Abstract

Purpose This study sought to describe Australian systems of income support for people with work disability. Specific aims were to summarise and compare the features of the income support systems, including the rehabilitation and employment services funded or provided by those systems, and factors affecting transition between systems. Further objectives were to estimate the prevalence of work disability in Australia and the national expenditure on work disability income support. Methods A mixed methods project involving collation and analysis of existing publicly available documentation and data, and interviews with 25 experts across ten major systems of income support. The prevalence of work disability and expenditure in each system, and in total, was estimated using publicly accessible data sources. System features and service models were synthesised from data sources, tabulated and compared qualitatively. Results In Australia during the 2015/2016 financial year an estimated 786,000 people with work disability received income support from a Commonwealth, state, territory or private source. An additional 6.5 million people accessed employer provided leave entitlements for short periods of work incapacity. A total of $37.2 billion Australian dollars was spent on income support for these people during the year. This support was provided through a complex array of government authorities, private sector insurers and employers. Service models vary substantially between systems, with case management the only service provided across all systems. Healthcare and return to work services were provided in some systems, although models differed markedly between systems. Income support ranged from 19 to 100% of earnings for a person earning the average weekly Australian wage pre-disability. There is a paucity of information relating to movement between systems of support, however it is likely that many thousands of people with long periods of work disability transition between systems annually. Conclusions This study demonstrates the substantial financial and human impact of work disability on Australian society. Findings indicate multiple opportunities for reducing the burden of work disability, including aligning case management and healthcare service models, and engaging employers in prevention and rehabilitation. The findings suggest a need for greater interrogation and evaluation of Australian work disability support systems.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Background

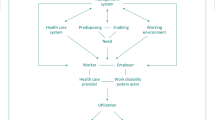

Work disability occurs when a health condition limits the ability of a worker to participate in paid employment [1]. Common diseases and illnesses of working age are the major causes of work disability, and include conditions with high prevalence such as low back pain, depression, anxiety and traumatic injury. In developed countries these conditions account for the majority of the population burden of disease [2,3,4]. Extended periods of work disability can have significant impact on the individual worker including financial stress, consequences for mental health, future employment prospects, and impact on family and social networks [5,6,7]. Prevention and rehabilitation of work disability therefore has significant potential to improve both individual and community health and productivity.

Most developed nations have established systems to support people with work disability. These may be variously described as social insurance, workers’ compensation, life insurance, social security, sickness absence, disability insurance, compulsory third party or employment injury insurance systems. While approaches vary dramatically between and within nations [8,9,10], these systems share some common features and objectives. They provide some level of income support for people experiencing an episode of work disability. They may also provide or fund services intended to return the disabled worker to employment, or to improve the health status of the worker [9, 11, 12]. These systems are typically regulated by a government authority but may be delivered and administered by either public or private sector organisations.

Evidence now suggests that these systems have a significant impact on the health and employment of outcomes of the work disabled person. Workers can experience interactions with these systems as stressful and this can contribute to poor mental health, loss of work function, elevated levels of disability and reduced quality of life [13, 14]. Aspects of the system administrative processes can impede return to work in some people [12]. The systems may also impact on others involved in worker rehabilitation such as healthcare providers [15] potentially limiting access to care [16].

Australia’s systems of income support for people with work disability operate within a large and diverse employment and social services landscape. This includes a working age population (15–65 years) of 16.2 million people, a labour force (persons employed part or full time) of 12.3 million, and 2.2 million actively trading businesses. The major components of the Australian approach to work disability support include (1) a set of cause-based personal injury compensation schemes operated by state, territory and national governments; (2) a single national social security disability and unemployment benefits system; (3) a large private sector life insurance industry that includes temporary and permanent disability insurance through the nation’s compulsory superannuation (pension) system as well as a private insurance market; and (4) compulsory employer provided leave entitlements for periods of short-term incapacity for most workers. Recent studies in some Australian systems have identified that policy variation contributes to differences in work disability duration [8] and health [17].

While the Australian systems operate largely independently, people with extended periods of work disability may receive income and other support from several of these systems, either consecutively or concurrently. This is because in some systems benefits are time limited, and thus people with long periods of work disability transition to an alternative system of support. Internationally, there is relatively limited evidence regarding these system transitions. Studies in the the United States suggest that up to 37% of social security disability recipients were injured at work [18] and that having a workers’ compensation claim substantially increases the probability of being a disability income support recipient [19]. A large Swedish register study demonstrated that an episode of long-term sick leave increases the risks of later disability pension and unemployment benefit receipt, after taking health status into account [20]. A register based study of discordant working age twin pairs demonstrated that a twin with mental illness-related sick leave was at significantly increased risk of later disability pension receipt and unemployment [21]. To our knowledge, there are no such studies in Australia.

