Abstract

Energy transitions are a complex technological-economic and social process. Currently, this involves the impact that innovation in technology and information as well as social practices can have on the way the energy is used. Therefore, business becomes much more complex and risky. In the particular case of the European Union, recent years were also marked by multiple changes at the political, economic, social and environmental context. Changes are already in course posing new challenges to European Electricity Utilities. The question that arises is how these subjects impact the structure, consolidation and governance of the electricity utilities and which drivers have the greatest impact on the speeding up the change. It is also our aim to understand how companies are responding to transition challenges in order to ensure the sustainability of their activities and their healthy stay in the market. In this article we present an insight of this issue through the analysis of thirteen indicators on the seven largest European energy utilities. Results allowed comprising the effects of the different economic and financial contexts on the variables under study.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

It is widely recognized that energy transitions always involve two main axes: massive infrastructure investment and governance. This becomes particularly critical for the ongoing energy transition to a low-carbon, sustainable energy system. Actually, the present concept of energy transition goes beyond that one which was currently used in 2007: “how to transform the economy in order to reduce emissions.” For energy utilities, namely for electricity utilities, times are highly uncertain. Therefore, it is interesting to understand how electric utilities have defined their corporate strategies in a changing and tendentially unstable environment, and as a consequence, how these strategies have impacted on the level of corporate performance.

As Sorrell (2015) states, the fastest, cheapest and safest way to mitigate climate change is to improve energy efficiency and to reduce energy demand. However, this is not straightforward and it can be highly controversial. Beyond the environmental problem, energy transition also comprises other major challenges which go far beyond a mere technological, infrastructure question: demand management, new market models—as capacity markets and virtual plants—and new market agents such as start-ups, prosumers among others. In this framework, there is an unprecedented governance challenge for governments, utilities and society as a whole.

In particular, the European electricity sector is characterized by a specific regulatory framework and responds to a set of policy measures applicable throughout the euro zone. In addition to the liberalization of the electricity market, the European Union (EU) has been promoting renewable energies (RE), energy efficiency and decentralized electricity generation. Concerns about fossil fuels, in particular the level of price volatility, the exposure to supply disruptions by non-EU countries and the increasing attention to anthropogenic factors in climate change, have led to a demand for energy alternatives integrated into a common scenario at European level. The focus on renewable energy sources and energy efficiency has been seen as a key element of European policy to reduce energy dependency from non-EU countries, to restrict greenhouse gas emissions and to decouple energy prices from fossil fuels. Innovation in technologies, processes and products has been seen as playing a key role in pursuing these objectives and in promoting a low-carbon economy.

Besides the regulatory and policy framework that conditions the activity of the electric utilities, the European electricity sector, which is characterized by a great dynamism, was also affected by the recent financial and economic crisis.

The present paper characterizes economic, social, financial and environmental aspects that partially configure a context of changes and uncertainty in which electric utilities are integrated. Through these dimensions, the behaviour and performance of a set of European utilities are evaluated, in a particular phase of the sector transition towards a new economic, social, organizational and technological paradigm.

The evaluation includes a qualitative and quantitative analysis, based on disclosed corporate information, with the aim of understanding how European electric utilities identified and harvested opportunities for change, while seeking a balance among stakeholders. In the case under study, utilities corporate performance is assessed through a set of indicators, those most representative and reflecting the areas more affected by the ongoing changes, calculated based on information published by European electric utilities as part of their own annual, sustainability or corporate social responsibility reports.

As results, we seek to identify the main drivers of change and the consequent strategies adopted by companies to respond to an unstable business environment. It is also intended to characterize opportunities and threats for incumbents to challenge the current scenario of pessimism, as well as the indicators and results that characterize this change in corporate terms.

The article is structured as follows: the next section presents an overview of the current energy transition and the main challenges in the energy sector; Sect. 3 describes the methodology; and in Sect. 4 main results are analysed. Finally, Sect. 5 concludes and indicates the next topics for our research.

