Abstract

Business incubators have become a popular policy option and economic development intervention tool. However, recent research shows that incubated firms may not benefit significantly from their incubator relationships, and may even be more vulnerable to failure post departure (graduation) from an incubator. These findings suggest that the impact of business incubation on new venture viability may be contingent on the type of support offered by an incubator and attributes of business environments within which incubation services are provided. Incubation services that protect and isolate ventures from key resource dependencies may hinder venture development and increase subsequent vulnerability to environmental demands. Alternatively, incubation services that help ventures connect and align with key resource dependencies are likely to promote firm survival. We propose that incubators vary in the services and resources they offer, and that university incubators typically provide greater connectivity and legitimacy with respect to important contingencies associated with key industry and community stakeholders. This leads us to propose that university affiliation is an important contingency that affects the relationship between firms’ participation in incubators and their subsequent performance. The purpose of this study is to evaluate this contingency by examining whether firms graduating from university incubators attain higher levels of post-incubation performance than firms participating in non-university affiliated incubators. We test this by evaluating the performance of a sample of graduated firms associated with the population of university-based incubators in the US contrasted against the performance of a matched cohort of non-incubated firms. The analysis uses an enhanced dataset that tracks the number of employees, sales, and the entry and graduation (departure) points of incubated firms from a university incubation program, so as to delineate the scope of influence of the incubator.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Launching a new business is hard and approximately half fail within 5 years. These are harsh realities facing entrepreneurs as they contemplate starting a new business venture. US Census data shows that approximately 25 % of new businesses are abandoned within 1 year of founding, 55 % fail by their fifth year, and only 30 % last beyond their tenth year (Shane 2008). Why are these results so grim? Identifying factors that affect firm survival and performance has been a central focus of organizational research for decades, and a concept derived from ecological theories describing the “liability of newness” is frequently offered as a means of describing threats to the viability of new ventures. The liability of newness suggests that new and young firms face unique risks associated with poor employee role clarity, internal coordination, legitimacy and competitiveness relative to older firms (Stinchcombe 1965). Empirical research suggests that legitimacy problems associated with low levels of institutional support and connections to external resources may be the most potent among these potential threats (Baum and Oliver 1991; Singh et al. 1986).

Given these results, it should come as no surprise that entrepreneurs often seek to improve their association with legitimate institutions and their proximity to potential resource providers when they launch their ventures. One increasingly available and popular option for addressing these challenges is for a firm to join a business incubator. Although business incubators vary in the benefits they offer, they generally aim to support new ventures by buffering them environmental demands when those ventures are especially vulnerable to resource dependencies imposed by competitive business environments (Kuratko and LaFollette 1987). Many also offer institutional legitimacy resulting from their missions, associations, and reputation (Suchman 1995), e.g., university incubators. Firms choosing to join a business incubator expect to benefit from additional resources, connections, and legitimacy that can help a firm connect and align with key stakeholders such as suppliers, investors, distributors, and markets. These benefits are thought to promote firm survival and performance (Barney 1991; Makadok 2001), although the impact of these benefits may be contingent on local environmental conditions (Amezcua and Ratinho 2012). This reasoning has led to an explosive growth in the number of business incubators in the United States and the European Union. For every incubator that existed in 1980 there are now more than 100—the total number of business incubators has grown from 12 to over 1400 (Amezcua et al. 2011) and about 900 in the European Union (Bruneel et al. 2012). Furthermore, as a result of most incubators being publically funded (Lewis and Edward 2001), many policy makers have positioned incubators to play a central role in economic development and rejuvenation programs (Bruneel et al. 2012); thereby further bolstering the popularity of business incubation. Patton (2013) suggests that incubated firms should “…demonstrate unambiguous sustainability and performance advantages compared to their non-incubated counterparts…” To the extent that incubators are capable of contributing to a firm’s performance, we believe university-based incubators are relatively well positioned because they offer firms connectivity and legitimacy needed to address important demands imposed by local industry and community stakeholders. Thus, university-based incubators may offer advantages relative to non-affiliated incubators with respect to helping firms survive liabilities of newness (Amezcua and Ratinho 2012).

