Abstract

Illness-related absenteeism reduces firms’ output, an effect referred to as indirect cost (IC) and often included in cost-of-illness or cost-effectiveness (of health technologies) studies. The companies may foresee this effect and modify hiring or contracting policies. We present a model allowing the estimation of IC with such adjustments. We show that the risk of illness does not change the general shape and properties of the (expected) marginal productivity function. We apply our model to several illustrative examples and show that firm’s adjustments impact IC in an ambiguous way, depending on detailed company/market characteristics: in some cases the company reduces the employment (further increasing IC), in another—the opposite happens. Contrary to previous findings, teamwork and shortfall penalties may reduce IC in some settings. Our analysis highlights that IC should be split into the result of companies preparing for and actually experiencing sick leaves.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Medical technologies are often financed using public budget. To make informed decisions, it is vital to understand the economic consequences of a disease. The range of these consequences depends on whose perspective is taken (Suhrcke et al. 2012; Brouwer et al. 2006), e.g., from the public payer perspective only the cost of reimbursed drugs and publicly financed technologies are included. In several countries, however, a wider, societal perspective is recommended.Footnote 1 Using this perspective, we also need to measure the impact of illness on economic activity and on a foregone production, as a sick person not showing up for work (absenteeism) or having reduced productivity (presenteeism) constitutes a cost. This is an opportunity cost, i.e. defined based on counterfactual thinking: the society would have more goods to consume and enjoy, if not for the sickness. In the health technology assessment literature, this is called an indirect cost (henceforth, IC), see, e.g., Koopmanschap and Ineveld (1992).

Whether and how IC should be estimated is subject to research; Krol et al. (2013) review pending questions and prevalent opinions. Briefly, according to the human capital approach (HCA), IC should be estimated by multiplying the sickness duration (when human capital is idle) and the value of a time unit (a day, a week, etc.) of work (Berger et al. 2001). The latter is often approximated with wage, motivated by the economic proposition that labour is in the equilibrium remunerated at the level of marginal revenue. Henceforth, we refer to this estimation method as a wage-based estimate. In HCA, a person dying before the retirement age results in a long period of human capital not being productive—a substantial IC. The friction cost method (FCM) suggests a more realistic approach, accounting for, e.g., companies recruiting new employees to substitute for the ill (Koopmanschap et al. 1995; Berger et al. 2001).

Other mechanisms further complicating the picture were brought into discussion in the literature. The diminished productivity may be compensated within a firm by the same individual after recovery or by co-workers, a company may hire temporary agency workers (Bryson 2013); or, contrarily, one absent person may disrupt the work of the whole team (Krol et al. 2012). The strength of these mechanisms may vary between countries due to labour market specificity (Knies et al. 2013) or even between companies depending on the work organization (Leigh 1981). Pauly et al. (2002) present a microeconomic model in which teamwork results in IC being greater than a wage-based estimate (when replacement for the worker cannot be cheaply and immediately found). They also discuss the impact of a company having an output target to be met under penalty. Then, again, in their model IC is greater than a wage-based approximation.

While considering the teamwork and output shortfall penalty as Pauly et al. (2002), in the present paper we focus on a different element of the puzzle: companies do not only passively bear the consequences of sick-leaves but rather try to alleviate any negative shocks on their productivity (e.g., the companies may sponsor flu vaccines, Burton et al. 2003, or promote a health life-style among employees, Audrey and Procter 2015; Loeppke et al. 2015). We consider companies foreseeing sick-leaves and adjusting the total amount of workforce and the amount of goods they contract to deliver. In order to determine the effect of such adjustments on IC, we construct a microeconomic model of a company. Our model allows to differentiate between how preparing for sick-leaves (i) and the actual occurrence thereof (ii) impact the value of overall production; (i) happens via companies adjusting their behaviour in the labour and good markets, (ii) results from the reduction of the available workforce.

In the present paper, we focus on absenteeism only, neglecting presenteeism or the impact of illness on the economic activity of other family members (Liljas 1998). Focusing on IC (i.e. product not delivered to the market), we do not analyse company’s profit (obviously, the risk of sickness makes companies worse-off, and adjustments help to alleviate this loss). Thus, the output shortfall penalty is interesting only insofar as it impacts the value of production delivered onto the market via companies’ hiring and contracting policies.

In the next section, we present our model and introduce the technical assumptions used in the study. In the third section, we apply the model to several illustrative scenarios. The present study is a theoretical one (as many others in this line of research, e.g., Pauly et al. 2002; DeLeire and Manning 2004; Arnold and de Pinto 2014), and so we do not calibrate the model to any specific company. Hence, the exact values of parameters are of no direct importance and are not interpreted; we rather aim to demonstrate the variety of possible situations and prevalent mechanisms. In our model, we focus on companies’ expectations and adjustments before sick leaves actually occur. For that reason, we do not consider, for example, workers replacement (this being an ad hoc action after the illness has occurred). In “Discussion” section, we discuss our results. “Conclusions” section briefly concludes. We put all the proofs in the “Appendix”.

