Abstract

This study proposes a framework for the main parties of a sustainable supply chain network considering lot-sizing impact with quantity discounts under disruption risk among the first studies. The proposed problem differs from most studies considering supplier selection and order allocation in this area. First, regarding the concept of the triple bottom line, total cost, environmental emissions, and job opportunities are considered to cover the criteria of sustainability. Second, the application of this supply chain network is transformer production. Third, applying an economic order quantity model lets our model have a smart inventory plan to control the uncertainties. Most significantly, we present both centralized and decentralized optimization models to cope with the considered problem. The proposed centralized model focuses on pricing and inventory decisions of a supply chain network with a focus on supplier selection and order allocation parts. This model is formulated by a scenario-based stochastic mixed-integer non-linear programming approach. Our second model focuses on the competition of suppliers based on the price of products with regard to sustainability. In this regard, a Stackelberg game model is developed. Based on this comparison, we can see that the sum of the costs for both levels is lower than the cost without the bi-level approach. However, the computational time for the bi-level approach is more than for the centralized model. This means that the proposed optimization model can better solve our problem to achieve a better solution than the centralized optimization model. However, obtaining this better answer also requires more processing time. To address both optimization models, a hybrid bio-inspired metaheuristic as the hybrid of imperialist competitive algorithm (ICA) and particle swarm optimization (PSO) is utilized. The proposed algorithm is compared with its individuals. All employed optimizers have been tuned by the Taguchi method and validated by an exact solver in small sizes. Numerical results show that striking similarities are observed between the results of the algorithms, but the standard deviations of PSO and ICA–PSO show better behavior. Furthermore, while PSO consumes less time among the metaheuristics, the proposed hybrid metaheuristic named ICA–PSO shows more time computations in all small instances. Finally, the provided results confirm the efficiency and the performance of the proposed framework and the proposed hybrid metaheuristic algorithm.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Nowadays, supplier selection is an active research topic in the researche done in the supply chain management (Golmohamadi et al. 2017). Ranking suppliers and selecting the best methods increase the supply chain efficiency (Nourmohamadi Shalke et al. 2018; Hajiaghaei-Keshteli and Fathollahi Fard 2019). Moreover, supplier selection methodologies open some new directions to consider new concepts such as disruption risks. In this regard, considering supplier selection problems under disruption risk is a new concept that aims to provide fast the emergency assembles for different levels of the supply chain via injured people to minimize human suffering and death by an efficient and performance allocations of supply chain levels due to its difficulty by considering the budget of supporting companies and the restricted sources (Fathollahi-Fard et al. 2018).

Generally, two types of uncertainties are existed i.e., operational and disasters. The operational uncertainties relay to the structure of activities such as the time of ordering and prices of products. But, disasters are a recent motivated issue which can be defined as natural activities e.g. earthquakes, famine, floods, etc., imminent attacks of location facility planning e.g. terrorism, war, etc., diseases e.g. malaria, HIV/aids or COVID-19 or other similar situations (Perfetti 2015). The rate of natural disasters is increasing dramatically according to the growth of population, the global trends in urbanism, land usage and stressing of ecosystems (Fard et al. 2017; Fard and Hajaghaei-Keshteli 2018).The ability of rescue units to perform a variety of operations are limited because each rescue may be specialized in a particular type in the event of a disaster, planning is efficient and appropriate challenging work for emergency operations centers. On the other hand, how to manage time to perform operations and have a specialized team, requires training and expertise of the rescue team (Tirkolaee et al. 2020a). Based on this motivation, the supplier selection, and order allocation activities should be reconsidered to provide a plan to control uncertainty.

One of the most critical tasks during the supplier selection under disruption risk is to manage and execute all the supplies and logistics operations more efficiently (Perfetti 2015); to deliver the essential supplies from vendors to all retailers and people who need daily living supplies into the disaster areas (Akarte et al. 2007; Chang et al. 2012; Dweiri et al. 2015; Mazdeh et al. 2015). Another main issue facing to the disasters is when they do, they may entail devastating long-term economic and environmental, and also social ramifications. Besides them, the companies and the suppliers should consider that the recovery processes after disasters are very slow (Dweiri et al. 2015; Mazdeh et al. 2015; Cheraghalipour and Farsad 2018; Jahre et al. 2007).

Additionally, some review articles are showing the state-of-the-art in this area from different viewpoints including a general review on disruption risk in supply chain systems (Jahre et al. 2007; Tirkolaee et al. 2020a) to identify appropriate measures in different steps (phases) of disasters which are pre-disaster, during-disaster and post-disaster (Lotfi et al. 2021). Overall, earlier studies mainly have recommended the real-life constraints of disruption risks in the area of supplier selection studies.

As mentioned earlier, disruption is the type of real and non-planned uncertainty in which it is required data is one of the main issues when designing any supply chain network such as a supplier selection framework via lot sizing and other necessary real assumptions (Lotfi et al. 2021; Soltanifar and Sharafi 2022; Samadi et al. 2018). Notably, in the large-scale emergencies, data may not be available easily to communicate between the levels of supply systems (Fathollahi-Fard et al. 2018). Hence, designing a robust optimization model by considering the uncertainty of parameters and decision variables are so important. In this regard, scenario-based models are a helpful tool to add the disruption and uncertainty of parameters and variables (Tirkolaee et al. 2020a). Randomness and fuzziness are two main sources of uncertainty (Fathollahi-Fard et al. 2018; Fard et al. 2017]). A scenario-based approach can flexibility handle the uncertainty with a consideration of optimistic, pessimistic and realistic cases (Soltanifar and Sharafi 2022; Samadi et al. 2018; Wolpert and Macready 1997; Ha et al. 2008; Tirkolaee et al. 2021; Sadeghi-Moghaddam et al. 2017). This study applies a stochastic programming based different probabilistic scenarios to handle the supplier selection and order allocation framework.

Most importantly, this study contributes to the pricing and inventory decisions to cover operational activities in the supplier selection and order allocation parts with regards to the sustainability. The triple bottom line concept is created by the sustainable development goals to address economic, environmental and social factors. The proposed model includes three objectives to cover the total cost, the environmental emissions and job opportunities. The economic sustainability is addressed by the total cost of operational, pricing and inventory decisions in the supplier selection and order allocation sections. The environmental sustainability is addressed by the carbon emissions of transportation activities in the supply chain network. Finally, to achieve the social sustainability, the job opportunities measure the social justice to have more workers and to reduce the overtime.

Having a conclusion about the aforementioned contributions, this study intends to understand how a sustainable supply chain network under disruption risk should be managed. As such, this study mainly focuses on sudden-onset disasters that are followed by multiple related sub-disasters with a special attention to the logistics field. Using an economic order quantity (EOQ) model to improve the state of art for this issue as the main contribution of this paper, considering lot sizing in supplier selection and order allocation optimization problems and their possibilities of resolution for operational, pricing, and inventory decisions, is developed. These decisions with the goals of the total cost, environmental emissions, and job opportunities are formulated by a scenario-based stochastic mixed-integer non-linear programming approach. All of these contributions make a centralized decision-making.

This study also proposes a decentralized decision-making model to evaluate the competition among suppliers based on the price of the products and sustainability dimensions. In this regard, a Stackelberg game model is formulated as a decision-making approach between different types of suppliers. To manage the complexity of these optimization models, a hybrid metaheuristic benefits from the imperialist competitive algorithm, and particle swarm optimization is proposed to cope with an optimal solution in a reasonable time. To sum up, the main contributions of this study are presented as follows:

-

Proposing a novel mixed-integer non-linear stochastic programming approach in the presence of multiple suppliers;

-

Considering lot sizing for an order allocation optimization model;

-

Developing a sustainable supply chain network considering the goals of the total cost, environmental emissions, and job opportunities;

-

Covering operational, pricing and inventory decisions in the framework of supplier selection and order allocation;

-

Proposing quantity discounts under disruption risk with the use of an EOQ model;

-

Developing a decentralized decision-making approach to evaluate the competition of suppliers for the price of products with discount supposition.