Despite the popularity of business incubators as a means of improving the fates of new business ventures, there is limited evidence that they improve firms’ performance or viability (Aernoudt 2004; Amezcua et al. 2011; Amezcua 2010; Peters et al. 2004; Rothaermel and Thursby 2005; Scillitoe and Chakrabarti 2010). Albert and Gaynor (2001) and Scillitoe and Chakrabarti (2010) question whether business incubators are effective at commercializing opportunities into ventures.

In this paper, we present a study that seeks to address the question of whether university based incubators improve new venture performance relative to similar non-university incubator firms above and beyond the incubation period. We capture this disparity by contrasting a cohort of firms launched in university incubators against a specific cohort of firms (non-incubated firms) starting at approximately the same time to control for differences in economic conditions across different time frames and to control for imprinting effects (Milanov and Fernhaber 2009) that effect subsequent firm development. We employed a matched sample design of firms started at the same time, in the same place, in the same industry, and with the same number of initial employees to provide a closely analogous comparison group that can serve as a baseline for our analyses.

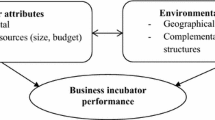

2 Analytical framework

The framework presented here is motivated by the Cobb–Douglas type production model (Douglas 1976). However, instead of modeling the macroeconomic production output function (GDP), we focus our attention on modeling the effect of university incubators on the performance of nascent firms.

The research propositions we are testing in our study are relatively straightforward proposals motivated by the general logic of resource dependence theory (Pfeffer and Salancik 2003). As we have asserted, university incubators offer advantages with respect to connectivity and legitimacy resulting from the education, research, and community outreach initiatives offered by their host institutions. This enhanced connectivity and legitimacy helps firms residing in university-based incubators to connect and align with the demands of local resource environments (Amezcua and Ratinho 2012). This leads us to propose that firms are likely to improved their odds of survival and realize improved performance after they join university-based business incubators.

- P1: :

-

Firms that choose to participate in university incubators will experience growth in jobs and sales above and beyond their time in the incubator.

Universities are relatively large institutions that often serve an important role in regional economies. Consequently, important local economic interests are likely to develop connections to a university in hopes of benefiting from the human capital, innovation, and other resources it provides to the community. The connections and positive reputation enjoyed by most universities serve as important assets to university-based business incubators. We believe that these assets are relatively unique to universities, and that non-affiliated incubators would be hard pressed to match the connections and legitimacy universities commonly offer. Resource dependence theory would suggest that superior connections and legitimacy provided by university-based incubators would enhance affiliated firms’ ability to address local resource dependencies (Amezcua and Ratinho 2012). Therefore, we offer the following research proposition:

- P2: :

-

Firms that choose to participate in university incubators will have better performance than that of a matched sample of non-university incubator firms.

3 Data and methods

This section will describe the variables used in the analysis, followed by the method used to build the cohort of university incubator startup firms representing the dataset to be analyzed, and finally present a description of the method of analysis upon which the research model is built.

3.1 Variables in the research model

The dependent variables used in the proposed research model represent the performance of the firm, as mentioned earlier, the focus of this research is to analyze the effect of external factors on the performance of a firm; a firm that strategically chooses to be part of university incubator. The firms’ industry classification is treated as an independent variable.

3.1.1 Firm performance

There is a vast body of work that uses sales and number of employees as performance measures for a firm. The number of employees can be used to measure of the rate of growth of the firm when paneled data is used. The sales data provides insight on economic output of a firm in a particular year. The data for the startup firms is retrieved from the National Establishment Time Series (NETS) database. The NETS database is constructed on a yearly basis by taking annual snapshots of all available firms on the Dun and Bradstreet (D&B) database (Walls 2013). We are working with the 2012 NETS database.

3.1.2 Firm industry classification

We add a categorical variable aimed at classifying the firms as either knowledge based firms or other firms. Firms are classified as knowledge-based firms as per the NAICS (North American Industry Classification System) classifications as prescribed by DeVol et al. (2009). Henceforth, this dichotomous variable will referred to as ‘industry’, where a value of 1 implies a firm is a Knowledge based firm, and a value of 0 if otherwise.