The model

We present our model starting with a simple, benchmark case with no illnesses: hence, no uncertainty (“No sick-leaves” section). Then, we introduce the risk of sick-leaves (“Sick-leaves” section). Finally, we discuss contracting the output and shortfall penalty (“Output guarantees and shortfall penalties” section).

No sick-leaves

The company maximises its profit by producing and selling a single type of good, whose price is determined in a perfectly competitive market (company’s actions do not influence the price, and the company can sell whatever it produces). The product cannot be stored; hence, we analyse the functioning of the company in a single period (of unspecified length), when the product is manufactured and sold.

We explicitly only consider labour as a production factor. One interpretation could be that the considered period is too short for a company to change the amount of capital; then, the cost of capital is fixed and does not impact the marginal analysis. We assume, however, that this fixed cost is low enough to leave a positive profit and make the company stay in the market.

We measure the quantity of labour in discrete values: 0, 1, 2, ...; interpreted, for example, as a number of full-time workers (or, less coarsely, a number of half-time workers, etc.). We believe that this is much closer to reality than assuming that the company can optimize the amount of labour in a continuous way. We still notice that this may be important for the results, as the optimal solution can discontinuously jump between neighbouring values. Discretizing the amount of labour allows to easily model (next subsection) the number of sick leaves using a binomial distribution (and the properties of this specific distribution are used in the proofs).

We assume the labour market to be perfectly competitive: company’s decisions do not impact the wage, and the company can hire whatever number of workers it wants.

With the above assumptions, the company’s profit, \(\pi (L)\), is given as:

where

-

p is the price of manufactured product,

-

w is unit cost of labour,

-

L is the number of employees, and is the only decision variable,

-

Y(L) is the output achieved by L employees.

The company maximizes Eq. 1 by setting L to some optimal \(L^*_h\) (subscript h denotes the all-healthy case). We let \(\text {MP}(L)\) denote the marginal product of hiring the L-th employee, \(\text {MP}(L)=Y(L)-Y(L-1)\), where we take \(Y(0)=0\). In the paper, we consider only unimodal functions \(\text {MP}(L)\) of two types: (i) either decreasing in L, denoting the declining marginal productivity of labour (consecutive employees contribute less and less to the overall output, cf. Figs. 1, 2) or (ii) first increasing and then decreasing in L (the company first requires some minimal amount of employees to operate effectively but then is subject to diminishing productivity of labour, cf. Fig. 3). Case (i) describes companies delivering simple products and services, while case (ii) characterizes companies delivering more complicated goods that require cooperation between some minimal number of team members. The latter type represents teamwork in our model.

It is easy to see that either \(L^*_h\) will be equal to the greatest L for which \(\text {MP}(L)p\ge w\), as long as the overall revenue exceeds cost, \(\pi (L^*_h)\ge 0\), or the company will quit the market (\(L^*_h=0\)). Taking a non-strict inequality implies that the company is also willing to hire a person if the value of additional product just covers the wage. This has no impact on the examples we consider.

Sick-leaves

In the case with illnesses, we assume that during the whole period every employee is either healthy or sick and absent. Parameter \(s, 0\le s<1\), denotes the probability of illness, and we assume s is known (e.g., based on historical data) and identical for all the employees. We also assume that individual employees being ill are independent events (hence, we do not consider contagious diseases). The company pays wages also to the ill.

We assume that the company is risk neutral; hence, it maximises the expected profit. The expected total product generated with L employees hired is now given as:

where

-

(I)

index i goes over all possible numbers of workers reporting for work,

-

(II)

measures the probability of exactly i workers being healthy,

-

(III)

denotes the total product attained with i workers.

The expected profit of hiring L workers is then given by:

We can use Eq. 3 while changing model parameters: work organization and effectiveness (the shape of \(Y({\cdot })\)), price (p), wage (w), and the probability of being ill (s). For given values of parameters, we let \(L^*_s\) denote the optimal number of workers. It is easier to analyse the impact of illnesses using marginal product. We let \(\text {MP}^E(L)\) denote the expected additional product of hiring the L-th employee, when illness is possible, while \(\text {MP}({\cdot })\) still denotes the additional product of hiring an additional employee with the assumption that all workers are healthy. It will be useful to express \(\text {MP}^E({\cdot })\) in terms of \(\text {MP}({\cdot })\). If all workers are sick, the L-th employee can be the only working person, or one of the two working (if all but one other employees are sick), or one of three, etc. Obviously, the L-th employee has to be healthy to contribute to the overall product. The following equation follows:

where

-

(I)

stands for the L-th hired worker contributing only when healthy,

-

(II)

index i goes over all possibilities of the L-th hired worker being exactly the i-th worker reporting for work (i.e. \(i-1\) other workers are healthy),

-

(III)

measures the probability of exactly \(i-1\) other workers being healthy,

-

(IV)

denotes the L-th hired worker’s (as the i-th working one) contribution.

