Abstract

This paper examines the profitability of alliances and mergers as strategic substitutes for entrepreneurial firms to obtain a cost-cutting advantage. In a Cournot oligopoly with linear demand, constant marginal costs and a subset of firms choosing whether to ally or merge, the preference of a device or the other depends on the number of firms in the industry, their efficiency degree before the agreement, the number of collaborating firms, and the amount of cost saving achieved by the agreement. In general, given the number of firms in the market, an alliance is preferred when the cost-cutting achieved is large and a merge when it is low. Consumers, on the other hand, are always better with an alliance than with a merger. Finally, when aggregate welfare is considered, we characterize the scenarios where socially inefficient mergers or alliances would be implemented. We also discuss two assumptions of the model that might lead to the result that alliances are preferred the more competitors in the industry—a paradox that contradicts the basic tenets of industrial organization theory.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The debate about alliances and mergers as strategic substitutes in searching for new opportunities to grow is gaining momentum in recent years because of the growing volume of these operations worldwide and across industries, as well as because of its academic interest. Through alliances, firms collaborate in search of mutual profits, but remain competitors in the product market, while through mergers and acquisitions (M&As) resources of involved firms are put under common ownership. Though often different in instances such as size, riskiness, and time duration, their key difference is ownership. Hence, since firms may choose between the two strategies to improve their performance, the analysis of the pros and cons of selecting one alternative or another becomes relevant.

Neither theoretical models nor empirical results are clear-cut in that sense. Theories include the resource-dependence theory and transaction costs—to analyze which strategy induces more cost-benefit advantages—and industrial organization theory—which suggests that alliances are more likely to occur in concentrated industries because a collusive behavior is easier to be established with the fewer competing firms. For instance, several articles (e.g., Yin and Shanley 2008; Das 2011; Atallah 2015) cite the three-firm Cournot oligopoly case with linear demand and constant marginal costs where an alliance between two firms is always better than a merger as the way to reduce their cost (Sawler 2005). These alliances are unequivocally the best strategy due to the fact that they avoid the problem of transferring market share to the firm that remains outside the agreement.

However, a more comprehensive assessment of the superiority of one type of agreement or another from the standpoint of firms, both those involved in the agreement and those remaining outside, consumers, and the society as a whole needs the consideration of a more general setup than one with three firms and two of them engaged in an agreement to saving costs. In fact, in an n-firm industry, where a subset of m firms may choose to collaborate to get access to a cost-saving opportunity, either through an alliance or through a merger, the analysis becomes richer and more variable results hold depending on the efficiency level of firms and cost cuts available by cooperation. Alliances are preferred to mergers in cost-efficient industries, the larger the cost reduction available by collaborating, and the more competitors in the industry, whereas mergers only become more probable with a higher number of collaborating firms. These results are also discussed in terms of consumer surplus and aggregate welfare to show that consumers always prefer alliances, while the only implemented mergers that are socially desirable overall are those achieved in efficient industries when the number of merged entities is relatively low.

Finally, since a key prediction of our model—that alliances are preferred the more competitors in the industry—contradicts the basic tenets of industrial organization theory, we end up our analysis with an interpretation of this result: for insiders, controlling the number of collaborating firms is the device they use to control for the degree of market competition. Beyond that, we provide a discussion of two assumptions that might explain the paradox. One is assuming that alliances and mergers offer similar cost reduction possibilities, when perhaps alliances can achieve larger cost cuts in concentrated industries. The second is the assumption in our model that entrepreneurs manage their own companies, whereas introducing strategic delegation and managerial incentives might induce alternative results.

The rest of the paper is organized as follows. In the next section, we revise the state of the arts regarding the choice between alliances and mergers. In Section 3, we present the model and obtain the main results. Section 4 is devoted to the analysis in terms of social welfare. Section 5 concludes the paper.

2 State of the Arts

Mergers and alliances are two common strategies for business growth. In the last decades, they have become significant, as they allow firms to enter new markets and achieve economies of scale in a globalized economy through collaborative efforts. Through strategic alliances, two or more firms agree to share costs or jointly manage assets in search of mutual profits, sometimes implying the sharing of assets through a separate entity called joint venture. Alternatively, if the firms are complex, transaction costs are high or control is required for success, all resources may be put under common ownership, either by the merger of two or more firms, or through the acquisition of one or more firms by another.

In 2015, companies worldwide announced over 47,000 transactions with a total value of more than 4.5 trillion USD (IMAA 2017). They rapidly and constantly increased in the last three decades, as in the 1980s, there were less than 10,000 transactions and their value amounted, yet by mid-1990s, less than 1 trillion USD worldwide. Figure 1 shows the evolution of mergers and acquisitions worldwide.

