Abstract

Competition is essential for businesses to succeed in the global economic system. This necessitates firms to reevaluate their competitive position in terms of innovation relative to competitors, among other things.

This explains why innovation has risen to the forefront of small business literature, reports, and government policy over the past twenty years. However, there hasn’t been much discussion of the potential effects of other innovation-related aspects on corporate performance.

This research proposes a clear object for the literature development by exploring the personal impact of product and process innovation, and then their interaction with outside collaborations. This aims is to expand the literature to include the local contribution of a sample of French manufacturing companies of a company’s performance and corporate social responsibility (CSR) activities during the period 2010–2020. In reality, study findings show that while process and product innovations fail to return on total assets, they are nonetheless advantageous to firm success in terms of accounting performance.

This means that while investing in creative businesses might increase consumer loyalty, it can also take time for them to become profitable. Additionally, we revealed evidence that innovation may make firms seem less transparent, particularly when there are outside stakeholders. This motivates firms to use CSR initiatives to communicate their sustainability and goodwill. It encourages companies to refer signals about their sustainability and goodwill through (CSR) activities. It encourages firms to use CSR initiatives to communicate their sustainability and goodwill. Instead of using a composite CSR score, as some previous studies have done, we are the first to break down the various ways that CSR activities might contribute to local well-being and to provide proof of their impact and innovation in each area.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

In the context of the current globalization and fierce competition, the increasing uncertainty of the global environment has prompted companies to rethink their management methods and the way they deal with employees (Tissioui et al 2016). Employees are also increase expressing new expectations. Therefore, human resource management seems to be a tense area (Martin and Sunley 1998) and its challenges have crucial for companies. In this view, improved business success is dependent in part on better human resource management (HRM) and, in particular, greater employee involvement channeling. “Whether we are talking about paternalism, charity, corporate citizenship, sustainable development, or even social responsibility,”.

Boidin and Ballet (2020) provide that “the firm has always felt accountable for its employees and it works hard to enhance their working and safety conditions.” It is widely acknowledged that including the human resources factor into a company’s strategy is necessary.

Increased global and regional competition has led companies reach the decision of creating or maintaining a competitive advantage through innovation. In Fact, both the fast-changing environment and its continuous evolvement make it imperative to improve corporate innovation capabilities. Innovation is not only an issue of interest to practitioners, but also aroused widespread concern in the academic community, especially in the study of the impact of some innovation norms on company performance. In the innovation specification, product and process innovation are often discussed. Growth of technology in the past few years, the manufacturing industry often makes improved products (product innovation) or changes in production methods (process innovation) into consideration.

The Brundtland Report in 1987 paved the way to a wide-ranging debate on the ecological innovation (e.g., ecological design, cleaner production) and in sustainability-oriented innovation, which incorporates ecological and social factors into the mainstream of the organization’s products, processes, and structures. Company’s first strategic sustainability behavior includes resistance, response, anticipation and innovation in sustainability. Secondly, level, innovative practices at the product, process, and organizational level are well determined. Thirdly, point dealt with is that the results of this study show that from the perspective of the triple bottom-line (economic, social and environmental dimensions), that is, the company is SOI, and the research on the ecological innovation is still stronger than that of innovation.

Therefore, the development of a comprehensive framework for corporate SOI is the main theoretical contribution proposed by Klewitz et al (2014). It is determined how different strategic sustainability behaviors explain the contingency in innovative practice types. Additionally, for more proactive SME behavior, as the innovation process.

The integrated framework has a higher ability to carry out for radical sustainable innovations. Although the innovation recorded in the work hall (2011) that often related to the improvement of economic performance, the relationship between innovation and performance among enterprises put forward. It is, then, concluded that product innovation has a substantial positive impact on revenue productivity, but process innovation is more important. Vagueness indicates that the analyzed company has certain market power.

Chesbrough (2003) also studied the increasing rate of consumer taste and technological change, which requires open innovation. These substantive advantages have prompted academics to examine whether the open innovation has influenced really by innovation results. Just as the literature has merged different aspects of open innovation (for example, breadth, depth), there are few studies on the interrelationship between external collaboration and innovation and the impact of processes and products on company performance, at least in developed countries. Research on manufacturing companies and open innovation is required because, in contrast to their counterparts in more innovative markets, the innovation of companies in developed markets frequently depends more on external technology and foreign direct investment (FDI). The transfer is preferred above internal resources or domestic R&D investments by Osano et al (2016).

Nyeadi and Adjasi (2020) find that productivity and economic growth is increase by foreign direct investment (FDI) through the introduction of innovation in host country firms. Innovation is also seen as the engine that drives a company’s success at the micro level. Innovation occurs when companies have the ability to establish new processes to manufacture current products more proficiently, or to differentiate existing products or introduce entirely innovative products to improve sales and profitability (Girma et al. 2005). The influx of FDI into the hospitality industry has spurred innovation through two main channels.

In this area, the injection of foreign capital through foreign direct investment prompts the parent company to transfer part of its long-term accumulated advantageous knowledge to the subsidiary via employee transfer or technology transfer. Due to the fact that multinational corporations are known to have superior technical and organizational skills than local businesses, this provides the way for subsidiaries to innovate and prosper in the marketplace (Maaso et al. 2013). Consequently, businesses associated with larger groupings might engage in more innovative activities (Terk et al. 2007).

On a second level, one of the ways in which FDI injects innovation into host country firms is by reducing financial constraints on firms, thereby enabling firms with capital to devote more resources to (R&D), thereby bringing more innovation into their operations. This is especially important because R&D not only stimulates innovation, but also enables firms to identify, absorb and exploit external knowledge (Kinoshita 2000). Furthermore, given the availability of funds, FDI companies may increase wages to attract and retain more skilled workers (Glass and Saggi 2002). The best approach to transfer technology to developing countries is FDI (Janzen and Carter (2013)). In addition, for companies, the transfer of new technologies through FDI is faster than international trade and licensing. Despite theoretically established links between FDI and innovation (e.g. Lin and Cheung (2022); Liu and Zou 2008; Fombang, et al. (2018)), the establishment of FDI innovation promotion in host enterprises is still not totally defined.

In this context, FDI can hinder innovation by host country companies. Thus, not only can FDI drive innovation, but also innovative firms can ultimately attract more FDI (see Stiebale et al., 2010; Maaso et al. 2013 and Garcia et al. 2013; Dunning 1993). Likewise, product life cycle theory assumes that multinational enterprises (MNEs) invest more in innovation early in the life cycle and shift to host companies that invest less in R&D later in the life cycle. As a result, FDI-based firms have a better chance of driving innovation than non-FDI firms. In addition, the pull factor theory also assumes that some MNCs enter the host country in order for the adoption and learning of some innovations available from the part of country firms to the benefit of host country firms that home country firms lack them (Dunning 1995).

According this research, FDI is a good catalyzer for innovation in host nation firm, according to Ghazel and Zulkhibri (2015) and Khachoo and Sharma (2016). In contrast, some research have also discovered a link between FDI and decreased corporate innovation (Barasa et al. 2018; Garcia et al. 2013; Stiebale and Reize 2010).

