Abstract

Recent interest in reducing budget deficits raises questions regarding the impact on legislative bargaining of cuts versus increases in government spending. Using an experimental design where the outcomes are theoretically isomorphic results in significant differences in bargaining outcomes: There are longer delays in reaching agreement with cuts than with increases, along with which legislative types get their proposals passed. These results can be attributed to a change in agents’ reference point in conjunction with differential responses to gains versus losses.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This paper contributes to the literature on voting in legislative bargaining games where a number of experiments have explored the distribution of “cash” benefits or “pork”.Footnote 1 More recently there are legislative bargaining experiments concerned with the distribution of pork along with a policy choice.Footnote 2 None of these experiments address whether bargaining outcomes differ when players bargain over losses rather than gains even though this is also a part of the bargaining process. This paper fills that void by comparing legislative bargaining over “taxes” as opposed to “pork”. Given Prospect Theory (Kahneman and Tversky 1979), bargaining over “taxes” (losses) involves reducing benefits, which might be expected to set off different responses compared to increasing benefits (gains). The experiment is designed to maintain a theoretical isomorphism, under expected utility theory, between gains and costs, so that any differences in outcomes can be attributed to moving from gains to losses. The experiment enables us to explore reference point effects (Kőszegi and Rabin 2006) in a previously unexplored area of interest to both economists and political scientists, and has potential implications for institutional design.

Models of legislative bargaining essentially involve committee decision making. This coincides with an early cornerstone of Charles Plott’s distinguished career—his interest in committee decision making and political economy (Fiorina and Plott 1978; Kormendi and Plott 1982) and the path dependence of outcomes in sequential voting (Levine and Plott 1977). These earlier studies of committee decision making involved unstructured bargaining whereas the present research involves structured bargaining, namely the Jackson and Moselle (2002; JM) model where legislators, with heterogeneous preferences, bargain over a one-dimensional public policy issue, along with a distribution of private goods that benefit each legislator’s home district.

In an earlier paper (Christiansen et al. 2014; CGK) we analyzed the JM model for the case of expanding benefits: A Baseline treatment in which there are no private goods available to “grease” the legislative bargaining “wheels”, and a Gains treatment in which there are private goods to distribute between potential coalition partners along with a decision on the public policy issue. This paper extends the previous one to a Costs treatment in which legislators must come up with reductions in private goods (aka “taxes”) to cover budget costs. The Costs treatment is structured so that it is theoretically isomorphic to the Gains treatment, resulting in the same stationary subgame perfect equilibrium (SSPE) outcome, the most common theoretical reference point for legislative bargaining experiments. Outcomes are also isomorphic to the efficient equal split (EES), a behavioral model that better organized the Gains treatment in CGK (and will be shown, to better organize behavior under the Costs treatment here as well).

There are a number of common outcomes between the earlier Gains experiment and the Costs experiment reported on here: Both serve to “grease” the legislative bargaining process, as there is significantly less delay in passing proposals than when bargaining strictly over a public policy. However, as between Gains and Costs, there is a significantly lower frequency of proposals passing without delay with Costs. Most of this increase has to do with rejections of proposals from the voter who cares the most about the public policy—a 23 percentage point reduction in her proposals passing without delay. In turn, this results in reductions in efficiency by just under 10%, along with a 20% reduction in that voter’s payoff, had her proposals passed at the same rate as in the earlier Gains experiment. This difference is consistent with reference point effects (another of the many topics Professor Plott has written on) in which legislators respond differentially to gains and losses, in conjunction with Prospect Theory type preferences (Kahneman and Tversky 1979).Footnote 3

This paper is related to a growing literature on legislative bargaining experiments. As noted, most early papers focus on purely distributive games, such as the bargaining model in Baron and Ferejohn (1989). Several experiments involve bargaining over two or more dimensions. These include the CGK paper where legislators with heterogeneous preferences also bargain over a one dimensional “public” policy. Other papers include Fréchette et al. (2012) and Christiansen (2015), which investigate the model in Volden and Wiseman (2007) where bargaining occurs over private and public goods, and funds for both come from a common budget. Agranov et al. (2016) examine a dynamic bargaining game over private and public goods where investment in public goods is durable. It is important to note that in each of these experiments bargaining is in the “gains” frame, that is, proposers are offering coalition members a higher payoff than they had before bargaining.

The paper is also related to how reference points affect bargaining outcomes because of differential responses to gains and losses. Camerer et al. (1993) study a shrinking-pie, multi-round, bilateral bargaining game and compare the results to an isomorphic treatment in which losses increase over time.Footnote 4 They find more dispersed offers, greater initial rejections and lower proposer payoffs with increasing losses as opposed to an equivalent shrinking of benefits. Other experiments focus on bargaining between buyers and sellers. Neale and Bazerman (1985) show that framing a collective bargaining game between union and management as a gain rather than a loss results in fewer negotiations being sent to arbitration (also see Bazerman et al. 1985).Footnote 5 A similar result is reported in Kristensen and Gärling (1997) where buyers and sellers negotiate over the sale price of a condominium. They show that when buyers perceive the seller’s first offer price as a gain, relative to their reference point, it results in higher counteroffers than if they perceive the first offer as a loss, thereby reducing the overall number of counteroffers and bargaining impasses.

Like the bilateral bargaining papers, the experiment in this paper speaks to the question of whether different reference points affect bargaining outcomes. But it extends earlier results in two important ways. First, bargaining is multilateral not bilateral. Second, the bargaining game is more complex than in earlier experiments since individuals with different preferences must simultaneously trade-off private goods along with the location of a common policy. This allows us to explore the implications for efficiency.

