Abstract

The present study investigates the relationship between land degradation and the evolution of the productive structure in Italy during the last 50 years (1960–2010). The objectives of the study are twofold: (i) to present and discuss an original analysis of the income–environment relationship in an economic-convergent and environmental–divergent country and (ii) to evaluate the impact of the (changing) productive structure and selected socio-demographic characteristics on the level of land vulnerability. The econometric analysis indicates that the relationship between GDP and land degradation across Italian provinces is completely reverted once we move from a cross-sectional analysis to panel estimates. While economic and environmental disparities between provinces go in the same direction, with richer provinces having lower levels of LD, over time the growth process increases LD with the economic structure acting as a significant variable.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The increasing importance of the ‘local’ and ‘regional’ dimensions in environmental policies and sustainable development strategies reflects the multifaceted interactions among the economic sphere and the ecological systems (Franceschi and Kahn 2003; Briassoulis 2011; Dasgupta et al. 2006). While impacting both emerging and developed countries, the degradation of the environment induced by biophysical and socio-economic drivers is strongly influenced by the territorial disparities observed between countries or regions (Galeotti 2007). Although the environment–economy debate is mainly based on the question whether a continued economic growth is a sufficient condition to reduce the human pressure on the environment (Dasgupta et al. 2002), socio-economic disparities have been a growing concern in sustainable development issues (Zuindeau 2007). Moreover, land resource polarization in healthy and disadvantaged regions determined spatially diverging rates of environmental degradation (Boyce 1994; Barrett and Graddy 2000; Fingleton 2001; Heerink et al. 2001; Kahuthu 2006).

Decreasing pressure on the environment may therefore depend on a combination of policy and economic factors oriented towards the reduction of socio-economic disparities among regions. Assessment has taken place and evidence found in the regional convergence of economic variables, population and social factors, life quality indicators, environmental governance and policy strategies (Rupasingha et al. 2004; Paudel et al. 2005; Papyrakis and Gerlagh 2007; Ranjan and Shortle 2007). However, convergence in variables depicting environmental degradation processes has less frequently been assessed in developed countries (Cavlovic et al. 2000; Aldy 2005; Chimeli 2007).

The hypothesis about the existence of a U-shaped relationship between environmental degradation and income, the so-called Environmental Kuznets curve (EKC), has fostered increasing interest among scientists and politicians for the (supposedly) beneficial role of rising income for environmental quality (Caviglia-Harris et al. 2008). According to the EKC hypothesis, accelerated wealth creation by economic growth is a precondition for the technological progress that, in turn, would provide a better environment (Magnani 2000, 2001; Bimonte 2002). At lower income levels, consumers prefer commodities other than the environment which results in the lack of ‘greening’ of products and policies (Spangenberg 2001; Vona and Patriarca 2011). Such a relation could be linear (de-coupling hypothesis) or polynomial (re-linking hypothesis). The EKC hypothesis, however, has received critical responses from both the theoretical and empirical perspective (Chimeli 2007; Galeotti 2007; Muller-Furstenberger and Wagner 2007). Moreover, there are few theoretical grounds to support the existence of an EKC relationship for other specific processes like soil resource depletion, land degradation and desertification risk (Salvati et al. 2011).

The present study is aimed at contributing to these knowledge gaps by investigating the relationship over time and space between a (divergent) process of environmental degradation and a (convergent) process of economic growth during the last 50 years (1960–2010) in Italy, a southern European country with different levels of land vulnerability and marked socio-economic disparities. The investigated process is land degradation (LD henceforth), a complex phenomenon induced by natural and anthropogenic drivers occurring in both developing and emerging countries (Sommer et al. 2011). Their ultimate outcome is the drastic reduction of land productivity with important socio-economic consequences (Romm 2011). Global warming, landscape transformations and population growth are responsible for triggering large-scale processes of LD (Geist and Lambin 2004). The Mediterranean region was recognized as a critical hotspot for LD due to the synergic impact of these factors in the last decades (Hill et al. 2008).

