Abstract

Determining effective policies to boost demand in each phase of the product life cycle (PLC) holds paramount importance for every supply chain member, profoundly influencing decision-making at each stage. This paper delves into the dynamic nature of the PLC, considering the distinct characteristics of each phase. Through an exploration of a differential game model, the manufacturer strategically adopts appropriate policies in each PLC phase, encompassing a blend of advertising and product quality enhancement. During the introduction-growth phase, the manufacturer concentrates on advertising to introduce the product and increase demand. Transitioning into the maturity phase, alongside sustained advertising efforts, the manufacturer allocates resources to enhance product quality. The key contributions of this study encompass the proposal of an optimal control model tailored to PLC phases, the formulation of differential equations governing quality level and goodwill, and the determination of optimal trajectories for wholesale and retail prices, advertisements, and quality levels through Stackelberg equilibrium. Furthermore, the study conducts a comprehensive analysis of the impact of these policies on the demand function, goodwill, and profit of supply chain members. A case study involving an Iranian mobile phone accessories manufacturer is scrutinized, offering managerial insights. Noteworthy findings highlight that higher initial product quality diminishes the necessity for advertising throughout the product life cycle, resulting in cost reduction. Additionally, the optimal pricing strategy for new products entering the market involves commencing with a low price and gradually increasing it in response to consumer demand.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In Today's competitive and diverse business world, it is crucial for supply chains (SCs) to be designed and engineered in alignment with product features and their life cycle. The product life cycle (PLC) refers to the duration from a product's introduction to the market until its eventual exit or discontinuation (Rink and Swan 1979). While each product follows a unique life cycle, most adhere to a bell-shaped curve with four phases: introduction, growth, maturity, and decline (Day 1981). For instance, items like desktop pencil sharpeners may initially experience high demand, gradually declining over time to become collector's items. Similar patterns are observable in fashion trends, fax machines, cars, and other products, with each phase posing specific challenges to supply chain management.

During the introduction phase, the sales volume is low, and due to the newness of the product, the competition is low or non-existent. As sales gradually increase, the product enters the maturity phase of its life cycle. In these two phases, the manufacturer commonly advertises its product, and this advertising (ads) is mainly focused on creating awareness and knowledge of the product (Asl-Najafi et al. 2021). With increased competition and market saturation, the product moves into the maturity phase. In this phase, intense competition for market share prompts manufacturers to differentiate through ads, quality improvements, or new features (Reiner et al. 2009; Stark 2011). Eventually, the product enters the decline phase, during which product demand steadily decreases. This is mainly because, over time, new, innovative, and reasonably priced products enter the market and attract customers. At this phase, usually any action to increase demand, for example, ads or quality improvement, has little effect and is not affordable (Frolova 2014).

In the principles of marketing, promoting advertisements and improving quality are recognized as two fundamental elements. These two essential factors play a significant role in the development and success of companies in markets.

Advertising serves as a highly effective tool in communicating with customers and increasing brand awareness in the supply chain. Proper ads not only facilitates product marketing but also strengthens brand credibility and trust. Ads provides customers with information about the capabilities, benefits, and features of the product, fostering a relationship between the producer and the consumer. Advertisements can provide further support to users in purchasing the product and inform them about the unique benefits and features of the product.

Enhancing product quality stands as a cornerstone in fostering customer trust and upholding market share. This endeavor not only amplifies customer satisfaction but also mitigates waste and bolsters productivity within the supply chain framework. Moreover, elevating quality is pivotal in fortifying relationships with business partners. Additionally, quality improvement is another strategy employed during the maturity phase to remain competitive. By enhancing the product's quality, customer trust can be established, and added value can be created for them. Furthermore, customers become more loyal to the product and are more likely to revisit and recommend it to others. The automotive industry provides a compelling illustration of the significance of both ads and quality improvement. During the initial product launch phase, automotive manufacturers engage in vigorous ads campaigns to raise awareness in the market regarding the features and advantages of their vehicles. Simultaneously, by enhancing the quality of cars, manufacturers bolster customer trust and foster a stronger preference for a particular brand. Quality enhancement encompasses improvements in safety systems, fuel efficiency, and overall operational efficiency. For instance, Bahman Automobile GroupFootnote 1 in Iran introduced the Fidelity car in 2021. Through technical assessments by experts and market analysis, the quality of this product steadily improved. By 2023, an upgraded model of the Fidelity was released, showcasing enhancements in appearance, technical specifications, as well as comfort and safety features.Footnote 2 This trend transcends the automotive sector, extending to technology-oriented companies, which continually strive to maintain competitiveness. They achieve this by consistently updating products, introducing innovative features, and fundamentally enhancing product quality throughout the entire product lifecycle. Twilo serves as a prime example of such practices, implementing a strategy centered around quality improvement. The company effectively utilizes a variety of advertising tools, including online ads, search engine optimization, and active participation in industry conferences and events.Footnote 3 By strategically integrating customer feedback at every stage of the product lifecycle, Twilo remains at the forefront, perpetually enhancing both product quality and development.

Optimal control, a powerful method of mathematical optimization, finds wide application across diverse fields including engineering, management, finance, economics, and even medicine, see. e.g. Orlova (2019), Nisal et al. (2020), Castro et al. (2022) and Wei et al. (2022). In optimal control problems, the objective is to find an optimal control law to direct state trajectories towards a predefined objective while maximizing utility or profit functions through control variables.

Motivated by the above discussion, we explore an optimal control model based on the Stackelberg game. Here, a manufacturer acts as the leader, producing a new product and selling it through a retailer acting as a follower. Throughout each phase of the PLC, the manufacturer adopts policies to boost sales. For this purpose, in the introduction and growth phases, treated as one integrated phase named "introduction-growth" due to their similar characteristics, the manufacturer focuses on ads while maintaining the initial product quality. This strategy aims to introduce the product effectively to the market. As the product enters the maturity phase and faces increased competition, the manufacturer not only continues advertising but also endeavors to improve product quality. In the final phase, there is no cost for ads and quality improvement, so the product ends its life according to its natural process. Continuous interaction between the manufacturer and retailer occurs across the PLC horizon, suggesting a suitable framework for modeling through a differential game approach. To achieve this, the goodwill function inspired by Nerlove and Arrow (1962), has been adopted in such a way that quality improvement activity has a positive effect on goodwill. Subsequently, dynamic market demand, pricing decisions, ads level, and product quality efforts are analyzed according to the different characteristics of the PLC phases and at each time.

In summary, the contributions of this article are as follows:

-

Proposing an optimal control model that includes a combination of ads and quality improvement policies tailored to the PLC phases.

-

Providing differential equations of quality level and goodwill appropriate to the characteristics of each phase of the PLC.

-

Determining optimal trajectories for wholesale and retail prices, ads, and quality levels in each phase of the PLC.

-

Analyzing the impact of policies adopted in each PLC phase on the demand function, goodwill and SC member's profit.

In the remainder of the paper, Sect. 2 presents a literature review. The description of the problem and the applied equations are comprehensively presented in Sect. 3. In Sect. 4, we derive the optimal trajectory for each of the control variables and the prices under the Stackelberg equilibrium. Some analytical results are presented in Sect. 5. In Sect. 6, through numerical examples and several sensitivity analyses, the performance of the proposed model will be evaluated and then the managerial insights will be expressed. In the last section, a summary of the research, conclusions, and suggestions for future research are presented.

2 Literature review

This article delves into the dynamic intricacies of the Product Life Cycle (PLC) to ascertain the optimal trajectories for pricing strategies, advertising, and quality levels, tailoring them to the unique characteristics of each PLC phase. Before introducing our model, a succinct literature review is presented to delineate the key distinctions between our work and other relevant studies. Our research is situated within two distinct yet interconnected research domains: mathematical models in Supply Chain (SC) management considering the PLC, and dynamic game-theoretic models examining the influence of quality improvement activities on goodwill.

