Abstract

An empirical exploration of global film franchises provides insights for managers of film franchises, investors in franchisable products, and scholars interested in motion picture performance. Performance tends to deteriorate as extensions are introduced: production budgets rise, advertising expenditures remain similar, and the number of opening-weekend theaters experiences a jump with the first sequel and then remains similar in subsequent installments. However, revenue, return-on-investment (ROI) and audience and critical reviews fall, and foreign performance becomes increasingly important. Offsetting deteriorating performance, risk falls: revenue and ROI become more predictable. An early change in the lead actor causes reduced performance, but changes in key product characteristics and inputs in later installments help prolong the franchise. ROI of the current installment is the most critical financial determinant of whether a further extension will occur, but high-budget films and those with higher domestic share of revenue are also more likely to yield further extensions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

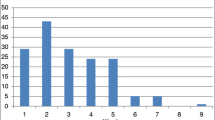

Over the past few decades, creating global film franchises (which we define as consisting of at least two globally marketed films in a series of sequels, prequels and/or spinoffs) has become a primary strategy for firms in the movie business, and in recent years, franchises have dominated the global box office. For example, in 2013, 9 of the 12 top-grossing films in the U.S. and Canada were part of film franchises, and the 9 accounted for almost 25% of domestic ticket sales (Richwine 2014).Footnote 1 Figure 1 illustrates the transition that has occurred.Footnote 2

We provide large-sample evidence on key franchise business decisions and outcomes. First, we use panel-data models with fixed franchise effects and binary indicators of each installment to describe how measures of economic performance (costs, revenues, return-on-investment (ROI), and several others) evolve with the order in the franchise. These estimates provide a baseline for what we should expect to observe as a franchise evolves, conditional on the franchise being extended.Footnote 3 Second, we examine how gaps between installments, changes in key inputs, and changes in key product characteristics impact performance.

Third, we provide a novel way of examining how risk evolves as further installments are introduced. The estimate of the franchise-specific fixed effect is refined as additional installments are made, but the estimate at any stage can be used along with the other regression coefficients to predict the performance of the next installment. We measure the risk of an installment using the root-mean-square error of these predictions. Thus, our measure of risk captures how predictability depends on the installment, and it employs the standard metric for evaluating the quality of forecasts. Analyzing risk in this way improves on the approach of Palia et al. (2008) by employing conditional variances; Palia et al. (2008) show that sequels have a lower unconditional standard deviation of ROI than non-PG-rated films.

Fourth, we consider the decision to make another installment. We estimate a duration model of the time until the next installment and associate predictions of long gaps with a higher probability that the franchise is terminated. Our examination of the installment-by-installment decision to extend the franchise is consistent with a real options framework (Amram 2002; Gong et al. 2011). The results contribute to the empirical literature on product line decisions (for example, Putsis and Bayus 2001) and brand extensions in particular.Footnote 4

1 Data and measures

Most of our data is from the-numbers.com; the-numbers.com/movies/franchises/lists the top movie franchises. We collect movie-specific data on all franchises with at least two movies released in theaters prior to 2014 (so the theatrical run is complete by July 2014, the time of data collection). Each movie is assigned to only one franchise, and we drop short/minor films. The first two movies combined must earn a global box office of at least $100 M U.S. 2013 dollars, and the production budget must be available. We focus on global franchises: every movie in the franchise must earn at least 2% but no more than 98% of its global revenues domestically (to ensure some domestic and some foreign revenue).Footnote 5 There are 143 franchises and 433 movies in the resulting sample. James Bond is by far the oldest franchise (beginning in 1963); the next global franchises begin in the late 1970s. Figure 1 shows how franchising begins to emerge as a primary strategy during the mid-1990s: franchise starts begin to rise in a non-steady way up to a peak of 12 in 2001.

For each movie, we collect cumulative box office revenue in domestic and foreign markets, the production budget, advertising expenditures (purchased from Baseline), Rotten Tomatoes (RT) audience and critic scores, year and month of release, the initial number of theaters (first weekend), MPAA rating and other characteristics summarized in Tables 1 and 2.Footnote 6 Advertising data is available for 395 movies in 139 franchises, and we use this subsample in our analysis of performance. ROI is total revenue divided by the sum of the production budget and advertising expenditures. We fill in gaps in the ratings, theaters and budgets using imdb.com, boxofficemojo.com and Google searches. We fill in gaps in the RT scores using rottentomatoes.com. We obtain the lead actor, director and the lead actor’s history of appearances from imdb.com, the-numbers.com and Wikipedia, and we obtain academy awards from Oscars.org. The “any award” indicator in Table 2 takes the value 1 if the film has at least one participant who has received an Academy Award for best actor, actress, or director (a measure of star power; see Ravid 1999). Only 8 franchises have 6 or more installments; we employ a 5-and-higher category in our analysis.