By investigating a time span of 50 years, Salvati et al. (2011) found an increasing environmental gap between ‘structurally vulnerable’ lands and non-vulnerable lands in Italy. Moreover, the long-term economic path of the country has been characterized by a continuous internal economic convergence from World War II to the end of the 1970s followed by a substantial stability in the average growth rate among regions. Beyond these facts stylized by two simplified indicators of income and environmental degradation, the Italian economic structure was changing drastically towards service-oriented activities and the ‘made in Italy’ industry, agricultural firms developed through quality production determining an overall reduction of utilized crop surface and socio-demographic dynamics rapidly modified the urban–rural axis traditionally observed before the 1980s: all these processes could have important consequences on the environment (Salvati and Zitti 2009).

The present study contributes to these issues exploring, with an empirical panel analysis based on six time observations (1960, 1970, 1980, 1990, 2000 and 2010), the relationship between the (possibly divergent) process of land degradation observed in the Italian provinces and the spatially heterogeneous income growth correcting for changes in the economic structure.

The objectives of the paper are twofold: (i) to present and discuss an original analysis of the income–environment relationship in an economic–convergent and environmentally divergent country and (ii) to evaluate how the (rapidly changing) economic structure impacts this relationship.

LD is measured by an index based on the on the Environmental Sensitive Area framework. Various interdisciplinary EU research projects carried out extensive evaluations of LD vulnerability using the same framework in several Mediterranean areas (Portugal, Spain, Italy, Greece) (e.g., Basso et al. 2000; Kosmas et al. 1999).

The structure of the paper is as follows: in Sect. 2, we provide descriptive evidence on economic and environmental dynamics in Italy; in Sect. 3, we describe our dataset and provide an econometric estimation of the impact of socio-economic variables on LD; Sect. 4 provides summary conclusions and policy implications.

2 Environmental divergence and economic convergence in Italy (1960–2010): the overall picture

Environmental quality has many different dimensions. All these dimensions have strict connection with each other, while each single dimension has different links with economic phenomena. In this paper, we focus on the aspect of environmental quality concerning LD which is described by an index that uses the ESA framework (ESAI). The procedure integrates indicators from different data sources and has been validated in several target sites (e.g., Basso et al. 2000; Kosmas et al. 1999).Footnote 1

Italy as study area presents some peculiarities. It is a Mediterranean country covering 301,330 km2 of which 23 % is flat, 42 % is hilly and 35 % is mountainous (Salvati and Bajocco 2011). The geographical partition into three divisions (North, Centre and South) reflects territorial disparities in the country with northern Italy, being one of the most developed regions in Europe and southern Italy, including Sicily and Sardinia, being one of the most disadvantaged regions in southern Europe. Italy shows disparities in population density, settlement distribution and natural resource availability and represents a paradigmatic case study to address the importance of the (changing) economic structure influencing the spatial distribution of vulnerable land (Costantini et al. 2009; Santini et al. 2010; Bajocco et al. 2011). The geographical distributions of the ESAI in the initial (1960) and final (2010) years of the sample are shown in Fig. 1. In both periods, the higher values of this LD index correspond to the Po plain, Apulia, Sardinia, Sicily and the provinces of Rome and Naples.

Figure 2 reports the variations along the whole period and along the two sub-periods 1960–1980 and 1980–2010. Consistently, we analysed in Salvati et al. (2011), the average ESAI score increased at the national scale from 1.34 in 1960 to 1.36 in 2010, indicating higher LD in the most recent period. A sharp increase was concentrated along the Adriatic coast, the Po plain and northern Sardinia. Besides, the analysis of the sub-periods shows different patterns of Land Degradation. While in the first period, the increases in the ESAI were concentrated all along the Adriatic coast, in the Centre-South in general, in North Sardinia and in Sicily, in the second period, the geographic distribution of the LD process was quite different since it mainly concerned in the North West and in South Sardinia with all the Centre South experiencing an increase in the ESAI below the country’s average (Fig. 3).

