Abstract

Software Outsourcing Partnership (SOP) is a client-vendor relationship focused solely on mutual trust and dedication that achieves mutually beneficial objectives. Often, a well-established outsourcing relationship may be converted into outsourcing partnerships. The development of SOP depends on various success factors. The research method attempts to solve the problem following a two-step process of Systematic Literature Review (SLR) and industrial survey with 70 experts. The results obtained are disseminated and analysed based on ‘expert level of experience’, ‘company affiliation’, and ‘expert outsourcing role’. Moreover, from a client-vendor perspective, factors are classified according to their criticality. Based on Spearman‘s correlation test (rs =0.406 and ρ = 0.040), we argue that the survey results regarding the factors are consistent with the previously published findings of the SLR. The results of this study suggest that, in rode to successfully renew or promote outgoing outsourcing ventures, outsourcing companies should address all the identified factors especially the most critical one.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Collaborative relationships such as outsourcing partnerships, that transcend traditional organizational boundaries, are the basic criteria for measuring the success of today’s trade. New inter-organizational as well as intra-organizational, structures and networks are created by organizations, that compete for competitive advantages through mutual support (Fahimullah et al. 2019). Organizational relationships in these networks go farther than old-style trades i.e. order and supply structure (Fahimullah et al. 2019). Here, all the joint struggles like risk, investment, loss, and profit are shared among partners (Lee and Kim 2005). Based on mutual trust, long-lasting corporate ties are established (Bamford et al. 2004). Collaboration also helps to minimize the investment needed for successful professional development to obtain and apply the requisite skills and capabilities. Coalitions, unions, joint ventures, alliances, or collaborations are usually called collaborative associations (Kinnula et al. 2007a).

One of the main strategies of rising companies to succeed in the market has been the advent of partnerships and alliances (Kinnula et al. 2007a). A partnership is an association of cooperation between autonomous organizations. Partnerships may enable organizations to remain competitive by joining new markets (Roy and Aubert 2002), gain access to a new resources pool (Moe et al. 2013), and increasing in-house efficiency (Kinnula et al. 2007a).

Since 1980, various kinds of business networks have been developed as a consequence of globalization, improvements in information technology (IT), economic changes, and quality improvement from developing countries, consequently, different kinds of business relations have been shaped for example strategic nets, multi-vendor contracts, and various types of alliances, association, joint ventures, coalition, and partnership (McIvor 2008). Different classes of organizations having different needs, therefore, various types of trade relations are needed (Lacity et al. 2010). Companies that produce software now uses widespread methods to source software development work; they build internal capabilities, or expand their internal capabilities, through acquisitions, joint ventures, or form outsourcing partnerships with overseas organizations (Lacity et al. 2010).

The work of Kishore (Srinivasan and Brush 2006) presents a theoretical categorisation of outsourcing associations into four kinds. These are assistance, alignment, dependency, and alliance. The partnership is a relation with poor control and a high degree of trust in the execution of the contract. Building partnerships in outsourcing is an alliance (Srinivasan and Brush 2006). Outsourcing partnership is a form of business alliance that is a mixture of both partnering and outsourcing, therefore, sympathetic comprehension of both terms is a pre-requisite to comprehend the compound term outsourcing partnership (Srinivasan and Brush 2006).

Software Outsourcing Partnership (SOP) is a long-time association grounded over the renegotiations of a mutually adjusted task that superseded commitment specified in the opening stage of the alliance as contractual terms and conditions (Lee and Kim 2005). It is a versatile, long-term strategic relationship focused on the exchange of future visions, goals, rewards, as well as risks. In practice, only productive outsourcing relationships are candidates for the promotion to outsourcing partnerships (Bamford et al. 2004). This type of relationship cannot be immediately established, but reasonably it forms over time (Khan and Ali 2015). The topmost difference between SOP and general outsourcing is its depth; the SOP relationship is much deeper (McIvor 2008). An association can be term as SOP, wherever the parties team up, combine resources, exchange confidential information about future plans, share benefits and risks, and make joint decisions in order to attain common advantageous results (Bamford et al. 2004). Outsourcing partnerships are a better tool for overcoming technical uncertainty and ambiguities, for that reason, it can effectually deal with uncertainty by exchanging information on unusual developmental events (Welty Peachey et al. 2018). Relationships with some features to create a trust are part of joint ventures and partnerships literature (Newell William et al. 2019). The distinctive distinction between a contractual relationship and a partnership is that in a partnership relationship organizations mainly focus on obtaining mutual trust and realizing broad business objectives while in conventional contract-based outsourcing arrangements main focus is given on achieving specific business goals through the fulfillment of formally signed contract (Newell William et al. 2019). The results from this study and published data support this conclusion that partnerships are about relationships not contracts (Newell William et al. 2019).

A partnership is widely reported and extensively explored in the management literature (Kinnula et al. 2007a; Welty Peachey et al. 2018; Newell William et al. 2019; Kedia and Lahiri 2007a). Such as collaboration between companies in the marketing literature (Rave and Piskin 2019a), collaborations among manufacturers and suppliers (Ali and Khan 2016), auditors and customers (Ali and Khan 2014a), manufacturers and sales agents (Li 2013), and buyers and sellers (Lee et al. 2000). In the computer-related literature, empirical studies on the outsourcing partnership begin to grow in the twenty-first century in America, Asia, and Europe (Rave and Piskin 2019a). In this paper, partnership is define as a reciprocally beneficial permanent bond, where future prospects, objectives, confidential statistics and strategies are exchanged with partner organizations on-demand, freely and proactively, in order to assist one another in concentrating on their capitals in the right direction (Ali and Khan 2016).

Kedia and Lahiri (Kedia and Lahiri 2007a) state that, at present organizational business-related studies reports widespread outsourcing of manufacturing work from developed countries to many developing countries, such as India, Ireland, China, Russia, Latin America, Ukraine, Malaysia Pakistan, and the Philippines, etc. This growth is due to the dynamism of the current competitive industrial environment, in which many new organizations are involved in the worldwide outsourcing of products and facilities. The analysis of relationships between clients and their foreign suppliers regardless of the growth of international cooperation is not adequately discussed in academic literature (Kedia and Lahiri 2007a).

This work regards SOP as “a strategic partnering relationship resulting from a method of transferring the responsibility for software development to non-employee group from an employee group for a particular business function, counting the transfer of assets, for example, human resources” (Ali and Khan 2014a).

1.1 Research aim and objectives

The study explores the gap in outsourcing contract modification or SOP creation concerning researchers and practitioners. We are specifically interested in finding and analysing a list of factors in the formation of outsourcing partnerships that are critically important to vendor in this empirical study. To achieve our goals, this study attempts to solve the problem following a two-step process i.e. a questionnaire survey design over the preliminary outcomes of the SLR. In particular, we are interested in examining the factors identified through SLR as well as an empirical survey based on three variables, such as expert level of experience, outsourcing role, and their organizational affiliation. Additionally, we distributed these factors into client-vendor groups based on expert’s organizational affiliation. Finally, we compared the results of two approaches used in the analysis to identify important variations between the factors found through the SLR and empirical survey.

To understand SOP from the practitioner’s perspective, the subsequent research questions (RQ) are put forward.

-

RQ1. What are the critical success factors, as reported in the published literature, to be developed by software outsourcing vendor organizations’ which contribute in promoting the exiting outsourcing relationship into partnership with client organization?. This question has been addressed in our published paper (Ali and Khan 2014a).

-

RQ2. What are the critical success factors, as reported by the practitioners during survey, to be developed by software outsourcing vendor organizations’ which contribute in promoting the exiting outsourcing relationship into partnership with client organization?

-

RQ3. How the identified success factors are linked with the expert’s level of experience?

-

RQ4. Do the identified factors vary based on the expert’s outsourcing role in the company?

-

RQ5. Do the identified factors vary based on the expert’s organizational affiliation?

-

RQ6. How can one use a reliable reference model to classify the identified factors into client-vendors groups utilizing a robust conceptual model?

-

RQ7: Are the factors found by literature and surveys substantially different?