There are well-known limitations of box office revenues and measured ROI that panel-data methods alleviate. First, non-box-office streams such as DVD sales and rentals, pay-per-view and merchandising are important but typically remain private information. Second, box office revenues are shared with the theater owner, and the shares are private information. Third, adjustments associated with paying leading actors shares of the revenue are private information.Footnote 7 Ravid (1999, p. 471) describes the standard assumptions: non-ticket revenue is a multiple of ticket revenue, and any further adjustments are either in proportion to ticket revenue or can be treated as noise. In panels using natural logs, these multiples need not be constant across all movies in the sample (the standard assumption in a cross-sectional analysis); we only need to assume that they can be decomposed into franchise, year and month effects. In this sense, our panel-data approach is more robust to measurement error.Footnote 8

In cases where a franchise is based on books or comics, we attempted to measure how the source material might constrain the franchise extension decision, but the difficulty of doing so in an objective way deterred us: constraints do not appear to bind. There are many cases where further installments are not introduced in a timely manner despite the availability of source material (the Hulk and John Carter movies), cases where the number of installments ends up exceeding the number of books (the Harry Potter and Twilight franchises), and cases where the franchise is either only loosely based on the source material or expands beyond it (the James Bond and Jason Bourne franchises and the Hobbit movies).Footnote 9

2 Results

We use a simple conceptual framework to organize the empirical analysis: Studios decide which films to make, when to make them, and make budgeting, production and marketing decisions primarily by trading off expected ROI and risk of the films being considered. In the case of franchise films, they also consider option value: making the next installment maintains the option to make subsequent ones. Decisions surrounding a film can be grouped as follows:

-

1.

The studio decides to make an additional installment and when to make it.

-

2.

The studio determines the budget and potentially makes changes to the cast and/or director.

-

3.

The studio chooses how much to advertise and how many theaters to launch the film in.

These three groups of decisions are often made in order, but in some instances, one or more of the items in category 2 are determined before those in category 1 (for example, when it is known that a lead actor has left the franchise). We begin by examining how variables in categories 2 and 3 along with several market outcomes depend on the installment order in the franchise; we leave an examination of 1 for later in the paper. In the models, the outcome of installment \(i\) in franchise \(j\) (\(y_{ij}\)) released in calendar month \(m\) of year \(t\) is given by:

where \(\alpha_{j}\) is a franchise-specific fixed effect,Footnote 10 \(\gamma_{i}\) is a binary installment effect (constant across all franchises), \(\lambda_{ijm}\) is a binary calendar-month effect (constant across all films released in the same calendar month), \(\eta_{ijt}\) is a binary year effect (constant across all films released in the same year), \(x_{ij}\) is a vector of control variables, \(\beta\) is a parameter vector, and \(\varepsilon_{ij}\) is a residual. Each installment of each franchise is observed only once; we focus on cumulative performance and final outcomes rather than weekly or monthly progress. Thus, the construction of the panel treats the franchise as the panel identifier and the installment as the “period.”Footnote 11 The panel is unbalanced because some franchises have only 2 installments, some 3, some 4, etc.

Tables 3 and 4 present baseline models that impose \(\beta = 0\). The estimated installment effects provide the typical trends in the outcomes of interest over the life of the franchise conditional on the franchise continuing. Some variables show no clear tendency to evolve as installments continue (for example, the propensities for the lead actor or MPAA rating to change). However, most exhibit clear patterns. For example, the budget tends to rise. The coefficient of .31 on installment 2 in the budget equation implies that installment 2’s budget is typically \((\exp (.31) - 1) \times 100 \simeq 36\%\) higher than installment 1’s. The point estimates suggest that the budgets in installments 3, 4, and 5-and-higher are 55, 75, and 99% higher than installment 1’s. Importantly, the inclusion of fixed franchise effects ensures that these are within-franchise estimates. Further, the inclusion of year effects ensures that these increases are not due to general inflation or a general tendency for production budgets to rise over time; they represent real increases in the costs of making subsequent installments that are distinct from such macro and industry-level effects. The results suggest that higher production budgets are not offset by lower marketing costs: advertising expenditures do not have statistically significant installment effects, and the number of theaters jumps 27% from installment 1 to installment 2 and then does not rise or fall substantially in subsequent installments.

Higher budgets, flat advertising expenditures, and the increase in the number of theaters are not typically associated with superior market outcomes: domestic and total revenue along with ROI all tend to fall in later installments. The RT scores also tend to fall, although the point estimates for the 5-and-higher installments suggest that the scores fall slightly less in long-lived franchises. RT scores are percentages of positive reviews, so the coefficients indicate how the percentage changes with the installment number. For example, the percentage of positive critical reviews is 18.8 points lower on installment 2 than on installment 1.Footnote 12 The foreign share of revenue rises. The foreign share is a fraction, so the coefficient provides the increase in the foreign share relative to the first movie in the franchise. For example, the coefficient of .058 on installment 3 means the foreign share is typically 5.8 percentage points higher on installment 3 than on installment 1.Footnote 13

Our conceptual framework assumes that the gap between installments, the budget, and any changes in key inputs or product characteristics are determined before marketing efforts and market outcomes are determined. Given this, it is useful to assess whether controlling for these pre-determined variables impacts our conclusions about installment effects.Footnote 14 The results in Table 5 generally strengthen the conclusions reached using Tables 3 and 4. Advertising and initial theaters lack significant installment effects, which reinforces our prior conclusion that marketing efforts do not diminish as additional installments are introduced. The tendency for domestic and total revenue and ROI to fall in later installments is strengthened: in each of these equations, all of the estimated installment effects are significantly different from each other at the 5% level or better. The tendency for the foreign share of revenue to rise remains present but is not as strong as in Table 4; the estimated installment effects are not significantly different from each other. The decline in the RT scores is stronger in Table 5 than in Table 4.