-

Applying a new hybrid evolutionary algorithm based on the imperialist competitive algorithm and particle swarm optimization for large-scale tests;

The rest of the directions of this paper can be organized as follows. The relevant studies in this research are collected and reviewed in Sect. 2. The concept of supplier selection and order allocation is prepared and accordingly, the sustainable supply chain network design model considering lot sizing and quantity of discount under disruption risk and its application to the transformer production is formulated as a centralized decision-making model in Sect. 3. In this section, we also propose a decentralized decision-making model to focus on the price of the products as the second model using a Stackelberg optimization model. In addition, Sect. 4 provides the representation of answers and solution approaches by proposing a new hybrid metaheuristic. The experimental results and different analyses for the case problem with different complexity are performed in Sect. 5. Eventually, the recommendations and future directions of this study are drawn in the final section of this study.

2 Literature review

The literature on supplier selection and order allocation is very old and many studies considered a variety of optimization models and multi-criterion decision-making approaches. As reviewed in a recent survey (Fard and Hajaghaei-Keshteli 2018), the analytic hierarchy process (AHP) approach is the most common technique in this area and more than 60 percent of studies have used the AHP model (Snyder and Daskin 2006; Hajiaghaei-Keshteli and Aminnayeri 2013; Atashpaz-Gargari and Lucas 2007; Devika et al. 2014; Molla-Alizadeh-Zavardehi et al. 2016; Tavakkoli-Moghaddam et al. 2016; Hajiaghaei-Keshteli et al. 2014; Önüt et al. 2009). Here, some important and recent studies are reviewed. For example, Akarte et al. (2007) applied a case study of the automobile manufacturing industry to rank the suppliers with the AHP method. Chan et al. (2012) Among the first studies applied a robust optimization model for the supplier selection and order allocation framework. Tirkolaee et al. (2020b) proposed a mixed-integer linear programming (MILP) mathematical model to formulate the green location allocation-inventory problem (LAIP) for collecting, processing/disposal of municipal solid waste (MSW) considering pollution emissions. They developed a comprehensive Methodology for designing an efficient MSW management system using a robust optimization approach to eliminate the uncertainty. Dweiri et al. (2015) did several sensitivity analyses to reveal the real case of automobile manufacturing for an optimization model using an exact solver with GAMS software. In another different study in 2015, Mazdeh et al. (2015) considered the lot sizing impact in a supplier selection and order allocation framework in the first studies. Since their model is much complex than the general version of supplier selection and order allocation optimization models, a heuristic algorithm was developed. In addition, Nourmohamadi Shalke et al. (2018) for the first time proposed a sustainable supplier selection considering the quantity discount. They offered a TOPSIS method to rank the suppliers. In another relevant work, Cheraghalipour and Farsad (2018) developed a bi-objective supplier selection and order allocation with a quantity discount. They minimized the total cost and environmental pollution while the social criteria were used to rank the suppliers. On the other hand, with competition in the fields of production and services, many organizations try your products with lower prices and higher quality providers. Tirkolaee et al. (2021) presented a green supplier selection (GSS) problem in an area where there are several raw agri-food materials and suppliers under uncertain conditions. The proposed method consists of a novel integration of AHP and fuzzy TOPSIS (AHP- fuzzy TOPSIS) and robust goal programming RGP approach. Appropriate configuration of agro-supply chains becomes all the more critical issues owing to specific characteristics of agro-products. Keshavarz-Ghorbani and Pasandideh (2021) developed a multi-product multi-period MINLP model or an agro-supply chain contributing to purchase, facility location, and transportation decisions. Since the adjusting the temperature conditions affects the quality of the products and the result their useful life, this model determines the appropriate temperature conditions based on a variety of products.

Multi-criteria decision models are widely used in supplier selection problems. Recently, Rafigh et al. (2021b) presented the problem of supplier selection by considering green production, green transportation, and green logistics. With regard to the game theory, they used a cooperative green supplier selection model. After creating the optimization model to consider the uncertainty, this cooperative game theory model is established in a fuzzy environment. In this regard, a fuzzy rule-based (FRB) system is deployed and the set of fuzzy IF–THEN rules is considered. The importance of the role of the supply chain in today’s world, ranking of suppliers is of particular importance in the study of supply chain issues. For this purpose, Soltanifar and Sharafi (2022) utilized the DEA technique. Basic DEA models are designed for positive inputs and outputs, while the use of negative data is unavoidable in many real-world issues, including supplier.

Safaeian et al., (2019) proposed a multi-objective supplier selection and order allocation framework to consider four objectives simultaneously in a fuzzy environment. They minimized the total cost while maximizing the service, quality and, reliability of this supply chain. A non-dominated sorting genetic algorithm (NSGA-II) tuned by the response surface method was handled to generate the non-dominated solutions. Feng et al. (2019) developed a hybrid fuzzy grey TOPSIS to evaluate the supplier selection provided the supplier ranking for a manufacturing company in China. In order to improve the risk evaluation and management of the fresh grape supply chain and enhance the sustainable level of the supply chain, Jianying et al. (2021) applied a neural network to evaluate the risk of the fresh grape supply chain from the perspective of sustainable development. Furthermore, three risk evaluation models respectively based on of single BP and optimized BP (GA-BP and PSO-BP) neural networks were constructed, trained, and tested, and the risk of the grape supply chain was evaluated using the optimal model. For the case study of maritime ships, Liu et al. (2020) proposed a green supplier selection to rank the suppliers of the ships with the use of a green degree. They provided an integrated approach with the use of group fuzzy entropy and cloud TOPSIS. Nezhadroshan et al. (2020) applied a fuzzy AHP and DEMATEL approach to address a resilient supplier selection problem in the case of a disaster in Mazandaran province.

More recently, the concept of resiliency and sustainability dimensions is highly interested in many studies. Fathollahi-Fard et al. (2020a) proposed stochastic programming to address a resilient supply chain for a water distribution network. They applied an improved Lagrangian heuristic to solve their optimization problem. Fathollahi-Fard et al. (2020a) developed a novel multi-objective stochastic model for the design of a closed-loop supply chain network by modeling all three sustainability dimensions including economic, environmental, and social goals. They implemented the concept of a sustainable closed loop supply chain for the application of ventilators using a stochastic optimization model. The efficiency of the proposed model is tested in an Iranian medical ventilator production and distribution network in the case of the COVID-19 pandemic.

Karampour et al. (2020) proposed a green supplier selection with the use of a vendor managed inventory contract. As a bi-objective optimization problem, multi-objective Keshtel and red deer algorithms were used. At last but not least, Fathollahi-Fard et al. (2020b) considered the economic, environmental, and social objectives for of a water distribution network. An improved social engineering optimizer was used to solve this multi-objective supply chain optimization problem.

Contrary to the previous works, although some studies (Nourmohamadi Shalke et al. 2018; Cheraghalipour and Farsad 2018) considered supplier selection and order allocation considering lot sizing and quantity discount, they did not add the economic order quantity (EOQ) supposition in their model. On the other hand, Sustainability in supply chain management is an inescapable and controversial issue due to government legislation and the social responsibilities of the organizations. Rahimi et al. (2019) developed a risk-averse sustainable multi-objective mathematical model in order to design and plan a network of the supply chain under uncertainty by incorporating conditional value at risk (CVaR) into the basic configuration of the two-stage stochastic programming. Jadidi et al. (2021) considered the joint pricing and sourcing decision problem for a buyer purchasing a product from a set of suppliers who offer quantity discounts. The buyer, in each period, had to determine retail price and the order quantities from the suppliers therefore, model formulated as mixed-integer nonlinear programming one, and solved it. Chen and Xu ( 2020) presented a differential game involving a fashion brand and a supplier. And they considered the level of fashion and advertising afforded as factors affecting goodwill. Because the original design (ODM) production strategy had become commonplace in the fashion supply chain. They constructed centralized and decentralized differential game models, which in the model the demand for products was affected by goodwill, retail price and promotion. Scheller et al. (2021) formulated an integrated master production and recycling scheduling model for describing the production and recycling of lithium-ion batteries. Optimization models are for the master recycling scheduling and the master production scheduling for analyzing current decentralized decisions of the recycler and remanufacturer.