2 Energy transition

The concept of energy transition has been approached in several ways in different contexts. Sovacool (2016) worked to present some definitions of energy transitions brought from the academic and policy literature. Following this author there is no standard or ordinarily accepted definition in the recent academic literature, but there is a common theme within them. Energy transition involves some change in an energy system, usually to a particular fuel source or technology. Some studies choose to focus on fuel dimension, such as oil, coal, gas and uranium, causing some to criticize this point of view. Other authors focus on the technological changes and others on the consequent social, political and economic impacts. Further visions quest to encompass the way technology shifts may affect stakeholders (suppliers, distributors, users, traders, regulators among other). Miller and Richter (2014) emphasize that energy transition is mainly about “social affairs and social considerations”. In this field, beyond the usual questions of employment, energy prices and energy access, energy transition implies both changes in the technological energy system and changes in the social system. Due to the complex grid of interactions intertwined among them, they in fact may be assumed a socio-technological system.

As a matter of fact, there is no precise definition in this matter and available proposals are still open because the complexity and time scale of the subject (Sovacool 2016).

On the other hand, Fabra et al. (2015) propose that energy transition is the set of policies and structural changes target in decarbonising the economy. European countries are implementing national policies to facilitate this transition through ambitious targets and policies to reduce emissions, increase renewable resources and improve energy efficiency. Fabra et al. (2015) review on the experience in Germany, UK and France reveals that the energy transition is a long process that requires a strong political support to deal with the conflicts of interests that may emerge when technologies, social aspects and institutions change.

Energy transition and technological options are typically two members of the same equation which solution involves profound and differential impacts both macroeconomic and microeconomic, namely in terms of investments and business strategies. Therefore, the economic science shall be in charge of the debate on the various dimensions concerned: innovation processes, social dynamics, employment, regulation, governance, welfare and economic growth.

A transition from a non-renewable energy system to a system based on renewable and sustainable energy sources has already begun in many countries (Biegel et al. 2014). Notwithstanding, there is a general consensus that energy systems of industrialized countries, namely the European Union (EU), are unsustainable. Climate change concerns, energy security problems, energy poverty and a problematic management of hybrid energy systems require an accelerated change to fundamental restructuring of the whole system and thus of the economy itself.

In short, energy transition means much more than new technologies. Indeed, one must be aware that energy systems are based on certain economic, social, political and organizational patterns (Miller et al. 2015; Sovacool 2014; Miller and Richter 2014).

3 Changes and challenges in energy sector

Changes in EU energy sector are grounded in two main sources: on the one hand, the EU’s policy framework, which strongly emphasises the search for autonomous and secure energy, the liberalization of energy markets and the promotion of a low-carbon economy, and on the other, the sector subordination to markets autonomous dynamics, mostly those relating to shifts on energy supply and demand and to industry-specific factors, namely technology developments and system operation.

During the last decades of twentieth century, European electric power sector rooted a sustained growth based on a steady demand increase escorted by the raise of wholesale prices. The system was operated accordingly to a centralized paradigm, adapted to follow and satisfy an unpredictable, inelastic and variable demand through a predictable and centralized supply. Electricity was provided to consumers through a passive and unidirectional network, and demand peaks were cautioned through installed capacity, in general based on fossil fuels or nuclear technologies. Large generators, while integrated into a scenario of political, economic and regulatory stability, have resorted to large investments in productive infrastructures, basing the competitive advantages on investment barriers to new entrants (asset-related advantages) and on economies of scale. The producing cost of electricity was heavily dependent on the price of raw materials (fossil fuels) and consequently the structure of costs relied on a high weight of variable costs.

However, profound changes have emerged simultaneously from EU political frameworks and from market fundamentals that posed unprecedented challenges for incumbent utilities to strive and growth.

3.1 EU’s policy framework

The EU has implemented two major reforms in its energy and climate policy. The first is the progressive liberalization of the electricity and gas markets and the second the ambitious plan for the energy and climate sectors as part of the so-called 2020 Climate and Energy Package. The Paris Agreement required urgent tackling energy-related greenhouse gas emissions to meet the long-term climate objectives and reinforced EU decarbonisation goals, while keeping a competitive and secure energy sector. In this context, “countries need to define and implement policies for an accelerated clean energy transition” (EC 2011).