2.1 Effects of changes in product characteristics, inputs and the gap between installments

The models in Table 5 control for within-franchise changes in key product characteristics (the lead actor and MPAA rating) and a key input (the director). Following Heath et al. (2015), we distinguish between changes that occur early in the life of the franchise and those that occur later on, and we also consider the effect of the gap between installments.Footnote 15 The variables we include to capture changes have impacts from the change onward; they shift the performance of the current film and all future ones in the franchise.Footnote 16 The gap variables are expressed as deviations-from-mean within each installment. Using deviations-from-means does not impact the coefficients on the gap variables, but it ensures a meaningful interpretation of the installment effects: the estimated installment effects capture changes that occur if there is no change in the production budget, marketing efforts, lead actor, MPAA rating or director and if the gap between installments equals the mean gap between those two installments. The effects of each gap also become permanent within the franchise once they occur.

The results in Table 5 suggest that changing the lead actor in installment 2 is associated with statistically significant and economically important reductions in revenue and ROI. By comparison, ratings changes (another product characteristic) and changes in the director (a key input) are not as important.Footnote 17 The estimated gap effects suggest that shorter gaps early in the life of the franchise are associated with higher revenues, ROI and RT scores; the point estimates tend to diminish or change sign as the installments progress.

Negative impacts might suggest that studios fail to optimize, but the results can also be explained using our conceptual framework (in which studios trade off expected ROI and risk and consider the option to extend the franchise further if the next installment is successful) while considering constraints studios face along with the potential endogeneity problems associated with OLS. Consider gaps. Movie production involves coordinating many inputs at great expense. Thus, even if shorter gaps are optimal, it might not always be possible or cost-effective to achieve them. Producing multiple films in a franchise at once could avoid some delays, but doing so is risky: if earlier installments do not perform well, the later ones will not either. Thus, studios might accept lower ROI on a film in preference to bearing the risk of producing several flops in a short period of time. Endogeneity also helps explain the results: studios likely pursue shorter gaps when they anticipate better performance, which would result in a negative relationship between observed gaps and performance.Footnote 18

Similarly, the negative effect of changing the lead actor early on can be interpreted using our framework. Managers in our framework voluntarily reduce ROI only if doing so reduces risk or enhances the option to make further installments. It is unlikely that changing the lead actor early on would reduce risk, and it is also unclear how doing so could enhance the option to make further installments. This leaves two possibilities. First, it is possible that managers anticipate even worse performance if the lead actor is not replaced; perhaps the franchise is worth continuing but requires a substantial reboot. Second, the change might be beyond the manager’s control. Useful instruments allow us to explore this possibility further: Lead actors who are stars and/or those who appeared in other movies in the period immediately prior to the release of installment 1 likely have higher opportunity costs than other actors, and thus they are more likely to leave because of exogenous other opportunities.Footnote 19

Table 6 provides 2SLS instrumental variables analyses. The second stage is the first-difference of Eq. (1) using installments 1 and 2; \(y_{ij} = \ln {\text{ROI}}_{ij}\). We focus on the change in the lead actor (denoted \(x_{2j}\)) as the sole endogenous variable of interest and drop the other elements of \(x_{ij}\) from the model. The resulting system of equations when installment 1 is released in month \(m\) of year \(t\) and installment 2 is released in month \(m'\) of year \(t'\) is:

where \(\beta_{1}\) is the coefficient of interest, \(u_{2j} = \varepsilon_{2j} - \varepsilon_{1j}\), \(\chi_{ijm}\) is a binary calendar month effect (analogous to \(\lambda_{ijm}\)), \(\xi_{ijt}\) is a binary year effect (analogous to \(\eta_{ijt}\)), \(z_{2j}\) is the instrument, \(\varphi\) is a parameter, and \(v_{2j}\) is a residual. As an example of the results, Column (2) shows that the probability that the lead actor changes in installment 2 rises by 23 percentage points if the initial lead actor appeared in a movie released during the 365 days prior to the release of installment 1. The second-stage coefficient is \(- \,.99\). The Staiger–Stock (1997) F-statistic is below 10, so the instrument is weak, but the Anderson–Rubin (1949) AR test, which is robust to weak instruments (implemented by Finlay and Magnusson (2009) in Stata), confirms that the lead-actor effect is significant at the 5% level. The point estimates in the 2SLS models are more negative than the OLS point estimate of − .25, although in every case − .25 remains in the 95% confidence interval.Footnote 20

2.2 Evolution of risk

The models in Table 5 allow us to assess how risk evolves as installments are released. We predict the next installment’s outcome using the estimated coefficients from the table but update the franchise fixed effects only as data becomes available. Thus, we use \(\alpha_{j} = 0\) to predict the outcome of installment 1 (all models contain a constant term, so 0 is the mean \(\alpha_{j}\)). For subsequent installments, we estimate \(\alpha_{j}\) by setting the sum of the previous franchise-specific residuals equal to zero (estimates of fixed effects set the sum of residuals equal to zero). This implies that to predict \(y_{ij}\) when \(i > 1\), the franchise effect employed is

where \(\widehat{y}_{kj}\) is the prediction from the appropriate model in Table 5 when \(\alpha_{j} = 0\). Using this approach, we predict \(y_{ij}\) for all movies. Then, we compute the root-mean-square error (RMSE) of these predictions by installment to assess how predictability evolves as installments are released. The RMSE measures risk: if it is larger, it is more difficult to predict the outcome. We focus on the three main financial outcomes: domestic revenue, total revenue and ROI (all in natural log form). Table 7 provides the results. In each case, the RMSE falls in later installments. Thus, our results suggest a tradeoff: performance declines in later installments, but so does risk.

