Abstract

Climate finance stakeholders across Africa have long sought to understand the complex nature of the climate cash flow architecture. Distribution models are critical mathematical tools for generating the general characteristics of the cash flow that are used to inform policy decisions. In this paper, we undertake a comprehensive investigation of the climate funds flowing into sub-Saharan Africa (SSA) by suggesting candidate climate finance models that can be used by policy makers to design simulations that can aid in assessing climate risks, identify more efficient climate finance schemes, and obtain optimal control parameter settings under different scenarios. This is achieved by considering climate finance as a form of insurance. Different dimensions of the data are examined following four distinct groupings of the data set. This is to account for different views of risk by the various climate finance participants. The frequency and severity of the approved funds are analyzed with the aid of various mathematical distribution models and regression analyses. The dynamics of a given variable relative to varying scenarios are examined. The findings obtained confirm the presence of emerging risks induced by the nature of the flow. Central Africa for instance records the lowest theme-specific projects and mitigation finance accounts for more than half of all the climate funds while sectoral-wise, adaptation finance is majorly concentrated in the energy sector. The perpetuation of the observed inequalities across the themes, subregions and sector-specific climate-related projects portends grave consequences as these risks begin to accumulate over time. The Burr mixture model best fitted the approved projects’ cost distribution and the factors driving the frequency and severity of approved projects ranged from Central Africa to projects in the general environment sector. One of the policy recommendations emphasized was the need to adopt a risk-adjusted distribution model for climate finance allocation in SSA.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

According to Strebel [1], a staggering sum of $219 billion in claims was paid globally by the re/insurance industry just within a two year period (2017–2018) following weather-related disasters. This clearly reflects the burden that climate change poses on the re/insurance sector worldwide. A move that led to the formation of the Sustainable Insurance Forum (SIF) in 2016 as emphasized by the International Association of Insurance Supervisors [2]. The SIF is a forum made up of insurance regulators and supervisors with particular focus on climate change. In spite of the amount of financial burden borne by the re/insurers, this value ($219 billion) only represents 44% of all the losses encountered. Cyclone Idai, for instance, caused Mozambique, Malawi and Zimbabwe an overall economic loss amounting to $2 billion but only 7% of these losses were covered by insurance [1]. This leaves the vast majority of losses seeking for cover from the individuals affected, their government, relief agencies and businesses operating in these localities. This therefore exerts more pressure on the governments of developing countries who already lack the capacity to adequately provide the basic necessities needed by their citizens. Moreover, the very low penetration of insurance in Africa adds adversely to the problem.

Climate finance therefore remains one of the key mechanisms towards drastically reducing the financial burden triggered by climate change. The reason being that it attempts to tackle the climate problem from the root in an all-encompassing manner. Based on this line of thought, climate finance can be viewed as some sort of long term insurance, given that if utilized properly it is bound to save, especially for developing countries, a lot in terms of money, time, expended effort and exposure to climate risk, which on its own, triggers multiple problems such as migration [3, 4], civil wars due to insufficient resources [5,6,7,8], food insecurity [9,10,11,12], loss of biodiversity [13], deaths [14, 15] and much more. Moreover, the goals of climate finance exhibit some of the characteristics of insurance; namely, loss prevention and mitigation plus the sharing of (climatic) risk burdens. Indeed for many years, the African continent has been paying the “premium” of long suffering given the multidimensional climatic challenges that have undermined the realization of sustainable development in the region.

A closer look at the interconnections between the climate system and the global financial system was presented by Larosa et al. [16]. Just as the financial crisis in the USA in 2008 led to huge financial losses across the globe plus the emotional devastation that followed suit, they argue that the climate crisis likewise poses the same if not greater destruction, given that it also an interconnected global emergency.

According to IAIS [2], from the year 2015, several governments, regulators, central banks as well as financial associations and institutions across the world have made sustainable finance their special focus. Of note is the formation of the Task Force on Climate-related Financial Disclosures to propel this mission.

Since 2003 climate funds (in millions of dollars) have been flowing into SSA from public, private and alternative sources. However, tracking these flows and the progress made through the use of quantitative techniques have been neglected within academic settings. This should not be the case due to the central role climate finance plays in actualizing not only the Paris Agreement [17] with regards to sustainably developing resilience towards climate-related challenges but also in achieving the millenium development goals [18]. Bowen et al. [19] employed a couple of integrated assessment models to determine the financial transfers needed to equalize climate mitigation effort across different regions. In the bid to assess the characteristics of developing countries and their climate mitigation allocation between the years 1998 to 2010, Halimanjaya [20] made use of a sample size of 180 countries, utilizing regression modelling where the attributes ranged from CO2 intensity to gross domestic product (GDP). Qualitative analyses on climate finance are not as highly limited as in the case of quantitative analyses. Some authors, for example Banga [21], have investigated how structural transformation is affected by climate finance in developing countries using the DEPSAE (driver-exposure-pressure-state-action-effect) model, while others such as Bird and Glennie [22] and Bowen [23] examined, respectively, the governance of international climate funds and different strategies employed to raise the funds. The ethics relating to climate finance was studied by Grasso [24] and Soltau [25]. The tracking, supervision and distribution of the flow of climate finance have also been investigated [26,27,28,29].

Donner et al. [29] employed machine learning algorithms to test the impact of different accounting assumptions as relating to adaptation finance for countries within the Oceania region noting an uneven distribution of adaptation aid. Adaptation finance was also the focus of Weiler and Sanubi [30] who assessed the factors driving the allocation of funds across different African countries. Our paper extends Savvidou et al. [31] which fully focused on the climate finance flowing into Africa. Savvidou et al. [31] noted that there was a lack of studies that provide disaggregated region, country- or sector-specific climate finance flows into the African continent and further undertook a quantitative mapping of only adaptation finance distribution into individual African countries and regions, taking note of the sectors receiving the highest finance. Additionally, adaptation finance disbursement ratios were estimated. There were, however, some gaps that were not addressed which we have taken steps to tackle in this paper. In particular, our contributions to knowledge are as follows: first, we broaden the scope to include, in addition to adaptation finance, mitigation and multiple foci climate finance flows. Second, we analyze the data from different perspectives thereby accounting for different levels of detail. Third, drawing from the insurance context, priority is given to investigating the rate at which the finance flows in (frequency) and the amount of the finance (severity). Appropriate models that best generate these attributes (frequency and severity) are also identified. These research areas enable the development of a robust and transparent tracking system of climate finance across Africa. Plus, they are required to understand and manage the inherent risks.

In recent times, sustainable insurance has been advocated by the United Nations Environment Programme Finance Initiative Insurance Working Group [32] as the panacea to tackling systemic risks brought about by environmental, social and governance problems. This paper takes the first step in tackling the frequency-severity dimensions of risk management by focusing solely on the SAA region.

The remaining part of this paper is organized as follows. The data used is described in Section 2 while Section 3 outlines the methodology employed. The empirical analysis is presented in Section 4 along with the results and discussion. Conclusions are made in Section 5.