Among many studies, Sofka et al. (2010) and Laursen et al. (2006) also contributed to the research, and proposed that the results of an innovation are usually measured by the results of innovation, such as the number of development projects, Increasing the frequency of new product sales or new product releases. This direction is spontaneous because it is unswervingly related to the results of innovation. But, it can also be very interesting to assess the influence of the type of innovation on firm performance. After all, innovation can not only improve one or two products, but also affect the company’s product/service range. Compared with the innovation performance of an enterprise, the overall economic performance should become an indicator to measure the sustainable development of an enterprise. This research will try to find the answer to the interrogation of how process and product innovation enable companies to fill this gap instead of achieving innovative results. In the contemporary period, Canh et al (2019) encountered a different issue. It is the fact that firms cannot merely pay attention to financial performance while ignoring societal an ecological challenge. In addition, according to Pizzi (2016), if a company cannot manage the environmental effect of its activities, it may have a negative influence on financial performance. Nevertheless, integrating these areas is not easy, and the company must find a strategy to achieve this goal, which is supported by the work of Drexhage (2010). Companies should be compelled to take on social obligations and make commitments to support the locality and society at large. The use of child labor and environmental degradation are two unethical corporate practices that are becoming more and more undesirable.

We believe that in addition to innovation performance, overall performance should also be analyzed, which has been the subject of many previous studies. To ensure a more balanced assessment of the impact of innovation, the performance metrics to be taken into account in this paper contain both economic and social contributions. Studying the effects of product and process innovation in isolation and determining if external collaboration is preferable to closed processes in accomplishing these two breakthroughs are other contributions of this work. Resources allocated by the corporation to open innovation initiatives are principally constrained in emerging countries since these initiatives are expensive, but provide no beneficial outcomes (Osano and Koine 2016). First, a model that assumes innovation as a process applied in this study and a definition of innovation through the effect of its activities on firm performance then elucidated. At a second level, the successful outcome of innovation applied on firm performance is to be highlighted in this research. In fact, a provision of further empirical evidence for the association between innovation and corporate performance has to be dealt with. According to practitioners, it exists between two important factors that strike the performance of a company which are process and product. The necessity of focalizing and mobilizing resources is vital for the creation of organizational structures and industrial procedures. Firms should rely on updated data based on technological vicissitudes in innovative countries in a timely manner, especially in high-tech training linked with supporting industries. This is an attempt to seek long-term cooperation opportunities with domestic and foreign companies in the same industry. Therefore, the academic and practical research collaboration’s role is fundamental to achieve both product and process innovation. Our research and innovation in France is our final contribution since this developed country has experienced a relatively marked increase owing to its technological changes in sustainable development. Although developed countries such as France are generally highly dependent on innovation, there is very little innovation research in these economies. Instead of providing a comprehensive CSR index, we provide specific breakdowns of CSR strategies for different types of businesses to help clarify the types of CSR that represent the priority of local businesses.

Considering that, organization and process innovation activities heavily affect innovation performance; companies have to place its focus on improving organizational and process innovation. At this level, the creation of creative environment is crucial for firms through programs that encourage innovation and reward the creativity available.

2 Literature review

The fundamental theoretical tenet of this work is the innovation notion established by economist Joseph Schumpeter in 1939. He thinks that the development of capitalism depends greatly on innovation activity. Czarnitzki et al. (2003) shown that growth is an endogenous factor of innovation in this regard. Through innovation, the knowledge and capital levels of innovative enterprises have been improved. Therefore, its importance varies from company to company, and this is clarified by the prejudices of those managers for investment choices, who have discretion to decide on the importance and select of investments. Some authors believe that in the current competition, the gain that a company can obtain is the possibility of continuous innovation (Huang et al. 2010). Firms can concentrate their efforts on developing organizational knowledge and adding value. A transition from skills to economic activities can be understood as the modernisation brought about by research & development operations. Firms now face international competition as a result of market globalization. Therefore, in order to thrive in a continually shifting environment, these businesses need to be inventive (Ding et al. 2003). Therefore, according to Charreaux, et al. (2001), using innovative techniques can help a company preserve or grow its stock market while eclipsing the competitive advantages of rival businesses.

Therefore, the strategic choice to engage in creative activities will result in economic growth, market growth, and long-term profitability for the organization (Azadegan 2011). Numerous studies have been conducted on the effects of innovation on long-term corporate performance. According to certain studies, there is a link between company value and innovation (Hill et al 1988). Yang et al. (2010) discovered a positive link between innovation and company performance in a study examining the impact of organizational control on innovative decision-making. Gunduz (2013) examined the relationship between investment and firm value and discovered that capital investment had a favorable effect on firm value.

The significance of the control measures employed by businesses adopting innovation strategies can also be used to explain the positive association between innovation and performance. According to studies (Yang, et al. 2010; Ndzana (2016)), businesses that implement these procedures utilize strategic controls, whereas businesses that employ other strategies, including diversification, use performance-based controls. The performance of businesses and innovation are both examined by Guan et al (2009). They argues that each company’s relationship with investment and sales is unique. Firms that make significant investments do better at boosting sales and profits. Yam et al. (2011) observed a sample of manufacturing companies and found that compared with companies that invest less in innovation; companies that pay high prices have very high sales, innovation growth, and return on assets (ROA).

Innovation strategy is regarded as a source of competitive advantage since it communicates to investors and other stakeholders that a company’s operations are expanding, according to Zhou et al. (2019a, b). As a result of the rise in R&D spending, senior managers are sending out signals. Therefore, the best course of action is to take advantage of any good financial market reaction. Such projects are very beneficial for performance and wealth development, these analysts underlined. Traditionally, the concepts of performance and innovation have been the subject of controversy in the literature. Their characterization at the company level is carried out through variables, such as the budget invested in R&D or the number of patents applied for, as well as innovation or turnover and growth rate. Naturalization expressed through restrictive definitions of the concepts of innovation and performance and the use of a limited number of major quantitative indicators based on corporate external data in empirical methods, we must oppose multiple perspectives on performance (social, environmental) and performance (social, environmental). In terms of innovation (also relative), it can better reflect the diversity of corporate management purposes and be closer to the organizational characteristics of small and medium-sized enterprises. By inviting us to get rid of the dominant performance and innovation evaluation criteria widely used in the scientific literature (Fig. 1).

Overview of the classification of types of innovation relevant to the manufacturing sector source: Mamasioulas et al. (2020)

Some researchers assert that the basic reason to improve their performance and success is the engagement of companies in innovative activities.

The relationship between innovation and performance is examined in 721 UK manufacturing firms Grosky et al (1993). It is indicated that the number of innovative companies has a positive effect on their operating margins. The conclusion is that innovative companies are generally more profitable non-innovative companies, despite their thin margins (Geroski et al. 1993). Joshi et al. (2012) examined the relationship between innovation and performance in technology services for 108 US firms. They conducted a declarative survey based on self-assessments of perceived performance relative to competitors. The researchers found that innovation is positively correlated with firm performance. (Das 2011; Josh et al 2012).