3.2 Cohort of firms for analysis

As described in the introduction, we limit the scope of this study to only include university-based incubation programs. A cohort of university-based incubated startup firms has been carefully crafted to be analyzed by the method as presented in Sect. 3.3. This cohort of firms represents university-based incubated firms that graduated (departure upon completion of the incubation program) between 1999 and 2009. To build this cohort of firms, we first need to identify the university incubation programs in the United States. We refer to the National Business Incubation Association (NBIA) website to identify a list of incubators that are associated with universities. The NBIA website hosts a comprehensive though not exhaustive list of incubators in the Unites States (Amezcua and Ratinho 2012). This culling of the NBIA website yielded 152 university based incubation programs operating across the United States. Upon identifying the university incubation programs, we are able to collect information on the current and graduated firms in these programs as described below.

3.2.1 Retrieving the university incubator firms

For each university incubator all the current and graduated (sometimes not listed) client/firm names are retrieved from the university incubator website. Once all the university incubator websites are visited and the firm names are retrieved, the set of university incubator firms representing the population of US based university incubator firms is now complete. The knowledge of the time in which the firms were at the university incubator is of significant importance to the current study. In this way, we can clearly model and analyze pre and post incubation performance of the incubated firms.

Close to none of university incubator websites had dates of entry or graduation for the firms listed on their webpage. To determine this information we used the ‘wayback machine’ located at the internet archive (https://archive.org/web/web.php). We ran each incubator’s web address though the ‘wayback machine’ which archives over 400 billion webpages. The ‘wayback machine’ provides snapshots of the website going back in time. In this manner, we were able to transform the current university incubator websites into longitudinal sources of data. As a result, we were able to determine the entry and exit dates for most of the firms by determining when firms were add or taken off the current client list. In this manner, we were able to estimate the time spent by the firms in a university incubator.

Furthermore, for each firm in the set of university incubator firms, the DUNS Number (a unique 9 digit identification number provided by D&B) is retrieved from the D&B website. Then the DUNS numbers for all the university incubated firms are searched for in the NETS Database. The NETS Database contains rich firm level data such as year of birth, year of death, first year metropolitan statistical area (MSA) code, current zip code, NAICS—North American Industry Classification System—Code, number of employees, sales etc. as described in Walls (2013) for US firms from Jan 01, 1989 through Jan 01, 2012.

A sweep through 152 US based University Incubator websites initially yielded 5897 firms. After processing the entire set of university incubator websites through the ‘wayback machine’ and additional 1754 firms were found bringing the total number of university based incubator firms to 7651. Of the 7651 firms, as a result of the ‘wayback machine’ we were able to determine the incubation time of 6305 firms of which 4482 firms are currently being incubated and universities. This leaves 1832 firms that have graduated from the university incubation program of which we found DUNS numbers for 1033 firms. Of the 1033 firms, a search through the NETS 2012 database yielded firm level data for 653 firms. It may seem as though many of the firms are not found but it is important to realize the NETS database extends only till Jan 01, 2012 and the data collected is up to December 2013.

3.2.2 Retrieving the non-university incubator firms

A complimentary cohort of non-university incubator startup firms is created to match the university incubator firms. The methodology for the matching builds upon previous studies performed by Siegel et al. (2003), Westhead (1997), and Westhead et al. (1994) that matched a cohort of firms that received a treatment to those that did not receive any treatment. Building upon the matching criteria from these studies, we perform one to one matching of incubated firm to firms that have the same year of birth, the same geographic area of birth (using the MSA), similar industry classification (NAICS codes matched for at least the first 3 digits), and approximately the same number of employees in the first year. The choice first three matching criteria are influenced by past literature. We choose to add the number of employees in the first year as a matching criterion. This deviates from past literature. The logic behind controlling for this is straightforward; given that the firms start in the same year, in the same geographic area, in a similar field another criteria that would add to them being similar would be the number of employees in the star (first) year. The choice to add this criteria to the matching is essential as if at the point of inception these firms should have the same capacity to produce output. All things being equal, we believe that control for start year employment further bolster the claim that the matched firms are similar.