Over the years, many organizations and researchers have grappled two challenging issues related to the PLC: (1) the different and unique characteristics of each phase of the PLC and their effects On the SC, and (2) how to purposefully use the different features of life cycle phases to increase profits. Several studies have investigated inventory control policies in SC where the demand mean varies over time in different phases of the PLC (Hsueh 2011; Zolfagharinia et al. 2014; Seifert et al. 2016; Sun et al. 2020).

Several studies focused on different aspects of the PLC and its impact on the reverse supply chain. Tibben‐Lembke (2002) examined the characteristics of the PLC and its effects on the reverse supply chain, providing insights into how products move through various stages of their life cycle and how this influences reverse logistics processes. Östlin et al. (2009) explored the effects of supply and demand balance in the reverse supply chain, particularly focusing on the effective delivery of remanufactured products during different phases of the PLC. Asl-Najafi and Yaghoubi (2021) contributed by proposing a dynamic mathematical model for optimizing retail pricing decisions, collection effort levels, and wholesale pricing in a closed-loop supply chain influenced by variant PLC phases. Their model accounts for variations in demand and return rates across different phases of the PLC, enabling better decision-making in managing product returns and pricing strategies. In another study, these researchers examined the strategies of coordination in product-service SCs that have a long PLC. The proposed model has demand, sales effort, and pricing in a dynamic manner that are determined according to the characteristics of each phase. In the following, separate short-term coordination schemes are considered for each phase so that the SC members can be coordinated effectively (Asl-Najafi et al. 2022). Bahrami and Yaghoubi (2024) presented a mathematical model with a perspective on the relationship between advertising, pricing, and PLC phases. They have investigated price-switching policies based on product life cycle phases.

Other studies focus on the dynamic aspects of SC management in relation to PLC, but there remains an unexplored area regarding the influence of quality and advertising on demand. Shakouhi et al. (2023) explored a pharmaceutical supply chain by incorporating the PLC and blended marketing strategies in scenarios of Nash and Stackelberg. Despite the dynamic nature of the subject, their demand and decision variables remain constant over time. Liu and Lu (2023) developed a closed-loop supply chain consisting of one manufacturer and one remanufacturer, spanning two periods, to examine the optimized decisions made by original equipment manufacturers throughout the entire PLC. Their analysis considers the impact of consumer preferences for green products and the substitution effect of remanufactured items. Feng et al. (2023) introduced a multi-faceted model encompassing financial, marketing, and operational aspects for retailers. This model incorporates a buy-now-pay-later scheme, taking into account the different stages of the PLC. While these studies have investigated various dynamic aspects of SC management in relation to the PLC, the influence of quality and advertising on demand has yet to be explored.

While these studies have explored dynamic aspects of SC management in relation to the PLC, there remains a gap in understanding how quality and advertising influence demand within the context of the PLC.

Another field used in this study is differential models of advertising-based goodwill and the effect of quality improvement on goodwill. Advertising is considered one of the most significant factors affecting goodwill and consumer demand. Articles that discuss ads are divided into two types of static and dynamic game theory models, that in the first model, actions and reactions among SC players are regarded in a single period (SeyedEsfahani et al. 2011; Wang et al. 2021; Karray et al. 2022; Khosroshahi and Hejazi 2023). In the dynamic models, a function of goodwill is presented to show the long–term perspective effect of ads efforts. Goodwill is often a vital factor in competition in studies and, given the cumulative nature of its formation process, supplies a means of expressly combining a dynamic viewpoint (Thepot 1983; Fershtman et al. 1990; Chintagunta and Rao 1996). Proposed models based on Nerlove and Arrow (1962) structure are very common in the existing literature on goodwill formation. Nair and Narasimhan (2006) have developed the basic model and considered the company's products and processes quality as a lever for the formation of goodwill and a significant competitive factor for a company.

Several studies focused on the interplay between quality, advertising, and goodwill within supply chain dynamics. De Giovanni (2011) emphasized quality as a vital resource for competitive advantage and developed an optimal control model illustrating how quality improvement positively influences goodwill, which in turn has a linear effect on demand. In the other study, De Giovanni (2013) examined a traditional supply chain model involving a manufacturer and a retailer, demonstrating that investing in product quality may yield more effective results compared to advertising efforts in enhancing goodwill. Liu et al., (2015) studied a model where quality improvement by the operations department positively affects both goodwill and demand, while the marketing department influences demand through pricing and advertising efforts. Reddy et al., (2016a, b) incorporated quality as a controlling factor within dynamic optimal control models of advertising, highlighting the importance of maintaining design quality over time. Ni and Li (2019) explored the impact of quality and advertising on a monopolistic producer's pricing strategy, considering product innovation as an investment to improve overall quality. Buratto et al. (2019) emphasized the role of pricing strategy and quality improvement in fostering manufacturer goodwill within supply chain coordination efforts. De Giovanni (2020) developed an optimal control model demonstrating the positive effects of advertising and quality on company goodwill, while Cesaretto et al. (2021) examined how excessive-quality can have a detrimental effect on goodwill and sales within a digital service strategy framework. Lu and Navas (2021) proposed a supply chain model considering the nonlinear effect of quality on goodwill function, emphasizing the roles of global and local advertising efforts in shaping overall goodwill dynamics.

In general, while the PLC concept holds considerable importance and exerts undeniable effects on SC performance, it's noteworthy that none of the papers employing an optimal control approach to model SC performance have taken PLC considerations into account. This research gap underscores the need for further exploration in this area of study. Table 1 provides a comprehensive overview of the more related literature under review, delineating the position of our work within the existing ones.

The main distinction of this work from the literature mentioned is that, for the first time, it examines an optimal control model capturing the dynamic interaction between the manufacturer and the retailer within the context of the PLC phases. In this model, product demand is contingent upon the various stages of the product life cycle. The application of different strategies to boost demand entails an optimal combination of marketing tools, specifically advertising and quality improvement, proposed in accordance with the distinct stages of the PLC.

3 Dynamic model for optimal pricing considering the PLC

We consider a two-echelon SC including a manufacturer as player \(m\), and a retailer, player \(r\). The manufacturer produces a new product at a cost equal to \(c\) and to supply it to the market, he sells it to the retailer at a price equal to \(w\left(t\right)\), then the retailer sells it to the consumer at \(p\left(t\right)\). It is assumed that the customer demand \({D}_{i}\left(t\right)\) (\(i\in \left\{I,M,D\right\}\) that respectively point to introduction-growth, maturity, and decline phases) depends linearly on the market demand base for each PLC phase \({d}_{i}\left(t\right)\), goodwill \(G\left(t\right)\), quality level \(Q\left(t\right)\), and time-varying retail price \(p\left(t\right)\). Figure 1 indicates the basic demand behavior assumed in this model in different phases of PLC and \({t}_{1},{t}_{2}\) and \(T\) display the end time of the introduction-growth, maturity, and decline (end of the PLC period) phases, respectively. To approximate the bell-shaped form, we have used linear functions over time to represent the dynamic demand function throughout the product life cycle, similar to many articles including Asl-Najafi and Yaghoubi (2021), Asl-Najafi et al. (2022), Feng et al. (2023), and Bahrami and Yaghoubi (2024), which are inspired by the classic life cycle and have approximated its bell-shaped form. In the product introduction-growth phase, the base demand starts with the initial value of \(\alpha\) and increases linearly with the \(L\) slope, and from the beginning of the maturity phase it is almost constant and the value reaches its highest value. As the maturity phase approaches, it decreases linearly with a slope of \(-\frac{\alpha +L{t}_{1}}{T-{t}_{2}}\) and reaches zero at the end of PLC \(T\). According to the given description the basic demand function in the PLC horizon is as follows:

According to the study by Hu et al. (2019), three types of curves can be considered to match the product demand curve during the product life cycle: the Bass Diffusion model, polynomial curves, and simple piecewise-linear curves (which we have utilized). Based on the results obtained from this study, polynomial curves and simple piecewise-linear curves have predicted the product demand throughout its life cycle with lower error percentages.

