Abstract

This article estimates the effects on depressive symptoms, family relationships, social support, and academic self-efficacy of participating in a forgivable loan program, using an instrumental variable (IV) estimation strategy. In particular, we estimate local average treatment effects (LATE) of program participation on these variables, using program eligibility as an instrument. In this case, estimation needs to account for endogeneity, given that not all eligible students decided to participate in the program and that variables affecting the decision to participate in the program might be related to the psychological variables being evaluated. We found negative effects on all the psychological variables. Additionally, we found that program participants were significantly more likely to move and attend elite, accredited, and more expensive universities, which explains the observed psychological symptoms. Results are interpreted in terms of the pressures that non-traditional students receiving financial aid face when adapting to college.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

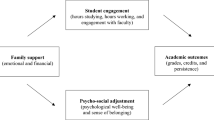

Finding that financial aid increases college enrollment and graduation might seem obvious. However, the decision to enter and stay in college is not fully rational, and therefore it cannot be explained by models based exclusively on profit maximization (Thaler 2015). For this reason, understanding the effects of financial aid on college enrollment requires to explore less obvious questions: How are students going to feel in the college context? Are they going to feel supported and accepted? Are they going to feel happy, successful, and competent? How is the sense of self-efficacy going to be affected by the new environment? This study describes the effects of a nationwide forgivable loan program on several psychological variables in a large sample of first-year college students. Specifically, this study focuses on the psychological outcomes of students participating in “Ser Pilo Paga,” a program that provided merit-based forgivable loans for tuition and living expenses to low SES students enrolled in high-quality institutions accredited by the government. To participate in the program, students should be ranked in top 9% in the national qualification exam and had to come from a household scoring below the poverty cutoff (Londoño-Velez et al. 2017). The entire loan became a grant if students graduate, but they had to assume the full costs of tuition and expenses if they did not. Prior research shows that the program increases low-SES students’ enrollment in high-quality institutions in Colombia, a country with very high levels of inequality (Alvarez et al. 2017). However, so far, only qualitative descriptions of its psychological effects have been conducted (Corredor et al. 2019). These descriptions point out that students in the program face strong symbolic and economic barriers when trying to adapt to college and that they display multiple agentive strategies to overcome these barriers. To provide quantitative estimations of the program’s psychological effects, differences between participants and non-participants in several psychological variables are evaluated using instrumental variable (IV) estimation. We find negative effects of program participation on depressive symptoms, family relationships, social support, and academic self-efficacy. These effects are explained by several features of the program such as placing students in elite universities, creating potential debt, increasing academic pressure, and allowing geographic mobility. These factors are also evaluated using an IV strategy.

Financial aid programs for college education

Literature on financial aid programs shows that providing financial aid to college students increases enrollment rates among financial aid recipients (Alvarez et al. 2017; Dynarski 2002; Londoño-Velez et al. 2017). Furthermore, financial aid favors the enrollment of low-income and minority students (Alon 2011). Regarding the effects of financial aid on persistence and graduation, the evidence is mixed (Hossler et al. 2009). Some research shows positive effects of financial aid (Alon 2007), while other evidence shows no effects on post-enrollment measures, even for 2-year programs (Welch 2014). Additionally, research points out that there are high attrition rates among financial aid beneficiaries, even in merit-based programs, and that financial aid for 4-year programs only improves persistence for students who are able to keep financial support (Henry et al. 2004). These results indicate that success for financial aid beneficiaries is not guaranteed. Take, for example, the case made by Alon (2005) showing that, in need-based programs, financial aid increases persistence but unobserved student characteristics associated with eligibility act in the opposite direction, in many cases offsetting the positive effects of financial aid.

To better understand the pressures derived from financial aid, particularly from forgivable loan programs, the effects of loans need to be described (Alon 2007). Research indicates that loan availability has positive effects on enrollment (Page and Scott-Clayton 2016), although these effects might be negative for minority or low-income students, who might be reluctant to assume the long-term financial burden and risk of loans (Dowd 2008; McKinney and Novak 2015). Similarly, evidence regarding the effects of loans on persistence is mixed (Hossler et al. 2009). The consensus among scholars is that loans are less effective than other types of aid when it comes to persistence (Alon 2007), in some cases showing negative effects (Dowd and Coury 2006; Herzog 2015). During college, debt can further discourage students who face a combination of increasing debt and poor academic performance (Alon 2007; Cofer and Somers 2000), particularly if they come from lower-income families (McKinney and Novak 2015).

Despite this evidence, forgivable loan programs have been proposed as a strategy to relieve cash-flow constraints (Bruce and Carruthers 2014). Making loans forgivable creates incentives for students to invest heavily in their academic progress and graduate to reduce or eliminate any debt. This type of strategy has been implemented, for example, in some European countries in which policy changes have led to increases in tuition (Hofman and Van Den Berg 2000). However, loans which can be forgiven depending on academic progress or student characteristics (e.g., low income) are not effective to increase the enrollment in higher education, in part due to their low popularity and take-up (Kroth 2015; Lauer 2002; Vossensteyn et al. 2013). Additionally, research suggests that making loan forgiveness conditional to graduation time has small effects on graduation (Häkkinen and Uusitalo 2003). This is so because students are loan averse and do not act rationally when comparing the college premium and the real interest rates of loans (Hämäläinen et al. 2017; Kroth 2015; Oosterbeek and van den Broek 2009). Consistently, they prefer to work part-time instead of obtaining a loan (Vossensteyn 2002; Vossensteyn and de Jong 2006). Data suggests also that the introduction of performance-related forgiveness produced a temporary decrease in enrollment and also had a lasting effect moving students toward less demanding programs (Vossensteyn and de Jong 2006). Regarding the conditions of forgiveness, performance-related forgiveness is more effective than progress-related forgiveness. However, most of the students’ progress through the curricula is explained by preexistent student and college characteristics (Hofman and Van Den Berg 2000; Van den Berg and Hofman 2005; Hämäläinen et al. 2017). Some negative interactions between working hours and study progress have been identified for students in forgivable loan programs (Hofman and Van Den Berg 2000).