Menon and Ravi (2021) purposed to investigate the factors that act as sustainability enablers in the electronics industry. They examined seventeen important factors affecting the stability of the electronic supply chain in India. These seventeen items are included:

Top management commitment, government policies and legislations, availability of funds/investment, research and development, state of the art technologies, materials and processes, green purchasing, environment management systems, environmental collaboration between supply chain partners, lean manufacturing practices, reverse logistic practices reducing, reducing consumption of resources/energy, training and literacy, culture related factors, human expertise, corporate social responsibility, health and safety standards, green labeling and packaging. their paper helped to find the causal factors for the implementation of sustainable supply chain management. They analyzed using the Grey-DEMATEL method. Using renewable energy (RE) is faster growing by each country. The managerial and designer of supply chain network design (SCND) have to plan to apply RE in pillars of supply chain (SC). Lotfi et al. (2021) presented resilience and sustainable SCND by considering RE (RSSCNDRE) for the first time. A two-stage new robust stochastic optimization is embedded for RSSCNDRE. The first stage locates facility location and RE and the second stage defines flow quantity between SC components.

Singh Yadav et al. (2021) determined the economic impact of the Medicine industry of the Coronavirus pandemic for aggravating items with a ramp-type demand with inflation effects in two-warehouse storage devices and wastewater treatment cost using PSO is developed. The effect of inflation was also considered due to the different costs associated with Block-chain applying the economic impact of the coronavirus medicine industry inventory system and wastewater treatment costs using PSO. Recently, researchers are paying attention to the issue of collection, recycling, and reproduction because this is important. Keshavarz-Ghorbani and Arshadi Khamseh (2021) presented the model with the repair process to improve the virtual age of used products and integrate forward flow as a closed-loop supply chain (CLSC). The products can be returned to the chain several times until they have the required quality to be repaired. They proposed mixed-integer non-linear model and solved by three metaheuristic algorithms: particle swarm optimization algorithm (PSO), genetic algorithm (GA), invasive weeds optimization algorithm (IWO). Roozbeh Nia et al. (2015) developed a multi-item economic order quantity (EOQ) model with shortage for a single-buyer single-supplier supply chain under green vendor managed inventory (VMI) policy. A hybrid genetic and imperialist competitive algorithm (HGA) was employed to find a near-optimum solution of a nonlinear integer-programming (NIP) with the objective of minimizing the total cost of the supply chain. Ma and Huang (2019) presented the life cycle attributes of products into consideration and investigates the situation in which the manufacturer tended to invest in green innovation and establish alliances with other supply chain members. They adopted to analyze and compared the optimal decisions and profits of closed-loop supply chain (CLSC) members as well as the efficiency of three green innovation alliance modes a two-cycle CLSC consisting of one manufacturer, one retailer, and one-third party recycler, Stackelberg game method.

This study also differs from other sustainable supply chain networks (Fathollahi-Fard et al. 2020a, 2020b; Karampour et al. 2020) due to the application of transformer production in the power electronic industry as well as different operational, pricing and inventory decisions. The use of an EOQ model gives this option to the managers to provide a modern inventory management during different periods. In addition to the aforementioned contributions, this paper controls the uncertainty for unpredicted events in the case of disaster. Therefore, the first optimization model as a centralized decision-making by proposing a novel Mixed Integer Non-Linear Programming (MINLP) model aims to propose a sustainable supply chain framework with lot sizing impact and quantity discount under disruption risks via focusing on the supplier selection and order allocation. Finally, we focus on the pricing decisions of the suppliers to provide a competition among them using a Stackelberg game theory model based on sustainability dimensions.

Moreover, to achieve the literature gaps, this study provides comprehensive literature in Table 1 by reviewing the latest papers in the recent decade. The literature review is divided into six characteristics, i.e., the type of supply chain and its related industry, type of discount, considering lot sizing and or disruption risk as well as the solution methodology. Among these properties, the disruption risk is quite new in this area, and this study is among the first studies proposing these uncertainty conditions with an EOQ model which has not been considered in the aforementioned studies in Table 1. As can be pointed, although there are several papers existing in the literature of supplier selection models, only a few studies contributed to the sustainability and none of them has considered the disruption risk and mixed uncertainty in their decision-making models. As far as we know, the benefits from an EOQ model for a sustainable supply chain are not considered in the literature review. In a nutshell, the main findings of Table 1 are summarized as follows:

-

This study applies a sustainable supply chain model and this type of supply chain is quite new in comparison with the general and green systems.

-

Most papers are employed a case study to verify the application of their proposed problem in a specific industry. However, no study applied the transformer production in the power electronics industry as a supply chain network.

-

Most papers are maintained on the quantity discount of suppliers and only a few of them are considered the exponential discount for the model;

-

Only a few researches have been added the disruption risk into their model;

-

More than 50% of papers have not considered the order allocation along with a mathematical model, yet;

-

As far as we know, no one of aforementioned papers did not use an EOQ model with a contribution to the disruption risk and quantity discount.

-

Using the metaheuristics are common in the literature review. However, an improved approach may be needed to better solve this complex problem;

The mentioned literature and Table 1 show that less attention has been reported to pricing and inventory decisions as well as lot sizing of emergency supplier selection and order allocation based on the sustainability concept. In this regard, this study contrary to previous works not only considers a sustainable supply chain network focusing on the supplier selection and order allocation framework considering lot-sizing impact but also adds the quantity discounts in this area.

3 Problem formulation

3.1 Proposed centralized decision-making model

The proposed sustainable supply chain is applicable for transformer production. This is because the transformer industry, such as the car tire and battery industries, is recyclable and can be implemented in a closed and stable supply chain. The raw materials used in electrical transformers will not normally be reusable except for a number of special components that can be recycled using special processes. Transformer products will last an average of about 30 years.

The transformers are including three main components including core sheets, oil and Cellulose insulation materials. Figure 1 shows the transformer and components. It is important that using pricing policies, customers are willing to return old products and replace them with new transformers that have less losses. The most important parameter in final consumption in the transformer is the thickness of the core sheet. The thinner the core sheets, energy losses are reduced. The thickness of the sheets is usually 0.3 and 0.23. Recently, sheets with a thickness of 0.18 have entered the market in Iran. The supply of these products in Iran usually have different difficulties as the main suppliers are from international companies. In Iran, due to international sanctions and politic issues, the supply of transformer production is faced with uncertainty and disruption risks.

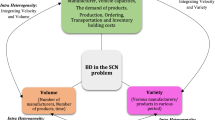

The aim of this section is to present a formulation for this problem considering lot sizing impact with quantity discount under disruption risk. This problem also covers the sustainability including economic, environmental and, social goals and, also applies an EOQ model to have a smart inventory system (Scheller et al. 2021; Li and Chen 2019). The proposed model has been developed according to Mazdeh et al. (2015). In addition, Fig. 2 shows a graphical example of this sustainable supply chain network under disruption risks which includes transformer manufacturing with international and national suppliers, which shows the different costs of the desired supply chain.

