Abstract

The purpose of this study is to construct a conceptual framework and examine the relationships between perceived financial capability, financial stressors, financial advice-seeking behavior, and short-and long-term financial behaviors. Furthermore, this study examines whether there exists an age difference in these relationships. Using the 2012 National Financial Capability Study, this paper suggests that perceived financial capability is positively associated with advice-seeking behavior, and short- and long-term desired financial behaviors. Further, financial stressors are negatively associated with financial behaviors, but positively associated with financial advice-seeking behavior. Seeking professional advice is positively associated with short- and long-term financial behavior and mediates the relationship between financial stressors and financial behaviors. A positive association is observed between short-term and long-term financial practice. Moreover, socio-demographic characteristics are also examined, including observations about age differences in the proposed relationships. Implications for consumers, financial practitioners, and policymakers are also discussed.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Financial behavior is considered one of the key determinants of overall financial well-being. Financial behavior can be affected by many factors, such as financial knowledge, financial ability and skills, financial self-efficacy, psychological factors, decision context, and overall social/economic environment (CFPB 2015). According to the Consumer Financial Protection Bureau (CFPB), financial behaviors can be related to routine money management (such as using credit cards prudently, managing debt, and being frugal) and can also be related to goal-setting and long-term planning (such as budgeting, building financial plans, saving, and investing). A recent Federal Research (2019) report on U.S. households’ economic well-being showed that, in 2018, although the majority of households reported an above average level of financial security and well-being, financial fragility was still persistent across the country, especially for the minoritized and less educated population. This report also indicated that around 40% of U.S. adults reported not being able to cover the unexpected expenses, or struggled to cover monthly bills, while simultaneously dealing with such expenses. Moreover, around 27% of young adults aged 18–29 received financial support, most likely from parents, other family members, and friends, in order to pay off bills, rent, education, and other general expenses. In terms of credit card use, this report revealed that 8 out of 10 adults had at least one credit card, but only 47% paid credit card bills in full. As high as 27% of the adults reported that they always revolved a credit card balance.

It is imperative that households possess or develop certain attributes and financial habits in order to deal with the dynamic economy and their changing financial goals and needs. As stated by Chien (2018), “not only do households differ in their financial goals and situations, but the goals of a particular household can change over time.” Research has showed that individuals who are financially knowledgeable are more likely to behave well financially (Hilgert et al. 2003; Hogarth and Hilgert 2002). Moreover, perceived control and self-regulation, along with financial knowledge, are significant when predicting individuals’ saving, budgeting, and spending behaviors. These attributes can also influence long-term financial decision making, such as retirement plan participation, which is considered an important means of financially preparing for the future (Howlett et al. 2008). Past findings, therefore, indicate that both perceived or self-assessed financial knowledge and skills, and actual financial knowledge, are associated with responsible financial behavior (e.g., Hilgert et al. 2003; Howlett et al. 2008). However, the existing research is not enough; there are continued and growing appeals for more research to understand individual and household financial behavior with the goal to promote healthy financial habits, foster sustained financial behavior, and increase long-term financial well-being.

Financial stress has been a well-known concern that many U.S. adults struggle with chronically. According to a CNBC report (2018), among 1000 U.S. adults polled by a banking company, 85% reported feeling financially stressed. Financial stressors are negative life events that may cause financial difficulties and stress (Grable and Joo 1999; Kim et al. 2003; McCubbin and Patterson 1983; Tokunaga 1993) and have been found to be adversely associated with emotions, well-being, behavior, and even health (Schneiderman et al. 2005). Negative and stressful life events may also trigger long-term depression (Hammen 2005; Faravelli and Pallanti 1989; Finlay-Jones and Brown 1981). Therefore, financial stressors may prompt or aggravate short- or long-term financial stress and anxiety. Stress-coping theories and research have suggested that individuals may adopt different coping behaviors under stressful or negative situations, and that their socio-economic status (such as age, income, and gender) can influence the coping styles they adopt (Lazarus and Folkman 1984; Caplan and Schooler 2007; Wills 1987). Literature has suggested that financial counselors and planners are capable of improving clients’ financial situation and well-being, reducing wealth volatility and debt, therefore alleviating financial stress (Grable and Chatterjee 2014; Staten et al. 2002; Kim et al. 2003).

The extant literature related to financial behavior has mainly focused on the effects of financial literacy and education (e.g., Allgood and Walstad 2016; Fernandes et al. 2014; Hilgert et al. 2003; Lusardi et al. 2010; Mandell and Klein 2009). Although some psychological factors, including risk preference and attitude (e.g., Bannier and Neubert 2016; Corter and Chen 2006; Finke and Huston 2003), personality (Norvilitis et al. 2006; Gillen and Kim 2014), and self-efficacy and self-control (Danes and Haberman 2007; Lim et al. 2014; Perry and Morris 2005) have previously been examined, past literature has focused primarily on certain sub-populations, such as college students or adolescents. However, there is a gap in the literature on the effects of impairing factors, such as financial stressor events and the perception of debt.

Within the last decade of economic recovery from the Great Recession, financial advisors and professionals have been considerably more involved in households’ financial decision making process. There are growing appeals for empirical evidence on financial professionals’ role in the relationships between psychological and non-psychological factors and financial behaviors. This study aims to expand the understanding of financial advice-seeking and financial management behaviors. To achieve this purpose, this study adapted stress-coping theories and established a conceptual framework to understand whether perceived financial capability, financial stressors, objective financial knowledge, and perceived over-indebtedness are associated with seeking financial advice from professionals as coping resources, and whether these factors are associated with peoples’ short- and long-term financial behaviors.

Perceived Financial Capability

Financial capability has become an increasingly important subject among scholars and policy makers. It refers to one’s ability to manage and control their finances (Taylor 2011). The concept can be reflected in a broader context, such as appropriately making financial decisions, or can be related to narrower financial practices, such as responsibly using credit cards. According to Taylor, financial capability needs to take into account a wide range of financial skills, knowledge, and behavior. Atkinson et al. (2006) identified four domains of financial capability: (1) managing money, (2) planning ahead, (3) choosing products, (4) getting help, information, and advice. Xiao and O’Neill (2016) argued that both knowledge and behaviors are important components of financial capability. Their study measured financial capability using objective financial knowledge, subjective financial knowledge, desirable financial behaviors, and perceived financial management ability.

Perceived financial capability therefore can be defined as an individual’s self-assessment and self-perception of their own abilities to manage finances. It serves as an indicator of actual capability of personal finance, because “financial capability hinges on self-assessment of the person” (Rothwell and Khan 2014, p. 5). Following Xiao and O’Neill’s (2016) categorization of financial capability, perceived financial capability could similarly consist of several components. First, perceived financial knowledge, sometimes referred to as financial confidence or subjective financial knowledge (e.g., Asaad 2015; Hadar et al. 2013), is a measure of one’s self-assessed level of financial knowledge. It is also a part of financial literacy that can be defined as how well an individual can understand, comprehend, and apply financial information to make the best financial decisions in the short- and long-term (Huston 2010; Mandell 2008).

The literature suggests that perceived financial knowledge and actual knowledge can both affect financial behaviors, including borrowing behavior, investment behavior, and financial advice seeking behavior (Allgood and Walstad 2016; Perry and Morris 2005). Hadar et al. (2013) pointed out that investment decisions relied more on subjective knowledge than on objective knowledge. Perceived financial knowledge has been found to significantly correlate with seeking financial advice, especially for those who had lower objective financial knowledge (Allgood and Walstad 2016). Perceived financial capability may jointly work together with other factors to have an impact on financial behaviors. Self-beliefs and perceptions of financial management skills can vary by gender and race/ethnicity. For example, a gender effect has been found in the relationship between financial self-efficacy and financial behavior (Dietz et al. 2003; Lim et al. 2014; Montford and Goldsmith 2016). Race/ethnicity may moderate the relationships between self-efficacy, locus of control, financial knowledge, and healthy financial management behaviors (Perry and Morris 2005).