Many of these transactions are cross-border, as both alliances and M&As have become a key instrument for internationalization (Achim 2015). On one hand, cross-border M&As allow to overcome legal barriers for entering foreign markets, get access to resources, and lowering competition. Thus, the acquisition of a national company by foreign firms is the most frequent type of foreign direct investment (Contractor et al. 2014). On the other hand, there is a parallel growth of cross-border strategic alliances, involving a wide range of agreements including joint ventures, research and development, and production and marketing. They are considered a powerful mechanism as they allow to combine competition and cooperation on a global scale (Kang and Sakai 2001).

The analysis of alliances and M&As has also important implications in terms of regulation. For instance, Weston (2001) reports that mergers and restructuring activities have increased the value of firms, while the high rates of merger activity have not increased concentration levels. Hence, structural-based antitrust guidelines might be bad policies in some cases. In addition, the interest in these sorts of transactions is academic as well (see Yaghoubi et al. 2016, for a recent review). In their aspirations for growth and higher profits, firms must choose between the two strategies. Hence, there is a far-reaching theoretical debate on the pros and cons of choosing one alternative or another. For instance, firms tend to use M&As to increase scale or cut costs while they collaborate with others to enter new niche markets (Dyer et al. 2004). Toshimitsu (2018) demonstrates the conditions for constructing a network alliance under differentiated Cournot duopoly with network externalities, so that firms provide perfectly compatible products.

A branch of the literature includes theoretical models that consider alliances and mergers as strategic substitutes: both are profitable as long as they allow firms to reduce costs, but neither theoretical models nor empirical results are clear to determine which option is preferred. Different theories explain why and in which circumstances alliances would be preferred to M&As and vice versa (Yin and Shanley 2008), including the resource dependence theory and transaction costs and industrial organization and institutional theories. Thus, when market imperfections lead to transaction costs, alliances and M&As can be cost-reducing alternatives. The strategy chosen will be that which induces more cost-benefit advantages, which depends on their success as external sources of innovation (Hagedoorn and Duysters 2002) and the resource complementarity and relational capabilities of the collaborating firms (Wang and Zajac 2007). Resource dependence theory, on its part, argues that the more control over a partner is needed, such as suppliers or buyers, firms prefer M&As to alliances (Finkelstein 1997). Introducing managerial delegation leads to mixed results: either mergers are more profitable if the output decision is delegated to an agent through a strategic rent-shifting contracts (Ziss 2001); alliances are preferred if managerial effort is introduced in a model of internal capital markets (Robinson 2008); or virtue is in the middle, with multiproduct oligopolistic firms finding it optimal to use different distribution channels for different products (Moner-Colonques et al. 2004).

Industrial organization theory suggests that alliances are more likely in concentrated industries because a collusive behavior is easier to establish the fewer firms in an industry. Likewise, institutional theory argues that firms operate in a socially organized environment where beliefs and norms might define whether such collaborative/collusive behavior is a common rule, acceptable, or not. Three factors to determine whether alliances or mergers are preferred are the resources and synergies they desire, their competencies at collaborating, and market factors; alliances are preferred with high uncertainty or with a low degree of competition (Dyer et al. 2004). Moreover, it is argued (Yin and Shanley 2008) that alliances are more likely if technological uncertainty is high, whereas mergers are more likely in capital-intensive industries and, more relevant for the purposes of our paper, the more competitors in the industry. (This seems to hold in our model when firms have low production costs before the agreement coupled with a low number of firms involved in the agreement.)

In this debate, the so-called merger paradox (Salant et al. 1983) goes in favor of alliances. In a Cournot framework in which firms produce a homogeneous good and face a linear demand, two main results emerge: (i) mergers are rarely profitable, and (ii) firms excluded from the merger benefit more than those inside the merger. Alliances, on the other hand, would be more profitable as they avoid the problem of transferring market share to the firms outside the agreement. Since this finding goes against empirical evidence, several articles have worked on different assumptions to solve the paradox. These include convex costs (Perry and Porter 1985), product differentiation with Bertrand competition (Deneckere and Davidson 1985), delegation (Ziss 2001), cost asymmetries between firms (Faulí-Oller 2002), sequential mergers with varying product differentiation (Ebina and Shimizu 2009), multidivisional mergers (Creane and Davidson 2004; Brito and Catalão-Lopes 2018), and complementary products (Economides and Salop 1992; Brito and Catalão-Lopes 2010). Recent research solves both components of the paradox assuming Stackelberg competition and convex costs (Heywood and McGinty 2008), Stackelberg competition and cost asymmetries (Gelves 2010), and cost asymmetries and product differentiation (Gelves 2014).

