innovation in communication technologies has substantially decreased the cost of exchanging information across larger distances, the costs of transmitting tacit knowledge still rise with increasing distance due to the need for face-to-face contact, mutual understanding and common knowledge. In an attempt to explain the superior success of Silicon Valley as an industrial cluster, Saxenian (1991, 1994) stressed the role of inter-firm networks and co-operation, demonstrating how learning processes and knowledge spillovers within a cluster are organized (see also Harhoff et al. 2003). Other ways in which the exchange of knowledge may spur innovation is inter-firm labor mobility (see Almeida and Kogut 1999), company-science links (Audretsch and Stephan (1996) and informal knowledge exchange networks (Tallman et al. 2004) based on mutual understanding and trust (Maskell 2001).

Localized ‘knowledge hubs’ such as universities or superior firms within an industry can be important factors for generating localized innovations in a given industry (Jaffe 1989; Mansfield 1995; Jaffe et al. 1993). This is particularly the case where they produce spinoff companies which tend to stay in the region and fuel growth and innovation in the industry (Audretsch et al. 2005; Klepper 2010). Florida (2002) has stressed the positive interaction between the geographical concentration of talented people and the location of high-tech industry, re-enforcing the growth of clusters of innovative industries and human capital as the main input to these industries. In addition to human capital, access to specialized financial capital (particularly venture capital) may also reinforce innovation and growth in localized industries (Kortum and Lerner 2000; Chen et al. 2010; Sorenson and Stuart 2001). Porter (1998) has stressed the role of fierce competition among firms in a cluster as another driver for superior innovation performance. The geographic concentration of an industry can also aide the commercialization of new knowledge by providing complementary assets along the value chain, both in terms of suppliers (Helsley and Strange 2002), and access to customers.

Though several empirical studies do find positive impacts of geographical clustering (see Baptista and Swann 1998; Zucker et al. 1998; Folta et al. 2006; Czarnitzki and Hottenrott 2009), the geographical clustering of firms in the same industry does not necessarily spur innovation. Jacobs (1969) has emphasized that it is rather sectoral diversity and the exchange of complementary knowledge across firms from different industries that drives innovation. Feldman and Audretsch (1999) provide empirical support for the existence of diversification externalities as key to innovation. In addition, geographical clustering of firms in the same industry can come at a cost, thereby limiting positive innovation externalities. Increased competition for scarce resources may raise the cluster firms’ costs and constitute obstacles to innovation, e.g. if supply of talented personnel is limited. Van der Panne (2004) indeed finds a negative impact of fierce local competition on innovation. There are also a number of empirical studies that do not support a positive link between geographical concentration of economic activities and innovation performance (Martin and Sunley 2003; Kukalis 2010; Love and Roper 2001a, b). Shaver and Flyer (2000) show even that innovative firms tend to locate away from other firms in their sector, while firms that choose to agglomerate tend to implement inferior technologies.

Another limiting factor is heterogeneity within a geographical cluster. If innovative capabilities and absorptive capacities of cluster firms differ substantially, superior firms may not benefit from knowledge that spills to weaker firms, nor will weaker firms be able to utilize this knowledge (Kukalis 2010, 455). Beaudry and Breschi (2003) find that firms located in a cluster with a large number of other innovative firms in the same sector, have a higher probability of innovating, while no such effect is seen if many non-innovative firms are present. McCann and Folta (2011) demonstrate that firms with higher knowledge stocks and younger firms benefit to a greater extent from cluster effects.

2.2 Clusters and innovation policy

Innovation policy soon noted the superior performance of high-tech clusters such as Silicon Valley and the Boston area and tried to develop policies to replicate these success stories in other locations. Cluster-oriented innovation policies became particularly popular among policy makers in Europe (Tödtling and Trippl 2005). Conceptually, they could build upon earlier attempts to establish regional concentrations of knowledge sources and innovative capacities, e.g. in the context of ‘innovative growth poles’ (Perroux 1950), endogenous regional development (Martin and Sunley 1998) or innovative milieus (Maillat 1995). Innovation-oriented cluster policies also borrowed from the innovation system approach (Frietsch and Schüller 2010), stressing the crucial role of interactions among actors to stimulate knowledge flows and profit from mutual learning.

In the past two decades, a variety of approaches have been adopted by innovation-oriented cluster policies (Uyarra and Ramlogan 2012). Top–down approaches actively support the establishment and development of industry clusters by subsidizing the relocation of firms into cluster regions, coordinating cluster actors and providing co-funding of innovation activities and R&D collaborations. Such an approach, with policy as the main driving force, can often be found in development contexts, but has also been adopted in European countries (see Fromhold-Eisebith and Eisebith 2005). Related to the top–down approach are policies that provide supportive infrastructures that may help firms in certain industries to strengthen their innovative efforts, and which might attract further actors, including start-ups, to relocate to the cluster region (Breschi and Malerba 2001). Such industry-specific infrastructures include research and education institutions, technical facilities and science parks.

Another way in which innovation policy seeks to stimulate bottom–up (private) initiatives is to establish and develop clusters (see Hospers et al. 2009; McDonald et al. 2006). In Germany, such an attempt has been made in the field of biotechnology through the instrument of ‘beauty contests’ (Eickelpasch and Fritsch 2005), or in the context of state initiatives (Falck et al. 2010). A more indirect way of facilitating the development of clusters is to promote R&D co-operation and other vectors of knowledge exchange amongst firms and research organizations, which often focusing on specific technologies or industry applications. While collaboration programs are widespread in innovation policy (see Hottenrott and Lopes-Bento 2014; Aerts and Schmidt 2008; Czarnitzki et al. 2007), most of them have no explicit regional focus and hence do not directly support the advance of geographical clusters in an industry. Other indirect means of promoting clusters include focusing existing innovation policy programs on firms that are already part of clusters, or to use sector or technology specific innovation programs in order to explicitly target regional clustering of actors when allocating funds.

Studies on the effectiveness of cluster policies often focus on competitiveness issues such as productivity, growth and the sustainability of networks in a cluster (see Uyarra and Ramlogan 2012 for an overview of evaluations on cluster policies). Only a few studies have examined the impact of such policies on innovation. Nishimura and Okamuro (2011a) have studied the effects of participation in the Japanese Industrial Cluster Project on patenting and university collaboration. They did not find a significant effect of cluster participation on a firm’s R&D productivity, but rather showed that participating firms collaborating with partners outside the cluster were more productive in terms of patent output. In further research focused on the same cluster program, Nishimura and Okamuro (2011b) discovered that cluster participants making use of indirect support measures within the program (e.g. information and consulting services, participating in events) significantly expanded their network activities, whilst direct R&D subsidies had only a weak effect. Falck et al. (2010) have evaluated the impacts of a regional cluster program in the German state of Bavaria and found a positive effect on firms’ probability to innovate while R&D expenditures of firms in the program’s target industries substantially decreased. Other program impacts include better access to external know-how, greater cooperation with public scientific institutes and improved availability of suitable R&D personnel. A study by Viladecans-Marsal and Arauzo-Carod (2012) analyzed whether a cluster policy targeting knowledge-based activities in Barcelona increased the number of knowledge-based firms in the region, thereby demonstrating a small though significant program effect.

