It is not a lucky word, this name “impossible”.

no good comes of those who have it so often in their mouths.

Thomas Carlyle (1795–1881)

Abstract

Although the negative effects of overconfidence are more likely to be mentioned in the literature, some researchers have argued that the benefits of overconfidence may outweigh its costs. We attempted to explore the positive effects of overconfidence in competitive situations. We had participants compete against fake opponents who were overconfident and then measured their competitive performance in two studies. In Study 1 we examined the effects of overconfidence on competitive performance in a competitive situation and the possible mechanism for this overconfidence. In Study 2 we investigated the characteristics of the performance in a competition after a mismatch between the level of confidence and the fake opponent’s actual competence was revealed. Our results indicated that overconfident individuals tend to be perceived as more competent and more likely to benefit in the process of competition. Even after a mismatch between the level of confidence and the real competence was revealed, the overconfident individuals were not punished in that they made as much money as the less overconfident and still got higher competence ratings. Together those studies suggested that overconfidence has its advantages in competitive situations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

It is a plain fact that we are in a world, whether in our own personal social life (Sheridan and Williams 2011) or the economic arena or the political life of a nation (Porter 2000; Rochet and Tirole 2003), in which competition occurs in all areas and at all levels. In such competitive situations, people continually compete with each other for resources (Buss 1988), especially limited ones, and profit from that competition. Many researchers have studied the characteristics of people who benefit more from competitive situations. Previous studies show that many factors, such as physical attractiveness (Anderson et al. 2001; Fink et al. 2014; Fisher and Cox 2009), gender (Niederle and Vesterlund 2008, 2011), motivation (Burguillo 2010; Vallerand et al. 1986), emotion (McIlroy 2014), intelligence (Cote and Miners 2006; Voola et al. 2004; Watkin 2000), and personality traits (Anderson et al. 2001; McAbee and Oswald 2013), may affect the performance of competitors. Some of the above factors, each of which has its own distinct effect on the competitive process, can influence the competitive advantage. For instance, a large body of studies on negotiation, which is a typical kind of competition, demonstrated that being male (Hong and Wijst 2013; Kray et al. 2004), having a high emotional intelligence and cognitive ability (Kim et al. 2014, 2015; Smithey Fulmer and Barry 2004), and having a positive emotion (de Melo et al. 2012; Sinaceur and Tiedens 2006; Van Kleef et al. 2010) tended to lead to favorable outcomes.

In addition, some personality traits, such as agreeableness and openness (Dimotakis et al. 2012; Sass and Liao-Troth 2015), as well as assertiveness (Elfenbein et al. 2010; Ma and Jaeger 2005), also have significant influences on competitive behaviors. Similarly, another personality trait, overconfidence, can have some influence on the performance of competitors (Parfitt and Pates 1999; Woodman and Hardy 2003). Although the negative effects of overconfidence in our daily lives, such as diagnostic errors in medicine (Berner and Graber 2008), the causes of war (Johnson et al. 2006), low interpersonal credibility (Schultze and Stabell 2004), and the pursuit of unreasonable goals (Kahneman and Lovallo 1993), were more likely to be mentioned in the previous literature, some researchers have argued that overconfidence is favored by natural selection and that the benefits of overconfidence may outweigh its costs (Compte and Postlewaite 2004; Johnson and Fowler 2011; Von Hippel and Trivers 2011), thus potentially conveying an evolutionary advantage. Johnson and Fowler (2011) indicated that overconfidence could improve a person’s social adaptability, which could cause individuals to have an easier access to benefits. What is more, overconfidence can affect opponents in a competition. Geller and Singer (1998) found that overconfidence can sometimes compel a rival’s opponents to back down short of war. Fu et al. (2013) also indicated that those who have a high level of confidence may discourage their opponents and deter them from entering into competition. Therefore overconfident individuals may be able to force their opponents to make concessions and thus be more likely to benefit from a competitive situation.

Previous researchers focused on the factors that influence competitive performance as well as on the relationship between the level of confidence and competition (Archard 2012; Cecchini et al. 2001; Matsumoto et al. 2000). However, no prior research has investigated the extent to which overconfident individuals gain (or lose) in a competition. In addition, no studies have previously researched a possible mechanism that could explain the relationship between overconfidence and gains (or losses). Finally, no one has adequately tested whether individuals will be punished or will continue to be rewarded by gains from subsequent competitions after a mismatch between confidence and actual competence is revealed.

Drawing on previous literature, the first goal of the current study was to explore the effects of overconfidence on competitive performance in a situation and to attempt to identify a possible mechanism (Study 1). The second goal was to reveal the characteristics of a competitive performance after a mismatch between the level of confidence and the opponent’s actual competence is revealed (Study 2). In the following section, we first introduce a detailed theoretical framework of the existing research and then show how we developed our hypothesis step by step.

Theoretical Framework and Hypothesis Development

Overconfidence and Its Behavioral Effect

Overconfidence refers to a groundless, high level of confidence (Forster and Sarasvathy 2007; Pillai 2010; Teigen et al. 2007). In general, overconfidence can be defined as a tendency to overestimate one’s own ability or knowledge relative to objective criteria (Krueger and Wright 2011; Moore and Healy 2008), or relative to others (the better than average effect) (Larrick et al. 2007), or relative to future uncertainty (Erceg and Galić 2014; Thunström et al. 2015).

Previous work has extensively examined the negative effects of overconfidence on vast areas of social life, including personal judgments and daily decision making (Dawes and Mulford 1996; Moore and Healy 2008), corporate economic investments and trade performance (Barber and Odean 2001; Cheng 2007; Malmendier and Tate 2005; Tekçe and Yılmaz 2015), and national political decisions (Bouris 2006; Ortoleva and Snowberg 2013).

In contrast to the above findings, however, the positive illusions hypothesis holds that, even when confidence is objectively unwarranted (overconfidence), it can be advantageous in some ways (Taylor and Brown 1994; Taylor et al. 2003). Johnson and Fowler (2011) found that overconfidence has evolutionary significance in natural selection because it can boost ambition, morale, or the credibility of bluffing, all of which can increase profits in conflict and help improve a person’s social adaptability. In addition, overconfidence has positive effects on emotion and motivation. Research has showed that an overly positive self-evaluation, which is noticeably lacking only in the clinically depressed (Alloy and Ahrens 1987; Pyszczynski et al. 1987), can enhance psychological well-being (Brunnermeier and Parker 2005; Caplin and Leahy 2001; Köszegi 2006) and further help to foster positive motivation and persistence (Taylor and Brown 1988). Moreover, overconfidence also appears to reap performance benefits. Von Hippel and Trivers (2011) and Compte and Postlewaite (2004) suggested that overconfidence increased the probability of success. Kyle and Wang (1997) found evidence that an overconfident manager can persist and survive longer over the long run because his overconfidence may hurt his rational opponent more than himself.

Additionally, the level of confidence has been demonstrated to have an obvious influence on the process of interpersonal interactions. For example, compared with under-confidence, people who have an overly positive self-judgment (overconfidence) can use this to help them convince observers they are smarter and more reliable. Thus people are more likely to be persuaded by overconfident individuals (Radzevick and Moore 2011) and have a tendency to follow their advice (Sniezek and Van Swol 2001). In addition, because perceived overconfidence makes others believe they are stronger and more powerful, overconfident individuals can prevail and hence do not have to make concessions (Kahneman and Tversky 1984; Leary 2007; Von Hippel and Trivers 2011). Therefore, in a competitive situation, which can be seen as a distinct form of interpersonal interaction (Decety et al. 2004), once an opponent is perceived as having a high level of confidence, competitors tend to believe that their opponent’s decision is appropriate and then make a concession. Based on these previous findings, we hypothesized that:

H1:

Overconfident people are more likely to benefit in competitive situations.

Perceived Opponent’s Competence and Overconfidence

Generally, a high level of confidence can convince others that the confident person has superior ability (Tenney and Spellman 2010; Tenney et al. 2008). In competitive situations, people often need to assess their opponents’ competence using superficial cues such as their sex (Sczesny and Kühnen 2004; Wood and Karten 1986), physical appearance (Jackson et al. 1995; Sczesny et al. 2006), and personality traits (Anderson and Kilduff 2009). Previous studies also showed that a high level of confidence will lead individuals to display more competence by both verbal and nonverbal cues during the process of associating with others (Anderson et al. 2012). For instance, Scherer et al. (1973) found that a high degree of confidence was expressed by paralinguistic cues such as increased loudness of voice, rapid rate of speech, and infrequent, short pauses. Walker (1977) indicated that nonverbal behaviors, such as gestures and eye-movements can also convey confidence. These competence cues enable individuals to be perceived as more competent, regardless of their real ability. More directly, Radzevick and Moore (2011) demonstrated that people were perceived to be more capable when they exhibited excessive confidence in their answers. Based on the above research, we can draw the conclusion that when individuals are more confident of their abilities, others will perceive them as more competent.

