Abstract

Fulfilling the international considerations of environment, societal, and governance challenges, the financial industry, especially banks, has initiated “Go Green” practices to help sustain the environment and enhance “banking” across the globe. Amidst the green and climate-friendly drives, there is scarce literature highlighting the banks’ green practices, environmental awareness, and their effects on bank reputation, especially the reputation of Islamic banks. This study aims to investigate the green banking practices of Islamic banks in a developing Islamic country. Focusing on the greening ambitions of banks, this study argues that the reputation of Islamic banks can be better enhanced through adopting green banking initiatives that will beget better climatic outcomes in Muslim societies. Therefore, the study illumes green banking practices and their impact on the reputation of Islamic banks in Pakistan. Moreover, this study checks the moderation effect of employees’ environmental awareness on banks' reputation. The study used deductive rationale and quantified the employees' data to unravel their go-green perceptions and bank green activities. In this regard, the 390 response data, collected through a survey from the employees of Islamic banks, were analyzed through Smart-PLS, using structural equation modeling technique. The study finds that banks’ employees-related practices (ERPs), daily operations-related practices (DORPs), customers-related practices (CRPs), and banks’ policy-related practices (PRPs) have a significant positive influence on bank reputation. The authors also find that there is a significant moderating impact of environmental awareness between the relationships of ERPs, DORPs, CRPs, PRPs, and bank reputation. The study might increase understating and enlighten regulators and bank management to sustainably transform their operations to green banking practices, particularly adding to the environmental sustainability in Pakistan.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

In order to meet the needs of UN sustainable development goals (SDGs), the banks’ scope must be amplified from mere conventional to more strategic and pro-environmental institutions (Carè, 2018). The growing population, use of conventional energies, carbon dioxide emissions, and hectic economic activities have worsened the global environment (Wang & Zhang, 2021). The worrying ecological conditions have led the banking industry to a major uptick in sustainable banking practices where green financing and investing activities are prioritized. Noticing the growing environmental concerns, banks are holistically working for promoting a sustainable and clean environment. Aiming to save money and protect the environment, the banking industry has emerged as the main driver of sustainable economic growth (Nwagwu, 2020). Being an active partner of the worldwide greening drives, the green banks are responsibly working to maintain and promote the environment (Ibe-enwo et al., 2019), thus proving their existence as an indispensable part of the sustainability moves. Green banking prevents damage to the environment by encouraging investments in pro-environmental goods and services (Linh & Anh, 2017; Nizam et al., 2019).

Climate changes are heavily impacting financial systems, and accordingly, financial institutions are working to ensure environmental, social, and governance considerations that ultimately generate sustainable growth (Park & Kim, 2020). A key agent of the financial system, banks' credit management should be primarily modeled to support those industries that invest in environment-friendly activities and introduce technologies for green environmental management (Dörry & Schulz, 2018). The waves of global warming, the deteriorating air quality, and the emissions of greenhouse gases have laid down the basis to work collectively for protecting the environment from further deterioration. Abdicating the responsibilities, banks’ customers feel guilty if their banks do not support the green projects that make the environment better (Burhanudin et al., 2021). In this regard, environmental awareness, the banks’ readiness, and the regulatory framework to govern the banking activities are fundamental to the success of green banking (Julia & Kassim, 2019). In the changing Go Green era, all the banking endeavors that aim to depollute the environment would be counted in the green banking initiatives. Several activities have been identified as green banking practices, like online banking (Khan, Hameed, Khan, Khan, & Khan, 2021) issuing green loans (Giraudet et al., 2021), use of green credit cards (Huang & Fitzpatrick, 2018), lesser use of equipment creating carbon emission, financial support of climate-friendly projects while banning those projects that have intensive carbon emission (Bukhari et al., 2020; Park & Kim, 2020). Banks’ proactive role is indispensable to honoring ecology-friendly considerations as a principle of lending that would stimulate industries to primarily work on environmental management (Sharmeen et al., 2019).

Several researchers highlighted the vulnerability of the ecological conditions of Pakistan. The metropolitan wind which is full of pollutants is probably very severe in Pakistan (Abbas et al., 2020). Pakistan was recurrently ranked fifth on the list of most vulnerable nations to climate change (Eckstein et al., 2019). Such contaminations, like heat waves, and debilitating smog/fog, have a direct impact on human lives and economic activities. The ecological contamination and impurity level in Pakistan is four times greater than the level set by the World Health Organization, and it is mainly due to the high level of carbon dioxide emission (Ullah & Takaaki, 2016). Taking the issue with a holistic approach, all the institutions, including financial actors, banks, and regulators have a binding role to address climate-related financial threats and risks (Galaz et al., 2018). In the pressing need for pro-environmental initiatives, the banking sector is supposed to work for climate-friendly resources to materialize a clean and green environment in Pakistan.

This research exclusively contributes to the existing literature on green banking, sustainable Islamic banking, and environmentalism. First, it highlights the green banking practices by taking into consideration the employees-related, bank operations-related, customers-related, and daily operations-related practices of Islamic commercial banks in a developing country, Pakistan. Most of the previous research on green banking was contextualized in advanced countries (Nizam et al., 2019), targeting mainly conventional banks (Ratnasari et al., 2021). This study will highlight green banking practices and their implications for banks and society. Being in the embryonic stage, the concept of green banking can add to the literature on corban and climate-friendly finance and can help meet the targets of the United Nations Framework Convention on Climate Change (Park & Kim, 2020). The study focuses on the banking sector of Pakistan which has a dual conventional and Islamic model (Khan et al., 2018), and where there is a dearth of studies on the sustainability drives of Islamic banks. Islamic banks have a different profit-sharing-based model than commercial banks. The growing banking industry in Pakistan and Islamic countries can better spotlight environmental awareness and more compliance with pro-environmental practices. The community residing in Islamic countries gives more weightage to the Islamic banking injunctions, and therefore, highlighting Islamic banking’s role in ‘Go Greening’ initiatives might add to the climate-friendly banking drives. Moreover, previous studies focused on examining the green banking practices and environmental performance of commercial banks thereby overlooking the practices of Islamic banks (Chen et al., 2022).

