Abstract

The acceleration of new technology venture launch and growth is an important and rapidly growing field of practice for university-based accelerators, incubators, and technology transfer offices. Based on four comparative case studies of fast-launching clean tech startups in the USA (two of which were university-affiliated), this paper explains how some technology startups are able to develop innovative products, form organizations, internationalize, and release products into global markets very rapidly, and highlights implications for university-sourced ventures. Findings show that two processes, “product emergence” and “organization emergence,” have to be managed strategically, with time as a critical variable to be considered. This paper suggests that there are dynamic tensions between temporal, financial, and human resources in the technology startup process. To start up quickly, the new international technology venture compresses two parallel timelines: product launch and organization launch, which can also accelerate the internationalization process. This study identifies the organizational formation pivot as a risky but necessary transition from a lean, informal, fast-paced technology development project to a structured, legally compliant organization, in the case of a university-sourced venture fully independent from the university that spawned it, that can be trusted for transactions and investment.

Résumé

Accélérer le lancement, la croissance et l’internationalisation des start-ups: tel est l’objectif des accélérateurs universitaires, des incubateurs et des services de valorisation de la recherche. A partir de la comparaison de quatre start-ups technologiques aux Etats Unis (dont deux affiliées à l’Université), ce papier étudie les mécanismes qui permettent aux jeunes pousses de mettre rapidement des produits sur le marché, d’organiser l’entreprise et de s’internationaliser. Le temps est une variable critique. Cet article suggère que le processus de démarrage de l’entreprise génère de fortes tensions financières, humaines et temporelles car l’entreprise compresse le temps pour tenir deux échéances en parallèle: lancement de produit et de l’organisation. Les accélérateurs jouent principalement en rattrapage d’une lacune de l’équipe fondatrice que ce soit pour avoir accès aux marchés domestiques, pour un accès à l’international ou pour des compétences managériales ou scientifiques. La compression du temps conduit les entreprises à se développer une organisation simplifiée et légère et à mettre sur le marché des produits à viabilité minimum. Les start-ups universitaires ont un meilleur accès international et nécessitent des compétences managériales pour se développer rapidement.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Summary Highlights

Contributions: This study explores the speed of new technology startup time, including simultaneous innovative product development, organizational creation, and internationalization, and makes important contributions to the study of time and entrepreneurship and to the practices of university-based incubators.

Research questions/purpose: How can the nascent international technology venture quickly and simultaneously launch new products or services, organize the company and internationalize? How are some technology ventures able to launch more quickly than others?

Basic methodology and information: Qualitative, inductive research for this paper includes four in-depth case analyses of clean tech startups in the USA that launched very quickly, including two that internationalized and two that were affiliated with university-based incubators. Data from 34 in-depth, semi-structured interviews and hundreds of pages of documents and archival records were organized and analyzed in Dedoose.

Results/findings: Findings show that two processes, product emergence and organizational launch, are impacted in different ways by compressing the venture launch timeframe. Tensions are identified between time, financial resources, and human workload. All four ventures launched rapidly for reasons that were financially driven, not market driven. While the startup teams were motivated by compressed timeframes, individuals were also susceptible to burnout.

Limitations: This study is based on four in-depth case analyses for the purposes of extending and improving theoretical understanding, and is not intended to provide a representative sample of technology ventures. Empirical research will be required to verify the findings and recommendations. All cases were based in the USA for comparability, with the understanding that the frameworks developed could be applied internationally, but applicability to other countries has not been tested.

Theoretical implications and recommendations: A new model of venture emergence stages of development reveals the organizational formation pivot that is especially precarious for startups that launch rapidly. The dynamic relationships between time, financial resources, and human workload need to be managed strategically, with understanding of the advantages and trade-offs of compressing the launch timeframe.

Practical implications and recommendations: University business incubators can provide early-stage technology ventures with physical resources, advice, and connections to the global academic community for rapid product development and internationalization, thus minimizing the search for funding until after product release, as well as provide timely legal and organizational development support during the organizational formation pivot to help establish structured, legally compliant enterprises that can be trusted for internal and external transactions.

Future research directions: Additional inductive research is needed on the temporal dimension of subsequent stages of entrepreneurial growth and development. Empirical research is required to verify the concepts developed in this paper. More exploration is needed of temporal and developmental differences between web/mobile app ventures and other technology startups.

Introduction

Expanding internationally usually comes as a second step after companies start up and launch products or services (Autio et al. 2000; Johanson and Vahlne 1977). This paper analyzes how time can be compressed to shorten the startup and internationalization process. It also explains why exposure to internationalization and international networks is a pre-condition for internationalizing quickly, which has been established by previous international entrepreneurship studies (Andersson et al. 2013; Coviello 2006; Evers and O’Gorman 2011). University-industry collaborations can provide the international networks that help to rapidly launch university spinouts into domestic and foreign markets.

Time is recognized as a key dimension in entrepreneurship that needs more study (Busenitz et al. 2003; McMullen and Dimov 2013; Welter 2011; Zahra et al. 2014). There is a “temporal tension” between the current state and the entrepreneur’s intention (desired state), which motivates the entrepreneur to drive the pace of venture launch (Bird 1992). Entrepreneurship is the journey of resolving that tension, with time as a critical dimension, a view that encourages a process-focused approach to entrepreneurship studies (McMullen and Dimov 2013). Zahra et al. (2014) posit that despite decades of research touching on various aspects of the temporal dimension of entrepreneurship, “…our knowledge of time as a dimension of context remains fragmented at best (p. 242).”

The study of venture creation speed is a subset of the study of time and entrepreneurship. The concept of time “compression” was introduced by Eisenhardt and Tabrizi (1995) to describe the process of squeezing together the steps necessary to achieve a product launch goal in a shorter time frame. This was contrasted with the “experiential” model of releasing what is now known as a “minimum viable product,” and rapidly reiterating based on experience with users, which can also result in faster product launch (Ries 2011). While the speeding up of new technology product development is generally regarded as benefiting the firm (Eisenhardt 1989a, b; Kessler and Bierly 2002; Kessler and Chakrabarti 1996; Markman et al. 2005), compressing the organization’s birth and development may be problematic (Brush et al. 2008; Capelleras et al. 2010; Dierickx and Cool 1989). This is especially important for university-supported startups, which can lack the managerial experience to move quickly through critical startup phases (Vohora et al. 2004).

The focus on time and international venture creation has primarily focused on the speed of internationalization and the “born global” firm that derives competitive advantage by rapidly expanding into international markets (Autio et al. 2000; Weerawardena et al. 2007). The capabilities developed by new technology ventures as they innovate and create products for market positively impact the success of internationalization efforts (Knight and Cavusgil 2004). But the role of speed and the respective rhythms of venture creation, product launch, and internationalization remain in shadow.