Although some studies have found that financial knowledge and financial capability can increase with age through accumulation of knowledge and experience (Alhenawi and Elkhal 2013; Henager and Cude 2016; Xiao et al. 2015), other researchers have found that the older population may experience a decline in their financial literacy associated with declines in cognitive abilities and intelligence, while their self-assessed confidence in managing money shows little relationship with age (Finke et al. 2016). A recent study showed a low correlation between actual financial knowledge and positive financial planning practice and skills (Alhenawi and Elkhal 2013), which also encourages more research to focus on the psychological concept of perceived financial capability and the potential association with financial behavior.

Perceived financial management skills are also an important component of perceived financial capability. This concept is related to financial self-efficacy, and both of them capture self-belief in one’s ability to reach financial goals (Farrell et al. 2016; Lim et al. 2014). Rothwell and Khan (2014) used an index that included self-assessment of financial knowledge and capability to keep track of money. They showed that perceived financial capability varied by demographics, with older people and men possessing higher perceived capability levels than younger individuals and women. Using perceived financial management skills as a proxy for financial self-efficacy, Lim et al. (2014) found a significant relationship between perceived financial management skills and financial help-seeking behavior among college students. Moreover, financial self-efficacy has been found to be associated with retirement plan choices (Dietz et al. 2003), financial risk-taking behavior (Montford and Goldsmith 2016), and wealth accumulation (Chatterjee et al. 2011).

Another component of perceived financial capability relates to numeracy, or math skills, which is essential for making responsible financial decisions (Bernheim 1998; Lusardi 2008; Lusardi and Mitchell 2007). It is defined as “the ability to process basic probability and numerical concepts” (Peters et al. 2006, p. 407). A general numerate level can be helpful for individuals to understand information with numbers, use better judgment, and to make better decisions (Peters et al. 2006). Financial numeracy can be considered a dimension of general literacy skills that may affect financial capability and behaviors, including savings, borrowing, and tax planning (Almenberg and Widmark 2011; Chen and Feeley 2014; Huhmann and McQuitty 2009). Lusardi (2012) suggested that numeracy (such as the understanding of interest compounding) is critical for individuals’ daily financial lives, because taking on mortgages, using credit cards, and so on, require a basic numeric ability; women, elderly, and those with lower education levels tend to report lower financial numeracy levels. However, there are few studies that investigate an individuals’ confidence in their numeracy abilities.

In this study, perceived financial capability and actual financial capability are both multi-dimensional concepts and share similarities to some extent. At the same time, perceived financial capability is different from the commonly studied concept of financial capability, because it captures individuals’ self-perceptions and confidence of financial knowledge, financial numeracy, and general money management skills, rather than measuring actual knowledge and skills. There is a rich literature focused on factors that can improve financial capability (e.g., Loke et al. 2015; Sherraden et al. 2011). Many previous studies have also examined the significance of financial capability on the overall psychological well-being of individuals (Taylor et al. 2011). However, the extant literature provides limited information on the multi-faceted concept of perceived financial capability and whether one’s self-assessed financial capability, together with objective financial knowledge and stressful financial events in life, can affect the demand for financial advice and short- and long-term financial behavior.

Financial Stressors

Although self-perception of efficacy can provide motivations for responsible financial behaviors, unpredictable things happen in life. Little is known of the effects of perceived financial capability and objective knowledge the co-occurrence of stressful life events. Stressors are recently occurring life events that can cause stress (Grable and Joo 1999; Tokunaga 1993). Financial stressors, specifically, refer to non-normative financial events, such as home foreclosure, and wage garnishment, that may affect the whole household’s social status (Kim et al. 2003; McCubbin and Patterson 1983). Moreover, job loss and unemployment are also two main sources of economics stressors faced by workers (Probst 2005). Specifically, Probst argued that employment instability, such as longer term and high frequency of being unemployed, underemployment, downward mobility, and forced early retirement are considered objective stressors that may lead to workers’ stress; whereas there could also be subjective stressors, including concerns about being laid off and reduction in wages for example. Among young unemployed individuals, although job loss could potentially reduce well-being, a more detrimental stressor to psychological well-being of these young individuals is failure to find a job (Winefield and Tiggemann 1989). Being unemployed for a long term could potentially cause chronic stress and negatively affect health (Sumner and Gallagher 2017). Waters (2000) suggested that individuals may use both problem- and emotion-focused coping strategies to deal with stress caused by unemployment. These coping efforts, along with cognitive appraisal can be related to psychological health.

Financial stressors can be categorized into three major types: (1) personal stressors, such as personal physical illness, investment losses, and wage garnishments; (2) family stressors, such as divorce, death, and job loss; and (3) direct financial stressors, such as foreclosure, bankruptcy, medical bills, and over-indebtedness (Joo and Grable 2004). These three types of stressors are not mutually exclusive because multiple stressors may happen simultaneously, and one may trigger or aggravate another stressful event. Recent stressful life events examined in prior studies, including death of family member(s) (a child, a spouse, a parent, or a close friend/relative), divorce, moving to a new location, loss of job, a severe financial problem, and serious health issues, are positively associated with depression.

Kim et al. (2003) found a significant relationship between seeking credit counseling help and financial stressor events that was negatively associated with financial well-being. Tokunaga (1993) measured the effects of distressing events on credit behavior and found a positive relationship between stressors and anxiety about money. Joo and Grable (2004) found stressor events had a negative relationship with financial behaviors, such as saving for retirement, budgeting, and paying credit cards in full. The literature has suggested an age difference in depression caused by stressful life events where younger adults showed significantly more depression symptoms than older generations (Maciejewski et al. 2000). In this study, direct financial stressors are examined as determinants of financial advice-seeking and short- and long-term financial behaviors.

Financial Advice-Seeking

Help-seeking behavior, in general, refers to active behaviors in seeking help from other sources to receive information, advice, treatment, or general support (Rickwood et al. 2005). Financial help- and advice-seeking behavior, therefore, can be defined as individuals’ and households’ information- and advice-seeking activities to solve problems, meet needs, and reach goals related to financial subjects. Grable and Joo (1999) suggested that financial advice-seeking behaviors, and psychological, sociological, and physiological help-seeking, are driven by similar factors. The areas of financial advice-seeking include retirement and education saving, investment, taxes, mortgages, debt and credit management, and bankruptcy (Sherraden 2013). Financial advice-seeking can be viewed as an information-search behavior. Stigler (1961) provided an information-search framework that views the search activities from a cost–benefit perspective. Later, Beales et al. (1981) provided an information-search source framework comprised of internal sources, such as knowledge, memories, skills, and emotions, and external resources, such as actively searching and learning new information through media and seeking advice from professionals and experts. The information source theories and frameworks have been adopted in studies of personal finance including investor information search patterns (Loibl and Hira 2009), financial market information intermediaries preferences (Lee and Cho 2005), and consumer mortgage shopping behavior (Lee and Hogarth 2000).