2 Data

The data set employed can be obtained from the climate funds update website (climatefundsupdate.org), maintained by Heinrich-Böll-Stiftung Washington, D.C. and Overseas Development Institute. The information and data are totally focused on different multilateral climate funds and tracking the flow of the finance into, mainly, developing countries in a bid to address the challenges of climate change. The period of the data used for this paper is from 2003 to February 2020. The data is not a time series data. Variables in the data include fund, fund type, country, world bank region, income classification, name of project, theme/objective, sector (OECD), sub-sector, approved year, end year, amount of funding approved (USD millions) and disbursed (USD millions). For example, Adaptation for Smallholder Agriculture Programme (ASAP) is of type multilateral. An example of one of the countries is Benin within the SSA world bank region. One of Benin’s climate-related projects is Project d’Appui au Developement du Maraichage au Benin (PADMAR). The fund’s objective is adaptation and the sector-specific target is the agricultural sector particularly, the agricultural water resources sector.

The category labelled sub-Saharan as described under the African world bank region variable was extracted giving 693 observations, 48 African countries and 20 multilateral funds.

2.1 Grouping the Data

The broader view of risk is multidimensional in nature. The donors, recipients, policymakers, regulators and other key climate players may view risk from different perspectives. This has motivated the need to present and analyze different groupings of the data set to obtain a more comprehensive understanding of the dynamics of the fundamental drivers of climate finance. Additionally, evaluating different dimensions of the data set allows for greater practical use of the findings from this research. As Pickering et al. [33] and Buchner et al. [34] pointed out, the dominant challenge associated with assessing international climate finance lies solely in the complete lack of understanding of its fragmented and complex architecture. That is, its nature by design sets a very high threshold that many African countries might not be able to surpass given the lack of specialized technical knowledge and institutional capacities, the proliferation of substandard processes and the speed with which climate change disasters are occurring in contrast to the pace of accessing the proportional amount of funds needed for specific climate-related projects.

This issue has led to a series of frictional episodes between developed and developing countries. For instance, major stakeholders in Africa are currently calling for a climate finance tracker in order to have a clearer view of the flow of climate funds [35]. In other words, they want to know the donors (from the developed countries) that are meeting their targets and those that are not to track exactly where the funds are going to and how they are being utilized and consequently, to have a concrete basis upon which they can then formulate weighty arguments that border on climate justice for Africa. We have taken this quest into account by attempting to break down the complexity inherent in the climate finance layout to a form that is easier to “digest.” Therefore, we study the data based on various classifications such as from the thematic perspective which are Mitigation general (MG), Adaptation (AD), Mitigation REDD (MR) and Multiple foci (MF). These represent the four main risk types. Other classifications are severity versus frequency; per country versus per region; per theme versus per sector based projects; aggregate level (portfolio) versus individual level perspectives which, in general, coincide with the top-down approach versus bottom-up approach, respectively.

The four distinct groupings are:

-

1.

Cost per sector-specific projects (cpssp). There are 684 observations.

-

2.

Aggregated number of projects and cost per theme per country (apctc). There are 48 observations.

-

3.

Aggregated number of SSA countries per number of thematic-based projects (aSSAt). Observations differ per theme in this case.

-

4.

Theme-based number of projects per country (tppc), \(n=155\) entries.

Tables 1, 2, 3, and 4 show the first few entries of the distinct groupings.

The structure of the data is as follows:

-

(I)

Funds represent the amount of the approved climate finance by a multilateral funding unit.

-

(II)

Fund indicator has two levels representing UNFCCC (0) and non-UNFCCC (1) multilateral financial mechanisms. UNFCCC means United Nations Framework Convention on Climate Change.

-

(III)

Theme indicator has four levels representing AD (1), MG (2), MR (3) and MF (4).

-

(IV)

Region indicator has four levels representing West Africa (WA) (1), Southern Africa (SA) (2), Central Africa (CA) (3) and Eastern Africa (EA) (4). This classification follows the African Union division [36].

-

(V)

Sector indicator has six levels representing the area where a country’s climate project is expected to improve:

-

Agriculture, fish, food and food security, health (0);

-

Disaster and preparedness (1);

-

Energy — generation, distribution, renewable sources, policy and transport as well as industry (2);

-

Forestry (3);

-

General environment protection, environmental research, other multisector (which includes environmental policies, administrative management, urban development, etc) and unallocated sectors (which are mainly bordering on environmental and admin issues as well) (4);

-

Water supply and sanitation (5).

-

-

(VI)

The time represents the year the project was approved. It has been scaled down (divided by 10000).

Remark 1

The project’s description summary was used to fit, into an appropriate sector, the few entries that did not have clearly stated sectors. In general, the number in the parentheses \((\cdot )\) serves as the indicators (ind).

With respect to Table 3, the first three rows (the case of MG finance) imply that six countries have zero MG projects, eight countries have one, thirteen countries have two and so on. We have 0 to 19 for MG, 0 to 17 for AD, 0 to 10 for MR, 0 to 9 for MF.

The disbursed proportion (Table 4) represents the proportion of the approved climate finance that has been paid out. The apctc and tppc groupings show that the various African countries have different project-cost and project-count experiences.

Tables 1, 2, 3, and 4 try to assess similar or different risk concerns. For instance, if the main risk concern is approved project fund distribution adequacy (which would be analogous to say, climate “price” distribution), the results from Table 1 analysis would give the most appropriate answer.

Remark 2

Although this paper concentrates on multilateral climate funds which cater mostly to least developed countries, we should note that there are other climate funding sources such as the bilateral donors, multilateral development banks and international development finance institutions among others. These mostly provide funds as loan rather than as grant which is obtainable from multilateral donors.

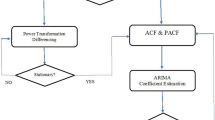

3 Statistical Methods

Given that this research is basically focused on the application of various distributional models as well as regression techniques, this section will briefly highlight the models used and references will be indicated to direct a rigor-inclined mathematical reader to in-depth details. Another reason for adopting this perspective is to simplify the process as much as possible for practitioners and policymakers.

3.1 Contingency Tables

Pearson [37] studied the relationship between two variables giving rise to the concept of contingency tables (CTs). A CT is made up of a collection of cells containing counts of items, events, people, etc. The organization of these cells is mostly in the form of cross-classifications which correspond to specific categorical variables. Different sampling models can be used to generate the cell values. A CT can have n-dimensions which correspond to counts on n categorical variables.

A two-way CT is applied in this paper. In a nutshell, a two-way CT can be described as follows: Suppose we classify N observations based on two categorical variables having same or different number of levels, say k and l. This two-dimensional table is represented in Table 5, where \(n_{p, q}\) is the observed frequency for cell (p, q) and \(n_p\), \(n_q\), respectively, represent the row and column totals.

3.2 Mathematical Distributions

A brief overview of the models that will be applied in this paper is highlighted here. For more in-depth understanding, the reader can refer to McCullagh and Nelder [38], Long [39], Cameron and Trivedi [40], Agresti [41], Winkelmann [42], and Zhou et al. [43].

