Abstract

Using a unique dataset of 4.6 million offers, we investigate the convergence of 28 regional housing markets in Poland from 2000 to 2019. The objective of the paper is twofold. First, we test whether the house prices in Poland are converging over time and identify convergence clubs. Second, we compare the housing market convergence before and after the global financial crisis. The test results suggest that there is little evidence of overall convergence. We identified three major convergence clubs in Poland formed during the study period. However, the results differed when considering subperiods (before and after the 3rd quarter of 2008)—we found three and four clubs in subperiods and some divergent housing markets. The paper fills the gap in knowledge on the convergence of regional housing markets within an emerging economy setting. Little is known about this phenomenon in Eastern European Countries with their unique institutional framework. Additionally, we address differences in house price convergence before, and after the financial crisis, a topic often overlooked in other empirical studies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The economic literature is abundant, with papers investigating the dynamics of house prices. Meen (1996) noted that one specific feature of house price movements is driven simultaneously by national and regional factors affecting supply and demand. Thus, housing market convergence has been an interesting research topic since the 1990s. To date, a significant body of empirical evidence has been gathered, primarily based on mature housing markets in the US and UK. Recently, many studies addressed house price convergence in developing countries; nonetheless, the gap in economic knowledge related to the dynamics of emerging property markets still exists.

This study investigated the convergence of 28 provincial major city housing markets in Poland using quarterly data from 2000 to 2019. The contributions of this paper are threefold. Firstly, convergence has been empirically tested and well developed in local markets, which were not studied in previous research projects. Secondly, the study covers a significantly more extended study period than those covered by studies using National Bank of Poland data. This allowed us to investigate pre-crisis and post-crisis convergence behaviour. Thirdly, the econometric methodology allowed for robust results comparable to the state-of-the-art method used in the field.

The rest of the paper is organised as follows. In Sect. 2, we discuss the concept of house price convergence. We also briefly summarise prior empirical research that addressed the general convergence and club convergence among regional housing markets between expectations and house price movements. In Sect. 3, we describe the data gathering process and introduce the empirical approach used. Section 4 summarises the research findings and discusses them in the context of the prior study. Finally, the last section presents concluding remarks, identifies research limitations, and discusses several directions for further studies.

2 Literature review

Although scientific interest in the convergence of economic systems can be traced back to the 1950s (Wójcik, 2016), the modern notion of economic convergence was formally introduced in the 1990s by Barro and Sala-i-Martín (1992) and Mankiw et al. (1992). Following their contributions, we can distinguish between β-convergence and σ-convergence. The β-convergence exists when the growth rate of low-income economies is higher than that of high-income ones. In contrast, the σ-convergence refers to the reduction of the dispersion of income levels across economies. Both types of convergence are related (Sala-i-Martin, 1996, p. 1329), as it can be proved that the existence of β-convergence is a necessary condition for the existence of σ-convergence. Nonetheless, empirical results demonstrate that β-convergence is a necessary but not sufficient condition for σ-convergence (Young et al., 2008).

Several similarities can be drawn between general economic convergence and house price convergence. As it is often argued, there should be a significant difference in house price dynamics across regions due to differences in demand and supply factors affecting separate regional markets (Canarella et al., 2012). Similar to economic growth research, two themes emerge from the vast literature on regional house price dynamics. First, several studies addressed time convergence, or inter-regional demand and supply shocks transmissions. In this research branch, convergence is defined as the tendency of house prices to react to a shock similarly—a phenomenon often referred to as the ripple effect. Among the multiple reasons for the ripple effect are (Meen, 1999): migrations, equity conversion, capital flows, and spatial patterns in housing market determinants (fundamental factors affecting demand and supply). Another important theme is the convergence or divergence of regional house prices. The other branch of research investigates convergence, defined as the diminishing dispersion regional house prices over time, or the situation where emerging regional housing markets (with lower house prices) have higher house price growth rates than more developed ones (catching-up process). On the other hand, in recent decades, several studies have reported divergence across regional housing markets and the existence of convergence clubs (regions having similar house price dynamics), with significantly different growth trajectories (Van Nieuwerburgh & Weill, 2010).

House price convergence has been a topic in regional housing and economic research at least since the seminal work of MacDonald and Taylor (1993). They investigated the long-run relationship between regional house prices in Britain. The authors searched for the segmentation of house prices and whether price shocks in a particular region affect house prices in other regions (MacDonald & Taylor, 1993). Empirical evidence suggests that there are apparent regional differences in the pattern of UK house price movements, in particular in the North and Scotland (Drake, 1995). Since then, the ripple effect has been a popular topic. More recently, Holmes and Grimes (2008) investigated fluctuations of regional housing markets in the United Kingdom. The authors used a two-stage procedure: principal component analysis and panel unit root tests to test convergence. The same research identified a ripple effect: regional housing markets respond to the shocks initiated in London. They found that regional adjustment speed is inversely related to the geographic distance to the central market in London (Holmes & Grimes, 2008). The existence of ripple effects in the United Kingdom has been confirmed by Hudson et al. (2017). A recent study revealed that regions tend to converge with income levels, but adjustments are asymmetric within the period of convergence (Tsai, 2018c).

Housing market convergence has drawn considerable attention from economists in the United States. House price convergence was investigated on regional and local levels (regions, states, and metropolitan areas). The results vary and are dependent on the testing procedure, as suggested by Canarela et al. (Canarella et al., 2012). They found mixed support for general housing market convergence across ten major metropolitan areas in the United States. Still, They suggested that house price changes generated in cities on the east and west coasts may be transmitted to other markets. Evidence of segmentation and divergent behaviour of several housing markets in the United States has been confirmed in other studies (Barros et al., 2012, 2014; Miles, 2015). Nissan and Payne (2013) revealed patterns of convergence between selected housing markets in the United States, but there was an absence of universal σ-convergence across states and regions. In another study, Payne (2012) highlighted differences in the speed of adjustment toward long-run equilibrium across the regional market in the United States.