From a psychological point of view, this type of program might create strong psychological pressures. These pressures are not unidimensional or exclusively related to debt. They come from the interaction of social and academic challenges that difficult working class students’ adaptation to college (Corredor et al. 2019) and which can lead them to drop out (Lohfink and Paulsen 2005) and have to pay college loans that would be otherwise forgiven. In the next section, we review literature related to the psychological effects of financial aid programs.

Studying in a forgivable loan program: under pressure

Literature on financial aid has traditionally focused on economic aspects of college enrollment and persistence. Even in cases in which the students’ college experience is considered, it is done so with the goal of explaining persistence (e.g., St. John et al. 2005). This literature, however, can help us to understand the pressures that act on financial aid recipients and the possible effects of this aid. Students in financial aid programs are subject to at least three different types of psychological pressure: academic pressure, social pressure, and financial pressure. Academic pressure can come from academic requirements to keep financial support, which might be a challenge for students coming from underprivileged backgrounds with poor school systems, for instance, those in need-based programs. Prior research has shown that grades are an important part of students’ experience and play a pivotal role in the decision-making process whether to stay or leave college (St. John et al. 2005). In fact, poor academic performance seems to influence the decision to drop out from college (Dowd 2004; Dowd and Coury 2006), particularly when facing growing economic debt (Alon 2007; Cofer & Somer, 200).

Secondly, financial aid programs allow students to be in a social and cultural environment that is different from the context in which they grew up, and this can increase social pressure. This assumption is reasonable, given that financial aid programs change the relationship between the net prices of college education and the budget constraints of students and their families while in college (Chen and Hossler 2017; Page and Scott-Clayton 2016), enabling these students to attend schools that otherwise would be too expensive. In fact, given the high costs of college education, financial aid has become a critical resource for non-traditional students (Chen and Hossler 2017). However, social class influences socialization and social integration (Rubin 2012), which, in turn, affects academic performance and persistence (Pulido and Herrera 2018; Robbins et al. 2004). For instance, academic integration—including having interaction with faculty, as well as participating in study groups and being satisfied with social life—increases the likelihood of graduating (Borba and Marin 2017; Lohfink and Paulsen 2005). Moreover, the educational background of parents, a proxy for social class, plays a central role in determining performance and perceived stress in university life (Shields 2002). Additionally, forgivable loan programs allow students to leave their hometowns to attend college, which is not a common practice in Colombia, a country with strong cultural differences among regions. The psychological effects of geographic mobility in international students are well-established, but little research has been devoted to the effects of within-country mobility (Constantine et al. 2004).

Thirdly, financial pressure can arise when students are receiving financial aid through loans, forgivable or not. Loans have negative psychological effects (Herzog 2015) due to uncertainty regarding graduation and to the negative affective effects of debt (Dowd and Coury 2006). More generally, psychological research has shown that debt, in general, has negative effects on psychological functioning, in some cases leading to high levels of anxiety and mental disorders (Walsemann et al. 2015). Our claim is not that debt is the sole factor that determines psychological pressure on beneficiaries, but that, in the context of forgivable loan programs, it is one of the factors exerting psychological pressure.

Not all financial aid recipients have different backgrounds from other students at the universities they attend. However, for those who do, college represents a challenge (Keels 2013). Prior research has shown, for example, that being the first in a family to attend college increases the feeling of being less prepared (Shields 2002). Consistently, research shows that social class influences both retention and GPA (Robbins et al. 2004), which makes it harder for non-traditional and working class students to perform at the level of their classmates from higher-SES backgrounds. Consistently, research shows that working class students face more difficult objective conditions, such as working more hours off-campus and being less likely to live in it (Rubin and Wright 2017).

Being different in terms of social class also affects the way students react to debt. For instance, low-SES students tend to be more averse to debt and more price sensitive than are students from other social classes (Callender and Jackson 2005; Dowd and Coury 2006). Working class students also have more difficulty in adapting socially to college (Rubin 2012). For instance, students whose parents did not attend college have a lower sense of college belonging (Pittman and Richmond 2007). In fact, both subjective and objective class backgrounds seem to influence academic adjustment to college and the sense of belonging (Ostrove and Long 2007). A related line of research shows that once in college, non-traditional students receive constant microagressions that undermine their sense of intelligence and competence, which sometimes creates a hostile and invaliding learning environment for them (Suárez-Orozco et al. 2015). Some college characteristics favor working class students’ adaptation and persistence, such as the public or private character of the institution (Cofer and Somers 2000), the availability of counseling (Dowd 2008; Page and Scott-Clayton 2016), or the diversity of the school in terms of social class (Leyton et al. 2012).

Psychological outcomes: the agony of education

To this point, we have shown that several sources of psychological pressure might act on students in financial aid programs. Some of them related to academic factors, others to social integration, and others to debt. Here we present a non-exhaustive list of variables that could be affected by these pressures. The college experience can affect how students perceive their family relationships. During the first year of college, students face new academic and social pressures that can conflict with their family routines and characteristics (Clark 2005). This process might be even harder for non-traditional students who strive to maintain healthy family relationships and, simultaneously, build support networks with other students and peer-mentors in order to cope with new aspects of college life (Hurtado et al. 1996). Similarly, the perception of social support might be affected by the college experience because working class students might struggle to socialize in college (Rubin 2012) and their prior social networks might be no longer compatible with the new environment. Students might be under pressure to modify their identity or behaviors to fit the dominant social norms or requirements of college life (Ferguson et al. 2017; Radmacher and Azmitia 2013) or if the social norms of prior networks contradict the social and cultural norms of college (Crockett et al. 2007). Critically, social support from peers and family is a core factor in determining persistence and psychological well-being in college students (Castillo et al. 2004; Crockett et al. 2007; Dennis et al. 2005).