From another perspective, capable individuals who appear to be powerful, knowledgeable, and reliable tend to take an advantageous position in interactions with others. There is no doubt that people who are perceived as competent can enhance their own competitiveness, such as by improving their social status (Kennedy et al. 2013). However, the perceived competence of individuals, which gives rise to positive social inferences about them, will have an impact on others’ social behaviors (Weiner 2005) and even damage others’ performance (Fu et al. 2013). For instance, some researchers have revealed that if individuals can be convinced of the quality of their opponents based on non-verbal behavior in a competition, the perceivers’ confidence will be hurt (Greenlees et al. 2005). Furthermore, Locke and Anderson (2015) indicated that a powerful individual will even decrease others’ participation. Therefore, individuals who are perceived as smarter or stronger may cause their opponents to withdraw from a competitive situation.

The literature on the relationship between overconfidence and perceived competence, as well as between perceived competence and performance, allows us to conclude that overconfident individuals are more likely to be perceived as more competent regardless of their actual competence, enabling them to dominate in competitive situations and to cause their opponents to make greater concessions and gain fewer benefits. Therefore, we hypothesized that:

H2:

Overconfidence can help individuals appear more competent than a lower level of overconfidence (or under-confidence) does.

H3:

Individuals perceived as competent are more likely to benefit in competitive situations.

H4:

The perception of competence can mediate the effect of overconfidence on the performance in competitive games.

The Effect of a Mismatch Between Confidence Level and Performance on Subsequent Outcomes

Another interesting issue is, when a mismatch between confidence level and performance is revealed to others, will an overconfident opponent with a low competence be punished and pay a price in a subsequent competition? Little evidence, however, has been generated about this area.

Evidence from studies on first impressions may give us some insight into the effects of a mismatch between overconfidence and low competence. People are strongly influenced by the first piece of information to which they are exposed (Lim and Benbasat 2000). First impressions are always inconsistent with people’s real personality traits, a fact which indicates the limitations of human information processing (Deffuant and Huet 2006; Lim et al. 2000). Furthermore, when they have a strong first impression, people tend to reinterpret subsequent information to fit their first impression (Fang and Rajkumar 2008). Thus, individuals are always biased in the direction of the initial influence when they evaluate subsequent information (Curhan and Pentland 2007; Lim and Benbasat 2000). Briñol et al. (2012) indicated that if an individual leaves a powerful first impression, they will come out better in a subsequent judgment. For instance, in a competitive situation, after receiving a favorable first impression about their opponents (such as positive body language), participants will report less confidence in their ability to win (Greenlees et al. 2005). More directly, Kennedy et al. (2013) found that group members still reacted positively to individuals who were revealed to be overconfident. Thus, it is reasonable to expect that overconfident individuals will not lose in a fair competition, even after their overconfidence on task- related competence is revealed to be groundless. Therefore, we hypothesized that:

H5:

During the process of competing, overconfident individuals will not lose even after the mismatch between a groundless confidence level and actual competence is revealed.

The Present Study

The two studies presented in this paper examined whether overconfident competitors perform better in a single competition task than in repeated ones and whether this difference could be attributed to the impact of a perceived competence of their opponents. To test the above hypotheses, the present research used two studies to investigate competition in a “betting” game in which the participants made decisions whether or not to bet with an opponent who had answers that were the opposite of theirs and who indicated that they were confident that their answers were correct. In our study, the “betting” game had the following advantages: First, real money was won or lost. This should have increased the participants’ motivation to win in the competition. Second, it could be repeated with the same sample to test, over the long run, whether the possible costs of overconfidence could outweigh its benefits. Third, the “betting” game captured the essence of competition. The experimenter provided the base-line resources for the competition (4 RMB). Once the competitors agreed to participate in the “betting” game, they each had to pay their 2 RMB which from their own money to the referee. Only the winner would get the resources—4 RMB. Those who chose not to participate would not lose any actual money, and those who participated without a competitor because their potential competitor refused to play would obtain the resources (the full 4 RMB) directly. The situation we modeled—the betting game—was simple, but general and captured the essence of a broad range of competition for resources including war, market competition, and litigation. When two or more individuals or organizations enter into a real competition, there are definite costs (e.g., money, time) to both or all competitors. At the end the winner takes the resources. However, if only one individual or organization claims the resources, the resources will usually be taken away by the claimant without any costs. In the present study, Study 1 tested Hypotheses 1–4 and Study 2 tested Hypothesis 5. In both studies, the participants played a betting game with fake opponents who were either overconfident or less overconfident.

In Study 1, we first measured the participants’ overconfidence using a 40 item general knowledge questionnaire, which told the participants to choose the correct answer from two options and to assess how sure he or she was that the selected option was correct. Second, we selected ten items out of the 40 which had opposite answers with equal probabilities of 50% accuracy between the participant and a fake opponent; then we asked the participants to make betting decisions for each of the ten selected items. The fake betting opponent’s choices on the ten items were all “to bet”. Thus, if the actual participant chose “to bet,” both of them should pay 2 RMB to the referee. Then the one who gave the correct answer would win 4 RMB for a reward. If the participant chose “not to bet”, his or her betting opponent will win the 4 RMB for a reward regardless of whether the answer was right or wrong. Finally, the participants were asked to complete a series of questions related to betting. Our goal in doing this was to test whether overconfident individuals are more likely to benefit in competitive games and to examine the possible mediators.

In Study 2, we employed a two-phase paradigm. Phase 1 and Phase 2 took the same approach used in Study 1. The only difference was that we gave the participants feedback about the correctness of their opponents between the two phases. Our reason was that we wanted to tell them about the mismatch between the confidence level and actual competence of their opponents. This additional operation was designed to test whether overconfident individuals will be punished when the mismatch between their confidence level and their actual competence was revealed to their equally competent opponents.

Study 1

Methods

Participants

Sixty college students (33 females and 27 males; mean age = 24 years, SD = 3.16) participated in the experiment. They were recruited using ads in which they were offered money (a standard fee of 15 Chinese RMB plus any income from the betting game) to participate in the experiment.

Materials and Procedure

When the participants came to the lab, they were led into one of the lab rooms and were told that the person who would do the experiment with him/her was in the other identical room. To make the participants believe that their betting opponent was real, the following procedures preceded the experiment. First, the participants were informed that he/she should come to the lab on time because the experimental task required him/her to work together with another participant. If one of them was late, the other would have to wait, and the experiment could not be performed. Second, we pasted notes stating “Experiment in Progress; Do Not Disturb” on two adjoining doors. The notes showed that two labs were available for the current experiment.

The experimenter told the participants that there were two parts to the experiment and the first part was to fill in a general knowledge questionnaire and the second part was to play a betting game with the other participant.

The general knowledge questionnaire contained 40 general knowledge items which are questions that are commonly used to measure general knowledge overconfidence. The following is the form of the item:

-

Which city in New Zealand has a greater area?

-

a. Hamilton b. Auckland

-

Chosen Answer: a b

-

Probability that my answer is correct (50%–100%): _____ %

As suggested by the form of the question, there were two tasks for the respondent to complete. First, the respondent had to state which of the two alternatives they believed was correct. Then the respondent had to indicate how sure he or she was that the selected alternative really was correct.

According to Yates et al. (1996), overconfidence in a general knowledge task is typically indexed by the difference between the participant’s average probability judgment and the proportion of questions the participant answers correctly, as follows:

To try our best to prevent the participants from getting extra information to deduce the knowledge level of the fake participants (e.g., I knew the correct answer of the item, my betting opponent’s answer was wrong, but he/she was very confident about his/her choice, so he/she is poorly informed, and his/her confidence on other items should not be trusted.), we selected very hard items to constitute the general questionnaire. A pilot study tested the level of difficulty of the general questionnaire on a separate group of participants (n = 26; mean age = 21 years, SD = 0.89) who only performed the general knowledge questionnaire. The results showed that the frequency of correct answers was 0.50 (SD = 0.09), which was no better than random guessing, indicating that the items on the general questionnaire were indeed very difficult.

In the present experiment, when they completed the questionnaire, the participants were required to express their “real” choice and their corresponding confidence level. The questionnaire was completed in triplicate with carbon paper.

