Abstract

We consider a sequential-move game in which a polluting monopolist chooses whether to acquire a green technology, and a potential entrant responds deciding whether to join the market and, upon entry, whether to invest in clean technology. Our paper compares two models: one in which environmental regulation is strategically set before firms’ decisions; and another where regulation is selected after firms’ entry and investment decisions. We show that a proactive regulation that strategically anticipates firms’ behavior can implement different market structures. In particular, policy makers can choose emission fees to induce competition and/or investment in clean technology, giving rise to market structures that maximize social welfare.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Climate change has lead some countries to regard environmental policy as urgent.Footnote 1 However, such policy still raises opposition given its potential impact on firms’ competitiveness and growth. As a consequence, environmental regulation should carefully consider market conditions and pollution. In particular, if the market structure changes as a result of regulation, a policy that does not anticipate such effects would yield suboptimal outcomes.Footnote 2 Instead, regulators should recognize the market dynamics that ensue due to environmental policy; especially given how dynamic market structures have become, both in terms of the number of competing firms and in their investment decisions in green technology. This paper shows that the traditional approach to environmental policy, where the regulator observes the current market structure and responds with regulation, yields to consistently lower welfare levels than a more strategic policy, where the regulator recognizes his active role in modifying future industry characteristics.Footnote 3

In order to analyze the effects of strategic emission fees, we examine two models. First, we consider a setting with the following time structure: In the first stage, the regulator sets emission fees; in the second, an incumbent firm chooses whether to invest in green technology; in the third, a potential entrant decides whether to join the market and, if so, whether to acquire green technology; and in the last stage, firms choose their output levels. We compare equilibrium results with those of a second model in which the regulator acts in the third stage, thus taking the market structure as given. In particular, we analyze how the emergence of different market structures, and how firms’ decision to acquire green technology, are affected by the time period in which the regulator sets emission fees. The second model, however, represents settings in which the regulator cannot credibly commit to an environmental policy, and thus adjusts fees after entry/exit and technology decisions have been made.

Using backward induction in the first model, we find that the entrant’s response depends on its entry costs and on the cost of acquiring the green technology. In particular, we identify cases in which the entrant stays out of the market regardless of the incumbent’s technology (blockaded entry), is deterred if the incumbent acquires green technology (deterred entry), or enters independent of the incumbent’s technology. The incumbent anticipates the entrant’s behavior in subsequent stages, and thus uses its investment in green technology as an entry-deterring tool when the cost of such technology are sufficiently low. Otherwise, the incumbent keeps its dirty technology since the cost of acquiring the green technology offsets its associated entry-deterring benefits; thus giving rise to a dirty duopoly (We also show that mixed duopolies can emerge, with one firm choosing green technology while the other keeps its dirty technology, when entry costs are low and technology costs take intermediate values).Footnote 4

These findings, however, are different in the second model, whereby the regulator chooses emission fees at the third stage of the game. In this setting, he cannot alter firms’ subsequent entry and investment decisions. In contrast, a proactive regulation that strategically anticipates firms’ behavior can now expand the set of market structures that a policy maker implements. In particular, he can choose emission fees to induce competition and/or investment in clean technology, giving rise to market structures that could not emerge otherwise, ultimately maximizing social welfare. Nonetheless, such policy decision is constrained since, for given entry and investment costs, the regulator cannot implement all market structures, but a subset of them, among which he chooses the market yielding the highest social welfare (second best). If, however, he ignores entry threats and investment decisions in future stages (taking the current market structure as given), he would generate market outcomes that yield even lower welfare levels (third best).

Therefore, regulatory agencies should be especially aware about the presence of potential competitors in the industry in order to design regulation considering its effects on entry and investment as well as its profound consequences on social welfare. Our results, furthermore, suggest that even if regulatory agencies gather accurate information about market conditions and firms’ costs, they would induce poor welfare outcomes if they ignore the strategic ramifications that unfold once environmental regulation is implemented. Our paper is especially relevant in developing economies where polluting industries are relatively concentrated, such as chemical, oil, and other natural resource extraction, and where policy makers seek to address environmental damages through regulation. In these contexts, the design of proactive (rather than reactive) regulation could have significant effects on market structures and firms’ decision to adopt green technologies.

Related Literature

Several studies consider a given market structure and examine how environmental regulation affects firms’ incentives to invest in abatement technologies, while other papers take firms’ technology as given and analyze how environmental policy produces changes in the number of firms competing in the industry. Specifically, the first group of studies shows that environmental policy can stimulate the adoption of new technologies that reduce marginal emissions or save abatement costs (Porter and van der Linde 1995; Zhao 2003; Requate 2005a; Krysiak 2008; Perino and Requate 2012; Storrøsten 2015). Several authors have demonstrated that firms’ incentives to adopt clean technology differ across market structures and policy instruments. They have also analyzed the optimal environmental policy scheme that generates the most incentives (see Katsoulacos and Xepapadeas 1996; Montero 2002; Requate and Unold2003).Footnote 5 Among different environmental regulations, it is well known that market-based instruments are preferred by economists and widely implemented in many countries (Requate 2005a). Specifically, emission fees are an effective instrument in providing incentives to acquire a new abatement technology in perfectly competitive markets (Parry 1998) as well as in oligopolistic markets (Montero 2002). Similarly, our paper examines how an appropriate emission fee induces firms to adopt clean technology. However, unlike the previous literature, we focus on an entry-deterrence model rather than markets that do not face entry threats.

Our results are also connected with the second group of papers, as they suggest that stringent emission fees could affect entry. Early studies have examined how a stringent emission quota acts as an effective instrument in leading to cartelization (Buchanan and Tullock 1975; Maloney and McCormick 1982; Helland and Matsuno 2003). An article survey by Heyes (2009) also concludes that environmental regulation helps incumbents to discourage entry and thus reduce market competition. However, few papers have analyzed entry deterrence in the case of an emission tax. Schoonbeek and de Vries (2009) examine the effects of emission fees on firms’ entry in a complete information context and Espinola-Arredondo and Munoz-Garcia (2013) analyze a setting of incomplete information. Both studies identify conditions under which the regulator protects a monopolistic market by setting an emission fee that deters entry.Footnote 6 However, they consider technology as given. Our paper is not only concerned about the role of emission fees hindering competition, but also examines firms’ technology choices by allowing incumbent and entrant to invest in green technology. This approach allows us to identify cases in which the regulator sets emission fees that do not support entry deterrence and promote the acquisition of green technology. In addition, our results show that, relative to settings where investment in green technology is unavailable (or prohibitively expensive), allowing both firms to invest in this technology attracts the potential entrant under larger conditions on entry costs, ultimately hindering the incumbent’s ability to deter entry.

Petrakis and Xepapadeas (2001) also analyze a sequential-move game in which the regulator pre-commits to an emission fee in the first stage of the game, comparing their results with those in a model where the regulator acts after firms invest in abatement; showing that welfare levels can be higher when the government pre-commits.Footnote 7 We provide a similar result, but in a context where a potential entrant can choose whether to enter the industry and, upon entry, whether to invest in abatement. This makes the pre-commitment model significantly more involved, as the market structure becomes endogenous in our setting.

Ulph and Ulph (2013) also study environmental policy in settings where governments cannot credibly commit to a future emission fee, and which other policy instruments they can use to compensate for this credibility problem, such as R&D subsidies. Like Petrakis and Xepapadeas (2001), however, their article assumes a given market structure which cannot be altered by environmental policy. Martín-Herrán and Rubio (2016) extend this setting to a dynamic game, showing that commitment problems lead to less stringent fees and more pollution levels than a regulator who can credibly pre-commit; which the welfare loss from this commitment problem decreases when firms face low abatement costs. As previous studies, they assume a given market structure.Footnote 8

The paper is organized as follows. Section 2 describes the model and the structure of the game, Section 3 examines the equilibrium of the game when the regulator moves first, and Section 4 studies the model in which the regulator sets emission fees in the third stage; Section 5 discusses our results.

2 Model

Consider a market with a monopolistic incumbent (firm 1) and a potential entrant (firm 2). Both firms produce a homogeneous good. The output level of firm i is denoted as qi, where i = 1,2. The inverse demand function is p(Q) = a − bQ, where a, b > 0 and Q is the aggregate output level. If firm 2 decides to enter it must incur a fixed entry cost, F > 0. For simplicity assume that production is costless.

Two different types of technology are available for both firms: a dirty (D) and a green (G) technology. We assume that firms initially have a dirty technology and, hence, if they adopt a green technology they must pay a fixed cost S > 0. Technologies differ in terms of their emissions, which are assumed to be proportional to output. In particular, if firm i acquires a clean technology its total emission level is Ei = 𝜃qi, where 𝜃 ∈ (0,1) describes the efficiency of the new technology in reducing emissions. Specifically, the green technology becomes more efficient with lower values of 𝜃. However, if firm i keeps its dirty technology every unit of output generates one unit of emissions. Environmental damage, Env, is assumed to be a linear function of aggregate emissions, that is \(Env=e{\sum }_{i = 1,2}E_{i}\), where e > 0 captures the marginal environmental deterioration. Finally, in order to guarantee that emission fees are positive under all market structures we consider that the environmental damage is substantial, \(e>\frac {a}{3\theta }\); but not too severe, i.e., e < a, as otherwise a zero output level would become socially optimal.