At a different level, financial aid programs allow students to attend institutions of higher quality than those that they would attend otherwise (Carruthers and Fox 2016; Hoxby and Turner 2013). This can affect students’ academic self-efficacy. High academic pressure can make students feel that their academic skills are insufficient for the demands of college courses, thus decreasing their levels of academic self-efficacy. Because high school quality relates to college performance (Fletcher and Tienda 2010) and there is a direct link between academic performance and the perception of self-efficacy (Chemers et al. 2001), students from weak high schools tend to reevaluate their perception of self-efficacy. Importantly, decreasing self-efficacy affects time use and other significant factors related to academic performance (Rodríguez and Clariana 2017).

Finally, the combined effect of these pressures can produce depressive symptoms. The relationship between acculturative stress during college adaptation and depressive symptoms in non-traditional students has been widely reported in the literature (Constantine et al. 2004; Crockett et al. 2007). The relationship between self-efficacy (or the lack of it) and depressive symptoms also has been previously explored (Castellanos et al. 2017). Although the presence of depressive symptoms does not necessarily imply a clinical condition, it points to a constant and acute negative psychological mood that can affect students’ well-being (Radloff 1977). Among the symptoms considered are depressed mood, feelings of guilt, failure, worthlessness, helplessness, loneliness and hopelessness, loss of appetite and sleep disturbance, and the feeling of not being able to handle the current life situation (Solís-Calcina and Manzanares-Medina 2019). In the following section, we will review the method and instruments used to assess these effects among students in a nationwide forgivable loan program.

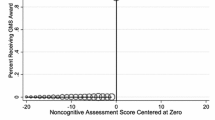

In particular, the present study aims to evaluate the effects of a forgivable loan financial aid program on several psychological variables: family relationships, social support, academic self-efficacy, and depressive symptoms. The first goal of this study is to evaluate these effects using an instrumental variable (IV) strategy. The second goal is to assess whether or not the observed effects stand when models include a set of relevant covariates. The third goal is to identify in which models self-selection endogeneity was not an issue and ordinary least squares (OLS) regression results should be used. The fourth goal is to evaluate the role of certain program features (e.g., academic accreditation, geographic mobility, elite university status, and costs) on the observed psychological effects using the same IV strategy. For models evaluating the effects of participation, local average treatment effects (LATE) were obtained using program eligibility as an instrument and program participation as the independent variable (Alon 2007; Angrist et al. 1996; Welch 2014). For models evaluating the effect of program features, program eligibility was used as an instrument and program features as independent variables, which produces an unbiased estimator of their effects (Angrist and Pischke 2008).

Method

This study was conducted in the context of a nationwide program (“Ser Pilo Paga”) launched in Colombia in 2014. This program provided low-SES students with forgivable loans to attend the college of their choice. To be eligible for the program, participants needed to fulfill three basic requirements: first, they had to come from a low SES household scoring below the poverty cutoff in the wealth index used by the government (Londoño-Velez et al. 2017). Secondly, they had to score in the top 10% of all high school seniors taking the SABER 11, the standardized test used for college admission in Colombia (equivalent to the US SAT). That is, students had to come from a low-SES background and have a relatively high academic performance. Thirdly, students needed to be admitted to a university with a quality accreditation provided by the government (Londoño-Velez et al. 2017). The program covered both tuition and living expenses for students, and it showed effects on enrollment in high-quality institutions for the first two cohorts (Alvarez et al. 2017). The loan becomes a grant if the students graduate.

Unobservable characteristics could differentiate eligible students who decided to participate in the program from eligible students who did not. In particular, self-selection for the program could be related to the psychological variables evaluated as outcomes. Therefore, participation in the program could not be treated as exogenous with respect to the psychological variables evaluated in this study, threatening the reliability of the model estimators (Welch 2014). For these reasons, this article uses an IV approach to estimate the effects of program participation on psychological variables.

Data, measures, and analysis strategy Footnote 1

In this study, we use data from 1487 surveys answered by individuals who were eligible for the program. Individuals in this sample were below the wealth threshold required by the program and scored slightly above or below the required test score required for it. The sample was obtained using a stratified random sampling procedure applying the Fan-Muller-Rezucha algorithm (Bondesson and Thorburn 2008). Eligible individuals from municipalities across the country were contacted and asked to answer a survey that included general socio-demographic and educational questions, as well as the psychological scales used in this study. The survey was 26 pages long and had 130 questions socio-demographic questions covering several topics including living conditions, housing, social networks, family characteristics, spending patterns, high-school education, sources of income, college applications, educational expectations, life project, perceived value of education, and time use. The survey was applied in mid-2016 when participants were at the end of their first academic term.

Four scales adapted from prior research and aimed at evaluating important aspects of students’ psychological well-being were analyzed. First, an adaptation of the Brief Family Relationship Scale was used to evaluate how participants perceived their family relationships (Fok et al. 2014). This scale focuses on the relationship dimension of the Family Environment Scale and assesses family cohesion, expressiveness, and conflict. Given the length of our questionnaires, we used a short version of seven items. The reliability of the scale was assessed (Bouquet-Escobedo et al. 2019). It obtained an adequate Cronbach’s alpha of .75.

Secondly, the perception of social support was measured using the Duke-UNC Functional Social Support Questionnaire (Broadhead et al. 1988). This scale measures functional social support, focusing on its affective and instrumental aspects. Among other elements, this scale evaluates the chances to talk to people about different aspects of life, the perception of love and affection, the support available in difficult decisions (e.g., academic decisions) and situations (e.g., being sick), and the company of others in activities such as invitations and visits. The scale included 11 items from the original scale, and it obtained a Cronbach’s alpha of .86.

Thirdly, academic self-efficacy was assessed using a scale measuring students’ confidence about their skills to perform academically, including scheduling, note taking, researching, and writing (Chemers et al. 2001). The scale also measures statements regarding general academic ability. A 7-item version was used (Cronbach’s alpha = .87). This variable was measured only for students who were enrolled in college, and therefore, it has a different sample size in the analysis section.