The life cycle of a product, such as the Windows operating system, is characterized by different phases: introduction, growth, maturity, and decline. Windows 8, released by Microsoft in 2012, initially faced criticism due to numerous bugs. However, Microsoft responded by improving its quality and releasing an enhanced version called Windows 8.1. Despite these efforts, Microsoft discontinued support for Windows 8.1 in January 2022, marking the end of its life cycle.

Footnote 4 This example highlights the importance of quality improvement during the PLC to increase demand and ensure long-term success.Footnote 5 According to the specific characteristics of each phase of the PLC (ie introduction-growth, maturity, and decline), different policies that are a combination of ads and quality improvement have been proposed and modeled in order to increase demand and subsequently SC members profits. In the following, differential game models are given for each PLC phase.

3.1 Modelling of introduction-growth phase

In the introduction-growth phase, the manufacturer uses an ads strategy in order to introduce the product and make it known and convert potential customers into actual ones. For example, during the introduction and growth phases, Google heavily promoted Google Glass, an optical computer display mounted on the head, targeting tech-savvy audiences interested in novelty and innovation, which stimulated rapid demand among these segments.Footnote 6 Similarly, manufacturers of VR headsets in the early stages of their product life cycle advertise for comprehensive gaming and entertainment experiences, as well as practical applications in education and training.Footnote 7 At this phase, no action is taken to improve the quality and the quality of the product is kept at the same level as the initial quality \({Q}_{0}\). In many products such as electronics, software, home appliances, etc., the quality level of the products is a factor of goodwill, meaning that a better quality product will have better fame due to support, higher service level, or lower failure rate. Conversely, lower quality products lead to lower service levels or higher breakdown rates, resulting in lower goodwill. By considering the effect of product quality level on goodwill in the famous Nerlove and Arrow (1962) model, we write the goodwill function in the introduction-growth phase as follows:

The control variable \(A\left(t\right)\) shows the ads rate at time \(t, t\in \left\{0,T\right\}\), \({\nu }_{I}\) and \({\theta }_{I}>0\) are positive constants that measure the effectiveness of ads and quality levels on goodwill in introduction-growth phase, respectively. \({\delta }_{I}>0\) is a decay rate and it measures the consumers forgetting effect in introduction-growth phase. \({G}_{0}>0\) indicates the initial goodwill at the beginning of the PLC and \({G}_{1}>{G}_{0}\) indicates the goodwill targeted by the manufacturer at the end of the first phase of PLC.

The demand function in this phase is as follows. In addition, assuming a finite time horizon \(0\le t\le {t}_{1}\) and a common discount rate \(\rho >0\), the objective functionals of the manufacturer and retailer in the first PLC phase are given in Eqs. (3) and (4).

In Eq. (2), the first part \((\alpha +Lt)\) is time-dependent basic market described earlier. \({\beta }_{i} , i\in \left\{I,M,D\right\}\) is sensitivity of customer to retail price on demand, \({\gamma }_{I},{\mu }_{I} , i\in \left\{I,M,D\right\})\) are measures of the positive goodwill and quality effect on demand, respectively. In Eq. (3), the cost related to ads level is considered as convex cost \(\frac{\tau }{2}{A\left(t\right)}^{2}\) where \(\tau\) is a constant (see for example: Erickson 2011; Machowska 2019; Xu et al. 2023).

3.2 Modelling of maturity phase

In the maturity phase, due to increasing competitors and limited market share, the manufacturer is forced to differentiate his product from others to stay competitive and increase his profit, one of the ways to differentiate is to improve the quality level of the product. Here the state variable \(Q\left(t\right)\) is considered as the level of total quality, and its improvement is attributed to the types of quality efforts \(q\left(t\right)\). The quality level means product style quality, product process quality, service level, business planning, and other product characteristics that increase the consumer's desire to use (Lambertini and Mantovani 2009; El Ouardighi and Kim 2010; Liu et al. 2015). For example, Tesco, in the initial production of its wireless earphone product, the TH5353, had a range of 10 m. As the product progressed through its lifecycle, the company improved its quality, increasing the range to 12 m.Footnote 8 Tesco employs various advertising methods, including television ads, city billboard advertising, online promotions, and participation in events, to market its products.Footnote 9

The following differential equation is introduced to describe the dynamics of the manufacturer’s quality improvement activity in the maturity phaseFootnote 10 (Vörös 2006; Liu et al. 2015; Lu and Navas 2021):

The control variable \(q\left(t\right)\) represents the manufacturer rate of quality efforts at time \(t, t\in \left\{ {t}_{1}, {t}_{2}\right\}\), \({\sigma }_{M}\) and \({\varepsilon }_{M}>0\) represent the effectiveness of quality efforts and the quality level decay rate, respectively. \({Q}_{0}>0\) indicates the initial quality level at the first phase of the PLC and the beginning of the maturity phase and \({Q}_{2}>{Q}_{0}\) shows the quality level targeted by the manufacturer at the end of the maturity phase of PLC.

As in the previous phase, the goodwill function in the maturity phase is given as:

\({G}_{2}>0\) represents the goodwill targeted by the manufacturer at the end of the PLC maturity stage.

The demand function in this phase depends on goodwill, quality level, and price according to Eq. (7). In addition, in a finite time horizon \({t}_{1}<t\le {t}_{2}\) and a common discount rate \(\rho >0\), the objective functionals of the SC members in the maturity phase are given in Eqs. (8) and (9).

The first term in Eq. (7) is the basic market demand at the maturity phase and other terms such as the components mentioned in the demand function in the first phase of the PLC. In Eq. (8), we assume that the cost of quality efforts is quadratic \(\left(\frac{\Omega }{2}{q\left(t\right)}^{2}\right)\) where \(\Omega\) is a constant (see for example: El Ouardighi 2014; El Ouardighi and Shniderman 2019; Lu and Navas 2021).

3.3 Modelling of decline phase

In the decline phase, due to the saturation of the market with more innovative and higher quality products at reasonable prices, product demand decreases, and usually, the impact of ads and quality increase on demand is insignificant and is not economical due to its high cost. Kodak, known for its photographic film, heavily advertised and improved film quality during its growth phase. They promoted film benefits and developed new technologies for better image quality. However, with the rise of digital photography, demand for film declined, leading Kodak to reduce film advertising and quality efforts. This shift reflects how market changes impact advertising and product development strategies during different product life cycle phases.Footnote 11 Therefore, it is suggested not to use any ads measure and quality level improvement action in this phase (\(q\left(t\right)=0 and A\left(t\right)=0, {t}_{2}<t\le T\)). According to the strategy adopted in the decline phase, the quality improvement and goodwill function are as follows:

In Eq. (10), because the effort to improve quality is zero, the quality level in this phase decreases by as much as the decay rate of quality level over time, indicating that the product lag behind technological advances and innovation over time. According to Eq. (11), due to zero ads, goodwill functions decrease at the rate of goodwill decline, which indicates that customers forget the product. At this stage, quality continues to affect goodwill.

The demand function in the decline phase that depends on PLC, goodwill, and quality level is shown in Eq. (12). Assuming a finite time horizon \({t}_{2}<t\le T\) and a common discount rate \(\rho >0\), the objective functionals of the manufacturer and retailer in the last PLC phase, as in the previous two phases, except that there is no cost for ads and efforts to improve quality, are stated in Eqs. (13) and (14).

It needs to be noted that the differential game problem mentioned includes four control variables \(A\left(t\right)\), \(q\left(t\right)\), and \(w\left(t\right)\) which are specified by the manufacturer, and \(p\left(t\right)\), which is specified by the retailer, and the two state variables are \(G\left(t\right)\) and \(Q\left(t\right)\).