Within nations, understanding the structure and function of work disability support systems is critical to achieving optimal employment, health and economic outcomes for individuals and society. This study sought to map Australian systems of income support for people with work disability. Specific objectives included summarising and comparing the features of Australian income support systems, including the rehabilitation and employment services funded or provided by those systems. We also sought to estimate the prevalence of work disability in Australia, determine the national expenditure on work disability income support, and identify factors affecting transition between income support systems.

Methods

Scope

Australia has a resident population approaching 25 million people of which 16.2 million are of working age [22] and thus may be eligible for income support for a period of work disability. For this project work disability was operationally defined as people of working age (at least 15 and < 65 years) who have acquired a temporary or permanent injury, illness or mental health condition, whose injury/illness completely or partially impacts their ability to work, and who were working in either temporary or permanent remunerated employment at the time the injury/illness was acquired.

Ten systems defined on the basis that they provide income support for the population in scope were identified for inclusion, following discussion with a project working group comprising social security, workers’ compensation, insurance industry, occupational health, employment and trade union representation. These ten systems represent the most substantial of the income support systems in Australia and include all of the four major components listed above (Table 1).

Five categories of service were identified for inclusion following discussion with the project working group. These included: (1) return to work services, where the goal is to return the person to the pre-injury/illness employer; (2) job finding or employment services, where the goal is to find new employment for the person; (3) healthcare and medical services provided by qualified healthcare practitioners; (4) functional supports, defined as provision of aids, equipment, or other supports to assist the person to maximise their functional capacity; and (5) case management or case co-ordination services.

Data Collection

Data was collected through (1) semi-structured interviews with sector experts and (2) existing system level documentation and data.

Semi-structured Interviews

A total of 20 semi-structured interviews were conducted by the first author involving 25 individuals, identified through referrals from the project working group and through the research team networks. Most interviews were conducted a single interviewee however five involved two interviewees. Interviewees were selected on the basis that they had expertise and experience within one or more of the in scope systems, and could comment knowledgeably on system features, services and data availability. In addition, some interviewees with experience and expertise working across systems were also identified for inclusion. Interviews were conducted over the telephone or face-to-face. An interview schedule was developed in consultation with the project working group and addressed the following topics: (1) The scope and features of a given system including coverage and eligibility, structure and governance, decision making processes; (2) the scope and features of services, supports and benefits provided by the system; (3) interactions between systems and services, including points of interaction between the system and other systems, and how changes in features of the system may impact other systems; (4) sources of data that describe system function and performance, and may be used to identify activity within a system and movement of people between systems; and (5) opportunities for improving work and health outcomes. Interviews lasted between 45 and 60 min. Interviews were audio recorded and transcribed. Data was thematically analysed using inductive techniques [23]. A single author constructed initial codes and themes and these were cross-checked and recoded in meetings with a second author.

Document and Data Collation

Concurrently with the interviews, the research team sourced documents and data describing system features, services and participants. This material was provided directly by members of the project working group and sourced from interviewees. A grey literature search was also conducted, including (a) a structured search of websites, document clearing-houses and research libraries using pre-determined keywords; and (b) hand searching of reference lists of documents provided by working group members and interviewees, to identify further relevant documents. Documents were included if they described the structure or operations of one of the in-scope systems, provided information relating to the performance of an in-scope system, described system data sources, or included information about interaction between systems. A total of 127 relevant documents were identified including legislation, policy documents, system performance reports, data summaries, financial statements, annual reports of system regulators, data dictionaries, claims handling manuals, and academic research. Of these, 19 were related specifically to employer provided entitlements; 39 to motor vehicle compensation; 36 to workers’ compensation; 17 to life insurance; 30 to social security; 6 to superannuation withdrawals; and 10 to defence and veterans compensation. Identified documentation was collated in a structured document library, with summary notes identifying the source and content of each document.

Information Synthesis

Synthesis of collected information occurred in a step-wise manner. First, interview and documentary evidence was combined to produce an overarching description of each system. These included information on system structure, governance and operations, coverage, benefits and entitlements, eligibility, services, processes and timing, outcomes, data sources, and interactions with other systems. Draft system descriptions were reviewed by members of the project working group and by some interviewees to ensure accuracy. Second, a summary of services provided by each system was produced, including descriptions of the nature of service provision and service delivery models. Third, for each system level dataset identified we described the data custodian, the content of the dataset, any notes regarding linkage with other datasets, and any examples of published analysis and reporting. Fourth, the number of people accessing each of the systems for the 2015/2016 financial year was determined. Our approach to calculating the ‘stock’ of recipients is described in in the following section. It became apparent during the data collection phase that there was very limited data regarding the movement or ‘flow’ of people between systems. The final step was then to thematically analyse the interview data to identify the major themes regarding inter-system movement.