In addition to addressing the temporal dimension of international venture creation, this paper also contributes to the study and practices of university technology transfer and entrepreneurship programs. Universities have an important stake in rapidly commercializing technologies, whether developed as a result of faculty-led research or as a result of incubating student-led entrepreneurial projects (Shah and Pahnke 2014). University business incubators (UBIs, including university-based accelerator, incubator, and technology transfer programs) speed the commercialization of university-sourced technologies (Grimaldi and Grandi 2005; Lee and Osteryoung 2004; Mian 1997). The scientific research from universities plays an important role in entrepreneurship (Cunningham et al. 2015; Guerrero et al. 2015), and international networks, like those found in the academic community, can help with rapid internationalization (Coviello and Munro 1995; Coviello 2006; Musteen et al. 2010; Yu et al. 2011).

How can the nascent international technology venture simultaneously launch new products or services, organize the company, and internationalize? This paper seeks to explain why some ventures are able to launch companies with innovative products and gain domestic and international market traction very quickly. By examining four comparative case studies of fast startups, including two nurtured by UBIs and two with very early international sales, we explore nascent technology organizations from the first intention to create a product through organizational emergence, product innovation, and product market introduction to a signal of market traction for the newly developed product. All companies were selected from the clean tech industry. The cases focus on the initial resources and conditions of the enterprise, the capabilities of the startup teams, and changes in the available resources and capabilities during the time period examined.

The dynamic relationships between financial resources, human workload, and time compression emerged as central themes of the analysis. Time is a resource to be managed strategically, partially substitutable for financial resources, with awareness of the advantages, trade-offs, and risks of compressing or decompressing a launch timeframe. While the duration of what constitutes a “fast” technology startup may vary from country to country based on local regulatory regimes and access to markets (Misra et al. 2012), the impacts of compressing that timeframe will create similar relational dynamics between temporal, human, and financial resources in any country.

The rest of the paper is structured as follows: The next section examines current knowledge on organizational creation time, innovation time, and internationalization time. The subsequent section explains the research design and how data have been collected to explore the mechanisms by which startup technology firms achieve rapid product and organizational emergence. This is followed by the main findings, based on the comparative case analysis. The discussion underlines the specificity of time as a resource. It also highlights the importance of the management of the timeline as a lever for influencing financial resources, organizational tensions, and the time required for launching start-ups. Implications for UBIs are explained in the conclusions.

Research background

The rapid simultaneous emergence of organizations and innovative products is a complex endeavor. To better understand the international technology startup process, we need to understand the relationship of time with three areas of study: innovative product development; organizational creation and development; and internationalization. Studies have examined pieces of these relationships, but there is no coherent framework that encompasses and explains these scattered pieces of the puzzle. This paper is an attempt to make sense of the temporal dimension of the nascent international technology startup. It is helpful to understand four areas of study as background for this research: innovation speed (in any size technology firm), the stages of venture creation (not specifically about speed of venture creation), venture creation speed (although not necessarily in international technology firms), and internationalization speed.

Innovation speed

Innovation speed has been under scrutiny because time-to-market is a competitive dimension. Bluedorn and Denhardt (1988) discuss time as a critical organizational resource, mentioning the importance of “temporal structures” that control cycles of work. Innovation speed is a measure of the time spent between idea conception and commercialization (Kessler and Chakrabarti 1996). Research suggests that getting innovative products to market quickly benefits the firm (Eisenhardt 1989b; Kessler and Bierly 2002; Kessler and Chakrabarti 1996; Markman et al. 2005). However, there are differences in innovation conditions and processes between incumbent firms and startups (Antolín-López et al. 2015).

The ability to speed up innovation leads to competitive advantage (Gupta and Wilemon 1990; Kessler and Chakrabarti 1996; Markman et al. 2005). Fast decision-making in technology ventures results in improved performance (Eisenhardt 1989b). Barriers to accelerating new product development can be managed (Gupta and Wilemon 1990). Chen et al. (2005) found that speed to market generally positively influenced new product success, but the effect was moderated by market uncertainty. Quality and innovativeness are not antonymic with speed. While some analyses have shown that speeding up new product development may negatively impact quality (Crawford 1992; Lukas and Menon 2004), multiple studies have found a symbiotic relationship between product innovation speed and product quality (Goktan and Miles 2011; Kessler and Bierly 2002; Menon et al. 2002; Stanko et al. 2012). Stanko et al. (2012) conclude that speed to market leads to both better quality and lower costs—there is not necessarily a trade-off between them. They further found that products that are highly innovative result in a more positive relationship between speed and quality than less innovative products. Similarly, Goktan and Miles (2011) suggest that the radicalness of product and process innovations are positively correlated with the speed at which those innovations take place.

Innovation speed is most important in fast-paced technology industries in which, as Eisenhardt and Tabrizi (1995, p. 104) point out: “Fast product development emerges as more uncertain than predictable, more experiential than planned, and more iterative than linear.” While innovation speed is related to the external environment, some internal conditions also influence it: powerful project leaders and multifunctional teams are important for rapid product development (R. G. Cooper and Kleinschmidt 1994; Eisenhardt and Tabrizi 1995), while planning and extrinsic performance rewards negatively impact it (Eisenhardt and Tabrizi 1995).

Universities have a stake in innovation speed. University-based start-ups and spin-offs provide many benefits to the market because they are often based on innovative science (Guerrero et al. 2015). Final technological development needs to be undertaken as well as proof-of-concept, as most principal investigators of Universities and Public Sector Research Organizations remain in academia (Cunningham et al. 2015). The role of UBIs is to facilitate rapid commercialization of innovation by developing a large pipeline of ideas and rigorous selection processes; providing holistic capacity development for entrepreneurial teams, with regular monitoring and evaluation; and facilitating access to internal and external networks and sources of funding (Patton et al. 2009).

Stages of new venture creation

What does it mean to start up a venture quickly? Presumably, it means to either skip steps in the entrepreneurial process or move through them very quickly. While there is no consensus model of the stages of venture creation, numerous models are offered in the literature and in practice on how entrepreneurs are assembling resources (Ciabuschi 2012). Table 1 presents nine of these models, ranging from three to six stages. They include different perspectives, four from research journals (including one about university spinouts), three from books, one from a textbook, and one normative description from the venture capital industry.

The concept of time is not included in most of these models. They discuss stages and/or sequence of activities, but not timeframes. The exception is Reynolds and White (1997), but their consideration of startup time lumps together all new ventures, from the mom-and-pop store to the international technology venture. The lack of consideration of the temporal dimension is an issue both in the entrepreneurship literature (McMullen and Dimov 2013) and the internationalization literature (Welch and Paavilainen-Mäntymäki 2014).

The time horizon for the startup process, including activities engaged and their duration and sequence, varies depending on the industry (Liao and Welsch 2003). Vohora et al. (2004) examined university-based “spinout companies” and mapped phases of development with “critical junctures” between them. Bird (1992) introduced the idea of time pacing to describe the frequency of milestones in the entrepreneurial process. When Brown and Eisenhardt (1997; Eisenhardt and Brown 1998) studied time pacing in the computer industry, they found that many successful organizations set ambitious, self-constructed timeline intervals for new product releases.

Venture creation speed

Venture emergence occurs when four conditions have been achieved: intention, boundaries, resources, and exchange (Katz and Gartner 1988). The speed of venture emergence can be measured by the amount of time required to meet these four conditions, completed when exchanges in the form of sales have taken place (Schoonhoven et al. 1990). International exchanges (exports) by the new firm mark the completion of emergence for the international new venture (Kundu and Katz 2003).