Another study in Ukraine carried out by Lavorska (2014) examine the impact and importance of innovation in the performance of 6,900 companies. The research shows that the introduction of new products reduces short-term return on investment because innovation requires investment. A larger proportion of new product delays in a company’s production portfolio also has a positive impact on investment returns, allowing more diversified companies to benefit from economies of scale. The study also found that the relationship between the number of new products and the EBIT margin was not significant. Finally, ROE, TFP and company size have a positive effect on the number of new product launches, but less diversified companies are more inclined to innovate. (Lavorska 2014) and Benyetho (2017) conducted a survey to examine the relationship between technological innovation and the performance of 50 Moroccan exporting SMEs. At a first level, the research shows that the mentioned sample includes technological innovations in products and processes in the strategy. It also noticed that the relationship between innovation and revenue was negligible. Nevertheless, this research has found that innovation is in a great relation with the company image, formalization (reflecting the company’s structure, organization, and formalization through an organizational chart) and with a management type of choice, (innovative companies prefer the decision-making process). In fact, an extensive focus is on the relationship between innovation and performance. Yet, this relationship can be dependent on several other variables, notably the field of activity, type of sector, characteristics of the company (SMEs, etc.), context, processes, economic environment and use of ICT. An empirical study of 350 manufacturing SMEs from Canada has been already conducted by St-Pierre and Mathieu (2004). At this level, the research indicates that the organizational characteristics of innovative companies are innovative founders, young people, sound human resources policies, investment in research and development, product supply in line with market demand, cooperation with customers and principles, being indebted, reliance on new technologies and more modernization production facilities. Therefore, the study also found that innovation could lead to better profitability, strong growth and/or expansion into foreign markets. (Sargent and Matthews 2004).

2.1 Innovations in products and processes and their effects on corporate performance

The relationship between the characteristics of innovation and performance is also hotly debated in the literature; some authors point to a causal linkage between the two (Zhou et al. 2019a, b). Then, innovation would be a factor that determined performance and might have a good or negative impact on it. Other academics contend that the relationship is more “independent,” and that innovative businesses are not necessarily successful enterprises (Lallement et al. 2000).

Several works have highlighted the Handbook of the Organization for Economic Co-operation and Development (OECD) Huergo (2006). They classified into four types of innovation: products, processes, marketing and organizational innovations. Products, processes, marketing, and organizational innovations were divided into four categories. The introduction of a good or service that is both marginally and significantly improved in terms of features, traits, or components is the outcome of product innovation. Product innovation is generally driven by demand, but supply may also play a significant role in this area.

Thus, the challenge of this work is to compare the role of innovation in performance in four European countries: France, Germany, Spain and the United Kingdom. At this level, it exists a use of data by the company resulting from community innovation surveys harmonized at an international level. Despite a considerable number of national studies at the company level, analyzing this relationship, comparisons between countries using micro data are still rare. On the other hand, Slater et al. (2014) explain how escalating regional and worldwide competition, technological advancement, changing consumer preferences, and shortened product life cycles drive corporations to innovate persistently.

The authors have shown that process, marketing, and organizational innovations have a positive impact on the business performance of funding firms. The level of innovation activity is strictly linked to the level of innovation performance, which specifically means that the higher the level of process, organizational and marketing innovation activities the higher the innovation performance in terms of process, organization and marketing, the higher the performance of the company should be. According to Hall et al. (2009), R&D spending and firm size are what drive product and process innovation in Italian small- and medium-sized businesses (SMEs). Researchers that discovered this connection to be more pronounced have documented the beneficial effects of product and process innovation on SME productivity. Similar to this, Waheed (2011) demonstrated that process innovation improves productivity more than its product equivalents do using a sample of businesses from Bangladesh and Pakistan. In contrast to the other three types (process innovation, organizational innovation, and marketing innovation), which have a more significant impact on innovation outcomes that supports industry firms, Tuan et al. (2016) estimated that product innovation has a negligible impact on innovation performance.

A study of 113 auto parts companies in Konya is done to examine the types of innovation in the context of the Turkish automotive industry (the most innovative sector in Turkey) and its relationship with firm performance (Atalay et al 2013). The findings suggest that product innovation and process innovation influenced positively on firm performance due to industry-specific conditions. In fact, the influence of organizational innovation and marketing innovation is negligible. (Atalay et al 2013). Santi and Santoleri (2017) conducted a study to examine the association between innovation (product and process) and corporate performance in 1839 Chilean companies. The outcomes display that process innovation has a positive and significant relationship with enterprise growth. However, product innovation is negatively correlates with sales growth, especially for growing companies. As a result, the returns to innovation are heterogeneous, as some firms in the (innovation) field benefit more than others do.

Deltour and Lethiais (2014) conducted a study of 1088 SMEs in Brittany to understand the influence of innovation policy on the performance and ICT role (ICT resources (equipment, software and human IT skills and check resources) and ICT capabilities (investment in specific tools related to implementing innovation). The findings suggest that innovation, if not accompanied by ICT, can negatively affect the performance of SMEs. Consequently, it is vital for these companies for their innovation strategy support (in terms of products or processes) by investing in ICT. (Deltour 2014; Lethiais 2014). Hall (2011) suggest an empirical evidence relating productivity and innovation. The found that the beneficial effects of product innovation on incomes, whereas the effects of process innovation are less clear.

In this context, Martínez and Poveda (2021) claim that the relationship between the environment, innovation, and policies that promote growth and sustainability, as well as climate change, through empirical analysis. Different countries use different technologies and databases to innovate and understand how innovation can play a significant role in sustainable development and economic growth in emerging economies characterized by ecological wealth, biodiversity and vulnerability to climate change, Solis et al (2021).

The findings of this study presents the importance of innovation in producing clean processes and green goods and services, and in preventing and mitigating climate change. Indeed, greater innovation promises to reduce pollution, carbon dioxide emissions and environmental problems, as well as higher competitiveness and economic growth, while there is an urgent need for the development of policy tools to stimulate the innovation process and environmental standards to allow innovation to be sustainable. Promote development, responsible use of natural resources and activities contribute to control and prevent climate change.

Product innovation, on the other hand, is the secret to organizational regeneration and success. When compared to other types of innovation, fundamental product innovations provide consumers profits never before possible, significant cost savings, and the chance to launch new enterprises, all of which should improve organizational performance. A lot of study has done on the factors that contribute to a general incremental capacity for product innovation, and meta-analyses have combine the findings of many studies. Sengupta (2014) employed a model to represent the success rate of radical product innovation. An extensive collection of organizational elements that make up a company’s capability for radical innovation are identified on the basis of a thorough literature analysis. In fact, each of these elements contains smaller parts that add further texture. According to the Manual (2005), process innovation improves how goods or services are produced or delivered. The procedure can be brand-new or vastly enhanced from the existing iteration. According to the notion of creative destruction (Zhou et al 2019a, b), innovative businesses possess a competitive edge that enables them to supplant less innovative ones. A sustainable pathway for promoting economic growth and company performance has been identified as innovation. Theoretically, innovation ought to make it easier for businesses to enhance their financial performance. The empirical data, however, have not always supported this hypothesis; a number of studies have suggested that improvements in performance are not usually the result of innovations.