The paper proceeds as follows: Sect. 2 describes the underlying experimental design used to investigate the JM model. Section 3 briefly reviews results from CGK that provide the starting point for the present experiment. Section 4 describes the experimental procedures and the motivation for the parameter values chosen. Section 5 reports the results and Sect. 6 is a summary and conclusions section.

2 Implementation of the Jackson and Moselle model

The JM model extends the Baron and Ferejohn (1989; BF) legislative bargaining model by including a policy component in the bargaining process. In our case, three legislators must divide an exogenously determined level of private goods, X ≥ 0, while choosing over a one-dimensional policy proposal, y ∈ [0, Y]. If Y = 0 and X > 0 the game reduces to a straightforward BF divide the dollar game. On the other hand, if there is only the policy proposal to bargain over (Y > 0 and X = 0), the game reduces to a median voter game.

Legislators have heterogeneous preferences, which depend on the policy chosen and the legislator’s share of private goods. Legislator i’s utility function ui (y, xi) is nonnegative, continuous, and strictly increasing in xi for every y ∈ Y. Preferences over the public policy are assumed to be separable from the private good benefits, with ui single peaked in y, with the ideal point yi*.

A legislative bargaining round consists of a potentially infinite number of stages. In the first stage, one legislator is randomly selected to make a proposal. A proposal is a vector (y, x1, x2, x3) consisting of a public policy proposal and a distribution of private goods such that ∑ xi ≤ X. The proposal needs a majority of votes for approval. If the proposal is approved, the bargaining round ends and payoffs are awarded. If the proposal fails, the game moves on to a second stage in which a new proposer is randomly selected, and the process repeats itself until a proposal passes. Legislators are assumed to employ a discount factor 0 < δ ≤ 1 to their benefits from any delays in reaching agreement, so that an agreement in stage t ∈ {1, 2, …} is valued as δtui(y, xi).Footnote 6 There are multiple Nash equilibria to the game to the point that any proposal that is accepted constitutes a Nash equilibrium. As is standard in the literature, the stationary subgame perfect equilibrium (SSPE) is the point of comparison for experimental outcomes.Footnote 7

More concretely, three legislators must decide on a policy y ∈ [0, 100] (integer values only). Legislators’ ideal points are 0, 33, and 100 for types 1, 2, and 3, respectively. We refer to these types as T1, T2 and T3. Legislators also differ in the cost to deviating from their ideal point: Each integer deviation costs 1, 3 and 6 experimental currency units (ECUs) for T1, T2 and T3, respectively. To fix ideas about the policy proposal, subjects were told they must decide on a “bus stop location” on the line interval between 0 and 100, with the cost to deviating from their ideal location referred to as their “unit walking cost” (UWC).Footnote 8 There was no discounting of payoffs from delays in reaching agreement (δ = 1), although there will be “homegrown” preferences for reaching agreement within a reasonable time interval (which should not vary across treatments). As with δ somewhat less than 1, the major cost for rejecting a proposal that provides a voter with her continuation is that when a new proposer is chosen, she may be left out of the minimum winning coalition (MWC), with sharply reduced benefits.Footnote 9

Baseline treatments were run with bargainers deciding strictly over the public policy location. Payoffs in the experiment are in experimental currency units (ECUs), which were converted to dollars at a fixed conversion rate. Type i’s payoff in the Baseline was given by,

where yprop is the policy proposed, E is the legislators’ starting endowment, common to all players, and UWCi is i’s unit walking costs. In CGK, E was set at 600. Here it is set at 700 which is necessary to preserve the isomorphism with the earlier Gains experiment.

Proposers in the Gains treatment in CGK, in addition to choosing the public policy (y), had 100 ECUs in “cash” (c1, c2, c3) to distribute (Σci = 100). In the Costs treatment here, in addition to choosing the public policy location, proposers had to raise “taxes”, τ, equal to 200 ECUs, with the restriction that no more than 100 ECUs could come from any one player. (In order to avoid any positive or negative associations with taxes, subjects were told the 200 ECUs were “construction payments” needed to pay for the bus stop.) A proposal is a vector (y, τ1, τ2, τ3) such that ∑ τi = 200 and τi ≤ 100 for all i. This restriction on taxes is needed to generate the theoretical isomorphism between final outcomes in the Gains and Costs treatments. It might be thought of as a constitutional restriction, a result of a prior bargaining outcome, or a result of political “realities”. It might also simply reflect the fact that the legislature cannot get the requisite amount of spending cuts from any one legislator’s stock of private goods.

Under this structure, a net of 100 ECUs of private goods are added to the Baseline treatment under both the Gains and Costs treatments. In the Gains treatment, a proposer has 100 ECUs directly at her disposal to “grease the wheels”, in addition to specifying a policy proposal, yprop. In the Costs treatment, given the 100 ECU increase in players’ initial endowments, and because taxes must be less than or equal to 100, the proposer is able to allocate between 0 and 100 ECUs of private goods to any player, just as in the Gains treatment, albeit from a different starting point. That is, payoffs in the Costs treatment are:

the same payoff as in the Gains treatment where the private good allocations are ci = (100 − τi). Since nothing else about the bargaining game has changed, the outcomes are isomorphic in that they have the same SSPE outcome, but are clearly framed differently, on account of dealing with costs as opposed to benefits and the different values for E.