While there have been many studies of speed and innovation, understanding of the relationship between speed and venture creation is still developing (Capelleras et al. 2010). Time to market is an important factor for innovative startups (Heirman and Clarysse 2007). There have been a few studies of specific factors that impact the time of venture creation, based on panel data and surveys (Capelleras et al. 2010; Capelleras and Greene 2008; Clausen and Korneliussen 2012; Heirman and Clarysse 2007; Schoonhoven et al. 1990). But this approach does not capture the full picture of how some innovative technology ventures start up more quickly than others.

Some interesting results emerged from those studies. An important longitudinal study of 98 technology ventures by Schoonhoven et al. (1990) identifies factors that influence speed-to-market, including a particularly interesting result that increased spending (implying more financial resources available to the firm) was correlated with increased time-to-market. This finding challenges the assumption among venture investors that investing more resources accelerates innovative product launches. Clausen and Korneliussen (2012) found that entrepreneurial orientation, which includes the strategic, process-development and decision-making capacities of a firm that lead to the creation and market release of innovative products, has a positive impact on speed-to-market. There are indications that nascent entrepreneurs who aggressively pursue venture creation are more likely to launch their companies (Carter et al. 1996). Capelleras and Greene (2008) found that prior experience positively impacts speed of venture creation, as well as support from suppliers and customers; planning is detrimental; and the relationship between speed and growth is positive but weak. The latter result was contradicted by a later study that found that startups that take more time to launch subsequently have greater growth than those that take less time (Capelleras et al. 2010). Heirman and Clarysse (2007) found that the amount of startup capital has little influence over time-to-market, and that having employees who were involved with developing products prior to launch leads to faster time-to-market, with the surprising exception of software firms. There is also evidence that launching a firm rapidly may hurt the enterprise in the longer run (Brush et al. 2008; Capelleras et al. 2010; Dierickx and Cool 1989).

Mostly based on statistical analysis, these studies have been ambiguous and sometimes contradictory. New ventures that are developing innovative technology products are engaged in complex undertakings. The studies in this area have raised interesting questions; in-depth comparative case studies can provide more insights on the processes by which time-to-startup and time-to-market can be reduced simultaneously.

Speed of new venture internationalization

Traditionally, international business scholars described internationalization at the firm level as an incremental process (Johanson and Vahlne 2003; 1977) from near to far, facilitated by gains in resources. The more recent field of international entrepreneurship initially focused on internationalization guided mainly by particular elements of entrepreneurial orientation (Dess and Lumpkin 2005, Kessler and Chakrabarti 1996)—i.e., entrepreneurial characteristics of autonomy, innovativeness, pro-activeness, competitive aggressiveness, and risk taking. The number of early-stage technology companies that are rapidly internationalizing is increasing dramatically (Madsen 2013). The international new venture is defined by Oviatt and McDougall (1994) as “a business organization that, from inception, seeks to derive significant competitive advantage from the use of resources and the sale of outputs in multiple countries.” For our study of nascent international ventures, internationalization is marked by the achievement of early foreign sales. Oviatt and McDougall’s framework provides an important theoretical foundation that has subsequently been deepened and extended (S. A. Zahra 2005). Etemad (2004) proposes a meta-framework for international entrepreneurship using a systemic approach that nests the entrepreneur level within the firm level, which is in turn nested within the market level, thus integrating several lines of research.

Internationalization is usually seen as a second stage of the innovation process, except for the new venture that has achieved rapid internationalization, sometimes called the “born global” (Autio et al. 2000; Weerawardena et al. 2007). The founding team plays an important role in the timing of internationalization: Denicolai et al. (2015) underlined that firms founded by entrepreneurial teams are more likely to be both innovative and international than family firms or sole-entrepreneur firms. Turcan and Juho (2014) explore how new ventures internationalize beyond the start-up phase, emphasizing the need to develop substantive capabilities to internationalize, requiring time and financial resources. In a similar vein, Andersson and Evers (2015) build on international opportunity recognition and dynamic capabilities literature to explain how dynamic capabilities of the firm can be created for international opportunity identification leading to international firm growth.

While internationalization is widely accepted as being a process, few studies of internationalization have taken a temporal, processed-based approach (Welch and Paavilainen-Mäntymäki 2014). Autio et al. (2000) links the speed of initial internationalization with subsequent international growth. Chetty et al. (2014) promote a nuanced and multi-dimensional approach, recognizing that internationalization speed may vary over time as companies learn and then expand, and may accelerate or decelerate over time. Casillas and Acedo (2013) propose the explicit examination of the role of speed in the internationalization process as a means to identify and explain patterns of internationalization. Casillas and Moreno-Menéndez (2013) found that the depth of international activities in a country increases international growth in the short run, but that the learning accumulated from entering diverse countries is more favorable for long-term growth.

In studies of speed and international new ventures, one theme that has emerged is the importance of networks for accelerated internationalization (Acedo and Jones 2007; Musteen et al. 2010; Oviatt and McDougall 2005; Yu et al. 2011). The networks of the entrepreneurial team play a key role in internationalization (Coviello and Munro 1995; Coviello 2006; Evers and O’Gorman 2011). It takes time and resources to build these networks from scratch, so ventures that are successful at rapidly internationalizing may require access to existing networks (Johanson and Vahlne 2003). The scientific community is an international network embedded in universities. Universities have the opportunity to help facilitate relations with external networks (Grandi and Grimaldi 2003), such as university-industry collaborations, which could accelerate the internationalization process for university-affiliated ventures.

To speed up the process of startup creation and growth, reducing time to international markets for innovative products while quickly launching an emerging organization, it is necessary to understand the mechanisms by which innovation and organizational emergence can be accelerated (Capelleras et al. 2010; Eisenhardt and Tabrizi 1995; Markman et al. 2005). Capelleras et al. (2010, p.319) underline that “a better understanding of temporal events such as creating a new venture will require additional methodologies. In effect, there is a need for future research that explores more fully the actual processes of venture creation and temporal transitions by using a case study approach. It would be of particular interest to explore how organizational capabilities are developed over time in the venture gestation process.”

Time is a specific resource that cannot be acquired. International technology entrepreneurs seeking to launch enterprises quickly have to manage competing pressures: compressing time to innovate, time to form the company, and time to internationalize. This paper explores the mechanisms by which startup technology firms achieve rapid product innovation, organizational emergence, and internationalization. The focus is on mechanisms that are internal to the startup firm (and therefore able to be influenced by internal or external actors), not on factors beyond the firm’s control, such as market conditions, global forces, economic cycles, or the behavior of competitive firms. Whether given market conditions are national or global, some startup firms are able to develop innovative products and emerge more rapidly than others.

Research design and method

To understand how companies compress the time frame of venture launch, exploratory research without preconceived notions, as is possible with case research, is important. Ideally, comparative case studies for theory building start with a minimum of theories or hypotheses under consideration (Eisenhardt 1989a). The research question is explored with the case study research method using a multiple-case, replication design to ensure the validity of results by eliminating idiosyncratic findings (Yin 2009). Four startups were studied using in-depth, semi-structured interviews; company internal documents (e.g., business plans, incubator applications, and board meeting notes); and publicly available records and articles. The study used an embedded design to encourage a rich and granular understanding of the research topic and subjects (Yin 2009).

