Abstract

Purpose

Infertility affects one in eight women in the USA. In vitro fertilization (IVF) is an effective but costly treatment that lacks uniform insurance coverage. We evaluated the current insurance coverage landscape for IVF in America.

Methods

We conducted a cross-sectional analysis of 58 insurance companies with the greatest state enrollment and market share, calculated to represent the majority of Americans with health insurance. Individual companies were evaluated for a publicly available policy on IVF services by web-based search, telephone interview, or email to the insurer. Coverage status, required criteria, qualifying risk factors, and contraindications to coverage were extracted from available policies.

Results

Fifty-one (88%) of the fifty-eight companies had a policy for IVF services. Thirty-five (69%) of these policies extended coverage. Case-by-case coverage was stated in seven policies (14%), while coverage was denied in the remaining nine (18%). The most common criterion to receive coverage was a documented diagnosis of infertility (n = 23, 66%), followed by care from a reproductive endocrinologist (n = 9, 26%). Twenty-three (45%) of the companies with a policy had at least one contraindication to coverage. Three companies (6%) limited the number of IVF cycles to be covered, capping payments after 3–4 lifetime cycles.

Conclusion

Most Americans with health insurance are provided a public policy regarding IVF. However, there is great variation in coverage and requirements to receive coverage between insurers. Coupled with inconsistencies in state-level mandates and available choices for employer-sponsored plans, this may limit coverage of IVF services and, therefore, access to infertility treatment.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The availability and utilization of IVF has increased substantially over the last few decades, now accounting for the conception of 1.9% of all live births in the USA [1, 2]. As the average number of children in the American household declines and the average maternal age of conception rises, it is predicted that the demand for IVF and other forms of assisted reproduction will continue to increase in years to come [1, 3].

Despite its popularity, IVF may not be accessible to a large subset of the American population due to cost. [4, 5] The average out-of-pocket expense for a single IVF cycle in the USA is between $12,000 and $14,000. This does not factor in the cost of IVF-induced delivery, with the average bill approximated at $56,419. [6,7,8] Furthermore, multiple cycles of IVF are often required to achieve pregnancy, creating an even greater financial burden. [9] Without insurance coverage, the patient would be responsible for paying the total cost of this service, representing a barrier to receiving fertility care. Given the state of privatized health insurance in the USA, it is therefore unsurprising that prior studies described a positive correlation between insurance coverage status and IVF utilization [10,11,12].

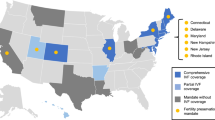

Nineteen states have issued regulations for employers requiring companies to provide access to insurance plans that cover fertility treatments. In addition to the terms of these regulations varying significantly for each state, majority of the regulations only apply to employers that match certain inclusion criteria. Furthermore, these regulations can be nonspecific in the determination of which fertility treatments are required, leaving the coverage status of IVF ambiguous. [13, 14] While prior studies have evaluated for differences in required coverage instituted by these state mandates, there has yet to be a comprehensive review of IVF coverage at the level of individual insurance companies. This study is the first of its kind to evaluate American insurance companies for the variability and availability of coverage for IVF services, along with the criteria that may be necessary to ultimately qualify for reimbursement.

Materials and methods

This study was exempt from the Institutional Review Board approval. Fifty-eight US health insurance companies, including national coverage determinants for Medicare and Medicaid, were evaluated in November and December of 2020 as part of a cross-sectional analysis. In an effort to represent the majority of Americans with health insurance, insurance providers were first selected based on the top 50 companies with the greatest market share in the USA [15]. These 50 insurers were compared to a list of insurance companies with the highest enrollment per state [16]. This led to an additional eight insurance companies, not already collected due to greatest market share, to undergo evaluation.