Poisson Distribution

Poisson distribution is a discrete probability distribution. A random variable X is Poisson distributed with scale parameter \(\mu > 0\) if its probability mass function is

where \(x = 0, 1, 2, \ldots\). We write \(X \sim \textrm{Poisson}(\mu )\).

Negative Binomial Model

The negative binomial distribution is a discrete probability distribution too. It is sometimes called Pascal distribution or Polya’s distribution. A random variable X is negative binomially distributed if its probability mass function is

where \(x = 0, 1, 2, \ldots\), \(r > 0\) and \(0< p < 1\). We write \(X \sim\) NB(r, p).

Gamma Distribution

We say that a continuous random variable \(X > 0\) is gamma distributed if its probability density function is

where \(x > 0\), \(\alpha > 0\) and \(\beta > 0\). We write \(X \sim \text {Gamma}(\alpha , \beta )\).

Exponential Distribution

We say that a continuous random variable \(X > 0\) is exponentially distributed with mean \(\alpha\) if its probability density function is

where \(x > 0\) and \(\alpha > 0\). We say X is an exponential random variable with rate \(\lambda\) if its probability density function is

where \(x > 0\) and \(\lambda > 0\). Exponential distribution is a particular case of the gamma distribution.

Weibull Distribution

We say that a continuous random variable \(X > 0\) is Weibull distributed with scale parameter \(\alpha > 0\) and shape parameter \(\beta > 0\) if its probability density function is

where \(x > 0\). We write \(X \sim \hbox {Weibull}(\alpha , \ \beta )\). Exponential distribution is a particular case of the Weibull distribution.

Lognormal Distribution

We say that a continuous random variable \(X > 0\) is lognormal distributed with parameters \(\alpha > 0\) and \(\beta > 0\) if its probability density function is

where \(x > 0\). We write \(X \sim \text {lognormal}(\alpha , \ \beta )\).

Burr Mixture Model

The mixture of the two Burr distributions used in Section 4 is given by the probability density function

for \(x>0\), \(a>0\), \(b>0\), \(c>0\), \(d>0\), \(\theta >0\), \(\phi >0\) and \(0<\alpha <1\).

3.3 Regression Models

Generalized linear models (GLM) assume that data is sampled from an exponential family of distributions whose probability density function is

where \(\theta _i, i=1, \ldots , n\) are the canonical parameters, \(\phi\) is the dispersion (scale) parameter, \(a_i, i=1,\ldots ,n\) are the prior weights of observed values, \(b(\cdot )\) and \(c(\cdot )\) are known functions.

Distributions in the exponential family include the gamma, Poisson, Gaussian and the negative binomial distributions. In insurance, they are used for frequency and severity computations [44, 45]. GLM’s general structure is composed of three components: i) random component, ii) systematic component, iii) link function. The random component specifies the response or dependent variable Y and the probability distribution hypothesized. The systematic component points out the explanatory or independent variables \((x_1, \ldots , x_n)\), which describe each instance \(x_i\) of the data set, where n is the total number of instances in the data set. Values of the explanatory variables are treated as fixed and not as random variables. The link function \(g(\mu )\) indicates a function of \(\mu =E(Y)\), the expected value or mean of Y.

In this paper, the lognormal, gamma and quasi-gamma regression models are used to model the severity of the data obtained. This is simply accomplished by replacing the link function with the desired distribution in basic R and MASS R packages [46]. For modelling frequency, log-Poisson, negative binomial, zero-inflated (ZI) and Hurdle models are employed. Negative binomial distributions are usually incorporated to take care of the over-dispersion and sparsity problems in count data. When the count data includes excess zeros, the ZI and Hurdle models are used to handle such problems. The ZI model [47] has a general structure as indicated in

For the hurdle model, the general form is

4 Data Investigation

4.1 Exploring the Data

The annual climate finance per project (Fig. 1a) indicates that the cost of most projects fall below $15 million dollars as indicated by the dash line. We note that MG received the highest funding (Fig. 1b, number 2) throughout the period 2003–2019, MR (3) the lowest. At the sectoral level (Fig. 1c), the energy/transport (2) and general environment protection/env research (4) sectors take the largest share of climate finance. Figure 1d seems to suggest that aside from region 3 (CA) all the other regions enjoy approximately the same proportion of climate finance. This notion however will be further investigated (Fig. 2).

4.2 Contingency Tables

Contingency tables are presented in Tables 6 and 7 to summarize the data based on two different variables. The cpssp (Table 1) data grouping is used here. The climate themes are kept constant as they move across SSA regions, various climate project sectors, the funding units and the approved funds.

4.3 Observations from the Contingency Tables

4.3.1 Policy Perspectives

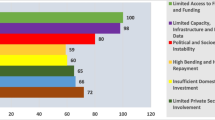

The findings from the contingency tables raise a couple of issues:

-

1.

Subregional level

West Africa has the highest number of approved projects across all risk types (Table 6: theme vs region). There are three arguments we try to put forward as possible explanations for this observation. Firstly, the region houses the highest population in Africa. This may be a quite trivial reason however. Secondly, the countries in this region may have a much more improved system of national climate finance readiness. That is, following the description given by United Nations Development Programme (UNDP) [48], West African countries, most probably, have the capacity to plan for and access; to allocate and deliver as well as properly use both domestic and international climate finance resources. They (most likely) are also able to effectively monitor and track the flow of climate funds while providing adequate report on how the funds are used. Recently, South Africa (one of the countries in Southern Africa) developed its first report on climate finance flow [49]. These are steps that need to be taken by other countries in the same region in order to strengthen the ongoing transparency discussions of climate finance usage, thus increasing the chances of the region (which generally stands in third place) having more approved projects. A third line of thought is the availability of more and/or efficient financial systems/channels which support the easy flow of climate funds. The presence of these types of financial linkages eases the process of climate finance flows hence climate project delays are minimized. Table 7 reveals that across all themes, projects that cost less than $5 million populate the approved funds’ category.

-

2.

Inequality

The contingency tables (Tables 6 and 7) beam light on the fault lines as relating to the equitable distribution of climate finance across SSA. The unequal access or unfair distribution can be seen glaringly in the case of Central Africa (CA) which is arguably the most vulnerable region in SSA but is seriously lagging behind given the number of approved projects the region has gotten so far. With the exception of MR, CA has the lowest number of theme-specific projects. Our findings align with those of Atteridge et al. [50] and Saunders [51] who showed that the most vulnerable countries are the least to obtain the relief that climate finance offers. This large disparity can also be noticed at the sector-specific level.

-

3.

Mitigation general

Gichira et al. [52] stated that as in 2011, almost 56% of all climate finance channelled into SSA were going into mitigation activities. Our result also reflects a similar stance. MG takes up about 48.6% of all climate finance and when MR is accounted for, mitigation activities in general will account for about 60% of all climate funds entering SSA.