The level of analysis is the firm, but the firm’s founding is part of the study. The “firm” level of analysis may, at the earliest stages, only include the entrepreneur or the start-up team, as well as the firm’s pre-launch resources and conditions. Company and individual names have been changed in this paper to ensure anonymity.

Conducting the cases in one industry was important because there can be differences in time-to-market in different industries based on competitive factors and the regulatory environment (Kessler and Chakrabarti 1996; Evers 2010). Theoretical sampling (Eisenhardt 1989a) was conducted drawing from four sectors of the clean tech industry for replication purposes and for sufficient diversity in the extreme examples to ensure that theoretical constructs would be generalizable. In other words, this study sought to balance the consistency that exists for an industry within the macro-environment with a diversity of examples to develop theoretical constructs that could be applicable across industries.

As described in Table 2, the four venture creation cases in this study represent four scenarios under consideration during the timeframe studied: one was nurtured by a UBI and quickly internationalized; one was nurtured by a UBI and did not internationalize, one had no university affiliation and quickly internationalized, and one had no university affiliation and did not internationalize. For the purpose of full disclosure, it should be noted that the startup that joined a UBI and achieved international sales was involved in an academic course and UBI managed by one of the authors. That author has no ongoing relationship with the startup, never had a personal financial relationship with the startup, and did not have a role in advising the startup during its tenure at the UBI.

With the global focus on venture acceleration (Hallen et al. 2014), we need to better understand the relationship between time and venture emergence. Capabilities, strategies, and conditions leading to rapid innovation and organizational emergence need to be identified in order to be empirically tested. Understanding the simultaneous speed of innovative product and firm emergence, and the consequences of that speed, is important to entrepreneurs, investors, and incubation professionals (including at UBIs), as well as scholars.

Scope delimitation

This research had the following boundaries, summarized in Table 3:

-

1.

Startups to be studied were in the clean tech industry. Some degree of commonality among companies was desired so that the research did not have to control for industry differences. Also, the authors possessed specialized knowledge needed to understand industry-specific lingo, historical events that impacted the industry, and other factors specific to the clean tech industry that made data collection and analysis more efficient and well informed.

-

2.

Startups to be studied were based in the USA. Because regulatory and market structures vary across countries, thus resulting in different timeframes for technology startups (Misra et al. 2012), all of the startups came from one country. The analysis did not need to control for national differences, but results should be generalizable internationally. Four qualified ventures were located and data was collected between January 2012 and December 2014.

-

3.

Time period studied was from first indication of an emergent organization until a clear signal of market traction. This time period was selected because it includes innovative product design, organizational emergence, product introduction to the market, enough market acceptance to indicate that the startup could be a viable business, and enough foreign sales to indicate whether it could be considered “born global.” The first indication of an emergent organization could include documented intention, resource gathering, some type of internal or external exchange, or establishment of an organizational boundary, which are the four conditions for organizational emergence outlined by Katz and Gartner (1988). A clear signal of market traction could include a major distribution deal, significant sales growth, or a sizable sale to a major industry firm. All four ventures released products and achieved market traction during the time frame studied.

In these four cases, the time period from the first sign of organizational emergence to market traction was very quick—25 months or less. Determining what “rapid” (or “quick” or “fast,” terms also used in this paper) meant was an iterative process. Based on experts’ experience and conversations with startup professionals, the original timeframe considered was approximately 2 years. After talking to dozens of clean tech startups, four willing and qualified firms were located for the study that started up within 25 months. External validation was sought to verify that this was indeed significantly faster than the average technology startup. Schoonhoven et al. (1990) conducted a study in a technology market with similar characteristics—hardware (with software elements) in a rapidly developing market with considerable regulatory changes and incentives. That study considered “waiting time” (from launch to first sale), which is a subset of the timeframe of this study. The duration of the startup time as defined in this study and of “waiting time” were calculated for each firm and are included in Table 3. The mean “waiting time” of the Schoonhoven et al. study was 21.07 months, with a standard deviation of 11.19. All four firms in this study were within the fastest 26.4 % of firms as defined by Schoonhoven et al. (1990). It should be noted that, in general, technology startups try to launch quickly. So these were among the fastest of the fast.

-

4.

The completion of the time period studied occurred within 8 years of case study data collection. The time period was in the recent past so that documentation was more likely to be available, and so that the memories of interview subjects would be more accurate and complete.

-

5.

The startup developed an innovative product or service. This was indicated by patent filings and/or product introductions new to a market. Three of the four startups applied for patents within the timeframe studied, and the fourth invested significant time and resources in research and development to adapt an existing product for an entirely new use in a different industry.

Data collection

An initial phone meeting was conducted with entrepreneurs or cofounders to identify key stakeholders during the study period, including cofounders, early team members, contractors, advisors, university officials, and early customers. The first interview was with the founding entrepreneur to establish an initial timeline and to gather basic information. A second interview with that person was conducted, usually toward the end of the data collection process, to answer questions that emerged. In all, 34 interviews were conducted with 28 informants, described in Table 4, with data uploaded to Dedoose (cloud-based qualitative data analysis software).

To triangulate information, additional data were requested during the process, including documents such as journals, business plans, board meeting notes, investment competition applications, and product descriptions. Other data were gathered through secondary research, garnering newspaper articles, incorporation documents, and patent filings.

Interviews were semi-structured, allowing deeper questioning on pertinent threads of conversation. The interview guide included seven topics: Foundational Information (including key milestones and other timeline information); Organizational Development; Funding; Resource Use; Product Innovation and Launch Speed; Substantive Capabilities to Dynamic Capabilities; and Market Making.

Data analysis and findings

Interviews were transcribed, uploaded to Dedoose, and coded. Documents were uploaded, reviewed, and analyzed. Initially, each case was considered separately, and timelines for each case were developed mapping the events described in the data. Second order analysis was conducted to find meaningful patterns in the data. When grouping second order analysis themes during the first case studied (Oil-less), the distinction (described in “Two distinct, simultaneous emergence processes” section) between the process of developing an innovative product and the process of creating an organization emerged. These processes unfold simultaneously and in parallel in new technology ventures. Comparison of coded data and second order analyses from the four cases led to most of the findings described in this paper. Comparison of the timelines resulted in the Stages of Development model depicted in Table 5 and the identification of the organizational formation pivot described in “Stages of development in fast startups” section.

Table 5 describes some characteristics of the ventures. Four case study synopses were constructed with special attention given to timelines.

Case analysis synopses

Company and individual names have been changed in this paper.

Oil-less

Steve Bingham received his Chemical Engineering degree from a technical university before entering the workforce in a trade unrelated to his degree. He started a few small home-based side-businesses to enhance his income. After a few years, he decided to pursue an MBA degree from a small, private university. While there, he got a job in operations at a biofuel manufacturing plant. In his second year of the MBA program, to prepare for his capstone business plan project, he wanted to come up with a scalable idea using his chemical engineering background. His big idea came at work when he was purchasing petroleum-based products for the equipment maintenance at a biofuel facility. He realized that there could be a sizable market for biologically based industrial products. However, he had limited resources to pursue developing these kinds of products, which require a lab with sufficient equipment to test products to ASTM standards.