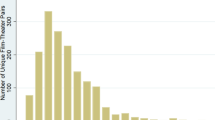

2.3 Franchise extensions

We do not observe explicit franchise terminations; we only observe that no further installment has been released by the time the data is collected. Given this, we estimate duration models to obtain insight into terminations. We assume that a prediction of a long gap until the next installment is associated with a higher likelihood of franchise termination. Our data suggests this assumption is reasonable: as Table 1 shows, the median gap between installments is approximately 3 years, and the distribution is skewed to the right (80% of observed gaps are 5 years or less).

There are several varieties of duration models, but preliminary tests indicated that a log-logistic model is appropriate.Footnote 21 A log-logistic duration model is essentially a linear regression model with censoring. Starting from installment \(i\) in franchise \(j\), the natural log of the time until the next installment (\(t_{ij}\), measured in months) is a linear function of variables \(w_{ij}\):

where \(\delta\) is a parameter vector, \(\omega_{j}\) is a random franchise effect (normally distributed with mean 0 and variance \(\theta\)) and \(\nu_{ij}\) follows a logistic distribution. Each film is an observation, and the dependent variable is either the time until the next installment or the time until the end of the sample period (in which case the observation is censored). The random franchise effects allow for the possibility that some franchises tend to have longer gaps than others. Estimation is more complicated than in a typical random effects model because of censoring but straightforward in Stata.

In preliminary analyses, we found that advertising expenditures and the initial number of theaters have insignificant effects on durations. Given this, in order to avoid losing observations due to missing data on advertising expenditures and theaters, we exclude these variables from the model, and we use a simple measure of ROI: total revenue divided by the production budget. The natural log of this “simple ROI” is very highly correlated with ln(ROI) (.89), so this substitution has essentially no impact on the estimated effect of ROI. In the results we report, we drop the first installment in each franchise from the estimation sample. Including first installments potentially biases results toward predicting short gaps (a lower likelihood of termination) because each franchise has at least two films. Dropping the first installments also allows us to consider whether lagged values of independent variables impact durations. However, the main conclusions we reach are robust to including the first installment or dropping the first two installments.

Table 8 provides the results. Column (1) includes only the natural log of the simple measure of ROI and its lag. Column (2) adds the effects of the budget and the foreign share of revenue. Column (3) includes RT Audience, early and late changes in the lead actor, director and rating, binary installment effects and a time trend. Column (4) includes all of the effects in Column (3) along with several additional control variables: we include binary effects for creative type, genre, MPAA rating, animated movies and any award (see Table 2).

In all of the columns, the current film’s ROI is a critical determinant of the time until the next installment, and the ROI of the preceding film has a statistically insignificant and economically small effect. Thus, the financial performance of the most recent installment matters more for guiding extensions than the prior history of the franchise.Footnote 22 Interpreted using Eq. (5), the coefficient on ln ROI is an elasticity: a coefficient of − .80, for example (Column (1)), indicates that doubling the ROI causes the time until the next installment to fall by 80%. Thus, the effects are clearly economically important. Under our assumption that long gaps are associated with a higher likelihood of franchise, termination, the results suggest that franchises with high ROI in the current installment are more likely to be extended. Columns (2)–(4) show that the effects of the budget and foreign share of revenue are also statistically significant and economically important. We conclude that higher-budget films and those with a lower foreign share of revenue are more likely to be extended.

Adding additional controls (Columns (3) and (4)) does not change our conclusions about the effects of ROI, the budget, or the foreign share of revenue, and we obtain additional insights. While early changes in the key inputs and product characteristics lack statistically significant effects, late changes in these variables result in statistically significant shorter gaps in at least one of the models. In our interpretation, such changes increase the likelihood that the franchise continues. As an example, the results in Column (3) indicate that changing the lead actor in installment 3 or higher reduces the expected time until the next installment by 31% \(((\exp ( - .37) - 1)\); the impacts of other binary effects can be computed the same way). The estimated installment effects suggest that, in comparison with installments 5-and-higher (the base installment effect), installment 2 is more likely to result in an extension and installment 3 is less likely to result in an extension. The latter result suggests that installments beyond the third are unlikely, but that if a franchise can last, eventually future installments become more likely. There is also some evidence in favor of a time trend that contributes to shorter durations—this is consistent with the franchising strategy becoming more popular in recent years.Footnote 23

3 Conclusion

The results suggest several insights for managers of film franchises, investors in franchisable products, and scholars interested in motion picture performance. Stakeholders should expect performance to deteriorate as extensions are introduced: cumulative box office revenues, ROI and audience and critical reviews tend to fall in later installments while inflation-adjusted production budgets tend to rise, advertising budgets remain roughly unchanged, and distribution efforts do not diminish. Interestingly, the fraction of box office revenue attributable to foreign markets rises in later installments. Industry practitioners and commentators in the business press have asserted that later installments in film franchises tend to appeal more to foreign audiences (see Moreshead 2012; Obst 2013), but we are the first to provide large-sample evidence that addresses this claim.Footnote 24 Offsetting deteriorating performance, risk falls as installments progress: revenue and ROI become more predictable.