The regulator sets a tax rate per unit of emission. In particular, it selects an emission fee τ that maximizes overall social welfare denoted as W = CS + PS + T − Env, where CS and PS are the consumer and producer surplus, respectively, and T is the total tax revenue.

We analyze a four-stage complete information game, with the following time structure:

-

1.

In the first period, the regulator sets an emission fee, τ.

-

2.

In the second period, the incumbent chooses its technology (dirty or green).

-

3.

In the third period, the potential entrant decides whether or not to enter and, if it enters, which technology to use.

-

4.

In the fourth period, if entry does not occur, the incumbent operates as a monopolist. If entry ensues, both firms compete a la Cournot.

We derive the subgame-perfect Nash equilibrium. Specifically, in the following sections, we first investigate two different market structures in the fourth period (with and without entry), and then examine firm 2’s decision over entry and technology in the third period. We next analyze the incumbent’s technology choice in the second period, and finally study the regulator’s optimal emission fee in the first period of the game. The time structure considers that the regulator chooses emission fees before firms choose their technology and whether to enter the industry, and thus he can strategically alter the conditions under which each market structure emerges. Alternatively, the regulator could take the market structure as given and respond to that with an optimal emission fee. For completeness, we explore this setting in Section 4.

No Regulation

As a benchmark, the next lemma analyzes equilibrium behavior when regulation is absent.

Lemma 1

When regulation is absent the incumbent does not invest in green technology under any parameter values. The entrant responds entering with dirty technology if and only if \(F<\frac {a^{2}}{9b}\) .

Therefore, if entry costs are sufficiently low, \(F<\frac {a^{2}}{9b}\), the entrant joins the industry and a dirty duopoly arises, while entry does not occur otherwise (and a dirty monopoly emerges). Hence, in the absence of regulation there are no incentives for firms to acquire green technology, whereas as we next show the introduction of an emission fee induces one or both firms to invest in clean technology.

3 Equilibrium Analysis—No Entry Threats

In this section, we briefly analyze the case in which entry is blockaded and only the incumbent operates during all periods, suffering no entry threats. In this setting, the third stage of the above time structure is absent. We next study all other stages, operating by backward induction.

Fourth Stage

In the fourth stage, the incumbent produces \( q_{1}^{m,K}\) units of output, where superscript m denotes monopoly and K = D,G represents the incumbent’s technology. Table 1 summarizes equilibrium output and profits (in rows) under each technology (in columns). (Appendix 1 describes the incumbent’s profit-maximization problem in all cases.) Firm 1 produces strictly positive output levels if the emission fee satisfies τ ≤ a in the case of dirty technology, and \(\tau \leq \frac {a}{\theta }\) in the case of green technology (as confirmed in the optimal emission fees found in the third stage of the game). We consider a nonnegative emission tax throughout the paper and thus assume τ ≥ 0. Profits are decreasing in the dirtiness of the green technology, 𝜃, and its associated cost, S.

Second Stage

In this stage, the incumbent anticipates its fourth-stage profits from keeping its dirty technology, \(\pi _{1}^{m,D}\), and those from investing in the green technology, \(\pi _{1}^{m,G}\), and invests if and only if \(\pi _{1}^{m,G}\geq \pi _{1}^{m,D}\), that is, if \( S\leq \frac {(a-\tau \theta )^{2}}{4b}-\frac {\left (a-\tau \right )^{2}}{4b} \equiv S^{M}\left (\tau \right ) \). Intuitively, the incumbent knows that it will enjoy monopoly profits in subsequent stages, and thus invests in the green technology only if this technology is sufficient efficient at lowering emissions, i.e., 𝜃 is low enough.

First Stage

In this setting, the regulator anticipates only two possible market structures: a green monopoly, which emerges if S ≤ SM (τ); or a dirty monopoly otherwise. Graphically, cutoff SM (τ) splits the S-line into two regions, one for the green monopoly to the left of SM (τ) and one for the dirty monopoly otherwise. Importantly, when the regulator increases emission fee τ, cutoff SM (τ) shifts leftward since SM (τ) decreases in τ, shrinking the region of S values where a green monopoly can be sustained.

We then need to analyze optimal fee in each market structure, the welfare that emerges in each case, and then which is the market structure that the regulator seeks to induce. For illustration purposes, consider parameter values a = b = 1, e = 0.8, 𝜃 = 0.45, and S = 0.02. At these parameters, the conditions for positive output levels identified in the fourth stage become τ ≤ a = 1and \(\tau \leq \frac {a}{\theta }= 2.22\) (so we assume τ ≤ 1 hereafter); and cutoff SM (τ) becomes \( S^{M}\left (\tau \right ) =\frac {9(1-\tau )(31-9\tau )}{1600}\). It is straightforward to show that, in this context, the green monopoly can be implemented with relatively low emission fees τ < 0.84, while the dirty monopoly arises when τ ≥ 0.84.Footnote 9 We next find the optimal fee in the admissible range of fees that implement a green monopoly, as follows

which is positive, and monotonically decreasing in τ, entailing the corner solution τ∗(G) = 0. Similarly, we find the optimal fee among all emission fees that induce a dirty monopoly

which is negative, and monotonically increasing in τ, yielding a corner solution at τ∗(D) = 1. We can now evaluate each social welfare at their corresponding emission fee, we obtain \(W^{G}\left (\tau ^{\ast }(G)\right ) =\frac {7}{40}\) and WD (τ∗(D)) = 0. Therefore, seeking to maximize welfare, the regulator sets an emission fee τ∗ = τ∗(G) = 0, and a green monopoly emerges in equilibrium.Footnote 10

In this setting, the regulator can only implement a monopoly (either green or dirty) and, importantly, the incumbent cannot use its investment decision to deter entry. In the following section, we relax these assumptions, considering a potential entrant assessing industry prospects.

4 Equilibrium Analysis—Entry Threats

4.1 Fourth Stage

No Entry

If entry does not ensue, the incumbent’s equilibrium output and profits coincides with that when entry threats are absent, as summarized in Table 1.

Entry

Let \(q_{i}^{d,KJ}\) denote the equilibrium output level of firm i when both firms compete. The superscript d denotes a duopoly market and KJ represents firm 1 (incumbent) choosing technology K and firm 2 (entrant) selecting technology J, where K,J = {D,G}. Four possible cases can arise (D, D), (D, G), (G, D), and (G, G), in which the first (second) term of every pair denotes the technology choice of firm 1 (firm 2, respectively). We separately analyze two groups according to the technology acquired by firm 1: {(D, D), (D, G)} and {(G, D), (G, G)}. Equilibrium results for the case in which firm 1 uses a dirty technology are presented in Table 2, where the left-hand column considers that firm 2 keeps its dirty technology while in the right-hand column it adopts green technology.

Table 2 shows that firms’ output and profits decrease in emission fees, when both have dirty technology. However, under a (D,G)-duopoly the green entrant’s output and profits increase in emission fees if its technology is sufficiently clean, i.e., \(\theta <\frac {1}{2}\). Finally, the incumbent’s output in the (D,G)-duopoly is smaller than the entrant’s, since emission fees more severely impact the dirty than the green firm. As a consequence, the green firm captures a larger market share than that keeping its dirty technology. Table 3 analyzes the case in which firm 1 decides to acquire a green technology, i.e., (G, D) and (G, G).

Similar intuitions to those in Table 2 apply when the incumbent is a green type, whereby output and profits decrease in τ unless the green technology is sufficiently clean.

4.2 Third Stage

In this stage of the game, firm 2 decides whether or not to enter and, upon entry, its technology type, taking the emission fee as given. The next lemma analyzes the entrant’s optimal responses.

Lemma 2

When firm 1 adopts technology K , whereK = {D,G}, firm2 responds:

-

1.

Not entering if \(F>\max \left \{ \overline {F}^{KG},\overline {F} ^{KD}\right \} \) ;

-

2.

Entering and adopting a green technology when\(F\leq \overline {F}^{KG}\)andS ≤ SK;and

-

3.

Entering and adopting a dirty technology otherwise;

where the entry costs cutoffs for a dirty incumbent are\(\bar {F}^{DG}\equiv \frac {\lbrack a-\tau (2\theta -1)]^{2}}{9b}-S\),\(\bar {F}^{DD}\equiv \frac {\left (a-\tau \right )^{2}}{9b}\),and\( S^{D}\equiv \frac {4\tau (1-\theta )(a-\tau \theta )}{9b}\); while those for a green incumbentare\(\bar {F}^{GG}\equiv \frac {(a-\tau \theta )^{2}}{9b}-S\),\(\bar {F}^{GD}\equiv \frac {\left [ a-\tau \left (2-\theta \right ) \right ]^{2}}{9b}\),and\(S^{G}\equiv \frac {4\tau (1-\theta )(a-\tau )}{9b}\).