The EU ambitious goals, of reducing its greenhouse gas emissions by 40% by 2030 relating 1990 levels and the plan to move to a carbon-free power sector by 2050, require a paradigm move that involves significant changes in upstream, grid and downstream organization and technologies. The energy transition cannot be achieved without considerable investment in new forms of electricity production, to ensure the replacement of existing facilities at the end of life with other less carbon-intensive and more “flexible” capacity, while enabling the reduction of CO2 emissions (Genoese and Egenhofer 2015). This path unveils three structural changes: (1) the increasing intermittence of production affecting the electrical system; (2) the development of means to control demand; (3) transition to capital-intensive assets with low marginal cost. In fact, a new cycle of investments for replacing end-of-life equipment is getting closer and it should be integrated into the previous concerns and objectives. If this opportunity for transforming European energy system is missed, there is the risk of performing it in an unadjusted manner maintaining carbon-intensive assets while EU remains tied to high emissions for the next decades (EC 2011).

Verbruggen et al. (2015) stressed that “the electricity sector is essential for spearheading the transition to a low-carbon energy economy” but recent events have shown that energy transition is sensitive to pressures from traditional energy systems developing efforts to delay the transition speed. To deal with, it may be necessary to define new economic models with new variables assumed to be predominant. New business models and reinforced financial management strategies, as well as innovative production and energy management techniques, are key to respond appropriately to ongoing changes (Ratinen and Lund 2012). Respondents have also to reposition themselves from the position of energy suppliers to product and service providers. However, mobilizing capital to invest in renewable energy technologies is particularly challenging in a context of global economic uncertainty (EC 2011). Masini and Menichetti (2013) call for the importance of understanding the behavioural context in which investors, which can play a key role, make decisions, in order to leverage some key drivers of the investment process.

A set of forces has been working in the transformation of the European sector, transforming it into a more distributed and simultaneously more connected system. Therefore, at this stage of development for a distributed and connected system, centralized generation and distributed generation technologies contribute to a more diversified electrical matrix. Transmission and distribution segments increasingly share with bidirectional flows and greater automation and intelligence in the network. The role of the consumer in this phase changes from a passive agent to one with the ability to share the energy it generates in the network, becoming a prosumer. The new system also presents another aspect of sustainability, with increasing renewable generation, efficiency and energy security.

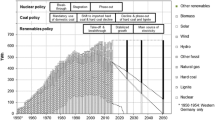

To provide a change in the system in the face of the challenges presented, incumbent companies are investing in increasing generation capacity, infrastructure and network improvements, e.g. with smart meter implementation programs, R&D incentives, incentive programs for collaborators, funds dedicated to research, among others. This requires financial resources or financial engineering and new skills for product and service development and for innovation. It should be noted that funding to assist in the transition process comes from R&D Funds set-up in the EU with contributions from member countries. The EU released funds to finance investment projects aimed at achieving the 2020 targets for smart, sustainable and inclusive growth, including low-carbon projects. The transition for a cleaner European energy matrix had also the feed-in-tariffs as a viability mechanism for investments. The mechanism used for renewable sources is the establishment of a sales tariff above the market rate. Therefore, the feed-in-tariffs guarantee a price to the generator for a period of up to 20 years, being attractive because of reducing the risks of the ventures. The measures implemented allowed doubling electricity production in 5 years from 238 TWh in 2007 to 463 TWh in 2013, changing the energy matrix and reducing CO2 emissions (OECD/IEA 2014). During 2008–2012 generation from fossil fuel power plants reduced by 260 TWh, and it is expected that this trend to continue for 2012–2020 and 2020–2035, with reductions in fossil and nuclear generation in the order of 200 TWh for both periods. Growth in renewable generation was supported by an increase in installed capacity of around 100 GW between 2008 and 2012, with particular emphasis in wind and solar PV. For the periods 2012–2020 and 2020–2035 is expected the increment of renewable capacity of about 140 and 165 GW respectively (OECD/IEA 2014).