Finally, the Center for Epidemiologic Studies Depression Scale (CES-D) was used to assess depressive symptoms in program participants (Radloff 1977). This scale measures the levels of depressive symptomatology, focusing particularly on affective components and depressive mood. The components assessed by the scale include depressed mood, guilt, sleep problems, and feelings of worthlessness, helplessness, and hopelessness. In this study, a short version of 10 items of the CES-D scale was used (Cronbach’s alpha = .76).

All the scales required students to rate in a Likert scale their agreement regarding how well a series of statements represented them or their current situation. All had been used previously in social and educational research and represent reliable indicators of psychological well-being and other psychological variables (e.g., Crockett et al. 2007; Philip et al. 2016; Robbins et al. 2004; Yates et al. 2012).

Sociodemographic characteristics of students and their families were also included in models as covariates. This information was coded in the following way: Gender and ethnicity were represented as dummy variables in which 1 represented male and white students, respectively, and 0 represented female and non-white students. The covariates also included age measured in years, and number of family members, student’s work status, and parental education (coded in two variables to indicate whether the student’s mother and father had primary, secondary, technical, or higher education). SES status was represented in “stratum”, an official measure used by the Colombian government, in which 6 is the higher possible SES level. In this case, given the characteristics of the program, students belonged to the three lower strata.

As noted above, unobserved factors can affect simultaneously the decision to participate in an educational support program and the outcomes of the program (Pike et al. 2011), thus creating endogeneity. This problem has been addressed previously using IV estimation (Alon 2007; Welch 2014). This approach produces an unbiased estimate of the effects of an endogenous predictor by using an instrumental variable that is correlated with the predictor but not with other determinants of the outcome measure, such as the regression error (Angrist and Imbens 1995; Pike et al. 2011). At the core of this strategy is the idea that local average treatment effects (LATE) for eligible students can be estimated using program participation as the endogenous regressor and program eligibility as the instrument in the IV model (Angrist et al. 1996). Formally, this model follows the standard IV form:

The dependent variable in Eq. (1), Participationi, is a binary indicator of program participation for student i, which is 1 if the student participated in the program and 0 otherwise. Eligibilityi is a binary indicator of program eligibility that is 1 if the student were eligible for the program (students who fulfilled all requirements) and 0 otherwise. \( {\underset{\_}{X}}_{ij} \) is a vector of j sociodemographic characteristics for each student i, and ηi is the error term for this equation. In Eq. (2), the dependent variable, Yi, is the outcome of interest for the ith individual. \( \hat{Participation_i} \) represents the fitted values for Participationi obtained from Eq. (1), which is the first stage regression in the two-stage least squares (2SLS) regression analysis. The coefficient β1 represents the LATE of program participation in psychological outcomes. \( {\underset{\_}{X}}_{ij} \) is the same vector of covariates used in Eq. (1), and εi is the error term of Eq. (2). Given that Eligibilityi is uncorrelated with εi but correlated with Participationi, it works as an instrument for estimating \( \hat{Participation_i} \) (Alon 2007). This IV approach produces a predicted \( \hat{Participation_i} \) that is uncorrelated with the error term, εi, and an average effect, β1, that is free of bias in the second stage procedure. In this case, β1 estimates the effect of program participation on the psychological outcomes for the subpopulation that was eligible for the program. For this reason, the results of this study must be interpreted as LATE for the subpopulation of eligible students, as is the usual case for this type of IV design in situations of imperfect compliance (Angrist et al. 1996). This strategy has been used previously to estimate the effects of the same program on academic performance and enrollment (Alvarez et al. 2017; Londoño-Velez et al. 2017).

Results

Table 1 lists the descriptive statistics of the four psychological scales used in this study. On average, students scored 3.02 on the family support scale, 3.78 on the social support scale, 4.01 on the academic self-efficacy test, and 2.16 on the depressive symptoms scale. All these Likert scales have a minimum value of 1 and a maximum value of 5. In this sample, the average age was 17.38, and the average score in the national exam was 314, which is slightly above the cutoff point for the program (310). Forty-five percent of students met all eligibility requirements of the program, and 35% of them participated in the program. Sixty-eight percent of participants were attending college. The majority of the sample (70%) self-identified as non-white. The sample was balanced in terms of gender: 46% were men and 54% were women.

Table 2 reports on four models estimating perceptions of family relationships. The first model presents an IV estimation of the program effect, while instrumenting program participation using program eligibility. The second model presents the same IV estimation but includes the set of sociodemographic characteristics as covariates. Models including covariates evaluate the effect of program participation while controlling for other relevant factors that could influence the relationship between participating in the program and family relationships. OLS models are reported and interpreted when no endogeneity is found (Angrist and Pischke 2008). Similar models for all variables were run using enrolled students only, and results were almost the same as those of models including all participants. Given that differences were trivial, we do not present them here as full tables. In the few cases in which models with enrolled students produced different results, they are mentioned explicitly in the text. Models with college students only were run in order to rule out the possibility that the observed effects were consequences of entering college, thanks to the forgivable loans program. This variation was not conducted for self-efficacy, given that only enrolled students answered the self-efficacy measure.

Models presented in Table 2 show significant negative effects of program participation on perception of family relationships, social support, and self-efficacy. Results also show that participating in the program increases depressive symptoms. For all models, partial R-squared values for the first stage regression (Eq. 1) were significant indicating that the instrument is not weak. Endogeneity checks were calculated for all models using the Durbin-Wu-Hausman (DWH) tests, finding that endogeneity was only an issue for models predicting academic self-efficacy. These results indicate that there was no self-selection for all other models (family relationships, social support, and depressive symptoms). That is, eligible students that decided to participate in the program were not different in the outcome variable prior to the program from those that decided not to participate. In this case, regular OLS estimates are reliable (Angrist and Pischke 2008). Not surprisingly, results held for models that did not present endogeneity, given that no IV correction of the OLS models was necessary (see Table 3). As a whole, these effects suggest that the program has negative psychological effects during the first year of college and that the only variable that affects participation of eligible students is academic self-efficacy. Although significant, the effect size of program participation is not large: 1.3% for family relationships (d = 0.144), 2.0% for social support (d = 0.142), 7.4% for academic self-efficacy (d = 0.512), and 3.2% for depressive symptoms (d = 0.299). These effects range from small to medium effect size, which is not uncommon in research on acculturation and mental health in college students (Yoon et al. 2013).