Estimating the Prevalence of Work Disability

There is no national source of work disability data in Australia. While some systems maintain well organised and centralized databases with complete or near complete capture of cases, the quality and completeness of reporting varies. Other systems have limited or highly fragmented data systems dispersed across multiple organisations. There are no common data standards between systems. Acknowledging these limitations, we adopted a “bottom up” approach to estimating the prevalence of work disability, using an array of publicly accessible data sources.

The approach involved two major steps. First, we estimated the number of people receiving income support payments who met our operational definition of work disability within each system. Second, we aggregated the outcome from each of the in-scope systems to calculate the total number of work-disabled income support recipients. For the three lump sum systems we counted claim finalisation (payment of the lump sum) as the indicator of income support receipt. For the remaining systems we counted all new claims receiving an income support payment during the time period. The 2015/2016 financial year was selected as the most recent full year for which data was available across all ten systems. We note that it is possible for a single individual to receive income support from multiple systems within a given year. While this is not the norm, this does mean that the number of individuals in receipt of income support will be lower than the total number of recipients reported.

The data available within each system varies substantially in its completeness, accuracy, quality and relevance for this exercise. Thus it was necessary to make some assumptions regarding the number of eligible recipients or the proportion meeting the operational definition of work disability, in order to estimate the number of recipients for each system. Where assumptions were required we referred to publicly available reports, and adopted a conservative approach. Where feasible, assumptions were tested with system experts to verify the approach and provide assurance that estimates were not over-inflated. Further information regarding the method of estimating prevalence is included in the supplementary tables.

Estimating Income Support Expenditure

We sought to calculate the total annual expenditure per system on income support for people with work disability, as well as the average annual expenditure per recipient. The number of work disabled income support recipients was expressed as a rate per 1000 working age Australians (the recipient rate). The recipient rate provides a method of standardising the number of recipients against a common denominator. We selected the total Australian working age population as our denominator as this reflects the total available pool of individuals from which the system recipients are drawn.

Finally, we calculated the minimum and maximum weekly amount of income (net of income taxation) provided under each system, for a person working full-time with national average weekly earnings (AWE) prior to the onset of the health condition leading to work incapacity. This was determined by either applying system rules regarding the percentage of AWE covered, or in the social security and Department of Veterans Affairs (DVA) pension systems by accessing current payment rates for the various pensions and allowances. For the three lump sum systems we report the average lump sum payment. All figures are reported in Australian dollars (AUD$).

Results

Characteristics of Income Support Systems

Table 2 presents an overview of the main features of Australian systems of income support for people with work disability. The systems are variously regulated by state, territory and commonwealth government authorities established under a diverse array of legislation (see Supplementary Table 1). The approach to governance and benefit delivery varies substantially. A diverse mix of public, for-profit private and not-for-profit entities are involved in case management, administering income support payments and service provision.

Each system can be categorised according to whether they provide national or jurisdictional (state or territory) coverage; whether eligibility is conferred on the basis of the mechanism via which the health condition was acquired (mechanism based systems) or by the presence of an injury, illness or health condition that affects capacity to work, regardless of the mechanism (disability based systems). Systems can also be categorised according to how they are funded, with some being funded by employer payroll, others funded through insurance premiums paid by an employer, a person registering a motor vehicle or through a private or group insurance policy, while the social services system is funded through commonwealth appropriations.

The individual systems vary in complexity from those operated by a single organisation (such as the social security system operated by the Commonwealth Government) through to those that involve multiple system operators (such as the MVA compensation systems operated by state and territory government authorities) and to the highly devolved system of employer provided leave which is effectively operated through the nation’s more than two million employers.

The characteristics of people who receive support also varies between the systems. While musculoskeletal and mental health conditions are common, individuals may enter these systems with one of a wide range of health conditions ranging from mild illness resulting in a sick leave day to serious acquired disability with life-long consequences for participation in employment. The disability-based systems typically support populations with a more diverse range of conditions. For example, data from one life insurer indicated that a quarter of income protection recipients presented with injury or poisoning, and another quarter with musculoskeletal conditions, 15% of recipients had neoplasms (cancers), and 15% had mental health conditions [24]. There is also demographic variation between systems. Approximately 60–70% of workers’ compensation recipients are male. In contrast, the life insurance and social security systems include approximately even numbers of male and female recipients. Recipients of MVA compensation are more likely to be under 25 years of age than in other systems [25], while the age group with the largest proportion of workers’ compensation claims is 35–54 years of age. The modal age group for the disability support pension (DSP) is 55–64 years, for sickness allowance and newstart allowance 45–54 years, and for youth allowance 16–20 years.