The study determines the corporate reputation of Islamic banks through the lens of environmental performance in Pakistan which has a huge financial and environmental impact on the socio-economic fabric of citizens. The greening performance of Islamic banking can help pave the way for sustainable economic growth (Mehreen et al., 2020). It is also pertinent to mention that Islamic banks are emerging agents of change in Pakistan where the “Go Green” concept is getting roots in the offering of green products (Qureshi & Hussain, 2020). The Islamic banks with green initiatives might have a deep impact on the sustainability drives of financial industry. The sustainable role of Islamic banking industry has dire policy implications for achieving the US SDGs (Jan, 2021). This study will be a new one to determine the banks’ reputation through environment-friendly drives of Islamic banks in Pakistan. This study also investigates the environmental awareness of bank employees that helps determine their green orientations. So far, the existing studies on green banking practices have rarely focused on employees’ awareness of the green banking regulatory framework. The moderation effect will prove a plausible addition to the existing models on green banking and will reinforce the greening initiatives as the environmentally aware employees or management can better work for climate-friendly banking (Borah & Baruah, 2020).

2 Literature review

2.1 Green banking and corporate reputation

Amidst the race for economic and financial growth, organizations and governments are compromising on the environment which leads to degradation and climatic issues. Therefore, international bodies are more concerned about the environment and are encouraging pro-environmental initiatives (Sarma & Roy, 2020). To this end, green banking presents more inclusive efforts to save the existing and future generations from environmental harm. Similarly, the increasing trend in the literature on environmental sustainability evidences the green concerns which have given birth to many green activities including green finance and green banking (Sun et al., 2020a, 2020b). Green banking exalts banks, industry, economy, and overall society through pro-environmental practices and reducing carbon footprints from operations. Green banking recognizes the responsibility to adopt practices that can keep the environment clean and green. Green banks support those initiatives that are helpful to transform the traditional economy into low carbon, and climatic-friendly economy (Burhanudin et al., 2021). Green banking accepts the environmental responsibility of banks where the banks ethically and administratively cover low carbon footprints and pro-climate activities (Huidong Sun et al., 2020a, 2020b).

The vision of green banking carries the notion to inculcate greening and environmental consciousness, letting employees and customers develop green behavior, and offering such products and services that are helpful to curb environmental threats (Park & Kim, 2020). This is truly a paradigm shift in the banking industry to focus on greening aspects of investments, financing, and provision of services in line with UN sustainable development goals. The environmental risks have irreversible and far-reaching effects on all sectors including banks, and there is a need for studies that identify such risks (NGFS 2019). Overcoming the anthropogenic load of the ecosystem, green banking follows the eco-responsible principles that give triple benefits i.e., achieving economic efficiency, discouraging harmful effects on the ecosystem, and promoting the good image of banking (Kondyukova et al., 2018). Previous literature demonstrates that green banking is an emerging banking model that might encourage all stakeholders to work collectively for the benefit of society, governments, the general public, and the environment. Investigating green banking, especially in developing Asian economies, might prove to be a launching pad for future bank policy-making and will also be helpful in environmental management. The well-being of employees, customers, and future generation depends on the environmental standing and provision of climate-friendly products and services of banks.

Nath et al. (2014) supported that banks when abdicating their responsibility of taking green initiatives will lose their reputation. The sustainable activities of banks can enhance their reputation along with reducing costs and risks. This study attempts to examine how banks’ reputation can be increased through sustainability and green drives in Pakistan, as evidenced by previous studies where corporate social responsibility was used as an antecedent of corporate reputation (Ruiz & García, 2019). The environmental responsibility of banks also matters in the image building and reputation of banks (Quevedo-Puente et al., 2007).

2.2 Green banking in Pakistan

The worldwide unprecedented environmental concerns led countries to keep the agenda of environmental protection on their priority list. The climate and warming issues badly affected the world economies. The government of Pakistan established a Ministry of Climate Change that aimed to formulate a National Climate Change Policy (NCCP) in 2012. The provinces were also directed to make laws that correspond to the Federal Environment Protection Act of the federal government (SBP, 2017). The State Bank of Pakistan (SBP) is quite optimistic and is thoroughly working to regulate the greening drives in financial markets and instruments in Pakistan. Especially, the SBP issues different circulars to commercial (Islamic) banks to proactively operationalize green banking activities. SBP launched new guidelines for banks in October 2017 to meet international standards where the initiatives of green banking, the development of a mechanism to finance climate-friendly industry, and the adoption of green practices for internal control were the key points (SBP 2018). The SBP also advised banks to go online for saving the time and effort of customers and get rural inclusion in the banking network (Khan et al., 2019a; b). Digital banking is a part of the pro-environmental drive where the click-and-mortar set is concentrated instead of a physical system, and therefore, the SBP promotes it to have banking channels free of papers and physical equipment. The spiraling energy issues also impact the industrial and human growth in Pakistan where the banks can help reduce climate hazards. Taking this motive, the SBP encourages banks to work sustainably and rely on renewable energy resources to realize the dream of a sustainable financial system.

Few scholars addressed the green banking initiatives in Pakistan. For example, using qualitative research design Javeria et al. (2019) investigated the problems and challenges in the way of green banking in Pakistan. They proposed further studies to examine the transformation from conventional to sustainable (green) banking using quantitative models. In their recent work on green banking, Rehman et al. (2021) found that there is a positive impact of green banking practices (policy, operations, and investments) on the environmental performance of conventional banks in Pakistan. They exhibited how environmental performance can be predicted through green banking initiatives and directed future researchers to use more comprehensive frameworks for understanding green banking in Pakistan. The current study is a leading one incorporating a comprehensive set of practices including daily operations-related, customers-related, bank policy-related, and employees-related practices of the Islamic banks. The corporate reputation aligning with the green performance of Islamic banks has not been investigated so far, and it could be a good addition to the literature on the greening drives of Islamic banks. This study also believes that the green practices of Islamic banks can be moderated by the environmental awareness of the employees and management. It is more likely that environmentally aware employees will accelerate the pace of green banking and the reputation of banks.

2.3 Islamic green banking and corporate reputation

Islamic banking which is an icon of ethical banking has the potential to address the issues of equity, and sustainability for curbing the environmental and economic woes of any society (Kenourgios et al., 2016). The “Go Green” drive of Islamic banking denotes the fact that Islamic banks take care of both the existing and next generations. Today, the environment is key attention in sustainable Islamic banking where climate change, rising emissions from conventional energy resources, global warming, and pollution control are the main concerns. So far, there is limited research on the sustainability orientation of Islamic banking (Aliyu et al., 2017), especially the greening facets of Islamic banks that are covering the institutional and societal aspects need more descriptive, explanatory, and explorative models. Correlating bankers’ green behavior with green banking growth in the Malaysian Islamic banking industry, Ali et al. (2020) found that the five types of green orientations have a significant impact on the growth of green banking. They reported that conservation, sustainability in work, no harm to the environment, influencing fellows, and taking green initiatives have a positive relationship with green Islamic banking.

