Abstract

The present work aims to explore whether there exists a systematic frustration in terms of income expectations among those who have obtained high level of education in Italy, and if this mismatch between expected and effective incomes negatively affects their perception of happiness. We adopt a reference-dependent preferences model combined with the concept of “illusory superiority bias” to analyse data on “happiness” in Italy, provided by the biennial survey conducted by the Bank of Italy on the Italian households’ incomes and wealth between 2004 and 2014. Our results show a positive effect produced by education on incomes. High educated workers have on average higher income than other people, and this difference is statistically significant controlling for working experience and other possible confounding factors. However, the disutility resulting from the frustration of expectations produces negative effects on perceived happiness. Even though highly educated people are actually able to find better job matching in comparison to less educated workers, they are also more likely to seeing their income expectations frustrated.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The present work aims to explore whether there exists a systematic frustration in terms of income expectations among those who have obtained high level of education in Italy, and if this mismatch between expected and effective incomes negatively affects their perception of happiness.

As reported by Cunado and Pérez de Gracia (2012), empirical studies present some inconclusive results on the connection between educational levels and subjective well-being. Indeed, some empirical works have found a positive effect of education on happiness (Di Tella et al. 2001; Stevenson and Wolvers 2008), others a not significant (Inglehart and Klingemann 2000) and in some cases even a negative effect (Clark and Oswald 1996). These contrasting results according to Clark and Oswald (1996) may be due to two factors: (1) highly educated people have higher job expectations which are more difficult to fulfill; (2) the dispersion of incomes increase with education. Considering these premises, Italy seems to represent an ideal context to study the possible effect of frustrated income expectations on happiness. Indeed, according to the Istat Report (2015) only a small number of Italian Ph. Doctors (17.9% in 2008 and 15.6 2% in 2010) believe that their PhD qualifications contributed towards improving their professional conditions, especially in terms of incomes.

In addition, the Fondazione Mingrantes’s report (2016) has warned about the increasing tendency of high qualified young Italians to move abroad to find better wage and job opportunities. This has attracted increasing attention of Italian media and generated a huge public debate on the conditions of the higher educated individuals in Italy.

As better explained in the next section, we will adopt a reference-dependent preferences model (Köszegi and Rabin 2006; Sugden 2003) combined with the concept of “illusory superiority bias” (Hoorens 1995) to understand how education might influence perceived utility.Footnote 1 Specifically, we assume that higher levels of education might represent an obstacle to the achievement of income expectations if ability is not perfectly observable by employers. Indeed, in addition to the fact that employers would offer a wage that reflects their beliefs about the average quality of the workers, the illusion of highly educated individuals of ending up in better job matching in comparison to lower educated workers, might imply an inflation of income expectations. In turn, the systematic frustration of these expectations may negatively affect their perceived happiness.

In support to these assumptions, a study conducted by AlmaLaurea (a Consortium of Italian universities which collects information on graduate and postgraduate students) in 2015 shows how since their graduation the 74% of Italian Doctors strongly believe to have more chances to find a job abroad, and the 10% choose to work abroad mainly in relation to higher incomes, opportunities to apply their skills and to carry out research activities. Observing the highly-qualified individuals from another perspective, it is possible to identify a further discrimination in terms of gender inequality. In fact, in all cases female workers with a post-graduate qualification earn salaries that are substantially lower than their male colleagues (Istat 2015). This might be explained in relation to a tendency of women to work part-time (the 19.5% of female workers work part-time compared to 9.1% of men), but also in relation to a higher number of temporary contracts within this category (with a gap of around 10% points between women and men).

This disadvantage contributes towards increasing women’s degree of dissatisfaction, in particular about both the limited possibility to make career (women attribute an average value of 5.1 in a range from 0 to 10, whereas men 5.6) and work stability (5.5 for women, whereas 6.1 for men) (Istat 2015).

Therefore, the picture drawn by all these reports describes either an under-utilisation of qualified figures or an engagement of young qualified individuals in positions which not specifically require their competences (in particular for women). Even when this part of the workforce finds a job, the labour market seems to require to these young workers to rely more on their enthusiasm rather than on stable and remunerative work contracts (see also Argentin et al. 2014).

Given the general dissatisfaction declared by high qualified individuals in both AlmaLaurea and Istat surveys, we believe that Italy is a particularly suited context for testing the hypothesis that the illusory superiority bias is playing some role. The situation depicted by the above reported surveys indeed does not mean that all the high qualified individuals in Italy are in poor conditions. If the expectations of high qualified individuals were systematically frustrated, no one, at least in principle, would continue to acquire such qualifications. Therefore, there should exist among them someone who has reached his/her expectations, the problem is that, possibly because of an illusory superiority bias, they tend to believe that “if there is anybody who could do it, it’d be me”. The number of apical job positions are quite limited in all the economies, but especially in a context like the Italian one, in which the typical firm is a small family-owned business (see Manfra 2002), high educated workers face a very strong competition to reach these positions. Therefore, a possible explanation to the high level of dissatisfaction among qualified individuals is that, being affected by ISB, their evaluations do not take into account the possibility that other workers, endowed with higher level of ability, have reached the positions that they were dreaming of. In other words, they do not realise that having reached a high level of qualification is a necessary but not sufficient condition for obtaining top job positions. Obviously, it may be argued that the ISB should in principle affect people independently of educational levels. However, it must be noted also that the higher the level of qualification of an individual, the higher the income dispersion among all those with similar characteristics. Thus, even though ISB may affect both high and low educated people, those with the highest educational level will have more probability of ending up in a situation in which they do not get what they think to deserve.