Change in ESAI between 1960 and 2010 (left panel) and in the two subsamples 1960–1980 (centre panel) and 1980 and 2010 (right panel). Source: own elaboration on data provided by Consiglio per la Ricerca e la sperimentazione in Agricoltura (CRA). Note: classes represent the quartiles of the distribution; the class including the zero has been shifted in order to separate positive and negative changes

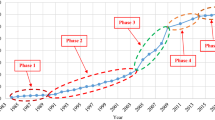

The extent of the spatial disparities on LD can be summarized by calculating the Gini coefficient of the ESAI distribution across Italian provinces (see Fig. 5). From 1960 to 2010, the Gini coefficient of the ESAI increased by 4.2 %, indicating an overall divergence in the level of LD. Besides, by looking at the infra-period evolution, a more fragmented and interesting picture emerges. During the period from 1960 to 1980, a process of sharp divergence occurred since the Gini coefficient increased monotonically by 25 %. In the following period, an opposite process of convergence (−17 %) took place.

The geographic distributions of economic and environmental disparities in Italy have strong similarities, in particular concerning the relevance of the North–South axis. However, over time the two phenomena experienced opposite patterns. Figure 4 displays the change in GDP per capita in the two sub-periods. Regional relative economic performance has not changed as much as LD dynamics. However, it is worth to notice that on average, the regional economic end environmental dynamics seem to be negatively related, with regions experiencing high economic growth in each sub-period having lower LD dynamics in the same time span.

This diverging trend of the spatial evolution of LD and per capita GDP growth is the starting point of our analysis. This can be explained referring to Fig. 5 where we plot the annual Gini coefficient of the Italian provinces per capita GDP (economic Gini) and the 5 years laggedFootnote 2 ESAI Gini (environmental Gini). The economic Gini shows a fairly opposite pattern compared to the ESAI. Indeed, regional economic inequalities have decreased during the process of industrialization of the South, while, on the contrary, LD was initially diverging; this picture changed after 1980 when the economic GINI increased again, while environmental conditions were converging.

In our view, this puzzle can be solved once we make the two following hypotheses: (i) poorer regions are usually characterized by higher LD; (ii) the specific path of economic growth that occurred in Italy since the 1960s had a negative impact (eventually lagged) on LD. In other words, considering the stylized fact on Italian regional economic growth, we can assume that during the first part of the time-span considered a process of economic catch-up occurred and thus poorer regions—with lower environmental quality—have grown more with a resulting higher land depletion that increased regional inequalities in LD. An exactly opposite argument holds for the following period of economic divergence and environmental convergence.

Over the same time span considered, Italy experienced a huge process of structural change moving from a development paradigm based on industrialization to the so-called tertiarization process. Indeed, the national ratio between value added in industry and in the service sector decreased from 79 % in 1960 to 34 % in 2010. Besides, regional disparities have been huge also from this perspective since the tertiarization process was more intense in the Centre-South provinces (Fig. 7) where the service sector was already dominant due to the low industrial base (Fig. 6). Thus, it seems that the process of structural change can provide further insight on the relationship between LD and the economic dynamics and transformations.

Change in industry to services ratio between 1960 and 2010 (left panel) and in the two subsamples 1960–1980 (centre panel) and 1980 and 2010 (right panel). Source: own elaboration on ISTAT. Note: classes represent the quartiles of the distribution; for the highest class in the left panel this distinction was not applied because only a single province reports a positive growth

Finally, another important driver of land degradation is the demographic pressure. In particular, in the first sub-period, Italy experienced an increase in population density in the North as a result of a process of North to South migration (Figs. 8 and 9). Such a process slightly persisted in the second sub-period although the decreasing demographic trend in the South stopped as a result of migrations from foreign countries. Indeed, this happened in particular from the late 1980s when Italy shifted from being a net emigration country to a net immigration one.

Population’s percentage growth between 1960 and 2010 (left panel) and in the two subsamples 1960–1980 (centre panel) and 1980 and 2010 (right panel). Source: own elaboration on ISTAT. Note: classes represent the quartiles of the distribution; the class including the zero has been shifted in order to separate positive and negative changes

All in all, the descriptive evidence seems to suggest interesting links between the process of LD and the evolution of economic and demographic variables. The econometric analysis in the next section will help us to understand whether these links are statistically significant and whether there is a causality relation that goes from socio-economic indicators to LD.