Regarding the covariates affecting family relationships, age and three types of mother’s education (secondary, technical and higher) had significant positive effects. The effect of age was not significant for analyses conducted for college students only. For functional social support, the following covariates related significantly with students’ social support: mother’s education (secondary, technical, higher) and father’s education (higher). For models including college students only, the effect of father’s education was not significant. The only covariate that relates significantly with academic self-efficacy is gender, with men having higher levels of academic self-efficacy than do women. For depressive symptoms, there is a significant effect of employment. This effect suggests that students who have a job present lower levels of depressive symptoms. This effect, however, was not replicated in models including college students only.

Explaining program effects

So far, we have shown that program participation has negative effects in several psychological variables. Although IV estimation is designed to assess causality (Angrist and Pischke 2008), it does not provide an explanation of the mechanism producing the observed causal effects. To solve this limitation, we use an IV estimation strategy to identify the program features that might be producing the negative psychological outcomes (Angrist and Pischke 2008). In this strategy, eligibility is used as an instrument, the possible mechanisms are used as independent variables, and the psychological effect as the dependent variables.

Program participants face three type of pressures: academic pressure, social pressure, and financial pressure. To evaluate academic pressure, we used university accreditation as the independent variable. We made this decision because accredited universities have standardized academic processes and are usually more demanding than non-accredited universities. To evaluate social pressure, two variables were used as independent variables: geographic mobility and elite university status. Geographic mobility was selected because the program allowed students to move to a different city for college, which is not common in Colombia, a country with huge cultural differences among regions. These cultural differences might increase social pressure on program beneficiaries. Elite university status refers to the fact that students are attending a university in the top 5% by student strata, a proxy to SES. Environments at elite universities are shaped by highbrow cultural capital which is unfamiliar for most working-class students and increases social pressure (Corredor et al. 2019). Finally, to assess financial pressure, we used university cost as a proxy to possible debt. Given that students were enrolled in a forgivable loan program in which if they graduate the loan becomes a grant, university cost should not play a role on determining the psychological symptoms. However, if those psychological symptoms are related to costs, it is possible that foreseeable debt plays a role in determining the psychological symptoms.

Results of the IV analyses show that all dependent variables had an effect on the psychological symptoms. Table 4 presents the results of these models. Additionally, similar models including the set of covariates presented in Table 3 were evaluated and the significant effects of the independent variables held. In three models, the Wu-Hausman and Durbin tests showed that the independent variable was not endogenous. In all these cases, OLS regressions showed that these variables had significant effects on psychological symptoms. These models predicted depressive symptoms using costs (B = 0.0130; 0.0030; p < .01), depressive symptoms using elite university status (B = 0.1378; 0.0299; p < .01), and family relationships using costs (B = − .0513, SE = 0.0167; p < .01). For all models, the partial R-squared values for the first stage regression were significant indicating that the instrument is strong. This indicates additionally that eligibility had a significant effect on the independent variables used in these models. That is, eligible students were significantly more likely to move and attend elite, accredited, and more expensive universities. Overall, these models indicate that academic, social, and financial pressure play a role in determining the psychological effects of the program, which can be useful to redesign public policy to decrease these pressures in financial aid programs.

Conclusions

Using an IV estimation, this study finds that participating in a forgivable loan program for college education has a significant LATE on several psychological variables: family relationships, social support, academic self-efficacy, and depressive symptoms. These results are consistent with prior research evaluating the intent-to-treat (ITT) effects of the same program through direct OLS estimation (Alvarez et al. 2017). Additionally, this study shows that the effect of the program is related to academic, social, and financial pressure: the academic quality of the institutions to which students attend, the geographic mobility of students in the program, the fact that many students end up in elite institutions, and the costs of the program. These results are consistent with prior literature showing that working class students face a combination of academic and social pressure in college (St. John et al. 2005; Dowd and Coury 2006; Rubin 2012). Results also show that, to some extent, college costs explain the negative psychological effects of the program, despite the forgivable nature of the loans. This result is consistent with prior literature showing that working class students are risk averse (Callender and Jackson 2005) and react negatively to financial aid framed as loans (Lauer 2002; Vossensteyn and de Jong 2006). Accordingly, the design of public policy programs needs go beyond “rational” models of college enrollment and persistence that focus exclusively on the expected college wage premiums (Lyons and Hunt 2003). This would imply, for example, recommending psychological counseling which is likely to be a key element in the success of financial aid beneficiaries. Future research needs to evaluate the psychological trajectories of students in the long run. Data for this study was obtained during the beneficiaries’ first year of college, a critical but early moment in students’ college experience. It would be interesting to explore whether the effects observed here last or decrease the longer students stay in college, if they stay at all. These results must not be taken as evidence against government support for college education, a basic requirement for equality (Camus et al. 2018). On the contrary, our results call for careful consideration of the conditions under which public support for college education is provided (e.g., raising the possibility of free access to education in public institutions and in private institutions fulfilling certain diversity criteria and offering counseling and support programs).

Notes

The database belongs to the Colombian National Planning Department and was collected by the authors of this article and other co-investigators to generate a baseline for the Ser Pilo Paga program (Alvarez et al. 2017). The data was made public for research at http://sinergiapp.dnp.gov.co/#Evaluaciones/EvalFin/282.

References

Alon, S. (2005). Model mis-specification in assessing the impact of financial aid on academic outcomes. Research in Higher Education, 46(1), 109–125. https://doi.org/10.1007/s11162-004-6291-x.