1.2 Contribution of the study

The initial results regarding RQ1 were published in a conference paper (Ali and Khan 2014a). In the published conference paper (Ali and Khan 2014a) only the SLR protocol with initial list of factors was presented. No empirical analysis was presented in our previously published conference paper. This paper is based on an empirical survey; the contribution of the SLR is only to find the list of factors to be used in empirical questionnaire. Specifically, in this paper, we have extended our earlier work (Ali and Khan 2014a) in the form of various analyses based on the respondent’s level of experience, company affiliation, and experts outsourcing role. We aimed to expand the results of a previous SLR study (Ali and Khan 2014a).

This article extends our preceding work with the addition of the below-mentioned details:

-

In connection to RQ1— grounded on the results from SLR, a detailed explanation is given in section 4.1.

-

A questionnaire survey was performed to respond from RQ2 to RQ5 based on the outcomes of the previous SLR report. The outcomes of this analysis are summarized in sections 4.2 to 4.5.

-

A conceptual model for mapping success factors (SFs) was developed for RQ6 based on the survey outcomes. We present the outcomes of classification and distribution of the SFs for the conceptual mapping through a reference framework in 4.6.

-

Finally, to address RQ7, we have compared the outcomes of the empirical survey with those found through SLR in section 4.7.

This entire study aims at the development of a model in the form of a factors classification framework for Software Development Outsourcing (SDO) organizations. The potential applications of the framework model will be in SDO organizations for guiding SDO prior to initiate contract renewal or outsourcing partnership formation endeavors.

1.3 Paper outline

This subsection is based on the paper’s structural compositions: An overview of the relevant literature is given in Section-II. A detailed methodology is presented in Section III prior to our results in Section IV. Section V discussed the results while section VI presents the limitations of the study. Section VII is implication while the conclusion is given in Section VIII.

2 Background and Motivation

Literary outsourcing partnership is alienated in three different perspectives, (i) social perspectives, (ii) economic perspectives, and (ii) strategic management perspectives (Li 2013). The former most are based on the theory of agency and transaction cost. It focuses on coordination, corporate governance, productivity, and financial linkages among allies (Lee et al. 2000). But it doesn’t care about the reasons for outsourcing except for cost-effectiveness (Li 2013). Social perspective is also grounded on the theory of relationship exchange and social communication, emphasis on the existence of trust among clients and vendors (Li 2013). It is renowned from the rest for its emphasis on some issues for example equity, cooperation, and mutual trust. In addition, the two sides share common goals and are mutually assured over written SLA (Sun et al. 2002). There is a structured contract, but it is not enough for outsourcing deals to succeed alone (Assmann et al. 2003). From this point of view, the basis for the extension or dissolution of a relationship is a two-way agreement (Yang et al. 2005). The final one is grounded on the resource dependency theory that describes how, by introducing an outsourcing model; businesses achieve their objectives (Tuten and Urban 2001). However, it does not deal with the topic of relationship management (Ellram and Edis 1996).

2.1 Existing Literature

Previous authors such as Li (Li 2013), Roses et al. (Roses 2013), Yilitalo (Wang 2011), Kedia and Lahiri (Kedia and Lahiri 2007a), Kinnula (Kinnula et al. 2007a), Ellram (Ellram and Edis 1996), Tuten and Urban (Tuten and Urban 2001), Juntunen (Kinnula et al. 2007b), Gong et al. (Gong et al. 2007), Flemming and Low (Flemming and Low 2007), Zhang and Huang (Zhang and Huang 2009), Beulen and Ribbers (Beulen and Ribbers 2002), Bocij (Bocij and Hickie 2008), Ee et al. (Ee et al. 2013), Kotabe et al. (Kotabe et al. 2008), Piltan et al. (Piltan and Sowlati 2016), have addressed some of the problem of outsourcing. Few of these are summarized below:

Wang (Wang 2011) researched, the evolution of outsourcing association with connection to the development of client and vendor organizations and proposed a three-stage evolution model based on the published literature. Furthermore, the author concludes cost-saving, operational quality, and access to skilled human resources as the foremost benefits of outsourcing. According to the author, all these benefits depend on better relationship formation and ongoing management (Wang 2011).

Through a literature survey of previous outsourcing management research and a manifold case analysis of four outsourcing relations, Gong et al. (Ee et al. 2013) built an IT outsourcing relationship model. Four interconnected components comprise the model design, operationalisation, partnership efficiency, and outsourcing performance. Another research focuses on the operationalisation of the relationship, which includes five key aspects that affect the quality of the relation between the parties (performance management, transfer, agreement management, operational relationship, and knowledge exchange) (Wei et al. 2018).

Zhang and Huang (Zhang and Huang 2009), discussed partnership quality, outsourcing business characteristics, and other management elements based on typical analysis and proposes an index system model using analytic hierarchy process (AHP) and Hopfield neural network system (HNNS).

A case analysis of an Asian IT outsourcing relationship was carried out by Beulen and Ribbers (Lacity and Hirschheim 2012). Authors state that at present many organizations in the manufacturing industry transfer their companies to lower wages in Asian countries. Utmost vendors in Asia are comparatively inexperienced in terms of managing outsourcing relationships. They added not only the vendors are inexperienced, but the outsourcing clients also do not have a good track record in managing outsourcing relationships. Furthermore, in addition to the experience level of both clients and vendors, cultural issues are also important to be addressed.

Sun et al. (Szu-Yuan et al. 2002) explore the SFs of the IS outsourcing partnership through surveys and case studies based on a social perspective. As an outcome of their study authors design a research model of outsourcing partnership and give recommendations to the partner organizations to safeguard the success of the outsourcing venture.

Dwyer et al. (Dwyer et al. 1987), states that the development of partnerships and cooperation are multifaceted practices, where economic, psychosocial, and legitimate practices are simultaneously happening. Communication, common aims, partner compatibility, and mutual trust are the essential elements of outsourcing partnerships (Ylitalo et al. 2004). bi-directional decision making, increased flexibility, the development of technical skills, free management time, increased financial control, greater quality of service, and cost savings are the key reasons for outsourcing collaborations (Bocij and Hickie 2008).

Li et al. (Li et al. 2008), presented and discussed a special type of outsourcing in which internal service is source to an external provider through organizational restructuring and reform. They further state that the nature of partnerships formed among clients and their suppliers does not receive sufficient consideration in the published literature.

Based on the psychological contract theory and transaction cost theory, from vendors’ perspective, Wei et al. (Wei et al. 2018) discuss how the security of outsourcing information impacts the quality of partnerships and project results. Grounded on the data analysed from 180 IT offshore outsourcing projects, they conclude that information security reduces project performance and partnership quality. They further stated that regardless of the increase in research, focused on the significance of knowledge protection in outsourcing partnerships the existing literature offers contradictory interpretations on whether knowledge protection impedes project performance.

In view of Kotabe et al. (Kotabe et al. 2008), in the last two decades outsourcing has gained much attention in the academic discussions and managerial practices. But, we still do not recognize the full consequences of outsourcing policies for enhancing the efficiency of organizations. Furthermore, so far no universal justification has been given for how outsourcing could lead to worsening organization’s in-house capability. They create an evolutionary stage model that links outsourcing to the growth of organizational capacity and further find that a backbiting sequence may occur.

2.2 Critical factors in outsourcing partnership formation

Critical factors are those factors that are important for successful breaking or making the SOP i.e. inducing either negatively or positively in SOP formation (Forrest and Martin 1992). Table 1 summaries the success factors identified in relevant studies, few of them are discussed as follows:

Bruce et al. (Bruce et al. 1995), present communication, flexibility, trust, equality in power, commitment, mutual contribution and benefits, and strong personal interactions as SFs for collaborative product development.

Millson et al. (Millson et al. 1996), identified accepting each other strengths and weaknesses, proper information sharing, equal rights for intellectual property, mutual goals, and exit strategy as SFs for new product development.

Virolainen and Veli-Matti (Virolainen 1998), identified shared goals, mutual trust, bidirectional information sharing, timely communication with the client, support from top management, distinct value addition by vendor, mutual understanding, and long-term mutual commitment as SFs for sourcing partnership formation between customer and suppliers.