Early changes in the lead actor are associated with reduced ROI in OLS and 2SLS analyses. Thus, early in the life of the franchise, satiation effects that might reduce performance (Sood and Dreze 2006) must be balanced against benefits associated with continuity of key characteristics that audiences associate with the franchise. This result is similar to those of Heath et al. (2015), who show that early substantial “innovations” within a brand are associated with worse performance while later ones are not. Our results suggest that changing the lead actor is associated with larger impacts than changing other product characteristics (the MPAA rating) or a key input (the director).

The likelihood of a further extension depends critically on the financial performance of the most recent installment. The results of our duration analysis show that a high ROI on the most recent installment makes the next installment occur sooner. Under our assumption that predictions of long durations are associated with a higher likelihood of franchise termination, the model suggests that an extension is more likely to occur if the ROI of the current film is higher. Other financial variables also matter: a high budget on the most recent installment and a low foreign share of revenue make continuation more likely. Durations have an inverted-U relationship with the installment number: a fourth installment takes longer to materialize (which suggests that franchise terminations are more likely after the third installment), but if the franchise can make it past the fourth installment, further extensions become more likely (James Bond and Star Trek are extreme examples of this). Changes in key product characteristics and inputs in later installments also help prolong the life of the franchise.

An interesting issue we leave for future work is attrition bias: we have not controlled for the endogeneity of the existence of the installment in the models of performance. In the cases of revenue and ROI, controlling for attrition bias would only strengthen our results: studios only make movies they expect to perform well, so if anything, installment effects in those models are biased upward. However, the impact of attrition bias on the other models is less clear. Testing for attrition bias is challenging in our context, because we do not observe an explicit franchise termination decision, and as a result, we cannot employ standard approaches that rely on a binary indicator of whether attrition has occurred. Developing and employing appropriate tests in this context is an interesting area for further research.

Notes

The domestic market includes the U.S., Canada, Puerto Rico and Guam (www.the-numbers.com/glossary.php).

Sources and definitions are discussed in Sect. 1. The low number of starts in recent years reflects the lack of time to observe sequels by the time of data collection (July 2014) and not the end of enthusiasm for franchises.

Our fixed-effect panel-data estimators control for a rich set of variables that cannot be measured directly but tend to remain relatively constant within the franchise: story lines, main cast and characters, the nature of the special effects, etc. In standard cross-sectional analyses of performance, there is no way to control for such factors. Standard cross-sectional analyses include a binary indicator for sequels; studies that do this include Prag and Casavant (1994), De Vany and Walls (1999), Ravid (1999), Ravid and Basuroy (2004), Ainslie et al. (2005), Basuroy et al. (2006), Brewer et al. (2009), Hennig-Thurau et al. (2009), Walls (2009), Moon et al. (2010), Gong et al. (2011), Dhar et al. (2012), Joshi and Mao (2012), Walls and McKenzie (2012), and Opitz and Hofmann (2014). Chisholm et al. (2015) review the literature. Only a few studies examine installment effects, and none do so using our fixed-effects approach with binary installment effects. Basuroy and Chatterjee (2008) include a count of the installment order in a model of domestic revenue, but their data includes only 11 sequels. Heath et al. (2015) include a count of the installment order in their models of revenue and ROI. Our analysis of changes in product characteristics is related to Sood and Dreze (2006), Hennig-Thurau et al. (2009) and Heath et al. (2015).

Using existing brand names to help launch new products is one of the most common product line expansion strategies; see Aaker and Keller (1990), Park et al. (1991), Keller and Aaker (1992), Reddy et al. (1994), Keller and Lehmann (2006), and Volckner and Sattler (2006). In the literature on motion picture economics, duration models have been used to analyze the length of the theatrical run, but not the decision to make a movie; see De Vany and Walls (1997), Nelson et al. (2001), Deuchert et al. (2005), Chisholm and Norman (2006) and McKenzie (2009).

We do not examine the decision of whether to market a franchise internationally (see Walls and McKenzie 2012), but this decision appears to be determined primarily by fixed franchise characteristics: in the cases we drop, the 2% cutoffs apply to the first movie most of the time and to one of the first two in all but three cases.

We focus on cumulative performance. Some prior research uses higher frequency data (such as weekly) to examine specific aspects of release strategies; key contributors include Krider and Weinberg (1998), Elberse and Eliashberg (2003), Dhar et al. (2012) and Walls and McKenzie (2012). Also, we do not examine performance within specific foreign countries; prior work that does so includes Neelamegham and Chintagunta (1999), Elberse and Eliashberg (2003), Craig et al. (2005), and Akdeniz and Talay (2013). We create the franchise-level genre and creative type variables in Table 2 using the genre and type of the first movie in the franchise.

