Abstract

This paper provides empirical evidence of the existence of a long-run causal relationship between GDP and health care expenditures, for a group of Latin American and the Caribbean countries and for OECD countries for the period 1995–2014. We estimated the income elasticity of health expenditure to be equal to unity for both groups of countries, that is, health care in Latin American and OECD countries is a necessity rather than a luxury. We did not find evidence of a causal effect in the opposite direction, i.e. from changes in health expenditure to GDP. We present conclusive evidence of the cross-country dependence of the analyzed series, and consequently we used panel unit root tests, panel cointegration tests, and long-run estimates that are robust to such dependence. Specifically, we use the CIPS panel unit root test and the panel Common Correlated Effects estimator. We also show that the results obtained by mistakenly using methods that assume cross-section independence are unstable.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Total health care expenditures (HE) as a percentage of Gross Domestic Product (GDP) has increased in almost all regions of the world. Measured as a percentage of GDP and averaged over 192 countries, HE has increased from 5.8% in 1995 to 6.8% in 2014.Footnote 1 This increase can be seen among developed countries, such as the members of the Organization for Economic Co-operation and Development (OECD), as well as Latin American (LA) countries, most of which are categorized as developing economies.Footnote 2 However, there are clear differences in the amount of resources each country expends on health care, with higher percentages of GDP assigned to HE in richer countries. OECD countries had an average ratio of HE to GDP of 9.3% in 2014, while the figure in LA was 6.8%.Footnote 3 Among OECD countries the current discussion is related to how to contain HE, while in LA countries increases in HE are seen as positive. International institutions like the Pan American Health Organization include among their goals and strategies increasing HE as this may guarantee the crucial goal of achieving universal health care coverage in developing countries. This objective is formulated under the premise of a positive and significant correlation between HE and GDP.

There is extensive literature that empirically documents the long-run relationship between GDP and HE, mostly using data on OECD countries. This is expected given that as income levels rise, citizens demand improved quality of life, including wider access to high quality health care, which they can also afford. There is almost no such evidence on developing countries and for specific regions like Latin America. Should we expect a different result in LA from that in OECD countries? On the one hand, if health care is provided to obtain a higher level of well being in the sense that it is intended to fulfill a need, it can be expected that in poorer countries the income elasticity of HE would be lower than in richer countries.Footnote 4 On the other hand, if a country grows more rapidly and has more need to undertake health care related reforms, as is the case for LA countries compared with OECD members, we can expect changes in GDP will have more impact on HE in developing countries.Footnote 5 Hence, the overall effect could go in either direction: the HE income elasticity could be stronger or weaker in LA than in OECD countries.

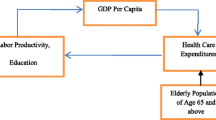

It may also be the case that changes in HE have long-term effects on GDP. Higher levels of HE in a country, if reflected in a healthier population, may increase the productivity of the work force and, in turn, improve GDP. The empirical literature on OECD countries does not yield evidence in this direction on the causality between HE and GDP. The lack of effect may be because a long period of time is needed before improvements in labor productivity become evident.

The simultaneity in the relationship between HE and GDP poses a challenge to quantify it empirically. Another methodological aspect that has to be considered when using time series for the estimation is the non-stationarity of the series, which makes cointegration techniques suitable. A third methodological concern related to the use of panels of countries over time is the potential cross-country dependence of the series. Several authors have recently made important methodological contributions to accommodate cross-section dependence to the traditional tools used in panel cointegration analysis.

In this paper we provide empirical evidence for the existence of a long-run relationship between HE and GDP for a group of Latin American and the Caribbean countries (LA), and compare the results to those obtained for OECD countries. We do so using a set of panel unit root and panel cointegration tests, as well as long-run estimators that are robust to the presence of cross-section dependence.

We estimated unitary income elasticity of HE for both groups of countries analyzed, that is, we found evidence that HE is a necessity as opposed to a luxury. In line with previous results, we did not find a long-run causal effect from HE to GDP. Additionally, we present evidence supporting the hypothesis of cross-section dependence in LA and OECD, and show that the use of methods that are not robust to this feature of the data leads to inconclusive results.

The paper is organized as follows. In “Previous empirical evidence” section we review the existing empirical literature on the long-run relationship between HE and GDP. The empirical model and the methodology are outlined in “Methodology” section. “Data” section presents sources of data and descriptive statistics of the main variables. In “Results” section we discuss the results and provide evidence of their robustness. Final section presents the “Conclusions”.