To date, a substantial body of empirical evidence has been assembled, primarily for mature economies. Most evidence is based on metropolitan housing markets in developed countries (the United States and the United Kingdom). More recently, convergence has also been investigated in several other housing markets due to better access to house price data. Stevenson (2004) explored convergence and ripple effects in Ireland. Oikarinen (2004) identified ripple effects in Finland, spreading from the Helsinki Metropolitan Area to major regional centres and then to peripheral regions. Teye et al. (2017) explored house price convergence between Amsterdam, Friesland, Groningen, Limburg, Overijssel, Utrecht, and Zuid-Holland. A more general pan-European study based on housing market data from 11 EU and 4 non-EU countries highlighted the importance of introducing a single currency (Euro) in 1992 in house price convergence among various countries (Tsai, 2018a).

Luo et al. (2007) studied regional house price dynamics between eight capital cities in Australia and discovered pair-wise convergence between selected cities. Empirical evidence of regional house price convergence has also been found in Spain (Larraz-Iribas & Alfaro-Navarro, 2008). A South African study by Burger and Rensburg (2008) investigated convergence for different housing units and found mixed evidence. Interesting research on cross-border house price convergence comes from empirical studies on regional markets in Malaysia and Singapore (Fereidouni et al., 2016; Lean & Smyth, 2013). Some evidence of housing market convergence between four major cities in Taiwan was found by Tsai, who highlighted the role of improving transportation infrastructure in economic convergence (Tsai, 2018b). Since 2010, following the general trends in urban and real estate economic research, a growing body of evidence has been gathered on convergence in regional housing markets in China (Gong et al., 2016; Lee et al., 2016; Meng et al., 2015; Tsai & Chiang, 2019).

Typically, housing market convergence has been investigated on a regional level. However, there are examples of studies that have addressed local (intercity) house price convergence. Holmes et al. (2018) studied house price movements across districts (boroughs) of London and found strong support for convergence theory. The results show that price differentials are stationary, and prices move together in the long run. Convergence is more substantial between proximate (adjacent) districts, similar quality of life (presence of amenities), and for certain property types (weaker convergence for cheaper market segments). House price convergence at the local level has also been investigated in Poland. Examples include house price and rates of return convergence in Szczecin (Gnat, 2016, 2017) and house price convergence across the Szczecin Metropolitan Area (Gnat, 2014).

The classic view on economic convergence and empirical procedures to test for its presence was questioned by Phillips and Sul (2007, 2009). They argued that the traditional approach yields the biased and inconsistent estimates of β-convergence parameter due to heterogeneity issues. Their proposed new t-log convergence test allowed for heterogeneity and temporal changes and addressed significant drawbacks of previous methods. Most importantly, if no overall convergence is found, the Phillips and Sul procedure follows the identification of convergence clubs. The emergence of a new wave of empirical research on residential price convergence was triggered by a growing concern about the role of housing in business cycles (Leamer, 2007) and the need for more sophisticated and focused housing policies that could account for differences in regional development. Since 2010, several studies have investigated club convergence in housing markets using Phillips and Sul’s (2007) approach (Table 1). House price convergence patterns in the United States were investigated by Kim and Rous (2012), Apergis and Payne (2012), as well as Montañés and Olmos (2013). Housing convergence clubs at the regional or city level were also identified in other countries, including South Africa (Apergis et al., 2015), the United Kingdom (Holmes et al., 2018; Montagnoli & Nagayasu, 2015), Australia (Churchill et al., 2018), China (Meng et al., 2015) and Spain (Blanco et al., 2016). In general, the results from empirical studies using Phillips and Sul’s (2007) approach questioned the traditional view of the convergence of housing markets. They emphasised the differences that force clusters of regional markets to follow different house price trajectories. For example, a Spanish empirical study suggests that regional house prices do not converge to a common trend (Blanco et al., 2016). The authors identified four separate groups that converge to different house price levels. Club membership was explained by population growth, rental market size, initial housing supply, and geographical situation.

Few papers have addressed fluctuations in regional housing markets in Poland (Bełej, 2018; Brzezicka & Wisniewski, 2016; Tomal, 2021a, 2021b; Trojanek, 2010), and even fewer have directly tested for convergence. Drachal (2018) questioned the convergence of house prices in major cities in Poland; however, the results were problematic due to data limitations and the applied econometric methods. The evidence is mixed. However, as in another study, the authors found evidence of regional house price convergence in Poland (Zelazowski, 2019). The potential limitation of that study was the price data, which was aggregated at the regional level, most likely leading to significant measurement bias. Only recently, two recent studies investigated the existence of convergence clubs in regional housing markets (Matysiak & Olszewski, 2019; Tomal, 2019), applying Phillips and Sul’s approach (2007). Additionally, Matysiak and Olszewski (2019) used ordered probit to examine factors behind membership in the clubs found. Recent work on the convergence of rental housing markets in Poland also explored the factors behind club formation (Tomal, 2021c).

2.1 Club convergence methodology

To study the convergence of prices of houses in polish cities, we employed the classification procedure for creating the clubs proposed by Philips and Sul (2007). Let Xit be the price of a square meter in city i = 1,…,N at time t = 1,…,T. Philips and Sul (2007) assume that Xit has a time-varying factor representation:

where, from one point of view, git is a systematic component, while ait is a transitory component. From another point of view, μt is an idiosyncratic element, which can change over time and is a common factor for all cities; also time-varying, and \({\delta }_{it}\) can be interpreted as the relative share in \({\mu }_{t}\) of city i at time t. This approach ensures the transition path of \({\delta }_{it}\), which is essential due to considering the individual behavior of paths that may diverge transitionally. Moreover, it is assumed that there is some point in the future when all cities converge (i.e., for all cities i = 1,…,N). Obtaining the convergence point can be achieved in different ways by different cities. For example, some cities can reach the converging point in the future with a common path, and some can form clubs.