A frequently cited result in the literature (Sawler 2005) provides a theoretical interpretation why alliances are preferred to mergers in highly concentrated industries. Using a three-firm Cournot model with linear demand and constant production costs, it states that an alliance of two firms is always better than a merger to reduce their costs. More detailed, when efficiency gains from joining forces are low, firms prefer an alliance rather than remain independent and this rather than a merger, while if the cost saving is high, an alliance is better than a merger and this is better than to remain independent. In any case, an alliance is the best strategy to saving costs.

In what follows, we provide an extension of this setup by considering an industry model where n firms operate and m of them, n > m ≥2, seeks to collaborate to get access to cost-saving opportunity. The main goal is to reevaluate what is accepted in the literature about how industry-level factors (number of firms in the industry, the efficiency level, the number of collaborating firms, and the cost reductions induced by the agreement) determine the choice of firms seeking to reduce costs, namely to form an alliance or get involved in a merger. In this framework, variable results are obtained depending on the cost structure and the cost cuts available by cooperation.

Recent models that analyze a multi-firm environment include Atallah (2015), Cunha and Vasconcelos (2015), Delbono and Lambertini (2016), and Escrihuela-Villar (2018), but they focus on the profitability of mergers alone. Thus, multi-firm mergers involving leaders and followers in Stackelberg markets may be profitable but are welfare reducing (Atallah 2015), and horizontal mergers when the amount of capital is the strategic variable are privately efficient both for insiders and outsiders, and may be socially efficient if the market size is large enough (Delbono and Lambertini 2016). Other recent multi-firm analyses include Heywood and McGinty (2011), who model cross-border mergers of m domestic and n foreign private firms to show that the presence of a welfare maximizing public firm increases the incentive for mergers; the analysis of mergers in Stackelberg markets either with cost convexity (Brito and Catalão-Lopes 2011) or linear costs (Cunha and Vasconcelos 2015), and the effects of becoming the market leader in these type of mergers (Liu and Wang 2015). Nonetheless, none of them discusses the choice between mergers and alliances, neither the effects of industry concentration on this strategic choice.

3 A Simple Model

Consider a Cournot oligopoly of n identical firms, i =1,2, …,n, each producing a homogeneous good. The inverse demand function is linear as

where \( Q={\sum}_{i=1}^n{q}_i \) is the total production and qi denotes the production of firm i. The marginal production cost of each firm is constant, equal to c, and must be c < 1 due to the demand expression. Without further loss of generality, we assume the first m of these firms, 2 ≤ m < n, have the chance of combining their resources to reduce their marginal cost by an amount of r, 0 < r < c < 1. This reduction can be achieved either by forming an alliance or by merging among them. In the first case, the partners combine their productive structures, but remain independent in the product market when they sell their product. In the second, the involved firms act as a unique entity in both production and selling spheres.

The analysis is conducted in terms of a two-stage game in which the firms’ owners decide their organizational form in the first stage and then compete in the second stage. Thus, at the first (organizational) stage, the owners of the m firms simultaneously and independently decide whether to compete either by forming an alliance among them or by merging; that is, they choose their organizational form, which, in turn, determine their unit cost. At the second (quantity competition) stage of the game, each firm i chooses the output level qi to maximize profits in a non-cooperative way. We look for the subgame Nash perfect equilibrium. In the second stage, each firm chooses the output level that maximizes its profit given the organizational form chosen in the first stage.

If m firms agree, in the first stage, to cut their costs by merging between them (scenario M), the profit function of the merged entity is given by

where q is the output produced by the m merged firms and qj, j = m, m + 1, …, n is the output of each non-merged firm, whereas the profit of each non-merged firm is

The solution of this problem is, respectively,

and the corresponding profits by

Contrariwise, if m firms decide, in the first stage, to form an alliance to develop new production processes together (e.g., joint R&D investments), but sell their product separately (scenario A), then the profit function of each allied firm is given by

and that of each non-allied firm is

In this case, each firm inside the alliance produces

and obtains the profit

To avoid the possibility that mergers are not implemented due to a merger paradox—i.e., if mergers are not profitable, we check the conditions for profits by merger insiders to be higher than those of the outsiders. Consequently, we impose the following assumptions on the marginal production cost of each firm before any agreement, and on cost reduction achieved by merging.

Assumption 1

The marginal production cost of each firm before any agreement is signed, c, is such that \( >{c}_L\equiv \frac{\sqrt{m}-1}{n-m+2\sqrt{m}} \)

Assumption 2

The cost reduction r that each firm that takes part of an alliance or a merge can achieve is such that \( \ge {r}_L\equiv \frac{\left(\sqrt{m}-1\right)\left(1-c\right)}{n+1-m+\sqrt{m}} \).Footnote 1

These two assumptions, together, guarantee that the profit of each insider exceeds the profit of an outsider. We may now compare the profits insiders expect to obtain for alternative market configurations. Proposition 1 states the preference relation of collaborating firms for a merger or an alliance.