If a matched non-university incubator firm for the university incubator firm is not found then the university incubator firm is excluded from the study, in this manner for each university incubator firm there is a matched non-university incubator firm. For the 653 university incubator firms, 224 viable non-university incubator matches are found. Hence, the incubator firm cohort and the non-university incubator firm cohort each contain 224 firms that will be analyzed by the method as presented in Sect. 3.3. A point to note is that the match criteria for start year predate the time of interest in the study i.e., the graduation date. The firms were matched so as to start in the same year. Hence, the data used to test the hypothesis is the data that is available around the time of graduation. The match was performed around the start year. We understand that endogeneity is a potential problem in all longitudinal matched studies. However, we have taken a number of steps that we believe limit the likelihood that endogeneity is biasing our results. Further, we have taken every measure to be conservative across to board in terms of the sampling, frame matching, etc.

3.3 Method of analysis

We build upon the pretest–posttest design (Winer 1962) where our dependent variables are job and sales respectively (over time), and the independent variables are incubation (1: university incubated firm, 0: non-university incubated firm) and industry (1: knowledge based firm, 0: other firm). The dependent variables (jobs and sales) consider seven periods of time: First year of operation, 2 years before graduation (from the university incubation program), 1 year before graduation, graduation year, 1 year after graduation, 2 years after graduation, and 2012.

We control for heterogeneity at the firm level not the incubator level. The unit of analysis is not the incubators but the firms. In this study, incubation is a sampling frame. The focus of this study is to contrast the performance of startup firms that join university incubators with startup firms that do not around the time of graduation of the university incubated firms. Consequently, we did not control for differences within populations (of university incubated firms) as our analysis is focused on differences between populations (university incubated versus non-university incubated).

In the event of comparing means from multiple groups to each other, the use of any of the family of t tests would lead to an increase in the Type 1 error (Roberts and Russo 1999). Hence, we perform a Repeated Measures ANOVA, using a generalized linear model (GLM), to analyze the data collected from the testing. This procedure has the added benefit of allowing for the correction of within subject error.

With respect to the Repeated Measures ANOVA, we fitted two models to analyze change over time (growth) for the dependent variables, viz., one for jobs and one for sales. For each model, within the context of the repeated measures ANOVA lexicon, we model the dependent variables (jobs and sales over time) as the within subject variables and the independent variables (incubator and industry) as the between subject variables. The dependent variables are characterized as scale measure whereas the independent variables are characterized as ordinal measures.

Following this procedure, we conducted a Latent Growth Curve analysis to investigate whether either incubator membership or technology status affected the differential rates of change in the trajectories of employment numbers and sales, given that not all firms evidenced identical trajectories of change.

4 Results

This section presents the results from the Repeated Measures ANOVA for each of the models analyzed, followed by a Latent Growth Curve analysis (using MPLUS software). To determine whether there is a change in the performance over time, the focus of the analysis is placed on the within subject treatment effect.

4.1 Jobs growth over time

Table 1 presents the within-subject effects for the job growth over time. A review of that all firms experience a statistically significant increase in jobs. The interaction between the dependent and independent variables reveal that incubators have a significant effect on job growth and industry does not have a statistically significant effect on job growth.

Furthermore, as seen in Table 2 the pairwise comparison of the effect of incubation on the estimated marginal mean job growth was significant (at .05 level). This reveals that on average over time the university incubated firms had 3.965 more jobs than non-university incubated firms.

These results are further supported by Fig. 1, which show a greater rate of increase (slope) in jobs over time for university incubated firms than non-university incubated firms. They also showed a greater magnitude in jobs over time for university incubated firms than non-university incubated firms.

As it can be seen in in Table 3 the pairwise comparison of the effect of industry on the estimated marginal mean job growth was not significant (at .05 level). These results are further supported by Figs. 2 and 3, where both figures show a greater rate of increase (slope) in jobs over time for university incubated firms than non-university incubated firms. Hence there is no statistically significant difference in job growth among firms from different industry groups.

4.2 Sales growth over time

Table 4 presents the within-subject effects for the sales growth over time. A review of that all firms experience a statistically significant increase in sales. The interaction between the dependent and independent variables reveal that incubators have a significant effect on sales growth and industry does not have a statistically significant effect on sales growth.

Furthermore, as seen in Table 5 the pairwise comparison of the effect of incubation on the estimated marginal mean sales growth was significant (at .01 level). This reveals that on average over time the university incubated firms had $437,583 more in sales than non-university incubated firms.

These results are further supported by Fig. 4, which show a greater rate of increase (slope) in sales over time for university incubated firms than non-university incubated firms. They also showed a greater magnitude in sales over time for university incubated firms than non-university incubated firms.

