Abstract

There is no doubt that environmental regulation policy will increase the production cost of manufacturing enterprises, then can this policy help improve the business performance in the long run? This study aims to explore whether the environmental regulation policy could increase the business performance of manufacturing enterprises (BPME). With the panel data of 467,649 manufacturing enterprises from China Industry Enterprise Database (2010–2013), we employ the comparative statistical analysis to examine the influence of China’s environmental regulation policy, in the form of Ten-Thousand Enterprises Energy Conservation and Low Carbon Program (TEP), on the BPME. The empirical results show that first, TEP and BPME are positively correlated, and enterprises with excellent initial performance are more likely to be concerned by TEP. Second, the impact of TEP on BPME is first restrained and then promoted, indicating that there is an inverted U-shaped relationship between the policy and the performance. Third, this promotion effect is mainly reflected through the innovation compensation mechanism and is easier to be seen in non-state-owned, western, and technological-intensive enterprises. This study further confirms the Porter hypothesis and provides the Chinese government with reference for adjusting environmental regulation policies as well as achieving sustainable development.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Environmental protection and economic development are the main contradictions in the current process of Chinese modernization. The view that environmental protection can improve environmental performance has become a consensus, but different people have different opinions on its impact on the economic benefits, and the discussion has never stopped (Falcone et al., 2020). Enterprise profit and environmental protection targets cannot be both obtained from the perspective of conventional wisdom (Crotty, 1992). Some argue that environmental policy may set obstacles to the operation of enterprises (Guo et al., 2013; Shadbegian & Gray, 2005), and the related enterprises have to spend enormous amounts of costs to control pollution emissions, resulting in profits decline and performance release (Yao et al., 2019). But scholars who adhere to Porter Hypothesis believe that environmental regulation policies can promote the growth of corporate performance (Deng et al., 2019; Lanoie et al., 2011), especially for the important role of green finance policy in the sustainable development of firms (Falcone, 2020). Wang and Zhi (2016) revealed the internal contradiction and balanced strategy between green finance and environmental protection, and green finance has become an important way to promote energy-saving production. Green finance policies can promote the development of enterprises by stimulating green innovation, but privately owned enterprises tend to be more vulnerable than state-owned ones in this regard (Yu et al., 2021). Different from the previous points of view, Deng and Li (2020) discussed the inverted U-shape relationship between China's New Environmental Protection Law and corporate financial performance, which is a nonlinear relationship between environmental regulation policy and enterprise performance (Alpay et al., 2002). Besides that, more uncertain relationship forms have been discussed by authors like Testa et al. (2011) and Chen et al. (2020). Manufacturing enterprises are the most vulnerable to environmental policy regulation. Research on the performance changes of manufacturing enterprises under an environmental policy can most clearly reflect whether the environmental regulation policy is beneficial or not to the improvement of enterprise performance. Many scholars have discussed the effect of environmental policy on the performance of manufacturing enterprises, and confirmed the positive correlation between them (Lian et al., 2016; Liu et al., 2021; Sen et al., 2015), while some conclude that the Porter Hypothesis per se is not supported in China's manufacturing sector (He et al., 2020). Regardless of promoting or hindering, these studies have a common shortcoming, that is, they do not clarify the influence logic and regulation mechanisms of environmental policies.

This paper attempts to clarify the impact and explain whether the environmental policy plays a role of promotion or hindrance on the manufacturing firms performance, and analyze the characteristics and logic of the impact process. Specifically, this study takes the Ten-Thousand Enterprises Energy Conservation and Low Carbon Program (TEP), issued by Chinese government in December 2011, as the research object, and analyses its impact on the business performance of manufacturing enterprises (BPME). Therefore, this paper aims to address the following three questions: “whether it influences”, “what the influence is” and “how it influences”. These questions cover three aspects of the research content. (1) Correlation analysis between the TEP and the business performance. This aspect focuses on whether or not the influences of policies on the performance premium of enterprises are related to the implementation of environmental regulation policies. (2) Dynamic analysis of the TEP and the business performance. That is, whether or not the performance growth rate of enterprises as influenced by the policy can increase markedly after testing the environmental regulation. (3) Influencing mechanism of the TEP on the business performance. This mechanism, which mainly involves the innovative compensation effect and subsidy regulatory mechanism of the government, is tested.

The contribution of this paper lies in that it offers evidence that TEP, a kind of environmental regulation policy, has a positive influence on the BPME. Enterprises with excellent performance are easy to be “selected” by TEP, and the positive effect of TEP on BPME is first inhibited and then released. The innovative compensation effect and government subsidies are main factors for improving the growth rate of business performance, which verifies Porter hypothesis to a certain extent.

Following on this introduction, Sect. 2 gives a brief retrospect of the research on the relationship between environmental regulation policies and enterprises performance. Section 3 presents the research protocol of study area, research hypotheses, variables measurement, and data acquisition. Section 4 illustrates the models and methods used in this study. Section 5 describes and discusses the results of data analysis, reveals the relationship between TEP and BPME, and tests the hypotheses. Section 6 is the conclusion part, which points out the contribution, limitations and future research direction of this study.

2 Literature review

The existing academic studies on the relationship between environmental regulation policies and business performance of enterprises mainly form three representative frameworks, namely, innovative compensation theory, compliance cost theory, and idiosyncratic hypothesis.

2.1 Positive effect on business performance

Although they may increase expenditure for pollution control, reasonable and appropriate environmental regulation policies can motivate enterprises to make technological progresses and innovations to offset the increased production costs, thus achieving a win–win situation between environmental governance and performance improvement. In 1991, the “Porter hypothesis” was proposed, which symbolized an important turning point in the research on the relationship between environmental regulation policies and the business performance. Statistically, environmental regulation policies do not increase enterprise expenditure but stimulate enterprises to offset increased production costs and improve competitiveness through innovation (Porter, 1991; Porter & Linde, 1995a). Lanjouw and Mody (1996) investigated the relationship between the environmental technological innovation of enterprises and government environmental regulations in the US, Japan and Germany, and proved a positive correlation between them, while such a positive correlation has a certain lag phase. Mohr (2002) derived results consistent with “Porter hypothesis” by employing a general equilibrium framework with a large number of agents, external economics of scale in production, and discrete changes in technology.

On the basis of previous studies, researchers have found that the expenditure for pollution control is positively correlated with enterprises’ R&D investment but negatively correlated with the capital stock and the average age (Hamamoto, 2006; Li et al., 2018). The R&D investment stimulated by environmental regulation policies can significantly increase the growth rate of enterprises’ total factor productivity (TFP) (Wu et al., 2020). Lanoie et al. (2011) have used the data from more than 4200 enterprises in seven OECD countries, discussed the influencing mechanism of environmental regulation policies on the business performance, and proved that environmental regulation policies can induce innovation that may lessen costs. Qian et al. (2019) have measured the coupling degree of the environmental regulation policy and the economic growth on the basis of the systematic coupling model and found that the implementation of the environmental regulation policy in China is conducive to the generation of the “innovation compensation” effect, thereby forcing economic growth. Therefore, environmental regulation policies can promote enterprises to carry out innovative activities, and relevant literature (Anna, 2020; Boons et al., 2013; Deng et al., 2019; Rubashkina et al., 2015) provides supporting evidence for the “Porter hypothesis”.

2.2 Negative effect on business performance

Scholars who advocate this view are influenced by neoclassical economic theory. They agree with the compliance cost theory of business performance and posit that environmental regulation policies can increase the excess production cost of corporates. As a result, such policies can influence the efficiency and profit level of enterprises, thus decreasing business performance. Some researches argue that environmental regulation policies can facilitate the internalization of external pollution, such that enterprises are required to completely or partially alter production to adapt to changes in the external policy environment. Under this circumstance, enterprises may get sanctioned for failing to meet the requirements of the environmental regulation policies. Both conditions inevitably increase the corporate costs for pollution control in varying degrees, such as electric power (Gollop & Roberts, 1983), automobile (Lee et al., 2011), and coal mining industry (Li, Chi, et al., 2019; Li, Zhao, et al., 2019), and weaken competitiveness (Walter, 1982). As a result, power generation cost increased, and the productivity of enterprises largely decreased.