Additionally, \({\delta }_{it}\) can be modelled in a semiparametric form using a slowly varying function in the form of:

where \({\delta }_{i}\) is fixed across time but varying across cites, and L(t) is a slowly varying function, for which \(L\left(t\right)\to \infty\) when \(t\to \infty\) (e.g., log t function). This solution also allows the elimination of the common component \({\mu }_{t}\) by scaling to obtain the transition coefficient \({\delta }_{it}\) or relative loads:

The \({h}_{it}\) parameter can also be treated as a transition path but in relation to panel average. The estimation of relative transition parameter \({h}_{it}\) can be achieved by using trend estimation from a smoothing filter such as the Hodrick–Prescott (HP) filter (\(\widehat{{\theta }_{it}}=\widehat{{b}_{it}{\mu }_{t}}\)), giving

The testing procedure for convergence is conducted using log t regression, where the null hypothesis assumes convergence: \({H}_{0}:{\delta }_{it}=\delta\). To verify the relative convergence (similar growth rate), we extend this null by the assumption \(\alpha \ge 0\). Suppose the absolute convergence (converge to the same value in long-term) is verified that it has to be assumed that \(\alpha \ge 1\). The alternative hypotheses are respectively \({H}_{A}:{\delta }_{it}\ne \delta\) or \(\alpha <0\) for relative convergence and \({H}_{A}:{\delta }_{it}\ne \delta\) or \(\alpha <1\) for absolute convergence. Testing the null hypothesis requires the following steps: Firstly, the variance ratio \(\frac{{H}_{1}}{{H}_{t}}\), where \({H}_{t}=\frac{1}{N}\sum {\left({h}_{it}-1\right)}^{2}\), for \({h}_{it}=\frac{{X}_{it}}{{N}^{-1}}\sum {X}_{it}\) is calculated. Next, estimate the regression of long-run variance \(log\left(\frac{{H}_{1}}{{H}_{t}}\right)-2logL\left(t\right)=\widehat{a}+\widehat{b}logt+\widehat{{u}_{t}}\), where \(L\left(t\right)=log\left(t+1\right)\), while \(\widehat{\alpha }\) is an estimator of \(\alpha\) and \(\widehat{b}=2\widehat{\alpha }\). This regression is often called the log-t regression. The last step is to check the significance of \(\alpha\) with autocorrelation and a heteroscedasticity test with a 5% significance level. The null hypothesis is rejected if the t statistic is lower than − 1.65.

The implication of the above-described procedure of testing the convergence is finding a set of cities (clubs) that converge similarly. This can proceed if the convergence for all cities is rejected. The four-step algorithm for clustering was presented by Philips and Sul (2007) and is also implemented in R software (see Sichera and Pizzuto 2019). The first step is ordering the observations Xit by the last observation of the panel. Secondly, the initial (core) set of k cities is established. The \(2\ge k>N\) highest individuals are included in the core group, and the log t regression is estimated to calculate the test statistic of convergence. Finally, the initial group is chosen by group size k* to maximise the test statistic regarding significance at the 5% level:

Next, the algorithm includes the additional cities to the core group one by one after running the log t test. Another individual is added to the core group if the t statistics exceed the critical value c. Additionally, to include another city, the whole extended group’s significance must be satisfied (i.e., \({t}_{k}>-1.65\)). A subgroup is formed for cities that have not exceeded the critical value c, and the significance is checked. If the test confirms the convergence, we formulate a second group; in other cases, the algorithm is repeated from the first step to determine a smaller subgroup. When there is no k during the core group formulation, the remaining cites are treated as divergent.

2.2 Data

This study used a unique database of more than 4.6 million housing offers in 28 provincial cities in Poland in 2000–2019 (Trojanek, 2018). Earlier studies on regional house price dynamics used either the National Bank of Poland (NBP) or the Central Statistical Office (CSO) data. The NBP house price indices are a part of the Public Statistics Statistical Research Program from 2013. They are probably the most established source of information on residential price dynamics in Poland, published quarterly since 2010 (data from 3rd quarter 2006). Nonetheless, we found that NBP data did not suit the objective of this study for two reasons. Firstly, the NBP dataset has been criticised on methodological grounds. There is no transparent information about the sample size and the exact methods used (Kokot, 2017).

Additionally, there are notable differences in recorded transaction volume and average house prices between NBP data and complete information on housing transactions (Gluszak et al., 2018; Hill & Trojanek, 2020; Konawalczuk, 2014). Secondly, the NBP dataset does not cover the beginning of the 2000s, which we consider a particularly interesting period for studying housing market convergence. The alternative CSO dataset on house prices was unsuitable for our research, mainly because of the relatively short time series. It covers residential house prices dynamics of regional house prices since 2015. Additionally, it only includes data on ownership. Sales of cooperative ownership rights to housing units are omitted despite the relatively high share of those market transactions.Footnote 1

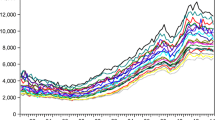

The dataset on house price dynamics used in this study is novel and unique. A detailed description of dataset formation can be found in Trojanek (Trojanek, 2021). Using the collected information on apartment offers, geometric average prices for 1 m2 of the usable floor area of apartments were determined and smoothed with Arima-X13 (Fig. 1).

The dataset covers house prices in 28 major cities in Poland from the beginning of 2000 to the end of 2019. It consists of quarterly data (80 observations). The time series presented in Fig. 1 (as geometric average prices per square meter) clearly shows the change in the price level in 2007. The direction of change in the time series of housing price indices in individual cities is similar, but the strength of these changes is already more differentiated. Periods of the price increase and decrease can be seen in the studied period. The economic slowdown primarily caused the price drop in 2000–2002. Poland had one of Europe’s biggest housing booms before the GFC in 2008/9. Then, between 2003 and 2007, apartment prices rose due to Poland’s accession to the EU and the country’s economic situation. Furthermore, the main determinants include a favourable economic situation, decreasing unemployment, rising household income, or non-fundamental factors such as media coverage of the possibility of raising VAT, the last opportunity to take advantage of the relief, or the widespread belief that housing prices will only rise (Trojanek, 2021). Furthermore, speculative capital has entered the market. On the supply side, there is unquestionably a scarcity of available land with development potential (the effect of changes in legal regulations). The global financial crisis, limited availability of housing loans, and the economic slowdown all slowed growth. Apartment prices began to rise again in 2014 (in some cities, sooner or later), influenced by an increase in demand caused by the economic situation, government programs supporting the purchase of a first apartment, low-interest rates, and the development of Poland’s residential rental market (including Airbnb) (Trojanek et al., 2021).

We aimed to compare the convergence of apartment prices before and after the financial crisis. Therefore, we analysed three different periods: for the whole sample (2000–2019), the period before (2000–2008 Q3), and the period after (2008 Q4–2019) the financial crisis. In each case, we tested for convergence and identified convergence clubs. We report club membership and parameter \(\widehat{b}\). Additionally, we present relative transition paths for cities within the clubs and average relative transition paths for each club. Instead of using the classical HP (Hodrick-Prescott) filter, we used the boosted HP filter proposed by Phillips and Shi (2021) as it is a remedy for the problem of selecting the optimal value of the tuning parameter λ. Phillips and Sul (2007) concluded that for small samples (T < 50), the initial sample fraction should be 0.3 and for large samples (T > 100) 0.2 to achieve the best results in terms of both size and power of the test. Therefore, we used trim = 0.25 for the whole period and the value of 0.3 for both sub-periods under study (Table 2).