3.2 Market dynamics

Following Tayal (2016) “as market dynamics force the hand of electricity utilities globally, changing the business model away from a conventional, grid-based system towards one that embraces distributed solar and storage across the entire network is the only long-term solution for electricity businesses”. However, in competitive markets, the utilities are more exposed to the threats that appear from the new technologies such PV solar or storage systems, in part due to expected reduction in electricity use and demand. The transition of electricity business to news ways of operating may also be inhibited by some remaining barriers such as regulatory, institutional and financial frameworks.

One other aspect is the banking sector view about the energy transition. Some banking institutions have already identified the decentralized electricity system as a necessary transition given the financial impact that would result from maintain existing models and have adjusted credit and stock ratings of involved electricity business accordingly. Other still assume that the financial risk created by disruptive technologies involve declining utility revenues, increase costs and investments and lower profitability potential (Tayal 2016).

Structural changes occurring in electricity markets all over the world are significantly affecting the type of players and business models operating in these markets. The development of smart consumption and smart production implies markets that are no longer dominated by (pre-liberalization) vertically integrated firms. Nowadays, many small players, with very diverse core activities, are entering the market and completely changing the value chain. These structural changes have important economic and social impacts.

According to Burger and Weinmann (2014), the European electricity supply industry faces sudden and drastic changes to its traditional business model. Decentralized and renewable energy generation turns the previous one-way street from power generation to load centres upside down, and millions of European consumers become producers. In addition, new entrants from other industry sectors threaten the dominant position of the established companies.

In fact, since 2008 power sector has been confronted with a set of circumstances that led to the fall of electricity prices, the reduction of demand and the loss of shareholder value for publicly traded utilities (McKinsey and Company 2014). Between 2004 and 2008, the increasing electricity demand across Europe and the steady increase in commodities prices led to an increase in wholesale prices and a high profitability for electric utilities. From 2008 onwards, this trend has changed as a result of the confluence of the following factors: reduced electricity demand due to economic deceleration; decline in fossil fuel prices as a result of the fall in the carbon price and the commercialization of shale gas; increased installed capacity resulting from prior investment decisions; promotion of new energy and environmental policies in EU. As a result, the incumbents found themselves saddled with oversupply capacity, in face of falling prices and declining profits. Between 2008 and 2013, total profits declined by almost 30% in power sector (McKinsey and Company 2014). The crisis had a direct financial impact on power utilities performance, while EU political framework demanded for new operating systems and new business models.

In this scenario, following Burger and Weinmann (2016), energy companies in continental Europe have to face a challenge, once the expected business growth in proper traditional markets was not assured. The challenge was to grow in new markets or to transform into Utilities 2.0 becoming a provider of service solutions to maintain revenues (Accenture 2015).

3.3 Paradigm shift in the sector

In short, market fundamentals and EU policies pushed the electric sector towards a new organizational, social and technological paradigm. The promotion of renewable energies as lead to a decentralized production of electricity based on generators from variable size, geographically disperse, taking advantage for natural availability of RE resources. Electricity-producing costs for RE are, on the one hand, very little dependent on the costs of raw materials, but on the other, very dependent on a heavy fixed cost structure. New players are entering in the system (prosumers, service providers, traders) affecting the pattern electricity is produced and used. An integrated, disperse and flexible system with emphasis on demand management and on storage poses new challenges in planning, design and operation the electricity networks/power systems (Schleicher-Tappeser 2012; Lund et al. 2016). The new paradigm brings less controllable electricity demand and supply which requires more monitoring and smarter control of the system to safely find energy demand with optimal generation level and network capacity.

4 Methodology and results

4.1 Utilities responses to the challenges

In recent years we have seen important changes in the EU electricity sector that will intensify in the coming decades. Drivers of change undergo through decentralized low-carbon power generation system, new technologies development, energy efficiency enhancement, restrictive environmental policies, commodities prices volatility, digitalization and greater weight and participation of new market players. The previous drivers may configure groundbreaking challengers for electric utilities business model (see Fig. 1).

Some authors as McKinsey and Company (2014) and Sioshansi (2015) defend that the traditional competition advantages of the electric utilities are now losing position or being transformed into disadvantages relating new entrants, which may present greater agility to respond to recent changes. New investments and investor mobilization (EC 2011; Verbruggen et al. 2015; Masini and Menichetti 2013) are essential for enhancing the defined objectives. Corporate performance is a nuclear vector to minimize risks and uncertainties and to capture new investments.