Besides, some researchers investigated the economic development in the US from 1973 to 1985 in the absence or presence of environmental regulation policies and concluded that involuntary investment in pollution control equipment due to the environmental regulation policies can greatly influence economic growth and decrease GNP by 0.191% (Jorgenson & Wilcoxen, 1990). Using plant-level data from paper mills, oil refineries, steel mills for the 1979–1990 period, Shadbegian and Gray (2005) revealed that the levels of productivity in the three industries decreased by USD1.74, USD1.35, and USD3.28 when the expenditure for pollution reduction was increased by USD1. Enterprises may adjust their strategies under the restriction of environmental regulation policies. This tendency may be inappropriate because enterprises may convert investment from innovative to environment-friendly projects (Walley & Whitehead, 1994), which indicates a link between higher pollution-abatement operating costs and lower productivity (Gray & Shadbegian, 2003). Studies have found that the incentive of the environmental tax on the enterprise emission reduction is insufficient, and environmental pollution cannot be effectively controlled. The negative externality of the environmental pollution leads to a decline in productivity (Fan & Zhang, 2018; Guo et al., 2013). As a result, the correlation between the productivity of enterprises and expenditure for environmental pollution control and emission reduction turned to be negative. That is, the higher the expenditure of enterprises for pollution control and emission reduction, the lower their productivity (Saygili and Meryem 2016; Yao et al., 2019).

2.3 Uncertain effect on business performance

With the deepening of studies, scholars have discovered that environmental regulation policies do not simply inhibit or promote the business performance of enterprises (Chen et al., 2020). Instead, a monotone functional relationship exists between them, which is caused by many uncertain factors. Such a monotone functional relationship shows strong uncertainty. Majumdar and Marcus (2001) discussed the influence of environmental regulation policies on the productivity of electric power companies on the basis of their business data. They concluded that improved environmental regulation policies can increase productivity, whereas imperfect ones can decrease productivity. Other studies have explored the effect of environmental regulation policies in the US and Mexico on the business performance of enterprises in the food industry through comparative analysis. These studies reported that the environmental regulation policies in the US do not influence the profitability or productivity of food processing enterprises, whereas the increasing environmental standards in Mexico can improve the productivity of the food processing industry (Alpay et al., 2002). Conversely, several studies have evaluated the influence of energy tax policies on the manufacturing industry by using production census data from the UK. However, these studies have discovered neither significant impacts of energy tax policies on the statistics of employment, total output or TFP (Martin et al., 2009), nor effect on state-level aggregate output (Henderson & Millimet, 2005). Recent study tells us that the implementation of environmental regulation policy does not significantly improve the production performance (Wang & Zhang, 2020), which highlights the uncertain relationship between environmental regulation policies and corporate growth performance (Grossman & Krueger, 1995). Strict environmental policies can urge enterprises to increase investment in advanced technologies and innovative products, thereby improving business performance, while economic policy tools exert negative influence on the business performance of enterprises (Testa et al., 2011).

Existing research provides good reference for the present study but with several shortcomings. First, previous studies have mainly selected the end-control policy variables of environmental regulation policies, such that the studies are easily disturbed by endogenous problems and non-policy factors (Anna, 2020). Second, most studies focus on the macroscopic and mesoscopic levels and discuss the influence of environmental regulation policies on economic growth, industrial transformation and upgrading, and industrial productivity. These studies indirectly analyze the impacts of environmental regulation policies on the business performance but lack microscopic interpretation. Third, existing research mainly collects data through questionnaire surveys or case studies, which result in subjective and less persuasive conclusions. For these reasons, this study aims to avoid the above problems and provide a certain supplementation to existing literature. Specifically, the TEP, which is a front-control regulation policy on the right to use energy, is selected as the policy variable. Moreover, the business performance of enterprises is decomposed into several quantity and efficiency indexes on the basis of microscopic enterprise data. The influence and relevant influencing mechanisms of environmental regulation policies on the business performance are discussed directly.

3 Research design

3.1 Study area

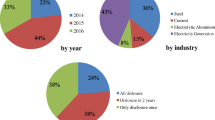

This study takes TEP as the research object, which is issued by China’s twelve departments, including the National Development and Reform Commission, on December 7, 2011. According to TEP, the regulation covers enterprises with comprehensive energy consumption of approximately 10,000 tons of standard coal in 2010. Hotels, restaurants, business enterprises, schools, and associated organizations with a comprehensive energy consumption of at least 5,000 tons of standard coal in 2010 are all within the scope of this regulation. In terms of quantity, most objects of TEP regulation are industrial manufacturing enterprises. Therefore, we choose the data of manufacturing enterprises from the China Industry Enterprise Database (2010–2013)and explores whether or not implementing environmental regulation policies can influence the BPME.

This research focuses on manufacturing enterprises for the following two reasons. (1) Manufacturing enterprises in China are major consumers of fossil fuel and account for more than 90% of the entire output of the industry. They are the main sources of greenhouse and harmful gases, such as industrial CO2, nitrous oxide, and sulfur dioxide. In the context of the study, environmental regulation policies are based on the regulatory policies for carbon reduction. (2) The development level of the manufacturing industry is an important content that measures the productivity level of a country and plays an important role in China’s national economy. It accounts for about 30% of the GDP. Therefore, results of investigating manufacturing enterprises have a strong practical significance.

3.2 Research hypotheses

On the basis of the analysis of the existing research results and the “Porter hypothesis”, externality theory, policy tool theory, and “idiosyncratic hypothesis”, this paper puts forward the following three hypotheses.

H1

TEP is positively related to the business performance.

The “innovation–compensation theory” believes that the environmental regulatory policy will drive enterprises to develop innovative activities, like developing circular economy (Ungerman & Dedkova, 2020) or new production technology (Liu, Tong, et al., 2020; Liu, Zhu, et al., 2020), which can be used to offset the increased costs caused by the policy regulation and improve business performances gradually. According to the content of TEP, the enterprises regulated by this policy include those with high energy consumption, which is closely related to the scale and the performance of enterprises. The higher the energy consumption, the better the business performance may be. A positive correlation is observed between energy consumption and the enterprises performance. While most enterprises the TEP targets are industrial firms, it can be seen that there could be a positive correlation between the environmental policy regulation and firms’ performance.

H2

TEP influences the growth rate of business performance across manufacturing enterprises.

TEP aims to urge enterprises to improve their technology and production mode and promote environment-friendly development by controlling the emissions of pollutants. In this process, although enterprises cannot achieve a rapid growth in business performance for the short term, they can greatly benefit in the long run. That is, the TEP can “improve” the business performance. However, manufacturing enterprises with different ownership types and are located across regions and industries is diverse. Thus, other enterprises may perceive varied levels of pressure from the same environmental regulation policies. Enterprises can adopt various countermeasures according to their practical situations, thus resulting in different levels of change in the BPME. As such, the effects of these policies also differ.

H3

As time goes on, the positive effect of TEP on the business performance can be intensified or the negative effect be weakened.

The “idiosyncratic hypothesis” suggests that more attention should be paid to factors influencing TEP’s effect, like enterprise heterogeneity, policy implementation duration, and policy intensity (Andersson et al., 2015). All factors may bring uncertainty to the relationship between environmental regulation policies and the firms’ performance (Rammer et al., 2017). As an environmental regulation policy, the TEP can influence the BPME because of its cost-increasing and innovative compensation effects according to the existing academic theory. The former is manifested instantly, while the latter is developed at a later period. That is, the TEP can increase the cost or decrease the profit of enterprises in the short run. However, the increased cost can be compensated by technological improvement or innovative production mode over time. Moreover, new performances can be created.

3.3 Variables measurement

This study operationalizes the dependent variable, business performance, as the data of gross and efficiency indicators of enterprises, as many scholars (Dechezleprêtre & Sato, 2017) have evaluated and analyzed it before. With reference to Bernard and Jensen (1999), gross and efficiency indicators were selected to measure business performance while the common profit and performance indexes in the stock market were ignored. The gross index includes total industrial output value and enterprise scale (i.e., number of employees), while the efficiency index includes three efficiency indicators (i.e., industrial added value per capita, capital stock per capita, and wage per capita) and TFP.