When the participants completed the general knowledge questionnaire, they were told that the experimenter would pay close attention to him/her and the other participants at all times.

When all the items on the general questionnaire were completed, the experimenter left one of the three copies for the participant, who was told that one of the two copies the experimenter took away would be given to his/her betting opponent who was taking part in the experiment with him/her, and the other one would be kept by the experimenter to choose items for their bets. After that, the experimenter randomly gave one of the fake general knowledge questionnaires, which were filled out by the experimenter previously, to the participant.

There were two versions of fake questionnaires that represented either a very overconfident bettor or a less overconfident bettor. The items in the fake questionnaires were exactly the same as the general knowledge questionnaire: the same items and the same distribution. Both of the fake questionnaires were filled by the same “Chosen Answers” (the correctness was 50%) but different confidence ratings. Confidence ratings in the very overconfident fake questionnaire were 85, 90, 95, and 100% and in the less overconfident fake questionnaire were 50, 55, 60, and 65%. In each version, the four confidence ratings were randomly assigned (in a ratio of 1:1:1:1) to the items. Thus, using the “mean probability judgment” minus “the correctness of the questions” yielded a very overconfident bettor’s overconfidence level of 42.5% and a less overconfident one’s of 7.5%.

The participants were told that the fake general knowledge questionnaire, which they should seriously compare with their own questionnaire, was done by their betting opponent who was in the other identical room. At the same time, the experimenter told the participants: “I will help your betting opponent do the second part of the experiment first and then will come back”. Then the experimenter left the participant’s room.

Ten items, for which the participants had selected the opposite answers to those on the fake questionnaires, were chosen from the questionnaires which were filled out by the participants. Five of the ten items the participants had previously responded to were correct and five were wrong.

About 10 min later, the experimenter came back to the participant’s room and told the participant that his/her betting opponent has just finished completing the betting game. Before playing the betting game, the participants were taught the details of the betting game.

The participants were told that a referee was employed to guarantee the fairness of the betting game. For each of the betting items, the experimenter would provide 4 RMB for the winner. There were ten betting items and they could choose “to bet” or “not to bet” in each betting situation. Then the experimenter explained the following betting rules to the participants:

If your choice is “to bet”, and your betting opponent’s choice is “to bet” also, then each of you should pay 2 RMB to the referee. In the end, the one who gave the correct answer to the betting item will win 4 RMB for a reward.

If you and your betting opponent chooses “not to bet” at the same time, then neither should pay for the refereeing fee but you cannot get the 4 RMB for the bet.

If either you or your betting opponent chooses “not to bet”, however, and the other chooses “to bet”, then the one whose decision is “to bet” will win the 4 RMB as a reward.

To ensure that the participants fully understood the rules, they had to pass a short comprehension quiz before proceeding to the betting. The following is an example of the quiz questions:

If your choice is “to bet” and your betting opponent’s choice is “not to bet”, then you should pay _____ RMB for refereeing and your betting opponent should pay _____ RMB for refereeing. In such a case, you _____ (can; cannot) win the 4 RMB for a reward and your betting opponent _____ (can; cannot) win the 4 RMB for a reward.

The participants were then told that his/her betting opponent’s choices on the ten items were all “to bet”. They should make their betting decision—“to bet” or “not to bet”—after the experimenter read the number of each of the ten selected items one by one. In the process of making their decisions, they could refer to their betting opponent’s questionnaire to see their opponents’ choices and confidence ratings.

Finally, the participants were required to complete the following questions:

1. Please rate the confidence level of your betting opponent on a 10-point scale from extremely low = 1 to extremely high = 10.

The item was used to check the effectiveness of the manipulation. If the manipulation was effective, the confidence rating of the fake very overconfident participant should be higher than that of the fake less overconfident participant.

2. Please rate your own confidence level on a 10-point scale from extremely low = 1 to extremely high = 10.

The item was also used the check the effectiveness of the manipulation. If the manipulation was effective, their confidence rating should be lower for themselves than for the fake very overconfident participant.

3. Please estimate the percent of the 10 betting items to which your betting opponent gave the correct answer _____.

The question was used to learn whether the participants thought that higher confidence is connected to greater correctness.

4. Please rate the task-related competence of your betting opponent on a 10-point scale from extremely weak = 1 to extremely strong = 10.

The question was used to learn whether a high confidence person would be recognized as more competent.

5. Please rate the bias between your betting opponent’s average accuracy and their average confidence rating (on a 10-point scale from extremely small = 1 to extremely large = 10).

This item was used to explore whether the participants could discriminate the degree of the match between the confidence and the relative accuracy of their betting opponents.

Immediately following this procedure, the participants were given all the correct answers to the ten items and were told how much money they had made in the betting game.

When the experiment was finished, the participants were asked to report whether they had any suspicions about the existence of their betting opponents during the progress of the experiment. None of the participants answered “Yes”. All the participants were fully debriefed, thanked, and paid for participating in the experiment. The flowchart of the overall process is shown in Fig. 1.

Results and Discussion

As expected, before the betting game started, accuracy, confidence, and overconfidence about the 40 general knowledge questions did not differ between the participants in the group who bet with the very overconfident bettors (n = 30) and the individuals in the group who bet with the less overconfident bettors (n = 30) (see Table 1 for details).

The Effectiveness of the Confidence Manipulation

The rating of the confidence level of the fake very overconfident bettor (M = 8.87, SD = 1.25) was higher than the rating of the fake less overconfident bettor (M = 5.90, SD = 2.48), t(58) = 5.84, p < 0.001. The participants recognized that their own confidence levels (M = 6.77, SD = 1.48) were equal to those of the fake less overconfident bettors, F(1, 29) = 2.66, p > 0.10, and their own confidence (M = 6.10, SD = 1.85) was lower than that of the fake very overconfident bettors, F(1, 29) = 56.74, p < 0.001. These results thus indicated that the confidence manipulation was valid.

Rating the Bias of the Opponents’ Average Accuracy and Average Confidence

The participants were not sensitive to the match between their betting opponents’ confidence and their relative accuracy, thus they rated the bias of the fake less overconfident betting opponent (M = 5.17, SD = 1.90) and the fake very overconfident betting opponent (M = 5.77, SD = 2.11), t(58) = 1.16, p > 0.10 as being statistically equal.

Rating of the Competence of the Fake Bettor

In line with the results of the perception of bias, the participants tended to consider the fake very overconfident bettors (M = 6.93, SD = 1.17) as being more competent than the fake less overconfident bettors (M = 5.10, SD = 1.19), t(58) = 6.03, p < 0.001. The fake very overconfident bettor (M = 5.03, SD = 1.30) was also perceived as being more accurate on the general knowledge items than the fake less overconfident bettor (M = 4.03, SD = 1.10), t(58) = 3.22, p < 0.01. These results indicated that there were psychological advantages of overconfidence in this competition.

Numbers Choosing “Not to Bet”

In the betting game, when betting with a fake very overconfident betting opponent, the participants tended to choose “not to bet” (betting with the very overconfident bettor: M = 3.13, SD = 1.72; betting with the less overconfident bettor: M = 1.50, SD = 1.36), t(58) = 4.09, p < 0.001. The fake very overconfident bettor (M = 11.67, SD = 7.86) made more money than the fake less overconfident bettor (M = 5.27, SD = 5.86), t(58) = 3.589, p < 0.01.

Mediation Effect of Peer-Rated Competence on Monetary Reward

Further analysis showed that the relationship between the type of fake bettors and amount of money made in the betting game was mediated by the peer-perceived task competence. We used Preacher and Hayes’ (2008) bootstrapping procedure with a 5000 resample with replacement to derive a 95% bias-corrected confidence interval for the indirect effect of overconfidence on the amount of money made in the betting game as transmitted via peer-perceived task competence. This analysis revealed that the difference between the mediated and unmediated effects of overconfidence in the bettors’ manipulations on money made in the betting game was estimated to lie between 1.22 and 8.35 with a 95% confidence interval. Because the interval excludes zero, this indicated a statistically significant indirect (or mediated) effect (Preacher and Hayes 2008). This suggests that overconfident individuals made more money in the betting game because their betting opponents perceived them as more competent at the task, even though they were not more competent at the task.

In sum, the findings from Study 1 suggested that overconfident individuals made more money in the betting game. Further, the findings suggested that this relationship was mediated by peer-perceptions of competence: overconfident individuals made more money because their betting opponents perceived them as more competent at the task.