The indices, parameters and, decision variables are described as follows:

Indices

- i :

-

Index of suppliers, \(i=\{1, 2, \dots , n\}\), \({I}_{s}\) is the symbol of disrupted suppliers, and \({I}_{s}^{\prime}\) is also displayed the non-disrupted supplier

- s :

-

Index of scenarios,\(s=\{\mathrm{1,2},\dots ,{2}^{n}\}\)

- j :

-

Index of types of products,\(j=\{\mathrm{1,2},\dots ,m\}\)

- \({k}_{i}\) :

-

Index of discount domain for supplier i,\({k}_{i}=\{\mathrm{1,2},\dots ,{K}_{I}\}\)

Parameters

- \({a}_{ij}\) :

-

The fixed ordering cost of product type j from supplier i

- \({s}_{ij}\) :

-

The fixed operating cost of product type j from supplier i

- \({fj}_{i}\) :

-

The fixed job opportunities in the supplier i

- \({ee}_{ij}\) :

-

The environmental emissions for ordering product type j from supplier i

- \({C}_{ij}\) :

-

The manufacturing cost of product type j from supplier i

- \({vj}_{ij}\) :

-

Variable job opportunities for the manufacturing of product type j from supplier i

- \({em}_{ij}\) :

-

The environmental emissions for manufacturing the product type j from supplier i

- \({Cap}_{i}\) :

-

The capacity of supplier i

- \({h}_{i}^{b}\) :

-

The maintenance cost related to the purchased pieces from the supplier i

- \({h}_{i}^{v}\) :

-

The maintenance cost of supplier i

- \({D}_{j}\) :

-

The demand of markets for product type j

- \({LO}_{i{jk}_{i}}\) :

-

The lower bound for a discount domain \({k}_{i}\) for supplier i and product type j

- \({UP}_{i{jk}_{i}}\) :

-

The upper bound for a discount domain \({k}_{i}\) for supplier i and product type j

- \({w}_{i{jk}_{i}}^{A}\) :

-

The purchasing cost of product type j from supplier i, when the price is in the scope of discount domain \({k}_{i}\)(the case of general discount \(A\))

- \({w}_{ij{k}_{i}}^{I}\) :

-

The purchasing cost of product type j from supplier i, when the price is exactly within the bounds of the discount domain \({k}_{i}\) (the case of incremental discount \(I\))

- \({w}_{ij}\) :

-

The purchasing cost of product type j from supplier i, when the case of no discount exists

- \({d}_{i}^{N}\) :

-

1, if the case of no discount is existed in the supplier i.; otherwise 0

- \({d}_{i}^{A}\) :

-

1, if the case of general discount is existed in the supplier i; otherwise 0

- \({d}_{i}^{I}\) :

-

1, if the case of incremental discount is existed in the supplier i; otherwise 0

- \({\alpha }_{i}\) :

-

The probability of local disruption for supplier i

- \({\alpha }^{*}\) :

-

The probability of global disruption for all suppliers

- \({\delta }_{s}\) :

-

The probability of disruption for scenario s

- \({B}_{j}\) :

-

The cost of shortage for product type j

- γ:

-

The weight of penalty for the objective function in the total cost

Decision variables

- \({Q}_{j}\) :

-

Amount of ordering product type j

- \({x}_{i}\) :

-

1, if the supplier i is selected to supply the demands; otherwise 0

- \({y}_{ij}^{s}\) :

-

A portion of demand for product type j from supplier i in scenario s should be ordered

- \({p}_{ij{k}_{i}}^{{\prime}{\rm A}}\) :

-

1, if the discount domain \({k}_{i}\) of supplier i is selected for product type j in the case of general discount \(A\); otherwise 0

- \({p}_{i{jk}_{i}}^{{\prime}{\rm I}}\) :

-

1, if the discount domain \({k}_{i}\) of supplier i is selected for product type j in the case of incremental discount \(I\); otherwise 0

- \({u}_{j}^{s}\) :

-

Amount of non-supplied demands for product type j in scenario s

- \({fa}_{ij{k}_{i}}^{s}\) :

-

An auxiliary variable of supplier i for product type j when the price is in the scope of discount domain \({k}_{i}\)(the case of general discount) in scenario s

- \({fi}_{ij{k}_{i}}^{s}\) :

-

An auxiliary variable of supplier i for product type j when the price is in the scope of discount domain \({k}_{i}\)(the case of incremental discount) in scenario s

To consider the above notations, some assumptions should be considered to understand the developed formulation. The main assumptions are as follows:

-

Amount of \(UP_{ij0}\) and \(LO_{ij0}\) are equaled to zero in the presumptions of model.

-

\(UP_{{ijk_{i} - 1}} = LO_{{ijk_{i} }} \forall i \in I,k_{i} ,UP_{{ijk_{i} }} = + \infty\)

-

\(d_{i}^{N} + d_{i}^{A} + d_{i}^{I} = 1\)

-

If a supplier doesn’t this ability to supply a piece or a product, the model considers a big scalar number to eliminate the limits of this supplier.

-

The shortages will be penalized.

-

The purchaser after consuming the order supplied from supplier i, receives the order from supplier i + 1.

-

The proposed decision-making model considers a number of items, periods and suppliers along with quantity discounts under disruption risks.

-

The demand of each item in each period is independent, deterministic and known.

-

The time of each period is finite.

-

The unit purchase price of each supplier can be different.

Additionally, supplying the pieces and products is considered by the impact of global and local probabilistic disruption. Each supplier personally is connected to these disruptions. As mentioned earlier, the disruptions can be considered by different natural events e.g. earthquake, famine, tsunami, cyclone, hurricane, flood and etc., imminent attacks on location facility planning e.g. terrorism, war, civil disorder and etc., disease e.g. malaria or HIV/aids and a pandemic, such as the COVID-19 or other similar situations (Perfetti 2015). Tirkolaee et al., (2020c) developed a novel mixed-integer linear programming (MILP) model to formulate the sustainable multi-trip location-routing problem with time windows (MTLRP-TW) for medical waste management in the COVID-19 pandemic. To deal with the uncertainty, a fuzzy chance-constrained programming approach was applied. Rafigh et al., (2021a) presented a sustainable closed-loop supply chain under uncertainty to create a response to the COVID-19 pandemic. Their article for the first time implements the concept of a sustainable closed loop supply chain for the application of ventilators using a stochastic optimization model. The efficiency of the proposed model was tested in an Iranian medical ventilator production and distribution network in the case of the COVID-19 pandemic. In this regard, please consider \({\alpha }_{i}\) called as the probability of local disruption for supplier i. In other words, it means the supplier can provide the pieces and products by the probability of \({1-\alpha }_{i}\) and conversely the probability of \({\alpha }_{i}\) means that the disruption is existed for the supplier and the providing of pieces and products have not been occurred (Castellano and Glock 2021; Chatterjee and Chaudhuri 2021). Furthermore, please assume that \({\delta }_{s}\) is the probability of disruption for scenario s including a personal subset of suppliers (\({\mathrm{I}}_{\mathrm{s}}\subset \mathrm{I}\)) which are providing the pieces and products without any disruption. Also, the set of \(s=\{1,\dots ,h\}\) considers the whole possibilities of scenarios. It should be noted that the total number of scenarios are equaled as \(h = 2^{m}\).

The probability of local disruption is independent from others. Therefore, the probability of disruption under independent risks of local disruption can be estimated by following the formula:

Moreover, besides local disruption for each supplier, a global disruption for all suppliers is possible in which the whole of them aren’t available to supply any demand. Also, most companies around the world have had severe supply chain disruptions since the first wave of the epidemic. Lahyani et al. (2021) focused on how prepared companies were when the second wave struck. Their study was about the impacts of COVID-19 disruptions on Supply Chain Management during this second wave in Saudi Arabia. Analyses were shown in the COVID-19 pandemic that companies were expected to begin searching for a more diversified supplier base in the near term, thus looking to build a versatile, but cost-effective, supply chain. Shifting supply chains nearby, decreasing the suppliers' base, and increasing the digitalization of supply chains are essential tactics companies have to start committing to. Recent research shows that natural disasters can cause global disruption. The probability of this event may so less. But, it may have very bad consequences. In this regard, please consider that \(\alpha^{*}\) is the probability of global disruption for all suppliers at a same time. As discussed earlier, global and local disruption is independent of each other. So, the probability of \(\delta_{s}\) for each disrupted scenario under risks for both disruptions is computed as follows:

According to the Eq. (2), if the probability of global disruption \((\alpha^{*} = 0)\) is equated to zero, this case leads to transform \(\delta_{s}^{*}\) to \(\delta_{s}\) by considering only local disruptions.