Previous empirical evidence

The empirical literature devoted to estimating the long-run relationship between HE and GDP has traditionally focused on a demand function approach that models the HE income elasticity with data on OECD countries. Applying unit root and cointegration tests to individual OECD member countries in different time periods over the years 1960 to 1993, Hansen and King (1996) found no evidence of a cointegrating causal relationship between GDP and HE, while Roberts (2000) found such a relationship, and Blomqvist and Carter (1997) found heterogeneous results depending on particular characteristics of the countries.Footnote 6

With the development of unit root and cointegration techniques specifically applied to panel data, several authors have studied the long-run relationship between HE and GDP using panels of OECD countries with different sample sizes and approximately 20 years of data, ranging from 1960 to 1990. McCoskey and Selden (1998) concluded that the series are stationary, a result found also in Lago-Peñas et al. (2013), in which the authors estimated the HE income elasticity to be 0.3 in the short run and 0.7 in the long-run. In contrast, Gerdtham and Löthgren (2000), Gerdtham and Löthgren (2002), Clemente et al. (2004), and Dreger and Reimers (2005) found evidence of the non-stationarity of the series, and agreed on the existence of a cointegrating relationship between HE and GDP. Dreger and Reimers (2005) estimated unitary HE income elasticity.Footnote 7

The tests and estimators used until now have been criticized for being based on the unrealistic assumption of cross-country independence. Following new methodological proposals to test and estimate cointegrating relationships for cross-sectional dependent observations, and using OECD data from 1971 to 2004, Baltagi and Moscone (2010) estimated HE income elasticity equal to 0.446. Narayan et al. (2011) also found evidence of a cointegrating causal relationship between GDP and HE, while French (2012) found evidence of long-run causal relationships between HE and GDP in both directions.Footnote 8 Halıcı-Tülüce et al. (2016) show a positive effect of public HE on GDP, while they found a negative effect of private HE on GDP, for a panel of low-income and a panel of high-income countries.Footnote 9

Papers focused on developing countries are scarce. Using Fix Effects and Instrumental Variable estimators Farag et al. (2012) obtained an income elasticity of HE below one for 173 developed and developing countries in the period 1995–2006, and found that the elasticity in low income countries is lower than it is in high income countries. Using similar data and method Ke et al. (2011) found a positive relationship between GDP and HE. Regrettably, these authors did not discuss the stationarity of the data, a requisite for the methodology applied in their work. More recently, Kouassi et al. (2018) obtained an income elasticity of HE below one for 14 Southern African Development Community member countries over the period 1995–2012, using heterogeneous panel data model with cross sectionally correlated errors.

To our knowledge, only one paper has used cointegration techniques on a group of LA countries, but it did so to address a different question, namely how health status, measured by life expectancy, affects income. This work by Mayer (2001) found evidence of a long-term conditional Granger causality between health status and income using a panel of 18 LA countries with data from 1975 to 1990.

Methodology

We use the following linear heterogeneous panel regression model to study the long-run relationship between health care expenditures (HE) and GDP:

where \(he_{it}\) is the (natural logarithm of) per capita health care expenditures in the ith country at time t, \(gdp_{it}\) is the (natural logarithm of) per capita gross domestic product, and \(u_{it}\) is an error term. The parameter \(\alpha _{i}\) is a country-specific intercept, and \(\beta _{i}\), the crucial parameter in our analysis, measures the income elasticity of health care expenditures in country i.

To provide evidence of the existence of a long-run relationship between health care expenditures and GDP in a panel of countries, we first established whether the variables of interest present a unit root. Secondly, we tested the existence of a cointegrating relationship, and finally, we estimated Vector Error Correction (VEC) models to confirm the existence and study the direction of the long-run relationship of interest.

So called “first generation” panel cointegration techniques were developed under the assumption that there is independence across countries, that is, the error terms \(u_{it}\) in equation (1) are not correlated across individual units i. There are a variety of panel unit root tests that operate under the premise of cross-section independence such as those developed by Breitung (2001), Breitung and Das (2005), Choi (2001), Hadri (2000), Harris and Tzavalis (1999), Im et al. (2003), and Levin et al. (2002). Once the non-stationarity of the series had been verified, and checked that all have the same integrated order, the analysis continued with the set of panel cointegration tests developed by Pedroni (1999). An important limitation to this methodology is the validity of the hypothesis of independence of shocks that affect health care expenditures across countries. Cross-country dependence could lead to significant size distortion in the panel unit root tests. As with most macro series, the independence assumption is difficult to sustain. In our time frame a concern for cross-country dependence emerged as a consequence of the 2008 financial crisis, which may have had heterogeneous impacts across countries.

Following this critique, the methodological literature provided a solution in the form of the “second-generation” panel cointegration techniques. We followed this line of panel cointegration literature by first testing the hypothesis of cross-section dependence, and then estimating the long-run relationship of interest by applying unit root tests, cointegration tests, and computing VEC models estimates that are robust to the existence of such dependence. Additionally, we compared tests and estimation results obtained using first and second-generation methods to present further evidence of the existence and consequences of the cross-country dependence in the group of analyzed countries.

Since first generation panel cointegration methods are well known and have been thoroughly described in articles and textbooks such as Baltagi (2008), we will describe the second-generation methods in the context of our study.