A web-based search of individual insurance companies was completed to identify whether the insurer had a publicly available policy on IVF. If no policy on IVF was found by web-based search, direct contact with the company was made by phone or email to confirm the presence or absence of a public policy. At this point, if no publicly available policy could be confirmed, the insurance company was deemed to not have a public policy, though provide coverage on a case-by-case basis for the purposes of this study. This was because although a public policy could not be identified, we cannot rule out that these companies may cover this treatment. Identified policies were categorized into three groups based on the available coverage status: not covered, covered on a case-by-case basis, and covered with or without criteria. Insurance companies were placed into the covered category if any of the available plans would provide coverage of IVF services, either with no criteria or criteria that were universal to receive coverage. These companies were further classified according to whether coverage was provided for all plans under that insurer, or coverage varied depending on the specific insurance company plan. Case-by-case basis status was defined as a policy that did not explicitly state that the company would grant or deny coverage but rather each patient must undergo an individualized review of each patient’s medical history before a decision would be made. This was oftentimes accompanied by a statement that read coverage would be provided on a “case-by-case basis.”

If present, criteria that were required for coverage were extracted from the insurance company policy. Any contraindications to coverage were separately extracted. There were certain medical conditions mentioned in policies that were not required, though increased the likelihood of an individual receiving coverage by this company. These conditions or factors were collected and categorized accordingly. Data was compiled and analyzed in Microsoft Excel (Microsoft Corp., Redmond, WA). Categorical variables were compared using chi-squared test with a 95% confidence interval and significance set to p < 0.050.

Results

IVF coverage

Of the 58 companies evaluated in this study, 51 (88%) had a publicly available policy on IVF services (Fig. 1). Thirty-five (69%) of the fifty-one insurers with a public policy provided coverage for IVF services, which was significantly more than the number of companies that explicitly denied coverage (n = 9, 18%, p < 0.001). The remaining seven insurers with a policy (14%) stated that coverage would be provided on a case-by-case basis. Of the companies that offered coverage of IVF services, 12 insurers (34%) extended this coverage to all plans, while 23 (66%) would have reimbursement vary according to the type of plan. Three (9%) of the thirty-five companies that provided reimbursement had a limit on the number of treatments that would be covered, with a maximum of either three or four lifetime cycles.

Criteria required for IVF coverage

Twenty-six policies (74%) had criteria that were required to receive coverage (Table 1). Of the companies that provided coverage, the most common criterion was a documented diagnosis of infertility (n = 23, 66%). This criterion was further specified by two of these companies (9%) as having a diagnosis of infertility for at least 2 years (Arkansas BCBS, CareFirst). Physician care or consultation was required in 17 (49%) of policies that provided coverage, with the most common specification requiring care from a reproduction endocrinologist before reimbursement would be considered (n = 9, 26%). One company (11%) had a further specification for the care provided by a reproductive endocrinologist, stating that for the duration of care from this specialist, at least 25 oocyte aspirations should be performed per calendar year (Anthem Blue Cross).

Qualifying conditions and risk factors

Sixty-six percent (n = 23) of companies with a policy included one or more medical risk factors. Ten total medical risk factors were identified throughout these policies (Table 2). A qualifying risk factor is not a requirement, though if present in a patient’s medical history, may increase their eligibility for coverage. Among the most common risk factors was a diagnosis of endometriosis, present in 14 policies (40%), with approximately one-third (29%) of these company policies requiring a specific severity of endometriosis to qualify for reimbursement. Two companies (6%) required a diagnosis of moderate to severe endometriosis (stage 3–4), while eight companies (23%) would only consider coverage of IVF for endometriosis if the disease was classified as severe (stage 4). Risk factors cited as frequently as endometriosis in policies were male factor infertility (n = 14, 40%) and tubal factor infertility (n = 14, 40%).

IVF contraindications

Of those insurers with a policy, 23 companies (45%) had criteria that were contraindications to receiving coverage for IVF services. Six total disqualifying criteria were identified (Table 3). The most common criterion that would result in the denial of coverage was infertility due to voluntary sterilization, included in policies significantly more often than the remaining five criteria (p < 0.001). Interestingly, one company (Arkansas BCBS) would deny coverage once the individual had three live births by any means within their lifetime.

Discussion

The majority of Americans with health insurance are provided a publicly available policy on IVF services. While approximately 70% of insurance companies with a policy offered coverage for IVF services, only one-third were consistent in providing this coverage throughout all available plans. Furthermore, three-quarters of all insurers that offered coverage for IVF services had criteria to be met before coverage would be provided. These criteria varied significantly between company policies, leaving the true coverage status of a company ambiguous. Limiting coverage to certain plans, along with numerous and diverse criteria required for coverage, may create an artificial barrier in receiving care.