To satisfy how to calculate the amount of purchaser from suppliers, some formulation has been proposed. First of all, an approach to consider the average of inventory of purchaser is illustrated. To simplify the computations, the disruption risks have not been considered. The average of inventory of purchaser during the order period from supplier i, is varied from zero to \(Q_{i}\). Obviously, the order period is equaled to \(\frac{Q}{D}\). As a result, the average of inventory for each purchaser in each unit of time received from supplier i, is estimated as the following formula:

Also, the total cost of the purchaser according to the computed average of inventory is:

Additionally, the cost of each supplier is calculated as follows:

Overall speaking, the total cost of the whole system is formulated as follows:

Regarding to Eq. (6), the proportion of formulation to \(Q_{j}\) i s convex. So, Eq. (6) is transformed into a derivative one and the new formulation is equaled to zero to find the optimal amount of \(Q_{j}\)

By replacing the new amount of \(Q_{j}\) in the function of \({profit}^{sc}\), the total cost of the system is:

Eventually, the final formulation for the developed problem has been noted as follows:

s.t

The main objective function of the proposed Mixed-Integer Non-Linear Programming (MINLP) model is justified by Eq. (9). The first objective function aims to minimize the total cost of the system. Equation (10) is to minimize the environmental emissions for operational and manufacturing activities in the system. Equation (11) is to maximize the social benefits from fixed and variable job opportunities in this supply chain network. Equations (12) to (20) is to present constraints of developed formulation. First of all, Eq. (12) guarantees that the demand of the purchaser should be supplied or considered as a shortage. Equation (13) ensures that the limitation of variable capacity of suppliers is existed. In the other words, if the supplier is not selected, any order is not allocated to it. Vice versa, if the supplier is selected to provide the order, its capacity has been used to support the demand. Equations (14) to (16) are to represent the discount domain of supplier to consider the case of general discount. Similarly, Eqs. (17) to (19) are to consider the discount domain of supplier in the case of incremental discount. To illustrate more in an example, Eq. (14) shows that if a supplier by a general discount is selected, amount of order is only limited on the defined discount domain of supplier. Equation (15) ensures that the volume of order should be lower than the predefined upper bound. Conversely, Eq. (16) guarantees that the volume of order should be higher than the predefined lower bound. Finally, the continuous and binary variables are ensured by Eq. (20).

As can be envisaged at the first glance of the model, it is non-linear and non-convex. Since the global solution is not available due to the situation of objective function. The linearization of the objective function should be planned and changed by adding more variables and constraints. Following changes are proposed to add to the general formulation:

s.t.

First of all, to handle the above model, it is transformed into a single objective formulation to ease the computational of the model. In this regard, the goal attainment approach is implemented. For the goal attainment method, the maximum diversion of objectives from their goals is minimized by leveraging the developed model, as shown below:

Indices:

j | Objective function |

\({Q}_{j}\) | Value of the jth objective function |

bj | Goal of the jth objective function |

Wj | Refers to the weight of the jth objective function |

where Qj is the value of the jth objective function, bj is the goal of the jth objective function, and Wj refers to the weight of the jth objective function that has an inverse relationship with the priority of the objectives. In this regard, Qj is equaled to the set of {\({cost}^{sc}, {enviornment }^{sc}, {social }^{sc}\)}.

3.2 Proposed decentralized decision-making model

To consider the competition of prices between suppliers, assume that there are two suppliers, one is a national supplier and another is an international supplier. With regards to sustainability and environmental emissions, the green or emission level as a decision variable is evaluated by the carbon emission tax procedure. The considered demand function for sustainable and green parts depends on the carbon emissions reduction level. To escape the unnecessary complexity of the nonlinear expressions, the demand function can be formulated as Eq. (48). This form of demand function is quite popular in the literature (Safaeian et al. 2019; Feng et al. 2019).

where in Eq. (48), a, b, and m are the potential size of the market, b, and m represent the market sensitivity coefficients. Also, e and p are emission reduction and price of the national supplier, respectively. The parameters’ and decision variables’ correlations could be achieved by the presented demand linear formation nature and running analytical investigations on them (Liu et al. 2020). Following the literature, the CE reduction cost is considered as \(\theta e^{2}\). Consideration of this structure defines the investment of carbon reduction too. This approach to addressing the carbon emission cost structure is a common method as the body of the literature reveals (Nezhadroshan et al. 2020; Fathollahi-Fard et al. 2020a). Leading energy companies are facing a dilemma regarding the emission abatement. Emissions pose costs including tax, environmental fines and penalties, on the other hand, technological investments demand huge amount of capital to be spend on reducing the emission rates of the fuels to be used in the business process. Hopefully, the green preferences of the consumers come in favor of the investments to be spent on this regard. Nevertheless, corporations and business owners are compelled to follow the carbon regulations imposed by the governments.

In this model, the decentralized decision-making scenario is carried out to obtain a win–win solution, motivating both members to decide in a coordinated mechanism. The decisions are determined in the following order, first, the supply chain leader (the international supplier) determines the emission abatement level and wholesale price (in a decentralized structure), then the national supplier determines the price. However, as the Stackelberg model is handled by the backward induction, this is the retailer who optimizes its own decision variable(s) and then the leader (the international supplier) determines its decision variables. This structure is proposed as it is applicable for the case of transformer production in Iran. In this industry, the main suppliers are divided into two types, international and national suppliers. The international suppliers are more important than the national suppliers as their decisions have a significant impact on the decisions of national suppliers. It is because that most of components in this industry are supported by international suppliers. The national suppliers buy the components and manufactured products from international suppliers.

The intended decision variables and parameters of the developed models are as follows:

Decision variables

- e :

-

The effort of Emission reduction

- w :

-

The wholesale price of the manufacturer

- p :

-

The selling price of the national supplier

Parameters

- D :

-

The demand of consumer

- a :

-

The size of the market

- b :

-

The sensitivity coefficient of the price of national supplier

- m :

-

The sensitivity coefficient of emission

- e 0 :

-

The initial production emission

- c :

-

The production cost for the international supplier

- t :

-

The carbon tax of government

- θ :

-

The cost coefficient of emission reduction

In this instance, there is a Stackelberg game procedure. The leader of the channel plays the international supplier or the upper stream role of the supply chain, while the follower of the channel plays the national supplier or the lower stream of the supply chain. The upper stream tries to maximize profit. On the other hand, the lower stream follows his own maximum profit. One of the popular approaches to solve the Stackelberg game procedure is backward induction. Equations (49) and (50) represent the profit functions of the upper stream and the lower stream, respectively. These Equations are developed based on the consumer’s demand function.

By the maximization of Eq. (50), the movement of the retailer and his own price can be determined. Afterward, by the maximization of Eq. (49), the decision variables of the international supplier can be determined.

Theorem 1

By backward induction and under a decentralized decision-making scenario the optimal closed-form of decision variables for the national supplier and the upper stream of international supplier can be calculated as follows:

Proof. Since \(\frac{{\partial^{2} \pi_{r}^{d} }}{{\partial p^{2} }} = - 2b < 0\), the profit function of the national supplier in p is concave for each e and w. \(p(w,e) = \frac{a + em + bw}{{2b}}\) can be achieved by the application of the first order optimality condition (\(\frac{{\partial \pi_{r}^{d} }}{\partial p} = 0\)). Also, the best response for the international supplier can be calculated by some calculations and the application of the best response of the national supplier into the profit function of the international supplier. The proof is complete.

The supply chain’s and its members’ optimal profit function applying to Eqs. (49) to (53) can be calculated as:

To determine the confliction of the channel, a mechanism is proposed in the Stackelberg model to set the international supplier (the upstream of the supply chain) for making a division of the profits as known, a revenue sharing contract. In a revenue sharing contract, the items are sold by the international supplier at a unit cost (\(w_{RS} < c\)), and also, a fraction α of the total revenue of the national supplier is received. The constraint \(w_{RS} < c\) guarantees the coordination of the channel. Furthermore, the distribution of profit among the supply chain members will be resolved by α according to the following equations:

Necessary optimality condition \(\frac{{\partial \pi_{m}^{RS} }}{\partial w} = 0,\frac{{\partial \pi_{m}^{RS} }}{\partial e} = 0, \, \frac{{\partial \pi_{r}^{RS} }}{\partial p} = 0\) yields:

4 Proposed solution algorithm

For solving the centralized model, metaheuristic algorithms are applied. However, for the decentralized model, the exact solver using GAMS software is used. This section aims to offer a new hybrid ICA with considering the benefits of PSO to solve the problem. The literature showed that the supplier selection is NP-hard (Samadi et al. 2018). So, the metaheuristic is a proper approach when the size of the problem increases. Regarding the No Free Lunch theory, there is no metaheuristic to solve all optimization problems satisfactorily (Wolpert and Macready 1997). This means that the current metaheuristics may need a set of modifications or hybridizations to tackle such problems more efficiently (Hajiaghaei-Keshteli and Fathollahi Fard 2019). This attempt motivates us to contribute a new hybrid metaheuristic by considering the benefits of two well-known current algorithms i.e. ICA and PSO. Here, first of all, the solution representation is illustrated. Then, ICA and PSO are explained individually. Consequently, the proposed hybrid ICA-PSO is addressed in details.