Though previous studies found that the performance of conventional commercial banks can be increased with sustainable green banking, little research exists on how the reputation and performance of Islamic banks can be exalted with greening adaptability. Agreeing with the recommendation that policymakers should give more focus to introduce interactive green products and services (Sharmeen & Yeaman, 2020), this study argues that Islamic banks can better work for sustainable banking with ethical and responsible approaches. It is also reported that stakeholders’ engagement and development of emotional attachment are necessary for conventional and Islamic banks to convert to green banking practices (Bukhari et al., 2019, 2020). The current study proposes that the reputation of Islamic banks can be increased with green banking practices of the banks.

3 Theoretical background and hypotheses development

This study utilized the stakeholders’ theory (Frooman, 1999) as underpinning for the underlying assumptions that the growth of green banking depends on the orientation and interests of stakeholders (customers, employees, community, management, etc.). There is a central role of the stakeholders’ conceptions about green banking behavior that might cause enhance banks' reputations. Green innovation in banking can be spurred using the lens of stakeholders’ theory where stakeholders’ pressures like government, customers, suppliers, employees, and competitors have a significant impact on developing greening behavior (Lin et al., 2014).

The banking practices related to employees may result in increasing the banks' good reputation. Such activities might include the training of employees to work for greening like saving papers, energy saving, use of renewable sources of energy, lesser use of carbon emissions, etc. Such type of practices leads to banking reputation and development (Zafar et al., 2019). The daily operations of banks also matter in reducing environmental pressures like decreasing paper usage and controlling the wastage of materials. The daily operations also include using online platforms like ATMs, online banking, mobile banking, and SWIFT for funds transfers as well as smart ways of waste management (Shaumya & Arulrajah, 2017). These green operations enhance banks’ sustainability and thereby promote banks’ reputation. In terms of customers-related green practices, banks favor the environment by extending loans to those customers that focus on renewable energy and work for environmental protection. Banks sponsor those customers that have climate-friendly proposals like tree plantation drives, smart city projects, solar systems, and clean water schemes. Banks also offer guidance to such drives through consultancies and other media platforms.

Zheng et al. (2021) worked on green finance and postulated the four dimensions that shape bankers' conceptions that lead to green development. Rehman et al. (2021) connected the environmental performance of commercial banks with the four dimensions of green banking practices (employees related, operations related, customers related, and policy related). They found that the mentioned practices do lead to the better performance of commercial banks. Moreover, the reduction in harmful environmental activities like cutting paper usage and minimum use of coal and oil-based energies have a negative impact on the overall banking performance.

This study believes that customers’ selection on the basis of environment-friendliness exalts the reputation of banks. The Islamic banks’ policy concerning green branches, green infrastructure, involvement of management in environment-related planning, and buying from climate-friendly suppliers are key to “Go Green” banking that consequently excites corporate reputation. Lunching green banking products by Islamic banks testify to sustainable policies and their implementation (Qureshi & Hussain, 2020). Islamic banks are especially interlinked with environmentally friendly banking that ethically works to sustain the environment by supporting natural resources, maintaining and motivating cleanliness, and striving to meet social and environmental responsibilities (Masukujjaman et al., 2015). Considering the employees-oriented green banking practices, we propose the following hypotheses;

H1

The green banking employees-related practices have a positive impact on the reputation of Islamic banks.

H2

The green banking daily operations-related practices have a positive impact on the reputation of Islamic banks.

H3

The green banking customers-related practices have a positive impact on the reputation of Islamic Banks.

H4

The green banking policy-related practices have a positive impact on the reputation of Islamic banks.

3.1 Green banking and moderation of environmental awareness

One of the main prerequisites of environmental protection is environmental awareness, which refers to employees’ awareness of the rules and regulations of environmental policies regarding banking. The effective planning and implementation of policies depend on environmental awareness (Kokkinen, 2013). It has been observed that green practices have not solely been able to translate into greening behavior or reputation. Gadenne et al. (2009) reported that despite the green attitude of the employees, the climate-friendly practices and their implementation were low. They attributed it to the fact that it is environmental awareness that translates into greening actions within organizations. Recently, Arocena et al. (2021) found the moderating influence of environmental awareness on the relationship between ISO standardization and firms’ environmental performance. Cao and Chen (2019a, 2019b) investigated the moderation effect of environmental awareness and declared that green innovation policy is stronger when environmental awareness is higher. Similarly, Khan et al. (2022) examined the moderation of environmental awareness in the hospitality industry and found that environmental awareness strengthens employees’ sense of sustainable development. The moderating role of environmental awareness was also investigated by Rustam et al. (2020) who reported that environmental awareness has a significant effect on environmental disclosure and customers' eco-friendly consumption behavior.

This study believes that environmental awareness will strengthen the association of employees-related, daily operations-related, customers-related, policy-related practices, and the reputation of Islamic banks in Pakistan. Therefore, the following moderation hypotheses are posited;

H5

Environmental awareness moderates the relationship between employees-related practices and the reputation of Islamic banks.

H6

Environmental awareness moderates the relationship between daily operations-related practices and the reputation of Islamic banks.

H7

Environmental awareness moderates the relationship between customers-related practices and the reputation of Islamic banks.

H8

Environmental awareness moderates the relationship between bank policy-related practices and the reputation of Islamic banks.

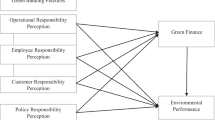

Figure 1 details the conceptual model explaining the proposed hypotheses of this study.

4 Methodology

4.1 Data collection

To meet the objectives of this study, the required data were collected through an online questionnaire from the employees of Islamic banks in the Khyber Pakhtunkhwa (KP) Province of Pakistan. The target population of the study consisted of all the personnel of Islamic banks as well as the employees working in Islamic branches of conventional banks. The major chunk of the data collection was conducted online through a virtual questionnaire, as some of the bank employees were cautious in personal contacts due to COVID-19. In some areas where there were no Corona lockdowns, the scholars and their research assistants personally visited the banks and circulated the questionnaire. The data collection process was thoroughly discussed and approved as per the SOPS of the banks and government. Chiefly, the respondents were contacted through emails and social media (WhatsApp).