In order to explore the relationship between income expectations and perception of happiness, the paper is structured as follows: the first section describes a theoretical model to better explain the role of income expectations on happiness and to clarify our research question; the second presents the results obtained from an empirical analysis of secondary data gathered from the Bank of Italy’s survey on Households’ Income and Wealth (SHIW from hereon) for the period 2004–2014, which contains detailed individual data on level of education, income, other socioeconomic characteristics and level of perceived happiness in Italy. Finally, some conclusions will be drawn.

2 The Complex Relationship Between Education and Perceived Utility

In this section, we will use a model of reference-dependent preferences (see Köszegi and Rabin 2006; Sugden 2003) in combination with another concept introduced in psychology by Hoorens (1995), to the so called “illusory superiority bias” (from now ISB). This will be done in order to show how education, interpreted as a proxy of human capital, can influence perceived utility. A reference-dependent model is particularly suited to model situation in which the utility of individual depends on the realised outcome as much as on the distance from the latter and a reference point. This kind of model has been, for instance, recently used by Gneezy et al. (2014) to study the relationship between customer satisfaction for a product and expected product quality. In particular, the model proposed by Gneezy et al. assumes that consumers are uncertain about the quality of products and use prices to formulate expectations. Using field experiments, they found that when price is high and quality is relatively low, consumers tend to evaluate it more negatively than a low-quality product with a low price. This because they suffer a disutility deriving from the frustrations of their expectations on quality, in turn, spurred by the price. Similarly, in our model the reference point is the individual expected income, which as in Clark and Oswald (1996) is alimented by education. See also Clark et al. (2008) for a discussion of the role of relative income in explaining the Easterlin paradox. Also, Lehmann (2009) in his analysis about the motivations for choosing to go to University from the students coming from low income families in Canada, reported that main driver to a such expensive investment is the expected high return in terms of income.

Imagine a simple linear utility function for individual i at time t:

Here wit denotes the individual’s own wage, while \(\theta = c \in \left( {0,\left. 1 \right]} \right.\) when E(w) > w, i.e. when expectations about income are not fulfilled and \(\theta = b \in \left( {0,\left. 1 \right]} \right.\) when w > E(w) with c > b, thus, as in Kahneman and Tversky (1979) losses are evaluated more than gains.

Each worker i is endowed with a human capital level (schooling) that may be high hh, or low hl, with obviously hh > hl which is assigned to each worker by nature. A fraction n (1 − n, respectively) of the population of workers (normalized to unity) is endowed with high level of schooling (low level of schooling, respectively). These proportions are common knowledge in the economy. We assume that there is also a continuum of risk-neutral firms. Each firm is run by an entrepreneur endowed with a level of entrepreneurial ability ej distributed in the population of firms as a U[0,1]. In period 1, firms make an irreversible investment decision, k, at cost rk. Workers and firms come together in the second period. The labor market is not competitive; instead, firms and workers are matched randomly, and each firm meets a worker.

If firm j meets worker i, they produce together, their output is:

Therefore, firms managed by more talented entrepreneurs are also characterised by a larger output.

We suppose that higher educated people (hi = hh) are convinced that they have more probability of being matched with entrepreneurs with higher level of ability. In other words, they suffer from an illusory superiority bias. In particular, we follow Ferrante (2009), according to whom education spurs individual expectations about available working opportunities. Thus, we assume that they believe that with a probability greater than ½ they will end up with an entrepreneur that is better than average, i.e. with an entrepreneur endowed with a level of ability higher than ½.

For both firms and workers, it is costly to destroy a match, and wage is determined by the solution of a Nash bargaining among the parties. In particular, we assume for simplicity that a fraction µ of the produced output goes to the worker while the remaining 1 − µ goes to the firm.Footnote 2

Firms maximise expected profit with respect to k:

where \(E\left( {h_{i} } \right) = nh_{h} + (1 - n)h_{l}\) is the average level of human capital in the economy. So, deriving for k and equalising the derivative to zero, we have that:

More talented entrepreneurs manage firms endowed with higher level of capital k. Moreover, the availability of a qualified workforce, as captured by the average level of human capital, induces firms to invest more. Now we have that substituting (4) in Eq. (2) and using the fact that wage is a share µ of total output, the expected incomes for a worker will be:

In order to simplify the notation, note that with \(E\left( {e_{j} } \right) = 1/2 \,\) and let use denote \(H = E\left( {h_{i} } \right)^{\delta }\) so, deriving with respect to hi, we have that:

Therefore, worker ‘i’ expectations positively depend on the level of his/her human capital hi. However, also wage increases as h goes up. Thus, the sign of derivative of the utility function in Eq. (1) with respect to h, crucially depends on how actual wage reacts to increases in level of human capital of the worker, which in turn depends on the realised matching with the entrepreneur jFootnote 3:

If a worker has drawn an entrepreneur with an ability level that is lower/higher than the average, the second term of the derivative is negative/positive.