\(\text {MP}^E({\cdot })\) is, comparing with \(\text {MP}({\cdot })\), scaled downwards by (I) and stretched rightwards, as the values of \(\text {MP}^E(L)\) are determined by the values of \(\text {MP}(i)\) for all \(i\le L\). The relations between \(\text {MP}\) and \(\text {MP}^E\) are illustrated, e.g., in Fig. 1 (in this particular case the optimal levels of employment coincide: \(L^*_h=L^*_s\)).

It can be shown that introducing the risk of illnesses does not change the general properties of the marginal productivity, i.e. \(\text {MP}^E({\cdot })\) behaves qualitatively in the same way as \(\text {MP}({\cdot })\). That is expressed more formally by the following two propositions.

Proposition 1

Assume \(\text {MP}(L)\) is decreasing in L. Then \(\text {MP}^E(L)\) as defined in Eq. 4 is decreasing in L for any s.

Hence, diminishing marginal productivity is preserved under sickness in the model. The analogous result holds for the teamwork case (with initially increasing marginal productivity).

Proposition 2

Assume \(\text {MP}(L)\) is first increasing, up to some \(L_1\), and then decreasing in L. Then \(\text {MP}^E(L)\) as defined in Eq. 4 is first increasing and then decreasing in L for any s. \(\text {MP}^E(L)\) attains maximum for some \(L_2\ge L_1\).

Hence, after introducing illness in our model we can still be looking for the optimal number of workers by looking at the point where \(\text {MP}^E({\cdot })\) has dropped below the wage-to-price ratio, \({w}/{p}\), for the first time, as the marginal productivity is not multimodal. For a decreasing \(\text {MP}({\cdot }), \text {MP}^E({\cdot })\) is decreasing but no general statements can be made as to where it will drop below \({w}/{p}\). For an initially-increasing \(\text {MP}({\cdot }), \text {MP}^E({\cdot })\) is also initially increasing and attains maximum for a greater or equal number of workers than \(\text {MP}({\cdot })\) does. As the following proposition says, this maximum increases with the risk of illness.

Proposition 3

Assume \(\text {MP}(L)\) is first increasing, up to some \(L_1\), and then decreasing in L. Let \(L_2(s)=\max \left( {\mathrm{argmax}}_{L\in \left\{ 0,1,\ldots \right\} }\left( \text {MP}^E(L)\right) \right) \) for a given risk of illness, s. Then \(L_2(s)\) is non-decreasing in \(s\in [0,1)\).

The proposition is formulated in a way to avoid comparing sets with multiple maxima. Surely, the optimal number of workers, \(L^*_s\), must be greater than or equal to \(L_2\) (assuming the company does not want to leave the market). Hence, the lower bound for optimal \(L^*_s\) increases with s for teamwork-oriented marginal productivity. In this sense, the teamwork makes it more plausible for the (foreseen) risk of illness to increase the employment and reduce the absenteeism-related product loss.

Output guarantees and shortfall penalties

Shortfall penalties were considered by Pauly et al. (2002), and we also introduce this element in our model in examples IV and V to see how it interacts with other assumptions. We assume the market requires the company to predefine the amount of goods delivered; the company may freely choose this amount, but it needs to sign a contract before knowing the actual number of workers showing up for work. The consumers will purchase exactly the contracted amount (or what’s available, if less). The perfectly competitive market is still assumed. In case of a shortfall, the company (additionally to not collecting a part of revenue) needs to pay a penalty. For simplicity, we assume that the penalty per unit of good equals p, but obviously other values could be used. A possible interpretation is that the potential customers want to be assured of receiving goods from particular manufacturer and require in advance contracts promising a particular size of order.

Obviously, a mixed model might also be considered: some companies promising delivery and otherwise paying penalties but charging higher price, and other companies ad hoc filling in the gaps (with the price depending on the amount of gaps). A single company might actually combine these two mechanisms. Not to overly complicate the model, we assume that all the companies have to predefine all their output.

The expected profit with guaranteed output (denoted by a superscript G) is now given by

where (I) denotes the output effectively charged (equal to G for \(Y(i)\ge G\); when \(Y(i)<G\), the company pays a penalty). The company maximizes Eq. 5 selecting L and the guaranteed delivery (G, only natural values). We look for optimal values numerically and use the same notation, i.e, \(L^*_h\) and \(L^*_s\) (\(G^*_h\) and \(G^*_s\)) for the case without and with sick leaves, respectively.

Examples

We present five scenarios how the illness impacts the companies’ functioning: examples I–III (“No guaranteed output” section) without and examples IV and V (“Guaranteed output” section) with guaranteed output. The companies differ between the examples with respect to the nature of the marginal productivity function (and so the teamwork orientation). We focus on qualitative differences between the examples, and the specific values of \(Y({\cdot }), w, p\), and s are of no special importance. For brevity, we do not present \(Y({\cdot })\) in details, as it would require specifying multiple numbers and the general shape can be read off the figures.

In each example, we analyse the impact of the risk of illness, i.e. the difference between the outcomes for a given s and when setting \(s=0\), i.e. for \(L^*_s\) and \(L^*_h\), respectively. We focus on the impact of illness on the total product delivered to the market, i.e. indirect cost, and not on the company’s profit. Apart from illustrating possible situations, the examples show how we can disentangle various mechanisms generating IC.