The staff members were briefed about the purpose of the survey and requested to fill out the questionnaire and share it with their colleagues within the branch as well as in other Islamic branches. More than 50 Islamic branches of different Islamic banks were visited for data collection purposes, comprising almost 75% of the banks. Specifically, four main cities, namely Peshawar, Kohat, Bannu, and Dera Ismail Khan districts of KP, were chosen for data collection. The authors clarified to the respondents that data-giving is quite optional and depends on their free will. They were also ensured that their data will be carefully handled with complete secrecy and sanctity. The respondents spent their free time filling out the questionnaire and rated their most appropriate choices. Some small prizes were also announced for the respondents to be distributed on a draw basis, and follow-up emails were sent to accelerate the data collection. The respondents were also promised to get the final findings of this study once it is completed. Finally, we received 390 responses, which were then used for the final analysis. Table 1 provides the respondents’ demographics.

4.2 Measures

The online version of the questionnaire was divided into sections A and B. Section A was concerned with the demographics and data profiles of the respondents, whereas the B section was devoted to measuring the proposed constructs. The measures of the represented constructs were adapted from the available works of literature with slight modifications to suit the context of the current study. A five-point Likert scale (1 “strongly disagree” to 5 “strongly agree”) was used for measuring the degree of satisfaction of the respondents.

The measures of employees-related practices, daily operations-related practices, customers-related practices, and bank policy-related practices were adapted from previous studies (Rehman et al., 2021; Shaumya & Arulrajah, 2016). The instrument and measure of environmental awareness were taken from Cao and Chen (2019a, 2019b). Moreover, we borrowed a four-item scale for bank corporate reputation from Ruiz and García (2019).

4.3 Data analysis

As our model was predictive in nature, we conducted structural equation modeling (SEM) using the Smart-PLS (version 3). PLS-SEM is extensively used in research articles where the data are collected through survey questionnaires (Hair et al., 2017). Several reasons justify that the adopted PLS-SEM approach is an appropriate tool for the current study. PLS is useful for testing complicated cause–effect relationships among constructs (Reinartz et al., 2009), and according to Beh et al. (2019), the PLS-SEM approach is particularly suitable for checking moderating effects. The study intends to investigate the moderation effects of management’s environmental awareness; thus, the adopted PLS approach was reasonable. Following Hair et al. (2017), the study used a two-step approach to evaluate the results of the collected data. First, we validated the measurement model to know the external measures of goodness, and second, we tested the proposed relationships among the constructs by applying the structural model.

5 Data analysis and results

5.1 Demographic information

The authors contact the respondents for giving their opinions on how they perceive green banking practices and their bank's reputation. Table 1 elaborates the respondents’ data which are diversely spread in terms of gender, education, geography, and level of experience. The diverse data comprehensively cover the employees’ ratings of their opinions on the given phenomenon.

Table 1 further indicates that there were a majority of male respondents (60%) which is a usual phenomenon in Pakistani banking culture. The employees whose ages were less than 25 years were mainly responsive and gave their perceptions of the green banking practices and their impact on the bank's reputation. Similarly, the number of respondents with a bachelor's level of education constituted the major portion (57%) while the experience bracket of smaller than 3 years was greater (59%) in numbers.

5.2 Common method bias (CMB)

In this research, we used Harman’s single-factor test, to examine the presence of CMB in our dataset (Podsakoff et al., 2003). In our case, the principal component analysis illustrates that all the variables produced six distinct factors that together accounted for 61.26% of the total variance, and the first factor produces only 17.40% of the variance. Therefore, our results show that CMB is not a serious concern for this research. Moreover, the degree of multicollinearity among the independent variables was assessed through both variance (VIF) and tolerance values (Cohen et al., 2003). In our case, the VIF scores are between 1.34 and 1.82 and the tolerance value is greater than the recommended cut-off level of 0.10, which indicated the multicollinearity issue is not present in our dataset.

5.3 Measurement model

The measurement model in PLS-structural equation modeling represents how the external walls of any model support the goodness of proposed measures. Before conducting the structural model, it is compulsory to have a goodness of fit of the observed indicators or constructs to successfully run the model for hypotheses testing (Hair et al., 2017). Table 2 shows that the measurement model accurately and satisfactorily describes the model fit and goodness of our measures. The table explains the loadings of each construct having met the standards, i.e., greater than 0.70 (Nunnally, 1978).

Table 2 further details that Cronbach’s values using Alfa (α) meet the cut-off standards. The Alfa values represent that the measures have no reliability issue. The composite reliability (CR) values also indicate that the items, constructing the latent variables, have a good level of internal consistency. The values are reasonably expressing the goodness of the constructs as per the designated criteria of previous studies (Hair et al., 2017; Khan et al., 2021). To get the appropriate convergent validity, the average variance extracted (AVE) is used in the PLS-SEM. Table 2 elucidates that the AVE values are in the proper range, i.e., higher than 0.50 for each construct, thereby indicating a sound convergent validity.

5.4 Descriptive statistics, correlation, and discriminant validity

Descriptive statistics, correlation coefficients, and the diagonal values on the correlation table are further steps explaining the relationships among the constructs. To this end, Table 3 gives details that how the means values (M) and the level of dispersions through standard deviation (SD) lie in the data. The first two columns M and SD show the descriptive statistics of the given variables depicting that there is overall little dispersion and the means values are around 3.5. The correlation coefficients show that the variables are positively associated with each other having different levels of correlation. The correlation coefficients, lower than 0.70 (Hair et al., 2017), also depict that there is no issue of multicollinearity among the predictors. The diagonal bold values in the table picturize divergent validity where all the values are higher in their respective rows and columns, thereby showing a good divergent validity of the constructs.

All the values in Tables 2 and 3 conjecture that the measurement model and the correlation coefficients are advocating goodness of fit and sound measures that can be used for further detailed analysis of the inner model. The inner/structural model in PLS-SEM allows checking the relationships among the latent constructs and hypotheses testing.

5.5 Structural model

The hypothesized relationships among the constructs were checked using the structural model using smart-PLS. There were four direct links in the model and one moderating variable (environmental awareness) that was found to have a stringent effect on the direct relationships with the outcome variable (banks’ reputation).

Table 4 and Fig. 2 put forth the results of hypotheses testing and also show the moderating effect of environmental awareness. Overall, the model explains a 59% (R2) variance in the banks’ reputation. Hypothesis 1, i.e., employees-related practices (ERPs → BR), has a significant relationship (β = 0.23; p < 0.05) with bank reputation indicating that employees’ inner feelings for green banking can increase bank reputation. Hypothesis 2, which postulates that banks’ daily operations practices have a significant impact (DORPs → BR) on bank reputation, was supported (β = 0.18; p < 0.05). Our data evidence that the banks’ routine green practices lead to a good reputation of the banks in Pakistan. The third hypothesis was stating that customers-related practices have a positive effect on bank reputation and we find that it was supported. Table 4 shows that CRPs → BR is highly significant (β = 0.21; p < 0.05) on 99% confidence level. The final direct hypothesis PRPs → BR representing the bank policy-related practices and their impact on bank reputation was also found significant (β = 0.33; p < 0.05).