Focusing on the case of “poor” matching, i.e. \(e_{j} < 1/2\), the second term of the above calculated derivative is negative. Note that after some simple passages derivative (7) may be rewritten as:

The first term will be higher than the second term if:

Thus when:

So, given the fact that θ cannot be negative, we will have that inequality 8 is never satisfied when \(e_{j} < \frac{1}{2}\). Therefore, if \(e_{j} < \frac{1}{2}\), then an increase in the level of human capital leads to a decrease in perceived utility because the second term of (7) will be always higher than the first one.

It is straightforward to show that if \(e_{j} > \frac{1}{2}\), then the opposite holds (i.e. an increase in education leads to an increase of perceived utility). These results are coherent with the mixed empirical findings that econometric literature produced on the relation between education and life satisfaction. Note that \(E\left( {e_{j} } \right) = 1/2 \,\) is the expected job matching of a worker that is not affected by the ISB. However, if we assume that high educated individuals have a biased perception of being able of finding an above the average entrepreneur, i.e. \(E\left( {e_{j} } \right) = 1/2 + b \,\) where 0 ≤ b ≤ 1/2 is a bias that increases the expectations of those with h = hh, we have that an actual matching ej > ½ + b is required for satisfying inequality (8). Thus, the larger the bias, the less likely inequality 8 is satisfied. This is in line with Clark and Oswald (1996), who sustain that educated people have high job expectations, which may produce negative effects on happiness when they are frustrated on the job market.

Summing up, following Clark and Oswald we will try to answer to the following question: do highly educated workers have more probability of ending up with their expectations unfulfilled? We may have 2 cases and related different implications: (1) the matching between workers and entrepreneurs are purely random, but highly educated individuals are affected by ISB as supposed above; (2) higher educated individuals are actually more likely to find capable entrepreneurs.

In case 1, more educated individuals are convinced of having more chance of being matched with a better than average entrepreneur. Thus, since the expectations about the job matching enters in Eq. 5, highly educated individuals will tend to have upward biased expectations about their wages, implying that on average the most educated workers will end up with an actual wage that is lower than that expected. However, this does not necessarily mean that an increase in education will automatically lead to negative consequences on perceived utility, since the sign of derivative 7 depends on actual matching. Some of the highly educated workers will end up in good matching, because they have drawn an entrepreneur endowed with a level of ability that is higher than ½ +b, while the remaining will be matched in a poor one. Obviously, the larger the bias due to education, the lower the probability of drawing an entrepreneur that is “good enough”. Therefore, if case 1 holds, then the contrasting empirical findings reported by Cunado and Pérez de Gracia (2012) may be due to the institutional setting of the country analysed. In countries where the matching between workers and firms is close to pure randomness, the sign of the relationship between education and happiness (assuming that happiness is a good proxy for perceived utility) is not a priori predictable. Obviously, in case 2, higher educated individuals, being more capable to find good matching, will also have less probability of seeing their expectations frustrated. This does not mean that all highly-educated individuals are able to meet their expectations. In some cases, casual errors may lead to suffer a misalignment between reality and aspirations. However, on average we may expect that if case 2 holds, then an increase in education leads to an increase in perceived utility, since highly educated workers will have more chances to end up with a high ability entrepreneur.

Therefore, our empirical model will test the following hypotheses:

H1:

Have higher educated people more probability of not fulfilling their income expectations with respect to low educated workers as implied by our assumption of ISB?

H2:

Does the inability to meet income expectations imply negative effects on perceived utility? If not, then our reference dependent preferences model is not valid and the explanation of the contrasting findings obtained on the empirical ground must be searched using other approaches.

H3:

After having controlled for actual incomes and for the possible effect of the misalignment between the latter and aspirations, does an increase in education lead to either an increase or a decrease of perceived utility?

3 An Empirical Analysis of the Relation Between Education, Expectations and Happiness: Data and Empirical Strategy

The proposed analysis is based on data provided by the biennial survey conducted by the Bank of Italy on the Italian households’ incomes and wealth between 2004 and 2014. In addition to information such as age, sex, educational qualifications, professional status, incomes and financial investments of Italian families, since 2004 this survey has been collecting data on perceived happiness. In fact, it includes the following question: “Considering the overall aspects of your life, how much do you feel happy in a range from 1 (extremely unhappy) and 10 (extremely happy)?”. This variable (from now on “happiness”) justifies our choice to consider the period 2004–2014.Footnote 4 Recently, this survey has included about 8000 families (around 24,000 individuals).Footnote 5

Since one the aim of the paper is to test the role of education in spurring income expectations, we decided to focus our attention only on those who are in their working age (18–64). We also excluded from the sample those who have declared of not being able to work. Our empirical strategy follows three steps. Firstly, a modified mincer equation will be estimated using a technique suggested by Wooldridge (1995) to extend Heckman’s selection model to the case of repeated cross sections. In particular, more educated people have more probability of being employed than less educated ones and obviously, we can observe wage only if an individual is employed. Clearly, this generates a selection bias which according to Wooldrige can be addressed in the following way: (1) estimating a probit equation for the selection into employment separately for each time period for which one data are available; (2) calculating the associated inverse Mills’ ratio (IMR from hereon); (3) using the selected sample to estimate a pooled regression of the logarithm of the hourly wage on education, other meaningful control variables and a set of interactions between the estimated IMRs and time period dummies.