The present paper intends to understand how companies sailed the hectic waters of the crisis and prepared themselves to face the ongoing changes. In particular, economic and financial performance of power sector companies was examined during three distinct periods (2005–2007 pre-crisis period; 2008–2011 crisis period; and 2012–2015 post-crises period) to analyse the effects of a rapidly changing external environment on corporate performance and on the business commitment with the policies in course. For this purpose, an analysis of the collected data relating electric utilities economic and financial but also environmental and social performance was fulfilled. For this purpose was used a Analysis of Variance (ANOVA) to identify statistic significance between the groups of variables from the three defined periods. The software SPSS was used to apply the technique. Variance of each variable was split into components explained by different sources. In the present case, it was assumed that significant differences among group averages for the same variable were accounted by a set of factors from the external environment of companies. The following issues, which were assumed as the most relevant for the mentioned effects, framed the collection of data: profitability, efficiency on assets use, asset management, debt discipline, decarbonisation and renewable energy (see reasoning in Table 1).

4.2 Sample selection and data collection

The sample used in this study comprises the largest seven European electricity generation companies, presenting simultaneously the highest industry values for the following criteria: installed generation capacity (MW), total revenue (euro), total assets (euro), number of employees. The application of the previous criteria to a universe of thirty-two European power companies allowed to select the following sample: EDF, ENEL, EON, ENGIE, Iberdrola, RWE and Vattenfall (see Table 2). All of them present their main headquarters in Europe, although they may possess heavily globalized businesses, at this moment.

Larger companies were chosen as object of the present study. The selection criteria followed four types of rational:

-

They tend to be more affected by the ongoing changes due to the scale of its activities

-

They are subject to greater scrutiny and attention from stakeholders because of its importance on providing goods and services, as also by its dimensioned impacts

-

Its structure and resources allow a greater range of actions that are of interest to analyse

-

They may present a reduced agility in adopting more radical changes because of the size

Data were collected on companies’ publicly available reports since 2005 until 2015 in order to cover a period long enough to recognize the most significant changes in business performance. Given the availability of data and the objectives of the research, a set of indicators considered as the most representative of the companies’ performance in the face of current challenges was selected. The listing and respective reasoning is presented in Table 1.

A first approach to the collected data allowed constructing the following figures to better understand the behaviour of the sample for each one of the defined indicators during the analyses period. As can be verified some indicators present a similar behaviour for all the companies of the sample, while others present a greater variability, in some cases moving in opposite directions (for example, see Figs. 2, 3, 4, 5, 6).

4.3 Results

Nonparametric test, the Kruskal–Wallis test, was used in the analysis, since it was not guaranteed normality criterion. In order to study the effect of external environment changes on the performance of the sample companies, the data were grouped into three categories of dummy that correspond to: 0—pre-crisis period 2005–2007; 1—crisis period 2008–2011; and 2—post-crises period 2012–2015.

Results are presented in Table 3. Using the Kruskal–Wallis test, we conclude that the variables EBITDA, total revenue, net debt, total assets, capital expenditure, net debt/total assets, total annual electricity generation from renewable sources (TWh) and total installed capacity for electricity generation (MW) are significantly influenced by the dummy categories that correspond to period 0, 1, 2.

The results obtained mean that significant differences were found among the average of each one of the previous variables for the three defined periods (2005–2007 pre-crisis period; 2008–2011 crisis period; and 2012–2015 post-crises period).

The distribution of the values of dependent variable total revenue (T_RVN) is different for the three periods. In fact, T_RVN rose during the crisis period for almost all the sample, decreasing during the pos-crisis period but still remaining well above the pre-crisis level. Having to deal with a decreasing electricity demand in EU, utilities answered with investments both in developing markets (e.g. Latin America) and in renewable power plants. In addition to strengthening internationalization, utilities have promoted strategies of vertical and horizontal diversification. As acting in various areas of the value chain (exploration, production, transport and distribution of energy), companies have also invested in new segments (e.g. gas distribution, water or waste treatment) and promoted new costumer services, which diversified the risks and ensured their sources of income through vertical and horizontal business integration.