5.6 Moderation results of environmental awareness

Figure 2 and Table 4 also specify the moderating influence of environmental awareness on the four paths of the direct hypotheses. The results explain that H5, i.e., environmental awareness (ERP × MEA → BR), moderates the path of employees-related practices and bank reputation (β = 0.08; p < 0.05). The higher the employees-related green practices, the better will be the banks’ reputation. The environmental awareness also moderates the daily operations-related practices (DORP × MEA → BR) and bank reputation (β = 0.10; p < 0.05), thereby supporting H6. The next hypothesis (H7) believed that environmental awareness moderates customers-related practices and bank reputation. Our results support the H7 (β = 0.12; p < 0.05) indicating that the customers-related practices improve the banks’ reputation if there is environmental awareness among the bank employees. The study also finds that the relationship between banks’ policy-related practices and bank reputation is moderated by employees’ environmental awareness (β = 0.14; p < 0.05); thus, H8 is supported.

6 Discussion

The study attempted to investigate the impact of green banking practices on bank reputation using the context of Pakistani banks. Data were gathered from banks’ employees and were analyzed using structural equation modeling with Smart-PLS. Previously, few studies examined the direct relationship of green practices with banks' environmental performance (Rehman et al., 2021), but this study uniquely examined the impact of green banking practices on bank reputation. Additionally, the study used a moderator (Environmental Awareness) to know whether the link between green practices and bank reputation is changed with the moderator.

The study found that employees-related practices of banks such as banks’ training and orientation of employees have a larger effect on bank reputation. This result is supported by previous studies (Rehman et al., 2021; Shaumya & Arulrajah, 2017) which reported that performance rewards to employees and the provision of other privileges based on employees' green performance increase the banks' environmental performance. If the employees are educated enough about green banking practices, they will take care of environmental protection, saving energy, and other issues that are consistent with environmental sustainability. The banks’ daily operations-related practices such as minimum use of papers, effective utilization of digital file processing, increasing focus on ATMs, LED lighting, Swift transfers, etc. are effectively increasing the banks’ Go Green imperatives thus adding to the overall reputation. This study found that daily operations-related practice has a significant impact on bank reputation. Tara et al. (2015) described that the banks’ green operations lead to their overall success thereby adding to banks’ reputation. The use of e-statements, intranet, online approval, and online meetings determine green banking operations. Such online activities will reduce costs and other resources of banks (Khan et al., 2021) as well as recapitulate the green initiatives on the part of banks. The other dimension of green initiatives is concerned with customers, i.e., choosing the right customer to sustain green activities. Customers with green projects such as environmental protection, tree plantations, and other environmentally friendly projects assume to be supported through loans, and other bank advances. For reputation causes, banks may provide guidance and support to those who can potentially work for a better and sustainable environment. Preferring customers based on green works is the notion that is hypothesized in this study, and the result supported that customers-related practices have a sizable effect on the bank's good reputation. Another perspective of green initiatives is the banks’ policy formulation and implementation. Focusing on banks’ green policies, Rehman et al. (2021) encapsulated that green policies lead to sustainable banking activities. Similarly, corresponding to our findings, Galletta et al. (2021) acknowledged that banks’ green policies have a major impact on banks’ performance and reputation. This study conceded that the bank policies related to the environment and sustainability will strengthen their reputation.

This study explored the moderating role of management environmental awareness (MEA) and how it affects green banking practices and bank reputation. Several studies substantiated that bankers’ knowledge and their attitude have a positive influence on the development of green banking and sustainable economic development (Raihan, 2019; Zheng et al., 2021). Previous studies also disclosed that MEA is a key to accelerating the pace of green banking. The current study checked the MEA whether strengthens the link between green banking initiatives and bank reputation. As found by Rustam et al. (2020) that there is a positive moderation effect between firms' sustainable relationship and green choice, this study too finds that environmental awareness supports green banking activities and reinforces the banks' reputation. Similarly, Cao and Chen (2019a, 2019b) reported that environmental awareness has a significant moderating impact on green strategies. Awareness about green technology, green behavior, and green loans all is imperative for management to understand and implement them for environmental betterment.

7 Conclusion

Amidst the global sustainability drives and fulfilling the sustainable development goals (SDGs), this study targets the banking sector by identifying the green banking practices (employees-related, daily operations-related, customers-related, and bank policy-related practices) and their ultimate effect on bank reputation. Unique in several aspects, this study focused on Islamic banks for data collection. The sustainable role of Islamic banks in Muslim countries is quite fruitful and can help stimulate such initiatives in other traditional banks due to the enhanced reputation of Islamic banks. Commercial banks, competing with Islamic banks, are also likely to extend their portfolio and include such green banking practices. The employees’ opinions of Islamic banks were quantified using a survey method by rating their inputs about green banking initiatives and their bank reputations. The study found that there is a direct link between green banking activities and the good reputation of Islamic banks that are supposed to be more ethical and green in their essence. The banks that care for greening and sustainability will help materialize the sustainable development goals in Pakistan and other Islamic countries. The employees and management's environmental awareness was also found to have moderating effect in strengthening the cause of sustainable banking. The higher the management's environmental awareness, the higher the chances to practice green banking, thus contributing to the banks' reputation and performance. Though the management of Islamic banks can work in multiple ways to achieve their banks’ future growth and reputation, the study finds that green banking activities can better add to the future growth and reputation of the Islamic banking industry.

8 Theoretical and managerial implications

Concentrating on the green banking practices in Islamic banks, this study devotes itself to exploring the green behaviors of bankers and the ultimate reputation of their banks. There is a dearth of research on green banking in Pakistan (Rehman et al., 2021), especially in emerging Islamic banks. The Islamic banks can be proved as a symbol of change that can better impart the global idea of sustainable goals. This research might help achieve the base for future research on green banking and green finance in Pakistan and other developing countries. Theoretically, the green initiatives on the part of banks and other financial institutions can be further researched using many models that can highlight various aspects of green banking. The study also furnishes theoretical implications for academicians and researchers in Islamic banking and finance to sort out the climate-friendly and Shariah-compliant practices in Islamic banking. The theoretical bases will translate into policymaking and practical steps that might provide sound food for academia and practitioners. This research also highlighted the management’s environmental awareness which is the first step in understanding the importance of green initiatives and environment-friendly acts. Such conceptions can be further explored in future research for better assimilation of green banking.