Forrest and Martin (Forrest and Martin 1992), mentioned bottled up the contract on mutual objectives and goals, good interpersonal relations, commitment, communication, and compatibility as SFs for research-intensive collaboration between a small and large organization in the biotechnology industry.

Bruce (Bruce et al. 1995) identified choice of a partner, equal contribution, founding the ground rules, trust and flexibility in communication, personal relationships and long-term commitment, mutual benefits and power control, and other environmental and employee-specific factors as SFs for ICT product development collaboration.

Millson (Millson et al. 1996) conducted a qualitative study on partnerships between small and large organizations. They noted understanding of each other strengths and faintness, information sharing, joint property rights, strategy-related goals, and exit plans.

Rhodes et al. (Rhodes et al. 2016), argue that relationship interaction factors such as communication, coordination, cooperation, collaboration, integration activities, and conflict resolution has a long-lasting impact on client perceived value than relationship quality factors such as trust and loyalty in the context of services outsourcing. Katato et al. (Katato et al. 2019), identify factors affecting long-term business outsourcing relationships through case-study with Thailand-based firms. Sun et al. (Szu-Yuan et al. 2002), mentioned communication, commitment, mutual understanding, inter-dependence, trust, and conflict resolution as SFs.

Gonzalez et al. (Gonzalez et al. 2015), explore IS outsourcing satisfaction factors. They take into account the degree of outsourcing, client and provider relationships, and role of the Client Company’s top management as IS outsourcing satisfactions factors. In another study (González-Ramírez et al. 2019), authors explore IS satisfaction factor from managers’ perspective. Sanchez and Terlizzi (Sanchez and Terlizzi 2017), explore time and cost-related agile project management SFs for IS development projects.

Santos et al. (dos Santos and Macaria da Silva 2015), identify SFs of IT outsourcing from the provider perspective. The identified SFs are cost management, price flexibility, service catalogue, and service standardization. Carvalho et al. (de Carvalho et al. 2018), integrate and correlated SFs in IT outsourcing.

Mehta and Mehta (Mehta and Mehta 2017), developed an integrated framework for moving toward a successful Offshore IT Outsourcing. Gopalakrishnan (Gopalakrishnan et al. 2017), explores IT outsourcing satisfaction from vendor viewpoints. Cha and Kim (Cha and Kim 2018), conduct an industrial case study with top IT outsourcing (ITO) companies in Korea and identify SFs, from the client perspective, for mutual collaboration with suppliers in the ITO industry. Similarly, Blijleven et al. (Blijleven et al. 2019), conduct multiple case studies in IT outsourcing for SFs identification in the context of lean implementation for strengthening the stakeholders’ relationships.

Ikediashi and Okwuashi (Ikediashi and Okwuashi 2015), identify 31 FSs through a questionnaire survey. The factors were then grouped into six broad categories such as cost, strategy, innovation, quality, time, and social factors. Rahman et al. (Rahman et al. 2021), execute a questionnaire survey to explore the factors affecting the decision of offshore outsourcing application maintenance. Könning et al. (Könning et al. 2019), conduct SLR on recent research developments in IT Outsourcing. Rahman et al. (Rahman et al. 2020), analyses the factors affecting the decision of offshore outsourcing application maintenance through SLR. Khan et al. (Rave and Piskin 2019b) explore influential factors for clients in the selection of offshore software vendors.

Ismail and razali (Ismail and Razali 2015) investigate factors for software testing projects outsourcing through a survey. They identify factors like needs identification, vendor selection, contract establishment, project planning, infrastructure setup, project monitoring, quality assessment, testing phase preparation, and project close-out. Bashir et al. (Bashir et al. 2020), identify SFs for software process improvement (SPI) in outsourcing organizations such as satisfaction, trust, commitment-based organizational culture, information sharing, mutual understanding, and strong relationship between partners from client-vendor perspectives.

Khan et al. (Rave and Piskin 2019b) find out various factors for clients such as skilled human resources, cost-saving, efficient relationships management, quality of product and services, and appropriate infrastructure in the selection of offshore SDO vendors.

2.3 Problem statement and motivation

Previous authors like Li (Li 2013), Roses et al. (Roses 2013), Yilitalo (Wang 2011), Kedia and Lahiri (Kedia and Lahiri 2007a), Kinnula (Kinnula et al. 2007a), Ellram (Ellram and Edis 1996), Tuten and Urban (Tuten and Urban 2001), Juntunen (Kinnula et al. 2007b), Gong et al. (Gong et al. 2007), Flemming and Low (Flemming and Low 2007), Zhang and Huang (Zhang and Huang 2009), Beulen and Ribbers (Beulen and Ribbers 2002), Bocij (Bocij and Hickie 2008), Ee et al. (Ee et al. 2013), Kotabe et al. (Kotabe et al. 2008), and Piltan et al. (Piltan and Sowlati 2016), have addressed some of the problems of outsourcing but they do not specifically focus on the identification of SFs. A significant proportion of the studies (Ellram and Edis 1996; Tuten and Urban 2001; Szu-Yuan et al. 2002; Dwyer et al. 1987; Forrest and Martin 1992; Bruce et al. 1995; Virolainen 1998; Rhodes et al. 2016; Gonzalez et al. 2015; Slowinski et al. 1993; Mohr and Spekman 1994; Halinen 2012; Zhu et al. 2001; Kern and Willcocks 2000; Anderson and Narus 1990; Embleton and Wright 1998; Ring and Van de Ven 1994; Blomqvist 2002; Brinkerhoff 2002; Kedia and Lahiri 2007b; Greiner et al. 2012; dos Santos and Macaria da Silva 2015; de Carvalho et al. 2018; Mehta and Mehta 2017; Gopalakrishnan et al. 2017; Cha and Kim 2018; Blijleven et al. 2019; Ikediashi and Okwuashi 2015; Rahman et al. 2021; Könning et al. 2019; Rahman et al. 2020) identifies success factor but majority of the studies conducted in the domain of outsourcing partnerships are from the perspective of business process (Ellram and Edis 1996; Tuten and Urban 2001; Dwyer et al. 1987; Rhodes et al. 2016; Katato et al. 2019; Zhu et al. 2001; Anderson and Narus 1990; Embleton and Wright 1998; Ring and Van de Ven 1994; Blomqvist 2002; Brinkerhoff 2002; Kedia and Lahiri 2007b; Greiner et al. 2012), IS (Szu-Yuan et al. 2002; Virolainen 1998; Rhodes et al. 2016; Gonzalez et al. 2015; Sanchez and Terlizzi 2017) or IT outsourcing (Bruce et al. 1995; Slowinski et al. 1993; Mohr and Spekman 1994; Halinen 2012; Kern and Willcocks 2000; dos Santos and Macaria da Silva 2015; de Carvalho et al. 2018; Mehta and Mehta 2017; Gopalakrishnan et al. 2017; Cha and Kim 2018; Blijleven et al. 2019; Ikediashi and Okwuashi 2015; Rahman et al. 2021; Könning et al. 2019; Rahman et al. 2020).

Only few studies have been conducted on some of the aspects of software outsourcing such as software testing projects outsourcing (Ismail and Razali 2015), managing outsourced software development projects (Ahimbisibwe 2015), client’s readiness assessment towards outsourcing software projects (Abd Hamid and Mansor 2016), management of outsourcing in software development processes (Núñez-Sánchez et al. 2019), outsourcing success in software start-ups (Rave and Piskin 2019b), selection of offshore software outsourcing vendors (Rave and Piskin 2019b). Although, like our study, the above studies were conducted from the software outsourcing perspective, still none of them focus on the formation of a partnership in software outsourcing. Moreover, majority of the above were not conducted in an offshore setting.

Kinnula (Kinnula et al. 2007a) was the first one to work on the formation and ongoing management of SOP, but their study was conducted from the perspective of SOP formation lifecycle process and did not identify factors affecting the formation of SOP. Furthermore, they neither conduct SLR nor their study performs industrial analysis from different perspectives. According to our knowledge and relevant keyword searching on different digital libraries, it has been confirmed that the authors of this study are the first ones to conduct an empirical studies on the SOP as a general and the identification and analysis of SFs as a particular.