It was also found statistical significance relating the following variables: net debt (N_DBT); total assets (T_ASS); capital expenditure (CAPEX); net debt/total assets (N_DBT/T_ASS), thus rejecting the null hypothesis. In fact, from 2008 until 2012, in the midst of the financial crisis, most utilities have resorted to bank credit to meet their commitments and to make investments through debt. In this period, which also corresponds to the highest CAPEX values, the debt-to-debt ratio increased for most companies. It reduced in the following period namely due to debt control and the resource to non-banking investment. From 2012, new investors entered in European energy markets providing loans or acquiring social shares.

Relating T_ASS, from 2008 until 2012, most utilities increased their assets following one or more situations: investments related to increases in capacity or installation of renewable energy, defined in previous periods; internationalization investments; fusions; and acquisitions. Results also reflect a reframing of the financial structure of companies to adapt themselves to the market environment, adjusting their indebtedness and reducing its weight in total assets. From 2012 onwards can be observed a reduction of some utilities assets following the decommissioning of nuclear power plants by political decision (e.g. Germany) and the closure of fossil power stations both to tackle the overcapacity problem and to withdraw from the market the less efficient plants. Therefore, the variation in total installed capacity (EL_CAP) shows significant differences over the period under analysis. That seems to confirm the increase of the capacity of renewable energies and the reduction of capacity by decommissioning less efficient and/or more polluting structures. Following Eurostat (2018), EL_CAP increased by 74.3% in the period from 1990 to 2015. However, the structure installed electrical capacity changed significantly over this period. The share of RE has increased, counting with a greater contribution from wind and solar technologies, while the share of nuclear and fossil fuels technologies decreased. The companies under study appear to be in line with this trend.

In the same way, for variable total annual electricity generation from renewable sources (EL_GENRE), the null hypothesis is rejected, as the distribution of variance shows significant differences between the different periods. This result is in line with the annual increases in the production of electricity from renewable sources during the all periods of the analysis (Eurostat 2018). It also reveals a growing weight in the contribution of renewable energy sources to EU electricity production.

The variable EBITDA presented a shifting behaviour among the sample throughout the periods under analysis. While for a given period, some companies present a strong increase in EBITDA, others show a moderate increment or even a decrease. In the following periods this situation may appear completely inverted. However, it was found statistical significance relating this variable means that on average in the sector there were significant changes in profit generation and on value generation for stakeholders.

The use of Kruskal–Wallis test allows to conclude that the remaining variables are not significantly influenced by the dummy categories, which means that distribution is the same for all dummy categories.

The number of employees (EMP_T) shows no significant differences among the three periods, meaning that on average in the sector there were no significant changes on employment. The investment in new markets, products and services allowed both geographical and functional relocation of existing employees and new hiring, which compensate eventual dismissals. In any case, it seems implicit a general concern for the conservation of human resources, preserving intellectual capital and know-how, as well as the return of the investment already made in the training and development of electricity sector employees.

In relation to variable EL_GENT, electricity production in EU has been decreasing over the last 10 years (Eurostat 2018). However, relating the companies from the sample, no statistical significance was identified in order to reject the null hypothesis. This may mean that they have been able to maintain their production levels against the trend of the sector, namely by investing in productive infrastructures outside the EU, or by investing in strategic assets in order to respond to a quite stable electricity demand in EU.

Variables (El_gent_ER/cap_ER) and (El_gent/el_cap) relate electricity generation with installed capacity, respectively, for renewable sources and global sources (fossil and non-fossil). If both terms of the ratio vary in the same direction, then it is possible that it presents no significant differences between the various periods of the analysis. Results may also mean that there are no relevant differences in production efficiency among the three periods considered.

The analysis of EL_CAP_ER indicates that companies from the sample pursued different strategies for RE capacity installation, spread all over the years 2005–2015. The companies started and encouraged their investments in different timeframes, which may imply that on the whole the variable does not present statistically significant differences between the various periods from the study.

Remain variables provide no-conclusive results due to missing data. Therefore, it was not possible to adequately assess the response of companies over time to the challenges of decarbonisation.