This research attempted to empirically investigate green banking in the Islamic banks of Pakistan. Islamic banks are an emerging phenomenon in the Islamic world and have a major contribution to the financial intermediation and partnership of funders and investors (Khan et al., 2019a; b). To work the UN agenda of 2030 in the shape of SDGs and the social acceptability of green banking, the green orientation of Islamic banks is critically important. This research calls for relevant policy-making and practical initiatives on the part of Islamic banks to work on the sustainability agenda. Particularly, the practitioners and directors of Islamic banks can devise such types of policies that are pro-environmental, reduce carbon emissions, and work on paperless and digital banking (Khan, 2021). Climate-friendly banking is dependent on environmental awareness and its practical implementation for safe, clean, and green banking in Pakistan. Today, banks are in dire need to include green strategies in their operations, buildings, investments, and financing strategies and keep highlighting the green rating standards given by the state bank of Pakistan, and the World Bank, upholding environmental and social norms, initiatives taken by public and private sector banks in Pakistan in implementing green banking practices and to list significant strategies for adoption of green banking. Based on the findings of the study, it is the right time to encourage such types of projects that have some positive environmental implications. Banks should discourage granting loans to those industries that are harmful to the environment. Furthermore, this research can spur the agenda of green banking in a socially responsible way thus appealing to society to be aware of the green initiatives and inculcating such worthy norms in the local community. The governing bodies and regulators of banks and other financial institutions may use the findings of the study to regulate green banking policies and make it mandatory for banks to disclose such types of activities in their financial statements.

9 Limitations and future research directions

Despite having a significant contribution to the literature on green banking, this study acknowledges certain limitations. The study quantified employees’ perceptions at a single time using primary data that could potentially limit the generalizability of the study. One might be cautious in applying the study’s results as the data have been gathered from one province. New researchers may focus on a large set of data thereby enabling more generalizability. The data collection and sampling size can be more rationalized in future studies to have more robust analyses and findings using a larger sample size or a longitudinal design. The study used a few green banking practices that can be broadened to cover other aspects of green banking like government mandatory requirements, environmental agencies' role, or community support for green banking. Secondary data can also be a worthy source for strengthening the results of such studies investigating the actual performances of banks in respect of going green. More descriptive and explanatory studies on green banking could further the agenda of green banking. The data for measurement and structural model were mainly taken from the employees of Islamic banks that could be more diversified, sampling conventional banking employees or using the interviews of the experts in the field. Future studies should examine the moderating effects of employee demographic variables on their perception of green banking practices and bank reputation relationships. Several control variables can also be added to future models like age, sustainable education, gender, media role in greening initiatives, and the leadership vision. We measured the bank's reputation through the employees’ perceptions and this can be further validated using other methods like bank sustainable rating by various formal agencies or other performance measures. Green banking, passing through its development stage, is worth exploring using the lens of mandatory disclosures, market, and environmental pressures, or cross-cultural studies on green banking that would help uplift the agenda of green banking in developing countries.

Data availability

The datasets generated during and/or analyzed during the current study are available from the corresponding author on reasonable request.

References

Abbas, S., Kousar, S., Yaseen, M., Mayo, Z. A., Zainab, M., Mahmood, M. J., & Raza, H. (2020). Impact assessment of socioeconomic factors on dimensions of environmental degradation in Pakistan. SN Applied Sciences, 2(3), 1–16.

Ali, Q., Parveen, S., Senin, A. A., & Zaini, M. Z. (2020). Islamic bankers’ green behaviour for the growth of green banking in Malaysia. International Journal of Environment and Sustainable Development, 19(4), 393–411.

Aliyu, S., Hassan, M. K., Mohd Yusof, R., & Naiimi, N. (2017). Islamic banking sustainability: A review of literature and directions for future research. Emerging Markets Finance and Trade, 53(2), 440–470.

Arocena, P., Orcos, R., & Zouaghi, F. (2021). The impact of ISO 14001 on firm environmental and economic performance: The moderating role of size and environmental awareness. Business Strategy and the Environment, 30(2), 955–967.

Beh, P. K., Ganesan, Y., Iranmanesh, M., & Foroughi, B. (2019). Using smartwatches for fitness and health monitoring: The UTAUT2 combined with threat appraisal as moderators. Behaviour & Information Technology, 40, 282–299.

Borah, S., & Baruah, S. (2020). Consumer awareness and green banking: A gareet banking approach. International Journal of Advanced Research in Engineering and Technology, 11(9), 226–231.

Bukhari, S. A. A., Hashim, F., & Amran, A. (2020). Green Banking: A road map for adoption. International Journal of Ethics and Systems, 36(3), 371–385.

Bukhari, S. A. A., Hashim, F., Amran, A. B., & Hyder, K. (2019). Green Banking and Islam: Two sides of the same coin. Journal of Islamic Marketing, 11(4), 977–1000.

Burhanudin, B., Ronny, R., & Sihotang, E. T. (2021). Consumer guilt and green banking services. International Journal of Consumer Studies, 45(1), 38–53.

Cao, H., & Chen, Z. (2019a). The driving effect of internal and external environment on green innovation strategy-The moderating role of top management’s environmental awareness. Nankai Business Review International, 10(3), 342–361.

Cao, H., & Chen, Z. (2019b). The driving effect of internal and external environment on green innovation strategy-The moderating role of top management’s environmental awareness. Nankai Business Review International, 10(3), 342–361.

Carè, R. (2018). Exploring the role of banks in sustainable development. In Sustainable banking (pp. 39–64): Springer.

Chen, J., Siddik, A. B., Zheng, G.-W., Masukujjaman, M., & Bekhzod, S. (2022). The effect of green banking practices on banks’ environmental performance and green financing: An empirical study. Energies, 15(4), 1292.

Cohen, J., Cohen, P., West, S. G., & Aiken, L. S. (2003). Applied multiple regression/correlation analysis for the behavioral sciences (0805822232). Retrieved from

de Quevedo-Puente, E., De La Fuente-Sabaté, J. M., & Delgado-Garcia, J. B. (2007). Corporate social performance and corporate reputation: Two interwoven perspectives. Corporate Reputation Review, 10(1), 60–72.

Dörry, S., & Schulz, C. (2018). Green financing, interrupted. Potential directions for sustainable finance in Luxembourg. Local Environment, 23(7), 717–733.