Financial advice can also serve as a stress-coping resource when individuals undergo difficult financial situations (Wills 1987). The concept of help-seeking has been widely studied as a coping mechanism in many disciplines, such as health behavior (e.g., Stewart et al. 2012), gerontology studies (e.g., Barusch 1988), community psychology (e.g., Hoyt et al. 1997; Liang et al. 2005), and education and youth behavior (e.g., Camara et al. 2017; Sheu and Sedlacek 2004). According to Wills (1987), the main purpose of seeking help is to cope with negative life events and stress caused by such events. Many sources, informal and formal, can serve as help providers, such as spouses, other family members and relatives, larger community networks (informal), and professional helpers and agencies (formal) which are considered providers of help and social support. Among these resources, financial professionals, who provide expertise, advice, and help related to personal financial management, can provide social support, under the stress-coping theoretical perspective, which can influence health and well-being (Lakey and Cohen 2000). The personal finance literature suggests that financial professionals can provide positive value to clients’ credit using, wealth accumulation, and debt management behaviors, and increasing their financial confidence, knowledge, and skills (Brenner 1998; Hilgert et al. 2003; Hira and Mugenda 1999; Staten et al. 2002). Using a stress- and help-seeking framework, Lim et al. (2014) revealed a positive relationship between perceived financial knowledge and financial help-seeking among college students. Specifically, those who reported having high perceived financial knowledge were more likely to seek financial advice and services provided by financial counselors or advisors, financial aid counselors, and credit counselors to college students.

The age effect has been observed in the literature but with mixed evidence regarding financial advice-seeking behavior. Some studies have identified a negative relationship between age and advice-seeking from financial professionals (Grable and Joo 1999; McClune 2010; Collins 2012); whereas others argued that older individuals were more likely to hire financial professionals (e.g., Bluethgen et al. 2008; Burke and Hung 2015). Kim et al. (2019) found that older adults’ financial advice-seeking behavior largely depends on their cognitive ability and financial literacy. In particular, compared to family members as an advice resource, those who are more financially literate and more cognitively capable are more likely to seek advice from financial professionals. In previous work, Kim et al. (2016) examined the rationale for seeking financial advice from professionals using a life-cycle perspective. They posited that there might exist a difference in the motivation of seeking professional advice between younger and older adults. Specifically, older people, who on average hold more wealth than younger individuals, benefit from seeking professional advice as a way to reduce the costs and risks of managing finances on their own. Cognitive decline may be another reason that older individuals have higher demands for professional financial management than younger people. There has been a limited understanding of whether seeking professional advice has a significant influence on the relationships between perceived financial capability and financial behavior, and whether it can mediate and alleviate the impact of financials stressors. More research is needed to understand the financial advice-seeking behavior as a coping strategy on short- and long-term financial behaviors and to further understand the age differences associated with advice-seeking and financial behaviors.

Short- and Long-Term Financial Behavior

Xiao (2008) defined financial behavior as “any human behavior that is relevant to money management,” such as “cash, credit, and saving behaviors” (p. 70). He noted that financial behavior can be a one-time and short-term action (e.g., saving for a small gift) or it can involve long-term commitment (e.g., saving for retirement). Wagner and Walstad (2019) defined short-term financial behavior as activities that “involve a money or credit management task that gives regular and timely feedback to remind people about what they need to do to change their financial behavior to avoid financial penalties and consequences” (p. 234–235). On the other hand, their definition of long-term financial behaviors is behavior involving “more planning for the future and are less influenced by regular feedback or learning by doing” (p. 235). Howlett et al. (2008) argued that self-regulation may guide individuals to be more resistant to short-term pleasure overspending so that long-term financial security during retirement can be reached. Short-term and long-term financial behaviors have been linked to objective financial knowledge, perceived financial knowledge, and perceived numeracy for young adults, using the 2009 National Financial Capability Study (NFCS) dataset (de Bassa Scheresberg 2013). In particular, those who were financially literate and more confident in their own knowledge and math levels were more like to behave positively in the short- and long-term in regard to emergency saving, responsible borrowing, and saving for retirement. However, this study did not differentiate between short- and long-term financial behaviors.

Henager and Cude (2016) observed an age effect in short- and long-term financial behaviors. Specifically, they used the 2012 NFCS and found that younger individuals’ perceived financial knowledge had a stronger effect on both short- and long-term behaviors than their objective financial knowledge. In contrast, being financially knowledgeable can be more beneficial to older adults for their long-term financial behavior. Subsequently, Wagner and Walstad (2019) also used NFCS to study short- and long-term financial behaviors, and their associations with financial education and socio-demographics. They posit that long-term financial decisions are more complicated than short-term ones, and because of the longer planning horizon, the consequences of the long-term behaviors are not immediate. Rather, the consequences, usually a penalty, are immediately following short-term financial behaviors, enabling the individual to make timely behavioral adjustments. However, these studies did not further examine the relationship between short- and long-term financial behaviors and whether how individuals perform in the short term influences long-term financial planning behavior.

Theoretical Background and Conceptual Framework

Stress-coping theories provide solid theoretical support for this study. Folkman and Lazarus (1980) defined coping behavior as “the cognition and behavioral efforts made to master, tolerate, or reduce external and internal demands and conflicts among them” (p. 223). Subsequently, Lazarus and Folkman (1984) further defined coping as “constantly changing cognitive and behavioral efforts to manage specific external and/or internal demands that are appraised as taxing or exceeding the resources of the person” (p. 141). Three main stages of coping are identified by Lazarus and Folkman (1984) as: (1) anticipation, (2) impact or confrontation, and (3) post-impact periods. To begin, during the anticipation period, the stressor events have not yet occurred, and the individual can use their cognitive appraisal process to evaluate the timing, extent, and potential influences of such events and predict if the events can be prevented. Some coping strategies that might be used during this stage include avoidant thinking about the threat and/or denying the possibility of the event. Self-control may be effective during this stage. Secondly, during the impact period when the harmful and stressful events are being experienced, the individual may assess the significance of the consequences and reassess if the events last for a longer period. The last stage is post-impact, when the events have ended. The individual may consider if any new demands and challenges exist after the stressful events.

Problem-focused and emotional-focused coping are forms of coping strategy that people adopt under different conditions. Problem-focused coping is usually adopted when the individual thinks there is a possibility that the stressful event or harmful condition can be amended, whereas emotional-focused coping is used when little can be done to modify the stressful condition (Lazarus and Folkman 1984). The current study focused only on problem-focused coping strategies, which, according to Lazarus and Folkman (1984), differ across situations and may include strategies to change current pressure, barriers, and obstacles.

Cohen and Wills (1985) developed a stress-coping model and posited that coping behaviors and coping resources, if properly adopted, can reduce psychological distress under adverse stressor events and situations by providing social support. Social support can contribute to improving individuals’ self-esteem and self-regulation. Alternatively, material support, such as money and services purchased, are considered significant coping resources, along with one’s own health and energy, positive beliefs, problem-solving skills, social skills, and social support (Lazarus and Folkman 1984). Therefore, financial service and advice providers can be considered as both social and material support resources under the social support and stress-coping perspectives by providing professional money management, and sometimes emotional and behavioral support (e.g., financial counseling and financial therapy) to their clients.

Coping behaviors, both problem-focused and emotional-focused, may change over the course of an individual’s life. Therefore, one of the purposes of this study is to examine if age could play a role in the relationships between financial stressors, financial advice-seeking behavior, and financial management behaviors. As summarized by Lazarus and Folkman (1984), the extant literature provides mixed evidence of the coping strategies used over the life course. For example, some research has found that coping strategies get more passive and impulsive as people age (e.g., Gutmann 1974; Pfeiffer 1977), whereas in other studies, older individuals were found more likely to adopt more realistic, effective, and mature coping behaviors than younger people (e.g., Vaillant 1977). Later, using stress-coping theories, Folkman et al. (1987) explained why age differences exist in coping behavior. A life-stage related developmental perspective supports the changes in the way people cope as they age. On the contrary, a contextual perspective suggests that the age differences in coping behavior are brought about by different events, situations, and people that individuals need to deal/cope with as they age.