Following Ferrante (2009), the results of this estimation will be interpreted as an “expected income” in relation to personal and contextual characteristics. Hence, we assume that individuals’ income expectations are developed in relation to both context (how the labor market usually works) and personal characteristics (how individual characteristics can be applied in the labour market). This represents the crucial assumption of our empirical strategy. We are aware that our estimation of the mincerian equation is subject to the ability bias, i.e. we may expect that individual ability is correlated with education, but since we cannot directly measure ability we have that educational levels will be positively correlated with the error term in the equation. In turn, this leads to an upward bias in the estimation of the returns of education. However, it should be noted that we are not interested in running this econometric exercise to have a precise estimation of the educational returns in Italy, instead to proxy individual income expectations. Therefore, if one is willing to accept the idea that people form expectations by observing what is happening around them (see Evans and Kelley 2004), thus our bias in educational returns is probably closer to their expectations than the real rate of returns.

Secondly, a dummy variable will be developed, named FrustratedExpectation (FEX from now on) as follows:

The FEX variable will be used as a dependent variable in a logistic regression to test whether a frustration of income expectations exists among both graduates and postgraduates (H1).

Finally, the third phase provides an ordinal logistic regression analysis to explore the relationship between happiness, education and FEX variables (H2 and H3). The results of this approach will be presented in the next section. Note that since the variable FEX is defined using the residuals from the mincerian equation estimation, one may argue that it must be orthogonal to each explanatory variable in the second step logistic regression. This would be confirmed, if individuals were not affected by the illusory superiority bias, since the probability of ending up in a situation of frustrated expectations should not depend on education. Instead, when the above depicted case 1 holds, we expect a positive relationship between education and probability of ending up with frustrated expectations. Indeed, if education spurs income ambitions, but better educated people are not able to draw jobs from a better distribution, then this will cause a systematic bias in their formulation of income expectations. Therefore, if we find a relation between FEX and education, this should be caused by this systematic bias of highly educated people. Instead, when the above depicted case 2 holds, since highly educated individuals are characterized by higher probability of obtaining better paid jobs, the misalignment between reality and aspirations should be purely random. Hence, we expect a not significant relationship between education and probability of ending up with frustrated income expectations since on average more educated individuals will end up in better job matching. It must be said also that obtaining the reference income by using the mincer equation approach has been questioned because this strategy requires exclusion restrictions whose validity is not guaranteed, i.e. the inclusion of regressors for predicting the reference income that are excluded from the happiness equation (see de la Garza et al. 2010). In our case, we will assume that the years of working experience are a possible determinant of income expectations but that do not have direct effect on perceived happiness. Indeed, it seems reasonable to assume that the number of working years influence wage but not happiness. Even though senior workers tend to have better positions with respect to younger ones, in our empirical model we are controlling for both wage and actual occupation, so it is difficult to believe that work experience may influence happiness through other channels. Furthermore, other possible lice-cycle effect should be captured by age dummies. Another criticism to the “mincerian” approach is that it unrealistically assumes that individuals formulate expectations as econometrician do (we invite the reader to de la Garza et al. (2010) and to Clark et al. (2008) to have a more complete overview of the pros and cons of the mincerian approach).

To partially cope with the drawbacks associated to our empirical strategy, we will check the robustness of our results by using two alternative ways to approximate the expected income: (1) calculating wage averages by groups that are defined by level of education and class of age (± 4 years of age with respect to the age of individual for which the expectations are calculated); (2) calculating wage averages by group defined by age, gender and education. Obviously also this approach has limitations, since the reference group are established by the researcher. An alternative may be to use self declared reference wage, however to the best of out knowledge there not exists a publicly available Italian survey which includes the necessary questions.

Table 1 shows some descriptive statistics about the average level of income and of declared happiness broken by the level of education and by gender. These statistics shows that those who have at least a university degree seem to have some benefits, in terms of income and happiness compared to lower educated individuals. See also Table 5 in Appendix for other descriptive statistics on the sample.

Note that the higher the educational level the higher the income dispersion. This is coherent with the idea that the most educated have also more probability of ending up very far from the average income of their peers.

4 Empirical Results

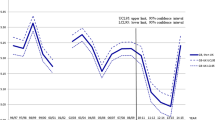

Table 2 shows the resulting estimations from the mincerian equation, based on the data from 2004 to 2014 provided by the Bank of Italy and controlling for selection using Wooldridge’s strategy. The labels used for the variables are mainly self-explanatory, however further clarifications are provided when necessary. First of all, the results associated with the control variables will be discussed in order to furnish an idea of the reasonableness of the entire model. Indeed, if the latter results turn out to be totally unexpected, this may cast doubts on the validity of the estimated model.