To the best of our knowledge, there are as yet no studies which analyze the role of geographical clusters in terms of the effectiveness of innovation support programs, which, rather than aiming directly to promote the emergence of clusters, rather use the existence of clusters to strengthen the programs’ impacts on innovation. This paper attempts to fill this gap.

2.3 Research questions

The aim of our paper is to determine whether focusing program activities on firms that are part of a geographical cluster increases the program’s effectiveness. Such an effect can result from different mechanisms. Firstly, firms from clusters may deliberately self-select into the program and carry their cluster advantages (in terms of innovativeness) into the program. Secondly, program managers may deliberately focus the allocation of program funds to firms in clusters, expecting a higher return from these firms. Thirdly, even when controlling for self-selection of firms and program managers, fund firms in clusters may be more effective by leveraging positive cluster externalities.

The first mechanism can result from information advantage that allows firms from a cluster to better assess the opportunities and prospects of obtaining public funding for their innovation activities. Such information advantages may arise through knowledge sharing within their local industry and from contact with local knowledge hubs such as universities or specialized technology transfer institutions. This is particularly true of programs that are rather demanding in the way planned innovation activities must be presented, or that require the building of consortia of project partners in order to be eligible for funding. For innovation programs that focus on technologies relevant to the innovation activities of the industries represented in a cluster, firms located in a cluster may subsequently have a head start in terms of receiving and assessing program information. Better information equates to lower application costs for the relevant program, providing greater incentives for firms in a cluster to participate in a program.

The second mechanism is related to the tender procedures of innovation programs, implying that only a limited number of applicants receive funding. The selection of applicants is typically based on pre-defined criteria, which often combine obligatory requirements and qualitative aspects. For the latter, peer-reviews by experts, as well as a degree of discretion on the part of program administrators is typical for many innovation programs in Europe, including the ‘Innovative SMEs’ program. As program managers are expected to run the program in such a way as to ensure that it will best meet its objectives, they are incentivized to select those applicants who they think will produce the highest returns. Having limited information about the future innovative capabilities of applicants, managers may use a firm’s location in a geographical cluster as a signal for higher innovative potentials. Program managers may also expect that these firms can profit from spillovers from other actors in the cluster, which may also increase the returns from the funds provided from the program to other cluster firms.

The third mechanism is linked to this assumed expectation of program managers. If firms in a cluster can exploit cluster externalities for more and better innovation activities, their investment in R&D and new products will be more productive.

3 Methodology and data

3.1 The ‘Innovative SMEs’ scheme

In 2007, the German federal government introduced a new scheme within its technology programs in order to provide better funding opportunities for SMEs. The scheme offers subsidies to SMEs for R&D projects, along with co-funding for project partners from industry or universities, covering a wide area of technology fields. In contrast to the government’s standard technology programs, ‘Innovative SMEs’ publishes tenders twice a year on fixed dates (mid-April and mid-October). The tenders do not predefine technological problems to be tackled in R&D projects but are open to all types of R&D within a certain field of technology. The scheme guarantees a quick evaluation of project proposals and reduces compliance costs of application through a two-step procedure. In a first step, a short (ten page) project outline must be submitted which is subject to evaluation by the program administration and an external expert panel. Projects selected in this stage must later submit a full proposal which will be checked for formal correctness only.

The scheme is administered by program agencies commissioned by the federal government. Each agency is specialized in a certain field of technology and does not only run the ‘Innovative SMEs’ scheme, but also a number of other federal and regional technology programs in their respective field. For this study, we use data from the first 4 years of the scheme, covering seven fields of technology (ICT, biotechnology, nanotechnology, photonics, production technologies, environmental technologies, safety technologies). The seven fields were administered by 14 different program agencies.

The scheme funds R&D projects that are either carried out by an SME alone or in co-operation with other firms, universities or public research organizations. The vast majority of funded projects (more than 80%) are co-operative projects. The scheme provides grants to SMEs and to their project partners to cover the direct costs of the R&D project. For SMEs, public subsidies typically cover 50% of the SME’s total project costs. In the case that the project focuses on basic research (which is very rarely the case), or if the SME is located in a disadvantaged region (i.e. East Germany), the subsidy rate may be somewhat higher. Project partners from universities or public research organizations may be refunded up to 100% of their project costs by the scheme.

The selection procedure is essentially based on the evaluation of a ten-page project summary. The evaluation combines a peer review process by external experts and a selection session involving the external experts as well as the program managers and sometimes representatives from the federal government. In the first 4 years of the scheme, the average rate of funded projects in the total number of submitted projects was 24%. The average project that received funding had total R&D costs of around €1.1 m and ran for a duration of 2.5 years. SMEs received public subsidies of approximately €0.25 m per project. In the first 4 years (2007–2010), a total of 2836 project proposals were submitted to the scheme, involving 3300 different SMEs. 675 proposals were selected for public funding, involving 1036 different SMEs. The total volume of these projects was €784 m, of which €482 m were funded from federal sources. The SMEs’ contribution to total project costs totaled €578 m, and the government contribution to their R&D costs was €307 m.

3.2 Empirical model

We evaluate the effects of clusters on the effectiveness of the ‘Innovative SMEs’ program by employing a control group design and a selection-correction approach of the Heckman (1979) type. The reason for choosing a selection-correction model instead of a matching procedure often used in evaluation R&D subsidy programs (see Hussinger 2008; Almus and Czarnitzki 2003; Görg and Strobl 2007) is related to our specific research question. We are interested in the interaction effect of receiving public subsidies and being located in a geographical cluster. As the latter is rather a continuous characteristic (i.e. a firm is to a lower or higher degree part of a cluster) we use continuous cluster measures. This implies that we cannot split our sample into distinct groups of firms that would combine the two events ‘receiving subsidies’ and ‘located in a cluster’, as would be required for a matching procedure. We prefer a selection-correction model over a combination of matching and regressing on program output for a matched group of treated and non-treated firms as we have strong and valid instruments. A selection-correction model is also more flexible when controlling for other subsidies which firms in the control group may have received.