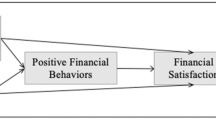

Along this line, Lazarus and Folkman (1984) developed a theoretical schematization of stress, coping, and adaption, which views coping behavior as a process that may involve change over time. In their schematization, coping behaviors occur when stressful events happen. The individual may adopt a problem- and/or emotional-focused coping strategy and start to seek external sources for support. Stressors may have short- and long-term effects on the individual. Short-term effects can be related to physiological changes and cause positive or negative feelings; whereas long-term effects may have prolonged influence, such as health-related impact, overall well-being, and social functioning. Lazarus and Folkman’s (1984) stress-coping theory and schematization were adapted for development of the conceptual framework for this study (see Fig. 1).

Specifically, being involved in foreclosure, filing for bankruptcy, experiencing a large recent income drop, and having overdue medical bills were considered stressful financial events, or financial stressors, in the current study. These are proposed to be associated with financial advice-seeking and short- and long-term financial behavior. Following Lazarus and Folkman’s (1984) stress-coping framework, financial advice-seeking was proposed to be a problem-focused coping behavior by individuals. The short- and long-term financial behaviors in this study adopted Wagner and Walstad’s (2019) categorization and corresponded to the short- and long-term impacts prompted by stressors and stress in Lazarus and Folkman’s schematization. Additionally, perceived financial capability (measured by perceived numeracy, perceived financial knowledgeability, and perceived financial management skills), objective financial knowledge, perceived over-indebtedness, and socio-demographic characteristics are also included in the conceptual model. The following hypotheses were developed to test the structural relationships depicted in the conceptual framework of this study.

Hypotheses

Hypothesis 1:

Perceived financial capability and objective financial knowledge are positively associated with financial advice-seeking and short- and long-term positive financial behaviors.

Hypothesis 1a:

Financial advice-seeking mediates the relationships between perceived financial capability, objective financial knowledge, and short- and long-term positive financial behaviors.

Hypothesis 1b:

Short-term positive financial behaviors mediate the relationship between perceived financial capability, objective financial knowledge, and long-term positive financial behavior.

Hypothesis 2:

Financial stressors are positively associated with financial advice-seeking and negatively associated with short- and long-term positive financial behaviors.

Hypothesis 2a:

Financial advice-seeking mediates the relationships between financial stressors and short- and long-term positive financial behaviors.

Hypothesis 2b:

Short-term positive financial behaviors mediate the relationship between financial stressors and long-term positive financial behavior.

Hypothesis 3:

Financial advice-seeking is positively associated with short- and long-term positive financial behaviors.

Hypothesis 3a:

Short-term positive financial behavior mediates the relationship between financial help-seeking behavior and long-term positive financial behavior.

Hypothesis 4:

Short-term positive financial behavior is positively associated with long-term positive financial behavior.

Hypothesis 5:

The proposed structural relationships differ by younger and older age groups.

Methodology

Data

This study uses the 2012 state-by-state NFCS, a national survey of U.S. adults’ financial attitudes, capability, and behaviors. This is a cross-sectional dataset funded by the Financial Industry Regulatory Authority (FINRA) Investor Education Foundation and conducted by ARC Research since 2009. The objectives of NFCS is to capture nation-wide financial capability and underlying factors. Survey participants were randomly selected using non-probability quota sampling methods and the survey was self-administered by participants online.Footnote 1 One thing to note here is that even though new waves (2015 and 2018) of NFCS are available, the key set of variables of financial advice-seeking has discontinued after the wave of 2012. Therefore, this study used the most recent wave that provides the financial advice-seeking variables.

The dataset consists of 25,509 U.S. adults aged 18 and older. To estimate the hypotheses in this study, respondents who selected “don’t know” or “prefer not to say” to the key variables and those who selected “prefer not to say” to the set of objective financial knowledge questions were excluded from the final sample. The final sample used in the statistical analysis in this study had 15,593 observations after data cleaning.

Variables

Perceived Financial Capability

Perceived financial capability was built as a latent construct that measured by three 1–7 scaled observed variables: perceived numeracy, perceived financial knowledgeability, and perceived financial management skills. The construction of this latent variables was based on the perceived elements categorized based on the literature, including perceived financial knowledge (Xiao and O’Neill 2016), perceived financial management skills (or financial self-efficacy) (e.g., Farrell et al. 2016; Lim et al. 2014), and perceived numeracy (e.g., Lusardi 2008; Lusardi and Mitchell 2007). First, perceived numeracy asked respondents to assess their math ability by showing a statement “I am pretty good at math,” where 1 = strongly disagree and 7 = strongly agree. Second, perceived financial knowledgeability was collected using a self-evaluated financial knowledge item, where 1 = very low and 7 = very high. The third item was self-assessed financial management capability. A statement of “I am good at dealing with day-to-day financial matters, such as checking accounts, credit and debit card, and tracking expenses” was given to the respondents, where 1 = strongly disagree and 7 = strongly agree.

Financial Stressors

Financial stressor events included (a) filing for bankruptcy or being involved in foreclosure in the past 2 years (coded as “1” and “0” otherwise); (b) experiencing a large unexpected income drop in the past 12 months (coded as “1” and “0” otherwise); and (c) having past due medical bills (coded as “1” and “0” otherwise). These three financial stressors were summated to form a 0–3 scale variable used in the SEM analysis, where a “0” means that none of the stressor events were experienced by the respondent; whereas a “3” indicates that the respondent had experienced all three types of stressor events.

Perceived Over-Indebtedness

Respondents were asked how they agreed with the statement “I have too much debt right now.” with 1 = strongly disagree and 7 = trongly agree. This variable was distinct from financial stressors because the financial stressors are actual events happened in the individuals’ lives that may possible bring stress and require different types of coping strategies to deal with; whereas, the perception of current debt situation is a self-assess gauge of overall indebtedness.

Objective Financial Knowledge

Objective financial knowledge was measured using five questions to gauge basic understanding of personal finance topics, including inflation, compounding, bonds, stocks, and mutual funds. Correctly answered questions were coded as “1” and “0” otherwise. An indexed objective financial score, from 0 to 5, was created by summing up the correct answers to the five questions, and a “0” means the respondent had zero correctly answered question among the 5; whereas a “5” means all 5 questions were answered correctly. A detailed list of the objective financial knowledge questions with correct answers marked is shown in the Appendix A.

Financial Advice-Seeking Behavior

Financial advice-seeking behavior was considered a coping strategy in the conceptual framework of this study. This is a latent variable constructed by five types of financial advice-seeking areas: debt counseling, savings/investments, mortgage/loan services, insurance, and tax planning. These were considered, according to Lazarus and Folkman (1984), as coping sources that individuals may rely on when they develop problem-focused coping behaviors. Five binary variables were created for each of the five types of advice providers to measure the latent variable of financial advice-seeking. The construction of the latent variable was based on the definition and framework of financial help-seeking developed by (Grable and Joo 2003), which indicates that individual’s financial problem-solving behavior can be generally related to personal finance across different areas, including retirement and education saving, investment, taxes, mortgages, debt counseling, etc. (Sherraden 2013).

Short- and Long-Term Positive Financial Behaviors

The measures of short- and long-term financial behavior were created adapting Wagner and Walstad’s (2019) categorization of financial behavior. Short-term behavior in the current study included: (1) making ends meet (= 1 if no difficulty covering monthly expenses and bills, and = 0 otherwise), (2) spending less than income (= 1 if spending was less than income, and = 0 if spending was equal to or higher than income), (3) managing checking accounts (= 1 if had a checking account and = 0 otherwise), and (4) paying off credit cards in full (= 1 if always paid credit cards in full, and = 0 otherwise). Each of these four behavioral variables was coded as binary variables, then summed up to create a 0–4 short-term behavior variable. The higher the score, the more positive short-term financial behaviors the individual had performed. Similarly, long-term financial behavior included: (1) having emergency saving, (2) managing savings account, (3) calculating retirement needs, and (4) managing investments outside of retirement accounts, which was also summed up on a 0–4 scaled variable, and the higher the summed score shows that the individual had conducted more positive long-term financial behaviors. Since NFCS is a cross-sectional dataset, the questions asking about short- and long-term financial behaviors were all collected at one time point during the time of the survey.