3 Previous experimental results

In CGK under the Baseline treatment 57% of stage 1 proposals passed without delay as opposed to 78% in the Gains treatment (p < 0.01).Footnote 10 Under the SSPE 100% of stage 1 proposals are predicted to pass, but this rarely happens in legislative bargaining experiments (see, Fréchette et al. 2005, for example). More importantly there were several glaring differences between actual and predicted outcomes under the SSPE: First, T2 proposers commonly form MWCs with T1s (81% of the time) as opposed to 16% of the time with T3s, their predicted coalition partner.Footnote 11 Second, as is commonly the case, proposers’ average payoffs were lower than predicted under the SSPE for both T1 and T2 (626.7 vs 684 for T1s and 620.1 vs 650 for T2s). Third, contrary to this, T3 proposers earned more than predicted under the SSPE (536.6 vs. 498).

These differences from the SSPE predictions are better captured by a behavioral model, the efficient equal split (EES). An EES is defined as the payoff-maximizing proposal that equalizes payoffs to within 1 ECU between the proposer and one other voter (predicted outcomes under the EES are shown in Table 1). It is obviously related to the other regarding preference literature (see Cooper and Kagel 2016 for a survey), in much the same way the highly unequal payoffs in the ultimatum game and the Baron–Ferejohn game fail to be satisfied. Under the EES, all three types have higher theoretical continuation values than under the SSPE.Footnote 12 This is reflected in the voting regressions, which showed that all three types could expect higher payoffs from the EES, with these payoffs quite close to being expected payoff maximizing proposals.Footnote 13 Despite the higher payoffs, the EES is not an equilibrium for risk neutral expected utility maximizers, since rather than accept an EES offer from a T3 proposer, T1 could make more holding out for an offer from T2 or becoming the proposer. However, it only takes a “fairness” norm along with a bit of “noise” for T1 partnering with T3 under an EES to be a stable outcome—for example, risk aversion can induce T1 to accept T3’s EES offer since T2 proposers occasionally form an MWC with T3s, resulting in sharply lower payoffs to T1. Impatience in not wanting to deal with additional rounds of bargaining would have similar effects given the relatively small increase in payoffs from partnering with T2 under an EES (34 ECUs). However, given loss aversion, it is not clear whether either of these two effects will have the same impact under Costs as Gains.Footnote 14

4 Experimental procedures

Experimental sessions consisted of 15 bargaining rounds, with between 12 and 18 subjects in each session. Subjects’ designation as a T1, T2 or T3 was randomly determined at the start of a session and remained the same throughout. In each stage of the bargaining process all subjects submitted a proposed policy along with a distribution of cash or taxes in the Gains and Costs treatments. One proposal was selected at random to be voted on, with subjects being able to view the payoffs to each of the three players from the selected proposal. If the proposal received a majority of votes, it passed, and payoffs were awarded. If the proposal failed to receive majority approval, a new stage began and new proposals were submitted. In either case the feedback to subjects included the payoffs to each player and how that player voted. The proposal and voting process repeated itself until a proposal passed.Footnote 15 Each bargaining round continued until all groups had passed a proposal, with the groups who finished early having a “please wait” screen until everyone finished. At the end of each bargaining round, subjects were randomly re-matched into new bargaining groups (subject to the constraint of a single player of each type in each group). One round, selected at random, was paid off on at the end of the session.

Subjects were recruited online from the undergraduate student population at Ohio State University enrolled in the Economics department subject pool using ORSEE (Greiner 2004). Experimental sessions typically lasted between an hour and an hour and a half. Software for conducting the experiment was programmed using zTree (Fishbacher 2007). We conducted four sessions of the Costs treatment for a total of 66 subjects.Footnote 16 There were two Baseline sessions with E = 700 with 36 total subjects. In what follows the Baseline sessions in CGK are pooled with these new sessions, as there were no significant differences in the average public policy and stage 1 acceptance rates between the two.Footnote 17 The conversion rate from ECUs to dollars was $1 = 33 ECUs for all sessions, along with a show-up fee of $6. Average earnings were $21 for the Costs sessions.

The parameters of the model were chosen to meet two primary objectives: first, we wanted the equilibrium to be in pure strategies since previous research shows that mixing is difficult to achieve in practice. This also helped meet the second objective, an equilibrium where players with opposite ideal points (“strange bedfellows”) frequently form coalitions under the SSPE. These coalitions between a T3 proposer and a T1 are especially interesting because not only must the T3 proposer give all of the private goods to T1 in the Gains treatment, she must fully tax herself in the case of Costs.

5 Results

The focus here is on comparing the Gains and Costs treatments to the Baseline treatment and to each other.Footnote 18 Unless otherwise noted, results are reported for rounds 7–15, at which point subjects are thoroughly familiar with the game and the functionality of the software. Data analysis focuses on stage 1 proposals and payoffs, as it covers most of the data, and once a proposal is rejected the analysis gets substantially more complicated (e.g., possible confounding effects of repeated play since group members to do not change from stage to stage). The Appendix provides results for all bargaining stages and shows that this restriction has virtually no effect on the results reported. To simplify the presentation and to make comparisons between treatments easier, we represent the private good allocations as xi = ci in the Gains treatment and as xi = 100 − τi in the Costs treatment. This normalizes the net private good allocations between the two treatments.

For both Gains and Costs, the average public policy compared to the Baseline is closer to the ideal point of the legislator who cares the most about it (T3): From 38.9 (1.8) under the Baseline to 52.8 (3.2) under Gains and to 47.4 (2.7) under Costs (standard errors of the mean in parentheses).Footnote 19 This increases total welfare compared to the Baseline treatment as it is closer to T3’s ideal point, and any movement in that direction increases total welfare. The EES continues to better organize the data for Costs than the SSPE, with average proposer payoffs from accepted proposals quite similar to Gains treatment. These results are detailed in the Appendix. What is more interesting, and novel, are the differences in acceptance rates between the Gains and Costs treatments, along with differences from the Baseline treatment, and the implications for proposer power.