4.1 Solution representation

When a metaheuristic is employed to solve a mathematical formulation, some encoding and decoding procedures are needed to be illustrated (Tirkolaee et al. 2021; Zandieh and Aslani 2019; Zhang et al. 2020; Vieira et al. 2020). A well-design of solution representation leads that the solution time would not be increased very much and whole of constraints should be considered in the solution representations (Sadeghi-Moghaddam et al. 2017; Zhang et al. 2020). Hence, a two-stage technique, namely, Random-Key (RK) has been utilized (Snyder and Daskin 2006). This technique showed its applications in different contents of engineering scopes e.g., scheduling (Hajiaghaei-Keshteli and Aminnayeri 2013; Yu et al. 2021), supply chains (Fard et al. 2017); (Samadi et al. 2018), and transportation and cross-docking centers (Tirkolaee et al. 2021; Wang et al. 2020). In the RK, firstly, a solution is made by random numbers and then this solution is converted to a feasible discrete solution by a procedure (Fard and Hajaghaei-Keshteli 2018).

Additionally, there are two types of decision variables in this study i.e. continuous variables (\({y}_{i}^{s}, {u}_{j}^{s}\)) and binary variables (\( x_{i} ,~p_{{ijk_{i} }}^{{'I}} ,~p_{{ijk_{i} }}^{{'A}} \)). In this regard, two different procedures are needed, minimally. Figure 3 shows the considered RK technique for choosing the suppliers and the type of discount. For instance, assume there are five suppliers (\(P_{1}\) to \(P_{5}\)) and among them; three suppliers should be selected. So, a random array distributed by U(0, 1) is generated. The higher amounts are decoded 1 for variables and the rest of them should be equaled to zero.

As shown in Fig. 4, at first, similar to the last one, again a matrix with |n| elements obtained by uniform distribution U(0, 1) is made. After, according to each element of this array, the following formula is considered:

where \(UP\) and \(LO\) are defined as the upper and lower bound of the amount of shipped products from supplier i, respectively. Figure 4 shows an example with three selected suppliers in which \(UP\) and \(LO\) are 80 and 20, respectively. All of these procedures are the same in all the scenarios.

4.2 ICA

Atashpaz-Gargari and Lucas (2007) for the first time offered ICA inspired by social developments. This metaheuristic is another evolutionary algorithm but instead of natural evolution; it is considered the human social evolution (Golmohamadi et al. 2017). The literature of ICA is very rich. There are several studies to consider this algorithm in different engineering applications. Since the ICA makes a robust interaction between the search phases i.e. exploration and exploitation (Wang et al. 2020; Fathollahi-Fard et al. 2020c; Bicocchi et al. 2019). This motivated several scholars to expand its applications and enhance the performance of ICA by generating some new hybrid and modified versions of ICA (Devika et al. 2014). For instance, from recent studies, Fathollahi Fard et al. (2017) employed ICA in a closed-loop supply chain network design problem. Furthermore, Molla-Alizadeh-Zavardehi et al. (2016) proposed a modified ICA for scheduling of single batch-processing machine problem considering fuzzy due date. So, the steps of ICA are explained repeatedly in several works. Hence, we present a summarized explanation of the structure of ICA as follows.

Generally, the counterpart of a solution in ICA is named as a country. Consequently, the ICA divides the initial population into two groups i.e. empires and their colonies. Originally, after forming the empires, an assimilation policy is considered for each colony. Actually, the imperialists guide their colonies in some specific ways with different characteristics to control them better. These properties include the language, economy and culture and etc. In the ICA, this event has been occurred by moving the colonies toward their imperialists. From another point of view, this step focuses on the new regions in the neighboring of the imperialists and maintains both exploitation and the exploration phases of the algorithm. After all, the new cost of colonies is reassessed. If in an empire, a better cost has been found by one of colonies. The positions of the imperialist and the colony will be exchanged. Then, revolution in a percentage of colonies has been happened. Another step of ICA aims to calculate the total power of each empire. The total power is depended on the cost of imperialist and the weighted summation of its colonies. In addition to the total power of each empire, in the weakest empire, one of the weakest colonies is selected. This colony will be given to an empire which has the most verisimilitude to possess the colony. Consequently, an empire which has no colonies should be eliminated. Finally, these sequences will be repeated if the stop condition will be satisfied. The stopping circumstance can be the maximum number of iterations or time or only one empire will be existed in the world. To achieve more details about algorithm and its steps, a pseudo-code is provided as depicted in Fig. 5.

4.3 PSO

PSO is a popular type of swarm intelligence approach. This well-known and successful metaheuristic was introduced firstly by Şenyiğit et al. (2013). Originally, the PSO is inspired by the social behavior of bird flocking and or fish schooling. Also, it has shown good performance in different engineering topics for current and new problems (Yu et al. 2021; Wang et al. 2020; Fathollahi-Fard et al. 2020c; Bicocchi et al. 2019). For instance, Tavakkoli-Moghaddam et al. (2016) showed a good performance of PSO for an integrated production scheduling and air transportation problem. Furthermore, Fathollahi Fard and Hajaghaei-Keshteli (2018) considered PSO for a new tri-level location-allocation model for forward/reverse supply chain network design problem. One of the main advantages of PSO is to consider the memory of requirements and speed of particles (Hajiaghaei-Keshteli et al. 2014). In the PSO, particles are changed according to the particle’s position and velocity. In addition, the PSO keeps the best value of all particles as gbest and also saves the best particle in the neighboring of each particle as pbest. To enhance the trade-offs between the exploitation and exploration phases, this algorithm utilizes the weights of gbest and lbest to move each particle (Fard et al. 2017). Figure 6 shows the pseudo-code of the proposed PSO.

4.4 Proposed hybrid ICA-PSO algorithm

Another novelty of this research is to introduce a new hybrid approach by employing the benefits of both ICA and PSO in an integrated manner. The last decade has seen a great performance of hybrid metaheuristics in several mathematical problems (Devika et al. 2014). In the proposed idea, the ICA is the main loop and the PSO is considered to improve the drawbacks of presented ICA. In the literature of ICA, several studies can be found to maintain the assimilation operator to modify its search operator (Molla-Alizadeh-Zavardehi et al. 2016). The properties of PSO are considered instead of assimilation operator of ICA. So, by using the updating formula of PSO per iteration, the colonies move toward their imperialist and the best imperialist in the world. To the best of our knowledge, this study is among the first works to propose this idea to improve the ICA. Note that the other steps of proposed hybrid algorithm are similar to its original ICA as previously discussed in Sect. 4.2. To add more details about the presented algorithm, a pseudo-code is addressed by Fig. 7.

5 Computational results

The computational results of proposed problem have been addressed in this section. First of all, the instances of our problem in different complexities and difficulties are generated. Then, the metaheuristics have been tuned by Taguchi experimental design method. After that, the metaheuristics have been validated by exact solver in small sizes. Finally, the extensive comparison with metaheuristics in different criteria e.g. the hitting time, the quality of solutions by considering the best, the worst and the average as well as the standard deviation of metaheuristics during thirty run times and also statistical analyses have been performed to find the best algorithm, efficiently. Finally, some sensitivities are done to compare both centralized and decentralized models. Note that for exact solver, the solution procedure is coded in GAMS23.4 optimization software. In addition, all experiments have been done on an INTEL Core 2 CPU with a 2.4 GHz processor and 2 GB of RAM.