Socio-Demographic Characteristics

Gender, race/ethnicity, income, and education were examined in the structural model. Gender was coded as 1 = female and 0 = male, and race/ethnicity was coded as 1 = non-Hispanic White and 0 = other. Income levels were coded as 1 ≤ $35,000, 2 ≥ $35,000 and < $75,000, and 3 ≥ $75,000. Education levels were coded as 1 if respondents reported having high school or lower degrees, 2 if respondents had some college experience but had not received any college degree, and 3 if respondents had college or post-graduate education.

Two Age Groups in the Multi-Group SEM Analysis

The survey categorized respondents’ ages into six groups: 18–24, 25–34, 45–44, 45–54, 55–64, and 65+. In order to conduct the multi-age group comparison analysis for the younger and older groups, two mutually exclusive groups were created with the younger group aged 18–44 and the older group aged 45 and older. The literature has suggested an age effect in coping behavior across life stages (Lazarus and Folkman 1984); however, the evidence about the age effect is mixed (see Gutmann 1974; Pfeiffer 1977; Vaillant 1977). Financial advice-seeking as a coping behavior has shown age-related patterns in the literature. For example, older individuals are more likely to seek professional advice, which can largely be influenced by cognitive ability and financial literacy, compared to younger individuals (e.g., Grable and Joo 1999; Kim et al. 2019). This pattern can possibly be explained from a motivational perspective that is, older people can benefit more from seeking professional advice due to more complex financial situations or possible declines in cognitive ability (Kim et al. 2019). Moreover, age differences are also found in the relationships between objective financial knowledge and perceived financial capability and short- and long-term financial behaviors (Henager and Cude 2016). Therefore, this study conducted an additional multi-group analysis to examine the age effect on the financial advice seeking mechanism.

The division of the younger (18–44) and older (45+) age groups in this study is supported by literature in the human development and developmental psychology disciplines (Armstrong 2008; Hall 1922; Wahl and Kruse 2005). According to Hall (1922), ages ranging from 24 to 45 refer to the prime life stage or middle life and ages from 45 until death include the senescence and senectitude stages. During the prime life stage, the primary life goals can be, for example, pursuing education, stabilizing a career, forming a family, and parenting could be the primary life goals, whereas building up wealth, retirement, and accomplishing life goals as the main concerns. The 18–44 age group in this current study overlapped with the mix of the later first age and second age categorized by Laslett (1991), which periods were characterized by education, productivity activities, such as income-earning and marriage. Whereas the older age group (45+) in the current study was close to the third and fourth age groups (or the period of old age) defined by Laslett (1991), including retirement and achieving personal needs before death.

Analyses

The proposed relationships were examined using SEM techniques using the maximum likelihood (ML) estimation method for the direct, indirect, and total effects of the antecedents and mediators of the short- and long-term financial behaviors. SEM is a widely used statistical method in psychology, behavioral finance, and sociology, among other areas, to test proposed relationships among variables (Hox and Bechger 1998; MacCallum and Austin 2000). SEM is also a more appropriate technique for understanding the complicated social, behavioral, and psychological phenomena (Schumacker and Lomax 2010), which are being examined in this study. An SEM model includes two types of models: the measurement model that shows how well the observed items measure the latent constructs, and the structural model estimates the relationships between exogenous and endogenous constructs (Golob 2003). The advantages of using SEM include that (a) it treats endogenous and exogenous variables as random variables with errors of measurement and can specify error-term covariances, (b) it allows latent constructs to be measured by multiple indicators, (c) it tests the overall model instead of individual path coefficients, (d) it can model multivariate mediation effects within the model and test path coefficients across groups, and (c) it can handle non-normal data and model dynamic behavioral phenomena (such as habits) (Fairchild and McDaniel 2017; Golob 2003).

The proposed conceptual framework comprises of both observed items, latent constructs, and multiple mediators with possible error-term covariances, and age-group analysis will be conducted, which can hardly be conducted simultaneously using other mediation analysis methods, such as methods proposed by Baron and Kenny (1986) and Sobel (1982). These mediation testing methods mainly use a series of regression models and are based on underlying assumptions of causal effects and unrelated errors. Moreover, MacKinnon (2008) suggested low power issues are usually observed for the Baron and Kenny (1986) methods. On the other hand, Alwin and Hauser (1975) argued that the estimation of mediation deeply rooted in path analysis and structural equations, which has also discussed by Fairchild and McDaniel (2017) as an advantage of using SEM over the other methods. SEM offers comparatively more efficient mediation analysis and tests complicated mediation models in one analysis (Gunzler et al. 2013).

An age-group analysis using multi-group SEM procedures were used to compare the paths between two age groups. Specifically, the proposed SEM model, including the factor loading and the path coefficients, was estimated for the two age groups (18–44 (younger) vs. 45 + (older)), adapting techniques used in previous studies (e.g., Angulo-Ruiz and Pergelova 2015; Qureshi and Compeau 2009).

Results

Sample Description

The average objective financial knowledge of the overall sample was 3.42 (on a scale of 0–5). The averages of the three measures of perceived financial capability were 5.37 for the perceived financial knowledgeability, 5.99 for the perceived financial management skills, and 5.85 for the perceived numeracy (on a scale of 1–7). Regarding financial stressors, among the full sample, 4.29% filed for bankruptcy or foreclosure, 24.16% had recent income drop, and 19.62% had overdue medical bills. On a scale of 1–7, the average perceived over-indebtedness was 3.81 for the overall sample. Regarding financial advice-seeking, 38.66% reported that they have sought advice for saving and investment in the past 12 months, 36.89% for insurance planning advice, 23.98% for tax planning advice, 8.46% for debt counseling, and 26.42% for mortgage and loan services. For short-term positive financial behavior, more than half of the sample (51.16%) could make ends meet, 46.35% had healthy spending habits, 97.79% had checking accounts, and half of the sample reported paying off credit cards in full. For long-term positive financial behavior, more than half of the sample (52.82%) had emergency funds, 86.40% reported managing savings accounts, 41.91% had investments outside of their accounts, money market accounts, or CDs, and 53.63% had calculated their retirement needs. The younger and older groups’ sub-sample descriptive summaries are also shown in Table 1. Among the 5951 younger respondents (< 44), the averages for perceived financial knowledgeability, financial management skills, and numeracy were 5.23, 5.76, and 5.73, respectively, while the averages were relatively higher for the older group with age of 45 and older, which were 6.14, 5.93, and 3.64, respectively. The mean objective financial knowledge scores were 3.06 for the younger group and 3.64 for the older group. The younger group reported filing for bankruptcy or foreclosure in the past 2 years, experiencing large income drop in the past year, and having overdue medical bills with 6.27%, 28.28%, and 26.58%, respectively, while the percentages for the older group were 3.07%, 21.61%, and 15.33%, respectively.

The sample t-test results comparing younger versus older groups are presented in Table 2, showing significant age group differences for all the key variables in this study. In particular, the older group showed significantly higher objective financial knowledge and perceived financial capability than the younger group. The younger group reported experiencing more financial stressors, including bankruptcy or foreclosure, income shock, and having overdue medical bills, than the older group. Moreover, the younger group also reported a significantly higher perception of over-indebtedness than the older group. The age effect was also seen in financial advice-seeking behavior. The older group sought significantly more saving and investment related professional consulting, whereas the younger group were more likely to seek professional advice for their insurance, debt, and loan issues. Lastly, the older group reported significantly more of the desired and responsible short- and long-term financial behaviors than the younger group.