According to certain studies, process innovation is superior to product innovation. For example, Hall et al. (2007) discovered that for (SMEs) Italian firms, firm size and investment in R&D are key drivers of product and process innovations. Researchers have shown both product and process innovations have a favorable impact on SMEs’ performance, but the latter is more significant. Additionally, Mohnen and Hall (2013) discovered that large organizations and older firms have a poor correlation between innovation and performance. Waheed (2011) conducted a comparable analysis with a sample of businesses in Bangladesh and Pakistan and found that process innovation has a greater impact on performance than product reward.

The result of the Lita et al. (2019) claim that there are positive effects of process, marketing and organizational innovations on the performance of companies by supporting companies. Specifically, the higher the level of innovation activities, the higher the innovation performance, which means that the more innovation activities in processes, organization and commercialization, the better the performance of innovation.

The findings of Lita et al. (2019) assert that the more innovative activities there are in processes, organizations, and commercialization, the better the performance of innovation. Second, the more innovative the level of performance of organizational and marketing processes, the better the performance of companies should be. In summary, in order to improve innovation and firm performance, companies that support the industry should focus heavily on process innovation activities, marketing and organization rather than product innovation activities.

Fagerberg et al., (2004) provide that the introduction of new products could have a positive and a significant impact on income and employment growth, at the same time, innovation in processes shows a more controversial issue probably because this type of innovation is more inclined to reduce costs. According to Foster et al. 2008, changes in the firm-specific demand are more important in determining firm longevity than technological efficiency and have a beneficial impact on measured productivity.

Mairesse and Robin (2009) demonstrated that product innovation inclines to be the primary driver of labor productivity based on a sample of French manufacturing and service enterprises, whereas process innovation is both economically and statistically negligible.

According to Vibeke et al. (2006), who studied a sample of businesses in four European nations, firms are more likely to involve in recognized inventive actions. Product innovation is driven by demand, whereas process innovation is driven by supply. Additionally, these authors claimed that product innovation is more operative and improves performance in France, Spain, and the UK while process innovation only improves performance in France. Strong evidence was established by Cassiman et al. (2010) that performance was affected by product innovation rather than process innovation.

Understanding how much of Foster et al (2008) findings can be attributed to inventive activity by new competitors and established businesses would be a highly fascinating area of research. In other words, the paper presents data regarding the makeup of overall productivity growth but not regarding its origins. According to research by Aghion et al. (2009), foreign companies’ entry into UK industries with cutting-edge technology fosters both innovation (as measured by patents) and productivity development. Despite the fact that the introduction of foreign corporations in these industries slows down innovation and performance growth of domestic firms in these sectors, it is argue that this is because enterprises deterred from catching up by the high cost. In contrast, Gorodnichenko et al. (2010) showed a significant correlation between innovation in all sectors, including the service sector, and international competition (self-reported by enterprises), using data from developing nations in Eastern Europe and the former Soviet Union. Thus, there is evidence that at least some entrance types promote innovative behavior, even though there isn’t much that shows how entry leads to innovation and then to a performance.

The majority of the studies mentioned have made sincere efforts to identify tools or controls that will allow them to claim that this association is causal. Although claimed that the introduction of new enterprises is a kind of innovation, to date, none of these research specifically addresses the influence of innovative activity and its relationship to performance.

Rosli et al. (2013 discovered that innovation in both products and processes, with the former having a bigger influence, is positively correlated with corporate performance. Small and medium-sized businesses are being forced to reevaluate their competitive position relative to their rivals due to the fierce rivalry in the global economy, particularly through innovation. This explains why innovation has risen to the forefront of small business literature, reports, and government policy over the past two decades.

The findings not only support pre-existing theories on the significance of innovation in explaining diversity in business performance, but they also convey to SMEs and policymakers the relevance of innovation in modern entrepreneurship.

Prior to engaging in genuine innovation, SMEs may decide to use internal or external sources of innovation, and further research should look into how they may determine the cost–benefit ratio of innovation. Zhou et al. (2019a, b) found that gender, product innovation, and corporate reputation have a favorable impact on the growth of manufacturing SMEs using a sample of 353 Vietnamese manufacturing SMEs.

However, other researches have concluded that product innovation is superior to product transformation. Zhou et al. (2019a, b), claimed that the introduction of new products could have a positive and significant impact on income and employment growth, at the same time, innovation in processes shows an e and more controversial probably due to the fact that this type of innovation is more inclined to reduce costs. Foster et al. (2008) theorized that fluctuations in company-specific demand, rather than technical efficiency, are the most important element in predicting firm longevity and that it has a beneficial impact on measured performance. While process innovation should be viewed as a technological efficiency, product innovation should be more closely related to changes in demand that are unique to the company.

Recent empirical investigations have demonstrated that there are considerable disparities between physical performance and income. Previous work linking productivity (income-based) to survival has confused the distinct and opposite effects of technical efficiency and demand on survival, underestimating the true impacts of both. This is because physical performance is inversely correlated with price while income performance is positively correlated with price. Additionally, we see that young producers charge less than the established companies. Thus, the research undervalues the performance benefits of new producers and the role that inputs play in the growth of total performance.

Grith et al. (2013) used firm-level data to compare the impact of innovation on performance across four European nations: France, Germany, Spain, and the United Kingdom. Despite the large number of national company-level research studying this relationship that is comparisons between nations utilizing micro data, these results from internationally harmonized community innovation surveys are still uncommon.

According to Zhou et al. (2019a, b), there is compelling evidence that performance is connected with product innovation rather than process innovation. We claim that business innovation choices related to the literature’s positive correlation between firm performance and exports.

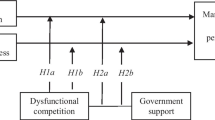

H1

Business performance is connected positively with both product and process innovation

2.2 Levels of novelty, open innovation and business performance

Because innovation is not simple and is often complicated, open innovation refers to how businesses collaborate with outside stakeholders to innovate. According to Chesbrough (2003), “open innovation” refers to working with outside stakeholders, whereas “closed innovation” occurs when all organizational innovations are the result of internal R&D spending and the internal research team. According to Greco et al. (2016) and Zhou et al. (2019a, b), the majority of studies on open innovation techniques show that they have a favorable impact on innovation performance. The preferential impact hypothesis is clearly supported by this data, as it is expected that businesses that connect with outside parties will internalize concepts and ideas more readily. This would foster an environment that encourages business innovation. Despite the anticipated benefits of open innovation, research questions the idea that openness always results in greater corporate performance. Business resources are indeed finite by nature, and working with outside partners is costly and necessitates significant maintenance expenses (Duysters et al. 2011), Lin (2014).

According to the open innovation (OI) model, businesses innovate by collaborating with other organizations. Numerous authors have discovered that particular IO tactics have a favorable impact on the effectiveness of economic and industrial innovation. However, as a corporation uses more external innovation partners, the phenomena of excessive research and excessive collaboration could lower OI’s marginal performance. This study proposes a curvilinear relationship between a company’s use of a wide range of external innovation channels (search breadth), the depth to which it is deeply inspired by those channels (research depth), and the degree to which it collaborates with those channels via various external channels (coupled OI). The 84,919 firms from the Community innovation survey conducted by Eurostat in 2008 in European nations are used to estimate the empirical models. The findings imply that while the search depth typically does not experience a marginal performance decline, search breadth related to all metrics of innovation performance.