3 Desertification risk and socio-economic dynamics in Italy: empirical analysis

3.1 Data description

The variables used in the present study have been made available at the NUTS-3 province scale (110 administrative units actually existing in Italy) from data provided by official statistical sources (mainly obtained from censuses of agriculture, population, and industry carried out by the Italian National Statistical Institute) for six time periods: 1960, 1970, 1980, 1990, 2000 and 2010. Since the number of Italian provinces increased over time, we proceeded to a re-aggregation of provincial data to the structure existing in 1960 for the purpose of not loosing important information on the administrative units subject to changes. The final sample is thus made of 92 provinces over 6 time periods for a total of 552 observations.

Together with the ESAI, a total of seven indicators have been calculated from the collected variables for each province. The chosen indicators are as follows: GDP, the shares of agriculture, industry and services in provincial GDP (AgrShare, IndShare and SvcShare), population density (PopDens), the total surface of agricultural land (TasShare) expressed as the percentage of the total surface area, and the average farm size (TasFirm). The selection of variables, the procedure for the construction of indicators, and the identification of the thematic dimensions needed to describe the territorial context possibly influencing the level of land vulnerability at the local scale have been set up according to the indications provided in Vogt et al. (2011). Although the indicators selected in the present study cannot be considered as an exhaustive description of the local socio-economic context in Italy, they provide a broad qualification of the economic structure, social traits and urban/rural characteristics observed in the Italian provinces. All selected indicators are easily and freely available from national statistical sources and regularly updated through time, allowing for full replicability of the illustrated approach.

3.2 Econometric analysis

The econometric analysis is developed with the aim to assess the relationship between LD, measured by the ESAI, and the economic characteristics and performances of Italian provinces. More specifically, we carried out two different analyses: in the first one, we test a relation between the ESAI and GDP per capita in cross-sectional terms with the aim to explain differences between provinces; in the second one, we assess the determinants of changes over time of the ESAI within each province, where primary importance is given to the growth performance. The between-province relation of the ESAI with the per capita income is assessed by estimating a simple quadratic function as in the following equation:

where the LD indicator e is a quadratic function of per capita GDP (expressed in deviation from the national mean) and a noise term ε. We further add the population density d as control variable since GDP is expressed in per capita terms, and thus, this variable allows to taking into account the impact of the effective demographic pressure. The quadratic term is introduced in order to control for nonlinearities in the relation as in the case of a L-shaped or U-shaped curve. In both cases, we would expect a positive quadratic term together with a negative linear coefficient, implying that for low levels of GDP per capita the relation is negative, while the curve becomes flatter or even increasing when the average income increases above a certain level.

Since the ESAI is an index ranging between 1 and 2, OLS regressions might not be appropriate as they could return predicted values outside this range. A solution would be to apply a log odd transformation to the rescaled (between 0 and 1) ESAI. Such procedure did not alter the estimation results (available upon request); hence, we preferred to use the standard form of the index because estimated coefficients have a clearer interpretation.

Because of the panel structure of the data, the use of a simple pooled OLS would return biased results as within and between provinces changes cannot be disentangled. To solve this problem, we use a between-group estimator, which eliminates within groups changes by estimating Eq. (1) on group means calculated over the six time intervals. The between-group estimates indicate the average relation across provinces over the period 1960–2010, but given the long time span, this relation may change over time. For this reason, we run OLS regressions of Eq. (1) for each of the six waves. In this case too, the only source of variability comes from provincial differences since all observations refer to a single year.