5 Conclusions and further research

The Kruskal–Wallis test allows identifying those variables that are significantly influenced by the dummy categories that correspond to pre-crisis period, crisis period and post-crises period.

It can be concluded that the variables relating financial and operational issues are those that present the greatest differences during the period under analysis. This may be due to the very nature of the financial crisis, which was followed by the sovereign debt crisis in the euro zone and the credit crisis. From their major effects may be highlighted the difficulty access to bank credit, the economic activity slowdown and the decline of purchasing power of families, especially in EU.

However, utilities from the sample seem to deal effectively with challenges raised in recent years, namely controlling their indebtedness, managing their assets, human resources and productive capacity, while keeping profitability fairly stable. Also, from the analyses of collected data, it may be recognized that there is a higher renewable power generation in recent years, with the consequent decline in carbonization and an increase in investments in equipment and management in the search for greater efficiency. The cost of renewable technologies has dropped due to more mature and proven technologies, which is more interesting for investors, namely for utilities to diversify theirs production portfolio. To allow financing of new areas, electric utilities reorganized their businesses in different units from organizational structure, namely, in some cases, businesses of renewable generation were separated from those of non-renewable generation, creating new companies for this purpose.

The advantages of size were used to make new investments, to enter and strengthen the position in new markets and to create new strategic partnerships. In some cases firms have segmented their business area into new companies for greater ease of operation, financing and investment. Efficiency gains, sale of services instead of electricity sales and consumer focus, vertical integration, business diversification are being assumed as key issues to value creation. Companies under study also seem to be aware of the social aspects of transition, which are being addressed into their strategies and into the development of new business models.

Challenges posed to electric utilities seem to be properly addressed, namely those relating profitability, debt discipline, asset management and renewable energy.

The analysis ended up focusing mainly on economic and financial results because heavily influenced by the crisis scenario. However, the analysis of the financial and non-financial reports allowed the collection of information, passive of further investigation, suggesting that:

-

Companies’ strive to overcome challenges reinventing solutions through innovation in technology and business. The existing know-how and the signature of protocols with entities from the scientific and technological system allowed speeding up solutions that allowed to follow the dynamics of the new players in the market and to respond to the increasing environmental restrictions.

-

The social aspect of the transition seems to be gaining ground in this new scenario, not only for employment issues, but also for the training and valorisation of employees, the creation of new structures of production, commercialization and consumption and the empowerment of agents from civil society.

-

Digital innovation seems to assume a main role to overcome transitional challenges and it is being strongly supported by electric utilities.

Although the sample was small, it allowed a first exploratory analysis of the effects of the ongoing changes in the performance of companies in the European electricity sector. New opportunities open up to a larger sample and with a wider range of indicators that can also be used to analyse other relevant issues (e.g. research, digitization, business diversification), obtaining more robust and conclusive results. A more comprehensive analysis would be relevant to better understand the reactions and strategies of companies before the emerging challenges, particularly in relation to issues that are still poorly reported.

References

Accenture. (2015). “The digitally enabled grid: How can utilities survive energy demand disruption? Exploring the challenges and opportunities of energy demand disruption in the digital era”.

Biegel, B., Hansen, L. H., Stoustrup, J., Anderson, P., & Harbo, S. (2014). Value of flexible consumption in the electricity markets. Energy, 66, 354–362.

Burger, C., & Weinmann, J. (2014). ESMT Innovation Index 2012—Electricity supply industry. + ESMT Business Brief No. BB–14–01.

Burger, C., & Weinmann, J. (2016). European utilities: Strategic choices and cultural prerequisites for the future. In F. P. Sioshansi (Ed.), Chapter 16: Future of utilities, utilities of the future, Walnut Creek: Elsevier.

Fabra, N., Matthes, F., Newbery, D., Colombier, M., et al. (2015). The energy transition in Europe: Initial lessons from Germany, the UK and France, towards a low carbon European power sector. Cerre - Centre on Regulation in Europe.

EC European Commission. (2011). Energy roadmap 2050. Communication COM (2011) 885 final of 15 December.