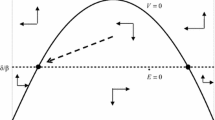

Figure 1a identifies the entrant’s responses when the incumbent keeps its dirty technology, while Fig. 1b depicts its responses when the incumbent adopts a green technology. Intuitively, when F and S are sufficiently low (close to the origin in Fig. 1), firm 2 chooses to enter with green technology irrespective of the incumbent’s technology. However, when entry is inexpensive but the green technology is costly (at bottom right-hand corner of both figures), firm 2 enters with a dirty technology. Finally, when entry costs are sufficiently high, (above both cutoffs \(\bar {F}^{KG}\) and \(\bar {F}^{KD}\)), firm 2 does not enter since its profits would be negative under all technologies, \(\pi _{2}^{d,KG}<\pi _{2}^{d,KD}<0\).Footnote 11

In addition, a comparison of the cutoffs across figures yields \(\bar {F}^{GD}< \bar {F}^{DD}\), which entails that firm 2 enters with a dirty technology under larger conditions when it faces a dirty than a green incumbent. Intuitively, the entrant anticipates that, upon entering with a dirty technology, it will face a more stringent emission fee when competing against a green than dirty incumbent; thus facing a cost disadvantage relative to its rival. Furthermore, \(\bar {F}^{DG}>\bar {F}^{GG}\) which implies that, when firm 2 enters, it invests in green technology under a larger set of (F,S) −pairs when its rival is dirty than when it is green. In other words, the entrant has more incentives to invest in the green technology when such investment provides a cost advantage against its rival, which occurs when firm 1 is dirty; but smaller incentives otherwise. Finally, cutoff SD > SG since 𝜃 ∈ (0,1) by definition, which confirms our previous intuition about the incentives of green entry when the incumbent keeps its dirty technology.

Figure 2 superimposes Fig. 1a and b to summarize the entrant’s responses. Interestingly, in some cases, the entrant’s behavior is unaffected by the incumbent’s technology, in other cases the entrant responds choosing the opposite technology, or stays out when the incumbent invests in green technology.

We next summarize the entrant’s responses depicted in Fig. 2.

Corollary 1

The entrant responds to the incumbent’s technology decision according to the following Regions I–V:

-

I.

No entry regardless of the incumbent’s technology choice if \(F>\max \left \{ \bar {F}^{DG},\bar {F}^{DD}\right \} \) .

-

II.

No entry when the incumbent is green, but entry when the incumbent is dirty in which case the entrant responds with:

-

(a)

Green technology if\(\bar {F}^{DG}\geq F>\max \left \{ \bar {F} ^{GG},\bar {F}^{GD}\right \} \)andS ≤ SD.

-

(b)

Dirty technology if\(\bar {F}^{DD}\geq F>\bar {F}^{GD}\)andS > SD.

-

(a)

-

III.

Dirty technology regardless of the incumbent’s technology choice if\(\bar {F}^{GD}\geq F\)andS > SD.

-

IV.

Entering and choosing the opposite technology than the incumbent if\(F\leq \overline {F}^{GD}\)andSD ≥ S > SG.

-

V.

Green technology regardless of the incumbent’s technology choice if\(F<\bar {F}^{GG}\)andS ≤ SG.

In region I, entry costs are sufficiently high to blockade entry regardless of the incumbent’s technology decision. In region II, however, the incumbent’s choice of a green technology deters entry, as it provides the incumbent with a cost advantage against its rival.Footnote 12 However, in region III, the incumbent’s technology choice has no effect on firm 2’s entry decision, nor on its technology choice. Intuitively, entry is relatively inexpensive but adopting the green technology is costly in this region, leading the entrant to respond entering with a dirty technology regardless of the technology adopted by the incumbent. In region IV, the entrant joins and chooses the opposite technology than the incumbent. In the case that the incumbent keeps its dirty technology, the entrant finds it profitable to invest in the green technology, given the intermediate cost of S, to have a competitive advantage against its rival. In contrast, when the incumbent invests in green technology, the entrant finds it too costly to acquire such a technology.Footnote 13 Finally, in region V, the costs of entering and adopting the green technology are both sufficiently low to make green entry a dominant strategy for firm 2.

The cutoffs on F and S identified in Lemmas 2–3 are a function of τ, implying that the regions under which firm 2 decides to enter (and its technology choice upon entry) is affected by the regulator’s choice of τ at the first period of the game. That is, regions I–V expand/shrink depending on the specific fee selected by the regulator.

4.3 Second Stage

Anticipating the entrant’s responses in the third stage, firm 1 selects its own technology; as the next lemma describes.

Lemma 3

In regioni = {I,IIa,IIb} the incumbent chooses a green technology if its cost satisfiesS < Si,where\( S_{I}\equiv \frac {\tau (1-\theta )\left [ 2a-\tau (1+\theta )\right ] }{4b}\),\( S_{IIa}\equiv \frac {5a^{2}-2\tau a(13\theta -8)+\tau ^{2}\left [ 5\theta ^{2}-16(1-\theta )\right ] }{39b}\),and\(S_{IIb}\equiv \frac { 5a^{2}-2\tau a(9\theta -4)+\tau ^{2}(9\theta ^{2}-4)}{39b}\).In region III (regions IV and V), the incumbent keeps its dirty technology(adopts green technology) under all parameter values.

Figure 3 depicts the results in Lemma 3.Footnote 14 In region I, the incumbent anticipates that the entrant stays out of the industry regardless of its technology decision, and thus adopts the green technology if the profit from green monopoly exceed that from a dirty monopoly, which occurs when S is sufficiently low, i.e., S < SI in the upper left-hand section of the figure. In regions IIa, entry is deterred if the incumbent chooses a green technology; otherwise, the entrant joins the industry investing in green technology. The incumbent then has relatively strong incentives to invest in green technology, and maintain its monopoly power, rather than saving this investment cost and face a tough entrant in a (D,G) duopoly. A similar argument applies in region IIb, where the incumbent anticipates that investing in green technology deters entry, but keeping its dirty technology attracts a dirty entrant. The threat of entry is, however, weaker than in region IIa since the incumbent’s profits in the (D,D) duopoly are larger than in the (D,G) duopoly. In region III, the incumbent anticipates dirty entry regardless of its technology decision, and thus chooses to keep its technology since investing in green technology is too costly in this region. In region IV, the entrant joins the industry but adopting the opposite technology of the incumbent. In this setting, the incumbent chooses between inducing a (D,G) or a (G,D) duopoly, and invests in green technology to induce a (G,D) duopoly since it is more profitable than the (D,G) duopoly, i.e., the incumbent enjoys a cost advantage against its rival. Finally, in region V, green entry occurs regardless of the incumbent’s technology decision, which leads the incumbent to invest in green technology given its low costs in this region.

4.4 First Stage

Let us finally analyze the first stage of the game. Define the set of market structures as M = {D,G,DD,GG,DG,GD} indicating, respectively, a dirty monopoly, a green monopoly, a dirty duopoly, a green duopoly, and the two types of mixed duopolies. For a given emission fee, τ, let M∗(τ) ⊂ M be the set of implementable market structures, i.e., those that emerge in stages 2–3 of the game when firms face a given fee τ and a given (F,S) −pair. Intuitively, starting from any (F,S) − pair in Fig. 3, a marginal change in fee τ shifts the position of all cutoffs for F and S, ultimately giving rise to one or more implementable market structures in M∗(τ). We next describe the regulator’s decision rule in the first stage of the game, and subsequently offer a numerical example.

Proposition 1

The regulator chooses the emission feeτthat solves

where mi ∈ M∗(τ), and the optimal fee in market mi, τ∗(mi), solves

In words, the regulator’s decision follows a two-step approach, starting from problem (2) and moving to (1):

-

1.

First, for every implementable market structure, mi ∈ M∗(τ), the regulator chooses the welfare-maximizing emission fee τ∗(mi) among all taxes that implement such a market mi, yielding W (τ∗(mi)).

-

2.

Second, the regulator compares the maximal welfare that each implementable market structure generates, i.e., W (τ∗(mi)) for all mi ∈ M∗(τ), and selects the fee that induces the market with the highest welfare.

Importantly, since the set of implementable market structures M∗(τ) does not necessarily include all elements in M, i.e., M∗(τ) ⊂ M, the regulator’s choice is constrained in terms of the markets he can implement, implying that his decision could lead to a second-best outcome. We next provide a numerical example to illustrate the regulator’s decision in the first stage of the game.

Example 1

Consider parameter values a = b = 1, e = 0.8, 𝜃 = 0.45, and costs F = 0.01 and S = 0.02. In this context, the conditions for positive output levels described in Section 2 entail \(\tau < \frac {a}{\theta }=\frac {1}{0.45}= 2.22\) and \(\tau <\frac {a}{2-\theta }=\frac {1 }{2-0.45}= 0.64\). (We thus restrict our attention to fees satisfying τ < 0.64.)