We want to better clarify that this estimation is not carried out to assess the educational wage premium in Italy, instead to have an empirical estimation of Eq. 5. Obviously, the underlying (maybe strong) assumption is that people formulate expectation by observing what is happening around them. In Table 2 we considered in a unique category (named University) both graduated and post graduated. This was necessary because the estimation of a separated probit selection equation for each time period implies to use a very low number of post graduated individuals in each regression and this did allow enough variability to estimate a separate coefficient for post graduated.

The results reported in Table 2 confirm the existence of a significant gender gap in Italy. In fact, they show how women’s incomes are lower than 12.3% in comparison to men. According to previous estimates obtained by Ferrante (2009), who only focused on the 2004 wave, the wage gap was about 20%. This result is a further confirmation of the disparity already highlighted in the introduction to this work.

The concavity of the relationship between years of working experience (working-exp is defined as respondents’ current age minus their age of first entering the labor market) and income, already observed in previous empirical works on Italy (see Fiaschi and Gabbriellini 2013), seems to be confirmed by our analysis. This might be explained by the fact that when the income growth reaches its maximum peak, then it starts to decrease, probably in relation to a reduction in terms of productivity of the worker.Footnote 6

The results associated with the variables related to both marital and employment status, seem very reasonable. In fact, singles and divorced people tend to receive lower incomes than married people, probably also because they do not receive family allowances. Considering the type of work, only low-skill free-lancers (named other autonomous worker) earn less than blue collars, whereas managers and self-employed earn more than the other categories.

Workers from southern Italy seem to earn less than those from the North, and this confirms Fiaschi and Gabbriellini (2013) findings, according to which there exists a significant income disparity between the North and the South. One explanation might be found in the limited availability of higher qualified positions in the South of Italy.

Focusing on the education, incomes seem to be related to the degree of qualification: those who have graduate or postgraduate qualifications earn 42% more than those with a low level of education (elementary or lower).

Our empirical analysis seems to support the hypothesis that the market is inclined to reward highly qualified individuals (at least in terms of incomes). Note that the total sample size reported in Table 2 differs from that reported in Table 1 because of missing observations on control variables.

The IMRs (not reported in table) were negative and significants (at least at the 5% level) thus supporting our choice of running the two step procedure. Not correcting for selection would have therefore produced a downward bias in our estimation of the regression coefficients.

Therefore, here the question is: is the market able to satisfy people’s aspirations? Table 3 replies to this question by reporting results obtained from a random intercept logit regression that uses the FEX (see previous section) as dependent variable, and the qualification and the same control variables of Table 2 as explanatory variables. Note that in Table 3, odds ratios are reported. Since individuals are nested into families, we allow for the presence of a random intercept at the family level to account for intraclass correlation among individuals in the same family and heterogeneity across families. In column 1, the dependent variable FEX1 is obtained from the mincerian approach, in column 2 we used age and education to calculate group average, in turn used as proxy for income expectation and thus for calculating FEX2, in column 3 we also add gender to the definition of the group for obtaining FEX3. As a robustness check, we also replicated the analysis reported in column 1, using a random intercept probit regression (the results are reported in the Appendix in Table 6). Indeed, this check allows to exclude that our results depend on the specification of the link function used in the estimated statistical model. Note that in all the tests reported at the end of Table 3 we reject the standard logit regression in favour of a random intercept specification.

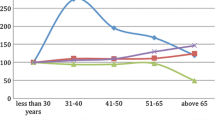

Table 3 shows how those who have lower qualifications are less likely to see their income expectations disappointed in comparison to those who have a high school diploma (reference category). By contrast, those who have a university degree are the most likely to be frustrated in terms of incomes. The latter result is robust to all the alternative specifications of the FEX variable. It is worth to note that the results associated to the mincerian approach are the most conservative in terms of magnitude of the estimated effect. In particular, according to column 1, those who have at least a university degree have an odd of seeing their expectations frustrated that is twice than that associated to individual with high school diploma (2.9 and 2.4 in column 2 and column 3, respectively). In Fig. 1 we report the estimated probability (through the model reported in column 1) of observing the variable FEX1 equal to one associated to each educational level (keeping constant all other regressors and using only the fixed part of the model).

Predicted probabilities of seeing expectation frustrated. Note: Probability estimated on the basis of the model reported in column 1 of Table 3

Considering the other controls, note that since in column 2 the reference group used for obtaining the expected income is not defined on the basis of the gender, we have that women are characterized by an odd of being frustrated that is higher than that associated to men (about 2 time higher), the opposite is true when also gender is accounted for in the definition of the reference group. This suggests that if females compare themselves to males with similar age and educational level (so, in other words if they care about gender equity and thus pretend the same income of a male with similar characteristics), then they are more likely to end up in a situation of broken aspirations; at the opposite when they confront theirselves only with other women, they are characterized by a higher probability of fulfilling their expectations than man. Using the mincerian approach, we are instead implicitly assuming that women are confronting themselves with individuals of the same sex with the very same characteristics. Thus, if expectations are defined in such a way, gender does not play a role in determining the probability of not achieving income aspirations.