Cross-section dependence test

Let \(\rho _{ij}\) be the time series correlation between country i and country j of the variable he (and gdp). Then, the Pesaran (2004) statistic to contrast the null hypothesis of cross-section independence is:

where \(T_{ij}\) is the number of observations used to compute the correlation coefficient.

The CD statistic has a standard normal distribution under the null hypothesis of cross-section independence.

In our study, we computed \(30 \times 29\) correlations across LA countries, and \(35\times 34\) across OECD countries.

CIPS panel unit root test

Pesaran (2007) proposed testing the null hypothesis that all the panels contain a unit root, in a Dickey Fuller regression augmented with the cross-section average of lagged levels and first-differences of the individual series as proxies for the unobserved common factors that may produce cross-country dependence. The test implies two steps: first the separate estimation of cross-sectionally augmented Dickey Fuller (CADF) regressions for each country, and second the combination of individual unit root tests.

The CADF regression is:

where \(y_{it}\) stands for he and gdp, and \(\overline{y}_{t}=N^{-1} \sum _{i=1}^N {y}_{it}\).

The null hypothesis that all series contain a unit root, \(H_0: b_i=0\) for all i, is contrasted against the alternative hypothesis that at least one of the individual series in the panel is stationary, \(H_1: b_i<0\) for at least one i, using the following statistic:

where \(\tilde{t}_i\) is the ordinary least squares t-ratio of \(b_i\). The critical values for the CIPS test are given in Pesaran (2007).

Dynamic OLS and common correlated effects methods

There are to alternatives to estimate a long-run relationship with cointegrated panel data while allowing for the potential existence of cross-country correlation, one is Dynamic OLS (DOLS) using cross-sectionally demeaned data and the other is Common Correlated Effects (CCE) estimators.

Chen et al. (1999) and Kao and Chiang (2000) studied the asymptotic and finite sample properties of the DOLS estimator applied to panel data. Both articles concluded that the DOLS estimator proposed by Stock and Watson (1993) is super consistent under cointegration, even in models that include endogenous covariates, and that DOLS outperforms OLS and Fully Modified OLS estimators when applied to small samples. Pedroni (2001) introduced the between-dimension, group-mean panel DOLS estimator, which has the advantages over the within dimension DOLS estimator of allowing for the presence of heterogeneous cointegrating relationships and improved small sample performance.

In our study, the DOLS regression is:

where we choose \(K_i=1\) for all i, as we have a relatively short time period (T) in our panels.

Let \(\hat{\beta }_i\) be the OLS estimator of regression (2) and \(t_{\hat{\beta }_i}\) the corresponding t-statistic, obtained using country i data. The DOLS estimator is simply:

and the t-statistic is:

where \(t_{\hat{\beta }}\) is asymptotically distributed as a standard normal. The DOLS estimator was proposed under the assumption of cross-section independence, but applying the estimator to demeaned data it accommodates for cross-country dependence given by an unobserved time-specific factor common to all the countries in the panel.

A more flexible treatment of cross-country dependence is given in the CCE estimator proposed by Pesaran (2006). In our study, the CCE regression is:

This equation is the empirical counterpart of model (1) assuming that \(u_{it} = g(i)*f(t) + e_{it}\), where g(i) is a heterogeneous factor loading, f(t) is an unobserved common factor loading, and the error, \(e_{it}\), is iid. In the empirical model, the CCE regression, the cross-sectional averages \( \overline{he}_{t}\) and \(\overline{gdp}_{t}\) are proxies for the common factors. The CCE estimator is the average of the individual OLS slope coefficients of the model (5). The jackknife bias correction and the recursive mean adjustment methods were applied to correct for small T sample bias.

The advantage of the CCE estimator over the DOLS is that it allows for cross-sectional dependencies that are the result of a multi-factor error structure with heterogeneous responses across countries. However, the CCE estimator is consistent under the assumption of exogenous covariates, a requirement that is not necessary for the (super) consistency of the DOLS estimator.

Data

We used annual time series of per-capita health care expenditures and per-capita GDP in constant US dollars for 2010. Health care expenditures data were obtained from the Global health care expenditures Database of the World Health Organization (WHO), and GDP data from the World Bank’s World Development Indicators database. Our sample included a balanced panel of 30 LA countries and 35 OECD countries for the period 1995–2014.Footnote 10 The LA countries included in the sample are listed in Table 1, which also reports mean values and the last record of the variables of interest, by country for the period 1995–2014. Table 2 reports similar descriptive statistics for OECD countries.

Results

First generation panel unit root tests

Tables 3 and 4 show the results of the first generation panel unit root tests, that is, tests consistent under the hypothesis of independence across cross-sections for LA and OECD countries, respectively. In the first panel of both tables we present results considering a drift in all series, and in the third panel we model the series including a drift and a trend.Footnote 11 To alleviate the restriction imposed by the cross-section independence assumption, we also present results for demeaned series in the second and fourth panels of the tables, including a drift, and a drift and a trend, respectively.