Up to 70% of insurance companies with a publicly available policy on IVF services were found to extend some degree of coverage in one or more of their available plans. According to Mercer’s 2021 National Survey of Employer-Sponsored Health Plans, only 27–42% of employer respondents provided access to insurance plans that may cover IVF services [17]. From our study, there seems to be a disconnect between the number of insurance companies that provided fertility benefits determined by our analysis and the amount of employer-sponsored health plans that are incorporating coverage for IVF services identified in that national survey. With more than 155 million non-elderly Americans receiving healthcare benefits through employer-sponsored partnerships, lack of access to plans that provide coverage may hinder a large subset of the US population from seeking proper care for infertility. [18] Efforts to expand IVF coverage in the USA could therefore be focused at the level of the employer, such as offering benefits or incentives to companies that provide access to health insurance plans covering fertility services [3]. The recent development of direct fertility benefit providers such as Progyny and Carrot Fertility represents a new direction for employer sponsored coverage. Employers can now choose to add these specific fertility benefits to their existing health care plans, which allows the employers to provide coverage for fertility services without having to change their umbrella insurer [3].

State level mandates aimed to regulate employer-sponsored coverage for infertility services have been established in the past with varying levels of success. A study by Kawwass et al. found that despite 19 states having mandates, there were great inconsistencies in the extent of covered services between the states, along with multiple circumstances that do not hold employers accountable for following these regulations. [13] For instance, these mandates do not apply to health plans administered and funded directly by employers, with this type of coverage provided to 61% of workers with employer-sponsored health insurance. [13] In states such as California, Connecticut, and Maryland, there are exemptions from providing coverage for employers with certain religious affiliations. [13] Therefore, even in states with active mandates on infertility coverage, appropriate and equal access to care is not guaranteed. Furthermore, only one-third of the insurance companies in our study offered coverage for IVF services regardless of the company plan. Collectively with the absence of uniformity in state mandates and the decision by employers to not include plans with fertility benefits, coverage of IVF services being dependent on the type of company plan may be yet another barrier to receiving reimbursement for infertility care.

Seventy-four percent of insurance companies that offer coverage of IVF services had one or more criteria to be met before coverage would be fully considered. Inconsistencies in these criteria between company policies may only further contribute to gaps in infertility care. In our study, over a quarter of the policies that provided coverage for IVF services required current patient care from a board-certified reproductive endocrinologist. A handful of companies also required consultations with a urologist for investigation of male factor fertility. In 2015, 16 states had five or fewer practicing reproductive endocrinologists that were accredited by the Society for Assisted Reproductive Technology. [19] Furthermore, the highest number of male reproductive specialists is found in states that have mandated infertility coverage or in places with greater average medium incomes. This is also true for the number of available IVF centers. [19] Low concentrations of both specialists and centers providing IVF services in areas without state-level mandates or with lower average incomes may disproportionally affect those from rural or underserved areas. Individuals from a low socioeconomic class that are unable to travel outside of their geographic radius for may also be at a disadvantage to receiving care. High out-of-pocket costs of continued care from specialists and multiple cycles of IVF will only further discourage these patients from seeking infertility treatment.

Three of the insurance companies evaluated in this study chose to limit coverage to 3–4 cycles per lifetime. Similar limits can be seen in some of the state’s infertility coverage mandates such as in Hawaii, which does not require coverage exceeding one IVF cycle attempt. [13] In Arkansas, the state mandate only guarantees coverage until a lifetime maximum of $15,000 is reached, despite the average cost of a single IVF cycle estimated to be $12,400 in the USA. [6, 11] The 2021 National Survey of Employer-Sponsored Health Plans found that 88% of employer respondents placed a limit on infertility treatment coverage, with the most common type of limitation being a lifetime maximum dollar amount averaged at $16,250. [17] Successful live birth rate is approximately 30% after one IVF cycle, which increases to a success rate of 64% when at least six cycles are performed. [9, 21, 22] Some experts agree that multiple cycles of IVF may be cost-effective and necessary for specific causes of infertility, including severe tubal factor infertility and endometriosis. [23] Additional studies suggest the cost-effectiveness of IVF may also be highly influenced by maternal age, recommending against the restriction of funding to less than three cycles in younger women. [22, 24] Restrictions on the number of cycles or total cost of service may be limiting individuals from being able to afford the cost of continued treatment. These restrictions could also lead to dangerous practices including the transfer of multiple embryos at once, increasing the health risks and therefore health care costs for both the mother and baby in the long run [3, 17].