Acceptance rates for stage 1 proposals in the pooled Baseline treatment were 57% compared to 69% for Costs and 78% for Gains, with both significantly greater than in the Baseline (p < 0.05, using a Mann–Whitney test where outcomes from each bargaining round are the unit of observation). Although it is an accepted fact in the empirical literature on legislative bargaining that the introduction of private benefits helps to “grease the wheels” of the legislative bargaining process (see, for example, Evans 2004), at first blush it might seem paradoxical that the taxes needed to pay for the public policy can have the same effect. However, taxes which involve decreases in private benefits can help to form coalitions in much the same fashion as when the benefits are positive. This is immediately obvious once one recognizes that the taxes needed to pay for government expenses (the “bus stop” in this case) are capable of bringing T1 and T3 together by imposing the maximum tax on T2.

The difference between the acceptance rates in Gains and Costs is borderline significant at conventional levels using a Mann–Whitney test (p = 0.11).Footnote 20 The Appendix shows that increasing the power of the test by expanding the analysis to include all bargaining stages yields a p value of 0.05.Footnote 21 More importantly, the relatively small average difference in pass rates between Gains and Costs masks the fact that T1s accept EES proposals from T3s substantially more often with Gains than with Costs. This results in a substantial reduction in proposer power under Costs for T3s, a 100 ECU reduction in average earnings, compared to having these proposals accepted at the same rate as the Gains treatment.

Figure 1 plots T3’s and T1’s payoffs for all T3 proposals voted on in stage 1 where both players’ payoffs exceeded 500 ECUs.Footnote 22 Payoffs for proposals that T1s rejected (left hand panel) and accepted (right hand panel) are reported for both treatments. Multiple observations are represented by larger circles, with the number of “petals”, along with the circle coloring, indicating the number of observations.

The first thing to notice is the large cluster of proposals in both treatments at the EES, payoffs to T1 and T3 of 600 ECUs. There are also a number of proposals to the west of the EES with T3’s payoff below 600 in both treatments. These proposals look very much like the EES except that they involve policy locations slightly below 100.Footnote 23 We pool these with the (strict) EES proposals to form the class of “nearly efficient equal splits” (NEES), defined as y ∈ [90, 100] with nearly all private goods going to T1, x1 ≥ 90.Footnote 24

Of T3s’ proposals selected to be voted on, 54 and 47% were NEES proposals in the Gains and Costs treatments, respectively. And while these constitute a similarly large share of T3s’ proposals in both treatments, their acceptance rate is only 42% in the Costs treatment compared to 80% in the Gains treatment. This accounts for T3s’ lower pass rates for Costs compared to the Gains treatment \((p = 0.01\)).Footnote 25

There are repeated observations for the same T1s in Fig. 1, which could compromise the statistical significance of the results reported. Table 2 accounts for this, reporting the results of a probit for T1 votes on T3 proposals, with standard errors clustered at the subject level.Footnote 26 In the probit the dependent variable is 1 for a “yes” vote and 0 for a “no” vote. Explanatory variables consist of a dummy equal to 1 for the Costs treatment (0 otherwise), a dummy equal to 1 for an NEES proposal (0 otherwise), and an interaction term for the two dummy variables. The probits are run over proposals with payoffs to T1 at or below the NEES.Footnote 27

As expected, since T1 payoffs are higher under the NEES (than below it) the coefficient on the NEES variable is positive and significant (p < 0.05). The coefficient on the dummy for the Costs treatment is not significantly different from 0, but the coefficient on the interaction between the dummy for the Costs treatment and the dummy for NEES proposals is negative and significant (p < 0.10), indicating that T1s are less likely to accept an NEES in the Costs treatment.Footnote 28

This higher rejection rate on the part of T1s is consistent with the predicted effects of reference-dependent preferences of the sort modeled in Kőszegi and Rabin (2006). Assume a player’s utility is a linear combination of her payoff in the game, Ri, and a “gain–loss utility” term \(\mu \left( \cdot \right)\) relating her payoff relative to her endowment,

where E equals 600 in the Gains treatment and 700 in the Costs treatment, and \(\mu \left( \cdot \right)\) is the gain–loss function. As in Kőszegi and Rabin we assume \(\mu \left( \cdot \right)\) satisfies the usual assumptions from Prospect Theory: risk aversion over gains and loss aversion with diminishing sensitivity to losses as one moves farther from the reference point.Footnote 29

The effects of reference-dependent preferences are modeled here in terms of the EES. In what follows we assume \(\mu \left( \cdot \right)\) is identical for all players in the game and that it displays constant absolute risk aversion (CARA) over both gains and losses.Footnote 30 Notice that in this game the maximum payoff for any player is achieved by setting the policy at her ideal point and keeping all of the private goods (a tax of 0 in the Costs treatment), in which case her payoff is 700. This means that in the Costs treatment players always receive payoffs at or below their 700 endowment, while in the Gains treatment players may be above or below their 600 endowment. As a result, in the Costs treatment \(\mu \left( \cdot \right)\) will be negative for any proposal that has a chance of passing, while in the Gains treatment \(\mu \left( \cdot \right)\) can be positive or negative depending on the proposal, the player’s ideal point, and her unit walking cost.