The second step of the analysis is to assess the determinants of the evolution of the ESAI within each province over time.Footnote 3 This is done by estimating Eq. (1) in a panel framework as in Eq. (2):

where ν and η are the fixed effects and time dummies, respectively, y is GDPFootnote 4 and X is the vector of control variables. The introduction of the fixed effects controls for unobserved heterogeneity so that estimated coefficients capture only the time variation within each province and not the variability between groups. Time dummies control for specific shocks affecting all provinces in the same way in a specific year, such as the effect of the EU membership and the increased competition in some specific sectors from emerging countries like Spain and Portugal. We carried out five panel estimates adding sequentially four control variables selected form the indicators described in Sect. 2 and in Sect. 3.1. The first two variables allow to taking into account the sectoral composition of production: the share of value added in agriculture (AgrShare), and the ratio of the value added in the industrial sector to the value added in the service sector (Ind/Ser). We further add two control variables describing the agricultural sector: the average spatial dimension of agricultural firms (TasFirm) and the ratio of agricultural land over the total surface (TasShare). All these additional variables were tested in the cross-sectional estimates but have been dropped since all the correspondent coefficients were found non-significant.

As we already introduced above, the impact of economic processes on the environment has a relevant time dimension. Coherently, all regressors were lagged by one period (10 years). This formulation avoids problems of simultaneous causality—in particular for AgrShare, TasFirm and TasShare—which may lead to biased coefficients.Footnote 5 In addition, this choice is justified on a theoretical ground by considering the typical slowness of environmental processes in response to changes in socio-economic conditions. Besides, the estimates with the contemporaneous values of the independent variables confirm the main results and are included in Appendix.

According to the analysis in Sect. 2, since many socio-economic processes can be read in the North–South dimension, the dynamic analysis is also carried on by splitting the estimation into Centre-North and Centre-South provinces.

4 Results

Between-group estimates suggest the existence of a nonlinear relation between per capita GDP and LD across Italian provinces (Table 1), while population seems to play no role in explaining such differences. The linear coefficient for GDP is negative, while the square coefficient is positive and both are significant, indicating a significant nonlinear relation between LD and economic development. According to the coefficients of column 1, the turning point of the quadratic relation is reached for a GDP per capita above the national average by 20 %, implying that most of the observations lie in the range for which the ESAI-GDP relationship is negative while a minority of other observations concern regions located in the flat part of the, actually ‘L-shaped’, curve for which the effect is negligible.

The estimates for each wave (Table 2) confirm this relation for the years between 1980 and 2010, while for 1960 and 1970, the negative relation prevails since the quadratic coefficient is lower and less significant. These results suggest that poorer provinces are associated with a lower land quality.Footnote 6 Nonetheless, starting from the 1980s, the difference between rich and poor provinces was less pronounced because of the changing performances due to the process of economic convergence experienced in most of the second half of the last century. To sum up, the cross-sectional analysis points to an overall negative, although eventually convex, relationship between per capita GDP and the ESAI.

Compared with the cross-sectional estimates, the fixed effect estimates (Table 3) provide a different picture. The relationship between GDP and the ESAI is strictly positive and linear as the squared term is never significant. This means that, once checking for the variation within the geographical areas, economic growth impact negatively the environment, in line with the de-coupling hypothesis, contributing to land degradation in Italy, a process that has consequently been stronger in fast-growing provinces. The reliability of the fixed effect formulation is confirmed by the Hausman test shown at the bottom of Table 3. The coefficient of GDP is always significant and increases when controlling for the economic structure, passing from 0.037 to 0.044.

Among the other variables, population density and the share of agriculture in provincial GDP increase the degree of LD, whereas a higher share in industry relative to services was associated to lower values of the ESAI. While the land consumption effects of the primary sector is straightforward, the latter result is not trivial since both industry and services might impact negatively on the land quality. Nevertheless, the higher impact of service activities on LD might be explained by the complementarity with infrastructural developments (railroads, airports, tourism facilities) and by the increasing urbanization of marginal areas.

The estimates for the two subsamples of Centre-North and Centre-South (Table 4) indicate that the effects of GDP and population density are significant and of similar magnitude in the two regions. The main difference lies in the impact of structural change, which is significant only in the Centre-South sample. This result is in line with the stronger increase in the relative of the service sector in southern provinces documented in Sect. 2.

Finally, the estimates with contemporaneous regressors (Appendix, Tables 5 and 6) give the same sign for the value-added coefficient, confirming our main result, whereas the other variables are not significant, proving the effectiveness of our specification in eliminating the endogeneity bias.