-

4.

Adaptation

Sharma and Tomar [53] stressed the fact that temperature rise will continue even if green house gas were to stop this instant. The reason for this lies in the lifespan of carbon dioxide (of over 100 years) which is already in the atmosphere. This has led to calls for ramping up adaptation activities in a bid to speedily build up and fortify resilience. Mathur and Roy [54] also argued that an equal amount of priority, if not more, should be concentrated on adaptation when compared to mitigation projects. From Table 6, the number of adaptation projects is a little less than half of the number of mitigation projects. This weak performance definitely places a significant limitation on the adaptive capacities of Africans who are the most vulnerable to climate change impacts brought upon them mainly by developing countries. More worrisome, is the fact that they lack the financial, technological and knowledge-based resources to adequately adapt to climate extremes. Sectoral wise, AD funds are majorly concentrated in the energy sector. Atteridge et al. [50] noted that such concentrations could hinder the broader impacts of adaptation efforts in varying sectors of the economy and society. The data clearly reveals that the climate finance for AD which actually conveys the essence of the polluter pays principle only makes up 23.2% of all climate funds analyzed. Gichira et al. [52] attributed this problem to the perception and adoption of adaptation financing as a business opportunity by non-UNFCCC financial mechanisms and this has served as a stumbling block to achieving the climate goals set out in the Paris Agreement.

-

5.

Mitigation REDD

The sole objective for creating the MR theme was for the reduction of emissions from deforestation and the degradation of forests [55]. This is fully reflected in the approved projects under this theme as they all fall under the forestry sector targeting forest protection projects (Table 6).

-

6.

Water

Water and sanitation infrastructure remains the sector with the lowest number (4.6%) of projects (Table 6). The privatization of public finance, as argued by Gichira et al. [52] is a major reason for this dismal performance. Despite the water stress experienced in SSA [8, 56, 57] for instance, the drying up of the lake Chad [58], the water sector privatization was accepted by developing countries’ governments given the world bank’s earlier claims of the private companies’ capability in rehabilitating and expanding the facilities relating to water and sanitation through investments. However, as emphasized by Gichira et al. [52], anchoring on the fact that private companies were mainly driven by profits, the flow of public funds into private control resulted in the severe choking of the gains that were supposed to have accrued within this sector. The lack of protection of public goods from private interest, particularly in this case, completely goes against the insurance principle of utmost good faith which fully lies at the core of the formation of the United Nations Organization [32]. It is therefore important at this point to re-sound the note of warning by the World Economic Forum [59] of water crises ranking among the top five global risks of highest concern — a list in which climate risks dominate and continues to dominate alongside climate inaction [60].

The concerns noted from the contingency tables clearly show the utmost importance to determine the political and socioeconomic factors that drive the decision-making process of the donors. In addition, Gichira et al. [52] pointed out developing countries’ incapacity to engage effectively with the dominant agencies and players who control climate finance given the complicated processes that are consciously modeled into the procedure of accessing the funds. This same reasoning applies at the regional level. There may be a conscious effort to stifle some regions for instance CA from easily assessing climate finance. If this trajectory is allowed to continue, the goals for the Paris Agreement will not be attained.

4.3.2 Risk Management Strategies

The three risk assessment categories — loss controlling, risk trading and risk steering — will be tapped into to aid in proffering durable risk management options. Table 6 suggests that the risk appetite for MG funded projects by multilateral donors is much higher when compared to other themes. As a consequence, MG is driving most of the distributed climate funds in SSA. We can thus deduce that the limit on the cost of projects in this theme experiences higher thresholds which leads to more MG projects being proposed by SSA across each subregion (Table 6). This type of situation, however, exacerbates the risk of unequal climate finance distribution. To control this risk, UNFCCC should restrict the exposure of climate-related projects to high levels of imbalance which are primarily induced by the distribution of funds across the various risk types in SSA.

Furthermore, climate risk is the risk that each country aims to minimize or control. Undoubtedly, this is the risk they desire to “trade” in exchange for climate-related projects that enhance sustainable development. Table 6 indicates that agricultural and general environment sector-specific projects consume about 77.5% of all MG funded projects while AD finance focuses on the energy sector. We should note that this is quite the reverse when global climate finance flows are considered. The findings of Atteridge et al. [50] indicated that 66% of all mitigation funds (globally) are in the energy and transport sectors and that AD funds are concentrated in the agricultural sector, although their period of focus differs (2013–2017) in relation to this paper (2003–2020).

The unique trajectory in SSA may lie in the fact that agriculture makes up to 16% of SSA’s GDP and employs over 60% of its citizens [61]. Nevertheless, there is need to adopt some lessons from the principle of diversification which stimulates risk steering. Climate finance should be steered away from highly concentrated zones to areas that are hardly visible. For instance, only 36 projects have been apportioned to disaster and preparedness. This is too poor given that Africans, particularly the most vulnerable ones, are usually not prepared when extreme events occur. This is due to the presence of the climate’s change interaction with multiple stress points on the continent such as poverty, low capacity to adapt and very limited diversification options as a result of the heavy dependence on rain-fed agriculture [18]. As a consequence, we note that the level of recovery many years after the occurrence of a climatic extreme event is still very low [62].

Moreover, climatic attacks are happening at a much higher frequency than before in which more recent years are experiencing increased record-breaking climate extremes [63]. Projects designed for say agriculture and general environment sectors are mostly going to minimize climate induced losses in the medium to long term but in the short term adequate preparation for disasters like droughts and floods can save Africans and African governments a lot of distress as well as finance. Kreienkamp and Vanhala [64] did buttress the issue of mitigation and adaptation efforts being insufficient as preventive measures against climate change burdens. In a similar vein, water and sanitation projects need to be beefed up as they correspond to currently only 30 projects so far. In the event of a climate emergency, the lack of food and clean water has been pointed out as the major factors that drive up the number of deaths in Africa. This cause has been attributed to the fact that not only is the earth’s water cycle the worst hit under the “hammer” of climate change but even worse is the fact that over 50% of Africa’s population live in regions that suffer from absolute water scarcity [18]. Prioritizing water and sanitation projects under the climate finance system will bring about easier access to safe drinking water. This will not only aid in preventing deaths, but such prioritization will also go a long way in bridging the gender gap because women and girls particularly in rural Africa are much more vulnerable to water insecurity, exposing them more to violence, disease and female disempowerment [65, 66]. In fact, water and sanitation crises are already tending towards acute levels as about 46 million Nigerians still do not have access to clean water [67] and SSA accounts for up to 40% of all those who lack water globally [68].

Confirming that women are among the hardest hit, Botreau and Cohen [62] revealed that the devastating impact of the 2007–2008 and the 2010–2011 food price crises was still adversely affecting farmers in Africa, most especially women workers, ten years on. This implies that the adverse effects of the losses are increasing in a non-linear fashion with respect to the size of the losses experienced during the crisis period given the exceedance of a target climate threshold which further forces the climate event to operate within what we term the “climate change excess region.” This realization calls for a risk-adjusted reassessment of the distribution of climate finance. A more appropriate weight needs to be attributed to those sectors that lessen the adverse impact of these extreme events such as the degree of preparedness and the availability of clean water after catastrophic climate damages.