Many methods can be used to measure the technological innovation of enterprises. Previous studies have also explored the relationship between sustainable innovation and performance through establishing analytical frameworks (Boons et al., 2013; Hami et al., 2015; Provasnek et al., 2017). In view of the front end of innovation, the R&D input can be used to measure the technological innovation of enterprises. In view of the terminal end of innovation, productivity, number of patents, and output value of new products can be used to measure the technological innovation of enterprises. Reflecting the technological innovation of enterprises is easy because TFP directly influences the business performance. Hence, TFP was selected as the major measurement index of the technological innovation variable of enterprises.

The explanatory variable policy regulation was selected for discussing the changes in BPME before and after the issuance of TEP. Baumol and Oates (1975) provided a rigorous and comprehensive analysis of the economic theory of environmental policy, and established a theoretical framework for the study of environmental policy effects. The effect of environmental policy regulation is spatially heterogeneous and varies systematically with location-specific attributes such as unemployment levels (Millimet & List, 2004). By referring to previous researches (Dechezleprêtre & Sato, 2017; Henderson & Millimet, 2005; Porter & Linde, 1995b), policy regulation was operationalized by the dummy variables (0–1 type variables) defined by whether or not enterprises reported scale data on energy-saving and carbon emission reduction. That is, if the scale of the energy-saving and carbon emission reduction is higher than 0, the enterprise is influenced by the TEP. Moreover, the strength of the policy regulation (continuous variable) was defined by the ratio between the scale of energy-saving and carbon emission reduction and total industrial output value.

3.4 Data acquisition

This study collected data on enterprise samples from the China Industry Enterprise Database where the data span was set from 2010 to 2013 for the industrial manufacturing enterprises and used 2010 as the base period. To identify the key variables of business performance in this empirical study, the enterprise samples were first screened. Enterprise samples with total assets less than and equal to the total current assets or less and equal to the total fixed assets, annual sales volume of less than 5 million, variables lacking, and founded after 2010 were excluded. Finally, a total of 467,649 samples were obtained.

The research variables mainly include policy regulation, carbon reduction scale, total industrial output value, enterprise scale, industrial added value per capita, per capita wage, capital stock per capita, and TFP. For value-measured variables, an appropriate price index is selected for deflation, such that data across years can be compared directly. Moreover, core variables are standardized, or logarithms are chosen. Dimensional influence is eliminated to render data from various enterprises comparable. Table 1 lists the descriptive statistical analysis results of the full sample data, including variable names, calculation methods, mean, standard deviation (S.D.), minimum (Min.), and maximum (Max.).

The descriptive statistics indicate that regulated enterprises account for 4% of the total enterprise samples. Whether or not an enterprise is influenced by the TEP is uncertain. The standard deviation of the policy regulation variables reaches 19.5%. The carbon reduction scale obtains a mean of 0.342 and a standard deviation of 1.698, which is small. Thus, the carbon reduction scale among enterprises is close to each other. All per capita efficiency indexes are negative, which indicates that the industrial added value and total wage volume of many enterprises are highly diluted after standardizing the number of employees. This type of enterprises in general belongs to the labor-intensive industry. List et al. (2004) noted that environmental regulation policies may have different effects on different types of enterprises. Thus, this study realizes the necessity of dynamic analysis on the relationship between TEP and the business performance of different enterprise types across industries.

To test whether the collinearity of variables can cause adverse impacts on regression analysis, correlations among different variables are analyzed. Table 2 provides the results. Clearly, the correlation coefficient between the total industrial output value and TFP is relatively high (0.6729), whereas the correlation coefficients among the remaining variables are relatively low. Thus, the collinearity problem cannot restrict econometric regression in this study.

4 Models and methods

4.1 Correlation analysis between TEP and BPME

This study divides all samples of manufacturing enterprises into two categories, “ten-thousand enterprises” and “non-ten-thousand enterprises”, namely, “regulated enterprises” and “non-regulated enterprises”. Clearly, the performance indices of regulated enterprises, which are controlled by the TEP, are obviously higher than those of the remainder of the manufacturing enterprises (Table 3). However, this does not prove that there is a correlation between the TEP and the performance of regulated enterprises.

Is there a correlation between them? If so, is it positive or negative? (Fig. 1). If this correlation is positive, then is it endogenous / exogenous or essential / occasional? This study aims to analyze this correlation by constructing a regression model between the policy and performance of manufacturing enterprises, a model that testing prior performance premium of regulated enterprises and a model that testing the “self-selection” effect of TEP.

First, the regression model is improved on the basis of the method of Bernard and Jensen (1999). The correlation between the TEP and the BPME is also discussed. On this basis, Model 1 is constructed as follows:

where Xi denotes the performance characteristics of enterprises and covers two types of indices, namely, enterprise scale and enterprise efficiency. The logarithm value eliminates dimensional influences. Epi is the 0–1 type variable that reflects whether or not enterprises are influenced by the TEP. Sizei refers to the enterprise scale and is measured by the number of employees. Once again, the logarithm value eliminates the dimensional influences. Industryi and Areai are the 0–1 type variables of quartile industries and the provincial 0–1 type variable that the enterprises belong to. They are used to control for industrial and regional differences among manufacturing enterprises. Therefore, β1 can be interpreted as the difference (percentage) in the performance indexes of regulated compared with non-regulated enterprises, provided that all other characteristics are constant. If β1 is significantly higher than 0, then the TEP is positively related with the business performance. Otherwise, a negative correlation is observed.

Second, this study verifies whether or not regulated enterprises have prior performance premium, that is, whether or not the performance level of the regulated enterprises prior to the TEP is higher than that of non-regulated enterprises. In addition, is the correlation between the TEP and the business performance attributed to the excellent prior performance of non-regulated enterprises? To solve these problems, Model 2 is derived as follows:

where the coefficient β1 of the dummy variable of policy regulation can explain whether the performance of enterprises as influenced by the TEP during stage T in the initial stage (stage 0) differs from that of non-regulated enterprise. If β1 is significantly higher than 0, then the performance of regulated enterprises is better than that of non-regulated enterprises in the initial stage. However, if β1 is non-significantly higher than 0, then the performance of regulated enterprises is not better than that of non-regulated enterprises during the initial stage.

Third, if previous analysis can prove that the performance premium of regulated enterprises is partially attributed to “past” performance, then whether such a phenomenon is occasional or essential should be further verified. That is, do these enterprises become the regulation objects of environmental policies “by accident” or dependent on the “selecting” mechanism of these government policies due to their excellent performance? To address this problem, the “self-selection” effect of the TEP is tested, and Model 3 is set up as follows:

where Numit denotes the state variable of enterprises as influenced by the TEP during stage T. Numit is a 0–1 type dummy variable (the variable takes a value of 0 if the enterprise is not influenced by the TEP during stage T; otherwise, it takes a value of 1). All performance indicators adopt hysteresis terms. Xit −1 refers to the performance of enterprises in the first lagging period and is used to eliminate prior performance, possible simultaneity, and relevant endogenous problems. Numit − 1 pertains to the dummy variable of whether an enterprise is influenced by the TEP during the first lagging period. Di represents the other control variables that are used to determine the influence of industrial and regional differences and economic environment. Therefore, β1 can be interpreted as changes (percentage) in the probability of “being selected” by the TEP when performance index increases by 1%.

4.2 Dynamic analysis of TEP and the business performance

Considering that the environmental regulation policy itself may have a “self-selection” effect, manufacturing enterprises with high performance are likely to be “selected” by the government’s environmental regulation policies. Therefore, the adverse effect of the “self-selection” effect should be reduced when studying the influences of TEP on BPME. Hence, the indices of the performance growth rate and the policy stringency are introduced to investigate the effects of the TEP on the business performance.