As described in Appendix 2, only three market structures can be implemented by variations on τ in this context: a (G,D)-duopoly with relatively low fees, τ < 0.08; a (D,D)-duopoly with intermediate fees τ ∈ [0.08,0.45); and a green monopoly with relatively high fees τ ∈ [0.45,0.64). Therefore, the (F,S) = (0.01,0.02) pair lies in the region of admissible parameters that support a green monopoly when τ is relatively high. In this context, the incumbent adopts the green technology, which provides it with a substantial cost advantage relative to the potential entrant, deterring entry as a result. When τ decreases, however, such a region shrinks, moving the (0.01,0.02) pair to the area that sustains the (D,D) and eventually to the (G,D)-duopoly.

Hence, the set of implementable market structures is M∗(τ) = {GD,DD,G}. Next, the regulator chooses the welfare-maximizing emission fee τ∗(mi) within the interval of τ’s that implements every market structure, as follows:Footnote 15

and

Finally, the regulator compares the welfare that arises from optimal fees in these implementable market structures, obtaining

Therefore, the regulator selects a fee τ∗(G) = 0.45 which induces a green monopoly. Furthermore, if the regulator sets fees in the first stage but ignores the second and third stage (as if the market structure was not affected by fees), he would set a fee of τm,D = 0.6 to the initial dirty monopoly, which would still induce a green monopoly since τm,D ∈ [0.45,0.64), but yielding a lower social welfare of WG(0.6) = 0.04.

Example 2

Our results in Example 1 hold under other parameter values. For instance, a more damaging pollution (e = 0.9) does not affect the cutoffs for F and S that give rise to different market structures in the (F,S)-quadrant. As a consequence, the intervals of emission fees that the regulator can use are also unaffected, i.e., (G,D), (D,D), and G still arise under the same values of τ; and thus the same optimal fee applies, τ∗(G) = 0.45. However, a more harmful pollution lowers the social welfare for all market structures, graphically shifting WGD(τ), WDD(τ) and WG(τ) downwards, which entails a lower welfare in equilibrium WG(0.45) = 0.05.

4.5 Implementable Markets - Discussion

Our above results suggest that the green monopoly yields the highest social welfare when entry costs are sufficiently high, leading the regulator to set emission fees that implement this market structure. However, when the entry cost F is sufficiently low, the social welfare under duopoly increases while that under monopoly is unaffected, relative to our above analysis, making duopolies (G,D), (D,D), and (G,G) more attractive to the regulator. In particular, when the cost of the green technology, S, is relatively low, the (G,G)-duopoly is optimal; when this cost is intermediate, (G,D)-duopoly is socially preferred; otherwise, the (D,D)-duopoly is implemented.

When the cost of the green technology, S, decreases, all market structures where at least one firm invests in green technology—the green monopoly, (G,D) and (G,G)— yield a higher welfare. In this context, the regulator implements a green monopoly when entry cost F is relatively high. In contrast, when F is sufficiently low, a (G,D)-duopoly ((G,G)-duopoly) emerges if S is relatively high (low, respectively). A similar argument applies when the green technology is very efficient at reducing emissions, 𝜃 → 0, where similar market structures emerge in equilibrium.

4.6 Assuming that if Entry Occurs, It Must Be Dirty

For illustration purposes, this section discusses how our equilibrium results are affected if the entrant’s strategy space is restricted to only enter or stay out, producing with a dirty technology if entry occurs. In other words, the entrant only has access to the dirty technology, which could occur in industries where the incumbent has the ability to invest in green technology given its extensive experience.

In this context, our findings in the fourth stage of the game still apply, but restricted to the left columns of Tables 2 and 3 since the entrant cannot invest in green technology. In the third stage, the current setting is analogous to one in which the potential entrant faces an infinite cost of investing in the green technology (S → +∞), graphically depicted in the far right-hand side of Fig. 2. Therefore, the entrant’s behavior collapses to three cases: (1) if \(F>\overline {F}^{DD}\), no entry ensues regardless of the incumbent’s technology decision; (2) if \(\overline {F }^{DD}\geq F>\overline {F}^{GD}\), entry (no entry) ensues after the incumbent invests in dirty (green) technology; and (3) if \(F\leq \overline {F}^{GD}\), entry occurs regardless of the incumbent’s decision. In terms of Corollary 1, only regions I, IIb, and III can be sustained when the potential entrant only has access to dirty technology.

In the second stage, we can use our results from Lemma 3 to identify that the incumbent invests in the green technology in region I if and only if S < SI, and in region IIb if and only if S < SIIb; whereas in region III, the incumbent keeps its dirty technology under all parameter values. As a consequence, in region I we have a green monopoly if S < SI but a dirty monopoly otherwise; in region II, we expect a green monopoly that successfully deters entry if S < SIIb, but dirty oligopoly DD otherwise; and in region III, we have a dirty duopoly DDunder all parameter values.

Finally, in the first stage, and considering the same parameter values as in Example 1, only two market structures can be implemented in this context, M∗(τ) = {DD,G} Therefore, the mixed oligopoly where only the incumbent chooses a green technology, GD, could be implemented when the entrant has the ability to choose its technology, but cannot be sustained when this firm only has access to dirty technology, as discussed in our previous analysis of second-stage behavior. The green monopoly still yields a higher social welfare than DD, yielding the same equilibrium fee as in Example 1.

5 Regulator Moving in the Third Stage

In previous sections, we assume that the regulator acts before observing the market structure and investments decisions by all firms. How would our results change if the regulator sets emission fees in the third stage of the game (before firms choose their output levels)? In this setting, the order of play would be the following:

-

1.

In the first stage, the incumbent chooses whether to invest in green technology;

-

2.

In the second stage, firm 2 responds choosing to enter and, if so, whether to acquire green technology;

-

3.

In the third stage, the regulator sets an emission fee given the entry and investment patterns emerging from the previous stages; and

-

4.

In the fourth stage, firm 1 chooses its output as a monopolist (if entry does not occur) or competes with firm 2 (if entry ensues).

5.1 Third Stage

Solving the game by backward induction, we focus on the third stage since in the fourth stage firms’ output and profits coincide with those in Section 3. In the third stage, the regulator sets the optimal fees identified in the following Lemma.

Lemma 4

As a function of the market structure that ensues from the secondstage, the regulator chooses the following optimal emission fees: (1) Dirtymonopoly:τm,D = 2e − a;(2) Green monopoly:τm,G = 0;(3) Dirty duopoly:\(\tau ^{d,DD}=\frac {3e-a}{2}\);(4) Green duopoly:\(\tau ^{d,GG}=\frac {3e\theta -a}{2\theta }\);and (5) (G,D) and (D,G)-duopoly:\(\tau ^{d,GD}=\tau ^{d,DG}=\frac { 3e\theta -a}{1+\theta }\).

Like in Buchanan (1969), emission fees are more stringent in duopoly than in monopoly markets for a given technology, i.e., τd,KK > τm,K for all K = {D,G}. In addition, fees are more stringent in a dirty than green monopoly, that is τm,D > τm,G; and a similar ranking arises under a duopoly where both firms choose the same technology, τd,DD > τd,GG. Note that in the case of a green monopoly, the incumbent would only invest in green technology when receiving a subsidy.Footnote 16

5.2 Second Stage

We next analyze the entrant’s responses to the incumbent’s technology decision in the second stage of the game. Unlike in Section 3, the entrant can now anticipate the optimal fee that the regulator sets for each market structure in the subsequent stage, and decides whether to enter and invest in green technology if its associate costs F and S are sufficiently low. We find that in some cases the entrant’s behavior is unaffected by the incumbent’s technology, in other cases the entrant responds choosing the opposite technology, or stays out when the incumbent invests in green technology. (For compactness, all cutoffs of Lemma 5 are defined in its proof.)

Lemma 5

Assume that environmental damage d satisfies \( e\leq \frac {a}{1 + 2\theta (1-\theta )}\equiv \overline {e}\) . The entrant responds to the incumbent’s technology decision as follows:

-

I.

No entry regardless of the incumbent’s technology choice ifF > max{FA,FB}.

-

II.

No entry when the incumbent is green, but entry when the incumbent is dirty in which case the entrant responds with:

-

(a)

Green technology ifFA ≥ F > max{FC,FD} andS ≤ SA.

-

(b)

Dirty technology ifFB ≥ F > FDandS > SA.

-

(a)

-

III.

Dirty technology regardless of the incumbent’s technology choice ifFD ≥ FandS > SA.

-

IV.

Entering and choosing the opposite technology than the incumbent ifF ≤ FDandSA ≥ S > SB.

-

V.

Green technology regardless of the incumbent’s technology choice ifF ≤ FCandS ≤ SB.

Figure 4 identifies the four types of entrant’s responses of Lemma 4 in regions I–V. In Region I, entry costs are sufficiently high to blockade entry regardless of the incumbent’s technology decision. In region II, in contrast, the incumbent’s choice of a green technology deters entry. Regions IIa and IIb differ only in the entrant’s response to the incumbent’s decision to keep its dirty technology: entering with a green technology when it is relatively inexpensive in Region IIa, but respond with a dirty technology otherwise in Region IIb. However, in region III the incumbent’s technology choice has no effect on firm 2’s entry decision (since entry is inexpensive), nor on its technology choice (since the green technology is very costly), leading to dirty entry regardless. In Region IV, the entrant joins and chooses the opposite technology than the incumbent. In the case that the incumbent invests in green technology, the entrant finds it too costly to acquire such a technology. In other words, the intermediate cost of S exceeds the competitive disadvantage of operating in a (G,D)-duopoly. If in contrast, the incumbent keeps its dirty technology, the entrant becomes green and benefits from a competitive advantage in the (D,G)-duopoly. Finally, in Region V, entry and the green technology are both inexpensive, leading to green entry.