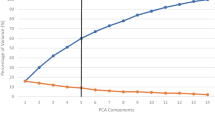

The empirical strategy consists of three steps, each step linked to one research question. The first model estimates the choice (c) of firms to participate in the program. In the second step, and considering the selection effect from the choice in the first step, we explore the determinants of a firm to being selected for funding (s) in the program. The third step models the impacts of program funding on the innovative performance (y) based on a difference-in-difference approach, again controlling for a potential selection bias. In each step, a vector of geographical clustering variables (gc) is included. In the output model (step 3), we interact this vector with the policy variable s in order to identify potential positive effectiveness impacts of allocating subsidies to beneficiaries from clusters. Selection biases are controlled for by including the estimated inverse Mills ratio (λ) from step 1 in step 2, and from step 2 in step 3. In step 1, we use information on the SME’s general innovative capacity as instruments z which determines a firm’s decision to participate in the program while at the same time not affecting the funding decision s. In step two, information on the available budget and the share of firms in the program’s main target group that have been previously funded serve as instruments (see Sect. 3.4 for more details on the instruments). In each model, a group of control variables (x) is used to capture firm-specific and technology-specific effects on the firms’ and program managers’ choices and the firms’ innovation performance (see the section on variables below). These control variables also include the instruments required to identify a potential selection bias.

The three models to be estimated read as follows:

with i representing a firm, a being a constant, β, χ, δ, ϕ and ϕ being parameters to be estimated and ε being a firm-specific error term.

Model (1) includes both firms that applied for funding in the program and firms that are part of the program’s target group but did not apply for funding. Model (2) is restricted to firms that applied for funding in the scheme. In models (2) and (3) we only consider firms that applied for funding through the ‘Innovative SMEs’ scheme (ci > 0). The control group for evaluating the impacts of the scheme on innovation performance [model (3)] includes unsuccessful applicants who either refrained from pursuing the proposed project, or who completed the project without any subsidies from the scheme, funding it either entirely from internal sources, or using public subsidies from other programs. Our control variables include indicators to describe the different categories of unsuccessful applicants.

3.3 Data

In order to estimate the three models, we require data on firms that participated in the ‘Innovative SMEs’ scheme, as well as firms from the target group of the program that did not submit a proposal. For the former group we require data both at the time at which a firm submits a proposal [in order to estimate models (1) and (2)], and following completion of the project that was submitted for funding [for model (3)]. This information was collected in two telephone surveys of all SMEs that submitted a project proposal in the first seven tenders of the scheme (two tenders in 2007–2009 each plus the first tender in 2010). For the latter group, we use information from the German innovation survey.

The first telephone survey of SMEs participating in the ‘Innovative SMEs’ scheme, included a total of 2857 different firms.Footnote 1 The survey was conducted around one and a half years after the funding decision had been made. For each SME we contacted the person responsible for the project proposal by telephone. We were unable to contact 552 SMEs, either because the person responsible for the project proposal was unavailable, telephone numbers were invalid, or because the firm denied having participated in the scheme. 199 SMEs refused to participate in the survey. 2106 SMEs responded to the telephone survey and provided information on project and firm characteristics. This equates to a return rate corrected for neutral losses of 91.4%.

A second survey targeted all SMEs when the projects which they submitted to the scheme, should have been completed (according to the time table presented in the proposal). The survey was conducted in spring 2011. Since most projects ran for a period of at least 2.5 years, only firms from the first three tenders were included in this survey. Of the 734 SMEs that qualified for the survey, 107 of these firms were classified as neutral losses as we were unable to contact them. 65 firms refused to participate in the survey. 562 SMEs provided information on the outcome of the projects which they had submitted to the scheme, giving a net response rate of 89.6%. The response rate was higher among firms subsidized under the scheme (94.5%) than it was amongst firms which had not received a subsidy from the scheme (88.1%). Of the 562 SMEs which provided information, 28% received funding from the ‘Innovative SMEs’ scheme for their project, 11% were rejected by the scheme but managed to receive funding for the same project from other public innovation programs.Footnote 2 20% executed the proposed project without public funding. The remaining 41% did not pursue the project after it was rejected by the ‘Innovative SMEs’ scheme.

In order to collect information on firms from the target group of the program that did not submit a proposal to the scheme, we use firm-level data from the German part of the Community Innovation Survey, which is managed by the Centre for European Economic Research (ZEW) in Mannheim. This survey is a panel survey (called Mannheim Innovation Panel—MIP) which is conducted annually (see Peters and Rammer 2013 for more details). We used the survey waves 2008–2011 which cover firm activities in the years 2007–2010. We restrict the sample to SMEs (i.e. less than 250 employees and less than €50 m annual sales) which engage in in-house innovation activities and which are operating in markets that are the main target sectors of the technology programs of the federal government. We determine these target sectors by examining the sector distribution of firms that received funding from these technology programs in the years 2002–2007. The target sectors include all manufacturing sectors (NACE rev. 2 10–33), as well as energy supply (35), waste disposal and recycling (38–39), air transport and logistics (51–52), broadcasting, telecommunication and computer services (60–63), consulting, technical and R&D services (70–72), and creative services (74). Firms that have submitted a project proposal to ‘Innovative SMEs’ were removed from the control group sample by matching all program participants with the MIP sample based on names and addresses. The total number of observations in the control group is 4884.

3.4 Variables

Our key variables of interest are indicators on geographical clustering of firms. We distinguish three types of clusters: industry, technology and knowledge. Industry clusters represent an agglomeration of firms from the same industry in a certain region. We use a simple measure—the number of firms in an industry and region. Industries are defined at the two-digit NACE level.Footnote 3 Data on the number of firms per industry is taken from the Mannheim Enterprise Panel, essentially a business register for Germany (see Bersch et al. 2014), using 2010 as the reference year.

Technology clusters represent geographical agglomerations of related technological activities. We rely on patent data, using the count of patents applied at the European Patent Office (EPO) and through the Patent Cooperation Treaty (PCT) at the World Intellectual Property Organization in Geneva. Patent data are taken from EPO’s Patstat database and cover the priority years 1998–2008. Patents are assigned to regions based on the inventor location, using fractional counting in the case of inventors from different regions. We use two methods in order to determine whether a firm is located in a geographical technology cluster. The first methods consists in assigning patents to the seven fields of technology that were targeted by the ‘Innovative SMEs’ scheme, employing an IPC-based classification of technology fields proposed by Schmoch (2008). This method can be used only for SMEs that applied to the program (c > 0) as we have no direct information on fields of technology for firms that did not apply to the program.Footnote 4 In order to obtain a technology cluster variable for the latter firms, we use an indirect method, assigning patents to industries, using the concordance between technology fields (as reported by IPC codes in patent files) and 3-digit NACE rev. 1.1 sectors proposed by Schmoch et al. (2003). For each firm, we count the number of patents applied for by inventors located in a firm’s region, that are assigned to the firm’s industry code. Since the concordance is only available for manufacturing firms, the second technology cluster indicator cannot be obtained for service firms.