Structural Model and Hypothesis Testing

The standardized parameter coefficients of the proposed relationships with direct, indirect, and total effects are presented in Table 3. The overall model (χ2 (df = 70) = 4248.79, p < 0.000Footnote 2) showed a good model fit with a root mean square error of approximation (RMSEA) of 0.062, a standardized root mean square residual (SRMR) of 0.050, and a comparative fit index (CFI) of 0.909 (Hooper et al. 2008; Hu and Bentler 1999; Kline 2005; MacCallum et al. 1996). The internal reliability was assessed by Cronbach’s alphas for each of the two latent variables in this study. The standardized Cronbach’s alpha coefficient for perceived financial capability, measured by perceived numeracy, perceived financial knowledgeability, and perceived financial management skills, was 0.716. Additionally, the standardized Cronbach’s alpha coefficient for financial advice-seeking behavior, including seeking advice on saving and investments, insurance, tax, debt, and mortgages or loans services, was 0.661. An alpha coefficient higher than 0.60 indicates acceptable internal consistency (Malhotra and Birks 2007).

Regarding the direct effects, perceived financial capability had positive associations with financial advice-seeking behavior (coef = 0.129) and with short- (coef = 0.141) and long-term (coef = 0.157) financial behaviors. Objective financial knowledge was positively associated with long-term financial behavior (coef = 0.081) and advice-seeking behavior (coef = 0.047), yet surprisingly, negatively associated with short-term financial behavior (coef = − 0.016). Therefore, Hypothesis 1 was partially supported. Hypothesis 2 was supported by the results. Specifically, financial stressors were negatively associated with short- (coef = − 0.153) and long-term (coef = − 0.039) financial behavior. Moreover, stressors were positively associated with financial advice-seeking behaviors (coef = 0.144). Perceived over-indebtedness showed consistent negative associations with advice-seeking and short- and long-term financial behaviors. Lastly, Hypotheses 3 and 4 were supported. Financial advice-seeking was significantly and positively associated with short- and long-term financial behaviors. Moreover, how people behaved financially in the short-run had a positive association with their long-term financial behavior (coef = 0.220). Four socio-demographic characteristics were also examined in the structural model. Women were less likely to have positive short-term financial behavior but were more likely to seek professional advice than men. White respondents were more likely to behave well in the long-term compared to non-White respondents. Lastly, income and educational attainment were positively associated with financial advice-seeking and short- and long-term financial behaviors.

The indirect and total effects in Table 3 indicate the mediating relationships in the posited structural model. Hypotheses 1a and 1b proposed that financial advice-seeking and short-term positive financial behaviors were two significant mediators. The results showed that perceived financial capability was indirectly and positively associated with short- (coef = 0.009) and long-term (coef = 0.077) positive financial behaviors. In other words, financial advice-seeking behaviors partially mediated the relationship between perceived financial capability and short-term financial behavior, while financial advice-seeking and short-term financial behavior had a combined partial mediating effect in the relationship between perceived financial capability and long-term positive financial behavior. Objective financial knowledge had similar positive indirect effects on both short- and long-term financial behaviors. Therefore, Hypotheses 1a and 1b were supported by the results. Notably, when the direct and indirect effects were combined, objective financial knowledge was significantly associated with long-term financial behavior (coef = 0.095), but was not significant for the short-term financial behavior.

The indirect associations between financial stressors and positive short- and long-term financial behaviors through the mediation of financial advice-seeking behavior were positive (coef = 0.010 and 0.017). A negative direct relationship between stressors and financial behaviors, both short- and long-term, existed. However, the advice-seeking coping behavior could shift the negative effects caused by financial stressors to positive. The perception of over-indebtedness had consistently negative indirect associations with both short- and long-term financial behaviors. Thus, Hypotheses 2a and 2b were supported. The direct and indirect relationships between financial advice-seeking and long-term financial behavior were significant, meaning that the short-term financial behavior partially mediated the relationship between financial advice-seeking and long-term financial behavior, and therefore, Hypothesis 3a was supported by the results.

Additionally, women were found less likely to conduct positive short-term desired and responsible financial behavior. However, the indirect effect was positive when mediated by financial advice-seeking behavior. Moreover, White respondents were more likely to have positive long-term financial behaviors, with or without seeking advice from financial professionals. Lastly, income and education both showed positive indirect effects on both short- and long-term positive financial behaviors.

Age Comparison: Multi-group SEM Analysis

The multi-age group SEM was conducted to compare the proposed relationships of the younger versus older age cohorts. Overall, the group-level goodness-of-fit showed a good model fit, with SRMRs of 0.052 for the younger group and 0.055 for the older group. The multi-age group results showed significant age differences in the posited structural relationships, supporting Hypothesis 5. Table 4 presents the standardized parameter estimates of the two age groups. In order to interpret the relationships in an easier way, Table 5 summarizes the directions of the relationships (only significant paths were marked with “+” or “−” signs). In particular, the age differences in the direct effects were shown in the following aspects. First, younger women (coef = − 0.044) were less likely to behave financially well than men in the short-term. However, this effect was not significant among the older women. Second, older White respondents tended to behave better than their older non-White peers in terms of short- (coef = 0.022) and long-term (coef = 0.033) financial practice, and were more likely to seek advice from financial professionals (coef = 0.028); whereas this racial effect was not shown within the younger group. Third, financial stressors were significantly and negatively associated with older respondents’ long-term financial behavior (coef = − 0.064). However, it had no significant effect on young adults’ long-term financial behavior. Younger women (coef = − 0.028) were less likely to conduct long-term financial desired behaviors than younger men; however older women (coef = 0.030) were more likely to behave financially better than older men. Additionally, objective financial knowledge (coef = 0.102) and perceived over-indebtedness (coef = − 0.155) were significantly associated with only older respondents’ financial advice-seeking behavior. However, the younger group’s financial advice-seeking behavior was not significantly affected by their actual financial knowledge or their perception of the current debt situation.

The age differences were also seen in the mediating effects in the proposed relationships. For example, the positive indirect relationship between objective financial knowledge and short-term financial behavior only existed in the older group (coef = 0.006); whereas the younger respondents’ short-term behavior was not significantly associated with their objective financial knowledge. Second, being female showed opposite indirect effects on short- and long- term financial behavior in the younger versus older groups. Recall that younger women are less likely, whereas older women were more likely, to seek financial advice than their male counterparts. Therefore, with the advice from financial professionals, older women may be more likely to report positive short- and long-term financial behavior than older men. Lastly, financial stressors had a positive total effect on younger respondents’ long-term financial behavior (coef = 0.052), but it was negative for the older group’s long-term behavior (coef = − 0.080).

Lastly, an additional robustness check was conducted to re-estimate the age group comparison results using a different age threshold that divided the total sample into 18–34 vs. 35+ groups. The goodness-of-fit indices for these two age groups were SRMR (18–34) = 0.058 and SRMR (35+) = 0.052, respectively. In general, the robustness results using a new age threshold did not alter the results in the previous age group comparison analysis significantly and most of the relationships and directions were consistent, which provided support to the structural validity of the overall model and the age group comparison results. The summary of significant paths for the robustness results is presented in Appendix—see Table 6, with significant relationships marked using either “ + ” or “−” signs. Detailed path coefficients of the robustness check for these two age groups are available upon request.