On a general note, the likelihood of a climate finance crisis occurring within Africa does not seem too far-fetched given some peculiar attributes surrounding the climate finance system. First of all, many climate-oriented African stakeholders do not understand the overly complex nature of the system in terms of assessing the funds and tracking their flow, hence there is a conspicuous absence of reports on the risks inherent as relating to the continent. This promotes poor climate finance risk communication. Secondly, owing to the first reason, there are little to no checks on these risks as they propagate through the network structure of climate finance across SSA. For instance, Chukwudum [69] observed that the network structure of climate finance in SSA suggests that the central funding units were the only climate funding sources flowing to the more isolated regions and the countries at the outermost parts of the isolated regions were mostly west African countries. In essence, the effectiveness of the climate flow is being adversely impacted by the risks that are emerging from different target sections, creating difficulty in identifying such risks. If left unchecked, these risks could accumulate and lead to a full blown climate financing crisis. Thirdly, the patterns that have been observed in the data do not suggest that the allocation of funds and projects are carried out in an objective manner across the themes, regions, and sectors. We must emphasize that a subjective distributive approach is not sustainable. Fourthly, African governments are still largely geared towards the provision of climate relief aid after the occurrence of a catastrophe. This poor decision-making structure which is rooted in a reactive approach cannot stabilize the rising climate issues induced by a defective climate financing system. Leading African climate players must factor in this intending risk in order to better prepare other innovative viable options.

The following sections seek to identify specific models that can be used to model the frequencies and severities of climate finance in SSA.

4.4 Frequency Modelling

Section 4.4.1 is aimed at comparing simulated and analytical solutions. Section 4.4.2 zooms in to assess the covariates in a bid to determine which of the variables are the main drivers while approving climate projects in SSA. These insights will be beneficial to policymakers who would need to evaluate the expected outcomes/number of projects while taking into account the determinant factors.

4.4.1 Fitting Frequency Distributions

Computing analytically the mean, variance and dispersion coefficient of the number of each thematic project per the number (\(n=48\)) of the SSA countries using the aSSAt data grouping gives the results displayed in Table 8.

Bootstrap

Using the bootstrap simulation of 1000 draws, 48 Poisson variables were drawn from the estimated mean of each theme and then the dispersion coefficient was recalculated and its density function plotted (Fig. 1). The estimated dispersion coefficients are \(MG=1.000092\), \(AD=1.001137\), \(MR=0.9968884\) and \(MF=1.001712\) (Fig. 3).

The bootstrapped results differ from the analytical solution. The results suggest that the data are Poisson distributed because D being approximately 1 corresponds to the data being independent and identically distributed as Poisson. A strong deviation of D away from 1 suggests that the underlying claim intensities are unequal or that the distribution is not independent and identically Poisson which is what the analytical solution is supporting.

Given these contrasting results, the negative binomial model is employed where we consider a random \(\lambda\) for each country. Now \(\lambda =\xi G\), where \(G \sim Gamma(\alpha )\) and \(\xi =mean\). The estimates \(\xi\) and \(\alpha\) of the updated model are then computed (Table 9).

The parameters are then used in the Poisson and negative binomial distributions to compute the expected number of countries with k specific-themed projects (\(k=0\) to 19 for MG; 0 to 17 for adaptation; 0 to 10 for MR and 0 to 9 for MF). The generated sequence of expected projects is compared to the observed values in Table 10 (for MF).

Based on the density plots (Fig. 4), the Poisson and negative binomial distributions perform fairly well with the exception of the case of adaptation projects. Poisson model is not a good fit for MR. When the empirical densities are plotted with respect to the apctc grouping, we obtain Fig. 5.

Comparing Figs. 4 and 5 individually (Fig. 6), we observe that only the densities for adaptation (plots c and d) and multiple foci (plots g and h) differ quite significantly when the aggregation of the number of theme-based projects changes from per country in Table 2 (apctc) to per the number of SSA countries in Table 3 (aSSAt).

4.4.2 Regression Modelling for Frequency

The aim of this section is to find out which variables significantly affect the number of climate projects approved in SSA. The tppc data in Table 4 is analyzed. Here, the disbursed proportion variable is used to represent the exposure which serves as the offset in the regression. The regression models used are the log-Poisson, the negative-binomial, zero-inflated and hurdle models as outlined in Section 3. Table 11 provides the estimates (with standard deviations in parentheses and p-values of only significant variables in italics) of the chosen models.

The models generally pinpoint theme MF and regions CA and EA as the variables that negatively drive the number of approved climate projects (Table 11). The significance is reflected across board (that is, all tested models). We note that the first category of each set of explanatory variables has been set to zero and used as the baseline references. Considering only the log-Poisson model for simplicity, we can compute the annual project intensity per theme as follows:

-

Project intensity for theme 1 (AD) = \(e^\textrm{intercept}=e^{2.923}=18.603\),

-

theme 2 = \(e^\textrm{intercept}*e^{MG}=18.603*e^{-0.564} = 10.58\).

-

Similarly, for theme 3 (MR) and theme 4 (MF), we obtain 12 and 9.13, respectively.

Comparing these results which are from the tppc sub-data set (Table 4) with the direct computations of the average annual number of projects from the cpssp data grouping (Table 1) having: theme 1 (AD) \(=22.429\), theme 2 (MG) \(=254\), theme 3 (MR) \(=5.286\) and theme 4 (MF) \(=9.063\) indicates that theme 2’s estimate is the furthest.

4.5 Severity Modelling

4.5.1 Fitting Severity Distributions

Figure 7 depicts the cost estimates of projects based on the apctc grouping (Table 2). A common underlying characteristic is the presence of heavy tails. The nonparametric (empirical) density of the cost of each climate project based on the sector-specific grouping, that is cpssp (Table 1), gives rise to Fig. 8. In order to model this cost distribution function, five parametric models were applied — the lognormal, Weibull, exponential, gamma and the Burr mixture distributions.

The first four distributions fell short as their Kolmogorov-Smirnov p-values were all less than 0.05. Only the Burr mixture emerged as the best fitting model, hence we concentrate on this distribution.

Burr Mixtures

Owing to the fact the climate finance together with all its related entities give rise to a highly complicated product, an accurate model is required to model the approved funds. In confirmation, the p-values of the first four fitted models (lognormal, Weibull, exponential and gamma) strongly suggest the same. This will allow for more reliable objective-oriented predictions. A mixture of two Burr distributions is more suited for the data set and the findings reveal that it gives the best fit (Table 12, Fig. 9a. Only the probability plots are provided).

Based on the structure of the data in Section 2.1, the Burr mixture is estimated for each indicator under the fund, theme, region and sector as displayed in Table 12.