In addition to education, another result that does not change in function of the definition of expectations, is that associated to the type of job. With respect to blue collars, all the other types of worker are less likely to end up in a situation of unrealised expectations.

Note also that in column 1 the results associated to the years of work experience seem to suggest that workers are aware of the fact that it exists a reverse U-shaped relation between their productivity and experience (as observed before) and thus they tend to adjust their expectations resulting into a lower probability of ending up in a situation of frustrated income aspirations. The same can not be said for age, which at the opposite seems to spur expectations (and this is true for all the three estimated models). So, we have that according to Table 2 older individuals are actually paid more than the youngsters, but this is not sufficient to fulfill their expectations. In economic literature, it is widely recognized that income inequality increases with age (see Ishikawa 2001), thus a a possible explanation to this finding may be formulated as it follows: if someone forms his expectations by “looking around them” then it follows that aged individuals will have also higher probability of ending up in formulating expectations that are beyond the real possibilities. In other words, as in the case of education, high income dispersion leads to higher probability of ending up below the group-mean.

We now turn to the estimation of the happiness equation. Also in this case, the model is estimated through a random intercept ordinal logistic regression. In particular, our aim is to test if once we have controlled for other influencing factors, the fact of not meeting income expectations negatively affects the level of “happiness” of the individuals. We use alternatively the three variables FEX1, FEX2, FEX3 as an explanatory variable in a model where happiness is used as dependent variable. Also in this case we allow for a random intercept at the family level. We also used the logarithm of income as the explanatory variables in order to test if, once controlled for the actual incomes, negative/positive effects are related to expectations.

The results of the analysis reported in Table 4 where in column 1, we do not control for the frustration of income expectations, in while column 2, 3, 4, the variables FEX1, FEX2, FEX3 are alternatively inserted to capture this effect.

Note that according to column 2, on the one hand, those who have at least a university degree are happier than others with lower qualifications, in particular their odds of being extremely happy are 17% higher than those with a high school diploma (reference category); on the other, it must be considered that according to Fig. 1 they have also the higher probability of not fulfilling their aspirations, and this in turn generates a significant reduction in the probability of declaring of being extremely happy. In particular, those with unfulfilled expectation have an odd of being extremely happy that is 13% lower than those who have achieved their aspirations.Footnote 7 So, this latter negative effect is able to almost entirely cancel out the positive effect of associated to the maximum level of education. Note also that in column 1, when the variable capturing frustrations is not included, the effect of the high level of education is not statistically significant. This offers some support to our idea that the mixed results obtained in the empirical literature about the relation between education and happiness, may depend upon on a downward bias of the coefficients tied to education, due to the omission of the FEX variable from the econometric model. Also in this case, when we use the FEX variable derived from the mincerian approach, the magnitude of the effect on happiness is lower than in other cases, so our results seem to not depend on the econometric model used to estimate the expected income (at the opposite the results derived from the mincerian equation are more conservative than those obtained with alternative approaches). Figure 2, highlights the reduction in the probability of being extremely happy (variable happiness equal to ten) when someone has reached/not reached his/her own expectation for each educational level (the probabilities are estimated from the model reported in column 2 in Table 4).

Estimated probability of being extremely happy. Note: The probabilities are estimated on the basis of model reported in column 2 in Table 4

It is worth to note that the higher the income, the higher the happiness. This confirms previous empirical evidences that highlighted how at the micro-level the Easterlin paradox is not confirmed (Stevenson and Wolvers 2008). Coherently with the model presented in the Sect. 2, education increases at the same time income and aspirations and this in turn implies less probability of realising them for high educated individuals. Therefore, even though the positive direct effect of obtaining a high level of education is almost cancelled out by the negative effect of the frustration of income ambitions, there is still an indirect role for education that passes through the positive relation with income. We also tested for a possible presence of an interaction effect between educational level and the FEX variable, but the results (not reported here) indicate that the interaction were not significant and consequently were excluded from the model. So, the frustration of income ambitions has similar effects on all the educational levels. However, we remind that high educated individual has a very high probability (see Fig. 1) of ending up in a such situation.

It is also worth to note that being married or having a large family (the variable is name fam_size) positively influences the degree of happiness, whilst again women seem to be penalized also in terms of perceived happiness. In particular females have an odd of being extremely happy that is 13% lower than that associated to the male counterparts. Also in this case we replicate in the Table 7 in the Appendix, our analysis carried out in column 2 of Table 4 using an alternative link function (in particular in Table 7 the results of a random intercept probit model are reported).

5 Conclusions

The relationship between education and happiness/life satisfaction has been widely studied by empirical literature. Despite of this substantial amount of attention, mixed results have been found. Some scholars reported a positive relationship between the variables, others a not significant relation or even a negative signed one. This paper tries to give a possible theoretical and empirical explanation of this empirical ambiguity.