The duration of income support varies markedly. Employer provided entitlements are usually accessed in cases of temporary illness, and a national standard of 10 days sick leave is available to most workers. Data from short-tail workers’ compensation schemes indicate that the majority of claims for time loss are of < 1 week duration. One short-tail scheme reported an average of 7 weeks (49 days), but that over a third of all time loss claims last only 5 days [26]. Long-tail workers’ compensation schemes may support recipients until retirement age. DSP recipients have a mean benefit duration of 608 weeks (11.7 years). Newstart Allowance recipients receive benefits for an average 129 weeks (2.5 years), Sickness Allowance 45 weeks (0.9 years), and Youth Allowance 79 weeks (1.5 years) [27]. Life insurance income support is typically time limited to 2 years, while TPD payments are usually provided in a lump sum following an assessment period.

All of the systems have structured datasets in some form. Data is variously collected and entered by employers, insurers, regulators and system administrators. Most systems collate some of the structured data centrally, although the content and extent of these centralized databases varies considerably. Some systems have developed and implemented system-wide data standards. For example the workers’ compensation systems have adopted the routine use of standardized coding systems including the type of occurrence classification system (TOOCS) [28] to capture the nature of injury/illness, mechanism and body regions affected. This has enabled inter-jurisdictional analyses and reporting such as that conducted routinely by Safe Work Australia. Standards for reporting of financial information apply to life insurers and superannuation funds [29, 30]. There are also substantial data gaps, relating to lack of centralisation (in some systems) and limited reporting. There are no data standards that apply across systems. Overall, the data landscape can be categorised as highly fragmented and siloed, with some ‘system-specific’ centralisation but no formal linkages between systems.

In summary, there is a substantial amount of variation between the Australian work disability income support systems with respect to their governance, structure, benefit delivery, coverage, eligibility, data capture and reporting.

Prevalence and Impact of Work Disability

Table 3 presents estimates of the prevalence of work disability resulting in income support payments for the 2015/2016 financial year, as well as expenditure and recipient rate estimates. We estimate that 6.5 million Australian workers accessed employer provided entitlements during the year at a rate of 412 per 1000 working age population and a total expenditure of $18.7 billion. There were a further 786,000 recipients of income support through the remaining nine systems with a combined rate of 49.4 per 1000 working age population and combined expenditure of $18.4 billion. The total expenditure on income support for work disability was estimated at $37.2 billion for the financial year.

The largest system by volume of recipients and expenditure was employer provided entitlements. The second largest system by volume and expenditure was social security, with the DSP being the major component. Workers’ compensation and life insurance systems were the next largest in terms of both volume and expenditure.

The volume of recipients and expenditure are functions of multiple factors, including any limits placed on system access, the amount of income support provided, and the extent and duration of incapacity of people accessing system benefits. For example, employer provided entitlements are available to most people in the labour force and there are few limits to access. However these entitlements are usually used for temporary illness and thus there is a very high volume of use but a relatively low expenditure per case at $2,861. In contrast, access to MVA compensation systems is restricted to people injured in a motor vehicle crash (and in some states to those not at fault for the crash), and while most people have mild to moderate injuries and recover, some have very serious injuries that result in life-long income support. These systems have a low volume of cases but a relatively high expenditure per case. Social security has relatively few barriers to access and thus there is a large volume of recipients. Disability support pensioners by definition have limited work capacity and tend to have long durations in the social security system; more than half of all DSP recipients have received the benefit for more than 10 years [27]. Thus there is a large volume of people with long periods of work disability in this system.

Transitions Between Income Support Systems

Review of system documentation and grey literature identified limited information on the movement of people between income support systems, with only three of the included documents involving information on cross system movement. The most comprehensive analysis was between benefits within the social security system [31], in a report which shows the proportion of benefit recipients entering and exiting the social security system from and to work. We were unable to identify reports of other system interactions, such as the impact that changes in the boundaries of one system (e.g., restriction or expansion of eligibility) may have on other systems. This lack of documented information and data was confirmed by interviewees, who were unable to identify further data sources related to inter-system transfers. Analysis of interview data identified a number of themes regarding the movement of people between systems that provide some insight. These include that the majority of disabled workers return to employment after a short period of absence, but that a small proportion will interact with multiple systems. Interviewees reported that system policy and product design strongly influence the pathway through the income support systems for workers with long periods of disability, but that these pathways are influenced by personal and psychosocial factors. Interviewees also identified multiple gaps in coverage, where workers ‘fall between the cracks’ and must rely on their personal or family resources. These themes provide a basis for future research and analysis, and are summarised in Table 4.