We found evidence for both LA and OECD countries of the existence of a unit root in (the natural logarithm of) GDP and HE when we used the Breitung, and the HT tests. The results with the IPS test were in the same direction in all but two cases for OECD countries. However, the LLC test rejected the null hypothesis of a unit root in all but one of the specifications. Additionally, the Hadri test in its two versions rejected the null hypothesis of the stationarity of the series in levels and in first differences in almost all models.

In summary, the battery of tests applied did not provide consistent evidence of the non-stationarity of the analyzed series, which may be the result of increased size in the tests due to cross-country dependence.

Cross-section dependence and second-generation panel unit root tests

We applied the CD Pesaran (2004) statistics and found evidence supporting the hypothesis of cross-country dependence for (the natural logarithm of) HE and GDP, in levels and in first differences using LA and OECD countries. The results are shown in Table 5.

The CIPS, a panel unit root test that is robust to the presence of cross-section dependence, applied to HE and GDP, modeled with drift, and with drift and trend, does not reject the null hypothesis that all panels contain a unit root, while it does reject the null hypothesis when the test was applied to the series in first differences. We interpret these results, reported in Table 5, as clear and consistent evidence that both series have a unit root, in the panels of LA and of OECD countries.

We ruled out the possibility that the results are driven by a specific country by applying the CIPS test in a sensitivity exercise excluding one country at a time from the panel of LA and OECD countries. The results are reported in Tables 12 and 13 in the Appendix.

Panel cointegration estimates

We use two approaches, CCE and DOLS panel estimates, to quantify the long-run relationship between HE and GDP. The results are reported in Table 6. We applied the DOLS estimate to the original series, which is the untransformed data, and to the demeaned data. The second alternative accommodates for some forms of cross-country dependence. We report the results obtained using untransformed data to show how different the estimates are when cross-country dependence is ignored.

The estimated income (GDP) elasticities of health care expenditures range from 1 to 1.8 for LA countries, and from 1.3 to 1.7 for OECD countries.Footnote 12 Using the CCE estimate with small T recursive correction we obtained a point estimate for the group of LA countries equal to 1.011, that is, we estimate an increase in HE equal to 1.011% when GDP increases in 1%, while for OECD countries an increase in GDP of 1% generates an estimated rise of 1.535% in HE. In all panels and methodologies points estimates are statistically significant at the 1% level, and we cannot reject the null hypothesis of a unitary elasticity at the one percent level of significance. That is, for both groups of countries analyzed we found evidence that health care is a necessity and not a luxury, and did not find significant differences in the estimated elasticities between LA and OECD countries. These results were obtained with estimates that are robust to at least some forms of cross-country correlation. However, if we neglect to address dependence across countries, we obtain estimates that are above 3, so by using these results we would mistakenly conclude that health care is a luxury. We study the sensitivity of the estimates to country exclusion and reassuringly found consistent results.Footnote 13

We used the residuals from the previous CCE and DOLS estimations to test the existence of a cointegrating relationship between HE and GDP. We conducted the CIPS panel unit root test by Pesaran (2007) on CCE residuals, and Pedroni (2004) and Pedroni (1999) panel unit root test on DOLS residuals.Footnote 14 Table 7 presents the results of the cointegration tests. Using CCE residuals we obtained clear evidence of a cointegrating relationship between HE and GDP in both LA and OECD countries. However, the results were not conclusive with DOLS residuals. To provide further evidence on the cointegration between HE and GDP we used the cointegration test proposed by Westerlund (2007), which allowed to obtain critical values robust to cross-country dependence by bootstrapping.Footnote 15 The results obtained, reported in Table 7, are in line with those obtained using the CCE residuals along with the CIPS unit root test.

Long-run panel causality estimates

The final step in the empirical analysis of the long-run relationship between HE and GDP was to confirm the existence of the cointegrating relationship, and to establish the direction of this relationship. Both tasks were carried out by estimating the Vector Error Correction Model, that in our study is in the form of:

where \(\hat{\varepsilon }_{i,t}=he_{it}-\left[ \hat{\alpha }_i+\hat{\beta }_i * gdp_{it} \right] \) are the residuals from the estimation of equation (1). The long-run adjustment coefficients, \(\delta _1\) and \(\delta _2\), capture how \(he_{it}\) and \(gdp_{it}\) respond to deviations from the equilibrium relationship. If at least one of the coefficients is significantly different from zero we confirm the existence of a long-run relationship between the two variables. We infer that causality, in the sense of Granger, is from gdp to he if \(\delta _1\) is statistically different from zero, and from he to gdp if \(\delta _2\) is significantly different from zero. We also interpret the parameters \(\phi \) as short run effects.