Kang (2009) and Zhou et al. (2019a, b) pointed out that, within a framework of costs and benefits, the marginal performance of open innovation can decrease and that the overdependence can have a negative impact on the performance of companies. Open innovation and innovative performance have been shown to be inversely related by Duyster et al. (2011) and Zhou et al. (2019a, b). In other words, if a company continues to rely on an additional externality, oversight and excessive cooperation could degrade the marginal performance of open innovation.

External information is a crucial source for technical progress in the field of “open innovation.” The relationship between outside information and the effectiveness of technical innovation has been studied by these authors. Depending on the various techniques used to supply this external knowledge, the impact of external knowledge on the performance of technological innovation may change. We distinguish three ways that knowledge is supplied from outside the organization: technology purchase, R&D collaboration, and informal network information sharing. To investigate the connection between the three sources of outside information and the effectiveness of technological innovation, we put forward three hypotheses.

These authors demonstrate that the performance of technological innovation is positively correlated with the dissemination of information from an informal network and the acquisition of technologies. The performance of technological innovation, however, has an inverted U-shaped relationship with R&D collaboration. This suggests that depending on the specific technique of giving external knowledge, the impact of external knowledge on technological innovation differs. In fact, this work has significant implications for businesses when deciding on the best way to obtain outside expertise. Open innovation was examined in detail and breadth by Laursen and Salter (2006), Zhou et al. (2019a, b), and Laursen and Salter (2006). According to these writers, companies may be able to develop more successfully if external collaboration is implemented more widely and deeply. The depth describes the amount of information that businesses may glean from external sources, while the scope describes the quantity of external sources of information.

How firms set up their hunt for novel concepts with commercial potential is a crucial component of the innovation process. The adoption of open research tactics, which entail the use of a wide range of actors and external sources, by many innovative organizations to assist them achieve and sustain innovation, has been advised by new models of innovation. This study ties research strategy to creative performance using a large sample of industrial firms. It finds that wide and in-depth research is curvilinear (assuming an inverted U shape) related to the performance. The level of innovation and openness of Spanish agriculture enterprises was investigated by Bayona-Saez et al (2013). They also looked into how a company’s innovation performance is impacted by how open it is. The extent and breadth of cooperation agreements have a positive impact on achieving radical goals, but they have no impact on incremental innovations, according to research using a sample of Spanish agribusiness companies and three dimensions of openness: the breadth and depth of information sources, the scope of cooperation agreements, and external R&D spending. Type of invention isn’t’ benefited by the depth of external knowledge and external R&D. We have found that the degree of openness has an impact on both the incremental and radical implementation of innovation for the remaining Spanish businesses.

All industries are impacted by globalization in today’s cutthroat marketplace. In both academic and commercial research, the open innovation (OI) model has grown in significance. Given this interest, the paper by Obradovi et al. (2021) summarized the most recent findings, outlined the intellectual landscape of OI in the manufacturing research field, and proposed a research agenda for the future. The theoretical underpinnings, research trends, and methodology of this field of study are revealed by this study, which is based on a content analysis of 239 publications that were indexed in the Web of Science and Scopus databases. By combining earlier studies, outlining potential areas for future study, and offering advice for practitioners, the author has discovered evidence and advanced our understanding of OI in manufacturing.

This paper evaluates the function of OI in manufacturing research and highlights current trends in research, including cooperation, open strategy, breadth, depth, and innovation from a manufacturing’business perspective. This study also includes theoretical perspectives (such as institutional theory, knowledge-based view, resource-based view, supply chain management, and transaction cost economics theory) and offers future directions for research on Industry 4.0, sustainability, and commitment-based HR practices. The research overview provides practitioners with a list of suggestions for overcoming obstacles to implementing and utilizing OI methods in manufacturing.

Today, innovation calls for quick external change. Prause (2015) generated a well-known open invention. Industry 4.0 appears to be a good fit for the open innovation strategy because businesses are gaining knowledge from other societal sectors. Open innovation is the process of using external influencing variables to strengthen internal innovation capabilities, according to Fuller et al (2006). This may make it more appealing to use Industry 4.0 technologies, particularly for tech firms. Virtual communities and living labs are referred to Prause (2015) this context. He also stresses the value of user data from online communities, such as reviews, comments, and endorsements, as sources of new ideas. However, due to potential privacy and intellectual problems, especially in relation to giant technology businesses, this adopted method needs to be handled carefully.

Zhu et al. (2019) emphasize the importance of noting that large companies can be dependent on (R&D) to produce innovative Industry 4.0 products. SMEs, however, lack these skills. A closed-loop innovation model describes how a big company develops and markets a technology or idea. However, due to the range of talents and the availability of financing, the era when large firms sought out open innovation have changed Chesbrough (2012). Companies increasingly need technology development and technology exploration to enhance value Weking, et al (2018).

On the other hand, technological research entails actions that let businesses obtain fresh information from the outside. External networking, client retention, R&D outsourcing, and in-house licensing are four areas of technological exploration. According to von Hippel (2005), technology companies develop their inventions rather than passively absorbing them, and other businesses in other economies desire to do the same, which is always connected with open innovation Chesbrough (2012). The adoption of open innovation to deploy Industry 4.0 in digital enterprises is generally praised by open innovation thinkers.

The literature on innovation networks contains certain significant gaps Leifer et al (2011) found. A theoretical framework based on network theories is used to address this, and it is reinforced with a theory for the product design level. According to the conventional literature and the scenarios provided, the theoretical framework’s link strength dimension shows that frail links are essential to get knowledge connected to study networks and strong linkages are required to employ that knowledge in the field-operating network. The alteration network is a transitional stage that serves as a link for business people to find the necessary information. The processing network is another transitional stage where business owners can obtain funding and organizations eager to commercialize discoveries.

Companies keep the foundation of their competitive edge by embracing radical innovation and imitating it. Fundamental innovations have a greater impact on performance than innovations, according to Rubera and Kirca’s (2012) research.

H2

Open innovation is positively JINrelated with business performance

2.3 CSR and innovation

Studies on strategic management conducted by Flammer (2015) emphasized the critical part that CSR plays in establishing a sustainable competitive advantage. This study investigates whether corporate social responsibility is impacted by product market competitiveness (CSR). I take advantage of an essentially natural experience made possible by the significant import tariff reductions that occurred in the US manufacturing sector between 1992 and 2005 in order to generate exogenous variation in product market competition. Domestic companies respond to tariff reductions by boosting their commitment to CSR, according to research using the difference-in-difference technique. This finding supports the idea that “CSR as a competitive strategy” enables businesses to set themselves apart from international competitors. Generally speaking, these findings show that trade liberalization is a significant influence on CSR behaviors. Examining the factors or reasons why a corporation engages in CSR is crucial since it has a substantial influence on other programs and value Shen et al (2020a).