Alon, S. (2007). The influence of financial aid in leveling group differences in graduating from elite institutions. Economics of Education Review, 26(3), 296–311. https://doi.org/10.1016/j.econedurev.2006.01.003.

Alon, S. (2011). Who benefits most from financial aid? The heterogeneous effect of need-based grants on students’ college persistence. Social Science Quarterly, 92(3), 807–829. https://doi.org/10.1111/j.1540-6237.2011.00793.x.

Alvarez, M. J., Castro, C., Corredor, J., Londoño, J., Maldonado, C., Rodríguez, C., ... & Pulido, X. (2017). El Programa Ser Pilo Paga: Impactos Iniciales en Equidad en el Acceso a la Educación Superior y el Desempeño Académico, Documentos CEDE, 59, 2–72.

Angrist, J. D., & Imbens, G. W. (1995). Two-stage least squares estimation of average causal effects in models with variable treatment intensity. Journal of the American Statistical Association, 90(430), 431–442. https://doi.org/10.2307/2291054.

Angrist, J. D., & Pischke, J. S. (2008). Mostly harmless econometrics: An empiricist’s companion. Princeton: Princeton University Press.

Angrist, J. D., Imbens, G. W., & Rubin, D. B. (1996). Identification of causal effects using instrumental variables. Journal of the American Statistical Association, 91(434), 444–455. https://doi.org/10.2307/2291629.

Bondesson, L., & Thorburn, D. (2008). A list sequential sampling method suitable for real-time sampling. Scandinavian Journal of Statistics, 35(3), 466–483. https://doi.org/10.1111/j.1467-9469.2008.00596.x.

Borba, B. M. R., & Marin, A. H. (2017). Contribuição dos indicadores de problemas emocionais e de comportamento para o rendimento escolar. Revista Colombiana de Psicología, 26(2), 283–294. https://doi.org/10.15446/rcp.v26n2.59813.

Bouquet-Escobedo, G. S., García-Méndez, M., Díaz-Loving, R., & Rivera-Aragón, S. (2019). Conceptuación y medición de la agresividad: validación de una escala. Revista Colombiana de Psicología, 28, 115–130. https://doi.org/10.15446/rcp.v28n1.70184.

Broadhead, W. E., Gehlbach, S. H., De Gruy, F. V., & Kaplan, B. H. (1988). The Duke-UNC Functional Social Support Questionnaire: Measurement of social support in family medicine patients. Medical Care, 709–723.

Bruce, D. J., & Carruthers, C. K. (2014). Jackpot? The impact of lottery scholarships on enrollment in Tennessee. Journal of Urban Economics, 81, 30–44. https://doi.org/10.1016/j.jue.2014.01.006.

Callender, C., & Jackson, J. (2005). Does the fear of debt deter students from higher education? Journal of Social Policy, 34(4), 509–540. https://doi.org/10.1017/S004727940500913X.

Camus, P., Ponce, N., Cataldo, F., & del Valle, M. (2018). Critical discourse analysis: The higher education reform in Chile in written media. Revista Colombiana de Educación, 75, 77–98. https://doi.org/10.17227/rce.num75-8102.

Carruthers, C. K., & Fox, W. F. (2016). Aid for all: College coaching, financial aid, and post-secondary persistence in Tennessee. Economics of Education Review, 51, 97–112. https://doi.org/10.1016/j.econedurev.2015.06.001.

Castellanos, V., Latorre, D., Mateus, S., & Navarro, C. (2017). Modelo explicativo del desempeño académico desde la autoeficacia y los problemas de conducta. Revista Colombiana de Psicología, 26(1), 149–161. https://doi.org/10.15446/rcp.v26n1.56221.

Castillo, L. G., Conoley, C. W., & Brossart, D. F. (2004). Acculturation, white marginalization, and family support as predictors of perceived distress in Mexican American female college students. Journal of Counseling Psychology, 51(2), 151–157. https://doi.org/10.1037/0022-0167.51.2.151.

Chemers, M. M., Hu, L. T., & Garcia, B. F. (2001). Academic self-efficacy and first year college student performance and adjustment. Journal of Educational Psychology, 93(1), 55–64. https://doi.org/10.1037/0022-0663.93.1.55.

Chen, J., & Hossler, D. (2017). The effects of financial aid on college success of two-year beginning nontraditional students. Research in Higher Education, 58(1), 40–76.

Clark, M. R. (2005). Negotiating the freshman year: Challenges and strategies among first-year college students. Journal of College Student Development, 46(3), 296–316. https://doi.org/10.1353/csd.2005.0022.

Cofer, J., & Somers, P. (2000). A comparison of the influence of debtload on the persistence of students at public and private colleges. Journal of Student Financial Aid, 30(2), 39–58.

Constantine, M. G., Okazaki, S., & Utsey, S. O. (2004). Self-concealment, social self-efficacy, acculturative stress, and depression in African, Asian, and Latin American international college students. American Journal of Orthopsychiatry, 74(3), 230–241. https://doi.org/10.1037/0002-9432.74.3.230.

Corredor, J., Álvarez-Rivadulla, M. J., & Maldonado-Carreño, C. (2019). Good will hunting: Social integration of students receiving forgivable loans for college education in contexts of high inequality. Studies in Higher Education, 1–15. Online First. https://doi.org/10.1080/03075079.2019.1629410.

Crockett, L. J., Iturbide, M. I., Torres Stone, R. A., McGinley, M., Raffaelli, M., & Carlo, G. (2007). Acculturative stress, social support, and coping: Relations to psychological adjustment among Mexican American college students. Cultural Diversity and Ethnic Minority Psychology, 13(4), 347–355. https://doi.org/10.1037/1099-9809.13.4.347.

Dennis, J. M., Phinney, J. S., & Chuateco, L. I. (2005). The role of motivation, parental support, and peer support in the academic success of ethnic minority first-generation college students. Journal of College Student Development, 46(3), 223–236. https://doi.org/10.1353/csd.2005.0023.