We estimated the VEC models using CCE and DOLS on demeaned data panel estimates. In Table 8, we report estimates and standard errors obtained with Newey-West (HAC standard errors) and seemingly unrelated (homoskedastic standard errors) methods. We find evidence of a long-run causal relationship between GDP and HE for the group of LA and OECD countries (coefficients of CCE and DOLS residuals statistically significant at the 1% level), and no evidence in the other direction in the relationship (coefficients of residuals close to zero and not statistically significant at the usual levels).

We also found evidence of a short run effect of past values of GDP on HE, for both LA and OECD countries (point estimates between 0.369 and 0.877, statistically significant at the 1% level). The short run effect of past HE values on GDP is heterogeneous across groups of countries: the HE in OECD countries has an estimated negative effect on GDP one year ahead (point estimates − 0.034 and − 0.039, statistically significant at the 5% level), but there is no evidence of this reaction in LA countries (point estimates close to zero and not statistically significant at the usual levels). These negative short run effect for OECD countries disappears when we include covariates in the equation, as shown in “Robustness to the inclusion of covariates” section.

Robustness to the inclusion of covariates

An important concern with the CCE estimator is that its consistency depends on the exogeneity of the covariates, that is, it suffers from omitted variables (consistency) bias. The related literature points out three main potentially relevant covariates in the health-income equation: (1) public health care expenditures, because a most predominant role of the public sector in financing health care tends to increase the total health care expenditure; (2) technological change, that generally increases health expenditure when new technology is adopted but may decrease it if it is relatively cost-efficient compared with previous technology; and (3) characteristics of the population that increase utilization of health care facilities.

To quantify the problem of potential bias in our estimations, we studied the robustness of the results to the introduction of covariates. Specifically, we augmented the health care expenditures equation by introducing as covariates public health care expenditures, measured as percentage of GDP, infant mortality rates per 1000 live births as a proxy for technological change, and, to control for pressure on health care facilities, percentage of total population living in urban areas, and dependency rates for elderly and young people, computed as the population aged 65 and over divided by the population aged 15–64, and the population aged 0–14 divided by the population aged 15–64, respectively.

We obtained the series on public health care expenditures from the Global Health Expenditure Database of the World Health Organization, and infant mortality rates, urban population, and dependency rates from the World Bank’s World Development Indicators.Footnote 16 When these controls are included the two dimensions of the sample, number of countries and number of time periods, are reduced. The list of LA countries was reduced to 28, because dependency rates were not available for Dominica and St. Kitts and Nevis. As we used growth rates for dependency rates and urban population the time span was reduced by one year.Footnote 17 Consequently, and to obtain comparable results, we estimated the model with and without controls with the same (reduced) sample.

We began the exercise by providing evidence of the cross-section dependence and non-stationarity of the covariates. The results are reported in Table 9. Using the CIPS unit root test, in almost all specifications and for LA and OECD countries, we did not reject the null hypothesis that the series in level contain a unit root, while we did reject the null hypothesis for the series in first differences. Also, the included covariates show cross-section dependence, with the exception of the percentage of urban population in OECD countries.

Once the non-stationarity of the controls was stablished, we computed CCE estimates of the health care expenditures equation without covariates and augmented with covariates. The results are reported in Table 10. The introduction of covariates reduces the estimated elasticities. The estimated elasticities ranged from 0.796 to 1.222 for LA countries, and from 0.838 to 1.042 for OECD countries. In all specifications with controls the elasticities are statistically significant at usual significance levels. Additionally, in all models with covariates and all but one without covariates, we did not reject the null hypothesis of the unitary income elasticity of health care expenditures.Footnote 18 Comparing the estimates by group of countries, we found that in most of the specifications the estimated elasticity for LA countries is higher than that for the group of OECD countries.

Turning to the points estimates for controls, in all the specifications and panels, the estimated coefficient of public health expenditures is positive, as expected, and the corresponding parameter is statistically significant at the usual significance level, while the dependency rates, urban population, and infant mortality rate are not significant.

The cointegration tests, conducted by applying the CIPS statistic to the CEE residuals, are also robust to the introduction of covariates. In all specifications the null hypothesis of non-stationarity was rejected at the 1% level of significance.

Finally, we estimated the VEC model, which includes the CCE residuals, and found evidence of a long-run causal relationship between GDP and HE, while finding no evidence of a relationship in the opposite direction. That is, the long-run causality analysis done before is robust to the introduction of the proposed controls. The results are reported in Table 11.

Turning to the discussion of short run effects, including controls we obtained positive estimated effects of HE and GDP on HE one year head, that are statistically significant. We also found a positive short run effect of GDP on GDP one year ahead, while there is no evidence of a short run effect of HE on GDP one year ahead.

In line with the CCE estimates of the health care expenditures equation, we obtained a positive and significant short run effect of increases in public health expenditures on total health expenditures for both groups of countries, LA and OECD: an increase of 1 % in the participation of public health expenditures on GDP rises total health expenditure as percentage of GDP in 0.4 to 0.5%. And only for the group of OECD countries, we found evidence that improvements in technology, as proxied by a reduction in the infant mortality rate, and higher dependency rates for young people, increase health expenditures in the short run.