Study 2

Methods

Participants

The participants were 64 undergraduate students (33 females and 31 males; mean age = 21.5 years, SD = 1.18). They were recruited for the experiment via posters displayed around the campus and were promised a monetary reward (the regular fee of 15 RMB plus the income in the betting game) for participating in the experiment.

Materials, Procedure, and Design

The materials were similar to those in Study 1. There were two phases in the experiment with two general knowledge questionnaires (40 items each) and similar fake questionnaires. The difficulties of both general questionnaires (M = 0.50, n = 26; M = 0.50, n = 22, respectively) were also pilot-tested on two separate groups of participants. The results indicated that the items of the general questionnaire were also indeed very difficult. The development of the fake questionnaires was completely identical to that of the fake questionnaires in Study 1.

After the participants completed Phase 1, which was identical to Study 1, the experimenter calculated how much money the participants and the fake participants made in the betting game. After that, the experimenter distributed a sheet of paper listing how much money the participant and his/her betting opponent made in the betting game and the number of betting items that the participant himself/herself and his/her betting opponent got right (5 each). The participants had already learned the confidence level of the fake participants, so they could infer the overconfidence level of their betting opponents by using the opponent’s confidence level minus the percent correct. Then, Phase 2 of the experiment began. Phase 2 was nearly a repetition of Phase 1 except for a change in the general knowledge questionnaire and the corresponding fake questionnaire.

The study had a 2 (betting with a very overconfident opponent vs. betting with a less overconfident opponent) × 2 (Phase 1 vs. Phase 2) mixed factorial design with repeated measures on the second factor.

Results

As expected, accuracy, confidence, and overconfidence in the two general knowledge questionnaires (employed in Phase 1 and Phase 2 separately) did not differ between the participants in the group who bet with the very overconfident betting opponent (n = 32) and the individuals in the group who bet with the less overconfident betting opponent (n = 32) (see Table 2 for details).

The Effectiveness of the Confidence Manipulation

In both Phase 1 and Phase 2, the participants believed that the confidence levels of the fake very overconfident betting opponents (Phase 1: M = 5.91, SD = 0.96; Phase 2: M = 5.66, SD = 0.97) was higher than that of the fake less overconfident bettors (Phase 1: M = 3.91, SD = 1.55; Phase 2: M = 4.38, SD = 1.31) (Phase 1: t(62) = 6.19, p < 0.001; Phase 2: t(62) = 4.43, p < 0.001). These results indicated that the confidence manipulation was valid.

In Phase 1, the confidence of the fake less overconfident bettors (M = 3.91, SD = 1.55) was rated higher than that of the participants’ own (M = 4.66, SD = 0.94), F(1, 31) = 5.073, p < 0.05, η2 = 0.141, and the confidence of the fake very overconfident bettors (M = 5.91, SD = 0.96) was also rated higher than that of the participants’ own (M = 3.72, SD = 1.05), F(1, 31) = 53.411, p < 0.001, η2 = 0.633. These results were similar in Phase 2. The participants rated their own confidence level (betting with a fake very overconfident bettor: M = 4.16, SD = 0.97; betting with a fake less overconfident bettor: M = 4.43, SD = 1.08) as lower than that of a fake very overconfident bettor (M = 5.66, SD = 0.97), F(1, 31) = 46.500, p < 0.001, η2 = 0.600, but equal to that of a fake less overconfident bettor (M = 4.37, SD = 1.31), F(1, 31) = 0.054, p > 0.10, η2 = 0.002. These results also indicated that the confidence manipulation was valid.

The Effectiveness of the Feedback Manipulation

Without feedback, the participants did not detect the difference in bias between the fake less overconfident bettors (M = 4.32, SD = 1.20) and the fake very overconfident bettors (M = 4.81, SD = 1.31), t(62) = 3.013, p > 0.10, which replicated the findings of Study 1. The fake very overconfident bettors (M = 4.84, SD = 1.02) were also rated as more accurate on the general knowledge items than the fake less overconfident bettors (M = 4.31, SD = 1.03), t(62) = 2.07, p < 0.05. By revealing the actual performance, the participants realized that the bias of the fake very overconfident bettors (M = 4.47, SD = 1.22) was greater than the bias of the fake less overconfident bettors (M– = 3.84, SD = 1.05), t(62) = 2.20, p < 0.05. The fake very overconfident bettors (M = 4.69, SD = 0.93) were also rated as no more accurate on the general knowledge items than the fake less overconfident bettors (M = 4.94, SD = 0.88), t(62) = 1.11, p > 0.10. These results suggested that the feedback manipulation was valid.

Rating of the Competence of the Fake Bettor

In line with the results of Study 1, the fake very overconfident bettors (M = 5.00, SD = 0.98) were perceived as more competent than the fake less overconfident bettors in Phase 1 (M = 3.81, SD = 0.99), t(62) = 4.79, p < 0.001. When the competence ratings of the fake bettors were analyzed with a 2 (type of bettor: fake very overconfident vs. fake less overconfident) × 2 (phase: Phase 1 vs. Phase 2) repeated measures ANOVA, the analysis revealed a main effect of phase, F(1, 62) = 7.58, p < 0.01, η2 = 0.109; and a significant effect of type of bettor, F(1, 62) = 14.23, p < 0.001, η2 = 0.187; and a significant type of bettor × phase interaction, F(1, 62) = 10.75, p < 0.01, η2 = 0.148. Further analysis showed that the competence rating of a very overconfident bettor was equivalent for Phase 1 (M = 5.00, SD = 0.98) and Phase 2 (M = 4.94, SD = 0.95), F(1, 62) = 0.14, p = 0.712. However, the fake less overconfident bettors were rated significantly more competent in Phase 2 (M = 4.53, SD = 0.95) than in Phase 1 (M = 3.81, SD = 0.10), F(1, 62) = 18.19, p = 0.000. Even so, the fake very overconfident bettors (M = 4.94, SD = 0.95) were perceived as marginally more competent than the fake less overconfident bettors (M = 4.53, SD = 0.95), t(62) = 1.712, p = 0.092. These results indicated that the psychological advantages of overconfidence partially persisted into Phase 2.

Number Choosing “Not to Bet”

In Phase 1, when betting with the fake very overconfident betting opponents, the participants tended to choose “not to bet” (betting with the very overconfident betting opponents: M = 4.00, SD = 2.06; betting with the less overconfident betting opponents: M = 2.41, SD = 2.01), t(62) = 3.13, p < 0.01, which replicated the results of Study 1. When the number of participants who chose “not to bet” was analyzed with a 2 (type of bettor: fake very overconfident vs. fake less overconfident) × 2 (phase: Phase 1 vs. Phase 2) repeated measures ANOVA, the analysis revealed a main effect of phase, F(1, 62) = 6.06, p < 0.05, η2 = 0.089; and a marginally significant effect of type of bettor, F(1, 62) = 3.53, p = 0.065, η2 = 0.054; and a significant type of bettor × phase interaction, F(1, 62) = 8.01, p < 0.01, η2 = 0.114. Further analysis showed that, after revealing the actual performance and overconfidence of the fake bettors, the participants tended to make a “to bet” choice when their betting opponents were the fake very overconfident bettor (choice of “not to bet”: Phase 1: M = 4.00, SD = 2.06; Phase 2: M = 2.66, SD = 2.34), F(1, 62) = 14.00, p < 0.001. There was no behavioral change on the part of the participants after they received the performance information about their opponents when their betting opponents were the fake less overconfident bettors (choice of “not to bet”: Phase 1: M = 2.41, SD = 2.01; Phase 2: M = 2.50, SD = 2.06), F(1, 62) = 0.07, p > 0.10.

Those results suggested that after getting the actual performance of the very overconfident bettors, the participants adjusted their betting choices.

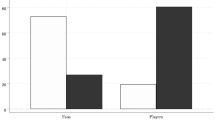

Money Made in the Betting Game

In Phase 1, the fake very overconfident bettors (M = 16.63, SD = 8.73) made more money than the fake less overconfident bettors (M = 10.00, SD = 8.86), t(62) = 3.01, p < 0.01, which was in line with the results of Study 1. When the monetary reward was analyzed with a 2 (type of bettor: fake very overconfident vs. fake less overconfident) × 2 (phase: Phase 1 vs. Phase 2) repeated measures ANOVA, the analysis revealed a main effect of phase, F(1, 62) = 4.55, p < 0.05, η2 = 0.068; and a marginally significant effect of type of bettor, F(1, 62) = 3.74, p = 0.058, η2 = 0.057; and a significant type of bettor × phase interaction, F(1, 62) = 6.38, p < 0.05, η2 = 0.093 (see Fig. 2 for details). Further analysis showed that the monetary reward of the less overconfidence bettor was the same in Phase 1 (M = 10.00, SD = 8.86) and Phase 2 (M = 10.44, SD = 8.63), F(1, 62) = 0.08, p > 0.10. However, the fake very overconfident bettor made significantly less money in Phase 2 (M = 11.44, SD = 9.93) than in Phase 1 (M = 16.63, SD = 8.73), F(1, 62) = 10.86, p < 0.01. Those results suggested that the overconfidence level was responsible for the very overconfident fake bettor’s reward after their actual performances were revealed. In Phase 2, the fake very overconfident bettor’s reward was equivalent to the fake less overconfident bettor’s, F(1, 62) = 0.18, p > 0.10, which suggested that, although the monetary benefits of initial overconfidence did not persist into Phase 2, the overconfident individuals were also not punished.