First, Model 4 is established to test the influence of the TEP on the business performance in terms of growth rate:

where ΔXiT is the explanatory variable and refers to the growth rate of performance at an interval of [0, T]. Model 4 indicates that the main explanatory variable pertains to whether an enterprise is regulated by the TEP during the initial stage and aims to discuss whether regulated enterprises in the initial stage achieve rapid improvement in business performance during the follow-up management period [0, T]. β1 reflects that the growth rate of the business performance of regulated enterprises in the [0, T] is higher (or lower) than that of non-regulated enterprises. If the TEP can facilitate a rapid improvement in the business performance, then it is expected to reveal that β1 is significantly higher than 0; otherwise, β1 is not higher than 0 or non-significant.

Second, the ratio between carbon reduction scale and total industrial output value is used to measure the stringency of TEP. Studies have measured the stringency of environmental policy and explored its impact on enterprise production (Brunel & Levinson, 2013; Deng et al., 2019; Sato et al., 2015). With respect to manufacturing enterprises, the energy use scale is closely related to the output scale. When other conditions are fixed, the higher the output, the greater the energy consumption. For the same goal of the environmental regulation policy, manufacturing enterprises with different production scale represent different regulatory intensities. Therefore, the ratio of the carbon reduction scale to the total industrial output value is used to measure the intensity of TEP in this paper. Here, the intensity, which represents the policy stringency, is used to replace the dummy variable policy regulation in Model 4, and the Model 5 is constructed. This paper analyzes the different effects of TEP on BPME by evaluating the effect of the policy intensity on the growth of the enterprise performance.

where ΔXiT refers to the growth rate of performance at an interval of [0, T]. If the growth rate of enterprise performance can be improved with the increase of policy intensity, β1 will be significantly greater than 0, otherwise, β1 will not be greater than 0 or not significant.

After empirically testing the entire sample, heterogeneous analysis and robustness test on ownership, regional, and industrial differences among manufacturing enterprises are performed.

4.3 Influencing mechanism of the TEP on the business performance

Enterprises in China are facing dual pressure from the intensifying internal trade competition and increasing requirements on environmental protection. Thus, a mechanism-based verification is required to determine whether environmental regulation policies implemented by the Chinese government can decrease the business performance and thus inhibit economic growth or facilitate a win–win situation between environmental protection and economic growth.

First, this study poses the following question “Can environmental regulation policies stimulate enterprises to carry out technological innovation?” Many studies have reported that environmental regulation policies not only increase the production cost of enterprises but also generate an innovative compensation effect. The actual effect is finally determined by superposing the two effects. In this study, the basic models of these effects are constructed (Fig. 2). The influencing path of the innovative compensation effect is positive ( +), whereas that of the cost-increasing effect is negative ( −). Hence, the sign of the total effect is uncertain (?).

For the mechanism-based test on innovative compensation effect, the innovative effect is directly recognized using the mediating effect model, and the cost effect is indirectly identified with reference to universal practices in the academic circle. Notably, data on the cost changes of enterprises caused by the TEP are inaccessible. Hence, using cost data as the variable for recognizing cost effect is difficult but can be tested using the innovative compensation effect. Moreover, this study is restricted by the accessibility to the data on the technological innovation of enterprises. Thus, TFP is applied to measure the innovation performance of enterprises. The mediating effect process represented by Model 6 is as follows:

where Performance denotes the business performance and is measured by the normalized results of the standard deviation of all main indices for 2011 and 2010. Treat stands for the strength of regulation of the TEP on manufacturing enterprises in the base period (2010). Innovation refers to the innovation level of enterprises in 2011 and is measured by TFP. Controls represents a group of control variables (i.e., characteristics of enterprises in the base period). Coefficient c is the total effect of TEP on the business performance. Coefficients a and b refer to the influences of the policy on the innovation of manufacturing enterprises and that of innovation on the business performance, respectively. The product of a and b is the mediating effect that can be used to identify the innovative effect of the environmental policy on the business performance. Coefficient c′ denotes the residual effect of the policy on the business performance after eliminating the innovative effect and is used to recognize cost effect.

Second, if the innovative compensation effect is confirmed in the previous text, then the regulating effect of government subsidies in this process must be further interpreted to verify the policy effect of “increasing financial and policy supports to energy-saving tax”, which is proposed in the TEP. This study easily speculates that if the government provides regulated enterprises with certain subsidies to stimulate innovations, then the business performance can be easily improved. Therefore, Model 7 is established as below:

where Xit denotes the business performance at stage T. Treati0 is the strength of the policy in the base period, whereas Subit refers to government subsidies to manufacturing enterprises at stage T. Meanwhile, differences across enterprise scale, industries, and provinces should be controlled. Coefficient β2, the product of government subsidies and strength of policy, is used to capture the mediating effect among government subsidies on the business performance. If government subsidies are beneficial for the development of the innovative effect, then the value of β2 is significantly higher than 0.

5 Results and discussion

5.1 Correlations between TEP and BPME

Based on the screened sample data of manufacturing enterprises from 2010 to 2013, six groups of regressions are performed on Model 1 by using Stata 13.1. Table 4 presents the estimation results of β1 in each group of regression.

The indices indicate that β1 of total industrial output value is 0.94, that is, the total output of regulated enterprises is 94% higher than that of non-regulated enterprises. Furthermore, enterprise scale, industrial added value per capita, wage per capita, capital stock per capita, and TFP of regulated enterprises are 165.1%, 94.8%, 66.5%, 141.2%, and 63.2% higher than those of non-regulated enterprises, respectively. Cross-section analysis highlights that regulated enterprises have considerable performance premium. The TEP is significantly positively correlated with the business performance. The β1 value in all groups of regression is higher than 0 and significant at the 0.1% level.

In the robustness test based on the annual data of samples, the premium of each index of regulated enterprises is higher than that of non-regulated enterprises (Table 5), and the regression results in Table 4 remain unchanged (β1 > 0, significant at the 0.1% level). Clearly, the performance premium of regulated enterprises is obvious, and a robust positive correlation is observed between the policy and business performance. Therefore, Hypothesis 1 is supported. The performance level of enterprises regulated by TEP is relatively higher than that of non-regulated ones, which shows that high firm performance is highly correlated with TEP (Sen et al., 2015), but whether this spillover performance is brought by TEP remains to be further tested.

To recognize the sources of such a correlation, the prior performance of regulated enterprises and “self-selection” effect of the TEP are tested by using data in the base period (2010) and stage 1 (2011). Considering that the TEP is implemented in 2011 and that regulated enterprises may have generally responded in 2010, this paper uses the year 2010 as the base research period. Sample data are brought into Model 2 to obtain the regression results of β1 (Table 6).

According to the regression results in Table 6, total industrial output value, employment scale, industrial added value per capita, wage per capita, capital stock per capita, and TFP of regulated enterprises are higher by 77.9%, 174.4%, 73.3%, 49.7%, 107.9%, and 57.5% than non-regulated enterprises, respectively. Clearly, regulated enterprises are superior to non-regulated enterprises in terms of initial performance, which indicates that the positive correlation between the performance of regulated enterprises and the TEP may be related to the relatively excellent initial performance. The initial performance of an enterprise has an important influence on its later performance (Deng 2018; Zhu et al., 2020). But why do regulated companies have excellent initial performance? Is it because manufacturing companies with excellent initial performance are more likely to be concerned by TEP?

This study constructs a Probit econometric model for the explanatory variable that belongs to the 0–1 type variable in Model 3, and puts the core variable data into this model. Table 7 presents the regression results of the core variables. Taking total industrial output value as an example, Table 7 shows that every 1% improvement in prior performance may increase the probability of being chosen by the TEP by 0.17%.

The remaining indices, except for industrial added value per capita, confirm that improving prior performance may result in the increasing probability of being selected by the TEP. That is, enterprises with excellent performance can easily attract the attention of the regulation. In China, all national policies require a “pilot scheme” on specific objects before being officially released (Hughes et al., 2020; Zheng & Li, 2020; Zhu, 2013). Selecting pilot objects typically holds a certain subjectivity and purpose because running a pilot project requires cost (Ko & Shin, 2017), risk (Chien, 2019), and fairness considerations (Hou et al., 2016), which is a consequence of a game under the superposition of multiple factors and proves the “conscious” selection mechanism of environmental policy to a certain extent.