Suppose T1 is considering whether to accept a current offer relative to the next bargaining stage in terms of her expected gain–loss utility. If she is the proposer in the next stage, or T2 is the proposer, T1 receives 634 under the EES, while if T3 is proposer T1 receives 600. T1 also faces the possibility of a payoff below 600 if T2 and T3 choose to partner together instead of playing the EES, which happens just over 10% of the time when T2 or T3 is chosen as proposer.Footnote 31 With reference-dependent preferences inducing risk aversion in Gains, T1s may be willing to accept less than their continuation value. In contrast, this will produce risk-loving behavior in Costs with T1s rejecting equivalent offers.

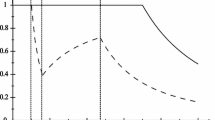

This is illustrated in Fig. 2. It shows T1’s gain–loss utility as a function of payoffs in the game for both Gains and Costs treatments, along with the inherent uncertainty in payoffs governed by which type is chosen as proposer. Under the EES, T1’s payoffs are as low as R if T2 and T3 occasionally partner together to 634 as proposer, with the expected value of \(\mu \left( \cdot \right)\) on the chord connecting the two possible payoffs. Notice that the chord lies below \(\mu \left( \cdot \right)\) in the Gains treatment, meaning that T1s are risk averse with respect to their possible payoffs. However, this is never the case in the Costs treatment where the chord is always above the gain–loss function because T1s are always below their initial endowment. In this case \(\mu \left( \cdot \right)\) induces risk-loving, resulting in players requiring higher payoffs to vote in favor of a proposal, compared to the absence of a reference point effect, all else equal.Footnote 32 While it is not guaranteed that T1 will be risk averse with respect to \(\mu \left( \cdot \right)\) in the Gains treatment, she will be more risk averse in Gains than in Costs.Footnote 33 All else equal, this would increase the chance that an EES proposal from T3 with a relatively low payoff of 600 to T1 is rejected in the Costs treatment.

Reference-dependent preferences should not affect either T2 or T3 voters when proposers follow the EES since T2 and T3 receive as much in the EES as they could ever expect to get in a future stage of the game so that risk preferences are irrelevant. Moreover, they only affect T1s voting on an EES from a T3 since the payoff in an EES offer from T2 is also as much as T1 can ever expect to get in the next stage of the game if it is rejected. This means the only predicted effect of reference-dependent preferences on the behavioral equilibrium is that in the Costs treatment T3s should respond by improving the payoffs of T1s or by splitting payoffs with T2s. However, the first option violates the fairness norm underlying the EES, and under the second option, T3s would be even worse off than under an EES with T1s, and T2s would then be subject to the same endowment effect as T1s.

This large drop in T1s accepting T3 proposals resulted in significant costs for T3s compared to what they would have earned if T1s continued to accept proposals at the same rate as in the Gains treatment. Using the acceptance rates of NEES proposals in both treatments, we can calculate the proposer’s expected payoff in Costs from offering an NEES proposal if T1s voted the same way as in the Gains treatment: Expected payoffs would increase from 430 when the acceptance rate is 42% as it is in Costs to 535 when it is 80%, as it is in Gains.Footnote 34 This is a difference of over 100 ECUs on the most common T3 proposal so there are substantial costs to T3 from these higher rejection rates.

This raises the question as to why T3s continue to stick to EES proposals in the Costs treatment. First, each proposer, including T3, faces strategic uncertainty when they choose their proposal, as they are unsure of what responders will accept. As a result proposers initially opt for some sort of a fairness norm, of which the EES (or an NEES) is a prime candidate, so there is some learning required for T3s to respond with better offers. Second, it is difficult for a T3 to respond by offering T1 higher payoffs, as T3 is already taxing herself the maximum amount possible in the Costs treatment. So offering T1 more means moving the policy location to the left, which imposes a high cost on T3 and quickly makes for a much more inequitable payoff compared to T1, which would be hard for T3 to propose.

6 Summary and conclusions

This experiment investigates the impact on legislative bargaining from increasing versus decreasing benefits under a design that should result in no difference between the two when agents are expected utility maximizers. Although a situation in which there is a theoretical isomorphism between Gains and Costs is unlikely to occur outside the laboratory, the theoretical isomorphism effectively sets “other things equal” within the experiment to isolate the impact of increasing versus decreasing benefits from possible confounding effects. The experiment also serves to investigate the impact of reference point effects within a structured bargaining environment that eliminates the potential confounds identified in Zeiler and Plott’s (2005) critique of the original Kahneman et al. (1990) “mugs” experiment.

Using the Jackson and Moselle (2002) legislative bargaining model, there are minimal differences in average policy outcomes and total welfare for accepted proposals under a Gains treatment, where legislators have private goods available to “grease” the bargaining “wheels”, and a Costs treatment, where it is necessary to reduce private goods to pay for a public policy. Subjects in both treatments commonly choose the efficient equal split (EES), or something quite close to it. Under an experimental design where both the standard theoretical equilibrium (SSPE) and the EES predict no differences, it takes significantly longer for agreement to be reached under the Costs compared to the Gains treatment, a result that is consistent with earlier bilateral bargaining studies. The results are also consistent with the struggles of Greece, the Netherlands, and the United States to achieve budgetary compromises under shrinking budgets in recent years.

The sharpest decline in acceptance rates is with respect to T3s forming coalitions with T1s, as stage 1 acceptance rates decline by 23 percentage points, despite T3s making similar proposals to the dominant player (T1s) under both Gains and Costs. Given that T3 has the highest cost to deviations from her ideal point, this means total welfare would have been higher in Costs but for this decrease in T3 acceptance rates.Footnote 35 This behavior can be explained by reference dependent preferences of the kind specified in Kőszegi and Rabin (2006). To keep predicted outcomes the same under the Gains and Costs treatments requires increasing bargainers’ initial endowments under the Costs treatment compared to the Gains treatment. We argue this change in bargainers’ reference point, in conjunction with Prospect Theory type preferences, results in a sharp increase in T1’s payoff requirements for accepting T3’s proposals. The fact that T3s do not respond to this with higher offers is inhibited by the high own cost of providing more attractive offers. As a result there is a sharp increase in T1s rejecting T3s’ proposals.