A knowledge cluster refers to knowledge generating activities that are concentrated in a certain region. We focus on knowledge that is relevant for the fields of technology targeted by the ‘Innovative SMEs’ scheme. We measure the stock of knowledge by ascertaining the total amount of federal funding allocated for R&D in the respective field of technology in the 8 years prior to the start of the program (2000–2007).Footnote 5 Federal R&D funding includes both project-based funding for universities, research institutes and enterprises as well as institutional funding for government research labs. Data is taken from the so-called ‘Profi’ database of the federal government which contains data on all R&D projects that received federal funding through technology programs, as well as federal institutional funding streams (see Aschhoff 2010). We again use two different methods in order to assign this stock of knowledge to SMEs. One method consists in directly assigning this knowledge stock on the basis of the field of technology for an SME applied for funding. This method is only feasible for SMEs with c > 0. For the other SMEs, we assign knowledge stocks via industry codes. For this purpose, we examine the distribution of all federal technology funding to firms during 2000–2007 according to field of technology and the firms’ industry. For each 2-digit industry, we calculate the share of each of the seven fields of technology in total federal technology funding, also considering fields of technology beyond the seven fields covered by the ‘Innovative SMEs’ scheme. The firm-specific knowledge cluster indicator is calculated by weighting the funding volume in a technology field against the share of this field in total federal technology funding for the 2-digit industry of the SME, and totaling these weighted funding volumes across the seven fields.

Apart from the second technology indication for which we use the 2-digit level, the data for the cluster variables are measured at the 3-digit NUTS level.Footnote 6 There are more than 400 NUTS3 areas in Germany; although the size of these areas varies considerably, they have an average area of around 1000 km2 and an average population of around 200,000. In order to calculate cluster variables, we define a region for each firm. This region includes all NUTS areas whose geographical centre is within a 50 km distance from the firm’s location. This means that the NUTS area in which a firm is located is always part of the region, while for many firms neighbouring NUTS areas are also included, particularly in large metropolitan areas consisting of several NUTS areas (such as the Ruhr).Footnote 7

We assume that geographical cluster effects will be stronger the larger a cluster. Cluster size is measured both in absolute terms (i.e. stock of firms, stock of patents, allocated Federal funding) and through a relative measure. The relative measure represents the share of a region in all activities within an industry, a technology field or a knowledge area. This specification enables the identification of geographical clusters in industries, fields or areas of a small size. We also control for differences in the size of regions by including the logarithm of a region’s GDP in the estimation.

The dependent variables of models (1) and (2) are indicator variables that take the value 1 if a firm submitted a project proposal to the scheme (1), or if the project proposal was selected for funding by the program administration (2). For the output model (3), we use two alternative dependent variables which capture different aspects of program effectiveness, input additionality (see Czarnitzki and Lopes-Bento 2013) and output additionality (see Hottenrott and Lopes-Bento 2014). Input additionality is measured by the change in the ratio of R&D expenditure over sales between the year prior to the start of the project (which is 2007 or 2008) and the year in which the project ended (2010 or 2011). We use the R&D to sales ratio rather than the absolute amount of R&D expenditure in order to better control for the varying business cycle situations of firms. The period covered by our study, 2007–2011, was characterized by a severe economic recession in 2009, with a drop in real GDP in Germany of 5%. Many firms experienced a sharp decline in sales and had to adjust their expenditure, including R&D spending, accordingly. Economic recovery took place at a varying pace in each sector. By relating R&D expenditure to the firm’s sales volume we attempt to capture the different impacts of the economic crisis on individual firms. Note that no R&D expenditure data from the recession year 2009 is used in the input additionality model.

Output additionality is measured in terms of the sales generated by new products that resulted from the project submitted to the scheme. Since the vast majority of R&D projects submitted to the ‘Innovative SMEs’ scheme aimed at developing new products, we believe that this variable is a fair indicator of project success, particularly as the scheme intends to support new product development (as does most other SME-related R&D programs in Germany). New product sales are often the preferred output measure for product innovation (see OECD and Eurostat 2005). We are aware, however, that the measure is still a crude proxy as it does not capture other relevant output dimensions of projects (i.e. developing generic knowledge/technologies used, out-licensing) and as the submitted project may be subject to spillovers to and from other innovative activities in the firm. We exclude firms with projects that did not aim at developing product innovations from this part of the analysis. To control for size effects, this sales figure is divided by the firms’ sales level in the year the project ended. Information on these variables is taken from the second telephone survey. Given that this survey was conducted close to the (planned) end of the project, not all firms had yet generated sales with new products. These firms were asked to estimate the likely annual sales volume of the product innovations developed in the course of the project, and we took this estimate as the output measure.

In the first model, a firm’s capacity to innovate serves as an instrument to control for a potential selection bias. Since ‘Innovative SMEs’ is a rather demanding scheme in terms of the ability of a firm to develop and apply new technology, firms would need to have sufficient in-house resources to be able to prepare a competitive proposal. We use the R&D to sales ratio and the share of graduates employed by firms (both measured for the year prior to application) as proxies for this capacity. Both variables have proven to have a strong impact on the participation decision while they neither effect the funding decision, nor show correlation with the residuum of the first model.

In the second model, supply and demand restrictions are used as instruments. On the supply side, we use the budget available per submitted proposal and field of technology in each tender. If budgets are tight, program managers may have to reject proposals despite their high quality, whereas abundant budgets may stimulate generous selection decisions as program managers are incentivized to spend most of their budget to avoid cuts in subsequent years. On the demand side, one must consider that the potential of SMEs in Germany which conduct high-level R&D in the various fields of technology is limited, and many of these SMEs have received public funding in previous years from federal technology programs. We observe the number of SMEs that received funding from technology programs in the field in which they submitted a proposal to the ‘Innovative SMEs’ scheme and divide this number by the number of SMEs with a high R&D intensity (7% or more) that are active in the respective field of technology. The latter figure is taken from the results of the German innovation survey, assigning firms to fields of technology based on their 4-digit industry code. Both variables have proven to be strong instruments which have explaining the funding decision while showing no correlation with the performance variables in model 3.