5.2 Optimization effect

Based on the previous analysis, the TEP carries out a “selection” mechanism, and manufacturing enterprises with excellent performance are easier enlisted by policy regulation. Therefore, the business performance is positively correlated to environmental policies. However, do environmental policies have an optimization effect and thus improve the performance of regulated enterprises?

This study has taken the year 2010 as the base research period and used “after = 1, 2, and 3” to represent the changes in the enterprise performance after the implementation of TEP for 1, 2, and 3 years, respectively. Thus, “after = 1, 2, and 3” refers to the performance changes in 2011, 2012, and 2013, respectively, compared with those in 2010. Meanwhile, the fixed effects of industry, province, and year are controlled for to eliminate the disturbance of the self-selection effect on the optimizing effect of environmental policies. Model 4 is regressed using the sample data, through which the growth rates of the business performance at 1, 2, and 3 years after the TEP are implemented. Table 8 provides the regression results of β1.

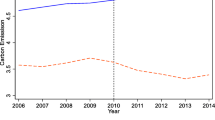

Table 8 shows that after one year of the TEP implementation, the growth rate of all the performance indices of the sample enterprises decreased in varying degrees (β1 < 0). Greenstone et al. (2012) found almost all of the effect occurs in the first year of nonattainment status, suggesting that environmental investments in pollution abatement have a short-term impact on productivity. Growth rates in terms of total industrial output value and enterprise scale became positive at 0.129 and 0.124 after two years, respectively. Meanwhile, the reduction of growth rates of other indexes shrank gradually but turned positive after three years (β1 > 0). Clearly, the TEP initially inhibits the business performance, and then improves performance (Lanoie et al., 2008). In the early stage, manufacturing enterprises play games with environmental regulation policies, thereby affecting their business performance. The growth rate of the business performance decreases due to the policy regulation. However, over time, enterprises should have adapted to policies continuously and have taken the initiative to carry out innovations on the production mode and adjust management activities. These initiatives can promote a balance between the enterprise development and the environmental policy and then improve the business performance. Therefore, same with previous researches (Hu et al., 2017; Peng et al., 2018; Wu, 2017), the environmental regulation can indeed improve the growth rate of enterprise performance. Therefore, same with previous researches (Hu et al., 2017; Peng et al., 2018; Wu, 2017), we also find the inverted U-shape trend of enterprise performance changes (Deng & Li, 2020), and the environmental regulation can indeed improve the growth rate of enterprise performance.

Nevertheless, this study poses the question of whether the influence of the same environmental regulation policy on the performance of different manufacturing enterprises is the same. The regression analysis in Model 5 is performed by introducing policy intensity. Table 9 presents the regression results of γ1.

According to Table 9, the growth rate of TFP increased annually within the observation period. The growth rates of remaining five indices declined one year after the TEP but turned positive one by one after two years. Moreover, the growth rates of all indices increased with the strengthening of the policy. The following is the explanation for this tendency. At the beginning of the TEP implementation, enterprises experienced difficulty in adapting to the external shocks brought about by the policy in the short run, thereby decreasing business performance and the relevant growth rates of enterprises. To prevent a further reduction of the performance, regulated enterprises positively responded to policy regulations and carried out initiatives to strengthen the technological innovation and improvement of the production mode. Innovation is an indispensable factor to promote the growth of enterprise productivity (Aghion & Howitt, 1992), and new technologies may substantially reduce the long-run cost of abatement (Harmsen et al., 2019; Jaffe et al., 2003; Wu et al., 2019). In this sense, regulated enterprises could offset the negative effects of policy variables on production cost during the game with policy regulation, thereby reversing the decreasing growth rate of business performance. Researchers have found that strict policies will stimulate enterprises to strengthen R&D and obtain more patents related to environmental protection (Jaffe & Palmer, 1997). This point of view is widely accepted (Brunnermeier & Cohen, 2003; Calel & Dechezleprêtre, 2016), for the development of enterprises needs to be at the cost of innovation expenditure (Aghion et al., 2016).

In order to ensure the robustness of the research results, this paper uses the method of heterogeneity analysis, which is conducted from the perspectives of differences in ownership, region and industry, to test. According to the Regulation on Registration and Classification of Enterprises published by the National Bureau of Statistics and State Administration for Market Regulation of China, all manufacturing enterprises in the database are classified according to ownership with reference to the authoritative division in the academic circle. The enterprises are further classified into state-owned, private, foreign-funded, and joint-equity enterprises. A regression analysis of Model 5 is conducted on the basis of sub-sample data, which are classified by ownership. Table 10 displays the regression results of γ1.

In general, the growth rates of business performance of all kinds of enterprises first decreased and then increased as the policy regulation strengthened (Table 10), which illustrates that there is an inverted U-shaped relationship between the TEP and the BPME. And what has been proven before that business performance of regulated enterprises is better than that of non-regulated enterprises thereby indicating a considerable optimizing effect of the TEP. Moreover, environmental regulation is more conducive to the development of foreign-funded and private enterprises. Similarly, enterprise samples were divided into eastern, middle, and western enterprises according to geological location, and were divided into labor-, capital-, and technological-intensive enterprises as well. From the above perspective of regions and industries, the results also show the changing characteristic of first decline and then rise, and the environmental regulation turns out to be more effective in improving the performance of western and technological-intensive enterprises. By introducing indicators of performance growth rates and policy stringency, this study confirms that TEP has a strong optimization effect on BPME, and this effect promotes the BPME in varying degrees and is more beneficial for the foreign-funded, private, western, and technological-intensive enterprises. Different from the conclusion of Deng and Li (2020), our results tend to believe that the response of non-state-owned enterprises to environmental regulation policies is more sensitive, while that of state-owned ones is less obvious. But before the promotion effect is released, the environmental regulation policy plays a restraining effect, and over time, this hindering effect will be gradually offset with the increase in environmental performance (Chen et al., 2020). That is, Hypothesis 2 is supported.

5.3 Mechanism-based test

According to previous studies, environmental regulation policies may simultaneously bring negative (cost-increasing effect) and positive (innovative compensation effect) impacts on the business performance of enterprises. That is, the negative effect may be remarkable in the short run, thereby decelerating the growth rate of performance and even causing a negative growth rate. However, the growth rate of performance became positive after a certain period. Is this change attributed to the innovative compensation effect? Hence, regression analysis (Model 6) was conducted, and Table 11 presents coefficients c, a, c′, and b.

As shown in Table 11, the total effect of TEP on the business performance is negative (c = − 0.0193, − 0.1081, −0.3866, −0.3247, −0.1328, and 0.1714, which are all negative and significant at the 0.1% level except TFPs), whereas the policy can facilitate the innovation of enterprises (a = 0.9188, 1.6700, 0.9184, 0.9158, 0.9192, and 0.9524, which are all positive and significant at the 0.1% level). In addition, the innovation has positive effects on the business performance (b = 0.4236, 0.0432, 0.1860, 0.1932, 0.0454, and 0.4245, which are all also positive and significant at the 0.1% level). However, the residual effect of policy on the business performance is negative after eliminating innovation (c′ = − 0.4086, −0.1802, −0.2157, − 0.1478, −0.1746, and −0.2329, which are all negative). Under normal circumstances, a policy’s effect is most obvious in the first few years after the policy is issued (Dong & Liu, 2020). Since TEP was issued in 2011, it is easy to capture the effect in the first several years like 2011 to 2013, and the data of 2010 can be used as the base period data for comparative study. Therefore, measuring the innovation behaviors of enterprises with TFP can notably capture the negative effect of TEP on business performance but positive effect on enterprises innovation (Li et al., 2020; Li, Chi, et al., 2019; Li, Zhao, et al., 2019). This finding demonstrates that the positive growth rate of the business performance may be attributed to the notion that the innovative effect offsets the early cost-increasing effect. In this process, the negative effect of TEP on the BPME was gradually weakened, whereas the positive effect intensified, thus indirectly verifying the existence of the cost-increasing effect. This result also supports Hypothesis 3.