We obtained an unexpected positive and significant coefficient of the short run effect of the infant mortality rate on GDP for LA countries, although the point estimate is close to zero (equal to 0.008). Also, we found a significant negative effect of public health expenditures on GDP that is higher in absolute value for OECD (point estimate equal to − 0.202) than for LA countries (point estimate equal to − 0.036). These odd results may suggest that the group of control variables used is not sufficient to overcome all the potential sources of omitted variables bias. In particular, infant mortality rates may not be a convenient proxy to technological change. An alternative proxy is life expectancy, but regrettably the series in the period under analyzes is non-stationary in first differences.Footnote 19 More appropriate measures to account for technological change are research and development in health care and surgical procedures, thought such information is not available for the group of LA countries.

Other potential confounding factors in the HE-GDP equation are related to institutional characteristics of the health system, such as health insurance coverage, and type of insurance (public vs. private) As noticed in Acemoglu et al. (2013) “... the spread of insurance coverage, have not only directly encouraged increased spending but also induced the adoption and diffusion of new medical technologies”. Thus, falling to control for insurance coverage would upward-bias the income elasticity of health expenditure, under the premiss that insurance coverage is higher in countries with higher GDP. For this reason, our estimates for the income elasticity of HE should be interpreted as an upper bound of its true value, and the conclusion that HE is a necessity rather than a luxury good stands. Unfortunately, we did not find a measure of insurance coverage that is comparable across LA countries.

Conclusions

We provide evidence of the existence of a long-run causal relationship between GDP and HE based on a group of 30 LA countries, most of them developing countries, and the 35 OECD countries for the period 1995 to 2014. We did not find significant differences between the two groups of countries. The estimated income elasticities of HE are close to the unitary value, and there is no evidence of a long-run causal effect of HE on GDP.

We used cointegration techniques that are robust to the presence of cross-country dependence, since we found conclusive evidence against the traditional assumption of cross-section independence. We also showed that if cross-country dependence is mistakenly discarded, the results of panel unit root and cointegration tests are inconsistent. Our results are robust to the exclusion of countries in the data, and to the introduction of covariates in the model.

Our results are in line with recent literature that has found a positive HE income elasticity for OECD countries, and no evidence of HE being a luxury good. A novelty of our work is that we provide similar evidence for a group of countries, those of Latin America and the Caribbean, that has not been studied before.

We also show that GDP does not react in the long-run to changes in the level of HE. This conclusion seems to contradict the call from international institutions to raise HE through increased public funding, based on the view that HE plays a key role in development and in improving the standard of living. We do not think that we are providing evidence against the role of HE in development, since GDP growth may not be the appropriate measure of development. We consider that the Human Development Index (HDI) and labor productivity measured as the growth rate of GDP per hour worked are more appropriate indicators of living standards. Regrettably, the non-availability of this information prevents us from using it in our analysis. HDI is computed from 1980 on a five years basis, and has only been available on a yearly basis since 2010. As well, the growth rate of GDP per hour worked is only available for some OECD countries. We leave the study of the long-run relationship between development and HE to the future, and hope for the availability of the necessary data.

Notes

Unweighted average computed using data from the Global Health Expenditure Database of the World Health Organization.

See Fig. 1 in the Appendix.

Assuming that health care costs and health status of the population are similar across countries.

The growth rate of GDP over the last 20 years was (slightly but still) higher among LA countries than among OECD members.

Sen (2005) finds a positive HE income elasticity with a panel of 15 OECD countries from 1990 to 1998, but using a different methodology. His results are obtained with Generalized Least Squares and Instrumental Variables estimators.

There are at least two other related papers that used panel cointegration techniques with methodological refinements, namely Liu et al. (2011) who showed the existence of structural breaks in the causal relationship between GDP and HE, and Mehrara et al. (2010) who estimated HE income elasticity below one using a panel smooth threshold regression.

The three papers used different methodologies. The main results in Baltagi and Moscone (2010) were based on a Common Correlated Effects estimator, Narayan et al. (2011) used Westerlund (2007) cointegration test and Dynamic OLS estimators, which are not consistent under cross-section dependence, and French (2012) used the Panel Analysis of Non-stationarity in Idiosyncratic and Common components (PANIC) approach of Bai and Ng (2004).

This paper uses unitroot tests that are consistent under the assumption of cross-country dependence, GMM estimators, and test for Granger Causality.

The Latin American and the Caribbean region includes 41 countries. We omitted countries from the sample for which we did not have the complete series of both variables for the time period of interest.

Table 14 in the Appendix presents estimated elasticities by country, obtained with the CCE estimator.

We report the results of the sensitivity analysis in Table 15 in the Appendix.

We conducted Pedroni’s test on the CCE residuals, with similar results.

We briefly describe the test in “Westerlund (2007) cointegration test” section in the Appendix.