When environmental damages are larger, our results from Lemma 5 are affected by the relative position of cutoffs FB and FD, as the following corollary describes.

Corollary 2

Assume that environmental damage e satisfies \( e>\overline {e}\) . The entrant responds to the incumbent’s technology decision as follows:

-

I.

No entry regardless of the incumbent’s technology choice ifF > max{FA,FD}.

-

II.

No entry when the incumbent is green (dirty), but entry when the incumbent is dirty (green) in which case the entrant responds with:

-

(a)

Green technology ifFA ≥ F > max{FC,FD}.

-

(b)

Dirty technology ifFD ≥ F > max{FA,FB}.

-

(a)

-

III.

Dirty technology regardless of the incumbent’s technology choice ifFB ≥ FandS > SA.

-

IV.

Entering and choosing the opposite technology than the incumbent ifF ≤ min {FB,FD} andSA ≥ S > SB.

-

V.

Green technology regardless of the incumbent’s technology choice ifF ≤ FCandS ≤ SB.

Relative to our previous Fig. 4, as environmental damage becomes more severe, firms anticipate that the emission fee the regulator imposes during the third period will become more stringent, shifting all cutoffs downwards, and expanding Region I where no entry occurs regardless of the incumbent’s investment decision. For illustration purposes, Fig. 5 depicts the entrant’s responses in this case.

5.3 First Stage

The next proposition analyzes firm 1’s technology decision and the ensuing market structure.

Proposition 2

In regioni = {I,IIa,IIb,III,IV } the incumbentinvests in green technology ifS ≤ Si,but keeps its dirty technology otherwise. In region V, the incumbent investsin green technology under all parameter values. (For compactness, cutoffsSIthroughSIVaredefined in theAppendix.) Therefore, the following market structures ensue:

-

In region I, a green monopoly exists ifS ≤ SI,but a dirty monopoly arises otherwise.

-

In region IIa, a green monopoly emerges ifS ≤ SIIa, but a (D,D)-duopoly arises otherwise.

-

In region IIb, a green (dirty) monopoly emerges ifS ≤ SIIband\(e\leq \overline {e}\)(\(S\leq S_{IIb}^{\prime }\)and\(e>\overline {e}\)),but a (D,G)-duopoly ((G,D)-duopoly) arises otherwise.

-

In region III, a (G,D)-duopoly exists ifS ≤ SIII, but a (D,D)-duopoly arises otherwise.

-

In region IV, a (G,D)-duopoly exists ifS ≤ SIV,but a (D,G)-duopoly arises otherwise.

-

In region V, a (G,G)-duopoly emerges under all parameter values.

Overall, when the green technology is sufficiently inexpensive, the incumbent can invest in it to deter entry, thus giving rise to a green monopoly; as identified in Regions I, IIa, and IIb. When the green technology becomes more expensive, these regions sustain a dirty monopoly or a duopoly where at least one firm keeps its dirty technology. In Regions III–V, the incumbent cannot use its investment in green technology as an entry-deterring tool. However, in Regions III and IV this firm can invest in green technology to leave no incentives for the potential entrant to adopt the same technology, and thus enter at a cost disadvantage in the (G,D)-duopoly. Finally, in Region V, entry and investment costs are sufficiently low to induce green entry under all parameter conditions (as found in Lemma 5), which leads the incumbent to invest in green technology as well, giving rise to a (G,G)-duopoly.

Unlike in Section 3 (where the regulator acts first), firms can now evaluate their profits from investing/not investing in green technology (and from entering/not entering for firm 2) at the optimal emission fee that the regulator will set in the fourth stage of the game. As a consequence, the cutoffs for F and S that yield different market structures in the (F,S) -quadrant are now evaluated at equilibrium fees; as opposed to those in Section 3 whereby the regulator could alter the position of these cutoffs by varying τ in order to induce different market structures.

5.4 Welfare and Profit Comparison Across Models

We next extend the previous numerical example, evaluate the welfare that arises when the regulator acts in the third stage of the game, and compare it against that when he acts first.

Example 3

Figure 6 evaluates the cutoffs of Fig. 5 at the same parameter values as in previous examples, superimposing the cutoffs identified in Proposition 2.Footnote 17 The figure helps us identify the specific market structure that emerges in equilibrium for each (F,S) combination.Footnote 18 Overall, a monopoly emerges, either green or dirty, when entry costs are relatively high. When entry costs are intermediate and investment costs are high, the incumbent can deter entry by keeping its dirty technology; a suboptimal outcome. Otherwise, entry occurs, yielding a dirty duopoly DD when investment costs are sufficiently high, a mixed duopoly (GD or DG) when they are intermediate, or a green duopoly when these costs are low.

When the regulator acts in the third stage of the game, the (F,S) = (0.01,0.02) pair considered in Examples 1–2 lies now in region IV of Fig. 5, where a (D,G)-duopoly arises.Footnote 19 In this context, the optimal emission fee (from Lemma 4) is τDG = 0.055, yielding a social welfare of WDG = 0.015. Therefore, the regulator cannot implement the green monopoly when acting third, and social welfare becomes lower than when he acts first (where WG(0.45) = 0.07, as shown in the previous examples).

In summary, if the regulator had the ability to directly choose the number of firms in the industry and their technology, our numerical example shows that the green duopoly would yield the highest social welfare (such market structure and technology would be the first best). However, a green duopoly is not an implementable market structure (see Example 1). When we focus on implementable markets, the regulator can only use τ in order to induce firms to enter and/or invest in green technologies. In that context, the green monopoly becomes the best implementable market (second best). Finally, when he acts in the third stage of the game, a (D,G)-duopoly emerges in equilibrium (third best).

Interestingly, the incumbent’s equilibrium profits may be larger when the regulator acts in the first stage than when he acts in the third stage. Indeed, when the regulator acts first, a green monopoly emerges, yielding profits of \(\pi _{1}^{m,G}(\tau )=\frac {(a-\tau \theta )^{2}}{4b}-S\). In the context of our ongoing parameter example, the emission fee that induces such market structure is τ = 0.45 (see Example 1), which entails \(\pi _{1}^{m,G}(0.45)= 0.14\). However, when the regulator selects fees in the third stage, a (D,G)-duopoly arises, with equilibrium profits \(\pi _{1}^{d,DG}(\tau )=\frac {\left [ a-\tau (2-\theta )\right ]^{2}}{9b}\), where the emission fee in this setting is τ = 0.055 (see Example 3), yielding equilibrium profits \(\pi _{1}^{d,DG}(0.055)= 0.09\). In words, when the regulator chooses fees in the first stage the incumbent faces a more stringent emission fee and incurs the cost of investing in green technology, relative to the setting where the regulator acts in the third stage. However, this time structure allows the incumbent to use the green technology investment as an entry-deterring tool, ultimately increasing its equilibrium profits. Overall, both the incumbent and the regulator are better off by having emission fees set in the first stage of the game, as this time structure is profit and welfare improving.

6 Discussion

A regulator that does not consider entry threats and potential investments in green technology would run the risk of setting emission fees that induce suboptimal market structures. Hence, environmental regulation will benefit from setting emission fees before entry and investment decisions are made. Such early policy would provide regulators with a wider set of market structures to implement, ultimately helping them reach a larger social welfare.

In addition, our results suggest that, even when the regulator acts first, if he ignores entry threats and investment decisions in future stages, he would set a emission fee corresponding to the existing dirty monopoly, τm,D. In this case, he would inadvertently induce a market structure yielding lower welfare levels than even those achieved when he acts third. Therefore, regulatory agencies should be especially aware about the presence of potential competitors in the industry, their investment decisions after the policy, and design regulation taking into account that it can affect entry and the adoption of clean technology.

Furthermore, if the green duopoly is one of the implementable market structures, M∗(τ), the use of emission fees can help the regulator achieve such a market when he acts first, while he can only take the market structure as given when acting third.

Our paper could be extended to consider that firms, rather than incurring a fixed cost to acquire green technology, face a continuum of investment choices which increase in the cleanliness of the technology. Our paper could be extended to consider that firms, rather than incurring a fixed cost to acquire green technology, face a continuum of investment choices which increase in the cleanliness of the technology. To make this investment decision richer, we could assume that the investment affects the firm’s marginal cost of production (perhaps being higher when it uses a green technology than otherwise) and that the green technology also has a positive effect on market demand, thus leading to product differentiation. Our model can also be extended to allow for the incumbent and entrant to exhibit asymmetric costs of investing in green technology. These costs could, for instance, coincide when the incumbent keeps its dirty technology, but the entrant could face a lower investment cost if the incumbent invests in green technology (e.g., because the former learns from the investment experience of the latter).