No guaranteed output

Example I

Consider a company characterised by declining marginal productivity (Fig. 1, dark bars), a small probability of illness (\(s=5\%\)), \(w=2\), and a normalized price \(p=1\).

With current parameters, \(\text {MP}^E(L)<\text {MP}(L)\); hence, the risk of illness can only result in hiring the same or lower number of workers, for any wage. It is optimal to hire ten employees, regardless of the 5% risk: \(L^*_h=L^*_s=10\). Thus, even if the company foresees sick-leaves, there are no adjustments. Still, the risk of illness results in \(Y^E(L)<Y(L)\), and in particular \(Y^E(10)<Y(10)\): the same number of employees delivers (in terms of expected values) a product reduced by \(Y(10)-Y^E(10)\approx 1.044\) (graphically in Fig. 1, the difference in the area of the first ten dark and light bars). As \(p=1\), this is exactly the value of a lost product, i.e. IC.

According to the wage-based estimate, often used in applied research, IC would be estimated as the number of sick leaves multiplied by wage: \(L^*_s\times s\times w = 10\times 5\%\times 2=1\). The difference between the actual (in our model) and approximated (by wage-based estimate) IC is small in this case, showing that when there are no adjustments, the two values coincide.

We assumed that company’s actions do not change the equilibrium price. If we take our model to the whole market, and assume all the companies are affected by the risk of illness, then all the companies will reduce the actual output. Then, also under perfect competition assumption we make, we should adjust the price, p, upwards. In other words, taking the model to the market level would require making p endogenous. That would complicate the IC definition, as the value of a unit of good would also change. We do not pursue this issue in the present manuscript but it seems one of the issues to be considered in further research.

Example II

We consider a greater risk of illness, \(s=10\%\), and set \(w=2.5\). Should there be no illness, it would be optimal to hire nine employees, \(L^*_h=9\), but with illness it drops to \(L^*_s=7\), cf. Fig. 2. Analogously to Example I, the expected IC is given by \(\left( Y(L^*_h)-Y^E(L^*_s)\right) \times p=\left( Y(9)-Y^E(7)\right) \times 1\), in Fig. 2 the difference in area between the first nine dark bars and the seven light bars. The expression for IC can be rewritten in the following form

with both (I) and (II) positive (and both easily readable off Fig. 2: the difference between nine or seven dark bars vs. the difference between seven dark or seven light bars, respectively). Then (I) denotes the output loss resulting from the company adjusting to the expected sick-leaves and effectively reduced marginal productivity of employees; and (II) denotes the loss resulting from the actual sick-leaves (in the company after adjustment). As easily seen in Fig. 2, (I) can be much larger than (II). Thus, it is the expectations and adjustments that are responsible for the major part of indirect cost.

The wage-based estimate would yield \(L^*_s\times s\times w=7\times 10\% \times 2.5=1.75\); much less than the actual loss in the model. Hence, by not accounting for the impact of the general phenomenon of illness occurrence on the company’s hiring policy and only basing the estimates on the observed number of sick-leaves, we may substantially underestimate the IC.

The difference between examples I and II is only quantitative: both examples use a declining \(\text {MP}\). Hence, quite small quantitative changes in input parameters can result in important qualitative differences in the results concerning the value of IC as well as the main mechanism driving the IC.

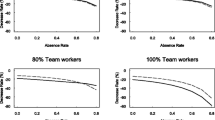

Example III

In Examples I and II, we assumed a declining marginal productivity of labour. We now assume that marginal productivity first increases (up to eight employees) only then to be diminishing, cf. Fig. 3. This type of situation can occur in companies that offer a non-scalable good (e.g., have to deliver a complete project) requiring a team of some size, but also have some defined capacity limiting the productivity when the number of employees is increased. We take \(w=3\) and the risk of illness \(s=10\%\).

Now, \(L^*_h=9\) but, surprisingly, \(L^*_s=11>L^*_h\). That is the result of the marginal productivity defined in Eq. 4 being smeared rightwards as discussed in “Sick-leaves” section. The IC is given as (analogously to Eq. 6)

Now, (I) is negative: company’s adjustments increase employment and output (with no illness). In total, combining (I) and (II), we end up with an increased value of product delivered to the market, hence, a negative IC (we might call it indirect gains). Estimating the IC using wage-based estimate would yield \(L^*_s\times s\times w=3.3\), an obvious overestimation.

Guaranteed output

Example IV

We take the marginal productivity function as in Fig. 4, \(p=1\), and \(w=4.9\). Without illness, the company would hire six employees and contract the whole output: \(L^*_h=6, Y(L^*_h)=45\) (the sum of the first six dark bars in the figure), and \(G^*_h=45\).