5 Conclusions

In the present study, we analysed the relationship between land degradation and the economic structure of the Italian provinces during a period encompassing 50 years, from 1960 to 2010. The focus on the productive structure of Italian provinces was therefore conducted with the aim of verifying whether changes in the economic base at local scale might impact the spatial distribution (and variations over time) of a process of environmental degradation strongly linked to the local socio-economic context (Salvati and Zitti 2009). In this perspective, the time span investigated here is particularly meaningful since it encompasses different phases of the post-war Italian economic system: from the process of industrialization to the shift towards a post-modern, service-centred society (Antrop 2000).

As the econometric analysis figured out, from a cross-sectional perspective, economic variables and LD levels have a similar geographical distribution: poorer regions are usually characterized by higher LD. Such inequalities had slightly reduced along the whole period considered. However, the analysis of time changes allowed by the fixed-effects panel estimates depicts a different framework since areas with higher GDP growth rate have experienced increasing LD. Among the other variables used as controls, population density, the share of agricultural activities and the relevance of the service sector significantly increase the level of LD. Thus, we can conclude that the specific path of economic growth had a significant impact on the LD process.

Our findings show the limits of the theoretical approach à la EKC and stress instead the importance of territorial disparities (Ansuategi 2003; Bruvoll and Medin 2003; Maddison 2006; Auffhammer and Carson 2008) and specific processes of structural change from both the economic and the environmental side (Patriarca and Vona 2012).

While the income variable still provides a valuable indication of the development stage of a territory with a direct impact on the level of LD, changes in the economic structure at the local scale should be considered as a possible driver especially due to (indirect) feedback effects on the environment (Mukherjee and Kathuria 2006). Developmental policies should incorporate measures to reduce the impact of rapid changes in the economic base, especially as far as the society shifts from traditional rural systems, with low population density and limited accessibility, to service-oriented, high-density territories (Tan 2006). Results indicate that these processes can consolidate the environmental gap between rich and poor regions (Salvati and Zitti 2009), thwarting possible beneficial effects of development on the environment or even promoting negative feedbacks, as indicated by rural poverty-LD spirals possibly observed in some southern Italian districts.

Coordination between multi-target policies specifically aimed at contrasting the spiral between LD and poverty, economic marginality and socio-demographic polarization seems an effective strategy to reduce environmental disparities and socio-economic inequalities (Briassoulis 2011; Patriarca and Vona 2012). To promote a more spatially equitable and polycentric development (Zuindeau 2007), these integrated policies should avoid approaches stimulating the development of single economic sectors through state-induced industrialization as occurred during the post-war phase (1950–1990) in southern Italy.

Notes

This LD index ranges from 1 to 2. The ESAI procedure is described in the sample descripition section.

We lag the ESAI in the Figure by 5 years since we consider the process of growth to act in-time and that this process causes, with a delay, a change in the environmental GINI. In other words economic changes happen fist and exert a delayed effect on LD.

As we are using variables at 10 years intervals, problems of non stationarity of the series and possible spurious results are ruled out.

In the cross-section estimation we used GDP per capita to compare provinces having different dimension. In the dynamic estimation we shift to GDP we analyse changes and thus, since there’s no dimensional bias, we address directly the impact of overall economic growth. However, estimations using the per capita GDP return very similar results (available upon request).

Simultaneous causality can be better addressed by using an IV type estimator, but unfortunately, due to the peculiarity of the dataset (Italian provinces over 50 years) we could not find suitable instruments.

Since we do not assess causality at this stage the negative relation can be also due to the land endowment. Economic activities tend to locate where infrastructures are better developed. Hilly regions, for example, are likely to act as a barrier to economic growth due to the difficulty to develop transport links to markets.

References

Aldy, J. E. (2005). An environmental Kuznets curve analysis of U.S. state-level Carbon Dioxide emissions. Journal of Environment and Development, 14, 48–72.