3 Research Methodology

The method attempts to solve the problem following a two-step process i.e. an SLR followed by a questionnaire survey. These two techniques were incorporated as a data collection methodology for the extraction and verification of factors to SOP formation. To answer RQ1, this study implements the SLR process whereas the remaining RQs are answered through the data gathered using an empirical survey. First of all, the available literature was reviewed by executing SLR, and as a result; we have acknowledged twenty-six SFs for SOP formation. Furthermore, to validate the findings of SLR, based on the initial outcomes of SLR, a questionnaire was designed to get the perception of the experts practicing outsourcing for several years. Through the questionnaire, we get an opinion from experts regarding the factors that motivate outsourcing clients in upgrading or renewing their existing outsourcing relationship to a partnership with vendor organizations. For the sake of analysis, the contributing experts were divided into different levels on the basis of their industrial experience (i.e. senior, intermediate, and junior) and role in outsourcing (i.e. contract negotiator, decision-makers, outsourcing manager, and academician). Further, experts were distributed into client-vendor groups based on their company type and factors were classified as belonging to clients or vendors. Finally, the results of the two methods were correlated. Our approach can be seen as a two-stage process and is presented in much detail in the subsequent subsections.

3.1 Data Collection Phase-1: SFs Identification Via SLR

The outcomes of this section are based on the data collected in two-stage as presented below:

In the first stage of data collection, different factors that influence clients to renew or promote their current contract-based outsourcing relation with their vendors to a partnership were identified. The SLR helps to analyse and test specific data based on study questions by using the analytical approach of primary studies. In our previous research, SLR was also adopted as the main approach (Ali et al. 2019). We developed a review plan, usually called a protocol, before performing the review. The protocol elucidates various phases of the SLR such as planning, conducting, and reporting. Our protocol related information can be found in (Ali and Khan 2014a).

We found 5, 908 papers by using our predefined search string on the listed venues. Just 156 out of 5, 908 publications qualify the criteria of inclusion/exclusion. To finalise, the repetition was removed by rejecting four articles, which were indexed in more than one database. We get 152 articles as a final sample for our SLR. To minuscule the reviewer’s bias in data extraction, the inter-rater reliability test was conducted by selecting twenty random articles from the primary sample of articles. Using the listed inclusion/exclusion criteria with the quality checklist the two secondary reviewers make the final selection. To estimate the inter-rater agreement between primary and secondary reviewers, we carried out the nonparametric Kendall concordance coefficient (W). The W value of Kendall falls between 0 (complete disagreement) and 1 (complete agreement) (Von Eye and Mun 2006). The same procedure was adopted, during the primary selection, as an inter-rater reliability test. The results of our SLR study are summarized in Table 2.

3.2 Empirical survey

A survey has been employed here to study the perception of experts regarding the criticality of various SFs through an online questionnaire with outsourcing experts by utilising Google Drive the online survey tool. This is a free survey tool used for such study design.

We choose survey for this empirical study because survey is considered to be an appropriate method for collecting hidden empirical data (Lethbridge et al. 2005). Moreover, it is one of the empirical research methods best suited for the collection of data from heterogeneous sources. That is why survey results often reveal a high level of external validity. It is complementary to other empirical research methods such as controlled experiments that typically show a high-level of internal validity (Ciolkowski et al. 2003). Secondly, our study nature is both quantitative and qualitative and a questionnaire survey is the most common method for such type of mixed research (Creswell 2013). A questionnaire-based survey is considered to be an appropriate tool for collecting tacit quantitative and qualitative information (Lethbridge et al. 2005).

In the below sub-sections, we describe the process of designing, data gathering, and analysis. Here, we will cover data collection, the methods that choose participants, and questionnaire data analysis strategies.

3.2.1 Survey Design

A survey design provides a numeric or quantitative description of the opinions or trends of a population by studying a sample of that population. The researcher then generalises or makes assertions concerning the population, from sample results. A questionnaire survey is also deliberated as quantitative because it is an appropriate technique for collecting and evaluating quantitative data. It allows the investigator for conversation and exploration of new themes that arise during the data collection (Lethbridge et al. 2005).

Designing a survey is a two-step process i.e. sampling and questionnaire design. Sampling is defined as scanning, listing, approaching, and appointing suitable subject experts to participate in the survey (Creswell 2013). The investigator pre-designed a series of questions for experts to be replied to in the design process. In the subsections below, these steps are further elaborated.

Sampling

Sample can be obtained through a methodical approach or non- methodical approach (Creswell 2013). In the methodological approach, with the aid of certain statistics, samples are collected directly from the entire available population. While in a non-methodical approach, it is difficult to list the entire population (Creswell 2013). Our technique can be seen as a non-methodical approach, since it was difficult to enlist all the software companies engaged in outsourcing. Cox et al. (Cox et al. 2009), Niazi et al. (Niazi 2005), and Khan et al. (Khan et al. 2012) have followed a similar approach.

Designing Questionnaire

The core component of a survey is its questionnaire. The results of surveys mainly depend on the questionnaire that scripts the dialogue (Krosnick 2018). The script of our questionnaire is composed of the following segments.

-

Composition: The questionnaire was distributed into three separate parts, i.e. demography, a list of 26 variables to be weighed by the seven-point Likert scale, and indications of submission. The composition was adopted from (Cox et al. 2009; Niazi 2005; Khan et al. 2012).

-

Questions type: For data collection as an instrument to collect self-reported data, we used a closed format questionnaire. The questionnaire script was based on the SFs identified via SLR. To rank the importance of SFs, the experts were asked to weights each SF relative importance from extremely agree to slightly disagree. To gain the tacit facts on SFs some open-ended questions were also incorporated in the questionnaire to find any other SFs distant from the identified ones.

-

Rating scale: An evaluation scale is a range (e.g., satisfaction, frequency, agreement) that aid in measuring different phenomena and their characteristics in the questionnaires (Menold and Bogner 2016). Experts participants rate the content of each item and question by choosing the relevant category (Menold and Bogner 2016). The total numbers of response categories are also a very important characteristic of the evaluation scale. It determines the ease of understanding of the range in question and thus contributes to the degree of differentiation of the rating scale. Krosnick et al. (Krosnick and Fabrigar 1997), conclude that the best measurement (in expressions of the degree of differentiation, validity, and reliability) could be reached through a scale with five-seven categories. Studies show that participants also favored scales of this length (Krosnick and Fabrigar 1997).

Study (Menold and Bogner 2016) confirms that using too many rating categories makes it difficult for survey participants to answer the individual question because with the increase in the rating categories, the clarity of the meaning of the individual categories decreases. Conversely, if very few categories are used, the rating scale is not appropriately differentiated (Menold and Bogner 2016). Researchers (Maitland 2013; Menold et al. 2014; Saris and Gallhofer 2014) concluded that test-retest validity and reliability can be increases through verbally labelling all the rating scale categories (Maitland 2013). Menold and Kaczmirek (Menold et al. 2014) and Saris and Gallhofer (Saris and Gallhofer 2014) found that completely verbalized response scales also amplify cross-sectional reliability.

According to Menold and Bogner (Menold and Bogner 2016), a non-substantive category like “no opinion”, “not sure”, “don’t know” in rating scales should always be given because it is expected that participants who do not have an appropriate judgment on the issue in question would then feel obligated to give a substantive answer.

In this study, seven points Likert scale from extremely agree to slightly disagree with “not sure” as a substantive category is incorporated as shown in Appendix 6.

-

Content: All 26 factors were used as input to the questionnaire survey for rating.

-

Testing: Psychometric quality criteria have been used to check the effects of rating scales. These criteria include systematic measurement error, reliability, and validity (Menold and Bogner 2016). The questionnaire test was carried out by six experts working extensively in the domain around the world. Experts were identified based on our previous collaboration experience and were selected based on their expertise and relevance to the research field. In this study, systematic measurement error in the form of item nonresponse, middle response pattern, extreme response pattern, participants preferences, and the technical hitches they face while answering survey questions have been tested (Menold and Bogner 2016; Menold et al. 2014).