As it can be seen in in Table 6 the pairwise comparison of the effect of industry on the estimated marginal mean sales growth was not significant (at .05 level).

These results are further supported by Figs. 5 and 6, where both figures show a greater rate of increase (slope) in sales over time for university incubated firms than non-university incubated firms. Hence there is no statistically significant difference in sales growth among firms from different industry groups.

4.3 Latent growth curve analysis

Having conducted the Repeated Measures ANOVA analyses, we fitted a Latent Growth Curve model to the employment data, with the intention of determining whether incubator membership or the technology status of firm could explain the differential rates of change in either employment or sales growth over time (Fig. 7). To correct for stochastic effects well known to inhabit longitudinal data [see Sivo et al. (2005)], we evaluated the viability of autoregressive-moving average (ARMA) processes, and as such processes have the potential to distort parameter estimates. In addition, given the possibility a quadratic component to change, as evidenced in Figs. 1, 2, 3, 4, 5 and 6, we simultaneously model both a linear (base parameters = −2, −1, 0, 1, 2) and quadratic process in the flexible Latent Growth Curve procedure.

Overall, the Latent Growth Curve ARMA model (χ2 = 37.7762, df = 12) fitted the data well according to key fit indices including the CFI (>.99), SRMR (<.03), RMSEA (<.06), and McDonald’s Centrality index (>.90). These indices have been shown in prior monte-carlo research to perform well in model selection (Fan and Sivo 2007; S. A. Sivo et al. 2006; Sivo et al. 2005).

A review of the Latent Growth Curve results estimated for the data suggests that neither incubator membership (t = −1.6764; p > .05) nor technology status (t = −.0437; p > .05) affected the initial status of employee growth (firm size) to a statistically significant degree. Furthermore, the technology status of a company (technology vs. non-technology oriented) had no impact on either linear (t = .00675; p > .05) or quadratic (t = .2776; p > .05) growth rates. Yet, Incubator status (whether or not a company is supported by an incubator) did have a statistically significant impact on linear (t = 1.9834; p < .05) and quadratic (t = 2.2721; p < .05) components to employee growth rates. Firms that received the support of university incubators evidenced a statistically significant increase in employment growth compared to their matched counterparts (without an incubator affiliation). These results are unlikely to have been distorted by autocorrelation given the data were filtered of an extant autoregressive process (t = 104.6, p < .05; no sign of a moving-average process was witnessed for these data, p > .05).

5 Discussion

Firm performance data for graduated university incubator firms is collected and compared to firm performance data for a matched cohort group consisting of similar firms (not in university incubators). This is done to eliminate as much of the external influences as possible so a viable comparison could be made to elucidate the effect of the university incubator on firms.

We proposed firms that choose to participate in university incubators would experience growth in jobs and sales over and beyond their time in the incubator; our findings support this proposition. The results showed that all (knowledge based and other) firms in university incubators experience positive growth in number of employees and sales over time whereas the startup firms in the cohort group are relatively flat in terms of growth in number of employees and sales over time. It is important to notice in Furthermore, as seen in Table 2 the pairwise comparison of the effect of incubation on the estimated marginal mean job growth was significant (at .05 level). This reveals that on average over time the university incubated firms had 3.965 more jobs than non-university incubated firms. And Fig. 4, after graduation, university incubated firms’ jobs and sales steadily grew.

Next, we proposed firms that choose to participate in university incubators would have better performance than that of a matched sample of non-university incubator firms; our findings support these propositions. It is important to notice in furthermore, as seen in Table 2 the pairwise comparison of the effect of incubation on the estimated marginal mean job growth was significant (at .05 level). This reveals that on average over time the university incubated firms had 3.965 more jobs than non-university incubated firms. And Fig. 4, after graduation, university incubated firms’ jobs and sales steadily grew at a statistically significant and greater rate than non-incubated firms.

We also controlled for industry, separating firms into knowledge based firms and other (not knowledge based) firms. Figures 2, 3 and Figs. 4, 5 show a greater rate of increase (slope) in jobs and sales over time for university incubated firms than non-university incubated firms. They also showed a greater magnitude in jobs and sales over time for university incubated firms than non-university incubated firms, especially after graduation from the incubation program.