Extended research was discussed on the basis of verification of the innovative compensation effect. Using government subsidies as regulation mechanisms, the positive effects of the TEP on the BPME were verified. Model 7 was calculated, and only the β2 value was introduced. Table 12 presents the regression results.

Table 12 shows that all β2 values are positive. During the implementation of environmental policies, government subsidies are conducive to relieve the impacts and cost increases brought about by policy regulation, thus solidifying and improving the business performance of enterprises (Lim et al., 2018; Zhu & Liao, 2019). The sustainable development of enterprises cannot be realized without innovation, which is an irregular management activity of enterprises. Such a development is characterized by long periods, high risks, and high costs. Government subsidies can offer guidance to and support for the innovation activities of enterprises to an extreme extent (Joo & Suh, 2017), such that enterprises can take the initiative to update technologies, modify production mode, and realize environment-friendly growth (Hizarci-Payne et al., 2020). Therefore, this empirical study finds that government subsidies can improve the business performance (Xu et al., 2020), thereby indirectly confirming the existence of the innovative compensation mechanism.

6 Conclusion

This study has used the China Industry Enterprise Database (2010–2013) and offers evidence that the environmental regulation policy, in the form of TEP, has a positive contribution to BPME, and this link is more often assumed than tested. The results can provide positive references to the assessment of TEP and can be used to verify the Porter Hypothesis to a certain extent. Based on the performance premium of regulated enterprises, the dynamic and inverted U-shaped relationship between the TEP and the BPME is clearly described. The self-selection mechanism and optimizing effect of the TEP are interpreted, which verify its innovative compensation effect on manufacturing enterprises (Deng et al., 2019; Liu, Tong, et al., 2020; Liu, Zhu, et al., 2020). Moreover, such an innovative compensation effect is higher than the cost-increasing effect. Differing from previous opinions, this study also confirms that the environmental regulation policy is more conducive to the performance improvement of non-state-owned, western, and technological-intensive enterprises.

The results provide a further understanding of public policies and offer ideas that are beneficial for improving, adjusting, or diffusing policies. Environmental regulation policies are significant for the sustainable development of economy and society (George et al., 2019; Neves et al., 2020), for the policies are beneficial for environmental protection and can also achieve stable economic growth by promoting enterprise innovation. However, such a regulation must be conditional and limited. Therefore, in practice, Chinese government at all levels should strengthen the collaborations among policies and support the optimization and upgrade of the industrial structure by formulating various environmental regulation policies and implementing effective policy tools. Meanwhile, manufacturing enterprises in China should aim to change their production and management philosophies, positively cope with environmental regulation policies, and increase R&D inputs to realize an innovation-driven development and green growth of performances.

However, some limitations to this research need to be revealed and modified in the future. For instance, although the data of this paper is the latest industrial enterprise data published by the government, it may be a little outdated, which may affect the timeliness of the conclusion. In addition, this paper uses the ratio between the carbon reduction scale and total industrial output value to measure the intensity of environmental regulation policy. Although this method can reflect the regulatory effect of the policy to a large extent, it cannot explain all the effects of the policy. Although this method can reflect the regulatory effect to a large extent in the pro-environmental aspect, it cannot explain the effect in other areas, which means there are still some evaluation loopholes. Future studies need to collect recent data and cases and perfect the research model to analyze precise influences of TEP and that of other environmental regulation policies on the BPME.

References

Aghion, P., Dechezleprêtre, A., Hemous, D., et al. (2016). Carbon taxes, path dependency and directed technical change: evidence from the auto industry. Journal of Political Economy, 124, 1–51. https://doi.org/10.2139/ssrn.2202047

Aghion, P., & Howitt, P. (1992). A Model of Growth Through Creative Destruction. Econometrica, 60, 323–351. https://doi.org/10.2307/2951599

Alpay, E., Kerkvliet, J., Buccola, S. T., et al. (2002). Productivity growth and environmental regulation in mexican and U.S. food manufacturing. American Journal of Agricultural Economics, 84, 887–901. https://doi.org/10.1111/1467-8276.00041

Andersson, U., Forsgren, M., & Holm U. (2015). The Strategic Impact of External Networks: Subsidiary Performance and Competence Development in the Multinational Corporation. In: Forsgren, M., Holm, U., & Johanson, J. (eds). Knowledge, Networks and Power. Palgrave Macmillan, London. https://doi.org/10.1057/9781137508829_13.

Anna, J. B. (2020). Endogenous innovation potential: regional SEMs’ perspective in emerging economies. International Journal of Economics & Business Administration, 4, 435–449.

Baumol, W. J., & Oates, W. E. (1975). The Theory of Environmental Policy (2nd Edition). Cambridge University Press. https://doi.org/10.1017/CBO9781139173513.

Bernard, A. B., & Jensen, J. B. (1999). Exceptional exporter performance: cause, effect, or both? Journal of International Economics, 47, 1–25. https://doi.org/10.1016/S0022-1996(98)00027-0

Boons, F., Montalvo, C., Quist, J., et al. (2013). Sustainable innovation, business models and economic performance: an overview. Journal of Cleaner Production, 45, 1–8. https://doi.org/10.1016/j.jclepro.2012.08.013

Brunel, C., Levinson, A. (2013). Measuring environmental regulatory stringency. OECD Trade and Environment Working Papers, Paris: OECD Publishing. https://doi.org/10.1787/5k41t69f6f6d-en.

Brunnermeier, S., & Cohen, M. A. (2003). Determinants of environmental innovation in US manufacturing industries. Journal of Environmental Economics and Management, 45, 278–293. https://doi.org/10.1016/S0095-0696(02)00058-X

Calel, R., & Dechezleprêtre, A. (2016). Environmental policy and directed technological change: evidence from the European carbon market. The Review of Economics and Statistics, 98, 173–191. https://doi.org/10.1162/REST_a_00470

Chen, Y., Singhal, V., & Zhu, Q. H. (2020). Environmental policies and financial performance: stock market reaction to firms for their proactive environmental practices recognized by governmental programs. Business Strategy and the Environment. https://doi.org/10.1002/bse.2693

Chien, C. V. (2019). Rigorous policy pilots: Experimentation in the Administration of the Law. IOWA Law Review, 104, 2313–2350.

Crotty, J. R. (1992). Neoclassical and Keynesian approaches to the theory of investment. Journal of Post Keynesian Economics, 14, 483–496.

Dechezleprêtre, A., & Sato, M. (2017). The impacts of environmental regulations on competitiveness. Review of Environmental Economics and Policy, 11, 183–206. https://doi.org/10.1093/reep/rey027

Deng, J. Q., Zhang, N., Ahmad, F., et al. (2019). Local government competition, environmental regulation intensity and regional innovation performance: an empirical investigation of Chinese provinces. International Journal of Environmental Research and Public Health, 16, 1–16. https://doi.org/10.3390/ijerph16122130

Deng, X., & Li, L. (2020). Promoting or inhibiting? the impact of environmental regulation on corporate financial performance-an empirical analysis based on China. International Journal of Environmental Research and Public Health, 17(11), 3828. https://doi.org/10.3390/ijerph17113828

Deng, Z., Li, D. Y., & Pang, T. (2018). Effectiveness of pilot carbon emissions trading systems in China. Climate Policy, 18, 992–1011. https://doi.org/10.1080/14693062.2018.1438245

Dong, F., & Liu, Y. J. (2020). Policy evolution and effect evaluation of new-energy vehicle industry in China. Resources Policy, 67, 101655. https://doi.org/10.1016/j.resourpol.2020.101655

Falcone, P. M. (2020). Environmental regulation and green investments: the role of green finance. International Journal of Green Economics, 14, 159–173. https://doi.org/10.1504/IJGE.2020.10032078

Falcone, P. M., Alisa, G., Germani, A. R., & Morone, P. (2020). When all seemed lost a social network analysis of the waste related environmental movement in Campania. Italy. Political Geography., 77, 102114. https://doi.org/10.1016/j.polgeo.2019.102114

Fan, Q. Q., & Zhang, T. B. (2018). Environmental regulation policy and pollution control mechanism in China’s economic growth path. The Journal of World Economy, 41, 171–192. in Chinese.