4.5.2 Regression Modelling for Severity

The aim of this section is to find out which variables are significant in determining the approval of climate funds for climate-related projects across SSA. The cpssp data (Table 1) is employed here. The time variable is used to represent the exposure which serves as the offset in the regression models. Table 13 provides the estimates (with standard deviations in parentheses and p-values of only significant variables in italics) of the chosen models.

Across all models, under fund type, non-UNFCCC negatively impacts the severity of climate finance significantly (Table 13). With respect to the positive significant variables that affect climate finance severity, MG, EA and general environment protection (GEP) are the leading indicators under theme, region and sector-specific projects, respectively. The first category of each set of explanatory variables has been set to zero and used as baseline references. The lognormal regression model further suggests that the region SA is also a significant variable. However, this result was not corroborated by the gamma and quasi-gamma regression models.

4.5.3 Policy Implications

The level of climate finance disbursement is extremely worrisome (Table 4). Africans must therefore, instead of waiting, rise up to their own responsibilities by accounting sufficiently for the factors driving climate change risk when making decisions at the local, national and regional levels. Three key points that have been highlighted by Rothwell [70], which we have adapted to suit the present narrative, include:

-

1.

Enforcing policies that focus on protecting the climate.

-

2.

The rigorous promotion of scientific integrity as relating to climate change in Africa.

-

3.

Celebrating those who support climate protection. To add to this third point, African governments can also take advantage of the fast growing entertainment industry on the continent to drive the climate agenda and to spread the “gospel” of sustainable development.

4.6 Political Economy of Climate Finance

Within this context, Gichira et al. [52] and Stewart et al. [71] gave compelling assertions of how economic interests controlled by the political machinery of developed countries tend to strangulate the climate finance benefits for developing countries. For one, profit-induced private sector-driven climate financing is more likely to accumulate more debt for developing countries. Nevertheless, the domestic policy factors of developed countries are constructed to support this routeway thereby making the long term benefits of global agreements such as the Paris Agreement untenable. SSA countries, on their part, need to become more responsible by concretely developing their national and regional climate finance readiness through the use of economic and regulatory policy instruments. Briner et al. [72] laid strong emphasis on the need for the presence of solid national institutions, as required by the multilateral international financiers, which can effectively handle the complexities that characterize the processes and environmental standards embedded in accessing climate funds. This is cognizant of the fact that multilateral funding entities are the ones that undertake the development of the project pipeline coupled with managing and facilitating climate finance. Thus, their demand for capable disbursing and implementing institutions is fundamental.

Robust national strategies by design insist on the relevant expertise, qualified staff, experience and intelligent internal controls [73]. If African countries cannot clearly show that their institutions (both political and economic including social) can efficiently handle the significant inflow of climate finance and the subsequent climate-related project investments, leveraging additional funds will not be possible. Even worse, they will be further extricated from the decision-making process at the international level as relating to policy formulation and financial mobilization given that currently, as asserted by Gichira et al. [52] and Markkanen and Anger-Kraavi [74], developing countries’ governments are less engaged in climate finance, or more generally, climate-related negotiations at the global meetings. This highly constricts their influence.

A step in the right direction therefore entails that comprehensive reliable records, on how climate finance flows are being utilized, should be made public for the sake of transparency and for the purpose of further qualitative and quantitative analysis. This cannot be accomplished without proper monitoring and evaluation systems. Also, providing an enabling environment that is devoid of political and economical upheavals is critical for securing investments that are financed by climate funds. Climate change is everybody’s business plus. The vulnerable communities at the local levels of African countries bear most of the brunt of its adverse effects, hence African governments owe transparency and accountability to their citizens as well as to the global community.

Additionally, African governments must take into account the very sluggish pace in which climate finance is being disbursed across the region. With this sort of momentum, Africans cannot make giant strides in the fight against climate change. Structured mechanisms for climate finance should be developed at local levels such as annual allocations from the state or local government budgets. This is a serious challenge which demands a strong political will. Caravani et al. [75] was quick to point this out, that while this local funding mechanisms may exist in African countries, funding is hardly available and most of them are still dependent on international donors. However, Kenya has been praised for providing budgetary allocations to their County Climate Change Funds which is a sub-national climate finance unit.

5 Conclusions

This paper zoomed into several pathways through which climate finance flows from multilateral donors into SSA and then set out to model both the frequency and severity of the flows’ tracks. Four distinct groupings were extracted from the main data set with the aim of stimulating a series of insights with respect to the structure of the risks surrounding the climate finance flow system. The results obtained highlighted the fundamental issues relating to the equitable distribution of the climate funds across the subregions of SSA as well as the accumulation of risks. Of note was the disproportionate distribution of funds mostly across sector-specific climate-related projects which, as emphasized in the paper, tends to aggravate the existing inequalities in the region. Various mathematical distributions were fitted to the sector-specific project approved costs with the Burr mixture model giving the best fit. Regression analysis for severity identified general environment protection as the sector projects driving the flow of climate finance. Finally, we argued that the sluggish pace at which mitigation and adaptation projects are being undertaken portends more crushing claims burden for the continent’s insurance sector and in particular for African governments who are seen as sovereign risk bearers. This will become evident as more Africans become aware of the dire need for insurance and risk transfer opportunities in general, in the face of climate extremes.

Given that the slow disbursement of climate funds from international donors directly impedes the actualization of the Paris Agreement, we see that an understanding of the lagging effect is paramount. Additionally, developing a risk-adjusted model to appropriately determine the allocation of the frequency and severity of projects that should be undertaken in each sector is critical. These investigations can be accomplished in future studies.

Data Availability

The data sets generated and/or analyzed during the current paper are freely available online at climatefundsupdate.org.

References

Strebel, B. (2019). Africa must become more resilient to climate risk. World Economic Forum on Africa: Here’s how.

IAIS. (2018). Issues paper on climate change risks to the insurance sector. https://www.sustainableinsuranceforum.org/

Bohnet, H., Cottier, F., & Hug, S. (2018). Conflict-induced IDPs and the spread of conflict. Journal of Conflict Resolution, 62, 691–716.

Internal Displacement Monitoring Centre. (2017). Global report on internal displacement: The global report on internal displacement presents the latest information on internal displacement worldwide caused by conflict, violence and disasters. https://www.internal-displacement.org/global-report/grid2017/

Burke, M., Miguel, E., Satyanath, S., Dykema, J., & Lobell, D. B. (2009). Warming increases the risk of civil war in Africa. Proceedings of the National Academy of Sciences, 106, 20670–20674.

Fjelde, H., & Uexkull, N. V. (2012). Climate triggers: Rainfall anomalies, vulnerability and communal conflict in sub-Saharan Africa. Political Geography, 31, 444–453. https://doi.org/10.1016/j.polgeo.2012.08.004

Maystadt, J. -F., Ecker, O., & Mabiso, A. (2013). Extreme weather and civil war in Somalia: Does drought fuel conflict through livestock price shocks? International Food Policy Research Institute Discussion Paper 01243.