We consider the risk of a sick-leave \(s=25\%\). Looking numerically for the optimal combination of L and G, we obtain \(L^*_s=5\) and \(G^*_s=34\). Again, there are the two sources for IC considered earlier: firstly, company reducing the number of hired workers due to foreseeing the possibility of them being ill and, secondly, workers actually getting ill. In the present example, having to contract the output beforehand does not change the number of workers hired: without shortfall penalties the company would also hire five workers, simply by looking at the \(\text {MP}^E({\cdot })\). In this case, there is an additional effect, however: \(Y(5)>34\), which means that it may happen (with probability \(75\%^5\approx 24\%\)) that all five workers will be available but still, due to (optimally set) \(G^*_s\) the company will only produce and deliver to the market 34 units of good.

We treat this \(G^*_s<Y(L^*_s)\) as a constituent of IC but we agree it may be disputable. On one hand, it deprives the market of the goods that could be delivered. On the other hand, the consumers made contracts with companies beforehand, and so there are no consumers expecting the company to deliver these extra units.

Summing up, with no illness the company would hire six workers and promise (and deliver) 45 units of good. Expectations and adjustments result in hiring five workers only and promising on the safe side 34 units of good. Thus the expectations and adjustments, even with no illness actually occurring, lead to \(\text {IC}=11\). Workers actually getting ill reduces the expected delivered product further to ca. 30.45, increasing IC to ca. 14.55.

Should there be no contracting, the company would still hire five workers but would not artificially limit the production to \(G^*_s=34\). Then the expected delivered output would amount to 31.875 units. Thus, guaranteeing output and shortfall penalties per se contributes to the indirect cost.

The wage-based approach yields \(L^*_s sw=6.125\) and underestimates the IC.

Example V

We modify, comparing with example IV, \(p=2\) and \(w=4.9\), but the \(\text {MP}({\cdot })\) function is the same as in Example IV. With no illness, \(L^*_h=8\), and it is optimal to contract the whole production, \(Y(L^*_h)=52\). With a high risk of illness, \(s=40\%\), we get \(L^*_s=12\), even though \(\text {MP}^E(12)<w\) (cf. Fig. 5), as hiring many employees allows the company to manage the delivery of a contracted output better. The company will set \(G^*=49\), would be able to produce 48.26 units on average, but will actually produce 46.39 units on average, only (not using its full capacity on some occasions, due to limited guaranteed output). IC is thus equal to 5.61.

Interestingly, now the guaranteed output mechanism reduces IC: without it, \(L^*_s=10\) (looking at the \(\text {MP}^E({\cdot })\) function, cf. Fig. 5), and the company would deliver 43.8 on average.

With the wage-based approach, we would get \(L^*_s\times s\times w=12\times 40\%\times 4.9=23.52\); an overestimation of IC.

An example can be also constructed with shortfall penalty resulting in such an increase in employment that IC is negative (not presented for brevity).

Discussion

We showed that sick leaves combined with company expecting and preparing for them may impact company’s functioning and IC in very different ways. Companies aware of the risk of the sick leaves may hire fewer or more workers. In the former case, the actual IC is greater than as estimated using standard, wage-based, methods (multiplying observed average sick leaves by the daily wage); in the latter case, the IC is reduced and even possibly negative. In our model, the former case is associated with diminishing marginal productivity, and the latter is more easily associated with an initially-increasing marginal productivity (which we interpert to represent teamwork). As shown by Example V, having to pay shortfall penalties for undelivered guaranteed output may actually reduce IC.

The above findings are contrary to what was observed by Pauly et al. (2002). The difference lies in our approach to finding substitutes for sick workers. Pauly et al.’s result hold when the cost of finding substitutes exceeds the wage. In our case, even though we do not model the process of looking for substitutes, the possibility to hire more workers preparing for the sick leaves (setting \(L^*_s>L^*_h\) as in Examples III and V) can be treated as hiring substitutes for the expected sick workers at the standard wage w. Their results and ours are not in disagreement, in this sense.

Our model allows to differentiate between various mechanisms generating IC, some of them not included in the standard wage-based approach. We believe that when analysing IC more attention should be paid to how illness as a phenomenon (as opposed to the actual occurrence) distorts the companies’ functioning and generates cost to the society. We might also go beyond the hiring or contracting policy. For example, in the present study the firm cannot store its product. Storing would smooth the impact of shocks caused by illnesses, and looks especially attractive when the company faces shortfall penalties. However, it should be noted that storing goods generates cost (frozen capital, insurance, storage area, guarding), and this cost increases IC. The overall net impact on IC may be, thus, difficult to define and estimate.

We agree that our approach to modelling teamwork is a bit naïve; we do not, e.g., directly model the variety of competences needed in a team to complete the project, which may be perceived as a definition of teamwork. In real life, the workers in the same company may differ with respect to how team-work-oriented their job is (e.g., Pauly et al. 2008, estimated the multipliers measuring the effect of worker’s absence on the product for various professions). Accounting for this would require defining various types of labour and extending the model, which is left for further research.

In the paper, we directly considered only absenteeism, not presenteeism. Nonetheless, the absent workers are still paid by the company, and the company does not replace the absent workers; hence, effectively there is no difference between the two-eeisms. The differences would emerge, e.g., if the model was extended to allow for ad hoc replacement or process reorganization: the company is sure to notice the absence of a worker, but may overlook the reduced productivity.