George, H. E., George, P. J., Emmanuel, H. G., et al. (2019). Environmental regulation and economic cycles. Economic Analysis and Policy, 64, 172–177. https://doi.org/10.1016/j.eap.2019.07.005

Gollop, F. M., & Roberts, M. J. (1983). Environmental regulations and productivity growth: the case of fossil-fueled electric power generation. Journal of Political Economy, 9, 654–674. https://doi.org/10.2307/1831072

Gray, W. B., & Shadbegian, R. J. (2003). Plant vintage, technology, and environmental regulations. Journal of Environmental Economics and Management, 46, 384–402. https://doi.org/10.1016/S0095-0696(03)00031-7

Greenstone, M., List, J. A., & Syverson, C. (2012). The effects of environmental regulation on the competitiveness of U.S. manufacturing. Working Papers, Massachusetts Institute of Technology, Dept. of Economics, Cambridge, MA: Department of Economics, Massachusetts Institute of Technology, 12–24. https://doi.org/10.2139/ssrn.1759405.

Grossman, G. M., & Krueger, A. B. (1995). Economic growth and the environment. Quarterly Journal of Economics, 110, 353–377. https://doi.org/10.2307/2118443

Guo, Z., Zhou, X. M., & Wang, P. (2013). Analysis of the impact of environmental policy on China’s economic sustainability: based on CGE model. Shanghai Journal of Economics, 25, 70–80. (in Chinese).

Hamamoto, M. (2006). Environmental regulation and the productivity of Japanese manufacturing industries. Resource and Energy Economics, 28, 299–312. https://doi.org/10.1016/j.reseneeco.2005.11.001

Hami, N., Muhamad, M. R., Ebrahim, Z., et al. (2015). The impact of sustainable manufacturing practices and innovation performance on economic sustainability. Procedia CIRP. https://doi.org/10.1016/j.procir.2014.07.167

Harmsen, J. H. M., van Vuuren, D. P., Nayak, D. R., et al. (2019). Long-term marginal abatement cost curves of non-CO2 greenhouse gases. Environmental Science & Policy, 99, 136–149. https://doi.org/10.1016/j.envsci.2019.05.013

He, W. J., Tan, L. M., Liu, Z. J., et al. (2020). Property rights protection, environmental regulation and corporate financial performance: revisiting the porter hypothesis. Journal of Cleaner Production, 264, 121615. https://doi.org/10.1016/j.jclepro.2020.121615

Henderson, D. J., & Millimet, D. L. (2005). Environmental regulation and US state-level production. Economics Letters, 87, 47–53. https://doi.org/10.1016/j.econlet.2004.08.013

Hizarci-Payne, A. K., Ipek, I., & Kurt, G. G. (2020). How environmental innovation influences firm performance: a meta-analytic review. Business Strategy and the Environment. https://doi.org/10.1002/bse.2678

Hou, J., Liu, Y. S., & Wu, Y. (2016). Comparative study of commercial building energy-efficiency retrofit policies in four pilot cities in China. Energy Policy, 88, 204–215. https://doi.org/10.1016/j.enpol.2015.10.016

Hu, D., Wang, Y. D., & Huang, J. S. (2017). How do different innovation forms mediate the relationship between environmental regulation and performance? Journal of Cleaner Production, 161, 466–476. https://doi.org/10.1016/j.jclepro.2017.05.152

Hughes, S., Yordi, S., & Besco, L. (2020). The role of pilot projects in urban climate change policy innovation. Policy Studies Journal, 48, 271–297. https://doi.org/10.1111/psj.12288

Jaffe, A. B., Newell, R. G., Stavins, R. N., et al. (2003). “Technological change and the environment”, In Mäler, K. G., & Vincent, J. R. Handbook in Environmental Economics, Chapter 11, 461–516, Elsevier Science. https://doi.org/10.2139/ssrn.252927.

Jaffe, A. B., & Palmer, K. L. (1997). Environmental regulation and innovation: a panel data study. The Review of Economics and Statistics, 79, 610–619. https://doi.org/10.1162/003465397557196

Joo, H. Y., & Suh, H. (2017). The effects of government support on corporate performance hedging against international environmental regulation. Sustainability, 9, 1–25. https://doi.org/10.3390/su9111980

Jorgenson, D. W., & Wilcoxen, P. J. (1990). Environmental regulation and U.S economic growth. Rand Journal of Economics, 21, 314–340. https://doi.org/10.2307/2555426

Ko, K., & Shin, K. (2017). How Asian countries understand policy experiment as policy pilots? Asian Journal of Political Science, 25, 253–265. https://doi.org/10.1080/02185377.2017.1360784

Lanjouw, J. O., & Mody, A. (1996). Innovation and the international diffusion of environmentally responsive technology. Research Policy, 25, 549–571. https://doi.org/10.1016/0048-7333(95)00853-5

Lanoie, P., Laurentlucchetti, J., Johnstone, N., et al. (2011). Environmental policy, innovation and performance: new insights on the porter hypothesis. Journal of Economics and Management Strategy, 20, 803–842. https://doi.org/10.1111/j.1530-9134.2011.00301.x

Lanoie, P., Patry, M., & Lajeunesse, R. (2008). Environmental regulation and productivity: new findings on the Porter hypothesis. Journal of Productivity Analysis, 30, 121–128. https://doi.org/10.1007/s11123-008-0108-4

Lee, J., Veloso, F. M., & Hounshell, D. A. (2011). Linking induced technological change, and environmental regulation: evidence from patenting in the US auto industry. Research Policy, 40, 1240–1252. https://doi.org/10.1016/j.respol.2011.06.006

Li, H., He, F., Shao, Y. M., et al. (2018). The effects of environmental regulation and financial constraints on corporate R&D investment in China. Journal of Scientific & Industrial Research, 77, 442–446.

Li, J., Zhao, M., & Yang, Y. E. (2019a). Environmental regulation and firms’ performance: a quasi-natural experiment from China. Chinese Journal of Population, Resources and Environment, 17, 278–294. https://doi.org/10.1080/10042857.2019.1651193

Li, Y., Chi, Y. H., & Lin, T. Y. (2019b). Coal production efficiency and land destruction in China’s coal mining industry. Resources Policy, 63, 1–11. https://doi.org/10.1016/j.resourpol.2019.101449

Li, Y., Ding, L. L., & Yang, Y. L. (2020). Can the introduction of an environmental target assessment policy improve the TFP of textile enterprises? a quasi-natural experiment based on the huai river basin in China. Sustainability, 12, 1–19. https://doi.org/10.3390/su12041696

Lian, T. H., Ma, T. Y., Cao, J., et al. (2016). The effects of environmental regulation on the industrial location of China’s manufacturing. Natural Hazards, 80(2), 1381–1403. https://doi.org/10.1007/s11069-015-2008-z

Lim, C. Y., Wang, J. W., & Zeng, C. (2018). China’s “mercantilist” government subsidies, the cost of debt and firm performance. Journal of Banking & Finance, 86, 37–52. https://doi.org/10.1016/j.jbankfin.2017.09.004

List, J. A., McHone, W. W., & Millimet, D. L. (2004). Effects of environmental regulation on foreign and domestic plant births: is there a home field advantage? Journal of Urban Economics, 56, 303–326. https://doi.org/10.1016/j.jue.2004.03.007

Liu, M., Liu, Y., & Zhao, Y. L. (2021). Environmental compliance and enterprise innovation: empirical evidence from Chinese manufacturing enterprises. International Journal of Environmental Research and Public Health, 18(4), 1924. https://doi.org/10.3390/ijerph18041924

Liu, Y., Tong, K. D., Mao, F., et al. (2020b). Research on digital production technology for traditional manufacturing enterprises based on industrial. International Journal of Advanced Manufacturing Technology, 107, 1101–1114. https://doi.org/10.1007/s00170-019-04284-y

Liu, Y. Q., Zhu, J. L., Li, E. Y., et al. (2020a). Environmental regulation, green technological innovation, and eco-efficiency: the case of Yangtze River economic belt in China. Technological Forecasting and Social Change, 155, 1–21. https://doi.org/10.1016/j.techfore.2020.119993

Majumdar, S. K., & Marcus, A. A. (2001). Rules versus discretion: the productivity consequences of flexible regulation. Academy of Management Journal, 44, 170–179.