5.1 Instances

The parameters of model are generated randomly by an approach benchmarked from Mazdeh et al. (2015). The instances are classified in three levels i.e. small, medium and large sizes. In each level, four test problems are generated. To be fair the comparison of metaheuristics, the stopping condition is time interval according to the size of model. Accordingly, the time of test problems increases while the size of problem increases to consider a fair competition of algorithm. As a result, Table 2 provides these details of test problems.

5.2 Calibrations of metaheuristics

When a metaheuristic is used to solve a mathematical model, it is needed to consider a plan to calibrate the metaheuristics’ parameters (Fathollahi-Fard et al. 2020c; Bicocchi et al. 2019). Here, Taguchi experimental design method is employed to achieve this goal. Taguchi and Jugulum (2002) proposed this methodology to decrease the number of experiments to assess the quality production management. Todays, this approach has been considered by several metaheuristics’ papers to tune them, efficiently. There are several recent papers employed this methodology to tune the metaheuristics e.g. Tirkolaee et al. (2021), Sadeghi-Moghaddam et al. (2017) and Fard and Hajaghaei-Keshteli (2018).

Accordingly, there are two main components to find the best value for each algorithm parameter. Signal to noise (S/N) and relative percentage deviation (RPD) are two metrics to control the quality of candidate values for algorithm’s parameters. Theses parameters are called factors in this approach. Regarding to S/N, this indicates the variation of response variables for factors. The higher value of S/N brings a better capability of metaheuristics’ collaborations. In a minimization optimization model, S/N ratio is formulated as follows:

In each metaheuristic, for each factor, maximum three values are selected to examine an optimal case of parameters. This information has been provided in Table 3.

Due to thirty run times of metaheuristics for each instance, RPD metric is employed to assess the performance of algorithms. Hence, this metric for a minimization optimization model is formulated as follows:

where \({Min}_{sol}\) is the best solutions among all solutions and \({Alg}_{sol}\) is the output of algorithm. It is evident that the lower value of RPD brings better quality. Accordingly, Taguchi method based on the factors given in Table 3 for ICA and ICS-PSO has offered L27 as the orthogonal arrays of methodology. Also, L9 has been proposed for PSO to consider the trails of orthogonal arrays. In regards to S/N and RPD, Figs. 8, 9, 10, 11, 12 and 13 presents the behavior of algorithms in these metrics. Accordingly, the proper value of parameters is evident. Finally, the best value for metaheuristics’ parameters is given in Table 4.

5.3 Validation of metaheuristics

In this part, the presented metaheuristics are validated by exact solver i.e. GAMS for small sizes. The results are given in Table 5. Note that metaheuristics are run for thirty times. So, the best, the worst, and the average of solutions along with the standard deviation of outputs during thirty run times are noted in this table. Additionally, the hitting time of metaheuristics is given in this table. The hitting time is the first time that the best solution is ever found (Tavakkoli-Moghaddam et al. 2016). It brings the convergence rate of algorithms.

From Table 5, although a surprising similarity between the results of algorithms has been seen, the standard deviation of PSO for the two smallest test problems and also ICA-PSO for the two last test problems in the table shows a strengthen behavior. As a result, the proposed hybrid ICA-PSO is almost better than its individual ones.

Moreover, to validate the metaheuristics, the gap of solution is reached according to the best solution found by GAMS. In this regard, the amount of gap is depicted by Fig. 14. From this graph, ICA reveals a better performance in comparison with PSO except in P4 test problem. Clearly, ICA-PSO shows the best behavior in this item and generates a robust solution in comparisons with two other metaheuristics.

The behavior of time computation of exact method and hitting time of metaheuristic is provided in Fig. 15. It is evident that the time of exact solver by increasing the size of model increases exponentially. From Fig. 15, the need of metaheuristic is can be resulted for this problem. Furthermore, while PSO consumes the less time among the metaheuristics, the proposed hybrid metaheuristic named ICA-PSO shows more time computations in all of small instances.

5.4 Comparison of obtained metaheuristics

This part aims to present a state of art comparison with metaheuristics by considering different criteria e.g. the best and the worst and the average of solutions as well as the standard deviation of outputs during thirty run times. Also, considering the hitting time of metaheuristics along with the statistical analyses are performed to highlight the performance of algorithms to achieve the best one. Accordingly, the outputs of metaheuristics are noted in Table 6. Additionally, the convergence analysis of algorithms has been examined by the hitting behavior of metaheuristics as shown by Fig. 16. Moreover, Fig. 17 reveals the statistical analyses of metaheuristics based on RPD metric to highlight the performance of them to select the most efficient one in this study.

From Table 6, it is evident that ICA-PSO finds the best values in most of the items. But, in some instances e.g. P7 and P8, ICA shows a better performance. Conversely, PSO is the weakest metaheuristic in most of the items.

According to Fig. 16, by increasing the size of the problem, the behavior of metaheuristics has been changed. While the hybrid ICA-PSO has the highest hitting time between P5 and P7, PSO reaches the best value in two sizes P5 and P7. After that, ICA-PSO algorithm shows the best behavior in this item and has the lowest amount of hitting time. Generally, ICA is the worst metaheuristic in this item. Vice versa, ICA-PSO reveals an efficient behavior to assess the convergence rate of metaheuristics.

From Fig. 17, it can be resulted that the proposed ICA-PSO has extremely better than its individual metaheuristics. In summary, the hybrid ICA-PSO algorithm has pros and cons as follows:

The advantages are:

-

Employ the benefits of both ICA and PSO in an integrated manner.

-

Consider ICA as the main loop and improve the drawbacks of using PSO.

-

Use the updating formula of PSO per iteration, and move the colonies toward their imperialist and the best imperialist in the world.

-

The least Gap behavior of metaheuristics.

-

Best result in the statistical analysis of metaheuristics in terms of RPD.

The disadvantages is:

-

The hitting time of metaheuristic is high.

5.5 Comparison of centralized and decentralized models

Here, we compare the centralized and decentralized decision-making models. The results of this comparison, are reported in Table 7. In this table, we document the results of solving the case instance as a decentralized model and without this approach. Based on this comparison, we can see that the sum of the costs for both levels is lower than the cost without the bi-level approach. However, the computational time for the bi-level approach is more than for the centralized model. This means that the proposed optimization model can better solve our problem to achieve a better solution than the centralized optimization model. However, obtaining this better answer also requires more processing time.

6 Discussion and conclusion and future works

This paper addressed a supplier selection framework considering lot-sizing impact with quantity discounts under disruptions risk by a new hybrid ICA and PSO for the first time. Both centralized and decentralized decision-making models were created to address the manufacturing and recycling of electronic products. A comprehensive literature review was provided by maintaining on the researches during the last decade. The details of the model and formulation are proposed and illustrated. Due to the proposed model was a type of non-linear and non-convex for the objective function, a linearization of the formulation was developed and illustrated the replaced decision variables and constraints. To address the problem, not only the exact solver using by GAMS software was used but ICA and PSO were also hybridized with each other to employ the benefits of them, efficiently. The test problems were generated by benchmarked approach. The metaheuristics were compared with each other in different criteria. As a result, the proposed hybrid metaheuristic ICA-PSO showed the best performance according to the results. Finally, a comparison of the centralized and decentralized models was done to show that the decentralized model is more complex than the centralized decision-making model. However, the decentralized model founds a better solution.

According to the results obtained operationally and practically, it can be pointed out that the selection of a supplier in the event of a disturbance is extremely important. And perspectives is generated because there is uncertainty and supply disruption in supply chain networks unpredictably. Generally, two types of uncertainties are existed i.e., operational and disasters. The operational uncertainties relay to structure of activities such as the time of ordering and prices of products. But, disasters are a recent motivated issue which can be defined as natural activities e.g. earthquake, famine, flood etc., imminent attacks of location facility planning e.g. terrorism, war etc., disease e.g. malaria, HIV/aids or COVID-19 or other similar situations like international sanctions. But with the necessary planning, destructive economic, environmental and social consequences can be largely avoided. The following main conclusions are yielded according to the numerical results of this study:

-

(1)

A novel MOMILP formulation was proposed considering lot-sizing impact with quantity discounts under disruptions risk by a new hybrid ICA and PSO of transformer production.