In particular, in the second section of this work, we develop a theoretical model in which the perceived utility of an individual depends on both the realised income and the distance between the latter and income aspirations. The main conclusion of our theoretical model is that education spurs both wage and aspirations. This implies that when the latter cannot be satisfied by the labour market, the positive effect that education may produce on happiness, thanks to the increase in the realised income, may be offset by the disutility associated with the frustration of expectations. In the second section, we argued also that if highly educated people are affected by the so called illusory superiority bias, i.e. they are wrongly convinced that they have more chances of ending up in a good-job matching, then it is very likely that they will experience a misalignment between realised income and income expectations. In turn, this may cancel out the positive effect of education on individual happiness. The biennial survey conducted by the Bank of Italy on the Italian households’ incomes for the period 2004–2014 provided data to empirically investigate this issue. The main lessons learned from our econometric exercise might be synthesised as follows.

First of all, as expected, there exists a positive effect produced by education on incomes. This means that investing in education produces economic benefits for those who choose to continue their studies. Graduated and post graduated workers have on average higher income than other people, and this difference is statistically significant controlling for working experience and other possible confounding factors.

The second result of our analysis is directly connected to the first one in terms of discrepancy between expectations and goals effectively achieved. Graduated people are indeed more likely to fall into the category of individuals with unfulfilled income expectations. According to our theoretical model, this may be caused by a sort of upward bias in the income expectations which is alimented by education.

The third highlight is strongly connected to the second one. Indeed, the disutility resulting from the frustration of expectations produces negative effects on perceived happiness. This confirms that the reference-dependent model may be a good instrument to investigate the complex relationship between education and happiness. Even though the frustration of expectations produces negative impacts on happiness, at least graduated people appear to be happier than other workers. In the theoretical model presented in Sect. 2 we referred to two extreme situations, one in which job matching is purely random, but highly educated workers are affected by the illusory superiority bias of being able to influence the probability of ending up in a good job-match; and one in which highly educated are actually able to influence job matching. In the real world, it is likely that the truth lies somewhere in between these extremes. Perhaps, highly educated people are able to find better matching but not always as good as they believe, and this implies that they are more likely to seeing their income expectations frustrated. However, on average there is a positive effect of education on happiness. As alternative explanations, it may be argued that highly educated people also give importance to non-pecuniary aspects of their job. In other words, they are willing to bear a disutility given by not-fulfilling their income expectations in exchange of some other immaterial job characteristics (let us call this a trade-off effect); or that they are on average happier because they are healthier than other workers (see Cutler and Lleras-Muney 2006). However, the first explanation seems to be in contrast with the dissatisfaction of post graduated workers, deriving from the impossibility to apply their skills, especially in the case of women, as resulted from the Istat Report 2015 on Italian PhDs. Indeed, our empirical findings confirm the concerns emerged from the Istat report: Italian women are paid less than men and seem also characterized by lower levels of happiness. It must be underlined that our estimation strategy has not allowed to distinguish between graduated and post graduated individuals, so our results are not directly comparable. Despite this, we found that women are not characterised by a higher likelihood of ending up in a situation of frustrated expectation than men. It is therefore reasonable to surmise that the source of the lower level of satisfaction for female may be searched among other non-pecuniary job characteristics as the Istat report seems to suggest.

We must also remark that because of data availability we were forced to focus our attention on happiness rather than on job satisfaction. It is therefore possible that the negative consequences of not realizing income expectations passes mainly through a reduction in job satisfaction and this in turn adversely affects overall happiness. With the data at hand, thus we were not able to test whether the effect of the frustration of income ambitions is direct or mediated by a downward levelling off in the level of job satisfaction. For instance, Easterlin (2006) has challenged the traditional “set-point model” for studying happiness, suggesting the use of the life domain approach to better understand the role that each dimension may play in determining happiness in the various stages of the life- trajectories of individuals. We leave therefore to future research efforts the difficult task to clarify this issue.

Considering the possible positive effects of education on health and consequently on happiness, the Bank of Italy’s data do not allow to test this hypothesis because of data unavailability. This is another limitation of our work.

Notes

The illusory superiority bias may be defined as a perceptual distorsion that affects individuals when they compare themselves to other people. In particular, when people are affected by ISB they tend to believe that they are better than others and they will have a brighter future.

We are implicitly assuming that µ > 0 since a µ = 0 will imply that workers do not receive a wage for their job.

Obviously when expectations are perfectly realized, i.e. w = E(w), the second term of Eq. (1) is equal to zero, and therefore the derivate is calculated only for the first term.

The question is asked only to survey’s respondent and not to all his/her family members. Furthermore, from 2004 to 2010, only a random half of the respondents were interviewed about their perceived happiness. The discussion about an appropriate measure of well-being goes behind the scope of this paper. As observed by Stevenson and Wolvers (2008), even though happiness and life satisfaction may be considered as two different concepts, much of the economics literature assessing subjective well-being used the measures of “life satisfaction” and “happiness” interchangeably. Indeed, these alternative measures of well-being are highly correlated and have similar covariates. See also Frey and Stutzer (2002) for a discussion of the reason why question about subjective happiness may be a good proxy for perceived utility. Unfortunately, in Bank of Italy’s survey a question on job satisfaction was introduced only in two waves (2006–2008) and asked only to half of the occupied respondents implying thus a modest sample size (around 2000 individuals). This has prevented us to test if the effect of frustrated expectations on happiness passes only through a possible relation with job satisfaction.