3.4 Life cycle model

Considering the Eqs. (1)–(14) a differential game including the manufacturer and the retailer during PLC is created as follows:

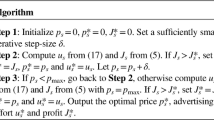

4 Determination of feedback Stackelberg equilibria

In this section, we seek to gain the optimal values of each of the variables, and for this purpose, we apply the backward induction method. In this method, the leader first checks what the follower's best response to each decision will be, and based on that, chooses a strategy that maximizes his profit. Next, the follower, who has been informed of the leader's decision, gives the best response (Barron 2013). In this study, like many articles in the literature, such as He et al. (2007), Zhang et al. (2014), and Zheng and Shi (2022) the manufacturer is the leader and the retailer is the follower. In order to explain the proposed solution, it is necessary to provide a brief explanation regarding the optimization of functions. In the book written by Kirk (2004), it is mentioned: “Suppose that \(\text{u}\) has continuous first and second partial derivatives with respect to all its arguments and that \({\text{t}}_{0}\), \({t}_{f}\), \(x\left({t}_{0}\right)\), and \(x\left({t}_{f}\right)\) are specified. Suppose \(\dot{\text{x}}\) has a discontinuity at some point \({t}_{1}\in \left\{{t}_{0}, {t}_{f}\right\}\) and the function \(Y\) is given as follows:

if \(x^{*}\) is an extremal for \(Y\), then \({x}^{*}\left(t\right)\), \(t\in \left\{{t}_{0}, {t}_{f}\right\}\), is an extremal for \({Y}_{1}\) and then \({x}^{*}\left(t\right)\), \(t\in \left\{{t}_{0}, {t}_{f}\right\}\), is an extremal for \({Y}_{2}\)”. According to this point, it can be concluded that in the problem of the proposed model, the optimal solution that maximizes the function \({J}_{PLC}^{m}={J}_{I}^{m}+{J}_{M}^{m}+{J}_{D}^{m}\) for the manufacturer is the optimal solution of each of \({J}_{I}^{m}\), \({J}_{M}^{m}\) and \({J}_{D}^{m}\), and the same can be interpreted for the retailer. Therefore, the optimal value obtained according to the initial values of goodwill and the quality level obtained from the final value in the previous phase is the optimal value for the entire function, which is the sum of the phases.

For solving the differential game and get optimal paths for quality improvement, ads efforts, and prices, we set up the current-value Hamiltonian for the two players in each phase of PLC. It should be noted that for simplicity and without losing the generality of the problem, it is assumed that \({\nu }_{i}=\nu , {\theta }_{i}=\theta , {\delta }_{i}=\delta , and {\varepsilon }_{i}=\varepsilon\). Considering \({\lambda }_{i}^{m}\) and \({\lambda }_{i}^{r}\) (\(i\in \left\{I,M,D\right\}\)) as adjoint variables that measure the shadow prices of a goodwill additional unit, the current-value Hamiltonians for the manufacturer and the retailer in the introduction-growth phase are as follows:

According to the necessary conditions specified by the maximum principle, the optimal values of each variable in the introduction-growth phase are obtained as follows:

Theorem 1

In the first phase of PLC (\(0\le t\le {t}_{1}\)), the optimal retail and wholesale prices and ads level are given by

In addition, by placing the optimal value of the ads level in the differential equation of goodwill and solving it, the path of optimal goodwill in the introduction-growth phase is:

The values of parameters \(K,Z,h,u,{\zeta }_{j}\) and \({\epsilon }_{j}\) are shown in Appendix A.

Proof

The proofs of all Theorems of this study are present in Appendix B.

The derived equations illustrate the relationship between pricing, ads, and product demand dynamics during the early stages of the PLC. Notably, the optimal pricing decisions are influenced by factors such as production costs, market demand, ads effectiveness, and initial quality level. Moreover, the ads level is determined by a function involving parameters related to market characteristics, time dynamics, and advertising effectiveness.

In the maturity phase, the current-value Hamiltonian for the manufacturer and the retailer are as follows:

\({\eta }_{i}^{m}\) and \({\eta }_{i}^{r}\) (\(i\in \left\{I,M,D\right\}\)) in Eqs. (21) and (22) are adjoint variables that determine the shadow prices of an additional unit of quality level.

Similar to the previous phase, according to the necessary conditions specified by the maximum principle, the optimal values of each variable in the maturity phase are obtained as follows:

Theorem 2

In the maturity phase of PLC (\({t}_{1}<t\le {t}_{2}\)), the optimal retail and wholesale prices, ads level, and quality improvement can be described as:

By placing the optimal control variables in the differential equations of the goodwill and quality level and then solving them, the optimal goodwill and quality level trajectories in the maturity phase are:

The values of parameters \({n}_{j}\) and \({\psi }_{j}\) are shown in Appendix A.

The derived equations depict the intricate relationship between pricing, advertising, quality level, and product demand dynamics during the maturity phase of the PLC. Notably, optimal pricing decisions are influenced by factors such as production costs, demand-related parameters, advertising effectiveness, and quality improvement efforts. Additionally, the level of advertising is determined by a function that incorporates parameters related to advertising budget, time, and other factors influencing consumer behavior. The optimal quality improvement during the maturity phase is calculated based on parameters associated with initial product quality, time, and market dynamics.

The current-value Hamiltonian for the manufacturer and the retailer in the decline phase are calculated as follows:

Based on the discussions provided, during the decline phase, the decision variables are solely the retail and wholesale prices. The optimal values for these variables, in accordance with the necessary conditions specified by the maximum principle, are as follows:

Theorem 3

In the decline phase of PLC (\({t}_{2}<t\le T\)), the optimal retail and wholesale prices can be obtained as:

Therefore, the optimal goodwill and quality level trajectories in the decline phase are obtained by solving differential Eqs. (10) and (11) as follows:

Theorem 3 outlines optimal pricing strategies for the decline phase of the PLC, critical for both retailers and manufacturers grappling with dwindling product demand and market saturation. It underscores the dynamic nature of pricing decisions during this phase, stressing the importance of strategic adjustments to enhance profitability amidst declining demand. The derived expressions for optimal retail and wholesale prices consider factors like production costs, demand-related parameters, advertising effectiveness, and quality improvement. These prices are optimized to strike a balance between revenue generation and cost considerations.

5 Analytical results

In this section, to check the proposed model, some parameters considered in the problem are analyzed, and the trend of decision variables is shown with the changes in these parameters. Furthermore, practical insights beneficial for decision-makers in this domain are provided.

Proposition 1

(Trends of quality efforts over time) The optimal rate of quality efforts increases with time, and in the maturity phase, the manufacturer should enhance this rate over time (for \(t_{1} < t \le t_{2}, q^*\)is an increasing function of t ).

Proof

The proofs of all Propositions of this study are present in Appendix B.

Practical Insight

This proposition provides a strategic guideline for manufacturers, emphasizing the importance of continuous efforts to improve the quality of the product throughout its life cycle. In practical terms, it implies that as a product matures, and especially when facing increased competition, investing in the enhancement of product quality becomes crucial. Manufacturers should allocate resources and efforts to not only sustain but also elevate the quality of the product to meet or exceed market expectations. This proactive approach can lead to increased customer satisfaction, trust, and brand loyalty, contributing to long-term success in the market.

Proposition 2

(Trends of the quality level trajectory with initial quality level) The quality level trajectory at any time of the product life cycle has a direct relationship with the initial quality level of the product (\(q^{*} (t) \) is an increasing function of Q0).

Practical Insight

This proposition highlights the critical role of the initial quality level in determining the overall quality trajectory of a product throughout its life cycle. For managers and decision-makers, it underscores the importance of making strategic decisions regarding the initial quality standards of a product. Starting with a higher initial quality level is likely to result in a more favorable quality trajectory, potentially leading to sustained customer satisfaction and positive perceptions in the market. Managers should consider investing in technologies, processes, and resources that contribute to a higher initial quality level, as this can set a positive tone for the entire PLC. Additionally, focusing on maintaining and enhancing quality standards from the outset can contribute to building a strong and positive brand image, fostering customer loyalty, and ensuring the product's competitiveness in the market.