According to the literature now available, CSR is utilized to enhance a company’s reputation, please stakeholders, and enhance its social standing. CSR can be used to set a business apart from competitors. The majority of research (Zhou et al. 2019a, b) noted that when CSR is incorporated into a business plan, it frequently involves technology advancement. The opposite of in what way innovation affects a firm’s choice to engage in CSR, however, rarely receives scrutiny. This study uses 2016 data from Chinese A-listed companies as a sample and bases its findings on stakeholder theory. The relationship between corporate social responsibility (CSR) and investment in technical innovation studied using statistical analysis using SPSS 22 on the sample data, with a focus on how the atmospheric environment affects this relationship. This study demonstrates a considerable positive relationship between corporate social responsibility and technological spending. More research revealed that when there is a poor air environment, environmental laws by the government have raised business-running costs and reduced the amount of investment in technological innovation.

CSR will be enhanced in response to public pressure, nevertheless. As a result, there is little connection between CSR and investments in technological innovation. When the atmosphere is favorable, businesses do not need to raise their operational costs. Companies are resorting to carrying out their social obligations and expanding their investments in technology innovation in order to improve their reputation and boost profitability. Additionally, it will reinforce the link between CSR and financial support for technology innovation.

Companies profit greatly from innovation, yet this approach can also have negative effects on business performance Miller et al, (2007). Helfat (1994) said that this is because probing for capital-intensive demands make innovation hazardous and necessitate several firm-specific investments; moreover, the return on investment in innovation is utterly unpredictable.

In reality, stakeholders have the ability to voice their worries regarding an innovator’s innovation efforts. Because each investment in innovation usually involves a new set of fixed assets, equipment and facilities, skills or technology, starting an innovative project would be too expensive for a agreement Shen et al. (2020b).

Marzi et al. (2017) demonstrated that the most influential research streams and journals deal with product and process innovation in manufacturing settings. Using Data consists of 418 articles from more than 150 journals between 1985 and 2015. As a result, manufacturing innovation is regarded as a traditional research area (Schroeder et al. 1989; Terziovski 2010; Aas et al. 2015). Adner and Levinthal (2001) investigated the relationship between firm wealth and its sustainability of a continuous innovation process.

Management experts have stressed the importance of innovation for the survival and growth of manufacturing companies. (Damanpour 1991; Smith and Tushman 2005; Knight, and Cavusgil 2004; Buffington 2016; Visnjic et al. 2016). Furthermore, in manufacturing, the innovation process introduces innovative products and processes that foster the organizations ‘ability of the penetration or the creation of new products (e.g. Becheikh et al. 2006). This ability aims to respond to clients’ requests and competition (Smith, W and Tushman 2005). But in recent decades, completion challenges in manufacturing competitiveness experienced exponential growth. Companies are currently facing extreme competition from the growing pressures not only of technological change but also of global challenges (Davis and Davis (2004)).

Therefore, the overall literature on the concept of product and process innovation in manufacturing companies has faced a radical change (Reichstein, & Salter (2006); Antonioli et al. 2013; Wu et al. 2015) to produce an important number of articles covering this broad and many-sided phenomenon. However, no recent snapshot offers a complete perspective on the main topics studied, the evolution of this area, key findings and possible direction for future research taking into consideration product and process innovation in manufacturing companies.

The industrial world carries a mission that consists of is offering products with affordable prices to meet customer demands. In addition, this latter aim at respecting the global effort of CO2 emission reduction, which need strict rules to be applied emission cases. At this level, however, a clear contradiction between productivity and sustainability takes place and enables both the innovation and the circular economy to appear as two important strategies. In fact, Stavropoulos et al. (2021) research targeted through the long-term environmental modeling impact of the new short-term good production (economics of innovation) and the repurchase influence to repair and reuse products for prolonged use (circular economy) and to study the link between the two economies. Consequently, the environmental effect definition, during the life cycle of a product, paved the way to introduce and describe the two terms of innovation and circular economy.

This study presents the evaluation of two products: a well-known mid-priced vehicle, as well as an expensive mobile phone with multiple generations. Two environmental impact indicators are supported which are the purchase cost and the recurring costs, instead of the calculation of the impact directly in the production phase, because of the huge size of production data needed. To sum up, although these results are indicators showing the modeling complexity, they can still be used to build a modeling framework, making evidence, at the same time, that innovation and the circular economy are not contradictory concepts.

On the author hand the fourth industrial revolution, enterprises introduced the advantages of innovation thanks to its wide variety of new technologies. Taking the example of Korean enterprises, which have attempted to boost their innovation activities formed from investments that adopt new technologies, technical and non-technical innovation elements, to guarantee the growing and developing of their sustainable performance. Another study of a similar nature is done by Jin and Choi (2019), focusing on 160 businesses from 2009 to 2017 in the IT and business Korean service sectors (80 major businesses and 80 SMEs). It is proven that increases in product innovation, together with R&D, and firm age, have positively impacted corporate performance. Therefore, both major enterprises and SMEs should regard technological advancements as their primary priority in order to increase their sustainability and ensure long-term success.

This study determines at how company innovation and CSR are related. Companies that invest a lot in innovation activities tend to raise stakeholder concerns regarding transaction-specific investments. Companies effectively adopt CSR as signal of sustainability and goodwill to win the support of stakeholders. We use an instrumental variable technique to test our hypothesis because CSR is endogenous to a company’s innovation activity. We conclude that more companies that are creative are more involved in CSR activities, based on a sample of 3315 US companies that listed on the stock exchange between 2001 and 2011.

Companies working in high-risk environments or in areas with low wealth will experience this effect more strongly. Additionally, businesses that innovate more reap bigger financial rewards from their CSR efforts.

H3

If implemented with external stakeholders, process and product innovations are linked to a social contribution.

3 Research methodology

3.1 Method and data generation

Using a panel regression analysis this study aims to identify whether innovation activities (including product innovation, process innovation and open innovation) have a significant influence on performance Stockbrokers /accountants of SMEs and large companies.

Source: The National Institute of Statistics and Economic Studies collects, produces, analyzes and disseminates information on the French economy and society.

Another resource that was used to collect information about the performance and innovation of published French companies was the Worldscope and World Bank databases. This information was evaluated using Stata 13. Using a sample of 80 companies the French IT and business services sector, we examine ours hypothesizes. The study period included the years 2010 to 2020, and Table 1 deals with the company descriptions.

By using the Wald test, as recommended by Baum (2001), the issue of heteroskedasticity was examined in the supplied data, and then significant probability results were attained. The autocorrelation in the data was analyzed using Wooldridge’s (2002) methodology. Additionally, the within- and between-group variation in our data is examined. The findings showed that, in general, our variables’ between-variation value was lower than its within-variation value. STATA software was used, along with interactive tools, to test this data. We use panel data, which consists of 880 observations for 80 French companies listed on the stock exchange over a period of 11 years from 2010 to 2020.