Miguel, E., Satyanath, S., & Sergenti, E. (2004). Economic shocks and civil conflict: An instrumental variables approach. Journal of Political Economy, 112, 725–753. https://doi.org/10.1086/421174

Ciais, P., Reichstein, M., Viovy, N., Granier, A., Ogee, J., Allard, V., Aubinet, M., Buchmann, N., Bernhofer, C., Carrara, A., Chevallier, F., De Noblet, N., Friend, A. D., Friedlingstein, P., Grünwald, T., Heinesch, B., Keronen, P., Knohl, A., Krinner, G., … Valentini, R. (2005). Europe-wide reduction in primary productivity caused by the heat and drought in 2003. Nature, 437, 529533. https://doi.org/10.1038/nature03972

Rosenzweig, C. E., Tubiello, F., Goldberg, R., Mills, E., & Bloomfield, J. (2002). Increased crop damage in the U.S. from excess precipitation under climate change. Global Environment Change, 12, 197–202. 10.1016S0959-3780(02)00008-0

Sanchez, J. L., Fraile, R., de la Madrid, J. L., de la Fuente, M. T., Rodriguez, P., & Castro, A. (1996). Crop damage: The hail size factor. Journal of Applied Meteorology, 35, 1535–1541.

van der Velde, M., Tubiello, F. N., Vrieling, A., & Bouraoui, F. (2012). Impacts of extreme weather on wheat and maize in France: Evaluating regional crop simulations against observed data. Climatic Change, 113, 751–765. https://doi.org/10.1007/s10584-011-0368-2

Reed, D. H. (2012). Impact of climate change on biodiversity. In: Chen, W. Y., Seiner, J., Suzuki, T., & Lackner, M. (Eds.), Handbook of Climate Change Mitigation. Springer, New York. 10.1007/978-1-4419-7991-9_15

Azongo, D. K., Awine, T., Wak, G., Binka, F. N., & Oduro, A. R. (2012). A time series analysis of weather variability and all-cause mortality in the Kasena-Nankana Districts of Northern Ghana, 1995–2010. Global Health Action. https://doi.org/10.3402/gha.v5i0.19073

Egondi, T., Kyobutangi, C., Kovats, S., Muindi, K., Ettarh, R., & Rocklov, J. (2012). Time-series analysis of weather and mortality patters in Nairobi’s informal settlements. Global Health Action, 5, 23–32. https://doi.org/10.3402/gha.v5i0.19065

Larosa, F., Ameli, N., Rickman, J., & Kothari, S. (2021). Beyond standard economic approaches: Complex networks in climate finance. Working paper No. 19/WP/2021, Department of Economics, Ca’Foscari University of Venice.

United Nations. (2016). Paris agreement. Chapter XXVII Environment: United Nations Treaty Collection.

African Union. (2014). African Climate Change Strategy. AMCEN-15-REF-11.

Bowen, A., Campiglio, E., & Martinez, S. H. (2015). The optimal and equitable climate finance gap. GRI working paper 184, Grantham Research Institute on Climate Change and the Environment.

Halimanjaya, A. (2015). Climate mitigation finance across developing countries: What are the major determinants? Climate Policy, 15. https://doi.org/10.1080/14693062.2014.912978

Banga, J. (2020). Essays on climate finance. Doctoral thesis, Universite Grenoble Alpes.

Bird, N., & Glennie, J. (2011). Going beyond aid effectiveness to guide the delivery of climate finance. Working paper, Overseas Development Institute. https://www.odi.org/resources/docs/7106.pdf

Bowen, A. (2011). Raising climate finance to support developing country action: Some economic considerations. Climate Policy, 11, 1020–1036. https://doi.org/10.1080/14693062.2011.582388

Grasso, M. (2011). The role of justice in the North-South conflict in climate change: The case of negotiations on the adaptation fund. International Environmental Agreements - Politics, Law and Economics, 11, 361–377. https://doi.org/10.1007/s10784-010-9145-3

Soltau, F. (2009). Fairness in international climate change law and policy. Cambridge: Cambridge University Press.

Buchner, B., Brown, J., & Corfee-Morlot, J. (2011). Monitoring and tracking long-term finance to support climate action. Technical report, Organisation for Economic Co-operation and Development and International Energy Agency. http://www.oecd.org/environment/cc/48073739.pdf

Carraro, C., & Massetti, E. (2012). Beyond Copenhagen: A realistic climate policy in a fragmented world. Climatic Change, 110, 523–542. https://doi.org/10.1007/s10584-011-0125-6

Clapp, C., Ellis, J., Benn, J., & Corfee-Morlot, J. (2012). Tracking climate finance: What and how? Technical report, Organisation for Economic Co-operation and Development and International Energy Agency.https://doi.org/10.1787/5k44xwtk9tvk-en

Donner, S., Kandlikar, M., & Webber, S. (2016). Measuring and tracking the flow of climate change adaptation aid to the developing world. Environmental Research Letters, 11, 054006.

Weiler, F., & Sanubi, F. A. (2019). Development and climate aid to Africa: Comparing aid allocation models for different aid flows. Africa Spectrum, 54, 244–267. https://doi.org/10.1177/0002039720905598

Savvidou, G., Atteridge, A., Omari-Motsumi, K., & Trisos, C. H. (2021). Quantifying international public finance for climate change adaptation in Africa. Climate Policy, 21, 1020–1036. https://doi.org/10.1080/14693062.2021.1978053

United Nations Environment Programme Finance Initiative Insurance Working Group. (2009). The global state of sustainable insurance: Understanding and integrating environmental, docial and governance factors in insurance.

Pickering, J., Skovgaard, J., Kim, S., Roberts, J. T., Rossati, D., Stadelmann, M., & Reich, H. (2015). Acting on climate finance pledges: Inter-agency dynamics and relationships with aid in contributor states. World Development, 68, 149–162. https://doi.org/10.1016/j.worlddev.2014.10.033

Buchner, B., Oliver, P., Wang, X., Carswell, C., Meatlle, C., & Mazza, F. (2017). Global landscape of climate finance 2017. Climate Policy Initiative, 1–20.

Prentice, A. (2021). Africa calls for climate finance tracker after donors fall short. Reuters Business. https://www.reuters.com/business/sustainable-business/africa-calls-climate-finance-tracker-after-donors-fall-short-2021-10-19

West Africa Brief. (2017). The six regions of the African union. www.west-africa-brief.org/content/en/six-regions-african-union

Pearson, K. (1904). Mathematical contributions to the theory of evolution. London: Dulau and Co.

McCullagh, P., & Nelder, J. A. (1989). Generalized linear models (2nd ed.). London: Chapman and Hall.

Long, S. J. (1997). Regression models for categorical and limited dependent variables. SAGE Publishing.

Cameron, A. C., & Trivedi, P. K. (1998). Regression analysis of count data. Cambridge: Cambridge University Press.

Agresti, A. (2002). Categorical data analysis (2nd ed.). New York: Wiley-Interscience.