3 Results and discussion

3.1 Entire period 2000–2019

Analyzing the full sample (2000–2019), the clustering algorithm created three clubs. The first one includes the following cities: Warszawa, Gdańsk, Kraków, Gdynia, Rzeszów, Lublin, Białystok, Katowice, Zielona Góra, and Radom, Dąbrowa Górnicza. In the second club, there are 13 cities: Wrocław, Poznań, Toruń, Szczecin, Bydgoszcz, Olsztyn, Opole, Łódź, Tychy, Kielce, Gliwice, Gorzów Wielkopolski, and Chorzów. In the last club, we have: Częstochowa, Sosnowiec, Zabrze, Bytom. In general, the second and third group include smaller cities. The only exception are Wrocław and Poznań, both highly populated and economically developed cities, which would fit well in the first club (mainly more developed and larger cities). This is also confirmed by the relative transition path for the second club (Fig. 2). The first two clubs have similar and significant convergence speed (for club 1 is \(\widehat{b}\) = 0.112 and \(\widehat{b}\) = 0.134 for club 2). The value of \(\widehat{b}\) indicates the relative convergence (similar rate of growth within the club). The last club has an insignificant value of \(\widehat{b}\), while the value is close to the first and second clubs. The difference between the clubs is also clearly demonstrated using the average transition paths presented in Fig. 3 (club three is below the unity value) (Figs. 4, 5).

3.2 Subperiod 2000Q1–2008Q3

Considering only the first period of the analysed time (i.e., until 2008 Q3Footnote 2), four clubs were created, and two cities are divergent (Table 3). The first club contains the largest cities in Poland: Warszawa, Wrocław, Kraków, and Gdańsk, with adjoining Gdynia. In the second club, seven cities can be classified as medium cities in Poland. The third club contains ten cities, while four smaller cities are in the fourth club. Two cities in Poland did not get into any clubs: Poznań (the fifth largest and prosperous) and Bytom (medium size and highly industrialised). All clubs are converging relative; in other words, they have similar growth rates within their clubs. The fastest convergence speed is observed in the fourth club and then in the first club. The slower convergence and insignificant is seen in the second and third (most numerous) clubs. The first club has a much higher average transition path than the remaining clubs, which is presented in Fig. 6.

We can observe the following results for the analysed period (before the crisis) compared to the whole sample. The three clubs were created at a full sample. For the pre-crisis period, four clubs were formulated, and the two cities occurred divergent (Figs. 7, 8).

3.3 Subperiod 2008Q4–2019Q4

Three clubs were created considering the housing market condition after the financial crisis (see Table 4). The first club includes the five largest cities: Warszawa, Kraków, and Gdańsk, with adjoining Gdynia (the same set as for the pre-crisis period). The second club consists of 14 cities. This club is marked by the significant and negative value of the parameter, which indicates weak convergence (Mendez, 2020). Another five cities (of medium and small sizes in the examined group) form the third club. This club converges the fastest and is also significant. Four cities (Sosnowiec, Chorzów, Zabrze, and Bytom) were not classified to any club, and they are divergent. Similar to the pre-crisis period, the first club is substantially higher at average transition path than the second and third clubs (see Fig. 9).

The study contributes to understanding real estate markets by providing empirical evidence on the dynamics of regional housing markets in Poland. In this paper, we compared the convergence patterns before and after the housing crisis that affected Poland, like most developed and emerging economies in the world in 2007–2008. Compared to the existing evidence about Poland, this research adds to the body of knowledge by using novel and more reliable data on residential house prices. The contribution of the study is threefold.

Firstly, we did not use the NBP dataset for prices on primary residential markets in selected cities in Poland as the transaction data often lag behind the actual market developments in the primary market as prices are typically set months or years before the transactions are finalised (for more discussion see Hill et al., 2021). Secondly, prior evidence on convergence clubs in Poland (Matysiak & Olszewski, 2019; Tomal, 2019) was based on NBP data and investigated a significantly shorter period (starting from Q3 2006). That prevented them from addressing the house price dynamics patterns in major Polish cities before the crisis. We used a longer time series starting from 2000 to address the expansion phase of the Polish property market till 2007–2008. Thirdly, we used an expanded set of cities in Poland, investigating the convergence patterns for 28 cities instead of 16 as in prior research. This extends the body of empirical evidence on smaller housing markets and enables us to assess the validity of the results by comparing the membership of selected pairs of cities.

The convergence clubs identified in this study are, to some extent, similar to the results from previous studies based on NBP data. In particular, we found that Kraków and Warszawa belong to the same club (Club 1) in both subperiods (pre-crisis and post-crisis), as in Matysiak and Olszewski (2019) and Tomal (2019). All studies agree that both Warszawa and Kraków constitute Poland’s first tier of regional property markets. However, there are subtle differences regarding the other markets belonging to the club. Matysiak and Olszewski (2019) include also Wrocław and Gdańsk, whereas Tomal (2019) adds Wrocław, Gdańsk, Poznań, and Rzeszów in the case of the primary market or Gdańsk in the case of the secondary market. In our research, in pre-crisis and post-cricis periods, the first tier (Club 1) consists of Warszawa, Kraków, Gdańsk, Gdynia and Wrocław. A recent study suggests spillover from the first tier of regional housing markets to other convergence clubs in Poland (Tomal, 2020). Aside from scientific relevance, this study has important policy implications. The uniform housing policy is more likely to be effective if convergence is strong. Similarly, housing policy tools may prove ineffective when divergence across markets is present.