Proposition 1

Let \( {r}_1=\frac{\left( cm-1\right){n}^2-\left(2c{m}^2-\left(2+3c\right)m+2+c\right)n+c{m}^3-\left(1+3c\right){m}^2+\left(3+2c\right)m-c-1}{n^3-2\left(m-1\right){n}^2+m\left(m-2\right)n+m-1} \). Firms engaged in cost saving prefer an alliance whenever the efficiency gain achieved exceeds r1. Otherwise, they prefer a merger.

Proof. See the Appendix.

Consequently, the choice between mergers and alliances depends on the number of insiders and outsiders, their efficiency degree, and the cost reduction achieved by the involved firms. Figure 2 provides a graphical interpretation for industries with different efficiency levels.

The intuition behind Proposition 1 is as follows. An alliance may be better than a merger because an alliance enables, as a merger, the partners to reduce their cost, but unlike a merger, it avoids the problem of transferring market share to the firms outside the deal. However, mergers are sometimes preferred: when competition is high, mergers are preferred because they reduce the number of competitors, and thus the merger paradox effect. Our model predicts that overall results depend on the number of insiders and outsiders in the agreement, the cost efficiency of the industry and the cost reduction firms can achieve by collaborating.

Proposition 1 is better interpreted through two additional remarks. Firstly, we may focus on the cost structure of the industry and the efficiency gain achieved. Thus, for low values of marginal cost, c, firms prefer to ally; particularly, the more number of competitors in the industry and the fewer the number of collaborating firms. Then, as c rises, they prefer to merge for low levels of cost reduction, r, and to ally for higher levels. Now, since \( \frac{\mathit{\partial}{r}_1}{\mathit{\partial c}}>0 \),Footnote 2 in less efficient industries mergers are implemented if only small cost reductions are available, while the lower the production cost, we may find industries which are efficient enough as to make r1≤0. In such industries, a horizontal alliance is always the best strategy. Hence, from Proposition 1, the following remark holds.

Remark 1

In an n-firm industry with linear demand and constant marginal costs, the optimal cooperation among m firms is as follows:

-

i.

An alliance if the industry is of high efficiency or if it is of low efficiency and firms can obtain large cost reductions by collaborating.

-

ii.

A merger if the industry is of low efficiency and firms can obtain low cost reductions by collaborating.

The intuition behind this result is as follows. In less efficient industries (higher costs), profits are lower and the degree of competition is higher; consequently, mergers are preferred by insiders, reducing the number of competitors in the industry this way.

A second remark will follow if we analyze Proposition 1 in terms of the number of competitors in the industry or the number of insiders in a collaborative strategy. Here, the interpretation of the proposition is not straightforward, as \( \frac{\mathit{\partial}{r}_1}{\mathit{\partial n}} \) and \( \frac{\mathit{\partial}{r}_1}{\mathit{\partial m}} \) yield complex expressions. For the sake of interpretability, we may perform comparative statics. Consider for instance the simplest case where n =3 and m =2. The condition for the excess profit an alliance compared to a merger to be positive reduces to −10r2+ (28c +8)r −16c2−4c +2. We depict in Fig. 3 the feasible region in the (c, r)-space, to show where firms would prefer an alliance and where they would prefer to merge.

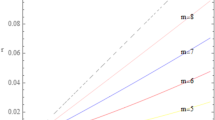

For industries with a higher number of competitors, we need to interpret the threshold value r1 for different combinations of n, m, and c. We know from Proposition 1 that the lower r1, more alliances will be implemented. Since this depends on the three variables mentioned, we may plot the contour lines for r1 in the (n, m)-space, when c takes different values. We obtain the result depicted in Fig. 4.

In Figure 4, we may see that lower r1 levels are observed for higher values of n and lower values of m: the contour lines are lower the higher n (moving rightwards) and the lower m (moving downwards). Thus, from Proposition 1 the following remark holds.

Remark 2

In an n-firm industry with linear demand and constant marginal costs where m firms can cooperate to achieve a cost reduction, alliances are likely to be implemented:

-

i.

The larger the number of competitors in the industry,

-

ii.

The fewer the collaborating firms.

Remark 2 implies that the larger the number of outsiders, alliances are more probable to be implemented. That is, all else being equal, the effect of the merger paradox is stronger if the proportion of participants involved in the merger is smaller. Consequently, mergers will tend to be implemented among a larger number of firms.