Proposition 3

(Trends of advertising rate with initial quality level) The advertising rate in the first phase decreases with the increase of the initial quality level of the product if the consumers forgetting effect is low (\(for\, \frac{Z{\nu }^{2}{\gamma }_{I}}{2\tau }+\frac{1}{2}\sqrt{\frac{{Z}^{2}{\nu }^{4}{\gamma }_{I}^{2}+4Z{\nu }^{2}\tau {\gamma }_{I}^{2}}{{\tau }^{2}}}<\varepsilon and \,0<t \le {t}_1\), A*(t) is a decreasing function of Q0). In the growth phase, the advertising rate always diminishes with the enhancement in the initial quality level of the product (\(for \, t_{1}< t \le t_{2} \), A*(t) is a decreasing function of Q0).

Practical Insight

Decision-makers can use this insight to optimize ads strategies based on the initial quality level of their products. When introducing a high-quality product, especially in the growth phase, allocating resources toward ads may require less emphasis compared to a scenario with lower initial quality. This proposition guides marketers in tailoring their ads efforts to align with the perceived impact of initial quality on consumer awareness and demand throughout the PLC.

6 Experiment analysis

In this section, in order to better understand the effects of dynamic optimal pricing considering advertising and quality improvement strategy across PLC, we have provided a practical example and presented analyses based on our model's parameters. Finally, we will discuss the results obtained as well as managerial insight derived from our analyses.

6.1 Real example

In recent years, with the increase in the capabilities of smartphones, the need for its accessories has also grown, and the mobile accessories market has become prosperous, so that the value of this market in 2021 is reported to be 86.6 billion dollars.Footnote 12 Due to its dynamics and great progress in this industry, its products have a short life cycle and reach the decline stage quickly and are replaced by products with more advanced technology, so its manufacturers should use management tools like the ones suggested in this article to stay competitive. The data utilized in this section is inspired by a supply chain that includes a mobile phone accessories manufacturer in Iran called Tsco, which can sell products through retail stores such as the online store https://emalls.ir. This manufacturer produces various mobile phone accessories, including speakers, phones, power banks, chargers, cables, AirPods, and hands-free devices. All of these have a classic or bell-shaped PLC, and the problem investigated in this research corresponds to it. In this research, data related to this company's Airpod product has been used and some problem parameters such as the market base demand at the beginning of the introduction phase, product life cycle phase times, and production cost per product unit are collected from the information system and database analysis. Therefore, in this example, \({t}_{1}=24\), \({t}_{2}=57\), and \(T=65\) (each unit is equivalent to one month) are considered. Other parameters were acquired through interviews with experts and managers within the company, given their unavailability, and are stated in Table 2.

The results obtained from the analysis of the numerical example are summarized in the form of diagrams in the following figures. According to Fig. 2, the best decision for the manufacturer is to continuously increase ads in the introduction-growth phase up to reaching level 24. Then, by entering the maturity phase, due to the decrease in the effect of goodwill on the amount of demand compared to the previous phase, the ads will significantly reduce and reach level 4 and after that, it will increase slightly until \(t=50\), and then it will diminish until it reaches zero level at the beginning of the decline phase.

Figure 3 illustrates the optimal trend of quality efforts over time. As explained in the model, the manufacturer takes measures to improve quality only in the maturity phase and q is equal to zero in the other two phases. In the maturity phase, \(q\) increases exponentially to reach the targeted quality level \(({Q}_{2})\) at the end of this phase.

Figure 4 shows the optimal path that the quality level state variable takes during the PLC. Based on that, in the introduction-growth phase, due to the insignificant decay rate of the quality level and the lack of efforts to improve quality, the quality level is constant at the initial level of \(Q=10\). At the beginning of the maturity phase, when the effect of improve the quality efforts is less than the effect of the decay rate of the quality level, \(Q\) decreases slightly, and from the \(t=35\) point onwards, with the exponential increase of \(q\), the quality level also increases exponentially until it reaches the quality level \(Q=60\). In the decline phase, due to the lack of efforts to improve the quality and the high rate of quality level decay rate, \(Q\) is decreasing until at the end of this phase it becomes \(Q=18\).

According to Fig. 5, the optimal trajectory of goodwill grows with a low slope at the beginning of the introduction-growth phase, and at the end of this period, with the product becoming known and the ads level increasing sharply, \(G\) increases rapidly. With the beginning of the maturity phase up to \(T=30\), despite the upward trend of \(Q\), due to the sharp diminish in \(A\), goodwill is decreasing, and after that, as the level of ads promotes and the level of quality grows, \(G\) also increases. In the decline phase, due to the decrease in \(Q\), the absence of ads and the decay of goodwill, \(G\) is decreasing until it is equal to \(33\) at the end of this phase.

Figure 6 shows the optimal pricing path in this chain. At the time of introduction, the manufacturer declares the wholesale price equal to 2.2 and increases the price with the passage of time and the augment in ads costs. At the beginning of this phase, the retail price has a slight difference from the wholesale price, but over time, this price is growing and the difference with the wholesale price is increasing. With the beginning of the maturity phase and due to the diminution of as costs, the wholesale price also detracts sharply, and after \(T=30\) due to the growth of ads costs and quality improvement, it is augmenting. The trend of increasing and decreasing the retail price in this phase is exactly in line with the wholesale price. In the last phase, the manufacturer lowers the price due to not spending money on quality improvement and ads, as well as preventing a sharp decrease in the demand for this product. The retail price is also reducing in this phase, and for \(T>62\), due to the low demand for the product, the retailer has to sell the product at a price lower than the purchase price.

It should be noted that due to the non-operational nature of price changes in short periods, the manufacturer and retailer can divide each phase into several periods and obtain the average price for each period and announce it to the buyer as the price of the product. For example, for this numerical example, the first phase can be divided into 4 periods of 6 months, so the manufacturer offers a price of 3 for the first 6 months of selling the product, which is the average price of the product during this period.

Figure 7 indicates the trend of product demand during its life cycle and according to the presented model, demand is a linear combination of basic market demand, retail price, goodwill, and product quality level. In the first phase, with time, the increasing effect of the basic market demand and goodwill overtook the decreasing effect of the price and the demand is growing. With the beginning of the maturity phase, with the stability of the basic market demand, the demand diminishs due to the decline in goodwill, but its slope is less than the reduction in goodwill because the price decrease and the gain in the quality level have a positive effect on it. After \(t =30\) with the pick up of goodwill and quality level, the demand increases. In the decline phase, with the decrement in the basic market demand relative to time and the lack of ads and efforts to improve quality, the low price does not have much effect on the demand and it decreases.

The trends of manufacturer and retailer profit over time are shown in Fig. 8. The profits of these two players have a direct relationship with the demand and price of each one, and their trends are influenced by these two factors. At the end of the decline phase, because the retail price is lower than the wholesale price, the retailer's profit becomes negative.

6.2 Sensitivity analysis

In this part, the influence of the main parameters on decision variables and supply chain performance is considered.

Figure 9 shows that \(L\) has a positive effect on the retail price, and as the number of customers per unit of time increases, the manufacturer and then the retailer will sell the product at a higher price. An enhancement in this parameter also leads to a growth in the advertising rate in the introduction-growth and maturity phases, so goodwill also increases. In the decline phase due to the absence of advertising, \(L\) does not affect the goodwill trend (Fig. 10). As shown in Fig. 11, the amount of increase in customers per unit of time does not affect the quality level of the product, and the manufacturer should try to reach the desired quality level at the end of each phase, regardless of this parameter. The manufacturer and the retailer can expect that as \(L\) grows, their cumulative profits will increase over the entire PLC time horizon. This is if their profits fall steeper in the decline phase. For the examined example, due to the stability of the level of quality and goodwill and the increase of the retail price, with the increase of this parameter in the decline phase, the demand experiences a sharper decrease that the manufacturer may even be forced to sell his products below the production price which leads to a loss for the manufacturer at the end of the decline phase (diagram L = 30, Figs. 12, 13).