In all three models, following the literature on microeconometric modeling of innovation program impacts (Takalo et al. 2013; Wallsten 2000; Lach 2002; Hussinger 2008; Berube and Mohnen 2009; Czarnitzki and Lopes-Bento 2012, 2014), we use a number of control variables (see Table 5 in the “Appendix”) including size, age, sector, export activity, access to external financing (proxied by a credit rating index of Germany’s largest credit rating agency, Creditreform) and, since there is still a preferential treatment of East German firms in public innovation programs (i.e. higher subsidy rates), whether a firm is located in Eastern Germany. In the model of firm decisions to participate in the scheme, we consider prior experience in participating in federal technology programs or in other public innovation programs. In the second model on the program administration’s decision to fund a project, we capture characteristics of the proposed project (strategic focus, technological ambition, barriers that affected the process of drafting the proposal, active guidance by the program administration when completing the proposal). Control variables of the output model include the R&D to sales ratio at the project start, the patent stock per employee at the project start, the strategic focus of the project, and whether the project was conducted in cooperation with others. The input additionality model also contains an indicator capturing difficulties in providing own resources to co-fund the project. The output additionality model also includes the change in R&D to sales ratio between the project start and end, to control for the size of R&D investment made during the project. In both additionality models we consider two policy variables (funding from the ‘Innovative SMEs’ scheme and funding from any other public program). The input additionality model also includes an indicator for firms that completed the rejected project without public funding. Descriptive statistics of all model variables, including the source of data for each variable, are shown in Table 6 in the “Appendix”.Footnote 8

4 Estimation results

Table 1 presents the estimation results for a SMEs’ decision to participate in the ‘Innovative SMEs’ scheme. Geographical clustering plays a decisive role in this decision. SMEs located in clusters are significantly more likely to submit a proposal to the program. This result holds for all three types of cluster variables when measuring clusters based on the absolute size of activities. For the alternative specification based on the share of a region’s activities in terms of the national total, only the knowledge cluster variable shows a significant impact. The geographical clustering effect seems to be stronger for knowledge clusters and less strong for industry and technology clusters. The result may indicate that firms in a cluster are more aware of funding opportunities and tend to be more receptive to government support schemes. It may also indicate, however, that government agencies and intermediaries (such as technology transfer offices) are more active in promoting funding opportunities in cluster regions. Since we have no record of the regional distribution of such promotion activities, we cannot control for the impact of these activities on firm choices.

Prior experience with public innovation programs is a major factor in a firm’s decision to seek funding as part of the ‘Innovative SMEs’ scheme. Firms that participated in Federal technology programs show a 3.5 percentage point higher propensity to submit a project proposal to the scheme. Experience with other R&D programs raises this propensity by around 6%. Another main driver of an SME’s decision to participate in the program is its innovative capacity. R&D intensity and human capital are two highly important determinants. Larger and younger SMEs show a higher propensity to submit proposals. Firms selling on international markets are also more likely to seek public funding. Interestingly, firms from East Germany show a significantly lower propensity to apply to the ‘Innovative SMEs’ scheme. This primarily reflects the extensive supply of other R&D support programs for this part of Germany (including programs co-funded by EU Structural Funds) which typically show a much higher success rate for applications.Footnote 9 A firm’s credit rating does not affect the decision on program participation while we find significant heterogeneity across sectors.

Turning to our second research question, we find some support that the program administration tends to choose proposals from firms located in knowledge clusters. We find a positive impact for both specifications of this cluster variable (see Table 2), though the significance level of the cluster effects is lower than those found for a firm’s decision to participate in the scheme. We do not find any significant effects for industry clusters and only a statistically very weak effect for technology clusters. When interpreting this result, one should keep in mind that program managers will have only restricted information on the existence of clusters. They might be well aware of knowledge clusters in their knowledge area since they are typically involved in providing funding for R&D projects to the main actors in such clusters (universities, government labs, large companies, high-tech start-ups). They have a much less comprehensive overview, however, of the regional distribution of patent activities in their field of technology, particularly as most program managers are specialized in a subfield within the seven technology areas covered by the program. They will also have little information on the existence of industry clusters, particularly if many firms in a cluster are not conducting R&D at the technological frontier.

Firm characteristics only play a minor role for the selection of a positive evaluation of a proposal by the program management. We find a weak negative effect of firm age, i.e. younger firms proof to be somewhat preferred over older ones. There are almost no sector effects. Strong effects can be found for a firm’s prior experience with public innovation programs. Firms having received subsidies either from Federal technology programs or from other schemes, are more likely to receive funding for their ‘Innovative SMEs’ project. There is also a strong positive effect for firms that were unsuccessful with their project proposal in an earlier tender round, but which submitted another proposal (or a re-worked version of their original proposal) in a later tender. Around 4% of all SMEs that were unsuccessful in a tender submitted a proposal in a later tender, with approximately 80% of them being successful in the second trial. This suggests a learning effect.

Characteristics of the proposed project are highly relevant for success in the scheme. Program managers tend to chose projects that focus on strategic R&D rather than on further developing established technologies. Co-operative projects have an advantage over individual projects. The projects of firms which reported that the list of technologies targeted by the scheme was too narrow were more likely to fail. Equally, the projects of firms which had difficulty providing their own resources for the R&D project were likely to fail. Firms that contacted the program administration to seek advice when completing the proposals had a significantly better chance of receiving funding.

Supply and demand restrictions are highly relevant for the selection choice of program managers. If the number of submitted proposals per available budget in a certain field of technology is low, more projects receive funding. This is straightforward since project size and the amount of required co-funding from the state per project do not significantly vary within a field of technology. If managers wish to exploit the available budget, their main parameter is the number of projects which receive funding. If the number of SMEs within a certain field of technology that received funding from the ‘Innovative SME’ scheme is high compared to the estimated potential of SMEs in that field, the probability of them receiving funding decreases. This essentially reflects the program management’s attempt to focus funding on ambitious projects.

We do not find a statistically positive impact of the inverse Mills ratio in model 2, implying that the explanatory variables used in model 1 are sufficient for modeling an SMEs’ choice to participate in the program, and that there are no unobserved variables that may affect both the decision to participate in the program and the probability of receiving funding. In fact, the group of program participants seems to be quite homogenous and clearly differs from the average innovative SME in Germany, particularly with respect to innovative capacity. The average R&D intensity of program participants is 0.22 (R&D expenditure over sales), compared to 0.1 for the average innovative SME in the sectors targeted by the program. Program success does not depend on R&D intensity, however,Footnote 10 but is strongly driven by project characteristics.

When turning to the third stage of our models, geographical clusters do not show any impact on input and output additionality. We find statistically significant positive impacts neither from the cluster variables, nor from the interaction between cluster and funding variables (Tables 3, 4). The result is consistent for both specifications of our cluster variables. There are also no positive cluster effects for firms having received subsidies from other public funding sources. We even find two negative interaction effects for input additionality in case of other public funding and industry clusters, and no public funding and knowledge clusters. Our results therefore suggest that focusing public funding on firms located in clusters, which is the case for the ‘Innovative SMEs’ scheme as cluster firms tend to self-select into the program and program managers tend to favor applicants from clusters to some extent, does not help maximize the program’s impacts. The program which we are looking at, at least, does not seem to profit from general positive effects of industry clusters on firms’ R&D investment as found in other studies (Gerlach et al. 2009).