Ansuategi, A. (2003). Economic growth and transboundary pollution in Europe, an empirical analysis. Environmental and Resource Economics, 26, 305–328.

Antrop, M. (2000). Changing patterns in the urbanized countryside of Western Europe. Landscape Ecology, 15(3), 257–270.

Auffhammer, M., & Carson, R.T. (2008). Forecasting the path of China’s CO2 emissions using province-level information. Journal of Environmental Economics and Management, 55(3), 229–247.

Bajocco, S., Salvati, L., & Ricotta, C. (2011). Land degradation versus fire: A spiral process? Progress in Physical Geography, 35(1), 3–18.

Barrett, S., & Graddy, K. (2000). Freedom, growth, and the environment. Environment and Development Economics, 5, 433–456.

Basso, F., Bove, E., Dumontet, S., Ferrara, A., Pisante, M., Quaranta, G., & Taberner, M. (2000). Evaluating environmental sensitivity at the basin scale through the use of geographic information systems and remotely sensed data: An example covering the Agri basin (Southern Italy). Catena, 40, 19–35.

Bimonte, S. (2002). Information access, income distribution, and the environmental Kuznets Curve. Ecological Economics, 53, 145–156.

Boyce, J. K. (1994). Inequality as a cause of environmental degradation. Ecological Economics, 11, 169–178.

Briassoulis, H. (2011). Governing desertification in Mediterranean Europe: The challenge of environmental policy integration in multi-level governance contexts. Land Degradation and Development, 22(3), 313–325.

Bruvoll, A., & Medin, H. (2003). Factors behind the environmental Kuznets Curve: A decomposition of the changes in air pollution. Environmental and Resource Economics, 24, 27–48.

Caviglia-Harris, J.L., Chambers, D., & Kahn, J.R. (2008) Taking the “U” out of Kuznets: A comprehensive analysis of the EKC and environmental degradation. Ecological Economics, 68(4), 1149–1159.

Cavlovic, T. A., Baker, K. H., Berrens, R. P., & Gawande, K. (2000). A meta-analysis of environmental Kuznets Curve studies. Agricultural and Resource Economics Review, 29(1), 32–42.

Chimeli, A. B. (2007). Growth and the environment, are we looking at the right data? Economic Letters, 96, 89–96.

Costantini, E. A. C., Urbano, F., Aramini, G., Barbetti, R., Bellino, F., Bocci, M., et al. (2009). Rationale and methods for compiling an atlas of desertification in Italy. Land Degradation and Development, 20, 261–276.

Dasgupta, S., Hamilton, K., Paudey, K. D., & Wheeler, D. (2006). Environment during growth: accounting for governance and vulnerability. World Development, 34(9), 1597–1611.

Dasgupta, S., Laplante, B., Wang, H., & Wheeler, D. (2002). Confronting the Environmental Kuznets Curve. Journal of Economic Perspectives, 16(1), 147–168.

Fingleton, B. (2001). Externalities, economic geography, and spatial econometrics: Conceptual and modelling developments. International Regional Science Review, 2, 197–207.

Franceschi, D., & Kahn, J. R. (2003). Beyond strong sustainability. The International Journal of Sustainable Development & World Ecology, 10, 211–220.

Galeotti, M. (2007). Economic growth and the quality of the environment: Taking stock. Environment, Development and Sustainability, 9, 427–454.

Geist, H. J., & Lambin, E. F. (2004). Dynamic causal patterns of desertification. BioScience, 54, 817–829.

Heerink, N., Mulatu, A., & Bulte, E. (2001). Income inequality and the environment: Aggregation bias in environmental Kuznets curves. Ecological Economics, 38, 359–367.

Hill, J., Stellmes, M., Udelhoven, T., Roder, A., & Sommer, S. (2008). Mediterranean desertification and land degradation: Mapping related land use change syndromes based on satellite observations. Global and Planetary Change, 64(3–4), 146–157.

Kahuthu, A. (2006). Economic growth and environmental degradation in a global context. Environment, Development and Sustainability, 8, 55–68.