3.2.2 Data Gathering

In terms of data collection, this work specifically concentrates on the following two aspects.

-

1.

To confirm the SLR results.

-

2.

To get the perception of the experts engaged in the global outsourcing projects.

Executing On-line Surveys

Firstly, experts were invited via an open letter of invitation, which provides brief overview of the work. In particular, the nature of the survey, the topics to be discussed during the survey, and the expected time to complete it were mentioned. It also entrusted the confidentiality and privacy of the participant or its organization through the measures taken by the investigator. The invitation letter was posted on the below listed social media and companies’ websites.

-

Yahoo groups (https://groups.yahoo.com)

-

LinkedIn (https://linkedin.com) and to

-

Software Companies in China, Saudi Arabia, and Pakistan.

Besides, we also send an invitation through email to the authors of practitioners’ articles, to participate in the online survey. During the SLR, these practitioners’ written articles were noted. Sums of 151 experts were contacted back for participation in response to these invitations. After receiving their consent the web link of the survey forms were sent to these experts. We acknowledge 77 completed survey forms within the survey time limit. However, seven survey forms were rejected after the consistency requirements were applied. There were only 70 survey forms left for further review after exclusion. Of the 70 survey forms, 32 were completed by overseas experts, while the remaining 38 were completed by local experts. Our response rate to the survey was 34.65%. Some experts give a quick answer to our survey invitation and for others, we sent a reminder. This reminder helped considerably.

3.2.3 Data Analysis

The final sample of questionnaire data was then further analysed on the basis of expert experience level, their outsourcing role, and organizational affiliation, i.e. vendor-client. The reason behind expert classification is that outsourcing decision requires experts from different experience level in the form of contract negotiator, decision-maker, outsourcing facilitator, dispute resolution specialist, outsourcing manager, or communication engineers, etc. Moreover, prior to the redesign, experts were grouped haphazardly, which often led to experts with significant experience knowing about most of the outsourcing factors, leaving those with little experience confused and frustrated. Furthermore, expert classification is aligns with the preceding literature such as (Khan and Niazi 2012a).

Client-vendor distribution is based on the empirical survey outcome using a reference model developed by Prikladnicki et al. (Prikladnicki et al. 2004). The same methodology is used by Khan et al. (Khan et al. 2018; Khan et al. 2017). We also adopted it in our preceding work (Ali et al. 2020). Although, we distribute the factors based on the reference model (Prikladnicki et al. 2004) into either belongs to the clients or vendors. The factors are equally important to both client and vendor because the frequency on the other side is not zero. However, the main target of our study is vendors. Therefore, we recommend vendor to focus on all the mentioned factors, especially the critical ones.

In our survey, contributors are requested to carefully choose the options on the 7-point Likert scale against the listed SFs. Data were then imported into the qualitative software package for further analysis. For analysis purposes (RQ3 to RQ6), we have tested linear by linear association using chi-square tests, to find a significant difference among the identified factors. To evaluate major differences between ordinal variables linear by linear association testing is a more prevailing method compared to Pearson chi-squared testing (Halinen 2012). The result of linear association test will be considered significant if the p- value is = < 0.05, which is the designated alpha level.

In order to compare the results of SLR and survey (RQ7), we have conducted the Spearman rank-order correlation test. Since the SLR outcomes were in the form of frequency data (not distributed into groups) and were therefore suitable to be tested using Spearman. Conversely, the questionnaire survey responses were taken on seven Likert scales. Therefore, the responses were assembled into three groups i.e. A, B, and C, as presented in Table 3. First category is positive (A) = (EA+ MA + SA). Second group is neutral, neither or not sure (B) while the third category is negative (C) = (EDA + MDA + SDA).

4 Results

The section presents the results of the SLR and empirical survey. Specifically, the outcomes relevant to study research questions are discussed. We have responded to RQ1, RQ2, RQ3, RQ4, RQ5, RQ6, and in subsections 4.1, 4.2, 4.3, 4.4, 4.5, 4.6, and 4.7 below.

4.1 Summary of Factors, Identified Via Systematic Literature Review (RQ1)

After completing the final selection phase, we start extracting data from the finally selected articles. A list of quotes from each article in the final sample of 152 articles was noted at the last stage of the data extraction process. For the purpose to classify these quotes into different groups each primary investigator individually goes through these quotes. To reach an initial categorisation of the factors, a primary investigator codes factors with the help of a secondary investigator.

For coding, a qualitative coding method based on the Grounded theory (Strauss and Corbin 1990) was used, and finally a list of 39 factors names were coded. These names were further analysed by overseas collaborators and some names were merged. Finally, we got twenty-six factors as illustrated in Table 2.

This process was explored in more detail in our previously published conference paper (Ali and Khan 2014a). Six of these SFs were ranked as critical success factor (CSF) such as ‘mutual interdependence and shared values’, ‘mutual trust’, ‘effective and timely communication’, ‘organizational proximity’, and ‘quality production’.

‘Mutual interdependence and shared values’ (68%) is the most common SFs identified in our study. Similarly ‘mutual trust’ (59%) is the 2nd most cited CSF in our findings. It was also found that 58% of articles in our study have cited ‘effective and timely communication’ as a generally recognised CSF to be addressed by vendor organizations. Likewise, 57% of the papers in our study have quoted ‘quality production’ while more than half of the articles in our study described ‘organizational proximity’ (52%) and ‘3C- coordination, cooperation and collaboration’ (50%) as CSFs for outsourcing partnerships.

4.2 Summary of Factors, Identified Via an Empirical Survey (RQ2)

Table 3 demonstrates that all the reported factors were positively agreed upon by more than 60% of the survey experts. Likewise, other highest-ranked SFs, in the survey are ‘quality production’, ‘success stories of the past projects’, ‘effective communication’, ‘top management engagement’, ‘access to complementary skills, new markets, and technologies’, and ‘effective relationship management’, where 97% of the participants agreed positively on all these factors. Literature as described follow has obtained similar findings:

-

In view of Webb (Webb and Laborde 2005) effective and timely client-vendor communication gives an organization a chance to form strong relations for quality production. Partnerships are the most appropriate way to enter new markets, new technologies, and skills that are not available from internal sources.

-

According to Berger et al. (Berger and Lewis 2011), active communication amongst outsourcing partners is supposed to be a vital element of a successful relationship such as partnerships.

-

Beulen and Ribbers (Beulen and Ribbers 2002) states that effective relationship management is vital to the formation of an outsourcing partnership.

-

Effective communication provides a strong opportunity to build partnerships (Webb and Laborde 2005).

-

Today’s outsourcing relationships are not formed solely for cost savings, but due to the best quality provided to the other side (Baliyan and Kumar 2014).

-

Partnerships provide both parties with entry to new markets, up-to-date technologies, and skills that are not accessible in-house, and to conduct learning activities for mutual benefit (Lee and Lim 2005).

-

Success stories of past projects are an important factor and generally mature and successful outsourcing arrangements may transform into outsourcing partnerships (Ali and Khan 2014b).

-

Correspondingly, the second extremely agreed SFs in the questionnaire are ‘organisational transparency and receptivity’, ‘mutual interdependence and shared values’, ‘3C (cooperation coordination, collaboration)’, and ‘mutual trust’.

This also confirms the literature results of the following reports:

-

According to Bowersox (Bowersox et al. 2003), a long-term partnering relationship is formed for the purpose to achieve mutual benefits greater than the organizations might be able to attain independently.

-

According to Alexandrova (Alexandrova 2012), how organizations ‘acquire expertise’ from their partners should be given extraordinary attention, as it is the key source of growth in strategic competencies.

-

Literature discloses that the present trading style is shifting from competition to cooperation, teamwork, and coordination (Kumar and van Dissel 1996).

-

In partnership organizations with mutual goals takes combined decisions, share assets, information, risks, and benefits, and work together with the aim to achieve mutual valuable outcomes (Kinnula et al. 2007b).