Provision of Services and Service Gaps

Table 5 summarises the services usually funded in each of the systems. There is wide variation in both the type of services funded and the models of service delivery. Workers’ compensation, DVA compensation and MVA compensation (statutory benefits schemes) were the only systems to fund all services.

Case management was the only service provided across all systems. Case management refers to the coordination and/or management of the benefit/claim process, including assessment, eligibility determination, and benefit and service delivery and termination. All included systems had some form of case management. Approaches vary markedly, with case management provided by employers, regulators, private insurers, superannuation funds and third party organisations. The responsibilities, obligations, resources and capabilities of case managers varies widely between and within the systems.

Six of the systems offered return to work services. The most structured and widely delivered services are provided by employers and workers’ compensation schemes. Return to work obligations are mandatory in workers’ compensation and thus use of return to work services is commonplace. In other systems however, return to work services are not mandatory, or may not be accessed as widely. Services may be provided within the employer (e.g., by human resources department) or by a third party such as an occupational rehabilitation or occupational health provider.

Four systems routinely fund healthcare and treatment. In other systems people may be provided with limited funding or rely on the public healthcare system or personal private health insurance cover. Systems where a lump sum benefit payment is offered typically do not pay for healthcare and treatment services, however lump sum MVA compensation schemes may offer an initial payment for medical services until fault is determined. Life insurers are restricted by legislation from funding healthcare services that are funded by private health insurers or the national public healthcare system known as Medicare.

People with long periods of work disability may become unemployed. While there are legislative protections in place within most workers’ compensation systems that require employers to re-employ injured people for up to twelve months, such protections do not exist in other systems, meaning that employers may choose to terminate employment. Six systems offered job finding or employment services. Social security may require recipients to engage with new employer services to continue to receive benefits. However, some social security benefit recipients may be exempted from participating in new employer services on disability or incapacity grounds. These services are provided either through the Commonwealth government Disability Employment Services or Job Active programs, or through an array of private sector occupational and vocational rehabilitation providers contracted to insurers and compensation scheme regulators.

Four systems funded or provided access to disability-related functional supports such as aids and equipment, home and vehicle modifications. These systems typically require that the functional support must achieve a specific goal, and workers are usually assessed for their need for a functional support on a case-by-case basis.

Discussion

Australia has a diverse and complex array of systems providing income support and services for people with work disability. These are regulated by state, territory or Commonwealth governments and operated through many public or private organisations. The amount and duration of income support varies substantially between and within systems, as do the models and types of services provided or funded. Collectively, these systems provided income support for a period of temporary or permanent work disability to more than three quarters of a million Australians, with at least an additional 6.5 million accessing employer sick leave benefits. The total combined direct cost of income support alone was $37.2 billion in the 2015/2016 financial year. While most work disabled people will return to employment after a short period of incapacity, some people with long periods of work disability will access support through multiple systems. These people may experience gaps in income support during which they are reliant on personal and family resources. While there is no quality data in Australia to estimate the volume of people transitioning between systems, it is likely that many thousands of workers experience such transitions annually.

The International Labour Organisation has described Australia’s systems of workers’ compensation as an ‘employer liability’ model, in contrast to the social insurance schemes that are common in North and South America, Asia, Europe and much of Africa; whereas the Australian disability benefit system is considered a non means tested ‘social insurance’ model more akin to those in these other regions [10]. These broad categorisations are useful for high-level international comparison, but do not reflect the complexity and diversity in the Australian work disability policy landscape, nor do they capture the full gamut of social protection programs in place. The policy underpinning Australia’s national approach to work disability is as fragmented as the support systems themselves, and with some notable exceptions [8, 14, 22, 32, 33] there is a sparse evidence base to support macro-level system design. We have recently reported some unintended consequences of well-intentioned policy reform [32]. There is a clear need for more robust evidence to determine the effectiveness and efficiency of the current approach, and identify opportunities for reform.

Confounding these efforts are the lack of national data standards, the siloed approach to data capture and a relative lack of centralisation, analysis and reporting. Australian workers’ compensation and social security systems have invested in data capture and analysis, and these systems now have sophisticated methods of monitoring performance and evaluating impact of policy and practice reform [8, 31, 32, 34]. However this is far from universal and other systems have been criticized for the lack of consistent, quality data. The Australian Securities and Investment Commission (ASIC) recent assessment of the Australian life insurance industry noted that data limitations can mean that it is difficult to compare performance between insurers, it is difficult for boards and senior management to assess performance, and it is difficult for consumers and others to assess the outcomes and performance of the life insurance sector [35]. These criticisms also apply to some other major components of the Australian systems of income support for people with work disability.