Allowing multiples to vary by year is important; Moul (2016) summarizes how the box-office share of total revenue falls and then rises in the aggregate during the 2000s as DVDs diffuse and then are replaced by pay-per-view and streaming. Further, the domestic share of revenue has declined steadily in recent decades.

Peter Jackson, director of the Lord of the Rings and Hobbit films, is informative about how flexible studios are when converting source material to films: “Our idea then was to do The Hobbit as one movie and Lord of the Rings as two movies…. It’s not been a grand plan; It’s been a sort of a staggering, stumbling, lurching kind of a plan that we’ve ended up where we’ve ended up.” (Maclean’s, January 5, 2015). At the time of writing Jackson had directed three Lord of the Rings films and three Hobbit films.

Preliminary Hausman tests reject a restriction to random franchise effects. To implement the Hausman tests, we use auxiliary regressions with cluster-robust standard errors as described by Cameron and Trivedi (2010, p. 268) modified for an unbalanced panel.

Year effects are still important to include, because they capture any year-to-year macroeconomic, international, or industry-level effects that influence outcomes (including inflation). However, the year effects are just binary effects in the models; they are not the “period” in the panel. Calendar month effects control for seasonality.

Moon et al. (2010) find that sequels have lower critical assessments than original movies, but their analysis is cross-sectional. Our results are within-franchise estimates.

Including year effects in the model ensures that this effect is distinct from macro-level trends that have increased the foreign share of the box office over time. Domestic and foreign revenue were roughly equal in 2000 but the gap has been growing since then (Walls and McKenzie 2012). The year effects also ensure that the other effects we document (changes in initial theaters, for example) are not due to macro or industry-level trends.

Of course, these pre-determined variables are still not necessarily causal because studios might revise budgets, etc. in anticipation of impacts on outcomes. We lack useful instruments that would permit an instrumental variables analysis of every endogenous variable (a standard problem in analyzing motion picture performance). However, the controls are not our main focus; we are mainly assessing the robustness of the installment effects.

Heath et al. (2015) consider an aggregated measure of “innovation” that includes changes in actors, ratings, directors, and other characteristics. We distinguish between a key input (the director) and two key product characteristics (the lead actor and the rating). Basuroy and Chatterjee (2008) also consider the gap between installments, but their sample size is not sufficient to interact gap effects with installment effects as we do. The gap variables do not take on non-zero values until the referenced installment is reached.

The variable for installments 3 and higher is a count of how many changes have occurred, so the estimated coefficient applies to each change that occurs. Unreported analyses confirm that the most important distinction is between changes in installment 2 and changes that occur in later installments; estimating a separate coefficient for each installment does not yield additional significantly different effects.

John et al. (2017) find that particular directors impact performance in a positive way. Our results suggest that if these impacts are important in franchises, then directors tend to be replaced with others of similar quality.

It is also worth noting that the negative relationship might not hold when gaps are extremely short (under 1 year, for example). We do not have many observations of extremely short gaps between installments, so using the model to infer outcomes associated with such gaps is comparable to conducting an out-of-sample forecast.

In contrast, appropriate instruments are not available to sort out exogenous versus endogenous effects of all of the changes we consider in Table 5. For example, articles in Variety, Daily Variety and Hollywood Reporter suggest that studios are capable of predicting which rating they will obtain, and in some cases movies are modified post-production to ensure a particular rating. Thus, rating changes do not appear to be driven by exogenous forces.

Our results are also consistent with those of Han and Ravid (2016), who find important negative impacts of exogenous departures of stars in Broadway theater shows. Of course, in the case of movies (in contrast to Broadway shows), changes in the lead actor are typically accompanied by substantial changes in the storyline and are often part of an effort to reboot the franchise (Bohnenkamp et al. 2015). Thus, our estimates of lead-actor effects are unlikely to be attributable solely to the change in the actor; the effects are also due to the substantial changes in product characteristics compared to previous installments.

Due to space constraints and the availability of thorough textbook treatments (see Cameron and Trivedi (2005) and the Stata v14 manual), we do not provide more details on duration models; Eq. (5) (the accelerated failure time form of our model) is sufficient for the discussion that follows in the text. A log-logistic model allows for the empirical durations we observe (installments are most likely to be observed with a gap of 2–3 years; lower or higher gaps are less likely). Our main conclusions are robust to reasonable alternative specifications.

Considering the lags of other variables does not overturn this conclusion, so for brevity we have eliminated all other lags from the models we present.

The remaining effect we report—RT Audience—has an insignificant and economically small effect. Replacing RT Audience with RT Critic does not change this conclusion. The high correlation between the two RT scores (.73) makes distinguishing their effects challenging (see Basuroy et al. 2014), so we include only one of the two scores in the model.

There are many possible explanations for this finding. Domestic consumers might be more willing to watch first installments because of higher incomes or different tastes, and the greater availability of alternative entertainment options might make them less likely to consume sequels. Franchises might take more time to build an audience in foreign markets, and extensions may be more attractive to foreign consumers for cultural reasons (Monga and John 2007). Akdeniz and Talay (2013) find that the positive relationship between sequels and performance is weaker in countries with individualistic cultures. Their results are consistent with ours: U.S. consumers are among the most individualistic and move on to other entertainment products more readily.