Despite the absence of effects of geographical clustering, the input additionality model shows a positive contribution of the ‘Innovative SMEs’ scheme to the change in R&D intensity of subsidized SMEs. Funded firms have increased their R&D intensity by 8–9 percentage points compared to firms that applied to the program but did not receive public support. We find a much higher positive effect for other public R&D funding (19 percentage point increase in R&D intensity, significant at the 1% level). These results imply that subsidizing the R&D expenditure of SMEs has been highly effective. One should note, however, that there was a severe economic recession during the period analyzed which made financing of R&D difficult for many SMEs. Access to public funds clearly made a difference and helped firms to maintain a level of R&D they would otherwise have had to reduce.

When controlling for the pre-level R&D intensity, there are hardly any significant impacts of our other control variables on the change in R&D intensity. Neither the type of the project nor a firm’s general financial situation substantially affects changes in R&D intensity. We find a positive impact for firms that reported difficulties in providing own resources for co-financing the project submitted to the scheme. This result suggests that the program administration was capable of focussing subsidies on those SMEs which needed it most.

With respect to output additionality, we find a negative impact of the program. SMEs funded through the ‘Innovative SMEs’ scheme show a significantly lower level of sales with new products originating from the funded project compared to SMEs that were able to co-fund their rejected project through another public program, or that funded the project entirely from their own sources. A main driver for this result is that many SMEs subsidized by ‘Innovative SMEs’ were not yet able to market a product which resulted from the funded project. This does not imply project failure, but may reflect different levels of ambition among ‘Innovative SMEs’ projects and non-funded projects which results in differences in short-term commercial success. It should not be forgotten, that our measure of innovation output refers to sales of new products shortly after product launch. Immediate commercial success of new product developments tends to be higher for less ambitious product innovations, e.g. adaptations of existing products or customer-specific, further developments of technologies. Such innovations often respond to a demand explicitly articulate by users and are rather easy to market. Firms developing more substantial innovations are less likely to generate significant sales directly after the development project. This is result of the greater efforts required in marketing the product, and the potential need to adapt technology after intial user experiences (see Colombo et al. 2015).

There is evidence in the survey data suggesting that the projects of control group firms are less risky and closer to the market than those selected for funding. This is not surprising since the control group consists of firms that completed the unsuccessfully submitted project using only their own funds. Firms are more likely to do this if projects are low risk, and spillovers are low, than if projects are more radical and thus higher risk. The heterogeneity in innovative ambition is partially, but perhaps not fully, captured by our control variables on project characteristics (strategic research vs. further developing established technologies). The significant and negative coefficient of the inverse Mills ratio also points in this direction, as is it implies that there are unobserved variables that increase the probability of receiving funding from the scheme and at the same time lower the output variable.

5 Conclusion

We use data from a German innovation program, ‘Innovative SMEs’ that provides grants to SMEs for conducting R&D projects to examine the role of geographical clustering for the effectiveness of the funding scheme. While the program is not specifically focused on supporting clusters, it may leverage the existence of clusters to maximize the impact of government investment by allocating funding to firms located in clusters and generate higher impacts by exploiting positive cluster effects.

We find that firms located in a cluster are more likely to participate in the program. This result is consistent for all three cluster measures used; industry, technology and knowledge clusters. We are unable to determine whether this result is due to information spillovers among cluster firms concerning funding opportunities, or whether it reflects program promoting activities targeted at clusters. We also find that the program administration tends to select projects from firms that are located in knowledge clusters but not in industry or technology clusters. This finding may reflect the greater ability of program managers to observe knowledge clusters (which are determined by the location of large research facilities at universities, national laboratories or large corporations).

We do not find any impact of geographical clustering on the program effectiveness either in terms of input additionality (change in R&D intensity), or output additionality (sales with new products). What we do find is a positive impact of the program on SMEs’ increase in R&D expenditure, and a negative impact on innovation output, irrespective of whether funded firms are part of a geographical cluster. The positive input additionality may be driven by the specific economic environment as the reference period (2007/08–2010/11) was characterized by a severe recession that posed a considerable challenge to SMEs in terms of funding their R&D. The availability of public funding sources clearly eased this situation and allowed funded firms to maintain or expand their R&D activities where these would otherwise have had to be reduced. The negative output additionality may reflect unobserved heterogeneity in the innovative ambition of publicly funded and non-funded projects, the former heading for more radical innovations which need more time to be placed in the market.

While our results must be viewed with some caution, as looked only at short term program effects in an economic turbulent period, we can still derive some tentative policy conclusions. Firstly, innovation programs can have effects on geographical clustering even if the program is not designed to support clusters. Two selection mechanisms are responsible for indirect impacts. Firms from clusters strongly select into the scheme, and the program management tends to favor projects from cluster firms. Secondly, this implicit cluster orientation of the program does not transfer into higher program impacts with regard to the firms’ innovative capacities or innovative performance, at least not in the short run. There is hence little justification for the observed focus on geographical clusters. The program might instead expand its impacts by motivating more firms not located in geographical clusters to participate in the program, e.g. by advertising the program outside established routes such as industry fairs, industry associations, and research and technology organizations as these tend to be located in clusters.

As part of future research, it would be worth analyzing likely indirect cluster effects of technology programs by looking at other programs within Germany and in other countries. It would also be interesting to compare the impacts of dedicated cluster programs with those of R&D programs that indirectly support firms in clusters via the selection mechanisms described above.

A main shortcoming of this study is the lack of information on how firms are embedded in their geographical clusters, i.e. which linkages they have with other actors in the cluster. It may well be the case that both the higher propensity of cluster firms to participate in the program, and the program management’s choice to favor projects from cluster firms, is driven by firms strongly embedded in clusters. One may also expect differences in the program’s input and output additionality impacts if one controls for heterogeneity in the firms’ cluster involvement. We leave this to future research.

Notes

Note that some firms participated in several tenders. In such cases, data on the first participation was collected.

In addition to ‘Innovative SMEs’, the federal government offers another large program to finance R&D projects in SMEs, called ‚Central Innovation Program for SMEs’ (ZIM). This program considerably increased its funding volume in 2009 and 2010 in response to the economic crisis.

NACE is the official industry classification used in the European Union. It is largely equivalent to international industry classifications of the United Nations (ISIC).

One could use the patent stock of firms with c = 0 to determine their technology focus, but only a small fraction of these firms (around 20%) show patenting activity in the past 10 years.

Although the ‘Innovative SMEs’ scheme started in 2007, no financial flows occurred in that year.

NUTS is the official regional classification used in the European Union.

We also tested alternative definitions of regions (e.g. using only the NUTS area in which a firm is located, or using a larger distance threshold) which yielded very similar results.

Correlation tables can be obtained from the authors upon request.