Steve knocked on the door of the Chair of the science department in early fall of 2010 to see if he could use university laboratory and equipment in their new science building to work on his project. That was the first intention he demonstrated of commercializing his idea (and the beginning of our timeline). The Chair told him to make an appointment, so Steve returned the next day after setting an appointment. The Chair sent him to a chemistry professor, a retired chemical engineer from a global oil company, who thought it would be an inspirational applied learning opportunity for biology and chemistry majors. The professor agreed not only to let Steve use the lab and equipment for R&D, he provided student lab assistants and interns. He coordinated resources and monitored Steve’s work, providing valuable technical advising in the process. During that semester, Steve worked on developing petroleum-free products, and after about 4 months developed an innovative product formulation that that passed all four ATSM standards. He decided to patent the formulation.

In January 2011, Steve started his MBA capstone course, and he now had his business idea. He also decided this was more than an academic exercise and applied to join a UBI. He was not accepted, since he did not have a specific product or market yet. He started by considering the automotive market, but abandoned this idea because of the extensive testing and approval process that would be required to put such a product on the market. He pivoted to developing industrial products, but the cost of producing a sufficient amount to enter the market without funding was daunting. He knew he needed a product and some revenue to attract investors. He also needed a way to manufacture his product, so he approached the CEO of the biofuel facility where he worked. The CEO agreed to let Steve use equipment if it was during his off-hours, when the equipment was not in use, and if he cleaned up after himself.

In April, in order to create and market a product with his limited resources, Steve pivoted again to a petroleum-free product for a niche consumer sport and recreation market. He quickly developed a formulation to test. Over the next couple of months he experimented and tested until he developed a minimum viable product. He recruited some MBA classmates, who became his startup team. Everyone worked in exchange for promises of ownership shares.

In June, after graduating from the MBA program, Steve again applied to the UBI, and this time he was accepted. This gave him office and warehouse space, access to domestic and international connections, and weekly mentoring. He applied to many startup business plan and investor competitions in the USA and EU to attain validation and funding. (Oil-less placed well in three global competitions over the next year, which brought significant exposure and a modest financial award, but no immediate investors).

In early July, Oil-less released and sold their first product. They bottled the product by hand in the back room of the UBI. The initial product did not work very well in the opinion of expert customers, so they went back to the lab until they had addressed all of the product issues. In the process, they developed a second formulation to capture more of their niche market.

All of this occurred in the first year.

Meanwhile, there was some turnover on his team, who were still unable to be compensated. A sales professional came and went after about 3 months. A couple of the MBA graduates left, needing more stable employment. Steve was left with a team of three. They were selling and promoting products through guerilla marketing, while seeking additional funding. They would throw product-bottling parties, convincing friends to join their production line in exchange for pizza and beer. In November, the company incorporated with assistance from an attorney provided by the UBI (prior to that they operated as a sole proprietorship), and in December they achieved a significant international distribution deal that included an immediate order for 500 bottles of the product. They also engaged in their first international sales, and it became clear that they were entering a global market for their product. This was a clear sign that they had achieved market traction. While the startup team did not have previous international business experience, they had access to international networks through the UBI, business plan competitions, and distributor relationships.

Evenout

In late January 2012, Gary Watkins, an experienced electrical engineer in the mid-Atlantic region who had been laid off from a major telecommunications company, decided to go to a power industry trade show to explore entrepreneurial opportunities. He returned home and developed an idea for a product that could help regulate grid demand, providing power when demand was greatest and rates were highest, reducing the need for “peaker plants.” Peaker plants are turned on only when demand and therefore rates are highest, and are the dirtiest, most polluting suppliers of energy into the grid. In February, he talked to his wife Lisa, a former engineer who had been raising their kids, about his idea, his first signal of intention to start up a company. Within a few weeks they decided to cofound the venture and he started working on the product, modifying off-the-shelf components. A month after that, he contacted a former coworker, who had relocated to the West Coast, to write the software needed to make his product work. Lisa had incorporated a company a couple of years earlier that she had decided not to pursue, and brought it off the shelf to serve as the corporate entity for Evenout. She also became CEO of the firm, allowing Gary to focus on the technology development.

In May, Lisa submitted an application to a global clean tech startup competition. They were accepted into the competition, providing free mentoring and classes. She went on a steep learning curve to understand how to start up a technology company while Gary was developing the product. In July, he contacted the regional grid operator to research tying the products into the grid. He was surprised to find out that while the law had recently changed allowing such relationships, the actual mechanisms and protocols for doing so had not been established. Evenout needed to develop a viable product to be installed with individual customers while also working with the grid operator to enable the device to interface with the power grid.

New technologies were being developed to support a more efficient “smart grid,” and regulatory changes were being implemented to allow entrepreneurial opportunities to create more grid efficiency. In this newly emerging business model, it was the grid operator who would ultimately compensate enterprises like Evenout in exchange for helping reduce the cost of energy during the most expensive times of day and year. Evenout would then share some of their revenue with their customers. In other words, Evenout would be paying their customers to be their customers, making a profit in the process.

By September, Evenout had a minimum viable product and solicited friends and neighbors to be customers. This milestone coincided with a modest family investment. However, issues with the grid operator were still being worked out, and this beta rollout brought out technical issues in the product itself that needed further development. By this time, they had access to three incubators as affiliates, including one UBI, providing startup mentoring services. They also needed help with sales if they were to scale. In January, they partnered with a sales organization to generate more customers. In February, they secured a booth at a trade show, where they got the more than 60 customers needed to rigorously test their product at a minimum scale.

By May of 2013, Gary and Lisa realized that the work it would take to convince a sufficient number of individual customers of their business proposition was not viable at that time. They shifted gears to market to multi-unit property management companies so they could conduct large numbers of installations with a single contract. They severed the partnership with the sales organization, procured another family investment, and scrambled to work out issues with the grid operator so that they could start generating revenue.

In September 2013, they paid the grid operator a hefty connection fee and finally went live with their product installations. They discovered that their business model did not generate as much revenue as expected. This was a low point for Gary and Lisa, but Gary kept developing the product to make it more responsive and efficient while Lisa continued to pursue large multi-unit contracts. In February 2014, at the same time that they secured a sizable SBA loan, they closed a contract with a large property management company. This signaled market traction for Evenout. Gary and Lisa did not have previous international business experience and their initial business model precluded internationalization in the short term. Therefore, they did not seek connections to international networks, although they had exposure through the global startup competition.

G-Home

Larry Paxton, who had started up a modestly successful internet-based specialty products company with a global market, had an idea for another business. He lived in an old home in the Pacific Northwest that was very inefficient, and there was no existing reasonably priced way to increase its efficiency. That led to his idea for a new type of energy-efficiency product with a large (potentially global) market. In January 2009, Larry Paxton contacted and hired his friend Jerry Perkins, who was a creative and resourceful craftsman in the building trades, to help develop his product, thus signaling his intention to start a new venture. In February, he filed paperwork to create an LLC. They installed a first iteration of the product in February in Larry’s home. Within a couple of months it failed miserably, but this gave them a starting point for a process of rapid reiteration and testing. By August, they had developed the product enough to file for a patent.