Figure 14 shows that by increasing the effectiveness of ads in the goodwill function, the manufacturer generally raises the ads rate so that with the increase of goodwill, the demand function, and profit will increase. In the example given, due to considering the amount of \({G}_{1}\) = 40 at the end of the introduction-growth phase, in diagram \(\nu\) = 0.5 due to the low ads rate, the manufacturer is forced to increase the ads rate to reach this point of goodwill. In diagram \(\nu\) = 1.5, because the rate of advertising and goodwill is high, to reach the expected goodwill, the manufacturer reduces the rate of advertising at once. With the gain of bb and the growth of the ads rate in the two phases of introduction-growth and maturity, the manufacturer's cost also increases and he is forced to increase the wholesale price. The retailer, who bought the product at a higher price, augments the retail price (Figs. 15, 16).

6.3 Managerial insights

The results that can support decision-makers in this supply chain are obtained from the analysis of this research and shown as follows:

-

Depending on the shape of the product life cycle (PLC) diagram, specifically the downward slope of demand during the decline phase, the profits of the players involved may become negative in the final phase. If the demand drops sharply, the manufacturer may be required to sell the products to the retailer below the production cost, which results in losses. To incentivize the manufacturer to continue production during this phase, a cost-sharing contract can be initiated by the retailer. It is also possible that the market demand may force the retailer to sell the product at a price lower than the purchase price during the final phase. In such cases, the manufacturer can implement incentive policies such as profit-sharing, or revenue-sharing contracts to compensate for the retailer's loss and encourage further purchases during this period.

-

The more the manufacturer supplies the product to the market with better initial quality, during the product life cycle, the less ads is needed for the product, so its costs are reduced. Furthermore, the level of product quality remains higher and increases the demand throughout the life cycle.

-

The optimal pricing strategy for a new product entering the market is for the manufacturer and retailer to announce a low price and gradually increase it in response to growth in consumer demand. As the product reaches the end of its life cycle and becomes less popular, a significant reduction in price may be necessary in order to stimulate sales.

-

When consumers are seeking a novel and trendy product, it is more suitable to buy at the beginning of the PLC and the product's entry into the market, because the price is much lower and the product is innovative. But for those customers who do not pay attention to fashion and the quality and reputation of the product and its brand are more important to them, it is suggested to buy it at the end of its PLC.

-

Effective identification of customer behavior is crucial for profitability and developing optimal strategies in any supply chain. If customers react normally to advertising and the goodwill of a product depends normally on the advertising rate, then the best advertising strategy is for manufacturers to promote their product during the introduction-growth phase to reach maximum impact. However, in the maturity phase, such a level of advertising is not required, and potential customers can be converted into actual customers with a lesser amount of advertising. Conversely, if the goodwill of a product is highly dependent on the advertising rate and customers significantly consider advertising, then the optimal strategy is to invest heavily in advertising during the growth phase to constantly remind and emphasize the product's superiority over other competitors.

7 Conclusion

In this study, we have established a differential game involving a manufacturer and a retailer with a product life cycle approach and different policies to increase demand in each phase of the PLC. The different policies considered in each phase are as follows: in the introduction-growth phase, the manufacturer only uses ads to increase demand, in the maturity phase, in addition to ads, he also spends money to improve the quality of the product, and in the decline phase, when the product is considered out of fashion, no action is taken to increase the demand. The goodwill depends on the quality level and ads, and on the other hand, time-dependent demand also depends on the goodwill and product quality level. The manufacturer controls wholesale price, ads level, and product quality improvement effort, and sells it to consumers through the retailer who sets the retail price.

The main novelties in this article lie in proposing an optimal control model that includes a combination of ads and quality improvement policies tailored to the characteristics of each PLC phase. The feedback Stackelberg equilibria for players’ variables and their profits have been determined and a numerical example was solved, then sensitivity analysis was done based on some important parameters of the problem. Finally, management tips based on parametric analysis, the real example and sensitivity analysis were presented.

Our study addresses the fundamental questions: "What is the optimal control model integrating advertising and quality improvement strategies tailored to different phases of the Product Life Cycle?" "How are differential equations developed to represent the quality level and goodwill specific to each phase of the PLC?" and "What are the optimal trajectories determined for wholesale and retail prices, advertising investments, and quality levels during each phase of the PLC?".

Previous studies such as Nair and Narasimhan (2006), De Giovanni (2011), and Lu and Navas (2021) have examined the function of goodwill and quality improvement, as well as the optimal paths of advertising and quality level. However, they have ignored the effect of product life cycle phases. Other studies (Asl-najafi and yaghoubi 2021; Feng et al. 2023; and Bahrami and Yaghoubi 2024) have investigated the demand function during the product life cycle without considering the impact of marketing tools such as advertising and quality improvement and their optimal trajectory during the product life cycle. To date, no study has adequately addressed these questions, and our work integrates PLC dynamics into an optimal control framework for supply chain management.

Findings demonstrate that quality improvement efforts positively influence goodwill formation, which in turn, substantially impacts demand dynamics. Notably, superior initial product quality reduces long-term advertising costs over the product life cycle while sustaining high-quality levels and boosting demand. Contrary to existing literature, which typically considers the goodwill function and quality level with fixed pricing assumptions regardless of time, optimal pricing strategies require a nuanced approach that responds to fluctuations in consumer demand across different phases of the PLC, as considered in this study. Specifically, gradual price increases in response to increased demand during the introduction-growth phase, followed by necessary price reductions during the decline phase, are recommended to mitigate the effects of declining demand.

For further development, it can be considered various cooperation contracts between these two members in each PLC phase according to the characteristics of each phase to increase their profits. In this study, linear equations have been employed to model the basic demand function, capturing the bell-shaped trend of the product life cycle. For future investigations, leveraging the Bass diffusion model or probability density functions such as the Beta distribution could provide alternative approaches to model the basic demand trend. In this article, it is assumed that when the manufacturer advertises, it has an effect on goodwill and demand functions at the same time, however, in the real world, the effect of ads occurs with a delay in these functions, therefore we can investigate goodwill with delayed ads efforts similar to the work done by Machowska (2019).

Availability of data and materials

All data used in this paper is available.

Notes

In the introduction-growth phase, due to the novelty of the product and the high quality of the devices and the production process, the decay rate of the quality level is very low, and therefore \({\varepsilon }_{I}\) is considered zero. Since there is no attempt to increase the quality level in this phase and \(q\left(t\right)=0\), therefore \(\frac{dQ\left(t\right)}{dt}={\sigma }_{I}q\left(t\right)-{\varepsilon }_{I}Q\left(t\right)\) becomes zero and we avoid bringing the differential equation in the introduction-growth phase.

References

Asl-Najafi J, Yaghoubi S (2021) A novel perspective on closed-loop supply chain coordination: product life-cycle approach. J Clean Prod 289:125697

Asl-Najafi J, Yaghoubi S, Zand F (2021) Dual-channel supply chain coordination considering targeted capacity allocation under uncertainty. Math Comput Simul 187:566–585

Asl-Najafi J, Yaghoubi S, Noori S (2022) Customization of incentive mechanisms based on product life-cycle phases for an efficient product-service supply chain coordination. Comput Ind 135:103582

Bahrami H, Yaghoubi S (2024) Price switching policies under advertising effect and dynamic environment in supply chain: product life-cycle approach. Expert Syst Appl 247:123347

Barron, E. N. (2013). Game theory: an introduction (Vol. 2): John Wiley & Sons.