3.4 Club membership explanation

Housing clubs do not form randomly, and their members share several characteristics. The economic literature investigated the factors influencing the formation of convergence clubs. Basically, two approaches were applied. Some papers used a logit model to explain what factors increase the probability of two cities belonging to the same housing convergence club (Holmes et al., 2018; Tomal, 2021c). On the other hand, based on the principles of regional economics, several papers adopted a concept of a hierarchy of housing markets and applied the ordinal logit model to explain convergence club membership (Blanco et al., 2016; Matysiak & Olszewski, 2019). We used the latter approach. Following the guidelines in economic growth literature (Bartkowska & Riedl, 2012; Galor, 1996), as well as prior housing studies (Blanco et al., 2016; Holmes et al., 2011; Matysiak & Olszewski, 2019), we explored the role of latent, fundamental factors that affect the convergence patterns. We accounted for initial conditions on the market and structural characteristics. In the former group, we considered the initial population of the city (Pop) and the level of house prices (Price) at the beginning of the convergence period. Structural characteristics correspond to salient demand (employment, wages, migrations, etc.) and supply (construction, planning) factors that affect the housing market. Due to data access issues, not all valid structural characteristics are available for the entire study period (for example, some are only available for selected years during the post-crisis subperiod). From the initial set of potential indicators, we chose the annual housing stock growth as a proxy for changing housing supply (HStock) and unemployment rate (Unemp) as a demand indicator. The descriptive statistics are presented in the table (Table 5).

To explain the formation of housing clubs across cities in Poland, we use an ordered regression model (McKelvey & Zavoina, 1975), similarly to most of the prior studies both in housing (Blanco et al., 2016; Holmes et al., 2018; Matysiak & Olszewski, 2019) and income growth research (Bartkowska & Riedl, 2012). In the empirical setting, we adopted in the study, the dependent variable (club) takes values from 1 to 3 and represents the housing club to which a city belongs. The club variable is ordinal, as housing clubs can be ranked based on the steady-state house price levels of cities in the given club (see Table 5), and values assigned (members of Club 1, first-tier housing markets) receive the highest value—3 or 4).

Due to the relatively small sample, our explorative analysis has some obvious limitations related to the robustness and stability of estimation results. For the same reason, we opted against including the extended set of explanatory variables and limited the number of structural characteristics and initial conditions indicators. The estimation results for the entire study period (1Q2000–4Q2019), as well as two subperiods before (1Q2000–3Q2008) and after (4Q2008–4Q2019) the financial crisis of 2008, are presented in the Table 6.

Estimation results are generally in line with expectations. The fit of the models is also satisfactory. Pseudo R-squared is 0.1973 for the entire study period and equals 0.4010 and 0.4735 in models covering before and after-crisis subperiods, respectively. That particular finding suggests that subperiods models perform better than our general model for the entire study period (Fig. 10).

The coefficients have expected signs (except unemployment in the model for the entire study period, alas it was not statistically significant) and are generally consistent and relatively stable across subperiods analysed. The estimates indicate that initial conditions affected the probability of belonging to the given club.

In general, cities with a larger population (Pop) were more likely to belong to higher-ranked housing clubs (positive coefficient). The effect was stronger before the financial crisis, but the estimation results were statistically significant at conventional levels in both subperiods.

Housing stock growth is positively linked with the city’s chances to belong to a higher-ranked club (club 2 or club 1). The HStock variable was statistically significant in the global model (encompassing the entire study period) and post-crisis subperiod (at 0.01 significance level). The results suggest that relatively high residential construction (and strong activity of residential developers) is associated with Poland’s first- and second-tier housing markets. Furthermore, the probability of a city belonging to a higher-ranked housing market decreased with the unemployment rate (Unemp) before and after the financial crisis (negative coefficient). In the former subperiod, the coefficient was statistically significant.

To explore the role of initial conditions and structural characteristics in the probability of belonging to the respective clubs and facilitate interpreting the results, we calculated the marginal effects of all explanatory variables. Additionally, we compare the role explanatory variables in both subperiods—before (from 1Q2000 to 3Q2008) and after the financial crisis (from 4Q2008 to 4Q2019), and plot marginal effects on probabilities (Fig. 11).

We observe that the initial population was instrumental in both subperiods and helped to explain the club membership. In both subperiods, cities with an initial population of 600,000 inhabitants most likely belonged to club 1 (first tier of housing markets in Poland). For example, in the initial period, they show a probability of 0.45 to belong to club 1, a probability of 0.38 to belong to club 2, and only 0.15 and 0.02 to belong to respectively to club 3 or club 4.

The structural characteristics (supply and demand factors) also played an instrumental role in explaining housing club membership. The high housing stock growth translated into club 1 membership, especially in the post-financial crisis subperiod. For example, cities with an average annual housing stock growth of 2.5% experienced a high probability of belonging to club 1 (0.56) or club 2 (0.43). On the other hand, the probability of belonging to club 3 was very low (less than 0.01). Similarly, the unemployment rate was also helpful in explaining house price convergence clubs. The tendency was particularly strong before the financial crisis. The cities with low unemployment rates typically belonged to club 1, while cities with the high unemployment rate, say 10%, usually belonged either to club 4 or club 3 (probability of 0.18 and 0.56 respectively). Meanwhile, they were less likely to belong to club 2 or club 1 (probability of 0.17 and 0.09, respectively).

As noted before, this explanatory study has some limitations. Obviously, we could not investigate several housing market fundamentals due to the methodology adopted (and a small number of observations for econometric modelling). Therefore, the alternative approach, as in Tomal (2021a, 2021b, 2021c), is feasible. However, it would only help us to explain the likelihood of belonging to the same convergence club. Still, it would not allow us to see how these factors affect the probability of belonging to the particular convergence club based on the value of fundamental demand and supply factors (especially considering the apparent hierarchy of housing markets).

4 Conclusions

In this study, we investigated the housing market convergence in Poland before and after the global financial crisis of 2007–2008. This particular empirical approach differs from prior evidence that can be found in the economic literature. Additionally, it sheds new light on regional residential market dynamics in Poland.

The contribution of this paper is twofold. Firstly, we fill the gap in the body of knowledge on the convergence of regional housing markets within an emerging economy setting that has been understudied. Compared with the vast amount of research on convergence in the United States and the United Kingdom, little is known about this phenomenon in Eastern European countries with their unique institutional framework. Second, we add to the body of empirical evidence on the convergence of regional housing markets in Poland. Contrary to prior research done by Zelazowski (2019) and Drachal (2018), and in line with recent studies of Tomal (2019, 2021b, 2021c), we used Phillips and Sul’s (2007) log t convergence test. This approach allows for identifying convergence clubs. We identified three major convergence clubs in Poland formed during the study period (2000–2019). The results differed when we considered subperiods before and after the global financial crisis (before and after the 3rd quarter of 2008). In the pre-crisis subperiod, we identified four clubs and two divergent housing markets. In the post-crisis subperiod, we identified three clubs and four divergent housing markets.