Mediation Effect of Peer-Rated Competence on Monetary Reward

An analysis showed that the relationship between the type of fake participants and the amount of money made in the betting game was mediated by the peer-perceived task competence in Phase 1, replicating the results of Study 1. We also used Preacher and Hayes’ (2008) bootstrapping procedure and found an indirect effect ranging from 0.11 to 0.30. Because zero was not in the 95% confidence interval, we concluded that the indirect (or mediated) effect was indeed significantly different from zero. This suggests that overconfident individuals made more money in the initial betting game because their betting opponents perceived them as more competent at the task.

However, peer-rated competence did not mediate overconfidence or the amount of money made in the betting game in Phase 2. The type of fake participants was not a significant predicator of the amount of money made in the betting game, β = 0.055, F(1, 63) = 0.185, p > 0.10. These results indicated that the confidence manifested after the truth about their owner’s ability was revealed, no longer influenced the choice of the opponents in the betting.

On the basis of these results, we can now draw a conclusion that the benefits of overconfidence partially persisted into Phase 2. Though the very overconfident bettors did not make more money than the less overconfident bettors in Phase 2, their betting opponents still maintained a high impression of their competence.

General Discussion

Utilizing two studies, the current research examined the effects of overconfidence on competitive performance and its possible mediators (Study 1). In addition, we further explored whether overconfident individuals would still benefit after the mismatch between their level of confidence and their actual competence was revealed (Study 2). As expected, compared with opponents with a low level of overconfidence, those who were more overconfident were perceived as more competent and were more likely to benefit in the process of competition. Even after the mismatch between the level of confidence and their real competence was revealed, the overconfident individuals were not punished but were still perceived as more competent than individuals with a low level of confidence and made an equal amount of money, suggesting that the benefits of overconfidence still existed in the long run.

Although numerous previous studies investigated the negative effects of overconfidence (Barber and Odean 2001; Bouris 2006; Moore and Healy 2008; Tekçe and Yılmaz 2015), more and more research has focused on the positive aspects of overconfidence (Taylor and Brown 1994; Taylor et al. 2003). Studies have confirmed that overconfidence can not only promote the ability to be happy and help to foster motivation and persistence (Taylor and Brown 1988) but also reap performance benefits and increase the probability of success (Compte and Postlewaite 2004; Von Hippel and Trivers 2011). To examine the positive effects in another important daily area, the present study explored the overconfidence effect in competitive situations. Partially in line with previous research that showed that overconfidence enhances an individual’s position in a group (Anderson et al. 2012), our study provided evidence that overconfident individuals are more likely to benefit than those who have a low level of confidence in competitive situations. This is probably because people are more likely to be persuaded by overconfident opponents (Radzevick and Moore 2011). That is, individuals tend to believe the answers proposed by overconfident opponents and may doubt their own answers in competitive situations (i.e., betting games in the current study). On the other hand, overconfidence is likely to be interpreted as a strong and powerful personality trait, and overconfident individuals can make others believe they can prevail (Kahneman and Tversky 1984). In keeping with the above discussion, because they trusted the overconfident opponents, the participants in Study 1 made concessions in the competition and tended to choose “not to bet”. In addition, because more overconfident opponents were rated as more competent, perceived competence was the mediator and could mediate the relationship between overconfidence and a monetary reward in a competition. Previous studies showed that overconfidence can lead individuals to display more competent cues, including verbal cues (loudness of voice and a rapid rate of speech) (Scherer et al. 1973) and nonverbal cues (smiles and gestures) (Walker 1977), which seem to be the obvious indictors of competence and which undoubtedly help such individuals gain an advantage in a competitive situation. Therefore, overconfident individuals can obviously benefit considerably as a result of their perceived competence in a competitive situation.

Extending the findings from Study 1, we also examined whether overconfident individuals would be punished when the mismatch between overconfidence and competence was revealed in the subsequent competition. A recent research study on social status indicated that group members still reacted positively to individuals, even after they were revealed as overconfident (Kennedy et al. 2013). In line with this, Study 2 examined the effects of revealing a mismatch between overconfidence and actual competence on the subsequent performance during competitive situations. The two-phase design indicated that overconfidence not only brought short-term benefits and no long-term costs and even had “impression” advantages. Though the fake very overconfident competitors did not make more money than the less overconfident competitors in Phase 2 of the betting game, the individuals resisted revising their relative higher ability ratings of them after they received the performance feedback. How to interpret this result? According to previous theory, a first impression, which is formed based on limited human information processing, is always inconsistent with people’s real personality traits (Deffuant and Huet 2006; Lim et al. 2000). When two people meet for the first time, they immediately form initial ideas about each other based on initial cues (Naylor 2007). These early impressions tend to remain predominant and continue to influence the individuals’ long-term interaction behaviors (Rabin and Schrag 1999). They can even have further impacts as the relationship develops (Bergmann et al. 2012). Following the same logic, in the presence of a very positive first impression, a person may generously ignore negative issues that are encountered later (Lindgaard et al. 2006). Briñol et al. (2012) further demonstrated that leaving a first powerful impression caused individuals to come out better in subsequent judgment situations. Thus, because of the impact of a first impression of great confidence, individuals will not have any loss in subsequent competitions, even when a mismatch between the person’s confidence level and their actual competence is revealed.

However, it is worth pointing out that the positive effect of overconfidence is not necessarily appropriate for individuals who are problem or pathological gamblers. In real-world situations, most problem and pathological gamblers continue to gamble despite accumulating losses because they overestimate their abilities (Wohl et al. 2007; Fortune and Goodie 2012). Studies also showed that cognitive distortions, including overconfidence, in addition to serious financial consequence, may result in other severe problems, such as relationship difficulties, health problems, and even criminalization in problem and pathological gamblers (Gyollai et al. 2014). The main reason for the differences on the effects of overconfidence between problem gambling and non-problem gambling may be that problem gamblers are much more overconfident than non-problem gamblers (Goodie 2005). Some additional cognitive distortions, such as the gamblers fallacy, availability of others’ wins, inherent memory bias, and illusion of control were also found to be more serious in problem and pathological gamblers than in non-problem gamblers (Michalczuk et al. 2011; Fortune and Goodie 2012). Thus, extreme overconfidence may interact with various cognitive distortions and result in serious consequence in competing or gambling contexts for problem and pathological gamblers. Camchong et al. (2007) even showed some significant neuropsychological differences between problem and non-problem gamblers in the neural activation areas associated with overconfidence (Camchong et al. 2007). Therefore, there are obvious differences between problem gamblers and non-problem gamblers in the level and effects of overconfidence and only moderate overconfidence may sometimes benefit non-problem gamblers.

Theoretical Implications

Although many scholars have previously noted the disadvantages or negative aspects of overconfidence (Dawes and Mulford 1996; Moore and Healy 2008), a comparative paucity of work has examined the positive side of overconfidence (Compte and Postlewaite 2004; Taylor and Brown 1988; Von Hippel and Trivers 2011). Overconfidence, retained in evolution, must have its own advantages. Johnson and Fowler (2011) indicated that overconfidence has its own evolutionary significance in natural selection. Therefore, it was important for the present research to make an in-depth exploration of the positive effects of overconfidence on the outcomes of gain or loss in competitive situations. First, our results extended the research about the positive effects of overconfidence to competitive situations. Previous research on social status, in keeping with self-enhancement theory, showed that overconfidence leads to higher social status in both short- and long-term groups (Anderson et al. 2012). However, our findings, which fit with the idea that overconfidence has certain advantages in competitive situations, are consistent with the prediction of an evolutionary model for overconfidence. Johnson and Fowler (2011), in their evolutionary model, put forward that, if contestants have imperfect information about each other’s strengths, some contestants might back off because of thinking (or believing) his or her opponent who seemed to be more overconfident was stronger and more powerful than him/herself. Thus, overconfident individuals are more likely to benefit from competition.