One of the primary motivations for the Jackson-Moselle model was to explain the formation and composition of stable political parties. In their model, groups of legislators can increase their expected payoffs by forming binding agreements (“political parties”) prior to the legislative bargaining game, which specify how they will vote and what they will propose if selected as proposer. In our experimental set-up the SSPE predicts that there are two stable parties, T1–T2 and T2–T3.Footnote 36 However, given the deviations from the SSPE in favor of the EES, in the Gains case a T2–T3 party is unstable (CGK 2014). The reason is that in Gains the empirical continuation values of T2 and T3 exceed the values predicted under the SSPE. This leaves fewer gains for these players from establishing a binding agreement with one another before the proposer is selected, and greater gains to T2s and T3s from partnering with T1s. Since T1s prefer to form a party with T2, this is the only stable party. T1–T2 is also the only stable party based on empirical continuation values in the Costs treatment. But a T2–T3 party is closer to being stable in Costs than in Gains on account of T3’s lower continuation value in Costs, which increases the surplus for T2 and T3 to divide.Footnote 37 So while going from Gains to Costs hurts T3 in the bargaining game, it makes her a more attractive target to T2 as a partner in a political party. This suggests that a shift from bargaining over an expanding budget to bargaining over a shrinking budget might also be associated with shifting political allegiances or political parties.

One of our referees suggested that the results reported here may have implications for a balanced budget requirement, which holds in many States, and has been suggested for the Federal government. With a static revenue stream and shifting public priorities, the implication of the results reported here is that it will be more difficult to pass a budget, as it would involve reducing benefits in a number of areas in order to increase benefits in other areas. This follows from the fact that budget reductions lead to higher rejection rates than budget increases.Footnote 38 “Rainy day” funds can help cushion this effect, but only for a limited time unless the economy improves, or there are increases in taxes. The latter would again be likely to generate considerable resistance.

One potential policy implication from this experiment is that the ability to turn budget cuts into negotiations over the allocation of private goods might incentivize less delay toward agreement. Consider that in our experimental design, an alternative way to achieve 200 ECUs in “taxes” is to make severe across-the-board cuts of 100 ECUs from each player, reducing endowments from 700 to 600, and then let players bargain over 100 ECUs in relief from the taxes, as in the Gains treatment. While standard theory predicts no change in outcomes between the two approaches, the experiment suggests that the latter approach may make agreement easier since legislators will no longer be bargaining over outcomes below their reference point. This was arguably at work in the U.S. when there was no agreement over budget cuts in 2011 even following the attempts at a “grand bargain”. As an alternative Congress opted for across the board budget cuts (“sequestration”). Agreement came later when in January 2014 parties in Congress were able to compromise on a budget deal for fiscal year 2014, repealing $61 billion in sequester cuts evenly divided between defense (which Republicans favored) and non-defense (which Democrats favored).Footnote 39

A natural extension of the Gains and Costs analysis would be to apply it to the Baron and Ferejohn (BF) legislative bargaining model. This is essentially a divide the dollar game with an uneven number of bargainers and majority rule which, to date, has only been studied under Gains treatments.Footnote 40 There are distinct differences between that model and the present one which may impact the Costs treatment differently from the one observed here. Most importantly, one of the robust findings with respect to the BF model is the high frequency of minimum winning coalitions (MWCs) where those not in the coalition get a zero allocation. This means that rejecting an offer in the current stage carries a significant amount of risk in the BF game. In our experiment a T1 who rejects an NEES offer knows that even in the case of a T2–T3 coalition in the next stage, the lowest her payoff can be is 500 ECUs. Whether rejection rates would be as high in a BF Costs treatment, which would in turn limit the amount of proposer power, is a topic for future research.

Notes

See Plott and Zeiler (2005).

Their emphasis is on using an eye-tracking technique to record information search to determine the extent to which agents use backward induction.

We want to distinguish reference point effects from pure framing effects. The former combine both a different initial setting (e.g., different initial endowments) and a pure framing effect (e.g., going from gains to losses). In contrast, in a pure framing effect initial endowments are the same, only the frame is switched.

If the game fails to terminate, a default decision (a policy location and split of the private goods) is implemented. It turns out that even if δ = 1 the default decision plays no role in the analysis when X > 0. See JM for details.

See Baron–Ferejohn for a discussion of the properties of the SSPE.

Instructions are at the web site: https://sites.trinity.edu/sites/sites.trinity.edu/files/instructions_gains_costs.pdf.

Christiansen et al. (2017) investigate the BF model under gains and costs with modest discounting of payoffs when proposals are rejected.

Using a Mann–Whitney test or proportions test with bargaining round as the unit of observation.

An MWC is defined as a proposal in which only one other legislator votes for it. In this case 3% of the time T2s proposals passed unanimously.

T1’s continuation value under the SSPE is 617 versus 622 under the EES. For T2 the continuation values are 550 and 555, respectively, and for T3 they are 298 and 332.

Estimated differences between the EES and the SSPE were 6.5ECUs, 46.5ECUs and 78.4ECUs for T1, T2, and T3 respectively. Estimated differences from payoff maximizing proposals were − 26.6, − 11.9, and 0 for T1, T2, and T3 respectively. See ESM of Table A1, in the appendix, for predictions under the SSPE.