Kosmas, C., Kirkby, M., & Geeson, N. (Eds.). (1999). The MEDALUS Project, Mediterranean desertification and land use: Manual on key indicators of desertification and mapping Environmentally Sensitive Areas to desertification. Luxembourg: Office for Official Publications of the European Communities.

Maddison, D. (2006). Environmental Kuznets curves: A spatial econometric approach. Journal of Environmental Economics and Management, 51, 218–230.

Magnani, E. (2000). The environmental Kuznets curve, environmental protection and income distribution. Ecological Economics, 32, 431–443.

Magnani, E. (2001). The Environmental Kuznets Curve: Development path or policy result? Environmental Modeling & Software, 16, 157–165.

Mukherjee, S., & Kathuria, V. (2006). Is economic growth sustainable? Environmental quality of Indian States after 1991. International Journal of Sustainable Development, 9, 38–60.

Muller-Furstenberger, G., & Wagner, M. (2007). Exploring the environmental Kuznets hypothesis: Theoretical and econometric problems. Ecological Economics, 62, 648–660.

Papyrakis, E., & Gerlagh, R. (2007). Resource abundance and economic growth in the United States. European Economic Review, 51, 1011–1039.

Patriarca, F., & Vona, F. (2012). Environmental Taxes, Inequality and Technical Change. Revue de l’OFCE, Presses de Sciences-Po, 0(5), 389–413.

Paudel, K. P., Zapata, H., & Susanto, D. (2005). An empirical test of environmental Kuznets curve for water pollution. Environmental and Resource Economics, 31, 325–348.

Ranjan, R., & Shortle, J. (2007). The environmental Kuznets curve when the environment exhibits hysteresis. Ecological Economics, 64, 204–215.

Romm, J. (2011). Desertification: The next dust bowl. Nature, 478, 450–451.

Rupasingha, A., Goetz, S. J., Debertin, D. L., & Pagoulatos, A. (2004). The Environmental Kuznets Curve for US countries: A spatial economic analysis with extensions. Paper Regional Science, 83, 407–424.

Salvati, L., & Bajocco, S. (2011). Land sensitivity to desertification across Italy: Past, present, and future. Applied Geography, 31(1), 223–231.

Salvati, L., Bajocco, S., Mancini, A., Gemmiti, R., & Carlucci, M. (2011). Socioeconomic development and vulnerability to land degradation in Italy. Regional Environmental Change, 11(4), 767–777.

Salvati, L., & Zitti, M. (2009). Convergence or divergence in desertification risk? Scale-based assessment and policy implications in a Mediterranean country. Journal of Environmental Planning and Management, 52(7), 957–971.

Santini, M., Cacciamo, G., Laurenti, A., Noce, S., & Valentini, R. (2010). A multi-model GIS framework for desertification risk assessment. Applied Geography, 30(3), 394–415.

Sommer, S., Zucca, C., Grainger, A., Cherlet, M., Zougmore, R., Sokona, Y., & Hill, J. (2011). Application of indicator systems for monitoring and assessment of desertification from national to global scales. Land Degradation and Development, 22(2), 184–197.

Spangenberg, J. H. (2001). The Environmental Kuznets curve: a methodological artefact? Population and Environment, 23, 175–191.

Tan, X. (2006). Environment, governance and GDP: Discovering their connections. International Journal of Sustainable Development, 9, 311–335.

Vogt, J. V., Safriel, U., Bastin, G., Zougmore, R., von Maltitz, G., Sokona, Y., & Hill, J. (2011). Monitoring and assessment of land degradation and desertification: Towards new conceptual and integrated approaches. Land Degradation and Development, 22(2), 150–165.

Vona, F., & Patriarca, F. (2011). Income inequality and the development of environmental technologies. Ecological Economics, 70(11), 2201–2213.

Zuindeau, B. (2007). Territorial equity and sustainable development. Environmental Values, 16, 253–268.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Esposito, P., Patriarca, F., Perini, L. et al. Land degradation, economic growth and structural change: evidences from Italy. Environ Dev Sustain 18, 431–448 (2016). https://doi.org/10.1007/s10668-015-9655-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-015-9655-9