Second, we developed a new research paradigm for the study of the overconfidence effect in competitive situations by creating a fake opponent. A previous paradigm has some limitations in competitive situations. For instance, previous research used paired participants in competitive situations (Tauer and Harackiewicz 2004; Tjosvold et al. 2006). However, if two real people competed against each other, the interaction between their own personality characteristics and the traits revealed in competing in a task will have an impact on the interpretation of the results. Thus, our paradigm successfully controlled for many factors, such as personality characteristics and verbal and nonverbal clues, in addition to controlling overconfidence. Meanwhile, we managed to integrate overconfidence and competition into a single research framework which helped to create a new pattern for analyzing the overconfidence effect in competitive situations.

Third, our study also contributes to the literature about whether overconfident individuals will continue to gain or lose in a subsequent competitive situation after the mismatch between confidence level and real competence has been revealed. Previous research indicated that overconfident people still benefit after their mismatched competence is revealed (Anderson et al. 2012). Partially in line with this result, we did not find that the very overconfident fake participants were punished; they still got monetary rewards that equaled those of the less overconfident fake participants. In contrast, the ability rating of the very overconfident fake participants was still maintained at a high level. This suggests that overconfidence still has some benefits because others feel certain about their evaluation of the individual’s abilities.

Practical Implications

Our results provide guidelines for imperfect information game playing. In imperfect information games, the optimality of a strategy can lead to a significant consequence: The player does not do worse, even if his strategy is revealed to his opponent; i.e., the opponent gains no advantage from figuring out the player’s strategy (Koller and Pfeffer 1995). This feature is particularly important in the context of game-playing programs, since they are always played the same way, so their strategy can be deduced by intensive testing (Koller and Pfeffer 1995). Similarly, through constant observation and testing, opponents will finally realize the mismatch between a player’s confidence level and their real competence. Based on this, the optimal strategy for an overconfident player is initially to keep his/her opponent in the dark about his/her overconfidence and thus to gain success quickly. Then, even if his overconfidence is deduced as a result of intensive testing and revealed to his opponent, a player will not do worse than his opponent. Therefore, in competitive imperfect information games, people can try adopting overconfidence as an optimal strategy for achieving victory.

Also, our findings provide practical suggestions in connection with competing for social resources. For instance, in the area of political and economic negotiations, previous studies have suggested that overconfidence in a negotiator is a major impediment to the effectiveness of the negotiations (Nadler et al. 2003). However, the present research offers evidence to the contrary. That is, overconfidence is not always destructive, and overconfident negotiators are more likely to make their opponents believe they can prevail. Overconfidence, which causes a negotiator to appear to be competent, can indeed help negotiators obtain beneficial outcomes. Furthermore, in product sales, a previous study showed that sellers’ overconfidence may reduce concessionary behavior and generate bargaining delays (Neale and Bazerman 1985). However, our findings provided new evidence that people are more likely to be persuaded by overconfident opponents (Radzevick and Moore 2011). This means that exhibiting appropriate overconfidence can help convince buyers that they are getting a great product. Therefore, sellers can reduce bargaining delays even if they do not make concessions. In general, our results, which seem to show that overconfidence could be expected to enable the overconfident individual take advantage of their perceived competence in accessing benefits, may have wide application in political and economic areas.

Limitations and Future Directions

Although the current studies manipulated overconfidence and established causality between overconfidence and the benefits gained in a competition, there were, of course, limitations. First, it should be noted that the designs did not allow overconfidence to emerge naturally. Thus, we cannot know with certainty whether actual people would have been responded to in the same way if they had truly exhibited overconfidence in a competition. However, previous research gives us reason to suspect that the overconfidence we manipulated was genuine. Overconfidence measured under similar conditions to the ones we used emerged even when the stakes were aligned to reward accuracy (Campbell et al. 2004; Goodie 2005). Moreover, our overconfidence measures were based on general knowledge questions for which prior work has shown that general knowledge overconfidence is “robust” (e.g., Klayman et al. 1999; Yates et al. 1996).

Second, there were only two levels of overconfidence. We could only test the difference between very overconfident bettors and less overconfident ones. It is still possible that the benefits of overconfidence in competition are lower for individuals who are extremely overconfident than those who are only moderately overconfident (e.g., Baumeister 1989). It is important that future research examine this issue further.

Third, the present study only explored the overconfidence effect at the behavioral level and could not reveal the individuals’ mental process during the competition with the overconfident opponents. Future research could examine the overconfidence effect by integrating cognitive neuroscience to uncover the possible cognitive and neural mechanisms of overconfidence. Based on an evolutionary model of overconfidence, Van Veelen and Nowak (2011) proposed that a “winning strategy” can be wired into the brain in two ways. The first involves a simple heuristic plus overconfidence, and the second involves perfect rationality without overconfidence. According to this hypothesis, we expect that different levels of overconfidence can activate distinct sets of brain regions. Future research should therefore employ a cognitive neuroscience approach to examine an individual’s neural processes when competing with overconfident opponents.

References

Alloy, L. B., & Ahrens, A. H. (1987). Depression and pessimism for the future: Biased use of statistically relevant information in predictions for self versus others. Journal of Personality and Social Psychology, 52, 366–378. https://doi.org/10.1037/0022-3514.52.2.366.

Anderson, C., Brion, S., Moore, D. A., & Kennedy, J. A. (2012). A status-enhancement account of overconfidence. Journal of Personality and Social Psychology, 103, 718–735. https://doi.org/10.1037/a0029395.

Anderson, C., John, O. P., Keltner, D., & Kring, A. M. (2001). Who attains social status? Effects of personality and physical attractiveness in social groups. Journal of Personality and Social Psychology, 81, 116–132. https://doi.org/10.1037/0022-3514.81.1.116.

Anderson, C., & Kilduff, G. J. (2009). Why do dominant personalities attain influence in face-to-face groups? The competence-signaling effects of trait dominance. Journal of Personality and Social Psychology, 96, 491–503. https://doi.org/10.1037/a0014201.

Archard, N. (2012). Adolescent girls and leadership: The impact of confidence, competition, and failure. International Journal of Adolescence and Youth, 17, 189–203. https://doi.org/10.1080/02673843.2011.649431.

Barber, B. M., & Odean, T. (2001). Boys will be boys: Gender, overconfidence, and common stock investment. Quarterly Journal of Economics, 116, 261–292. Retrieved from http://www.jstor.org/stable/2696449.

Baumeister, R. F. (1989). The optimal margin of illusion. Journal of Social and Clinical Psychology, 8, 176–189. https://doi.org/10.1521/jscp.1989.8.2.176.

Bergmann, K., Eyssel, F., & Kopp, S. (2012). A second chance to make a first impression? How appearance and nonverbal behavior affect perceived warmth and competence of virtual agents over time. In Y. Nakano, M. Neff, A. Paiva, & M. Walker (Eds.), Intelligent virtual agents (pp. 126–138). Berlin: Springer. https://doi.org/10.1007/978-3-642-33197-8_13.

Berner, E. S., & Graber, M. L. (2008). Overconfidence as a cause of diagnostic error in medicine. The American Journal of Medicine, 121, S2–S23. https://doi.org/10.1016/j.amjmed.2008.01.001.

Bouris, E. (2006). Overconfidence and war: The havoc and glory of positive illusions. The Journal of Politics, 68, 230–231. https://doi.org/10.1111/j.1468-2508.2006.00382_13.x.

Briñol, P., Petty, R. E., & Stavraki, M. (2012). Power increases the reliance on first-impression thoughts. Revista de Psicología Social, 27, 293–303. https://doi.org/10.1174/021347412802845513.

Brunnermeier, M. K., & Parker, J. A. (2005). Optimal expectations. American Economic Review, 95, 1092–1118. https://doi.org/10.3386/w10707.

Burguillo, J. C. (2010). Using game theory and competition-based learning to stimulate student motivation and performance. Computers & Education, 55, 566–575. https://doi.org/10.1016/j.compedu.2010.02.018.

Buss, D. M. (1988). The evolution of human intrasexual competition: Tactics of mate attraction. Journal of Personality and Social Psychology, 54, 616–628. https://doi.org/10.1037/0022-3514.54.4.616.

Camchong, J., Goodie, A. S., McDowell, J. E., Gilmore, C. S., & Clementz, B. A. (2007). A cognitive neuroscience approach to studying the role of overconfidence in problem gambling. Journal of Gambling Studies, 23, 185–199. https://doi.org/10.1007/s10899-006-9033-5.