The outcome of the empirical survey confirms the following SFs on third ranks (91%) of importance. These include, ‘bidirectional transfer of knowledge’, ‘flexible service level agreements’, ‘long-term commitments’, ‘flexibility and reliability’, and ‘relation specific investment and financial stability’. The following literature shows the value of these factors.

-

Many typical organizational partnerships use formally written agreements as a controlling tool. Because they help to put certain limitations on the power and behaviour of the individual partners that are mutually enforceable (Goo 2010). While partnerships use flexible SLA as a control tool for SDO engagements, this will be done through mutual trust (Mingay and Govekar 2002).

-

Commitment assures the partner that the relationship can continue for a long period (Henderson 1990), and has been classified as “a lasting desire to stay in a valued relationship” (Cha and Kim 2018).

-

The information might have two forms: explicit/formal and implicit/informal. BTK is essential for the apprehension of the capability and is delivered using the channels via active communication among the associates (Zahedi et al. 2016).

-

Klepper and Jones (Blijleven et al. 2019) point out that the partner’s financial stability is an integral element of the SOP because the relationship needs the client and the vendor company to invest in the relationship.

-

The collaboration style relationship is flexible, i.e. it allows for the adjustments over a negotiated period in contract/SLA and project specifications. This partnership is lifelong and can lead to contract renewals many times (Klepper 1998).

The findings of this study conclude that the fourth most significant element in the SOP vendor organization is ‘cross-cultural awareness and sensitivity’, i.e. 86%. More recent work in this area explains the significance of these factors as:

-

The failure of many cross-cultural software development relationships is concluded as cultural differences and lack of ability to improve ‘cross cultural sensitivity and differences’ (Johnson et al. 2006).

‘Constructive conflicts resolution mechanism’, win-win strategy’, ‘human resource management’, and ‘honesty and openness’ are classified as fifth-ranked (83% positively agreed) based on our survey results.

-

Conflicts represent the extent of disagreement in operational partnerships. Resolve the differences when arises (Kinnula 2006).

-

Traditional outsourcing is based on a win-loss mindset, whereas partner outsourcing is focused on a win-win attitude (Ali and Khan 2014a).

-

In the partnership, both parties openly share project status information (Kinnula et al. 2007b).

-

According to Khan and Niazi (Khan et al. 2009), human resource management is an important factor that vendors should solve effectively in outsourcing relations.

Seventy-one percent of the participants are positive about ‘governance and control’, ‘spurring innovation’, and ‘organizational proximity’ are significant factors for successful outsourcing. The significance of these factors is reported in the literature as follows:

-

The factor that governs organizational differences is ‘organizational proximity’ since it “belongs to the same reference space”. It also helps to establish common norms, statements, working standards, and practices (Torre and Rallet 2005).

-

Governance and control are concerned with taking corrective actions between distributed partners in problem situations for resolution. Likewise, it also requires the resolution of disputes of concern among various outsourcing partners (Becht et al. 2003).

-

Lee and Kim (Blomqvist 2002) state that in order to become partners, outsourcing vendors must be capable of creating innovative ideas.

We found two factors namely ‘new business opportunity’ and ‘social networking’ having a percentage below 70 %, i.e. 63%. Moreover, relevant literature also confirms that social networking amongst employees of the partner organization is a constituent component of the partnership (Ali and Khan 2014a).

4.3 Analysis of the Factors, Identified Via Empirical Survey, Based on Practitioner Level of Experience (RQ3)

In our empirical study, a total of 70 outsourcing experts have participated. We distribute these professionals into three different groups based on their proficiencies. ‘Junior’ experts are those with 1–5 years of outsourcing experience, those with 6–10 years’ experience would be considered at ‘Intermediate’ while those with more than 11 years of experience were considered as ‘Senior’ experts. The results of the percentage of responses from various outsourcing experts are shown in Table 3. Out of 70 participants of the survey, 20 experts were ‘Senior’, 35 were ‘Intermediate’, and 15 participants were ‘Junior’ as illustrated in Table 4.

The findings indicate that out of 26 SFs, twenty are those about which more than 80% of ‘Junior’ professionals say that might play a positive role in the development and management of SOPs. Twenty-one SFs were considered important for SOP formation by ‘Intermediate’ experts. All except two of the 26 SFs listed are considered critical by senior experts, who have more than ten years of experience. These two factors are:

-

‘Governance and control’ and

-

‘New business opportunity’.

For the given list of SFs as given in Table 3, we did not find any major difference based on levels of expert experience.

Seven factors have been extremely agreed upon by more than 50% of the senior-level experts. Factor ‘top management engagement’ gets the highest score (85%) in the ‘senior level’ experts category. ‘Effective on-time communication’ and ‘mutual trust’ get 80% ratification by senior experts. ‘Effective relationship management’ and ‘quality production’ have the third most (75%) in this category. Likewise, ‘3C (coordination, collaboration, and cooperation)’ and ‘success stories of the past projects’ are the fourth most significant factors to be considered having 65% occurrence.

In the ‘extremely disagree’ column of senior level experts, only three factors ‘cross culture understanding and sensitivity’, ‘governance and control’, and ‘honesty and openness’ were found with a count of only one as given in Appendix 5 (: Table 15). Conceptually similar work has also been carried out by Khan and Niazi (Khan and Niazi 2012b).

For intermediary experts, out of the 26 identified SFs, ten factors were extremely agreed by > = 50% of the intermediary experts. Factor ‘mutual trust’ gets the highest proportion (71%) of occurrence among the intermediary experts. ‘Effective on-time communication’ (69%) got the second rank while ‘quality production-66%’ got the third rank.

‘Effective relationship management’ and ‘top management engagement’ both united in the fourth rank with (63%) extremely agree endorsement by the intermediary experts.

‘Success stories of the past projects’ and 3Cs with 60% endorsement are ranked fifth by intermediate-level experts. ‘Cross culture awareness and sensitivity’, ‘access to novel markets’, innovations and complementary skills’, and ‘mutual interdependence and shared goals’ are the three SFs that shared the sixth rank with 51% occurrence in the intermediate expert’s group.

We found only two factors i.e. ‘honesty and openness’ and ‘new business opportunity’ in the extremely disagree list of intermediary experts with a count of only one as given in Appendix 1 (: Table 15). Conceptually similar work has also been carried out by Khan and Niazi (Khan and Niazi 2012b).

For junior professionals, out of the 26 identified SFs, eleven factors have been extremely agreed upon by > = 50% of junior level participants. It is interesting to note that in the group of junior level experts, ‘mutual trust’ has the highest percentage (87%).

‘Success stories of the past projects’ and ‘3C (coordination, cooperation, and collaboration)’ are the secondly high (71%) recognised factors while ‘effective on-time communication’, ‘flexibility and reliability’, ‘honesty and openness’, ‘human resource management’, ‘joint management infrastructure’, ‘long-term commitments, ‘ and ‘mutual interdependence and shared values’, and ‘quality production’ all share rank three (53%).

We bring into being about only one factor extremely disagrees by junior level experts i.e. ‘new business opportunity’. However, as seen in Appendix 1 (: Table 15), the factor has a frequency of only one. Table 5 offers information on the distribution of the common critical factors highly recognised by these groups of experts:

-

‘Effective relationship management’ and ‘top management engagement’ are quoted as strongly agreed in > = 50% by senior and intermediary level experts.

-

‘Mutual interdependence and shared values’ are strongly endorsed by > = 50% of intermediate and junior level practitioners.

We found only five factors as extremely agreed by > = 50% of experts in all the three categories of experts. These factors are: ‘3C (coordination, cooperation, and collaboration)’, ‘effective and on-time communication’, ‘mutual trust’, ‘success stories of past projects’, and ‘quality production’ as shown in Table 5. There is a clear consensus among our findings and other researchers. The following literature refers to the importance of these factors:

-

Kishore (Kishore et al. 2003) categorised outsourcing relations into four groups. These are alignment, support, alliance, and reliance. Alliance is a highly trusted relationship with low control over contract execution. An outsourcing partnership is a type of alliance relationship (Srinivasan and Brush 2006; McFarlan and Nolan 1995).