Limitations of this study include the cross-sectional nature of the study design, which cannot account for changes in policies that have occurred since original data collection and publication. This study is also unable to account for discrepancies between a company’s publicly recorded coverage status and their true coverage practices, including policies for IVF that were private and not made publicly available for review. Since we could not rule out coverage or the existence of any company policy for those companies without publicly available information, these companies were categorized into the group providing coverage on a case-by-case basis. Absence of a publicly available policy may have also skewed our results, with the possibility of over- or under-estimating the true coverage landscape in the USA. Our study was unable to address geographical differences in national insurance coverage due to many of the larger companies extending coverage throughout multiple states. In many cases, company policies did not specify differences in coverage between plan types (e.g., PPO, HMO), making us unable to uniformly collect this information. Additional studies are also required to draw conclusions on how state mandates and employer-level coverage play into the overarching policies of large insurance companies. Limiting the scope of our paper to IVF services only does not consider the cost of lab work, imaging, conservative treatments, and preliminary procedures that may be performed prior to IVF. Next, the authors of this study plan to evaluate the insurance coverage of these variables and how they could influence access to fertility care. Coverage of alternative fertility treatments to IVF will also be determined in future studies. The main strength of this paper lies in the large number and comprehensive list of US insurance companies that were evaluated, calculated to represent the majority of Americans with health insurance. Future studies should evaluate rates of IVF in those who are uninsured or pay out-of-pocket for these services.

Conclusion

Most Americans with health insurance are provided a company policy regarding IVF services. However, there is great variation in the extension of coverage and requirements to receive coverage between insurance providers. Coupled with the variability in state-level mandates, these inconsistencies may disproportionally affect individuals with a certain insurance status or plan under an insurer, socioeconomic status, and geographic location. Greater uniformity between policies may address some of these healthcare inequalities and improve coverage of IVF services.

References

Kushnir VA, Smith GD, Adashi EY. The future of IVF: the new normal in human reproduction. Reprod Sci. 2022;29(3):849–56. https://doi.org/10.1007/s43032-021-00829-3.

Eskew AM, Jungheim ES. A history of developments to improve in vitro fertilization. Mo Med. 2017;114(3):156–9.

van de Wiel L. Disrupting the biological clock: fertility benefits, egg freezing and proactive fertility management. Reprod Biomed Soc Online. 2022;14:239–50. https://doi.org/10.1016/j.rbms.2021.11.004.

Blakemore JK, Maxwell SM, Hodes-Wertz B, Goldman KN. Access to infertility care in a low-resource setting: bridging the gap through resident and fellow education in a New York City public hospital. J Assist Reprod Genet. 2020;37(7):1545–52. https://doi.org/10.1007/s10815-020-01781-y.

Schmidt L. Effects of infertility insurance mandates on fertility. J Health Econ. 2007;26(3):431–46. https://doi.org/10.1016/j.jhealeco.2006.10.012.

Patient Fact Sheet. Frequently Asked Questions about Infertility. Published online: American Society for Reproductive Medicine; 2003.

Collins J. Cost-effectiveness of in vitro fertilization. Semin Reprod Med. 2001;19(3):279–89. https://doi.org/10.1055/s-2001-18047.

Conrad M, Grifo J. How much does IVF cost? Forbes Health. Published June 22, 2022. https://www.forbes.com/health/family/how-much-does-ivf-cost/. Accessed 7 Nov 2022.