Buratto A, Cesaretto R, De Giovanni P (2019) Consignment contracts with cooperative programs and price discount mechanisms in a dynamic supply chain. Int J Prod Econ 218:72–82

Castro A et al (2022) Floquet engineering the band structure of materials with optimal control theory. arXiv preprint arXiv:2203.03387

Cesaretto, R., Buratto, A., & De Giovanni, P. (2021). Mitigating the feature fatigue effect for smart products through digital servitization. Comput Ind Eng 156:107218

Chintagunta PK, Rao VR (1996) Pricing strategies in a dynamic duopoly: a differential game model. Manag Sci 42(11):1501–1514

Day GS (1981) The product life cycle: analysis and applications issues. J Mark 45(4):60–67

De Giovanni P (2011) Quality improvement vs. advertising support: which strategy works better for a manufacturer? Eur J Oper Res 208(2):119–130

De Giovanni P (2020) An optimal control model with defective products and goodwill damages. Ann Oper Res 289(2):419–430

El Ouardighi F (2014) Supply quality management with optimal wholesale price and revenue sharing contracts: a two-stage game approach. Int J Prod Econ 156:260–268

El Ouardighi F, Kim B (2010) Supply quality management with wholesale price and revenue-sharing contracts under horizontal competition. Eur J Oper Res 206(2):329–340

El Ouardighi F, Shniderman M (2019) Supplier’s opportunistic behavior and the quality-efficiency tradeoff with conventional supply chain contracts. J Oper Res Soc 70(11):1915–1937

Erickson GM (2011) A differential game model of the marketing-operations interface. Eur J Oper Res 211(2):394–402

Feng L, Teng JT, Zhou F (2023) Pricing and lot-sizing decisions on buy-now-and-pay-later installments through a product life cycle. Eur J Oper Res 306(2):754–763

Fershtman C et al (1990) Market share pioneering advantage: a theoretical approach. Manag Sci 36(8):900–918

Frolova S (2014) The role of advertising in promoting a product.

Gaimon C (2002) Optimal control theory: applications to management science and economics. JSTOR

De Giovanni P (2013) Should a retailer support a quality improvements strategy? In: Advances in dynamic games: theory, applications, and numerical methods, pp 125–148

He X et al (2007) A survey of Stackelberg differential game models in supply and marketing channels. J Syst Sci Syst Eng 16(4):385–413

Hsueh C-F (2011) An inventory control model with consideration of remanufacturing and product life cycle. Int J Prod Econ 133(2):645–652

Hu K, Acimovic J, Erize F, Thomas DJ, Van Mieghem JA (2019) Forecasting new product life cycle curves: practical approach and empirical analysis. Manuf Serv Oper Manag 21(1):66–85

Karray S, Martin-Herran G, Sigué SP (2022) Cooperative advertising in competing supply chains and the long-term effects of retail advertising. J Oper Res Soc 73(10):2242–2260

Khosroshahi H, Hejazi SR (2023) A game theoretic approach for advertising and pricing decisions using a new environmental transparency-based demand function considering different government policies. Environ Dev Sustain 26(5):11145–11170

Kirk DE (2004) Optimal control theory: an introduction. Courier Corporation, Honolulu

Lambertini L, Mantovani A (2009) Process and product innovation by a multiproduct monopolist: a dynamic approach. Int J Ind Organ 27(4):508–518

Liu Y, Lu XB (2023) Emerging trends in closed-loop recycling polymers: monomer design and catalytic bulk depolymerization. Chem Eur J. https://doi.org/10.1002/chem.202203635

Liu G et al (2015) Strategic transfer pricing in a marketing–operations interface with quality level and advertising dependent goodwill. Omega 56:1–15

Lu L, Navas J (2021) Advertising and quality improving strategies in a supply chain when facing potential crises. Eur J Oper Res 288(3):839–851

Machowska D (2019) Delayed effects of cooperative advertising in goodwill dynamics. Oper Res Lett 47(3):178–184

Nair A, Narasimhan R (2006) Dynamics of competing with quality-and advertising-based goodwill. Eur J Oper Res 175(1):462–474

Nerlove M, Arrow KJ (1962) Optimal advertising policy under dynamic conditions. Economica 39:129–142

Ni J, Li S (2019) When better quality or higher goodwill can result in lower product price: a dynamic analysis. J Oper Res Soc 70(5):726–736

Nisal A et al (2020) Personalized medicine for in vitro fertilization procedure using modeling and optimal control. J Theor Biol 487:110105

Orlova EV (2019) Model for operational optimal control of financial recourses distribution in a company. Comput Res Model 11(2):343–358

Östlin J et al (2009) Product life-cycle implications for remanufacturing strategies. J Clean Prod 17(11):999–1009

Reddy PV et al (2016a) Quality effects in different advertising models—an impulse control approach. Eur J Oper Res 255(3):984–995

Reddy PV, Wrzaczek S, Zaccour G (2016b) Quality effects in different advertising models—an impulse control approach. Eur J Oper Res 255(3):984–995

Reiner G et al (2009) Life cycle profit–reducing supply risks by integrated demand management. Technol Anal Strateg Manag 21(5):653–664

Rink DR, Swan JE (1979) Product life cycle research: a literature review. J Bus Res 7(3):219–242

Seifert RW et al (2016) Dynamic product portfolio management with life cycle considerations. Int J Prod Econ 171:71–83

SeyedEsfahani MM, Biazaran M, Gharakhani M (2011) A game theoretic approach to coordinate pricing and vertical co-op advertising in manufacturer–retailer supply chains. Eur J Oper Res 211(2):263–273

Shakouhi F, Tavakkoli-Moghaddam R, Baboli A, Bozorgi-Amiri A (2023) A competitive pharmaceutical supply chain under the marketing mix strategies and product life cycle with a fuzzy stochastic demand. Ann Oper Res 324(1–2):1369–1397

Stark J (2011) Product lifecycle management, decision engineering. Springer, London

Sun H et al (2020) Inventory lot sizing policies for a closed-loop hybrid system over a finite product life cycle. Comput Ind Eng 142:106340

Thepot J (1983) Marketing and investment policies of duopolists in a growing industry. J Econ Dyn Control 5:387–404

Tibben-Lembke RS (2002) "Life after death: reverse logistics and the product life cycle. Int J Phys Distrib Logist Manag 32:223–244

Vörös J (2006) The dynamics of price, quality and productivity improvement decisions. Eur J Oper Res 170(3):809–823

Wang Y, Duan Z, Emery SL, Kim Y, Chaloupka FJ, Huang J (2021) The association between E-cigarette price and TV advertising and the sales of smokeless tobacco products in the USA. Int J Environ Res Public Health 18(13):6795

Wei Q, Wang X, Liu Y, Xiong G (2022) Data-driven adaptive-critic optimal output regulation towards water level control of boiler-turbine systems. Expert Syst Appl 207:117883

Xu C, Jing Y, Shen B, Zhou Y, Zhao QQ (2023) Cost-sharing contract design between manufacturer and dealership considering the customer low-carbon preferences. Expert Syst Appl 213:118877

Zhang J et al (2014) Strategic pricing with reference effects in a competitive supply chain. Omega 44:126–135

Zheng Y, Shi J (2022) A linear-quadratic partially observed Stackelberg stochastic differential game with application. Appl Math Comput 420:126819

Zolfagharinia H et al (2014) A hybrid two-stock inventory control model for a reverse supply chain. Transp Res Part e: Logist Transp Rev 67:141–161

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Informed consent

All authors have received, read and kept a copy of the paper and consent to the submission of the article.

Research involving human participants and/or animals

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

In the text of the article, to summarize and better understand the content, supplementary symbols are used, which are defined as follows:

Appendix B

In this section, the proofs of Theorems and Proposition are given in detail.

Proof of Theorem 1

In this Stackelberg game, our first task is to derive the optimal value for the decision variable concerning retail, denoted as the retail selling price of the product, \(p(t)\). Since the second-order derivative of \({H}_{I}^{r}\) with respect to \(p(t)\) is negative (\(\frac{\partial {H}_{I}^{r}}{{\partial }^{2}p}={-2\beta }_{I}\)), the sufficient condition guarantees that there exists a unique optimal solution for \(p(t)\).