-

Webb and Laborde (Webb and Laborde 2005) noted that ‘efficient and effective contact’ between client and vendor organizations creates an incentive for quality development and establishes an enduring partnership between clients and vendors. The most appropriate way to reach new markets, new technology, and skills that are not accessible internally is possible through partnerships.

-

Berger et al. (Berger and Lewis 2011), found communication effectiveness among outsourcing partners vital for fruitful partnership formation. Furthermore, for successful relationships such as partnerships, effective interaction among outsourcing partners is considered vital (Berger and Lewis 2011).

-

In view of Brown (Hagel and Brown 2005), companies began to recognize the advantages of outsourcing strategies, not to gain advantages in terms of production costs, but also to take advantage of the quality standard provided by offshore suppliers, owing to the development of free markets space under the conditions of globalization and developments in ICT.

-

Kumar (Kumar and van Dissel 1996) states that the current inter-organizational systems literature focuses on the transition from competition to collaboration, cooperation, and coordination in inter-organization system.

-

The success stories of the past projects are a significant factor and outsourcing partnerships will usually transform into established and profitable outsourcing arrangements (Ali et al. 2017).

-

Vendors should deliver quality software products by enhancing their software development skills in order to support the partnership relationship for upcoming outsourcing projects (Greiner et al. 2012).

4.4 Analysis of Factors, Identified Via Empirical Survey, Based on Expert Outsourcing Role (RQ4)

All the 70 responses we have received from various experts are split into four groups depending on the outsourcing role: academicians, outsourcing managers, decision-makers, and contract negotiators. The academician category consists of academic staff members, postdoc and academic researchers, and Ph.D. students having the experience and/or sound knowledge of software outsourcing. By decision-makers, we mean CEOs and CTOs. Outsourcing manager’s category consists of senior and junior managers, team leaders, and analysts while the negotiator category consists of the negotiators, facilitators, dispute resolution specialists, and outsourcing consultants.

In our survey eight participants were academicians, twenty-one participants were outsourcing managers and fifteen were decision-makers while twenty-six were negotiators/facilitators or dispute resolution specialists. This form of expert grouping was adopted from (Rave and Piskin 2019b). The distribution of views of the experts’ participants based on their outsourcing roles is given in Appendix 2 (: Table 16).

More than 75% of the academicians are agreed about all the SFs except ‘honesty and openness’, ‘Social networking’, ‘new business opportunity’, and ‘human resource management’ while more than 75% of the outsourcing managers are positive about the importance of all SFs except the ‘new business opportunity’. About seventy-three % of the decision makers have agreed about all SFs except the factor ‘new business opportunities’, ‘social networking’, and ‘governance and control’ and more than 75% of the negotiators agree with the importance of all the SFs except the ‘social networking’, ‘new business opportunity’, ‘governance and control’, ‘social networking’, and ‘spurring innovation’. The percentages of various SFs across the outsourcing roles are shown in Table 6. We have not noticed any major difference across expert outsourcing roles as illustrated in Table 6. The distributions of the most common SFs based on the expert’s role are shown in Table 7.

Nine factors i.e. ‘3C (coordination, cooperation, and collaboration)’, ‘access to new market, technology, and complementary skills’, ‘effective on-time communication’, ‘flexibility and reliability’, ‘shared values and mutual interdependence’, ‘quality production’, ‘mutual trust’, ‘success stories of the past projects’ and ‘top management engagement’ were ranked first with citation of 63% while two factors i.e. ‘effective relationship management’ and ‘organisational transparency and receptivity’ were ranked as second with exactly 50% endorsement by the academicians as ‘Extremely Agree’. We found three factors as the least important (Extremely Disagree) according to academician. These factors are ‘cross-culture understanding and sensitivity’, ‘governance and control’, and ‘new business opportunity’. However, the frequency of occurrence is only one.

Eleven factors have been endorsed by > = 50% of the outsourcing managers as ‘Extremely Agree’. Factor ‘mutual trust’ got the maximum proportion (76%) of endorsement among the managers. ‘Quality production’ (67%) got the second rank while ‘success stories of the past projects’ and ‘top management engagement’ both shared the third rank with (62%) occurrence in the expert manager’s group. Three factors i.e. ‘3C’, ‘effective on-time communication’, ‘long-term commitments’ shared rank three while four factors i.e. ‘effective relationship management’, ‘joint management infrastructure’, ‘organisational transparency and receptivity’, and ‘mutual interdependence and shared values’ shared rank four.

From the perception of managers, we considered only one factor as the least important (Extremely Disagree) i.e. new business opportunity.

The results of this analysis confirm that 12 factors have been endorsed by more than 50% of the decision-makers as ‘Extremely Agree’.

Similar to the outsourcing manager group ‘mutual trust’ received top rank (80%) in the group of decision-makers. ‘Effective on-time communication’, ‘quality production’, ‘top management engagement’, and ‘success stories of the past projects’ shared rank two with (73%) strongly endorsement by the expert managers. ‘3C (coordination, cooperation, and collaboration)’ was considered as third rank (67%) while both ‘flexibility and reliability’ and ‘effective relationship management’ were marked as fourth rank (60%) factors by the decision-makers.

‘Organisational transparency and receptivity’, ‘access to complementary skills, new markets, and’ technology’, ‘honesty and openness’, ‘joint management infrastructure’, received fifth rank (53%) based on the extremely agree column in the group of decision-makers in our practitioner’s survey. We found two factors as the least significant (Extremely disagree with a frequency of only one) in the views of the contract negotiator. These factors are ‘cross-culture understanding and sensitivity’ and ‘honesty and openness’.

As shown in Appendix 2 (: Table 16), the contract negotiator/facilitators show a complete agreement on the listed 26 factors incorporated in our survey. Out of these 26 factors, thirteen factors were cited with a percentage > =50 in the ‘extremely agree column’. It should be noted that ‘mutual trust’ has the highest percentage (81%) in the category of contract negotiators. ‘Effective on-time communication’ (77%) and ‘effective relationship management (69%) are the second and third highly recognized factors by the contract negotiators. ‘3C-65’ was ranked fourth while ‘quality production-65%’ was ranked fifth.

Other highly recognised factors by the contract negotiators are ‘top management engagement’ and ‘success stories of the past projects’ (58%) shred rank six, ‘gaining access to new markets, technology, and opposite skills’, ‘bidirectional transfer of knowledge’, ‘relation specific investment and financial stability’, and ‘flexibility and reliability’ (54%), shared rank seventh while ‘honesty and openness’ and ‘mutual interdependence and shared values’ (50%) shared rank eight. We found only one factor i.e. Honesty and openness as opposing (Strongly Disagree) by the facilitators.

Table 6 summarises the distribution of these factors analyses through expert role while summary of the most common SFs extremely agreed by all four types of experts are given in Table 7. Details are as follow:

-

Seven SFs such as ‘3C (coordination, cooperation, and collaboration)’, ‘effective on-time communication’, ‘effective relationship management’, ‘top management engagement’, ‘mutual trust’, quality production’, and ‘success stories of the past projects’ were extremely agreed by >50% of the practitioners across four categories.

-

‘Flexibility and reliability’ and ‘access to new markets, technology, and opposite skills’ were strongly endorsed by > = 50% of all experts except the manager.

-

‘Mutual interdependence and shared values’ was not endorsed by > = 50% of the decision-makers only, while ‘organisational transparency and receptivity’ was not endorsed in the strongly agreed list by > = 50% of the negotiator only.

-

‘Honesty and openness’ was referred to as extremely agreed by > = 50% of the decision-makers and negotiators while ‘joint management infrastructure’ was quoted as strongly agreed by > = 50% of the decision-maker and manager only.

4.5 Distribution of the Factors, Identified Via Empirical Survey, Based on Experts Affiliation (RQ5)

In our practitioner survey, the experts were asked to mention their organizational affiliation as a client or vendor in the SDO arrangements. Out of 70, 26 experts were from client organizations while the remaining 44 experts represent vendor organizations as illustrated in Appendix 4. Experts’ opinion distribution based on their organization as client-vendor are shown in Appendix 3 (Table 17) while the classification of CSFs into client or vendor based on the criterion are given in Tables 8 and 9.