Each of the Australian work disability support systems has been designed separately, and as a consequence there is relatively little policy consistency. This gives rise both to unexpected negative consequences, such as gaps in coverage, and presents multiple opportunities for reducing the national burden of work disability through cross-system collaboration. For example, our analysis of service models demonstrated that while many services are funded, provided or made accessible through the systems, the service delivery models vary considerably and there are substantial differences in the nature and extent of services between systems. There are also many areas of overlap. Notably all of the systems provide some form of case management. All of the systems interact in some way with healthcare systems (although only some fund healthcare), and most require involvement of primary care practitioners [36]. These areas of overlap provide opportunities to align service models between systems, to consolidate resources, develop best practices in service delivery, and ultimately to improve the efficiency and effectiveness of service delivery.

One concrete example of this is with regard to work capacity assessments. For people with more than temporary incapacity, all systems enforce some form of work capacity assessment or independent medical examination to determine eligibility for income support or healthcare, or confirm requirements for continued treatment. However there are inter-system differences in the standards against which degree of impairment are rated, and also variation in the purpose for which such assessments are requested, the use of data, and the sharing of information [37]. Numerous impairment standards are used, ranging from different versions of the American Medical Association guides in workers’ compensation and MVA systems to the ‘impairment tables’ in the social security system [38]. Problems with these assessments and their capacity to cause harm have been reported [39], and thus a national approach to developing a best practice in medical assessment seems sensible.

A second example is with respect to the role of employers. Evidence demonstrates the powerful role of employers in supporting return to work in people with work disability [40]. Employer beliefs around the role the workplace should play in influencing health appears to influence their approach to workplace based prevention and rehabilitation [41]. Each of the Australian income supports systems has a different approach to employer engagement. For example some workers’ compensation systems support workplace health promotion activities. Life insurers are funding workplace health assessment [42]. Superannuation funds have established a not-for-profit foundation focussing on mentally healthy workplaces [43]. The fragmented, system specific approach to employer engagement is unlikely to yield significant results in the short to medium term. A joint approach to employer engagement, to develop a clear business case that will encourage greater investment and involvement of employers, may yield more immediate and more sustainable results.

Our analysis demonstrated that the level of income support provided to an Australian with national average pre-disability earnings ranged from 19% and 100% of pre-disability income depending on the system of support. Workers’ compensation, MVA compensation and life insurance provide more generous benefits while the social security systems provides less generous benefits. International evidence suggests that more generous social insurance programs can moderate the harmful effects of long periods out of employment. A recent review of unemployment insurance reported that more generous benefits alleviate poverty and reduce the psychological distress associated with unemployment [44]. Analysis of a Dutch disability reform identified that reductions in benefit generosity were associated with adverse effects on life expectancy, particularly for women with low pre-disability earnings [45]. The impact of benefit levels on the health and employment prospects of Australians with work disability remains unknown, but is an important topic for future research.

Strengths of this study include its broad scope and the use of multiple information sources to construct an overarching picture of Australia’s systems of work disability support. Among some of the in-scope systems, lack of quality data meant that multiple assumptions were required to estimate the prevalence and impact of work disability. Where this was required the authors sought to validate assumptions with system experts. There were relatively few documentary sources describing the details of services delivered, beyond the high level service models. This presents an opportunity for future research, for example comparing the nature and quality of healthcare services provided between systems. An absence of data on between system interactions meant that we were unable to address a key study objective of mapping the movement of people with long periods of work disability through the ‘system of systems’. This also represents an opportunity for future research.

This study demonstrates the substantial financial and human impact of work disability on Australian society. The prevalence of work disability and the direct costs of income support are substantial. In context, the total estimated costs of $37.2 billion in 2015/2016 is slightly more than the annual government expenditure on primary healthcare ($34.6 billion) for the same financial year, and the number of people receiving income support exceeds the number of Australians receiving unemployment benefits at June 2016 by approximately 50,000 [22]. However, unlike primary care expenditure and unemployment benefits, financial support for people with work disability is disaggregated across the many systems described, with the costs ultimately borne by workers, employers and different levels of government. These findings suggest a need for greater interrogation and evaluation of Australian work disability support systems, and a focus on systems level research to support effective scheme design and management.

References

Loisel P, Anema JR, MacEachen E, Feuerstein M, Pransky G, Costa-Black K. Handbook of work disability: prevention and management. New York: Springer; 2013.

Hartvigsen J, Hancock MJ, Kongsted A, Louw Q, Ferreira ML, Genevay S, et al. What low back pain is and why we need to pay attention. Lancet 2018;391(10137):2356–2367.

Vos T. Global, regional, and national incidence, prevalence, and years lived with disability for 310 diseases and injuries, 1990–2015: a systematic analysis for the Global Burden of Disease Study 2015. Lancet 2016;388(10053):1545–1602.