In addition, we considered that the regulator is perfectly informed, but in a different setting he could be unable to observe the cost of clean technology. In this context, the position of the (F,S)-pair would be probabilistic, thus potentially inducing different market structures (each with an associated probability). It would be interesting to study how the optimal emission fee is set in this context, and whether uncertainty reduces the regulator’s incentives to move first.

Notes

President Obama recognized the urgency of policies tackling climate change during the presentation of the revised Clean Power Plan in August 3, 2015, when he mentioned: “We are the first generation to feel the impacts of climate change, and the last generation to be able to do something about it.”

Finland was in 1990 the first country to enact a carbon tax. While Neste was the only oil refinery and distribution company active in Finland when the tax was enacted, the St1 oil company entered the industry in 1995 and started its operations in 1997, suggesting that the carbon tax could have facilitated entry, or at least, did not prevent entry.

Dow Chemicals, a monopolist in the US magnesium industry, provides an example of how environmental regulation can deter potential entrants from joining an industry or, at least, how regulation may not facilitate further entry. Regulators accumulated information about Dow’s production during the Korean War, since in this period magnesium production plants were publicly owned and managed. In 1970, the EPA introduced the National Ambient Air Quality Standards (NAAQS), affecting the emissions of carbon monoxide and particulate matter, both of them generated in magnesium production. The following year, however, the state of Texas, where most Dow magnesium plants were located, passed its own Clean Air Act, allowing Dow to ignore some of the emission requirements in the NAAQS. Such state law led Dow to substantially increase its magnesium production during the early 1970s, which successfully deterred the entry of potential competitors, such as Kaiser Aluminum and Norsk Hydro; and delayed the entry of Alcoa until 1976. (For more details, see Friedrich and Mordike (2006)).

In particular, the incumbent’s decision gives rise to different market structures: a dirty monopoly, in which entry and technology costs are sufficiently high; a green monopoly, in which entry costs are high but technology costs are low; a dirty (green) duopoly, if low (high) entry costs are accompanied by high (low) technology costs; and a mixed duopoly, which occurs when entry costs are low and technology costs take intermediate values.

A traditional conclusion is that such incentives increase monotonically with regulation stringency (Requate and Unold 2003).

Our paper also connects with the literature on the optimal timing of environmental policy, such as Requate (2005b) who analyzes a monopoly investing in R&D and selling abatement technology to other firms.

Petrakis and Xepapadeas (2003) extended their model to consider optimal emission fees with and without pre-commitment when a regulator faces a polluting monopolist which may relocate to another country. As in Petrakis and Xepapadeas (2001), their setting assumes a specific market structure; as opposed to our model which allows for emission fees to alter the number of firms operating in the industry as well as the entrant’s technology decision.

Tarui and Polasky (2005) consider a similar model but allowing for the regulator to receive updated information about environmental damages in later stages, thus emphasizing the commitment problems identified in the previous literature.

Consider first the green monopoly. Investment cost S = 0.02 satisfies S < SM(τ) since this condition becomes, in this context, \(0.02<\frac { 9(1-\tau )(31-9\tau )}{1600}\), or τ < 0.84; a condition that holds in the admissible range of fees τ ≤ 1. Consider now the dirty monopoly. Investment cost S = 0.02 can satisfy S ≥ SM(τ) since this condition entails, in this context, \(0.02\geq \frac {9(1-\tau )(31-9\tau )}{ 1600}\), or τ ≥ 0.84; a condition that holds for all τ ∈ [0.84, 1]. Summarizing, for relatively low fees, τ ∈ [0, 0.84), the green monopoly can be implemented, whereas the dirty monopoly can be sustained otherwise.

Therefore, cutoff SM (τ) is evaluated at τ∗ = 0, becoming SM (τ∗) = 0.17 in equilibrium. Since S = 0.02, condition S < SM (τ∗) holds, and the incumbent chooses to invest in the green technology.

As shown in the proof of Lemma 2, cutoff \(\bar {F}^{KG}\) originates above \( \bar {F}^{KD}\), but crosses \(\bar {F}^{KD}\) at exactly SK.

In region IIa, the cost of investing in the green technology is sufficiently low to induce the entrant to respond with a green technology after observing that the incumbent keeps its dirty technology. In region IIb, however, the cost of the green technology is relatively high, leading the entrant to respond with dirty technology.

The entrant obtains higher profits (net of entry and investment costs) when responding with a green technology than a dirty technology, that is, profits are larger in the (G,G) than in the (G,D) duopoly. However, the intermediate cost of investing in the green technology, S, exceeds this profit differencial, leading the entrant to respond with dirty technology after observing that the incumbent invests in green technology.

Note that cutoff SI lies to the right-hand side of SD for all admissible parameter values, thus dividing region I into two areas, one in which the incumbent chooses a green technology and another in which it keeps its dirty technology. However, cutoff SIIa can lie to the right of SD or to the left depending on the specific parameter values at which these cutoffs are evaluated. If SIIa < SD, the incumbent would keep its dirty technology for all parameter values in region IIa. Otherwise, this region is divided into two areas. A similar argument applies to cutoff SIIb in region IIb.

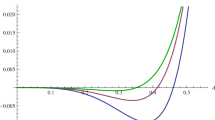

Both welfare functions WGD(τ) and WG(τ) are monotonically decreasing in τ for the admissible range of emission fees, τ ∈ [0, 0.64). WDD(τ) is non-monotonic in this range, but lies on the negative quadrant for all fees implementing this market structure τ ∈ [0.08, 0.45).

For the remainder of this section we focus on green technologies that have a significant impact at reducing emissions, 𝜃 < 1/2.

It is straightforward to evaluate the cutoffs we found in Lemma 5, Corollary 2, and Proposition 2 at the same parameter values as Examples 1–2, yielding cutoffs FA = 0.12 − S, FB = 0.08, FC = 0.11 − S, FD = 0.10, SA = 0.04, SB = 0.0054, and \(\overline {e}= 0.67\).

Cutoffs SIIa, SIII, and SIV are not depicted in the figure since they lie to the right-hand side of their corresponding region, thus not splitting the region into two areas. Indeed, SIIa = 0.14, SIII = 0.04 and SIV = 0.01. In addition, we consider cutoff \( S_{IIb}^{\prime }\), rather than SIIb, since the environmental damage satisfies \(e>\overline {e}\) given that e = 0.8 while cutoff \(\overline {e}\) becomes \(\overline {e}= 0.67\). (See Proposition 2 for more details about region IIb.)

Hence, the (F,S) = (0.01, 0.02) pair lies in a region IV of Fig. 5. Evaluating cutoff SIV in this context, yields SIV = 0.01. Therefore, S > SIV since 0.02 > 0.01, implying that the incumbent chooses to keep its dirty technology, and the entrant responds investing in the green technology, yielding a DG duopoly; as depicted at the bottom of Fig. 6 for intermediate values of S, i.e., between SIV = 0.01 and SA = 0.04.

References

Buchanan JM (1969) External diseconomies, corrective taxes and market structure. Am Econ Rev 59:174–177

Buchanan JM, Tullock G (1975) Polluters’ profits and political response: direct controls versus taxes. Am Econ Rev 65(10):139–147

Espinola-Arredondo A, Munoz-Garcia F (2013) When does environmental regulation facilitate entry-deterring practices. J Environ Econ Manag 65(1):133–152

Friedrich HE, Mordike BL (2006) Magnesium technology: metallurgy, design data, and applications. Springer, Berlin

Helland E, Matsuno M (2003) Pollution abatement as a barrier to entry. J Regul Econ 24:243–259

Heyes A (2009) Is environmental bad for competition? A survey. J Regul Econ 36:1–28

Katsoulacos Y, Xepapadeas A (1996) Environmental innovation, spillovers and optimal policy rules. Environmental Policy and Market Structure. Kluwer Academic Publishers, Dordrecht, pp 143–150

Krysiak FC (2008) Prices vs. quantities: the effects on technology choice. J Public Econ 92:1275–1287

Maloney MT, McCormick RE (1982) A positive theory of environmental quality regulation. J Law Econ 25:99–123

Martín-Herrán G, Rubio SJ (2016) The Strategic Use of Abatement by a Polluting Monopoly. Research Report, Fondazione Eni Enrico Mattei (FEEM), Aug. 23rd

Montero JP (2002) Market structure and environmental innovation. J Appl Econ 5(2):293–325

Parry I (1998) Pollution regulation and the efficiency gains from technological innovation. J Regul Econ 14(3):229–254

Perino G, Requate T (2012) Does more stringent environmental regulation induce or reduce technology adoption? When the rate of technology adoption is inverted U-shaped. J Environ Econ Manag 64:456–467

Petrakis E, Xepapadeas A (2001) To commit or not to commit: environmental policy in imperfectly competitive markets. Working Papers 0110, University of Crete, Department of Economics

Petrakis E, Xepapadeas A (2003) Location decisions of a polluting firm and the time consistency of environmental policy. Resour Energy Econ 25(2):197–214

Porter ME, van der Linde C (1995) Toward a new conception of the environment-competitiveness relationship. J Econ Perspect 9:97–118