Eckstein, D., Künzel, V., Schäfer, L., & Winges, M. (2019). Global climate risk index 2020. Retrieved from https://www.germanwatch.org/en/cri

Frooman, J. (1999). Stakeholder influence strategies. Academy of Management Review, 24(2), 191–205.

Gadenne, D. L., Kennedy, J., & McKeiver, C. (2009). An empirical study of environmental awareness and practices in SMEs. Journal of Business Ethics, 84(1), 45–63.

Galaz, V., Crona, B., Dauriach, A., Scholtens, B., & Steffen, W. (2018). Finance and the earth system–exploring the links between financial actors and non-linear changes in the climate system. Global Environmental Change, 53, 296–302.

Galletta, S., Mazzù, S., Naciti, V., & Vermiglio, C. J. B. S. (2021). Sustainable development and financial institutions: Do banks’ environmental policies influence customer deposits? Business Strategy and the Environment, 30(1), 643–656.

Giraudet, L.-G., Petronevich, A., & Faucheux, L. (2021). Differentiated green loans. Energy Policy, 149, 111861.

Hair, J. F., Sarstedt, M., Ringle, C. M., & Gudergan, S. P. (2017). Advanced issues in partial least squares structural equation modeling. Sage Publications.

Huang, L., & Fitzpatrick, J. (2018). Lending a hand: Perceptions of green credit cards. International Journal of Bank Marketing, 36(7), 1329–1346.

Ibe-enwo, G., Igbudu, N., Garanti, Z., & Popoola, T. (2019). Assessing the relevance of green banking practice on bank loyalty: The mediating effect of green image and bank trust. Sustainability, 11(17), 4651.

Jan, A. M., Mário, N., Albinsson, P. A., Martins, J. M., Hassan, R. B., & Mata, P. N. (2021). Alignment of Islamic banking sustainability indicators with sustainable development goals: Policy recommendations for addressing the COVID-19 pandemic. Sustainability, 13(5), 2607.

Javeria, A., Siddiqui, S. H., & Rasheed, R. (2019). Towards green banking in Pakistan: Problems, players and prospects. Pakistan Journal of Social Sciences (PJSS), 39(2), 365–376.

Julia, T., & Kassim, S. (2019). Exploring green banking performance of Islamic banks vs conventional banks in Bangladesh based on Maqasid Shariah framework. Journal of Islamic Marketing, 11(3), 729–744.

Kenourgios, D., Naifar, N., & Dimitriou, D. (2016). Islamic financial markets and global crises: Contagion or decoupling? Economic Modelling, 57, 36–46.

Khan, I. U. (2021). How culture influences digital banking? A comparative study based on the unified model. Technology in Society, 68(2022), 101822.

Khan, I. U., Ali, S., & Khan, H. N. (2018). Market concentration, risk-taking, and efficiency of commercial banks in Pakistan: An application of the two-stage double bootstrap DEA. Business and Economic Review, 10(2), 65–95.

Khan, I. U., Hameed, Z., & Hamayun, M. (2019a). Investigating the acceptance of electronic banking in the rural areas of Pakistan: An application of the unified model. Business & Economic Review, 11(3), 57–87.

Khan, I. U., Hameed, Z., Khan, S. N., Khan, S. U., & Khan, M. T. (2021). Exploring the effects of culture on acceptance of online banking: A comparative study of Pakistan and turkey by using the extended UTAUT model. Journal of Internet Commerce, 21, 183–216.

Khan, I. U., Khan, S. U., & Khan, S. (2022). Residents’ satisfaction with sustainable tourism: The moderating role of environmental awareness. Tourism Critiques, 3(1), 72–87.

Khan, S. U., Khan, I. U., Khan, M. H., & Khan, S. U. (2019b). Analyzing the acceptance of Islamic personal financing using extended TRA model: Evidence from Khyber Pakhtunkhwa. Pakistan Abasyn Journal of Social Sciences, 12(2), 277–289.

Kokkinen, E. (2013). Measuring environmental awareness in the world. University of Oulu.

Kondyukova, E. S., Shershneva, E. G., & Savchenko, N. L. (2018). Green banking as a progressive model of socially responsible business. Упpaвлeнeц, 9(6), 30–39.

Lin, H., Zeng, S., Ma, H., Qi, G., & Tam, V. W. (2014). Can political capital drive corporate green innovation? Lessons from China. Journal of Cleaner Production, 64, 63–72.

Linh, D. H., & Anh, T. V. (2017). Impact of stakeholders on the performance of green banking products and services: The case of Vietnamese banks. Economic Annals-XX, I(165), 143–151.

Masukujjaman, M., Siwar, C., Mahmud, M., & Alam, S. S. (2015). Bankers’ perception on green banking: An empirical study on Islamic Banks in Bangladesh. Management and Marketing Journal, 13(2), 295–310.

Mehreen, M., Marimuthu, M., Karim, S. A. A., & Jan, A. (2020). Proposing a multidimensional bankruptcy prediction model: An approach for sustainable islamic banking. Sustainability, 12(8), 3226.

Nath, V., Nayak, N., & Goel, A. (2014). Green banking practices–a review. IMPACT: International Journal of Research in Business Management, 2, 45–62.

Nizam, E., Ng, A., Dewandaru, G., Nagayev, R., & Nkoba, M. A. (2019). The impact of social and environmental sustainability on financial performance: A global analysis of the banking sector. Journal of Multinational Financial Management, 49, 35–53.

Nunnally, J. C. (1978). Psychometric Theory 2nd ed. In: New York: McGraw-Hill.

Nwagwu, I. (2020). Driving sustainable banking in Nigeria through responsible management education: The case of lagos business school. The International Journal of Management Education, 18(1), 100332.

Park, H., & Kim, J. D. (2020). Transition towards green banking: Role of financial regulators and financial institutions. Asian Journal of Sustainability and Social Responsibility, 5(1), 1–25.

Podsakoff, P. M., MacKenzie, S. B., Lee, J.-Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879.

Qureshi, M. H., & Hussain, T. J. J. O. A. (2020). Green banking products: Challenges and issues in islamic and traditional banks of Pakistan. Journal of Accounting and Finance in Emerging Economies, 6(3), 703–712.

Raihan, M. Z. (2019). Sustainable finance for growth and development of banking industry in Bangladesh: An equity perspective. MIST International Journal of Science and Technology, 7(1).