Campbell, W. K., Goodie, A. S., & Foster, J. D. (2004). Narcissism, confidence, and risk attitude. Journal of Behavioral Decision Making, 17, 297–311. https://doi.org/10.1002/bdm.475.

Caplin, A., & Leahy, J. (2001). Psychological expected utility theory and anticipatory feelings. Quarterly Journal of Economics, 116, 55–79. Retrieved from http://www.jstor.org/stable/2696443.

Cecchini, J., González, C., Carmona, Á., Arruza, J., Escartí, A., & Balagué, G. (2001). The influence of the physical education teacher on intrinsic motivation, self-confidence, anxiety, and pre-and post-competition mood states. European Journal of Sport Science, 1, 1–11. https://doi.org/10.1080/17461390100071407.

Cheng, P. Y. (2007). The trader interaction effect on the impact of overconfidence on trading performance: An empirical study. The Journal of Behavioral Finance, 8, 59–69. https://doi.org/10.1080/15427560701377232.

Compte, O., & Postlewaite, A. (2004). Confidence-enhanced performance. American Economic Review, 94, 1536–1557. Retrieved from http://www.jstor.org/stable/3592833.

Cote, S., & Miners, C. T. (2006). Emotional intelligence, cognitive intelligence, and job performance. Administrative Science Quarterly, 51(1), 1–28. https://doi.org/10.2189/asqu.51.1.1.

Curhan, J. R., & Pentland, A. (2007). Thin slices of negotiation: Predicting outcomes from conversational dynamics within the first 5 minutes. Journal of Applied Psychology, 92, 802–811. https://doi.org/10.1037/0021-9010.92.3.802.

Dawes, R. M., & Mulford, M. (1996). The false consensus effect and overconfidence: Flaws in judgment or flaws in how we study judgment? Organizational Behavior and Human Decision Processes, 65, 201–211. https://doi.org/10.1006/obhd.1996.0020.

de Melo, C. M., Carnevale, P., & Gratch, J. (2012). The effect of virtual agents’ emotion displays and appraisals on people’s decision making in negotiation. In Y. Nakano, M. Neff, A. Paiva, & M. Walker (Eds.), Intelligent virtual agents (pp. 53–66). Berlin: Springer. https://doi.org/10.1007/978-3-642-33197-8_6.

Decety, J., Jackson, P. L., Sommerville, J. A., Chaminade, T., & Meltzoff, A. N. (2004). The neural bases of cooperation and competition: An fMRI investigation. NeuroImage, 23, 744–751. https://doi.org/10.1016/j.neuroimage.2004.05.025.

Deffuant, G., & Huet, S. (2006, August). Collective reinforcement of first impression bias. Paper presented at the First World Congress on Social Simulation, Kyoto, Japan.

Dimotakis, N., Conlon, D. E., & Ilies, R. (2012). The mind and heart (literally) of the negotiator: Personality and contextual determinants of experiential reactions and economic outcomes in negotiation. Journal of Applied Psychology, 97, 183–193. https://doi.org/10.1037/a0025706.

Elfenbein, H. A., Curhan, J. R., Eisenkraft, N., Shirako, A., & Brown, A. (2010). Why are some negotiators better than others? Opening the black box of bargaining behaviors. Paper presented at the 23rd annual meeting of the International Association for Conflict Management. Cambridge, MA.

Erceg, N., & Galić, Z. (2014). Overconfidence bias and conjunction fallacy in predicting outcomes of football matches. Journal of Economic Psychology, 42, 52–62. https://doi.org/10.1016/j.joep.2013.12.003.

Fang, X., & Rajkumar, T. (2008, August). Cross cultural study of multimedia effects on first impression bias. Paper presented at the Proceedings of the Fourteenth Americas Conference on Information Systems, Toronto, Canada.

Fink, B., Klappauf, D., Brewer, G., & Shackelford, T. K. (2014). Female physical characteristics and intra-sexual competition in women. Personality and Individual Differences, 58, 138–141. https://doi.org/10.1016/j.paid.2013.10.015.

Fisher, M., & Cox, A. (2009). The influence of female attractiveness on competitor derogation. Journal of Evolutionary Psychology, 7, 141–155. https://doi.org/10.1556/JEP.7.2009.2.3.

Forster, W. R., & Sarasvathy, S. D. (2007). When hubris is good: An error based theory of entrepreneurial overconfidence. Working paper, Darden Graduate School of Business, University of Virginia, Virginia.

Fortune, E. E., & Goodie, A. S. (2012). Cognitive distortions as a component and treatment focus of pathological gambling: A review. Psychology of Addictive Behaviors, 26(2), 298–310. https://doi.org/10.1037/a0026422.

Fu, Q., Gürtler, O., & Münster, J. (2013). Communication and commitment in contests. Journal of Economic Behavior & Organization, 95, 1–19. https://doi.org/10.1016/j.jebo.2013.08.011.

Geller, D. S., & Singer, J. D. (1998). Nations at war: A scientific study of international conflict. New York: Cambridge University Press.

Goodie, A. S. (2005). The role of perceived control and overconfidence in pathological gambling. Journal of Gambling Studies, 21, 481–502. https://doi.org/10.1007/s10899-005-5559-1.

Greenlees, I., Bradley, A., Holder, T., & Thelwell, R. (2005). The impact of opponents’ non-verbal behaviour on the first impressions and outcome expectations of table-tennis players. Psychology of Sport and Exercise, 6, 103–115. https://doi.org/10.1016/j.psychsport.2003.10.002.

Gyollai, Á., Griffiths, M. D., Barta, C., Vereczkei, A., Urbán, R., Kun, B., et al. (2014). The genetics of problem and pathological gambling: A systematic review. Current Pharmaceutical Design, 20, 3993–3999. https://doi.org/10.2174/13816128113199990626.

Hong, A. P., & Wijst, P. J. (2013). Women in negotiation: Effects of gender and power on negotiation behavior. Negotiation and Conflict Management Research, 6, 273–284. https://doi.org/10.1111/ncmr.12022.

Jackson, L. A., Hunter, J. E., & Hodge, C. N. (1995). Physical attractiveness and intellectual competence: A meta-analytic review. Social Psychology Quarterly, 58(2), 108–122. Retrieved from http://www.jstor.org/stable/2787149.

Johnson, D. D., & Fowler, J. H. (2011). The evolution of overconfidence. Nature, 477, 317–320. https://doi.org/10.1038/nature10384.

Johnson, D. D. P., McDermott, R., Barrett, E. S., Cowden, J., Wrangham, R., McIntyre, M. H., et al. (2006). Overconfidence in wargames: Experimental evidence on expectations, aggression, gender, and testosterone. Proceedings of the Royal Society: Biological Sciences, 273, 2513–2520. https://doi.org/10.1098/rspb.2006.3606.

Kahneman, D., & Lovallo, D. (1993). Timid choices and bold forecasts: A cognitive perspective on risk taking. Management Science, 39, 17–31. Retrieved from http://www.jstor.org/stable/2661517.

Kahneman, D., & Tversky, A. (1984). Choices, values, and frames. American Psychologist, 39(4), 341–350. https://doi.org/10.1037/0003-066X.39.4.341.

Kennedy, J. A., Anderson, C., & Moore, D. A. (2013). When overconfidence is revealed to others: Testing the status-enhancement theory of overconfidence. Organizational Behavior and Human Decision Processes, 122, 266–279. https://doi.org/10.1016/j.obhdp.2013.08.005.

Kim, K., Cundiff, N. L., & Choi, S. B. (2014). The influence of emotional intelligence on negotiation outcomes and the mediating effect of rapport: A structural equation modeling approach. Negotiation Journal, 30, 49–68. https://doi.org/10.1111/nejo.12045.

Kim, K., Cundiff, N. L., & Choi, S. B. (2015). Emotional intelligence and negotiation outcomes: Mediating effects of rapport, negotiation strategy, and judgment accuracy. Group Decision and Negotiation, 24, 477–493. https://doi.org/10.1007/s10726-015-9435-9.

Klayman, J., Soll, J. B., González-Vallejo, C., & Barlas, S. (1999). Overconfidence: It depends on how, what, and whom you ask. Organizational Behavior and Human Decision Processes, 79, 216–247. https://doi.org/10.1006/obhd.1999.2847.

Koller, D., & Pfeffer, A. (1995). Generating and solving imperfect information games. Proceedings of the Fourteenth International Joint Conference on Artificial Intelligence, USA, 2, 1185–1192.