Dowd, A. C. (2004). Income and financial aid effects on persistence and degree attainment in public colleges. Education Policy Analysis archives, 12(21), 1–33. https://doi.org/10.14507/epaa.v12n21.2004.

Dowd, A. C. (2008). Dynamic interactions and intersubjectivity: Challenges to causal modeling in studies of college student debt. Review of Educational Research, 78(2), 232–259. https://doi.org/10.3102/0034654308317252.

Dowd, A. C., & Coury, T. (2006). The effect of loans on the persistence and attainment of community college students. Research in Higher Education, 47(1), 33–62. https://doi.org/10.1007/s11162-005-8151-8.

Dynarski, S. (2002). The behavioral and distributional implications of aid for college. American Economic Review, 92(2), 279–285.

Ferguson, G. M., Nguyen, J., & Iturbide, M. I. (2017). Playing up and playing down cultural identity: Introducing cultural influence and cultural variability. Cultural Diversity and Ethnic Minority Psychology, 23(1), 109–124. https://doi.org/10.1037/cdp0000110.

Fletcher, J., & Tienda, M. (2010). Race and ethnic differences in college achievement: Does high school attended matter? The Annals of the American Academy of Political and Social Science, 627(1), 144–166. https://doi.org/10.1177/0002716209348749.

Fok, C. C. T., Allen, J., Henry, D., & Team, P. A. (2014). The Brief Family Relationship Scale: A brief measure of the relationship dimension in family functioning. Assessment, 21(1), 67–72. https://doi.org/10.1177/1073191111425856.

Häkkinen, I., & Uusitalo, R. (2003). The effect of a student aid reform on graduation: a duration analysis (no. 2003: 8). Working paper series. Uppsala University, Department of Economics. Retrieved November 8th, 2019, from http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.202.7861&rep=rep1&type=pdf.

Hämäläinen, U., Koerselman, K., & Uusitalo, R. (2017). Graduation incentives through conditional student loan forgiveness (no. 11142). IZA discussion papers. retrieved November 8th, 2019, from https://www.econstor.eu/bitstream/10419/174052/1/dp11142.pdf.

Henry, G. T., Rubenstein, R., & Bugler, D. T. (2004). Is HOPE enough? Impacts of receiving and losing merit-based financial aid. Educational Policy, 18(5), 686–709. https://doi.org/10.1177/0895904804269098.

Herzog, S. (2015). Financial aid and college persistence: Do student loans help or hurt? Research in Higher Education, 1–29. https://doi.org/10.1007/s11162-017-9471-1.

Hofman, A., & Van Den Berg, M. (2000). Determinants of study progress: The impact of student, curricular, and contextual factors on study progress in university education. Higher Education in Europe, 25(1), 93–110.

Hossler, D., Ziskin, M., Gross, J. P., Kim, S., & Cekic, O. (2009). Student aid and its role in encouraging persistence. In J. C. Smart (Ed.), Higher education: Handbook of theory and research (Vol. 24, pp. 389–425). Dordrecht: Springer.

Hoxby, C., & Turner, S. (2013). Expanding college opportunities for high-achieving, low income students. Stanford Institute for Economic Policy Research Discussion Paper, (12-014).

Hurtado, S., Carter, D. F., & Spuler, A. (1996). Latino student transition to college: Assessing difficulties and factors in successful college adjustment. Research in Higher Education, 37(2), 135–157. https://doi.org/10.1007/BF01730113.

Keels, M. (2013). Getting them enrolled is only half the battle: College success as a function of race or ethnicity, gender, and class. American Journal of Orthopsychiatry, 83(2pt3), 310–322. https://doi.org/10.1111/ajop.12033.

Kroth, A. J. (2015). The effects of the introduction of tuition on college enrollment in Germany: Results from a natural experiment with special reference to students from low parental education backgrounds (unpublished doctoral dissertation). University of Michigan, Ann Arbor, Michan, US. Retrieved November 10th, 2019 from https://deepblue.lib.umich.edu/bitstream/handle/2027.42/111597/ankroth_1.pdf.

Lauer, C. (2002). Enrolments in higher education: Do economic incentives matter? Education+Training, 44, 179–185.

Leyton, D., Vásquez, A., & Fuenzalida, V. (2012). La experiencia de estudiantes de contextos vulnerables en diferentes Intituciones de Educación Superior Universitaria (IESU): Resultados de investigación. Calidad en la Educación, 37, 61–97. https://doi.org/10.4067/S0718-45652012000200003.

Lohfink, M. M., & Paulsen, M. B. (2005). Comparing the determinants of persistence for first-generation and continuing-generation students. Journal of College Student Development, 46(4), 409–428. https://doi.org/10.1353/csd.2005.0040.

Londoño-Velez, J., Rodriguez, C., & Sánchez, F. (2017). The intended and unintended impacts of a merit-based financial aid program for the poor: The case of Ser Pilo Paga. Documentos CEDE, 24, 1–54.

Lyons, A., & Hunt, J. (2003). The credit practices and financial education needs of community college students. Financial Counseling and Planning, 14(2), 63–74.

McKinney, L., & Novak, H. (2015). FAFSA filing among first-year college students: Who files on time, who doesn’t, and why does it matter? Research in Higher Education, 56(1), 1–28. https://doi.org/10.1007/s11162-014-9340-0.

Oosterbeek, H., & van den Broek, A. (2009). An empirical analysis of borrowing behaviour of higher education students in the Netherlands. Economics of Education Review, 28(2), 170–177.

Ostrove, J. M., & Long, S. M. (2007). Social class and belonging: Implications for college adjustment. The Review of Higher Education, 30(4), 363–389. https://doi.org/10.1353/rhe.2007.0028.

Page, L. C., & Scott-Clayton, J. (2016). Improving college access in the United States: Barriers and policy responses. Economics of Education Review, 51, 4–22. https://doi.org/10.1016/j.econedurev.2016.02.009.