It can, of course, be questioned whether firms apply economic reasoning to optimize their processes; probably, a large number of entrepreneurs running small and medium-size firms do not know the definition of \(\text {MP}(L)\). However, if we assume that firms aim to maximise profits, then companies by trial-and-error (e.g., analysing profits generated by varying employment levels caused by the natural rotation) can find optimal values of parameters. Moreover, firms applying optimal solutions will obtain better results and, assuming such a behaviour is rewarded (e.g., by greater resistance to shocks and a smaller risk of bankruptcy), should prevail in the market via the survival-of-the-fittest mechanism. Alternatively, the present study can be treated as an analysis of what would happen in an ideal, optimally managed company.

We assumed that the employer pays the ill, which may not be true for all the markets.Footnote 2 Should the salaries be paid by the insurer during the whole illness, that would probably result in wages being greater in order to include premium paid to the insurer, which would not change the expected values and the results. That might be formally verified in further research.

We did not aim to opt for HCA or FCM method, but our analysis suits the latter more. We neglected the possibility of replacements, à la HCA, but that was due to analysing only a single, short time period. More importantly, we defined IC as the actual difference in output in the model (treating the changes in the number of hired workers only as an intermediate result), and that is much closer to FCM. In HCA, we focus on people being ill, and so people simply not being hired will not be treated as a source of IC.

We briefly mentioned (“Example I” section) that moving our model onto the whole market level, to encompass multiple companies, may be challenging, as would require treating p as endogenous. Then, also juxtaposing the adjustments of multiple companies in hiring policy would impact the global labour market. Fortunately, no qualitative changes should be expected; e.g., the companies hiring less willingly would endogenously decrease w and simply alleviate the reduction in hiring, not changing the direction of the effect. If the companies vary with respect to the marginal productivity, then some may hire more, and some hire less, and these two effects may cancel each other out to some extent. Moving the current model to the whole market level is, again, left for further research.

Conclusions

Not only sick-leaves but also companies preparing for them can be formally analysed using microeconomic modelling. We showed, that even in a simple model a variety of situations can occur, and companies foreseeing the risk of illness can either alleviate or increase the IC. The switch between the two can happen with only a slight change of input parameters. In our model, surprisingly perhaps, teamwork and shortfall penalties may promote adjustments in labour force alleviating the output loss (and even leading to negative IC).

We would like to stress a general conclusion, however. Illnesses have dual impact on the firms’ functioning: (1) the possibility of illness occurring impacts how firms organise their processes and (2) the actual occurrence impacts the ultimate results. When calculating IC two streams should be explicitly accounted for. Methods typically presented in the literature do not look at the former and so may yield biased results. Considering various market (labour and good, possibly also capital) mechanisms is required to fully understand how indirect cost should be measured.

Notes

This assumption approximately holds, e.g., in Poland, where the employer pays the salary for the first 33 days of the illness, and then the public insurer takes over (the employee gets 80% of a regular wage). Similar model is used in Germany, where the employer pays full salary for at least first 6 weeks of illness, then the insurer pays 70% of salary. In Sweden, employer covers sick-leaves for the first 2 weeks of illness.

References

Arnold, D., & de Pinto, M. (2014). Sickness absence, presenteeism and work-related characteristics: Conference paper. Conference: Beiträge zur Jahrestagung des Vereins für Socialpolitik 2015: Ökonomische Entwicklung—Theorie und Politik—Session: Labor-Empirical Studies 5, No G16-V1.

Audrey, S., & Procter, S. (2015). Employers’ views of promoting walking to work: A qualitative study. International Journal of Behavioral Nutrition and Physical Activity. doi:10.1186/s12,966-015-0174-8.

Berger, M., Murray, J., Xu, J., & Pauly, M. (2001). Alternative valuations of work loss and productivity. Journal of Occupational and Environmental Medicine, 43, 18–24.

Brouwer, W., van Exel, N., Baltussen, R., & Rutten, F. (2006). A dollar is a dollar is a dollar—Or is it? Value in Health, 9, 341–347.

Bryson, A. (2013). Do temporary agency workers affect workplace performance? Journal of Productivity Analysis, 39, 131–138.

Burton, W., Morrison, A., & Wertheimer, A. (2003). Pharmaceuticals and worker productivity loss: A critical review of the literature. Journal of Occupational and Environmental Medicine, 45, 610–621.

Capri, S., Ceci, A., Terranova, L., Merlo, F., & Mantovani, L. (2001). Guidelines for economic evaluations in Italy: Recommendations from the Italian group of pharmacoeconomic studies. http://www.ispor.org/PEguidelines/source/Italy%20PE%20guidelines_Italy.

College Voor Zorgverzekeringen (2006). Guidelines for pharmacoeconomic research. http://www.ispor.org/PEguidelines/source/HTAGuidelinesNLupdated2006.

DeLeire, T., & Manning, W. (2004). Labor market costs of illness: Prevalence matters. Health Economics, 13, 239–250.