We believe that university resources do make a difference in how well firms are likely to perform, and in fact this is what our results indicate. We have theorized that amongst incubators, university incubators provide firms with the most comprehensive set of resources. We propose that incubators vary in the services and resources they offer, and that university incubators typically provide greater connectivity and legitimacy with respect to important contingencies associated with key industry and community stakeholders. This leads us to propose that university affiliation is an important contingency that affects the relationship between firms’ participation in incubators and their subsequent performance. This study shows that firms from university incubators outperform their matched cohort of firms not from university incubators. Being in an incubator is not the issue for the firm. Whether the firm can acquire the necessary resources is of prime importance. Hence, if an incubator is well endowed with resources that the firm can acquire then there is a greater likelihood that these firms will perform well.

We believe our findings provide the potential for more specific policy implications for non-university incubators. University incubators have particularly rich resources to begin with. The firms participating in these programs can choose those resources that enable them to be competitive in their environment. We believe that prior research that showed that incubators as a whole do not help (in terms of survivability of the firm) much is because a majority of that data comes from firms in relatively impoverished incubators in terms of resources. Hence, we propose that all incubators should strive to provide the resources provided by university incubators so as to best enable their firms in a competitive environment.

Conventional economic development practices focused on capital investment as the source of growth with the goal of driving down cost through firm specific subsidies with the objective of recruiting new and existing firms into a region. Quality of life issues had little of no importance and the goal was to get bigger. These transactions do create “podium moments” for political leaders allowing them to quickly promote their agendas. Today’s innovation based economy focuses on becoming more prosperous and is often a longer term process. The source of growth is innovation and organizational learning and the principle economic development means is to spur firm innovation through research, financing, and skills development. Quality of life issues are more important as a means to attract and retain knowledge based workers.

The notion of ‘growing your own companies’ is complicated in terms of what elements are necessary for an overall effective eco-system. Regional endowments vary, entrepreneurial talent is not created equal, and other factors such as access to capital play roles that are difficult to quantify. Controlling for these factors is also difficult when trying to understand how best to spur an innovation based economy. A better understanding of how regional endowments interact is important when putting together overall economic development strategies, especially in tough economic times with reduced financial resources available to stimulate economic growth.

Better decisions concerning public investment to spur economic prosperity can be made with a better understanding of how the individual components of an overall eco-system complement or depend on each other. Furthermore, an understanding of the marginal effects of these interventions and combinations of interventions would be extremely valuable in terms of understanding true return on investment.

6 Conclusion

Economic developers wishing to create an environment that promotes a thriving entrepreneurial sector can benefit from an understanding of what tools they need to support young startup companies.

The primary research questions guiding this study was—to what extent, and in what fashion, do university incubators affect the performance of startup firms above and beyond their time in the incubator? In contrast to prior studies, this study shows that university incubated firms performance continually improves above and beyond the incubation period, i.e., the number of jobs and sales grew over time. This study also shows that university incubated firms performance is superior to non-incubated firms above and beyond the incubation period. University incubated firms have greater employment and sales than then non-incubated firms. Further, we observe that university incubated firms grew faster (in number of jobs and sales) than the non-incubated firms above and beyond the incubation period.

References

Aernoudt, R. (2004). Incubators: Tool for entrepreneurship? Small Business Economics, 23(2), 127–135.

Albert, P., & Gaynor, L. (2001). Incubators-growing up, moving out, a review of the literature. In ARPENT: Annual review of progress in entrepreneurship (Vol. 1, pp. 158).

Amezcua, A. (2010). Boon or Boondoggle? Business incubation as entrepreneurship policy. Unpublished Manuscript.

Amezcua, A., & Ratinho, T. (2012). Entrepreneurial strategic groups: How clustering helps nascent firms. Unpublished Manuscript.

Amezcua, A., Bradley, S., & Wiklund, J. (2011). Cutting the apron string of BUSINESS INCUBATION Firms: Is the Liability of Newness. A liability? Presented at the 2011 Academy of Management Annual Meeting, San Antonio, TX, USA: Academy of Management.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99.

Baum, J., & Oliver, C. (1991). Institutional linkages and organizational mortality. Administrative Science Quarterly, 36(2), 187–218.