Philip, J., Ford, T., Henry, D., Rasmus, S., & Allen, J. (2016). Relationship of social network to protective factors in suicide and alcohol use disorder intervention for rural Yup’ik Alaska Native youth. Psychosocial Intervention, 25(1), 45–54. https://doi.org/10.1016/j.psi.2015.08.002.

Pike, G. R., Hansen, M. J., & Lin, C. H. (2011). Using instrumental variables to account for selection effects in research on first-year programs. Research in Higher Education, 52(2), 194–214.

Pittman, L. D., & Richmond, A. (2007). Academic and psychological functioning in late adolescence: The importance of school belonging. The Journal of Experimental Education, 75(4), 270–290. https://doi.org/10.3200/JEXE.75.4.270-292.

Pulido, F., & Herrera, F. (2018). Predictores de la felicidad y la inteligencia emocional en la educación secundaria. Revista Colombiana de Psicologia, 27, 71–84. https://doi.org/10.15446/rcp.v27n1.62705.

Radloff, L. S. (1977). The CES-D scale: A self-report depression scale for research in the general population. Applied Psychological Measurement, 1(3), 385–401. https://doi.org/10.1177/014662167700100306.

Radmacher, K., & Azmitia, M. (2013). Unmasking class: How upwardly mobile poor and working-class emerging adults negotiate an “invisible” identity. Emerging Adulthood, 1(4), 314–329. https://doi.org/10.1177/2167696813502478.

Robbins, S. B., Lauver, K., Le, H., Davis, D., Langley, R., & Carlstrom, A. (2004). Do psychosocial and study skill factors predict college outcomes? A meta-analysis. Psychological Bulletin, 130(2), 261–288. https://doi.org/10.1037/0033-2909.130.2.261.

Rodríguez, A., & Clariana, M. (2017). Procrastinación en estudiantes universitarios: su relación con la edad y el curso académico. Revista Colombiana de Psicología, 26(1), 45–60. https://doi.org/10.15446/rcp.v26n1.53572.

Rubin, M. (2012). Social class differences in social integration among students in higher education: A meta-analysis and recommendations for future research. Journal of Diversity in Higher Education, 5(1), 22–35. https://doi.org/10.1037/a0026162.

Rubin, M., & Wright, C. L. (2017). Time and money explain social class differences in students’ social integration at university. Studies in Higher Education, 42(2), 315–330. https://doi.org/10.1080/03075079.2015.1045481.

Shields, N. (2002). Anticipatory socialization, adjustment to university life, and perceived stress: Generational and sibling effects. Social Psychology of Education, 5(4), 365–392. https://doi.org/10.1023/A:1020929822361.

Solís-Calcina, G. L., & Manzanares-Medina, E. (2019). Control psicológico parental y problemas internalizados y externalizados en adolescentes de Lima metropolitana. Revista Colombiana de Psicología, 28, 29–47. https://doi.org/10.15446/rcp.v28n1.66288.

St. John, E. P., Paulsen, M. B., & Carter, D. F. (2005). Diversity, college costs, and postsecondary opportunity: An examination of the financial nexus between college choice and persistence for African Americans and whites. The Journal of Higher Education, 76(5), 545–569.

Suárez-Orozco, C., Casanova, S., Martin, M., Katsiaficas, D., Cuellar, V., Smith, N. A., & Dias, S. I. (2015). Toxic rain in class: Classroom interpersonal microaggressions. Educational Researcher, 44(3), 151–160. https://doi.org/10.3102/0013189X15580314.

Thaler, R. H. (2015). Misbehaving: The making of behavioral economics. New York: WW Norton.

Van den Berg, M. N., & Hofman, W. H. A. (2005). Student success in university education: A multi-measurement study of the impact of student and faculty factors on study progress. Higher Education, 50(3), 413–446.

Vossensteyn, H. (2002). Shared interests, shared costs: Student contributions in Dutch higher education. Journal of Higher Education Policy and Management, 24(2), 145–154.

Vossensteyn, J. J., & de Jong, U. (2006). Student financing in the Netherlands: A behavioural economic perspective. In P. N. Teixeira, D. B. Johnstone, M. J. Rosa, & J. J. Vossensteyn (Eds.), Cost-sharing and accessibility in higher education: A fairer deal? (pp. 213-239). (Higher Education Dynamics; no. 14). Dordrecht: Springer.

Vossensteyn, H., Cremonini, L., Epping, E., Laudel, G., & Leisyte, L. (2013). International experiences with student financing: tuition fees and student financial support in perspective: final report. Enschede: Center for Higher Education Policy Studies (CHEPS). Retrieved November 13th, 2019 from https://ris.utwente.nl/ws/files/5142796/international-experiences-with-student-financing-tuition-fees-and-student-financial-support-in-perspective.pdf.

Walsemann, K. M., Gee, G. C., & Gentile, D. (2015). Sick of our loans: Student borrowing and the mental health of young adults in the United States. Social Science & Medicine, 124, 85–93.

Welch, J. G. (2014). HOPE for community college students: The impact of merit aid on persistence, graduation, and earnings. Economics of Education Review, 43, 1–20. https://doi.org/10.1016/j.econedurev.2014.08.001.

Yates, T. M., Gregor, M. A., & Haviland, M. G. (2012). Child maltreatment, alexithymia, and problematic internet use in young adulthood. Cyberpsychology, Behavior and Social Networking, 15(4), 219–225. https://doi.org/10.1089/cyber.2011.0427.

Yoon, E., Chang, C. T., Kim, S., Clawson, A., Cleary, S. E., Hansen, M., ... & Gomes, A. M. (2013). A meta-analysis of acculturation/enculturation and mental health. Journal of Counseling Psychology, 60(1), 15–30.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Corredor, J.A., González-Arango, F. & Maldonado-Carreño, C. When unintended effects are really unintended: depressive symptoms and other psychological effects of forgivable loan programs for college education. High Educ 80, 645–662 (2020). https://doi.org/10.1007/s10734-020-00502-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10734-020-00502-9