Knies, S., Boonen, A., Candel, M., Evers, S., & Severens, J. (2013). Compensation mechanisms for lost productivity: A comparison between four European countries. Value in Health, 16, 740–744.

Koopmanschap, M., Rutten, F., van Ineveld, B., & van Roijen, L. (1995). The friction cost method for measuring indirect costs of disease. Journal of Health Economics, 14, 171–189.

Koopmanschap, M., & van Ineveld, B. (1992). Towards a new approach for estimating indirect cost of disease. Social Science and Medicine, 34, 1005–1010.

Krol, M., Brouwer, W., & Rutten, F. (2013). Productivity costs in economic evaluations: Past, present, future. Pharmacoeconomics, 31, 537–549.

Krol, M., Brouwer, W., Severens, J., Kaper, J., & Evers, S. (2012). Productivity cost calculations in health economic evaluations: Correcting for compensation mechanisms and multiplier effects. Social Science and Medicine, 75, 1981–1988.

Leigh, J. P. (1981). The effects of union membership on absence from work due to illness. Journal of Labor Research, 2, 329–336.

Liljas, B. (1998). How to calculate indirect costs in economic evaluations. Pharmacoeconomics, 13, 1–17.

Loeppke, R., Hohn, T., Baase, C., Bunn, W., Burton, W., Eisenberg, B., et al. (2015). Integrating health and safety in the workplace: How closely aligning health and safety strategies can yield measurable benefits. Journal of Occupational and Environmental Medicine, 57, 585–597.

Pauly, M., Nicholson, S., Polsky, D., Berger, M., & Sharda, C. (2008). Valuing reductions in on-the-job illness: ‘Presenteeism’ from managerial and economic perspectives. Health Economics, 17, 469–485.

Pauly, M., Nicholson, S., Xu, P. D. J., Danzon, P., Murray, J., & Berger, M. (2002). A general model of the impact of absenteeism on employers and employees. Health Economics, 11, 221–231.

Pharmaceutical Benefits Advisory Committee (2008). Guidelines for preparing submissions to the pharmaceutical benefits advisory committee. http://www.ispor.org/PEguidelines/source/Australia-Guidelines-for-preparing-submissions-to-the-Pharmaceutical-Benefits-Advisory-Committee-2008.

Pharmaceutical Benefits Board (2003). General guidelines for economic evaluations from the pharmaceutical benefits board. http://www.ispor.org/PEguidelines/source/Guidelines_in_Sweden.

Suhrcke, M., Sauto Arce, R., McKee, M., & Rocco, L. (2012). Economic costs of ill health in the European region. In J. Figueras & M. McKee (Eds.), Health systems, health, wealth and societal well-being: Assessing the case for investing in health systems (European Observatory on Health Care Systems). New York: Mcgraw Hill.

Walter, W., & Zehetmayr, S. (2006). Guidelines on health economic evaluation:consensus paper. http://www.ispor.org/PEguidelines/source/Guidelines_Austria.

Acknowledgements

This paper was partially prepared when M. Jakubczyk was at The University of Iowa, Tippie College of Business, which was possible thanks to the Fulbright Senior Award 2015/2016. We would also like to thank R. Amir for useful comments.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Appendix

Appendix

Proof of Proposition 1

We first show how \(\text {MP}^E({\cdot })\) can be presented in a different form, more convenient for the present proof. We start with rewriting Eq. 4 and then modify it (notice we write it for \((L+1)\)-th worker here and change how the summation range is denoted)

where we use the fact that for \(i\in {\mathbf {N}}, 0<i<L, {L \atopwithdelims ()i}={L-1 \atopwithdelims ()i} + {L-1 \atopwithdelims ()i-1}\). Hence, \(\text {MP}^E(L+1)\) is a weighted average (with weights s and \(1-s\)) of \(\text {MP}^E(L)\) and a similarly calculated expression in which we take \(\text {MP}\)s moved one worker to the right. As \(\text {MP}({\cdot })\) is decreasing it must be that

as \(\ge \) holds for each term of the summation. \(\square \)

Proof of Proposition 2

The proof takes several steps. First, notice that \(\text {MP}^E(1)=(1-s)\text {MP}(1)\), and \(\text {MP}^E(2)=(1-s)\left( s\times \text {MP}(1)+(1-s)\times \text {MP}(2)\right) \). Then, if \(\text {MP}(2)\ge \text {MP}(1)\), then \(\text {MP}^E(2)\ge \text {MP}^E(1)\) for any s. Thus, if \(\text {MP}({\cdot })\) is increasing initially, so is \(\text {MP}^E({\cdot })\).

Notice, that if \(\text {MP}({\cdot })\) is decreasing after some point, then \(\text {MP}^E\) must also decrease at some point. Say, we calculate \(\text {MP}^E({\cdot })\) for some \(0\ll L_1\ll L_2\), where already \(L_1\) is much greater than the point where \(\text {MP}({\cdot })\) started to be decreasing. Increasing \(L_2\) results in \(\text {MP}^E(L_2\)) being calculated (as a weighted sum in Eq. 4) averaging lower values of \(\text {MP}({\cdot })\) than when calculating \(\text {MP}^E(L_1)\) (the weights assigned to the values of \(\text {MP}({\cdot })\) prevailing in both sums can be made arbitrarily small by increasing \(L_2\)).