In summary, Proposition 1 and the two Remarks highlight the choice between alliances and mergers plays a strategic role for firms: by choosing mergers or alliances, insiders control the number of companies (i.e., one of the factors that determine the degree of competition) in the industry ex post. Since both strategies offer the same efficiency gain, the main advantage of alliances is that they do not transfer output to outsiders (i.e., they avoid the merger paradox effect), while the main advantage of mergers is that they allow to control the number of competitors in the market. In highly efficient industries, or when the efficiency gain is large such that the industry becomes highly efficient ex post, profits are higher and the degree of competition is lower. Here, firms can obtain large cost reductions by collaborating through a collusive agreement in which firms maximize joint profits without reducing the number of production plants (an alliance). Contrariwise, if competition is already high (less efficient industries with higher costs, hence lower profits), using mergers among a larger number of firms allow insiders to reduce the number of competitors in the industry in order to reduce the level of competition.

4 Welfare Implications

For the analysis of social welfare, we measure aggregate welfare as the non-weighted sum of consumer surplus and firms’ profits, that is, the profits achieved by firms involved in the agreement and those of firms that remain independent. We focus first on analyzing firms outside the merger or alliance. What they would prefer their competitors to do? It is easy to prove that firms outside any collaborative agreement prefer their competitors to collaborate through a merger if the industry is characterized by lower costs, which is exactly the opposite of what their competitors do according to Remark 1—see this result in the Appendix. To this, we add the effects on consumer surplus.

Proposition 2

Irrespective of the cost reduction achieved by firms that merge or form an alliance, consumers are better off under alliances than under mergers.

Proof. See the Appendix.

The intuition why a merger is worse for consumers compared to an alliance is as follows. If a subset of firms forms an alliance that improves their efficiency, they will increase production and outsiders will reduce theirs. This redistribution of production among firms unequivocally benefits consumers. However, this effect is lower when firms merge, due to the merger paradox effect. This result indicates that, if the consumer surplus was taken as the appropriate standard for antitrust policy (Pittman 2007), rather than a total welfare standard, the regulator should put emphasis on preventing mergers and favor alliances instead. If, otherwise, total welfare is the standard for antitrust guidelines, and we compute, for the two alternative scenarios of a merger and an alliance, total social welfare, the following proposition holds.

Proposition 3

Let \( {r}_2=\frac{\left(-3+c+m+2 cm-c{m}^2-2n+ cn+ cmn\right)}{1-5m+2{m}^2+8n+10 mn+2{m}^2n+8{n}^2-4m{n}^2+2{n}^3} \). An alliance is socially desirable if the efficiency gain that involved firms can achieve exceeds r2. Otherwise, a merger is socially better.

Proof. See the Appendix.

Figure 5 provides a graphical interpretation of Proposition 3 for industries with different efficiency levels.

Again, providing an intuition to this Proposition requires an analysis of r2 in detail. The cost reduction level above which an alliance is socially better than a merger depends on the number of insiders and outsiders in the agreement, their efficiency degree, and the cost reduction achieved by the involved firms. Since \( \frac{\mathit{\partial}{r}_2}{\mathit{\partial c}}>0 \),Footnote 3 mergers are socially desirable only in less efficient industries when small cost reductions are available, while we may find industries efficient enough as to make r2≤0—making alliances always socially preferred. However, \( \frac{\mathit{\partial}{r}_2}{\mathit{\partial n}} \) and \( \frac{\mathit{\partial}{r}_2}{\mathit{\partial m}} \) yield more complex expressions.

Taking into account Proposition 1, which determines when horizontal alliances are preferred to mergers by the collaborative firms, we know that if r1> r2 holds, we would find that alliances are socially desirable as soon as a smaller cost reduction is achieved, but insiders choose to merger if they have access to a higher cost reduction, up to r1. In such case, some mergers would be implemented that are not socially desirable. Figure 6 provides a comparative analysis of the welfare effects of alliances and mergers by comparing r1 – r2 for different values of n, m, and c. Thus, for any combination of n and m there is a wide light-colored area where r1> r2holds—particularly, in any industries but in efficient ones when the proportion of merged entities is too low compared to the number of competitors.

Hence, the following result holds.

Proposition 4

Implemented mergers are socially desirable in efficient industries when the number of merged entities is relatively low. Implemented alliances are socially desirable in less-efficient industries and the more competitors collaborate.

Proof. From Propositions 1 and 3.

The intuition behind this result is that when the efficiency gain that makes alliances socially better (r2) is lower than the gain required for firms to implement an alliance (r1), some mergers are implemented between r2 and r1 that are not socially desirable. The inverse occurs when r2 is above r1. Despite both threshold increasing in c, Proposition 4 compares them to show that all mergers are socially desirable when they are implemented in efficient industries, and alliances when they are implemented in less efficient industries.

5 Conclusions

In this paper, we have examined the choice between mergers and alliances in an n Cournot oligopoly with linear demand and constant marginal costs. Our model encompasses the analysis of Sawler (2005) as a special case at the time that revises the conclusions there. Particularly, it suggests that the choice is not unambiguous—as stated by Sawler (2005)—but depends on the number of insiders and outsiders, the efficiency level of the industry, and the cost reduction achieved by the agreement. The model suggests that strategic alliance favors consumers as regards to mergers, but less unequivocally, results can be derived as to which strategies will insiders prefer, as well as to which is preferable from a social point of view.