The next several months were all about product development, with Jerry leading the effort. Larry ran his Internet venture while also managing this new startup. The product did not just need to be invented and tested, it needed to be designed for manufacture at scale, and in a way that would minimize installation costs and mistakes. From March through June 2010, four other friends and connections were brought onboard to start developing marketing, sales, production, and installation processes. In May 2010, Larry leased a 10,000 square foot facility for R&D, production, and offices. In June, they started developing technical measurement equipment to ensure successful installations, including a software application to store the data and make it accessible for their manufacturing facility as well as independent installers. In July, they reached a milestone: they had developed a minimum viable product that was ready for production.

In August of 2010, Larry left his role as CEO of his Internet venture to be able to work full-time with G-Home. He solicited funds from family and friends to be able to start production. In September, he hired a consultant with deep financial and operational experience to develop HR and financial systems. This brought major changes to the culture and organization of G-Home as they prepared to go to market. In November, G-Home incorporated and sold its first products. In December 2010, the consultant was hired full-time as Director of Finance (which included HR). Two of the people who started earlier in the year left voluntarily when they realized they did not have the skills and capacities needed for a highly professional production environment. In January 2011, an article about G-Home was published in the major city newspaper, leading to a rapid increase in sales and a clear signal of market traction. G-Home did not internationalize during this time period. While Larry had experience accessing global markets through online sales in his previous venture, he made the strategic decision to internationalize slowly with G-Home’s customized home-improvement products.

Techlight

In late December 2004, Warren Campbell and his father Frank were driving to a family event. Warren was an engineer at a global technology company headquartered in Northern California, and Frank was a VC, consultant, and former executive. They both thought that Warren may have entrepreneurial talent, and were brainstorming business ideas. Warren wanted to develop a business in the solar industry because he was passionate about environmental causes and believed that solar energy was the key to our energy future. He recalled an issue with his home solar installation, and thought that he could come up with a better device to improve the solar installation process. A couple of weeks later, in early January 2005, he produced a concept paper that signaled his first intention to develop and commercialize a new solar technology accessory with global demand.

In February, Warren contacted his friend and former coworker Terry Gray to help him on the software side in exchange for shares in his future company. Terry agreed and they both worked on a prototype in their time outside of their jobs. Frank served as advisor and helped out 1 day per week. Warren was itching to work on the idea full-time, and when his employer, in June, offered a generous severance package to those employees who would volunteer to leave, Warren jumped on the opportunity. He started working for Techlight full-time in August 2005, with 9 months of pay from his former employer to support him. His first action was to develop a summary business plan.

Warren also recruited other friends, neighbors, and coworkers to come on board part-time in exchange for future shares. By fall of 2005, there were three other members of the startup team. In September, he and Terry decided to use an off-the-shelf processor for the device, rather than develop a custom processor, greatly accelerating the product development cycle.

Techlight incorporated in November 2005, an effort led by Frank, who became the board chair. He created formal processes with regular board meetings starting in January 2006 (consisting of Warren, Terry, and himself), voting procedures and proper notes. In December of 2005, Techlight filed its first patent. In January 2006, the company received a modest capital infusion from the three cofounders, primarily from Frank.

The first half of 2006 was used to complete product development (hardware and software) and develop marketing materials. They formed an agreement with a distributor in July. They decided to introduce their minimum viable product at a solar industry fair in August 2006. They got some interest and made a few sales. In October, they shipped their first products to those initial customers. Also in October, they showcased their new product at an international solar industry trade show.

During that fall, the other three members of the early team (not including Warren and Terry) left the venture or were dismissed as the company formalized roles and processes.

During 2006, Warren engaged in advocacy with a state task force developing new standards for California’s solar initiative. The new rules were released in January 2007, and Techlight’s device was an important technology for meeting the new standards. This led to an immediate and significant spike in sales, a strong signal of market traction. In addition, there was strong interest from other countries, particularly in the EU, since several European countries had significant incentives promoting solar development. With the experiences of the startup team working for a global technology company, and international connections through their distribution network, Techlight was well positioned for international growth. By 2008, about 25 % of sales were outside of the USA.

Two distinct, simultaneous emergence processes

The first case analysis revealed that there are two simultaneous processes in technology startups: product emergence and organizational emergence.

Product emergence: As mentioned in “Innovation speed” section, accelerating the development and release of innovative products in technology companies generally improves outcomes. The four ventures studied were all product and technology oriented in the earlier phases of their emergence, and all informants agreed that there was no downside to developing and releasing their products quickly. In all cases, there were technical issues and/or a lack of important features with the earliest releases, but this allowed them to solicit customer feedback to help with their design and manufacturing processes.

Organization emergence: It is not clear from the literature and from these cases that accelerating organizational emergence generally leads to better outcomes. All four ventures faced challenges that emerged from the earliest phase of organizational emergence that was characterized by undefined roles (everyone does whatever needs to be done) and ad hoc decision-making. For Oil-less and Techlight, these challenges included agreements regarding ownership and decision-making that were not formalized in legal documents. Techlight made equity agreements with individuals whose contributions to the company were quite limited.

Stages of development in fast startups

The entire period in this study is considered “early stage” in the launch, growth, and maturation of a startup venture. While three of the four cases were in industry sectors with global markets, this period of study was primarily a preparatory phase for internationalization. The achievement of international sales concluded the period of study for Techlight and Oil-less. While many accelerators and incubators are primarily interested in admitting ventures that have already achieved a signal of market traction, UBIs are well positioned to support entrepreneurial teams during the early stage addressed in this paper. This is because the innovative ideas are often spawned at universities and they have the breadth of resources available to support early stage ventures (Lee and Osteryoung 2004). Table 6 characterizes the two separate, simultaneous processes during the emergence of a technology startup.

Table 6 shows the two timelines operating in parallel. The entrepreneur starts with an idea and starts experimenting to figure out if there is a product that could be developed and viable. The entrepreneur calls on people he/she knows well and makes informal agreements with them to help out, and with whatever scarce resources are available starts prototyping a product. Decision-making is ad hoc so that progress can be made quickly. At some point in developing a product, at least one pivot in product strategy is usually required to develop a product that is marketable. For Techlight, this meant integrating an off-the-shelf electronic device rather than developing their own circuit boards. For Oil-less, this meant re-configuring the product for a smaller but easier-to-enter market. While one or more pivots on the product side is typical, it is not a necessity or requirement for starting up quickly. The startup team then settles on a minimum viable product that they can introduce to the market as quickly as possible.