Martin, R., Wagner, U. J., & Preux, L. B. D. (2009). The impacts of climate change levy on business: Evidence from microdata. LSE Research Online Documents on Economics.

Millimet, D. L., & List, J. A. (2004). The Case of the Missing pollution haven hypothesis. Journal of Regulatory Economics, 26, 239–262. https://doi.org/10.1007/s11149-004-7550-7

Mohr, R. D. (2002). Technical change, external economies, and the porter hypothesis. Journal of Environmental Economics and Management, 43, 158–168. https://doi.org/10.1006/jeem.2000.1166

Neves, S. A., Marques, A. C., & Patricio, M. (2020). Determinants of CO2 emissions in European union countries: does environmental regulation reduce environmental pollution? Economic Analysis and Policy, 68, 114–125. https://doi.org/10.1016/j.eap.2020.09.005

Olley, S., & Pakes, A. (1996). The dynamics of productivity in the telecommunications equipment industry. Econometrica, 64, 1263–1298. https://doi.org/10.2307/2171831

Peng, B. H., Tu, Y., & Elahi, E. (2018). Extended Producer responsibility and corporate performance: effects of environmental regulation and environmental strategy. Journal of Environmental Management, 218, 181–189. https://doi.org/10.1016/j.jenvman.2018.04.068

Porter, M. E. (1991). America’s green strategy. Scientific American, 264, 168. https://doi.org/10.1038/scientificamerican0491-168

Porter, M. E., & Linde, C. V. D. (1995a). Green and Competitive: Ending the Stalemate. Long Range Planning, 6, 128–129. https://doi.org/10.1016/0024-6301(95)99997-E

Porter, M. E., & Linde, C. V. D. (1995b). Toward a new conception of the environment-competitiveness relationship. Journal of Economic Perspectives, 9, 97–118. https://doi.org/10.1257/jep.9.4.97

Provasnek, A. K., Schmid, E., Geissler, B., et al. (2017). Sustainable Corporate entrepreneurship: performance and strategies toward innovation. Business Strategy and the Environment, 26, 521–535. https://doi.org/10.1002/bse.1934

Qian, S. S., Gao, M., & Huang, Q. H. (2019). Has environmental regulation achieved a win-win situation of energy conservation and emission reduction and economic growth? Ecological Economy, 35, 154–160. (in Chinese).

Rammer, C., Gottschalk, S., Peneder, M., et al. (2017). Does energy policy hurt international competitiveness of firms? a comparative study for Germany, Switzerland and Austria. Energy Policy, 109, 154–180. https://doi.org/10.1016/j.enpol.2017.06.062

Rubashkina, Y., Galeotti, M., & Verdolini, E. (2015). Environmental regulation and competitiveness: empirical evidence on the porter hypothesis from European manufacturing sectors. Energy Policy, 83, 288–300. https://doi.org/10.1016/j.enpol.2015.02.014

Sato, M., Singer, G., Dussaux, D., & Lovo, S. (2015). International and sectoral variation in energy prices 1995–2011: How does it relate to emissions policy stringency? GRI Working Papers 187, Grantham Research Institute on Climate Change and the Environment.

Saygili, M. (2016). Pollution abatement costs and productivity: does the type of cost matter? Letters in Spatial and Resource Sciences, 9, 1–7. https://doi.org/10.1007/s12076-014-0127-x

Sen, P., Roy, M., & Pal, P. (2015). Exploring role of environmental proactivity in financial performance of manufacturing enterprises: a structural modelling approach. Journal of Cleaner Production, 108, 583–594. https://doi.org/10.1016/j.jclepro.2015.05.076

Shadbegian, R. J., & Gray, W. B. (2005). Pollution abatement expenditures and plant-level productivity: a production function approach. Ecological Economics, 54, 196–208. https://doi.org/10.1016/j.ecolecon.2004.12.029

Testa, F., Iraldo, F., Frey, M., et al. (2011). The effect of environmental regulation on firms’ competitive performance: the case of the building & construction sector in some EU regions. Journal of Environmental Management, 92, 2136–2144. https://doi.org/10.1016/j.jenvman.2011.03.039

Ungerman, O., & Dedkova, J. (2020). Model of the circular economy and its application in business practice. Environment Development and Sustainability, 22, 3407–3432. https://doi.org/10.1007/s10668-019-00351-2

Walley, N., & Whitehead, B. (1994). It’s not easy being green. Harvard Business Review, 72, 46–51. https://doi.org/10.1145/2342356.2342398

Walter, I. (1982). “Environmentally induced industrial relocation to developing countries,” In S.J. Rubin and T.R. Graham (eds.), Environment and Trade, New Jersey: Allanhead, Osmun and Co.

Wang, C., & Zhang, Y. (2020). Does environmental regulation policy help improve green production performance? evidence from China’s industry. Corporate Social Responsibility and Environmental Management, 27, 937–951. https://doi.org/10.1002/csr.1857

Wang, Y., & Zhi, Q. (2016). The role of green finance in environmental protection: two aspects of market mechanism and policies. Energy Procedia, 104, 311–316. https://doi.org/10.1016/j.egypro.2016.12.053

Wu, G. C. (2017). Environmental innovation approaches and business performance: effects of environmental regulations and resource commitment. Innovation-Organization & Management, 19, 407–427. https://doi.org/10.1080/14479338.2017.1358102

Wu, L. P., Chen, Y., & Feylizadeh, M. R. (2019). Study on the estimation, decomposition and application of China’s provincial carbon marginal abatement costs. Journal of Cleaner Production, 207, 1007–1022. https://doi.org/10.1016/j.jclepro.2018.10.082

Wu, M. L., Wang, X. H., Chen, X. F., et al. (2020). The threshold effect of R&D investment on regional economic performance in China considering environmental regulation. Technology Analysis & Strategic Management, 32, 851–868. https://doi.org/10.1080/09537325.2020.1715362

Xu, J., Wang, X. H., & Liu, F. (2020). Government subsidies, R&D investment and innovation performance: analysis from pharmaceutical sector in China. Technology Analysis & Strategic Management. https://doi.org/10.1080/09537325.2020.1830055

Yao, Y., Jiao, J. L., Han, X. F., et al. (2019). Can constraint targets facilitate industrial green production performance in China? energy-saving target vs emission-reduction target. Journal of Cleaner Production, 209, 862–875. https://doi.org/10.1016/j.jclepro.2018.10.274

Yu, C. H., Wu, X. Q., Zhang, D. Y., et al. (2021). Demand for green finance: resolving financing constraints on green innovation in China. Energy Policy, 153, 112255. https://doi.org/10.1016/j.enpol.2021.112255

Zheng, S. L., & Li, Z. C. (2020). Pilot governance and the rise of China’s innovation. China Economic Review, 63, 1–18. https://doi.org/10.1016/j.chieco.2020.101521

Zhu, L., Wang, X., & Zhang, D. Y. (2020). Identifying strategic traders in China’s pilot carbon emissions trading scheme. Energy Journal, 41, 123–142. https://doi.org/10.5547/01956574.41.2.lzhu

Zhu, X. F. (2013). Learn from China’s local pilot schemes. Nature, 502, 38–38. https://doi.org/10.1038/502038b

Zhu, Z. S., & Liao, H. (2019). Do subsidies improve the financial performance of renewable energy companies? evidence from China. Natural Hazards, 95, 241–256. https://doi.org/10.1007/s11069-018-3423-8

Acknowledgements

We thank the anonymous reviewers for their helpful comments on this manuscript.

Funding

This research was supported financially by National Social Science Fund of China (No. 14BZZ021 and No. 16BZZ056).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of Interest

The authors declare no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhang, Y., Wang, J., Chen, J. et al. Does environmental regulation policy help improve business performance of manufacturing enterprises? evidence from China. Environ Dev Sustain 25, 4335–4364 (2023). https://doi.org/10.1007/s10668-022-02245-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-022-02245-2