Discussion and Implications

This study proposes a conceptual framework using stress-coping theories (Cohen and Wills 1985; Folkman and Lazarus 1980; Lazarus and Folkman 1984; Wills 1987) to understand individuals’ motivations and barriers to seek financial advice from professionals as coping strategies and to practice short-term and long-term financial management behavior. The results indicate four highlighted findings. First, consistent with Hypothesis 1, perceived financial capability is directly and indirectly associated positively with financial advice-seeking behavior and short- and long-term financial behaviors regardless of age cohorts, which echo the findings of the positive effect of financial capability, perceived financial knowledge, and self-efficacy on financial behaviors in the literature (Chatterjee et al. 2011; Lim et al. 2014). For example, perceived financial management skills are found positively associated with financial help-seeking behavior among college students (Lim et al. 2014), and people with high perceived financial literacy are more likely to seek financial advice related to savings and investment, mortgage and loan services, insurance, and tax planning (Allgood and Walstad 2016; Seay et al. 2016). Moreover, from a cost–benefit perspective (Stigler 1961), hiring financial professionals to cope with financial concerns can lower the marginal cost of searching for information and solutions. This current study provides a nuanced finding that compared to objective financial knowledge, the overall perception of self-financial capability, capturing self-assessed financial numeracy, knowledge, and management skill levels, show stronger and consistent positive associations with financial advice-seeking and short- and long-term financial behaviors.

Second, the literature suggests that financial advice and service providers, as external information sources, can serve as resources of social and material support that play important roles in the process of coping with stressful events (Beales et al. 1981; Lazarus and Folkman 1984; Wills 1987). Therefore, the current study hypothesized that recent experience of financial stressors has a positive relationship with seeking financial advice from professionals, which is supported by the results. On the other hand, the negative immediate and prolong effects of financial stressors on short- and long-term financial behaviors in this study also reinforce the proposed schematization by Lazarus and Folkman (1984) that stressors and stress may have lasting influences over time. Notably, when mediated by seeking financial advice, financial stressors are positively associated with short- and long-term financial behaviors. To sum up, experiencing recent financial stressful events may decrease the likelihood and possibility of conducting responsible short- and long-term financial behaviors (e.g., someone who recently experienced a large income drop may find it hard to make ends meet or pay off credit card debt in full). However, it did increase the demand for financial professional advice that showed positive mediating effects in the relationship between stressors and short- and long-term financial behaviors.

Third, financial advice-seeking behavior is positively associated with short- and long-term responsible financial behaviors, which ties well with previous studies showing positive value provided by financial professionals to clients’ overall financial wellness (e.g., Brenner 1998; Hilgert et al. 2003; Hira and Mugenda 1999; Staten et al. 2002). This study extends the understanding of the value of financial advice-seeking by showing that in terms of long-term financial responsible behaviors, financial advice-seeking is the strongest predictor among all the positive motivational factors, including perceived financial capability, objective financial knowledge, and short-term financial practice. Moreover, for short-term financial behavior, financial advice-seeking behavior is a significant predictor, along with perceived financial capability. Advice-seeking behaviors varies by age groups, confirming the last hypothesis of this study. The findings show that older people with higher financial knowledge and having recently experienced income shock are more likely to seek external professional advice. Furthermore, the results also indicate a significant mediating role of financial advice-seeking. With financial professional’s advice and support, individuals’ objective financial knowledge show indirect positive influences on short- and long-term financial behaviors and the negative effect of financial stressors is minimized. This study finds that financial advice is more commonly sought by older women and the mediating effect of advice-seeking show positive associations with older women’s short- and long-term financial behaviors. Recall that previous research finds that there is a difference in the coping behavior between younger and older people (Folkman et al. 1987; Pfeiffer 1977; Vaillant 1977); therefore, this study’s results might be a reflection of this discrepancy in coping and help and advice seeking behaviors in younger versus older individuals.

Lastly, in previous studies of short- and long-term financial behavior, few examined financial practices for short-term purposes and r long-term purposes. As Howlett et al. (2008) posited, there are tradeoffs between short-term financial enjoyment and pleasure and long-term financial security. Therefore, this current study proposes that individual’s financial behavior for the short-term may also relate to their long-term financial planning, such as retirement saving and wealth accumulation. The findings in this study confirm that there is a positive relationship between short- and long-term financial behaviors; meaning those who tend to plan responsibly in the short-term are more likely to also plan positively for their retirement and investment behaviors to reach financial security in the long-term.

This study contributes to the literature of financial advice-seeking behavior by establishing a conceptual framework and extending the understanding of the antecedents of seeking advice and consequential behavioral outcomes using the stress-coping theoretical schematization and coping theories (Cohen and Wills 1985; Lazarus and Folkman 1984; Wills 1987). The overall conceptual framework of the current study considers financial advice-seeking behavior as a problem-focused coping strategy when the individual is faced with stressor events, such as experiencing income drops, overdue bills, and bankruptcy. Based on Lazarus and Folkman’s (1984) stress-coping schematization and Wagner and Walstad’s (2019) categorization of short- and long-term financial behaviors, the current study conceptualizes the two types of financial behaviors as short- and long-term behavioral consequences of the coping strategy of seeking financial advice.

Moreover, the conceptual framework in this study also integrates perceived financial capability and objective knowledge as motivating factors, and financial stressors and perceived over-indebtedness as hinderers of seeking external advice and conducting positive financial behaviors. Previous studies show that financial knowledge and financial education are effective in improving individuals’ financial behavior (see Henager and Cude 2016; Wagner and Walstad 2019). This study, while consistent with previous studies (e.g., Kim et al. 2003; Lim et al. 2014; Tokunaga 1993), finds several additional behavioral and psychological factors that are significantly associated with advice seeking behavior. These include perceived financial capability and perceived over-indebtedness as antecedents of financial advice seeking and short- and long-term behaviors. The literature suggests that financial stressors are adversely associated with financial well-being and mental health (Kim et al. 2003; Tokunaga 1993; Maciejewski et al. 2000), and the positive relationship between financial stressors and financial advice seeking in this current study could indicate that financial professional services could serve as coping resources for individuals who experience recent financial stressor events and could potentially help in increasing financial well-being for these individuals who actively seek for advice.

The findings in this study provide implications for consumers, financial practitioners, and policymakers. For consumers, although objective financial knowledge has been found to be positively and significantly associated with financial behaviors in the literature, this study showed that perceived financial capability and seeking professional advice as a coping strategy had stronger predicting power in terms of improving short- and long-term financial behaviors regardless of age. Therefore, consumers not only need education that can enhance their financial knowledge but also need professional help to build financial confidence and perceived financial capabilities to manage finances. Additionally, sometimes one’s time, money, and expertise are limited, thus creating greater access for individuals to seek help and advice from professionals can solve their financial problems more efficiently. This study finds that women younger than 44 and men older than 45 are less likely to seek financial advice, and in the meantime, these two groups are also found to be less likely to behave financially well in the short- and long term. More research is needed to understand whether this is because they tend to use different coping strategies under stress, or other characteristics, psychological and non-psychological, that may be provide more explanations.

For financial practitioners and professionals, this study confirms the value of their services in terms of fostering positive short- and long- term financial behaviors. The age effect suggests that when working with clients, practitioners need to be aware that the motivators and hinderers of financial behaviors differ by age and other demographic characteristics. Financial stressors, objective knowledge, and perception of debt may differently influence younger versus older clients’ decision making and behavior. Undergoing similar financial stressful events may bring different levels of mental stress, lead to divergent coping behaviors, and generate distinct immediate and long-term effects on the individuals’ behavior, well-being, and even health. Therefore, different guidelines and approaches need to be developed when communicating with clients, especially those who recently experienced or currently suffer from financial stressful events (such as an unexpected loss or decrease of income, medical issues and bills, and bankruptcy), understand that most of them already actively cope by stepping ahead and seeking professional help and there might be emotional stress in this process. Certain appropriate delegation to other professionals (e.g., financial therapists) might be necessary when providing advice to clients. Lastly, for policymakers, because there exists a positive effect of financial advice-seeking behavior on short- and long-term financial behaviors, policies need to be developed to make financial services more reachable, affordable, and customized for individuals and households, especially for those who recently experienced financial stressor events, because these may be detrimental for their short- and long-term financial behaviors, and eventually may be harmful to financial well-being.