The lower propensity of program participation for East German firms is not related to a lower innovation propensity. Firms from East Germany show a similar share of innovators and R&D performers as firms in West Germany (see Rammer et al. 2016).

R&D intensity at the time of application is not statistically different between successful and unsuccessful program participants, and the variable is insignificant if included in model 2.

References

Aerts, K., & Schmidt, T. (2008). Two for the price of one? Additionality effects of R&D subsidies: A comparison between Flanders and Germany. Research Policy,37, 806–822.

Almeida, P., & Kogut, B. (1999). Localization of knowledge and the mobility of engineers in regional networks. Management Science, 45(7), 905–917.

Almus, M., & Czarnitzki, D. (2003). The effects of public R&D subsidies on firms’ innovation activities: The case of Eastern Germany. Journal of Business & Economic Statistics,21, 226–236.

Aschhoff, B. (2010). Who gets the money? The dynamics of R&D project subsidies in Germany. The Journal of Economics and Statistics,230(5), 522–546.

Audretsch, D. B., & Feldman, M. P. (1996). R&D spillovers and the geography of innovation and production. American Economic Review,83, 630–640.

Audretsch, D. B., & Feldman, M. P. (2004). Knowledge spillovers and the geography of innovation. In J. V. Henderson & J. F. Thisse (Eds.), Handbook of regional and urban economics (pp. 2714–2735). Dordrecht: Elsevier.

Audretsch, D. B., Lehmann, E. E., & Warning, S. (2005). University spillovers and new firm location. Research Policy,34, 1113–1122.

Audretsch, D., & Stephan, P. (1996). Company-scientist locational links: The case of biotechnology. American Economic Review,86(3), 641–652.

Baptista, R., & Swann, G. P. (1998). Do firms in clusters innovate more? Research Policy,27(5), 525–540.

Beaudry, C., & Breschi, S. (2003). Are firms in clusters really more innovative? Economics of Innovation and New Technology,12(4), 325–342.

Bersch, J., Gottschalk, S., Müller, B., & Niefert, M. (2014). The Mannheim Enterprise Panel (MUP) and firm statistics for Germany. ZEW discussion paper no. 14-104, Mannheim.

Berube, C., & Mohnen, P. (2009). Are firms that received R&D subsidies more innovative? Canadian Journal of Economics,42(1), 206–225.

Branstetter, L. G., & Sakakibara, M. (2002). When do research consortia work well and why? Evidence from Japanese panel cata. American Economic Review,92(1), 143–159.

Breschi, S., & Malerba, F. (2001). The geography of innovation and economic clustering: Some introductory notes. Industrial and Corporate Change,10(4), 817–833.

Chen, H., Gompers, P., Kovner, A., & Lerner, J. (2010). Buy local? The geography of venture capital. Journal of Urban Economics, 67(1), 90–102.

Colombo, M. G., Franzoni, C., & Veugelers, R. (2015). Going radical: Producing and transferring disruptive innovation. The Journal of Technology Transfer, 40(4), 663–669.

Cooke, P. (2001). Regional innovation systems, clusters, and the knowledge economy. Industrial and Corporate Change,10(4), 945–974.

Czarnitzki, D., Ebersberger, B., & Fier, A. (2007). The relationship between R&D collaboration, subsidies and R&D performance: Empirical evidence from Finland and Germany. Journal of Applied Econometrics,22(7), 1347–1366.

Czarnitzki, D., & Hottenrott, H. (2009). Are local milieus the key to innovation performance? Journal of Regional Science,49(1), 81–112.

Czarnitzki, D., & Lopes-Bento, C. (2012). Evaluation of public R&D policies: A cross-country comparison. World Review of Science, Technology and Sustainable Development,9(2–4), 254–282.

Czarnitzki, D., & Lopes-Bento, C. (2013). Value for money? New microeconometric evidence on public R&D grants in Flanders. Research Policy,42, 76–89.

Czarnitzki, D., & Lopes-Bento, C. (2014). Innovation subsidies: Does the funding source matter for innovation intensity and performance? Empirical evidence from Germany, Industry and Innovation,21(5), 380–409.

Eickelpasch, A., & Fritsch, M. (2005). Contests for cooperation—A new approach in German innovation policy. Research Policy,34(8), 1269–1282.

Falck, O., Heblich, S., & Kipar, S. (2010). Industrial innovation: Direct evidence from a cluster-oriented policy. Regional Science and Urban Economics,40, 574–582.

Feldman, M. P., & Audretsch, D. B. (1999). Innovation in cities: Science-based diversity, specialization and localized competition. European Economic Review,43(2), 409–429.

Florida, R. (2002). The economic geography of talent. Annals of the Association of American Geographers,92(4), 743–755.

Folta, T., Cooper, A. C., & Baik, Y. (2006). Geographic cluster size and firm performance. Journal of Business Venturing,21(2), 217–242.

Frietsch, R., & Schüller, M. (Eds.). (2010). Competing for global innovation leadership: Innovation systems and policies in the USA, EU and Asia. Stuttgart: Fraunhofer IRB Verlag.

Fromhold-Eisebith, M., & Eisebith, G. (2005). How to institutionalize innovative clusters? Comparing explicit top–down and implicit bottom–up approaches. Research Policy,34(8), 1250–1268.

Gerlach, H., Rønde, T., & Stahl, K. (2009). Labor pooling in R&D intensive industries. Journal of Urban Economics,65(1), 99–111.

Glaeser, E., Kallal, H., Scheinkman, J. A., & Shleifer, A. (1992). Growth of cities. Journal of Political Economy,100, 1126–1152.

Görg, H., & Strobl, E. (2007). The effect of R&D subsidies on private R&D. Economica,74, 215–234.

Harhoff, D., Henkel, J., & von Hippel, E. (2003). Profiting from voluntary information spillovers: How users benefit by freely revealing their innovations. Research Policy,32(10), 1753–1769.

Heckman, J. (1979). Sample selection bias as a specification error. Econometrica,47(1), 153–161.

Helsley, R. W., & Strange, W. C. (2002). Innovation and input sharing. Journal of Urban Economics,51(1), 25–45.

Hospers, G.-J., Desrochers, P., & Sautet, F. (2009). The next Silicon Valley? On the relationship between geographical clustering and public policy. International Entrepreneurship and Management Journal,5, 285–299.

Hottenrott, H., & Lopes-Bento, C. (2014). (International) R&D collaboration and SMEs: The effectiveness of targeted public R&D support schemes. Research Policy,43, 1055–1066.

Hussinger, K. (2008). R&D and subsidies at the firm level: An application of parametric and semiparametric two-step selection models. Journal of Applied Econometrics,23(6), 729–747.

Jacobs, J. (1969). The economy of cities. New York: Random House.

Jaffe, A. B. (1989). Real effects of academic research. American Economic Review,79(5), 957–970.