We now show that if \(\text {MP}^E(L+1)<\text {MP}^E(L)\) then \(\text {MP}^E({\cdot })\) must be strictly decreasing further on. This is the main part of the whole proof, and again it is done in several steps. First, \(\text {MP}^E({\cdot })\) is calculated as an expected value of \(\text {MP}({\cdot })\) function calculated for a variable distributed according to a binomial distribution. It is then useful to see how the probabilities change in this distribution. Denote by B(k, n, p) the probability of k successes in n independent experiments, where a single success comes with probability p. We are interested in

and this is increasing in k.

As noticed in the proof of Proposition 1, \(\text {MP}^E(L+1)\) is calculated as a weighted average of \(\text {MP}^E(L)\) (calculated based on \(\text {MP}({\cdot })\) for workers from 1 to L) and a weighted average of \(\text {MP}\) calculated for workers from 2 to \((L+1)\) with weights given by a binomial distribution \(B({\cdot },L-1,1-s)\). It will be useful to show that if

and so \(\text {MP}^E(L+1)<\text {MP}^E(L)\), then also

Let \({\varDelta }(i)\) denote \(\text {MP}(i)-\text {MP}(i-1)\), defined for \(i\ge 2\). \({\varDelta }({\cdot })\) is positive for the part of \(\text {MP}({\cdot })\) with increasing marginal productivity. Our assumptions guarantee that \({\varDelta }({\cdot })\) changes from positive to negative. Rewriting inequality 10

and, analogously, in order to prove inequality 11 we need to show that

Obviously some \({\varDelta }({\cdot })\) values in inequality 12 must be negative. Assume non-trivially that also some (for \(i\le i^*\)) are positive. Then

where (I) is positive, and (II) is negative. We have \(\text {(I)}+\text {(II)}<0\), and so

as Eq. 9 is increasing in k, and so the negative elements in (II) are inflated more than the positive elements in (I). Rewriting the last inequality we get

which proves inequality 13. As the final step, notice that just as we decomposed \(\text {MP}^E(L+1)\), we can decompose \(\text {MP}^E(L+2)\):

where the inequality results from omitting a negative term and \(1-s^2\ge 1-s\). This finishes the proof of \(\text {MP}^E({\cdot })\) being decreasing ever since the first decrease.

Finally, to show that the first decrease will only happen for some L greater than the point at which \(\text {MP}({\cdot })\) attains its maximum, it’s enough to revert the argument presented in the proof of proposition 1. \(\square \)

Proof of Proposition 3

We will show that if for some L we have \(\text {MP}^E(L) \le \text {MP}^E(L+1) \ge \text {MP}^E(L+2)\), then the difference \(\text {MP}^E(L+2)-\text {MP}^E(L+1)\) is strictly increasing in s. Based on the decomposition presented in the proof of Proposition 1, this difference amounts to

and so to

or, more concisely, to \((1-s)^2\sum _{i=0}^L {L \atopwithdelims ()i}(1-s)^i s^{L-i}{\varDelta }(i+2)\).

The derivative of this expression with respect to s is given as \(\text {(I)}+\text {(II)}+\text {(III)}+\text {(IV)}+\text {(V)}\), where

Now, \(\text {(II)}+\text {(IV)}=(1-s)^2 L\sum _{i=0}^{L-1} {L-1 \atopwithdelims ()i}(1-s)^i s^{L-1-i}{\varDelta }(i+2)\), while \(\text {(III)}+\text {(V)}=-(1-s)^2 L\sum _{i=0}^{L-1} {L-1 \atopwithdelims ()i}(1-s)^i s^{L-1-i}{\varDelta }(i+3)\).

Notice (cf. Eq. 8 in the proof of Proposition 1) that

Accounting for our assumptions, that directly proves that \(\text {(II)}+\text {(IV)}\ge 0\) and \(\text {(I)}\ge 0\) (applying the formula to \(\text {MP}^E(L+2)-\text {MP}^E(L+1)\)).

We can also decompose \(\text {MP}^E(L+2)\) into three elements as shown in first three lines of Eq. 14 in the proof or Proposition 2. Again, accounting for the fact that \(\text {MP}^E(L) \le \text {MP}^E(L+1) \ge \text {MP}^E(L+2)\) it must be that \(\text {(III)}+\text {(V)}\ge 0\).

If either \(\text {MP}^E(L) < \text {MP}^E(L+1)\) or \(\text {MP}^E(L+1) > \text {MP}^E(L+2)\), then the derivative is strictly positive (for \(s<1\)). \(\square \)

Rights and permissions

About this article

Cite this article

Jakubczyk, M., Koń, B. The impact of firms’ adjustments on the indirect cost of illness. Int J Health Econ Manag. 17, 377–394 (2017). https://doi.org/10.1007/s10754-017-9212-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10754-017-9212-1