The organizational formation pivot is always necessary for technology startups that adopt a “lean startup” (Ries 2011) approach, which included all four firms in this study. None of the firms studied spent much time on organizational development during the earliest phases—they were too busy developing their products. The organizational formation pivot occurs at about the time the first product is released into the market. In order to systematize manufacturing and organizational processes and successfully emerge as a viable and growing organization, there has to be a pivot to formalize agreements and professionalize management. The firm must provide the structure for employees, customers, suppliers, and future investors to conduct legal and reliable transactions to produce, purchase, market, and service the products domestically and internationally (for the born global firm). The chaos that would otherwise ensue would cause a firm to stumble and soon fail. Oil-less showed signs of this when the founder and his team were at odds—the team was ready for more professional management, while the founder continued to hold down another job and operate in an opportunistic, ad hoc manner. Companies that make this organizational pivot are able to systematize manufacturing and organizational processes so that an innovative product can be released and demand met, with professional management that can successfully bring the product to market and operate a sustainable company. Systematizing manufacturing is also necessary to reduce costs and continuously improve the product in response to customer feedback.

Patterns and common characteristics

While each company had a singular emergence story, patterns emerged upon analysis. Sometimes there were similarities in their answers to specific questions. In other cases, the patterns were discovered when reading all of the excerpts under a specific code.

Motivation for speed

One common factor that emerged in the interviews with founders was that they were not motivated to start up quickly for reasons related to market timing. They were all motivated to start up quickly in order to start generating revenue before they ran out of funds. When asked why they started up so quickly, the CEO of Techlight said, “I would say primarily at the time of what we were thinking the critical thing was just burn. How long can I go without salary? How long can we afford to pay (my cofounder)? And that kind of thing.” When asked about resources, Evenout’s CEO said, “…the other resource that is incredibly scarce is time.” It became clear in all cases that there was an important and dynamic relationship between time and financial resources, and this became an important theme of this analysis.

After the organizational formation pivot, the global technology startup is ready for the external funding required to scale internationally. This can accelerate growth. Prior to the organizational formation pivot, fast startups tend to receive little or no external funding, because funding is more expensive at such an early stage (in terms of ownership stake) and it is more time-consuming to pursue, with lower chances of success. During the timeframe of this study, all four ventures received modest capital infusions from family members. None of the ventures received any other external funding.

Startup team composition

Entrepreneurial teams are much more common in technology firms than solo entrepreneurs (Cooper, et al. 1990; Lechler 2001). Another commonality among all cases was that the initial startup team was sourced from people that the original entrepreneur (the person with the initial idea) already knew, as described in Table 6. Oil-less started when the CEO invited MBA classmates to become cofounders. G-Home’s founder invited a friend with technical skills to join him. The relationships between cofounders of the four firms were different from each other, but cofounders who knew each other well started all four firms. This pattern emerged for two reasons: (1) it saved time to work with people who the founders knew instead of trying to recruit talent; and (2) because the entrepreneurs were known and trusted by the people working with them, they were able to make delayed or reduced compensation arrangements based on future equity stakes. The exception to the latter point was the CEO of G-Home, who paid early team members and did not offer them ownership stakes.

Workload pressures

The pressure on the teams was intense in all cases. Oil-less, Techlight, and Evenout had to get the products to market in order to start receiving compensation. G-Home, started by an internet entrepreneur, put pressure on the team to perform as he saw his savings dwindle. There is an important and dynamic relationship between time and the startup team workload, including personal costs to the effectiveness and the mental, physical, and emotional health of the startup team member. As the CTO of Evenout said, “There’s a risk that it may not work well enough soon enough to meet your next objective. So it consumes a lot of emotional energy.”

A holistic approach to workload (which considers stress and mental effort) is important to consider—it is more than just work hours per week. One approach to conceptualizing this broader definition of workload is known as “subjective mental workload” (Hart and Staveland 1988), originally developed to assess workload for machine operators. The most established and well-known system for measuring subjective mental workload is NASA-TLX (task load index), which includes six rating scales: mental demand, physical demand, temporal demand, performance, effort, and frustration level (Hart and Staveland 1988). Other measures have also been developed that try to capture subjective mental workload, including Subjective Workload Assessment Technique (SWAT) and Workload Profile (WP), with varying degrees of diagnostic effectiveness (Rubio et al. 2004).

Another approach to assessing workload is to measure burnout. The term burnout is characterized by three underlying dimensions: exhaustion, depersonalization, and reduced ability to accomplish tasks (Maslach et al. 2001). The most established assessment of burnout is the Maslach Burnout Inventory (MBI) (Maslach and Jackson 1981). Originally developed for workers in human services, it was later expanded to include all professions with the MBI-General Survey (MBI-GS). Both of these MBI scales measure three dimensions: exhaustion, cynicism, and inefficacy (degree of ineffectiveness at work) (Maslach et al. 2001). Subjective mental workload and burnout assessments have been applied in many countries. An excessive workload resulting from a compressed startup timeframe leads to issues of burnout no matter where it happens.

Early startup team departures

While startup teams were comprised of connections of the founders, that did not prevent them from leaving. As pointed out in Table 5, all four ventures had early team members who quit because of workload issues. Sometimes the workload intensity was due to temporal pressures. For example, according to Evenout’s CTO, “(An early team member) worked … six hours a night (in addition to his regular job) for three months until he discovered that he could no longer function as a human being. He went beyond a normal burnout and just could not go any further.” Table 7 describes the roles of early team members who separated from the venture.

Scarce financial resources also impacted the intensity of the workload. This also caused early team members to leave the startup. As the CEO from Oil-less said, “They would come to me and say, ‘You know what, I think I am going to find a job. I love this a lot, and guess what, I have to make some money. I got kids at home.’” Another dynamic relationship that emerged was between financial resources and workload intensity, which became an important area for exploration.

Tensions between resources

Temporal and financial resource dynamics

Starting up quickly reduces the tensions between temporal and financial resources by saving scarce resources, which can delay the need for external funding and lead to more favorable investment terms while providing market advantages.

Financial (or equivalent) resources are important to entrepreneurs and have an important relationship with time.Footnote 1 Financial resources allow nascent international technology entrepreneurs the ability to buy parts or raw materials, secure facilities, compensate founding team members (sometimes), attend or exhibit at industry trade shows, explore international market opportunities, hire contractors for specialized needs, etc.

While it turned out that market timing was very important for some of the ventures studied, none of the entrepreneurs mentioned market timing as an important motivation for starting up quickly. In all cases, they were driven by the need to generate revenue before running out of funds. As the founder of G-Home said, “…there was this terrible, terrible sense of my bank account being drained and just this severe urgency around trying to make more progress before we ran out of money.”

The first mechanism highlighted in our study is the trade-off between startup rapidity and resource collection. This could help explain the finding by Schoonhoven et al. (1990) that higher expenditures (and therefore more funding) were associated with a longer startup timeframe. Significant funding (that is not draining one’s personal bank account) can reduce the sense of urgency. Less funding means the startup team has less time to achieve milestones, requiring speeding up progress. In other words, scarcity of financial resources speeds up technology venture launch. Of course, there are constraints to how much funding can be limited—a venture cannot be launched for nothing. The best way to phrase this may be: international technology ventures start up most quickly with the minimum funding required to remain viable. This temporal-financial tension also drives extraordinary resourcefulness (as with Oil-less), which can further reduce startup costs.