Bruneel, J., Ratinho, T., Clarysse, B., & Groen, A. (2012). The evolution of business incubators: Comparing demand and supply of business incubation services across different incubator generations. Technovation, 32(2), 110–121.

DeVol, R., Klowden, K., Bedroussian, A., & Yeo, B. (2009). North America’s high-tech economy: The geography of knowledge-based industries. Milken Institute Research Reports.

Douglas, P. (1976). The Cobb–Douglas production function once again: Its history, its testing, and some new empirical values. The Journal of Political Economy, 84(5), 903–915.

Fan, X., & Sivo, S. A. (2007). Sensitivity of fit indices to model misspecification and model types. Multivariate Behavioral Research, 42(3), 509–529.

Kuratko, D., & LaFollette, W. (1987). Small business incubators for local economic development. Economic Development Review, 5(2), 49–55.

Lewis, D., & Edward, J. (2001). Does technology incubation work?: A critical review. USA: Economic Development Administration, US Department of Commerce.

Makadok, R. (2001). Toward a synthesis of the resource based and dynamic capability views of rent creation. Strategic Management Journal, 22(5), 387–401.

Milanov, H., & Fernhaber, S. (2009). The impact of early imprinting on the evolution of new venture networks. Journal of Business Venturing, 24(1), 46–61.

Patton, D. (2013). Realising potential: The impact of business incubation on the absorptive capacity of new technology-based firms. International Small Business Journal, 32(8), 1–21.

Peters, L., Rice, M., & Sundararajan, M. (2004). The role of incubators in the entrepreneurial process. The Journal of Technology Transfer, 29(1), 83–91.

Pfeffer, J., & Salancik, G. R. (2003). The external control of organizations: A resource dependence perspective. Stanford, CA: Stanford University Press.

Roberts, M., & Russo, R. (1999). A student’s guide to analysis of variance (1st ed.). New York, NY: Routledge.

Rothaermel, F. T., & Thursby, M. (2005). Incubator firm failure or graduation?: The role of university linkages. Research Policy, 34(7), 1076–1090.

Scillitoe, J., & Chakrabarti, A. (2010). The role of incubator interactions in assisting new ventures. Technovation, 30(3), 155–167.

Shane, S. (2008). The handbook of technology and innovation management. New York, NY: Wiley.

Siegel, D. S., Westhead, P., & Wright, M. (2003). Science parks and the performance of new technology-based firms: a review of recent UK evidence and an agenda for future research. Small Business Economics, 20(2), 177–184.

Singh, J., Tucker, D., & House, R. (1986). Organizational legitimacy and the liability of newness. Administrative Science Quarterly, 31(2), 171–193.

Sivo, S., Fan, X., & Witta, L. (2005). The biasing effects of unmodeled ARMA time series processes on latent growth curve model estimates. Structural Equation Modeling, 12(2), 215–231.

Sivo, S. A., Fan, X., Witta, E. L., & Willse, J. T. (2006). The search for“optimal” cutoff properties: Fit index criteria in structural equation modeling. The Journal of Experimental Education, 74(3), 267–288.

Stinchcombe, A. (1965). Organizations and social structure. Handbook of Organizations, 44(2), 142–193.

Suchman, M. C. (1995). Managing legitimacy: Strategic and institutional approaches. Academy of Management Review, 20(3), 571–610.

Walls, D. (2013). National establishment time-series (NETS) database: 2012 database description. Oakland: Walls & Associates.

Westhead, P. (1997). R&D “inputs” and “outputs” of technology-based firms located on and off Science Parks. R&D Management, 27(1), 45–62.

Westhead, P., Storey, D. J., & Britain, G. (1994). An assessment of firms located on and off science parks in the United Kingdom. London, UK: HM Stationery Office.

Winer, B. (1962). Statistical principles in experimental design. New York, NY: McGraw-Hill.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Lasrado, V., Sivo, S., Ford, C. et al. Do graduated university incubator firms benefit from their relationship with university incubators?. J Technol Transf 41, 205–219 (2016). https://doi.org/10.1007/s10961-015-9412-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-015-9412-0

Keywords

- Resource endowments

- Economic development

- Regional development

- Entrepreneur support organizations

- Business incubation

- University based business incubators

- Graduate firms