Köszegi, B. (2006). Ego utility, overconfidence, and task choice. Journal of the European Economic Association, 4(4), 673–707. https://doi.org/10.1162/JEEA.2006.4.4.673.

Kray, L. J., Reb, J., Galinsky, A. D., & Thompson, L. (2004). Stereotype reactance at the bargaining table: The effect of stereotype activation and power on claiming and creating value. Personality and Social Psychology Bulletin, 30, 399–411. https://doi.org/10.1177/0146167203261884.

Krueger, J. I., & Wright, J. C. (2011). Measurement of self-enhancement (and self-protection). In M. D. Alicke & C. Sedikides (Eds.), Handbook of self-enhancement and self-protection (pp. 472–494). New York: Guilford.

Kyle, A. S., & Wang, F. A. (1997). Speculation duopoly with agreement to disagree: Can overconfidence survive the market test? Journal of Finance, 52, 2073–2090. https://doi.org/10.2307/2329474.

Larrick, R. P., Burson, K. A., & Soll, J. B. (2007). Social comparison and confidence: When thinking you’re better than average predicts overconfidence (and when it does not). Organizational Behavior and Human Decision Processes, 102, 76–94. https://doi.org/10.1016/j.obhdp.2006.10.002.

Leary, M. R. (2007). Motivational and emotional aspects of the self. Annual Review of Psychology, 58, 317–344. https://doi.org/10.1146/annurev.psych.58.110405.085658.

Lim, K. H., & Benbasat, I. (2000). The effect of multimedia on perceived equivocality and perceived usefulness of information systems. MIS Quarterly, 24, 449–471. https://doi.org/10.2307/3250969.

Lim, K. H., Benbasat, I., & Ward, L. M. (2000). The role of multimedia in changing first impression bias. Information Systems Research, 11, 115–136. https://doi.org/10.1287/isre.11.2.115.11776.

Lindgaard, G., Fernandes, G., Dudek, C., & Brown, J. (2006). Attention web designers: You have 50 milliseconds to make a good first impression! Behaviour & Information Technology, 25, 115–126. https://doi.org/10.1080/01449290500330448.

Locke, C. C., & Anderson, C. (2015). The downside of looking like a leader: Power, nonverbal confidence, and participative decision-making. Journal of Experimental Social Psychology, 58, 42–47. https://doi.org/10.1016/j.jesp.2014.12.004.

Ma, Z., & Jaeger, A. (2005). Getting to yes in China: Exploring personality effects in Chinese negotiation styles. Group Decision and Negotiation, 14, 415–437. https://doi.org/10.1007/s10726-005-1403-3.

Malmendier, U., & Tate, G. (2005). CEO overconfidence and corporate investment. The Journal of Finance, 60, 2661–2700. https://doi.org/10.1111/j.1540-6261.2005.00813.x.

Matsumoto, D., Takeuchi, M., Nakajima, T., & Iida, E. (2000). Competition anxiety, self-confidence, personality and competition performance of American elite and non-elite judo athletes. Research Journal of Budo, 32, 12–21.

McAbee, S. T., & Oswald, F. L. (2013). The criterion-related validity of personality measures for predicting GPA: A meta-analytic validity competition. Psychological Assessment, 25, 532–544. https://doi.org/10.1037/a0031748.

McIlroy, T. (2014). Deal or no deal: The effects of positive emotion expression on negotiation performance. Master’s thesis, The University of Queensland, Australia.

Michalczuk, R., Bowden-Jones, H., Verdejo-Garcia, A., & Clark, L. (2011). Impulsivity and cognitive distortions in pathological gamblers attending the UK National Problem Gambling Clinic: A preliminary report. Psychological Medicine, 41, 2625–2635. https://doi.org/10.1017/S003329171100095X.

Moore, D. A., & Healy, P. J. (2008). The trouble with overconfidence. Psychological Review. https://doi.org/10.1037/0033-295X.115.2.502.

Nadler, J., Thompson, L., & Boven, L. V. (2003). Learning negotiation skills: Four models of knowledge creation and transfer. Management Science, 49, 529–540. https://doi.org/10.1287/mnsc.49.4.529.14431.

Naylor, R. W. (2007). Nonverbal cues-based first impressions: Impression formation through exposure to static images. Marketing Letters, 18, 165–179. https://doi.org/10.1007/s11002-007-9010-5.

Neale, M. A., & Bazerman, M. H. (1985). The effects of framing and negotiator overconfidence on bargaining behaviors and outcomes. Academy of Management Journal, 28, 34–49. https://doi.org/10.2307/256060.

Niederle, M., & Vesterlund, L. (2008). Gender differences in competition. Negotiation Journal, 24, 447–463. https://doi.org/10.1111/j.1571-9979.2008.00197.x.

Niederle, M., & Vesterlund, L. (2011). Gender and competition. Annual Review of Economics, 3, 601–630. https://doi.org/10.1146/annurev-economics-111809-125122.

Ortoleva, P., & Snowberg, E. (2013). Overconfidence in political behavior. American Economic Review, 105, 504–535. https://doi.org/10.3386/w19250.

Parfitt, G., & Pates, J. (1999). The effects of cognitive and somatic anxiety and self-confidence on components of performance during competition. Journal of Sports Sciences, 17, 351–356. https://doi.org/10.1080/026404199365867.

Pillai, K. G. (2010). Managers’ perceptual errors revisited: The role of knowledge calibration. British Journal of Management, 21, 299–312. https://doi.org/10.1111/j.1467-8551.2009.00646.x.

Porter, M. E. (2000). Location, competition, and economic development: Local clusters in a global economy. Economic Development Quarterly, 14, 15–34. https://doi.org/10.1177/089124240001400105.

Preacher, K. J., & Hayes, A. F. (2008). Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behavior Research Methods, 40, 879–891. https://doi.org/10.3758/BRM.40.3.879.

Pyszczynski, T., Holt, K., & Greenberg, J. (1987). Depression, self-focused attention, and expectancies for positive and negative future life events for self and others. Journal of Personality and Social Psychology, 52, 994–1001. https://doi.org/10.1037/0022-3514.52.5.994.

Rabin, M., & Schrag, J. L. (1999). First impressions matter: A model of confirmatory bias. Quarterly Journal of Economics, 114, 37–82. Retrieved from http://www.jstor.org/stable/2586947.

Radzevick, J. R., & Moore, D. A. (2011). Competing to be certain (but wrong): Market dynamics and excessive confidence in judgment. Management Science, 57, 93–106. https://doi.org/10.1287/mnsc.1100.1255.

Rochet, J.-C., & Tirole, J. (2003). Platform competition in two-sided markets. Journal of the European Economic Association, 1, 990–1029. Retrieved from http://www.jstor.org/stable/40005175.

Sass, M., & Liao-Troth, M. (2015). Personality and negotiation performance: The people matter. Journal of Collective Negotiations. https://doi.org/10.2139/ssrn.2549992.

Scherer, K. R., London, H., & Wolf, J. J. (1973). The voice of confidence: Paralinguistic cues and audience evaluation. Journal of Research in Personality, 7, 31–44. https://doi.org/10.1016/0092-6566(73)90030-5.

Schultze, U., & Stabell, C. (2004). Knowing what you don’t know? Discourses and contradictions in knowledge management research. Journal of Management Studies, 41, 549–573. https://doi.org/10.1111/j.1467-6486.2004.00444.x.

Sczesny, S., & Kühnen, U. (2004). Meta-cognition about biological sex and gender-stereotypic physical appearance: Consequences for the assessment of leadership competence. Personality and Social Psychology Bulletin, 30, 13–21. https://doi.org/10.1177/0146167203258831.

Sczesny, S., Spreemann, S., & Stahlberg, D. (2006). Masculine = competent? Physical appearance and sex as sources of gender-stereotypic attributions. Swiss Journal of Psychology, 65, 15–23. https://doi.org/10.1024/1421-0185.65.1.15.

Sheridan, S., & Williams, P. (2011). Developing individual goals, shared goals, and the goals of others: Dimensions of constructive competition in learning contexts. Scandinavian Journal of Educational Research, 55, 145–164. https://doi.org/10.1080/00313831.2011.554694.

Sinaceur, M., & Tiedens, L. Z. (2006). Get mad and get more than even: When and why anger expression is effective in negotiations. Journal of Experimental Social Psychology, 42, 314–322. https://doi.org/10.1016/j.jesp.2005.05.002.

Smithey Fulmer, I., & Barry, B. (2004). The smart negotiator: Cognitive ability and emotional intelligence in negotiation. International Journal of Conflict Management, 15, 245–272. https://doi.org/10.1108/eb022914.