Dependency rates and urban population are non-stationary in levels and also in first differences. In order to have a model in which all variables are stationary in first differences, we used the growth rate of these variables, as it is standard in the literature.

We reject the unitary income elasticity hypothesis for the panel of OECD countries when we use the specification without covariates and the recursive correction for small T.

Transformations on the life expectancy series like growth rates are also non-stationary in first differences.

References

Acemoglu, D., Finkelstein, A., & Notowidigdo, M. J. (2013). Income and health spending: Evidence from oil price shocks. The Review of Economics and Statistics, 95, 1079–1095.

Bai, J., & Ng, S. (2004). A PANIC attack on unit roots and cointegration. Econometrica, 72, 1127–1177.

Baltagi, B. (2008). Econometric analysis of panel data. New York: Wiley.

Baltagi, B. H., & Moscone, F. (2010). Health care expenditure and income in the OECD reconsidered: Evidence from panel data. Economic Modelling, 27, 804–811.

Blomqvist, A. G., & Carter, R. (1997). Is health care really a luxury? Journal of Health Economics, 16, 207–229.

Breitung, J. (2001). The local power of some unit root tests for panel data. In B. H. Baltagi, T. B. Fomby, & R. C. Hill (Eds.), Nonstationary panels, panel cointegration, and dynamic panels. Advances in econometrics (Vol. 15, pp. 161–177). Emerald Group Publishing Limited.

Breitung, J., & Das, S. (2005). Panel unit root tests under cross-sectional dependence. Statistica Neerlandica, 59, 414–433.

Chen, B., McCoskey, S. K., & Kao, C. (1999). Estimation and inference of a cointegrated regression in panel data: A Monte Carlo study. American Journal of Mathematical and Management Sciences, 19, 75–114.

Choi, I. (2001). Unit root tests for panel data. Journal of International Money and Finance, 20, 249–272.

Clemente, J., Marcuello, C., Montañés, A., & Pueyo, F. (2004). On the international stability of health care expenditure functions: Are government and private functions similar? Journal of Health Economics, 23, 589–613.

Ditzen, J. (2018). Estimating dynamic common-correlated effects in Stata. Stata Journal, 18, 585–617.

Dreger, C., & Reimers, H.-E. (2005). Health care expenditures in OECD countries: A panel unit root and cointegration analysis. International Journal of Applied Econometrics and Quantitative Studies, 2, 5–20.

Farag, M., NandaKumar, A., Wallack, S., Hodgkin, D., Gaumer, G., & Erbil, C. (2012). The income elasticity of health care spending in developing and developed countries. International Journal of Health Care Finance and Economics, 12, 145–162.

French, D. (2012). Causation between health and income: A need to panic. Empirical Economics, 42, 583–601.

Gerdtham, U.-G., & Löthgren, M. (2000). On stationarity and cointegration of international health expenditure and GDP. Journal of Health Economics, 19, 461–475.

Gerdtham, U.-G., & Löthgren, M. (2002). New panel results on cointegration of international health expenditure and GDP. Applied Economics, 34, 1679–1686. (cited By 17).

Hadri, K. (2000). Testing for stationarity in heterogeneous panel data. The Econometrics Journal, 3, 148–161.

Halıcı-Tülüce, N. S., Doğan, İ., & Dumrul, C. (2016). Is income relevant for health expenditure and economic growth nexus? International Journal of Health Economics and Management, 16, 23–49.

Hansen, P., & King, A. (1996). The determinants of health care expenditure: A cointegration approach. Journal of Health Economics, 15, 127–137.

Harris, R. D., & Tzavalis, E. (1999). Inference for unit roots in dynamic panels where the time dimension is fixed. Journal of Econometrics, 91, 201–226.

Im, K. S., Pesaran, M. H., & Shin, Y. (2003). Testing for unit roots in heterogeneous panels. Journal of Econometrics, 115, 53–74.

Kao, C., Chiang, M.-H., et al. (2000). On the estimation and inference of a cointegrated regression in panel data. Advances in Econometrics, 20, 179–222.

Ke, X., Saksena, P., & Holly, A. (2011). The determinants of health expenditure: A country-level panel data analysis. World Health Organization, working paper, December 2011.

Kouassi, E., Akinkugbe, O., Kutlo, N. O., & Brou, J. M. B. (2018). Health expenditure and growth dynamics in the SADC region: Evidence from non-stationary panel data with cross section dependence and unobserved heterogeneity. International Journal of Health Economics and Management, 18, 47–66.

Lago-Peñas, S., Cantarero-Prieto, D., & Blázquez-Fernández, C. (2013). On the relationship between GDP and health care expenditure: A new look. Economic Modelling, 32, 124–129.

Levin, A., Lin, C.-F., & Chu, C.-S. J. (2002). Unit root tests in panel data: Asymptotic and finite-sample properties. Journal of Econometrics, 108, 1–24.