Australian Institute of Health and Welfare. Australian Burden of Disease Study: impact and causes of illness and death in Australia 2011. Canberra: AIHW; 2016.

Asfaw A, Pana-Cryan R, Bushnell PT. Incidence and costs of family member hospitalization following injuries of workers’ compensation claimants. Am J Ind Med. 2012;55(11):1028–1036.

Lyons RA, Finch CF, McClure R, van Beeck E, Macey S. The injury list of all deficits (LOAD) framework–conceptualizing the full range of deficits and adverse outcomes following injury and violence. Int J Inj Contr Saf Promot. 2010;17(3):145–159.

Newnam S, Collie A, Vogel AP, Keleher H. The impacts of injury at the individual, community and societal levels: a systematic meta-review. Public Health. 2014;128(7):587–618.

Collie A, Lane TJ, Hassani-Mahmooei B, Thompson J, McLeod C. Does time off work after injury vary by jurisdiction? A comparative study of eight Australian workers’ compensation systems. BMJ Open. 2016;6(5):e010910.

Lippel K, Lotters F. Public insurance systems: a comparison of cause-based and disability-based income support systems. In: Loisel P, Anema JR, editors. The role and influence of care providers on work disability; 2013. New York: Springer. p. 183–202.

International Labour Organisation. World Social Protection Report 2017–2019: universal social protection to achieve sustainable development goals. Geneva: International Labour Office; 2017.

Collie A. Australian workers’ compensation systems. In: Willis E, Reynolds L, Keleher H, editors. Understanding the Australian Healthcare System. 3rd ed. Melbourne: Elsevier Health; 2016.

Bartys S, Frederiksen P, Bendix T, Burton K. System influences on work disability due to low back pain: an international evidence synthesis. Health Policy. 2017;121(8):903–912.

Kilgour E, Kosny A, McKenzie D, Collie A. Interactions between injured workers and insurers in workers’ compensation systems: a systematic review of qualitative research literature. J Occup Rehabil. 2015;25(1):160–181.

Grant GM, O’Donnell ML, Spittal MJ, Creamer M, Studdert DM. Relationship between stressfulness of claiming for injury compensation and long-term recovery: a prospective cohort study. JAMA Psychiatry. 2014;71(4):446–453.

Kilgour E, Kosny A, McKenzie D, Collie A. Healing or harming? Healthcare provider interactions with injured workers and insurers in workers’ compensation systems. J Occup Rehabil. 2015;25(1):220–239.

Brijnath B, Mazza D, Kosny A, Bunzli S, Singh N, Ruseckaite R, et al. Is clinician refusal to treat an emerging problem in injury compensation systems? BMJ Open. 2016;6(1):e009423. https://doi.org/10.1136/bmjopen-2015-009423.

Elbers NA, Collie A, Hogg-Johnson S, Lippel K, Lockwood K, Cameron ID. Differences in perceived fairness and health outcomes in two injury compensation systems: a comparative study. BMC Public Health. 2016;16(1):658.

Reville RT, Schoeni RF. The fraction of disability caused at work. Soc Secur Bull. 2003;65(4):31–37.

O’Leary P, Boden LI, Seabury SA, Ozonoff A, Scherer E. Workplace injuries and the take-up of social security disability benefits. Soc Secur Bull. 2012;72(3):1–17.

Hutlin H, Lindholm C, Moller J. Is there an association between long-term sick leave and disability pension and unemployment beyond the effect of health status?—A cohort study. PLoS ONE. 2012;7(4):e35614. https://doi.org/10.1371/journal.pone.0035614.

Mather L, Blom V, Bergstrom G, Svedberg P. Adverse outcomes of sick leave due to mental disorders: a prospective study of discordant twin pairs. Scand J Public Health. 2017. https://doi.org/10.1177/1403494817735755.

Australian Bureau of Statistics. 6202.0—Labour Force, Australia. Canberra: Australian Bureau of Statistics; 2018.

Braun V, Clarke V. Using thematic analysis in psychology. Qualitative Res Psychol. 2006;3(2):77–101.

AIA Australia. Making a billion dollar difference to people’s lives. Melbourne: AIA Australia; 2016.

iCare. Insurance and care NSW annual report 2015–16. Sydney: iCare; 2016.

Office of Industrial Relations. Queensland Workers’ compensation scheme statistics 2015–16. Brisbane: OoIR; 2016.

Department of Social Services (DSS). DSS demographic data June 2016. Canberra: DSS; 2016.

National Occupational Health and Safety Commission (NOHSC). Type of occurrence classification system. Canberra: NOHSC; 2004.

Australian Prudential Regulation Authority (APRA). Life Insurance and Friendly Societies Reporting Requirements Sydney, Australia: APRA. 2017. http://www.apra.gov.au/lifs/ReportingFramework/Pages/life-companies-reporting-requirements.aspx.