Smith ADAC, Tilling K, Nelson SM, Lawlor DA. Live-birth rate associated with repeat in vitro fertilization treatment cycles. JAMA. 2015;314(24):2654. https://doi.org/10.1001/jama.2015.17296.

Dupree JM, Levinson Z, Kelley AS, et al. Provision of insurance coverage for IVF by a large employer and changes in IVF rates among health plan enrollees. JAMA. 2019;322(19):1920. https://doi.org/10.1001/jama.2019.16055.

Jungheim ES, Leung MYM, Macones GA, Odem RR, Pollack LM, Hamilton BH. In vitro fertilization insurance coverage and chances of a live birth. JAMA. 2017;317(12):1273–5. https://doi.org/10.1001/jama.2017.0727.

Jain T, Harlow BL, Hornstein MD. Insurance coverage and outcomes of in vitro fertilization. N Engl J Med. 2002;347(9):661–6. https://doi.org/10.1056/NEJMsa013491.

Kawwass JF, Penzias AS, Adashi EY. Fertility-a human right worthy of mandated insurance coverage: the evolution, limitations, and future of access to care. Fertil Steril. 2021;115(1):29–42. https://doi.org/10.1016/j.fertnstert.2020.09.155.

Weigel G, Ranji U, Long M, Salganicoff A. Coverage and use of fertility services in the U. S. Published online September 15, 2020. https://www.kff.org/womens-health-policy/issue-brief/coverage-and-use-of-fertility-services-in-the-u-s/. Accessed 7 Nov 2022.

National Association of Insurance Commissioners. 2017 Market share reports for the top 125 accident and health insurance groups and companies by state and countrywide. https://content.naic.org/sites/default/files/publication-msr-hb-accident-health.pdf. Accessed 10 June 2020.

Market Share and Enrollment of Largest Three Insurers – Individual Market | KFF. Henry J Kaiser Foundation. https://www.kff.org/private-insurance/state-indicator/market-share-and-enrollment-of-largest-three-insurers-individual-market/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D. Accessed 10 June 2020.

2021 Survey on Fertility Benefits. Mercer. Published 2021. https://resolve.org/wp-content/uploads/2022/01/2021-Fertility-Survey-Report-Final.pdf. Accessed 6 Nov 2022.

Health Insurance Coverage of the Nonelderly. KFF. https://www.kff.org/other/state-indicator/nonelderly-0-64/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D. Accessed 6 Nov 2022.

Ethics Committee of the American Society for Reproductive Medicine. Disparities in access to effective treatment for infertility in the United States: an Ethics Committee opinion. Fertil Steril. 2015;104(5):1104–10. https://doi.org/10.1016/j.fertnstert.2015.07.1139.

Dobbs, State Health Officer of the Mississippi department of health, et al. v. Jackson Women’s Health Organization et al. 597 US 1–66 (2022). Available at: supremecourt.gov. Accessed 7 Aug 2022.

National Summary Report: Live birth rate per intended egg retrieval. Society for Assisted Reproductive Technology. Published 2019. https://www.sartcorsonline.com/rptCSR_PublicMultYear.aspx?reportingYear=2019. Accessed 6 Nov 2022.

Stewart LM, Holman CDJ, Hart R, Finn J, Mai Q, Preen DB. How effective is in vitro fertilization, and how can it be improved? Fertil Steril. 2011;95(5):1677–83. https://doi.org/10.1016/j.fertnstert.2011.01.130.

Philips Z, Barraza-Llorens M, Posnett J. Evaluation of the relative cost-effectiveness of treatments for infertility in the UK. Hum Reprod. 2000;15(1):95–106. https://doi.org/10.1093/humrep/15.1.95.

Griffiths A, Dyer SM, Lord SJ, Pardy C, Fraser IS, Eckermann S. A cost-effectiveness analysis of in-vitro fertilization by maternal age and number of treatment attempts. Hum Reprod. 2010;25(4):924–31. https://doi.org/10.1093/humrep/dep418.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ha, M., Drees, A., Myers, M. et al. In vitro fertilization: a cross-sectional analysis of 58 US insurance companies. J Assist Reprod Genet 40, 581–587 (2023). https://doi.org/10.1007/s10815-022-02697-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10815-022-02697-5