-

(2)

In the decentralized model, considering the price competition between suppliers, one national supplier and the other international supplier about sustainability and environmental emissions, the green level or emissions as a decision variable with the carbon emission tax method was considered

-

(3)

In a decentralized model of the Stackelberg game procedure used. The leader of the channel plays the international supplier or the upper stream role of the supply chain, while the follower of the channel plays the national supplier or the lower stream of the supply chain. The upper stream tries to maximize profit.

-

(4)

A real-life case study problem was implemented by a new hybrid ICA and PSO for the first time. That the results were reported.

-

(5)

The results demonstrated that the decentralized model is more complex than the centralized decision model. However, the decentralized model finds a better solution.

The issues raised are the ones that somehow turn the transformer production conditions into an abnormal and uncertain situation. In fact, all supply chains from the beginning of the production process, supply, sales, and even services affect the after-sales crisis. Things that may occur include:

-

Increase in shipping price (due to the remoteness of the geographical location of the new supplier, exchange rate fluctuations, etc.)

-

Full payment before receiving the desired material or product (requires increasing the amount of liquidity, increasing credit, etc.)

-

Uncertainty about the delivery of a healthy product on time (Problems such as breakage, defect during loading, etc.)

-

Reducing the quality of the final product (due to non-cooperation of first-class suppliers and the use of substandard raw materials, etc.)

-

Loss of customers (due to low-quality products and rising prices of products due to rising prices of raw materials and transportation, no customer request and even no after-sales service and no guarantee of products provided to the customer)

Even cause lost sales.

Disruption risk affects managers and owners so much that it has led them to adopt various policies. One of these policies can be the use of backup suppliers to provide the choice of backup provider with problems and questions. Before deciding to choose it, they should be answered:

-

Can a new supplier that supports the previous supplier meet our standards?

-

Does it have the necessary approvals to produce our product?

-

Does it adapt to production processes?

Using the model presented in this article, suppliers can be internal and external and selected.

On the other hand, with the pricing policy and the plan to return worn-out products, and in exchange for delivering the product at a lower price, it introduced some products that can be reused in certain industries into the production cycle and reproduced them or re-produced them.

Disassembled and used some of their parts can consequently change the quality of products and raise questions like this:

-

Does the recycled product have the desired quality?

-

Is it possible to achieve a product with the desired quality by using the existing facilities?

-

Are required the use of new technologies in production?

-

Is it cost effective to use the recycling process in the industry?

Using the proposed model and the issue of pricing, a large part of the concerns of managers and owners of capital can be answered.

Generally, this work can open several new directions for future works. For instance, the proposed hybrid metaheuristic can be applied to solve other large-scale optimization problems. In addition, other recent metaheuristics like the red deer algorithm or social engineering optimizer, can be used for solving our optimization model in comparison with our metaheuristics. More intensive analyses on the considered risk model are needed to be explored. The proposed mathematical can be expanded by other real suppositions in this research area e.g. green and sustainable considerations can be added into the proposed model. The vehicle routing operations can be considered by different sizes of capacity to transform the products between suppliers and buyers.

Data availability

Enquiries about data availability should be directed to the authors.

References

Akarte G-H, Chaing C-H, LI, C.-W. (2007) Evaluating intertwined effects in e-learning programs: a novel hybrid MCDM model based on factor analysis and DEMATEL. Expert Syst Appl 32:1028–1044

Atashpaz-Gargari E, Lucas C (2007) Imperialist competitive algorithm: an algorithm for optimization inspired by imperialistic competition. In: IEEE Congress on evolutionary computation, 2007. CEC 2007, pp 4661–4667. IEEE

Bicocchi N, Cabri G, Mandreoli F, Mecella M (2019) Dynamic digital factories for agile supply chains: an architectural approach. J Ind Inf Integr 15:111–121

Bohner C, Minner S (2017) Supplier selection under failure risk, quantity and business volume discounts. Comput Ind Eng 104:145–155

Castellano D, Glock CH (2021) The average-cost formulation of lot sizing models and inventory carrying charges: a technical note. Oper Manag Res 14(1):194–201

Chang B, Chang C-W, WU, C.-H. (2012) Fuzzy DEMATEL method for developing supplier selection criteria. Expert Syst Appl 38:1850–1858

Chatterjee, S., & Chaudhuri, R. (2021). Supply chain sustainability during turbulent environment: examining the role of firm capabilities and government regulation. Oper Manag Res, 1–15

Chen Q, Xu Q (2020) Joint optimal pricing and advertising policies in a fashion supply chain under the ODM strategy considering fashion level and goodwill. J Comb Optim. https://doi.org/10.1007/s10878-020-00623-y

Cheraghalipour A, Farsad S (2018) A bi-objective sustainable supplier selection and order allocation considering quantity discounts under disruption risks: a case study in plastic industry. Comput Ind Eng. https://doi.org/10.1016/j.cie.2018.02.041

Devika K, Jafarian A, Kaviani A (2014) Sustainable closed-loop supply chain network design: hybrid metaheuristic algorithms based on triple line theories. Eur J Oper Res 25:243–257

Dweiri A, Lewandski L, Apte A (2015) Stochastic optimization for natural disaster asset prepositioning. Prod Oper Manag 19:561–574

Eslamipoor R, Sepehriar A (2014) Firm relocation as a potential solution for environment improvement using a SWOT-AHP hybrid method. Process Saf Environ Prot 92(3):269–276

Fallahpour A, Olugu EU, Musa SN, Khezrimotlagh D, Wong KY (2016) An integrated model for green supplier selection under fuzzy environment: application of data envelopment analysis and genetic programming approach. Neural Comput Appl 27(3):707–725

Fard AMF, Gholian-Jouybari F, Paydar MM, Hajiaghaei-Keshteli M (2017) A bi-objective stochastic closed-loop supply chain network design problem considering downside risk. Indust Eng Manag Syst 16(3):342–362

Fard AMF, Hajaghaei-Keshteli M (2018) A tri-level location-allocation model for forward/reverse supply chain. Appl Soft Comput 62:328–346

Fathollahi-Fard AM, Ahmadi A, Mirzapour Al-e-Hashem SMJ (2020b) Sustainable closed-loop supply chain network for an integrated water supply and wastewater collection system under uncertainty. J Environ Manag 275:111277

Fathollahi-Fard AM, Hajiaghaei-Keshteli M, Mirjalili S (2018) Multi-objective stochastic closed-loop supply chain network design with social considerations. Appl Soft Comput 71:505–525

Fathollahi-Fard AM, Hajiaghaei-Keshteli M, Mirjalili S (2020c) A set of efficient heuristics for a home healthcare problem. Neural Comput Appl 32(10):6185–6205. https://doi.org/10.1007/s00521-019-04126-8

Fathollahi-Fard AM, Hajiaghaei-Keshteli M, Tian G, Li Z (2020a) An adaptive Lagrangian relaxation-based algorithm for a coordinated water supply and wastewater collection network design problem. Inf Sci 512:1335–1359. https://doi.org/10.1016/j.ins.2019.10.062

Feng Y, Zhang Z, Tian G, Fathollahi-Fard AM, Hao N, Li Z, Tan J (2019) A novel hybrid fuzzy grey TOPSIS method: supplier evaluation of a collaborative manufacturing enterprise. Appl Sci 9(18):3770. https://doi.org/10.3390/app9183770

Golmohamadi S, Tavakkoli-Moghaddam R, Hajiaghaei-Keshteli M (2017) Solving a fuzzy fixed charge solid transportation problem using batch transferring by new approaches in meta-heuristic. Electron Notes Discrete Math 58:143–150

Ha DE, Murray AT, Li TC (2008) Decision support for network disruption mitigation. Decis Support Syst 44:954–969