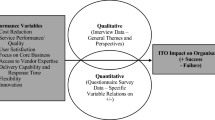

To measure the criticality of the identified SFs based on the extremely agreed by > = 50% criterion, this study classified the SFs into four classes i.e. belongs to both client and vendor, none of the client and vendor, to the vendor only, or the client only. Venn diagram as illustrated by Fig. 1 reflects the distribution of the factors using the above-mentioned criterion.

Seven CSFs as shown in Table 8 are found commonly critical to both Client-Vendors. Furthermore, six SFs as illustrated by the Venn diagram in Fig. 1 were found critical from the client’s view but are not critical from the vendor’s view.

The SFs critical from client’s perfective are:

-

Cross-cultural understanding & sensitivity– 58%

-

Access to new markets, technology, and opposite skills– 54%

-

Honesty and openness – 54%

-

Flexibility and reliability – 54%

-

Mutual interdependence and shared values – 54%

-

Governance and control – 50%

We found only two SFs that are critical to vendors only. These are:

-

Human Resource Management – 50% and

-

Joint management infrastructure – 50%

Furthermore, nine factors were such that, which were found not critical to none of the clients or vendors. These factors are:

-

Bidirectional transfer of knowledge (46%, 45%)

-

Constructive conflicts resolution mechanism (27%, 30%)

-

Relation specific investment and financial stability (35%, 39%)

-

Flexible service level agreements (31%, 27%)

-

New business opportunity (31%, 27%)

-

Long-term commitments (42%, 48%)

-

Organizational transparency and receptivity (35%, 39%)

-

Social Networking (19%, 20%)

-

Win-Win strategy (35%, 34%)

4.6 Classification of the Factors into Either Client or Vendors Only (RQ6)

In relation to RQ6, we have distributed the 26 factors into the vendor group or client group only using a robust reference model. In other words, we classify factors as belongs to either vendors or clients. In order to classify the identified factors from the clients’ only or vendors’ only perspective, we assembled the responses into A, B, and C groups, as illustrated in Appendix 3 (Table 17). Column A sums the all the positive responses i.e. A = extremely agree + moderately agree + slightly agree; Similarly, C sums all the negative responses i.e. C = slightly disagree + moderately disagree + extremely disagree, while column B counts all the not sure responses respectively as shown in Appendix 3 (Table 17). For the classification of factors, the approach used here is based on the work of (Prikladnicki et al. 2004). This reference model guides us in classifying the factors into either clients or vendors groups based on the opinion of the participant experts

Based on the strongly agreed responses, factors that were important to clients were put into the ‘client’ group while factors significant from the vendor’s perspective were put into the ‘vendor’ group. To determine the importance of a factor from the client-vendor perspective, we compare the %age of ‘extremely agree’ replies of both client and vendor as given in Appendix 3 (Table 17). For instance, 69% of the client organizations considered ‘3Cs (coordination, cooperation, and collaboration)’ as an SF for SOP formation. Though, this factor was significant to 59% of the vendor organizations. Therefore, 3Cs was assigned to the client’s group. Grounded on the extremely agree column %age in Appendix 3 (Table 17), clients’ or vendors’ only classification of the factors is accessible from Fig. 2.

4.7 Comparison of SFs Across Two Data Sets RQ7 (Questionnaire Survey vs SLR)

The findings of a comparative study of the factors found by SLR and questionnaires are presented in this section. Such comparison provides solid ground for the documentation of similarities and differences amongst the statistics of the two datasets.

Table 2 presents summary of the factors identified via SLR while Table 3 provides a summarized view of questionnaire survey responses. The SLR outcomes were in the form of frequency data and therefore were not distributed into groups. Conversely, the questionnaire survey responses were taken on seven Likert scales. Therefore, for the sake of convenience; the responses were assembled into three groups i.e. A, B, and C, as presented in Table 3. For obtaining tacit knowledge on the factors, as part of the open-ended question during the survey design, we ask the participants to write novel factors apart from those listed. Yet, no new factor was mentioned by the experts and this is the reason that the numbers of factors identified via the two datasets are the same as shown in Table 10.

Our survey results, as shown in Table 3, demonstrate none of the factors has a frequency equal to zero. We noticed that these factors were ranked up and down in both data sets. For Example, F16 (mutual interdependence & shared values) is the utmost relevant SF in the SLR data set and the eighth most critical factor in the data set for the empirical survey. Although, as illustrated by Fig. 4, the distributions of these variables are not the same in the two datasets, the variations are still less than the similarities as given in Table 10.

As stated before, that questionnaire survey data does not have a normality assumption, therefore, we performed Spearman’s rank-order correlation test for quantitative analysis of the two data sets. We computed the significant correlation among the outcomes of the SLR and empirical survey. Spearman’s association test is extensively adopted in qualitative studies as a non-parametric test for discovering positive or negative associations between two ordinals or continuous variables. Before proceeding with Spearman’s correlation test, first, we verify its two basic assumptions. The first assumption of ordinarily of data is clearly holding because the factors were evaluated using 7-point Likert scales from “extremely agree” to “extremely disagree” in the questionnaire survey. To check that scores on one variable are monotonically associated with the other variable a Scatter Plot was obtained as illustrated in Fig. 3. For conducting the Spearman’s association test using SPSS, data was prepared to be analysed using SPSS. For ranking the outcomes columns of the two data sets, we have applied MS excel rank function.

To compare these two datasets, in order to answer RQ7, Table 10 is obtained using % age of A (positive answer in the survey as shown in Table 3) only. It should be kept in mind that in Table 10, we assign the lowest ranks to the maximum % age of A and vice versa. When two or more factors have the same percentage, we keep them at the same ranking position and then adjust the ranking of the next factor accordingly. For example, in Table 10 both factor F5 (cross-culture understanding & sensitivity) and F24 (success stories of the past projects) have the same incidence rate in the SLR i.e. 32%. Therefore, they share ranks 11 and 12 and both receive rank 11 while the next factor F6 (access to a new marketplace, technology, and complementary skills) receives rank 13 because both rank 11 and 12 have been used.

This is acknowledged from Table 11 that rs (the coefficient of Spearman) is 0.406 at significance level ρ = 0.040.0. Since rs is similar to one that denotes the positive relation between the SLR and survey outcomes, i.e. when the frequencies or percentage of the SLR factors increase, the frequencies or percentage age of the survey factors will also increase and vice versa.

5 Summary and Discussions

After a rigorous examination of the sample paper using SLR, we came up with a list of 26 factors for SOP. To validate and extend the SLR findings, SLR was followed by an industrial survey and the outcomes of SLR were used as input to the empirical survey. This study results confirm the significant positive impact of the identified factors on outsourcing clients in the promotion of the vendor’s current contractual outsourcing agreements into a partnership. The results are confirmed to be equally impacting client in renewing their existing contact with the vendor organization. The long-term research objective of the present investigation is to provide strong support to SDO practitioners with a comprehensive system model in the form of factors that can help them in preparing and executing effective outsourcing ventures. The paper at hand aids to one module of the proposed framework i.e. the validation and analysis of the identified factors via an empirical survey. The results obtained suggest vendors should focus on all the listed factors in Table 2, particularly those stated with a high extremely agree count in Table 3. Factors indicate which key areas management should focus on to better design the SOP formation plan. The following criteria will be used to decide the criticality of the factors in this exploratory study:

If a factor is reported in the SLR final sample with a proportion greater than or equal to 50 %, or it is endorsed by the participant experts with an extremely agree in the survey with a > =50% then that factor will be measured as a CSF in this practitioner oriented empirical study.

Many authors (Khan et al. 2017; Khan et al. 2009; Khan and Niazi 2012b; Niazi et al. 2013; Garousi et al. 2016; Azeem and Khan 2011), for example, Niazi et al. (Niazi et al. 2013), described critical factors in SPI with similar criteria.