Unlike the random effects model, which has an individual particular effect that is unrelated to the independent variables, the fixed effects model has an individual specific effect that is fundamentally connected with the explanatory variables. According to Robinson (1991), random effects are estimated with removal, but fixed effects are evaluated using ordinary least squares (i.e., maximum likelihood). The random effects vary greatly while the fixed effects are constant across individuals (Kreft et al (1998). Random effects models are fundamentally the result of a partial pooling technique for statistical application. In this article, fixed-effects models are used to support the regression.

3.2 Research models

The two areas of focus in the current study are the separate effects of innovation categories on corporate performance as well as the interactions between process, product, and openness innovation on CSR and corporate performance.

We choose the following models to evaluate the preexisting hypotheses based on the related literature:

3.3 Definition and measurement of variables

3.3.1 The dependent variables

The equation will be applied with a few modifications to the companies taken into account, as well as the explanatory variables for these modifications, which obey a concern for data availability and study orientation.

The analysis will be carried out first of all companies in the French region of (80 companies) over a period of 11 years from 2010 to 2020 and covering 880 observations.

3.3.2 ROAit: return on assets measures the accounting performance of companies i in year t

The most used business performance metric by researchers (Arouri et al., (2011); Sufian, (2010) is return on assets (ROA). ROA is often used as a metric of organizational performance.

3.3.3 ROEit: return on equity measures the accounting performance of companies i in year t

Return on equity (ROE) is a ratio formula used to explain the company’s profit relative to the invested equity. Return on equity is the interest of shareholders in the returns they receive. Organizations with high ROE are more likely to generate cash flow from internal sources.

Therefore, the higher the ROE, the better the business results. ROE is the ratio of net income after tax divided by equity. ROE represents the rate of return on the funds invested in the company. ROE shows how an organization’s management effectively uses shareholder funds (Khrawish, 2011).

3.3.4 CSRit: Corporate social responsibility

We mark firms by awarding them points for each CSR activity they engage in (GSO data). Our CSR Index, which displays the total volume of CSR activity of the firm, is created by adding the scores of the 8 categories (on a scale of 0 to 8) Newman, et al (2018).

3.3.5 Independent variables

3.3.5.1 Product innovation

Product innovation: A dummy variable called “product innovation” has a value of 1 for companies that released any technologically novel or considerably improved products.

Process innovation: Process innovation is a dummy variable that takes 1 if there have been major or small process changes made or a new process created for the manufacturing or distribution of products; and 0 otherwise in year t.

Open innovation: If firm develop with the collaboration of outside partners, they receive a 1; if they just rely on internal R&D, they receive a 0.

3.3.5.2 Control variable

Size: Size is calculated as the natural logarithm of total assets i in year t.

Exp: Exports = direct export sales declared by companies.

Competition: Firm profitability is added to the control of a business’s capacity to invest with greater flexibility.

Lev: Leverage is the ratio of a company’s total debt to its total assets in year t.

Debt capacity reflects both a business’s ability to repay current debt and the ability to generate funds by taking on new debt as needed.

Panel data has two dimensions: one for companies (observation unit) and one for time. He is interested in identifying the effect associated with each business; it is an effect that varies from business to business.

4 Results and discussion

4.1 Descriptive statistics

The descriptive statistics for the variables in the study, which comprise the mean value, the standard deviation value, the minimum value, the maximum value, and the number of observations of the variables in the sample, are presented in Table 2.

It is clear that companies are driven to pursue innovations in products and processes. The average value of the ROE variable is 1.079. The CSR Index score of 1.710 indicates that it contributes on average to 2 out of 8 local communities Table 3. The average value of external innovation is only 10.44%, which is significantly less than that of the related products and processes, suggesting that external collaboration is likely far more time- and resource-consuming. Because of this, firms have less ability to innovate in this way. It is improbable that multicollinearity tampers with the regression results, based on the correlation matrix and VIF of the study’s variables.

4.2 The regression of our empirical model gives the following results

First, the coefficient of determination R2 varies between 46.55%, 59.89% and 54.66% for the both empirical models, which indicate a good linear quality of fit between the endogenous and exogenous variables. The value of R2 demonstrates the model’s overall relevance and the explanatory factors’ considerable impact on the explanation variable.

The Statistics tests are then shown in the table above, and they quantify the models’ overall significance. The significance of our model is due to the value, which is less than 5%. As a result, the dependent variable in our research model is significantly expected by the set of explanatory variables.

4.3 (H1): Business performance is connected positively with both product and process innovation

Regarding the ROA, the “Product innovation” ratio coefficient is positive (p = 0.005) and statistically significant at the 5% level (p = 0.04). (Model 1).

The above table demonstrates that the explanatory variable “Process innovation” is significant and has a positive sign for our research model, that the coefficient of the variable “Net Profit of the Company” is positive (0.0092) and statistically significant at the 5% level (4.6%), and that the variable “ROA” is positively correlated with the explanatory variable (Model 1).

For the second model, Product innovation is positive (0.167) and statistically significant at the 1% level in relation to the (ROE). The “Process innovation” ratio coefficient is significant and of a positive sign for our research model, the variable coefficient is also positive and statistically significant at the 5% level (< 0.05) in relation to (ROE).

Hypothesis (H1) is confirmed; this indicates that the hypothesis (H1) which states that Product and process innovation positively influence the (ROA and ROE) is confirmed. Based on statistical data, the process innovation regression is statistically significant as it is positive at the 1% level, which confirms the Process innovations and impacts business performance hypothesis.

This is reliable with the results of the Manual (2005) studies, which discovered that process innovation produces better ways to produce or deliver goods/services. The method can be entirely new or significantly improved over the previous iteration. Innovative companies have a competitive advantage over their less innovative competitors, according to Schumpeter’s 1940 creative destruction theory. Innovation has been acknowledged as a sustainable method to fostering economic growth and organizational performance (which goods and services are more desirable in terms of features or cost).

The main drivers of innovation inside businesses are evolving technologies, shifting consumer preferences, and shorter product lifecycles. The notion of creative destruction places a strong emphasis on the value of innovation in building a competitive edge over less innovative companies. Otherwise, innovative items and procedures may be thought of as a long-term strategy for boosting economic indicators and growth.

According to Fagerberg et al. (2004), the implementation of new products could significantly and favorably affect the increase of income and employment.

At the same time, innovation in processes displays a more provocative concern probably because this kind of innovation is more inclined to reduce expenses.

Lööf and Heshmati (2006): Foster et al. (2008) contend that product innovation is more effective and improves performance in the UK while process innovation simply improves performance in France. Cassiman et al. (2010) discovered compelling confirmation that performance was impacted by product innovation rather than process innovation.

4.4 The effect of open innovations on business performance (ROA and ROE) (H2)

The table of estimation results above shows that our empirical model exhibits a significant ratio effect of innovation on firm profitability.

In relation to the (ROA), the “Open Innovation” ratio coefficient is favorable ( 0.108) and statistically significant at the 1% level (p = 0.000). (Model 1).

Similar to the “Open Innovation” ratio, the “Open Innovation” ratio is favorable (0.140) and statistically significant at the 1% level (p = 0.000) in comparison to the (ROE), (Model 2).