Compared with recent papers on convergence clubs in housing markets in Poland, the analysis of our novel house price indices covers a much more extended period using an expanded set of cities. In addition, we addressed the potential differences in housing market convergence pre-and post-2008 financial crisis, a topic often overlooked in other empirical studies.

The study has important policy implications. Due to discrepancies between regional housing markets in Poland, the uniform housing policy will probably be inefficient. House price dynamics and related problems caused by housing affordability are different in the first-tier cities (Warszawa, Kraków, Wrocław, Gdańsk and Gdynia) than in other regional housing markets. In the presence of divergence across housing markets, reasonable policy should target separate clubs separately. The same conclusions are found in the case of rental housing markets by Tomal (2021c), which is not surprising considering the interlinkages between investment and rental housing market segments.

There are some natural extensions to this study. Recent advances in econometrics (Schnurbus et al., 2017) modify the traditional Phillips and Sul (2007) approach. There are also other procedures for extracting convergence clubs (Blanco et al., 2016; Corrado et al., 2005; Hobijn & Franses, 2000). The results applying the concept of stochastic convergence could shed new light on the house price dynamics in the regional housing markets in Poland.

Notes

The legal difference between the cooperative ownership right to premises and the ownership right is the right to use the real estate. The housing cooperative is the owner of the building and the perpetual usufructuary or owner of the land under the building. In the case of ownership of separate premises, the holder is entitled to ownership of the residential premises and a share in the co-ownership of the land. While the ownership gives the full right to use and dispose of the property, the cooperative right to premises requires the cooperative's opinion to be taken into account in most decisions concerning the property.

However, the way in which information on the transactions of these rights is collected is different, and access to it is radically different. The secondary housing market in Poland is dominated by two forms of apartment ownership: outright ownership rights (about 75% of apartment transactions) and cooperative ownership rights (about 25% of apartment transactions). In the case of the ownership rights, transaction information is collected by 380 units (country starosts and mayors of towns with poviat rights). Prices are recorded in the Property Price Register (PPR), as well as: the address of the location of the property, numbers of plots of land included in the property, type of property, area of land, date of conclusion of a notarial deed or determination of value and other available data about the property and its components. The cooperative ownership rights and information on transaction prices are not collected in the PPR—from a legal point of view, such premises are not real estate. This causes enormous difficulties in obtaining information on transactions in this law. Moreover, given the number of cooperatives and how they store and make these data available, this is a cost-intensive activity. Obtaining such data requires transcription of information from notarial deeds concerning individual premises.

To supplement and confirm the obtained results, we focused on establishing the moment of the financial crisis to divide the whole period into pre and post-crisis (initially, we chose the third quarter of 2008). We verify two other moments: one quarter earlier and one quarter later. Investigating the moment of splitting the studied period into subperiods, we notice no differences in club converegnace formation.

References

Apergis, N., & Payne, J. E. (2012). Convergence in US house prices by state: Evidence from the club convergence and clustering procedure. Letters in Spatial and Resource Sciences, 5(2), 103–111. https://doi.org/10.1007/s12076-011-0075-7

Apergis, N., Simo-Kengne, B. D., & Gupta, R. (2015). Convergence in provincial-level South African House Prices: Evidence from the club convergence and clustering procedure. Review of Urban and Regional Development Studies, 27(1), 2–17. https://doi.org/10.1111/rurd.12029

Barro, R. J., & Sala-i-Martin, X. (1992). Convergence convergence. Journal of Political Economy, 100(2), 223–251. https://doi.org/10.1086/261816

Barro, R., & Sala-i-Martin, X. (1995). Economic growth (1st ed.). Massachusetts Institute of Technology.

Barros, C. P., Gil-Alana, L. A., & Payne, J. E. (2012). Comovements among US state housing prices: Evidence from fractional cointegration. Economic Modelling, 29(3), 936–942. https://doi.org/10.1016/j.econmod.2012.02.006

Barros, C. P., Gil-Alana, L. A., & Payne, J. E. (2014). Tests of Convergence and long memory behavior in US housing prices by State. Journal of Housing Research, 23(1), 73–88.

Bartkowska, M., & Riedl, A. (2012). Regional convergence clubs in Europe: Identification and conditioning factors. Economic Modelling, 29(1), 22–31. https://doi.org/10.1016/j.econmod.2011.01.013

Bełej, M. (2018). Synergistic network connectivity among urban areas based on non-linear model of housing prices dynamics. Real Estate Management and Valuation, 26(4), 22–34. https://doi.org/10.2478/remav-2018-0033

Blanco, F., Martín, V., & Vazquez, G. (2016). Regional house price convergence in Spain during the housing boom. Urban Studies, 53(4), 775–798. https://doi.org/10.1177/0042098014565328

Brzezicka, J., & Wisniewski, R. (2016). Translocality on the real estate market. Land Use Policy, 55, 166–181. https://doi.org/10.1016/j.landusepol.2016.03.031

Burger, P., & Rensburg, L. (2008). Metropolitan House prices in South Africa: Do they converge? South African Journal of Economics, 76(2), 291–297.

Canarella, G., Miller, S., & Pollard, S. (2012). Unit roots and structural change: An application to US house price indices. Urban Studies, 49(4), 757–776. https://doi.org/10.1177/0042098011404935

Churchill, S. A., Inekwe, J., & Ivanovski, K. (2018). House price convergence: Evidence from Australian cities. Economics Letters, 170, 88–90. https://doi.org/10.1016/j.econlet.2018.06.004

Corrado, L., Martin, R., & Weeks, M. (2005). Identifying and interpreting regional convergence clusters across Europe. The Economic Journal, 115(502), C133–C160.