A fairness norm makes it difficult for a T2 proposer to deviate from the behavioral equilibrium and lower T1’s payoff below the EES in order to take a higher payoff for herself.

The software was designed to permit up to 15 stages of bargaining before the program moved onto a new bargaining round. All bargaining rounds ended well before 15 stages.

This compares to 3 sessions, with 39 subjects in the Gains treatment in CGK. The additional session for the Costs treatment compensated for one of the earlier sessions that ended after 11 bargaining rounds as a result of computer problems (the data for this session is used up through the 11th round). This, along with higher turnouts in the experiment reported here, accounts for the higher participation rate than in the Gains treatment.

There were three Baseline sessions with E = 600 totaling 42 subjects.

The reader is referred to CGK for detailed analysis of the Baseline treatment relative to the Gains treatment.

The movements in policy relative to the Baseline are statistically significant using a Mann–Whitney test with the outcomes in each bargaining round as the unit of observation (\(p < 0.01\)).

Unless stated otherwise, statistical tests reported are Mann–Whitney, with results for each group in each bargaining round as the unit of observation.

Another way to measure whether there is more difficulty in coming to agreement in Costs is to calculate the average number of stages until agreement is reached. The average rises from 1.3 stages in Gains to 1.5 stages in Costs (\(p = 0.10\)).

This criteria is used to eliminate proposals that essentially had no chance of being accepted in both the Gains and Costs treatments. Only 6 T3 proposals in Gains and 6 in Costs did not meet this criteria.

Note that because T3’s unit walking cost is so high, even a proposal that allocates all of the private goods to T1 and proposes a policy of 90 lowers T3’s payoff to 540.

NEES proposals yield payoffs of R3 ∈ [540,610] and R1 ∈ [590,610] and include the EES as a special case.

The results are similar if the data is restricted to EES proposals. The acceptance rates are 89 and 44% for Gains and Costs, respectively \((p\, < \,0.05\)).

Clustering at the session level results in no changes in the statistical significance of the coefficients. See the Appendix for more session level analysis of the data.

This restriction eliminates only 3 proposals in Gains and 1 in Costs where T1 has a payoff above the NEES. We do not include these in the probit because they provide higher payoffs to T1s than proposals at or below the NEES, resulting in a substantially higher probability of being accepted than the proposals included in the probit with payoffs to T1 at or below the NEES.

This result is not driven by egalitarian T1s who might dislike the relatively low payoff for T2. Running the same probit over T1 voters who simultaneously propose own payoffs above 600, which guarantees at least one other player a much lower payoff than the proposer, yields similar results.

See Kőszegi and Rabin (2006) for a formal description of the gain–loss function.

CARA utility functions were chosen for ease of use, but later we discuss the implications of utility functions displaying increasing or decreasing risk aversion.

Similar results would follow from satisficing assuming that small deviations from maximizing payoffs are more acceptable with Gains compared to Costs.

This follows from Harrington (1990) who shows that risk aversion will result in voters accepting lower offers than with risk neutrality. Similarly, voters will require higher offers than with risk neutrality to vote in favor of a proposal if they are risk loving.

To see why, note that for payoffs below 600 the level of local risk aversion is identical across treatments by the CARA assumption. However, for payoffs above 600, players in the Gains treatment are locally more risk averse than in Costs because they are above their endowment. Together this implies that players in Gains are globally more risk averse for any payoff distribution that includes the possibility of a payoff above 600. See Pratt (1964). With respect to other forms of utility, the same result will hold if individuals are more risk-loving over lower payoffs. In that case, players are locally more risk-loving in Costs for payoffs above 600 as before, and for payoffs below 600 since for any given payoff they are farther away from their endowment in Costs than in Gains.

This calculation holds the empirical continuation value constant.

If T3’s proposals in the Costs treatment were accepted at the same rate as in Gains, total average payoffs would have risen from 1473 to 1484.

A “stable” party is one for which no member can form an agreement with another set of players and achieve a higher payoff. JM assume parties split the gains according to the Nash bargaining. T2 and T3 are indifferent between forming parties with one another and with T1. However, because of the proximity of their ideal points, there are more gains for T1 from forming a party with T2 than with T3.

Using empirical continuation values from accepted stage 1 proposals adjusted to account for the varying frequency with which each type is selected the proposer, the benefit for T2 from partnering with T1 instead of T3 falls by more than half (12 ECUs in Gains to 5 ECUs in Costs). In short, a T2–T3 coalition is closer to being stable under Costs compared to Gains.

The implications would be similar for pay-as-you-go or cut-as-you-go budget requirements which limit the amount of government spending by forcing the legislative body to pay for new spending by cutting spending elsewhere.

Baron (1991) solves a legislative bargaining model with benefits and taxes where players get net payoffs that can be either positive or negative. The advantage to using the BF model to bargain over taxes is that payoffs for all players would be exclusively in the loss frame.

References

Agranov, M., Frechette, G., Palfrey, T., & Vespa, E. (2016). Static and dynamic underinvestment: An experimental investigation. Journal of Public Economics, 143, 125–141.

Baron, D. P. (1991). Majoritarian incentives, pork barrel programs, and procedural control. American Journal of Political Science, 35(1), 57–90.

Baron, D. P., & Ferejohn, J. A. (1989). Bargaining in legislatures. American Political Science Review, 83(4), 1181–1206.

Bazerman, M. H., Magliozzi, T., & Neale, M. A. (1985). Integrative bargaining in a competitive market. Organizational Behavior and Human Decision Processes, 34, 294–313.