We can conclude that hypothesis (H2) is confirmed, which states that open innovation positively affects the accounting performance of companies (ROA and ROE).

The findings of Inauen et al. (2012), who hypothesized that open innovation-oriented organizations are more likely to create fundamental innovations and are able to shift a bigger amount of new objects, are consistent with our results. Companies can preserve their competitive advantage by using fundamental innovation to boost their value, exclusivity, and inimitable characteristics.

According to Rubera et al. (2012), dramatic innovations rather than incremental ones are more favorable to improved performance. When modest developments can certainly imitate the innovative efforts of other businesses, the initial purpose of innovation may be especially helpful. In a developing environment, resources for research and development are severely limited. In this environment, open innovation is expected to be crucial in promoting radical business innovations that finally enhance company performance.

The interaction coefficients are crucial in the majority of social contribution categories (Table 4). These encounters are important because they provide a social contribution, which demonstrates once more how increasingly inventive businesses are assuming corporate social responsibility for the community (Model 3). Product, process, and open innovation all have a favorable impact on corporate performance.

In Table 4 two variables’ interaction coefficients are significantly positive at 1% respectively, with (Probability) 0.004 < 0.1; 0.081 < 0.1; 0.067 < 0. This is a convincing argument in favor of H3, underlining the importance of working with outside partners to deliver innovation.

The results are constant with previous studies, Padilla-Lozano, & Collazzo, (2021), Cheah et al. (2021), they report the impact of CSR activities on organizational competitiveness, tempting to reduce threats, improve employee relations, increase attractiveness, talent maintenance, and productivity. The CSR tools integration helps the emphasis of the significance of certification as a means of providing a competitive advantage, as well as increasing bargaining power in the supply chain to gain a competitive advantage. For R&D projects, firms require outside collaborators if they are to grow, maintain their competitive edge, and experience better financial success. Companies should use open innovation to test the limits of conventional operating paradigms Gobbo and Olsson (2010).

Firms that prioritize open innovation are more likely to develop radically and be able to sell more new products Sriram and Hungund (2021). Open innovation is prioritized by businesses, who are more likely to innovate radically and shift more novel objects.

Similar to this, Likewise et al. (2022) claimed that open and product innovations are important for company performance because they are assessed by (ROA). Next, he discovered that openness and technical innovation influenced CSR efforts favorably.

The size of the company has a positive and significant influence on the performance of the company. In fact, a 1% increase, increases in itself the performance of these companies (ROA) by 2.444. (Model 1). Concerning the variable size of the company, in direct relation with ROA, it gives us a result of positive and significant sign. In fact, our result is in agreement with the results of Smirlock (1985), and Pasiouras, and Kosmidou (2007) who empirically validated that there is indeed a positive relationship between sizes and the corporate performance.

Size and profitability have a favorable and statistically significant relationship, according to Akhavein et al (1997). The hypothesis that profitability is positively correlated with size has been supported by panel data regression analyzes by Bikker and Hu (2002) and Goddard et al (2004). These analyzes explore profitability ratios according to a set of endogenous and exogenous variables to banking establishments. However, this deduction does not match accurately with the thinking of Berger (2008) and Trachuk, and Linder (2022).

Therefore, the size of the company positively influences the accounting confirmed performance of companies. In fact, the table above shows that the explanatory variable “EXP” export is significant and of a positive sign for our research model, the coefficient of the variable net profit of the company is positive (4.71) and statistically significant at the threshold of 1%. It is in relation to the performance of companies, which indicates that exporting positively affects the ROA. This means that if French exports are high, the performance of the company is also high. Indeed, a 1% growth in exports makes it possible to increase the ROA of these firms from 4719 to the threshold of 1%. According to the estimations used, it can be seen that innovation and corporate social responsibility is statistically insignificant at the 1% level. We can conclude from the above-mentioned estimations that corporate social responsibility does not have an influence on the firm profitability.

The interaction coefficients are very important in model 2 (Table 4). Social responsibility positively affects accounting performance such that (P-value >) 0.013 < 0.1. Our results are consistent with Chen, et al, (2019), Zhou, et al, (2020). Shen et al. (2020b), on the other hand, believed that CSR had a considerable influence on other tactics and performances. It is crucial to look into the factors or arguments behind a company’s CSR commitments. According to existing research, CSR is utilized to enhance business reputation, please stakeholders, and enhance public perception Caputo et al. 2016 Kim and Shim (2018). CSR can be used to set a business apart from competitors. CSR can be used to set a business apart from competitors. The majority of the research, including those by Bocquet et al. (2017) and González-Ramos et al. (2014), noted that the inclusion of CSR in a corporate strategy frequently results in technological innovation. However, practically any research has been done on how innovation affects a company’s decision to engage in CSR Zhou (2020). Firms profit greatly from innovation, but it may also have negative effects on business success Miller (2007). Due to its high capital requirements, innovation is risky and necessitates numerous specialized business investments, while its return on investment is utterly volatile (Helfat 1994).

The regression in our model shows that the estimated coefficient (LEV) is statistically significant but negative. This leads to the conclusion that a decrease in total debt of assets and competition can have a positive influence on profitability at the 1% level. Focusing on model 2, Table 4 presents the results of estimating models with interaction between firm size (SIZE), (CSR), export, competition, and yield LEV of the company and the performance of companies. The individual log total assets coefficients of firm size (SIZE), export (EXP), competition and leverage (LEV) are significantly positive at threshold of 1%.

5 Conclusions

Regarding their impact on employment and income, manufacturing businesses are significant in France. As a result, they play a fundamental role in the industrialization and modernization of the entire economy. Product and process innovations are now; especially substantial for a company’s survival since they assist the company conserves a good advantage in fiercely competitive regional and global marketplaces. The works is still sparse, nevertheless, when it comes to the separate and joint effects of these two categories of innovation with outside with association on the performance of manufacturing companies. Additionally, little is known about how innovation affects a company’s overall profitability as well as other business objectives, such as CSR. This paper intends to enhance to the body of understanding on the aforementioned deficiencies.Pleas

Our study is based on two GSO datasets that span a significant number of organizations from 2010 to 2020. According to research findings, process and product innovations significantly improve corporate success. To put it more plainly, this conclusion shows that innovation makes goods and services more desirable in terms of structures or pricing, helping businesses retain or even increase their market share. As was well established, changes in products and processes affect how much of the market a company captures.

Product and process innovations, however, lose their particular significance when open innovation and this combination of innovation are implemented. This means that inventions that are supported by outside partners typically have a higher tendency to be advantageous than closed ideas.

Additionally, this outcome supports the claim that radical breakthroughs, which frequently result from working with outside partners and frequently lead to outcomes that are more preferable, are consistent with this thesis. As a result, businesses in wealthy nations should think about building alliances with various parties to boost their capacity for innovation and produce goods that perform better.

Some limitations can be noticed in this study. The first one is that this research dealt with a few samples. Future studies may attempt to test similar relationships using larger sample sizes (more than 80). Furthermore, panel regression analysis was also performed in this study. Researchers may try modifying methods through the implementation of two important techniques, which are experimental study designs, and longitudinal data collection techniques.