There are several limitations of this study. First, this study only examines financial stressors occurring within the past 1–2 years. Certain chronically stressful financial events may occur earlier in life or repeatedly happen with life-long adverse influences that may also affect financial behavior and advice-seeking behavior that could not be captured in this study. Next, more research is needed to study the stress-coping financial behaviors by also examining more psychological factors, such as the actual financial stress or anxiety, which was not able to be incorporated into this research due to limitations with the dataset. Moreover, future studies can continuously investigate financial advice-seeking topics when new waves of data become available. The other limitation is that the cross-sectional nature of the dataset made it impossible to track the individuals’ financial behavioral changes over time, therefore, no causal relationships can be concluded in this study. More research using longitudinal datasets and/or experimental approaches are needed to further understand the long-term relationships between financial stressor events, financial advice-seeking, and client’s financial behavioral changes. Lastly, this study aimed to construct a conceptual framework to understand the role of financial advice-seeking, along with other determinants, in determining the short- and long-term financial behavior. Within this framework, complex concepts such as perceived financial capability and financial stressors could possibly be further developed into separate research themes to deepen the understanding for each of their influences on financial advice seeking and financial management behavior.

Notes

2012 National Financial Capability Study State-by-State Survey Methodology. https://www.usfinancialcapability.org/downloads/NFCS_2012_State_by_State_Meth.pdf.

The Chi-squared (χ2) test assesses “the magnitude of discrepancy between the sample and fitted covariances matrices” with a null hypothesis that the model fits perfectly (Hu and Bentler 1999). However, the χ2 is sensitive and dependent to sample size, and it is expected to see a non-significant χ2 and reject the null hypothesis with a large sample size (Bentler and Bonnet 1980; Schermelleh-Engel et al. 2003). It is suggested that the χ2 should not be relied on as a test statistic, but rather a descriptive goodness of fit index. (Jöreskog and Sörbom 1993).

References

Alhenawi, Y., & Elkhal, K. (2013). Financial literacy of U.S. households: Knowledge vs. long-term financial planning. Financial Services Review, 22, 211–244.

Allgood, S., & Walstad, W. B. (2016). The effects of perceived and actual financial literacy on financial behaviors. Economic Inquiry, 54(1), 675–697.

Almenberg, J., & Widmark, O. (2011). Numeracy, financial literacy and participation in asset markets. Retrieved November 9, 2019, from https://ssrn.com/abstract=1756674.

Alwin, D. F., & Hauser, R. M. (1975). The decomposition of effects in path analysis. American Sociological Review, 40, 37–47.

Angulo-Ruiz, F., & Pergelova, A. (2015). An empowerment model of youth financial behavior. Journal of Consumer Affairs, 49(3), 550–575.

Armstrong, T. (2008). The human odyssey: Navigating the twelve stages of life. New York: Sterling.

Asaad, C. T. (2015). Financial literacy and financial behavior: Assessing knowledge and confidence. Financial Services Review, 24, 101–117.

Atkinson, A., McKay, S., Kempson, E., & Collard, S. (2006). Levels of financial capability in the UK: Results of a baseline survey. Financial Services Authority Consumer Research Paper #47. FSA: London.

Bannier, C. E., & Neubert, M. (2016). Gender differences in financial risk taking: The role of financial literacy and risk tolerance. Economics Letters, 145, 130–135.

Baron, R. M., & Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51, 1173–1182.

Barusch, A. S. (1988). Problems and coping strategies of elderly spouse caregivers. The Gerontologist, 28(5), 677–685.

Beales, H., Mazis, M. B., Salop, S. C., & Staelin, R. (1981). Consumer search and public policy. Journal of Consumer Research, 8(1), 11–22.

Bentler, P. M., & Bonnet, D. C. (1980). Significance tests and goodness of fit in the analysis of covariance structures. Psychological Bulletin, 88(3), 588–606.

Bernheim, D. (1998). Financial illiteracy, education and retirement saving. In O. S. Mitchell & S. Schieber (Eds.), Living with defined contribution pensions (pp. 38–68). Philadelphia: University of Pennsylvania Press.

Bluethgen, R., Gintschel, A., Hackethal, A., & Mueller, A. (2008). Financial advice and individual investors’ portfolios. Retrieved November 9, 2019, from https://ssrn.com/abstract=968197.

Brenner, L. (1998). When you need a financial expert. New Choices, 38(8), 81–82.

Burke, J., & Hung, A. A. (2015). Trust and financial advice. Journal of Pension Economics & Finance. https://doi.org/10.1017/S147474721900026X

Camara, M., Bacigalupe, G., & Padilla, P. (2017). The role of social support in adolescents: Are you helping me or stressing me out? International Journal of Adolescence and Youth, 22(2), 123–136.

Caplan, L. J., & Schooler, C. (2007). Socioeconomic status and financial coping strategies: The mediating role of perceived control. Social Psychology Quarterly, 70(1), 43–58. https://doi.org/10.1177/019027250707000106

CFPB. (2015). Financial well-being: The goal of financial education. Retrieved November 9, 2019, from https://files.consumerfinance.gov.

Chatterjee, S., Finke, M., & Harness, N. (2011). The impact of self-efficacy on wealth accumulation and portfolio choice. Applied Economics Letters, 18, 627–631. https://doi.org/10.1080/13504851003761830

Chen, Y., & Feeley, T. H. (2014). Numeracy, information seeking, and self-efficacy in managing health: An analysis using the 2007 Health Information National Trends Survey (HINTS). Health Communication, 29(9), 843–853.

Chien, Y. (September 2018). How do Americans rate in financial literacy? The St. Louis Fed on the Economy Blog. Retrieved November 9, 2019, from https://www.stlouisfed.org/on-the-economy/2018/september/how-americans-rate-financial-literacy.

Cohen, S., & Wills, T. A. (1985). Stress, social support, and the buffering hypothesis. Psychological Bulletin, 98(2), 310–357.

Collins, J. M. (2012). Financial advice: A substitute for financial literacy? Financial Services Review, 21, 307–322.

Corter, J. E., & Chen, Y. J. (2006). Do investment risk tolerance attitudes predict portfolio risk? Journal of Business and Psychology, 20(3), 369–381. https://doi.org/10.1007/s10869-005-9010-5

Danes, S. M., & Haberman, H. (2007). Teen financial knowledge, self-efficacy, and behavior: A gendered view. Journal of Financial Counseling and Planning, 18(2), 48–60.

de Bassa Scheresberg, C. (2013). Financial literacy and financial behavior among young adults: Evidence and implications. Numeracy, 6(2), 5.

Dietz, B. E., Carrozza, M., & Ritchey, N. (2003). Does financial self-efficacy explain gender differences in retirement saving strategies? Journal of Women and Aging, 15(4), 83–96. https://doi.org/10.1300/J074v15n04_07

Fairchild, A. J., & McDaniel, H. L. (2017). Best (but oft-forgotten) practices: Mediation analysis. The American Journal of Clinical Nutrition, 105(6), 1259–1271.

Faravelli, C., & Pallanti, S. (1989). Recent life events and panic disorder. The American Journal of Psychiatry, 146(5), 622–626. https://doi.org/10.1176/ajp.146.5.622