Australian Prudential Regulation Authority (APRA). Superannuation Reporting Framework Sydney, Australia: APRA. 2017 http://www.apra.gov.au/Super/Pages/Superannuation-reporting-framework.aspx.

Department of Social Services. Valuation Report 30 June 2015: baseline valuation. Canberra: Commonwealth of Australia; 2016.

Lane TJ, Gray S, Hassani-Mahmooei B, Collie A. Effectiveness of employer financial incentives in reducing time to report worker injury: an interrupted time series study of two Australian workers’ compensation jurisdictions. BMC Public Health. 2018;18(1):100. https://doi.org/10.1186/s12889-017-4998-9.

Vines P, Butt M, Grant G. When lump sum compensation runs out: personal responsibility or legal system failure? Sydney Law Rev. 2017;39(3):365–397.

Safe Work Australia. National Dataset of compensation based statistics. 3rd ed. Canberra: Commonwealth of Australia; 2004.

Australian Securities and Investments Commission (ASIC). Report 498: Life insurance claims: an industry review. Canberra: ASIC; 2016.

Mazza D, Brijnath B, Singh N, Kosny A, Ruseckaite R, Collie A. General practitioners and sickness certification for injury in Australia. BMC Fam Pract. 2015;16(1):100. https://doi.org/10.1186/s12875-015-0307-9.

Kosny A, Allen A, Collie A. Understanding independent medical assessments—a multi-jurisdictional analysis. Melbourne: Institute for Safety, Compensation and Recovery Research (ISCRR); 2013.

Guide to Social Security Law [Internet]. Commonwealth of Australia. 2018. http://guides.dss.gov.au/guide-social-security-law/1/1/i/10.

Kilgour E, Kosny A, Akkermans AJ, Collie A. Procedural justice and the use of independent medical evaluations in workers’ compensation. Psychol Inj Law. 2015;8(2):153–168.

Cullen KL, Irvin E, Collie A, Clay F, Gensby U, Jennings PA, et al. Effectiveness of workplace interventions in return-to-work for musculoskeletal, pain-related and mental health conditions: an update of the evidence and messages for practitioners. J Occup Rehabil. 2017;28(1):1–15.

Pescud M, Teal R, Shilton T, Slevin T, Ledger M, Waterworth P, et al. Employers’ views on the promotion of workplace health and wellbeing: a qualitative study. BMC Public Health. 2015;15(1):642. https://doi.org/10.1186/s12889-015-2029-2.

AIA Australia. Australia’s Healthiest Workplace Sydney, Australia: AIA. 2017. http://healthiestworkplace.aia.com/australia/eng/.

SuperFriend. Who is SuperFriend Sydney, Australia: SuperFriend. 2017. https://www.superfriend.com.au/.

O’Campo P, Molnar A, Ng E, Renahy E, Mitchell C, Shankardass K, et al. Social welfare matters: a realist review of when, how, and why unemployment insurance impacts poverty and health. Soc Sci Med. 2015;132:88–94.

Garcia-Gomez P, Gielen AC. Mortality effects of containing moral hazard: Evidence from disability insurance reform. Health Econ. 2018;27(3):606–621.

Acknowledgements

Some of the findings reported arise from a study commissioned by the Collaborative Partnership for Improving Work Participation. The Collaborative Partnership is a national effort bringing together public, private and not-for-profit organisations to improve work participation for people with temporary or permanent physical or mental health conditions which may impact their ability to work. The authors gratefully acknowledge the input of Dr Bronwyn Morkham and Professor Natasha Lannin throughout the project. The views and opinions expressed in this report are those of the authors and do not necessarily reflect the views of the project funders or the Collaborative Partnership for Improving Work Participation.

Funding

This study was funded by the Collaborative Partnership for Improving Work Participation via the Department of Social Services, Australian Government.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

Alex Collie, Michael Di Donato, and Ross Iles declares that they have no conflict of interest.

Disclosures

The views and opinions expressed in this report are those of the authors and do not necessarily reflect the views of the project funders or the Collaborative Partnership for Improving Work Participation.

Ethical approval

All procedures performed in studies involving human participants were in accordance with the ethical standards of the Australian National Statement on the Ethical Conduct in Human Research and with the 1964 Helsinki declaration and its later amendments.

Informed consent

Informed consent was obtained from all individual participants included in the study.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Collie, A., Di Donato, M. & Iles, R. Work Disability in Australia: An Overview of Prevalence, Expenditure, Support Systems and Services. J Occup Rehabil 29, 526–539 (2019). https://doi.org/10.1007/s10926-018-9816-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10926-018-9816-4