Requate T (2005a) Dynamic incentives by environmental policy instruments—a survey. Ecol Econ 54:175–195

Requate T (2005b) Timing and commitment of environmental policy, adoption of new technology, and repercussions on R&D. Environ Resour Econ 31:175–199

Requate T, Unold W (2003) Environmental policy incentives to adopt advanced abatement technology: will the true ranking please stand up. Eur Econ Rev 47(1):125–146

Schoonbeek L, de Vries FP (2009) Environmental taxes and industry monopolization. J Regul Econ 36(1):94–106

Storrøsten HB (2015) Prices vs. quantities with endogenous cost structure and optimal policy. Resour Energy Econ 41:143–163

Tarui N, Polasky S (2005) Environmental regulation with technology adoption, learning and strategic behavior. J Environ Econ Manag 50(3):447–467

Ulph A, Ulph D (2013) Optimal climate change policies when governments cannot commit. Environ Resour Econ 56(2):161–176

Zhao J (2003) Irreversible abatement investment under cost uncertainties: tradable emission permits and emissions charges. J Public Econ 87(12):2765–2789

Acknowledgments

We would like to thank Luis Gautier, Robert Rosenman, Richard Shumway, and Charles James for their helpful comments and discussions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Firms’ output choices

No Entry

If the incumbent keeps its dirty technology, it chooses output q1 in the fourth stage of the game to solve

Differentiating with respect to q1, we obtain a − 2bq1 − τ = 0, which yields an optimal output of \(q_{1}=\frac {a-\tau }{2b}\). If the incumbent adopts a green technology in the second stage of the game, this firm solves

entailing an optimal output \(q_{1}=\frac {a-\tau \theta }{2b}\), which decreases in the pollution factor 𝜃.

Entry

If entry occurs and both incumbent and entrant keep their dirty technology, the incumbent solves

while the entrant solves

where F represents its entry cost. Simultaneously solving the incumbent’s and entrant’s problems, yields a symmetric optimal output \(q_{1}=q_{2}=\frac { a-\tau }{3b}\).

If, instead, both firms adopt a green technology, the incumbent’s problem becomes

where S denotes the cost of the green technology. In this context, the entrant solves

Simultaneously solving the incumbent’s and entrant’s problems, we obtain a symmetric optimal output of \(q_{1}=q_{2}=\frac {a-\tau \theta }{3b}\).

If the incumbent keeps its dirty technology while the entrant adopts a green technology, the former solves problem Eq. A1 while the latter solves Eq. A4, which yields output \(q_{1}=\frac {a-\tau (2-\theta )}{3b}\) for the incumbent and \( q_{2}=\frac {a-\tau (2\theta -1)}{3b}\) for the entrant. Conversely, if the incumbent adopts a green technology and the entrant keeps its dirty technology, the former solves problem Eq. A3 and the latter solves Eq. A2, yielding analogous output levels.

Appendix 2: Numerical Example

1.1 Baseline

For parameter values a = b = 1, e = 0.8, 𝜃 = 0.45, the cutoffs for F and S become

Let us check if the (F,S) = (0.01, 0.02) pair lies in Region I–V of Fig. 3.

- ᅟ:

-

Region I. First, (F,S) = (0.01, 0.02) pair cannot lie in Region I, as for that we would need \(F>\overline {F}^{DD}(\tau )\), which in this context implies \(0.01>\frac {(1-\tau )^{2}}{9}\), or τ > 0.7, violating the initial condition on τ, i.e., τ < 0.64. Hence, the regulator cannot implement the market structures that arise in Region I with any value of τ.

- ᅟ:

-

Region IIa. Second, the (F,S) = (0.01, 0.02) pair cannot lie in Region IIa either, since for that we would need three conditions to hold: (1) \(F<\overline {F}^{DG}(\tau )\); (2) \(F>\max \left \{ \overline {F}^{GG}, \overline {F}^{GD}\right \} \), and (3) S < SD. Condition (1) entails in this context that \(0.01<\frac {(10+\tau )^{2}}{900}-0.02\), or τ > − 4.8, which holds by definition. Condition (2) can be divided into two conditions: (i) \(F>\overline {F}^{GG}\) and (ii)\(\ F>\overline {F}^{GD}\). Condition (i) entails \(0.01>\frac {1}{9}\left [ \frac {20-9\tau }{20}\right ]^{2}-0.02\), or τ < 1.068, which holds given that the set of admissible fees in this parameter example is τ < 0.64. Condition (ii) entails \(0.01>\frac {1}{9} \left [ \frac {20-31\tau }{20}\right ]^{2}-0.02\), or τ > 0.45. Finally, condition (3) implies \(0.02<\frac {11\tau (20-9\tau )}{900}\), or τ < 0.08. Therefore, conditions (2-ii) and (3) are incompatible, yielding that Region IIa cannot be sustained in equilibrium.

- ᅟ:

-

Region IIb. The (F,S) = (0.01, 0.02) pair can, however, lie in Region IIb as we show next. Region IIb can be sustained if (1) \(\bar {F}^{GD}(\tau )<F<\bar {F}^{DD}(\tau )\); and (2)S > SD. Condition (1) can be divided into two conditions: (i) \(\bar {F}^{GD}(\tau )<F\), and (ii) \(F< \bar {F}^{DD}(\tau )\). Condition (i) implies that \(\frac {1}{9}\left [ \frac { 20-31\tau }{20}\right ]^{2}<0.01\), which yields τ > 0.45; while condition (ii) entails that \(0.01<\frac {(1-\tau )^{2}}{9}\), which simplifies to τ < 0.7. Therefore, condition (i) restricts to set of admissible fees, τ ∈ [0, 0.64] to τ ∈ [0.45, 0.64], whereas condition (ii) holds for all admissible fees. Condition (2) implies \(0.02> \frac {11\tau (20-9\tau )}{900}\), or τ > 0.08. Combining conditions (1) and (2), we obtain that Region IIb can be supported for all fees τ ∈ [0.45, 0.64]. Finally, we examine which market structure arises in this Region IIb, since the market structure that emerges in equilibrium depends on whether S > SIIb or S < SIIb. In this parameter example, we find that \(0.02<\frac {\left (4 + 7\tau \right ) (100-89\tau )}{2,880}\) for all admissible fees in Region IIb, τ ∈ [0.45, 0.64]. As a result, a green monopoly emerges in Region IIb.

- ᅟ:

-

Region III. Third, the (F,S) = (0.01, 0.02) pair can implement a (D,D)-duopoly in Region III. Specifically, in this setting, for the (D,D)-duopoly to arise, we need that: (1)\(\ F<\overline {F}^{GD}(\tau )\); and (2) S > SD. From our calculations in Region IIb, we know that condition (1) holds when τ < 0.45, while condition (2) is satisfied when τ > 0.08. Hence, Region III can be sustained for fees in τ ∈ [0.08, 0.45], giving rise to a (D,D)-duopoly.

- ᅟ:

-

Region IV. Fourth, the (F,S) = (0.01, 0.02) pair can also lie in Region IV under some conditions. Recall that, in this region, the (G,D)-duopoly arises if (1) \(F<\overline {F}^{GD}\); (2) S < SD; and S > SG. From our above calculations, we know that condition (1) holds as long as τ < 0.45, and condition (2) is satisfied when τ < 0.08. Thus far, we restricted the set of fees sustaining Region IV to τ < 0.08. Finally, condition (3) holds when \(0.02<\frac {11(1-\tau )}{45}\), which is satisfied for all admissible fees in this region, τ < 0.08. As a consequence, Region IV can be supported for all fees satisfying τ < 0.08, and a (G,D)-duopoly emerges.

- ᅟ:

-

Region V. Finally, the (F,S) = (0.01, 0.02) pair cannot lie in Region V. Recall that this region can be sustained if: (1) \(F<\overline {F}^{GG}\); and (2) S ≤ SG. Condition (1) entails that \(0.01<\frac {1}{9} \left [ \frac {20-9\tau }{20}\right ]^{2}-0.02\), or τ > 1.068, which cannot holds given that the set of admissible fees in this parameter example is τ < 0.64. Therefore, Region V cannot be supported in equilibrium.

Summarizing the (G,D)-duopoly can be implemented with fees in τ ∈ [0, 0.08) (see Region IV); the (D,D)-duopoly can be implemented with fees τ ∈ [0.08, 0.45] (see Region III); and the green monopoly can be implemented with fees in τ ∈ [0.45, 0.64] (see Region IIb).

1.2 Higher entry cost, F = 0.1

In this subsection, we reproduce Appendix 2, but evaluating it at a higher entry cost, F = 0.1 rather than F = 0.01. For parameter values a = b = 1, e = 0.8, 𝜃 = 0.45, the cutoffs for F and S become

Let us check if the (F,S) = (0.1, 0.02) pair lies in Region I–V of Fig. 3.