The assumption of constant marginal costs implies a first limitation to our model, since the merger paradox is solved, among others, with the assumption of convex costs (Perry and Porter 1985). This considered, mergers, where partners integrate all their activities, face the classic merger-paradox result whereby market share is transferred to non-merging firms. Hence, alliances, where firms cooperate in production or R&D phases but sell their products independently, are preferred in a number of scenarios. In brief, alliances are preferred to mergers in highly efficient industries, the larger the cost reduction allowed by the agreement, and the larger the number of competitors in the industry. Mergers only become more likely the higher the number of involved firms. The analysis of social welfare allows us to show that some mergers implemented in less efficient industries would be socially undesirable, while the same happens to some alliances implemented in efficient industries, particularly if only few firms collaborate.

A key prediction of our model—that alliances are preferred the more competitors in the industry—contradicts the basic tenets of industrial organization theory, which suggests they should be more likely because it is easier to set a collusive behavior with fewer firms in an industry. Moreover, empirical evidence tends to validate the result that industry concentration favors alliances (see Yin and Shanley 2008, for a review). For instance, Das (2011) finds that the intensity of competition in the liner shipping industry increased the likelihood of the choice of acquisition from 1994 to 2006. Nonetheless, we suggest some rationale for the result we obtain in our model. First, admittedly, alliances are believed to be less easily sustained if the number of firms increases; however, this is not necessarily the case if the agreement does not include all firms in the industry (Lofaro 1999). Second, if the number of firms increases, the merger paradox is also stronger which is very much in line with the standard IO theory. Finally, controlling for the number of collaborating firms is the device insiders have to readjust the degree of market competition.

Beyond that, two other interpretations follow that might offer space for future model developments. On one hand, we are assuming the same cost reduction levels for mergers and alliances in any instance, when perhaps alliances can achieve larger cost cuts in concentrated industries. Indeed, other models analyze when mergers and alliances provide larger costs cuts (e.g., Wang and Zajac 2007) and, as Yin and Shanley (2008) suggest, in concentrated industries, there may be limits to the gains from M&As. On the other hand, we are assuming as well that entrepreneurs manage their own companies—but this is not common in large companies, which are common targets of M&A and alliance activities. Thus, this opens a line of research to introduce strategic delegation following examples in the literature such as Ziss (2001), Moner-Colonques et al. (2004) and Robinson (2008), where the role of managerial incentives might help to validate alternative results.

Notes

For the alliance scenario, we may as well check that profits of the allied firms are higher than those of non-allied firms as long as r ≥ c(1 − m). Since m > 1, this condition is always satisfied for any positive value of r.

\( \frac{\mathit{\partial}{r}_1}{\mathit{\partial c}}>0 \), for any n > m > 1.

In fact, \( \frac{\mathit{\partial}{r}_2}{\mathit{\partial c}}=\frac{\left(2-m+n\right)m+n+1}{1+2\left(1+n\right){m}^2+2n{\left(2+n\right)}^2-m\left(5+2n\left(5+2n\right)\right)} \) is positive for any n > m > 1.

References

Achim SA (2015) Recent trends in the study of mergers and acquisitions. Ekonomie a Management 18(1):123–133

Atallah G (2015) Multi-firm mergers with leaders and followers. Seoul J Econ 28(4):455–485

Brito D, Catalão-Lopes M (2010) Mergers of producers of complements: how autonomous markets change the price effects. Manch Sch 78(1):60–75

Brito D, Catalão-Lopes M (2011) Small fish become big fish: mergers in Stackelberg markets revisited. The BE J Econ Anal Policy 11(1):1–18

Brito, D., Catalão-Lopes, M. (2018). May larger merger synergies be bad news for consumers? Endogenous post-merger internal organization. Scandinavian Journal of Economics Forthcoming https://doi.org/10.1111/sjoe.12303

Contractor FJ, Lahiri S, Elango B, Kundu SK (2014) Institutional, cultural and industry related determinants of ownership choices in emerging market FDI acquisitions. Int Bus Rev 23(5):931–941

Creane A, Davidson C (2004) Multidivisional firms, internal competition, and the merger paradox. Can J Econ 37(4):951–977

Cunha M, Vasconcelos H (2015) Mergers in Stackelberg markets with efficiency gains. Journal of Industry, Competition and Trade 15(2):105–134

Das SS (2011) To partner or to acquire? A longitudinal study of alliances in the shipping industry. Marit Policy Manag 38(2):111–128

Delbono F, Lambertini L (2016) Horizontal mergers with capital adjustment: workers’ cooperatives and the merger paradox. Annals of Public and Cooperative Economics 87(4):529–539