References

Aaker, D. A., & Keller, K. L. (1990). Consumer evaluations of brand extensions. Journal of Marketing, 54(1), 27–41.

Ainslie, A., Dreze, X., & Zufryden, F. (2005). Modeling movie life cycles and market share. Marketing Science, 24(3), 508–517.

Akdeniz, M. B., & Talay, M. B. (2013). Cultural variations in the use of marketing signals: A multilevel analysis of the motion picture industry. Journal of the Academy of Marketing Science, 41, 601–624.

Amram, M. (2002). The value of film studios. Journal of Applied Corporate Finance, 15(2), 24–31.

Anderson, T. W., & Rubin, H. (1949). Estimation of the parameters of a single equation in a complete system of stochastic equations. Annals of Mathematical Statistics, 20, 46–63.

Basuroy, S., & Chatterjee, S. (2008). Fast and frequent: Investigating box office revenues of motion picture sequels. Journal of Business Research, 61, 798–803.

Basuroy, S., Desai, K. K., & Talukdar, D. (2006). An empirical investigation of signaling in the motion picture industry. Journal of Marketing Research, 43, 287–295.

Basuroy, S., Ravid, S. A., & Gretz, R. T. (2014). Pros vs. buzz—how relevant are experts in the internet age? Evidence from the motion pictures industry. University of Texas at San Antonio working paper.

Bohnenkamp, B., Knapp, A. K., Hennig-Thurau, T., & Schauerte, R. (2015). When does it make sense to do it again? An empirical investigation of contingency factors of movie remakes. Journal of Cultural Economics, 39(1), 15–41.

Brewer, S. M., Kelley, J. M., & Jozefowicz, J. J. (2009). A blueprint for success in the U.S. film industry. Applied Economics, 41, 589–606.

Cameron, A. C., & Trivedi, P. K. (2010). Microeconometrics using Stata (Revised ed.). College Station: Stata Press.

Cameron, A. C., & Trivedi, P. K. (2005). Microeconometrics: Methods and applications. Cambridge: Cambridge University Press.

Chisholm, D. (1997). Profit-sharing vs. fixed-payment contracts: Evidence from the motion pictures industry. Journal of Law Economics and Organization, 13(1), 169–201.

Chisholm, D. C., Fernandez-Blanco, V., Abraham Ravid, S., & David Walls, W. (2015). Economics of motion pictures: The state of the art. Journal of Cultural Economics, 39, 1–13.

Chisholm, D. C., & Norman, G. (2006). When to exit a product: Evidence from the U.S. motion-picture exhibition market. American Economic Review, 96(2), 57–61.

Craig, C. S., Greene, W. H., & Douglas, S. P. (2005). Culture matters: Consumer acceptance of U.S. films in foreign markets. Journal of International Marketing, 13(4), 80–103.

De Vany, A. S., & Walls, W. D. (1997). The market for motion pictures: Rank, revenue, and survival. Economic Inquiry, 35, 783–797.

De Vany, A. S., & Walls, W. D. (1999). Uncertainty in the movies: Does star power reduce the terror of the box office? Journal of Cultural Economics, 23, 285–318.

Deuchert, E., Adjamah, K., & Pauly, F. (2005). For oscar glory or oscar money? Journal of Cultural Economics, 29, 159–176.

Dhar, T., Sun, G., & Weinberg, C. B. (2012). The long-term box office performance of sequel movies. Marketing Letters, 23, 13–29.

Elberse, A., & Eliashberg, J. (2003). Sequentially released products in international markets: The case of motion pictures. Marketing Science, 22(3), 329–354.

Filson, D., Switzer, D., & Besocke, P. (2005). At the movies: The economics of exhibition contracts. Economic Inquiry, 43(2), 354–369.

Finlay, K., & Magnusson, L. M. (2009). Implementing weak-instrument robust tests for a general class of instrumental-variables models. The Stata Journal, 9(3), 398–421.

Gong, J. J., Van Der Stede, W. A., & Young, S. M. (2011). Real options in the motion picture industry: Evidence from film marketing and sequels. Contemporary Accounting Research, 28(5), 1438–1466.

Han, S. & Abraham Ravid, S. (2016). Actor replacement as a pseudo-natural experiment in the value of human capital—evidence from broadway shows. Yeshiva University Syms School of Business working paper.

Heath, T. B., Chatterjee, S., Basuroy, S., Hennig-Thurau, T., & Kocher, B. (2015). Innovation sequences over iterated offerings: A relative innovation, comfort, and stimulation framework of consumer responses. Journal of Marketing, 79(6), 71–93.

Hennig-Thurau, T., Houston, M. B., & Heitjans, T. (2009). Conceptualizing and measuring the monetary value of brand extensions: The case of motion pictures. Journal of Marketing, 73, 167–183.

John, K., Ravid, S. A., & Sunder, J. (2017). Managerial ability and success: Evidence from the career-paths of film directors. Journal of Corporate Finance, 44, 425–439.

Joshi, A., & Mao, H. (2012). Adapting to succeed? Leveraging the brand equity of best sellers to succeed at the box office. Journal of the Academy of Marketing Science, 40, 558–571.

Keller, K. L., & Aaker, D. A. (1992). The effects of sequential introductions of brand extensions. Journal of Marketing Research, 29, 35–50.