Following the necessary condition specified by the maximum principle for retail, we derive \(p(t)\) as follows:

From solving equation (B.1), the equilibrium value \(p(t)\) is obtained then, substuting this value in Eq. (15), we have:

Examining the concavity of the current Hamiltonian of the manufacturer and its associated Hessian matrix, we find:

Notably, the first principal minor is negative \({-2\beta }_{I}< 0\), and the second one is positive \({2\beta }_{I}\tau\) > 0. Thus, the current Hamiltonian of the manufacturer in the first phase of PLC is concave in both \(w(t)\) and \(A(t)\). Consequently, by examining the necessary conditions stipulated by the maximum principle for the manufacturer, we can ascertain the optimal values for the decision variables, \(w(t)\) and \(A(t)\).

According to Gaimon (2002), the necessary conditions for the maximum principle regarding the manufacturer in a case where the endpoint of the time interval and the value of the goodwill function at that point are specified, are as follows:

Solving equations (B.5) and the differential equation (B.6), and considering the condition \(G\left({t}_{1}\right)={G}_{1}\) (transversality condition \({\lambda }_{I}^{m}\left({t}_{1}\right)=B ,B\) is a constant to be determined), the optimal value for \({\lambda }_{I}^{m}\left(t\right)\) is obtained, leading subsequently to the optimal value for\(A\left(t\right)\).□

Proof of Theorem 2

In the maturity phase, similar to the preceding phase, we begin by determining the optimal retail price of the product, denoted as \(p(t)\). Since the second-order derivative of \({H}_{M}^{r}\) with respect to \(p(t)\) is negative (\(\frac{\partial {H}_{M}^{r}}{{\partial }^{2}p}=-2{\beta }_{M}\)), the sufficient condition guarantees that there exists a unique optimal solution for \(p(t)\).

The necessary condition of the maximum principle for the retailer in this period (\({t}_{1}<t\le {t}_{2})\) is as follows:

Next, to obtain the manufacturer's variables, we substitute the optimal \(p(t)\) into the current-value Hamiltonian of the manufacturer during this phase. By substituting the equilibrium retail price in Eq. (21), the manufacturer's current-value Hamiltonian is:

Examining the concavity of the current Hamiltonian of the manufacturer in the maturity phase and its associated Hessian matrix, we find:

It is evident that \({\left|{H\left({H}_{M}^{m}\right)}_{1}\right|=-2\beta }_{M}<0,\) \({\left|{H\left({H}_{M}^{m}\right)}_{2}\right|=2\beta }_{M} \tau >0\) and \({\left|{H\left({H}_{M}^{m}\right)}_{3}\right|=-2\beta }_{M}\tau \Omega <0\). Therefore, \({H}_{M}^{m}\) is concave in its variables, and the optimal solution can be determined by examining the necessary conditions stipulated by the maximum principle for the manufacturer.

Drawing inspiration from Gaimon (2002), the manufacturer's necessary conditions for the maximum principle in the maturity phase, given the endpoint of the time interval and the specified values of goodwill and quality level function at that point, are as follows:

Solving the associated differential Equations (B.13) and (B.14), while simultaneously considering critical transversality conditions \(\left\{\begin{array}{c}G\left({t}_{1}\right)={G}_{1}\\ G\left({t}_{2}\right)={G}_{2}\end{array}\right.\) and\(\left\{\begin{array}{c}Q\left({t}_{1}\right)={Q}_{0}\\ Q\left({t}_{2}\right)={Q}_{2}\end{array}\right.\), (where \({\lambda }_{M}^{m}\left({t}_{2}\right)={B}_{1} and\) \({\eta }_{M}^{m}\left({t}_{2}\right)={B}_{2}\), \({B}_{1}\) and \({B}_{2}\) are constants to be determined) yields the optimal solutions for the variables\(w(t)\), \(A(t)\), and \(q(t)\) throughout the maturity phase of the PLC, denoted by the time interval (\({t}_{1}\le t\le {t}_{2}\)). □

Proof of Theorem 3

In the final phase of the PLC, our approach involves the initial derivation of the retail price of the product, denoted as \(p(t)\). Given that the second-order derivative of \({H}_{D}^{r}\) with respect to \(p(t)\) is negative (\(\frac{\partial {H}_{D}^{r}}{{\partial }^{2}p}=-2{\beta }_{D})\), a sufficient condition ensures a unique optimal solution for \(p\left(t\right)\) in this phase.

Substituting the equilibrium retail price in the current-value Hamiltonian of the manufacturer, \({H}_{D}^{m}\) is:

In this phase, the only decision variable of the manufacturer is the wholesale price(\(w\left(t\right)\)), and because \(\frac{\partial {H}_{D}^{m}}{{\partial }^{2}w}=-{\beta }_{D}<0\), the Hamiltonian function is concave with respect to this variable.

By solving the Eq. (B.17) the optimal solution for the variable \(w(t)\) throughout the decline phase of the PLC (\({t}_{2}\le t\le T\)) are obtained

Proof of Proposition 1

To prove this proposition and demonstrate that the optimal rate of quality efforts increases over time, it is just necessary to illustrate that the first-order derivative of the optimal rate of quality efforts with respect to \(t\) is positive. Therefore, this derivative is shown in Equation (B.18).

Since all parameters are positive and as explained earlier, the quality level at the end of the maturity phase should be higher than at the beginning of the phase \(({Q}_{2}> {Q}_{0})\), and additionally, \({\text{e}}^{{t}_{2}(\varepsilon +\rho )}\) is always greater than \(1\) so the relation (B.18) is always positive and changes in quality efforts should be incremental over time. □

Proof of Proposition 2

To prove Proposition 2 and and show that the quality level trajectory has a direct relationship with the initial quality level, it is sufficient to show that the first derivative of the quality level trajectory in the phases of the product life cycle is positive with respect to \({Q}_{0}\). Since the quality level in the first phase (introduction-growth) is assumed to be constant, we avoid examining this issue in this period. The derivative of the optimal quality level in the second and third phases with respect to \({Q}_{0}\) are in equations (B.19) and (B.20).

In relation (B.19), since \({t}_{1}<t\le {t}_{2}\), then \(\frac{{e}^{t\left(\varepsilon +\rho \right)}-1}{{e}^{{t}_{2}\left(\varepsilon +\rho \right)}-1}\) is smaller than 1, so \(\frac{d{Q}^{*}\left(t\right)}{d{Q}_{0}}\) > 0 and also the relationship (B.20) is always positive. Therefore, with the increase of the initial value of the quality level, the quality level increases throughout the product life cycle.□

Proof of Proposition 3

To prove this proposition and illustrate that the rate of ads decreases with the increase of the initial value of the quality level, it is only necessary to show that the optimal advertising rate’s first-order derivative in the first and second phases with respect to \({Q}_{0}\) is negative, and these derivatives are shown in equations (B.21) and (B.22).

In relation (B.21), if \(\delta <\frac{Z{\nu }^{2}{\gamma }_{I}}{2\tau }+\frac{1}{2}\sqrt{\frac{{Z}^{2}{\nu }^{4}{\gamma }_{I}^{2}+4Z{\nu }^{2}\tau {\gamma }_{I}^{2}}{{\tau }^{2}}}\) (the decay rate is low), then \(\frac{d{A}^{*}\left(t\right)}{d{Q}_{0}}\) < 0 and also since all parameters are positive the relationship (B.22) is always negative. Therefore, with the increase of the initial value of the quality level, the rate of ads decreases throughout the two first of the PLC phases. □

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Bahrami, H., Yaghoubi, S. Dynamic optimal pricing considering advertising and improvement quality strategies over product life-cycle horizon. Flex Serv Manuf J (2024). https://doi.org/10.1007/s10696-024-09561-x

Accepted:

Published:

DOI: https://doi.org/10.1007/s10696-024-09561-x