Deneckere R, Davidson C (1985) Incentives to form coalitions with Bertrand competition. RAND J Econ 16(4):473–486

Dyer J, Kale P, Singh H (2004) When to ally and when to acquire? Harv Bus Rev 82(7/8):108–115

Ebina T, Shimizu D (2009) Sequential mergers with differing differentiation levels. Aust Econ Pap 48(3):237–251

Economides N, Salop SC (1992) Competition and integration among complements, and network market structure. J Ind Econ 40(1):105–123

Escrihuela-Villar, M. (2018). On mergers in a Stackelberg market with asymmetric convex costs. J Indust Comp Trade https://doi.org/10.1007/s10842-018-0276-5

Faulí-Oller R (2002) Mergers between asymmetric firms: profitability and welfare. Manch Sch 70(1):77–87

Finkelstein S (1997) Inter-industry merger patterns and resource dependence: a replication and extension of Pfeffer (1972). Strateg Manag J 18(10):787–810

Gelves JA (2010) Horizontal merger with an inefficient leader. Manch Sch 78(5):379–394

Gelves JA (2014) Differentiation and cost asymmetry: solving the merger paradox. Int J Econ Bus 21(3):321–340

Hagedoorn J, Duysters G (2002) External sources of innovative capabilities: the preference for strategic alliances or mergers and acquisitions. J Manag Stud 39(2):167–188

Heywood JS, McGinty M (2008) Leading and merging: convex costs, Stackelberg, and the merger paradox. South Econ J 74(3):879–893

Heywood JS, McGinty M (2011) Cross-border mergers in a mixed oligopoly. Econ Model 28(1–2):382–389

IMAA (2017). M&A statistics database. Institute for mergers, acquisitions and alliances. https://imaa-institute.org/mergers-and-acquisitions-statistics/Accessed 01-jun-2017

Kang NH, Sakai K (2001) The new patterns of industrial globalization: cross-border mergers and acquisitions and strategic alliances. Organization for Economic Cooperation and Development, Paris

Liu C, Wang L (2015) Leading merger in a Stackelberg oligopoly: profitability and consumer welfare. Econ Lett 129(1–3):1–3

Lofaro A (1999) When imperfect collusion is profitable. J Econ 70(3):235–259

Moner-Colonques R, Sempere-Monerris JJ, Urbano A (2004) Strategic delegation with multiproduct firms. J Econ Manag Strateg 13(3):405–427

Perry M, Porter R (1985) Oligopoly and the incentive for horizontal merger. Am Econ Rev 75(1):131–159

Pittman RW (2007) Consumer surplus as the appropriate standard for antitrust enforcement. Competition Policy International 3(2):205–224

Robinson DT (2008) Strategic alliances and the boundaries of the firm. Rev Financ Stud 21(2):649–681

Salant SW, Switzer S, Reynolds RJ (1983) Losses from horizontal merger: the effects of an exogenous change in industry structure on Cournot-Nash equilibrium. Q J Econ 98(2):185–199

Sawler J (2005) Horizontal alliances and the merger paradox. Manag Decis Econ 26(4):243–248

Toshimitsu T (2018) Strategic compatibility choice, network alliance, and welfare. Journal of Industry, Competition and Trade 18(2):245–252

Wang L, Zajac EJ (2007) Alliance or acquisition? A dyadic perspective on interfirm resource combinations. Strateg Manag J 28(13):1291–1317

Weston JF (2001) Merger and acquisition as adjustment processes. J Indust Comp Trade 1(4):395–410

Yaghoubi R, Yaghoubi M, Locke S, Gibb J (2016) Mergers and acquisitions: a review. Part 1. Stud Econ Financ 33(1):147–188

Yin X, Shanley M (2008) Industry determinants of the “merger versus alliance” decision. Acad Manag Rev 33(2):473–491

Ziss S (2001) Horizontal mergers and delegation. Int J Ind Organ 19(3–4):471–492

Acknowledgements

The authors would like to thank Kai Hueschelrath (the Editor-in-chief) and three anonymous reviewers for the fruitful suggestions provided. The authors gratefully acknowledge the financial support received from the Xunta de Galicia (Spain) through Research Project ED431B2016/001 Consolidación e estruturación–2016 GPC GI-2016 Análise económica dos mercados e institucións. This research has also received the funding of the program for the “Consolidation and Structuring of Competitive Research Units—Research Networks (Redes de Investigación)” (Ref. ED341D R2016/014), Proxectos Plan Galego IDT, from the Xunta de Galicia (Spain).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Proposition 1.