- ᅟ:

-

Region I. First, (F,S) = (0.1, 0.02) pair can lie in Region I. We need \(F>\overline {F}^{DD}(\tau )\), which in this context implies \(0.1>\frac { (1-\tau )^{2}}{9}\), or τ < 0.05, which is compatible with the initial condition on τ, i.e., τ < 0.64. Hence, the regulator can implement the market structures that arise in Region I with any value of τ, namely, a dirty monopoly if S > SI but a green monopoly otherwise. In this context, this condition entails \(0.02>\frac {11\tau }{80}\left [ \frac { 40-29\tau }{20}\right ] \), which simplifies to τ < 0.07. Therefore, we can summarize that, for emission fees in τ < 0.07, the regulator can implement a dirty monopoly, while for fees satisfying τ ≥ 0.07 a green monopoly is implemented.

- ᅟ:

-

Region IIa. Second, the (F,S) = (0.1, 0.02) pair cannot lie in Region IIa, since for that we would need three conditions to hold:(1) \(F< \overline {F}^{DG}(\tau )\); (2) \(F>\max \left \{ \overline {F}^{GG},\overline {F}^{GD}\right \} \) , and (3) S < SD. Condition (1) entails in this context that \(0.1<\frac {(10+\tau )^{2}}{900}-0.02\), or τ > 0.39, which holds in the admissible range of τ. Condition (2) can be divided into two conditions: (i) \(F>\overline {F}^{GG}\) and (ii)\(\ F>\overline {F}^{GD}\). Condition (i) entails \(0.1>\frac {1}{9}\left [ \frac {20-9\tau }{20}\right ]^{2}-0.02\), or τ > 1.7, which does not lie on the set of admissible fees in this parameter example, i.e., τ < 0.64. Condition (ii) entails \(0.1> \frac {1}{9}\left [ \frac {20-31\tau }{20}\right ]^{2}-0.02\), or τ > 0.49. Finally, condition (3) implies \(0.02<\frac {11\tau (20-9\tau )}{900}\), or τ < 0.08. Therefore, conditions (2-ii) and (3) are incompatible, yielding that Region IIa cannot be sustained in equilibrium.

- ᅟ:

-

Region IIb. The (F,S) = (0.1, 0.02) pair cannot lie in Region IIb as we show next. This region can be sustained if (1) \(\bar {F}^{GD}(\tau )<F< \bar {F}^{DD}(\tau )\); and (2)S > SD. Condition (1) can be divided into two conditions: (i) \(\bar {F}^{GD}(\tau )<F\), and (ii) \(F<\bar {F}^{DD}(\tau ) \). Condition (i) implies that \(\frac {1}{9}\left [ \frac {20-31\tau }{20} \right ]^{2}<0.1\), which yields τ > 0.51; while condition (ii) entails that \(0.1<\frac {(1-\tau )^{2}}{9}\), which simplifies to τ > 0.7, which does not lie in the admissible range of emission fees, τ < 0.64. Condition (2) implies \(0.02>\frac {11\tau (20-9\tau )}{900}\), or τ > 0.08. Since condition (1) does not hold in this example, Region IIb cannot be sustained in equilibrium.

- ᅟ:

-

Region III. Third, the (F,S) = (0.1, 0.02) pair can implement a (D,D)-duopoly in Region III. Specifically, in this setting, for the (D,D)-duopoly to arise, we need that: (1)\(\ F<\overline {F}^{GD}(\tau )\); and (2) S > SD. From our calculations in Region IIb, we know that condition (1) holds when τ < 0.51, while condition (2) is satisfied when τ > 0.08. Hence, Region III can be sustained for fees in τ ∈ [0.08, 0.51], giving rise to a (D,D)-duopoly.

- ᅟ:

-

Region IV. Fourth, the (F,S) = (0.1, 0.02) pair can also lie in Region IV under some conditions. Recall that, in this region, the (G,D)-duopoly arises if (1) \(F<\overline {F}^{GD}\); (2) S < SD; and (3)S > SG. From our above calculations, we know that condition (1) holds as long as τ < 0.51, and condition (2) is satisfied when τ < 0.08. Thus far, we restricted the set of fees sustaining Region IV to τ < 0.08. Finally, condition (3) holds when \(0.02<\frac {11(1-\tau )}{45}\), which is satisfied for all admissible fees in this region, τ < 0.08. As a consequence, Region IV can be supported for all fees satisfying τ < 0.08, and a (G,D)-duopoly emerges.

- ᅟ:

-

Region V. Finally, the (F,S) = (0.1, 0.02) pair cannot lie in Region V. Recall that this region can be sustained if: (1) \(F<\overline {F}^{GG}\); and (2) S ≤ SG. Condition (1) entails that \(0.1<\frac {1}{9}\left [ \frac {20-9\tau }{20}\right ]^{2}-0.02\), or τ < 1.7, which holds given that the set of admissible fees in this parameter example is τ < 0.64. Condition (2) holds when \(0.02\leq \frac {11(1-\tau )}{45}\), which is satisfied for all admissible fees, τ < 0.64. Therefore, Region V can be supported in equilibrium.

From our above results, for emission fees in τ ∈ [0, 0.07) a dirty monopoly or a (G,D)-duopoly emerge (see Region I and IV); for fees in τ ∈ [0.07, 0.08) a green monopoly or a (G,D)-duopoly arises (see Region IV); for fees in τ ∈ [0.08, 0.51] a green monopoly or a (D,D)-duopoly emerge (see Region I and III); and for fees in τ ∈ (0.51, 0.64) only a green monopoly arises (see Region I). We next summarize the market structures that can be implemented via emission fees. When more than one market emerges in equilibrium, we assume that the regulator chooses the Pareto superior equilibrium. For fees in τ ∈ [0, 0.07) a (G,D)-duopoly emerges (see Region IV); and for all other emission fees τ ∈ [0.07, 0.64) a green monopoly arises (see Region I).

In this setting, the welfare under a green monopoly is larger than under a (G,D)-duopoly, i.e., WG(τ) > WGD(τ). In addition, since WG(τ) is decreasing in τ, the regulator sets the lowest fee that implements this market structure τ∗(G) = 0.07, which yields WG(τ∗(G)) = 0.16.

Proof of Lemma 1

Response to Dirty Incumbent

When the incumbent keeps its dirty technology, firm 2’s profits from responding with green technology are positive if

which entails \(F\leq \frac {a^{2}}{9b}-S\equiv F_{NR}^{A}\), where NR denotes no regulation. If, instead, firm 2 responds choosing a dirty technology its profits are positive if

which implies \(F\leq \frac {a^{2}}{9b}\equiv F_{NR}^{B}\). Clearly, \( F_{NR}^{B}\geq F_{NR}^{A}\) for all values of S. Hence, when \(F\leq F_{NR}^{A}\) both profits are positive, when \(F_{NR}^{A}\geq F>F_{NR}^{B}\) only profits from dirty technology are positive, while when \(F>F_{NR}^{B}\) profits from all technologies are negative.

When both profits are positive, i.e., \(F\leq F_{NR}^{A}\), firm firm 2 has incentives to adopt a green technology if \(\pi _{2}^{d,DG}\geq \pi _{2}^{d,DD}\), entailing S < 0, which cannot hold, thus implying that the entrant enters with dirty technology. When \(F_{NR}^{A}\geq F>F_{NR}^{B}\) the profits from green technology are negative while those of dirty technology are positive, implying that firm 2 chooses to enter and keep its dirty technology. Finally, when \(F>F_{NR}^{B}\) firm 2 does not enter.

Response to Green Incumbent

When the incumbent invests in green technology, firm 2’s profits from responding with green technology are positive if

which entails \(F\leq \frac {a^{2}}{9b}-S\equiv F_{NR}^{A}\). If, instead, firm 2 responds choosing a dirty technology its profits are positive if

which also implies \(F\leq \frac {a^{2}}{9b}\equiv F_{NR}^{B}\). Since \( F_{NR}^{B}\geq F_{NR}^{A}\) for all values of S, similar responses emerge than when the incumbent keeps its dirty technology. Hence, the same three regions as above arise.

Incumbent’S Investment

When \(F\leq F_{NR}^{B}\) the entrant responds with dirty technology regardless of the incumbent’s decision (which holds true both when \(F\leq F_{NR}^{A}\) and when \( F_{NR}^{A}\geq F>F_{NR}^{B}\)). Therefore, the incumbent acquires green technology if \(\pi _{1}^{d,GD}\geq \pi _{1}^{d,DD}\), which entails

Hence, the incumbent keeps its dirty technology in this region. Finally, when \(F>F_{NR}^{B}\) firm 2 stays out of the industry regardless of the incumbent’s technology, implying that the incumbent chooses green technology if \(\pi _{1}^{m,G}\geq \pi _{1}^{m,D}\), which entails \(\frac {a^{2}}{4b} -S\geq \frac {a^{2}}{4b}\), or S ≤ 0. Therefore, the incumbent keeps its dirty technology in this region as well.

Proof of Lemma 2

Response to a Dirty Incumbent

If \(\tau <\frac {a}{ 2-\theta }\) both firms produce strictly positive output levels if the incumbent is dirty. Firm 2’s profits when choosing green technology are positive if

which entails \(F\leq \frac {\lbrack a-\tau (2\theta -1)]^{2}}{9b}-S\equiv \bar {F}^{DG}\). In addition, firm 2 profits when choosing a dirty technology are positive if