Liu, D., Li, R., & Wang, Z. (2011). Testing for structural breaks in panel varying coefficient models: With an application to OECD health expenditure. Empirical Economics, 40, 95–118.

Mayer, D. (2001). The long-term impact of health on economic growth in Latin America. World Development, 29, 1025–1033.

McCoskey, S. K., & Selden, T. M. (1998). Health care expenditures and GDP: Panel data unit root test results. Journal of Health Economics, 17, 369–376.

Mehrara, M., Musai, M., & Amiri, H. (2010). The relationship between health expenditure and GDP in OECD countries using PSTR. European Journal of Economics, Finance and Administrative Sciences, 24, 1450–2275.

Narayan, P., Narayan, S., & Smyth, R. (2011). Is health care really a luxury in OECD countries? Evidence from alternative price deflators. Applied Economics, 43, 3631–3643. (cited By 0).

Pedroni, P. (1999). Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxford Bulletin of Economics and Statistics, 61, 653–670.

Pedroni, P. (2001). Purchasing power parity tests in cointegrated panels. Review of Economics and Statistics, 83, 727–731.

Pedroni, P. (2004). Panel cointegration: Asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econometric Theory, 20, 597–625.

Persyn, D., & Westerlund, J. (2008). Error-correction-based cointegration tests for panel data. Stata Journal, 8, 232–241.

Pesaran, M. H. (2004). General diagnostic tests for cross section dependence in panels. Technical report, Institute for the Study of Labor (IZA).

Pesaran, M. H. (2006). Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica, 74, 967–1012.

Pesaran, M. H. (2007). A simple panel unit root test in the presence of cross-section dependence. Journal of Applied Econometrics, 22, 265–312.

Roberts, J. (2000). Spurious regression problems in the determinants of health care expenditure: A comment on Hitiris (1997). Applied Economics Letters, 7, 279–283.

Sen, A. (2005). Is health care a luxury? New evidence from OECD data. International Journal of Health Care Finance and Economics, 5, 147–164.

Stock, J. H., & Watson, M. W. (1993). A simple estimator of cointegrating vectors in higher order integrated systems. Econometrica: Journal of the Econometric Society, 61, 783–820.

Westerlund, J. (2007). Testing for error correction in panel data. Oxford Bulletin of Economics and Statistics, 69, 709–748.

Acknowledgements

We wish to thank Felipe Martin for expert research assistance.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Funding

This work was supported by the Fondo Nacional de Desarrollo Científico y Tecnológico (Fondecyt, Chile) [Project No. 11130058 to M.Nieves Valdés]

Conflict of interest

The authors declare that they have no conflict of interest.

Appendix

Appendix

Health care expenditures as percentage of GDP in the world, and in selected groups of countries

Health care expenditures as percentage of GDP between 1995 and 2014. Notes “LA” is the group of 33 Latin American countries. “OECD” is the group of 35 Organisation for Economic Co-operation and Development member countries. “ALL” includes 192 countries for which HE data is available in the Global Health Observatory of the WHO

Trends in health care expenditures and GDP

Sensitivity to country exclusion: CIPS panel unit root test

Individual country CCE estimates

See Table 14.

Sensitivity to country exclusion: CCE estimates

See Table 15.

Westerlund (2007) cointegration test

The following description of the test was taken from the help file that accompanies the Stata command xtwest coded by Persyn and Westerlund (2008).

The panel cointegration tests developed by Westerlund (2007) contrast the absence of cointegration by determining whether there is error correction for individual panel members or for the panel as a whole. Consider the following error correction model, where all variables in levels are assumed to be I(1):

where \(a_i\) provides an estimate of the speed of error-correction towards long-run equilibrium \(y_{it} = - (b_i/a_i) * x_{it}\) for the series i.

The Ga and Gt test statistics contrast \(H_0: a_i = 0\) for all i against \(H1: a_i < 0\) for at least one i. These statistics start from a weighted average of the individually estimated \(a_i\)’s and their t-ratio’s respectively. Rejection of \(H_0\) should therefore be taken as evidence of cointegration of at least one of the cross-sectional units.

The Pa and Pt test statistics pool information over all the cross-sectional units to test \(H_0: a_i = 0\) for all i vs \(H_1: a_i < 0\) for all i. Rejection of \(H_0\) should therefore be taken as evidence of cointegration for the panel as a whole.

If the cross-sectional units are suspected to be correlated, robust critical values can be obtained through bootstrapping.

Controls

Rights and permissions

About this article

Cite this article

Rodríguez, A.F., Nieves Valdés, M. Health care expenditures and GDP in Latin American and OECD countries: a comparison using a panel cointegration approach. Int J Health Econ Manag. 19, 115–153 (2019). https://doi.org/10.1007/s10754-018-9250-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10754-018-9250-3

Keywords

- Income elasticity of health care expenditures

- Panel cointegration

- Cross-section dependence

- Latin American and the Caribbean and OECD countries