Securing investors before having a product developed that is generating revenue is arduous, time-consuming, and unlikely to succeed. If an entrepreneur were able to secure angel investment before generating revenue, it would typically be very expensive for the entrepreneur in terms of ownership stake or other deal terms. The further along the venture founders can get before accepting funding, the more they will be able to retain ownership and control. This is why the startups studied were so highly motivated to launch as quickly as possible using only personal funding and support from family and friends. This is consistent with a finding of Gartner et al. (2012), who found that entrepreneurs with more personal resources are less likely to seek early stage financing, presumably in order to maintain more ownership and control of their enterprises. By starting up quickly, entrepreneurial teams are more likely to self-fund their ventures before running out of cash.

A good example is Techlight, who only raised funds from family, friends, and the founding team until they launched and achieved some market traction. The father of the entrepreneur was a venture capital professional who chaired the board of directors and worked 1 day per week for Techlight as an unpaid consultant. He made sure investment was limited in order to maintain control in the family and to motivate the startup team to get their product to market as quickly as possible. When they did start accepting external funding, they were able to issue only common stock to the investors (with no special voting rights), and the entrepreneur who sourced the idea maintained a majority stake in the firm until acquisition a few years later (after the period of study), following internationalization.

Reducing the time and financial resources necessary to start up can be a source of competitive advantage—the emerging company will be more flexible and resilient than a comparable venture that is burdened by creditor or investor obligations. Even if it was not their reason for starting up quickly, the earlier market timing that results from starting up quickly can be beneficial. Techlight was particularly fortunate in this regard. Their product was released just a few months before a state policy was announced that required such a product for solar installations to qualify for incentives. Their timing could not have been more perfect. If they had released their product a year later, they would have entered a more competitive landscape. It turned out they were in a “winner-takes-all” market niche, and they were able to claim the market globally. Table 8 describes the temporal/financial tension implications in four different situations (financial resource collection, external funding delays, control of the firm, and market advantages).

Temporal and human resource dynamics

To start up quickly, the entrepreneur with the initial idea needs to be able to work with people she/he knows well and trusts. There is not enough time to recruit the best possible candidates. There is not enough time to build relationships and trust, or to develop formal agreements that can take the place of informal trust. G-Home started with two friends that had worked together on previous projects. Evenout’s founding team was a married couple. Oil-less was started by a team that spent 2 years together in an MBA program. The Techlight founding team was comprised of two engineers that worked together for a technology company, along with the father of one of them. In those early phases of product and organizational development, ventures continue to add to their teams through existing connections without any formal hiring processes, and often with informal, verbal agreements.

Those early relationships are characterized by ambiguous role boundaries (everyone does whatever needs to be done), long hours, and a sense of team camaraderie that can occur in small teams operating under extreme pressure. Workload intensity is high. As a startup team member from G-Home put it, “It was literally a really majestic time of utter stress, because we were facing problems weekly that we were solving.” The pressure is temporal: from products that need to be developed and released before funding runs out, and from the financial need of those undercompensated startup team members to draw a sufficient salary once funding or revenue milestones are attained. The pressure is also universal, occurring within technology startups globally.

Once a minimum viable product is completed and ready to introduce to prospective customers, the organization needs to shift to become more professional, enabling legally compliant and mutually satisfactory domestic and international customer relations, supplier relations, employee relations, and future investor relations. To make this shift (the organizational formation pivot), roles, ownership agreements, and compensation packages need to be formalized. Members of the startup team may not have the appropriate skills and experience for these new roles. As the finance director for G-Home said, “…in a company with 15 or fewer employees you can’t afford to have people who you know aren’t very productive. Some of those people weren’t, but they filled a need at a time and place when finding the absolute right person could have been very difficult given the tenuous thing.” Entrepreneurs and team members may have different understandings of the informal, verbal agreements that were made in the early days. This can lead to, at the very least, difficult conversations and can result in startup team members resigning, being fired, or being demoted to lesser roles than they had expected. The Techlight CEO described this transition:

“There was that early group of co-founders, who were sort of the ones that wanted to be involved and then there was a shift from that group to a group that I actually pulled in and hired myself. That was a painful, challenging transition, essentially having to phase out people who either really didn’t have the time or weren’t suited for the roles that I originally had them in. That sort of goes along with the seriousness of that thing, that isn’t just a club anymore, we are trying to do a business and if somebody is not doing the job, I am sorry but we have to move on. That was kind of a difficult transition….”

A start-up team member from G-Home described his realization regarding his role:

“Once you start getting deeper than my experience, I found myself like, I could learn this stuff, but it would be better at this point to find somebody who already knows it, because we want to get out to market now. And I was very clear with (the entrepreneur) when it was time for me to go and I got another offer and I said this is best for both of us. And he agreed, he saw that I could definitely do it, but somebody else could do it faster.”

The tension that exists between temporal and human resources is exacerbated by speed—the differing needs of product development (fast is desirable) and organizational development (fast is problematic). Fast organizational development is problematic because the only ways to compress the time frame is to skip steps in the organizational development process, outsource them, or do them in a cursory manner. Problems arise when products are released into domestic and international markets too early, when more structured roles, processes, and policies are needed.

Table 9 portrays the temporal/human tension implications in four different situations (startup team formation, startup team dynamics, trade-off between product and organization development, and the organization formation pivot).

Financial and human resource dynamics

Human resources are expensive, especially in technology firms with highly skilled workforces. People are needed to make organizations work, but businesses will seek to minimize that expense in order to be as profitable as possible. This tension is often alleviated through outsourcing, automation, and layoffs.

In a startup technology enterprise with scarce resources, offering early team members some type of equity offering, such as convertible notes, frequently reduces this tension. This costs the startup nothing at the time, although it can raise issues later. Upon incorporation, one of the startups studied gave shares to 13 people, including several whose contribution turned out to be marginal, at best. Valuing team members’ contributions before they have started working on a project is a challenge for any startup. When the startup is trying to launch very quickly, it is unlikely that the entrepreneur is going to take the time to thoroughly consider (or solicit advice regarding) the deals she or he makes with each of the founding team members.

Those startup team members will need to start getting paid at some point, since they cannot pay their rent or feed their families with equity agreements in a risky technology startup. This tension increases workload intensity. Some of those early teammates will work longer hours and at a faster pace in order to reduce the time until they can receive sufficient compensation. Many just are not cut out for it. As the Oil-less CEO said, “(a startup team member) was in for about three months, then he was out, (another startup team member) was in also for three months, and then out, and (a third startup team member) was in for about four months, then out. It seems to be like people decide whether they want or can do it, in about three months.”

The escalating pressure on the early team can take its toll on human resources in the form of burnout. Just as there are limits to how little cash it can take to start up an enterprise, there are limits to how many hours and how much stress a startup team member can manage. Again, the Oil-less CEO: “Burnout was a total issue just because I was still like working fulltime plus and it was just tough.” Table 10 displays financial/human tension implications in three different situations (equity as remuneration, startup team workload intensity, and team member exit).

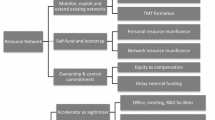

Discussion and contributions