Jaffe, A. B., Trajtenberg, M., & Henderson, R. (1993). Geographic localization of knowledge spillovers as evidenced by patent citations. Quarterly Journal of Economics,63, 577–598.

Klepper, S. (2010). The origin and growth of industry clusters: The making of Silicon Valley and Detroit. Journal of Urban Economics,67, 15–32.

Kortum, S., & Lerner, J. (2000). Assessing the contribution of venture capital to innovation. RAND Journal of Economics,31(4), 674–692.

Kukalis, S. (2010). Agglomeration economies and firm performance: The case of industry clusters. Journal of Management,36(2), 453–481.

Lach, S. (2002). Do R&D subsidies stimulate or displace private R&D? Evidence from Israel. Journal of Industrial Economics,50(4), 369–390.

Love, J. H., & Roper, S. (2001a). Location and network effects on innovation success: Evidence for UK, German and Irish manufacturing plants. Research Policy,30(4), 643–661.

Love, J. H., & Roper, S. (2001b). Outsourcing in the innovation process: Locational and strategic determinants. Papers in Regional Science,80(3), 317–336.

Maillat, D. (1995). Territorial dynamic, innovative milieus and regional policy. Entrepreneurship & Regional Development,7, 157–165.

Mansfield, E. (1995). Academic research underlying industrial innovations: Sources, characteristics, and financing. Review of Economics and Statistics,77(1), 55–65.

Marshall, A. (1890). Principles of economics. London: Macmillan.

Martin, R., & Sunley, P. (1998). Slow convergence? The new endogenous growth theory and regional development. Economic Geography,74(3), 201–227.

Martin, R., & Sunley, P. (2003). Deconstructing clusters: Chaotic concept or policy panacea? Journal of Economic Geography,3, 5–35.

Maskell, P. (2001). Towards a knowledge-based theory of the geographical cluster. Industrial and Corporate Change,10(4), 921–942.

McCann, B., & Folta, T. B. (2011). Performance differentials within geographic clusters. Journal of Business Venturing,26, 104–123.

McDonald, F., Tsagdis, D., & Huang, Q. (2006). The development of industrial clusters and public policy. Entrepreneurship and Regional Development,18, 525–542.

Nishimura, J., & Okamuro, H. (2011a). R&D productivity and the organization of cluster policy: An empirical evaluation of the Industrial Cluster Project in Japan. Journal of Technology Transfer,36(2), 117–144.

Nishimura, J., & Okamuro, H. (2011b). Subsidy and networking: The effects of direct and indirect support programs of the cluster policy. Research Policy,40, 714–727.

OECD and Eurostat. (2005). Oslo manual. Guidelines for collecting and interpreting innovation data (3rd ed.). Paris: OECD.

Perroux, F. (1950). Economic spaces: Theory and application. Quarterly Journal of Economics,64, 90–97.

Peters, B., & Rammer, C. (2013). Innovation panel surveys in Germany. In F. Gault (Ed.), Handbook of innovation indicators and measurement (pp. 135–177). Cheltenham: Edward Elgar.

Porter, M. E. (1998). Clusters and competition: New agendas for companies, governments, and institutions. In M. E. Porter (Ed.), On competition (pp. 197–287). Cambridge: Harvard Business School Publishing.

Rammer, C., Crass, D., Doherr, T., Hud, M., Hünermund, P., Iferd, Y., et al. (2016). Innovationsverhalten der deutschen Wirtschaft - Indikatorenbericht zur Innovationserhebung 2015. Mannheim: Centre for European Economic Research.

Sakakibara, M. (2001). The diversity of R&D consortia and firm behaviour: Evidence from Japanese data. The Journal of Industrial Economics,49(2), 181–196.

Saxenian, A. (1991). The origins and dynamics of production networks in Silicon Valley. Research Policy,20, 423–437.

Saxenian, A. (1994). Regional advantage: Culture and competition in Silicon Valley and Route 128. Cambridge: Harvard University Press.

Schmoch, U. (2008). Concept of a technology classification for country comparisons. Final report to the World Intellectual Property Office (WIPO). Karlsruhe: Fraunhofer Institute for Systems and Innovation Research.

Schmoch, U., Laville, F., Patel, P., & Frietsch, R. (2003). Linking technology areas to industrial sectors. Final report to the European Commission, DG Research. Karlsruhe: Fraunhofer Institute for Systems and Innovation Research.

Shaver, J. M., & Flyer, F. (2000). Agglomeration economies, firm heterogeneity, and foreign direct investment in the United States. Strategic Management Journal, 21(12), 1175–1193.

Sorenson, O., & Stuart, T. (2001). Syndication networks and the spatial distribution of venture capital investments. American Journal of Sociology,106, 1546–1588.

Takalo, T., Tanayama, T., & Toivanen, O. (2013). Estimating the benefits of targeted R&D subsidies. Review of Economics and Statistics,95(1), 255–272.

Tallman, S., Jenkins, M., Henry, N., & Pinch, S. (2004). Knowledge, clusters, and competitive advantage. Academy of Management Review,29, 258–271.

Tödtling, F., & Trippl, M. (2005). One size fits all? Towards a differentiated regional innovation policy approach. Research Policy,34(8), 1203–1219.

Uyarra, E., & Ramlogan, R. (2012). The effects of cluster policy on innovation. Compendium of evidence on the effectiveness of innovation policy intervention. Nesta working paper no. 12/05, London.

van der Panne, G. (2004). Agglomeration externalities: Marshall versus Jacobs. Journal of Evolutionary Economics,14, 593–604.

Viladecans-Marsal, E., & Arauzo-Carod, J.-M. (2012). Can a knowledge-based cluster be created? The case of the Barcelona 22@ district. Papers in Regional Science,91(2), 377–400.

Wallsten, S. J. (2000). The effects of government-industry R&D programs on private R&D: The case Small Business Innovation Research Program. RAND Journal of Economics,31(1), 82–100.

Zucker, L. G., Darby, M. R., & Brewer, M. B. (1998). Intellectual human capital and the birth of U.S. biotechnology enterprises. American Economic Review, 88(1), 290–306.

Acknowledgements

This research emerged from an evaluation study of the efficiency and effectiveness of the ‘Innovative SMEs’ scheme commissioned by the German Federal Ministry of Education and Research and conducted by the Centre for European Economic Research in co-operation with Prognos AG and the Institute for SME research at the University of Mannheim. We thank Thomas Eckert for processing administrative project data. We would also like to thank two anonymous reviewers for their very helpful comments. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Crass, D., Rammer, C. & Aschhoff, B. Geographical clustering and the effectiveness of public innovation programs. J Technol Transf 44, 1784–1815 (2019). https://doi.org/10.1007/s10961-017-9584-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-017-9584-x