Drachal, K. (2018). Causality in the polish housing market: Evidence from biggest cities. Financial Assets and Investing, 9(1), 5–20. https://doi.org/10.5817/fai2018-1-1

Drake, L. (1995). Testing for convergence between UK regional house prices. Regional Studies, 29(4), 357–366. https://doi.org/10.1080/00343409512331349023

Fereidouni, H. G., Al-Mulali, U., Lee, J. Y. M., & Mohammed, A. H. (2016). Dynamic relationship between house prices in Malaysia’s major economic regions and Singapore House Prices. Regional Studies, 50(4), 657–670. https://doi.org/10.1080/00343404.2014.928408

Galor, O. (1996). Convergence? Inferences from theoretical models. The Economic Journal, 106(437), 1056–1069. https://doi.org/10.2307/2235378

Głuszak, M., Czerski, J., & Zygmunt, R. (2018). Estimating repeat sales residential price indices for Krakow. Oeconomia Copernicana, 9(1SE), 55–69. https://doi.org/10.24136/oc.2018.003

Gnat, S. (2014). Price convergence of local property market in Szczecin Metropolitan Area in 2008–2013. Studia i Prace WNEiZ, 36(1), 213–225.

Gnat, S. (2016). Tests for the presence of price convergence on residential property market in several districts of Szczecin in 2006–2009. Folia Oeconomica Stetinensia, 16(1), 186–195. https://doi.org/10.1515/foli-2016-0011

Gnat, S. (2017). Study on convergence of rates of return of residential property market in Szczecin in 2006–2016 in market phases context. Studia i Prace WNEiZ, 50(1), 139–154. https://doi.org/10.18276/sip.2017.50/1-10

Gong, Y., Hu, J., & Boelhouwer, P. J. (2016). Spatial interrelations of Chinese housing markets: Spatial causality, convergence and diffusion. Regional Science and Urban Economics, 59, 103–117. https://doi.org/10.1016/j.regsciurbeco.2016.06.003

Hill, R., & Trojanek, R. (2022). An Evaluation of Competing Methods for Constructing House Price Indexes: The Case of Warsaw. Land Use Policy, forthcoming.

Hill, R., Pfeifer, N., Steurer, M., & Trojanek, R. (2021). Warning : Transaction Prices can be detrimental to your house price index (Graz Economics Papers-GEP No. 2021–11). Graz.

Hobijn, B., & Franses, P. H. (2000). Asymptotically perfect and relative convergence of productivity. Journal of Applied Econometrics, 15(1), 59–81.

Holmes, M. J., & Grimes, A. (2008). Is there long-run convergence among regional house prices in the UK? Urban Studies, 45(8), 1531–1544. https://doi.org/10.1177/0042098008091489

Holmes, M. J., Otero, J., & Panagiotidis, T. (2011). Investigating regional house price convergence in the United States: Evidence from a pair-wise approach. Economic Modelling, 28(6), 2369–2376. https://doi.org/10.1016/j.econmod.2011.06.015

Holmes, M. J., Otero, J., & Panagiotidis, T. (2018). Climbing the property ladder: An analysis of market integration in London property prices. Urban Studies, 55(12), 2660–2681. https://doi.org/10.1177/0042098017692303

Hudson, C., Hudson, J., & Morley, B. (2017). Differing house price linkages across UK regions: A multi-dimensional recursive ripple model. Urban Studies, 55(8), 1636–1654. https://doi.org/10.1177/0042098017700804

Kim, Y. S., & Rous, J. J. (2012). House price convergence: Evidence from US state and metropolitan area panels. Journal of Housing Economics, 21(2), 169–186. https://doi.org/10.1016/j.jhe.2012.01.002

Kokot, S. (2017). Analiza porównawacza indeksów cen nieruchomości publikowanych w Polsce. Problemy Rynku Nieruchomosci, 2017, 47–48.

Konawalczuk, J. (2014). Ocena wybranych baz danych prywatnych i publicznych wykorzystywanych do sporządzania w latach 2006–2012 raportów rynkowych dotyczących transakcji sprzedaży lokali mieszkalnych - na przykładzie Katowic. Studia Ekonomiczne, 204, 80–95.

Larraz-Iribas, B., & Alfaro-Navarro, J.-L. (2008). Asymmetric behaviour of Spanish regional house prices. International Advances in Economic Research, 14, 407–421. https://doi.org/10.1007/s11294-008-9166-7

Leamer, E. (2007). Housing is the business cycle (NBER working paper no. 13428).

Lean, H. H., & Smyth, R. (2013). Regional house prices and the ripple effect in Malaysia. Urban Studies, 50(5), 895–922. https://doi.org/10.1177/0042098012459582

Lee, C.-C., Lee, C.-C., & Chiang, S.-H. (2016). Ripple effect and regional house prices dynamics in China. International Journal of Strategic Property Management, 20(4), 397–408. https://doi.org/10.3846/1648715X.2015.1124148

Luo, Z. Q., Liu, C., & Picken, D. (2007). Housing price diffusion pattern of Australia’s state capital cities. International Journal of Strategic Property Management, 11(4), 227–242. https://doi.org/10.1080/1648715X.2007.9637571

MacDonald, R., & Taylor, M. P. (1993). Regional house prices in Britain: Long-run relationships and short-run dynamics. Scottish Journal of Political Economy, 40(1), 43–55. https://doi.org/10.1111/j.1467-9485.1993.tb00636.x

Mankiw, G., Romer, D., & Weil, D. (1992). A contribution to the empirics of economic growth. The Quarterly Journal of Economics, 107(2), 407–437.

Matysiak, G., & Olszewski, K. (2019). A panel analysis of polish Regional Cities: Residential price convergence in the primary market. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3408797

McKelvey, R. D., & Zavoina, W. (1975). A statistical model for the analysis of ordinal level dependent variables. The Journal of Mathematical Sociology, 4(1), 103–120. https://doi.org/10.1080/0022250X.1975.9989847

Meen, G. (1996). Spatial aggregation, spatial dependence and predictability in the UK housing market. Housing Studies, 11(3), 345–372. https://doi.org/10.1080/02673039608720862

Meen, G. (1999). Regional house prices and the ripple effect: A new interpretation. Housing Studies, 14(6), 733–753. https://doi.org/10.1080/02673039982524

Mendez, C. (2020). Convergence clubs in labor evidence proximate sources productivity and its from developed and developing countries. Springer.

Meng, H., Xie, W., & Zhou, W. (2015). Club convergence of house prices: Evidence from China’s ten key cities. International Journal of Modern Physics B, 29(24), 1550181. https://doi.org/10.1142/S0217979215501817

Miles, W. (2015). Regional house price segmentation and convergence in the US: A new approach. The Journal of Real Estate Finance and Economics, 50(1), 113–128. https://doi.org/10.1007/s11146-013-9451-y

Montagnoli, A., & Nagayasu, J. (2015). UK house price convergence clubs and spillovers. Journal of Housing Economics, 30(Supplement C), 50–58. https://doi.org/10.1016/j.jhe.2015.10.003

Montañés, A., & Olmos, L. (2013). Convergence in US house prices. Economics Letters, 121(2), 152–155. https://doi.org/10.1016/j.econlet.2013.07.021

Nissan, E., & Payne, J. E. (2013). A simple test of σ-convergence in US housing prices across BEA regions. The Journal of Regional Analysis and Policy, 43(2), 178–185.