Winkelmann, R. (2008). Econometric analysis of count data (5th ed.). Berlin: Springer.

Zhou, M., Li, L., Dunson, D., & Carin, L. (2012). Lognormal and gamma mixed negative binomial regression. Proceedings of the 29th International Conference on Machine Learning, Edinburgh, Scotland, UK.

Frees, E. W., Lee, G., & Yang, L. (2016). Multivariate frequency-severity regression models in insurance. Risks, 4. https://doi.org/10.3390/risks4010004

Heckman, P. E., & Meyers, G. G. (1983). The calculation of aggregate loss distributions from claim severity and claim count distributions. https://www.casact.org/sites/default/files/2021-02/pubs_proceed_proceed83_83022.pdf

Venables, W. N., & Ripley, B. D. (2002). Modern applied statistics with S (4th ed.). New York: Springer.

Lambert, D. (1992). Zero-inflated Poisson regression with an application to defects in manufacturing. Technometrics, 34, 1–14.

Vandeweerd, V., Glemarec, Y., & Billett, S. (2014). Readiness for climate finance. a framework for understanding what it means to be ready to use climate finance. Working paper, United Nations Development Programme, New York.

Cassim, A., Radmore, J. V., Dinham, N., & McCallum, S. (2021). South African Climate Finance Landscape 2020. Nature Conservation, Building and Nuclear Safety: Federal Ministry of Environment.

Atteridge, A. Savvidou, G., Canales, N., & Verkuijl, C. (2020). Submission to the UNFCCC Standing Committee on Finance. Stockholm Environment Institute (SEI), Linnegatan 87D, 104 51, Stockholm, Sweden.

Saunders, N. (2019). Climate change adaptation finance: Are the most vulnerable nations prioritised? Working paper, Stockholm Environment Institute, Stockholm.

Gichira, P. S., Agwata, J. F., & Muigua, K. D. (2014). Climate finance: Fears and hopes for developing countries. Journal of Law, Policy and Globalization, 22, 1–7.

Sharma, D., & Tomar, S. (2010). Mainstreaming climate change adaptation in Indian cities. Environment and Urbanization, 22, 451–465.

Mathur, V., & Roy, A. (2019). Financing resilience. In S. Saran (Ed.), Financing Green Transitions. Observer Research Foundation.

Arcidiacono-Barsony, C., Ciais, P., Viovy, N., & Vuichard, N. (2011). REDD mitigation. Procedia Environmental Sciences, 6, 50–59. https://doi.org/10.1016/j.proenv.2011.05.006

Holtz, L., & Golubski, C. (2021). Addressing Africa’s extreme water insecurity. Africa in Focus, Brookings. https://www.brookings.edu/blog/africa-in-focus/2021/07/23/addressing-africas-extreme-water-insecurity/

Mason, N., Nalamalapu, D., & Corfee-Morlot, J. (2019). Climate change is hurting Africa’s water sector, but investing in water can pay off. World Resources Institute. https://www.wri.org/insights/climate-change-hurting-africas-water-sector-investing-water-can-pay

Climate Home. (2013). Lake Chad’s receding waters linked to European air pollution. Climate Change News. https://www.climatechangenews.com/2013/06/18/lake-chads-receding-waters-linked-to-european-air-pollution

World Economic Forum. (2019). Global risks report, 14th edition. Insight Report.

World Economic Forum. (2021). Global risks report, 16th edition. Insight Report.

International Labour Organization. (2020). Report on employment in Africa (Re-Africa): Tackling the youth employment challenge. Geneva: International Labour Office.

Botreau, H., & Cohen, M. J. (2019). Gender inequalities and food insecurity: Ten years after the food price crisis, why are women farmers still food-insecure? Oxfam Research Reports., 10(21201/2019), 4375.

Smith, A. B. (2021). 2020 U.S. billion-dollar weather and climate disasters in historical context. NOOA Climate.gov. https://www.climate.gov/news-features/blogs/beyond-data/2020-us-billion-dollar-weather-and-climate-disasters-historical

Kreienkamp, J., & Vanhala, L. (2017). Climate Change Loss and Damage. Policy Brief: Global Governance Institute, University College London.

Fleifel, E., Martin, J., & Khalid, A. (2019). Gender specific vulnerabilities to water insecurity. Canada: University of Waterloo.

United Nations-Water. (2006). Gender, water and sanitation: A policy brief. https://www.unwater.org/publications/gender-water-sanitation-policy-brief

WaterAid. (2019). Nigeria. https://www.wateraid.org/uk/where-we-work/nigeria

Rodriguez, L. (2019). 4 factors driving the water and sanitation crisis in Africa. Global Citizen. https://www.globalcitizen.org/en/content/water-and-sanitation-crisis-sub-saharan-africa/

Chukwudum, C. Q. (2021). Climate finance across sub-Saharan Africa: Decision trees and network flows. Working paper. Proposal accepted for the Handbook of Research on Energy Transition in the African Economy Post-2050, scheduled to be published by IGI Global Publishers.

Rothwell, M. (2018). A practical guide to climate change for GI practitioners. Institute and Faculty of Actuaries.

Stewart, R. B., Kingsbury, B., & Rudyk, B. (Eds.). (2009). Climate finance: Regulatory and funding strategies for climate change and global development. New York University Abu Dhabi Institute: New York University Press.

Briner, G., Kato, T., Konrad, S., & Hood, C. (2014). Taking stock of the UNFCCC process and its interlinkages. Organisation for Economic Co-operation and Development/International Energy Agency Climate Change Expert Group Paper No. 2014/04, Organisation for Economic Co-operation and Development Publishing, Paris.

Global Environment Facility. (2014). Programming strategy on adaptation to climate change - least developed countries fund special climate change fund, the Global Environment Facility, Washington D.C.

Markkanen, S., & Anger-Kraavi, A. (2019). Social impacts of climate change mitigation policies and their implications for inequality. Climate Policy, 19, 827–844. https://doi.org/10.1080/14693062.2019.1596873

Caravani, A., Greene, S., Trujillo, N. C., & Amsalu, A. (2017). Decentralising climate finance: Insights from Kenya And Ethiopia. Working paper, Braced Knowledge Manager. https://cdn.odi.org/media/documents/11804.pdf

Acknowledgements

The authors would like to thank the Editor and the referee for careful reading and comments which greatly improved the paper.

Author information

Authors and Affiliations

Contributions

Queensley C. Chukwudum: conceptualization; data curation; formal analysis; writing; modelling and interpretation of data. Saralees Nadarajah: supervision of the research and revising the manuscript critically for important intellectual content; modelling.

Corresponding author

Ethics declarations

Ethical Approval

Not applicable

Conflict of Interest

The authors have no conflicts of interest to declare.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Chukwudum, Q.C., Nadarajah, S. Modelling Climate Finance Flows in Sub-Saharan Africa. Environ Model Assess 28, 977–998 (2023). https://doi.org/10.1007/s10666-023-09923-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10666-023-09923-z