Keller, K. L., & Lehmann, D. R. (2006). Brands and branding: Research findings and future priorities. Marketing Science, 25(6), 740–759.

Krider, R. E., & Weinberg, C. B. (1998). Competitive dynamics and the introduction of new products: The motion picture timing game. Journal of Marketing Research, 35, 1–15.

McKenzie, J. (2009). Revealed word-of-mouth demand and adaptive supply: Survival of motion pictures at the Australian box office. Journal of Cultural Economics, 33(4), 279–299.

Monga, A. B., & John, D. R. (2007). Cultural differences in brand extension evaluation: The influence of analytic versus holistic thinking. Journal of Consumer Research, 33(4), 529–536.

Moon, S., Bergey, P. K., & Iacobucci, D. (2010). Dynamic effects among movie ratings, movie revenues, and viewer satisfaction. Journal of Marketing, 74, 108–121.

Moreshead, C. (2012). Hollywood is now making films for foreign markets, and their taste in movies is awful. Business Insider (18 September 2012). http://www.businessinsider.com/hollywood-is-making-films-for-foreign-markets-2012-9.

Moul, C. C. (2016). Movies. In J. W. Brock (Ed.), The structure of American industry (13th ed., pp. 166–188). Long Grove, IL: Waveland Press.

Neelamegham, R., & Chintagunta, P. (1999). A bayesian model to forecast new product introductions in domestic and international markets. Marketing Science, 18(2), 115–136.

Nelson, R. A., Donihue, M. R., Waldman, D. A., & Wheaton, C. (2001). What’s an oscar worth? Economic Inquiry, 39(1), 1–16.

Obst, L. (2013). Sleepless in Hollywood: Tales from the new abnormal in the movie business. New York: Simon & Schuster.

Opitz, C., & Hofmann, K. H. (2014). Adverse selection and moral hazard in equity partnerships: Evidence from Hollywood’s slate of financing agreements. Journal of Economics & Management Strategy, 23(4), 811–838.

Palia, D., Ravid, S. A., & Reisel, N. (2008). Choosing to cofinance: Analysis of project-specific alliances in the movie industry. Review of Financial Studies, 21(2), 483–511.

Park, C. W., Milberg, S., & Lawson, R. (1991). Evaluation of brand extensions: The role of product feature similarity and brand concept consistency. Journal of Consumer Research, 18(2), 185–193.

Prag, J., & Casavant, J. (1994). An empirical study of the determinants of revenues and marketing expenditures in the motion pictures industry. Journal of Cultural Economics, 18, 217–235.

Putsis, W. P., Jr., & Bayus, B. L. (2001). An empirical analysis of firms’ product line decisions. Journal of Marketing Research, 38, 110–118.

Ravid, S. A. (1999). Information, blockbusters and stars: A study of the film industry. Journal of Business, 72(4), 463–492.

Ravid, S. A., & Basuroy, S. (2004). Managerial objectives, the r-rating puzzle, and the production of violent films. Journal of Business, 77(2 (pt2)), S155–S192.

Reddy, S. K., Holak, S. L., & Bhat, S. (1994). To extend or not to extend: Success determinants of line extensions. Journal of Marketing Research, 31(2), 243–262.

Richwine, L. (2014). Summer movie sequels equal profits for Hollywood studios. Los Angeles Times (2 April 2014). www.reuters.com/article/2014/04/02/film-sequels-idUSL1N0MP27420140402, downloaded July 7, 2014.

Sood, S., & Dreze, X. (2006). Brand extensions of experiential goods: Movie sequel evaluations. Journal of Consumer Research, 33, 352–360.

Staiger, D., & Stock, J. H. (1997). instrumental variables regression with weak instruments. Econometrica, 65, 557–586.

Volckner, F., & Sattler, H. (2006). Drivers of brand extension success. Journal of Marketing, 70, 18–34.

Walls, W. D. (2009). Screen wars, star wars, and sequels: Nonparametric reanalysis of movie profitability. Empirical Economics, 37, 447–461.

Walls, W. D., & McKenzie, J. (2012). The changing role of hollywood in the global movie market. Journal of Media Economics, 25, 198–219.

Weinstein, M. (1998). Profit sharing contracts in Hollywood: Evolution and analysis. Journal of Legal Studies, 27, 67–112.

Acknowledgements

Filson thanks the Lowe Institute of Political Economy and the Center for Innovation and Entrepreneurship at Claremont McKenna College for financial support. We thank Serkan Ozbeklik for useful conversations, and we thank Palin Liu, Jiyeon Kim and Eric Filson for research assistance. We thank two anonymous referees along with Richard Gretz, Tim Heath, Thorsten Hennig-Thurau, Avri Ravid and participants at the 2015 Mallen Motion Picture Economics Conference at Yeshiva University for comments and suggestions. We also benefited from feedback from seminar participants at Claremont Graduate University and Claremont McKenna College.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare they have no conflicts of interest.

Rights and permissions

About this article

Cite this article

Filson, D., Havlicek, J.H. The performance of global film franchises: installment effects and extension decisions. J Cult Econ 42, 447–467 (2018). https://doi.org/10.1007/s10824-018-9316-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10824-018-9316-6