Eurostat. “Statistics explained—Maximum electrical capacity (MW) EU-28, from 1990–2015”. http://ec.europa.eu/eurostat/statistics-explained/index.php/Electricity_and_heat_statistics. Accessed Feb 22, 2018.

Genoese, F., & Egenhofer, C. (2015). Reforming the market design of EU electricity markets: Addressing the challenges of a low-carbon power sector. CEPS task force report, July 2015.

IEA (2016). “World energy outlook 2016” factsheet. International Energy Agency. Retrieved from http://www.worldenergyoutlook.org/media/publications/weo/WEO2016Factsheet.pdf.

Lund, H., et al. (2016). Energy storage and smart energy systems. International Journal of Sustainable Energy Planning and Management, 11, 3–14.

Miller, C. A., Richer, J., & O’Leary, J. (2015). Socio-energy systems design: A policy framework for energy transitions. Energy Research & Social Science, 6, 29–40.

Miller, C., & Richter, J. (2014). Social planning for energy transitions. Current Sustainable/Renewable Energy Reports, 1, 77–84.

McKinsey & Company. (2014). “Beyond the storm: value growth in the EU power sector”. European Electric Power and Natural Gas. McKinsey & Company, Inc.

Masini, A., & Menichetti, E. (2013). Investment decisions in the renewable energy sector: An analysis of non-financial drivers. Technological Forecasting and Social Change, 80, 510–524.

OECD/IEA (2014). Energy policies of IEA countries, European Union 2014 Review, International Energy Agency. Retrieved from https://www.iea.org/publications/freepublications/publication/EuropeanUnion_2014.pdf.

Ratinen, M., & Lund, P. (2012). Analysing changes in electricity industries against actors and technologies: Utility to business transformations in Denmark, Germany, Finland and Spain. Journal of Technology Management & Innovation, 7(2), 87–100.

Schleicher-Tappeser, R. (2012). How renewables will change electricity markets in the next five years. Energy Policy, 48, 64–75.

Sioshansi, P. (2015). Electricity utility business not as usual. Economic Analysis & Policy, 48, 1–11.

Sorrell, S. (2015). Reducing energy demand: A review of issues, challenges and approaches. Renewable and Sustainable Energy Reviews, 47, 74–82.

Sovacool, B. K. (2014). What are we doing here? Analyzing fifteen years of energy scholarship and proposing a social science research agenda. Energy Research & Social Science, 1, 1–29.

Sovacool, B. K. (2016). How long will it take? Conceptualizing the temporal dynamics of energy transitions. Energy Research & Social Science, 13, 202–215.

Tayal, Dev. (2016). Disruptive forces on the electricity industry: A changing landscape for utilities. The Electricity Journal, 29, 13–17.

Verbruggen, A., et al. (2015). Europe’s electricity regime: Restoration or thorough transition. International Journal of Sustainable Energy Planning and Management, 05, 57–68.

EDF Annual reports; Corporate Social Responsibility reports or Sustainability reports (from 2004 to 2015).

ENEL Annual reports; Corporate Social Responsibility reports or Sustainability reports (from 2004 to 2015).

E.ON Annual reports; Corporate Social Responsibility reports or Sustainability reports (from 2004 to 2015).

ENGIE Annual reports, Corporate Social Responsibility reports or Sustainability reports (from 2004 to 2015).

IBERDROLA Annual reports, Corporate Social Responsibility reports or Sustainability reports (from 2004 to 2015).

RWE Annual reports, Corporate Social Responsibility reports or Sustainability reports (from 2004 to 2015).

Vattenfall Annual reports, Corporate Social Responsibility reports or Sustainability reports (from 2004 to 2015).

ENEL (2016). Capital Markets Day (Strategic Plan 2017–19).

Iberdrola (2016). Outlook 2016–2020, Update, London, February 2016.

Author information

Authors and Affiliations

Corresponding author

Additional information

3rd International Conference on Energy and Environment, Porto, 2017.

Rights and permissions

About this article

Cite this article

Guerra-Mota, M., Aquino, T. & Soares, I. European electricity utilities managing energy transition challenges. Environ Dev Sustain 20 (Suppl 1), 213–230 (2018). https://doi.org/10.1007/s10668-018-0170-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-018-0170-7