For more information on the sampling techniques used by the Bank of Italy, see the Supplements to the Statistical Bulletin: http://www.bancaditalia.it/statistiche/indcamp/bilfait/boll_stat.

For each individual, we demeaned the variable years of experience by subtracting the sample mean. Hence, the demeaned variable and its square were used in the model, instead of the original one. This operation was necessary to reduce the obvious collinearity that exists between the original variable and its square.

Note that the sample size differs in this case from that reported in Table 3, because of missing observations for the dependent variable (we remind that this question is not asked to all the participants to the survey).

References

AlmaLaurea. (2015). Indagine Almalaurea 2015 sui Dottori di Ricerca. Tra perfomance di studio e mercato del lavoro. https://www.almalaurea.it/.

Argentin, G., Ballarino, G., & Colombo, S. (2014). Investire in formazione dopo la laurea: Il dottorato di ricerca in Italia. Working papers no. 60, February, AlmaLaurea Inter-University Consortium. http://www2.almalaurea.it.

Bank of Italy. (2015). Survey on household income and wealth. Years 2004, 2006, 2008, 2010, 2012, 2014.

Clark, A. E., Frijters, P., & Shields, M. A. (2008). Relative income, happiness and utility: An explanation for the Easterlin paradox and other puzzles. Journal of Economic Literature,46(1), 95–144.

Clark, A. E., & Oswald, A. J. (1996). Satisfaction and comparison income. Journal of Public Economics,61, 359–381.

Cunado, J., & Pérez de Gracia, F. (2012). Does education affect happiness? Evidence for Spain. Social Indicator Research,108, 185–196.

Cutler, D. M., & Lleras-Muney, A. (2006). Education and health: Evaluating theories and evidences. NBER working paper no. 12352, July, National Bureau of Economic Research (NBER). http://www.nber.org/papers/w12352.

De la Garza, A., Mastrobuoni, G., Sannabe, A., & Yamada, K. (2010). The relative utility hypothesis with and without self-reported reference wages. ISER discussion paper no. 798, Institute of Social and Economic Research, Osaka University.

Di Tella, R., MacCulloch, R. J., & Oswald, A. J. (2001). Preferences over inflation and unemployment: Evidence from surveys of happiness. American Economic Review,91, 335–341.

Easterlin, R. A. (2006). Life cycle happiness and its sources. Intersections of psychology, economics, and demography. Journal of Economic Psychology,27, 463–482.

Evans, M. D. R., & Kelley, J. (2004). Subjective social location: Data from 21 nations. International Journal of Public Opinion Research,16, 3–38.

Ferrante, F. (2009). Education, aspirations and life satisfaction. Kyklos,62(4), 542–562.

Fiaschi, D., & Gabbriellini, C. (2013). Wage function and rate of returns to education. Unpublished manuscript, University of Pisa. http://www.ecineq.org/ecineq_bari13/FILESxBari13/CR2/p253.pdf.

Frey, B. S., & Stutzer, A. (2002). What can economists lean from happiness research? Journal of Economic Literature,40, 402–405.

Gneezy, A., Gneezy, U., & Oliè Lauga, D. (2014). A reference-dependent model of the price-quality heuristic. Journal of Marketing Research,LI, 153–164.

Hoorens, V. (1995). Self-favoring biases, self-presentation, and the self-other asymmetry in social comparison. Journal of Personality, 63(4), 793–817.

Inglehart, R., & Klingemann, H. D. (2000). Genes, culture, democracy and happiness. In E. Diener & M. S. Eunkook (Eds.), Culture and subjective wellbeing (pp. 165–183). Boston: MIT Press.

Ishikawa, T. (2001). Income and wealth. Oxford: Oxford University Press.

Istat. (2015). L’inserimento professionale dei Dottori di Ricerca. Anno 2014. Statistiche report. https://www.Istat.it.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica,47(2), 263–291.

Köszegi, B., & Rabin, M. (2006). A model of reference-dependent preferences. Quarterly Journal of Economics,121(4), 1133–1165.

Lehmann, W. (2009). University as vocational education: Working-class students’ expectations for university. British Journal of Sociology of Education,30(2), 137–149.

Manfra, P. (2002). Entrepreneurship, firm size and the structure of the Italian economy. Journal of Entrepreneurial Finance and Business Ventures,7(3), 99–111.

Stevenson, B., & Wolvers, J. (2008). Economic growth and subjective well-being: Reassessing the Easterlin paradox. Brookings Papers on Economic Activity, Economic Studies Program,39(1), 1–102.

Sugden, R. (2003). Reference-dependent subjective expected utility. Journal of Economic Theory,111(2), 172–191.

Wooldridge, J. M. (1995). Selection corrections for panel data models under conditional mean independence assumptions. Journal of Econometrics,68, 115–132.

Funding

The research activity carried out by Gabriele Ruiu has been in part financed by the “Fondo per il finanziamento dei dipartimenti universitari di eccellenza” (Law nr. 232/2016).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ruiu, G., Ruiu, M.L. The Complex Relationship Between Education and Happiness: The Case of Highly Educated Individuals in Italy. J Happiness Stud 20, 2631–2653 (2019). https://doi.org/10.1007/s10902-018-0062-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10902-018-0062-4