Oikarinen, E. (2004). The diffusion of housing price movements from center to surrounding areas. Journal of Housing Research, 15(1), 3–28. https://doi.org/10.5555/jhor.15.1.7w1528476k7nu4j5

Payne, J. E. (2012). The long-run relationship among regional housing prices: An empirical analysis of the US. Journal of Regional Analysis and Policy, 42(1), 28–35.

Phillips, P. C. B., & Sul, D. (2007). Transition modeling and econometric convergence tests. Econometrica, 75(6), 1771–1855.

Phillips, P. C. B., & Sul, D. (2009). Economic transition and growth. Journal of Applied Econometrics, 24(7), 1153–1185. https://doi.org/10.1002/jae.1080

Phillips, P. C. B., & Shi, Z. (2021). Boosting: Why you can use the hp filter. International Economic Review, 62(2), 521–570.

Sala-i-Martin, X. X. (1996). Regional cohesion: Evidence and theories of regional growth and convergence. European Economic Review, 40(6), 1325–1352. https://doi.org/10.1016/0014-2921(95)00029-1

Schnurbus, J., Haupt, H., & Meier, V. (2017). Economic transition and growth: A replication. Journal of Applied Econometrics, 32(5), 1039–1042.

Sichera, R., & Pizzuto, P. (2019). Convergence clubs: A package for performing the phillips and sul’s club convergence clustering procedure. R Journal, 11(2), 142–151. https://doi.org/10.32614/rj-2019-021

Stevenson, S. (2004). House price diffusion and inter-regional and cross-border house price dynamics. Journal of Property Research, 21(4), 301–320. https://doi.org/10.1080/09599910500151228

Teye, A. L., Knoppel, M., de Haan, J., & Elsinga, M. G. (2017). Amsterdam house price ripple effects in The Netherlands. Journal of European Real Estate Research, 10(3), 331–345. https://doi.org/10.1108/JERER-11-2016-0041

Tomal, M. (2019). House price convergence on the primary and secondary markets: Evidence from polish provincial capitals. Real Estate Management and Valuation, 27(4), 62–73. https://doi.org/10.2478/remav-2019-0036

Tomal, M. (2020). Spillovers across house price convergence clubs: Evidence from the polish housing market. Real Estate Management and Valuation, 28(2), 13–20. https://doi.org/10.1515/remav-2020-0012

Tomal, M. (2021a). Exploring the meso-determinants of apartment prices in Polish counties using spatial autoregressive multiscale geographically weighted regression. Applied Economics Letters. https://doi.org/10.1080/13504851.2021.1891194

Tomal, M. (2021b). Identification of house price bubbles using robust methodology: Evidence from Polish provincial capitals. Journal of Housing and the Built Environment. https://doi.org/10.1007/s10901-021-09903-3

Tomal, M. (2021c). Testing for overall and cluster convergence of housing rents using robust methodology: Evidence from Polish provincial capitals. Empirical Economics. https://doi.org/10.1007/s00181-021-02080-w

Trojanek, R. (2010). Dwelling’s price fluctuations and the business cycle. Economics and Sociology. https://doi.org/10.14254/2071-789X.2010/3-2/7

Trojanek, R. (2018). Teoretyczne i metodyczne aspekty wyznaczania indeksów cen na rynku mieszkaniowym. Wydanictwo Uniwersytetu Ekonomicznego w Poznaniu, Poznań

Trojanek, R. (2021). Housing Price Cycles in Poland—the Case of 18 Provincial Capital Cities in 2000–2020. International Journal of Strategic Property Management, 25(4), 332–345. https://doi.org/10.3846/ijspm.2021.14920

Trojanek, R., Gluszak, M., Hebdzynski, M., & Tanas, J. (2021). The COVID-19 pandemic, airbnb and housing market dynamics in Warsaw. Critical Housing Analysis, 8(1), 72–84. https://doi.org/10.13060/23362839.2021.8.1.524

Tsai, I. C. (2018a). House price convergence in euro zone and non-euro zone countries. Economic Systems, 42(2), 269–281. https://doi.org/10.1016/j.ecosys.2017.05.010

Tsai, I. C. (2018b). Housing price convergence, transportation infrastructure and dynamic regional population relocation. Habitat International, 79(July), 61–73. https://doi.org/10.1016/j.habitatint.2018.07.004

Tsai, I. C. (2018c). Relationships among regional housing markets: Evidence on adjustments of housing burden. Economic Modelling. https://doi.org/10.1016/j.econmod.2018c.09.026

Tsai, I. C., & Chiang, S.-H. (2019). Exuberance and spillovers in housing markets: Evidence from first- and second-tier cities in China. Regional Science and Urban Economics, 77, 75–86. https://doi.org/10.1016/j.regsciurbeco.2019.02.005

Van Nieuwerburgh, S., & Weill, P.-O. (2010). Why has house price dispersion gone up? The Review of Economic Studies, 77(4), 1567–1606. https://doi.org/10.1111/j.1467-937X.2010.00611.x

Wójcik, P. (2016). Estymacja jądrowa w badaniach regionalnej konwergencji. Wiadomości Statystyczne, 10(665), 7–21.

Young, A. T., Higgins, M. J., & Data, E. U. S. C. (2008). Sigma convergence versus beta convergence: Evidence from U.S. county-level data. Journal of Money, Credit and Banking, 40(5), 1083–1093.

Zelazowski, K. (2019). Price convergence in the regional housing markets in Poland. Real Estate Management and Valuation, 27(2), 44–52.

Funding

This work was supported by the National Science Centre of Poland under Grant number 2017/27/B/HS4/01848.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Trojanek, R., Gluszak, M., Kufel, P. et al. Pre and post-financial crisis convergence of metropolitan housing markets in Poland. J Hous and the Built Environ 38, 515–540 (2023). https://doi.org/10.1007/s10901-022-09953-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10901-022-09953-1