Ratnasari, T., Surwanti, A., & Pribadi, F. (2021). Implementation of Green Banking and financial performance on commercial banks in Indonesia. Paper presented at the Recent Developments in Asian Economics International Symposia in Economic Theory and Econometrics.

Rehman, A., Ullah, I., Ullah, Z., Zeeshan, M., Hussain, A., & Rahman, H. U. J. E., Development. (2021). Adoption of green banking practices and environmental performance in Pakistan: A demonstration of structural equation modelling. Environment, Development and Sustainability, 1–21.

Reinartz, W., Haenlein, M., & Henseler, J. (2009). An empirical comparison of the efficacy of covariance-based and variance-based SEM. International Journal of Research in Marketing, 26(4), 332–344.

Ruiz, B., & García, J. A. (2019). Modelling customer-based bank reputation: the moderating role of uncertainty avoidance. International Journal of Bank Marketing, 37(1), 340–361. https://doi.org/10.1108/IJBM-12-2017-0273

Rustam, A., Wang, Y., & Zameer, H. (2020). Environmental awareness, firm sustainability exposure and green consumption behaviors. Journal of Cleaner Production, 268, 122016.

Sarma, P., & Roy, A. (2020). A Scientometric analysis of literature on Green Banking (1995-March 2019). Journal of Sustainable Finance and Investment, 11, 143–162.

Sharmeen, K., Hasan, R., & Miah, M. D. (2019). Underpinning the benefits of green banking: A comparative study between Islamic and conventional banks in Bangladesh. Thunderbird International Business Review, 61(5), 735–744.

Sharmeen, K., & Yeaman, A. M. (2020). Benefits that islamic and conventioal banks can attain by implementing green banking. Journal of Islamic Monetary Economics and Finance, 6(4), 833–860.

Shaumya, K., & Arulrajah, A. (2016). Measuring green banking practices: evidence from Sri Lanka. Paper presented at the University of Sri Jayewardenepura, Sri Lanka, 13th International Conference on Business Management (ICBM).

Shaumya, K., & Arulrajah, A. (2017). The impact of green banking practices on banks environmental performance: Evidence from Sri Lanka. Journal of Finance and Bank Management, 5(1), 77–90.

Sun, H., Mohsin, M., Alharthi, M., & Abbas, Q. (2020a). Measuring environmental sustainability performance of South Asia. Journal of Cleaner Production, 251, 119519.

Sun, H., Rabbani, M. R., Ahmad, N., Sial, M. S., Cheng, G., Zia-Ud-Din, M., & Fu, Q. (2020b). CSR, co-creation and green consumer loyalty: Are green banking initiatives important? A moderated mediation approach from an emerging economy. Sustainability, 12(24), 10688.

Tara, K., Singh, S., & Kumar, R. (2015). Green banking for environmental management: A paradigm shift. Current World Environment, 10(3), 1029–1038.

Ullah, W., & Takaaki, N. (2016). Climate change vulnerability of Pakistan towards natural disasters: A review. International Journal of Environmental Protection and Policy, 4(5), 126.

Wang, Q., & Zhang, F. (2021). The effects of trade openness on decoupling carbon emissions from economic growth–evidence from 182 countries. Journal of Cleaner Production, 279(January), 123838.

Zafar, M. W., Zaidi, S. A. H., Sinha, A., Gedikli, A., & Hou, F. (2019). The role of stock market and banking sector development, and renewable energy consumption in carbon emissions: Insights from G-7 and N-11 countries. Resources Policy, 62, 427–436.

Zheng, G.-W., Siddik, A. B., Masukujjaman, M., Fatema, N., & Alam, S. S. (2021). Green finance development in Bangladesh: The role of private commercial banks (PCBs). Sustainability, 13(2), 795.

Funding

There is currently no funding available for this project.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

There are no competing interests to be declared by the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A: Cross-Item Loadings

Appendix A: Cross-Item Loadings

Constructs | BRP | BP | CRP | DOR | ERP | MEA |

|---|---|---|---|---|---|---|

BPR1 | 0.690 | 0.245 | 0.277 | 0.286 | 0.120 | 0.275 |

BPR2 | 0.742 | 0.355 | 0.416 | 0.601 | 0.341 | 0.368 |

BPR3 | 0.846 | 0.569 | 0.357 | 0.499 | 0.712 | 0.346 |

BPR4 | 0.763 | 0.448 | 0.240 | 0.410 | 0.683 | 0.190 |

BR1 | 0.537 | 0.891 | 0.485 | 0.545 | 0.505 | 0.294 |

BR2 | 0.583 | 0.918 | 0.453 | 0.536 | 0.529 | 0.323 |

BR3 | 0.506 | 0.879 | 0.392 | 0.435 | 0.475 | 0.261 |

CRP1 | 0.243 | 0.318 | 0.698 | 0.338 | 0.252 | 0.278 |

CRP2 | 0.292 | 0.361 | 0.748 | 0.369 | 0.211 | 0.311 |

CRP3 | 0.340 | 0.358 | 0.721 | 0.456 | 0.174 | 0.332 |

CRP4 | 0.396 | 0.379 | 0.743 | 0.458 | 0.320 | 0.253 |

DOR1 | 0.562 | 0.500 | 0.549 | 0.831 | 0.422 | 0.280 |

DOR2 | 0.521 | 0.438 | 0.432 | 0.769 | 0.389 | 0.258 |

DOR3 | 0.406 | 0.372 | 0.366 | 0.751 | 0.375 | 0.246 |

DOR4 | 0.493 | 0.443 | 0.408 | 0.763 | 0.426 | 0.281 |

ERP1 | 0.377 | 0.421 | 0.350 | 0.412 | 0.714 | 0.135 |

ERP2 | 0.726 | 0.491 | 0.259 | 0.443 | 0.829 | 0.327 |

ERP3 | 0.611 | 0.407 | 0.182 | 0.362 | 0.813 | 0.217 |

MEA1 | 0.213 | 0.174 | 0.248 | 0.199 | 0.146 | 0.729 |

MEA2 | 0.265 | 0.149 | 0.250 | 0.222 | 0.137 | 0.685 |

MEA3 | 0.307 | 0.261 | 0.312 | 0.222 | 0.210 | 0.783 |

MEA4 | 0.389 | 0.326 | 0.376 | 0.343 | 0.316 | 0.795 |

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Khan, I.U., Hameed, Z., Khan, S.U. et al. Green banking practices, bank reputation, and environmental awareness: evidence from Islamic banks in a developing economy. Environ Dev Sustain 26, 16073–16093 (2024). https://doi.org/10.1007/s10668-023-03288-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-023-03288-9