Camerer, C. F., Johnson, E. J., Rymon, T., & Sen, S. (1993). Cognition and framing in sequential bargaining for gains and losses. In K. Binmore, A. Kirman, & P. Tani (Eds.), Frontiers of game theory (pp. 27–47). Cambridge, MA: MIT Press.

Christiansen, N. (2015). Greasing the wheels: Pork and public good contributions in a legislative bargaining experiment. Journal of Economic Behavior & Organization, 120, 64–79.

Christiansen, N., Georganas, S., & Kagel, J. H. (2014). Coalition formation in a legislative voting game. American Economic Journal: Microeconomics, 6(1), 182–204.

Christiansen, N., Jhunjhunwala, T., & Kagel, J. H. (2017). Gains versus costs in legislative bargaining. http://www.econ.ohio-state.edu/kagel/CJK_all.pdf.

Cooper, D., & Kagel, J. H. (2016). Other regarding preferences: A selective survey of experimental results. In J. H. Kagel & A. Roth (Eds.), The handbook of experimental economics (Vol. 2). Princeton: Princeton University Press.

Diermeier, D., & Morton, R. (2005). Proportionality versus perfectness: Experiments in majoritarian bargaining. In D. Austen-Smith & J. Duggan (Eds.), Social choice and strategic behavior: Essays in the honor of Jeffrey S. Banks. Berlin: Springer.

Evans, D. (2004). Greasing the wheels: Using pork barrel projects to build majority coalitions in congress. Cambridge: Cambridge University Press.

Fiorina, M., & Plott, C. R. (1978). Committee decisions under majority rule: An experimental study. American Political Science Review, 72, 575–598.

Fishbacker, U. (2007). z-Tree: Zurich toolbox for ready made economic experiments. Experimental Economics, 10, 171–178.

Fréchette, G., Kagel, J. H., & Morelli, M. (2005). Nominal bargaining power, selection protocol, and discounting in legislative bargaining. Journal of Public Economics, 89, 1497–1517.

Fréchette, G., Kagel, J. H., & Morelli, M. (2012). Pork versus public goods: An experimental study of public good provision within a legislative bargaining framework. Economic Theory, 49, 779–800.

Greiner, B. (2004). An online recruitment system for economic experiments. In K. Kremer & V. Macho (Eds.), Forschung und wissenschaftliches Rechnen. GWDG Bericht 63 (pp. 79–93). Göttingen: Ges. für Wiss. Datenverarbeitung.

Harrington, J. E., Jr. (1990). The role of risk preferences in bargaining when acceptance of a proposal requires less than unanimous approval. Journal of Risk and Uncertainty, 3(2), 135–154.

Jackson, M. O., & Moselle, B. (2002). Coalition and party formation in a legislative voting game. Journal of Economic Theory, 103(1), 49–87.

Kahneman, D., Knetsch, J. L., & Thaler, R. H. (1990). Experimental tests of the endowment effect and the Coase theorem. Journal of Political Economy, 98(6), 1325–1348.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263–291.

Kőszegi, B., & Rabin, M. (2006). A model of reference-dependent preferences. The Quarterly Journal of Economics, 121(4), 1133–1165.

Kormendi, R., & Plott, C. R. (1982). Committee decisions under alternative procedural rules. Journal of Economic Behavior and Organization, 3, 175–195.

Kristensen, H., & Gärling, T. (1997). The effects of anchor points and reference points on negotiation process and outcome. Organizational Behavior and Human Decision Processes, 71, 85–94.

Levine, M., & Plott, C. R. (1977). Agenda influence and its implications. Virginia Law Review, 63, 561–604.

McKelvey, R. D. (1991). An experimental test of a stochastic game model of committee bargaining. In T. R. Palfrey (Ed.), Contemporary laboratory research in political economy. Ann Arbor: University of Michigan Press.

Neale, M. A., & Bazerman, M. H. (1985). The effects of framing and negotiator overconfidence on bargaining behaviors and outcomes. The Academy of Management Journal, 28(1), 34–49.

Palfrey, T. (2016). Experiments in political economy. In J. H. Kagel & A. E. Roth (Eds.), The handbook of experimental economics (Vol. 2). Princeton: Princeton University Press.

Plott, C. R., & Zeiler, K. (2005). The willingness to pay—willingness to accept gap, the ‘endowment effect’, subject misconceptions, and experimental procedures for eliciting valuations. The American Economic Review, 95(3), 530–545.

Pratt, J. W. (1964). Risk aversion in the small and in the large. Econometrica, 32(1/2), 122–136.

Volden, C., & Wiseman, A. E. (2007). Bargaining in legislatures over particularistic and collective goods. American Political Science Review, 101(1), 79–92.

Acknowledgement

Funding was provided by National Science Foundation (Grant No. SES-1226460), (Grant No. SES-1630288).

Author information

Authors and Affiliations

Corresponding author

Additional information

This is a substantially revised version of an earlier paper entitled, “The Effects of Increasing versus Decreasing Private Goods on Legislative Bargaining: Experimental Evidence”. We are grateful for comments received at the 2014 Behavioral Models of Politics Conference at Duke University, the 2013 Political Economy meeting at Cal Tech, and the 2013 Public Choice Society Meetings. We received able research assistance from Xi Qu and Matt Jones. This research has been partially supported by National Science Foundation Grant SES-1226460 and SES-1630288. Opinions, findings, conclusions or recommendations offered here are those of the authors and do not necessarily reflect the views of the National Science Foundation.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Christiansen, N., Kagel, J.H. Reference point effects in legislative bargaining: experimental evidence. Exp Econ 22, 735–752 (2019). https://doi.org/10.1007/s10683-017-9559-7

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-017-9559-7