First, let q be the output produced by the m merged firms. The profit function of the merged entity is then

while that of each of the other n – m firms that remain outside the merger is

Maximization of (10) and (11) leads to the best-reply functions \( q=\frac{1-c+r-\left(n-m\right){q}_j^M}{2} \) and \( {q}_j^M=\frac{1-c- mq}{n-m+1} \), respectively, and solving them, we get the optimal production levels given in Equation (4).

On the other hand, when m firms form an alliance, the profit function of each allied firm i, i =1,2, …,m, is

and that of each non-allied firm j, j = m, m + 1, …, n, is

Maximizing (12) and (13) results in the best-reply functions \( {q}_i^A=\frac{1-\frac{c-r}{m}-\left(n-m\right){q}_j^A}{m+1} \) and \( {q}_j^A=\frac{1-c-m{q}_i^A}{n-m+1} \), respectively. Next, solving these reaction functions, we get the solutions given in Equation (8).

Now, in equilibrium, the profit of each merged firm amounts to \( {\pi}_i^M=\frac{1}{m}{\left(\frac{1+\left(n-m+1\right)r-c}{n-m+2}\right)}^2 \), whereas that of each firm that forms part of the alliance amounts to \( {\pi}_i^A=\frac{\left(1- mc+ nr\right)\left(m-\left(1-\left(n-m\right)\left(m-1\right)\right)c+\left(n-m+1\right)r\right)}{m{\left(n+1\right)}^2} \). Thus, the difference-in-profits function is given by \( {\pi}_i^A-{\pi}_i^M= \)

The fact that n > m >1 implies that the function given in (14) is a concave function. The values of r for which \( {\pi}_i^A-{\pi}_i^M=0 \) are

and

However, 1+ c(n − m +1) > c, and as a consequence, this root is not binding. Hence, the only root to be considered for comparison is \( {r}_1=\frac{\left( cm-1\right){n}^2+\left(2\left(m-1\right)-c\left(2{m}^2-3m+1\right)\right)n+c{m}^3-\left(1+3c\right){m}^2+2 cm-c-1}{n^3-2\left(m-1\right){n}^2+m\left(m-2\right)n+m-1} \). This completes the proof of the proposition.■.

Proof of Proposition 2.

The consumer surplus when m firms form an alliance is given by \( {CS}^A=\frac{1}{2}{\left(\frac{n-\left(n-m+1\right)c+r}{n+1}\right)}^2 \), and when they merge, by \( {CS}^M=\frac{1}{2}{\left(\frac{n-m+1-\left(n-m+1\right)c+r}{n-m+2}\right)}^2 \). Consequently, the difference between both scenarios is given by

Which is a strictly concave function in r given that m > 1. On the other hand, the two real roots of (A8) as a second-degree equation are \( \frac{-2\left(1-c\right){n}^2+\left(2\left(m-2\right)+\Big(5-3m\right)c\Big)n+c{m}^2-\left(4c-1\right)m+3c-1}{2n-m+3} \) and 1 + (n − m + 1)c, where the former is negative, and the second is greater than the maximum feasible value of r, since 1 + (n − m + 1)c > c. Hence, CSA > CSM, for all admissible r satisfying Assumption 2.

Proof of Proposition 3.

In equilibrium, the profit of each firm j outside the agreement is \( {\pi}_j^A={\left(\frac{1- cm-r}{n+1}\right)}^2 \) if collaborating firms form an alliance and \( {\pi}_j^M={\left(\frac{1-c-r}{n-m+2}\right)}^2 \) if they merge.

Now, taking into account consumers, insider and outsider firms, the social welfare of an alliance as compared to a merger is

Then, it follows that an alliance is socially preferred to a merger, if an equation of the form

holds, where \( X=\left(1-m\right)\left(1+2{m}^2\left(1+n\right)+2n{\left(2+n\right)}^2-m\left(5+2n\left(5+2n\right)\right)\right). \)

The fact that n > m >1 implies that X <0. Consequently, the condition for the difference in social welfare, WA−WM, to be positive, reflected in (18), is a concave function. Hence, the two real roots define the region

where an alliance is socially better than a merger (and vice versa out of this region). However, the condition r < 1 + (n − m + 1)c is always satisfied from the fact that n > m > 1 and thus, r < 1 + 2c, which is the minimum value it can take. Consequently, the only condition required for a horizontal alliance to be socially preferred over a merger is that cost reduction provoked by both agreements is sufficiently high as \( r>\frac{\left(-3+c+m+2 cm-c{m}^2-2n+ cn+ cmn\right)}{1-5m+2{m}^2+8n+10 mn+2{m}^2n+8{n}^2-4m{n}^2+2{n}^3} \). This completes the proof of the Proposition. ■.

Rights and permissions

About this article

Cite this article

Antelo, M., Peón, D. On Cooperation Through Alliances and Mergers. J Ind Compet Trade 19, 263–279 (2019). https://doi.org/10.1007/s10842-018-0289-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-018-0289-0